• Business for - Valuation v/s Profit

• Increase in Serial Entrepreneur

• Is it only Numbers?

• Eternal Truth - Value is in the eye of buyer

(Logistic Co)

Numbers provide a sense of control, a sense of precision and the appearance of objectivity.

A Good Valuation Story + Numbers

Stories are more easily remembered than numbers and connect with human emotions.

Without narratives to back them up, numbers can be easily manipulated, used to hide bias or to intimidate those not in the loop.

Stories that are not anchored to or connected with numbers can veer into fairy tales, leading to unreal valuations.

The number crunchers The Storytellers

The number crunchers The Storytellers

BYJU's unique teaching style the idea of creating a digital platform for students. It’s valuation was relatively low, now the company has a valuation of over $16 billion

•

Instagram MVP focused on making it ease for users to taking and sharing photos quickly. It’s valuation was $1 billion when acquired by Facebook and now it’s in the range of $100 billion.

Dropbox service gained traction due to its simplicity and ease of use. Users can upload files from their device to the cloud, and access them from any device. Dropbox was valued at $9.2 billion and at the time of its IPO was around $8 billion.

• Limited History and Fierce Competition

• Financial Challenge to raise capital

• Small or no revenues and negative operating

• Illiquidity of Investments

• Focus on Intangibles – Value of the business idea or a technology under development or an innovation.

• Unique product/ Strategic business model and feasibility study is important

• Success ratio- Most don’t survive the test of commercial success and fail.

Product:

Success depends on consumer need and right vision-

E.g.- Zoom's valuation increased from around $1 billion in 2017 to over $100 billion in 2021.

Zoom's video conferencing platform was easy to use and reliable, with features that made it popular for remote work and virtual events.

Price:

Demands Constant Innovation, Evolving model, Pricing and Scalability-

E.g.- Airbnb's valuation increased from around $1.3 million in 2009 to over $100 billion in 2021.

Airbnb's pricing was often cheaper than hotels, especially in popular tourist destinations.

Place:

Aggressive expansion plans and marketing strategies leads to a successful startup

E.g. Uber's valuation increased from around $5.9 million in 2010 to over $70 billion in 2021.

Uber's app was available in multiple cities and countries around the world, making it easy for travelers to use the service wherever they went.

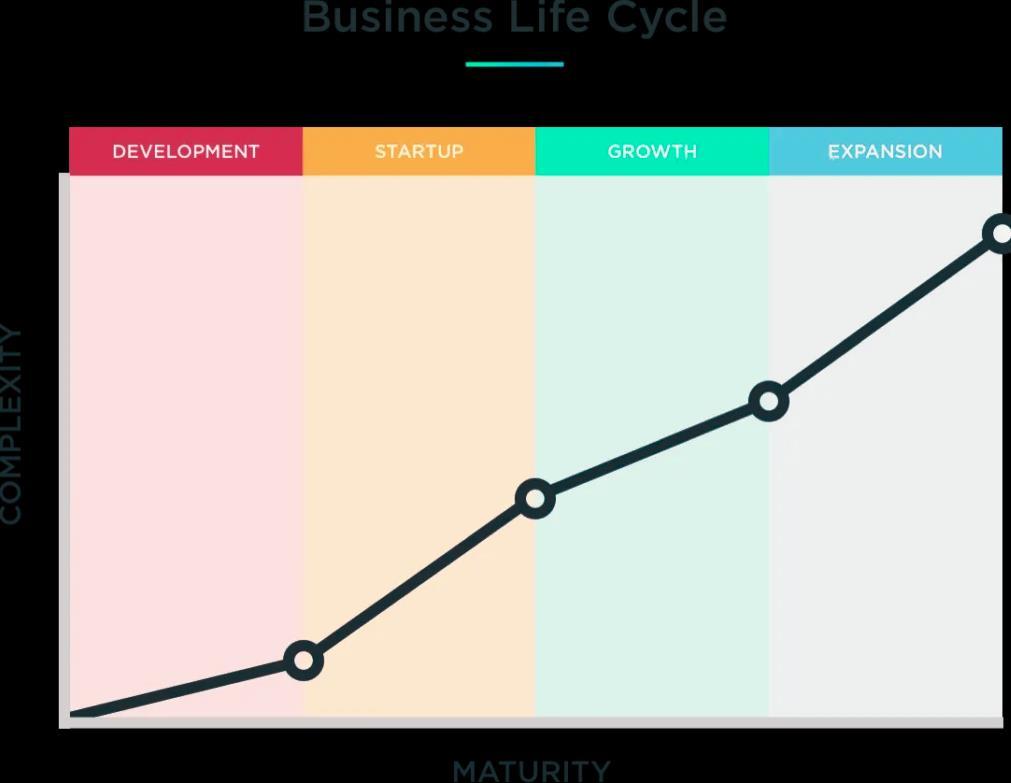

Methods of Valuation would depend upon the stage of the Company

• Asset Approach - Replacement Cost

• Income Approach - Discounted Cash Flow Method

• Market Approach - Comparable Companies/transaction

• Venture Capital Method

• Chicago Method

Generally accepted valuation methodologies

Preferential issue of shares to Indian resident Shares can not be issued below fair value

Net asset value method or Discounted cash flow method

Internationally accepted valuation methodologies

Preferential issue of shares to Non-resident Shares can not be issued below fair value

Shares can not be issued at more than fair value

NA

Transfer of shares between resident (R) and non-resident (NR) NA

NA

Shares can not be issued below fair value

In case of R to NR: Shares can not be transferred below fair value

Shares can not be transferred below fair value (NAV)

In case of NR to R: Shares can not be transferred at more than fair value

FINANCIAL REPORTING

• IFRS/Ind AS

COMMERCIAL VALUATION & FAIRNESS OPINION

• Merger and acquisitions

INTERNAL REPORTING REQUIREMENTS

• PE funds portfolio valuation

• Purchase price allocation (PPA)

• Private equity placement

• Fair valuation of tangible and intangible assets or Instruments

• Joint Ventures

• Internal management analysis

• Asset impairment

• Corporate restructuring (swap ratio)

Sr. No Relevant Section Valuation requirement/ Purpose Under Companies Act, 2013

1 Section 62 read with Rule 8(6) Valuation for Further Issue of Share Capital

2 Section 62 read with Rule

8(7) Valuation of IPR/ know-how/Value addition for Issue of Sweat Equity Shares

3

Section 62 read with Rule 13(2)(g) Valuation for Issue of shares on preferential basis

4 Section 230/ 232 Valuation under Scheme of Compromise/Arrangement or Scheme of Corporate Debt Restructuring (Mergers & Acquisitions)

5 Section 236 Valuation for Purchase of Minority Shareholding Under Insolvency and Bankruptcy Code, 2016

6 Section 59(3) Voluntary liquidation of corporate persons Under Foreign Exchange Management Act, 1999

For fresh Issue or transfer of equity instruments of Indian Company (Foreign Direct Investment)

FEMA Regulations

SEBI laws includes many rules and regulations which prescribes merchant banker to carry out valuation, however recently those are amended to recognize registered valuer (as per Companies Act,2013)

Steps of Valuation as prescribed by ICAI Valuation Standard

Define the valuation base, premise of the value and valuation date

Analyze the asset to be valued and collect the necessary information

Identify the adjustments to the financial and nonfinancial information for the valuation

Consider and apply appropriate valuation approaches and methods

Arrive at a value or a range of values

Market Approach

Income Approach

Cost Approach

Market Price Method

Discount Cash Flow Method

Replacement Cost Method

Comparable Companies Multiple Method

Comparable Companies

Transaction Method

Earning Capitalization Method

Reproduction Cost Method

Dividend Discount Model

Intangible Asset Valuation -

Relief from Royalty Method

•Multi Period Excess

Earning Method

•With and Without Method

Option Pricing Models

Valuation Multiple Formula

EV/ Sales Enterprise Value / Sales*

Remarks

• Provides Enterprise Value

• Mainly used in case of technology companies or companies in early stage of development (incurring losses)

EV/ EBITDA Enterprise Value / EBITDA*

• Provides Enterprise Value

• Mostly commonly used for valuing companies across industries specially manufacturing companies

PE Ratio Price/ Earnings*

• Provides Equity Value

• Mostly commonly used for valuing companies across industries specially manufacturing companies

• Need to evaluate impact of accounting policies

Price to Book Market Cap/ Net Worth*

• Provide Equity Value

• Mainly used in case of asset heavy business such as financial institutes

Industry Specific Multiples

• EV/ User: Social Media

• EV/ MW: Power Companies

• EV/ Room: Hotel Companies

* Base for Sales, EBITDA, Earnings, Net worth could be:

• Most recent financial year (Current)

• Last four quarters (Trailing)

F.C.A, Registered Valuer (IBBI)

Mobile No.: 9930547923

Email: niki@snco.in

Niki Darshak Shah Partner | SN & Co