Exposure Draft on New Standards on Auditing issued by

AASB of ICAI

AASB of ICAI

SA220 (Revised)

SA315 (Revised)

• AASB of ICAI has issued Exposure Drafts of 7 Standards

• New Proposed Standards are in line with corresponding International Standards

• Proposed revised standards will result in conforming amendments in other SA

• Shift from “Control” to “Management”

• Objective to encourage proactive quality management at firm and engagement level.

• To promote a more robust, proactive, scalable and effective approach to quality management.

Introduction

• SQM 1: Quality Management for Firms that Perform Audits or Reviews of Financial Statements, or OtherAssurance or Related Service Engagements

• SQM 2: Engagement Quality Reviews

• SA220: Quality Management for anAudit of Financial Statements

• SA250: Consideration of Laws and Regulations in anAudit of Financial Statements

• SA315: Identifying and Assessing the Risks of Material Misstatement

• SA540: Auditing Accounting Estimates and Related Disclosures

• SRS 4400: Agreed-Upon Procedures Engagements.

Introduction

Exposure Draft SA220 (Revised) Quality Management for an Audit of Financial Statements

Click to edit Master title style Relationship of SQM 1 with SQM 2 and SA220 (R)

SQM 1

Quality Management at the firm level

• Requires the firm to design, implement and operate a SQM to manage the quality of engagements performed by the firm.

SQM 2 Engagement Quality Reviews

• EQR form part of the firm’s SQM.

• SQM 2 builds upon SQM 1 by including specific requirements for:

• Appointment and eligibility of the EQ Reviewer;

• Performance of the EQR;

• Documentation of the EQR.

SA220 (R)

Quality Management at the engagement level

• Deals with auditor’s responsibilities regarding quality management at the engagement level and the related responsibilities of the engagement partner.

• Applies to audits of FS.

Page 5

• Clarifies and strengthens the key elements of quality management at engagement level.

• Focuses on role of the engagement partner in managing and achieving quality on audit engagement

• Encourage proactive management of quality at the engagement level.

• Keep the standard fit for purpose in wide range of circumstances.

• Emphasize the importance of professional skepticism.

• Enhance the documentation of the auditor's judgement.

Click to edit Master title style

Page 6 Overview

Click to edit Master title style

Snapshot of Key Changes

• Increased responsibilities of Engagement partner.

• Consideration of evolving environment, including changes made to the definition of Engagement Team to recognize different and evolving engagement team structures.

• Considers:

importance of professional skepticism and professional judgement in performing audit engagements.

Scalability: The Standard is intended to be applied in the context of the nature and circumstances of each audit

• Recognizes the growing role of technology in audit of financial statements. 'Resources Section' enhanced to include technological and intellectual resources in addition to the human resources involved in an audit engagement.

• Clarifies the relationship between SA220 and the Standards on Quality Management.

Page 7

• Proposed Standard deals with the specific responsibilities of the auditor regarding quality management at the engagement level for an audit of financial statements and the related responsibilities of the engagement partner.

• Standard to be read in conjunction with relevant ethical requirements.

• Applicability not yet notified.

Click to edit Master title style

Page 8

Scope andApplicability

To manage quality at the engagement level to obtain reasonable assurance that quality has been achieved such that:

• The auditor has fulfilled the auditor's responsibilities, and has conducted the audit, in accordance with professional standards and applicable legal and regulatory requirements; and

• The auditor's report issued is appropriate in the circumstances.

Page 9

Click to edit Master title style

Objective of Revised SA220

Key Changes in SA220 (R)

Click to edit Master title style Managing andAchieving Quality at the Engagement Level

The engagement partner’s overall responsibility to manage and achieve quality at the engagement level is to be established through his/her sufficient and appropriate involvement throughout the audit engagement.

Leadership Responsibilities

Increased emphasis on the leadership responsibilities of the Engagement Partner in managing and achieving quality at the engagement level.

Direction, Supervision and Review

Engagement partner is responsible for determining the nature, timing and extent of direction, supervision and review, in light of engagement circumstances.

Standback

Engagement partner shall be satisfied that his/ her involvement has been sufficient and appropriate to provide basis for taking overall responsibility.

Page 11

• The revised standard includes material on scalability, as the standard is intended to be applied in the context of the nature and circumstances of each audit.

• The objective of material on Scalability is to emphasize that the revised standard can be applied by firms of all sizes.

• SA 220 (Revised) includes certain paragraphs that highlight how the revised SA can be applied in the different circumstances. (Eg. Paragraph 8 and Paragraphs A13 — A14)

For example:

When an audit is carried out entirely by an engagement partner, which may be the case for an audit of a less complex entities, some of the requirements in this SA are not be relevant because they are conditional upon the involvement of other members of the engagement team.

Click to edit Master title style

Scalability

Click to edit Master title style

Clarifying Engagement Partner Responsibilities

• Engagement partner is required to take into account information obtained in the acceptance and continuance process in planning and performing the audit engagement.

• Requirements and application material are more explicit about what the engagement partner needs to review, including a listing of examples of significant judgments in relation to the audit engagement.

Page 13

Click to edit Master title style

Engagement Team may depend on the Firm's System of Quality Management

• SA220 (Revised) clarifies that, ordinarily, the engagement team may depend on the firm's policies or procedures, unless

―the engagement team's understanding or experience indicates that the firm's policies or procedures would not be effective or

―information provided by the firm or others indicates that the firm's policies or procedures are not operating effectively.

This approach avoids the risk that the engagement team blindly relies on the firm's system of quality management.

Page 14

Click to edit Master title style

Professional Skepticism is Central to Quality Management

The revised standard includes new introductory material on importance of Professional skepticism and Professional judgment in performing audit engagements.

Application material sets out the examples of impediments to professional skepticism, which includes common threats and biases (conscious or unconscious) and suggestions as to possible actions that the engagement team can take to mitigate these.

Page 15

Click to edit Master title style Engagement Resources

• Deals with modern auditing environment including the use of different audit delivery models and technology.

• Resources have been expanded beyond human resources to include technological and intellectual resources.

Page 16

Click to edit Master title style Definition of Engagement Team

• Changes in the definition recognize that, regardless of where individuals are located or how they are related to the firm, if an individual is performing audit procedures, then he or she is to be appropriately directed and supervised and the work reviewed in accordance with SA220 (Revised).

• Engagement team Definition as per SA 220 (R) All partners and staff performing the audit engagement, and any other individuals who perform audit procedures on the engagement, excluding an auditor's external expert* and internal auditors who provide direct assistance on an engagement. (Ref: Para. A15— A25).

*Explanation: As per existing SA 220, the definition of Engagement Team includes experts contracted by the firm, which was also in line with the erstwhile ICAl's Code of Ethics. However, the similar change has not been made in the proposed SA 220 (Revised) as compared to ISA 220 (Revised), because the said definition is in sync with the definition of the Engagement Team given under SQM 1 as well as ICAl's Code of Ethics (Revised 2019)

Page 17

Click to edit Master title style Documentation

Enhanced audit documentation of the auditor's judgments

• The revised Standard :

provides guidance on how the engagement partner's involvement in the audit could be evidenced and

emphasizes on the documentation of the auditor's consideration of judgmental matters such as circumstances that may pose risks to achieving quality on the audit engagement.

Page 18

Click to edit Master title style Other Important Points

―Includes interaction with SA 600 which explains how the requirements in SA 220 and other SAs are to be applied in group audit situations.

―Integrates the new quality management concepts in SQM 1/SQM 2, so that such concepts can be carried through at the engagement level.

SA 220 (Revised)

Page 19

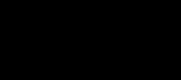

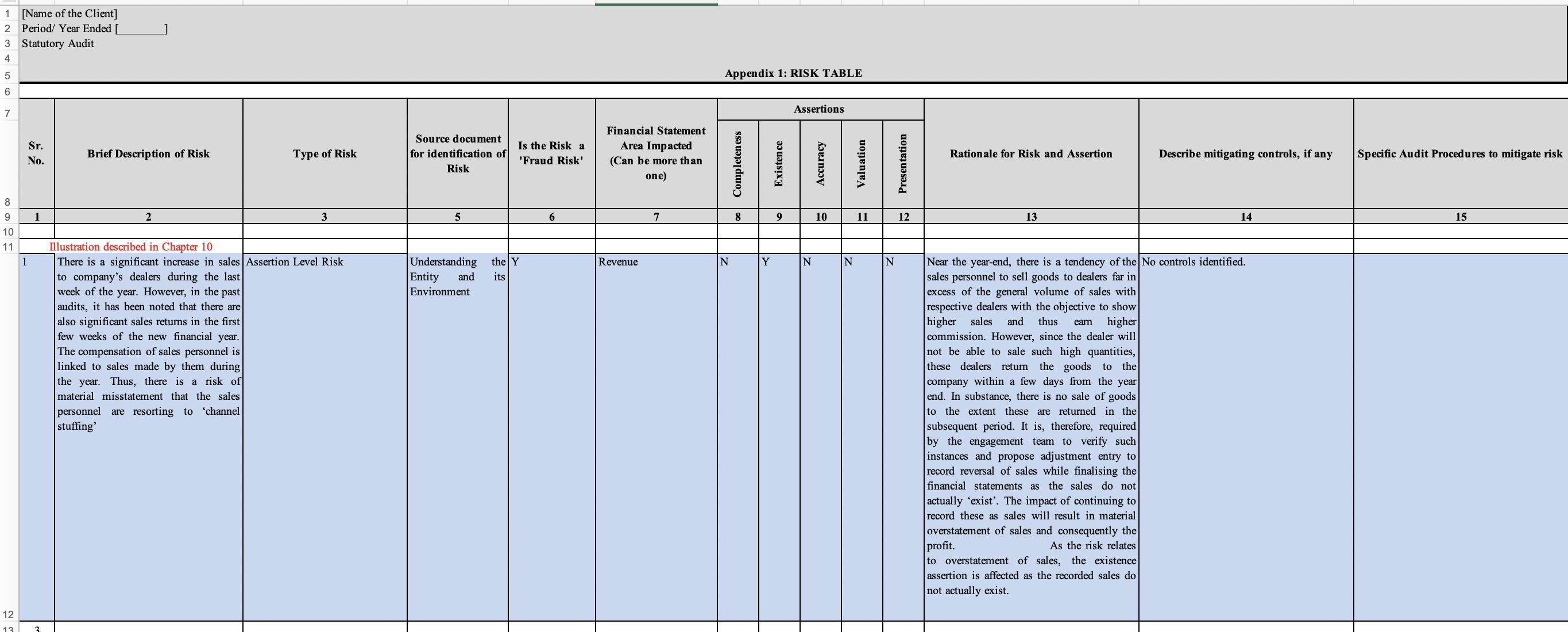

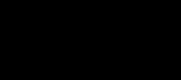

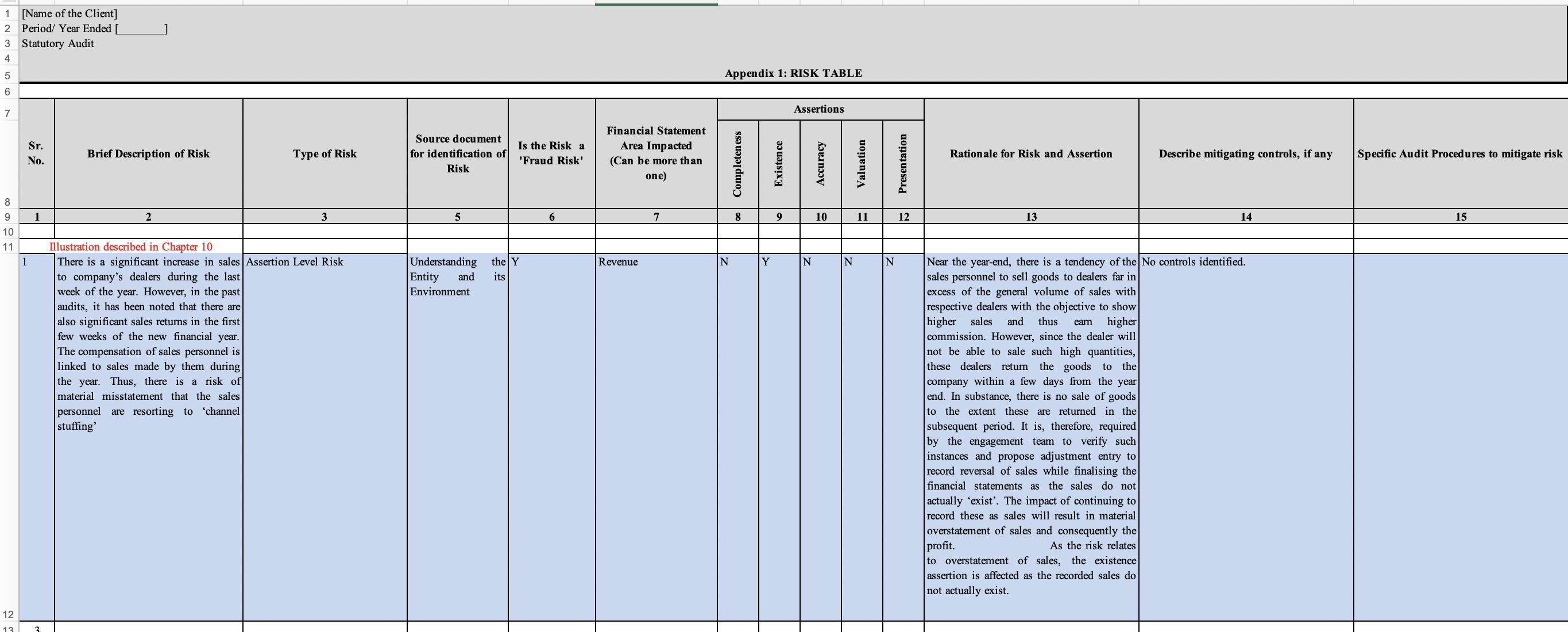

Exposure Draft SA315 (Revised) Identifying andAssessing The Risks of Material Misstatements

SA315 - Group of Standards

SA315 is a part of standard grouped as risk assessment and response to assessed risks. This group consist of total 6 standards on audit.

Total 6 Standards in the group - RiskAssessment and Response toAssessed Risks

300, Planning an audit of financial statements

315, Identifying andAssessing the Risks of Material Misstatement

320, Materiality in planning and performing an audit

330, TheAuditor's responses to assessed risks

402,Audit considerations relating to an entity

service organisation

450,

of

identified during audit 1 2 3 4 5 6

SA

SA

SA

SA

SA

using

SA

Evaluation

misstatements

1. The introduction of five new inherent risk factors to aid in risk assessment; subjectivity, complexity, uncertainty, change and susceptibility to misstatement due to management bias or fraud.

2. Anew spectrum of risk, at the higher end of which lie significant risks.

3. Requiring "sufficient, appropriate" evidence to be obtained from risk assessment procedures as the basis for the risk assessment.

4. Agreat deal more on IT, particularly IT general controls.

5. More on controls relevant to the audit and on the design and implementation work required for these controls.

22

SA315: Key revisions in Exposure Draft

SA315: Key revisions in Exposure Draft

6. Removal of considerations specific to smaller entities as a separate category of paragraph and inclusion of that material within the main body of the text and the addition of new material.

7. Other changes including:

―requiring inherent and control risk to be assessed separately (the extent standard permits a combined assessment);

―distinguishing between direct and indirect control components; and

―a new stand-back requiring reconsideration, when material classes of transactions, account balance and disclosure are not assessed as significant, but are material

23

SA315: PracticalAspect

Auditor's Responsibilities for theAudit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the Financial Statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with SAs will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decision of users taken on the basis of these Financial Statements.

As part of an audit in accordance with SAs, we exercise professional judgement and maintain professional scepticism throughout the audit. We also:

Identify and assess the risks of material misstatement of the Financial Statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

Scope

This Standard on Auditing (SA) deals with the auditor’s responsibility to identify and assess the risks of material misstatement in the financial statements.

Objective

The objective of the auditor is to

― identify and assess the risks of material misstatement,

― whether due to fraud or error,

― at the financial statement and assertion levels

― thereby providing a basis for designing and implementing responses to the assessed risks of material misstatement.

Page 25

Click to edit Master title style SA315: Scope and Objective

Audit Risk

• The risk that financial statements contain a material misstatement

And

• The risk that the auditor will not detect such a misstatement.

Audit Risk

INHERENT RISK CONTROL RISK AUDIT RISK

DETECTION RISK

Audit Risk

• Inherent Risk- Susceptibility of an assertion to be a misstatement that could be material, assuming that there are no related controls

• Fraud Risk (generally a part of Inherent & Control Risk) - Risk of an intentional act by one or more individuals

• Control Risk- Entity’s internal control system will not prevent, or detect and correct on a timely basis a material misstatement

• Detection Risk- Risk that the auditor will not detect a misstatement

Assertions Representations, explicit or otherwise, with respect to the recognition, measurement, presentation and disclosure of information in the financial statements which are inherent in management representing that the financial statements are prepared in accordance with the applicable financial reporting framework. Assertions are used by the auditor to consider the different types of potential misstatements that may occur when identifying, assessing and responding to the risks of material misstatement.

Significant risk An identified risk of material misstatement:

i. For which the assessment of inherent risk is close to the upper end of the spectrum of inherent risk due to the degree to which inherent risk factors affect the combination of the likelihood of a misstatement occurring and the magnitude of the potential misstatement should that misstatement occur;

Business Risk Arisk resulting from significant conditions, events, circumstances, actions or inactions that could adversely affect an entity's ability to achieve its objectives and execute its strategies, or from the setting of inappropriate objectives and strategies.

Controls - Policies or procedures that an entity establishes to achieve the control objectives of management or those charged with governance.

Click to edit Master title style SA315: Components Page 29

SA315: RiskAssessment Procedures and Related Activities

Click to edit Master title style

Page 30

RiskAssessment Procedures and RelatedActivities

Inquiries

• Inquiries with TCWG

• Inquiries with InternalAudit Functions

• Inquiries with key stakeholders including legal counsel, CFO, CEO, head of departments

Analytical Procedures

• Include both financial and non financial information

• Assist in setting the expectation for a particular account balance

• Identification of unusual and significant transactions

• Preliminary assessment or indication of risk of material misstatement

Observation and Inspection

• Entity operations

• Reviewing various minutes of meetings, policies, procedures and manuals

• MIS

• Physical presence at key locations

Click to edit Master title style Page 31

SA315:

External Factors

• Nature of Industry

• Regulatory Environment

• Financial Reporting Framework

Nature of Entity

• Organisation Structure

• Ownership and Governance

• Business Models

• Business Models Integration with IT

Others

• Related business risks

• Business performance tracking

Page 32

Click to edit Master title style SA315: Understanding the Entity

RelatedActivities (continued)

Internal and External Source of Information

Internal Sources

Financial Information

• Financial Statements

• Budgets

• Internal Reports and MIS

• Minutes of Meetings

• Statutory Returns

• Estimation Process etc.

NonFinancial Information

• Business Strategies

• Organisation Structure

• Minutes

• Operating performance

• Policies, Procedures and Manuals

External Sources

• Industry Information

• Credit RatingAgencies

• Creditors

• StatutoryAuthorities notices etc.

• Media and other external Parties

• TradeAssociation

• Industry forecasts

Click to edit

Master title style SA315: RiskAssessment Procedures and

RiskAssessment?

• Overall financial statement level: which refers to risks of material misstatement that relate pervasively to the financial statements as a whole and therefore potentially affect all assertions.

• These are those risks of material judgement that in auditor’s judgment are not confined to specific elements, accounts or items of the financial statements.

• As these impacts the financial statements as a whole, they result in change of overall behaviours and testing strategy relating to the audit as a whole.

RiskAssessment?

• Risks identifiable with specific assertions at the class of transactions, account balance, or disclosure level.

• For each account balance, class of transactions and disclosure, an assessment of risk (such as high, moderate, or low) should be made for each individual assertion (C, E,A, and V) being addressed.

Assertions

The Implementation Guide on “Risk Based Audit” issued by the Institute of CharteredAccountants of India considers the following assertions:

Completeness (C)

Accuracy (A)

Valuation (V)

Presentation (P)

Existence (E)

Risk of Material Misstatement

Financial Statement Level

Whether the risks have a pervasive effect on the financial statements

Management override of controls

Deficient control environment (management's lack of competence)

Integrity of the entity's management

Concerns about the condition and reliability of an entity’s records

Assertion Level for class of transaction, account balances and disclosures

Class of Transaction

Account Balances

Disclosures

Click to edit Master

Page 37

title style SA315: Identify andAssessing the risk of material misstatement

Click to edit Master title style SA315 : System of Internal Control

Control Environment

The entity's risk assessment process

The entity’s process to monitor the system of internal control

The information system and communication

Control activities

Page 38

Control Environment

• Management’s commitment to integrity and ethical values

• oversight over the entity's system of internal control by, TCWG

• HR policies and Procedures

• Roles and Responsibility

• Organisational Structure

Internal Control

Risk Assessment process

•Identifying business risks relevant to financial reporting

•Estimating significance of those risks

•Mitigation plan for those risks

•Evaluating entity's risk assessment process is appropriate

System of Internal Control

•monitoring the effectiveness of controls

•identification and remediation of control deficiencies identified

•entity's internal audit function

•entity's process for monitoring the system of internal controls appropriate

Information System

•Information flows through the entity’s information system

•IRPR process for all the transactions

•Communication between Management and TCWG

•External Communication

Control Activities

•Controls that address a risk that is determined to be a significant risk

•Control over JEs and non routine transaction bookings

•Controls over IT system (ITGC and ITAC)

•Segregation of duties

Master

Page 39

Click to edit

title style SA315 : System of

Click to edit Master title style SA315 : Discussion between team members

• The engagement partner and other key engagement team members shall discuss the application of the applicable financial reporting framework and the susceptibility of the entity’s financial statements to material misstatement.

• All team members need not be present in engagement team discussion • When there are engagement team members not involved in the engagement team discussion, the engagement partner shall determine which matters are to be communicated to those members.

Page 40

• If the auditor obtains new information which is inconsistent with the audit evidence on which the auditor originally based the identification or assessments of the risks of material misstatement, the auditor shall revise the identification or assessment.

Click to edit Master title

style SA315 : Reassessment of Risk of Material Misstatement

Page 41

If it is not documented, this is not audited.

Documentation:

―The discussion among the engagement team and the significant decisions reached;

―Key elements of the auditor's understanding

―the sources of information from which the auditor's understanding was obtained; and the risk assessment procedures performed;

―The evaluation of the design of identified controls, and determination whether such controls have been implemented

―The identified and assessed risks of material misstatement at the financial statement level and at the assertion level

―

Click to edit Master title style SA315 : Documentation

Page 42

Significant risks and risks for which substantive procedures alone cannot provide sufficient appropriate audit evidence, and the rationale for the significant judgments made

Page 43

Click to edit Master title style Documenting ROMM

SA315 : Small Entities

Small Entities:

• Some entities, including less complex entities, and particularly owner-managed entities, may not have established structured processes and systems (e.g., a risk assessment process or a process to monitor the system of internal control) or may have established processes or systems with limited documentation or a lack of consistency in how they are undertaken.

• When such systems and processes lack formality, the auditor may still be able to perform risk assessment procedures through observation and inquiry.

• Other entities, typically more complex entities, are expected to have more formalized and documented policies and procedures. The auditor may use such documentation in performing risk assessment procedures.

44

Way Forward

• Establish SQM 1 & SQM 2 within the firm

• May require a dedicated team to implement & monitor SQM 1 and SQM 2

• Assess whether these are meeting “Quality Management” Objective

• Redraft checklists for new standards proposed

• Identify implementation challenges NOW and draw a plan

• Assess the requirements of new standards and map the resources available- develop a plan to meet the gaps (example- availability of EQR, IT Professionals, etc.)

• Assess the additional effort required and sensitize clients now for additional time and fees

(example- IT professional in case of risk assessment; additional work in SA540)

45

46

Click to edit Master title style

CA. Pranav Jain Partner, BGJC &Associates LLP pranavjain@bgjc.co +91 98104 79822 Connectivity

to

48

Click

edit Master title style

Thank You! For More Information, Visit: https://taxmann.com/ Get in touch with us on Social Media: Download Taxmann App Follow us on Social Media:

AASB of ICAI

AASB of ICAI