3 minute read

Startup Spotlight: Trilo

Introducing: Trilo

Advertisement

Redefining Payments

Hamish Blythe, a founder at Trilo, became increasingly frustrated by the complexity, high costs, and fraud risks which the traditional card rails provide. After losing 3.4% of their revenue, and incurring several instances of fraud personally, they set out on a mission to change the payments landscape altogether, creating an efficient, rewarding and secure way to pay.

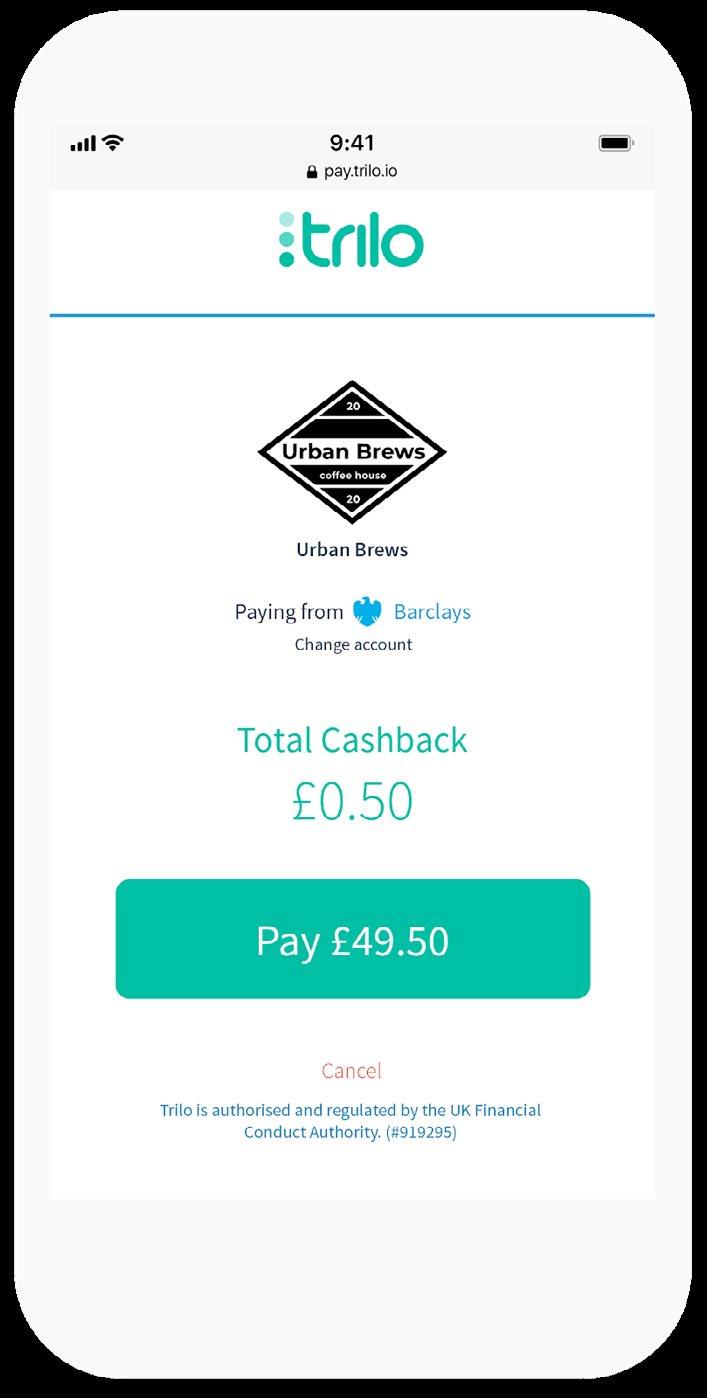

Trilo is a whole new way to pay, combining loyalty and payments in one simple platform. Merchants receive their money in minutes for only 0.2%, while engaging with their customers all in one platform. Merchants invest cashback instantly in their customers through Trilo, improving their experience, while increasing their average transaction value and converting visitors into customers.

Merchants and their customers are at the core of Trilo. Ensuring merchants no longer need to deal with an unending list of middlemen and expensive card schemes. Where many incumbents and upcoming payments providers are focusing purely on the merchant’s experience, Trilo has built an end to end payments network.

Through Trilo, merchants engage directly with their customers. With Trilo’s focus on consumers, we ensure your customer’s payment experience is frictionless and rewarding. Wherever consumers pay, they’ll instantly receive 1% cashback on everything, paying easily with their Trilo account. Consumers sign up and create their Trilo account once, at any of the merchants in the Trilo network. After this, they can pay in seconds with a few taps. Everything happens on their phone, with no download needed, something which enables seamless payments for both in-person and online purchases.

Trilo has recently received their FCA authorisation for both AIS and PIS activities, giving them the ability to unlock even more potential for merchants and consumers who have joined.

Ultra-Efficient Payments

Your money arrives in a few minutes, all for just 0.2%. For enterprise partners, Trilo has wiped out transaction fees altogether, replacing with a bespoke subscription model.

Built-in Loyalty

Invest cashback in your customers, instantly and effortlessly. Improving their experience, unlocking your revenue.

Omnichannel Platform

Trilo has solved both online and offline payments. You can accept payments from your customers regardless of connection status.

Simplicity is one of Trilo’s key goals. You can add Trilo to your business in minutes...

Unlimited Contactless

All offline payments are fueled through QR codes, with this Trilo can provide unlimited contactless payments - Enabling customers to pay without the risk of touching a pin pad.

Consumer-Centric

Trilo works with merchants to convert their customers away from cards, giving them a rewarding reason to switch. The more customers who convert, the more efficient the network becomes for all parties.

Trilo’s mission

Why should businesses be charged 1%, 2%, 3% whenever they get paid? Why should they wait for days before receiving their money while running the risk of fraud and chargebacks? Trilo’s mission is to redefine payments, connecting merchants and their customers in a never before seen way. In doing this, Trilo has built a new payments network using Open Banking, which completely cuts out the middlemen and cards from the old world.

Trilo is building a seamless payment experience, making your customers’ lives more comfortable and increasingly rewarding - All the while integrating loyalty and payments in one simple platform for you and your business.

Whether you’re operating online or offline, Trilo is redefining and improving the way you engage with your customers, putting you and them at the heart of of the network.