Digital Services –Egypt and India Perspective

November 2024

November 2024

•The credit is always applied to inputs at a standard rate in the ordinary course of business, so any direct and indirect expenses associated with sales subject to the standard rate are tax deductible*

05

– Place of supply, Threshold

•the place of jurisdiction include any local or Imported transaction to a benefit of a local customer.

•Thresholds;

•Stamdard goods and services 500k EGP.

•Table goods and services 0 EGP.

01 – Levy

• Standard goods and services (VAT)

•Table goods and services (table tax then

VAT or table tax only).

•Exempted Goods and services (57).

•Imported goods (custom tax +VAT).

•Imported services ( VAT or RCM).

02 – Rates

• 0%

•5%

•8%

•10%

•14%

•15% & 30%

04 – Time of supply

• Goods–Earlier of date of “risk transfer”, removal, invoice, payment on advance

• Services–Earlier of date of invoice or payment on advance* except 4 continuing services. ** professional fee.

•Excise tax

03 – VAT on B2C and B2B

• Exclusions: Salaries, public governmental services, Financing loans Intra combination group , stock and derivatives Exchange.

•Exemptions: 57 goods and services, fresh Food, milk products, Tea, sugar, coffee bean, education, health and medicine, financial services*, Insurance, mining products, flights and and overseas ships services.

• Credit for all expenses in course or furtherance of business

Place of Supply

• PoS Rules to determine levy/jurisdiction for goods and services

Levy

• Dual GST regime

• CGST+SGST on intra-state supplies

• IGST on inter-state supplies (including import of goods)

Time of Supply

• Goods–Earlier of date of removal/ invoice/ payment

• Services–Earlier of date of invoice or payment

Rates

• 0%

• 28%

• Cess as applicable

• Basic Customs Duty and Customs Cess

• Petroleum products,

• Alcohol, • Power

Stamp Duty

06 - Penalties

• Ban access to Egyptian markets.

• A risk review.

• 1.5% additional tax on the taxpayer per month or part of a month

05 – VAT Rate and VAT Refund

• Standard Rate14%

• Professional services 10%.

• Examption Servecies.

• A refund to recover input VAT they have incurred in Egypt

04 – Compliance and Obligations

• Registration, TRN, Invoicing EU, API Verification of local business TRN.

• Tax Period, Currency,

• Taxable amount at the VAT rate.

01 – Scope of Main Digital Services

• Streaming services

• Software and online licenses , Website design and tools.

• Legal, accounting, Consultancy and Professional services.

02 – Place of Services

• Egyptian Taxpayer, Business, NPO, Governmentl body.

• Pemanent resident in Egypt.

03 – VAT on B2C and B2B

• B2C > Simlified Vendor Registtaion “VAT Obligations”

• B2B > Revese Charge Mechanism “API”

Non-resident Vendor Recipient in Egypt

VAT to be paid in Egypt Renders Digital services

For the said services, a Recipient is considered to be in Egypt,.

Non-registered person having permanent residence in Egypt

Governmental Body, Public or Economic Authority, other Authority or non-registered entity in Egypt

Registered taxpayer in Egypt

If recipient has multiple establishments - Place of supply will not be in Egypt if the service is predominantly used by recipient's permanent establishment in another Country.

Where at the time of the performance of the service, there is no necessary connection between the physical location of the recipient and the place of physical performance

• Advertising on the internet

• Providing cloud services, Domain name, Email tools

• Provision of Content; e-books, music, images, videos.

• Software and other intangibles and other related services license and maintenance.

• Providing data or information: newspapers subscription, Forex tread, and the like.

• Online supplies of digital content (movies, television shows, and the like.

• Online gaming.

Services that require customer's physical presence in a specific location to receive are not remote services, even if they are booked online.

• Booking of hotel services

• Physiotherapy services

• Physical entry to entertainment or sporting events.

• Restaurant and catering services; and Passenger transportation services.

Popularly known as Online Information and Database Access or Retrieval Services (‘OIDAR’)

It refers to services:

• whose delivery is mediated by information technology

• over the internet or an electronic network and

• the nature of which renders their supply impossible to ensure in the absence of information technology

Advertisement on Internet Cloud services

E-books, Movies, Music etc. through telecommunication network or internet

Database access or Retrieval in electronic form through a computer network

Online supplies of digital content

Digital data storage

Online gaming except online money gaming

Supplier of Digital Services – Outside India

Recipient of Digital services - India

Recipient is registered under GST – B2C transaction

Supplier of Digital Services – Outside India

Recipient of Digital services - India

Recipient is registered under GST – B2B transaction

Taxability in the hand – Supplier of Digital services

Taxability in the hand – Recipient of Digital services

Taxation under Forward Charge Mechanism

Taxation under Reverse Charge Mechanism

Supplier of Digital Services – Outside India

Services through an Intermediary – Outside India

Recipient of Digital services - India

Recipient is registered under GST – B2C transaction

Taxability in the hand – Intermediary of Digital services

Invoice from intermediary separately identifies services by him and digital service provider

Taxation under Forward Charge Mechanism

Intermediary is not liable

Intermediary not responsible for collection or processing of payment

Terms and conditions of supply are not determined by intermediary

Standard Rate of VAT 14%

Digital services

• Digital Services are liable to VAT at a standard rate of 14%

• Advertising on the internet

• Providing cloud services, Domain name, Email tools

• Provision of Content; e-books, music, images, videos.

• Software and other intangibles and other related services license and maintenance.

• Providing data or information: newspapers subscription, Forex tread, and the like.

• Online supplies of digital content (movies, television shows, and the like.

• Online gaming.

Reduced Rate of VAT 10%

Professional services

• Legal, Accounting, Consultancy, Professional Certificates services and Freelancers services are liable to VAT at a rate of 10%.

Exemption of VAT

Educational services

• Training and Educational Services are exempted of VAT*.

• *Under certain conditions

• Place of supply of OIDAR services shall be the location of the recipient of service

• Person receiving such services shall be deemed to be located in the taxable territory, if any two of the following non contradictory conditions are satisfied, namely:

o Location of address presented by the recipient through internet

o The credit card or debit card or any other card by which the recipient settles payment;

o The billing address of the recipient;

o The IP address of the device used by the recipient

o The bank of the recipient in which the account used for payment;

o The country code of the SIM card used by the recipient;

o The location of the fixed land line through which the service is received by the recipient

Is in the taxable territory

• Liable to GST at a standard rate of 18%

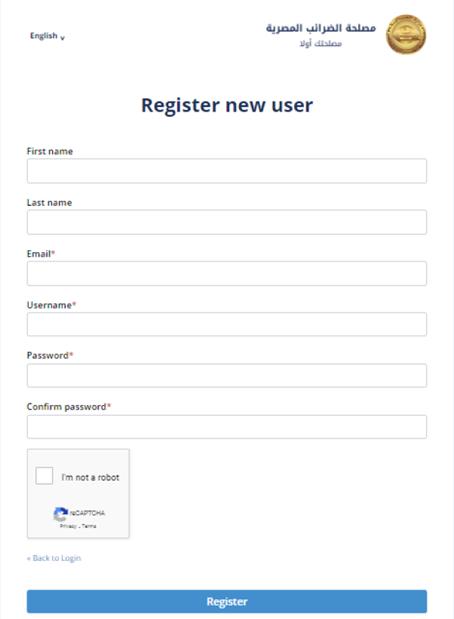

Submitting application

Review of application by ETA

Entry into designated register

Assigning registration no.

Fails to apply for registration

If a person responsible to apply for registration fails to apply, they will be treated as registered under the simplified vendor registration regime – starting from the date their sale value reaches the registration threshold.

https://www.eta.gov.eg/sites/default/files/2023-06/e-commerce_user_guide.pdf

Mandatory Registration

• Overseas supplier of Digital services liable to obtain GST registration

• Registration is mandatory irrespective of the Turnover

• Registration to be obtained within 30 days of becoming liable

Registration process

• Single registration under Simplified Registration Scheme

• Form GST REG – 10

• Application to be filed online

Registration by Representative

• Overseas supplier of digital services can appoint a person in the taxable territory for the purpose of:

o Registration under GST

o Payment of taxes

Invoicing Requirements (B2C)

• Invoice Reference; Invoice/receipt issuing date, Invoice/receipt number.

• Registrant data; The name and the tax registration number of registrant.

• Services Data; description of the service supplied, its amount, and the rate and the amount of VAT

• Additional data of advertising services; Name and ID of the consumer (EU).

Invoicing Requirements (B2B)

• Invoice Reference; Invoice/receipt issuing date, Invoice/receipt number.

• Registrant data; The name and the tax registration number of registrant.

• Customer data; The name of the resident taxpayer, tax registration number of the resident taxpayer (must me verified through API system).

• Services Data; description of the service supplied, amount (no VAT applying)*, the resident taxpayer must comply Reverse Charge Mechanism RCM .

API integration System.

• The system of non-resident Registrant should integrate with the API system, allowing for the automated exchange of information between the non-resident Registrant and the ETA, enabling real-time verification of the tax registration number and UIN of resident taxpayer .

https://www.eta.gov.eg/sites/default/files/2023-06/20230619_e-commerce_tax_api_platform.pdf

• VAT return; within the end of the month following the expiration of the taxable period (monthly tax return).

• Required Data; Supplier’s or platform’s registration Name –Tax Identification Number -Tax Period –Currency -Taxable amount at the standard rate -Taxable amount at a reduced rate(s), if any- Tax amount payable.

• Payment; When submitting a simplified vat return, you must include the bank transfer swift document in the attached icon, and the swift's specific details are as follows:

• Beneficiary Bank Name: Central Bank of Egypt

• Beneficiary Cust Name: Ministry of Finance/ Egyptian Tax Authority.

• SWIFT Code: CBEGEGCXXXX

• USD; IBAN Code - EG140001000100000004082189165

• Euro; IBAN Code - EG510001000100000004082189178

• GBP; IBAN Code - EG670001000100000004082189181

Monthly Return

• Monthly return

• Form GSTR-5A

• Timeline: 20th of month succeeding the relevant calendar month

Annual Return

• Exemption from filing of Annual Return unlike a domestic supplier of service who needs to file Annual Return in GSTR-9

• Exemption from filing of Annual Reconciliation Statement unlike a domestic supplier of service who needs to file the reconciliation statement in form GSTR-9C

Invoicing requirement

• Requirement to issue a Tax invoice

• Tax invoice to include name of Recipient State - This will be considered as official address of the recipient for determination o place of supply of service

Particulars Charges

Late VAT payment (1) ETA charges 1.5% additional tax on the taxpayer per month or part of a month

Late filing/Non filing of the VAT return/declaring inaccurate information (1)

VAT return not submitted within 60 days of the due date (1)

ETA is entitled to impose a penalty between EGP 3K and EGP 50K

A penalty between EGP 50K and EGP 2M will be imposed

Tax evasion (1) Penalty of EGP 5K to EGP 50K and/or imprisonment between 3 and 5 years. Double if recommitted within 3 years.

Not reporting invoices in time (1) Penalty between EGP 20K and EGP 100K

Failure to obtain registration by non-resident (2)

ETA may ban access to Egyptian markets until registration is obtained. Also, when Egyptian tax laws are not complied, ETA will contact the responsible person, and if they don't respond, ETA may commence a risk review.

A Risk Review may result in:

Registering the person for Egyptian VAT and sending an assessment of liability based on ETA’s calculation with additional penalties.

Registering the debt in the court in the responsible person’s Country

1. (Law no. 206 of 2020)

2. (Law no. 3 of 2022)

Higher of the following:

• INR 20000/- [i.e. INR 10000/- each under the CGST act and SGST act OR

• Amount equivalent to tax evaded

Higher of the following:

• INR 20000/- [i.e. INR 10000/- each under the CGST act and SGST act OR

• Amount equivalent to tax evaded

• INR 200/- per day of default [i.e. INR 100/- each per day under CGST Act and SGST Act] subject to a maximum of INR 10000/- [i.e. INR 10000/- each under CGST and SGST Act]

Failure to file GSTR-5A (monthly return)

Failure to obtain registration Interest for delay in payment of tax

• 18% P.A. for the period in default Failure for payment of Tax