PRESENTATION ON E- APPEALS SCHEME, 2023

JCIT(APPEALS)

Notification S.O 2352(E)

[No. 33/2023/

F. No. 370142/10/2023-TPL]

Dated-29th May, 2023

1

Webinar Organized by On 19th July, 2023

Speaker: HARI AGARWAL, FCA

2

1. Memorandum explaining the provisions in the FinanceBill,2023- Relevantextract.

2. Section 246- Appealable orders before Joint Commissioner(Appeals)

3. E-AppealsScheme,2023dated29.05.2023

4. Scope of the e-Appeals Scheme- Order under subsection(6)ofsection246oftheIncome-taxAct,1961 dated16.06.2023.

Synopsis S.NO. PARTICULARS

3

S.NO. PARTICULARS

Income-tax(SixthAmendment)Rules,2023vide

5.

CBDT Notificationdated29.05.2023

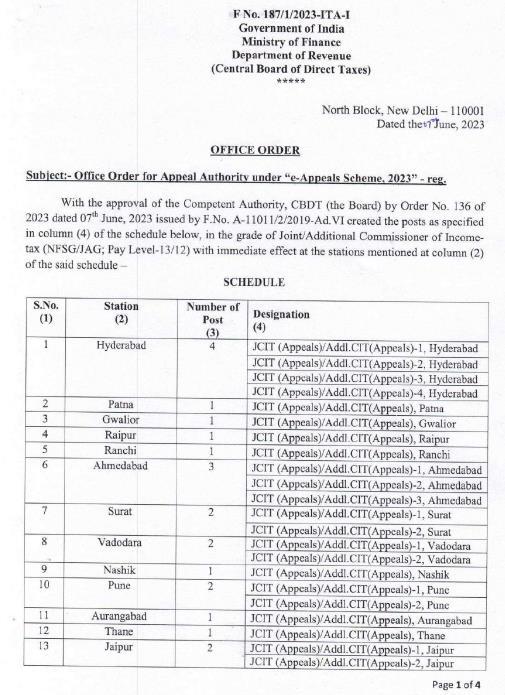

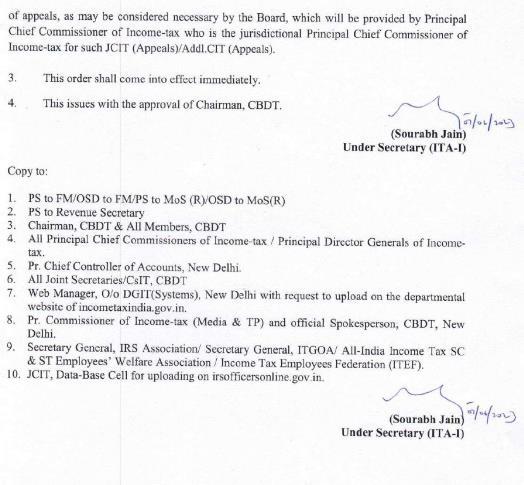

6. AppointmentofJCIT(Appeals)-List

7. Form35(Amended)

8. QuestionsandAnswers

Synopsis

4

MEMORANDUM EXPLAINING THE PROVISIONS IN THE FINANCE BILL, 2023 – RELEVANT EXTRACT.

Introduction of the authority of Joint Commissioner (Appeals)

5

Introduction of the authority of Joint Commissioner (Appeals)

• Thefirstauthorityforappeal,Commissioner(Appeals)are currently over burdened due to the huge number of appeals and the pendency being carried forward every year.

• In order to clear this bottleneck, a new authority for appeals is being proposed to be created at Joint Commissioner/ Additional Commissioner level to handle certain class of cases involving small amount of disputed demand.

• Such authority has all powers, responsibilities and accountability similar to that of Commissioner (Appeals) withrespecttotheprocedurefordisposalofappeals.

Contd. 6

Introduction of the authority of Joint Commissioner (Appeals)

• The earlier section 246 was providing for the appeal functions of Deputy Commissioner (Appeals). That institutionwasdiscontinuedintheyear2000.

• Accordingly,itisproposedtosubstitutesection246of the Act to provide for appeals to be filed before Joint Commissioner(Appeals).

Contd. 7

SECTION 246

APPEALABLE ORDERS BEFORE

JOINT COMMISSIONER (APPEALS)

8

Sec-246 Appealable orders before Joint Commissioner ( Appeals)

SEC 246.

(1) Any assessee aggrieved by any of the following orders of an Assessing Officer (below the rank of Joint Commissioner) may appeal to the Joint Commissioner(Appeals)against—

Contd. 9

(1) (a) an orderbeing an intimationundersub-section (1) of section 143, where the assessee objects to the making of adjustments, or any order of assessment

undersub-section(3)ofsection143orsection144,

wheretheassesseeobjectstotheamountofincome assessed, or tothe amount of tax determined,or to theamountoflosscomputed,ortothestatusunder whichheisassessed;

Sec 246 Appealable orders before Joint Commissioner ( Appeals)-Contd.

Contd. 10

Sec 246 Appealable orders before Joint Commissioner ( Appeals)Contd.

(1)(b) an order of assessment, reassessment or recomputation undersection147;

Section147: Incomeescapingassessment

Contd. 11

(1)(c) an order being an intimation under sub-section(1)ofsection200A;

Section200A: Processingofstatementsoftaxdeductedat source.

Sec-246

Appealable orders before Joint Commissioner ( Appeals)Contd.

Contd. 12

Sec- 246 Appealable orders before Joint Commissioner ( Appeals)Contd.

(1)(d) anorderundersection201;

Section201:

Consequencesoffailuretodeductorpay.

Contd. 13

Sec-246 Appealable orders before Joint Commissioner ( Appeals)Contd.

(1)(e) an order being an intimation under sub-section(6A)ofsection206C;

Section206C(6A):

Failuretocollectordeposit

Contd. 14

TCS

(1)(f) anorderundersub-section(1)of section206CB;

Section206CB: Processingofstatementsoftaxcollected atsource.

Sec-246

Appealable orders before Joint Commissioner ( Appeals)Contd.

Contd. 15

(1)(g)anorderimposingapenaltyunder ChapterXXI;and

CHAPTER

XXI–PenaltiesImposable

Sec-246

Appealable orders before Joint Commissioner ( Appeals)Contd.

Contd. 16

Appealable orders before Joint Commissioner ( Appeals)Contd.

(1)(h)anorderundersection154orsection155 amending any of the orders mentioned in clauses(a)to(g):

Clauses(a)to(g)ofSec246(1) (referredinpreviousslides)

Section154:Rectificationofmistake

Section155:Amendmenttoassessmentsconsequentto assessmentorre-assessmentofconnectedentities

Sec-246

Contd. 17

Sec-246 Appealable orders before Joint Commissioner ( Appeals)Contd.

Provided thatnoappealshallbefiled beforethe Joint Commissioner (Appeals) if an order referred to in this sub-section is passed by or with the prior approval of, an income-tax authority above the rank of Deputy Commissioner.

Contd. 18

Sec-246 Appealable orders before Joint Commissioner ( Appeals)-Contd.

Sec 246(2) Where any appeal filed against an order referred to in sub-section (1) is pending before the Commissioner (Appeals), the Board or an income-tax authority so authorised by the Board in this regard, maytransfersuchappealandanymatterarisingoutof orconnectedwithsuchappealandwhichissopending, totheJointCommissioner (Appeals)whomay proceed with such appeal or matter, from the stage at which it wasbefore,itwassotransferred.

Contd. 19

Sec-246 Appealable orders before Joint Commissioner (Appeals)-Contd.

Sec 246(3) Notwithstanding anything contained in subsection (1) and sub-section (2), the Board or an incometax authority so authorised by the Board in this regard, may transfer any appeal which is pending before a Joint Commissioner (Appeals)and anymatter arisingoutofor connected with such appeal and which is so pending, to theCommissioner(Appeals)whomayproceed withsuch appealormatter,fromthestageatwhichitwas before,it wassotransferred.

Contd. 20

Sec 246(4) Where an appeal is transferred undertheprovisionsofsub-section(2)or sub-section (3), the appellant shall be givenanopportunityofbeingreheard.

Sec-246 Appealable orders before Joint Commissioner ( Appeals)-Contd.

Contd. 21

Sec-246 Appealable orders before Joint Commissioner ( Appeals)-Contd.

Sec 246(5) For the purposes of disposal of appeal by the Joint Commissioner(Appeals),theCentralGovernmentmaymakeascheme, bynotificationintheOfficialGazette,soastodisposeofappealsinan expedient manner with transparency and accountability, by eliminating the interface between the Joint Commissioner (Appeals) andtheappellant,inthecourseofappellateproceedingstotheextent technologicallyfeasibleanddirectthatanyoftheprovisionsofthisAct relating to jurisdiction and procedure for disposal of appeals by the JointCommissioner(Appeals),shallnotapplyorshallapplywithsuch exceptions, modifications and adaptations as may be specified in the notification.

Contd. 22

Sec

246(6) For the purposes of sub-section (1), the Board may specify that the provisions of that sub-section shall not applytoanycaseoranyclassofcases.

Explanation.—Forthepurposesofthissection,"status"meansthecategoryunderwhichtheassessee isassessedas"individual","Hinduundividedfamily"andsoon.

Sec-246 Appealable orders before Joint Commissioner ( Appeals)-Contd.

Contd. 23

DIFFERENCE BETWEEN FACELESS APPEALS SCHEME AND E-APPEALS SCHEME

Direct e-communication among appellant, Joint commissioner of Income-tax (Appeals), Assessing Officer. And other income tax authorities.

NotthroughFacelessAppealCentre

BROAD FEATURES

Contd. 24

E- APPEALS SCHEME, 2023

Notification S.O 2352(E) [No. 33/2023/F. No. 370142/10/2023-TPL]

Dated-29th May, 2023

25

1.SHORT TITLE AND COMMENCEMENT

26

1. Short title and commencement

(1)This Scheme may be called the E- Appeals Scheme,2023.

(2) It shall come into force on the date of its publicationintheOfficialGazette.

27

2. DEFINITIONS

28

2(1)InthisScheme,unlessthecontextotherwiserequires,

(i)“Act”meanstheIncome-taxAct, 1961(43of1961);

(ii)“addressee”shallhavethesamemeaningasassignedtoitinclause(b)ofsub-section(1)of section2oftheInformationTechnologyAct,2000(21of2000);

(iii)“appeal”meansappealfiledbyapersonundersub-section(1)ofsection246orsection246Aof theAct.

(iv)“appellant” meansthe person whofilesappeal under section 246 or under section 246Aofthe Act.

(v) “authorised representative” shall have the same meaning as assigned to in sub-section (2) of section288oftheAct.

(vi)“automatedallocationsystem”meansanalgorithmforrandomisedallocationofcases,byusing suitable technological tools, including artificial intelligence and machine learning, with a view to optimisetheuseofresources.

(vii)“computersystem”shallhavethesamemeaningassignedtoitinclause(I)ofsub-section(l)of

section2oftheInformationTechnologyAct2000(21of2000)

•

2. Definitions

29 Contd..

2. Definitions – contd.

(viii)“computerresourceofappellant”shallincludetheregisteredaccountinthedesignatedportalofthe Income-taxDepartment,ortheMobileApplinkedtotheregisteredmobilenumberortheregistered emailaccountoftheappellant;

(ix)“digital signature” shall have the same meaning as assigned to it in clause (p) of sub-section (1) of section2oftheInformationTechnologyAct,2000(21of2000);

(x)“designated portal” means the web portal designated as such by the Principal Chief Commissioner of Income-taxorthePrincipalDirectorGeneralortheDirectorGeneralofIncome-tax,(Systems);

(xi)“e-appeal”meanstheappellateproceedingsconductedelectronicallyin‘e-appeal’facilitythroughthe registeredaccountoftheappellantinthedesignatedportal;

(xii) “electronicrecord” shall have the same meaning as assigned to it in clause (t) of sub-section (1) of section2oftheInformationTechnologyAct,2000(21of2000).

30 Contd.

2. Definitions - contd

(xiii)“e-mail”or“electronicmail”and“electronicmailmessage”meansamessageorinformationcreated or transmittedorreceived on a computer, computer system, computer resource or communication device including attachments in text, image, audio, video and any other electronic record, which maybetransmittedwiththemessage;

(xiv) “Mobile app” shall mean the application software of the Income-tax Department developed for mobile devices which is downloaded and installed on the registered mobile number of the appellant;

(xv) “National Faceless Appeal Centre” shall mean the National Faceless Appeal Centre as set up and notifiedundertheFacelessAppealScheme,2021;

(xvi) “real time alert” means any communication sent to the appellant, by the way of Short Messaging Serviceonhisregisteredmobilenumber,orbythewayofupdateonhisMobileApp,orbywayofan e-mail at his registered e-mail address, so as to alert him regarding delivery of an electronic communication.

Contd. 31

2. Definitions - contd

(xvii)“registeredaccount”oftheappellantmeanstheelectronicfilingaccountregisteredbytheappellant inthedesignatedportal;

(xviii)“registerede-mailaddress”meansthee-mailaddressatwhichanelectroniccommunicationmaybe deliveredortransmittedtotheaddressee,including-

(a)Thee-mailaddressavailableintheelectronicfilingaccountoftheaddresseeregisteredinthe designatedportal;or

(b)Thee-mailaddressavailableinthelastincome-taxreturnfurnishedbytheaddressee;or

(c)Thee-mailaddressavailableinthepermanentaccountnumberdatabaserelatingtothe addressee;or

(d)Inthecaseofaddresseebeingan individualwhopossessesthe Aadhaarnumber,thee-mail addressoftheaddresseeavailableinthedatabaseofUniqueIdentificationAuthorityofIndia;or

(e)Inthecaseofaddresseebeingacompany,thee-mailaddressofthecompanyasavailableonthe officialwebsiteoftheMinistryofCorporateAffairs;or

(f)Anye-mailaddressmadeavailablebytheaddresseetotheincome-taxauthorityoranyperson authorisedbysuchauthority;

Contd. 32

2. Definitions - contd

(xix) “registered mobile number” means the mobile number of the appellant, or his authorised representative, appearing in the user profile of the electronic filing account registered by the appellantinthedesignatedportal;

(xx)“Rules”meanstheIncome-taxRules,1962;and

(xxi) “video conferencing or video telephony” means the technological solutions for the reception and transmission of audio-video signals by users at different locations, for communication between peopleinreal-time.

(2) Words and expressions used herein and not defined but defined in the Act shall have the same meaningrespectivelyasassignedtothemintheAct.

Contd. 33

3. SCOPE OF THE SCHEME

34

3. Scope of the Scheme

• TheSchemeshallapplytoappeals,inrespectof such persons or class of persons, incomes or class of incomes, cases or class of cases, as coveredundersection246oftheActexceptthe cases excluded under sub-section (6) of that section.

(Section 246(6): For the purposes of sub-section (1), the Board may specify that the provisions of that sub-section shall not apply to any caseoranyclassofcases)

Contd. 35

4. APPEAL AUTHORITY UNDER THE SCHEME

36

4. Appeal Authority under the Scheme

4(1)The Joint commissioner (Appeals) [hereinafter referred to as JCIT (Appeals)], shalldisposeoftheappealsfiledbeforeitor allocated or transferred to it, in accordance withtheprovisionsofthisscheme.

Contd. 37

4. Appeal Authority under the Scheme - contd

4(2) The JCIT (Appeals) shall have such incometax authority, ministerial staff, executive or consultant to assist in the disposal of appeals,asmaybeconsiderednecessaryby theBoard.

Contd. 38

5. ALLOCATION OF APPEALS

39

5. Allocation of Appeals

5.The Principal Director General of Income-tax (Systems) or the Director General of Income-tax (Systems), as the case may be, shall, with the approvalofCentralBoardofDirectTaxes,devisea process to randomly allocate or transfer the appeals, referred to in paragraph 3, to the JCIT (Appeals).

Contd. 40

6. PROCEDURE IN APPEAL

41

6. Procedure in Appeal

6.(1)Theappealreferredtoinparagraph3shallbedisposed of by the JCIT (Appeals) under this scheme as per the followingprocedure,namely:-

(I)Onassignmentofanappeal,theJCIT(Appeals),

(a) may condone the delay of filing appeal if the appealisfiledbeyondthetimepermittedunder section 249 of the Act and record the reasons forsuchcondonationorotherwiseintheappeal orderpassedunderclause(IX);

Contd. 42

(I)(b)shallgivenoticetotheappellantasking him to file his submission within the date and time specified in such notice and also send a copy of such notice to theAssessingOfficer;

6. Procedure in Appeal- Contd.

Contd. 43

6. Procedure in Appeal- Contd.

Contd. 44

(I)(c) may obtain further information, documentorevidencefromtheappellant oranyotherperson;

(I) (d) may obtain a report of the Assessing Officer on grounds of appeal or information, document or evidence furnished by the appellant.

6. Procedure in Appeal- Contd.

Contd. 45

(I) (e) may request the Assessing Officer for making further inquiry under sub-section (4) of section 250 of the Act and submit a report thereof;

RemandReport

Contd.

6. Procedure in Appeal-

Contd. 46

(I) (f) shall serve a notice upon the appellant or any other person, or the Assessing Officer to submit information, document or evidence or report, as the case may be, as may be specified by it or relevant to the appellate proceedings, on a specified date andtime;

Appeal- Contd.

6. Procedure in

Contd. 47

(II)theappellantoranyotherperson,asthecase maybe,shallfurnishresponseasrequiredin “sub-clause (b), (c) or (f) of the clause (I)”, withinthedateandtimespecifiedtherein,or extendeddateandtimeasmaybeallowedon basisofanapplicationmadeinthisbehalf,to theJCIT(Appeals).

Contd.

6. Procedure in Appeal-

Contd. 48

(III) the Assessing Officer shall furnish report as required under sub-clause (d), (e) or (f) of clause(I),withinthedateandtimespecified therein or such extended date and time as may be allowed on the basis of an application made in this behalf, to the JCIT (Appeals);

Contd.

6. Procedure in Appeal-

Contd. 49

6. Procedure in Appeal- Contd.

(IV)theappellantmayfileadditionalgrounds of appeal to the JCIT (Appeals), in such form, as may be specified, specifying therein the reason for omission of such groundsintheappealfiledbyhim;

Contd. 50

6. Procedure in Appeal- Contd.

(V)wheretheadditionalgroundofappealisfiled,-

(a)the JCIT (Appeals) shall admit such additional grounds in case of orders passed under subsection (1) of section 143 of the Act or under section 200A of the Act or in any other case wheretheappealableorderis anorderpassed bytheCentralProcessingCentre;

Sec 200AProcessingofstatementsofTDS

Contd. 51

6. Procedure in Appeal- Contd.

(V)(b)inanyothercase,theJCIT(Appeals)shall send the additional ground to the Assessing Officer for providing comments ifany;

Contd. 52

6. Procedure in Appeal- Contd.

(V) (c) the Assessing Officer shall furnish their comments, within the date and time specified orsuch extended date and time as may be allowed on basis of an application made in this behalf, to the JCIT(Appeals);

Contd. 53

(V)(d) the JCIT (Appeals) shall, after taking into consideration the comments, if any, received fromtheAssessingOfficer,-

(A) if he is satisfied that the omission of such additional ground from the memorandum of appealwasnotwillfulortherewassufficient cause,admittheadditionalground;or

Contd.

6. Procedure in Appeal-

Contd. 54

(V)(d)(B) in any other case, for reasons to be recorded in writing in the appeal order passed under clause (IX) not admittheadditionalground;

6. Procedure in Appeal- Contd.

Contd. 55

(VI)theAppellantmayfurnishadditionalevidence,other than the evidence produced by him during the course of proceedings before the Assessing Officer, to the JCIT (Appeals), in such form, as may be specified, specifying therein as to how his case is covered by the exceptional circumstances specified insub-rule(1)ofrule46AoftheRules;

Contd.

6. Procedure in Appeal-

Contd. 56

(VII)wheretheadditionalevidenceisfurnished,-

(a) the JCIT (Appeals) shall admit such additional evidence in case of orders passed under subsection (1) of section 143 of the Act or under section 200A of the Act or any such case where the appealable order is an order passed by the CentralProcessingCentre;

6. Procedure in Appeal- Contd.

Contd. 57

(VII) (b) in any other case, the JCIT (Appeals) shall send the additional evidence to the AssessingOfficerforfurnishingareporton the admissibility of additional evidence in accordancewithrule46AoftheRules;

6. Procedure in Appeal- Contd.

Contd. 58

(VII)(c)theAssessingOfficershallfurnishthereport, as referred to in sub-clause (b), within such date and time specified or such extended date and time as may be allowed on the basisofanapplicationmadeinthisbehalf,to theJCIT(Appeals);

Contd.

6. Procedure in Appeal-

Contd. 59

(VII) (d) the JCIT (Appeals) may, after considering the additional evidence and the report, if any, furnished by the Assessing Officer admit or reject the additional evidence, for reasons to be recorded in writing, and the same shall form a part of the appeal order passedunderclause(IX);

6.

in Appeal- Contd.

Procedure

Contd. 60

(VII)(e)theJCIT(Appeals)shall,ifheadmitssuchevidence,before taking such evidence into account in the appellate proceedings,prepareanoticetoprovideanopportunityto the Assessing Officer to examine such evidence or to cross-examine such witness, as may be produced by the appellant,ortoproduceanyevidenceordocument,orany witnessinrebuttaloftheevidenceorwitnessproducedby the appellant, and furnish areport thereof and send such noticetotheAssessingOfficer;

6. Procedure in Appeal- Contd.

Contd. 61

(VII)(f)theAssessingOfficershallfurnishthereport within the date and time specified or such extendeddateandtimeasmaybeallowedon the basis of an application made on his behalf,totheJCIT(Appeals);

Appeal- Contd.

6. Procedure in

Contd. 62

(VII)(g) the Assessing Officer may request the JCIT (Appeals) to direct the production of any document or evidence by the appellant, or the examination of any witness, as may be relevanttotheappellateproceedings;

6. Procedure in Appeal- Contd.

Contd. 63

(VII)(h)theJCIT(Appeals)forthepurposeofmaking enquiries in the appeal proceedings to in sub-clause (c) or (e) of clause (I) or where the request referred to in sub-clause (g) is received,may,ifitdeemsfit,sendanotice-

6. Procedure in Appeal- Contd.

Contd. 64

(VII)(h)

(A) Directing the appellant to produce such documentorevidence,asitmayspecify;or

Contd.

6. Procedure in Appeal-

Contd. 65

(VII)(h)

(B)forexaminationofanyotherperson,beingawitness;

(i)theappellantoranyotherperson,asthecasemaybe, shallfurnish his response to thenoticereferred to in sub-clause (h), within the date and time specified in thenoticeor such extended dateand time as may be allowed on the basis of application made in this behalf,totheJCIT(Appeals);

Contd.

6. Procedure in Appeal-

Contd. 66

6. Procedure in Appeal- Contd.

(VIII) where the JCIT (Appeals) intends to enhance an assessment or a penalty or reducetheamountofrefund.-

Contd. 67

The JCIT (Appeals) shall prepare a show-cause notice containing the reasons for such enhancement or reduction, as the case may be, andshall,servethenoticeupontheappellant;

Contd.

6. Procedure in Appeal-

(VIII)(a)

Contd. 68

6. Procedure in Appeal- Contd.

(VIII)(b) The appellant shall, within the date and time specified in the notice or such extended date and time as may beallowedonthebasisofapplication made on his behalf, furnish his responsetotheJCIT(Appeals).

Contd. 69

(IX)TheJCIT(Appeals)shall,thereafter.-

(a)prepareinwritinganappealorderinaccordance with the provisions of section 251 of the Act statingthepointsfordetermination,thedecision thereonandthereasonforthedecision;and

6.

in Appeal- Contd.

Procedure

Contd. 70

(IX)(b) send such order after signing the same digitally to the appellant along with the details of the penalty proceedings, if any, to beinitiatedtherein;

6. Procedure in Appeal- Contd.

Contd. 71

(IX)(c) communicatesuch order tothe Principal Chief Commissioner or Chief CommissionerorPrincipalCommissioner or Commissioner in the line with subsection(7)ofsection250oftheAct;

6. Procedure in Appeal- Contd.

Contd. 72

(IX)(d)communicatesuchordertotheAssessing Officer for such action as may be requiredundertheAct;

6. Procedure in Appeal- Contd.

Contd. 73

(IX)(e) where initiation of penalty has been recommended in the order, serve a notice upon the appellant calling upon him to showcauseastowhypenaltyshouldnotbe imposed upon him under the relevant provisionsoftheAct.

6. Procedure in Appeal- Contd.

Contd. 74

(2) Notwithstanding anything contained in subparagraph(1),theappealmaybetransferredat any stage of the appellate proceedings, if considerednecessary,byanorderinaccordance with section 120 of the Act, to such

(Appeals)asmaybespecifiedintheorder.

6. Procedure in Appeal- Contd.

JCIT

Contd. 75

7. PENALTY PROCEEDINGS

76

7 (1) The JCIT (Appeals) may, in the course of appeal proceedings, for non-compliance of any notice, direction or order issued under this Scheme on the part of the appellant or any other person, as thecase may be, send a notice to the appellant or any other person for initiation of any penalty proceedings calling upon them to show cause as to why penalty should not be imposed upon him under the relevant provisionsoftheAct.

7. Penalty Proceedings

Contd. 77

7 (2) The appellant or any other person, as the case may be, shall furnish a response to the show-cause notice referred toin sub-paragraph(1)of this paragraphor in sub-clause(e)oftheclause(IX)ofsub-paragraph(1)of paragraph 6, within the date and time specified in such notice or such extended date and time as may be allowed on the basis of application made in this behalf, totheJCIT(Appeals).

7. Penalty Proceedings-Contd.

Contd. 78

7 (3) The JCIT (Appeals) shall, after taking into account all the relevant material available on the record, including the response furnished, if any, by the appellant or any otherperson,asthecasemaybe,-

7. Penalty Proceedings-Contd.

Contd. 79

(a)prepare a penalty order and serve a copy of suchorderafterdigitallysigningthesame;or

(b)forreasonstoberecordedinwriting,dropthe penaltyandsendanintimationthereof,

7.

Proceedings-Contd. 7

Penalty

(3)

Contd. 80

7. Penalty Proceedings-Contd.

7(3) to the appellant or any other person, as the case may be, and the Assessing Officer, for suchactionasmayberequiredundertheAct.

Contd. 81

8. RECTIFICATION PROCEEDINGS

82

8. Rectification Proceedings

8. (1) With a view to rectifying any mistake apparent from the record the

(Appeals)mayamendanyorderpassed by it in accordance with the provisions of the Act, by an order to be passed in writing.

Contd. 83

JCIT

8. Rectification Proceedings- Contd.

8.(2)SubjecttotheotherprovisionsofthisScheme, an application for rectification of mistake referred to in sub-paragraph (1) may be filed withtheJCIT(Appeals)by,–

(a) the appellant or any other person, as the casemaybe;or

(b)theAssessingOfficer.

Contd. 84

(8)(3)The JCIT (Appeals) shall examine the application and send the notice for grantinganopportunityto,–

8. Rectification Proceedings- Contd.

Contd. 85

8. Rectification Proceedings- Contd.

(8)(3)

(a) the appellant or any other person, as the case may be, where the application has beenfiledbytheAssessingOfficer;or

Contd. 86

8. Rectification Proceedings- Contd.

(8)(3)

(b) the Assessing Officer where the application has been filed by the appellant or any other person,asthecasemaybe,

Contd . 87

8. Rectification Proceedings- Contd.

(8)(3) calling upon them to show cause as to why rectificationofmistakeshouldnotbecarriedout undertherelevantprovisionsoftheAct.

Contd . 88

8. Rectification Proceedings- Contd.

8(4) The appellant or any other person, asthe case maybe,ortheAssessingOfficershallfurnisha response to the notice, as referred to in subparagraph (3), within the date and time specified therein, or such extended date and time as may be allowed on the basis of an applicationmadeinthisbehalf.

Contd. 89

8 (5) The JCIT (Appeals) shall, after taking into consideration the application and response,ifany,furnishedbytheappellant oranyotherperson,asthecasemaybe,or the Assessing Officer by an order in writing, —

8. Rectification Proceedings- Contd.

Contd. 90

8. Rectification Proceedings- Contd.

8(5)(a)rectifythemistakes;or (b) for reasons to be recorded in writing, rejecttheapplicationforrectification.

Contd. 91

8 (6) The JCIT (Appeals) shall send the order after digitallysigningitto,–

(a) the appellant or any other person, as the casemaybe;and

(b) the Assessing Officer for such action as may be required under the relevant provisionsoftheAct.

8.

Contd.

Rectification Proceedings-

Contd. 92

9. APPELLATE PROCEEDINGS

93

9. Appellate Proceedings

(9) (1) An appeal against an order passed by the JCIT (Appeals) under this Scheme shall lie before the Income Tax Appellate Tribunal having jurisdiction over the jurisdictional Assessing Officeroftheappellantassessee.

Contd. 94

9(2)Subject totheprovisionsofparagraph3ofthe Scheme, where any order passed by the JCIT (Appeals) is set-aside and remanded back to theJCIT(Appeals)bytheIncomeTaxAppellate Tribunal or High Court or Supreme Court, the order shall be assigned to a JCIT (Appeals) for further action in accordance with the provisionsofthisScheme.

9. Appellate Proceedings-Contd.

Contd. 95

10. EXCHANGE OF COMMUNICATION

BY ELECTRONIC MODE.

BY ELECTRONIC MODE.

96

10. Exchange of communication by electronic mode.

(10)ForthepurposesofthisScheme,—

(a) all communications between the JCIT (Appeals) and the appellant, or his authorised representative, shall be exchanged by electronic mode, to the extenttechnologicallyfeasible;and

Contd. 97

10. Exchange of communication by electronic mode- Contd.

(10) (b) all internal communications between the JCIT (Appeals), the Assessing Officer and the Principal Chief Commissioner or Chief Commissioner or Principal Commissioner or Commissioner, as the case may be, shall beexchangedbyelectronicmode.

Contd. 98

11. AUTHENTICATION OF ELECTRONIC RECORD

99

(11) For the purposes of this Scheme, an electronic recordshallbeauthenticatedby,–

(i) the JCIT (Appeals), in case of order passed under clause (IX) of sub-paragraph (1) of paragraph 6 or under sub-paragraph (3) of paragraph 7 or under sub-paragraph (5) of paragraph8,byaffixinghisdigitalsignature;

11. Authentication of electronic record

Contd. 100

(11)(ii)theappellantoranyotherperson,byaffixing his digital signature or under electronic verification code or by logging into his registeredaccountinthedesignatedportal;

Explanation. – For the purposes of this paragraph, "electronic verification code" shall have the same meaning as referred to in sub-rule(3)ofrule12oftheRules.

11. Authentication of electronic record-Contd.

Contd. 101

DELIVERY OF ELECTRONIC RECORD.

102

12.

(12)(1) Every notice or order or any other electronic communication under this Scheme shall be delivered to the addressee, being the appellant, by wayof,–

12.

Delivery of Electronic record

Contd. 103

(a) placing an authenticated copy thereof in theappellant'sregisteredaccount;or

12. Delivery of Electronic record-Contd. (12)(1)

Contd. 104

(b) sending an authenticated copy thereof to the registered e-mail address of the appellant or his authorised representative;or

12. Delivery of Electronic record-Contd. 12

Contd. 105

(12)(c) uploading an authenticated copy on the Mobile App of the appellant followedbyarealtimealert.

12.

Delivery of Electronic record-Contd.

Contd. 106

(12)(2)Every notice or order or any other electronic communication under this Scheme shall be delivered to the addressee, being any other person, by sending an authenticated copy thereof to the registered e-mail address of such personfollowedbyarealtimealert.

12. Delivery of Electronic record-Contd.

Contd. 107

(12)(3)Theappellantshallfurnishhisresponsetoany notice or order or any other electronic communication, under this Scheme, through his registered account, and once an acknowledgement is sent upon successful submission ofresponse, theresponseshall be deemedtobeauthenticated.

12.

Delivery of Electronic record-Contd.

Contd. 108

(12)(4) The time and place of dispatch and receipt of electronic record shall be determined in accordance with the provisions of section 13 of the Information Technology Act, 2000 (21of2000).

12. Delivery

of Electronic record-Contd.

Contd. 109

13. NO PERSONAL APPEARANCE UNDER THE SCHEME

110

13. No Personal appearance under the Scheme

(13) (1) A person shall not be required to appear either personally or throughauthorisedrepresentative in connection with any proceedingsunderthisScheme.

Contd. 111

(13)(2)Theappellantorhisauthorisedrepresentative, as the case may be, may request for personal hearing so as to make his oral submissions or present his casebeforetheJCIT (Appeals) and the concerned JCIT (Appeals) shall allow the requestforpersonalhearingandcommunicate thedateandtimeofhearingtotheappellant.

13.

No Personal appearance under the Scheme- Contd.

Contd. 112

13. No Personal appearance under the Scheme- Contd.

(13) (3) Such hearing shall be conducted through video conferencing or video telephony, including use of any telecommunication application software which supports video conferencing or video telephony,totheextenttechnologicallyfeasible, in accordance with theprocedurelaid down by theBoard.

Contd. 113

13. No Personal appearance under the Scheme- Contd.

(13)(4)Anyexaminationorrecordingofthestatementofthe appellantor anyother person shall beconducted by the JCIT (Appeals) under this Scheme, exclusively through video conferencing or video telephony, including use of any telecommunication application software which supports video conferencing or video telephony, to the extent technologically feasible,inaccordancewiththeprocedurelaiddown bytheBoard.

Contd. 114

(13)(5) The Board shall establish suitable facilities for video conferencing or video telephony including telecommunication application software which supports videoconferencingorvideotelephonyatsuchlocationsas maybenecessary,soastoensurethattheappellant,orhis authorised representative, or any other person is not denied the benefit of this Scheme merely on the ground that such appellant or his authorised representative, or any other person does not have access to video conferencingorvideotelephonyathisend.

13. No Personal appearance under the Scheme- Contd.

Contd. 115

14. Functions

of the Principal Chief Commissioner of Income-tax

of the Principal Chief Commissioner of Income-tax

116

National Faceless Appeal Centre.

14. Functions of the Principal Chief Commissioner of Incometax National Faceless Appeal Centre.

(14) The Principal Chief Commissioner of Income-tax (National Faceless Appeal Centre), with the prior approval of Board, fortheeffectivefunctioningoftheOfficeof the JCIT (Appeals) set-up under this Scheme, shall perform the following functions,namely:-

Contd. 117

14. Functions of the Principal Chief Commissioner of Incometax National Faceless Appeal Centre-Contd.

(14)(i)transferinandtransferoutofcasesfrom e-appealScheme;

Contd. 118

14. Functions of the Principal Chief Commissioner of Income-tax National Faceless Appeal Centre-Contd.

14. Functions of the Principal Chief Commissioner of Income-tax National Faceless Appeal Centre-Contd.

Contd. 119

(14)(ii)transferofcasesfromoneJCIT(Appeals) toanother;

14. Functions of the Principal Chief Commissioner of Income-tax National Faceless Appeal Centre-Contd.

(14) (iii) co-ordinate with the Principal Director General or Director General of Income tax(Systems)fordevisingprocessesfor allocationofappeals,ifrequired;

Contd. 120

(14)(iv)approvalofFormatsofnoticesor letter;

14. Function of the Principal Chief Commissioner of Income-tax National Faceless Appeal Centre-Contd.

14. Function of the Principal Chief Commissioner of Income-tax National Faceless Appeal Centre-Contd.

Contd. 121

14. Function of the Principal Chief Commissioner of Income-tax National Faceless Appeal Centre-Contd.

(14)(v) issuing Standard Operating Procedures for various processes and forconductingVideoConference;and

Contd. 122

14. Function of the Principal Chief Commissioner of Income-tax National Faceless Appeal Centre-Contd.

(14)(vi)

Contd. 123

any other procedural function assigned by the Board from time to time.

15. POWER TO SPECIFY FORMAT, MODE, PROCEDURE AND PROCESSES

124

15. Power to specify format, mode, procedure and processes

(15) The Principal Director General or the Director General of Income-tax(Systems)shall,inconsultationwiththePrincipal Chief Commissioner of Income-tax National Faceless Appeal Centre, if required, lay down the standards, procedures and processes for effective functioning of the Office of the JCIT

(Appeals) set-up under this Scheme, in an automated and mechanisedenvironment,includingformat,mode,procedure and processes with the prior approval of the Board, in respectofthefollowing,namely:—

Contd. 125

15. Power to specify format, mode, procedure and processesContd.

(15)(i) service of the notice, order or any othercommunication;

Contd. 126

15. Power to specify format, mode, procedure and processesContd.

(15)(ii) receipt of any information or documents from the person in response to the notice, order or any othercommunication;

Contd. 127

15. Power to specify format, mode, procedure and processesContd.

(15)(iii) issue of acknowledgment of the response furnished by the person;

Contd. 128

15. Power to specify format, mode, procedure and processes

Contd.

(15)(iv)provisionof"e-appeal"facilityincluding login account facility, tracking status of appeal, display of relevant details, and facilityofdownload;

Contd. 129

15. Power to specify format, mode, procedure and processes

Contd.

(15)(v)accessing,verificationandauthentication of information and response including documents submitted during the appellateproceedings;

Contd. 130

15. Power to specify format, mode, procedure and processesContd.

(15)(vi) receipt, storage and retrieval of information or documents in a centralisedmanner;and

Contd. 131

15. Power to specify format, mode, procedure and processesContd.

(15)(vii) any other function assigned by the Boardfromtimetotime.

Contd. 132

16. APPLICATION OF PROVISIONS OF THE ACT

133

16. Application of Provisions of the Act

Save as otherwise provided in this Scheme, the provisionsofclause(28CA)ofsection2,section120, section 129, section 131, section 133, section 134, section 136, section 140, section 154, section 155, section 282, section 282A, section 283, section 284, ChapterXXandChapterXXI,andotherprovisionsof the Act, shall apply to the procedure in disposal of appealbytheJCIT(Appeals)underthisScheme.

134

16. Application of Provisions of the Act- Contd.

Sec2(28CA) - "JointCommissioner(Appeals)"

Sec120- Jurisdiction of income-tax authorities

Sec129-Changeofincumbentofanoffice.

Sec131-Powerregardingdiscovery,productionofevidence,etc.

Sec133-Powertocallforinformation.

Sec134-Powertoinspectregistersofcompanies.

Sec136-Proceedingsbeforeincome-taxauthoritiestobejudicialproceedings.

Sec140-Returnbywhomtobeverified.

Sec154-Rectificationofmistake.

Sec155-Amendmenttoassessmentsconsequenttoassessmentorre-assessment ofconnectedentities

Sec282-Serviceofnoticegenerally.

Sec282A-Authenticationofnoticesandotherdocuments.

Sec283-Serviceofnoticewhenfamilyisdisruptedorfirm,etc.,isdissolved.

Sec284–Serviceofnoticeinthecaseofdiscontinuedbusiness. ChapterXX–AppealsandRevision

ChapterXXI–PenaltiesImposable

135

SCOPE OF E-APPEALS SCHEMEORDER UNDER

SUB-SECTION (6) OF SECTION 246 OF THE INCOME-TAX ACT, 1961 DATED 16.6.2023

136

Scope of the e-Appeals Scheme

Included in JCIT (A)

In Pursuance of the sub-section (6) of section 246 of the Income-tax Act,1961 (hereinafter referred to as “the Act”), read with sub-section (1) ofsection246oftheAct,theCentralBoardofDirectTaxes(CBDT)hereby specifies that all the appeals under section 246 and/or under clause (a), clause(b),clause(c),clause(ha),clause(hb),clause(q)ofsub-section(1) of section 246A of the Act shall be completed under the e-Appeals

Scheme,2023 notified under sub-section (5) of section 246 of the Act, exceptthefollowing:-

Section246(6):Forthepurposesofsub-section(1),theBoardmayspecify that the provisions of that sub-section shall not apply to any case or any classofcases

Contd. 137

Scope of the e-Appeals Scheme

Sec 246 Appealable orders before Joint Commissioner (Appeals).

246. (1) Any assessee aggrieved by any of the following orders of an Assessing Officer (below the rank of Joint Commissioner) may appeal to the Joint Commissioner (Appeals) against—

(a) an order being an intimation under sub-section (1) of section 143, where the assessee objects to the making of adjustments, or any order of assessment under sub-section (3) of section 143 or section 144,where the assessee objects to the amount of income assessed, or to the amount of tax determined, or to the amount of loss computed, or to the status under which he is assessed;

(b) an order of assessment, reassessment or recomputation under section 147;

(c) an order being an intimation under sub-section (1) of section 200A;

(d) an order under section 201;

(e) an order being an intimation under sub-section (6A) of section 206C;

(f) an order under sub-section (1) of section 206CB;

(g) an order imposing a penalty under Chapter XXI; and

(h) an order under section 154 or section 155 amending any of the orders mentioned in clauses (a) to (g):

Contd. 138

Scope of the e-Appeals Scheme –Contd.

Included in JCIT (A)

Section 246A- Appealable Orders Before Commissioner (Appeals)

246A(1) Any assessee or any deductor or any collector aggrieved by any of the following orders (whether made before or after the appointed day) may appeal to the Commissioner(Appeals)against—

Contd. 139

Included in JCIT (A)

Section246A-AppealableOrdersBeforeCommissioner(Appeals)

(1)(a)anorderpassedbyaJointCommissionerunderclause(ii)ofsub-section(3) of section 115VP or an order against the assessee where the assessee denies his liability to be assessed under this Act or an intimation under sub-section (1) or sub-section (1B) of section 143 or sub-section (1) of section200Aorsub-section(1)ofsection206CB,wheretheassesseeorthe deductororthecollectorobjectstothemakingofadjustments,oranyorder ofassessmentundersub-section(3)ofsection143[exceptanorderpassed in pursuance of directions of the Dispute Resolution Panel or an order referred to in sub-section (12) of section 144BA] or section 144, to the income assessed, or to the amount of tax determined, or to the amount of losscomputed,ortothestatusunderwhichheisassessed;

–Contd.

Scope of the e-Appeals Scheme

Contd. 140

Scope of the e-Appeals Scheme

Section115VP - Method and time of opting for tonnage tax scheme.

Section143(1)–Intimation-processingofreturns

Section143(1B)-PowerofCentralGovernment–Schemeforprocessingof returns

Section200A -Processingofstatementsoftaxdeductedatsource.

Section206CB-Processingofstatementsoftaxcollectedatsource.

Section143(3)–ScrutinyAssessmentOrder

Section 144BA(12) - Orders passed with the prior approval of Principal CommissionerorCommissioner

Section144–BestJudgmentAssessment

Contd.

–

Contd. 141

Included in JCIT (A)

Section246A-AppealableOrdersBeforeCommissioner(Appeals)

(1)(b) an order of assessment, reassessment or recomputation under section 147 [except an order passed inpursuance of directions of theDisputeResolutionPaneloranorderreferredtoinsub-section (12)ofsection144BA]orsection150;

Section147:Incomeescapingassessment

Section144BA(12):OrderspassedwiththepriorapprovalofPrincipal CommissionerorCommissioner

Section150:Caseswhereassessmentisinpursuanceofanorderon appeal,revisionetc.

Scope of the e-Appeals Scheme-Contd.

Contd. 142

Included in JCIT (A)

Section246A-AppealableOrdersBeforeCommissioner(Appeals)

(1)(c)anordermadeundersection154orsection155havingtheeffectof enhancingtheassessmentorreducingarefundoranorderrefusing to allow the claim made by the assessee under either of the said sections except an order referred to in sub-section (12) of section 144BA;

Section154:Rectificationofmistake

Section155:Amendmenttoassessmentsconsequenttoassessmentorreassessmentofconnectedentities

Section144BA(12):OrderspassedwiththepriorapprovalofPrincipal CommissionerorCommissioner

of

e-Appeals

Scope

the

Scheme-Contd.

Contd. 143

Scope of the e-Appeals Scheme-Contd.

Included in JCIT (A)

Section246A-Appealable OrdersBeforeCommissioner(Appeals)

(1)(ha)anordermadeundersection201;

Section201: Consequencesoffailuretodeductorpay.

Contd. 144

Scope of the e-Appeals Scheme-Contd.

Included in JCIT (A)

Section246A-Appealable OrdersBeforeCommissioner(Appeals)

(1)(hb) an order made under sub-section (6A) of section206C;

Section206C(6A):

FailuretocollectordepositTCS

Contd. 145

Scope of the e-Appeals Scheme-Contd.

Included in JCIT (A)

Section246A-Appealable OrdersBeforeCommissioner(Appeals)

(1)(q) an order imposing a penalty under Chapter XXI;

CHAPTERXXI–PenaltiesImposable

Contd. 146

APPEALS SPECIFICALLY EXCLUDED FROM JCIT(APPEALS)

Contd. 147

Scope of the e-Appeals Scheme-Contd.

Excluded from JCIT(A)

(i) Appeals against assessment orders passed before 13.08.2020 (Date of Introduction of Faceless

AssessmentScheme,2019)undersub-section(3)of section 143 or section 144 of the Act, having disputeddemandmorethanRs.10Lakh.

Contd. 148

Scope of the e-Appeals Scheme –Contd.

Excluded from JCIT(A)

(ii)Appealsrelatedto:

1. assessment orders passed with respect to cases pertaining to jurisdiction of CommissionerofIncome-tax(Central).

Contd. 149

Scope of the e-Appeals Scheme –Contd.

Excluded from JCIT(A)

(ii)Appealsrelatedto:

2. assessments completed in pursuance of search under section 132 or requisition undersection132AoftheAct.

Section 132 - Search and seizure.

Section 132A - Powers to requisition books of account, etc.

Contd. 150

Scope of the e-Appeals Scheme –Contd.

Excluded from JCIT(A)

(ii)Appealsrelatedto:

3. assessments completed in pursuance of any action under section 133A of the Act.

Section 133A - Power of survey.

Contd. 151

Scope of the e-Appeals Scheme –Contd.

Excluded from JCIT(A)

(ii)Appealsrelatedto:

4.assessmentswhereaddition/variationin income is made on the basis of seized/ impoundedmaterial.

Contd. 152

Scope of the e-Appeals Scheme –Contd.

Excluded from JCIT(A)

(iii) Appeals in cases pertaining to the jurisdictionofCommissionerofIncometax

(InternationalTaxation).

Contd. 153

Excluded from JCIT(A)

(iv) Appeals against the penalty orders passed before 12.01.2021(dateofintroductionofFacelessPenalty Scheme, 2021) with respect to cases referred to in category (i), having disputed demand of more than Rs.10lakh.

Category (i) Appeals against assessment orders passed before 13.08.2020 (Date of Introduction of Faceless Assessment Scheme, 2019) under subsection (3) of section 143 or section 144 of the Act, having disputed demandmorethanRs.10Lakh.

of

–Contd.

Scope

the e-Appeals Scheme

Contd. 154

Excluded from JCIT(A)

(v) Appeals against the penalty orders passed in categories of cases mentioned in point1to4of(ii)andof(iii)above.

Point(ii)

1.assessment orders passed with respect to cases pertaining jurisdiction of CommissionerofIncome-tax(Central).

2.assessments completed in pursuance of search under section 132 or requisition undersection132AoftheAct.

3.assessmentscompletedinpursuanceofanyactionundersection133AoftheAct.

4.assessmentswhereaddition/variationinincomeismadeonthe basisofseized/ impoundedmaterial.

Point(iii)

Appeals in cases pertaining to the jurisdiction of Commissioner of Income-tax (InternationalTaxation).

of the e-Appeals Scheme –Contd.

Scope

Contd. 155

Scope of the e-Appeals Scheme –Contd.

Excluded from JCIT(A)

(vi) Appeals against assessments orders passed on or after 12.09.2019 (date of introduction of EAssessment Scheme, 2019) under the eAssessment Scheme, 2019 or the Faceless Assessment Scheme, 2019 or under section 144BoftheAct.

Section 144B - Faceless Assessment

Contd. 156

Scope of the e-Appeals Scheme –Contd.

Excluded from JCIT(A)

(vii) Appeal against penalty orders passed on or after 12.01.2021 under the FacelesspenaltyScheme,2021.

Contd. 157

Scope of the e-Appeals Scheme –Contd.

2. For the purpose of this order, “disputed demand”means-

(i) the difference between the tax on total income assessed and the tax on the returned income,iffiled;

(ii) taxontotalincomeassessedwherenoreturn hasbeenfiled;

Contd. 158

Scope of the e-Appeals Scheme –Contd.

2(iii) for a penalty order, the amount of penalty imposed under Chapter XXI of theAct;and

Contd. 159

2 (iv) demand raised vide notice under section 156orintimationissuedundersub-section (1)ofsection143orundersub-section(1) ofsection 200A orunder sub-section(1)of section206CB,inanyothercase;

–Contd.

Scope of the e-Appeals Scheme

Contd. 160

Scope of the e-Appeals Scheme –Contd.

The disputed demand shall include applicable interest,surcharge&cess.

Contd. 161

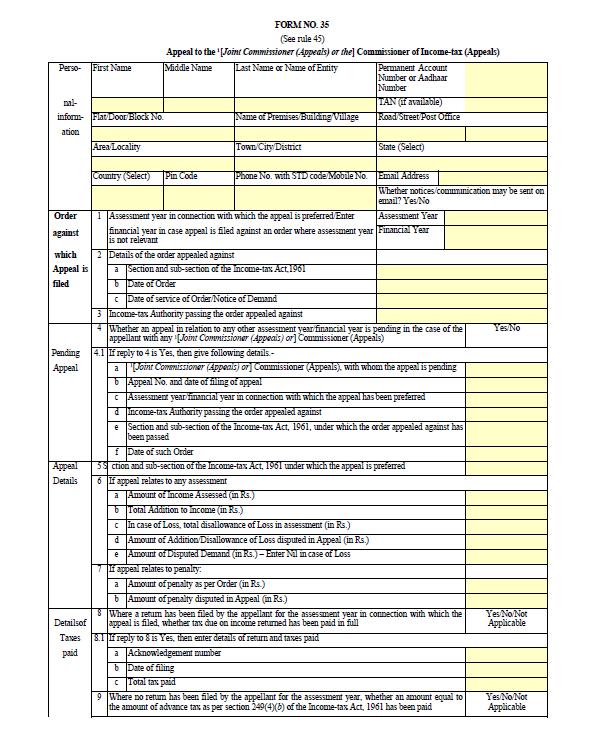

Income-tax (Sixth Amendment) Rules, 2023 vide CBDT Notification dated 29.05.2023 162

Income-tax (Sixth Amendment) Rules, 2023 vide CBDT Notification dated 29.05.2023

G.S.R. 396(E).—In exercise of powers conferred by sub-section (1) of section 249 read with section 295 of the Income-tax Act, 1961 (43 of 1961), the Central Board of Direct Taxes hereby makes the following rules further to amend the Income-tax Rules, 1962, namely:-

1. Short title and commencement. —(1) These rules may be called Income-tax (Sixth Amendment) Rules, 2023.

(2) They shall come into force from the date of its publication in the Official Gazette.

2. In the Income-tax Rules, 1962,—

(I) In rule 45,—

(A) in the marginal heading, for the words and brackets “Commissioner (Appeals)”, the words and brackets “Joint Commissioner (Appeals) or Commissioner (Appeals)” shall be substituted;

(B) in sub-rule (1), for the words and brackets “Commissioner (Appeals)”, the words and brackets “Joint Commissioner (Appeals) or the Commissioner (Appeals)” shall be substituted;

(II) In rule 46A,—

(A) in the marginal heading, for the words “Deputy Commissioner”, the words “Joint Commissioner” shall be substituted;

(B) for the words “Deputy Commissioner” wherever they occur, the words “Joint Commissioner” shall be substituted;

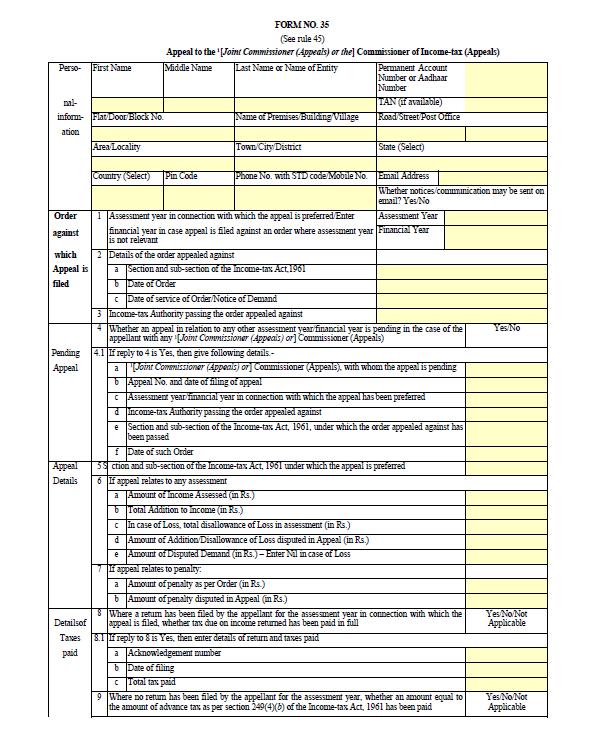

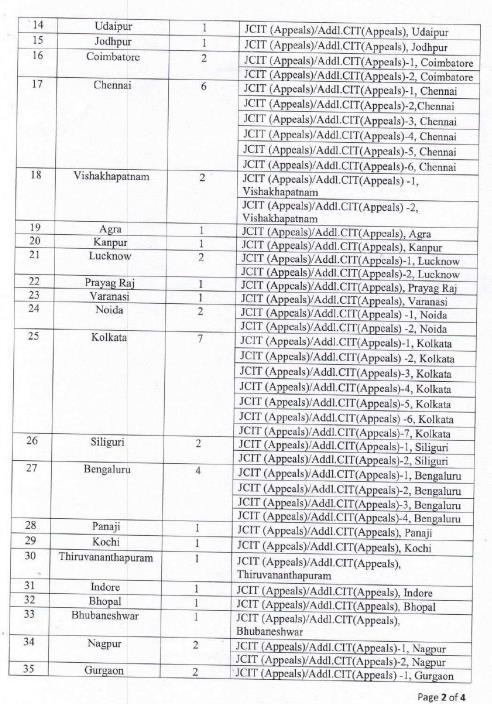

(III) In Appendix-II, in FORM NO. 35,—

(A) in the heading, before the words “Commissioner of Income-tax”, the words and brackets “Joint Commissioner (Appeals) or the” shall be inserted;

(B) before the word “Commissioner” wherever they occur, the words and brackets “Joint Commissioner (Appeals) or” shall be inserted.

Contd. 163

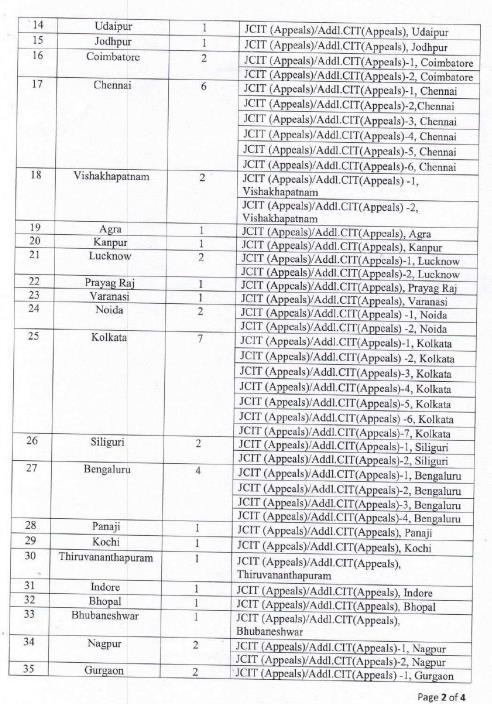

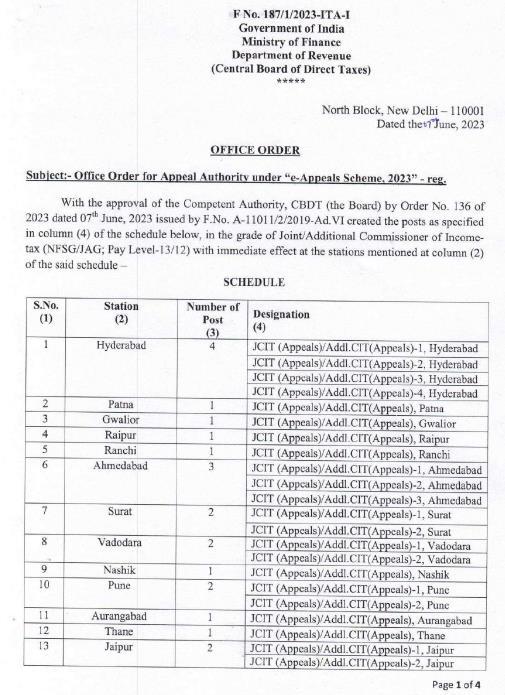

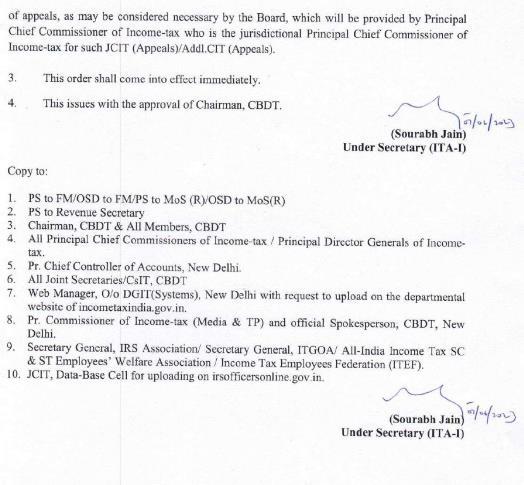

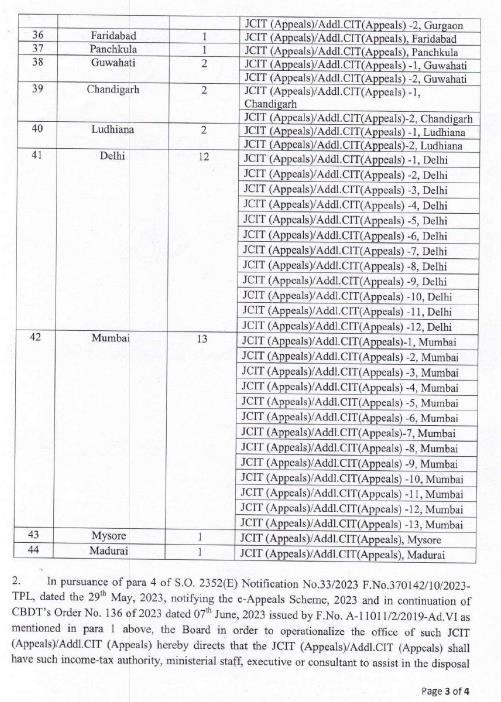

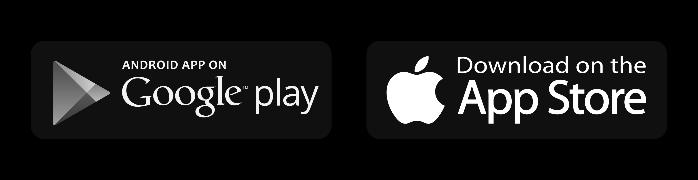

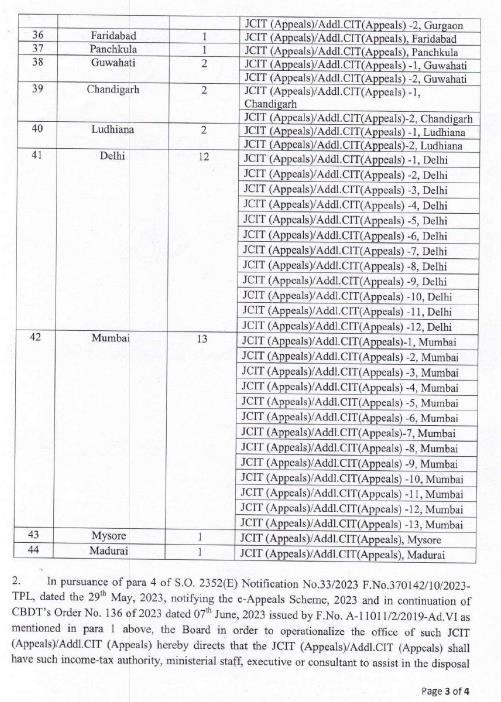

Appointments of Joint Commissioner of Income Tax (Appeals)- List

Contd. 164

Appointments of Joint Commissioner of Income Tax (Appeals)- List- Contd.

Contd. 165

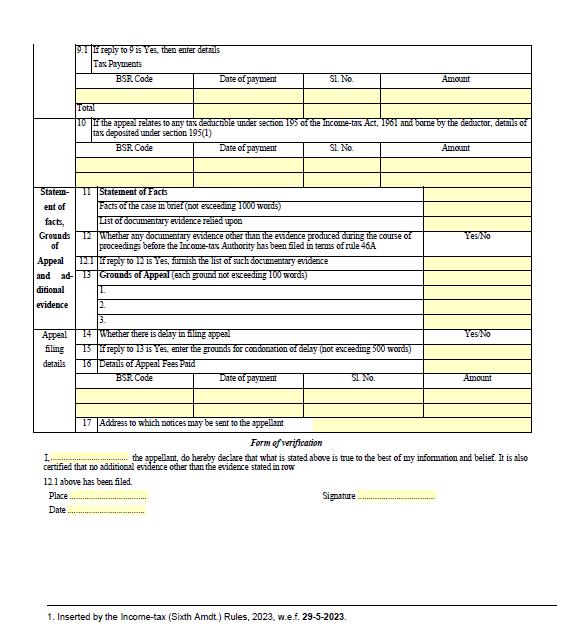

Form 35 (Amended)

Contd. 166

Form 35 (Amended)- Contd.

Contd. 167

168

Head office: 5-9-58/304,GuptaEstate,

BasheerBaghcircle, Hyderabad-500004

Branch office: No.214,Secondfloor, Westendmall,

RoadNo.36,Jubileehills, Hyderabad-500033

Thank You! For More Information, Visit: https://taxmann.com/ Get in touch with us on Social Media: Follow us on Social Media: Download Taxmann App