FAMILY SUCCESSION AND TAX IMPLICATIONS

20th April 2023

Presented by: CA. Darshak Shah

20th April 2023

Presented by: CA. Darshak Shah

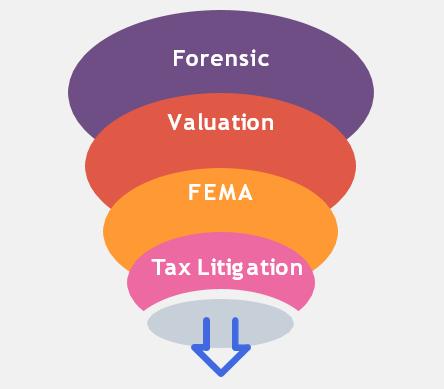

1. Practical answer in and around Family business with case studies

2. What are Family Business Growth drivers ?

3. How Private Trust can be used for Estate planning ? POEM in India

4. What are the tax implications in case of Reconstitution/ Wills / Family arrangement

• FB go for unrelated diversification to cope up рооr Communication, structure

• FB with several member go for majority poll or if not then delay decision or take low risk

• Trusteeship role builds Perpetuate business, In process younger generation may not get opportunity to cultivate fresh ideas.

April 18,2023

• Yongsters are ambitious, look modern in short time and existing busines manage by outside professional, so greater possibility of entrepreneurship among young generation

• Family businesses with greater level of professionalisation practiced both in business and family are likely to perform and perpetuate better over a long period of time. • Large business families are likely to approve new investments in diversified areas in small amounts to test the idea first before considering significant investments.

‘Shirt sleeve to shirt sleeve in three generations’ is a myth in growing economies.

• Entrepreneurship reflected in terms of starting green field ventures is likely to be low in families where family members get groomed into managerial roles in existing firms soon after their studies.

• New ventures are likely to be encouraged in business families when existing businesses are managed by outside professionals, leaving limited openings at senior levels for the family members.

• In family businesses where family members are competent managers, professionals find the environment very conducive to work, and draw synergies.

• Higher the level of mutual respect between family members and outside professionals, greater is likely to be the performance.

Since taxation is based on residential status of beneficiary above structure resulting into higher tax

Status of trust

Beneficiary to extent of share

Beneficiary to extent of share

Beneficiary to extent of share

Residential Status

Beneficiary to extent of share

If different then status of trustee

Beneficiary to extent of share

If different then status of trustee

Beneficiary to extent of share

Taxability in hands of Trustee or beneficiary

Income distributed –

Beneficial / trustee

Income not distributedTrustee

Refer – Table B

Revocable Indian settlor Taxable in his hand

Revocable Foreign settlor Based on status of beneficiary

Irrevocable POEM World income is taxable

Irrevocable Foreign & Indian beneficiaries Indian beneficiary taxed on distribution

Whether gift received from HUF is taxable u/s 56

Here Abhay is not receiving any asset or stock in trade

Unrelated partners

I. Saiyam will get a property of worth Rs. 1.50 crore of firm and Rs. 50 lakh cash against capital of Rs. 1 crore

Transfer to outsider

SO NOT APPLICABLE

Cash received

Add: FMV of assets received

Less: Capital A/C Capital Gain on 1 crore paid by firm which will be attributed to other assets as per Rule 8AB

FMV 1.5 crore

Less: COA 1.2 crore 30 Lakh

To distribute assets in ratio of 40:40:20 between wife , brother & mother and to give control of business.

No emotional disputes within family

Condition transfer at the time of execution of will

Initially shares of A Pvt Ltd. To be distributed equally between brother & wife