The term “Sustainability Reporting” encompasses the practice of disclosing the economic, environmental, and social impacts of an organization’s everyday operations. This type of reporting is crucial as it provides stakeholders with a clear insight into the organization’s contributions toward sustainable development.

Recognizing the importance of accurate and transparent disclosures, sustainability reporting has gained global acceptance. Nations such as the United Kingdom, the United States, and China have made it mandatory for companies to prepare these reports. India, aligning with global standards, has introduced a requirement under the Environmental, Social, and Governance (ESG) framework termed the “Business Responsibility and Sustainability Report” (BRSR). The top 1000 listed entities in India are now required to issue a BRSR along with their annual reports, detailing their performance against the nine principles of the “National Guidelines on Responsible Business Conduct” (NGRBC).

The journey towards formalized sustainability reporting in India began in 2009 when the Ministry of Corporate Affairs (MCA) issued Corporate Social Responsibility Voluntary Guidelines to steer businesses toward sustainable practices. In July 2011, the scope was broadened with the “National Voluntary Guidelines on Social, Environmental, and Economic Responsibilities of Business,” which outlined comprehensive principles for businesses to integrate into their operations.

In 2012, the Securities and Exchange Board of India (SEBI) mandated that the top 100 listed companies by market capitalization file a Business Responsibility Report (BRR), a requirement that expanded to the top 500 listed companies in 2017. The year 2019 marked a significant advancement in this area when the MCA formulated the National Guidelines on Responsible Business Conduct (NGRBC), and SEBI ruled that the annual reports of the top 1000 listed entities must include a “Business Responsibility Report”. This progression culminated in the SEBI notification dated 5th May 2021, which introduced the comprehensive reporting requirement under ESG through the BRSR framework.

The Business Responsibility and Sustainability Report (BRSR) requires listed entities to disclose their performance in alignment with the nine principles of the National Guidelines on Responsible Business Conduct (NGRBCs). Designed to enable comparability across different companies’ sectors, the BRSR mandates quantitative and standardized disclosures centred on environmental, social, and governance (ESG) parameters over time. The structure of reporting for each of these nine principles includes categories of essentials and leadership indicators.

Previously, compliance with the BRSR guidelines was optional until the end of the financial year 2021-22. Starting from the financial year 2022-23, however, it has become a mandatory requirement. According to the format outlined by the Securities and Exchange Board of India (SEBI), the disclosures in the report are organized into three main sections:

Section A: General Disclosures – This section requires companies to provide general information, including basic details about the organization, such as its scale, size, sector, products, and employee strength. It also includes information on Corporate Social Responsibility (CSR) initiatives. Additionally, this section addresses the company’s operations in relation to environmentally sensitive areas, including proximity to protected zones and areas critical for social reasons, such as regions facing water scarcity.

Section B: Management and Process – In this part of the BRSR report, the focus is on the organization’s commitment to principles of business responsibility. It involves disclosures regarding the governance framework, policies, procedures, and processes that conform to the principles of NGRBCs. This section aims to provide insights into the managerial infrastructure and the ethical commitments of the organization.

Section C: Principle-wise Performance – This section details the organization’s performance relative to each of the nine NGRBC principles and their core elements. It showcases how the organization plans to uphold its commitment to conducting business sustainably.

Organizations have the option to report under two categories: “Essential” or “Leadership.” Choosing the “Essential” option means the organization reports the minimum required information necessary for compliance with responsible business conduct. The “Leadership” option allows organizations to report additional voluntary actions they have undertaken that go beyond the basic requirements, highlighting their leadership in sustainability and responsibility.

The Business Responsibility and Sustainability Report (BRSR) is designed around the nine principles established by the National Guidelines on Responsible Business Conduct (NGRBCs), which are further supported by a guidance note to assist companies in understanding the required scope of disclosures for each principle. These principles are organized under the three categories of Environmental, Social, and Governance (ESG), with each category addressing specific aspects of responsible business conduct. Here’s a detailed discussion of each principle:

The organization is expected to conduct its business with integrity, operating in an ethical, transparent, and accountable manner. The practices adopted by the company should be robust, featuring well-defined roles and responsibilities to prevent conflicts of interest and ensure accountability at all levels. This principle champions a corporate culture where businesses are responsible not only to their shareholders but also to the broader community. It emphasizes the importance of avoiding corruption and cultivating a culture of trust across all business dealings.

The following extract from the annual report of a listed company outlines its compliance with the requirements of Principle 1:

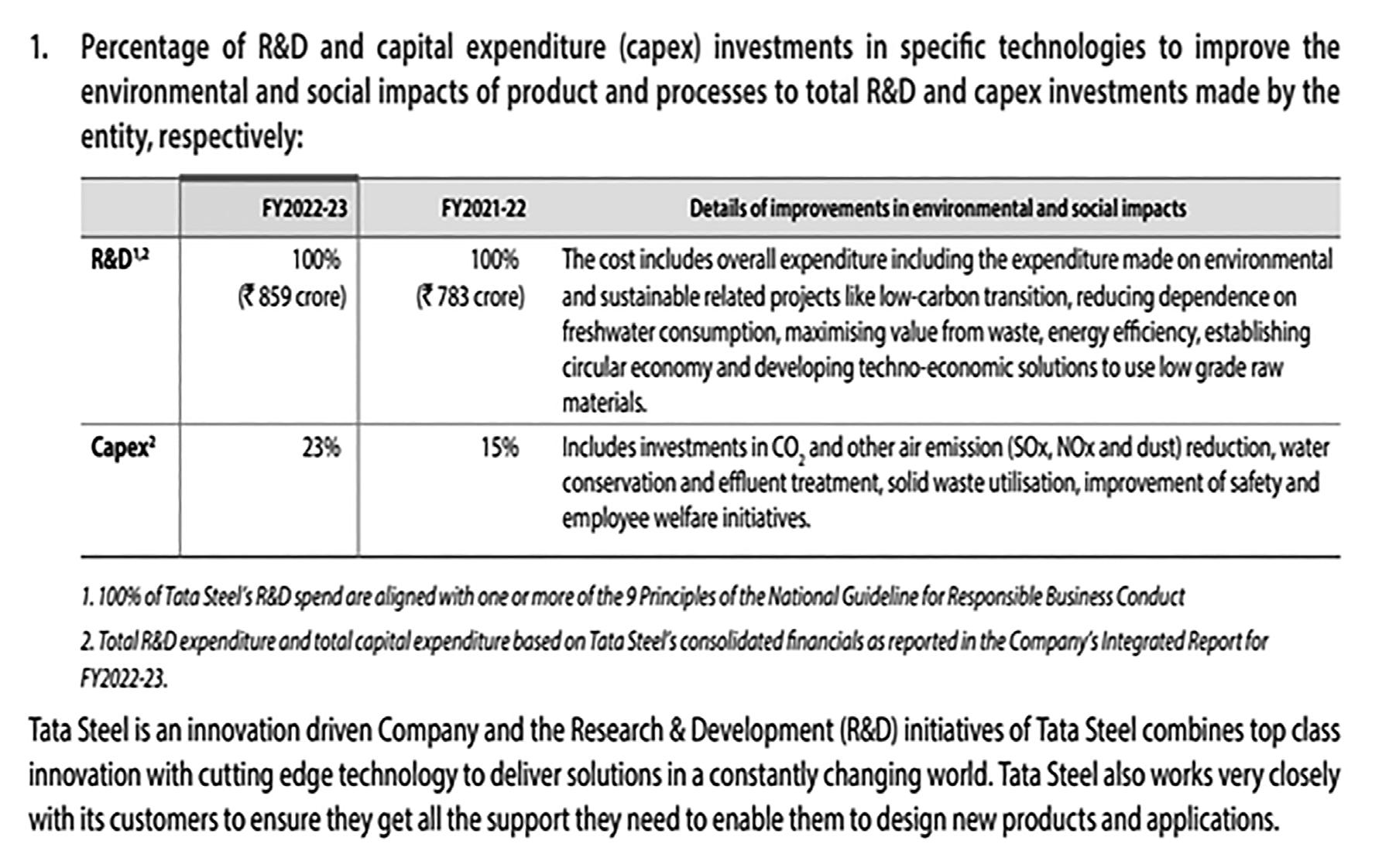

This principle advises organizations to concentrate on creating and providing safe and sustainable goods and services. This principle promotes innovation and the development of products and services that not only minimize environmental impacts but also prioritize customer safety. It encourages businesses to integrate sustainability into their core operations, ensuring that their offerings are both environmentally friendly and safe for consumers.

The following extract from the annual report of a listed company outlines its compliance with the requirements of Principle 2:

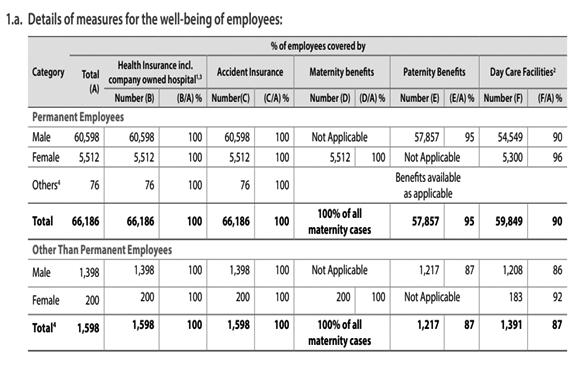

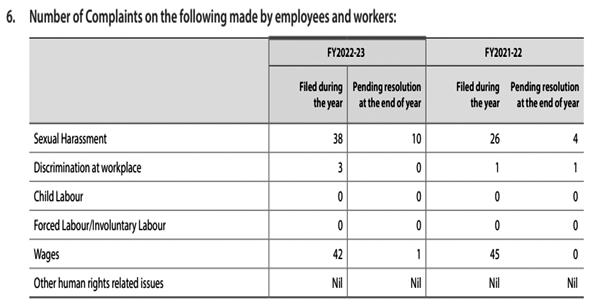

This principle prioritizes the well-being of employees and everyone involved in the value chain by emphasizing the necessity of fair wages, decent working conditions, and social protection. It also aims to eradicate child labour and forced labour, requiring organizations to adhere to labour laws and ensure health and safety standards in the workplace. This principle advocates for a supportive and secure working environment that upholds the dignity and rights of all workers.

The following extract from the annual report of a listed company outlines its compliance with the requirements of Principle 3:

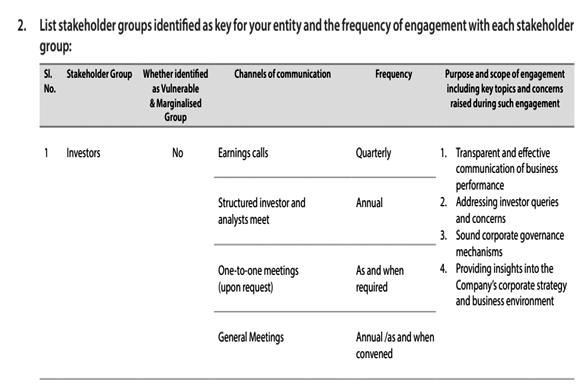

This principle emphasizes the importance of active engagement with stakeholders, urging organizations to listen to their concerns and consider their interests in decision-making processes. Organizations are also expected to maintain transparency, keeping stakeholders informed about how their operations and business decisions impact people and the environment. Additionally, this principle encourages businesses to fairly and transparently balance the occasionally conflicting needs of various stakeholders, ensuring that no group is disproportionately disadvantaged or overlooked.

Core Elements of Fourth Principle

Transparent policies and procedures

Identify the interested parties

Share benefits to the stakeholder

The following extract from the annual report of a listed company outlines its compliance with the requirements of Principle 4:

This principle addresses human rights concerns that arise directly or indirectly from business operations. Organizations are required to acknowledge and respect human rights in accordance with international standards, ensuring that their activities do not harm individuals or communities. This includes preventing discrimination, promoting equality, and safeguarding the dignity of all those affected by their operations. Additionally, this principle underscores the obligation of businesses not only to refrain from violating human rights but also to actively advocate for them within their sphere of influence.

The following extract from the annual report of a listed company outlines its compliance with the requirements of Principle 5:

The organization should establish policies, procedures, and practices to assess and mitigate the environmental impacts caused by their business activities. They should also evaluate the environmental risks linked to their operations and implement measures to reduce these risks. Moreover, this principle promotes the restoration of ecosystems that have been damaged by business operations, emphasizing a commitment to protecting and preserving biodiversity.

Core Elements of Sixth Principle

Optimum use of natural and manmade resources

Measure the performance of environmental protection

Compare own activities with the industry best practices

The following extract from the annual report of a listed company outlines its compliance with the requirements of Principle 6:

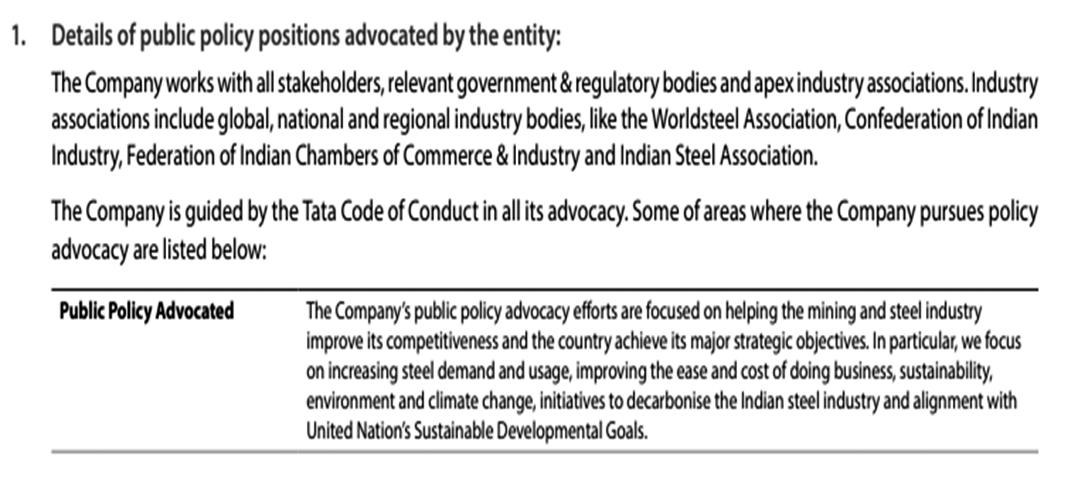

This principle of the Business Responsibility and Sustainability Report (BRSR) emphasizes ethical engagement in influencing public and regulatory policies. Businesses are encouraged to ensure their actions are transparent and aligned with the public interest. This principle calls for organizations to integrate the core elements of BRSR comprehensively into their policy-making processes. It advocates for the promotion of policies that serve the public good rather than pursuing actions that benefit only their own interests.

The following extract from the annual report of a listed company outlines its compliance with the requirements of Principle 7:

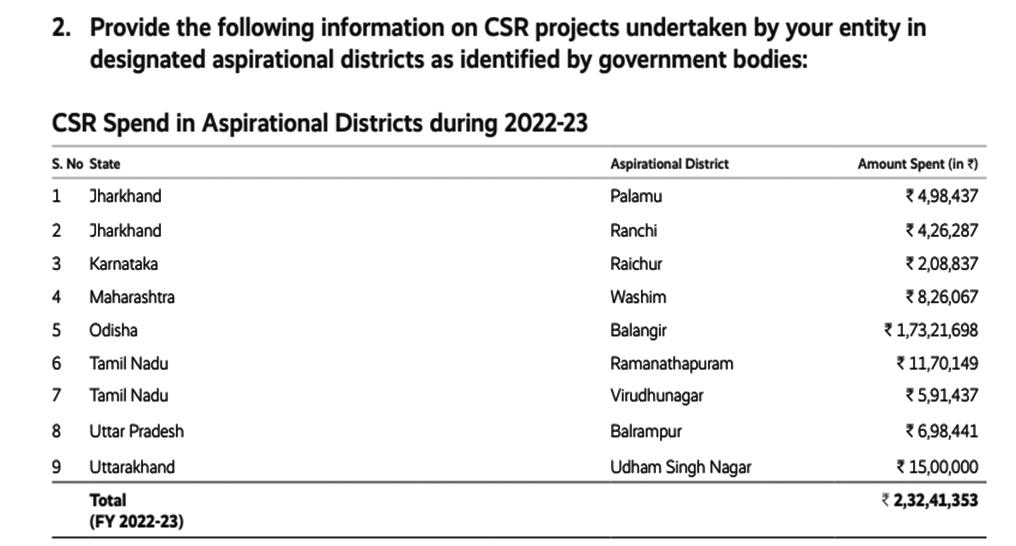

To promote inclusive growth and equitable development, the eighth principle emphasizes the need for collaboration among various stakeholders, including government bodies, businesses, and civil associations. This principle advocates for a unified approach where all parties work cohesively to improve livelihoods and support marginalized communities. Additionally, it calls for organizations to actively monitor, evaluate, and document the negative impacts of their activities

on society and the environment. Based on these assessments, they must develop and implement action plans to effectively mitigate these impacts, ensuring progress towards inclusive and equitable growth.

Identify impact of activity on social, clutural and economic aspects of people

Core Elements of Eigth Principle

Develop creative products and techonologies for better quality of life

Displacement or relocation of existing communities should not occur due to business

The following extract from the annual report of a listed company outlines its compliance with the requirements of Principle 8:

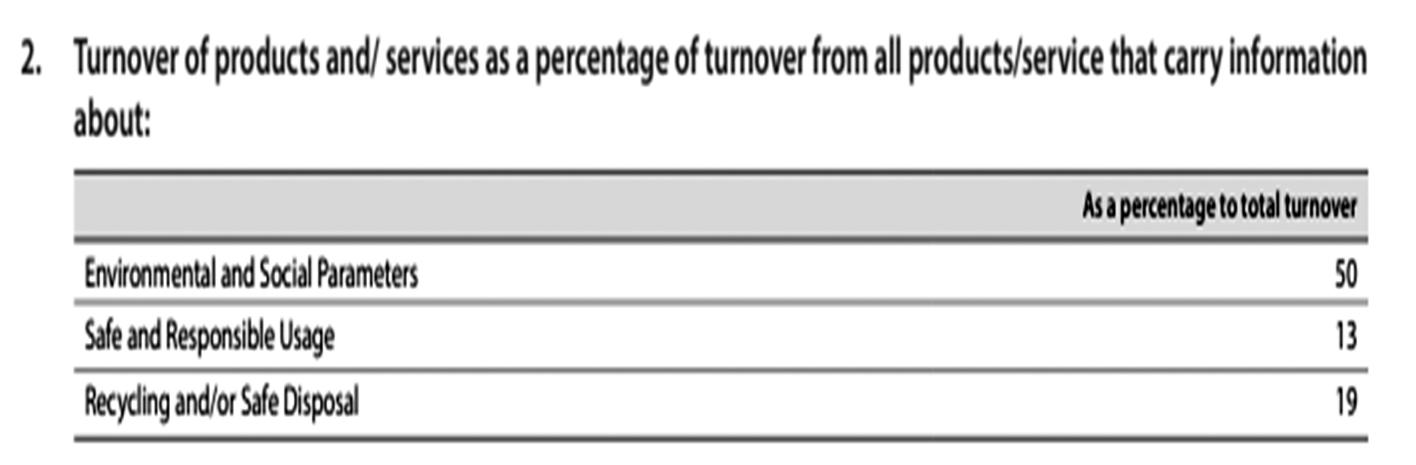

This principle underscores that the fundamental objective of any business is to offer valuable products or services to customers while earning reasonable profits. It stresses the importance of responsible conduct in all consumer interactions, ensuring product safety and reliability, and providing truthful information with fair pricing. This principle also mandates prompt and transparent handling of

consumer complaints. Moreover, it advocates for ethical marketing practices and the eradication of deceptive advertising, thereby fostering trust and loyalty among customers by prioritizing their best interests.

Reduce negative impacts of products and services on consumers

Core Elements of Ninth Principle

Transparent disclosure of all kinds impact to the user and environment

Privacy of customer needs to be maintained

The following extract from the annual report of a listed company outlines its compliance with the requirements of Principle 9:

Currently, the Securities and Exchange Board of India (SEBI) mandates that only the top 1000 listed companies integrate the Business Responsibility and Sustainability Report (BRSR) with their annual reports. However, it is anticipated that this requirement will soon be extended to other listed and unlisted companies. Given that the BRSR provides crucial sustainability-related information, the assurance of such reports is essential. This need for assurance will lead to the emergence of ESG (Environmental, Social, and Governance) audits.

An ESG audit is a process designed to help companies evaluate the environmental and social risks associated with their products, services, and operations. Additionally,

it aims to assist businesses in reviewing risks in their supply chains, enhancing risk management capabilities, and improving transparency with stakeholders.

In response to the growing necessity for BRSR report assurance, the Institute of Chartered Accountants of India (ICAI) has issued the Standard on Sustainability Assurance Engagements (SSAE) 3000, which pertains to Assurance Engagements on Sustainability Information. This standard provides a framework for assurance engagements on an entity’s sustainability information.

It is important to note the following effective dates for the application of SSAE 3000: a) On a voluntary basis for assurance reports covering periods ending on 31st March 2023. b) On a mandatory basis, assurance reports cover periods ending on or after 31st March 2024.

The evolution of sustainability reporting in India demonstrates an increasing commitment to transparency and responsible business practices. By adhering to the nine National Guidelines for Responsible Business Conduct (NGRBC) principles, Indian businesses are positioned to achieve sustainable development. For listed entities, adopting the Business Responsibility and Sustainability Report (BRSR) framework extends beyond compliance with regulatory requirements. It represents a significant opportunity to showcase their dedication to ethical and sustainable practices. This commitment not only fosters long-term value creation but also enhances societal well-being, marking a crucial step forward in the integration of sustainability into core business strategies.

Founded 1972

Evolution From a small family business to a leading technology-oriented Publishing/Product company

Expansion

Launch of Taxmann Advisory for personalized consulting solutions

Our Vision

Aim

Achieve perfection, skill, and accuracy in all endeavour

Growth

Evolution into a company with strong independent divisions: Research & Editorial, Production, Sales & Marketing, and Technology

Future

Continuously providing practical solutions through Taxmann Advisory

Editorial and Research Division

Over 200 motivated legal professionals (Lawyers, Chartered Accountants, Company Secretaries)

Monitoring and processing developments in judicial, administrative, and legislative fields with unparalleled skill and accuracy

Helping businesses navigate complex tax and regulatory requirements with ease

Over 60 years of domain knowledge and trust

Technology-driven solutions for modern challenges

Ensuring perfection, skill, and accuracy in every solution provided

Income Tax

Corporate Tax Advisory

Trusts & NGO Consultancy

TDS Advisory

Global Mobility Services

Personal Taxation

Training

Due Diligence

Due Dilligence

Advisory Services

Assistance in compounding of offences

Transactions Services

Investment outside India

Goods

Transaction Advisory

Business Restructuring

Classification

Due Diligence

Training

Advisory

Trade Facilitation Measures

Corporate

Corporate Structuring

VAT Advisory

Residential Status

Naveen Wadhwa

Research and Advisory [Corporate and Personal Tax]

Chartered Accountant (All India 24th Rank)

14+ years of experience in Income tax and International Tax

Expertise across real estate, technology, publication, education, hospitality, and manufacturing sectors

Contributor to renowned media outlets on tax issues

Vinod K. Singhania Expert on Panel | Research and Advisory (Direct Tax)

Over 35 years of experience in tax laws

PhD in Corporate Economics and Legislation

Author and resource person in 800+ seminars

V.S. Datey Expert on Panel | Research and Advisory [Indirect Tax]

Holds 30+ years of experience

Engaged in consulting and training professionals on Indirect Taxation

A regular speaker at various industry forums, associations and industry workshops

Author of various books on Indirect Taxation used by professionals and Department officials

Manoj Fogla Expert on Panel | Research and Advisory [Charitable Trusts and NGOs]

Over three decades of practising experience on tax, legal and regulatory aspects of NPOs and Charitable Institutions

Law practitioner, a fellow member of the Institute of Chartered Accountants of India and also holds a Master's degree in Philosophy

PhD from Utkal University, Doctoral Research on Social Accountability Standards for NPOs

Author of several best-selling books for professionals, including the recent one titled 'Trust and NGO's Ready Reckoner' by Taxmann

Drafted publications for The Institute of Chartered Accountants of India, New Delhi, such as FAQs on GST for NPOs & FAQs on FCRA for NPOs.

Has been a faculty and resource person at various national and international forums

the UAE

Chartered Accountant (All India 36th Rank)

Has previously worked with the KPMG

S.S. Gupta Expert on Panel | Research and Advisory [Indirect Tax]

Chartered Accountant and Cost & Works Accountant

34+ Years of Experience in Indirect Taxation

Bestowed with numerous prestigious scholarships and prizes

Author of the book GST – How to Meet Your Obligations', which is widely referred to by Trade and Industry

Sudha G. Bhushan Expert on Panel | Research and Advisory [FEMA]

20+ Years of experience

Advisor to many Banks and MNCs

Experience in FDI and FEMA Advisory

Authored more than seven best-selling books

Provides training on FEMA to professionals

Experience in many sectors, including banking, fertilisers, and chemical

Has previously worked with Deloitte

Taxmann Delhi

59/32, New Rohtak Road

New Delhi – 110005 | India

Phone | 011 45562222

Email | sales@taxmann.com

Taxmann Mumbai

35, Bodke Building, Ground Floor, M.G. Road, Mulund (West), Opp. Mulund Railway Station Mumbai – 400080 | Maharashtra | India

Phone | +91 93222 47686

Email | sales.mumbai@taxmann.com

Taxmann Pune

Office No. 14, First Floor, Prestige Point, 283 Shukrwar Peth, Bajirao Road, Opp. Chinchechi Talim, Pune – 411002 | Maharashtra | India

Phone | +91 98224 11811

Email | sales.pune@taxmann.com

Taxmann Ahmedabad

7, Abhinav Arcade, Ground Floor, Pritam Nagar Paldi

Ahmedabad – 380007 | Gujarat | India

Phone: +91 99099 84900

Email: sales.ahmedabad@taxmann.com

Taxmann Hyderabad

4-1-369 Indralok Commercial Complex Shop No. 15/1 – Ground Floor, Reddy Hostel Lane Abids Hyderabad – 500001 | Telangana | India

Phone | +91 93910 41461

Email | sales.hyderabad@taxmann.com

Taxmann Chennai No. 26, 2, Rajan St, Rama Kamath Puram, T. Nagar

Chennai – 600017 | Tamil Nadu | India

Phone | +91 89390 09948

Email | sales.chennai@taxmann.com

Taxmann Bengaluru

12/1, Nirmal Nivas, Ground Floor, 4th Cross, Gandhi Nagar

Bengaluru – 560009 | Karnataka | India

Phone | +91 99869 50066

Email | sales.bengaluru@taxmann.com

Taxmann Kolkata Nigam Centre, 155-Lenin Sarani, Wellington, 2nd Floor, Room No. 213

Kolkata – 700013 | West Bengal | India

Phone | +91 98300 71313

Email | sales.kolkata@taxmann.com

Taxmann Lucknow

House No. LIG – 4/40, Sector – H, Jankipuram Lucknow – 226021 | Uttar Pradesh | India

Phone | +91 97924 23987

Email | sales.lucknow@taxmann.com

Taxmann Bhubaneswar

Plot No. 591, Nayapalli, Near Damayanti Apartments

Bhubaneswar – 751012 | Odisha | India

Phone | +91 99370 71353

Email | sales.bhubaneswar@taxmann.com

Taxmann Guwahati

House No. 2, Samnaay Path, Sawauchi Dakshin Gaon Road

Guwahati – 781040 | Assam | India

Phone | +91 70866 24504

Email | sales.guwahati@taxmann.com