Establishing Presence in India

Direct tax perspective

Suyash Sinha

23 June, 2023

Contents

• Key modes of setting up presence in India

o Liaison Office

o Branch/ Project office

o Unincorporated joint venture

o Subsidiary

• Key risks associated with each mode

o Permanent Establishment (PE) risk

o Residence risk – having POEM in India

o AOP risk

• Key risk mitigation strategies

• Jurisdictional Analysis for tax efficient cash repatriation

• Anti-abuse provisions

o Transfer Pricing

o Thin Capitalization norms

o General Anti-avoidance rules

© 2023 | Shardul Amarchand Mangaldas & Co Privileged and Confidential 2

How are foreign enterprises taxed?

• Foreign Enterprises are taxed on their business income earned from India at the rate of 40% (plus applicable surcharge and cess) on net basis if the foreign enterprise carries out its business in India through a fixed base or a PE – where a Tax Treaty exists between India and country of Residence of the Foreign Enterprise.

• Where no Tax Treaty exists :

• Concept of ‘business connection’ – which is wider that the concept of PE under India’s Tax Treaties

• Significant Economic Presence – ‘Digital Tax’

• Foreign Enterprises are also subject to Indian withholding taxes at applicable rates for the following Income streams

• Royalties

• Fee for technical/ Included services

• Interest

• Capital Gains

© 2023 | Shardul Amarchand Mangaldas & Co Privileged and Confidential 3

Modes of establishing presence in India

© 2023 | Shardul Amarchand Mangaldas & Co Privileged and Confidential 4 Foreign Company Liaison Office (LO) Branch/ Project Office (BO/ PO) Unincorporated joint venture (JV) Subsidiary

Liaison Office (LO)

An extension of the foreign company, akin to representative office – good tool to test waters

Easy to set up - Low min. capital requirement & profit making track record in immediately preceding 3 years

Set up under express approval from RBI. Can carry out only permitted activities. Cannot carry out business activities.

Permitted activities – typically preparatory & auxiliary

Permanent Establishment risk if scope of activities exceeds permitted activities, in such case TP will also apply

© 2023 | Shardul Amarchand Mangaldas & Co Privileged and Confidential 5

Branch / Project Office

An extension of the foreign company – PE

Set up under express approval from RBI. Can carry out only permitted business activities – usually similar to the HO

Dependent on receipts from HO and business activities carried out it India – can also remit profits to HO

Transfer Pricing Regulations apply on all transactions between the HO & BO/PO –Arm’s length criteria

© 2023 | Shardul Amarchand Mangaldas & Co Privileged and Confidential 6

PERMANENT ESTABLISHMENT

(“PE”) RISK

© 2023 | Shardul Amarchand Mangaldas & Co Privileged and Confidential

7

What is a PE?

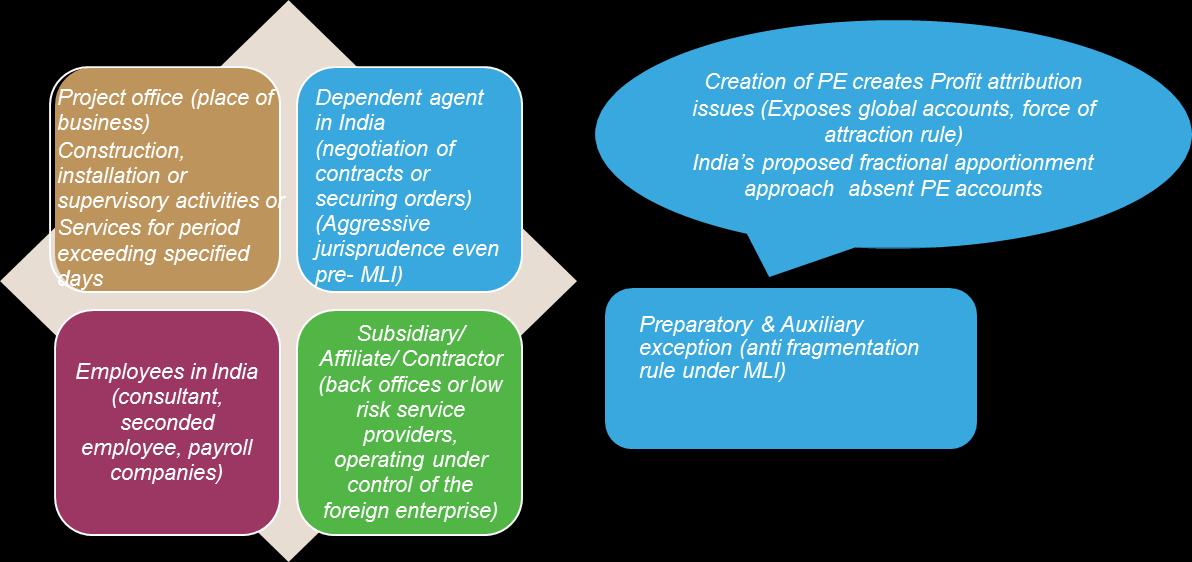

Very broadly, PE is the minimum threshold of ‘physical presence’ that a foreign enterprise must meet in the source country to be subject to taxes there (say, India) in respect of its business income. Typically, a PE may arise in India if:

A foreign enterprise has a fixed place of business in India (branch, project office, warehouse, place of management, workshop);

A foreign enterprise has employees present in India for significant durations rendering services on its behalf or undertaking other business activities; and

A foreign enterprise has a dependent agent in India who negotiates or concludes contracts in India or secures orders in India on its behalf

Once a foreign enterprise sets up a PE in India, it will need to maintain separate books of accounts in India for such PE for purposes of tax payment and audit.

In case a PE is created, profits of the foreign enterprise that are attributable to the Indian PE are subject to Indian taxes at 43.68%.

© 2023 | Shardul Amarchand Mangaldas & Co Privileged and Confidential

8

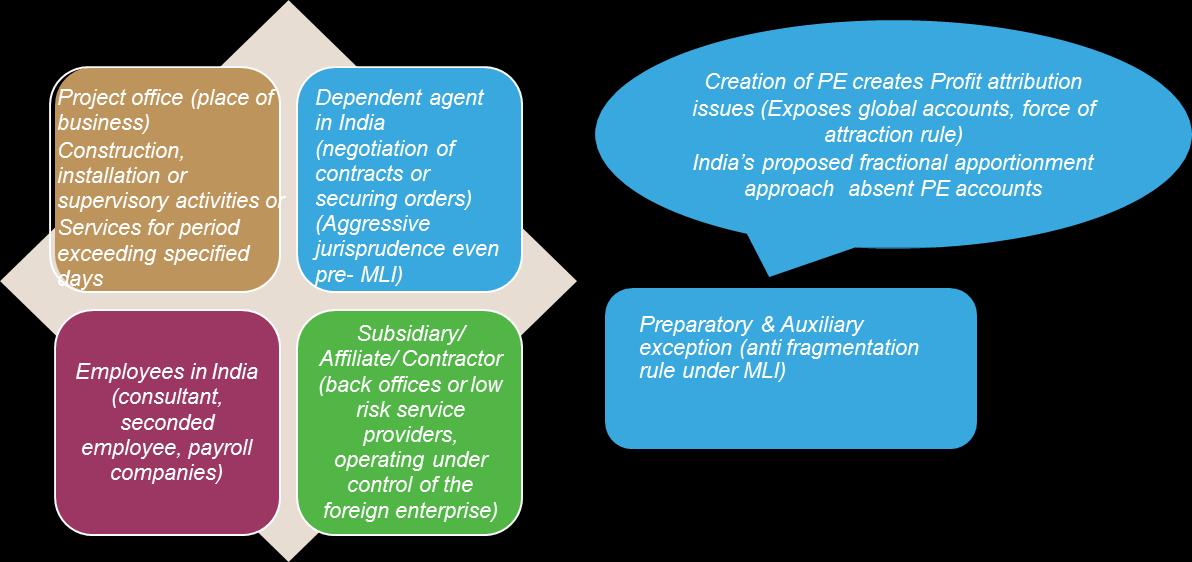

Factors that can give rise to a PE:

© 2023 | Shardul Amarchand Mangaldas & Co Privileged and Confidential

9

Managing PE exposure

Do’s

Remunerate contractor at arm’s length to prevent any additional attribution (transfer pricing study recommended)

Don’ts

Contracts, correspondence and conduct should not indicate the authority to negotiate or conclude contracts

Clear demarcation of roles & responsibilities, and risks & rewards with the contractor

Social media references, official and networking websites and business cards should not allude to a PE

Monitor employees duration of stay for service PE & fixed place PE thresholds – use secondment structures where applicable

Close intra- group interdependence should not blur the identity of individual entities (including Indian contractor and foreign enterprise) to third parties

Control on contractor restricted to stewardship activities

Visiting employees should not have any fixed place or room at any premises at their disposal

Exploring appropriate secondment structures?

© 2023 | Shardul Amarchand Mangaldas & Co Privileged and Confidential 10

Unincorporated JV & AOP risk

What is an AOP?

An association of persons or an AOP is a separate taxable entity recognized under tax laws. When two or more persons combine to undertake a joint enterprise with commonness of purpose, risks and rewards, they may be treated as an association of persons or AOP under the ITAct.

Why is AOP a risk for unincorporated JV’s?

An AOP is considered to be tax resident in India in any previous year, in every case, except where during that year the control and management of its affairs is situated wholly outside India.

As such, in case the control and management of the affairs of the AOP is even partially situated in India at any time during the relevant tax year, by virtue of I Co participating in the decisions that concern control and management of the affairs of the AOP from India, the AOP may be classified as a tax resident of India.

Tax Treatment

In case an AOP is treated as an Indian tax resident, entire income of the AOP (, i.e., income of both F Co and I Co), net of deductible expenditure, would be taxed in India in the hands of AOP. Further, since AOP is treated as a tax resident of India , the provisions of Tax Treaty will not be applicable.

As such, the AOP’s income (to the extent of I Co’s share) will be taxed at the maximum marginal rate of 42.744% and AOP’s income (to the extent of F Co’s share) will be taxed at 43.68% applicable to foreign companies under the ITAct.

© 2023 | Shardul Amarchand Mangaldas & Co Privileged and Confidential

11

Project

F Co. I Co.

Such association is voluntary

When will AOP not come into existence?

(a)Independence & separation in roles, responsibility, use of resources, costs incurred, risk & rewards

Association of 2 or more persons

(a)Each member earns profit or incurs losses, based on performance of the contract falling strictly within its scope of work.

Common purpose – to earn income jointly

(a)The resources and materials used for any area of work should be under the risk and control of respective members.

Common management/ Joint participation

(a)Control & management should not be unified (except for coordination)

© 2023 | Shardul Amarchand Mangaldas & Co Privileged and Confidential 12

Subsidiary

Separate legal entity – taxed at corporate tax rates applicable to domestic company

Ring fencing of PE risk – No default PE, unless factors creating a PE under the relevant tax treaty are present

Can carry out business operations & generate business income

Repatriation of profits permissible – Dividend, interest, royalty, FTS

Transfer Pricing regulations apply to all transactions between the Foreign company & the Indian subsidiary

Thin capitalization norms applicable

© 2023 | Shardul Amarchand Mangaldas & Co Privileged and Confidential

13

POEM RISK – TAX RESIDENCE OF FOREIGN COMPANY IN INDIA

© 2023 | Shardul Amarchand Mangaldas & Co Privileged and Confidential

14

Residence Risk - POEM

• Please note that a foreign company can be treated as an Indian tax resident if its place of effective management (“POEM”) is in India. As a result thereof, the global income of the foreign company could be subject to tax in India per the provisions of the IT Act and the benefits, if any, under the applicable tax treaty can be denied.

• POEM is defined under the IT Act to mean a place where key management and commercial decisions necessary for the conduct of the business of such foreign company, as a whole are, in substance made. Further, the POEM test is applied each year to a foreign company to ascertain its residential status for Indian tax purposes.

• Additionally, note that POEM test shall not be applicable for a foreign company so long as its total turnover or gross receipts in any financial year does not exceed INR 500 million

• For a foreign company having active business outside India (“ABOI”) – POEM presumed to be outside India if majority of board meetings take place outside India. However, if the board is standing aside, and key decisions are taken by Indian affiliate, POEM will be in India (cases where the board is merely following a group policy in re HR, IT, accounting etc. are not covered).

© 2023 | Shardul Amarchand Mangaldas & Co Privileged and Confidential

15

Residence Risk – POEM – ABOI Criteria

Passive income (interest, dividend, royalty, FTS, intragroup sales, etc.) is less than 50% of total income

Assets in India are less than 50% of total assets

Employees situated or resident in India are less than 50% of total employees

Payroll expenses on such employees is less than 50% of total payroll expenses.

© 2023 | Shardul Amarchand Mangaldas & Co Privileged and Confidential 16

Jurisdictional Analysis

Particulars Domestic tax law US Singapore Mauritius Netherlands UAE

Dividend 21.84% 15% (if more than 10% of the voting power is held by a US company).

25% in any other case.

10% (if 25% or more of the shares are held by a Singapore company). 15% in any other case

5% (if more than 10% is owned directly by a Mauritian company). 15% in any other case.

10% 10%

Interest 5.46*%-43.68% 15% 15% 7.5% 10% 12.5%

Royalties/ FTS 21.84% 15%, (restricted scope of FTS due to make available clause)

10%, (restricted scope of FTS due to make available clause)

15% for royalties; 10% for fee for technical services

10% (restricted scope of FTS due to make available clause)

10% Fee for technical services are not taxable in India (unless UAE resident has a PE in India)

Capital gains on sale of shares and/ securities in Indian company

Taxable No benefit India can tax sale of shares in an Indian company.

India’s taxation rights restricted in case of transfer of other financial instruments, such as debt securities.

Same as Singapore. Sale of shares to a non-resident purchaser not taxable in India.

In case of sale of shares to an Indian resident, transaction is taxable only if more than 10% stock is sold.

Separate rules apply if the Indian company derives its principal value from immovable property.

Same as Singapore.

* The IT Act also allows for reducing the cascading effect of taxes on dividends by providing a deduction of an amount equal to the dividend received from a domestic or foreign subsidiary to the extent of the dividend declared by the domestic company prior to the due date for filing its ITR

**5% rate is available in case of long term infrastructure bonds, rupee denominated bonds (4% rate applicable where such bonds are listed on IFSC, ECB, Govt. bonds and securities issued to FII/QFIs etc.

- Not available July 1, 2023 onwards

© 2023 | Shardul Amarchand Mangaldas & Co Privileged and Confidential 17

Forms of business entities

Direct presence

Liaison office

Purpose Akin to a representative office –cannot engage in business activities .

Taxability

• No branch profits tax in India

Branch office

Set up as on office of the foreign enterprise

Project office

Set up for a specific project

Taxed

Taxed

• No ring fencing of Indian operations in case of direct entry

• Approval route under exchange control laws

• Direct entry may create a permanent establishment (PE) in India. Business profits attributable to PE taxed at 43.68% (inclusive of applicable surcharge & cess)

© 2023 | Shardul Amarchand Mangaldas & Co Privileged and Confidential 18

as a PE

Not a taxable presence under the preparatory and auxiliary exception as a PE

Forms of business entities

Separate taxable entity

Subsidiary

Ordinary tax rate

(A) Applicable CIT rate if tax holidays / deductions are not opted:

• New domestic manufacturing company - 17.16%

• Any other company – 25.17%

(B) Applicable CIT rate if tax holidays / deductions are not opted:

• 29.12% if turnover is less than INR 4 billion in FY2020-21

• 34.94%, in all other cases

WHT on Dividends

Taxable in the hands of shareholders.

WHT at 10.92% on dividends (subject to tax treaty relief in India) in case of resident shareholders and 21.84% in the hands of non-resident shareholders

PE risk Ring fenced – as separate legal entity – No presumption of PE as against direct presence unless other ingredients present

Unincorporated joint venture

Taxed as a separate taxable entity “association of persons” (AOP) except in certain circumstances. If shares of members determinate – tax rates applicable to members Indeterminate share – maximum marginal rate (35.88%)

No distribution tax

PE risk may arise if employees of foreign company visit India for prolonged durations to carry out business activities

© 2023 | Shardul Amarchand Mangaldas & Co Privileged and Confidential 19

Forms of taxable entities

Separate taxable entity

Subsidiary

Unincorporated joint venture

Liability of shareholder/ member

Shareholder not personally liable for taxes of the company (directors may be liable in case of gross neglect or misfeasance)

Members personally liable for taxes of LLP in case of nonrecovery

A subsidiary in the form of a company preferred choice –greater acceptance by banks, financial institutions & government bodies floating tenders

No straight jacket formula

© 2023 | Shardul Amarchand Mangaldas & Co Privileged and Confidential 20

Established

Certainty in tax treatment

tax jurisprudence Less certainty in comparison to a company

ANTI- AVOIDANCE RULES

© 2023 | Shardul Amarchand Mangaldas & Co Privileged and Confidential

21

Anti-Avoidance Rules

Transfer pricing regulations

• Include secondary adjustments

• Concept of deemed international transaction

• Mandatory annual reporting of related party transactions

• Bilateral and unilateral advance pricing arrangements and safe harbor rules available

Thin Capitalisation norms

• Disallowance of interest expense in excess of 30% of EBITDA

• Carry forward of disallowed interest expense permitted for 8 years

General anti avoidance rules

• Codifies substance over form doctrine

• Broad powers to re-characterize transactions lacking commercial substance

• Currently untested

© 2023 | Shardul Amarchand Mangaldas & Co Privileged and

Confidential

Anti- Abuse Rules

Limitation of Benefits(LOB) clause in Treaties

© 2023 | Shardul Amarchand Mangaldas & Co Privileged and Confidential

23

Transfer Pricing GAAR

General Anti-Avoidance Rules (GAAR)

Applies to :

An ‘ImpermissibleAvoidance Arrangement

Assessment Year 2018-19 onwards

Provisions apply even to a step in or part of the arrangement

Provisions apply in addition to any other basis of determination of tax liability

Threshold - tax benefit arising, in aggregate, to all the parties to the arrangement does not exceed INR 3 crores (30 million)

A tax benefit obtained from the arrangement on or afterApril 1, 2017, irrespective of when the arrangement is entered into;

Main purpose – tax benefit

Creation of rights or obligations –not ordinary created on arm’s length

Results directly or indirectly in misuse/ abuse of provisions of Income-tax Act, 1961

Lacks or deemed to lack ‘commercial substance’

Note: Tax benefit includes – reduction, avoidance or deferral of tax, as defined.

Purpose not bona fide

Presumption against the taxpayer, unless proved otherwise – if main purpose of a step in or part of the arrangement is to obtain a tax benefit, notwithstanding the fact that the main purpose of the ‘whole arrangement’ is not to obtain a tax benefit

© 2023 | Shardul Amarchand Mangaldas & Co Privileged and Confidential

24

GAAR – To override Tax Treaty claim

An Arrangement is deemed to lack commercial substance if:

• The substance or effect of the arrangement as a whole is inconsistent or differs significantly from, the form of its individual steps; or it involves or includes

(a) round trip financing;

(b) an accommodating party;

(c) elements that have effect of offsetting or cancelling each other; or

(d) a transaction which is conducted through one or more persons and disguises the value, location, source, ownership or control of funds which is the subject matter of such transaction; or

• it involves the location of an asset or of a transaction or of the place of residence of any party which is without any substantial commercial purpose other than obtaining a tax benefit; or

• it does not have a significant effect upon the business risks or net cash flows of any party to the arrangement apart from any effect attributable to the tax benefit that would be obtained.

Factors that are not relevant:

• Period or time for which the arrangement exists;

• Fact of payment of taxes directly or indirectly under the arrangement;

• Fact that an exit route (including any transfer of activity or business or operations) is provided by the arrangement

© 2023 | Shardul Amarchand Mangaldas & Co Privileged and Confidential

25

Transfer Pricing

Multinational Enterprises or MNEs operate through a multi –tiered corporate structure spread across the globe. Such integrated structure also provides opportunities to these MNEs to manipulate the prices of intra-group transactions in order to reduce the Indian taxes and shift it to other jurisdictions.

The Act contains transfer pricing regulations or TP regulations that requires that the transactions between related parties (one of which is a non-resident) must be undertaken at arm’s length. Arm’s length price of a transaction means the price which independent or unrelated parties would have adopted under comparable circumstances for same or similar transactions.

For purpose of transfer pricing, two parties are related if they participate in each other’s control, capital or management or are under a person’s common control or management (Section 92A)

Examples – Charging excess consideration by the overseas entity from the Indian entity for intra-group sale of goods or services or charging excess royalties or interest from Indian group entities; or where the Indian entity under-prices its sale to overseas group entity.

Examples: Holding >26% voting power, loan given >51% book value of assets, Guarantee given >10% of borrowings, Power to appoint >50% of Board of Directors, etc.

© 2023 | Shardul Amarchand Mangaldas & Co Privileged and Confidential

26

Transfer Pricing

Domestic Transfer Pricing: TP may be applicable between purely domestic entities, if any entity claiming specified tax holidays and aggregate to related party transactions >INR 20 crores in a financial year.

Because of transfer pricing, if intra-group transactions are not at arm’s length price, the difference between arm’s length price and transfer price may be imputed as income or disallowed as a tax expense, as the case may be, and taxed in India.

© 2023 | Shardul Amarchand Mangaldas & Co Privileged and Confidential

27

Transfer Pricing

Deemed transfer pricing

Two unrelated parties (including Indian parties) may also be subject to transfer pricing regulations, if the transaction between them is governed by a prior agreement between their offshore affiliates.

For example, an asset sale in India between two unrelated parties pursuant to a global transaction could be subject to Indian transfer pricing.

© 2023 | Shardul Amarchand Mangaldas & Co Privileged and

Confidential

28

Key takeaways

• Form of business presence – direct entry or setting up of legal entity should be evaluated on a case to case basis based on business objectives

• Right blend of repatriation mechanics to strike a balance between tax efficacy (in India and abroad) and exposure to anti avoidance rules

• Structuring of investments for exit tax efficacy should meet GAAR commercial substance test

• Any continued business interaction with India, directly or through contractors or consultants, should be vetted for PE exposures

• Secondment structures should be carefully implemented to pass the test of integration

• Indian tax authorities aggressive on source based taxation – all receipts emanating from India should be vetted for withholding tax exposures

• Global reorganization and business acquisitions with Indian assets and business interests need to consider Indian tax implications

© 2023 | Shardul Amarchand Mangaldas & Co Privileged and Confidential 29

Shardul Amarchand Mangaldas & Co Advocates & Solicitors Amarchand Towers 216 Okhla Industrial Estate Phase III New Delhi 110 020 T +91 11 4159 0700 4060 6060 F +91 11 26924900 New Delhi Mumbai Gurgaon Bengaluru Chennai Ahmedabad Kolkata 30

Thank You! For More Information, Visit: https://taxmann.com/ Get in touch with us on Social Media: Follow us on Social Media: Download Taxmann App