SettlementCompensationTaxApproaches:

Thedealforcompensationisdone;untilthetaxconsequencesareconsidered. Litigationpractitionersneedabasicunderstandingofincometax,capitalgainstax(CGT),goodsand servicestax(GST)andtheATO'sadministrativepracticesintaxingcompensationsettlementsto maximisetheclientsaftertaxcompensationandavoidprofessionalnegligenceclaims.Thetermsof settlementcansignificantlyinfluencethetaxtreatmentandpartyresponsibleforanytaxliabilityandtax administrationcompliance.

©RonJorgensen2022

Introduction Overview

Thispaperprovidesanintroductiontotaxationprinciplesandrulesofthumbinsettlingcommonclaims andpreparingtermsofsettlementincluding: settlementcompensationtaxapproaches incometax capitalgainstax goodsandservicestax dutyandpayrolltax taxationofcompensationinterestandlegalfees taxationadjustmentsandindemnities draftingtermsofsettlement CONTENTS Introduction................................................................................................1 Overview....................................................................................................1 IncomeTaxandCapitalGainsTax...........................................................2 GoodsandServicesTaxIntroduction.....................................................13 Duty..........................................................................................................19 PayrollTax...............................................................................................20 Examples.................................................................................................21 Landdamage...........................................................................................21 Landdisposalcompulsorylandacquisition.............................................22 Breachofcontract....................................................................................22 Employmentterminationcompensation..................................................23 Personalinjurylumpsums.......................................................................24 Defamationdamages...............................................................................24 Professionalnegligence...........................................................................25 DraftingSettlementDeed........................................................................25 1.1 Goods&ServicesTax.......................................26 1.2 PrivateRuling.....................................................26 1.3 DisputingPrivateRuling.....................................26 1.4 TaxIndemnity.....................................................27 1.5 NoticeofClaim...................................................27 Conclusion...............................................................................................27 Glossary...................................................................................................29

LitigationConference2022 TheLawSocietyofTasmania 18November2022

examplesofcommonclaimsettlements

Landdamage

Compulsorylandacquisition

Breachofcontract

Employmentterminationcompensation

Personalinjurylumpsum

Defamationdamages

Professionalnegligence

IncomeTaxandCapitalGainsTax

Insummary,theRulesofThumbforincometaxandcapitalgainstax(CGT)are:

Rule1Generally,itisbetterforacompany(flat30%taxrate)thananindividual(progressive47%rate) tobetaxedonrevenuecompensation.

Rule2Generally,itisbetterforanindividual(23.5%rateafterthe50%CGTDiscount)thanacompany (30%rate)tobetaxedoncapitalcompensation.

Rule3Compensationreplacingareceiptistaxedinthesamewayasthesubstitutedreceipt,evenif receivedasalumpsum.

Rule4Compensationalteringconsiderationistaxedasanadjustmenttotheoriginaltransaction consideration.

Rule5Generally,compensationforthedisposalofanunderlyingassetistaxedasconsiderationofthe disposaloftheunderlyingasset.

Rule6Generally,compensationforpermanentdamageorreductioninvalueoftheunderlyingassetis taxedasanadjustmenttothevalueoftheunderlyingasset.

Rule7Compensationreferrabletoanunderlyingassetistaxedinthesamewayastheunderlying assetfromwhichthecompensationwasderived.

Rule8CompensationnotreferrabletoanunderlyingassetistaxedasaseparateCGTassetRightto SeekCompensation.

Rule9Compensationexpressedasanundissectedlumpsumisgenerallyattributedconsiderationfor thedisposalofaseparateCGTassetRighttoSeekCompensation.

Rule10Punitivedamagescanneverrelatetoanunderlyingasset,soisconsiderationfordisposalofthe separateCGTRighttoSeekCompensation.

Rule11Pre-judgementinterest(otherthanforpersonalinjuries)isassessableasincomeandcannever relatetoanunderlyingassetbutifundissectedisconsiderationfordisposaloftheseparate CGTRighttoSeekCompensation.

Rule12Generally,LegalFeeswillbeageneraldeductionwhenincurredinrespectofcompensationfor replacingareceiptofassessableincomeoralteringconsiderationwhichwasageneral deduction.

Rule13Generally,LegalFeeswillbeanelementofcostbasewhenincurredinrespectof compensationforanunderlyingCGTassetortheseparateCGTRighttoSeekCompensation.

Rule14Generally,additionalcompensationtodefrayorindemnitythetaxliabilityinrespectofa paymentofcompensationisadditionalconsiderationfortherecoupmentofconsideration,for thedisposaloftheunderlyingassetorCGTRighttoSeekCompensation.

2 ©RonJorgensen2022

Overview

ATORulingTR95/35Incometax:capitalgains:treatmentofcompensationistheprimarysourceofthe incometaxandcapitalgainstaxtreatmentofcompensationpayment.ATORulingTR95/35referstothe previoustaxlawbeforerewrittenintheITAA1997,socanbedifficulttointerpret.

Broadly,thetaxationofcompensationvariesdependingon:

1.natureofthedefendantindividual,company,trust,partnership,Australiantaxornon-taxresident

2.natureoftheplaintiffindividual,company,trust,partnership,Australiantaxornon-taxresident

3.natureofthepaymentsubstituteforamountorpaymentforchangeinconsideration

4.natureoftheassetrevenueasset,capitalasset,depreciatingasset,tradingstockorexempt asset

5.natureoftheclaimcontractproceeds,damages,punitivedamages,interest,legalfees

Tocorrectlyassessthelikelytaxtreatmentofasettlement,thelitigationpractitionerwillneedtoknowthe natureofthepayer,thepayee,theassetandtheclaimsettled.

NatureofthePayerandthePayee

Rule1Generally,itisbetterforacompany(flat30%taxrate)thananindividual(progressive47%rate) tobetaxedonrevenuecompensation.

Anindividualortrusteepaysincometax1ontaxableincome(i.e.assessableincomelessallowable deductions)2atprogressivemarginaltaxrateseachfinancialyear(30June),3onorbeforethefollowing 31August(unlessthelodgementdateisextendedbytheATO).4

Assessableincomeincludesordinaryincome5(e.g.remuneration,businessincomeandprofitmaking schemeincome)andstatutoryincome6(e.g.capitalgainstax,tradingstockincomeandgrantsand subsidies).

Allowabledeductionsincludegeneraldeductions7(e.g.expensesincurredtogainassessableincomeor inconductingabusinessthatisnotcapital,privateordomesticinnature)orspecificdeductions8(e.g.tax compliancecosts,9carexpenses,10baddebts11anddeductiblegifts12)intheincomeyearincurredand referrable,unlessdeferredordeemednotdeductible.

1 Sec.4-1ITAA1997

2 Sec.4.15ITAA1997.

3 Sec.4-5ITAA1997.

4 Sec.5-5ITAA1997.

5 Sec.6-5ITAA1997.

6 Sec.6-10ITAA1997.

7 Sec.8-1ITAA1997.

8 Sec.8-5ITAA1997

9 Sec.25-5ITAA1997.

10 Sec.28-12ITAA1997.

11 Sec.25-35ITAA1997

12 Sec.30-15ITAA1997

3 ©RonJorgensen2022

Forexample,forthefinancialyearended30June2022(FY2022),thetax-freethresholdandprogressive marginaltaxratesforAustraliantaxresidentindividualsandtrusteesare:

Individualbeneficiaryortrustee<3yrs13

FY2022taxableincome (column1) Taxon column1 %on excess (marginal rate)

Trustee

FY2022taxableincome (column1) Taxon column1 %onexcess (marginalrate)

$0-$416$00% $0-$18,200$0$0$417-$640$050% $18,201-$45,000$019%$641-$45,000$12719% $45,001-$120,000$5,09232.5%$45,001-$120,000$8,55032.5% $120,001-$180,000$29,46737%$120,001-$180,000$32,92537% $180,001+$51,66745%$180,001+$55,12545%

Relevantly,fortheFY2022,aprivatecompany14willbeabaserateentityforayearofincomeandpay 25%15corporateratetaxiftheprivatecompany'saggregateturnover(ofordinaryincomeandtheordinary incomeofanyconnectedoraffiliateentity)workedoutattheendofthatyearofincomeislessthan$50m andnomorethan80%oftheprivatecompany'sassessableincomeisbaserateentitypassiveincome (BREPI).16

Non-taxresidentindividualsdonothaveatax-freethresholdandhavedifferentprogressivetaxrates.

Rule2Generally,itisbetterforanindividual(23.5%rateafterthe50%CGTDiscount)thanacompany (30%rate)tobetaxedoncapitalcompensation.

AcapitalgainorcapitallossismadefortheincomeyearifaCGTevent(e.g.adisposal,17release,18 creatingrights,19creatingatrust,20becomingentitledtotrustasset21disposaltoendtrustincome22or capitalinterest23)happensinrespectofaCGTasset(e.g.land,shares,loan24orUPE25),unlessthe capitalgainisdisregardedordeferredbyrolloverorthecapitallossisdenied.26

Acapitalgainismadewherethemodifiedcapitalproceeds27fromtheCGTeventexceedthemodified costbase28oftheCGTasset.29Acapitallossismadewherethemodifiedcapitalproceeds(sec.116-20 ITAA1997)fromtheCGTeventarelessthanthemodifiedreducedcostbase30oftheCGTevent.31

AcapitalgaininrespectofaCGTassetacquiredbefore20September1985(pre-CGTcommencement) isdisregarded(e.g.adisposal)32

AnetcapitalgainisincludedintheassessableincomeofthetaxpayerfortheincomeyearoftheCGT event.33

13 Deutsch,Friezer,Fullerton,HanleyandSnape,TheAustralianTaxHandbook,ThomsonReuters2021. 14 Sec.103AITAA1997. 15 Thefuturerateswillbe:YE2019andYE2020-27.5%;YE202126%;YE202225%. 16 Sec.23AAITRA1986;ATOLawCompendiumRulingLCR2019/5BaseRateEntities. 17 Sec.104-10(CGTeventA1)ITAA1997disposalofCGTasset. 18 Sec.104-25(CGTeventC2)ITAA1997cancellation,releaseorsurrenderofCGTasset.

19 Sec.104-35(CGTeventD1)ITAA1997creatingcontractualorotherrights.

20 Sec.104-55(CGTeventE1)ITAA1997creatingatrustoverCGTasset.

21 Sec.104-75(CGTeventE5)ITAA1997beneficiarybecomingentitledtotrustasset(otherthanunittrust).

22 Sec.104-80(CGTeventE6)ITAA1997disposaltobeneficiarytoendincomeright.

23 Sec.104-85(CGTeventE7)ITAA1997disposaltobeneficiarytoendcapitalright.

24 Sec.108-5ITAA1997;TD2;TD3.

25 Sec.108-5ITAA1997;ATOPrivateBindingRulingPBR1012571177732;ATOPrivateBindingRulingPBR1012648073225.

26 Sec.102-20ITAA1997.

27 Sec.116-20ITAA1997.

28 Sec.110-25ITAA1997.

29 Sec.102-5ITAA1997.

30 Sec.110-55ITAA1997.

31 Sec.102-10ITAA1997.

32 Sec.104-10(5)ITAA1997-DisposalofaCGTAsset:CGTeventA1;ATODeterminationTD7.

33 Sec.6-10ITAA1997;sec.102-5ITAA1997.

4 ©RonJorgensen2022

Anindividualortrust(butnotacompany)34thatacquiredaCGTassetatleast12monthsbeforetheCGT event35mayreducethecapitalgainby50%undertheCGTgeneraldiscount.36

NatureofthePayment

Rule3Compensationreplacingareceiptistaxedinthesamewayasthesubstitutedreceipt,evenif receivedasalumpsum.

Compensationgenerallyacquiresthecharacterofthatforwhichitissubstituted.37

Forexample:

1.Compensationreplacingordinaryincome(e.g.businessprofits)istaxedasordinaryincome.38

2.Compensationreplacingunderpaymentofremunerationistaxedasremuneration.39

3.Compensationunderanincomecontinuancepolicyreplacingremunerationistaxedas remuneration.40

4.Compensationreimbursingadeductibleexpense(e.gcartravelexpenses)isanassessable reimbursement.41

5.Compensationreplacingunusedannualleaveandlongserviceleaveistaxedasremuneration.42

Alumpsumpaymentmaybedissectedandtaxedintoitsvariouscomponents.

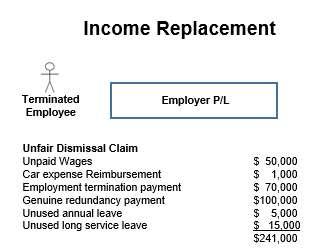

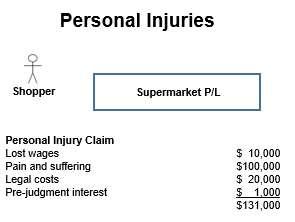

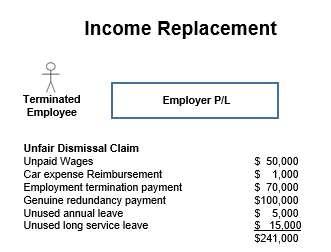

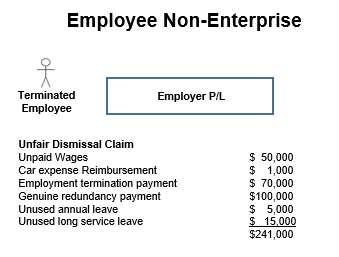

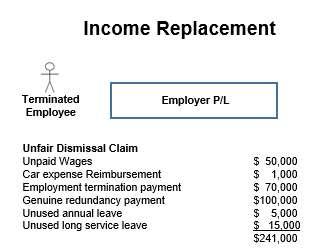

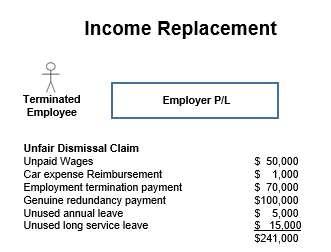

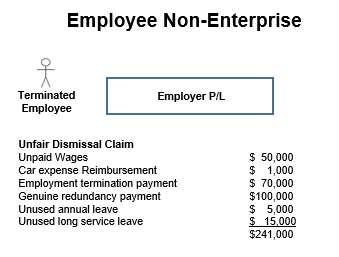

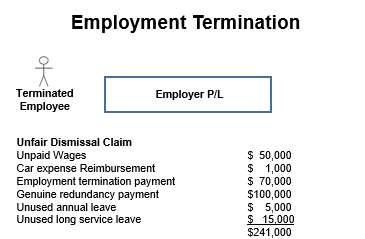

Example1

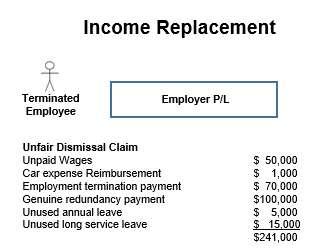

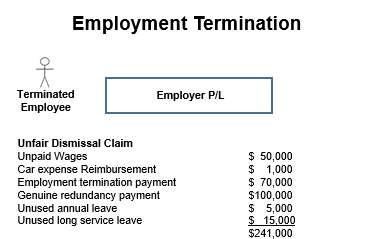

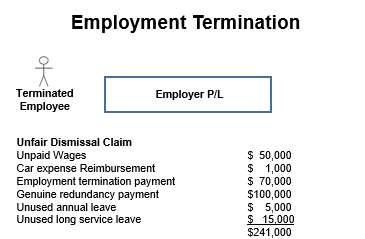

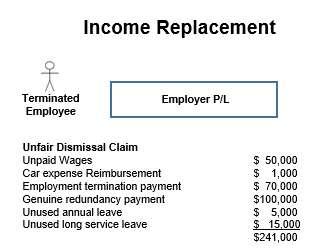

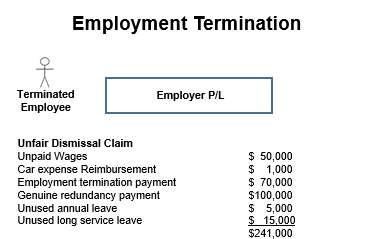

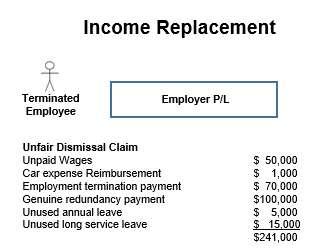

EmployerP/L.constructivelyterminatedMrEmployeeandsettledtheunfairdismissalclaimforpaymentofvariousAwardentitlementsand agreedemploymentterminationpaymentandgenuineredundancypayment.

Thecompensationamountsaretaxedinthesamemannerasthesubstitutedincome:

34 Sec.115-10ITAA1997. 35 Sec.115-25ITAA1997. 36 Sec.115-100ITAA1997;sec;115-227ITAA1997;ATODeterminationTD2002/10.

37 FCTvDixon[1952]HCA65.

38 FCTvInkster[1989]FCA626;ATODeterminationTD93/58.

39 Cuttikonda&ShethvFCT[2022]AATA1325.

40 YCNMvFCT[2019]AATA1592

41 Sec.15-70ITAA1997.

42 HeinrichvFCT[2011]AATA16.

43 Cuttikonda&ShethvFCT[2022]AATA1325.

44 Sec.15-70ITAA1997.

45 Sec.82-130ITAA1997;DibbvFCT[2004]FCAFC126.

46 Sec.83-170ITAA199:$10683+$5,320p/serviceyeartaxfreethreshold.

47 Sec.83-10ITAA1997;HeinrichvFCT[2011]AATA16.

5 ©RonJorgensen2022

Unpaidwagesassessableremuneration43 Carexpensereimbursementassessablereimbursement44 Employmentterminationpaymentassessableremuneration45 Genuineredundancypayment-taxfree46 Unusedannualleaveassessableremuneration47 Unusedlongserviceleave-assessableremuneration48

However,wherealumpsumpaymentismadethatarerevenueandcapital(e.g.personalinjury compensation49)andtherevenuecomponentcannotbedissected,theentireamountwillbetreatedas capitalcompensation(discussedbelow).50

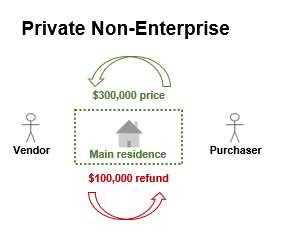

Rule4Compensationalteringconsiderationistaxedasanadjustmenttotheoriginaltransaction consideration.

Compensationalteringconsiderationisanadjustmenttotheoriginaltransactionconsiderationresultingin theamendmentoftheoriginaltaxtreatment.51

Arecoupmentorreimbursementofageneraldeductibleexpensereducestheassessableincomederived andthegeneraldeductionincurredontheoriginaltransactionrequiringtheoriginaltaxtreatmenttobe amendedandtaxpaidorrefunded(asapplicable).52Therecoupmentorreimbursementofaspecific deductionexpenseistreatedbylegislationinthesamemanner.53

Arecoupmentofanon-deductibleexpenseisadisposalofanassetsubjecttocapitalgainstax treatment.54

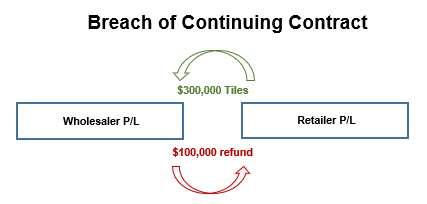

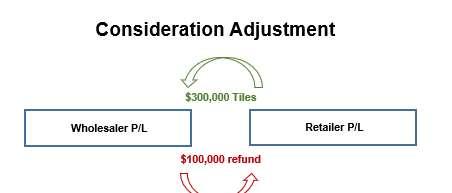

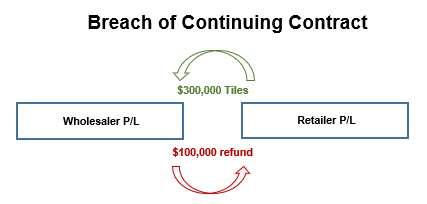

Example2

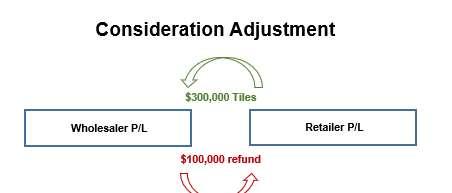

InJune2019,WholesaleP/LsoldEuropeanfloortilestoRetailerP/Lfor$300,000.InDecember2019,thetilesdeliveredwereinferiornonEuropeantilesvaluedat$200,000.InJune2020,RetailerP/LsettledtheclaimbyWholesalerP/Lrepaying$100,000.

InFY2019,WholesalerP/Lderived$300,000assessableincomeandpaidtaxandRetailerP/Lincurred$300,0000generaldeductionand paidtax.Assettlementoftheclaimreducedtheconsiderationoftheoriginaltransaction,WholesalerP/LwillamendtheFY2019return reducingassessableincomeandreceivearefundofoverpaidtax.RetailerP/LwillamendtheFY2019returnincreasingassessableincome toreversethedeductionandpayadditionaltax.55

48 Sec.83-75ITAA1997;HeinrichvFCT[2011]AATA16.

49 Sec.118-37ITAA1997

50 McLaurinvFCT[1961]HCA9;AllsopvFCT[1965]HCA48.

51 HRSinclair&SonP/LvFCT[1966]HCA39;Div.20ITAA1997.

52 HRSinclair&SonP/LvFCT[1966]HCA39

53 sec.20-20(3)ITAA1997.

54 FCTvRowe[1977]HCA16.

55 HRSinclair&SonP/LvFCT[1966]HCA39.

6 ©RonJorgensen2022

Example3

InJune2019,VendorsoldaninvestmentpropertytoPurchaserfor$300,000.InDecember2019,Purchaserwasadvisedthatcontraryto vendorwarranties,theinvestmentpropertyhadasbestoscontaminationsowasvaluedat$200,000.InJune2020,Purchasersettledthe claimbyVendorrepaying$100,000.InJune2022,Purchasersellstheinvestmentpropertyfor$210,000.

InFY2019,Vendorderived$300,000assessableincomeandpaidcapitalgainstaxandPurchaserincurred$300,0000capitalgainstaxcost base.Assettlementoftheclaimreducedtheconsiderationoftheoriginaltransaction,VendorwillamendtheFY2019returnreducing assessableincometo$200,000andreceivearefundofoverpaidcapitalgainstax.PurchaserwillamendtheFY2019capitalgainscostbase oftheinvestmentpropertyto$200,000.WhilePurchaserhasnoimmediatetaxconsequencebecausethereisnodisposaloftheinvestment property,whenPurchaserselltheinvestmentpropertythePurchaserpayscapitalgainstaxon$10,000calculatedusingthereducedcapital gainscostbase($210,000capitalproceeds-$200,000adjustedcostbase).56

Rule5Generally,compensationforthedisposalofanunderlyingassetistaxedasconsiderationofthe disposaloftheunderlyingasset.

Compensationreceivedwhollyinrespectofthedisposaloftheunderlyingasset,orpartofanunderlying asset,isconsiderationforthedisposalofthatasset(orpartasset).57

Example4

InJune2019,AuthoritygavenoticeundertheLandAcquisitionAct1993(Tas)tocompulsorilyacquirepartofLandowner'sfarm.TheFarm wasvaluedat$1,000,0000andtheacquiredlandwasvaluedat$300,000.InJune2021,LandownerandAuthoritysettledthecompensation claimandAuthoritypaid$300.000.InJune2023,Landownersellstheinvestmentpropertyfor$900,000.

ThedisposalofcompulsorilyacquiredlandtotheAuthoritywillbeaCGTeventsubjecttocapitalgainstax,58 unlesscompulsorilyacquired rolloverreliefapplies.Alandownercanchoosecompulsorilyacquiredrolloverreliefwherelandiscompulsorilyacquired:59

1.underacompulsorylandacquisitionstatute;orunderalandacquisitionagreemententeredintoafternoticeinvitinganegotiated acquisitionprovidedthatthenoticestatedthatifnegotiationswereunsuccessful,thelandwouldbecompulsorilyacquiredundera compulsorylandacquisitionstatute;and

2.themoneyisreceivedascompensationforthecompulsoryacquisitionoftheland;and

3.themoneyisexpendedtoacquirereplacementlandusedinabusinessortobeusedforthesameorsimilarpurposeasthe compulsorilyacquiredlandortorepairorrestorepartoftheretainedland;and

4.atleastsomeoftheexpenditureisincurredwithinoneyearbeforethecompulsorilyacquisitionofthelandorwithinoneyearafterthe endoftheincomeyearinwhichthecompulsorilyacquisitionoflandoccurred.

Landownerdidnotsatisfytherequirementsforrolloverrelief.

56 ATORulingTR95/35at[10]andExample5.

57 ATORulingTR95/35at[4]andExample2.

58 Sec.104-10ITAA1997;ATODeterminationTD2001/9.

59 Sec.124-70ITAA1997andsec.124-75ITAA1997.

7 ©RonJorgensen2022

AsthecompensationisfordisposaloftheFarm,thecompensationisattributabletotheunderlyingasset,land.InJune2021,theLandowner reducesthecapitalgainscostbasefortheFarmto$700,000($1,000,000-$300,000compensation).WhileLandownerhasnoimmediatetax consequencebecausethereisnodisposaloftheFarm,whenLandownerselltheFarmLandownereffectivelypayscapitalgainstaxon $300,000calculatedusingthereducedcapitalgainscostbase(reducedforthe50%CGTDiscount).

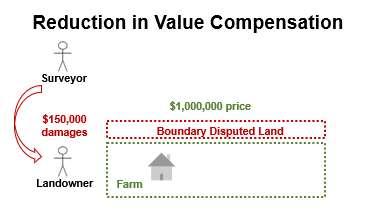

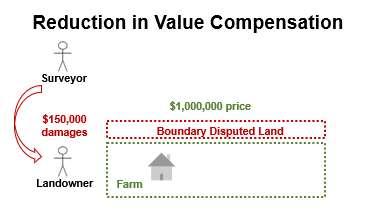

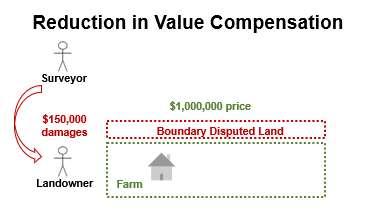

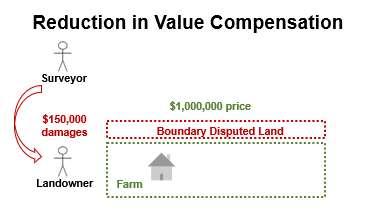

Rule6Generally,compensationforpermanentdamageorreductioninvalueoftheunderlyingassetis taxedasanadjustmenttothevalueoftheunderlyingasset.

Compensationreceivedwhollyinrespectofthepermanentdamageorpermanentreductioninvalueof theunderlyingassetwherethereisnodisposaloftheunderlyingassetisarecoupmentofallorpartof theacquisitioncostsoftheassetreducingthecostbaseoftheasset.60

ThereceiptofcompensationinrespectofaCGTassetnotdisposedofisnotassessableintheyearof incomereceived,butistaxedasanincreaseincapitalgainintheyearofdisposaloftheland(i.e. taxationofthecompensationisdeferreduntildisposalofthelandandoverallneutral).

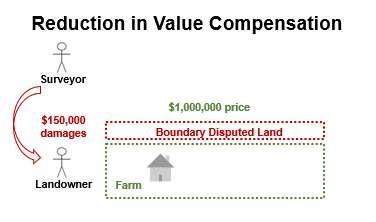

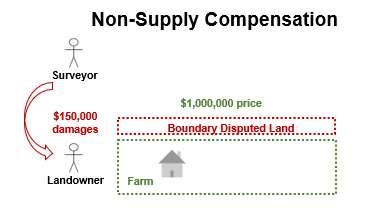

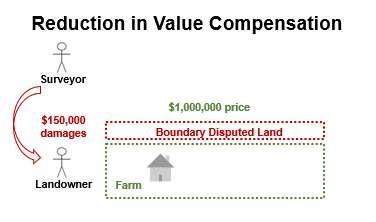

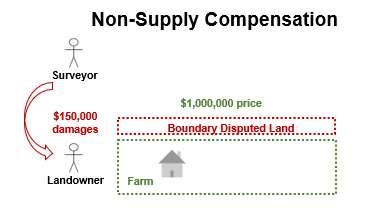

Example5

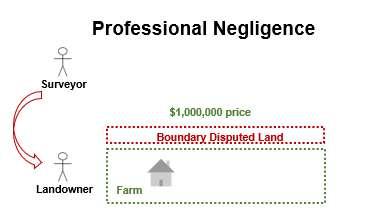

InJune2019,LandownerengagedSurveyortoboundarychecktheFarmduringduediligencetoacquiretheFarm.Surveyorconfirmedthe boundariesoftheFarmwerecorrectandtheLandowneracquiredtheFarmfor$1,000,000.Adisputeovertheboundaryarosewiththe neighbouranditwasidentifiedthattheNorthernboundarieswereincorrectandtheFarmwereresurveyedwithaconsequential15% reductioninpropertysize.InJune2020,LandownersettledtheclaimbySurveyorpaying$150,000damages.InJune2022,Landownersell theFarmfor$900,000.

ThecompensationhasadirectandsubstantiallinktotheFarmPropertyconcerningthereductioninvalueduetothereducedsizeofthe land.61

InFY2019,Landownerincurred$1,000,0000capitalgainstaxcostbasefortheFarm.AsthecompensationisforlossofvalueoftheFarm thecompensationisattributabletotheunderlyingasset,land.InJune2020,theLandownerreducesthecapitalgainscostbasefortheFarm to$850,000($150,000compensation).WhileLandownerhasnoimmediatetaxconsequencebecausethereisnodisposaloftheFarmwhen LandownerselltheFarmLandownerineffectpayscapitalgainstaxon$150,000calculatedusingthereducedcapitalgainscostbase ($900,000-$850,000)(reducedforthe50%CGTDiscount). NatureoftheAsset

[1993]VicSC273.

8 ©RonJorgensen2022

Rule7Compensationreferrabletoanunderlyingassetistaxedinthesamewayastheunderlying assetfromwhichthecompensationwasderived. Whereanamountofcompensationhasadirectandsubstantiallinktoanunderlyingassetthathasbeen disposedof,permanentlydamagedorpermanentlyreducedinvalue,thecompensationisreferrableto andtaxedinthesamewayastheunderlyingasset.62 Thetransferoflandmaybetaxableasadisposalof: 1.tradingstockofapropertydevelopmentbusiness;63 2.anisolatedprofit-makingscheme;64or 60

61 CarborundumRealtyP/LvRAIAArchitectureP/L

62

63

64

ATORulingTR95/35at[6]andExample5.

ATORulingTR95/35at[70][82].

Div.70ITAA1997;BarinaCorporationLtdvFCT(1985)4NSWLR96.

Sec.6-5ITAA1997;ATORulingTR92/3.

3.aCGTasset.65

Theregimeshavesignificantlydifferenttaxtreatments.

Landheldastradingstockintheordinarycourseofapropertydevelopmentbusinessistaxedonthe followingbasis:66

1.acquisitionandancillarycosts(e.g.developmentcosts)ofpurchasedtradingstockarean allowablegeneraldeduction67intheyearthetradingstockisheldforuseinabusiness;68and

2.disposalconsiderationoftradingstockisassessableincomeintheyearofdisposalofthetrading stock;69and

3.wheretheopeningtradingstockvalue(e.g.thepreviousyear30Juneclosingtradingstock value)70exceedsclosingtradingstockvalue(e.g.thecurrentyear30Juneclosingtradingstock value),anallowablegeneraldeductionisincurred;71or

4.wheretheclosingtradingstockvalue(e.g.thecurrentyear30Juneclosingtradingstockvalue)72 exceedsopeningtradingstockvalue(e.g.thepreviousyear30Juneclosingtradingstockvalue), assessableincomeisderived.73

Thereceiptofcompensationinrespectoftradingstocklandwillbeassessableincomeintheyearof incomereceived.Asthetradingstocklandismaintainedatcost,whenthelandiseventuallysold,the amountofassessableincomeisless(i.e.taxationofthecompensationclaimisessentiallyaccelerated, butoverallneutral).

Landacquiredforanisolatedprofit-makingpurpose(e.g.sale)otherthanintheordinarycourseofa propertydevelopmentbusinessistaxedasordinaryassessableincomeonthenetprofitintheincome yearofdisposaloftheland.74

Thereceiptofcompensationinrespectofisolatedprofit-makingschemelandisnotassessableinthe yearofincomereceivedunderordinaryprofitandlossaccountingmethodologybutistaxedasordinary assessableincomeintheyearofdisposaloftheland(i.e.taxationofthecompensationclaimisdeferred untildisposalofthelandandoverallneutral).75

Landacquiredotherthanastradingstockorisolatedprofit-makingschemeistaxedonanynetcapital gainintheincomeyearoftheCGTevent(e.g.disposal)76andanindividualortrust(butnotacompany)77 thatacquiredaCGTassetatleast12monthsbeforetheCGTevent78mayreducethecapitalgainby 50%undertheCGTgeneraldiscount.79

65 Pt3.1and3.3ITAA1997.

66 Sec.70-5ITAA1997.

67 Sec.8-1ITAA1997.

68 Sec.8-1&70-15ITAA1997.

69 Sec.6-5ITAA1997.

70 Sec.70-40ITAA1997.

71 Sec.70-35ITAA1997.

72 Sec.70-45ITAA1997.

73 Sec.70-35ITAA1997.

74 Sec.6-5ITAA1997;FCTvWhitfordsBeachP/L[1982]HCA8;ATORulingTR92/3.

75 FCTvThorogood[1927]HCA36;ATOInterpretativeDecisionATOID2009/63.

76 Sec.6-10ITAA1997;sec.102-5ITAA1997;sec.104-10(5)(CGTeventA1)ITAA1997.

77 Sec.115-10ITAA1997.

78 Sec.115-25ITAA1997.

79 Sec.115-100ITAA1997;sec;115-227ITAA1997;ATODeterminationTD2002/10.

9 ©RonJorgensen2022

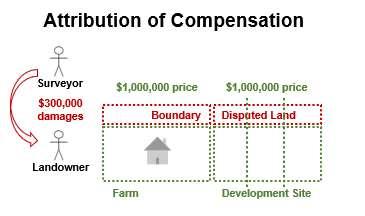

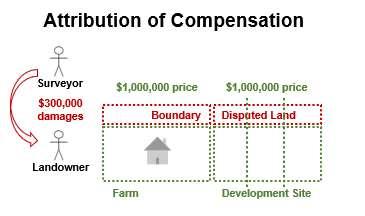

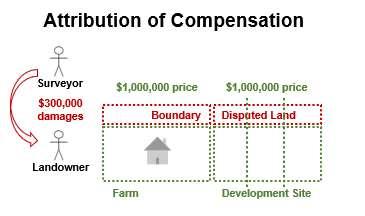

InJune2019,LandownerengagedSurveyortoboundarychecktheFarmandadjacentPropertyDevelopmentSiteduringduediligenceto acquirethoseproperties.SurveyorconfirmedtheboundariesoftheFarmandtheDevelopmentSitewerecorrectandtheLandowner acquiredtheFarmfor$1,000,000andtheDevelopmentSitefor$1,000,000.TheDevelopmentSitecouldbesubdividedintothree(3)life styleproperties(hobbyfarms)withminimaldevelopmentworksandcosts.Duringdevelopmentworks,itwasidentifiedthattheNorthern boundarieswereincorrectandtheFarmandDevelopmentSitewereresurveyedwithaconsequential15%reductioninpropertysize.In June2020,LandownersettledtheclaimbySurveyorpaying$300,000damages.InJune2022,LandownerselltheDevelopmentSitelotsfor $3,000,000($1,000,000each).

TheFarmisobjectivelycharacterisedasaCGTassetsinceacquiredforlongterminvestmentanduseasafarm.TheDevelopmentSiteis objectivelycharacterisedasanisolatedproperty-makingscheme(beingthefirstdevelopmentundertakenbyLandownerwithminimalnumber oflots,developmentworkandcosts).ThecompensationhasadirectandsubstantiallinktotheFarmPropertyandDevelopmentSite concerningthereductioninvalueduetothereducedsizeoftheland.80

InFY2019,Landownerincurred$1,000,0000capitalgainstaxcostbasefortheFarmand$1,000,000developmentcostsfortheprofitmakingscheme.Asthecompensationisforlossofvalueofthepropertiesthecompensationisattributabletotheunderlyingasset,land.In June2020,theLandownerreducesthecapitalgainscostbasefortheFarmto$850,000($150,000compensation)andbooksthe$1,500,000 compensationfortheDevelopmentSiteasincomeunderordinaryprofitandlossaccountingmethodologiesallocatedequallytoeachLot. WhileLandownerhasnoimmediatetaxconsequencebecausethereisnodisposaloftheFarmortheDevelopmentSite,whenLandowner selltheFarmLandownerpayscapitalgainstaxon$150,000calculatedusingthereducedcapitalgainscostbase(reducedforthe50%CGT DiscountandwhenLandownersellstheDevelopmentSitelotsLandownerpaysordinaryincometax(notreducedforthe50%CGT Discount).

Rule8CompensationnotreferrabletoanunderlyingassetistaxedasaseparateCGTassetRightto SeekCompensation.

Whereanamountofcompensationdoesnothaveadirectandsubstantiallinktoanunderlyingassetthat hasbeendisposedof,permanentlydamagedorpermanentlyreducedinvalue,thecompensationis referrabletoandtaxedinthesamewayasaseparateCGTassetRighttoSeekCompensation.

TheCGTassetRighttoSeekCompensationariseswhenthecauseofactionaccrues81andgenerallyhas noorminimalcostbase(e.g.mitigationcosts,legalfeesetc)82becausethemarketvaluesubstitutionrule doesnotapply.83

Whereaclaimarisesunilaterally(e.g.breachofcontract,personalinjuryorwrong),anotionalunderlying assetoftheRighttoSeekCompensationisdeemedcreated.84

Inrespectofpersonalinjuryorwrong,thecompensationpaidinsettlementoftheRighttoSeek Compensationisexemptfromcapitalgainstaxevenifliabilityisnotadmittedandinanundissectedlump sum.85ThebroadinterpretationoftheCGTpersonalinjuryexemptionrecognisessettlementsare generallynotattributed.

AcapitalgainorcapitallossmadefromaCGTeventrelatingdirectlytocompensationforwrongorinjury sufferedininanoccupationorpersonallyisdisregarded.86

80 CaborundumRealtyP/LvRAIAArchitectureP/L[1993]VicSC273.

81 ATORulingTR95/35at[112].

82 ATORulingTR95/35at[104].

83 ATORulingTR95/35at[113].

84 ATORulingTR95/35at[177].

85 ATORulingTR95/35at[212].

86 Sec.118-37ITAA1997;ATORulingTR95/35at[210]and[217].

10 ©RonJorgensen2022

Example6

Wheresettlementoccursatleast12monthsaftertheCGTassetRighttoSeekCompensationcauseof actionaccrues,thecapitalgainmaybereducedbythe50%CGTDiscount.87

Rule9Compensationexpressedasanundissectedlumpsumisgenerallyattributedconsiderationfor thedisposalofaseparateCGTassetRighttoSeekCompensation.

Ifcompensationisreceivedasanundissectedlumpsumandcannotbereasonablyapportionedagainst theseparateheadsofclaim,thewholeamountistreatedasbeingconsiderationreceivedforthedisposal ofaseparateCGTassetRighttoSeekCompensation.88

Expressingasettlementasanundissectedlumpsumwilloftenbedisadvantagesbecausetherecanbe nodeferraloftaxbyallocatingtoanunderlyingassetnotdisposedofforanextendedtime.

Expressingasettlementasanundissectedlumpsuminrespectofarevenueassetmaybeadvantages wherethecauseofactionhasbeenheldforatleast12monthsbecausetheeffectivedisposalofa separateCGTassetRighttoSeekCompensationmaybesubjecttothe50%CGTDiscount.

Alumpsumpaymentmaybedissectedandtaxedintoitsvariouscomponents.

Example7

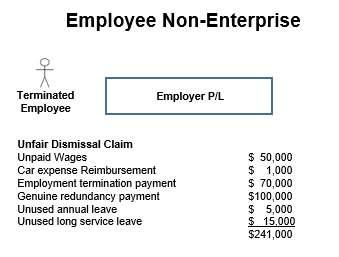

EmployerP/L.constructivelyterminatedMrEmployeeandsettledtheunfairdismissalclaimforpaymentofvariousAwardentitlementsand agreedemploymentterminationpaymentandgenuineredundancypayment.Employeeagreedto$70,000infullsettlementofallclaimswith noadmissionofliability.

Ifthelumpsumwasdissectedandallocatedtothestatutoryentitlements(unpaidwages,89 unusedannualleaveandunusedlongservice leave90),theamountwouldbetaxedat47%asremuneration.

Ifdissectedandallocatedtoagenuineredundancypayment,theamountwouldbetaxfree.91

Ifundissectedtheamountwouldbetaxedat23.5%asacapitalgainondisposaloftheCGTassetRighttoSeekCompensationreducedby the50%CGTDiscount.

Accordingly,weredissectinglumpsumcompensationisadvantageoustotheplaintiff(e.g.taxfree genuineredundancypayment)thetermsofsettlementshouldspecificallydissectandallocatethe amountstoensurecorrectlytaxed.

NatureoftheClaim

Rule10Punitivedamagescanneverrelatetoanunderlyingassetsoisconsiderationfordisposalofthe separateCGTRighttoSeekCompensation.

87 Div.115ITAA1997.

88 ATORulingTR95/35at[18];Example12,Example13.

89 Cuttikonda&ShethvFCT[2022]AATA1325.

90 HeinrichvFCT[2011]AATA16. 91 sec.83-170ITAA199:$10683+$5,320p/serviceyeartaxfreethreshold.

11 ©RonJorgensen2022

Punitivedamagesarecompensationoverandabovetheamountrequiredtorestitutetheplaintifffor damagessuffered(i.e.punish)soisconsiderationforthedisposaloftheseparateCGTRighttoSeek Compensation.92

Rule11Pre-judgementinterest(otherthanforpersonalinjuries)isassessableasincomeandcan neverrelatetoanunderlyingassetbutifundissectedisconsiderationfordisposaloftheseparateCGT RighttoSeekCompensation.

Althoughuncertain,theATOconsiderspre-judgmentinterestawardedaspartofacompensationamount (otherthanforpersonalinjuries)93isassessableincomeundertheordinaryincomeprovisionssocannot relatetotheunderlyingland.Ifthetaxpayerreceivesanundissectedlumpsumcompensationamount andtheinterestcannotbeseparatelyidentifiedandsegregatedoutofthatreceipt,nopartofthatreceipt canbesaidtorepresentinterest.Ifthecompensationcannotbedissecteditislikelythatthewhole amountrelatestothedisposaloftherighttoseekcompensation.94

Post-judgementinterestisassessableincomeundertheordinaryincomeprovisions.95

Rule12Generally,LegalFeeswillbeageneraldeductionwhenincurredinrespectofcompensationfor replacingareceiptofassessableincomeoralteringconsiderationwhichwasageneraldeduction.

LegalFeesareageneraldeductioniftheadvantagesoughtbyincurringthelegalexpenseisrevenuein nature.

Exampleofgeneraldeductionlegalexpensesincludeproceedingstorecoverunpaidremuneration,96total andpermanentdisabilityinsurancebenefits97workplacedefamationcompensation98andtocollectunpaid royalties.99

Rule13Generally,LegalFeeswillbeanelementofcostbasewhenincurredinrespectof compensationforanunderlyingCGTassetortheseparateCGTRighttoSeekCompensation.

Legalfeesandchargesconnectedwiththeproceedingsandincurredduringthecourseofproceedings maybeincidentalcostsincludedinthecostbase.100

Taxationadjustmentsandindemnities

Rule14Generally,additionalcompensationtodefrayorindemnitythetaxliabilityinrespectofa paymentofcompensationisadditionalconsiderationfortherecoupmentofconsideration,forthedisposal oftheunderlyingassetorCGTRighttoSeekCompensation.

Thecourtmayawardadditionalcompensation(grossup)todefraythetaxliabilityinrespectof compensation101orrequireanindemnityforthetaxliabilityinrespectofcompensation.102

Suchamountswillbeadditionalconsiderationfortherecoupmentofconsideration,forthedisposalofthe underlyingassetorCGTRighttoSeekCompensation.103

However,somedecisionsconsidertaxliabilityistooremoteforanawardofcompensationor indemnity.104

92

ATORulingTR95/35at[18];Example7.

93 ATOInterpretativeDecisionATOID2010/213.

94 ATORulingTR95/35at[26][234][246].

95 ATOPrivateBingingRulingPBR1051432028079.

96 RomaninvFCT[2008]FCA1532;ATODeterminationTD93/29.

97

ATOInterpretativeDecisionATOID2002/193.

98 ATOInterpretativeDecisionATOID2001/549.

99 ATOPrivateBingingRulingPBR1051949572762.

100 Sec.110-25(6)ITAA1997;ATORulingTR95/35at[157];ATODeterminationTD2017/10at[1].

101 TuitevExelby[1994]QCA506.

102 ProvanvHCLRealEstateLtd92ATC4644;(1992)24ATR238.

103 ATORulingTR95/35at[253].

104 NamolP/LvAWBaulderstoneP/L[1993]FCA934;CarborundumRealtyP/LvRAIAArchitectureP/L[1993]VicSC273.

12 ©RonJorgensen2022

GoodsandServicesTaxIntroduction

Insummary,theRulesofThumbforgoodsandservicestax(GST)are:

Rule1ThesuppliermustberegisteredorrequiredtoberegisteredforGSTorthetransactionisnot subjecttoGST.

Rule2Thesuppliermustmakealegallybindingsupplyofgoods,services,orrightsorobligationsor thetransactionisnotataxablesupplysubjecttoGST.

Rule3Thesupplymustbeinthecourseorfurtheranceoftheenterpriseorthetransactionisnota taxablesupplysubjecttoGST.

Rule4ThesupplymustbeconnectedwithAustraliaorthetransactionisnotataxablesupplysubject toGST.

Rule5ThesupplymustbeforconsiderationorthetransactionisnotataxablesupplysubjecttoGST.

Rule6CompensationconcerningtheconsiderationinrespectofanEarlierSupplyistaxedasan adjustmenttotheEarlierSupplyconsideration.

Rule7CompensationpaidinrespectofaCurrentSupplyisattributedtotheCurrentSupply.

Rule8AdiscontinuanceofaclaimwithoutconsiderationisaDiscontinuanceSupplynotsubjectto GST.

Rule9Wherethesubjectofaclaimisnotasupply(e.g.forDamagesorLegalCosts),theclaimitselfis notasupply(Non-SupplyCompensation).

Rule10CourtJudgmentandpaymentofajudgmentdebtisnotasupply,soisnotsubjecttoGST.

Overview

ATORulingGSTR2001/4Goodsandservicestax:GSTconsequencesofcourtandout-of-court settlementsistheprimarysourceoftheGSTtreatmentofcompensationpayments.

GSTisleviedonthevalue(ordeemedvalue)oftaxablesuppliesofgoods,services,rightsandthings connectedwithAustraliamadeinthecourseorfurtheranceofanenterprisethatisregisteredorrequired toberegisteredbutdoesnotincludeGST-freeorinputtaxedsupplies.105

Suchanenterpriseisentitledtoaninputtaxcreditorreducedinputtaxcreditinrespectofcreditable importationsandcreditableacquisitionsofgoods,services,rightsandthingsobtainedinthecourseor furtheranceoftheenterprisethatarenotreferabletoGST-freeorinputtaxedsupplies.106

Wherethereisachangeofconsiderationforasupply,therecipientmayhaveanadjustmentevent relatingtopreviouslyclaimedinputtaxcreditsresultingapaymentorrefundofGST.107

Inmosttransactionsthedefendantandtheplaintiffwillmakemutualorcorrespondingsupplies(e.g. goods,services,mutualreleasesofrightsorobligationsorcounterclaims)sothetermssupplierand recipientareusedtodenotethecapacity.

Broadly,theGSTtreatmentofcompensationvariesdependingon:

1.theGSTregistrationstatusofthedefendantunregistered,GSTregisteredorrequiredtobeGST registered

2.theGSTregistrationstatusoftheplaintiffunregistered,GSTregisteredorrequiredtobeGST registered 3.thescopeofthedefendant'senterpriseinthecourseoforoutsidethecourseoftheenterprise

105 Sec.9-5GSTA1999. 106 Sec.11-20GSTA1999.

107 Div.75GSTA1999;ATORulingGSTR2006/7.

13 ©RonJorgensen2022

4.thenatureofthesupplynon-supply,non-enterprisesupply,enterprisesupply,GST-freesupply andinputtaxedsupply

5.thenatureoftheassetresidential,newresidentialorcommercialpropertyorexcludedasset 6.natureoftheclaimcontractproceeds,damages,interestandlegalfees

Tocorrectlyassessthelikelytaxtreatmentofasettlement,thepractitionerwillneedtoknowthenatureof thepayer,thepayee,theassetandtheclaimsettled.

Rule1ThesuppliermustberegisteredorrequiredtoberegisteredforGSTorthetransactionisnot subjecttoGST.

IfthesupplierisnotregisteredforGST,therecipientwillneedtodetermineifthesupplierisrequiredto beregisteredforGST.

IfthesupplierisnotregisteredorrequiredtoberegisteredforGST,thesupplierdoesnotchargeGSTor issuetaxinvoicesandtherecipienthasnoinputtaxcreditasthetransactionisnotsubjecttoGST(rather thanbeingGST-free).

IfthesupplierisGSTregistered,thesupplieron-chargesGST(GSTexclusive)orabsorbstheGSTinthe price(GSTinclusive)andremitstheGSTtotheATO.

AGSTregisteredrecipientclaimsaninputtaxcreditfortheGSTpaid(reclaimingtheGST).Wherethe recipientisnotGSTregistered,therecipientcannotclaimaninputtaxcreditandGSTleviedonthe increaseinvalueofthetransaction.GSTischargedandreclaimedoneachincreaseinvalueofthe transactionuntilleviedontheultimateconsumer.

Anentity108carryingonanenterprise109orthatintentstocarryonanenterprisefromaparticulardatemay registerforGST.110Anentity111carryingonanenterprise112withaGSTturnoverofatleastthe$75,000 registrationturnoverthreshold113isrequiredtobeGSTregistered.114Anentitymustapplyintheapproved formtobeGSTregisteredwithin21daysafterbecomingrequiredtoberegistered.115

Anenterpriseincludesactivitiesdonebyoneormore(usuallyassociated)entitiesinthecommencement, operationorterminationoftheenterpriseormultipleseparateenterprises.116

Anenterpriseisverybroadandisanactivity,orseriesofactivities,doneintheformofabusiness,inthe formofanadventureorconcerninthenatureoftradeoronaregularorcontinuousbasisintheformofa lease,licenceorothergrantofinterestinproperty.117

Employment,private,recreational,individualphilanthropicandlocalgovernmentactivitiesareexcluded frombeinganenterprise.118 108 Sec.184-1GSTA1999;ATORulingMT2006/1ABNRegistrationrulesapplytoGSTregistration:ATODeterminationGSTD2006/6 109 sec.9-20GSTA1999;ATORulingMT2006/1ABNRegistrationrulesapplytoGSTregistration:ATODeterminationGSTD2006/6. 110 Sec.23-10GSTA1999;ATOPracticeStatementPSLA2011/8at[43]. 111 Sec.184-1GSTA1999;ATORulingMT2006/1ABNRegistrationrulesapplytoGSTregistration:ATODeterminationGSTD2006/6 112 sec.9-20GSTA1999;ATORulingMT2006/1ABNRegistrationrulesapplytoGSTregistration:ATODeterminationGSTD2006/6. 113 Sec.23-15GSTA1999;$150,000registrationturnoverthresholdforanot-for-profitentity;ATOPracticeStatementPSLA2011/8at[41]. 114 Sec,23-5GSTA1999. 115 Sec.25-1GSTA1999;ATOPracticeStatementPSLA2011/8at[44]. 116 Sec.9-20GSTA1999;ATORulingMT2006/1at[102]. 117 Sec.9-20GSTA1999;ATORulingMT2006/1. 118 Sec.9-20GSTA1999;ATORulingMT2006/1at[329].

14 ©RonJorgensen2022

Example8

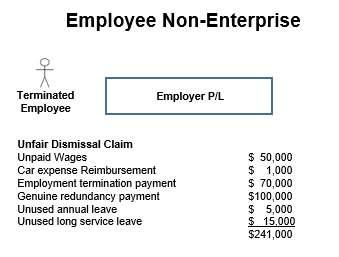

EmployerP/L.constructivelyterminatedMrEmployeeandsettledtheunfairdismissalclaimforpaymentofvariousAwardentitlementsand agreedemploymentterminationpaymentandgenuineredundancypayment.

Astheemployeeismakingasupplyinconnectionwithemployment,theemployeeisexcludedfrombeinganenterpriseandthesupplyisnot subjecttoGST.

Rule2Thesuppliermustmakealegallybindingsupplyofgoods,services,orrightsorobligationsor thetransactionisnotataxablesupplysubjecttoGST.

Asupplyreferstothingspassingfromonepartytoanotherbytransfer,provision,creation,grantrelease orsurrender119andmustbelegallybindingandnotamereexpectation.120

Accordingly,non-bingingmemorandumofunderstandingortermsoftradearenotsuppliesofrights.

Exgratiapaymentsarenotsupplieseitherbecausetheyarenotlegallybindingornotbeingconsideration inrespectofasupply.121

Rule3Thesupplymustbeinthecourseorfurtheranceoftheenterpriseorthetransactionisnota taxablesupplysubjecttoGST.

AsupplynotinthecourseofanenterpriseisnotataxablesupplysubjecttoGST.

Thesaleofamainresidenceisnotusuallyasupplyinthecourseofanenterprise.122

Example9

119

ATORulingGSTR2001/4at[23]and[25]. 120 ATORulingGSTR2001/4at[37]. 121

ATORulingGSTR2001/4at[36]. 122 ATORulingMT2006/1at[244].

15 ©RonJorgensen2022

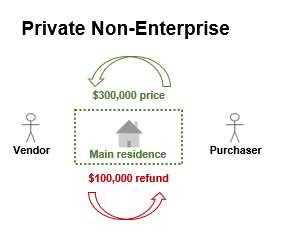

InJune2019,VendorsoldtheVendor'sCGTmainresidencetoPurchaserfor$300,000.InDecember2019,Purchaserwasadvisedthat contrarytovendorwarranties,theinvestmentpropertyhadasbestoscontaminationsowasvaluedat$200,000.InJune2020,Purchaser settledtheclaimbyVendorrepaying$100,000.

AstheMainResidenceisaprivateasset,theVendorisnotmakingasupplyinthecourseofanyenterpriseandthesupplyisnotsubjectto GST.

Rule4ThesupplymustbeconnectedwithAustraliaorthetransactionisnotataxablesupplysubjectto GST.

Asupplytoanon-residentoutsideAustraliawhoisnotinAustralia(e.g.anAustralianpermanent establishment)whenthesupplyismadeisGSTfreeifthesupplyisnotdirectlyconnectedwithreal propertyinAustralia.123

Example10

InJune2019,SolicitorprovidedconveyancingandtaxadviceandconveyancingservicestoForeignClienttoacquireaFarminAustralia. ForeignClientdidnotpaythelegalfeessoSolicitorsueForeignClientforbreachofretaineranddebt.InJune2020,Solicitorsettledthe claimbyForeignClientpaying$100,000.

TheconveyancingandlegaladvicetoForeignPersonisnotasupplyconnectedwithAustraliasoisnotataxablesupply.Althoughrelatingto theFarm,theadviceisnotsufficientlyconnectedtorealpropertyinAustralia.However,theconveyancingservicesisasupplyconnectedto AustraliabeingsufficientconnectedtorealpropertyinAustralia

Rule5ThesupplymustbeforconsiderationorthetransactionisnotataxablesupplysubjecttoGST.

Thesupplymustbeforconsideration(i.e.movethesupply)ratherthanbeingextraneoustothesupplyof thetransactionisnotsubjecttoGST.

Considerationisdefinedbroadlyandincludesmoney,givingproperty,grantorforbearanceofrightsand obligations124andmaybeprovidedbyathirdparty(e.g.manufacturersrebate)125andexpressly regardlessofwhethermadeincompliancewithacourtorderorinsettlementofproceedings.

ApaymentofAustralianCurrencyisnotarelevantassetforGSTunlessbeingtradeasthesubjectofa foreignexchangetransaction.

Agiftisnotforconsiderationsosettlementtermsthatprovideforagifttoanon-profitbody(e.g.bya celebrityofdefamationdamages)islikelynotasupplysubjecttoGST.

Adiscretionarytrustdistributionisnotforconsiderationsosettlementtermsthatprovidefora discretionarytrustdistributionislikelynotasupplysubjecttoGST.However,anyin-speciedistributionof property(otherthanAustralianCurrency)mayitselfbeasupply.

Rule6CompensationconcerningtheconsiderationinrespectofanEarlierSupplyistaxedasan adjustmenttotheEarlierSupplyconsideration.

123 Sec.38-190(1)GSTA1999;ATORulingGSTR2003/7at[24][25]and[44].

124 Sec9-15GSTAA1999;ATORulingGSTR2001/6.

125 TT-LineCompanyP/LvFCT[2009]FCAFC178governmentferryrebate.

16 ©RonJorgensen2022

WherethesubjectoftheclaimisanEarlierSupplybetweentheparties,compensationpaidisattributed tothatEarlierSupply.126

WheretheonlysupplyisanEarlierSupply(otherthanaDiscontinuanceSupply),compensationpaidfor theearliersupplyorinreductioninthepriceoftheearliersupplyisconsiderationforthatsupply127which mayresultinaGSTadjustmenteventwithadditionalGSTpayableorrefundable.

Example11

InFQJune2019,WholesaleP/LsoldEuropeanfloortilestoRetailerP/Lfor$300,000+$30,000GST(EarlierSupply).InDecember2019, thetilesdeliveredwereinferiornon-Europeantilesvaluedat$200,000+$20,000GST.InFYJune2020,RetailerP/Lsettledtheclaimby WholesalerP/Lrepaying$100,000.

InFQJune2019,RetailerP/Lpaid$30,000GSTandclaimeda$30,000inputtaxcreditandWholesalerP/Lremitted$30,000GSTonsaleof theEuropeanfloortiles.InFQJune2020,RetailerP/LreducedtheconsiderationoftheEarlierSupplyto$200,000+$20,000GST.Retailer P/LhadanadjustmenteventforthechangeinGSTof$10,000($30,000-$20,000)intheFQJune2020BusinessActivityStatementand receivesarefundofthe$10,000inputtaxcreditfromtheATO.128

Rule7CompensationpaidinrespectofaCurrentSupplyisattributedtotheCurrentSupply.

WherethesubjectoftheclaimisnotanEarlierSupplybetweentheparties,compensationpaidis attributedtotheCurrentSupply.129

WheretheonlysupplyisaCurrentSupply(otherthanaDiscontinuanceSupply),compensationis considerationforthatCurrentSupply.130

Example12

17 ©RonJorgensen2022

InFQJune2019,BrandNameP/LsuedPlagiariserP/LforbreachofTradeMarkandpassingoffforuseofBrandName.InFQJune2020, BrandNameP/LsettledtheclaimbyPlagiariserP/Lpaying$100,000plus$10,000GSTandsub-licencingtheuseofBrandNameto

GSTintheFQJune2020BusinessActivityStatementandPlagiariserP/Lclaimed$10,000GSTinputtaxcreditsintheFQJune2020

PlagiariserP/L. InFQJune2020,BrandNameP/LmadeaCurrentSupplyofBrandNameLicencefor$100,000plus$10,000GSTandremitted$10,000

BusinessActivityStatementandreceivedarefundofthe$10,000inputtaxcreditfromtheATO.131

126 ATORulingGSTR2001/4at[46]. 127 ATORulingGSTR2001/4at[101]. 128 ATORulingGSTR2001/4at[104]and[126]. 129 ATORulingGSTR2001/4at[48]. 130 ATORulingGSTR2001/4at[49].

Rule8AdiscontinuanceofaclaimwithoutconsiderationisaDiscontinuanceSupplynotsubjectto GST.

WherethesubjectoftheclaimisnotanEarlierSupplybetweenthepartiesoraCurrentSupplycreated bythetermsofsettlement,discontinuanceoftheactionisattributedtoaDiscontinuanceSupplycreated bythetermsofsettlement.132

Termsdiscontinuingaclaimwillinvariablyreleaserightsoffurtherlegalactionandclaimsprovide obligationssuchasconfidentialityfornoconsiderationotherthanthemutualexchangeofrightsand obligationsisnotasupplyforconsideration.133

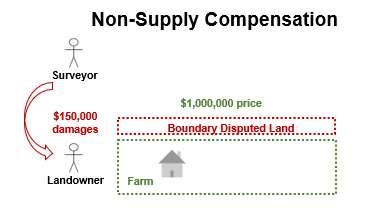

Rule9Wherethesubjectofaclaimisnotasupply(e.g.forDamagesorLegalCosts),theclaimitselfis notasupply(Non-SupplyCompensation).

Adisputeinrespectofanincidentthatdoesnotrelatetoasupply(e.g.breachofcontract,property damage,negligence,orpersonalinjuryorotherunilateralincident),isnotitselfasupply.134

AnorderforpaymentofLegalCostsisakintodamagesforthecostsoftheclaimfordamagesoisnota supply.135

Example13

InJune2019,LandownerengagedSurveyortoboundarychecktheFarmduringduediligencetoacquiretheFarm(EarlierSupply).Surveyor confirmedtheboundariesoftheFarmwerecorrectandtheLandowneracquiredtheFarmfor$1,000,000.Adisputeovertheboundaryarose withtheneighbouranditwasidentifiedthattheNorthernboundarieswereincorrectandtheFarmwereresurveyedwithaconsequential15% reductioninpropertysize.InJune2020,LandownersettledtheclaimbySurveyorpaying$150,000damages.

ThecompensationdoesnothaveaconnectionwiththeEarlierSupplyoftheSurveyingservicesortoaCurrentSupply.

FQJune2020,theLandownerdisposesoftheclaimagainsttheSurveyorforprofessionalnegligencedamagethatdoesnotrelatetoand EarlierSupplyoraCurrentSupplysoisaNon-SupplyandnotsubjecttoGST.

ATORulingGSTR2001/4at[49].

ATORulingGSTR2001/4at[55].

ATORulingGSTR2001/4at[71].

ATORulingGSTR2001/4.

ATORulingGSTR2001/4at[60].

Sec.9-10(4)GSTA1999;ATORulingGSTR2001/4at[61]and[67].

18 ©RonJorgensen2022

Acourtgivingjudgementorimposinguponthedefendanttopayajudgementsumorotherobligationis notasupplybythecourtsoisnotsubjecttoGST.136

132

133

134

Rule10CourtJudgmentandpaymentofajudgmentdebtisnotasupply,soisnotsubjecttoGST.

Thepayment,inmoney,ofajudgementdebtisanexcludedsupplyofcurrency.137 131 ATORulingGSTR2001/4at[104]and[126].

135

136

137

Duty

Insummary,theRulesofThumbforDutyare:

Rule1ThetransferringdutiablepropertyunderasettlementissubjecttoDuty,unlessanexemptionor concessionapplies.

Rule2Compensationalteringconsiderationistaxedasanadjustmenttotheoriginaltransaction consideration.

Overview

Rule1ThetransferringdutiablepropertyunderasettlementissubjecttoDuty,unlessanexemptionor concessionapplies.

ThetransferofdutiablepropertyunderasettlementissubjecttoDutyunlessanexemptionofconcession applies.

Transferdutyischargedonthetransfereeonthedutiablevalue138(i.e.thegreaterofconsideration139or unencumberedvalue140withoutreductionforGST)ofadutiabletransaction141(i.e.transfer)inrespectof dutiableproperty142(i.e.landorlanduseentitlement)asatthedateofthedutiabletransaction(i.e. signingorsettlementofthecontractofsale),143unlessexemptoraconcessionapplies.

Landholderdutyischargedontheacquirerontheunencumberedvalue144oftherelevantacquisition145 (e.g.transfer,allotment,redemption)ofasignificantinterest(e.g.50%ormore)interestinaprivateunit trustschemeorprivatecompanyor90%ormoreinapublicunittrustschemeorpubliccompany146)ina landholder(e.g.privatelandholderorpubliclandholderunittrustorcompany)147withatleast$500,000,148 unlessexemptoraconcessionapplies.

Landuseentitlementdutyischargedontheacquirer149onthedutiablevalue150oftheacquisitionofa landuseentitlement(i.e.ashareinacompanyoraunitinaunittrustthatgrantstheowneroccupationof landownedbythecompanyortheunittrust)byanallotmentofsharesorunits.151

Forexample,exemptionsorconcessionsmayincludeundertheDeceasedEstateConcession,152 Marriage/RelationshipBreakdownExemption153orCompulsoryAcquisitionExemption.154

Rule2Compensationalteringconsiderationistaxedasanadjustmenttotheoriginaltransaction consideration.

Analterationtoconsideration(includingGST)ofanearlierdutiabletransactionwillbeanadjustmentto theoriginaltransactionconsiderationsoadifferentamountofdutywasthenpayable.

138 Sec.18DAT2001. 139 Sec.19DAT2001. 140 Sec.20DAT2001. 141 Sec.6orsec.7DAT2001. 142 Sec.9DAT2001. 143 Sec.10DAT2001;MederivCSR(Vic)[2010]VCAT49. 144 Sec.81DAT2001.

145 Sec.65&sec.66DAT2001;Noteasignificantinterestforapublicunittrustschemeorcompanyis90%ormore. 146 Sec.66DAT2000. 147 Sec.61DAT2001. 148 Sec.61DAT2001. 149 Sec.87DAT2001. 150 Sec.90DAT2001. 151 Sec.DAT2001. 152 Sec.47DAT2008inconformitywithanorderunderTestatorFamilyMaintenanceAct1912(Tas). 153 Sec.56,sec.56Aorsec.57DAT2001. 154 Sec.57ADAT2001.

19 ©RonJorgensen2022

'Consideration'isthemonetaryconsiderationpaidorvalueofnon-monetaryconsiderationgiventhat movesthedutiabletransaction155andisgenerallythecontractualamountspecified156butmayincludethe valueofcollateralagreements157orpropertygiven158whetherreceivedfromtheacquirerorthirdparty159 ortheassumptionofliabilities,160butexcludesarebateordiscount(asopposedtoarefundorset-off).161

'Unencumbered'valueistheamountforwhichthedutiablepropertymightreasonablyhavebeensoldin theopenmarketatthetimethecontractofsalewasenteredinto(orthedutiabletransactionoccurred) freefromanyencumbrances(e.g.mortgages,caveats,liensandcharges162).

Wherethecompensationalterstheconsiderationofanearlierdutiabletransaction(e.g.proceedsorGST) orevidencesachangeintheunencumberedvalueofdutiablepropertyatthetimeofthedutiable transaction,thetaxpayermayappyforareassessmentofdutyandpayadditionaldutyorobtainarefund ofoverpaiddutywithin5yearsofthedutiabletransaction.163

PayrollTax

Insummary,theRulesofThumbforDutyare:

Rule1CompensationalteringWagesistaxedasanadjustmenttoWagesinthepreviousorcurrent period.

Overview

Rule1CompensationalteringWagesistaxedasanadjustmenttoWagesinthepreviousorcurrent period.

AnalterationtoWages(excludingGST)ofanearlierperiodwillbeanadjustmenttoWagesinthe previousorcurrentperiod.

Upto6.1%payrolltaxisleviedontheTasmanianwages(ordeemedwages)payablebyanemployer(or groupemployer)totheemployees,directors,certainformerdirectorsanddesignatedcontractors,164ifthe totaltaxableAustralianwagesexceeds$1,250,000perannum.165

'Wages'(ordeemedwages)includeremunerationpayableforservicesorunderprescribedcontracts,166 non-cashbenefits,167taxablefringebenefits,168superannuationcontributions,169shareandoption plans,170terminationpayments171ofemployees,directors,certainformerdirectorsanddesignated contractors,172butexcludingtheexemptwages173orexemptmotorvehicleandaccommodation allowancecomponents.174

155 Sec.19DAT2001;CSR(NSW)vDickSmithElectronicsHoldingsP/L[2005]HCA3.

156 CSRVvBuckland[1959]VR517at529.

157

158

CSR(NSW)vDickSmithElectronicsHoldingsP/L[2005]HCA3.

BrookfieldMultiplexLtdvInternationalLitigationFundingPartnersPteLtd(No3)[2009]FCA450at[15][16];[2009]FCAFC147at[223][234].

159 DenamanP/LvCSRV[2001]VCAT2233.

160 DavisInvestmentsP/LvCSR(NSW)[1958]HCA22;ArchibaldHowieP/LvCSR(NSW)[1948]HCA28.

161

162

OaklandPropertyHoldingsP/LvCSR(NSW)[2009]NSWSC1190at[21]&[24]-[25].;RulingDA.012

CSR(Vic)vBradneyP/L[1996]VSC71.

163 Sec.28TAAT1997;TaxationAdministrationGuidelines(Tas).

164 Sec.7PTAT2008.

165 Pro-ratedforeachcalendarmonth.

166 Sec.13PTAT2008.

167 Sec.13PTAT2008. 168 Sec.14PTAT2008. 169 Sec.17PTAT2008. 170 Sec.18PTAT2008. 171 Sec.27PTAT2008. 172 Sec.31PTAT2008. 173 Pt.4PTAT2008. 174 Sec.29&30PTAT2008.

20 ©RonJorgensen2022

WagesexcludesGST175andiftheemployerisaninterposedintermediary,anyamountspayable(e.g. ImportantlyTerminationPaymentsexcludestaxfreeparofa genuineredundancypaymentandcompensationforpersonalinjury.176

WherethecompensationalterstheconsiderationofWages,thetaxpayermayappyforareassessment ofpayrolltaxandpayadditionalpayrolltaxorobtainarefundofoverpaidpayrolltaxwithin5yearsofthe dutiabletransaction.177

Examples

Belowareanumberofcommoncompensationclaimsandarebasedonconsolidationsoftheexamples inthispaper.

Landdamage

InJune2019,LandownerengagedSurveyortoboundarychecktheFarmduringduediligencetoacquiretheFarm.Surveyorconfirmedthe boundariesoftheFarmwerecorrectandtheLandowneracquiredtheFarmfor$1,000,000.Adisputeovertheboundaryarosewiththe neighbouranditwasidentifiedthattheNorthernboundarieswereincorrectandtheFarmwereresurveyedwithaconsequential15% reductioninpropertysize.InJune2020,LandownersettledtheclaimbySurveyorpaying$150,000damages.InJune2022,Landownersell theFarmfor$900,000.

ThecompensationhasadirectandsubstantiallinktotheFarmPropertyconcerningthereductioninvalueduetothereducedsizeofthe land.178

Forincometax,inFY2019,Landownerincurred$1,000,0000capitalgainstaxcostbasefortheFarm.Asthecompensationisforlossof valueoftheFarmthecompensationisattributabletotheunderlyingasset,land.InJune2020,theLandownerreducesthecapitalgainscost basefortheFarmto$850,000($150,000compensation).WhileLandownerhasnoimmediatetaxconsequencebecausethereisnodisposal oftheFarmwhenLandownerselltheFarmLandownerineffectpayscapitalgainstaxon$150,000calculatedusingthereducedcapitalgains costbase($900,000-$850,000)(reducedforthe50%CGTDiscount).

ForGSTthecompensationdoesnothaveaconnectionwiththeEarlierSupplyoftheSurveyingservicesortoaCurrentSupplysoisaNonSupplyandnotsubjecttoGST.

175 Sec.44PTAT2008.

176 TSRORulingPTA.004TerminationPayments.

177 Sec.28TAAT1997;TaxationAdministrationGuidelines(Tas).

178 CarborundumRealtyP/LvRAIAArchitectureP/L[1993]VicSC273.

21 ©RonJorgensen2022

Landdisposalcompulsorylandacquisition

InJune2019,AuthoritygavenoticeundertheLandAcquisitionAct1993(Tas)tocompulsorilyacquirepartofLandowner'sfarm.TheFarm wasvaluedat$1,000,0000andtheacquiredlandwasvaluedat$300,000.InJune2021,LandownerandAuthoritysettledthecompensation claimandAuthoritypaid$300.000.InJune2023,Landownersellstheinvestmentpropertyfor$900,000.

ThedisposalofcompulsorilyacquiredlandtotheAuthoritywillbeaCGTeventsubjecttocapitalgainstax,179 unlesscompulsorilyacquired rolloverreliefapplies.Alandownercanchoosecompulsorilyacquiredrolloverreliefwherelandiscompulsorilyacquired:180

1.underacompulsorylandacquisitionstatute;orunderalandacquisitionagreemententeredintoafternoticeinvitinganegotiated acquisitionprovidedthatthenoticestatedthatifnegotiationswereunsuccessful,thelandwouldbecompulsorilyacquiredundera compulsorylandacquisitionstatute;and

2.themoneyisreceivedascompensationforthecompulsoryacquisitionoftheland;and

3.themoneyisexpendedtoacquirereplacementlandusedinabusinessortobeusedforthesameorsimilarpurposeasthe compulsorilyacquiredlandortorepairorrestorepartoftheretainedland;and

4.atleastsomeoftheexpenditureisincurredwithinoneyearbeforethecompulsorilyacquisitionofthelandorwithinoneyearafterthe endoftheincomeyearinwhichthecompulsorilyacquisitionoflandoccurred.

Landownerdidnotsatisfytherequirementsforrolloverrelief.

Forincometax,asthecompensationisfordisposaloftheFarm,thecompensationisattributabletotheunderlyingasset,land.InJune2021, theLandownerreducesthecapitalgainscostbasefortheFarmto$700,000($1,000,000-$300,000compensation).WhileLandownerhas noimmediatetaxconsequencebecausethereisnodisposaloftheFarm,whenLandownerselltheFarmLandownereffectivelypayscapital gainstaxon$300,000calculatedusingthereducedcapitalgainscostbase(reducedforthe50%CGTDiscount).

ForGST,thecompulsoryredemptionoflandbyanauthoritydoesnotconstituteasupplyforGSTpurposes,unlessthelandownerhas activelyinstigatedorcausedtheredemption.181

Dutyisgenerallypayablebythetransfereebutisnotpayablebythecrownoncompulsoryacquisitionundercrownimmunitybutonlysome crowninstrumentalitiesenjoycrownimmunity.182

Breachofcontract

InJune2019,WholesaleP/LsoldEuropeanfloortilestoRetailerP/Lfor$300,000.InDecember2019,thetilesdeliveredwereinferiornonEuropeantilesvaluedat$200,000.InJune2020,RetailerP/LsettledtheclaimbyWholesalerP/Lrepaying$100,000.

Forincometax,inFY2019,WholesalerP/Lderived$300,000assessableincomeandpaidtaxandRetailerP/Lincurred$300,0000general deductionandpaidtax.Assettlementoftheclaimreducedtheconsiderationoftheoriginaltransaction,WholesalerP/LwillamendtheFY 2019returnreducingassessableincomeandreceivearefundofoverpaidtax.RetailerP/LwillamendtheFY2019returnincreasing assessableincometoreversethedeductionandpayadditionaltax.183

179 Sec.104-10ITAA1997;ATODeterminationTD2001/9.

180 Sec.124-70ITAA1997andsec.124-75ITAA1997.

181 ATORulingGSTR2006/9at[80]to[90];HornsbyShireCouncilvFCT[2008]AATA1060;SXGXvFCT[2011]AATA110.

182 McKetchnievConnell(No2)(1993)9WAR162;ProspectCountyCouncilvCSD(NSW)92ATC4799(1992)24ATR280.

183 HRSinclair&SonP/LvFCT[1966]HCA39.

22 ©RonJorgensen2022

ForGST,inFQJune2019,RetailerP/Lpaid$30,000GSTandclaimeda$30,000inputtaxcreditandWholesalerP/Lremitted$30,000GST onsaleoftheEuropeanfloortiles.InFQJune2020,RetailerP/LreducedtheconsiderationoftheEarlierSupplyto$200,000+$20,000 GST.RetailerP/LhadanadjustmenteventforthechangeinGSTof$10,000($30,000-$20,000)intheFQJune2020BusinessActivity Statementandreceivesarefundofthe$10,000inputtaxcreditfromtheATO.184

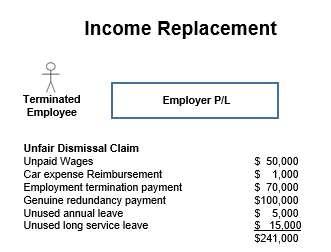

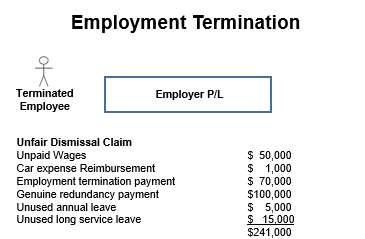

Employmentterminationcompensation

EmployerP/L.constructivelyterminatedMrEmployeeandsettledtheunfairdismissalclaimforpaymentofvariousAwardentitlementsand agreedemploymentterminationpaymentandgenuineredundancypayment.

Incometaxonthecompensationamountsisinthesamemannerasthesubstitutedincome:

Unpaidwagesassessableremuneration185

Carexpensereimbursementassessablereimbursement186

Employmentterminationpaymentassessableremuneration187

Genuineredundancypayment-taxfree188

Unusedannualleaveassessableremuneration189 Unusedlongserviceleave-assessableremuneration190

GSTisnotpayableonthecompensationbecauseEmployeeisdeemednottobecarryingonanenterpriseandmakingasupplyinthe courseofanenterprise.191

PayrolltaxispayableonthecompensationbeingadditionalWages192 orTerminationPaymentWages193 otherthanthetaxfreecomponentof thegenuineredundancypayment.194

184 ATORulingGSTR2001/4at[104]and[126].

185 Cuttikonda&ShethvFCT[2022]AATA1325.

186 sec.15-70ITAA1997.

187 sec.82-130ITAA1997;DibbvFCT[2004]FCAFC126.

188 sec.83-170ITAA1997:$10683+$5,320p/serviceyeartaxfreethreshold.

189 Sec.83-10ITAA1997;HeinrichvFCT[2011]AATA16.

190 Sec.83-75ITAA1997;HeinrichvFCT[2011]AATA16.

191 Sec.9-20GSTA1999;ATORulingMT2006/1at[329].

192 Sec.13PTAT2008.

193 Sec.27PTAT2008.

194 TSRORulingPTA.004TerminationPayments.

23 ©RonJorgensen2022

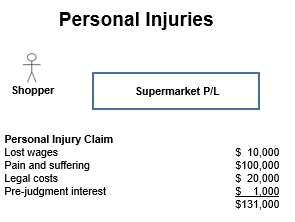

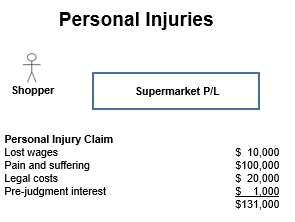

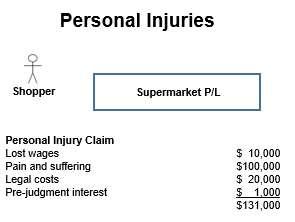

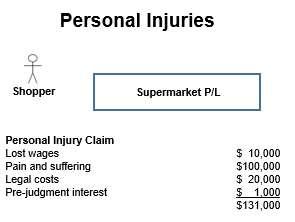

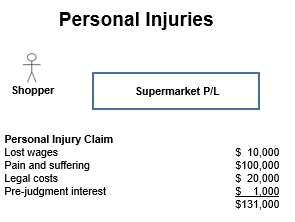

Personalinjurylumpsums

ShopperslippedandfellinaliquidspillwhileshoppinginSupermarketP/LsustainingbackinjurieswhichprohibitedShopperfromworkingfor twomonths.SupermarketP/Lsettledthepersonalinjuryclaimbypayingdamagesforlostwages,painandsuffering,reimbursementoflegal costsandprejudgmentinterestof$131,000.

Incometaxonthecompensationamountsisinthesamemannerasthesubstitutedincome:

Unpaidwagesassessableremuneration195 PainandSufferingdisregardedcapitalgain196 Legalcostsdisregardedcapitalgain197 Pre-judgmentinterest-disregardedcapitalgain 198

GSTisnotpayableonthecompensationbecauseaclaimforpersonalinjuriesdoesnotarisefromasupplyandisaNon-Supply.199 PayrolltaxisnotpayableonthecompensationbeingforpersonalinjuriesandnotadditionalWages200 orTerminationPaymentWages.201

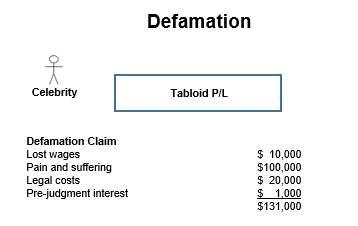

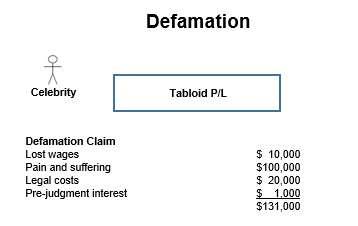

Defamationdamages

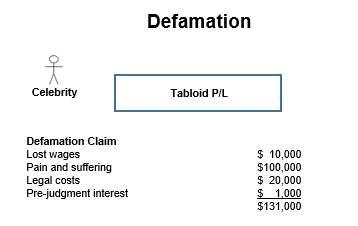

195

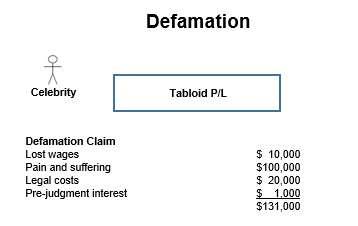

CelebritywasaccusedinanarticlepublishedbyTabloidP/Lofbuyingdrugsatalocalcoastaltownrestaurantwiththearticlefeaturinga photographofCelebritybeinghandedabagofsmalldriedleaves.Afteralengthytrial,theCourtdeterminedthearticlewasdefamatory becausethesmallbagofleaveswasaspecialmixofItalianherbsusedincookingattherestaurantforCelebritytouseathome.TabloidP/L wasorderedtopaydamagesforlostwages,painandsuffering,reimbursementoflegalcostsandprejudgmentinterestof$131,000.

Incometaxonthecompensationamountsisinthesamemannerasthesubstitutedincome:

Unpaidwagesassessableremuneration202

LossofReputationdisregardedcapitalgain203

Legalcostsdisregardedcapitalgain204

Pre-judgmentinterest-disregardedcapitalgain 205

GSTisnotpayableonthecompensationbecauseaclaimforpersonalinjuriesdoesnotarisefromasupplyandisaNon-Supply.

Cuttikonda&ShethvFCT[2022]AATA1325.

196 sec.118-37ITAA1997ATORulingTR95/35at[210]and[217].

197 Sec.110-25(6)ITAA1997;ATORulingTR95/35at[157];ATODeterminationTD2017/10at[1].

198 Sec.118-37ITAA1997;ATORulingTR95/35at[245].

199 ATORulingGSTR2001/4at[71].

200 Sec.13PTAT2008. 201 Sec.27PTAT2008;TSRORulingPTA.004TerminationPayments.

202 Cuttikonda&ShethvFCT[2022]AATA1325.

203 sec.118-37ITAA1997ATORulingTR95/35at[210]and[217].

204 Sec.110-25(6)ITAA1997;ATORulingTR95/35at[157];ATODeterminationTD2017/10at[1]. 205 sec.118-37ITAA1997ATORulingTR95/35at[245].

24 ©RonJorgensen2022

206

PayrolltaxisnotpayableonthecompensationbeingforpersonalinjuriesandnotadditionalWages207 orTerminationPaymentWages.208

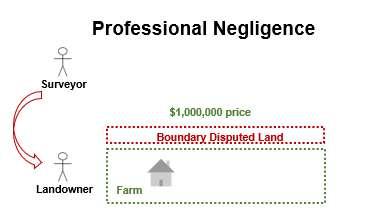

Professionalnegligence

InJune2019,LandownerengagedSurveyortoboundarychecktheFarmduringduediligencetoacquiretheFarm.Surveyorconfirmedthe boundariesoftheFarmwerecorrectandtheLandowneracquiredtheFarmfor$1,000,000.Adisputeovertheboundaryarosewiththe neighbouranditwasidentifiedthattheNorthernboundarieswereincorrectandtheFarmwereresurveyedwithaconsequential15% reductioninpropertysize.InJune2020,LandownersettledtheclaimbySurveyorpaying$150,000damages.InJune2022,Landownersell theFarmfor$900,000.

ThecompensationhasadirectandsubstantiallinktotheFarmPropertyconcerningthereductioninvalueduetothereducedsizeofthe land.209

Forincometax,inFY2019,Landownerincurred$1,000,0000capitalgainstaxcostbasefortheFarm.Asthecompensationisforlossof valueoftheFarmthecompensationisattributabletotheunderlyingasset,land.InJune2020,theLandownerreducesthecapitalgainscost basefortheFarmto$850,000($150,000compensation).WhileLandownerhasnoimmediatetaxconsequencebecausethereisnodisposal oftheFarmwhenLandownerselltheFarmLandownerineffectpayscapitalgainstaxon$150,000calculatedusingthereducedcapitalgains costbase($900,000-$850,000)(reducedforthe50%CGTDiscount).

ThecompensationdoesnothaveaconnectionwiththeEarlierSupplyoftheSurveyingservicesortoaCurrentSupply. ForGST,FQJune2020,theLandownerdisposesoftheclaimagainsttheSurveyorforprofessionalnegligencedamagethatdoesnotrelate toandEarlierSupplyoraCurrentSupplysoisaNon-SupplyandnotsubjecttoGST.

DraftingSettlementDeed

Recitalsareanon-bindinganaidtointerpretationandestablishagreedfactsbetweentheparties.210

Whenpreparingasettlementdeedandconsentorders,theRecitalsareinvaluableinestablishingor severingtheconnectionbetweenthecompensationandthegroundsofclaimandunderlyingasset.

TheATOwillgenerallyaccepttheallocationofanamountbetweenitsdissectedpartsprovidetheparties dealwitheachotheratarm'slengthinreachingtheiragreement.211

Thesettlementdeedorconsentordercanallocatecompensationbetweendifferentclaims,assetsand rightsandobligationsonarationalbasistocreatethenexusbetweenthecompensationandtheagreed taxtreatment.

Thesettlementdeedorconsentorderscanprescriberightsandobligationstoensurethepreconditions fortaxtreatment(e.g.GSTregistration)aremaintained.Forexample,thepartiescanbepreventedfrom retrospectivelycancellingregistrationaftercompletionwhichwouldresultinadifferentGSTtreatment.212

ThesettlementdeedorconsentorderscanmakerelevantelectionssuchasapplyingtheGST-freeGoing ConcernConcession.213

206 ATORulingGSTR2001/4at[71].

207 Sec.13PTAT2008.

208 Sec.27PTAT2008;TSRORulingPTA.004TerminationPayments.

209 CarborundumRealtyP/LvRAIAArchitectureP/L[1993]VIcSC273.

210 FranklinsP/LvMetcashTradingLtd(200+9)76NSWLR3603at[379]-[391].

211 ATORulingTR1999/16at[33]-[35].

212 EmpireSecuritiesP/LvMiocevich[2004]WASC118.

213 Sec.38-325GSTA1999;

25 ©RonJorgensen2022

ThesettlementdeedcanprovidetermstoobtainaprivaterulingfromtheATOtodeterminethecorrector agreedtaxtreatmentofcompensation.

Thesettlementdeedcanprovidethetaxindemnitytermsanddisputeresolutionprocedures.

Exampleclausesare:

1.1

Goods&ServicesTax

(a)ExpressionsusedinthisclausehavethemeaningascribedtothemundertheGSTA1999,unlessthecontextotherwiserequires.

(b)AllamountsinrespectofataxablesupplyareexpressedasGSTexclusiveamounts(unlessotherwisestated).

(c)Ifapartymakesataxablesupplyunderthisdeed,therecipientofthattaxablesupplymustinadditionalsopaytheamountofanyGST payableinrespectofthattaxablesupply.

(d)TherecipientofthetaxablesupplyunderthisdeedwillpaytheGST: (i)atthesametimeandinthesamemannerinwhichthepaymentforthetaxablesupplyisdue;or (ii)inanyothercase,atthedateandinthemannerthesupplierspecifiesbyNoticetotherecipient.

(e)TherecipientofataxablesupplyunderthisdeedisnotobligedtopaytheGSTonataxablesupplyuntilthesuppliergivestherecipienta validtaxinvoiceforthattaxablesupply.

(f)Ifapartyistopay,reimburseorcontributetoanyliabilityoroutgoingincurredbyanotherpartytoathirdpartyunderthisdeed,theamount tobepaid,reimbursedorcontributedwillbetheamountoftheliabilityoroutgoingnetofanyinputtaxcredittowhichthepayingpartyis entitledinrespectofthatliabilityoroutgoing.

(g)Eachpartywarrantsinrespectofataxablesupplyunderthisdeedthatatthetimeofthattaxablesupplythat:

(iii)thepartywasandisregisteredorrequiredtoberegisteredforGST;and

(iv) Schedule1wasandiscorrect;and

(v)thepartywas,isorwillbeandwillremainregisteredforanABNandforGSTpurposesatthetimeofthetaxablesupplyso thatanyinputtaxcreditinrespectofthetaxablesupplycanbeclaimedbytherecipient.

1.2

PrivateRuling

(a)Aftertheexecutionofthisagreement,thePurchaserwill,atthePurchaser'ssolecost,applyonbehalfoftheVendorandthePurchaserto theCommissionerforaprivaterulingunderDivision359TAA1953onwhetherthesupplyofthePropertyunderthisagreementbythe VendortothePurchaseris:

(i)whollyorpartlytheinputtaxedsupplyofresidentialpremisesundersection40-65GSTA1999andnotnewresidential premisesundersection40-75GSTA1999;or

(ii)whollyorpartlythetaxablesupplyundersection9-5GSTA1999inrespectofwhichGSTispayableundersection9-40 GSTA1999;and

(iii)ifpartlynotataxablesupplyandpartlyataxablesupplyundersection9-5GSTA1999,thetaxableproportionundersection 9-80GSTA1999.

(b)Therelevantprovisionstoberuleduponarelimitedtotheprovisionsspecifiedinthisagreement,unlessotherwiseagreedbetweenthe partiesinwriting.

(c)IftheCommissionerhasdeclinedtomakeaprivateruling,hasmadetheprivaterulingonabasisotherthanbeingwhollyorpartlyaninput taxedsupplyortaxablesupplyorhasnotgivenaprivaterulingtotheVendorandthePurchaserbefore[DATE],thesupplyoftheProperty underthisagreementwillbewhollyataxablesupplyundersection9-5GSTA1999inrespectofwhichGSTispayableundersection9-40 GSTA1999.

(d)TheVendorandthePurchaserwilltreatthesupplyofthePropertyunderthisagreementwhollyorpartlyastheinputtaxedsupplyorthe taxablesupplyofthePropertyinconformitywiththeprivaterulinggivenbytheCommissioner.

(e)TheprivaterulinggivenbytheCommissionerwillbindtheVendorandthePurchaserandthepartieswillnotobject,reviewordisputetothe privaterulingmadeunderPartIVCTAA1953ortheJudiciaryAct1901(Cth)orgenerallyinanycourtortribunalofcompetentjurisdiction.

(f)TheVendordelegatestothePurchasertheday-to-daymanagementoftheprivaterulingunderthisagreementsubjecttothePurchaser disclosingallcorrespondencesbetweenthePurchaserandtheCommissionerinrespectoftheprivateruingwithinareasonabletime

(g)Eachpartywillprovideorwillcausetobeprovidedtoeachotherpartyallreasonableassistance,informationandexplanationinrespectof theProperty,thetransactionscontemplatedbyoreffectedpursuanttothisagreement.

(h)Therecipientofanyinformationordocumentunderthisagreementmustcontinuallymaintaintheconfidentialityofthatinformationother thanasrequiredbylaw.

(i)ThePurchaserwillpaytheVendor(ortheVendor'slawyers)anamountofupto$[AMOUNT]plusGST(orsuchadditionalamountas agreedbythePurchaser)forreasonablelegalfeesanddisbursementsincomplyingwithanyinformationrequestandcorrespondencefrom thePurchaserortheCommissionerinrespectofthelodgedprivaterulingapplication.

1.3

DisputingPrivateRuling

(a)Apartywillwithin5BusinessDaysofthereceiptofnoticefromtheCommissionerorothergovernmentauthorityinrespectofan investigation,auditorliabilityorpotentialliabilityunderthisagreementtgivetheotherpartywrittennoticecontainingacertifiedcopyofthe notice,anyadjustmentsheetsandreasonsfordecisiongivenbytheCommissionerorothergovernmentauthority.

(b)ThePurchasermay,atthePurchaser'ssolecost,onbehalfoftheVendororthePurchaser(asapplicable)dispute,object,revieworappeal anynoticeorassessmentunderthisagreementunderPartIVCTAA1953,theJudiciaryAct1901(Cth)orgenerallyinanycourtortribunal ofcompetentjurisdiction.

(c)ThePurchaserwillpaytheamountofanydisputedliabilityunderthisagreementtotheVendorortheCommissioner(asapplicable)asand whenduewithoutdeduction.

26 ©RonJorgensen2022

1.4

(d)Eachpartywillprovideorwillcausetobeprovidedtoeachotherpartyallreasonableassistance,informationandexplanationinrespectof orarisingoutoforinconsequenceofthenoticefromtheCommissionerorothergovernmentauthorityunderthisagreement.

(e)TheindemnitywillapplytoanyincreaseoradditionalliabilityimposedontheVendorconsequentialofthePurchaseractsoromissions underthisagreement.

(f)ThePurchaserwillpaytheVendor(ortheVendor'slawyers)theamountofreasonablelegalfeesanddisbursements(tobeagreed)in complyingwithanyinformationrequestandcorrespondencefromthePurchaserortheCommissionerorgovernmentauthorityinrespect thisagreement.

(g)Apartywilltakesuchaction,pay,reimburseormakeacompensatoryadjustmenttotheotherpartyinrespectofanyliabilityunderthis agreementtogiveeffecttothedeterminationofthedisputeofliabilityunderthisagreement.

TaxIndemnity

(a)Eachparty(indemnifier)willcontinuallyindemnifyeachotherparty(indemnified)for7yearsfromtheendofaFinancialYearagainstany increasedofanyamountwhichanindemnifiedmaybeliabletopayinrespectofanyTaxAssessmentarisingoutofperformingthisdeed.

(b)Eachparty(indemnifier)willcontinuallyindemnifyeachotherparty(indemnified)for7yearsfromtheendofaFinancialYearagainstany increasedofanyamountwhichanindemnifiedmaybeliabletopayinrespectofanyTaxAssessmentarisingoutofcarryingonthe Business.

(c)Eachparty(indemnifier)willcontinuallyindemnifyeachotherparty(indemnified)for7yearsfromtheendofaFinancialYearInterest againstanyincreasedofanyamountwhichanindemnifiedmaybeliabletopayinrespectofanyTaxAssessmentinrelationtoorarising outofanyEnterprise,investmentorliabilityotherthancarryingontheBusiness,excepttotheextentthatsuchloss,damageorinjury

1.5

NoticeofClaim

(a)Theindemnifierdoesnothavetoindemnifyanindemnified,unlesstheindemnifiedhasgivenaNoticetotheindemnifierwithin10Business DaysofthereceiptofaTaxAssessment.

(b)TheNoticemustcontainfullparticularsoftheclaimunderthisclauseandacertifiedcopyoftheTaxAssessment,anyadjustmentsheets andreasonsfordecisionsuppliedbytheGovernmentalAgencyrelatingtothatTaxAssessmentandtherelevantreturnlodgedbythe indemnified.

(c)TheindemnifiermaydisputetheTaxAssessmentonbehalfoftheBusinessasagentfortheindemnifiedortheBusiness(asapplicable).

(d)IfpaymentoftheTaxAssessmentisrequiredinordertodisputetheTaxAssessment,beforeservinganyprocessfordisputingtheTax AssessmenttheindemnifiermustpaytheamountoftheTaxAssessmentto:

(i)theindemnified,iftheindemnifiedhasalreadypaidtheamountoftheTaxAssessmenttotherelevantGovernmentAgency; or (ii)therelevantGovernmentalAgency.

(e)TheindemnifiermustcontinuallyindemnifytheindemnifiedforanyamountincurredindisputingtheTaxAssessment(includingLegal Fees).

Conclusion

Underthepressureofnegotiatingacompensationclaimandpreparingtermsofsettlementitiseasyto forgetabouttheresultanttaxliabilities.Welldraftedtermsofsettlementspecifyandfacilitatetheagreed taxtreatmentandresponsiblepartyliablefortaxandfortaxadministrationcompliance.

Ifalitigationpractitionerappliesthefollowingrulesofthumb,mostcompensationsettlementswillbe taxedcorrectly:

1.theATOappliesanunderlyingassetlook-throughapproach,butnotforun-dissectedamounts,so bespecificandavoidundissectedcompensationintermsofsettlement;

2.thetaxtreatmentofthecompensationisalignedwiththetaxtreatmentoftheunderlyingassetso understandfromthetaxaccountantsthetaxnatureandtreatmentoftheunderlyingassetbefore negotiatingtermsofsettlement;

3.thetaxtreatmentofthecompensationisalignedwiththenatureoftheheadofclaimsettled,but notfor'allclaims'settlement,sobespecificandavoidallclaimssettlements;

4.thetermsofsettlementcandeterminethetaxtreatmentandpartyliabletotaxandreporting obligations;and

5.thecourtshaveaninconsistentapproachtotax-grossupcompensation,butthisshouldbea standardsettlementtermforplaintiffs;and

6.leavingtaxtothetaxaccountantspostsettlementisusuallytoolatesoengageearlywiththetax accountants.

27 ©RonJorgensen2022

1November2022

RonJorgensen Partner-Tax ThomsonGeerLawyers

CharteredTaxAdviser

AccreditedSpecialistinTaxLaw

T0380803729

M0414967411

F0380803599

ALevel23,RialtoSouthTower,525CollinsStreet,Melbourne,Victoria,3000

Erjorgensen@tglaw.com.au

Wwww.tglaw.com.au

Disclaimer

ThispublicationcontainscommentaryofageneralnatureonlyanddoesnotconstitutetaxationadviceandarethoseoftheauthorandnotthoseofThomson Geer.ThomsonGeerrecommendsthatyouobtainprofessionaladviceregardingyourspecificcircumstances.Noliabilityisacceptedforanylossoccasionedas aresultofanymaterialinthispublication.

28 ©RonJorgensen2022

Glossary

Abbreviation

ATO AustralianTaxationOffice

CA2001 CorporationsAct2011(Cth)

CGT capitalgainstax

CSR CommissionerofStateRevenue

DAT2001 DutiesAct2001(Tas)

FCT FederalCommissionerofTaxation

GST goodsandservicestax

GSTA1999ANewTaxSystem(GoodsandServicesTax)Act1999(Cth)

ITAA1997IncomeTaxAssessmentAct1997(Cth)

PTAT2008PayrollTaxAct2008(Tas)

TAA1953 TaxationAdministrationAct1953(Cth)

TAAT1997TaxationAdministrationAct1997(Tas)

FQ FinancialQuarter

FY FinancialYear

TSRO TasmanianStateRevenueOffice

29 ©RonJorgensen2022

Advice|Transactions|Disputes Domestic&CrossBorder RonJorgensenTaxPartner LawSocietyofTasmania LitigationConference2022 SettlementCompensationTaxApproaches Advice | Transactions | Disputes Domestic & Cross Border Introduction settlementcompensationtaxapproaches taxationofcompensation,interestandlegalfees taxationadjustmentsandindemnities draftingsettlementdeedsandconsentorders commonexamplesettlementtransaction TomPeters,ThrivingonChaos: HandbookforaManagementRevolution 1 2

natureofthepayer(individual,trust,company,partnership,taxorforeignresident)

natureofthepayee(individual,trust,company,partnership,taxorforeignresident)

natureofthepayment(substituteamount,changeconsideration,transfer)

natureoftheasset(capital,revenue,exempt)

natureoftheclaim(contractproceeds,damages,punitivedamages,interest,legals)

Advice | Transactions | Disputes Domestic & Cross Border

Introduction Variesdependingon

Advice | Transactions | Disputes Domestic & Cross Border IncomeTax&CGT NatureofthePayerandPayee Rule1Generally,itisbetterforacompany(flat30%taxrate)thananindividual (progressive47%rate)tobetaxedonrevenuecompensation. Rule2Generally,itisbetterforanindividual(23.5%rateafterthe50%CGT Discount)thanacompany(30%rate)tobetaxedoncapital compensation. Achildoffivecouldunderstandthis.Send someonetofetchachildoffive GrouchoMarx 3 4

IncomeTax&CGT

NatureofthePayment

Rule3Compensationreplacingareceiptistaxedinthesamewayasthe substitutedreceipt,evenifreceivedasalumpsum.

IncomeTax&CGT

NatureofthePayment

Rule4Compensationalteringconsiderationistaxedasanadjustmenttothe originaltransactionconsideration.

Advice | Transactions | Disputes Domestic & Cross Border

Advice | Transactions | Disputes Domestic & Cross Border

5 6

IncomeTax&CGT

NatureofthePayment

Rule5Generally,compensationforthedisposalofanunderlyingassetistaxed asconsiderationofthedisposaloftheunderlyingasset.

IncomeTax&CGT

NatureofthePayment

Rule6Generally,compensationforpermanentdamageorreductioninvalueof theunderlyingassetistaxedasanadjustmenttothevalueofthe underlyingasset.

Advice | Transactions | Disputes Domestic & Cross Border

Advice | Transactions | Disputes Domestic & Cross Border

7 8

IncomeTax&CGT

NatureofAsset

Rule7Compensationreferrabletoanunderlyingassetistaxedinthesame wayastheunderlyingassetfromwhichthecompensationwasderived.

IncomeTax&CGT

NatureofAsset

Rule8Compensationnotreferrabletoanunderlyingassetistaxedasa separateCGTassetRighttoSeekCompensation.

Advice | Transactions | Disputes Domestic & Cross Border

Advice | Transactions | Disputes Domestic & Cross Border

9 10

IncomeTax&CGT

NatureofAsset

Rule9Compensationexpressedasanundissectedlumpsumisgenerally attributedconsiderationforthedisposalofaseparateCGTassetRight toSeekCompensation.

IncomeTax&CGT

NatureoftheClaim

Rule10Punitivedamagescanneverrelatetoanunderlyingassetsois considerationfordisposaloftheseparateCGTRighttoSeek Compensation.

Rule11Pre-judgementinterest(otherthanforpersonalinjuries)isassessable asincomeandcanneverrelatetoanunderlyingassetbutif undissectedisconsiderationfordisposaloftheseparateCGTRightto SeekCompensation.

Advice | Transactions | Disputes Domestic & Cross Border

Advice | Transactions | Disputes Domestic & Cross Border

12

11

IncomeTax&CGT

NatureoftheClaim

Rule12Generally,LegalFeeswillbeageneraldeductionwhenincurredin respectofcompensationforreplacingareceiptofassessableincomeor alteringconsiderationwhichwasageneraldeduction.

IncomeTax&CGT

NatureoftheClaim

Rule13Generally,LegalFeeswillbeanelementofcostbasewhenincurredin respectofcompensationforanunderlyingCGTassetortheseparate CGTRighttoSeekCompensation.

Advice | Transactions | Disputes Domestic & Cross Border

Advice | Transactions | Disputes Domestic & Cross Border

13 14

TaxationAdjustments&Indemnities

Rule14Generally,additionalcompensationtodefrayorindemnitythetaxliability inrespectofapaymentofcompensationisadditionalconsiderationfor therecoupmentofconsideration,forthedisposaloftheunderlyingasset orCGTRighttoSeekCompensation

NatureofthePayerandPayee

Rule1ThesuppliermustberegisteredorrequiredtoberegisteredforGSTor thetransactionisnotsubjecttoGST.

Advice | Transactions | Disputes Domestic & Cross Border

IncomeTax&CGT

Advice | Transactions | Disputes Domestic & Cross Border

GST

15 16

GST

NatureoftheSupply

Rule2Thesuppliermustmakealegallybindingsupplyofgoods,services,or rightsorobligationsorthetransactionisnotataxablesupplysubjectto GST(notexgratia).

Rule3Thesupplymustbeinthecourseorfurtheranceoftheenterpriseorthe transactionisnotataxablesupplysubjecttoGST.

GST

NatureoftheSupply

Rule4ThesupplymustbeconnectedwithAustraliaorthetransactionisnota taxablesupplysubjecttoGST.

Rule5Thesupplymustbeforconsiderationorthetransactionisnotataxable supplysubjecttoGST(notgiftortrustdistribution).

Advice | Transactions | Disputes Domestic & Cross Border

Advice | Transactions | Disputes Domestic & Cross Border

17 18

GST

NatureoftheSupply

Rule6CompensationconcerningtheconsiderationinrespectofanEarlier SupplyistaxedasanadjustmenttotheEarlierSupplyconsideration.