DemystifyingtheOnusinthecaseof InputtaxCredit(ITC)

April18,2024

Goods and Service Tax (GST)

Index

Introduction to Input Tax Credit (ITC)

Conditions & Eligibility for ITC

Onus to prove eligibility

Genuineness of the transaction

Department Clarifications

Supplier doesn’t pay the taxes – legal position

Registration Certificate is cancelled

Non-existent supplier

2

Introduction to ITC

A registered person is eligible to take,

ITC on supply of goods or services,

which are used or intended to be used in the course or furtherance of business,

subject to conditions and restrictions prescribed under the CGST Act.

Except for certain goods or services specified in Section 17 of the CGST Act, ITC is generally available to the registered person on all goods and services

3

Conditions for ITC – Section 16

Possession of tax invoice or debit note;

Details of such invoice/ debit note has been furnished in GSTR 1 by the supplier and reflected in GSTR 2B of the recipient;

Goods or services have been received;

ITC is not restricted as per auto-generated statement in Form GSTR 2B;

Tax charged by supplier has actually been paid to Government; and

Recipient has furnished GSTR 3B

4

Onus to prove eligibility

Section 155 of the CGST Act provides that

“Where any person claims that he is eligible for input tax credit under this Act, the burden of proving such claim shall lie on such person.”

The recipient is availing ITC & hence is liable to prove the genuineness of the transaction

The Hon’ble Supreme Court has, in State Of Karnataka v. Ecom Gill Coffee Trading (P) Ltd. [2023] 148 taxmann.com

352 (SC), examined a similar provision under the Karnataka VAT Act and held as follows: -

5

Onus to prove eligibility

“The dealer claiming ITC has to prove beyond doubt the actual transaction which can be proved by furnishing the name and address of the selling dealer, details of the vehicle which has delivered the goods, payment of freight charges, acknowledgement of taking delivery of goods, tax invoice and payment particular etc. The aforesaid information would be in addition to tax invoice, particular of payment etc. In fact, if a dealer claims Input Tax Credit on purchases, such dealer/ purchaser shall have to prove and establish the actual physical movement of goods, genuineness of transaction by furnishing the details referred above and mere production of tax invoices would not be sufficient to claim ITC.”

6

Onus to prove eligibility

In the matter of Shiv Trading v. State Of UP [2023] 156

taxmann.com 715 (All), the Hon’ble High Court of Allahabad, held as follows:

“the petitioner failed to discharge its onus to prove and establish beyond doubt the actual transaction, actual physical movement of goods as well as the genuineness of the transactions and as such, the proceedings have rightly been initiated against the petitioner under section 74 of the GST Act. ”

The recipient produced tax-invoice, e-way bill, weighment receipt, bilty etc, but since the supplier was found non-existent, movement was held as doubtful

This decision has been affirmed by the hon’ble Supreme Court

7

Onus to prove eligibility

In the matter of Malik Traders v. State of UP [2023] 155

taxmann.com 517 (All), the Hon’ble High Court of Allahabad, held as follows:

“ …………………….. onus is to be discharged by the petitioner to prove and establish beyond doubt the actual transaction and physical movement of goods. But in the case in hand, the petitioner has failed to prove and establish actual physical movement of goods and genuineness of transaction as such the proceedings has rightly been initiated.”

Here also, the petitioner produced invoices, payment made through banking channel, bilties etc.

8

Onus to prove eligibility

The above decisions have categorically held that

Onus to prove genuineness of the transaction is on the recipient of goods or services

What is meant by genuineness of the transaction ?

9

Genuineness of the transaction

The hon’ble Supreme Court and High Courts have held that genuineness of transaction to be proved by following, in addition to invoices & payment proof:

Name of address of selling dealer

Actual movement of goods

Details of vehicle by which goods have been received

Payment of freight charges on such goods

Acknowledgment of delivery of such goods

The above list is not exhaustive, and more evidence may be required on case to case basis

10

Genuineness of the transaction

The Government says that a recipient should be able to trace the supplier and also hold him responsible for payment of GST

The issue arises where a recipient had only few transactions with a particular supplier and only those transactions are in question

Or transactions have executed through a broker and neither the broker nor the supplier is reachable

In case of a regular supplier, generally the recipient should be able to comply with these requirements

11

Genuineness of the transaction

What happens if

Supplier hasn’t deposited GST, even after follow up by the recipient

His registration certificate is cancelled or non-existent taxable person

12

Department clarifications

Press release dated 04th May 2018, provides that in cases of default in payment of tax by supplier, recovery shall be made first from the supplier & recovery from recipient would be under exceptional circumstances.

Circular 183 dated 27th December 2022, provides that in cases of default in payment of tax by supplier, certificate can be produced from a chartered accountant certifying that supplier has paid taxes in GSTR 3B

The new circular shows change in Government stand. Government wants taxpayers to handle non payment of GST commercially and not legally

13

Supplier doesn’t pay –legal position

The statutory condition of Section 16(2)(c) stands violated

Read with Section 155, Revenue can seek to deny the credit

Constitutional validity of Section 16(2)(c) has been challenged in several high courts and a final judicial decision is awaited

14

Supplier doesn’t pay

In the VAT regime, several high courts, including hon’ble Delhi High Court in the case of Arise India Ltd. and On QuestMerchandisingIndia (P.) Ltd. v. Government of NCT of Delhi, [2017] 87 taxmann.com 179 (Delhi) held that

Denial of input tax credit to bona fide purchasers for nonpayment of tax by the selling dealers is not justified

Equating bona fide purchasers with those with hand in glove with fraudulent sellers is violative of Article 14 of the Constitution

The hon’ble Madras High Court in D Y Beathel Enterprises also given the same verdict

15

Registration certificate is

cancelled

The hon’ble Supreme Court, in the case of State of Maharashtra v. Suresh Trading Company, [1998] 1998 taxmann.com 1747 (SC), has held,

“purchasing dealer is entitled by law to rely upon the certificate of registration of selling dealer….. ”

When the certificate of registration was valid during the period of transaction, the purchasing dealer is entitled to rely upon the same

16

Non-existent supplier

The Hon’ble Orissa High Court has, in the case of Santosh Kumar and Co, 54 STC 322 addressed this issue

“Government should take appropriate action against fictitious dealers, as registration cannon be granted to a non-existent person. Officers under collusion with these fictitious dealers, who has failed to perform due diligence must be put under enquiry.”

17

Non-existent suppliers

“

we must bring to the notice of the State that registration of dealers is indeed a serious matter and its officers authorised to grant registration should be very careful. Once a certificate of registration is issued to a person and he becomes a registered dealer, he is entitled to certain benefits under the Act. Certificates granted by the public officers have their value and people in the commercial field would in normal course accept such certificates to be genuine. The fact that registration has been granted, yet the person holding the certificate is a fictitious one seem to be contradictions in term. A certificate of registration can be granted only when the dealer, apart from being a businessman, satisfies the other requirements prescribed by law. A registration certificate cannot be granted to a non-existent person. The fact that there have been some persons who are labelled by the department as fictitious dealers goes to show that the officers under the Act either collude with dishonest people in the field or fail to exercise due diligence and allow fraud to be practised in the commercial field. Whether it is collusion or negligence, these officers bring disrepute to the State and introduce uncertainty and lack of confidence into a true field of trust. It is high time that the State Government institutes appropriate enquiries, take such steps as are necessary to eliminate fictitious dealers from the field and also take strong action against persons connected with such matters so that there be no recurrence of it in future.

18

”

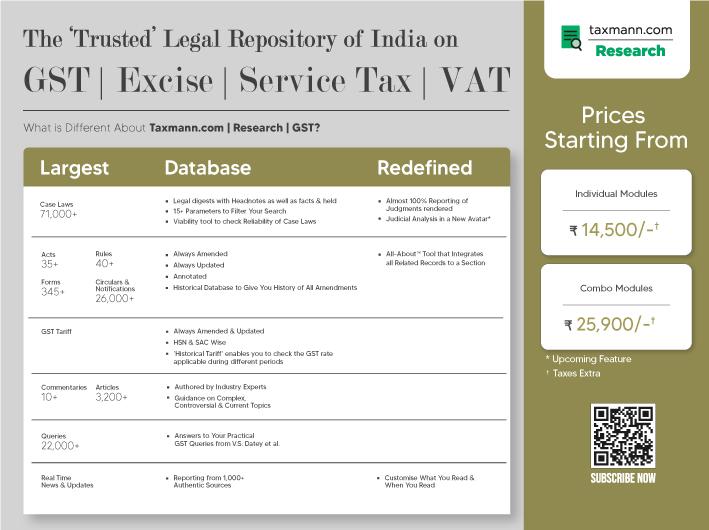

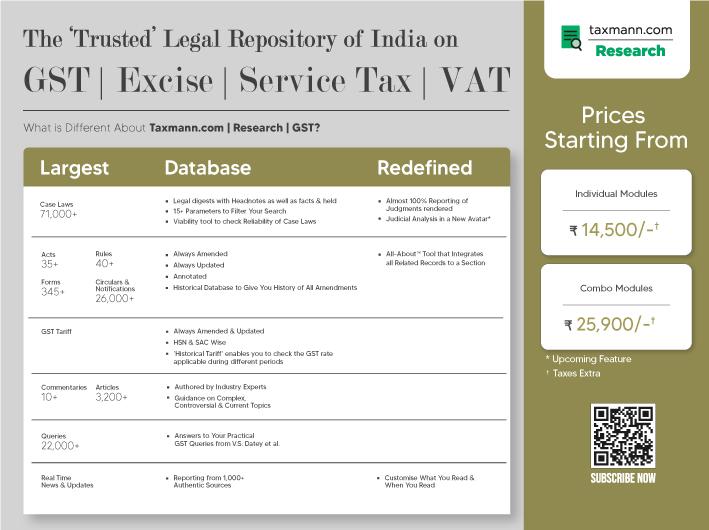

20 Thank You! For More Information, Visit: https://taxmann.com/ Download Taxmann App Follow us on Social Media