AFFORDABLE TEXAS

We have extensive experience in affordable housing development. We represent for-profit developers, non-profit developers and public housing authorities utilizing a variety of financing techniques, including low income housing tax credits, CDBG Disaster Recover y Funding, private activity bonds, historic tax credits, HUD programs (including RAD and CNI), investment syndications and conventional financing.

Our attorneys routinely structure complex transactions providing comprehensive solutions that utilize all aspects of financing in the affordable housing arena.

We are focused on the development of affordable housing and inner city revitalization.

A TEN-LAWYER BOUTIQUE LAW FIRM BASED IN WASHINGTON, DC SPECIALIZING IN TAX-EXEMPT MUNICIPAL BOND FINANCE WITH A SPECIAL EMPHASIS IN TAX-EXEMPT MULTIFAMILY RENTAL HOUSING BOND FINANCE OVER 200 YEARS OF EXCEPTIONALLY BROAD EXPERIENCE IN MUNICIPAL FINANCE, having served as underwriter's or purchaser's counsel, and in other roles as counsel in thousands of tax-exempt bond and loan financings. In the last six years alone, attorneys on the NGO team have served as counsel in more than 950 private and public transactions in 46 states, including over 80 financings in Texas.

ARCHITECTS OF THE STRUCTURES AND MODEL DOCUMENTATION for a number of the industry’s major tax-exempt debt programs, including the country’s leading tax-exempt bond and loan private placement program, short term cash backed tax-exempt bonds used since 2008 with FHA insured and rural development loans, the Freddie Mac TEL private placement structure and the Fannie Mae M.TEBs rated publicly offered bond structure.

UNDERWRITER’S COUNSEL FOR NEARLY $1.5 BILLION IN AGGREGATE “GOVERNMENTAL PURPOSE” TAX-EXEMPT WORKFORCE HOUSING BOND FINANCINGS SINCE 2020, including the five of the first six of these financings to close in the State of Texas.

FULL SERVICE PRACTICE that includes cash flow analyses, rebate computations and yield proof calculations and reports, and opinions and reports required in bankruptcy and debt defeasance transactions.

GROWING TO MEET DEMAND In the last two years our firm has added a new partner, hired two new outstanding associate attorneys and three new exceptionally qualified financial analyst/paralegals.

We would love to discuss potential financing opportunities with readers of the Texas Affordable Housing Magazine. How can we and our clients help you choose or design the right financing product for your project, assemble a first rate financing team, and manage your tax-exempt debt financing to achieve industry leading results?

NORRIS GEORGE & OSTROW PLLC 1627 EYE STREET, N.W., SUITE 1220 • WASHINGTON, D.C. 20006

www.ngomunis.com

Our experienced teams work closely together to provide full-service solutions for your business. According to Affordable Housing Finance magazine's annual rankings, M&T Bank was ranked in the Top 25 of Affordable Lenders nationally for 2022.

M&T Realty Capital Corporation®

• Fannie Mae MAH

•Freddie Mac TAH

•FHA

•Private Placement

•Bridge Loans

•CDFI Placement

M&T Bank

• Full range of M&T Bank commercial products and services

Wilmington Trust Trustee Services

• Multifamily market rate and affordable housing bonds

• Taxable/tax-exempt bonds

• Senior living/assisted living bonds

• Military housing bonds

• Pooled multi-family trusts

• Public/privately placed bonds

• College/university housing bonds

mtrcc.com wilmingtontust.com

Investment products are not insured by the FDIC or any other governmental agency, are not deposits of or other obligations of or guaranteed by Wilmington Trust, M&T Bank, or any other bank or entity, and are subject to investment risks, including the possible loss of the principal amount invested.

Wilmington Trust is a registered service mark used in connection with various fiduciary and non-fiduciary services offered by certain subsidiaries of M&T Bank Corporation including, but not limited to, Manufacturers & Traders Trust Company (M&T Bank), Wilmington Trust Company (WTC) operating in Delaware only, Wilmington Trust, N.A. (WTNA), Wilmington Trust Investment Advisors, Inc. (WTIA), Wilmington Funds Management Corporation (WFMC), Wilmington Trust Asset Management, LLC (WTAM), and Wilmington Trust Investment Management, LLC (WTIM). Such services include trustee, custodial, agency, investment management, and other services. International corporate and institutional services are offered through M&T Bank Corporation’s international subsidiaries. Loans, credit cards, retail and business deposits, and other business and personal banking services and products are offered by M&T Bank. Member FDIC.

Equal Housing Lender. ©2023 M&T Realty Capital Corporation. Member FDIC. NMLS# 1024366. All rights reserved. M&T Realty Capital Corporation is a wholly-owned subsidiary of M&T Bank. Member FDIC. Third-party trademarks and brands are property of their respective owners. M&T Bank and its affiliates and subsidiaries. All rights reserved. AMP-4789 230605

Wells Fargo Commercial Real Estate’s experienced bankers can provide the financial guidance you need to help navigate your company’s business decisions. With our industry knowledge, products, and services, we can help keep your business moving forward.

Last year, the day before the start of the Texas Housing Conference, I attended a Banksy exhibit and since then have had a poster hanging on my office wall which reads, “There’s nothing more dangerous than someone who wants to make the world a better place.” It served as a bit of inspiration on some challenging days at work, but what I’ve really learned over the last year is that there IS something more dangerous, and that is a huge team of people who want to make some positive change for a good cause!

The enormous number of professionals who have committed time and resources to the Texas Affiliation of Affordable Housing Providers is astonishing, and I want to thank each and every one of our members for their support. That support comes in so many different ways, from sponsoring a webinar to participating in a committee, from attending a fundraising event to reaching out to a legislator.

In December last year, we celebrated the 25th anniversary of this organization, and it was a truly memorable and humbling experience. TAAHP started with the vision and leadership of Edwina Carrington, Dick Kilday, Sally Gaskin and JOT Couch. (If you find Sally at the conference, ask her to tell the story!) Later presidents (and now legends) Chris Bergman, Mike Lankford, Jerry Wright and Diana McIver continued to grow and strengthen the organization. The legacy continued with Granger MacDonald, Mike Clark, Mike Sugrue, and Linda McMahon, who held on through the recession. Dan Markson, Toni Jackson, Barry Kahn and George Littlejohn followed, expanding the conference and membership through a period of significant growth. Then Justin MacDonald, Mahesh Aiyer, Bobby Bowling, and Nicole Asarch stepped up, doing some very heavy lifting while we transitioned to our new (and very thankfully current) Executive Director. I became a board member under the leadership of Debra Guerrero, who catapulted TAAHP to a new level of recognition from peer organizations and lawmakers, and Dan Kierce, who calmly and astonishingly managed us through the shutdown caused by the pandemic. Then Janine Sisak and Chris Akbari didn’t miss a beat, hosting wildly successful conferences and adding several new programs, working groups, goals, and member benefits.

I look at this list of people and now fully appreciate what they have done and are still doing for TAAHP, and in turn how they have truly served Texans in need of safe, decent, affordable housing. I look at that list a second time and can think of a hundred people who are not on it, but who have contributed so much time and energy (and money!) to our common goal. Again, it’s astonishing!

This year, much of the focus was on our legislative agenda, which called for long hours at the Capitol, and many miles driven by Nathan Kelley as chair of the Government Affairs Committee. It required hundreds of phone calls and personal visits by the Andrade-Van De Putte lobbying team, and incredible wrangling from our staff, particularly in organizing events like our Rally Day at the Capitol earlier this year. Others – Steve LeClere, Khayree Duckett, Nick Walsh and many more – worked tirelessly and pitched in at a moment’s notice. And the result? New legislation that will directly and positively impact the ability to provide affordable housing in Texas! This includes the added provision for a state housing tax credit, improvements to the laws governing developments owned in partnership with public facility corporations, and efficiencies added to the private activity bond program, among others. Success in a legislative session is always exciting, but we cannot forget all the other accomplishments of this group. The scholarship committee raised an unprecedented amount of funds, and we formed a separate non-profit, the TAAHP Foundation, to accept donations and administer the program. We hosted educational webinars throughout the year, including our holiday anniversary event; and of course, we are having our biggest conference yet, thanks in large part to the masterful Kristi Sutterfield! We are in constant engagement with TDHCA and other stakeholders through the work of so many committees, while also just taking care of business internally. That leads to a big, big thank you to Roger, Naomi, Whitney, and Amanda, the hardest working staff in Texas. Finally, I would be remiss not to recognize our four board members who are leaving, all after several years of service. Cheers to David Saling, Audrey Martin, Terri Anderson, and Dan Kierce! Your dedication is unmatched. And last but not least, hats off to incoming President Valerie Williams! Well done, y’all!

Thank you to TAAHP’s leaders, members, and numerous others who have worked so hard over the last quarter century to bring together the incredible level of advocacy and expertise needed to successfully represent the affordable housing industry in Texas. Because of those well established roots, TAAHP has a clear path to continue its mission to be the primary advocate and leading resource for the affordable housing industry in Texas. Thank you!

Edwina Carrington (1998) Dick Kilday (1999) Sally Gaskin (2000) JOT Couch (2001) Chris Bergman (2002) Mike Lankford (2003) Jerry Wright (2004) Diana McIver (2005) Granger MacDonald (2006) Mike Clark (2007) Mike Sugrue (2008) Linda McMahon (2009) Dan Markson (2010) Toni Jackson (2011) Barry Kahn (2012) George Littlejohn (2013) Justin MacDonald (2014) Mahesh Aiyer (2015) Bobby Bowling (2016) K. Nicole Asarch (2017) Debra Guerrero (2018) Dan Kierce (2019) Janine Sisak (2020) Chris Akbari (2021) Jean Latsha (2022)

JOT Couch (Texas Inter-Faith) Tom Dixon (Boston Capital) Marie Keutmann (MMA/Boston Financial) Tim Kemper & Wendy Tillery (Reznick) Chris Bergmann & Ken Valach (Trammel Crow) Evan Becker (Edison Capital) Linda McMahon & David Saling (JP Morgan Chase Bank) K. Nicole Asarch & Mark Ragsdale (PNC Bank) Jerry Wright (Jerry Wright) Valerie Williams (Bank of America)

John Garvin (2000-2005) Jim Brown (2006-2013) Frank Jackson (2013-2017) Roger Arriaga (2018-Present)

Gail Gonzales

LOOKING TOWARD THE FUTURE: HEALTHY PARTNERSHIPS THAT PAY OFF THE UNINTENDED CONSEQUENCES OF DECONCENTRATION FACTORS

Whitney Parra-Gutiérrez, TAAHP

TEXAS 88TH LEGISLATIVE SESSION RECAP: BIG WINS FOR AFFORDABLE HOUSING

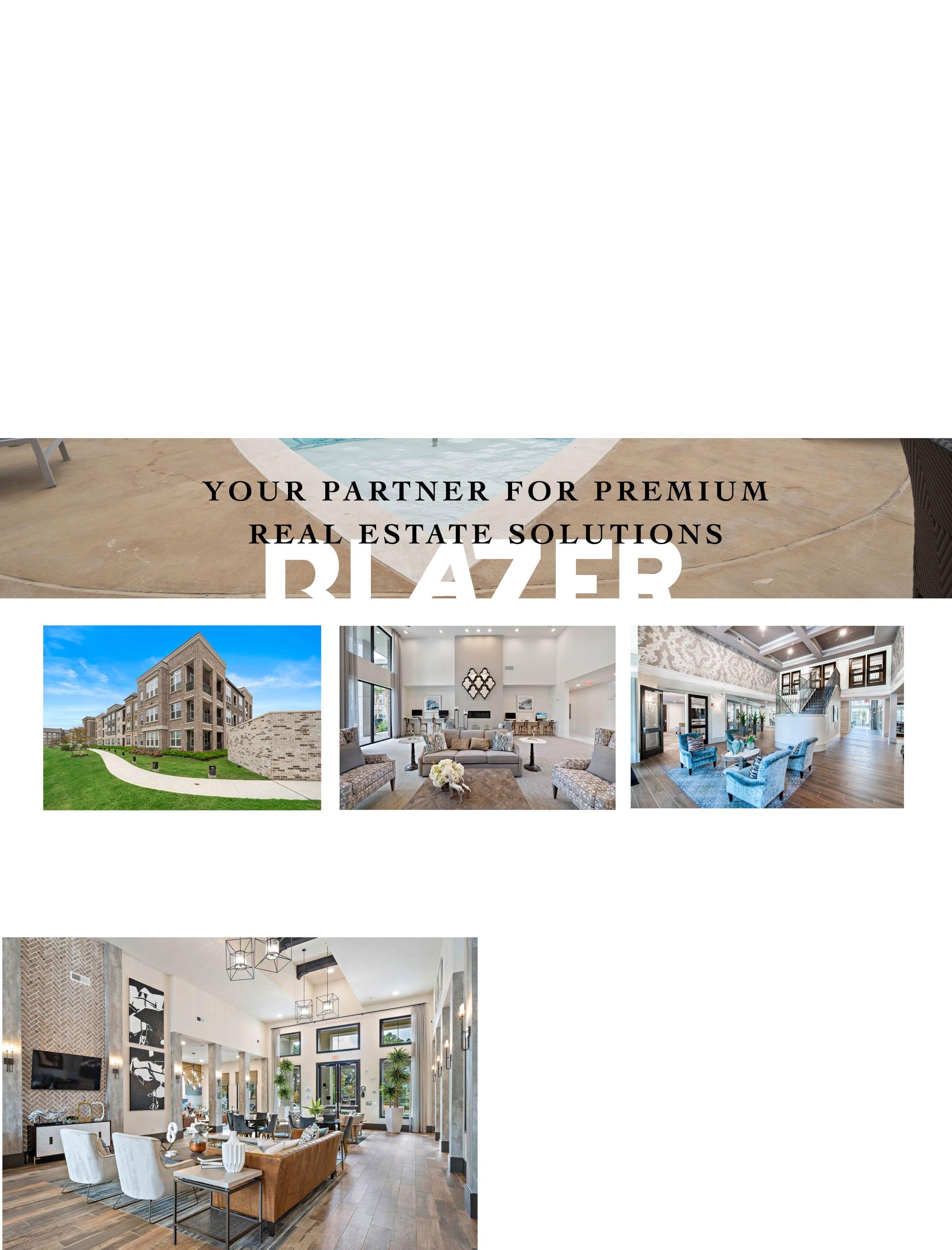

AMTEX, Blazer Building, Dominium, Cesar Chavez Foundation, H+UO Architects, HOME, Housing Authority of Brownsville, New Hope Housing, Saigebrook / O-SDA

SPOTLIGHT: AFFORDABLE HOUSING COMMUNITY SUCCESS STORIES

The Elizabeth Group, National Church Residences

SPOTLIGHT: AFFORDABLE HOUSING REHAB COMMUNITY SUCCESS STORIES

SPECIAL THANKS TO Amy Connolly, Diana McIver, Megan Lasch, and Keli Savage, Erika Rich

Published By TEXAS AFFILIATION OF AFFORDABLE HOUSING PROVIDERS 2401 E 6th Street, Ste 3037, PMB 153 Austin, TX 78702 (512) 476-9901; www.taahp.org

Advertising, Sponsorship Sales KRISTI SUTTERFIELD, CONFERENCE DIRECTOR kristi@taahp.org

Contributing Editor

WHITNEY PARRA-GUTIERREZ, POLICY & REGULATORY MANAGER whitney@taahp.org

Publisher ROGER ARRIAGA, EXECUTIVE DIRECTOR roger@taahp.org

Art Director / Design / Editor

NAOMI BLUDWORTH, DEPUTY EXECUTIVE DIRECTOR naomi@taahp.org

Contributing Editor

AMANDA DOYLE-NICHOLLS, OPERATIONS MANAGER amandadn@taahp.org

On the Cover: Hartwood at Canal - Photo Credit: RealPage

Although every attempt is made to be as comprehensive and accurate as possible, the Texas Affiliation of Affordable Housing Providers (TAAHP) and its affiliates are not responsible for any misprints, errors, omissions, deletions, or the accuracy of the information in the publication. TAAHP and its affiliates do not accept responsibility for any loss, injury or inconvenience sustained by anyone using this publication. Information may have changed since print date.

Copyright© 2023 by the Texas Affiliation of Affordable Housing Providers. All rights reserved. No part of this publication may be reproduced or transmitted in any form, by any means, electronic, mechanical, photocopying or otherwise without the written permission of the Publisher. The Texas Housing Conference™ is a protected trademark.

TTAAHP members are changing our industry. Over the last five years, TAAHP has been steadily impacting the affordable industry. Your membership, participation, engagement, and energy are making a difference.

Legislative Impacts: TAAHP just completed the most successful legislative effort in its 25-year history! Not only will the new Texas State Tax Credit change the landscape of affordable housing in Texas for the foreseeable future, but tax credit development caps will also be significantly increased for each development. But there’s more: Cost per square foot limitations will now be tied to inflation rates to allow for changing costs and efficiencies made to private activity bonds will now allow for more developments each year. Simultaneously, TAAHP defended the industry by working diligently to save Public Facilities Corporations (PFCs) from extinction and while also keeping the requirement of letters of state representative support from being added to 4% tax credit developments across the state.

Roger Arriaga Executive Director

Taking Care of Business: TAAHP has successfully worked to keep your developments in play by advocating for supplemental tax credits for prior year developments. In addition to this, many of our QAP recommendations have been accepted as ways to save costs and provide clarity while maintaining compliance for tax credit developments. Separately, TAAHP’s monthly education webinars and newsletters continue to provide needed information to keep your businesses in strong, informed positions. And of course, with yet another record-breaking year for attendance, the Texas Housing Conference opens channels of business opportunities for everyone!

Advocacy Recognition: TAAHP continues to grow as an influential stakeholder. Multiple media outlets are regularly seeking our input, comment, and resources. We’ve been interviewed, quoted, and sourced in numerous news outlets. Also, our affordable housing educational materials are being accessed by elected officials as well as being requested by stakeholders in other states. Further, our bi-annual One Voice Rally Day had a record turnout and reached nearly every office at the Texas Capitol. The success of our resources and outreach has prompted elected officials and other organizations to seek TAAHP input, testimony, and support on far reaching affordable housing legislation.

Looking to the Future: Building high quality affordable housing is a key component of what TAAHP represents. Just as important is what we do to provide encouragement and support the younger generations affiliated with our industry. In 2022, TAAHP awarded over $57,000 in scholarships to students who live in TAAHP member owned or affiliated developments. These recipients are truly inspirational and are genuinely appreciative of your donations, which they see as investments in their future. Our newest venture is to begin TAAHP internships and mentorships for up-and-coming students whose interests include affordable housing. To facilitate these initiatives, TAAHP has now created the TAAHP Foundation as a way to grow and sustain these initiatives. We’re helping to build your future teams!

TAAHP members have been the foundation to these wonderful accomplishments. If you’re not a current member, we hope that you’ll consider becoming a part of this growing success story. If you are a member, thank you! And please take a minute to appreciate what you’re helping create.

Over the last two years, TAAHP has worked to provide the most relevant and timely education to help your business stay afloat of market disruptions while continuing to effectively perform. From How to Do a Tax Exempt Bond Deal in Texas to Year-15 Exit Strategies, TAAHP provided valuable industry expertise that:

+ Brings you the latest information you need in challenging times

+ Changes the perspective of decision makers

+ Gives creative alternatives for today’s environment

+ Matters to you and your organization

Top Row, Left to Right: Jean Latsha, President; Chris Akbari, Immediate Past President; Valerie Williams, President-Elect

Second Row, Left to Right: Nathan Kelley, First VP; Eleanor Fanning, Second VP; David Saling, Treasurer; Audrey Martin, Secretary

Bottom, Left to Right: Janine Sisak, Dan Kierce, Terri Anderson, Meghan Cano, Gilbert Gerst, Quinn Gormley, Darrell Jack, Lora Myrick, Stephanie Naquin, Rick Sheffield, Darren Smith, Hector Zuniga

Top Row, Left to Right: Jean Latsha, President; Chris Akbari, Immediate Past President; Valerie Williams, President-Elect

Second Row, Left to Right: Nathan Kelley, First VP; Eleanor Fanning, Second VP; David Saling, Treasurer; Audrey Martin, Secretary

Bottom, Left to Right: Janine Sisak, Dan Kierce, Terri Anderson, Meghan Cano, Gilbert Gerst, Quinn Gormley, Darrell Jack, Lora Myrick, Stephanie Naquin, Rick Sheffield, Darren Smith, Hector Zuniga

When families spend 30-50 percent of their income on rent and utilities, they’ll make sure food is on the table and a roof is over their heads. Typically, they’ll also forego doctor visits, dental care, medicines, and more. This housing insecurity creates a constant, toxic stressor for a growing number of families. Constant worry about providing the basics for living creates a cascading effect producing more emergency room visits, dire health crises, and a vicious cycle of uncertainty for home budgets, steady work, and family health. A 2017 study by the National Bureau of Economic Research found that "increasing access to housing subsidies led to reductions in hospitalizations and emergency room visits for children” and also found a link between stable housing and improved mental health. Hospitals and taxpayers ultimately pay the financial price for failure to manage acute and chronic care effectively.

affordable housing is a far cry from the public housing of the 1960s, ’70s, and ’80s. Tax credit developments built today are beautiful, well-maintained properties that residents are proud to call home. Housing that serves the needs of working families, retirees, and the elderly is now not just a goal but a mandate by the state. Unfortunately, the current affordable housing shortage in Texas means that only 25 of every 100 extremely low income residents in need can secure affordable housing, and an even smaller percentage end up in ideal, healthy housing communities.

Privately owned housing that is affordable due to its age, insufficient management, investment, and oversight is rife for lead poisoning, respiratory illnesses, cancer, and unintentional injuries or death. These conditions result in poor school attendance and performance, missed workdays for parents, and the loss of loved ones disproportionately affecting communities of color and low-income families. Still, some don’t understand or believe there is a direct link between health and housing or that it can’t be proven – unless they work in healthcare.

Healthy housing is high quality, achieves affordability by design and not by age, and includes proximity to parks, grocery stores, transportation, and many other amenities and services. Much of this is achieved thanks to a significant change to affordable housing development pioneered by President Reagan in 1986 through the introduction of housing tax credits. As a result, today's

There are four pathways where housing and health intersect, and the former affects the latter: housing stability, affordability, the quality and safety of the home, and the neighborhood. The National Center for Healthy Housing (NCHH) noted that 37 percent of Texas housing was built before 1978 and, to this day, may contain leadbased paint causing neurological deficits, anemia, abnormal vitamin D metabolism, nephropathy, hypertension and reproductive abnormalities. As recently as 2019, nearly 5,000 Texas children tested had elevated blood lead levels. The Panhandle and western areas of Texas continue to represent the highest risk for Radon levels averaging twice

Periodic health fairs are offered at Foundation Communities' Laurel Creek community in Austin providing a variety of health screenings for residents.SVN Affordable | Levental Realty is a nationally recognized leader in the niche market of Affordable Housing brokerage focusing solely on valuing, marketing and selling Project Based Section 8 and Section 42 housing through our national platform and proprietary database Our financial, regulatory and statutory expertise, paired with our strategic alliance of industry professionals, allows us to successfully identify a customized disposition strategy and transaction structure that ensures maximum value and minimal risk for our clients

If you are interested in obtaining a formal opinion of value for your Affordable Housing asset or partnership interest, please contact us at 513.321.7589.

Carson Stephens, Senior Advisor

Carson Stephens, Senior Advisor

the EPA action level. Radon gas typically enters a home through the foundation, causing lung cancer.

These conditions where people are born, live, learn, work, play, and age are social determinants of health. Statistics on Social Determinants of Health reveal:

+ Individuals in the lowest income quintile have nearly three times greater risk of developing heart disease than those in the highest income quintile.

+ Lack of access to transportation can result in missed medical appointments, difficulty accessing healthy food options, and limited job opportunities.

+ The landmark federal mobility program Moving to Opportunity demonstrated that adults who used vouchers to move to better-resourced neighborhoods experienced a lower prevalence of diabetes, extreme obesity, physical limitations, and psychological distress versus those who did not move.

Keep Building and Provide More Opportunities: Redefining "high-opportunity" areas to focus on essential amenities rather than cost-driving factors would help provide more much-needed healthy housing in Texas. Lawmakers could let cities with robust affordable housing policies make the final decisions on their planning and eliminate regulations such as the "two-mile, same year" and "census tract rules" that discourage high-quality affordable housing where it is needed. Supplementing the Housing Tax Credit by offering subsidies through federal programs like HOME Investment Partnership, a Community Development Block Grant, or the National Housing Trust Fund can help build more

quality affordable housing in these areas and reduce regulatory costs. Streamlining the application process for these programs would make it easier for developers to participate. Additionally, affirmative marketing policies are needed to promote the availability and educate income-eligible families about high-opportunity homes and encourage them to apply.

In an interview with healthcare and development leaders, CVS Health Associate Vice President & Head of Impact Investment Strategy Keli Savage noted that she has "been hoping Congress will soon provide incentives or a special bonus for developers who incorporate a healthy housing component.” Austin-based, Megan Lasch, president of O-SDA Industries, LLC, shared that, “Texas just passed a bill creating a new state tax credit, and the buyer for those would mainly be insurance companies. It’s the third time the bill has been presented, and while it just gets our toe in the water with a $25 million credit, it’s a start.”

A national housing study suggests that, as an easy first step, housing providers could “look up the local tax-exempt hospital’s Community Health Needs Assessment (CHNA). Its CHNA will illuminate how much the hospital has thought about housing as a social determinant of health and serve as a useful benchmark to guide initial conversations.”

Follow the Model of Successful Mobility Programs: The Housing Choice Voucher Program in Dallas is notable for helping families find rental units in high-opportunity areas and helping pay moving costs and security deposits. The Dallas Housing Authority Dallas has reported significant success in moving substantial numbers of families to higher-opportunity neighborhoods. Families say their children are doing well in school, and their neighborhoods are more peaceful. However, it’s often the case that vouchers expire before high-opportunity relocations become available. Extending voucher deadlines per typical

waiting lists, source of income protections, and pay-to-stay policies could help.

Healthcare organizations are increasingly looking for ways to reduce medical claims, and affordable housing stands out as ripe for investment. That's why some of the largest organizations like Aetna, United Health Group & Elevance (formerly: Anthem) have invested more than $2.5B in the past two decades and have increased their annual investment volumes over the past few years. Other healthcare companies like Humana are taking notice and building out their own affordable housing investment platforms.

CVS Health: Leading By Example: CVS Health recognizes the direct link between housing, improved health outcomes and lowered healthcare expenditures. Since 1997, CVS Health and Aetna, a CVS Health company, have invested more than $1.5 billion in affordable housing and community initiatives. Aetna has invested nearly $150 million in affordable housing in Texas (more than half of that in the last four years) and provides numerous programs and services to residents to address other social determinants of health such as food insecurity, lack of transportation and barriers to accessing quality healthcare.

Home-based care partnerships between healthcare companies and developers are more important than ever. Project Health, a free mobile CVS Health program, offers blood pressure, cholesterol, glucose level and body mass index

screenings for early detection of chronic conditions such as diabetes, hypertension, and heart disease to affordable housing communities nationwide. Recently, assessments were added to help identify people requiring additional evaluation for depression. Following these screenings, participants meet with a nurse practitioner for low or no-cost treatment referrals and advice on follow-up care. Walter D. Woods, Vice President of Philanthropy at CVS Health said they are “addressing social determinants of health at the community level, which is where we can make a meaningful and lasting impact.”

In addition, CVS Health has an entire team within its Workforce Initiatives Program partnering with state and federal workforce agencies as well as developers to provide innovative employment services and training to underserved communities. The Workforce program has taken more than 120,000 people off of public assistance, breaking the cycle of poverty which often spans generations. Recent data on Aetna Medicaid members in Texas revealed those living in affordable housing experienced a 42 percent decrease in per member/per month costs, a 400 percent increase in mental health outpatient visits (over hospitalization), and a 20 percent decrease in emergency department per member/per month costs. Many other case studies have shown similar statistics. CVS Health’s Keli Savage hopes that over time, they can, “connect all the vast amounts of data to look at prescription adherence, shopping habits, primary care usage, and chronic disease management over a five-year period and be able to show how much that adds up in tax savings.”

Photo Credit: Shutterstock

Housing providers have a key role to play in data collection too, but becoming HIPAA compliant and tracking sensitive health data is not an appropriate role or expectation. If affordable housing providers report resident move-in dates, a health insurer could conduct a cost study analysis to compare the pre- and post-move-in healthcare claims data. For example, their data may indicate a reduction of emergency room visits and increased primary care visits. Likewise, healthcare players new to affordable housing may not care to learn the complexities of tax credit financing and architecture and need to partner with qualified consultants or non-profit organizations.

Megan Lasch of O-SDA Industries noted that, "CVS Health was a stellar partner who went out of their way to provide resources for residents like mobile health checkup buses and wellness checks at the properties in addition to the equity that they provided for the development."

In 2017, Nurses Transforming Healthcare in Spicewood, Texas, providing clinical intake services, conducted a survey and found that 41 percent of patients had significant housing concerns. The survey has continued, and the figure has climbed to 64 percent due to the shortage of affordable homes. Seventy-six percent said they did not go to the doctor as needed due to cost. These findings spurred a pilot program for creating an ecosystem of connected care, community assessment, outreach, education, and programs. The group will publicize success stories from the program

to generate public funding support. Community Nurse Navigators will then pull together a wide array of resources into an app the public can easily access.

Anthem, Inc., the parent company of Amerigroup Texas, has invested millions in affordable housing in Texas as part of Anthem and Amerigroup’s commitment to improving lives and communities. The funds, established through investments made to the federal Housing Tax Credit program, and Amerigroup Texas played an important role in helping to direct funds to Texas initiatives. In Kyle, Texas, $55 million of this funding is helping to finance the Balcones Trails complex, a housing development that will feature onsite healthy living resources supported by Amerigroup.

Funding and incentivizing healthy communities by building more high-quality, affordable homes is just a first step. No single entity can tackle the challenges around health and housing alone, but meaningful progress can be made by sharing strengths and resources. Building relationships takes time and the vision of leaders to get people excited about the benefits for everyone. Small collaborations, like data-sharing, are one way to build trust and learn to communicate effectively across industries. If Texas legislators can streamline the process, ease the regulations put in place over the last decade, and consider additional funding mechanisms, health care and housing organizations can house more citizens in need, meaningfully impact their physical and mental health, reduce expenditures and produce better outcomes and cost savings for all Texans.

Photo Credit: ShutterstockStifel is a global financial services firm providing investment banking, capital markets, and asset management services to corporations, financial sponsors, investors, institutions, and governments. As a national leader in multifamily housing finance, we help our clients achieve strategic objectives through comprehensive investment banking services, in-depth housing sector knowledge, debt structuring, and trading expertise.

• Bonds secured by FHA-insured mortgages

• Essential function workforce housing

• Fannie Mae Tax-Exempt Bond Collateral (M.TEB) (forward and immediate delivery)

• Collateralized short-term multifamily housing bonds

• 501(c)(3) housing bonds

• S&P global ratings and Moody’s Investors Service unenhanced project finance-rated bonds

• USDA rural development pooled bond financings

• Agency and private label securitization

• Fannie Mae workforce housing taxable bonds

455-5594

Strong Texas Begins with a Stable Home and Texas has long prided itself as an affordable place to call home. Housing affordability has positioned Texas as one of the top states in the country for new job creation. The prospect of housing affordability continues to motivate folks to pick up roots and replant them here in search of new and greater opportunities. It’s been quoted countless times, but over the 2010-2020 period, roughly 1,000 people moved to Texas EVERY DAY. With that significant of a swell in population comes strains on infrastructure, housing supply, and overall affordability. It was made clear how prominent a role housing affordability would play in the 88th legislative session when the interim hearings of both House and Senate committees devoted time and focus to the topic. For this reason, TAAHP placed a greater emphasis on pre-session strategy, advocacy, and relationship building ahead of the 88th Legislative Session, which ultimately yielded many positive results.

The Government Affairs/Legislative Advisory (GALA) committee invested a substantial amount of time over the interim session developing a comprehensive list of legislative priorities, drafting proposed legislation, and identifying Housing Champions to carry our message to the Texas Legislature. In the end, our priorities were distilled into 1) crafting a new State Housing Tax Credit program, 2) saving the Public Facility Corporation (PFC) development tool, 3) improving the efficiency of the 4% Housing Tax Credit/Private Activity Bond program, and 4) modernizing the Housing Tax Credit program statute.

Aided by our lobby team, Andrade-Van De Putte and Associates (AVDP), the GALA team set out to make a big impact on the 88th by introducing five pieces of legislation. Advocating for such a robust agenda required a significant amount of legwork and support from our lobby team, GALA committee, TAAHP staff and membership. There were hours spent on planning calls, hosting housing workshops for Freshman legislators and their staff, holding one-on-one meetings with legislators and staff, testifying before House and Senate committee meetings,

You to the GALA Committee Members A

Thank

Emily Abeln, Brinshore Development, LLC

Christopher Akbari, ITEX

Dan Allgeier, Lakewood Property Management

Terri Anderson, Anderson Dev. & Const, LLC

Bobby Bowling, Tropicana Building Corp.

Meghan Cano, CHR Partners

Khayree Duckett, Dominium

Eleanor Fanning, Portfolio Resident Services

and participating in the final bill/deal-making process. All this energy advanced TAAHP’s position as THE voice for housing affordability matters in the State of Texas.

In the end, TAAHP supported bills that successfully passed, including: 1) HB 1058, a landmark State Housing Tax Credit bill, 2) HB 2071, a sweeping PFC reform bill, 3) HB 1766, a private activity bond program improvement bill and 4) HB 4550, a housing tax credit program improvement bill. In addition to those successfully passed bills, we were able to combat several anti-affordable housing bills that would have been detrimental to the Housing Tax Credit program’s ability to put units on the ground where they are needed most.

These victories were not accomplished in a vacuum. They took focused effort by our organization, in concert with others including the Houston Region Business Coalition (HRBC), the Texas Apartment Association (TAA), the Texas Association of Builders (TAB), Rural Rental Housing (RRH), Texas Association of Local Housing Finance Agencies (TALHFA) and the Texas Chapter of the National Association of Housing and Redevelopment Officials (TXNAHRO). If not for our organizations consolidating our strength and advocating as one voice, our successes would have been muted.

Further, TAAHP and the GALA committee owe a debt of thanks to the TAAHP staff; Roger, Whitney, and Naomi, as well as the AVDP team, and the lobby teams of our industry friends that helped to shepherd these bills through to successful passage. Additional thanks to Governor Abbott’s team, including Catarina Gonzales, Lt. Governor Dan Patrick, House Speaker Dade Phelan, and their staff, along with Chairman Lozano and the members of the House Urban Affairs Committee and Chairman Bettencourt, and members of the Senate Local Government committee for giving our issues a venue to be elevated and heard. Lastly, I would like to thank Representatives Goldman, Jetton, Darby, Cunningham, Cortez, and Gervin-Hawkins, plus Senators Perry, Bettencourt, Parker, Alvarado, and Menendez for their willingness to carry these bills and tirelessly champion our priorities as their own.

Debra Guerrero, The NRP Group

Toni Jackson, The Banks Law Firm

Nathan Kelley, Blazer

Dan Kierce, RBC Capital Markets

Tim Lang, Tejas Housing Group

Jean Latsha, Pedcor Investments

Steven LeClere, Monarch Private Capital

Diana McIver, DMA Development Co., LLC

Kim Parker, Palladium USA International, Inc.

Joel Pollack, Streamline Advisory Partners

Rick Sheffield, Rowlett HFC

Janine Sisak, DMA Development Co., LLC

Lisa Stephens, Saigebrook Development

Nick Walsh, The NRP Group

Nathan Kelley Government Affairs Committee Chair

TAAHP approached the 88th Texas Legislative Session with vision and bold ideas about how to address housing affordability issues affecting our state. Throughout the 140 days of the session, TAAHP members prioritized items foundational to the Texas affordable housing industry with a focus on building relationships, advancing legislative priorities, supporting legislation that would advance TAAHP’s mission, and limiting legislation harmful to the industry. As a result of the efforts of so many on the TAAHP leadership team, members, lobbyists, and staff, the Texas legislature passed bills that will positively impact the industry, including establishing a new state housing tax credit funding resource, reforming public facility corporations, and streamlining the private activity bond program. While not all priorities made it over the finish line, TAAHP made great strides in advancing these essential policy solutions during the 88th Texas Legislative Session.

TAAHP began working on strengthening its relationships with members of key housing committees at the end of the 87th Legislative Session. Early last year, the Texas House Committee on Urban Affairs and the Texas Senate Committee on Local Government were assigned housing-related interim charges—directives to committees to study special policy issues and make recommendations for future legislation. TAAHP was not only asked to contribute ideas for potential affordable housing interim charges but was also invited to serve as an expert witness for both committee hearings.

Leading up to the 88th Legislative session, TAAHP’s Government Affairs Committee worked to develop a legislative agenda addressing the most pressing issues facing the affordable housing industry in Texas. Four legislative priorities were formed, including reforming Public Facility Corporations, modernizing Section 2306, instituting a

TAAHP'S 2023

LEGISLATIVE PRIORITIES

Establish a Texas Housing Tax Credit (HTC) Program

Protect & Improve Public Facility Corporations (PFC) to Ensure Workforce Housing for Texans

Modernize Housing Tax Credit Program Regulations to Increase Affordable Housing

Streamline the Tax-exempt Bond Program

88TH LEGISLATIVE SESSION BILL STATISTICS

15 Housing Related Bills Passed

state housing tax credit, and streamlining Private Activity Bonds. Made up of over 42 members, TAAHP’s Government Affairs Committee and its four subcommittees, each of which focused on one bill, worked diligently to develop recommendations for what would ultimately be included in draft bills.

TAAHP hosted two complimentary luncheons and presentations at the Texas Capitol months before the session began. Over 30 participants representing Texas House and Senate legislators, the Governor’s office, and TDHCA attended the lunch and learn events. Presentations provided information about the affordable housing industry in Texas and various policy changes that can collectively help preserve and produce affordable housing.

tion was recognized with a resolution on both the House and Senate floors as Affordable Housing Day at the Capitol.

It is through these combined efforts that TAAHP was able to successfully educate legislators about Housing Tax Credits and position itself as a valuable resource in the affordable housing space.

Execution: Delivering

TAAHP’s Government Affairs Committee, its leadership, lobby team, and staff worked diligently to connect with as many legislators as possible throughout the session. Meetings occurred with all members from the House Urban Affairs Committee and Senate Local Government Committee, the Lt. Governor’s, Governor’s and the Speaker’s offices, and many other key members. Numerous one-on-one presentations were made to elected officials, specifically those in priority committees such as Local Government and Urban Affairs, with a goal to inform and educate legislators about the importance and impact of each priority measure.

Over 80 TAAHP members met with all 181 Texas legislators to deliver TAAHP's message and legislative priorities at the Texas Capitol on behalf of the industry for TAAHP’s Rally Day on March 21st. For the first time in TAAHP’s history, the organiza-

More than any other session, TAAHP was sought out to provide input on housing bills and offer testimony and support. TAAHP members traveled from across the state to testify at committee hearings and drop cards in support for 15 bills. TAAHP also successfully opposed bills that would have made it more difficult to build affordable housing in the state, such as HB 2856 from Rep. Valoree Swanson that would have required state representative letters for 4% housing tax credit transactions. At one hearing, three TAAHP members were at the Capitol until 11:30 PM testifying in support of TAAHP supported bills. Without a doubt, TAAHP members have been the association's most valuable advocacy resource.

TAAHP leadership went above and beyond to build the organization’s reputation and collaborate with other organizations throughout the state, and these efforts proved to be worthwhile. TAAHP worked consistently with the Texas Apartment Association (TAA), Texans for Reasonable Solutions, Houston Region Business Coalition (HRBC), Texas Housing Group (includes six major TX metros), Texas Association of Builders (TAB), Texas Association of Local Housing Finance Agencies (TALHFA), Rural Rental Housing Association (RRHA), and Real Estate Council of Austin (RECA).

continued on next page...

TAAHP’s active involvement during this legislature, both in supporting and opposing bills, yielded positive results.

HB 1058: State Tax Credits Texas’ most significant achievement in affordable housing was the passage of HB 1058 by Representative Goldman establishing an annual $25 million State Housing Tax Credit that would mirror and supplement the federal HTC program that is continuously oversubscribed. TAAHP became engaged with this bill after failing for two consecutive legislative sessions. Rep. Goldman reintroduced HB 1058 for its third attempt this session and its successful passage will make Texas the 27th state with its own state tax credit program. This state housing tax credit is a long-term, permanent solution that will help to cover the funding gaps on developments and sustain affordable housing construction over the next 10 years. It brings private investment dollars into Texas communities in exchange for credits against state insurance premiums and corporate franchise taxes. It is the most significant financial commitment by the state of Texas towards addressing its housing affordability crisis.

HB 2071: Public Facility Corporations Authored by Rep. Jacey Jetton, HB 2071 was one of a dozen bills that sought to add guardrails to the state’s public facility corporation’s statute. Public Facility Corporations (PFC) are a critical tool for creating housing and economic development. This session, the goal was to protect the PFC tool from being eliminated, create a state structure that allows for local flexibility, and improve the program to better align the public benefits with private sector incentives. After months of negotiations with different stakeholders on how to save the program, HB 2071 received overwhelming bipartisan support in both chambers of the Texas legislature. The bill

passed with votes of 142-5 in the House and 28-3 in the Senate, signaling widespread consensus among lawmakers that the concerns of the program needed to be addressed.

TAAHP members were heavily involved in the successful passage of HB 2071. Every committee hearing for the PFC bill had immense TAAHP representation. HB 2071 was the first PFC bill to be heard by the Urban Affairs Committee, where over 30 TAAHP members submitted letters of support and provided public testimony. In preparation for HB 2071 on the House Floor, TAAHP launched an advocacy email campaign where we asked members to email letters to their legislators encouraging them to support the bill. Over 50 letters were sent to 33 House members – our most effective advocacy campaign to date.

HB 1766: Private Activity Bonds Authored by Rep. Drew Darby, HB 1766 institutes a conditional 55 percent bond financing cap applicable in a year when demand for private activity bonds is too high. Currently, no limit exists for how much of the total cost of a development may be financed using these private activity bonds, which can lead to developers using the bonds to cover far more than the 50 percent of costs required to receive the tax credit, ultimately diluting the pool of available PAB funding. This bill would also give top priority to properties that closed a reservation of bonds within four years of the application but needed additional bonds to remain eligible to receive 4% housing tax credits and to properties that previously received an allocation but need additional PAB issuance to maintain compliance with the 50 percent financed-by test.

HB 4550: Section 2306 Improvements HB 4550 increases the developer cap from $3 million to $6 million, adjusts cost

of square foot limitations to reflect inflation, and requires TDHCA to issue the final 8609 commitments within 120 days from the date when the department received the complete cost certification. This bill included two of three of TAAHP’s priorities – increasing the developer cap and addressing cost per square foot.

HB 14: Third Party Reviews Filed by Rep. Cody Harris, HB 14 streamlines the approval process for property development and building reviews, requiring cities and counties that fail to complete such projects in a timely manner to utilize third-party reviewers. Site plan reviews consume the most time in the permitting process, and long delays increase the development cost. Tackling this bureaucratic bottleneck can relieve backlog and pressure on staff.

HB 2127: Landlord/Tenant Regulations Endorsed by the Texas Apartment Association (TAA), HB 2127 ensures consistent and predictable landlord/tenant laws in Texas. Currently, local regulations create a patchwork of different rules across the state that are burdensome and confusing to landlords. The law explicitly blocks cities from regulating evictions or otherwise prohibiting, restricting, or delaying the eviction process.

With more than 8,000 bills filed in the 88th Texas Legislative Session and only 15 percent successfully passing out of both chambers, no one ever expects to get all priorities addressed in a single legislative session and TAAHP's priorities are no different. While this session proved to be the most successful in TAAHP's history, there is still much work to do. Of TAAHP's 88th Legislative Session goals, the following measures did not make it to the Governor's desk this time around:

• Census Tract Rule modernization

• Limits to Resolution of No Objection requirements

• Some components of Private Activity Bond program improvements

The 88th Legislative Session proved, once again, to be a whirlwind process of give and take to navigate the rough waters of what is the Texas legislative process. Overall, TAAHP was successful in its efforts to improve the standing of affordable housing in the State. Now that the session is over, the process for preparing for the 89th legislative session is already underway.

A leader in multifamily and affordable housing finance, providing debt and equity solutions nationwide.

Merchants Capital is ranked the Affordable Housing Lender nationwide. * #2

*Affordable Housing Finance 2022 Top Lenders survey.

Government policies typically begin with good intentions but throw in a scandal and a Federal court case, and soon endless layers of rules and oversight are added, along with unintended consequences. Such is the case with efforts to avoid creating high-poverty areas in Texas, referred to as “deconcentration,” for housing developed using housing tax credits (HTC). Texas has the most regulated Housing Tax Credit program in the U.S. with a lengthy Qualified Allocation Plan (QAP) to prevent an over-concentration of poverty. In fact, developers are working hard to follow the QAP and provide beautiful, well-maintained, supportive communities with access to amenities and jobs that lift people out of poverty.

For better or worse, Texas doesn’t regulate or incentivize market-rate privately owned developments or investors to maintain or improve aging or ill-kept properties (sometimes owned and operated by what many refer to as slumlords). These impoverished areas are what most people, including lawmakers, think of when they hear the term “affordable housing.” Generally, people care about those less fortunate, but primarily with a “not in my neighborhood” stigma that pervades an industry striving to serve our working families and the elderly. To be fair, elected officials just want to represent their constituents and keep them happy. The result is that numerous, desperately needed affordable housing developments are halted by outdated, inaccurate perceptions, neighborhood disapproval, and overly prescriptive regulations, such as strict deconcentration factors (see the sidebar) delaying, or in some cases pre-

venting, the revitalization of impoverished areas with the development of quality, affordable housing.

Industry regulations complicate matters further:

1. Multiple restrictions and costly requirements make new HTC builds nearly impossible

2. Land costs combined with zoning issues compound the problem

3. Trying to simultaneously serve the most populated cities and most rural areas in the nation with limited resources and a “one size fits all” program isn’t working

4. Our most populous cities have no authority to appeal or overrule decisions of the stateadministered housing tax credit program

The issue that perpetuated poverty concentration began in 1986 when the Housing Tax Credit Program incentivized private entities to invest in qualified census tracts by offering a 130 percent credit to develop within them. The Qualified Census Tracts Program was actually set up to incentivize building or refurbishing these impoverished areas, many of which were already racially segregated. After a case was tried in federal court claiming the 130 percent credit perpetuated institutionalized segregation, the Texas legislature pre-emptively included deconcentration factors into state law. These changes resulted in about

half the awards going to tracts with above-average white populations. Despite the fact that in 2015, the Supreme Court ultimately sided with the TDHCA in the case, the deconcentration factors codified by the legislature in 2013 remain.

In another case in 2000, a member of the Texas Department of Housing and Community Affairs board was convicted of mail fraud for conspiring with a developer to buy land and corresponding housing tax credits. This left another black eye on the agency, according to well-known multifamily developer and TAAHP Past President, Diana McIver, who said:

"In response to this controversy…the state legislature worked to restore credibility to the Texas Department of Housing and Community Affairs and add transparency to the application process in 2001 when they began to heavily legislate the QAP" including:

• the creation of a pre-application process

• the addition of much more transparency, such as allowing applicants to visit TDHCA offices and view competing applications, a process that is now online, instead of filing a formal request

• implementing a scoring ranking system. Previously, although applications were scored, the scoring was inconsequential. Now applications that meet threshold requirements and incorporate desired development characteristics are awarded tax credits

• requiring review and support from neighborhood organizations and state elected officials

• obtaining support from local governments

• notifying community leaders, including school district superintendents

McIver noted, “Such a high-level involvement by the state legislature is rare in HTC programs across the country; generally, the board and staff are policymakers.”

Any proposed development must meet the following eligibility (threshold) requirements:

1 Two Mile, Same Year – Cannot award two developments in the same year and county that are within two miles of one another. Houston can waive this rule.

2 Twice the State Average Per Capita (9% & 4% HTC) – Cannot award a development within a municipality or county that has more than twice the state average of HTC units per capita.

3 One Mile, Three Year* (9% & 4% HTC) Cannot award a development that is a mile or less from another development that was successfully awarded within the last three years that serves the same target population. Applies to counties over 1 million in population.

*Can be waived by local resolutions

4 Census Tract Limitation – Cannot award a development in a tract that has more than 20% HTCs per total households. Applies to areas with a population over 100,000. Unless in a place where the population is less than 100,000.

5 Proximity to Development Sites (9% HTC) – Cannot award two developments in any given application round that are within 1,000 feet of each other that serve the same target population, applicable only in a county with a population less than 1 million.

6 One Award Per Census Tract (9%) –Cannot award two developments in the same year and same census tract in an urban subregion.

Housing Tax Credits and the Qualified Allocation Plan are the building blocks that help redefine our cities by creating healthy, sustainable communities that serve the needs of many different population groups – not just house people. Many members of the general public would be surprised to learn that the vast majority of housing tax credit developments include typical features found at any market-rate property, such as pools, playgrounds, fitness centers, and computer labs, as well as proximity to amenities like public transportation, childcare, and community revitalization efforts. The QAP also encourages the development of energy-efficient and environmentally sustainable affordable housing via scoring incentives for green building practices.

Research shows that moving families from high-poverty areas to neighborhoods with higher incomes can lead to better economic outcomes for children and adults. Studies, such as the Moving to Opportunity (MTO) experiment, found that children who relocate to higher-income areas experience increased educational attainment, higher employment rates, and higher earnings later in life. Relocating families to neighborhoods with lower crime rates and safer environments can positively impact their safety and security and also contributes to a better quality of life. However, there are incentives to build in high opportunity areas and extreme de-concentration measures are not necessary to further encourage developers to do so.

The QAP fosters collaboration between government agencies, nonprofit organizations, and private developers, encouraging partnerships that can leverage resourc-

es, expertise, and community engagement to maximize the impact of affordable housing initiatives.

Modify the “Two-Mile, Same Year” Rule: Created with good intentions over 20 years ago, this factor has limited the ability of large cities (except for Houston which can waive the rule by city council approval), to support highly qualified developments near dense job centers and transit-oriented development areas. Growing cities know their local landscape best and should be empowered to waive this rule. Amy Connolly, assistant director of the City of Fort Worth Neighborhood Services Department, noted the dire impact on cities with the following points:

1. Lost revenue: Most of the 9% tax credit deals pay property taxes. When deals fall through:

a. Cities and property taxing jurisdictions lose the property taxes gained when law limits them to one development within two miles.

b. Cities lose revenue from building permits and fees.

c. Cities also lose the federal investment in private housing markets when they cannot be awarded more than one development within two miles.

2. A housing shortage crisis: Fort Worth is currently facing a 32,000+ affordable rental housing unit shortage. This means denser urban areas compete with themselves for needed developments or have to wait longer to apply for additional developments — adding cost.

3. Diverse areas are not recognized at a state level: Most competing developments are not in the same neighborhood and are separated by major interstates or state roads. The Two Mile Rule is too blunt an instrument for ensuring that there is no concentration in poverty.

Continued on page 48

No one would say that these two locations are in the same neighborhood or the same “area of town.” Each development is located on opposite sides of I-35, opposite sides of rail lines, and major streets.

NOT APPROVED

Crossroads Apartments

1105 E. Lancaster Avenue, Fort Worth, TX 76102

Proposed by Union Gospel Mission Applied for tax credit of $9,286,300

continued from page 46

4. Losing out on developments: Fast-growing urban villages, transit-oriented development areas, and tax increment districts are pitted against each other for new tax credit developments OR they lose out on the development altogether.

68 total units of affordable housing, including extremely low-income housing units

APPROVED

Magnolia Lofts

300 E. Magnolia Avenue, Fort Worth, TX 76110

Proposed by The NRP Group Received tax credit of $15,000,000

67 total units of affordable housing, including extremely low-income units

In

5. Zoning Competition: Where otherwise two separate developers might obtain all necessary local approvals to move forward, the knowledge that only one development will be awarded tax credits creates unnecessary competition that often results in politics playing a bigger role than policy with respect to the production of affordable housing.

Diana McIver DMA Companies, Presidentmy opinion, there was a mistake in that one mile becoming two-mile rule – they should have been set it up to serve different populations… like senior versus family versus supportive housing for the homeless because they each serve three different demographics.

Remove The “One Award per Census Tract Rule”: The 9% housing tax credit program incentivizes housing developments in census tracts where there are no other existing tax credit developments. This requirement emphasizes development sites in less attractive locations where market demand is more limited and disincentivizes developments in densely populated urban areas where there is the most need. Additionally, this limitation causes developers to pursue sites in the same census tracts within a region, thereby increasing land prices when only a few census tracts are favored in the tax credit scoring matrix and multiple developers are competing for those same sites.

Lack of legislative support for modifying deconcentration seems to stem from the fear of mass expansion of impoverished areas, yet the factors TAAHP recommends keeping ensure that won't happen. TAAHP proposes that legislators view this from a conservative lens and instead loosen the regulations put in place to help more citizens, developers, and the economy by placing housing where residents need it. In the next legislative session, TAAHP will work to gather support, educate, and improve communication with decision-makers in the Capitol.

Grant large Texas municipalities flexibility on state regulations that affect where developments are located. Amending the Resolution of No Opposition (RONO) requirement for 4% HTCs and removing the clean census tract point incentive would significantly open up more areas to build affordable housing. . These major cities have robust planning capabilities, data, and the knowledge to do so effectively. The state allowed this in Houston yet has rejected it for our other major cities according to McIver.

Change local zoning restrictions: Amy Connolly stated that, “where the schools are really good, and property values are high, and income levels are higher, you tend to get more points. But the problem is, those are the hardest places to get zoning. There's plenty of multifamily zoning in Fort Worth, but the vast majority of the tax credit development that has come to us in the last two years required rezoning. So, while we have a lot of multi-zoning, it’s probably not in the places where you’re going to get a tax credit.”

Change the conversation: In the same way that ad campaigns have made smoking “uncool” and spurred public smoking bans, educating our legislators and the general public by showing what affordable housing looks like today can change public opinion – and then perhaps the need to ask for community approvals becomes moot.

Finally, the Texas Tribune cited another big issue in March of 2023: Texas just isn’t building enough homes to keep pace with its population boom. In fact, “Texas, a state of more than 29.5 million people, ranked 49th in state spending on housing and community development as a share of its overall budget.”

Texas built its reputation on providing a plethora of good jobs and affordable housing which is why so many are still moving here. Right now, we don’t even have enough housing for those who can afford it. While the right way to create affordable housing is a controversial issue and there is no single idea that will solve it, these suggestions are a start. Helping the most vulnerable among us is exactly the way a rising tide lifts all boats creating more revenue, tax dollars, and better health for all our citizens. The perfect storm is brewing for more poverty and homelessness if we don’t address our overall housing shortage and ease the stifling restrictions of deconcentration.

TAAHP offers several ways to stay informed and get involved. TAAHP sends e-mail newsletters monthly to members. Members who want to take a more hands-on approach can get involved in TAAHP committees. For more information, visit www.taahp.org

ABOUT US Community Housing Resource (CHR) Partners is a national nonprofit, based in Texas, dedicated to developing quality, affordable housing with built-in social services.

Onsite social services like job readiness programs, financial literacy, and afterschool homework help are offered at no additional cost to residents.

Promotes self-sufficiency, education, health and wellness, and stable communities, allowing residents to improve their lives.

We partner with experienced residential developers to increase the stock of quality for affordable housing nationwide.

Together with local businesses and community leaders, we empower lowincome residents to flourish, prosper and grow

Our advisors provide a wealth of industry insight, resources, and support for maximum

We’re resourceful, experienced, creative problem solvers in affordable housing and financing. With a specialty in the Housing Tax Credit program and other state and federal funding sources, we guide our clients through the process in Texas while mitigating the bureaucracy. One of our proprietary GIS “viewer” mapping system facilitates the site selection process and structure a successful real estate transaction.

“We’re pleased to open our second affordable housing community in Austin to address the needs of Latinos and working families. It’s fitting to name this property after Lena Guerrero, a positive force in the community who fought tirelessly for farmworkers and the disenfranchised,” said Paul Chavez, president, Cesar Chavez Foundation. “She embodied the values of our organization’s founder, civil rights and farm labor leader Cesar Chavez.”

The Cesar Chavez Foundation’s (CCF) newest affordable housing community in Austin, Los Portales de Lena Guerrero, features 97 units of affordable housing for families, including four permanent supportive units for transitional-aged youth in partnership with Lifeworks, an Austin-based nonprofit dedicated to improving the lives of youth and families from crisis to safety and success.

The community houses a Si Se Puede Learning Center, CCF’s flagship after school program available to young residents offering services including arts and crafts, after-school homework assistance, social events, annual income tax preparation, notary service, and health fairs. Community amenities include a picnic area, playground, and multi-use community space, as well as resources for transitional-aged youth in the Austin area.

“We are proud to work with LifeWorks in building sustainable and affordable living spaces for families and transitional-aged youth in need of housing. We are setting the bar for what can be achieved both individually and community wide, ”said Alfredo Izmajtovich, executive vice president of housing and economic development for the Cesar Chavez Foundation.

The property includes 97 affordable units developed using 4% low-income housing tax credits from TDHCA, AHFC General Obligation (GO) Bonds, City of Austin CDBG Funds, a Citibank construction and permanent loan, and National Equity Fund (NEF) equity.

Developer: Cesar Chavez Foundation

Syndicator: National Equity Fund

Lender: Citibank

Architect: JHP Architecture

Families and individuals earning between 30 and 60 percent of the Area Median Income (AMI). In addition, at least four units are leased to transition-aged youth referred to the community and served by LifeWorks. The Housing Authority of the City of Austin referred voucher holders to the property as well.

• On-Site Maintenance

• Playground

• Pool

• After School Programs

• On-Site Management

SUPPORTIVE SERVICES

• Adult, Health and Community Supportive Services

• Partnership with LifeWorks

For More Information please contact: Ellen Moskalik, emoskalik@chavezfoundation.org

THE POWER TO

At the 2023 Texas Housing Conference, we congratulate the Texas Affiliation of Affordable Housing Providers for community outreach that’s making a lasting difference in people’s lives.

In the State of Texas, the Texas Affiliation of Affordable Housing Providers is known for advocating and promoting the development of Affordable Housing.

We’re proud to share our goal of improving lives with you.

What would you like the power to do?

At Goodman, we believe in American dependability. Units are designed, engineered and assembled in the U.S.A.

Hartwood at Canal boasts an unparalleled community in Houston’s historic Second Ward. At our brand-new community, you’ll find shared spaces for relaxation, productivity, and entertainment. Canal offers nine floor plans available in one, two, and three bedroom layouts. Hartwood at Canal offers a pet-friendly home to fit every lifestyle. Canal has an inviting interior that includes wood-like floors, large windows for ample natural light, island kitchens, stone countertops, tile backsplashes to create a modern cooking space and so much more. Our gated community has over

7,500 square feet of amenity and green space. Canal mixed floorplans are offered at 30, 50 & 60% AMI and market rents which caters to working families, seniors and veterans with incomes ranging from $15K to $60K. Canals’ commitment to our residents is to create an exceptional living experience while enhancing the value of our communities. Hartwood at Canal implements programs, such as our After School Program, food pantry, walking club and job placement opportunities to promote a sense of belonging among residents, our values of pride, connection, care and belonging serve as our compass.

150 Units: 10 at 30% AMI, 40 at 50% AMI, 50 at 60% AMI and 50 offered at market-rate

9% Tax Credits funds through Texas Department of Housing and Community Affairs and HOME Funds through the City of Houston

Location:

5601 Canal Street

Houston Texas 77011

Spacious clubroom with kitchen, swimming pool with tanning deck, children's activity room, fire pit, fitness center, media/game room, business/learning center and library, on-site storage, gated entry, parking garage, dog park, elevators and package lockers

Children supportive services, monthly food pantry, annual health fair, weekly exercise classes, notary services, arts & crafts twice monthly

Developer: Canal Street Developers, LLC

Syndicator & Lender: Bank of America, N.A.

Architect: Mucasey & Associates Architects

Built Green

so Residents Can Save Even More!

Energy Star-Rated Appliances

Hurricane Harvey besieged Houston in August 2017 with the most destructive storm in the City's history. A mind-boggling 60 inches of rain and Category 4 winds devastated the City over four days causing $125 billion in damages and displacing thousands of Houstonians.

In an effort to help replace valuable apartment homes that were lost during Hurricane Harvey, AMTEX partnered with the City of Houston, APV Redevelopment Corporation, and Harris County Community Services Department to build Richcrest, a 288-unit affordable housing community, with a grant from HUD, which included Hurricane Harvey CDBG Recovery funds.

AMTEX greatly appreciated its partnership with Houston Housing Authority to secure the Land Lease for the much-needed property tax exemption, and with Harris County, which provided the funds necessary to make the project financially feasible through the CDBG-DR Harvey funds.

Richcrest, completed in 2022, now beautifully graces the Greenspoint High Opportunity (Priority) area of North Houston serving residents with well-appointed apartment homes and service-rich programming. The 13-acre site was chosen, in part, because it did not suffer Hurricane Harvey storm damage, nor is it in a flood zone.

The Richcrest development team exceeded its 34% Section 3 goal in hiring Minority/Women Business Enterprise businesses to work on the project as a commitment to help struggling contractors and local business owners also recover post-Harvey.

To help give under served children unique learning opportunities, Richcrest partners with the local YMCA and dedicates special areas of the community for after-school enrichment

Location: 540 Richcrest Drive Houston, TX 77060

For More Information please contact: Mark Morgan, AMTEX / AMCAL Phone: (818) 706-0694 ext. 176 mmorgan@amcalhousing.com

programs, water safety and swimming classes, supportive services, and a Teen Leadership and Education program.

For its admirable contribution to Houston's recovery efforts and restoring affordable homes, AMTEX's Richcrest Apartments won CoStar’s 2023 Impact Award for Multifamily Development of the Year for Houston.

288 Units 1-, 2- & 3-bedroom units. 100% of the units are affordable for individuals and families earning between 30% and 60% AMI.

The total project budget for Richcrest Apartments was $57,665,567. Project funding included a $16,710,000 loan from Harris County Community Development Block Grant Disaster Recovery (CDBG-DR). Hudson Housing Capital funded the $17,915,567 in competitive 4% tax credits from the Texas Department of Housing and Community Affairs. Citibank provided the construction loan ($30 million) and a permanent loan for this project. ($23 million).

Photos by Mitchell Hester/CoStar

Photos by Mitchell Hester/CoStar

• Furnished Clubhouse/Community Center featuring Kitchen and Dining Room, Mail Room, Fitness Center, and Business Center

• Children's Play Area

• Swimming Pool

• Picnic Area and Grill Facilities

• Fully Enclosed Dog Park

• Community Garden

• Proximity to the Greenspoint area of Houston, bus transportation, Harvest Time Church, Greenspoint Elementary, Houston Police Academy, Greenspoint Mall, George Bush Intercontinental, Manufacturing & Distribution employers, including Amazon HOU2.

• Health and Nutrition Programs

• After School Programs and Tutoring

• Computer Training

• Job Training

• Parenting Classes

• Water Safety and Swimming Classes

• Teen Leadership Program

Natural gas offers measurable advantages to help you stand out from the competition – lower energy bills, readily-available hot water, the most preferred cooking method and more. CenterPoint Energy’s Natural Gas Advantage Multi-Family Program helps you add up even more benefits. Visit us at booth #8 to discover we can add to your bottom line with:

• Cash incentives

• Favorable utility allowances

• Energy, cost and environmental savings benefits

CenterPointEnergy.com/Multi-Family

Josh Tingler • 713-207-4320

Joshua.Tingler@CenterPointEnergy.com

CenterPointEnergy.com/Multi-Family

©2023

Houston, TX

Developer: AMTEX Multi-Housing, LLC / AMTEX Richcrest Fund, LLP

Syndicator: Hudson Housing Capital

Lender: Harris County CDBG, Hudson Housing Capital, & Citi Bank

Architect: HEDK Architects

The Richcrest development team exceeded its 34% Section 3 goal in hiring Minority/Women Business Enterprise businesses

All units offer contemporary living for residents with balconies/ patios, ample storage space, and modern kitchens and bathrooms included in every unit. All kitchens have garbage disposals, dishwashers, and other amenities. Each unit also includes connections for a washer and dryer and provides a ceiling fan in each bedroom. Also, Richcrest will have security cameras installed including license plate cameras at the entrance to provide safety for residents and property management can monitor all activity on the cameras from anywhere.

so Residents Can Save Even More!

Energy Star® Appliances

15-SEER AC Units

For More Information:

(817) 230-4111

www.kestreloncooper.com

Kestrel on Cooper is a mixed-income, multi-family community in central Arlington, providing 90 units of high-quality affordable housing available to households at various income levels. The three-building property has units available at 30%, 50%, and 60% of area median income and market rate.

Saigebrook and O-SDA worked closely with the City of Arlington and the Heart of Arlington Neighborhood Association to ensure the development met the needs of the residents it would be housing, integrating the community in every stage of design and development. In their commitment to Art in Public Places, Saigebrook and O-SDA partnered with local artist and sculptor, Art Fairchild, who created a custom sculpture that compliments that context of the community and is on display for all to enjoy. The final art selection was made by members of the Heart of Arlington Neighborhood Association.

Quality, affordable housing is critical to creating a thriving local economy. We are proud that Kestrel on Cooper helps meet the need for affordable yet modern housing solutions in an urban center that is close to jobs, schools and Arlington’s bustling Entertainment District.

Megan Lasch O-SDA Industries President

Megan Lasch O-SDA Industries President

so Residents Can Save Even More!

Kestrel on Cooper was a 2020 LITHC 9% award, this property was in the process of going through a very active community engagement process to obtain zoning approval when the global pandemic hit. The development team had to pivot and figure out how to keep the zoning process moving forward while learning to build “virtual relationships” and trust with the surrounding community. It was imperative to keep the process moving forward to meet the TDHCA commitment deadlines for funding.

The project started construction in May of 2021 and also had to overcome massive construction cost increases during the construction bidding and closing process. Luckily, between the determination of the development team, the City of Arlington’s willingness to step up and provide creative financial assistance, and the Supplemental Credits issued through TDHCA, the project was able to move forward. The development was completed on time and on budget in the fall of 2022 and is on set to convert to permanent financing in June of 2023. This project is a true testament to the importance of a collective problem-solving approach between developer, local government, and TDHCA.

Kestrel on Cooper has a National Green Building Standard (NGBS) Certification and incorporates Energy Star appliances, high-efficiency lighting, and low-flow plumbing fixtures.