2024 Cannabis Market Brief

2024 Cannabis Market Brief

DRIVEN. DEDICATED. DETERMINED.

This document contains information that is up to date as of March 1st 2024 It is crucial to note that this regulatory landscape changes everyday, making this document only as accurate up to the date that it was published

TABLE OF CONTENTS Cannabis Legalization Landscape........................................................................................ Adult-Use Cannabis Landscape........................................................................................... Florida................................................................................................................................ Hawaii................................................................................................................................ Maryland Minnesota Missouri............................................................................................................................. New York........................................................................................................................... Ohio.................................................................................................................................... Pennsylvania.................................................................................................................... Virginia............................................................................................................................... Medical Cannabis Landscape............................................................................................... Idaho, Indiana, Kansas.................................................................................................... Kentucky, Nebraska, North Carolina............................................................................ South Carolina, Tennessee Wisconsin Wyoming............................................................................................................................ 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16

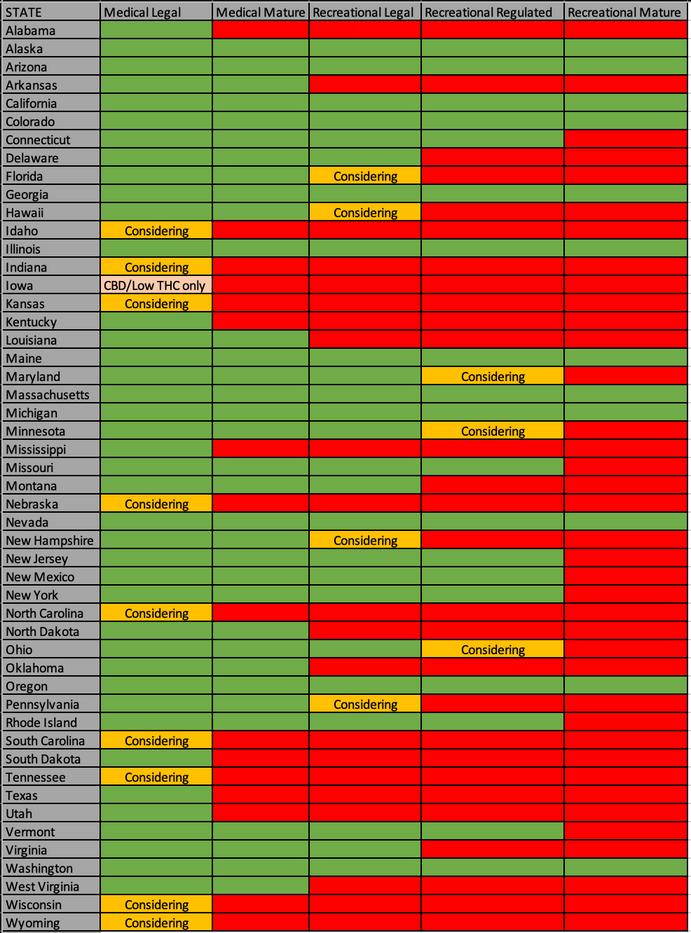

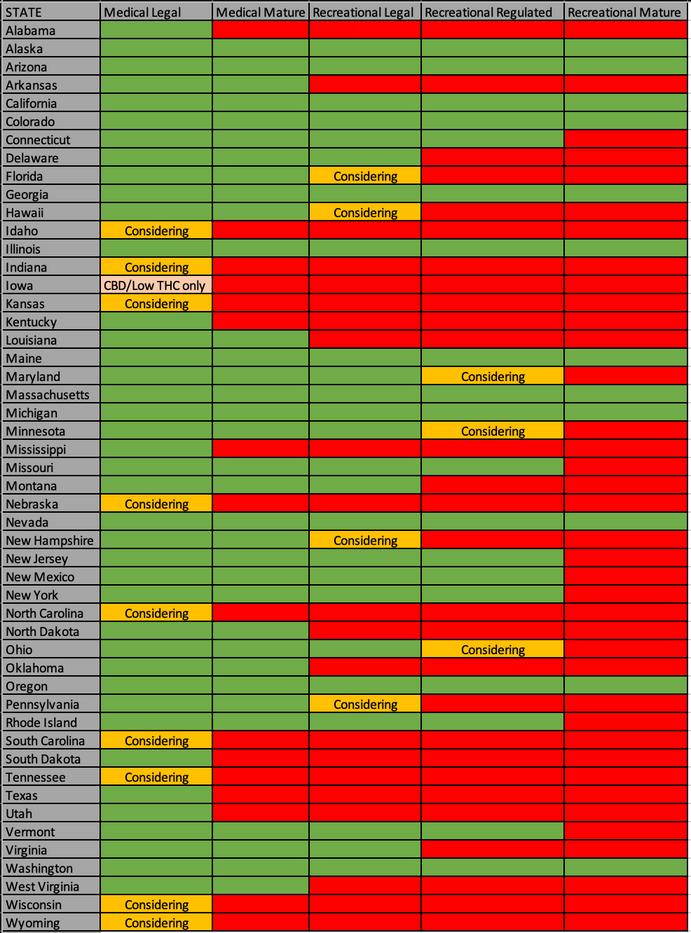

CANNABIS LEGALIZATION LANDSCAPE IN THE U.S.

- 1 -

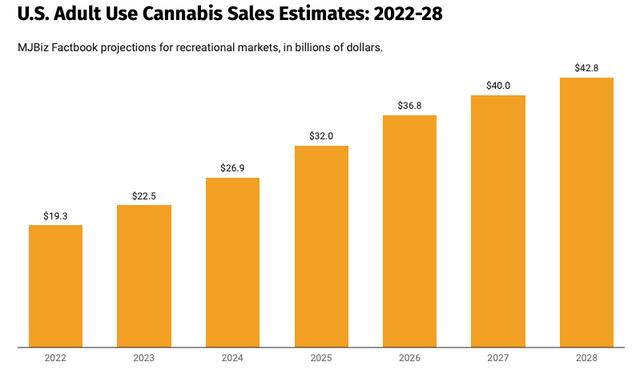

Adult-Use Cannabis Landscape: Navigating Growth, Legislation, Licensing and Consumer Trends

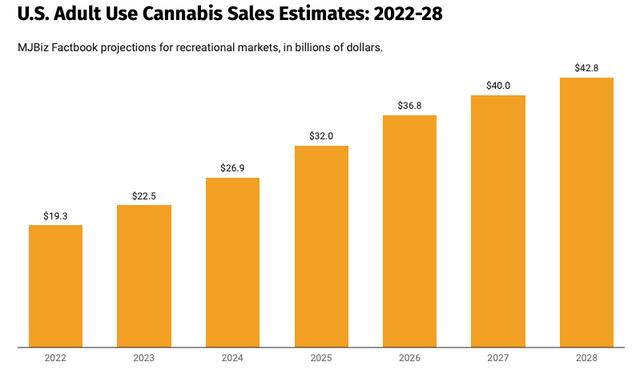

The US cannabis market is poised for growth in 2024, with total sales forecasted to increase by 10%. This growth is indicative of both the market potential and the challenges that lie ahead in navigating the complexities of this market across different states. The industry's landscape is expected to be significantly influenced by legislative developments, market dynamics, and consumer preferences.

One of the major developments to watch in 2024 is the rescheduling of cannabis by the Drug Enforcement Administration, following a recommendation from the Department of Health and Human Services in December 2023. This move, expected to acknowledge the medical value of cannabis, could lead to significant tax relief for cannabis businesses by eliminating the application of Section 280E, which currently prohibits state-legal cannabis businesses from deducting ordinary business expenses from their tax filings. However, the timeline and the immediate financial impact of such a change remain uncertain due to various state-level challenges and the presence of a vibrant illicit market.

The following pages provide an overview of states that have either recently legalized adult-use cannabis, are in the process of setting up an adult-use regulatory framework, or accepting adult-use applications in 2024.

- 2 -

FLORIDA

Legalization Status: Florida Amendment 3, the Marijuana Legalization Initiative, is set for a vote on November 5th, 2024. A 60% supermajority vote is required for its approval, and Gov. Ron DeSantis recently stated that the Supreme Court will approve the initiative. The initiative has garnered support from Smart and Safe Florida, with significant funding from cannabis establishments, indicating strong backing within the state for moving toward legalization.

Regulatory Framework: Florida's regulatory framework for adult-use cannabis will be determined by the outcome of the Amendment 3 initiative vote. The initiative also suggests that Medical Marijuana Treatment Centers could be able to convert to a dual use license (selling to both medical patients and adult-use customers), with the Florida State Legislature potentially providing for additional licensure. The exact regulatory details will be developed based on the amendment's requirements and subsequent legislative actions.

Licensing & Regulatory Agencies: Florida currently does not have a licensing framework for adult-use cannabis, as it remains illegal for adult-use purposes. The state currently regulates medical cannabis through the Florida Department of Health's Office of Medical Marijuana Use (OMMU), focusing on the medical program. Any future licensing for adult-use cannabis would be established following legalization. It is important to recognize that according to HB 1053 which was passed in January 2025, the minimum distance required between cannabis cultivation, processing, and dispensary centers has changed from the existing 500 feet to 1,500 feet, while also extending the buffer zone from K-12 schools to daycare centers, churches, and post-secondary educational institutions.

Market Potential: Florida has over 776,365 active medical cannabis patients representing more than 20% of the whole country’s registered patient count. Ultimately, with nearly 2 million monthly adult cannabis consumers, Florida could prove the second biggest market in the country when the state transitions to adult use.

- 3 -

HAWAII

Legalization Status: Hawaii is making significant strides toward the legalization of adult-use cannabis. In early February 2024, the Senate approved bill SB3335 which aims to legalize adult-use cannabis beginning January 1st, 2026. This legislation is part of a broader effort to establish a regulatory body under the state Department of Health to manage the legal cannabis market.

Regulatory Framework: Efforts to develop a comprehensive strategy for the legalization of adult adult-use cannabis are underway, with a task force working on recommendations for a dual-use cannabis system. This task force is exploring various aspects of legalization, including regulatory frameworks, tax implications, and measures to ensure the medical cannabis industry is not adversely affected. Preliminary recommendations include initially allowing only current medical cannabis dispensaries to sell adult-use cannabis with the same stringent testing standards as the medical cannabis industry.

Licensing & Regulatory Agencies: Currently overseen by the Hawaii Department of Health for medical cannabis. Hawaii's Attorney General has also released a draft proposal for legalizing adult-use cannabis, which includes provisions for personal possession, cultivation, and purchase from licensed retailers that would start in January 2026. Key provisions of the draft include a 14% tax on cannabis, allowing adults to cultivate up to six plants and establishing a Cannabis Control Board to regulate the market and issue business licenses.

Market Potential: Hawaii's current cannabis market is valued at $240 million, with potential growth to $354 million upon legalizing adult adult-use use. This represents a 48% increase, with dispensaries currently accounting for 21% ($50 million) of the market. Legalization efforts aim to balance medical industry protection while expanding access and addressing regulatory challenges.

- 4 -

MARYLAND

Legalization Status: Maryland voters approved a ballot referendum in the 2022 General Election to allow the use of cannabis by adults starting July 1, 2023. During the 2023 legislative session, the General Assembly passed legislation that provided a framework for implementing legal adult-use sales.

Regulatory Framework: Maryland's regulatory framework for adult-use cannabis is managed by the Maryland Cannabis Administration, overseeing licensing for cultivation, processing, and sale. Sales are taxed at 9%, with revenues supporting state programs and social equity initiatives to aid communities previously impacted by cannabis prohibition. The framework restricts public consumption and includes legal reforms like expungement for certain cannabis offenses. It aims to ensure safety, public health, and economic opportunities while addressing past injustices related to cannabis enforcement.

Licensing & Regulatory Agencies: The licensing of adult-use cannabis businesses is overseen by the Maryland Cannabis Administration. The first round of applications for new adult-use licenses ended in December 2023 and was only open to social equity businesses defined as those whose business is at least 65 percent owned by people who’ve lived in a designated “disproportionately impacted area” for a minimum of five of the last ten years and they must also have attended a public school in such an area for at least five years. The state also created caps on the number of licenses that can be awarded per region, with 11 standard dispensary licenses available in Baltimore City, compared to one in Worcester, for example. So far, the state has given out 169 adult-use licenses with no confirmation about the next possible application period but has claimed to use a data driven model to understand if th bounds of social equity requirements.

Market Potential: Maryland's adult-use cann experience significant growth, as adult-use 2023 and are predicted to expand to $2.1 bil Maryland, bordering states without adult-us prime market attracting consumers from ne adult-use sales in July 2023 saw a remarkab jumping to $87 million, a 105% rise from the adult-use transactions.

- 5 -

MINNESOTA

Legalization Status: In May 2023, Minnesota legalized cannabis for adult use, becoming the 23rd state to do so. Legal possession and cultivation took effect on August 1, 2023, with retail sales expected to begin in early 2025.

Regulatory Framework: Minnesota's adult-use cannabis framework, enacted in 2023, establishes the Office of Cannabis Management to regulate the industry, including issuing licenses. The law includes a 10% tax on sales, alongside criminal justice reforms such as automatic expungement for certain convictions. Local governments can impose regulations and fines for public use but cannot outright ban cannabis businesses.

Licensing & Regulatory Agencies: The Office of Cannabis Management will oversee the issuance of licenses across 15 types of cannabis businesses starting in early 2025. The licensing process aims to support small businesses and ensure fair and transparent operations within the cannabis industry. Preference in licensing will be given to "social equity" applicants such as people who were convicted of possessing/selling cannabis, veterans, or emerging farmers, to promote equitable market access.

Market Potential: The Minnesota adult-use cannabis market is projected to reach $1.5 billion by 2029, with about 15% of the adult population, or approximately 650,000 people, expected to purchase cannabis each month. This estimate is based on customer data from other states with legalized adult-use cannabis. The law also allocates funds for substance abuse disorder treatment and prevention, indicating an equitable approach to legalization.

- 6 -

MISSOURI

Legalization Status: Since December 2022, adult-use cannabis has been legal in Missouri, following voter approval of a statewide ballot initiative. Sales began in early February 2023, with the state witnessing over $833.4 million in adult-use cannabis sales within a year. Additionally, Missouri has expunged at least 100,000 non-violent cannabis convictions from state records as part of its legalization efforts

Regulatory Framework: Missouri's regulatory framework for adult-use cannabis encompasses a 6% state tax on cannabis sales, earmarking revenue for veterans' services, drug addiction treatment, and the public defender system. This framework was established following the legalization of adult-use cannabis, with the Department of Health and Senior Services overseeing the licensing and regulation of dispensaries. This ensures that sales and distribution comply with health and safety standards, reflecting a comprehensive approach to managing and overseeing the adult-use cannabis market in the state.

Licensing & Regulatory Agencies: The Department of Health and Senior Services is responsible for licensing and regulating dispensaries for adult-use cannabis use. While the state manages the application and issuance of licenses, applicants must also adhere to local laws. Following the legalization of adult-use cannabis, the state swiftly initiated sales, with 215 dispensaries, including microbusinesses, being licensed initially. In October 2023, the first round of 48 microbusiness licenses were distributed and the next application window for 48 more microbusiness licenses will open between 15th-29th April 2024.

Market Potential: The Missouri adult-use cannabis market is expected to significantly grow, with adult-use sales projected to bring in $650 million in 2023, resulting in total sales of approximately $958 million for that year. This market is forecasted to expand further, reaching $1.1 billion in 2024 and growing to $1.4 billion by 2026, indicating strong growth potential.

- 7 -

NEW YORK

Legalization Status: New York legalized adult-use cannabis through the Marihuana Regulation and Taxation Act (MRTA), which was signed into law on March 31, 2021. It marks a significant shift in the state's approach to cannabis, aiming to create a regulated market that ensures safety while addressing social equity.

Regulatory Framework: Overseen by the Office of Cannabis Management (OCM), the framework introduces a tiered THC-based tax and a 13% retail sales tax to generate revenue, while also focusing on social equity by reserving licenses for impacted communities and offering automatic expungement for certain past convictions. Local governments have regulatory power which allows them to opt in or out of adult-use cannabis within their jurisdiction. The law aligns public cannabis use with tobacco regulations, underscoring New York's commitment to public safety, social justice, and economic growth through its cannabis market framework.

Licensing & Regulatory Agencies: New York's Office of Cannabis Management (OCM) prioritizes equity applicants, microbusinesses, small farmers, and veteranowned businesses for licensing to foster a diverse market. With the first issuance targeting 100 dispensaries for these groups, New York aims for an inclusive industry. The first round of applications concluded on December 18, 2023, and 400 licenses have been given out of 7000 applications, showcasing the state's commitment to expanding its cannabis sector.

Market Potential: In 2023, New York's adult-use cannabis market recorded $104.2 million in sales through October, with projections estimating a significant increase to $400 million in 2024. This performance is part of a broader trend where New York, despite its large population, has taken a backseat to other states like Missouri and Maryland in cannabis sales due to a slower rollout of its adultuse program.

- 8 -

OHIO

Legalization Status: Ohio became the 24th state to legalize cannabis for adult use in December 2023 through a citizens' initiated measure, Issue 2. This law legalizes the possession, home cultivation, and retail sale of cannabis for individuals aged 21 or older.

Regulatory Framework: The regulatory framework for Ohio's adult-use cannabis is under development, with detailed specifics pending. The law calls for the establishment of a Division of Cannabis Control within the Department of Commerce to regulate the cannabis market.

Licensing & Regulatory Agencies: The Division of Cannabis Control (DCC) is tasked with overseeing the licensing and compliance process for the adult-use cannabis market. As of early 2024, the DCC released the first initial licensing framework allowing dispensaries currently licensed as medical cannabis facility to apply for a dual-use license (medical and adult-use) and cultivators to get a 10(B) dispensary license which offers one or three dispensary licenses dependent on the level of the medical cannabis cultivator. It would also give a current medical dispensary operating in Ohio an additional adult-use-only dispensary. Adult-use license applications will be open on June 7th, 2024, with licenses being issued starting September 7th, 2024, which is subject to change due to ongoing development in the legislation. The adult-use law also states that 50 adult-use only licenses will be available in a future application round. That date and application process are yet to be determined

Market Potential: With the transition to include adult-use sales, significant growth is anticipated. Projections estimate that retail cannabis products will generate between $250-400 million in tax revenue annually by the fifth year of sales and provide nearly 3000 new jobs in the first year post-legalization. Governor Mike DeWine wants the adult-use sales to begin as soon as possible to limit the development of an illicit market, which could mean that current medical dispensaries will receive their dual-use license sooner than expected.

- 9 -

PENNSYLVANIA

Legalization Status: Pennsylvania is actively working towards the legalization of adult-use cannabis, with bipartisan support in the legislature and endorsement from Governor Josh Shapiro in February 2024. A notable push for legalization includes SB846, a bipartisan bill co-authored by Republican State Sen. Dan Laughlin and Democratic State Sen. Sharif Street, indicating a concerted effort across party lines to address cannabis reform.

Regulatory Framework: The proposed regulatory framework for Pennsylvania's adult-use cannabis market is under review, with legislation focusing on social equity and local control. Governor Shapiro's 2024-2025 budget proposal anticipates the legalization of adult-use cannabis and suggests a 20% tax on revenue, with licensed shops launching sales starting January 1, 2025, pending legislative approval.

Licensing & Regulatory Agencies: Details regarding specific licensing and regulatory agencies for Pennsylvania's potential adult-use cannabis market remain pending but will aim to oversee comprehensive market regulation. The state is considering a Cannabis Regulatory Control Board to license and regulate both medical and adult-use cannabis industries. Municipalities will be able regulate the cannabis industry within their jurisdictions.

Market Potential: Pennsylvania's market potential for adult-use cannabis is significant, bolstered by the state's large population and the success of its medical cannabis program. Governor Shapiro's budget estimates suggest that legalization could generate approximately $16 million in cannabis tax revenue in 2025, with increases expected in subsequent years.

- 10 -

VIRGINIA

Legalization Status: Virginia legalized cannabis for adult use in July 2021, but as of the latest updates, the establishment of a retail sales framework is still pending after Virginia’s House of Delegates gave preliminary approval to a bill that would legalize and regulate the retail sale of cannabis in February 2024, with a final vote on the measure expected soon. Virginia's Senate subcommittee has also shown support for a bill introduced by Sen. Aaron Rouse that aims to kick off adult-use cannabis sales in January 2025.

Regulatory Framework: The regulatory framework for Virginia's cannabis market is under development, with significant updates anticipated to enhance consumer safety and public health. The state has introduced stricter regulations on hempderived products, including limits on THC content and the prohibition of Delta-8 THC products. The General Assembly plays a crucial role in refining cannabis legislation, focusing on establishing a comprehensive legal retail cannabis market.

Licensing & Regulatory Agencies: The Virginia Cannabis Control Authority is expected to oversee and regulate the adult-use cannabis market. A proposed Senate Bill 423, if passed, would allow companies in the state's medical cannabis program to expand their offerings to include adult-use cannabis sales starting July 1, 2024, and open the market to additional licensees by early 2025. This bill outlines the regulatory responsibilities and establishes the framework for licensing retail stores, growing operations, testing facilities, wholesaling, and manufacturing operations.

Market Potential: The market potential for cannabis in Virginia is considerably high due to its legal status and the state's significant population size. However, the lack of a retail sales framework currently hampers the realization of this potential. A report by the Joint Legislative Audit & Review Commission found that legal sales of adult-use cannabis in Virginia could eventually produce up to $300 million in annual state tax revenue through a predicted 25-30% cannabis tax rate, while creating between 11,000 and 18,000 jobs.

- 11 -

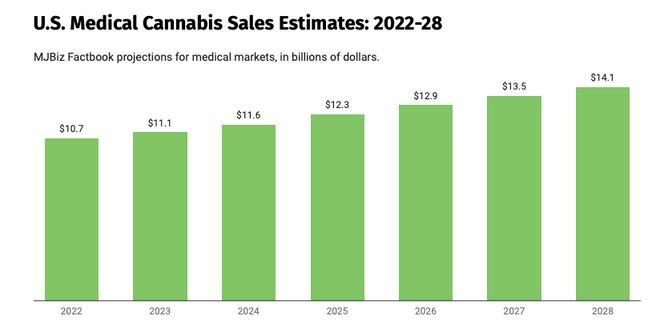

Medical Cannabis Landscape: Navigating Growth, Legislation, Licensing and Consumer Trends

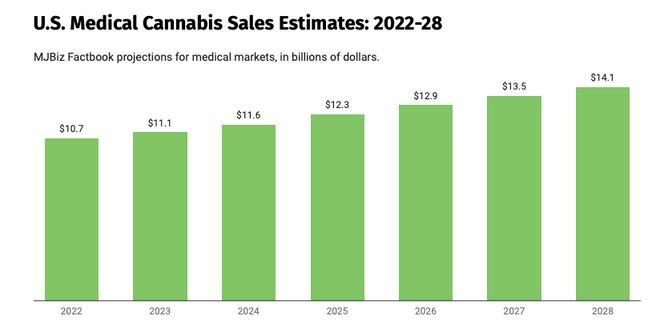

2024 is poised to be a substantial year of growth for the medical cannabis market in the U.S., with projections suggesting a valuation upwards of $11 billion. This growth is driven by ongoing state-level legalization and an expanding base of medical professionals and patients recognizing its benefits. The medical cannabis market is also becoming increasingly pivotal because it provides states with a foundational framework that paves the way for a transition towards adult-use legalization.

The market is expected to diversify with innovative product offerings aimed at specific medical conditions, fueled by advancements in cannabis research. However, the industry faces challenges such as federal-state legal discrepancies and the need for standardized dosing. The competitive landscape will likely see more states entering the market, with a potential change in market structure due to the rescheduling of cannabis, marking a significant year of opportunity and evolution for the U.S. medical cannabis sector.

The following pages provide an overview of states that have either recently legalized medical cannabis, are in the process of setting up medical regulatory framework, or accepting medical applications in 2024.

- 12 -

Idaho

In 2024, Idaho activists, led by Kind Idaho, are making a renewed push to legalize medical cannabis through a ballot initiative. This effort aims to allow patients with specific medical conditions access to cannabis, either through state-licensed dispensaries or home cultivation. The initiative proposes possession limits, establishes a regulatory framework for dispensaries and production facilities, and includes a 4% excise tax on sales. Previous attempts faced challenges, but with 68% of Idahoans supporting medical cannabis legalization, advocates are optimistic. They need to collect at least 74,000 signatures by April 2024 to qualify for the ballot.

Indiana

In Indiana, the 2024 legislative session has seen the introduction of a dozen bills aimed at legalizing cannabis in various capacities, including for medical use. These bills propose the establishment of medical cannabis programs, decriminalization of possession, and procedures for the lawful production, sale, and use of cannabis. Some bills specifically target the use of medical cannabis for people with serious medical conditions, with proposed oversight by newly established commissions. The efforts reflect a growing interest in cannabis legalization, influenced by the potential tax revenue benefits observed in neighboring states where cannabis is legal.

Kansas

In Kansas, momentum for legalizing medical cannabis is growing, yet legislative progress has been slow. Despite bipartisan support in the House for a medical cannabis bill in 2021, the Senate has yet to address it. This proposed bill would allow smokeless cannabis products for specific medical conditions. In 2024, SB 135 was introduced to regulate medical cannabis cultivation, distribution, and use. Advocates argue for its medical benefits, especially as a safer alternative to opioids. The ongoing legislative efforts and public support reflect a significant push toward establishing a medical cannabis program in Kansas.

- 13 -

Kentucky

Medical cannabis was legalized in Kentucky with the signing of Senate Bill 47 by Governor Andy Beshear on March 31, 2023. The law allows for the legal purchase of medical cannabis starting January 1, 2025. The Kentucky Cabinet for Health and Family Services is tasked with establishing regulations for the program, including policies for dispensaries and these regulations must be finalized by July 1, 2024.

Nebraska

Nebraskans for Medical Marijuana is attempting to put a pair of statutory measures relating to legalization before voters in the November 2024 election. One petition the group is circulating aims to establish a doctor-patient system, and the other would create the framework for a regulated medical cannabis industry. The campaign has until July 3, 2024, to collect roughly 87,000 valid signatures per petition to land each on the ballot.

North Carolina

In North Carolina, the Senate passed the North Carolina Compassionate Care Act with strong bipartisan support, aiming to legalize medical cannabis for certain conditions. However, its future in the House remains uncertain. Hemp-derived products like CBD remain legal, with new regulations pending. The Eastern Band of Cherokee Indians has legalized cannabis use on tribal lands, marking a significant shift. Despite these developments, comprehensive legalization faces challenges due to political differences, particularly on issues like social equity and industry regulation. The state stands at a crossroads, with potential changes to cannabis laws on the horizon.

- 14 -

South Carolina

In South Carolina, the Senate officially approved a medical cannabis legalization bill in 2022, sending it to the House for consideration. This move marks a significant step towards legalization in the state, indicating strong support for medical cannabis under certain conditions. The Compassionate Care Act, as passed by the Senate in January 2023, prohibits smokable forms and home cultivation, focusing instead on dispensing through licensed facilities. This legislation aims to cater to patients with qualifying conditions, including cancer and multiple sclerosis, among others. The bill's future now depends on House approval and the governor's stance, which remains unclear.

Tennessee

Tennessee is attempting to make strides toward medical cannabis legalization and lawmakers have recently reintroduced a bill that would put marijuana legalization referendum questions on the 2024 ballot. The state established the Tennessee Medical Cannabis Commission in 2021 to oversee the development of a comprehensive medical cannabis program. Efforts are focused on reclassifying cannabis to facilitate legal status and research. While previous legislation has begun to regulate hemp-derived cannabinoid products, broader legalization efforts confront challenges, including the state's conservative stance on certain policies. The push for legalization reflects a growing acknowledgment of cannabis's potential economic and health benefits.

Wisconsin

In January 2024, Wisconsin Republicans proposed a highly restricted plan to legalize medical cannabis for severely ill individuals with chronic diseases, such as cancer. The proposal, unveiled by Rep. Jon Plumer, would allow medical cannabis to be dispensed at only five state-run locations and would not permit smokable forms of cannabis. While this move represents a step towards establishing a medical cannabis program, it falls short of the broader legalization efforts previously advocated by Democratic Governor Tony Evers and other Democrats. The bill's introduction reflects ongoing discussions and differing viewpoints within the state on the extent and form of cannabis legalization.

- 15 -

Wyoming

In Wyoming, cannabis activists attempted to set their sights on the 2024 ballot to push for decriminalization and medical cannabis initiatives. Despite gathering a significant number of signatures, they fell short of meeting the state's strict requirements for ballot inclusion in 2024. The initiatives aimed to decriminalize possession of small amounts of cannabis and establish a medical cannabis program for patients with certain qualifying conditions. Activists are determined to continue their efforts, both through the legislative process and by preparing for future election cycles, to bring reform to Wyoming's cannabis laws

- 16 -

DRIVEN. DEDICATED. DETERMINED.

To discuss this brief, please contact: Greg D'Agostino Partner 617.388.6477 greg@tenaxstrategies.com To learn more about our firm, please visit: www.TenaxStrategies.com Pete D'Agostino Partner 617.416.5344 peter@tenaxstrategies.com

2024 Cannabis Market Brief

2024 Cannabis Market Brief