Topics

• Fair Market Value

• Types of Securities – Financial Instruments

• Implications of Issuing Shares at a Premium

• Implications of Issuing Shares at a Discount

• Implications under FEMA

• Valuation Methods for Determining Share Value

• Relevant Date for Share Valuation

• Handling Notices Issued Under Section 68

• Overview of Form 2 Filing for Start-ups with DPIIT

• DTAA Implications

FDI

• Total FDI inflows in the country in the last 24 years (Apr 2000 to Mar 2024) are $990.97 Billions while the total FDI inflows received in the last 10 years (Apr 2014 to Mar 2024) was $667.410 Billions which amounts to nearly 67% of total FDI inflow in last 24 years.

Fair Market Value

• Explanation (b) to Section 56(2)(vii) "fair market value" of a property, other than an immovable property, means the value determined in accordance with the method as may be prescribed

✓ Prescribed in Rule 11U & Rule 11UA

Property

Explanation (d) to Section 56(2)(vii) "property" means the following capital asset of the assessee, namely:

i. immovable property being land or building or both;

ii. shares and securities;

iii. jewellery;

iv. archaeological collections;

v. drawings;

vi. paintings;

vii. sculptures;

viii. any work of art; or

ix. bullion;

Securities

• "securities" shall have the same meaning as assigned to it in clause (h) of section 2 of the Securities Contracts (Regulation) Act, 1956

[Rule 11U(h) : The Income Tax Rules, 1962]

SCRA – Sec 2(h) - Securities

Section 2(h) “securities” include

• (i) shares, scrips, stocks, bonds, debentures, debenture stock or other marketable securities of a like nature in or of any incorporated company or other body corporate;

• (ia) derivative;

• (ib) units or any other instrument issued by any collective investment scheme to the investors in such schemes;

• (ic) security receipt as defined in clause (zg) of section 2 of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002;

• (id) units or any other such instrument issued to the investors under any mutual fund scheme;

• (ii) Government securities;

• (iia) such other instruments as may be declared by the Central Government to be securities; and

• (iii) rights or interest in securities;

Equity

o “equity instruments” means equity shares, convertible debentures, preference shares and share warrants issued by an Indian company [Rule 2(k) : TheForeign ExchangeManagement(Non-DebtInstruments)Rules,2019]

Explanation:-

i) Equity shares issued in accordance with the provisions of the Companies Act, 2013 shall include equity shares that have been partly paid. “Convertible debentures” means fully, compulsorily and mandatorily convertible debentures. “Preference shares” means fully, compulsorily and mandatorily convertible preference shares. Share Warrants are those issued by an Indian company in accordance with the regulations by the SEBI. Equityinstruments cancontainanoptionalityclausesubjecttoaminimumlock-inperiodofone year or asprescribedforthespecificsector,whicheverishigher,butwithout anyoptionorrighttoexitatanassuredprice .

ii) Partly paid shares that have been issued to a person resident outside India shall be fully called-up within 12 months of such issue or as may be specified by the Reserve Bank from time to time. 25% of the total consideration amount (including share premium, if any) shall be received upfront.

iii) In case of share warrants, at least 25% of the consideration shall be received upfront and the balance amount within 18 months of the issuance of share warrants.

Section 68 – Cash Credits

• Provided further that where the assessee is a company (not being a company in which the public are substantially interested), and the sum so credited consists of share application money, share capital, share premium or any such amount by whatever name called, any explanation offered by such assessee-company shall be deemed to be not satisfactory, unless—

a) the person, being a resident in whose name such credit is recorded in the books of such company also offers an explanation about the nature and source of such sum so credited; and

b) such explanation in the opinion of the Assessing Officer aforesaid has been found to be satisfactory:

Interplay between

• Section 56(2)(viib) and Section 68

• Section 56(2)(viib) and Transfer Pricing Provisions

• Income Tax Act and FEMA

Section 2(24) – Income includes

• (xvi) any consideration received for issue of shares as exceeds the fair market value of the shares referred to in clause (viib) of subsection (2) of section 56;

Section 56(2)(viib)

• where a company, not being a company in which the public are substantially interested, receives, in any previous year, from any person [being a resident], any consideration for issue of shares that exceeds the face value of such shares, the aggregate consideration received for such shares as exceeds the fair market value of the shares:

• Provided that this clause shall not apply where the consideration for issue of shares is received—

– (i) by a venture capital undertaking from a venture capital company or a venture capital fund or a specified fund; or

– (ii) by a company from a class or classes of persons as may be notified by the Central Government in this behalf:

• Provided further that where the provisions of this clause have not been applied to a company on account of fulfilment of conditions specified in the notification issued under clause (ii) of the first proviso and such company fails to comply with any of those conditions, then, any consideration received for issue of share that exceeds the fair market value of such share shall be deemed to be the income of that company chargeable to income-tax for the previous year in which such failure has taken place and, it shall also be deemed that the company has under reported the said income in consequence of the misreporting referred to in sub-section (8) and sub-section (9) of section 270A for the said previous year.

Explanation.—For the purposes of this clause,—

• (a) the fair market value of the shares shall be the value—

– (i) as may be determined in accordance with such method as may be prescribed; or

– (ii) as may be substantiated by the company to the satisfaction of the Assessing Officer, based on the value, on the date of issue of shares, of its assets, including intangible assets being goodwill, know-how, patents, copyrights, trademarks, licences, franchises or any other business or commercial rights of similar nature, whichever is higher;

• (aa) "specified fund" means a fund established or incorporated in India in the form of a trust or a company or a limited liability partnership or a body corporate which has been granted a certificate of registration as a Category I or a Category II Alternative Investment Fund and is regulated under the Securities and Exchange Board of India (Alternative Investment Fund) Regulations, 2012 made under the Securities and Exchange Board of India Act, 1992 (15 of 1992);

• (ab) "trust" means a trust established under the Indian Trusts Act, 1882 (2 of 1882) or under any other law for the time being in force;]

• (b) "venture capital company", "venture capital fund" and "venture capital undertaking" shall have the meanings respectively assigned to them in clause (a), clause (b) and clause (c) of Explanation to clause (23FB) of section 10;

Scenarios

Timing of Issue

Incorporation Subscription Issue Price 10 No Impact

First Year Further Issue of Capital Issue Price 10 No Impact

Subsequent Years Further Issue of Capital Issue Price 50 FMV = Rs 75; then Rs 25 is taxable in the hands of investor 56(2)(x)

Subsequent Years Further Issue of Capital Issue Price 100 FMV = Rs 75; then Rs 25 is taxable in the hands of company 56(2)(viib)

Subsequent Years Further Issue of Capital Issue Price 75 FMV = Rs 75; No Impact

Notification No 81/2023

Dated 25th Sept 2023

• The Central Board of Direct Taxes (CBDT) has issued the notification amending Rule 11UA that prescribes methods for the valuation of investments made by resident and non-resident investors in closely held companies (e.g., start-ups).

• The valuation helps determine if the Angel Tax will be imposed on start-ups.

• Rule 11UA(2) – inserted – 29th Nov 2012

• Rule 11UA(2) – amended – 24th May 2018

• Rule 11UA(2) – substituted – 25th Sep 2023

Rule Definitions Description

11U(b) Balance Sheet in relation to any company, means,

11U(c) Merchant Banker means category I merchant banker registered with Securities and Exchange Board of India established under section 3 of the SEBI Act, 1992

11U(d) Quoted Shares & Securities in relation to share or securities means a share or security quoted on any recognized stock exchange with regularity from time to time, where the quotations of such shares or securities are based on current transaction made in the ordinary course of business;

11U(e) Recognised Stock Exchange shall have the same meaning as assigned to it in clause (f) of section 2 of the Securities Contracts (Regulation) Act, 1956

11U(f) Registered Dealer means a dealer who is registered under Central Sales Tax Act, 1956 or General Sales Tax Law for the time being in force in any State including value added tax laws

11U(g) Registered Valuer shall have the same meaning as assigned to it in section 34AB of the Wealth-tax Act, 1957 read with rule 8A of Wealth-tax Rules, 1957

11U(h) Securities shall have the same meaning as assigned to it in clause (h) of section 2 of the Securities Contracts (Regulation) Act, 1956

11U(i) Unquoted Shares & Securities in relation to shares or securities, means shares and securities which is not a quoted shares or securities;

11U(j) Valuation Date means the date on which the property or consideration, as the case may be, is received by the assessee.

• Angel tax is imposed on unlisted companies that receive share application money or premiums from their investors over the fair market value of the unquoted equity shares.

• The tax was first introduced through the Finance Act 2012, under Section 56(2)(viib)

• Originally, the provision applied to share application money/premium received from resident investors.

• The Finance Act 2023 expanded the scope of the provision to include share application money/premium received from a person, irrespective of his residential status.

• With this change, excess share application money or premium received from nonresident investors may also be subject to angel tax.

Valuation of Shares & Securities

• Section 56(2)(viib) - Issue/receipt of Shares - the FMV of Shares when issued at price exceeding FV -

• Receipt of Consideration – By the Company

• Issue of Shares – By the Company

Income-Tax Act does not define the term ‘Shares and Securities’; but Rule 11U(h) states that it shall have the same meaning as assigned to it under the Securities Contracts (Regulation) Act, 1956.

New Valuation Methods and Benchmarking

Method and Benchmark Applicable to Fresh issue of Residential status of shareholder Rule 11UA(2)(A)

(b) Benchmarking with shares issued to VCF / VCC / SF

Merchant Banker as per sp ecified 5 new methods

Benchmarking with shares issued to notified entity

New Valuation Methods and Benchmarking

Method and Benchmark Applicable to fresh issue of Residential status of shareholder

Valuation by Merchant Banker a s per DCF

Benchmarking with CCPS issued to VCF / VCC / SF

Valuation of CCPS by Merchant

Banker as per specified 5 new m ethods

Benchmarking with CCPS issued to the notified entity

Benchmarking with unquoted eq uity shares as per methods ment ioned above

Section 56(2)(viib)

Explanation

• (aa) "specified fund" means a fund established or incorporated in India in the form of a trust or a company or a limited liability partnership or a body corporate which has been granted a certificate of registration as a Category I or a Category II Alternative Investment Fund and is regulated under the SEBI (Alternative Investment Fund) Regulations, 2012;

• (b) "venture capital company", "venture capital fund" and "venture capital undertaking" shall have the meanings respectively assigned to them in clause (a), clause (b) and clause (c) of Explanation to clause (23FB) of section 10;

Unquoted Shares Section Perspective

Securities - Rule 11U(h) –

Section 2(h)

• "securities" shall have the same meaning as assigned to it in clause (h) of section 2 of the Securities Contracts (Regulation) Act, 1956 (42 of 1956)

SCRA, 1956

Section 2(h) “securities” include —

• (i) shares, scrips, stocks, bonds, debentures, debenture stock or other marketable securities of a like nature in or of any incorporated company or other body corporate;

• (ia) derivative;

• (ib) units or any other instrument issued by any collective investment scheme to the investors in such schemes;

• (ic) security receipt as defined in clause (zg) of section 2 of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002;

• (id) units or any other such instrument issued to the investors under any mutual fund scheme;

• (ii) Government securities;

• (iia) such other instruments as may be declared by the Central Government to be securities; and

• (iii) rights or interest in securities;

• The Income Tax Officer has to compute the fair market value following the prescribed method and he cannot adopt the market value as fair market value.

Old Rule 11UA(2)

(a) valuation of jewellery

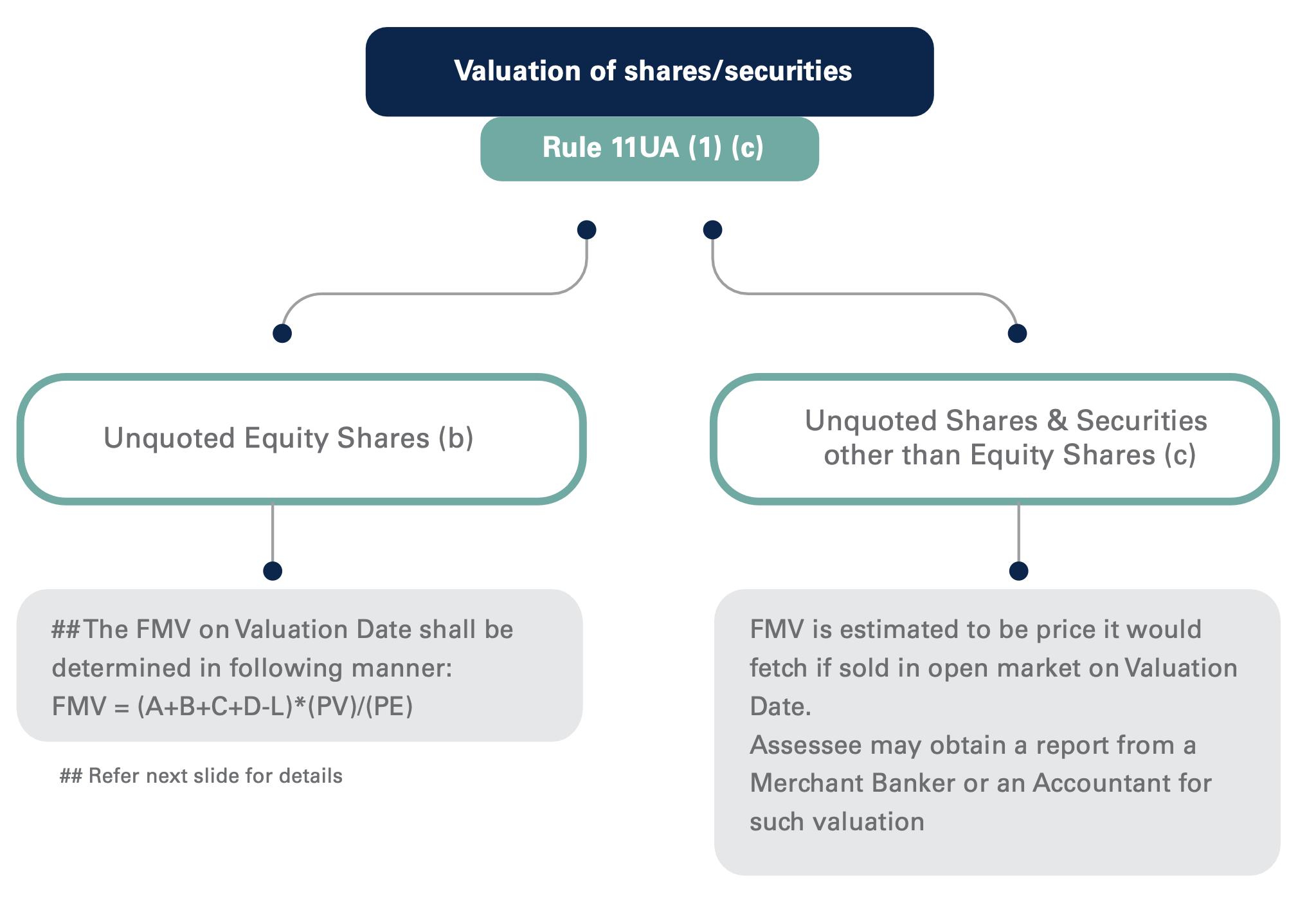

Rule 11UA(1)

Rule 11UA(2)

(b) valuation of archaeological collections, drawings, paintings, sculptures or any work of art

(c) valuation of shares and securities

(a) fair market value of quoted shares and securities

(b) fair market value of unquoted equity shares

(c) fair market value of unquoted shares and securities other than equity shares – Merchant Banker or Accountant

(a) fair market value of unquoted equity shares

(b) fair market value of unquoted equity shares – Merchant Banker

Rule 11UA(2)

(A)

New Rule 11UA(2)

fair market value of unquoted equity shares

(a) fair market value of unquoted equity shares - Auditor - Book Value

(b) fair market value of unquoted equity shares – Merchant Banker - DCF

(c) VCF / VCC / SF – Benchmarking Price

(d) fair market value of unquoted equity shares – Merchant Banker – 5 methods

(e) Notified entity – Benchmarking Price

(B) fair market value of compulsorily convertible preference shares

(i) Resident – Rule 11UA(2)(A) (a), (b), (c), (e)

(ii) Non-resident – Rule 11UA(2)(A) (a), (b), (c), (d), (e)

Rule 11UA(3) MB Report not older than 90 days

Rule 11UA(4) Safe Harbor Rule – 10%

Rule 11UA(2)

Rule 11UA(4) – Safe Harbor – Applicability

fair market value of unquoted equity shares

(a) fair market value of unquoted equity shares - Auditor - Book Value

(b) fair market value of unquoted equity shares – Merchant Banker - DCF

(c) VCF / VCC / SF – Benchmarking Price

(d) fair market value of unquoted equity shares – Merchant Banker – 5 methods

(e) Notified entity – Benchmarking Price

(B) fair market value of compulsorily convertible preference shares (CCPS)

(i) Resident

(ii) Non-resident

Rule 11UA(2)(A)

a) Book Value – Auditor

b) Discounted Cash Flow (DCF) – MB

c) Benchmarking Price – VCC / VCF / SF

d) Panchatantra – MB

e) Benchmarking Price - NE

2+5 Methods

• In addition to the two methods for valuation of shares, namely, Discounted Cash Flow (DCF) and Net Asset Value (NAV) method, available to residents under Rule 11UA,

• 5 more valuation methods have been made available for nonresident investors, namely,

– Comparable Company Multiple Method,

– Probability Weighted Expected Return Method,

– Option Pricing Method,

– Milestone Analysis Method,

– Replacement Cost Method.

New Rule 11UA(2)(A)(a) – FMV of unquoted equity shares

Assets

A book value of the assets in the balance-sheet Book Value Liabilities

L book value of liabilities shown in the balance sheet Book Value

PV the paid up value of such equity shares; Book Value PE total amount of paid up equity share capital as shown in the balance-sheet; Book Value

Notified classes of person exempt from Section

56(2)(viib)

The Finance Act 2023 has enhanced the scope of section 56(2)(viib) to make it applicable to share application money/premium received from any person, regardless of residential status. Further, Proviso to section 56(2)(viib) gives power to the Central Government to notify class or classes of persons to whom the provisions of said section shall not apply. In the exercise of the power, the CBDT has notified the following class or classes of persons:

1. The Government and Government related investors such as central banks, sovereign wealth funds, international or multilateral organizations or agencies, including entities controlled by the Government or where direct or indirect ownership of the Government is 75% or more;

2. Banks or Entities involved in Insurance Business where such entity is subject to applicable regulations in the country where it is established or incorporated or is a resident;

Notified classes of person exempt from Section 56(2)(viib)

3. Any of the following entities, which is a resident of any country or specified territory, and such entity is subject to applicable regulations in the country where it is established or incorporated or is a resident:

a) Entities registered with SEBI as Category-I Foreign Portfolio Investors;

b) Endowment funds associated with a university, hospitals or charities;

c) Pension funds created or established under the law of the foreign country or specified territory;

d) Broad-Based Pooled Investment Vehicle or fund where the number of investors in such vehicle or fund is more than 50, and such fund is not a hedge fund or a fund which employs diverse or complex trading strategies

The board has notified 21 Countries/Specified Territories for the purpose of point (3).

Section 2(oaa) – Registered Valuer

✓ "registered valuer" means a person registered as a valuer under section 34AB

The Wealth-Tax Act, 1957

Rule 11U(b) - "balance-sheet", in relation to any company, means

• (i) for the purposes of rule 11UA(2), the balance-sheet of such company (including the notes annexed thereto and forming part of the accounts) as drawn up on the valuation date which has been audited by the auditor of the company appointed under section 224 of the Companies Act, 1956 (1 of 1956) and where the balance-sheet on the valuation date is not drawn up, the balance-sheet (including the notes annexed thereto and forming part of the accounts) drawn up as on a date immediately preceding the valuation date which has been approved and adopted in the annual general meeting of the shareholders of the company; and

Rule 11U(b) - "balance-sheet", in relation to any company, means

• (ii) in any other case [viz. rule 11UA(1)(c)(b)]

– (A) in relation to an Indian company, the balance-sheet of such company (including the notes annexed thereto and forming part of the accounts) as drawn up on the valuation date which has been audited by the auditor of the company appointed under the laws relating to companies in force; and

– (B) in relation to a company, not being an Indian company, the balance-sheet of the company (including the notes annexed thereto and forming part of the accounts) as drawn up on the valuation date which has been audited by the auditor of the company, if any, appointed under the laws in force of the country in which the company is registered or incorporated;

Rule 11U(j) - Valuation Date

• "valuation date" means the date on which the property or consideration, as the case may be, is received by the assessee

IVS Framework

Section 60. Departures

Para 60.1.

• A “departure” is a circumstance where specific legislative, regulatory or other authoritative requirements must be followed that differ from some of the requirements within IVS.

• Departures are mandatory in that a valuer must comply with legislative, regulatory and other authoritative requirements appropriate to the purpose and jurisdictionof the valuationto be in compliance with IVS.

• A valuermay still state that the valuationwas performed in accordance with IVS when there are departures in these circumstances.

Para 60.2.

• The requirement to depart from IVS pursuant to legislative, regulatory or other authoritative requirements takes precedence over all other IVS requirements.

Para 60.3

• As required by IVS 101 ScopeofWork , para 20.3 (n) and IVS 103 Reporting , para 10.2 the nature of any departures mustbe identified (for example, identifying that the valuationwas performed in accordance with IVS and local tax regulations). If there are any departures that significantly affect the nature of the procedures performed, inputs and assumptions used, and/or valuation conclusion(s), a valuer must also disclose the specific legislative, regulatory or other authoritative requirements and the significantways in which they differ from the requirements of IVS (for example, identifying that the relevant jurisdiction requires the use of only a market approach in a circumstance where IVS would indicate that the income approach shouldbe used).

Para 60.4.

• Departure deviations from IVS that are not the result of legislative, regulatory or other authoritative requirements are not permitted in valuations performed in accordance with IVS.

Registered Valuer

• Under section 34AB of the Wealth Tax Act, 1957, various categories of valuers are registered by ITD all over India.

• In the absence of any other legislation or government formed association for valuers, valuers registered by ITD are considered to be government registered valuers.

• As of February, 2011, there were a total of 9751 valuers across the country

• It is understood that the indicative number of valuers registered under Section 34AB of the Wealth Tax Act, 1957 as of 2016 is 7482 (Agricultural land: 54, Immovable property: 5163, Jewellery: 119, Plant & machinery: 935 and Shares & debentures: 132).

Section 56(2)(X)(c)

–

(x) where any person receives, in any previous year, from any person or persons on or after the 1st day of April, 2017,

• (c) any property, other than immovable property, —

• (A) without consideration, the aggregate fair market value of which exceeds fifty thousand rupees, the whole of the aggregate fair market value of such property;

• (B) for a consideration which is less than the aggregate fair market value of the property by an amount exceeding fifty thousand rupees, the aggregate fair market value of such property as exceeds such consideration

• (1) The Chief Commissioner or Director General shall maintain a register to be called the Register of Valuers in which shall be entered the names and addresses of persons registered under sub-section (2) as valuers.

• (2) Any person who possesses the qualifications prescribed in this behalf may apply to the Chief Commissioner or Director General in the prescribed form for being registered as a valuer under this section: Provided that different qualifications may be prescribed for valuers of different classes of assets.

• (3) Every application under sub-section (2) shall be verified in the prescribed manner, shall be accompanied by such fees as may be prescribed and shall contain a declaration to the effect that the applicant will —

– (i) make an impartial and true valuation of any asset which he may be required to value;

– (ii) furnish a report of such valuation in the prescribed form;

– (iii) charge fees at a rate not exceeding the rate or rates prescribed in this behalf;

– (iv) not undertake valuation of any asset in which he has a direct or indirect interest.

The Wealth-Tax Act, 1957

• (4) The report of valuation of any asset by a registered valuer shall be in the prescribed form and be verified in the prescribed manner.

Section 2(r) – Valuation Officer

✓ "Valuation Officer" means a person appointed as a Valuation Officer under section 12A, and includes a Regional Valuation Officer, a District Valuation Officer, and an Assistant Valuation Officer

• VO – Valuation Officer

• RVO – Regional Valuation Officer

• DVO – District Valuation Officer

• AVO – Assistant Valuation Officer

The Wealth-Tax Act, 1957

Section 38A – Powers of Valuation Officer

(1) For the purposes of this Act, a Valuation Officer or any overseer, surveyor or assessor authorised by him in this behalf may, subject to any rules made in this behalf and at such reasonable times as may be prescribed,—

– enter any land within the limits of the area assigned to the Valuation Officer, or

– enter any land, building or other place belonging to or occupied by any person in connection with whose assessment a reference has been made under section 16A to the Valuation Officer, or

– inspect any asset in respect of which a reference under section 16A has been made to the Valuation Officer,

The Wealth-Tax Act, 1957

✓ and require any person in charge of, or in occupation or possession of, such land, building or other place or asset to afford him the necessary facility to survey or inspect such land, building or other place or asset or estimate its value or inspect any books of account, document or record which may be relevant for the valuation of such land, building or other place or asset and gather other particulars relating to such land, building or other place or asset:

✓ Provided that no Valuation Officer, overseer, surveyor or assessor shall enter any building or place referred to in clause (b), or inspect any asset referred to in clause (c) (unless with the consent of the person in charge of, or in occupation or possession of, such building, place or asset) without previously giving to such person at least two days' notice in writing of his intention to do so.

The Wealth-Tax Act, 1957

✓ (2) If a person who, under sub-section (1), is required to afford any facility to the Valuation Officer or the overseer, surveyor or assessor, either refuses or evades to afford such facility, the Valuation Officer shall have all the powers under sub-sections (1) and (2) of section 37 for enforcing compliance of the requirements made.

The Wealth-Tax Act, 1957

Valuation under IT Act

• For issuance of valuation reports under the Companies Act, 2013, a valuer registered with IBBI is eligible to use any of the methods including Discounted Cash Flow Method as per the Valuation Standards.

• However, the eligible valuer for undertaking valuation and issuing valuation report under Rule 11UA(2)(b) of the Income-tax Act, 1961 can use either book value method or Discounted Cash Flow Method.

Valuation under IT Act

• Consequently, the fair value derived under Companies Act, 2013 may be fundamentally different from what is sought as a fair market value under Income Tax Act, 1961.

• Hence, this disparity can be reconciled by allowing methods and approaches prescribed under ICAI Valuation Standards (or International Valuation Standards) as an accepted practice in deriving fair market value under Income Tax Act, 1961.

• Presently, valuers registered with IBBI are not eligible valuers under Income Tax Act.

The method for valuation of buyback of equity shares of a private or unlisted company under in Companies Act 2013 or its Rules?

✓ As per Companies Act 2013, valuation is not required for buy back of shares, however valuation report can be obtained from Chartered Accountant or Registered Valuer for justifying the buyback price.

Rule 11UA of the Income Tax Act states “value shall be determined by a merchant banker or an accountant”.

• Is a registered valuer considered as an accountant under Income Tax Act?

• Section 288

• In case of a private company, for transactions involving issue and transfer of shares, valuation report of registered valuer is required under the Companies Act but under Income Tax Act if the valuation is carried out under

Discounted Cash Flow Method, the valuation report should be from a merchant banker only.

• This valuation interplay between the Acts has been creating confusion.

• Are the two Valuers required to give similar Valuations?

• Such situation arises only when a company issues shares and chooses to ascertain Fair Market Value based on DCF method under 11UA(2).

• In such cases, a company normally appoints a person who is both a merchant banker and a registered valuer.

• Ideally, there should not be a very high difference between the two values as valuation date is same for both.

Date: June 27, 2019

Background:

• The assessee has the option under Rule 11UA (2) to determine the FMV by either the ‘DCF Method’ or the ‘NAV Method’. The AO has no jurisdiction to tinker with the valuation and to substitute his own value or to reject the valuation. He also cannot question the commercial wisdom of the assessee and its investors.

Judgement and Conclusion:

• It is a well settled position of law with regard to the valuation, that valuation is not an exact science and can never be done with arithmetic precision.

• Also, an important angle to view such cases, is that, here the shares have not been subscribed by any sister concern or closely related person, but by an outside investors like, Anand Mahindra, Rakesh Jhunjhunwala, and Radhakishan Damani who are one of the top investors and businessman of the country and if they have seen certain potential and accepted this valuation, then how AO or Ld. CIT(A) can question their wisdom.

Valuation of share can be done only on basis of FMV and Not Market Value:

DCIT Mumbai vs Ozoneland Agro Pvt Ltd (ITAT Mumbai)

Date: 2nd May 2018

Background

• A.O. observed that two persons transferred their shares to the assessee at Rs.75.49 per share whereas, on the same day all the other shareholders transferred their shareholdings to the assessee at Re.1 per share. He observed that when the market rate is Rs.75.49/share, the assessee has purchased the shares at less than the market price i.e., Re.1 per share and therefore, the transactions attract provisions of section 56(2) (viia) of the I.T. Act.

• The assessee however argued that under section 56(2)(viia) FMV as calculated under Rule 11U is to be considered and not market price. And FMV of the shares were negative and hence the section has no applicability in the given case.

Judgement and Conclusion

• The Tribunal on due consideration ruled that the action of AO was outside the ambit of law and only FMV under Rule 11U can be considered and not Market price.

• Hence dismissing appeal by the AO.

Application of Section

56(2)(via)

in case of Bonus Issue

Commissioner of Income-Tax vs Dalmia Investment Co. Ltd

[1964] 52 ITR 567 (SC)

Date:13th March 1964

Background

• There has been a constant flip flop by the CBDT on the issue that whether the provisions of the given section would apply on fresh issue of shares. As the ambiguity prevails the highly celebrated case can be referred for determining applicability of section on Bonus Issue.

Judgement and Conclusion

• The apex court in the given case while adjudicating the issue of taxability on transfer of shares held that the Bonus shares were acquired “Without Payment of price and not without consideration” hence it can be implied that Section 56(2) (viia) would not apply in case of bonus issue.

Share Valuation Framework –

• In the case where the company has issued shares at a premium during the year and at a value greater than fair value, the difference between issued price and fair value price is taxed in the hands of the company.

• The tax auditor of the company has to report such an event under the specific clause in the tax audit report.

• Here the company has a choice to adopt either:

– Break-up as per 11UA (no certificate is required), or

– Fair value to be determined as per DCF and by the merchant banker.

• This section is applicable to investee companies in which the public are not substantially interested (typically privately held companies).

Share Valuation Framework

• Further, if an investee company is a venture capital undertaking and has received VC investment, section does not apply.

• Further, a notified and registered start-up is also exempt from valuation requirements.

• The section does not apply where the investor is a nonresident.

Tax Implications for Company Issuing of Shares when

Section 2(22B)

✓ Fair Market Value, in relation to a capital asset, means —

• (i) the price that the capital asset would ordinarily fetch on sale in the open market on the relevant date; and

• (ii) where the price referred to in sub-clause (i) is not ascertainable, such price as may be determined in accordance with the rules made under this Act;

The Income Tax Act, 1961

Section 56(2)(vii) – Explanation

✓ Explanation.—For the purposes of this clause,—

✓ (a) "assessable" shall have the meaning assigned to it in the Explanation 2 to sub-section (2) of section 50C;

✓ (b) "fair market value" of a property, other than an immovable property, means the value determined in accordance with the method as may be prescribed;

Explanation. —For the purposes of this clause, the expressions "assessable", "fair market value", "jewellery", "property", "relative" and "stamp duty value" shall have the same meanings as respectively assigned to them in the Explanation to clause (vii).

Sections under IT Act & Rules under IT Rules

Section Rule

56(2)(viib) 11U(b)

11U(j)

11UA(1)(c) 11UA(2)

Sections 56(2)

Sections under IT Act

Section 50C – Explanation

✓ Explanation 1: For the purposes of this section, "Valuation Officer" shall have the same meaning as in clause (r) of section 2 of the Wealth-tax Act, 1957

✓ Explanation 2: For the purposes of this section, the expression "assessable" means the price which the stamp valuation authority would have, notwithstanding anything to the contrary contained in any other law for the time being in force, adopted or assessed, if it were referred to such authority for the purposes of the payment of stamp duty.

The Income Tax Act, 1961