CA RohitVaswani

CA RohitVaswani

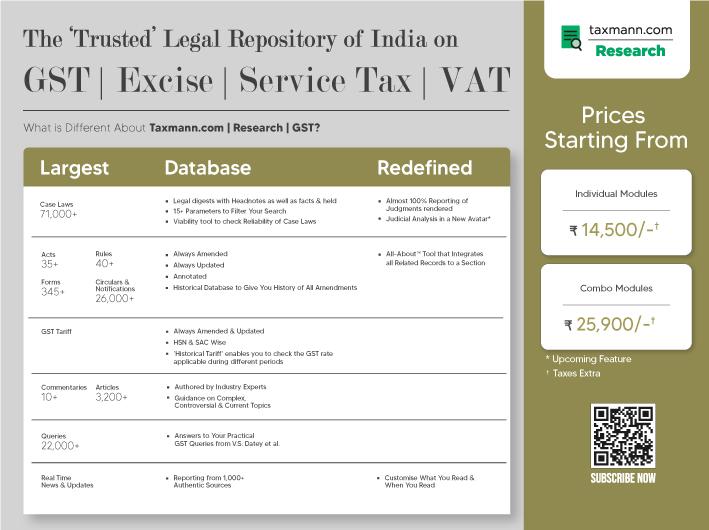

Objections: Sec.74 of DVAT Act, 2004

• Any person who is dis-satisfied with -

Appeal to CCE(Appeals): Sec.85 of ChapterV of Finance Act, 1994

• (a) an assessment made under this Act (including an assessment under section 33 of this Act); or (b) any other order or decision made under this Act; may make an objection against such assessment, or order or decision, as the case may be, to the Commissioner:

Appeals to Appellate Authority: Sec.107 of CGST Act, 2017

• Any person aggrieved by any decision or order passed by an adjudicating authority subordinate to the [Principal Commissioner of Central Excise or] Commissioner of Central Excise may appeal to the Commissioner of Central Excise (Appeals).

• Any person aggrieved by any decision or order passed under this Act or the State GST Act or the UnionTerritory GST Act by an adjudicating authority may appeal to such Appellate Authority as may be prescribed within three months from the date on which the said decision or order is communicated to such person.

• Appeals can be made to correct errors or clarify and interpret the law. Appeals can involve rehearing on questions of law as well as on facts of the case.

• Review challenges the correctness of a judicial order based on new evidence or facts/ evidence not considered earlier. Review can be done only after the passing of the order and generally by the same authority.

• Revision involves a superior authority examining the legality of an order by a subordinate authority. Revisions can be made when the case has been decided. Revisions can involve cases that involve erroneous inference, non-exercise, or improper jurisdictional exercise.

• Order passed by the same authority passing the order to rectify any mistake or error which is apparent from the records.

CA RohitVaswani

CA RohitVaswani

First Appeal to Appellate Authority

Revision by Revisional Authority

Second Appeal to Appellate Tribunal

Appeal to High Court Appeal to Supreme Court

CA RohitVaswani

Rectification of errors apparent on the face of record

Section-161

Without prejudice to the provisions of section 160, and notwithstanding anything contained in any other provisions of this Act, any authority, who has passed or issued any decision or order or notice or certificate or any other document, may rectify any error which is apparent on the face of record in such decision or order or notice or certificate or any other document, either on its own motion or where such error is brought to its notice by any officer appointed under this Act or an officer appointed under the State Goods and Services Tax Act or an officer appointed under the Union Territory Goods and Services Tax Act or by the affected person within a period of three months from the date of issue of such decision or order or notice or certificate or any other document, as the case may be:

Provided that no such rectification shall be done after a period of six months from the date of issue of such decision or order or notice or certificate or any other document:

Provided further that the said period of six months shall not apply in such cases where the rectification is purely in the nature of correction of a clerical or arithmetical error, arising from any accidental slip or omission:

Provided also that where such rectification adversely affects any person, the principles of natural justice shall be followed by the authority carrying out such rectification.

Appeal u/s 107 of the CGST Act, 2017

Writ Jurisdiction under Article 226 of the Constitution of India

CA RohitVaswani

Godrej Sara Lee Ltd. v. Excise andTaxation Officer-Cum-Assessing Authority

[2023] 3 Centax 49 (SC)

Fine Points:

Article 226 does not, in terms, impose any limitation or restraint on the exercise of power to issue writs.

While it is true that exercise of writ powers despite availability of a remedy under the very statute which has been invoked and has given rise to the action impugned in the writ petition ought not to be made in a routine manner, yet, the mere fact that the petitioner before the high court, in a given case, has not pursued the alternative remedy available to him/it cannot mechanically be construed as a ground for its dismissal.

CA RohitVaswani

It is axiomatic that the high courts (bearing in mind the facts of each particular case) have a discretion whether to entertain a writ petition or not.

One of the self-imposed restrictions on the exercise of power under Article 226 that has evolved through judicial precedents is that the high courts should normally not entertain a writ petition, where an effective and efficacious alternative remedy is available.

At the same time, it must be remembered that mere availability of an alternative remedy of appeal or revision, which the party invoking the jurisdiction of the high court under Article 226 has not pursued, would not oust the jurisdiction of the high court and render a writ petition “not maintainable”.

CA Rohit

6. At the end of the last century, this Court in paragraph 15 of the its decision reported in (Whirlpool Corporation v. Registrar of Trade Marks (1998) 8 SCC 1) carved out the exceptions on the existence whereof a Writ Court would be justified in entertaining a writ petition despite the party approaching it not having availed the alternative remedy provided by the statute.The same read as under:

(i) where the writ petition seeks enforcement of any of the fundamental rights;

(ii) where there is violation of principles of natural justice;

(iii) where the order or the proceedings are wholly without jurisdiction; or

(iv) where the vires of an Act is challenged.

Appeals to Appellate Authority.

Section 107.

(1) Any person aggrieved by any decision or order passed under this Act or the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act by an adjudicating authority may appeal to such Appellate Authority as may be prescribed within three months from the date on which the said decision or order is communicated to such person.

CA RohitVaswani

Adjudication Order u/s 73(9)

Order of Provisional Assessment u/s 60

Adjudication Order u/s 74(9)

Best Judgement Assessment of non-filers of returns u/s 62

Summary Assessment u/s 64

Best Judgement Assessment of unregistered persons u/s 63

CA RohitVaswani

Goods Detention Order/Goods Release Order u/s 129

Application for Registration/ Cancellation or suspension of registration u/s 29

Rejection of application for revocation of cancellation of registration u/s 30

DeeVee Projects Ltd. v. Government of Maharashtra

[2022] 135 taxmann.com 189/91 GST 159 (Bom.)

20. Reading the provision, we can see that appeal under section 107(1) can be filed against a decision or order passed under Central GST Act or State GST Act or the Union Territory GST Act by an adjudicating authority. It is also clear that this provision does not include any decision or order passed under the Rules framed under Central GST Act or any other Rules. In this case, the respondents maintain that the impugned order and action has been passed and taken under rule 86-A of the Rules, 2017. Therefore, we find that no appeal remedy could have been available to the petitioner under this provision.

Kantilal Somehand Shah v. CC & CE

[1982] 10 ELT 902 (Cal.)

(Under Customs Act, 1962)

30. The expression "any decision or order" as in section 128 of the said Act, are of wide amplitude and include all orders or decisions passed under the said Act. The authorities, deciding the Appeal, as indicated hereinbefore, function as quasi-judicial authorities in the matter of disposing the Appeals. It is also true that Sections 128, 130 and 137 form a complete machinery for obtaining appropriate and necessary reliefs. The availability of appropriate remedy, as indicated hereinbefore, under Article 226 of the Constitution of India, would be available in appropriate cases and under special circumstances.

Hindustan Steel & Cement v. Asstt. STO

[2022] 141 taxmann.com 342/93 GST 685 (Ker.)

It is obvious that the learned counsel for the petitioners in these cases is correct and contenting that whether or not a payment is made under Section 129(1)(a) or security is provided under Section 129 (1) (c), the person who is the subject matter of proceedings under section 129 of the CGST Act has the right to challenge those proceedings, culminating in an order under subsection (3) of Section 129, before the duly constituted Appellate Authority under Section 107 of that Act. The fact that the culmination of proceedings in respect of a person who seeks to make payment of Tax and Penalty under Section 129(1)(a) does not result in the generation of a summary of an order under Form DRC-07 cannot result in the right of the person to file an appeal under Section 107 being deprived. The fact that the system does not generate a demand or that the system does not contemplate the filing of an appeal without a demand does not mean that the intention of the legislature was different.

Sec. 2 (4) “adjudicating authority” means

any authority, appointed or authorised to pass any order or decision under this Act,

but does not include

the Central Board of Indirect Taxes and Customs,

the Revisional Authority,

the Authority for Advance Ruling,

the Appellate Authority for Advance Ruling,

the National Appellate Authority for Advance Ruling,

the Appellate Authority,

the Appellate Tribunal and

the Authority referred to in sub-section (2) of section 171

CA RohitVaswani

No appeal shall lie against any decision taken or order passed in case of following matters-

An order to direct transfer of proceedings from one officer to another officer

an order pertaining to the seizure or retention of books of account, register and other documents

an order sanctioning prosecution under this Act

an order passed under section 80 (Payment of tax due in instalment)

CA RohitVaswani

Any person aggrieved by any decision or order passed

The Commissioner may, on his own motion, or upon request from the Commissioner of State tax/UT tax

CA RohitVaswani

The Commissioner may, on his own motion, or upon request from the Commissioner of State tax or the Commissioner of Union territory tax,

call for and examine the record of any proceedings in which an adjudicating authority has passed any decision or order under this Act or the State Goods and Services Tax Act or the Union Territory Goods and ServicesTax Act,

for the purpose of satisfying himself as to the legality or propriety of the said decision or order and may, by order,

direct any officer subordinate to him to apply to the Appellate Authority within six months from the date of communication of the said decision or order for the determination of such points arising out of the said decision or order as may be specified by the Commissioner in his order.

Where, in pursuance of an order under sub-section (2), the authorised officer makes an application to the Appellate Authority, such application shall be dealt with by the Appellate Authority as if it were an appeal made against the decision or order of the adjudicating authority and such authorised officer were an appellant and the provisions of this Act relating to appeals shall apply to such application.

Authorisation of officers of State tax or Union territory tax as proper officer in certain circumstances.

CGST Act, 2017

Section 6(3) Any proceedings for rectification, appeal and revision, wherever applicable, of any order passed by an officer appointed under this Act shall not lie before an officer appointed under the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act.

Delhi GST Act, 2017

Section 6(3) Any proceedings for rectification, appeal and revision, wherever applicable, of any order passed by an officer appointed under this Act, shall not lie before an officer appointed under the Central Goods and ServicesTax Act.

Any decision or order passed by the Adjudicating Authority of CGST

• Appeal to be filed with Central GST Appellate Authority

Any decision or order passed by the Adjudicating Authority of SGST

• Appeal to be filed with State GST Appellate Authority

CA RohitVaswani

CGST Act, 2017

Section 162:

Save as provided in sections 117 (Appeal to High Court) and 118 (Appeal to Supreme Court), no civil court shall have jurisdiction to deal with or decide any question arising from or relating to anything done or purported to be done under this Act.

CA RohitVaswani

Assessment proceedings, etc., not to be invalid on certain grounds.

Section 160. (1) No assessment, re-assessment, adjudication, review, revision, appeal, rectification, notice, summons or other proceedings done, accepted, made, issued, initiated, or purported to have been done, accepted, made, issued, initiated in pursuance of any of the provisions of this Act shall be invalid or deemed to be invalid merely by reason of any mistake, defect or omission therein, if such assessment, re-assessment, adjudication, review, revision, appeal, rectification, notice, summons or other proceedings are in substance and effect in conformity with or according to the intents, purposes and requirements of this Act or any existing law.

(2) The service of any notice, order or communication shall not be called in question, if the notice, order or communication, as the case may be, has already been acted upon by the person to whom it is issued or where such service has not been called in question at or in the earlier proceedings commenced, continued or finalised pursuant to such notice, order or communication.

POA

Relied upon Documents

Facts of the Case Grounds of Appeal

CA RohitVaswani

About the Supplier & Business Profile

Reference to finding by Adjudicating Officer & Order

Reference to Submissions and Personal Hearing

Reference to ASMT10, SCN etc.

Chronology of events happened

Clean Facts and No Mixing of Grounds with Facts

CA RohitVaswani

Challenge of ‘Vires’Act, Rule, Notification

Jurisdiction

Consideration of all Reply/Documents

Submitted

Speaking Order

Limitation Period

Opportunity of Being Heard

Appeal by Any Person

Appeal by Commissioner (Department)

Normal Period: within 3 months from the date on which the said decision or order is communicated to such person

Condonation of Delay: within a further period of 1 month

Normal Period: within 6 months from the date of communication of the said decision or order

Condonation of Delay: within a further period of 1 month

CA RohitVaswani

Jindal Pipes Ltd. v. State of U.P.

[2020] 114 taxmann.com 467/78 GST 248/ 34 GSTL 48 (All.)

Learned counsel for the petitioner has submitted that in the counter affidavit in paragraph 5, it had been admitted that order for depositing ₹ 2,79,397.48 was served upon the driver of the vehicle, Sri Narendra Kumar who was a driver of the transport agency and, therefore, the order was neither served on the consignee nor on the consignor. Learned counsel relied upon a judgment of this Court reported in S/S. Patel Hardware v. Commissioner of State GST [2021] 127 taxmann.com 284/[2019] 21 GSTL 145 (All.) wherein it has been specifically held that the order by which tax was levied and the penalty was imposed had to be served upon a person who was likely to be aggrieved by the order. It specifically holds that the driver was not a "person aggrieved" to whom the order ought to have been communicated and, therefore, the order definitely was not served upon a person who was likely to be aggrieved and, therefore, learned counsel for the petitioner submits that the appeal which was filed on 6.3.2019 was well within the limitation provided by section 107 of the Act.

Having heard the learned counsel for the petitioner and the learned Standing Counsel, I am of the view that the order was served on the driver and, therefore, was definitely not served on a person who would have been aggrieved by the order and, therefore, the service on the driver was no service at all.

Meritas Hotels (P.) Ltd. v. State of Maharashtra

[2021] 133 taxmann.com 222/[2022] 89 GST 453 (Bom.)

18. In the light of the above discussion, we are of the considered opinion that it was incumbent upon the petitioner to file the appeal within the statutory period of limitation prescribed by subsection (1) and sub-section (4) of Section 107 of the said Act, to be reckoned taking into consideration the date of communication of impugned assessment order as April 20, 2019, which the petitioner failed to do. Consequently, we find no merit in the writ petition. The writ petition is dismissed with no order as to costs.

CA Rohit

In the case of: Modern Steel v.Addl. Commissioner

Citation: [2023] 156 taxmann.com 452 (All.)

Date of Order: 19-10-2023

Held: 12. Now coming to the second issue as to the period of extension of limitation for filing the appeal, this Court finds that no plausible ground has been taken in the appeal filed by the assessee for condoning the delay except that the earlier counsel, to whom papers were handed over, did not file the appeal and by mistake the delay had occurred. Moreover, Section 107(4) of the Act provides that the Appellate Authority may, if satisfied that the appellant was prevented by sufficient cause from presenting the appeal within the aforesaid period of three or six months, as the case may be, allow it to be presented within further period of one month. Once it is found that limitation period having been prescribed in the statute had expired, the Appellate Authority rightly proceeded to dismiss the appeal.

In the case of: Penuel Nexus (P.) Ltd. v.Addl. Commissioner

Citation: [2023] 152 taxmann.com 208/98 GST 957/75 GSTL 582 (Ker.)

Date of Order: 13-06-2023

Held: 10. The Central Goods and Services Tax Act is a special statute and a self-contained code by itself. Section 107 has an inbuilt mechanism and has impliedly excluded the application of the Limitation Act. It is trite, that the Limitation Act will apply only if it is extended to the special statute. It is also rudimentary that the provisions of a fiscal statute have to be strictly construed and interpreted.

11. On an appreciation of the language of Section 107(4) and the above analysed factual and legal background, this Court is of the view that there is no illegality in the action of the 1st respondent in rejecting the appeal as time-barred.

169. (1) Any decision, order, summons, notice or other communication under this Act or the rules made thereunder shall be served by any one of the following methods, namely:-

(a) by giving or tendering it directly or by a messenger including a courier to the addressee or the taxable person or to his manager or authorised representative or an advocate or a tax practitioner holding authority to appear in the proceedings on behalf of the taxable person or to a person regularly employed by him in connection with the business, or to any adult member of family residing with the taxable person; or

(b) by registered post or speed post or courier with acknowledgement due, to the person for whom it is intended or his authorised representative, if any, at his last known place of business or residence; or

(c) by sending a communication to his e-mail address provided at the time of registration or as amended from time to time; or

(d) by making it available on the common portal; or

(e) by publication in a newspaper circulating in the locality in which the taxable person or the person to whom it is issued is last known to have resided, carried on business or personally worked for gain; or

(f) if none of the modes aforesaid is practicable, by affixing it in some conspicuous place at his last known place of business or residence and if such mode is not practicable for any reason, then by affixing a copy thereof on the notice board of the office of the concerned officer or authority who or which passed such decision or order or issued such summons or notice.

108. Appeal to the Appellate Authority. -

(1) An appeal to the Appellate Authority under sub-section (1) of section 107 shall be filed in FORM GST APL-01, along with the relevant documents, [electronically], and a provisional acknowledgement shall be issued to the appellant immediately.

[Provided that an appeal to the Appellate Authority may be filed manually in FORM GST APL-01, along with the relevant documents, only if-

(i) the Commissioner has so notified, or

(ii) the same cannot be filed electronically due to non-availability of the decision or order to be appealed against on the common portal,

and in such case, a provisional acknowledgement shall be issued to the appellant immediately.]

(2) The grounds of appeal and the form of verification as contained in FORM GST APL- 01 shall be signed in the manner specified in rule 26.

[(3) Where the decision or order appealed against is uploaded on the common portal, a final acknowledgment, indicating appeal number, shall be issued in FORM GST APL-02 by the Appellate Authority or an officer authorised by him in this behalf and the date of issue of the provisional acknowledgment shall be considered as the date of filing of appeal:

Provided that where the decision or order appealed against is not uploaded on the common portal, the appellant shall submit a self-certified copy of the said decision or order within a period of seven days from the date of filing of FORM GST APL-01 and a final acknowledgment, indicating appeal number, shall be issued in FORM GST APL-02 by the Appellate Authority or an officer authorised by him in this behalf, and the date of issue of the provisional acknowledgment shall be considered as the date of filing of appeal:

Provided further that where the said self-certified copy of the decision or order is not submitted within a period of seven days from the date of filing of FORM GST APL-01, the date of submission of such copy shall be considered as the date of filing of appeal.]

Any Officer not below the rank of Joint Commissioner (Appeals)

• Where such decision or order is passed by the Deputy or Assistant Commissioner or Superintendent

• Where such decision or order is passed by the Additional or Joint Commissioner Commissioner (Appeals)

CA RohitVaswani

CA RohitVaswani

100% of Admitted Demand

• No appeal shall be filed unless the appellant has paid in full, such part of the amount of tax, interest, fine, fee and penalty arising from the impugned order, as is admitted by him

• a sum equal to 10% of the remaining amount [25% in case of order u/s 129(3)]of tax in dispute arising from the said order, in relation to which the appeal has been filed (subject to maximum of 25 crore rupees under each act)

Sec.107(7)/(8)

• Where the appellant has paid the amount under sub-section (6), the recovery proceedings for the balance amount shall be deemed to be stayed

• The Appellate Authority shall give an opportunity to the appellant of being heard Opportunity of being heard

The Appellate Authority may, if sufficient cause is shown at any stage of hearing of an appeal, grant time to the parties or any of them and adjourn the hearing of the appeal for reasons to be recorded in writing

• Provided that no such adjournment shall be granted more than three times to a party during hearing of the appeal

• The Appellate Authority may, at the time of hearing of an appeal, allow an appellant to add any ground of appeal not specified in the grounds of appeal, if it is satisfied that the omission of that ground from the grounds of appeal was not wilful or unreasonable.

• The Appellate Authority shall, after making such further inquiry as may be necessary, pass such order, as it thinks just and proper, confirming, modifying or annulling the decision or order appealed against but shall not refer the case back to the adjudicating authority that passed the said decision or order.

CA RohitVaswani

CA RohitVaswani

• Provided that an order enhancing any fee or penalty or fine in lieu of confiscation or confiscating goods of greater value or reducing the amount of refund or input tax credit shall not be passed unless the appellant has been given a reasonable opportunity of showing cause against the proposed order:

• Provided further that where the Appellate Authority is of the opinion that any tax has not been paid or short-paid or erroneously refunded, or where input tax credit has been wrongly availed or utilised, no order requiring the appellant to pay such tax or input tax credit shall be passed unless the appellant is given notice to show cause against the proposed order and the order is passed within the time limit specified under section 73 or section 74.

1)The appellant shall not be allowed to produce before the Appellate Authority or the AppellateTribunal any evidence, whether oral or documentary, other than the evidence produced by him during the course of the proceedings before the adjudicating authority or, as the case may be, the Appellate Authority except in the following circumstances, namely:-

(a) where the adjudicating authority or, as the case may be, the Appellate Authority has refused to admit evidence which ought to have been admitted; or

b) where the appellant was prevented by sufficient cause from producing the evidence which he was called upon to produce by the adjudicating authority or, as the case may be, the Appellate Authority; or

(c) where the appellant was prevented by sufficient cause from producing before the adjudicating authority or, as the case may be, the Appellate Authority any evidence which is relevant to any ground of appeal; or

(d) where the adjudicating authority or, as the case may be, the Appellate Authority has made the order appealed against without giving sufficient opportunity to the appellant to adduce evidence relevant to any ground of appeal.

CA RohitVaswani

CA RohitVaswani

• No evidence shall be admitted under sub-rule (1) unless the Appellate Authority or the AppellateTribunal records in writing the reasons for its admission.

Power

• (a) to examine the evidence or document or to crossexamine any witness produced by the appellant; or

• (b) to produce any evidence or any witness in rebuttal of the evidence produced by the appellant under sub-rule (1).

• Nothing contained in this rule shall affect the power of the Appellate Authority or the AppellateTribunal to direct the production of any document, or the examination of any witness, to enable it to dispose of the appeal.

Sec.107(12)/(13)

• The order of the Appellate Authority disposing of the appeal shall be in writing and shall state the points for determination, the decision thereon and the reasons for such decision.

• The Appellate Authority shall, where it is possible to do so, hear and decide every appeal within a period of 1 year from the date on which it is filed (period of stay shall be excluded)

• On disposal of the appeal, the Appellate Authority shall communicate the order passed by it to the appellant, respondent and to the adjudicating authority.

Appeal Order shall be final & binding

• A copy of the order passed by the Appellate Authority shall also be sent to the jurisdictional Commissioner or the authority designated by him in this behalf and the jurisdictional Commissioner of State tax or Commissioner of UnionTerritory Tax or an authority designated by him in this behalf.

• Every order passed under this section shall, subject to the provisions of section 108 or section 113 or section 117 or section 118 be final and binding on the parties

The views expressed, presentation made, charts made here are for educational purpose only and may not represent legal provisions of the act, rules or any other provisions of GST law and are personal views of the presenter/author. And presenter/ author shall not be liable for any damages of whatsoever nature due to any action taken on the basis of this presentation.