The Regional Competitiveness Report was created with the understanding that what gets measured is what gets done. For six years, it has served as a trusted resource by business, government, and nonprofit leaders throughout Tampa Bay. Over time, the findings have illuminated successes and regional challenges.

This annual report showcases the continued impacts of COVID-19 on our community and on the personal and professional lives of Tampa Bay residents.

At a high level, Tampa Bay is moving the needle. Data in this report shows year-over-year improvements in 36 of the 67 indicators. The region has improved in stack ranking against peer and aspirational communities in 26 indicators. Systems change is a long-term process, and much like a dance, we expect a rhythm of a few steps forward and one step back. In true form, there are also areas where our performance decreased, and rankings fell. However, holistically we are moving in the right direction.

The region continues to attract new residents of all ages. Tampa Bay ranks first in Net Migration, and the positive trends in Population Age 25-34 In-Migration Rate demonstrate that those in early labor force years are also drawn to the area; a great sign that we are attracting workforce talent.

This influx is exciting news for the business community, but progress must also be reflected in home-grown talent. Early childhood education and pre-kindergarten enrollment are critical, and educational attainment must improve across all degree types. A better educated, more prepared workforce will translate to improvements in average wages, median household incomes and overall li of the region.

Additionally, increased population growth also puts pressure on existing transit and transportation options. Tampa Bay continues to be challenged with low transit ridership, long commute times, and a high rate of pedestrian and cyclist fatalities. And because transportation and housing alone make up more than 54% of Tampa Bay residents’ budgets, a ordability, once a draw for our area, is now a major concern.

The 2023 Regional Competitiveness Report helps paint an objective picture of successes and, importantly, opportunities for advancement. When used as a common base of knowledge, the report allows us to work collaboratively for positive community change. While research is a cornerstone of these e orts, true transformation will occur when we act upon what we have learned.

We encourage you to keep this document as a quick-guide and visit the website www.stateo heregion.com to explore detailed information aligned with each indicator. Your individual and collective e orts are necessary to move our community forward. We look forward to all we will accomplish together for Tampa Bay in 2023 and beyond. A er all, the best way to predict the future is to help create it.

Sincerely,

The 60+ indicators of the Regional Competitiveness Report were selected through the expertise of more than 100 business, government, and nonprofit leaders. Progress helps position Tampa Bay as a regional powerhouse and creates a more prosperous future for all residents of Tampa Bay. Each year, we measure our performance, and track the region’s progress against 19 peer and aspirational communities and the country as a whole.

The drivers of our regional economy – identified here as Economic Vitality, Innovation, Infrastructure, Talent, and Civic Quality – represent the critical needs of our residents and businesses. Together, they create a framework for prosperity and lead to critical Outcomes that indicate whether our economy is growing, and if that growth is being enjoyed by everyone.

Our comparison communities reflect both peer and aspirational relationships with Tampa Bay. Factors such as population and demography, the size of the economy, and the presence of regional assets –including ports and research universities – were considered, as well as the frequency of competition for economic development projects.

Pinellas, Polk, and Sarasota. For the purposes of this report, data is either composed by combining individual county-level data, or data from the four Metropolitan Statistical Areas (MSAs):

Tampa-St. Petersburg-Clearwater (Hernando, Hillsborough, Pasco and Pinellas)

Homosassa Springs (Citrus)

Lakeland-Winter Haven (Polk)

North Port-Sarasota-Bradenton (Manatee and Sarasota)

When MSA-level data is used to create a regional value, the component values are weighted by an appropriate factor (population, number of households, etc.) It should be noted that o en the Tampa Bay regional value remains close to the value of the Tampa-St. Petersburg-Clearwater MSA due to its size (it is the 18th largest MSA in the nation).

THE 2023 REGIONAL COMPETITIVENESS SUMMARY REPORT is provided as a resource for the entire community, to help each of us make a positive impact on the competitiveness and prosperity of Tampa Bay. Understanding how to read and analyze the information presented within the report is key to it becoming the most useful and relevant tool for everyday use.

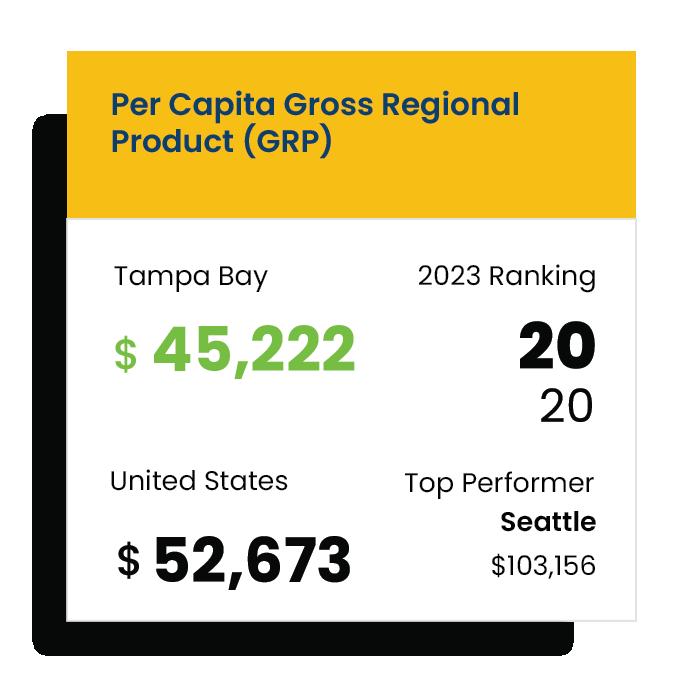

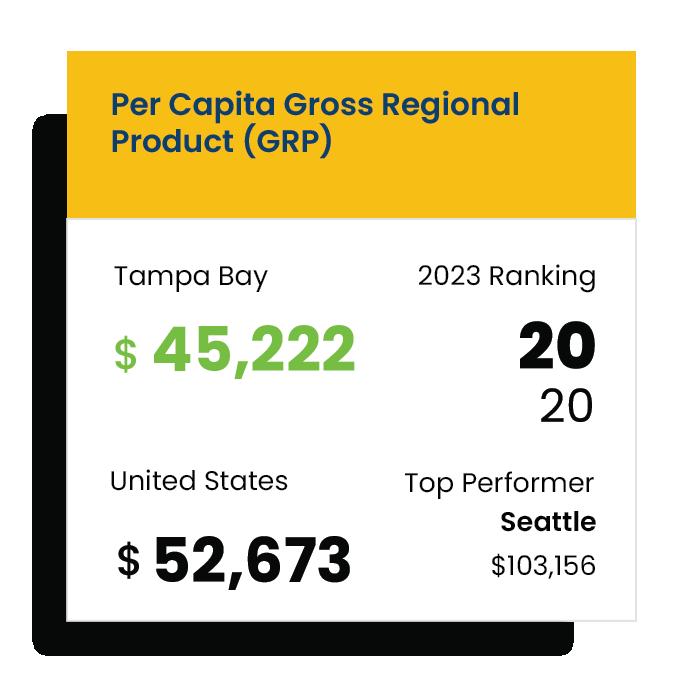

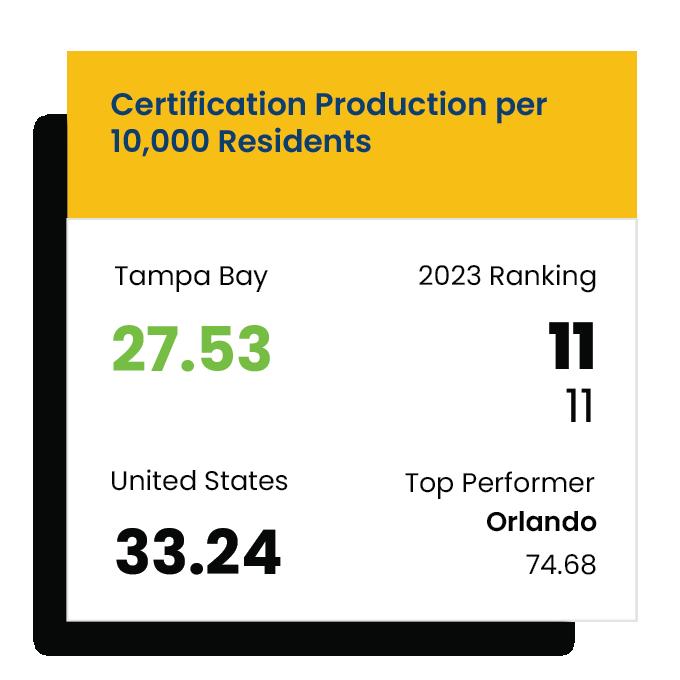

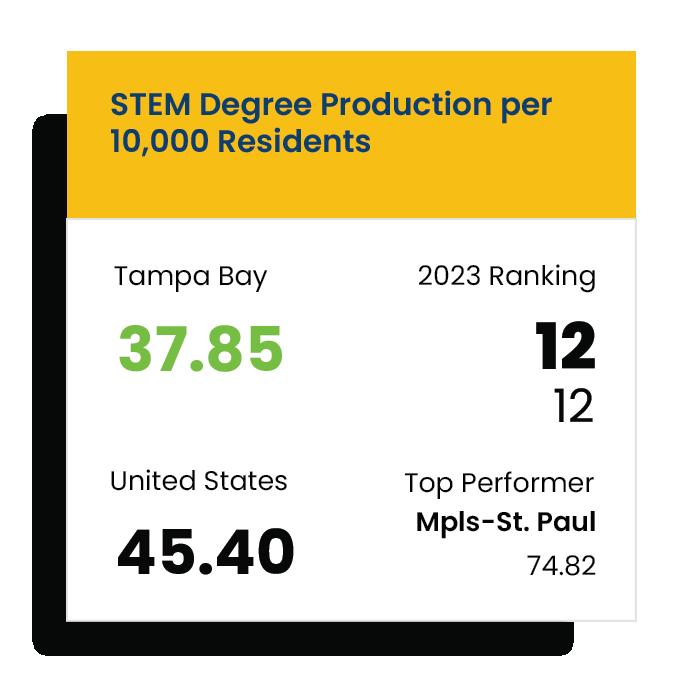

2023 RANKING:

TAMPA BAY:

The absolute value for Tampa Bay is noted to provide additional context to the relative ranking. When displayed in green, the value improved. When displayed in red, the value worsened. When displayed in black, the value remained the same.

UNITED STATES:

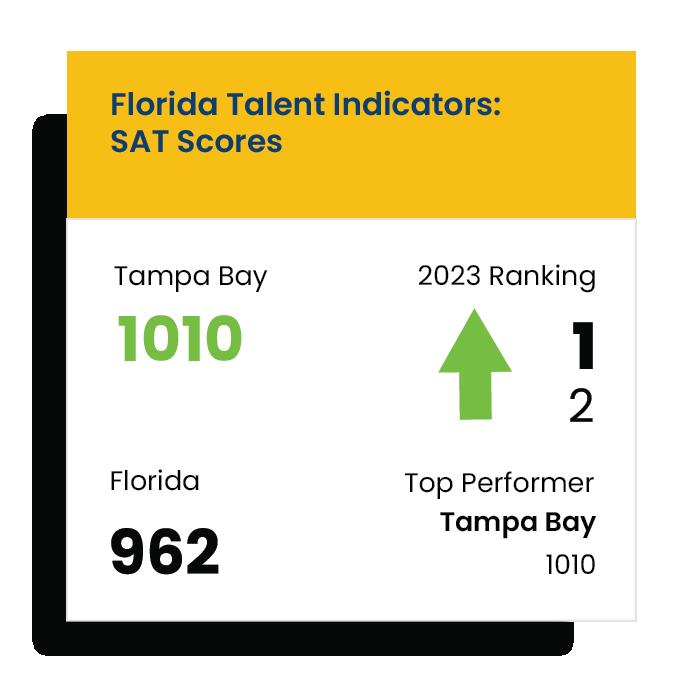

Where available, information for the United States is included to illustrate how Tampa Bay compares to national performance. In the Florida Talent indicators, this section of the tile is the state average.

The bold ranking highlights Tampa Bay’s relative position among the cohort in the 2023 report, and the ranking below it indicates its position in the 2022 report. When the arrow appears in green, the ranking improved over the previous year. When displayed in red, the ranking worsened. When there is no arrow, the ranking remains the same.

TOP PERFORMER:

This is the top performer among the 20 markets, and its value.

THE COMPLETE DATA SET for each indicator, including the ranking and performance for all 20 markets, as well as the data source, can be found at www.stateo heregion.com.

Disclaimer: The Tampa Bay Partnership Foundation has, to the best of its ability, compiled the information contained within and used it to produce this publication. The data is believed to be the latest available at the time of production, accurate, and from reliable sources. The Tampa Bay Partnership Foundation welcomes constructive criticism and corrections of the errors that may appear in a project of this complexity. For more information on the methodology for this report, please contact Dr. Lucia Farriss, Senior Director of Research, Analytics, and Public Policy, at Lfarriss@tampabay.org.

THE REGIONAL COMPETITIVENESS REPORT is made possible through the engaged support of business and community leaders throughout Tampa Bay, both past and present.

This project expands and advances previous regional e orts, such as the Economic Market report and the Regional Economic Scorecard, led by the Tampa Bay Partnership and the former University of South Florida Center for Economic Development and Research (CEDR).

The strategic vision and leadership of Chuck Sykes, President and CEO of Sykes Enterprises and the chair of the Regional Indicators Task Force, was instrumental in the creation of the inaugural Regional Competitiveness Report in 2017, along with that of the participating task force members, including:

Robbie Artz

Michael Baughen

Len Becker

David Call

Gino Casanova

Bob Clifford

David Cohen

Tom Corona

David Doney

Nathaniel Doliner

Lee Evans

Gina Gallo

Scott Garlick

Brett Lafferty

Marty Lanahan

Rhea Law

Mark Lilly

Chad Loar

Suzanne McCormick

Seth McKeel

David Pizzo

Dr. Ed Rafalski

Amy Rettig

Nick Setteducato

Marlene Spalten

Matt Spence

William Walsh

Chuck Warrington

Melanie Williams

The production of the 2023 Regional Competitiveness Report relied upon the feedback and guidance of the following stakeholders across the region, who shared their time and insight to help us make this a better, more useful resource for the community:

Aaron Neal

Jared Austin

Alison Barlow

Devon Barnett

Emily Benham

Glenn Brown

Eddie Burch

Rick Casey

Rodney Chatman

Sarah Combs

Jesse Coraggio

Bill Cronin

Sheff Crowder

Jacki Dezelski

Robin DiSalvo

J.P. DuBuque

Josh Dunn

Catherine Godwin

Stanley Gray

Bill Hoffman

Kim Jowell

Eric Larson

Carl R. Lavender, Jr.

JoLynn Lokey

Matthew Pleasant

Jessica Scites

Mark Sharpe

Kyle Simpson

Kelley Sims

Dave Sobush

Matt Spence

Micki Thompson

Chuck Tiernan

Harry Walsh

Outcomes measure the growth of the regional economy as a whole and on a per person basis, the extent to which economic growth is enjoyed by everyone, and the attractiveness of the region to its current and potential residents. Outcomes are shaped by our performance within the following drivers and indicate whether we are making progress toward our goal of economic competitiveness and prosperity.

Tampa Bay leads in Net Migration, evidence of the region’s attractiveness. Our young adult in-migration rate continues to improve; Tampa Bay ranks 8th at 8.18%.

Tampa Bay’s Unemployment Rate has improved over the last three reports, currently ranking 5th.

Although fewer workers remain unemployed, a ordability remains a concern. Following national trends, Tampa Bay saw an increase in overall poverty, where 12.74% of the region lives at this threshold. In contrast, Full-Time Worker Poverty Rates improved. Tampa Bay ranks 11th among comparison communities at 2.18%, just above the national average of 2.31%. Seattle is the top performer at 1.31%.

Tampa Bay’s per capita Gross Regional Product (GRP) has also improved, with year-over-year performance increasing from $41,620 to $45,222. However, the region continues to rank 20th for the sixth consecutive year, every year this report has been released. Although the growth rate of Tampa Bay’s GRP is 7.64%, which is above the national average, the region has fallen in rankings from 5th to 9th.

Economic Vitality measures the quantity and quality of jobs within a region, the relative incomes that its residents earn, the wealth they attain, and the economic opportunities seized by its entrepreneurs.

Tampa Bay is clearly a region on the rise and demand for space has accelerated prices for real estate. Tampa Bay ranks first in Existing Home Sales Price Growth Rate with an increase of 26%. Nationally, this increase was 11%. While in previous years, the Partnership tracked upward momentum in this indicator as a positive, this unprecedented rate of acceleration is exacerbating a housing crisis as local wages have not kept pace. Tampa Bay has an average wage of $57,427 and ranks 18th among comparison communities. Seattle, by comparison, has an average wage of $103,110, and saw home sales price grow 10%.

Tampa Bay ranks 5th in Business Establishment Start Rate, creating new companies at a rate of 11.50%, trailing just behind the leader, South Florida, at 12.74%. We also continue to have strong year-over-year performance in Advanced Gross Regional Product Growth Rate. We currently sit at 16% and rank 4th. Austin is the top performer at 28.04%.

Infrastructure measures the quantity and quality of the investment a region makes in getting people here, getting them around, and keeping them safe while they are on the move.

Air passenger tra ic is back in a big way, showing tremendous improvement from –52.06% between 2019-2020 to 82.22% between 2020-2021. However, our ranking fell from 4th to 9th against comparison communities. On the roads, Tampa Bay drivers improved their commute times by an average of 1.3 minutes, but other communities are making better strides in commute times and our ranking fell from 11th to 13th.

Tampa Bay continues to see an opportunity to improve transit service – ranking near the bottom for both transit supply and demand. Pedestrian and cyclist safety continues to be a concern with the region’s fatality rate per 100,000 residents ranking 19th at 4.38, more than quadruple that of the top performer Minneapolis-St. Paul with a fatality rate of 0.81.

All four Florida-based MSAs track near the bottom for this safety metric, including holding the bottom three ranks, which points to a need for additional infrastructure investment.

There were no updates to Pavement Condition Good or Fair, or Annual Hours Lost to Congestion source data. The information provided is from the 2022 edition of the Regional Competitiveness Report.

Please also be aware that the 2022 findings for Pavement Condition Good or Fair indicator shown here reference 2020 data, the latest available data at the time of publication.

Talent measures who is working today and how well the region's talent pipeline is being prepared for the jobs of tomorrow.

Tampa Bay maintained a steady graduation rate for high school seniors and improved from 10th to 6th in the high school graduation rate for economically disadvantaged students.

Although our percentage of disconnected youth (those 16-24 neither enrolled in school nor working) grew from our last report, our ranking amongst comparison communities improved to 14th. We continue to be 19th in educational attainment for all degrees, despite year-over-year progress in the region. Tampa Bay ranks last in Labor Force Participation Rate at 76.74%. The leader in this category is Minneapolis-St. Paul at 85.70%.

Florida Talent measures specific educational pipeline indicators tracked by the state of Florida, and compares the Tampa Bay MSA against 3 other comparison MSAs, Jacksonville, Orlando, and South Florida.

Less than half of Tampa Bay children are ready for kindergarten, a metric that has dropped since last year. However, our ranking improved to 3rd. We continue to rank last in 3rd grade English Language Arts Florida Standards Assessment (also known as the third-grade reading test) with only 50.47% of students passing with a 3 or better. Among Florida Talent Indicators, Tampa Bay leads in SAT scores.

Innovation measures the extent to which a community and its institutions are generating new ideas, and the market’s reception of these ideas.

In this year’s update, we find that while university research and development funding decreased in Tampa Bay, the region’s ranking at 16th place held steady. University Technology Licensing income fell by $4.5 million and dropped to 12th place. Our regional patent awards per 10,000 residents rose slightly, while the national average fell, but we remain at 17th among comparison communities for the fi h consecutive year. Small business awards for innovation and technology transfer research (SBIR/STTR) increased from $1.41 to $4.02 per capita, but the region still is awarded less than half of the national average and almost 10 times less than the best performing community, Raleigh-Durham, at $39.59 per capita.

Civic quality measures the affordability of a region, the health and safety of its citizens, and the recreational opportunities that impact its quality of life.

This year’s update reveals a decline in a ordability. Tampa Bay residents are spending 54% of their income on housing and transportation alone. Tampa Bay ranks in the bottom quartile for all three indicators connected with a ordability.

We saw a modest increase in the volume of mental health providers and physicians, but both are still in the lowest quartile. The data shows that increased demand for services is partially being addressed by increasing numbers of providers, but competitive communities are increasing access faster, and making it easier for residents to receive help. For example, Portland has more than 3.7 times the amount of Mental Health Providers per 10,000 Residents, and almost 1.5 times as many Primary Care Physicians per 10,000 Residents.

Tampa Bay continues to perform very well in Air Quality (3rd place) and has a lower crime rate than most comparison communities. It should be noted that the Regional Competitiveness Report has had to update the crime statistics indicator and analysis based on available data. The 2023 Report utilizes a crime index, where values are relative to the U.S. average (which is set at 100). Tampa Bay scores 90 on the Total Crime Index, meaning it has a better than average rate. Anything over 100 would be above average crime.

Crime Indicators in the 2023 Regional Competitiveness Report utilize data from a new source (an index) and should not be compared to previous issues, which measured crime per 100k residents.

The new Total Crime indicator is composed of both personal crime and property crime. The Violent Crime indicator is composed only of personal crime.

THIS CHART PRESENTS THE QUINTILE (five equal groups) rankings of each indicator for each comparison community in an “at a glance” fashion. While readers are discouraged from using this tool to assume an overall score, deeper shades indicate the community holds a more competitive position relative to the comparison markets.

Tampa Bay is competitive in Economic Vitality indicators such as business start rates, home sales price growth, and advanced industry GRP growth rate. This shows that we are developing and attracting important business sectors that correlate with better pay and increased innovation. From a housing perspective, while increases were once a positive indicator; the rapid acceleration of home prices has caused a ordability concerns.

This year, we also see strengths in the Outcomes section, with competitive net migration and unemployment rates. Population growth has likely contributed to gross regional product increases.

As with previous years, opportunities for growth and improvement are clustered in the Talent and Civic Quality indicators. While many Tampa Bay values improved from last year, other communities have advanced as well.

We continue to trail the competitive set in educational attainment and workforce participation rates. And while the university-led innovation indicators show relative strength compared to the private industry measures, innovation in Tampa Bay has room to improve.

In terms of Infrastructure, Tampa Bay finds itself in the lower area of the ranking tables in most indicators, with improvements needed in public transportation options, ridership, and safety for cyclists and pedestrians. Airline passengers and walkability hit mid-tier.

In sum, this suggests that Tampa Bay continues to attract new residents, but e orts must continue to assess the relationship between driver and outcome indicators to propel improvements to the quality of life for residents and economic growth for the region.

As with earlier issues of the Regional Competitiveness Report, we look forward to helping convene and activate around this data. Collaborative strategies will create a more competitive and prosperous Tampa Bay, and we all have a role to play.

16-24 Year Olds Neither Employed norin School

Production per 10,000 Residents Degree Production per 10,000 Residents

Degree Production per 10,000 Residents

School Graduation Rate

School Graduation Rate Economically Disadvantaged

& 4-Year Olds Enrolled in School Educational Attainment Rate: AA/AS+ Educational Attainment Rate: BA/BS+ Educational Attainment Rate: Graduate/Professional

Year Old Educational Attainment Rate: BA/BS+ Labor Force Participation Rate: Age 25-64 Cultural/Recreational Establishments per 10,000 Residents Mental Health Providers per 10,000 Residents

ordability: Costsas Percentageof Income

per 10,000 Residents

Crime Index

Crime Rate Index Share of Children in Foster Care Unemployment Rate NetMigrationPopulationAge 25-34 In-Migration Rate Gross Regional Product (GRP) Growth Rate Per Capita Gross Regional Product (GRP) Financial Instability Rate: ALICE+Poverty Poverty Rate Youth Poverty Rate Full-Time Worker Poverty Rate

Solutions are not created in siloes. The volunteer leadership of the Community Foundation Tampa Bay, United Way Suncoast, and the Tampa Bay Partnership is demonstrative of the collaborative nature of this work. Thank you for your engagement within our community, and your commitment to a more competitive and prosperous Tampa Bay.

(Leadership lists are current as of January 6, 2023)

TAMPA BAY BOARD OF TRUSTEES

Mike M. Starkey, Chair Liveperson AI

Ronald L. Ciganek Commercial Banking Executive

Richard J. Dobkin Retired Finance Executive

Patricia I. Douglas

Retired Attorney

Dr. Andrew Hafer Innovation Entrepreneur

Oscar J. Horton Sun State International Truckers, LLC.

Thomas F. Kennedy Westpro Group, Commercial Real Estate

Edward F. Koren Attorney

Karen B. Lanese Lanese & Associates CPA Firm

Christopher C. Lykes Banking Executive

Sareet Majumdar ICTC Global Manufacturing Solutions

Andres S. Prida Prida, Guida and Perez P.A.

Julie A. Rockwell Rockwell Financial Group

Mark D. Sena MediaSphere Partners, LLC

Linda O. Simmons

R.R.Simmons Construction

Dr. Kevin Sneed University of South Florida

Willie C. Tims Jr. Retired Executive

Susan L. Touchton Volunteer Community Leader

Kay Annis Wilson

Retired CEO, Volunteer Community Leader

David Pizzo, Chair Florida Blue

Lori Baggett PODS Enterprises, LLC

Eric Bailey CapTrust Financial Advisors

Sam Blatt Amazon

James Camp Raymond James Financial

Kimberly Crum Pinellas County Government

Scott Curtis Raymond James Financial

Mike Daigle M&J Daigle LLC

Tammy Davis Steven Douglas

Brian Deming Crucis

Jacki Dezelski Manatee Chamber of Commerce

J.P. DuBuque

Greater St. Petersburg Area EDC

Jamie Egasti Voyant Beauty

Estella Gray Florida Blue

Kimberly Hopper First Horizon Bank

Robert Lane Kerkering, Barberio, & Co.

Traci Larsen Regions Bank

Chad Loar PNC Bank

Melva McKay Bass Suncoast Credit Union

Sara Nichols Appspace

Rebecca Pickett Better Choice Company

Thais Rodriguez-Caez EY

R. Anthony Rolle, PhD University of South Florida

Sonja Rosario Citibank

Laura Schmidt

EY

Brian Auld, Chair Tampa Bay Rays

Brian Butler Vistra Communications

Ravi S. Chari, MD HCA West Florida

Nikky Flores JPMorgan Chase

Richard Hume TD Synnex

Rhea F. Law University of South Florida

Chad Loar PNC Bank

Carolyn Monroe Old Republic National Title Holding Co.

John A. Moore Bayfront Health St. Petersburg

Jim O’Connell Partners Asset Management

David Pizzo Florida Blue

Benjamin J. Pratt The Mosaic Company

Cary Putrino Fi h Third Bank

Melissa Seixas Duke Energy Florida

Helen Wesley TECO Peoples Gas System

Pierre Caramazza Franklin Templeton

Bob Cli ord WSP USA

Braulio Colón Helios Education Foundation

Robin W. DeLaVergne Tampa General Hospital

Melanie Fowler HDR Engineering, Inc.

Steve Griggs

Tampa Bay Lightning

Michael G. Jones Regions Bank

Christine S. Kefauver Brightline Trains

Kara Klinger Deloitte & Touche, LLP

Dan Malasky Tampa Bay Buccaneers

Thomas Mantz Feeding Tampa Bay

Merritt Martin Mo itt Cancer Center

Andy Mayts Shumaker, Loop & Kendrick, LLP

Iwan Mohamed Truist Bank

Jessica Muro United Way Suncoast

Edwin Narain AT&T

Keith O’Malley USAA

United Way Suncoast Board of Trustees continued

Emily Scott BayCare

Alex Sink Community Volunteer

Michael Smith Fi h Third Bank

Robert Thompson Community Volunteer

Sean Wilkinson Publix

Steve Raney Raymond James Bank

Amy Rettig Nielsen

Robin Roark, MD McKinsey & Company

Marlene Spalten Community Foundation Tampa Bay