Capital Gains

[Sec. 45 to Sec. 55A]

CHAPTER

Basis of Charge : [Sec. 45(1)]

transfer of a capital asset effected in the previous year unless

Definition of ‘Capital Asset’ : [Sec. 2(14)]

Capital Asset meansa b

c

but does NOT include

i stock-in-trade [other than the securities referred to in sub-clause (b) above], consumable stores or raw materials

Note:

ii Personal effects of movable nature other than

iii Agricultural land in India

iv Special Bearer Bond, 1991,

v Gold Deposit Bonds Deposit Certificates

Gold Monetisation Scheme, 2015

Explanation to Sec. 2(14):

Explanation

Vodafone International Holdings B.V. v. Union of India (2012)

rights in or in relation to an Indian company, including rights of management or control or any other rights whatsoever.

Determining whether an asset is Stock-in-trade or Capital asset:

manner in which it is held.

not a pure question of law but essentially a question of fact. magnitude and frequency of buying and selling of shares, the period of holding of such shares, ratio of sales to purchases and the total holdings

[PVS Raju v. ACIT (2012) 340 ITR 75 (AP)]

Surplus on sale of shares or securities taxable as ‘Business Income’ or ‘Capital Gains’?

[Circular No. 06/2016, dated 29.02.2016] to distinguish the shares held as investments from the shares held as stock-in-trade.

no universal principle in absolute terms can be laid down to decide the character of income from sale of shares and securities (i.e. whether the same is in the nature of capital gain or business income),

vide Circular No. 06/2016 dated 29.02.2016 the Assessing Officers in holding whether the surplus from sale of listed shares or securities would be treated as Capital Gain or Business Income, shall take into account the following:

a assessee opts

b more than 12 months as Capital Gains shall not be put to dispute by the Assessing Officer once taken applicable in subsequent Assessment Years

c i.e

unlisted shares, irrespective of the period of holding, it shall be treated as Capital asset.

Items

of precious metals; to what extent constitutes Jewellery:

Explanation 1 to section 2(14), jewellery includes:

Gold utensils cannot be regarded as of personal effects and thereby they are capital assets

JUDICIAL DECISIONS:

CIT v. Benarashilal Kataruka (1990) 185 ITR 493 (Cal.)

Items of silverware including dinner plates of different sizes, finger bowls, and jugs were held to be personal effects.

The main factor in deciding whether an article constitutes personal effect is the nature of the article. no capital gains will arise on the sale of silver utensils.

Ramanathan Chettiar v. CIT 1985 Mad. , a large number of the same type of silver articles

Maharaja Rana Hemanth Singhji v. CIT (1976) 103 ITR 61 (SC)

Only those effects can be legitimately said to be personal which pertain to the assessee’s person. capital gains are taxable in the present case.

CIT v. Saroj Goenka 1983 140 ITR 88 Chen.

Note:

Unlisted Bond or Unlisted Debenture which is transferred, matured or redeemed on or after 23.07.2024 shall always be deemed as Short Term Capital Asset irrespective of period of holding. [Inserted by Finance (No.2) Act 2024]

Long Term Capital Asset

Note:

Explanations to Sec. 2(42A)

Bharti Gupta Ramola v. CIT [2012] (Delhi)

Types of Capital Gain:

Short Term Capital Gain [Sec. 2(42B)]:

Long Term Capital Gain [Sec. 2(29B)]:

TAX RATES ON CAPITAL GAINS

Short Term Capital Gains: regular income-tax except in the case covered under section 111A as below.

Tax on

Short

Term Capital

Gains

where STT is charged: [Sec. 111A] a short term capital asset chargeable to Securities Transaction Tax (STT),

i tax @ 20% (15% if transferred before 23.07.2024) ii [Amended by Finance (No. 2) Act, 2024 w.e.f. 23.07.2024]

Note: Provided Resident Individual or Resident HUF shall be reduced falls short of the maximum amount which is not chargeable to incometax

Provided further

[For Details on Taxation of transactions under International Financial Services Centre IFSC refer at the end of the Chapter ‘Miscellaneous Topics’]

Tax on Long Term Capital Gains : [Sec. 112]

a) In case of a Resident Individual or Resident HUF:

i tax @ 12.5% (20% if transferred before 23.07.2024)

[Amended by Finance (No. 2) Act, 2024 w.e.f. 23.07.2024] ii as reduced by

Provided Resident individual or Resident HUF shall be reduced falls short of the maximum amount which is not chargeable to income-tax

Long Term Capital Asset being Land or Building or both:

If a Resident Individual or HUF transfers a long term capital asset being Land or Building or both which was acquired before 23.07.2024 and the tax computed as per new rate of 12.5% without indexation, EXCEEDS the tax computed as per old rate of 20% with indexation, then such excess tax shall be IGNORED. [Inserted by Finance (No. 2) Act, 2024 w.e.f. 23.07.2024]

Analysis:

(b) In case of a Domestic Company: i tax @ 12.5% (20% if transferred before 23.07.2024)

[Amended by Finance (No. 2) Act , 2024 w.e.f .23.07.2024] ii

(c) In case of a Non-resident (not being a company) or a Foreign Company: i 12.5%

ii. tax @ 12.5% [Amended by Finance (No. 2) Act, 2024 w.e.f. 23.07.2024] ii In case transfer is made before 23.07.2024, i ii iii

Note: Example:

In case of Resident Individual:

In case of Non-Resident Individual: other than Long Term Capital

Tax will be computed as under: other than Long Term Capital

Option to Tax LTCG @ 10% without Indexation for Specified Securities: (First proviso to Sec. 112) transfer of long term capital asset, being: listed securities (other than units), or zero coupon bonds before giving effect to 2nd proviso to section 48 (i.e. indexation),

other than units lower of the following: OR

Note: This Proviso is applicable only where transfer is made before 23.07.2024. [Inserted by Finance (No. 2) Act, 2024 w.e.f. 23.07.2024]

Practical Question:

Solution: such excess tax shall be ignored

Computation of Capital Gain (as per new provision) for A.Y. 2025-26:

Less:

but the amount of Capital Gains shall be as per new provision only.

Deductions under Chapter VI-A not allowed against any LTCG: [Sec. 112(2)]

Tax on LTCG on transfer where STT is charged: [Sec. 112A]

long term capital asset

STT has a equity share

b of a unit of an equity oriented mutual fund ULIP to which exemption u/s 10(10D) does not apply unit of a business trust) the tax exceeding ` 1,25,000 shall be 12.5%. [Amended by Finance (No. 2) Act, 2024 w.e.f. 23.07.2024]

However. if transferred is made before 23.07.2024 the tax on such long term capital gains exceeding ` 1,00,000 shall be 10%

Note: Aggregate limit of long term capital gains not taxable during the previous year shall not exceed ` 1,25,000. Provided shall be reduced falls short of the maximum amount which is not chargeable to income-tax

Points to Note: The following are the transactions where benefit of Sec. 112A shall not be available, if STT was not paid at the time of acquisition:

other than the following acquisition of listed equity shares in a company made as per Securities Contracts Regulation Act, 1956, if applicable:

Explanation 1 a 23FB

Practical Question:

Mr. A (age 45)Mrs. B (age 62)Mr. C (age 81)Mr. D (age 82) Residential

(i) If Mr. A, Mrs. B, Mr. C and Mr. D pay tax as per default tax regime u/s 115BAC. Computation of Tax liability for the A.Y. 2025-26

Mr. A (age 45)Mrs. B (age 62)Mr. C (age 81)Mr. D (age 82) Residential StatusResidentNon-residentResidentNon-resident

Note:

(ii) If Mr. A, Mrs. B, Mr. C and Mr. D exercise the option to shift out of the default tax regime and pay tax under the optional tax regime as per the normal provisions of the Act

Computation of Tax liability for the A.Y. 2025-26

Mr. A (age 45)Mrs. B (age 62)Mr. C (age 81)Mr. D (age 82) Residential StatusResidentNon-residentResidentNon-resident

Definition of Transfer : [Sec. 2(47)]

Kartikeya Sarabhai v. CIT (1997) 228 ITR 163 (SC)

Anarkali Sarabhai v. CIT (1982) 224 ITR 422 (SC)

Explanation 2 to Sec. 2(47):

Explanation a b

Seshasayee Steels (P.) Ltd. v. ACIT [2020] 421 ITR 46 (SC)

Any transaction which enables the enjoyment of immovable property will be considered as enjoyment as a purported owner thereof for being treated as a “transfer” of a capital asset u/s 2(47)(vi).

Facts:

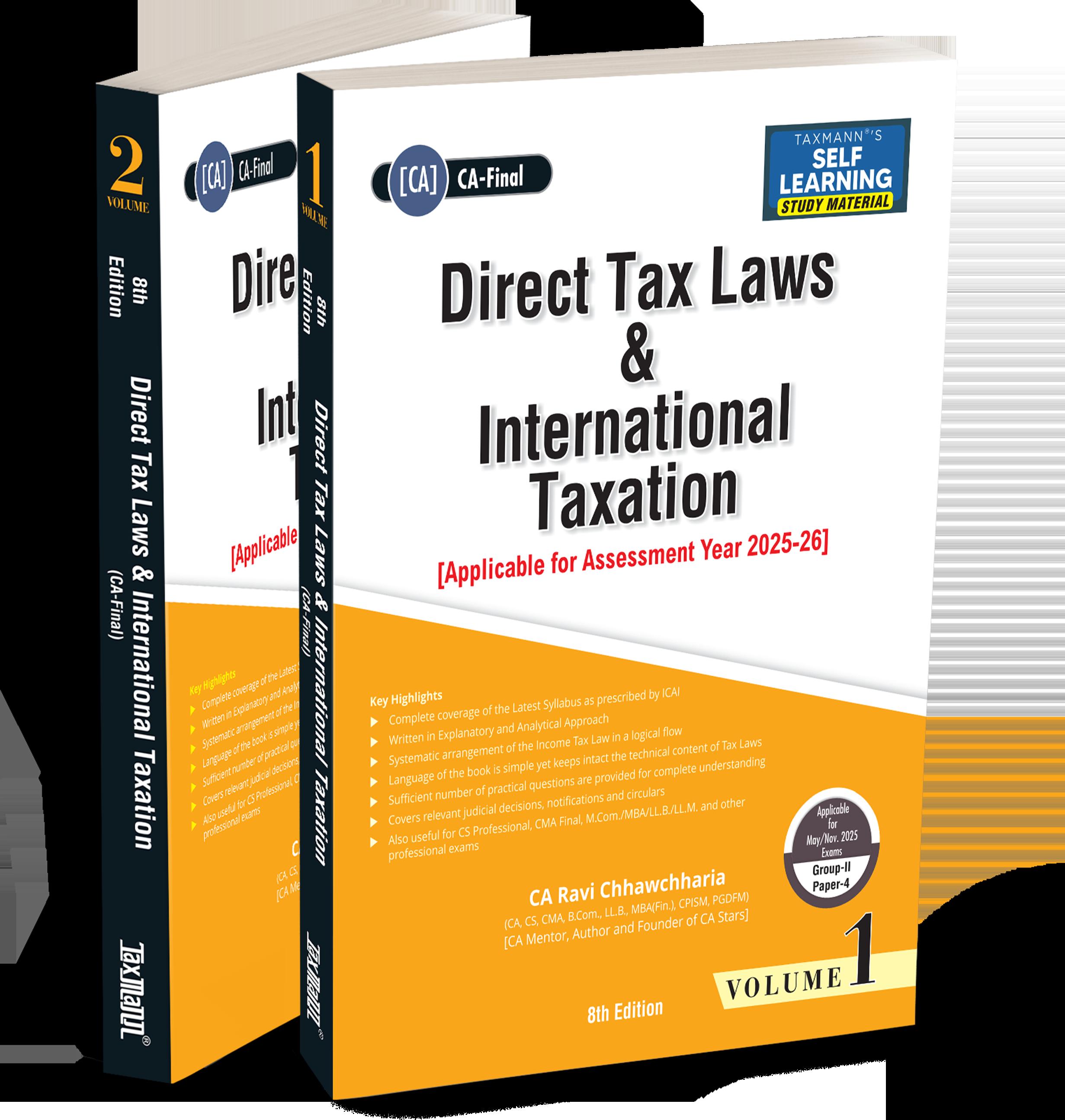

Direct Tax Laws & International Taxation (DT) | A.Y. 2025-26 | Study Material

AUTHOR : RAVI CHHAWCHHARIA

PUBLISHER : TAXMANN

DATE OF PUBLICATION : OCTOBER 2024

EDITION : 8TH EDITION

ISBN NO : 9789364550789

NO. OF PAGES : 1234

BINDING TYPE : PAPERBACK

DESCRIPTION

This book offers a comprehensive and practical application of Direct Tax Laws and International Tax, honing the reader’s analytical skills. It perfectly balances an in-depth study and a summarized approach, presented in an explanatory and analytical manner. It is helpful for students preparing for CA-Final, CS-Professional, CMA-Final, M.Com/MBA/LL.B./LL.M, and other professional exams.

M.Com/MBA/LL.B./LL.M, and other professional exams.

The Present Publication is the 8th Edition for the CA Final | New Syllabus | May/Nov. 2025 Exam | A.Y. 2025-26). This book is authored by CA Ravi Chhawchharia, with the following noteworthy features:

• [Complete Coverage] of the latest syllabus as prescribed by the ICAI

• [Detailed Index] A well-organized index at the beginning helps students navigate through sections and other details

• [Provisions] Comprehensive yet concise explanations of provisions, maintaining technical accuracy

• [Judicial Decisions] Landmark/Prescribed by ICAI: Highlighted in bold and underlined, with case names provided before the facts and decisions

• [Other Judicial Decisions] Only the ratio of the case is included, without requiring students to remember case names

• [Practical Questions with Updated Solutions | Section-Based Questions] Included below the relevant provisions

• [Multi-Section Questions] Placed at the end of each chapter in the ‘Practical Questions’ segment

• [Amended & Updated] Incorporates the latest applicable provisions and amendments for A.Y. 2024-25, relevant for the November 2024 exams

• [Judicial Decisions, Circulars & Notifications] Thoroughly covered

• [Past Exam Solved Questions] Includes solved questions from past exams, including the CA-Final May 2024 paper BUY NOW