Standard on Auditing (SA) 700, ‘Forming an Opinion and Reporting on Financial Statements,’ outlines the auditor’s responsibilities in forming an opinion on financial statements and issuing the related written report. This standard dictates the format and content of the auditor’s report, which auditors must strictly follow. Despite various guidance notes and technical guides issued by the Institute of Chartered Accountants of India (ICAI), the Quality Review Board (QRB) has identified numerous instances of non-compliance with SA 700. Below, we highlight some common non-compliances related to the reporting requirements of SA 700, along with guidelines recommended by the Auditing and Assurance Board (AASB) of ICAI.

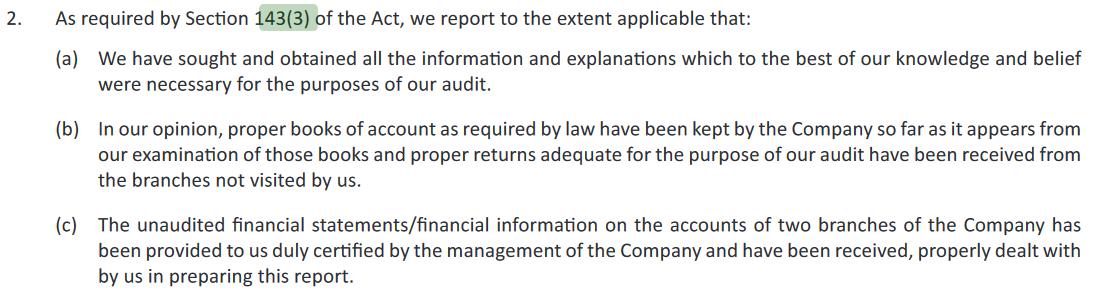

Section 143(3)(c) of the Companies Act 2013 mandates that the auditor must confirm whether the report on the accounts of any branch office of the company, audited under subsection (8) by someone other than the company’s auditor, has been sent to the auditor. Additionally, the auditor must describe how this report has been considered when preparing his own report.

AASB has observed that auditors often fail to comply with the requirements of Section 143(3)(c) of the Companies Act, 2013, and SA 700 when issuing consolidated audit reports. Specifically, they do not adequately report on the accounts of the branch offices of the holding company, subsidiaries, associates, and jointly controlled entities. Even when auditors do comply, they often place this information in the incorrect section of the audit report.

In addition to the reporting responsibilities prescribed under the Standards on Auditing (SA), auditors have additional duties under Section 143(3)(c), including reporting on the accounts of the company’s branch offices. When issuing the audit report for a company with multiple branches, the auditor must state whether the report on the branch office accounts obtained from another auditor has been considered and how it has been addressed in the consolidated audit report.

The AASB has clarified that these additional reporting responsibilities should be included in a separate section of the auditor’s report, titled ‘Report on Other Legal and Regulatory Requirements.’ Below is an extract from the audit report of a listed entity that demonstrates the correct presentation as per Section 143(3)(c):

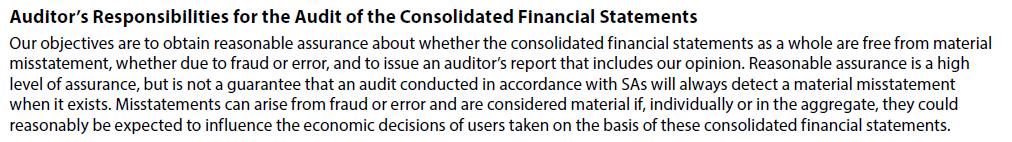

Paragraph 37 of SA 700 requires the auditor to state that misstatements can arise from fraud or error and that they are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users of the financial statements. Alternatively, the auditor can provide a definition or description of materiality in accordance with the applicable financial reporting framework. This information must be reported under the “Auditor’s Responsibilities for the Audit of the Financial Statements” section of the audit report.

The concept of materiality is applied by the auditor in planning and performing the audit, evaluating the effect of identified misstatements, and considering uncorrected misstatements, if any, on the financial statements. It also influences the auditor’s opinion in the audit report. Materiality is subjective, and judgments about materiality are made in the context of surrounding circumstances. Materiality is affected by the size or nature of a misstatement or a combination of both. Therefore, SA 700 requires auditors to explain the concept of materiality and the extent to which it has been applied while conducting the audit in the ‘Auditor’s Responsibilities for the Audit of the Financial Statements’ section of the audit report.

Despite clear guidance in SA 700, auditors often fail to appropriately address the materiality concept in their reports. To ensure users of the financial statements understand that materiality has been considered, this concept must be described in the ‘Auditor’s Responsibilities for the Audit of the Financial Statements’ section of the auditor’s report.

Below is an extract from the audit report of a listed entity that demonstrates the correct reporting of the concept of materiality as per SA 700:

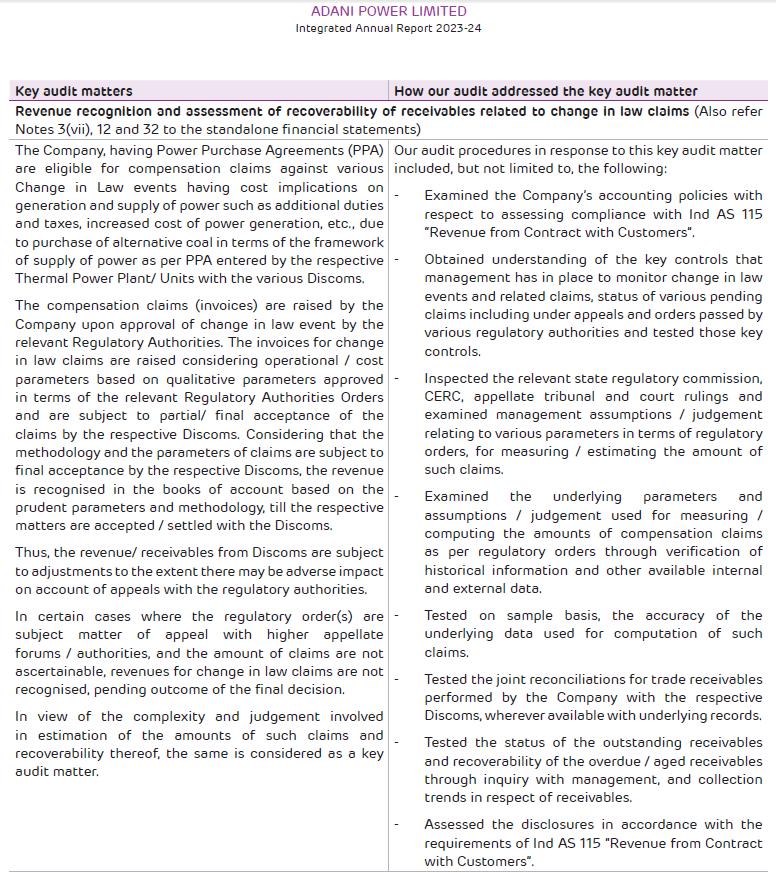

When reporting key audit matters, the auditor must comply with SA 701, ‘Communicating Key Audit Matters in the Independent Auditor’s Report.’ The auditor should describe each key audit matter under a separate section titled ‘Key Audit Matters,’ using appropriate subheadings. This must be done unless prohibited by law or regulation or if the auditor determines that the adverse consequences of disclosure would outweigh the benefits.

Each key audit matter description in the audit report should include a reference to the related disclosures in the financial statements. It should also explain why the matter was considered a key audit matter and how it was addressed during the audit.

For unlisted entities where reporting key audit matters is not mandatory, auditors often opt for voluntary reporting but tend to do so partially. Typically, they include the introductory part of key audit matters but omit the areas of key audit matters and how they were addressed.

SA 700 stipulates that if an auditor voluntarily decides to communicate key audit matters in the audit report, it must be done in accordance with SA 701. Therefore, for unlisted companies where key audit matter reporting is not mandatory, if the auditor chooses to report on key audit matters voluntarily, this reporting must comply with SA 701. Consequently, the auditor’s report should include the specific areas of key audit matters and how they were addressed.

Below is an extract from the audit report of a listed entity demonstrating the appropriate reporting of key audit matters and how they were addressed as per SA 701:

To enable regulators, banks, and third-party stakeholders to verify the credentials of documents, the council, in its 379th meeting held on 17th-18th December 2018, made the Unique Document Identification Number (UDIN) mandatory for all practising Chartered Accountants.

The ICAI has addressed doubts regarding UDIN through a set of Frequently Asked Questions (FAQs). Specifically, in FAQ number 96, the ICAI clarified that separate UDINs are required for the audit of financial statements and for tax audits, as these are distinct assignments. Each assignment requires a true and fair view, necessitating individual UDINs for both financial statements and tax audit reports.

The UDIN is an identifier for documents attested by an auditor. It has been observed that, in many instances, the UDIN mentioned in audited standalone financial statements corresponds to the UDIN generated for the tax audit report. Additionally, some auditors state the UDIN in Annexure-A rather than in the main independent auditor’s report.

Since the audit of financial statements and tax audit are distinct assignments, separate UDINs are required for each document. The ICAI has mandated the UDIN process to ensure the authenticity of documents attested by its members. This allows users to verify the UDIN and confirm that the attestation by an ICAI member is genuine. Therefore, it is not sufficient to state the UDIN in Annexure-A; it is mandatory to include the UDIN in the main audit report signed by the member.

Founded 1972

Evolution From a small family business to a leading technology-oriented Publishing/Product company

Expansion

Launch of Taxmann Advisory for personalized consulting solutions

Aim

Achieve perfection, skill, and accuracy in all endeavour

Growth

Evolution into a company with strong independent divisions: Research & Editorial, Production, Sales & Marketing, and Technology

Future

Continuously providing practical solutions through Taxmann Advisory

Editorial and Research Division

Over 200 motivated legal professionals (Lawyers, Chartered Accountants, Company Secretaries)

Monitoring and processing developments in judicial, administrative, and legislative fields with unparalleled skill and accuracy

Helping businesses navigate complex tax and regulatory requirements with ease

Over 60 years of domain knowledge and trust

Technology-driven solutions for modern challenges

Ensuring perfection, skill, and accuracy in every solution provided

Corporate Tax Advisory

Trusts & NGO Consultancy

TDS Advisory

Global Mobility Services

Personal Taxation

Training

Due Diligence

Due Dilligence

Advisory Services

Assistance in compounding of offences

Transactions Services

Investment outside India

From