www.tmslglobal.com ServingTax,Technologically SunilKumar TMSL FateofGSTITCafterretrospective cancellationofVendorRegistration _________________________ JigarDoshi&SunilKumar March-2023

TableofContents

•RelevantLegalProvisions

-InputTaxCredit

-Cancellationofregistration

•SupplierNonexistentatdeclaredPOB

-IllustrativeTransaction

-SampleNotices

-LitigationStrategy

•NonpaymentoftaxbyVendor

-IllustrativeTransactions

-SampleNotices

-LitigationStrategy

•FakeInvoicing

•Wayforward-AutomatingP2P ProcessesfromGSTperspective

•Q&A

RelevantLegalProvisions

.

WhocanclaimITC?

•EveryregisteredpersoniseligibletoclaimcreditofinputtaxofGSTpaidongoodsorservicesorbothwhichare usedbyhiminthecourseorfurtheranceofbusiness

ConditionsforclaimingITC?

•Possessionoftax-payingdocument

•DetailsofinvoicefurnishedunderFormGSTR-1andcommunicatedtorecipient

•ReceiptofGoods/services

•PaymentoftaxbysuppliertoGovernment

•Returnisfiledbytherecipient

•Paymentismadetovendorwithin180daysinspecifiedcases

•Creditisclaimedwithinthespecifiedtimelimit,etc.

NatureofITC?

ClaimingITC-GSTProvisions TMSL

•ITCmechanismconstitutesaconcessiongrantedbythelegislature

VedantaLimitedvsUOI[2023]146taxmann.com262(Orissa)

CancellationofRegistration-GSTProvisions

GroundsforcancellationofGSTregistration(Section29ofCGSTAct):

Sl.No.GroundsforCancellation

CancellationbasedonApplicationfiledbyRP[Section29(1)]

1. Discontinuation/transferofbusiness

2. Changeinconstitutionofbusiness

3.Nolongerliabletoberegistered

4.Optingoutofvoluntaryregistration

Suo-motocancellationbyPO[Section29(2)]

5.ContraventionofspecifiedprovisionsofGSTlaw(Rule21)

6.Non-furnishingofFormGSTR4withinthreemonthsfromitsduedate

7. Non-furnishingofreturns(i.e.FormGSTR3B)byanypersonotherthanacompositedealer:

-Forsixcontinuousmonths(Normaltaxpayers)

-Twotaxperiods(TaxpayersoptedforQRMPScheme)

8.Non-commencementofbusinesswithinsixmonthsfromregistration

9.Registrationobtainedbymala-fidemeans

TMSL

CancellationofRegistration-GSTProvisions

Contraventionofspecifiedprovisions(Rule21ofCGSTRules):

Issuanceofaninvoice/billwithoutsupplyofgoods/servicesinviolationofGSTlaw

ViolationofSection171andrelatedrules

ViolationofRule10AofCGSTRulesi.e.nonfurnishingofbankaccountdetailsafter grantofcertificateofregistration 5.ExcessclaimofITC

WhereITCisavailedinviolationofSection16oftheCGSTActorrulesmade thereunder 6.Under-reportingof

FurnishingdetailsofoutwardsuppliesinGSTR-1foroneormoretaxperiodswhichis inexcessoftheoutwardsuppliesdeclaredinGSTR-3Bforsaidtaxperiods

ViolationofRule86B(i.e.Restrictionsonuseofamountavailableinelectroniccredit ledger)

TMSL

Sl.No.ContraventionDescriptionofContravention

adeclaredplace

1.Notdoingbusinessfrom

Doesnotconductanybusinessfromdeclaredplaceofbusiness 2.Fakeinvoicing

3.Non-compliancewith Anti-profiteering provisions

4.Non-furnishingofBank accountdetails

outwardsupplyinGSTR3B

7.Non-compliancewith Rule86B

CancellationofRegistration-GSTProvisions

RetrospectivecancellationofRegistration:

•POisempoweredtocancelregistrationfromanyretrospectivedate,ashemaydeemfit,inthecircumstances coveredinSl.No.5to9.Relevantprovisionreadsasunder:

Theproperofficermaycanceltheregistrationofapersonfromsuchdate,includinganyretrospective date,ashemaydeemfit,where,—

•Opportunityofbeingheardismandatorytobegivenbeforecancellingregistration

Whatisthemeaningof‘ashemaydeemfit’?

Canregistrationbecancelledarbitraryfromanyretrospectivedate?

Undoubtedly,thisexpression'asitdeemsfit'confersajurisdictionofwidestamplitudeonthequasi-judicial tribunal.Butthatdoesnotmeanthatsuchtribunalcanpassanyorderintotaldisregardofthestatutory provisionsunderwhichthequasi-judicialtribunaliscreatedandisconferredjurisdictiontoresolvedisputes arisingintheimplementationofthestatute……

…….thediscretionaryjurisdictionhastobeexercisedkeepinginviewthepurposeforwhichitisconferred,the objectsoughttobeachievedandthereasonsforgrantingsuchwidediscretion.

(NarendarSinghVs.ChhoteySingh,AIR1983SC990)

TMSL

(a).. (b).. (c)..

[Section29(2)ofCGSTAct]

MostCommonGroundsforRegistrationCancellation

A.Non-Existentofsupplieratdeclaredplaceofbusiness

B.Non-filingofGSTR3BbySupplier

C.FakeInvoicing(otherthanA)

TMSL

CommonGrounds

SupplierNonexistentatdeclared POB.

ABCRecruitmentCo.

TMSL XLimited ManpowerSupply Services 1 Fieldvisitandcancelled registration retrospectively GSTAuthority GSTAuthority FlowofInformation SCNfordenyingITC Contract Payment 3 4 2

IllustrativeTransaction

AllegationSample-NonexistenceofvendoratPOB

TMSL

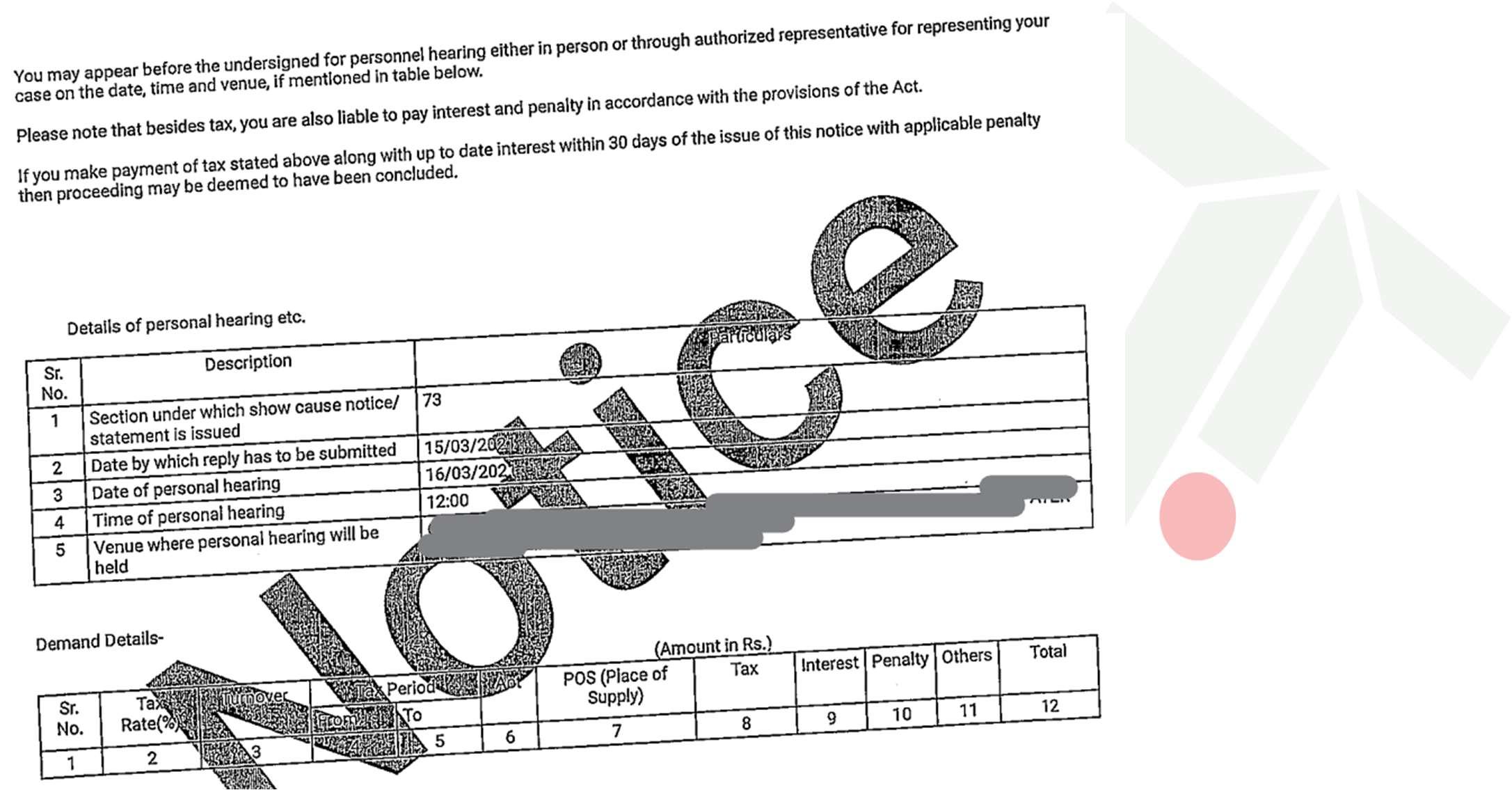

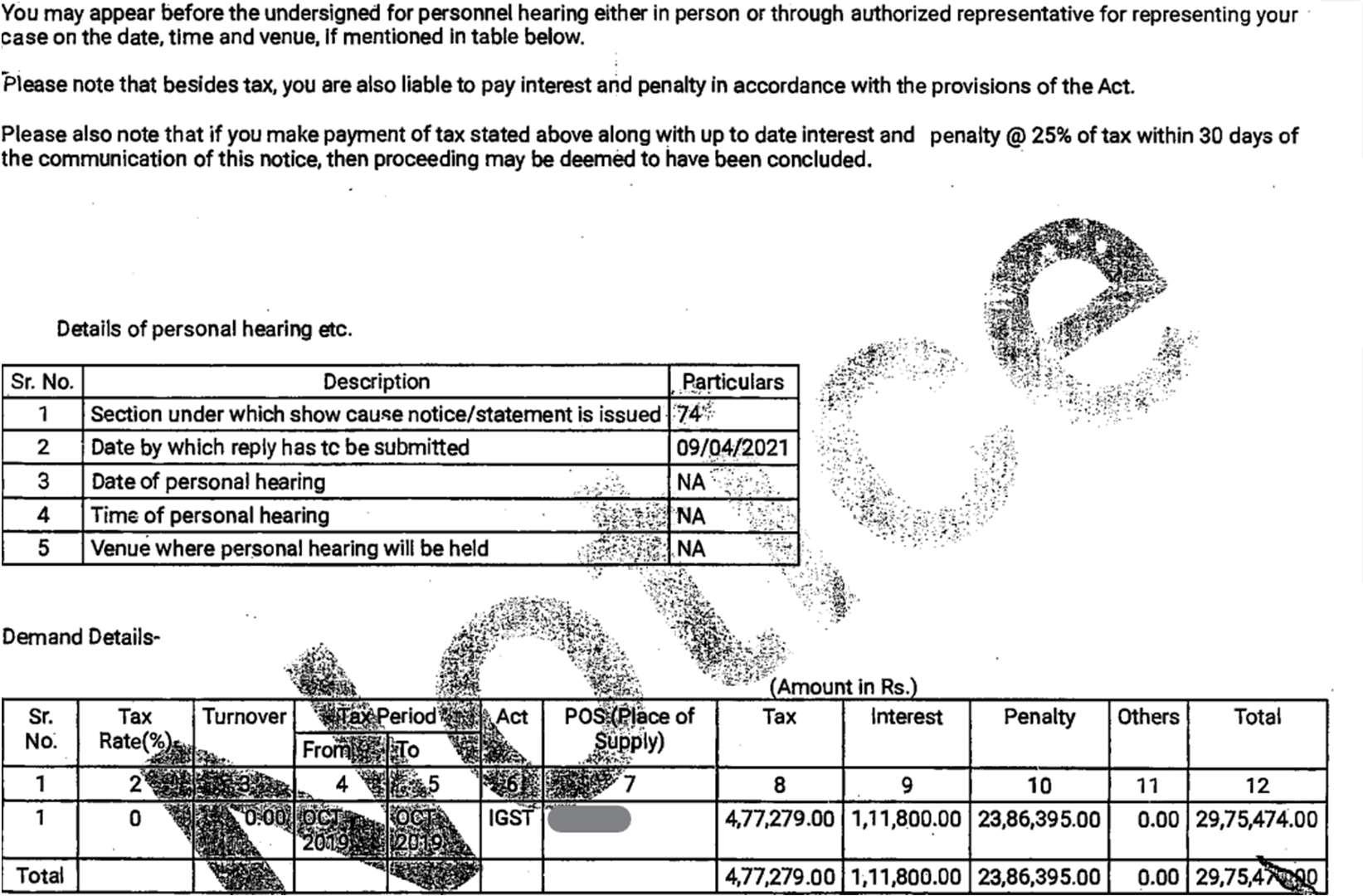

Allegation–SampleNotice(DRC01)

TMSL

Allegation–SampleNotice(DRC01)

TMSL

•Substantiategenuinenessoftransaction:Submitallthenecessarydocumentsforsubstantiatinggenuinenessof transactions.Fore.g.inrespectofManpowersupplyservicesfollowingcanbesubmitted:

(a)CopyofAgreement

(b)Invoicedetails

(c)Paymentdetails

(d)Listofpersonsemployed

(e)Samplejoiningletter

(f)Sampleattendancerecords

(g)CopyofGSTR2A

(h)ScreenshotofreportshowingdifferencebetweenGSTR1and3B(asshownonGSTNportal)

Note:BurdenofprovingclaimofITCliesonrecipient(Section155ofCGSTAct).

SupremeCourtviewsofsubstantiatinggenuinenessoftransaction:

DealerclaimingITChastoprovebeyonddoubttheactualtransactionwhichcanbeprovedbyfurnishing

-Nameandaddressofsellingdealer,

-Detailsofthevehiclewhichhasdeliveredthegoods,

-Paymentoffreightcharges,

LitigationStrategy TMSL

-Acknowledgementoftakingdeliveryofgoods,

-Taxinvoicesandpaymentparticularsetc.

LitigationStrategy TMSL

Aforesaidinformationwouldbeinadditiontotaxinvoices,particularsofpaymentetc.Infact,ifadealerclaims Creditonpurchases,suchdealer/purchasershallhavetoproveandestablishactualphysicalmovementofgoods, genuinenessoftransactionsbyfurnishingdetailsreferredaboveandmereproductionoftaxinvoiceswouldnot besufficienttoclaimITC.

Burdentoprovegenuinenessoftransactionisonpurchasingdealer.Mereproductionofinvoicesand/orpayment bychequeisnotsufficientandcannotbesaidtobeprovingburden.

StateofKarnatakaVs.EcomGillCoffeeTrading(P)Ltd(2023)4Centax223(SC)

•Substantiatereasonablestepsweretakentoensuresupplierisnotfictitious:Submitnecessarydocumentsto substantiatereasonablestepsweretakenthatsupplierisnotfictious.Likesubmittingvendoronboardingprocess followedbyCompany,copyofportalshowingactivestatusofvendoronGSTNportal,etc.

LitigationStrategy

•ReliancewasplaceonGSTregistrationgrantedbyGSTAuthorities:Substantiatethattransactionwasdonerelying onactiveregistrationgrantedbyGSTAuthorities.

Apurchasingdealerisentitledbylawtorelyuponthecertificateofregistrationofthesellingdealerandtoact uponit.Whatevermaybetheeffectofaretrospectivecancellationuponthesellingdealer,itcanhavenoeffect uponanypersonwhohasacteduponthestrengthofaregistrationcertificatewhentheregistrationwascurrent.

Theargumentonbehalfofthedepartmentthatitwasthedutyofthepersondealingwithregistereddealersto findoutwhetherastateoffactsexistswhichwouldjustifythecancellationofregistrationmustberejected.To acceptitwouldbetonullifytheprovisionsofthestatuewhichentitlepersonsdealingwithregistereddealersto actuponthestrengthofregistrationcertificates.

TheCalcuttaHighCourtunderGSThasobservedthatITCcannotbedeniedtoagenuinebuyeronthefactthat supplierisfake.Thepetitionerwiththeirduediligencehasverifiedthegenuinenessandidentityofthesupplier asregisteredtaxablepersonasavailableatthegovernmentportal.Thepetitionercouldnotbefaultedifthey appeartobefakelateron.Matterwasremandedtoconsiderbasedonmerits.

TMSL

StateofMaharashtravSureshTradingCompany[1998]1998taxmann.com1747(SC)/[1998]109STC439(SC)

LGWIndustriesLtdvUOI[2022]134taxmann.com42(Cal)

LitigationStrategy

•AskforFieldVerificationReport:Thetaxpayershouldaskforthecopyoffieldverificationreport.Itwouldhelpto understandthegroundswhichenabledtheauthoritiestoissueSCNanditwillalsohelpinmakingaprecisereply:

Whiletheprincipleiswellestablishedthatthepersonconcernedshouldbeadequatelyinformedofthecase againsthim,theremaybequestionsraisedabouttheextentandcontentofinformationtobegiven.Courts mayhavetodecidewhetherinaparticularcasealltherelevantmaterialorevidencewasdisclosedtohimor not.Thecourtmayholdinacasethatitwasnotnecessarytodiscloseaparticulardocumentorthatwhat wasdisclosedwasadequate;theextentandcontentoftheinformationtobedisclosedwoulddependupon factsofeachcase.

PrinciplesofAdministrativelawbyM.P.JainandS.N.JainFourthEditionof1986page248,

•OpportunityofCrossexamination:Itisimportanttoaskfortheopportunitytocrossexaminethepersonswho havemadesubmissionsbasedonwhichSCNisissued.

Therecanbenodenyingthatwhenanystatementisusedagainstanasseesee,anopportunityofcrossexaminationofthepersonswhomadethosestatementsoughttobegiventoasseesee,Rightofcross examination,ofthepersonwhohadgivenastatementagainsttheasseesee,eveninaquasijudicial proceedingisavaluablerightgiventotheaccused/noticewhichcannotbetakenawayunlessthe circumstancesrelatingtounavailabilityofsuchpersonreferredtoinSection136Bexists.

BasudevGargvsCommissionerofCustoms[2014]42taxmann.com62(Del)/[2013]294ELT353

TMSL

LitigationStrategy TMSL

•ArguePrincipleofLexnonCogitAdimpossibilia:Thebuyercannotbeputinjeopardywhenhehasdoneallthat thelawrequireshimtodoandfurtherthatthepurchasingdealerhasnomeanstoascertainandsecurecompliance ofsellingdealer.HowcanITCbedeniedifsubsequentofthetransactionsuppliersarenotfoundattheirplaceof business?Areauthoritiesnotcompellingtoforecastafutureevent?ReliancecanbeplacedonjudgmentslikeOn QuestMerchandisingIndiaPLtdv.GovernmentofNCTofDelhi[2017]87taxmann.com179(Delhi)/[2018]10 GSTL182/[2017]64GST623(Delhi)

•Veracityofotherregisteredpersoncannotbechecked:GrantingregistrationisaresponsibilityofGovernmentand itsveracityoftaxpayercannotbecheckedbyrecipient.

•ArgueSCNetc.iscrypticandvague:Theessentialrequirementsofpropernoticearethatitshouldspecifically statechargeswhichthenoticeehastoreply.Ifchargesarenotcomingclearlythensuchnoticewouldnotbevalid. Relianceinthisregardcanbeplacedonvariousdecisionsincludingthefollowing:

(a)OryxFisheries(P.)Ltd.v.UnionofIndia[2010]13SCC427

(b)CCEv.ShitalInternational[2010]1taxmann.com413(SC)

(c)DilipN.Shroffv.Jt.CIT[2007]161Taxman218/291ITR519(SC)

(d)NKASServices(P.)Ltd.v.StateofJharkhand[2021]131taxmann.com230(Jharkhand)/[2022]63GSTL18etc.

LitigationStrategy

•Otherimportantarguments:

-ITCavailedisavestedRightunderArticle300AofConstitutionandthereisnoprovisionunderlaw whichrequiresreversalofimpugnedITC

-ProvisionforcancellationofregistrationwithretrospectivedateisArbitraryasitgivesthesame treatmentgenuineandbogustransaction(nointelligibledifferentia)

-Honesttaxpayersshouldnotbeharassed

-Co-relatinggroundswithArticle14ofConstitutionandshowcasingthathowtheprocedureadoptedby authoritiesisarbitrary

-EnsurethatDINismentionedindocumentsissuedbyCGSTAuthorities

TMSL

LitigationStrategy–Conclusion

Sl.No.Particulars

1. Substantiategenuinenessoftransaction

2. Substantiatereasonablestepsweretakentoensuresupplierisnotfictitious

3. ArguethatreliancewasplacedonGSTregistrationgrantedbyGSTAuthorities

4.AskforfieldverificationreportOptingoutofvoluntaryregistration

5.AskforOpportunityofCrossExamination

6.ArgueSCNCrypticandVague(woulddependhownoticeisissued)

7.ArgueITCavailedisavestedright

8.Arguethatlawdoesnotcompelataxpayertodoimpossiblethings

9.Otherpoints

-Arguehowprocedureisarbitrary

-Honesttaxpayersshouldnotbeharassed

-DINismentionedindocumentsissuedbyCGSTAuthorities

TMSL

NonfilingofGSTR-3BbyVendor

.

ABCTradingCo.

TMSL XLimited Supplyofgoods 1 CancelledRegistration RetrospectivelyasGSTR 3Bnotfiled GSTAuthority GSTAuthority FlowofInformation SCNfordenyingITC Contract Payment 2 3 4

IllustrativeTransaction

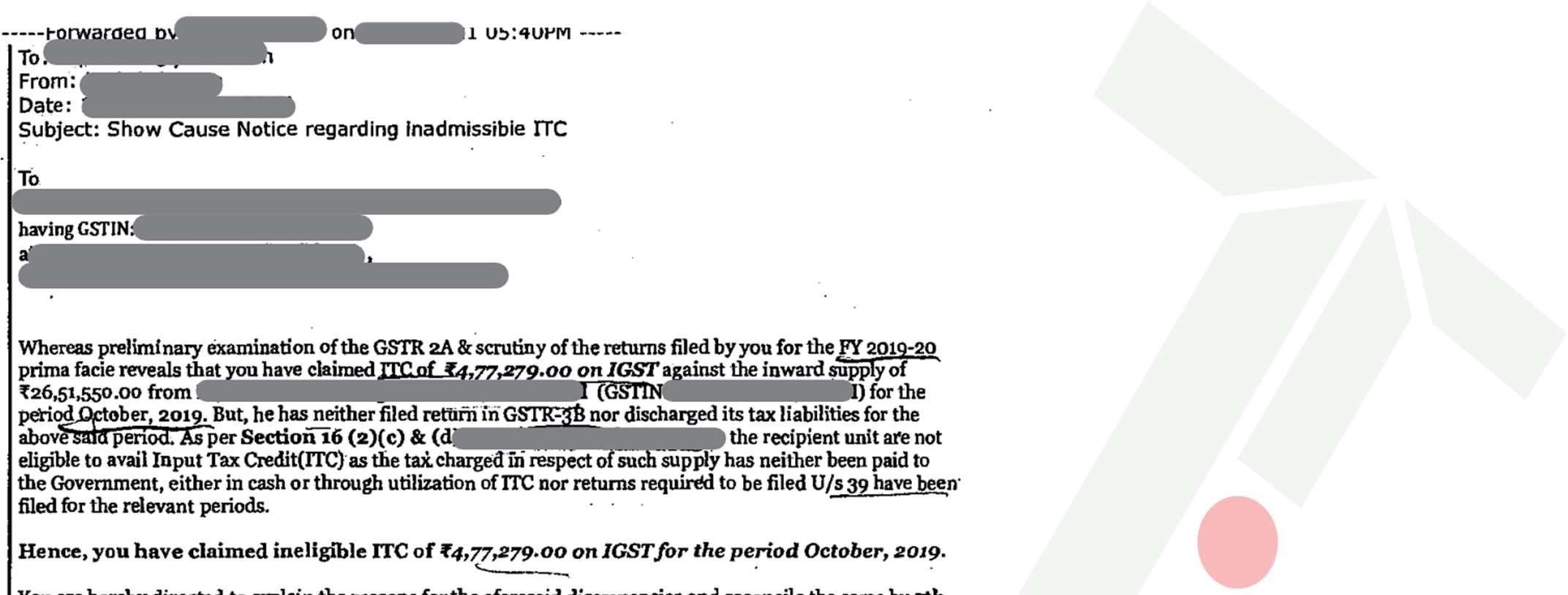

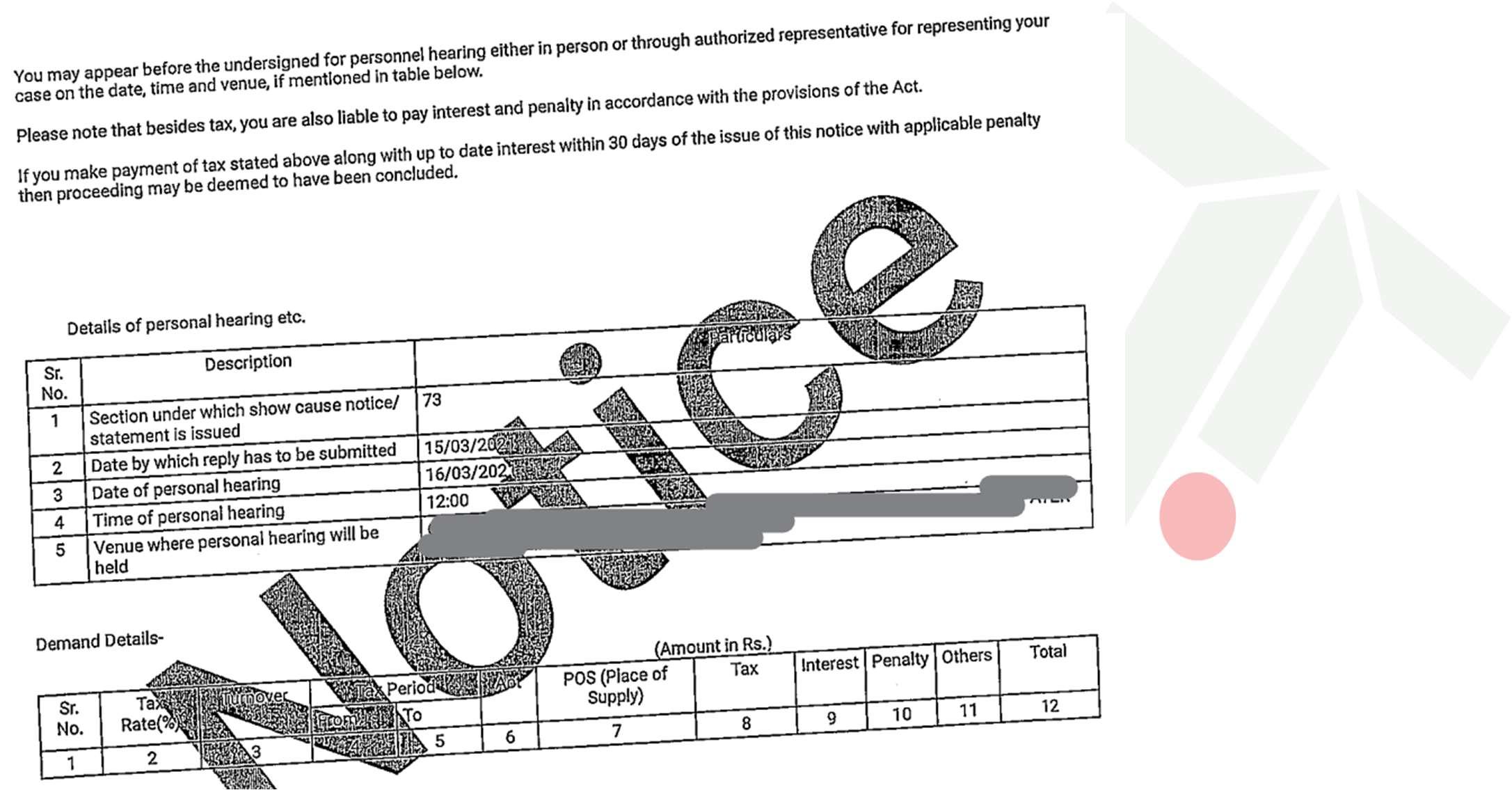

Allegations–SampleNotice(DRC-01)

TMSL

Allegations–SampleNotice(DRC-01)

TMSL

Allegations–SampleNotice(DRC-01)

TMSL

LitigationStrategy

•Substantiatevalueofsupplyandtaxispaidtovendor:Submitallthenecessarydocumentsforsubstantiating thatvalueofsupplyalongwithtaxispaidtothesupplier.Documentssuchas:

(a)CopyofAgreement

(b)Copyoftaxinvoices

(c)E-waybill(incaseofgoods)

(d)Paymentdetails(BankStatementetc.)

(e)Otherdocumentsassoughtbyauthorities

•Nomechanisminlawtocrosscheckwhetherpaymentismadebysupplier:Itisneitherpossiblenorpracticable forrecipienttoverifyactualpaymentofGSTbysuppliersincedepositofGSTisnottransactionwisebut cumulativemonthwise.Thelegislatureshouldhaveconsideredtheabsurdityandeventualityofsuchprovisionof law.

•ArguePrincipleofLexnonCogitAdimpossibilia:Thebuyercannotbeputinjeopardywhenhehasdoneallthat thelawrequireshimtodoandfurtherthatthepurchasingdealerhasnomeanstoascertainandsecure complianceofsellingdealer.ReliancecanbeplacedinjudgmentslikeOnQuestMerchandisingIndiaPLtdv.

GovernmentofNCTofDelhi[2017]87taxmann.com179(Del)/[2018]10GSTL182/[2017]64GST623(Delhi)

TMSL

LitigationStrategy

•Initiateproceedingsagainstsupplier:Atafirstinstancetheauthoritiesshouldadjudicatethesupplierandin exceptionalscenariositshoulddemandtaxfromrecipient.

GSTCouncilrecommendationinthisregard:

Therewouldnotbeanyautomaticreversalofinputtaxcreditfrombuyeronnon-paymentoftaxbytheseller.In caseofdefaultinpaymentoftaxbytheseller,recoveryshallbemadefromtheseller;however,reversalof creditfrombuyershallalsobeanoptionavailablewiththerevenueauthoritiestoaddressexceptional situationslikemissingsupplier,closureofbusinessbysupplierorsuppliernothavingadequateassets,etc.

(DecisionofGSTCouncilinits27thmeeting)

MadrasHighCourtviewsonimpugnedGSTprovisions

IftaxnotreachedtoGovt.kitty,theliabilitymayhavetobeeventuallybornebyoneparty,eitherselleror buyer.Whenithascomeoutthatsellerhascollectedtaxfrompurchasingdealers,omissiononpartofsellerto remittaxinquestionmusthavebeenviewedveryseriously,andstrictactionoughttohavebeeninitiated againsthim.Inthiscase,theHighCourtheldthatorderpassedbyauthorityhasafundamentalflaws,andit quashedtheorderonfollowinggrounds:

-Non-Examinationofthesupplierintheenquiry

-Non-initiationofrecoveryactionagainstthesupplierinthefirstplace

TMSL

D.Y.BeathelEnterprisesV.StateTaxOfficer[2021]127taxmann.com80(Mad)/86GST400/[2022]58GSTL269

LitigationStrategy TMSL

•PreconditionoftaxpaymentcanbearguedasagainstArticle19(1)(g)ofConstitution:Practicallyitisnot possibleforrecipientofsupplytorunaftersupplieratdifferentpartsofIndiaforverificationofactual deposition/paymentofGSTathisend,thereshallbeseriouseffectoflossoftradeonthepartofsmallscale supplierssinceafterpaymentofconsiderationincludingGSTcomponent,norecipientofsupplywouldaffordto losebenefitofITCandassuch,pre-conditionofpaymentoftaxwouldeventuallyresultintolossoftradeand businessbysmallscalesuppliers

•Statuedoesnotprovideanyprotectiontorecipient:Statuedoesnotprovideanyprotectiontorecipientof supplytotheextenthispaymentofamountconsiderationtogetherwithGSTtosupplierofgoodsandservicesbut providesforinterestandpenalliabilityuponrecipientduetonon-depositionofsuchcollectedamountofGSTby supplier.Suchaprovisionisnotonlyabsurdbutalsodiscriminatory

•ReliedonGSTregistrationgrantedbyGSTAuthorities:(sameasdiscussedpreviously)

LitigationStrategy

•FavorableJudgmentsundererstwhileVATandExciseLaws:

CaseParticulars

AriseIndia Limited

Section9(2)(g)ofDelhiVATcouldnotbeinvokedbyVATofficertopenaliseabonafidepurchasingdealerforthe failureofasellingdealertosubmittherequisiterecordsprovingthegenuinenessofthetransaction.HighCourt allowedthepurchasertotakecreditevenifthesellingdealerhadnotdischargedVATonthesaleofgoods.The SLPwasfiledbeforetheSupremeCourtandrejected(nothingwasdiscussedonmerits).

OnQuest

Merchandising India(P.)Ltd.

TataMotors Limited

DelhiHighCourtobservedthatbuyercannotbeputinjeopardywhenhehasdoneallthatlawrequireshimtodo andfurtherthatpurchasingdealerhasnomeanstoascertainandsecurecomplianceofsellingdealer

JharkhandHighCourtheldthatonceabuyerofinputreceivesinvoicesofexcisableitemsunlessfactuallyitis establishedtocontrary,itwillbepresumedthatwhenpaymentshavebeenmadeinrespectofthoseinputs basedoninvoices,buyerisentitledtoassumethatexcisedutyhasbeen/willbepaidbythesupplieronthe excisableinputs.ThebuyerwillbeentitledtoclaimModvatcreditonthesaidassumption.Itwouldbemost unreasonableandunrealistictoexpectbuyerofsuchinputstogoandverifytheaccountsofthesupplierorto findoutfromdepartmentofCentralExcisewhethertheactualdutyhasbeenoninputspaidbysupplier.No businesscanbedonelikethis,andthelawdoesnotexpecttheimpossible.

TMSL

LitigationStrategy

•FavorableJudgmentsundererstwhileVATandExciseLaws:

CaseParticulars

JuhiAlloys Limited

SMIElectrowire PvtLtd.

TheAllahabadHighCourtheldthatonceitisdemonstratedthatthebuyerhadtakenreasonablestepstoensure thattheinputsinrespectofwhichcreditbeingtaken,appropriateexcisedutywaspaid,whichisaquestionoffact inthiscase,itwouldbecontrarytotheRulestocastanimpossibleorimpracticableburdenontheassessee.

InacasebeforethePunjabandHaryanaHighCourt,theAppellantpurchasedCCcooperrodsfromavendor whosepremiseswereraided.Thevendor(proprietor)statedthathewasonlyinvolvedinfacilitatingpartiesto obtainfraudulentModvat/Cenvatcreditandnotsellinganygoods.Basedonthestatement,ashowcausenotice isissuedtotheAppellantforwronglyavailedcredit.TheHighCourtheldthatthemerefactthattheAppellant purchasedgoodsfromasellerwhoengagedinfraudulentactivitieswouldnotbyitselfraiseaninferenceofguilt orwrongdoingoftheAppellant.

Mahalaxmi

CottonGinning

PressingandOil Industries

Notably,theBombayHighCourt,inacase,haveheldthatITCisaconcessionandlegislaturecanputconditions andrestrictionrelatingtoitsavailment.TheHighCourtupheldthepre-conditionofpaymentoftaxbythe supplier.

OnyxDesignsTheKarnatakaHighCourtheldthatintheabsenceofanyotherallegationsmadeagainstthepurchasingdealerin theassessmentorders,merelyforthereasonthatsellingdealershadnotdepositedthecollectedtaxamountor someofthesellingdealershadbeensubsequentlyderegisteredcouldnotbeagroundtodenytheinputtax credit.

TMSL

LitigationStrategy–Conclusion

Sl.No.Particulars

1. Substantiatevalueofsupplyandtaxpaidtosupplier

2. Arguethatlawdoesnotprovideanymechanismtocrosscheckwhethertaxispaidornot

3.Arguethatlawdoesnotcompelataxpayertodoimpossiblethings

4.ArgueauthoritiesshouldfirstadjudicatesupplierandinexceptionalcasesaskrecipienttoreverseITC

5.Arguethatpre-conditionforpaymentoftaxisagainstArticle19(1)(g)

6.RelyonthejurisprudenceoferstwhileregimeandargueprovisionisagainstArticle14

7.Otherpoints

-Statuedoesnotprovideanyprotectiontorecipient

-TransactionwasdonerelyingoftheregistrationgrantedbyGSTauthorities

-DINismentionedindocumentsissuedbyCGSTAuthorities

TMSL

FakeInvoicing.

ABCTradingCo.

TMSL XLimited Supplyofgoods 1 Visit/Investigation Foundsupplierengagedin papertransactions GSTAuthority GSTAuthority FlowofInformation SCNfordenyingITC Contract Payment 2 3 4

IllustrativeTransaction

Allegations–SampleIntimation(DRC-1A)

TMSL

CBICClarificationonFakeInvoice

1.RPissuedtaxinvoicewithoutsuppliesofGoods/ services

Activitydoesnotsatisfycriteriaof‘Supply’u/s.7so nodemandandrecoveryistobemadeagainst issuerofinvoicebutpenaltyshallbeimposed u/s.122(1)(ii)

2.RegisteredpersonavailedandutilizedfraudulentITC basedonthetaxinvoiceissuedwithoutunderlying supply

PersonavailingtheITCshallbeliablefordemandor recoveryu/s.73or74ofCGSTActonaccountof availingandutilizingfraudulentITCandintermsof section75(13),nopenaltyincludingu/s122tobe leviedifpenalactionistakenundersection74of CGSTAct.

3.RPavailsITCbasedonthesaidtaxinvoiceand furtherpassesonthesaidITCtoanotherregistered personbyissuinginvoiceswithoutunderlying supplyofgoodsorservicesorboth

PersonavailingtheITCshall‘NOT’liablefordemand orrecoveryu/s.73or74ofCGSTAct,asthecase maybeandliableforpenalactionu/s.122(1)(ii)and 122(1)(vii)ofCGSTAct

ProsecutionprovisionswouldalsobeapplicabledependinguponthequantumofInvolved

TMSL Sl. No. ParticularsClarification

LegalStrategy–Conclusion

Sl.No.Particulars

1. Substantiategenuinenessoftransaction

2. Substantiatereasonablestepsweretakentoensuresupplierisnotfictitious

3. ArguethatreliancewasplacedonGSTregistrationgrantedbyGSTAuthorities

4.Askforreportthatconcludesthatsupplierisengagedinfaketransactions

5.AskforOpportunityofCrossExamination

6.ArgueSCNCrypticandVague(woulddependhownoticeisissued)

7.ArgueITCavailedisavestedright

8.Arguethatlawdoesnotcompelataxpayertodoimpossiblethings

9.Otherpoints

-Arguehowprocedureisarbitrary

-Honesttaxpayersshouldnotbeharassed

-DINismentionedindocumentsissuedbyCGSTAuthorities

TMSL

.AutomatingP2PProcess

AUTOMATION

SOMEFOODFORTHOUGHT:

RoboticProcessAutomationWillHelpHumansBecomeMoreHumanatWork!

Ifdebuggingistheprocessof removingsoftwarebugs,then programmingmustbethe processofputtingthemin.

EdsgerDijkstra

Thefirstruleofanytechnologyused inabusinessisthatautomation appliedtoanefficientoperationwill magnifytheefficiency.Thesecondis thatautomationappliedtoan inefficientoperationwillmagnifythe inefficiency.

BillGates

38

P2PMODEL–ANIDEALSCENARIO

Y

39 VendorBlock Vendor ERP Onboarding Checks N HowBOTshelp KYVBOTMCABOTMSMEBOT •GSTINstatus •E-invoiceapplicability •Fakeinvoicecheck •Companyidentity check •Companyactive status •MSME registration validitycheck ReValidationY PO N POBlock

P2PMODEL–ANIDEALSCENARIO

Y

40 VendorBlock Vendor ERP Onboarding Checks N ReValidationY PO N POBlock GRN GRNAutomation HowBOTshelp GRNBOT •VerifyGRNlineitemswithPOlineitems •Auto-captureGRNintoERPsystem •GenerateExceptionreport

Y

41 VendorBlock Vendor ERP Onboarding Checks N ReValidationY PO N POBlock GRN GRNAutomation InvoiceRecording Automation Processingfor payment HowBOTshelp IDPBOT2AReconBOT •ConvertPDFinward invoicecopiestoexcel database •FetchGSTR-2A •Reconcileinwardinvoice datawithGSTR-2A

P2PMODEL–ANIDEALSCENARIO

P2PMODEL–ANIDEALSCENARIO

HowBOTshelp

KYVBOT2BReconBOT180DaysBOTTDSBOT

•FetchvendorGST returnfiling status

•FetchGSTR-2B

•ReconcilePRwith GSTR-2B

•ReverseITCfornonpaymenttovendor within180days

•DeductTDSasper IT

•Prepare&fileTDS return

Paymentto Vendor

InvoiceRecording Automation

Processingfor payment

Y Y

42 VendorBlock Vendor ERP Onboarding Checks PO ReValidation GRN N Final validation N Y N POBlock

Block

Full/GSTPayment

GRNAutomation

Y Y

43 VendorBlock Vendor ERP Onboarding Checks PO ReValidation GRN N Final validation N Y N POBlock Full/GSTPayment Block Paymentto Vendor GRNAutomation InvoiceRecording Automation Processingfor payment

P2PMODEL–ANIDEALSCENARIO

1001-BPinnacleCorporatePark,

COMMUNICATIONADDRESS www.tmslglobal.com WEBSITE

CONTACTUS

BRINGABOUTATAXREVOLUTIONAT YOURORGANIZATION

BKCCSTLinkRd,NexttoTrade Center,BandraKurlaComplex, BandraEast,Mumbai, Maharashtra400051

JigarDoshi: +919820203026 Jigar.doshi@tmsl.in SunilKumar: +918802792528 Sunil.kumar@tmsl.in

tmslglobal tmslglobal tmslglobal tmslglobal

tmsl