29 Sustainable Denim Production Using Open-End Versus Spun Yarn Kontoor Brands is examining its manufacturing processes to look for ways to reduce energy and its carbon footprint.

29 Sustainable Denim Production Using Open-End Versus Spun Yarn Kontoor Brands is examining its manufacturing processes to look for ways to reduce energy and its carbon footprint.

CComing off the challenging but strong year in 2022,the textile industry faces additional challenges and opportunities in 2023.

This issue of Textile World features a review of investments made last year in the industry — and it is an impressive list.Companies large and small in a variety of diverse industry sectors clearly illustrate an appetite for investing in U.S.textiles.

Large,historic companies like Mount Vernon Mills and Milliken & Company continue to invest in capacity.On the other hand,family owned business Beverly Knits is creating new opportunities with Creative Dyeing & Finishing LLC.The acquisition gives Beverly the ability to provide solutions from knitting all the way to a completed garment.

Yes,there are headwinds in the economy with rising interest rates,inflation and faltering economies around the globe.But there also are positive trends like near-shoring and the clear demonstration that global supply chains are vulnerable —a fact made evident during the pandemic.

The year 2023 also is a year jam packed with industry events with something for everybody —ITMA 2023,INDEX™23, JEC World 2023,Techtextil North America/ Texprocess Americas and the Advanced Textiles Expo,just to name just a few.But the schedule begs the questions: Has COVID changed the show and sales environment significantly? Will people want to participate? Will exhibitors invest? Will attendees travel?

The consensus seems cautious,but optimistic on both fronts.There are many people who miss the networking and sense of discovery that trade shows bring,as well as the search for and discovery of new technologies that can be leveraged or considered in a company’s investment plans.

The strong dollar may hurt U.S.exports but compared to recent years,it creates a buying

opportunity for U.S.companies to purchase equipment from euro-denominated suppliers.

In addition,there is investment chasing new dominant trends in the industry that are tied to green and sustainable manufacturing — things that measurably reduce the carbon footprint of textile manufacturing. Technologies that reduce consumption of water,energy,use more environmentally friendly chemistries,and less of them,are sought after.And new materials that have a “greener”story than traditional products are being explored.

It seems that brands and retailers continue to drive demand.And demand parameters have changed over the past five years. The cheap needle and a blind eye to sources have shifted to a place of valuing things such as traceability,authenticity and ethical origins of manufacture.More and more,companies are appointing a chief sustainability officer or vice president of sustainability.It may not be a bad thing to see these initiatives and investments valued in the supply chain.

Surely,2023 will see accelerating changes in the industry.The one thing that has always stood out about U.S.textiles is the companies that are successful have found success because of quick and smart adoption of innovations and acceptance of change.By all counts those qualities remain important today.

Fingers crossed that a negative black swan doesn’t shift the gears of the post-COVID recovery,and just maybe 2023 will yield more opportunities and fewer challenges.

James M. Borneman jborneman@TextileWorld.com

EDITOR IN CHIEF James M. Borneman

EXECUTIVE EDITOR Rachael S. Davis

TECHNICAL EDITORS Dr. Lisa Parillo Chapman

Dr. Peter J. Hauser

Dr. Trevor J. Little

Dr. William Oxenham

Dr. Behnam Pourdeyhimi

Dr. Abdel-Fattah Seyam

Dr. Andre West

CONTRIBUTING EDITORS Jim Kaufmann

Stephen M. Warner

INTERNET CONTENT EDITOR Rachael S. Davis

CIRCULATION MANAGER Julie K. Brown-Davis

ADVERTISING BUSINESS MANAGER Denise Buchalter

ART & PRODUCTION MANAGER Julie K. Brown-Davis

OWNER/PUBLISHER James M. Borneman

ADVERTISING REPRESENTATIVES

UNITED STATES/CANADA Turner Marketing & Media, LLC

+864-594-0921 • sturner@textileworld.com

MEXICO, CENTRAL & SOUTH AMERICA Virgilio L. González

+ 58-412-622-2648 • Fax +58-212-985-7921 • vlgonzalezp@gmail.com

EUROPE (except ITALY) Sabine Dussey

+49-171-5473990 • sabine.dussey@dussey.de

ITALY Ferruccio & Filippo Silvera

+39-022-846716 • Fax +39-022-8938496 • info@silvera.it

ASIA James M. Borneman

+678-483-6102 • jborneman@textileworld.com

INTERNET & CLASSIFIEDS OPPORTUNITIES Julie Davis

+678-522-0404 • jdavis@textileworld.com

PO Box 683155 | Marietta, GA 30068, USA

Telephone +678-483-6102 | www.TextileWorld.com

Pearl River,N.Y.-based Anellotech has announced plans to start advanced lab testing and scale-up of its Tex-TCat™ mixed textile waste recycling technology. The solution is a fluid bed catalytic pyrolysis process that effectively recycles mixed waste textiles directly into the same chemical feedstocks such as benzene,toluene and xylenes.The closed-loop, fiber-to-fiber process then uses these compounds to make virgin polyester and nylon.According to the company,lab-scale studies have shown that Tex-TCat is capable of handling a variety of textile materials including cotton, polyester,nylon,elastane, acrylic and polyurethane. The technology is one solution to the mixed waste stream that ends up in landfills since it tackles single fiber garments as well as blends and traditionally non-recylable blends.

“Tex-TCat has the potential to divert large quantities of previously unrecyclable textiles from landfills and provide major brands,through their existing suppliers, with recycled content,”said David Sudolsky,president and CEO of Anellotech. “The technology promises to be a key enabler of the textile industry’s work to become more sustainable.”

Advanced materials manufacturer Hollingsworth & Vose (H&V), headquartered in East Walpole,Mass.,has announced a $40.2 million expansion project in Floyd County,Va.The expansion includes a 28,000-squarefoot addition to existing facilities and will add 25 new jobs.Governor Youngkin approved a $558,700 grant from the Commonwealth’s Opportunity Fund to assist Floyd County with the project.

“Hollingsworth & Vose has generated positive economic impact and job opportunities in Floyd County for more than four decades,and this significant investment further solidifies the company’s commitment to Virginia,” Governor Youngkin said.

“We’ve been a part of the Floyd,Virginia,community since 1976,”said Josh Ayer, H&V CEO.“This facility is essential to serving both our global and domestic customers.We chose Virginia for this expansion because of its positive business environment and strong support from the Commonwealth of Virginia and Floyd County.”

Warp knit fabric producer Apex Mills,Inwood,N.Y.,has announced plans to acquire a former HanesBrands facility in Patrick County,Va.The

revalyu Resources,a Germany-based chemical polyethylene terephthalate (PET) recycling company, has announced plans to open its first U.S.based PET recycling plant in Statesboro,Ga.The $50 million investment covers the initial phase of the development,which when complete,will result in capacity to process more than 225,000 pounds per day of post-consumer plastic bottles into sustainable esters and rPET chips. The facility will employ 70 associates initially.Eventually,the facility will have capacity to process up to 450,000 pounds per day. revalyu reports its proprietary chemical recycling process has processed more than 6 billion bottles into recycled PET of the highest purity.According

$3.1 million investment will retain 96 jobs and create 44 additional positions. Apex will maximize the full capacity of the facility to fulfill contracts for the Hanes basic apparel brand.Virginia Governor Glenn Youngkin approved a $300,000 grant from the Commonwealth’s Opportunity Fund to assist the county with the project. Apex Mills also is eligible to receive state benefits from the Virginia Enterprise Zone Program as well as funding and services to support employee training through the Virginia Jobs Investment Program.

“The Apex Mills family of companies has been

to the company,its process uses 91-percent less energy and 67-percent less water than conventional polyester recycling processes.revalyu’s rPET chips may be used in any sustainable PET product, but are mostly used in the textile industry.

“We thank all our U.S. customers,partners,and the Statesboro community for their support,trust, and confidence in us,”said Jan van Kisfeld,managing director of revalyu.

”Expanding our operations to the U.S.is an important milestone for our global expansion strategy.It brings us closer to our target of recycling more than two million pounds of used PET bottles per day by 2026 and contributes to solving the plastic waste problem.”

manufacturing Made in the USA textiles for 80 years,and as part of our dedication to support and grow the domestic textile industry we are continually seeking facilities and communities committed to this same goal,”said Jonathan Kurz,president and CEO,Apex Mills.

“When we became aware of the imminent closing of the HanesBrands Woolwine operation and learned more about the rich tradition of textile manufacturing in Patrick County we ultimately made the decision that this was where we wanted to locate our next fabric formation facility.” TW

It’s the technology that produced your fabric that makes your product so special.

The Itema weaving machines guarantee to worldwide weavers the most innovative technology tailored on the latest market trends: superior performances, eco-efficiency and textile mastery are the features you immediately feel when relying on Itema.

DISCOVER MORE

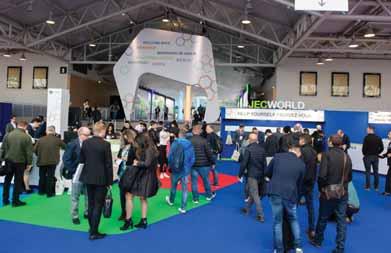

The global textile industry will converge on Milan in June for the 19th edition of ITMA.

TW Special Report

SSince 1951, the European Committee of Textile Machinery Manufacturers (CEMATEX) has organized what is generally regarded as the largest and most comprehensive textile machinery trade show in the world. Held once every four years, ITMA has become a platform for emerging trends and innovative solutions, new knowledge and best practices, and establishing relationships with textile industry leaders. The next edition of the show will be held June 8-14, 2023, at the Fiera Milano Rho fairgrounds in Milan, Italy. Milan is hosting ITMA for the sixth time since its inception at the now 19th edition of the show.

ITMA is owned by CEMATEX, and is organized by ITMA Services.

The overall theme for ITMA 2023 is “Transforming the World of Textiles.” Four sub-themes under this umbrella title include advanced materials, automation and digital future, innovative technologies, and sustainability and circularity.

ITMA’s quadrennial schedule somewhat insulated the event from pandemic-related effects. The last show took place in 2019, and now, 4 years later, the 2023 event is on track to occur with minimal disruption for organizers. CEMATEX President Ernesto Maurer noted in a recent interview with Textile World that the

industry has been very supportive of the event and strong participation is expected in June (See sidebar on page 10).

As of TW ’s press time, exhibition space is almost sold out and more than 1,570 exhibitors from 42 countries have booked exhibit space. Italy, Germany and Spain form the top three countries based on the number of exhibiting companies; and the top sectors are finishing, spinning, weaving, printing, knitting, winding and nonwovens.

“We are also pleasantly surprised that a number of exhibitors have taken up larger stand surface,” Maurer said. “On average, we see a more than 10 percent increase in the space booked by exhibitors.” Companies with the largest exhibit space include Epson, Groz-Beckert, Karl Mayer/Stoll, Lonati, Muratec, Oerlikon, Pai Lung, Picanol, Reggiani Macchine, Rieter, Saurer, Savio, Stäubli, Trützschler and Vandewiele.

“After weathering over two years of the pandemic, the global business community is eager to get down to real business,” noted Charles Beauduin, chairman of ITMA Services. “Businesses are looking at longterm investments in key technologies to remain competitive. As the world’s most established showcase of its kind, ITMA is the quintessential platform for the industry to buy and sell, and to collaborate face-to-face.”

Fiera Milano Rho is one of the largest fairgrounds in the world, spanning 345,000 square meters of covered gross exhibition space over 20 pavilions. The venue is well equipped with conference rooms, as well as a host of restaurants, bars and coffee houses. The fairground is located in the west of Milan and connected to the city center via a metro station, Rho Fiera. It is also served by railway and there are 14,000 parking spaces for visitors.

• Chapter 1 : Machinery for spinning preparation, man-made fiber production, spinning, auxiliary machinery and accessories

• Chapter 2 : Machinery for winding, texturing, twisting, auxiliary machinery and accessories

• Chapter 3 : Machinery for web formation, bonding and finishing of nonwovens and felting, auxiliary machinery and accessories

• Chapter 4 : Weaving preparatory machinery, weaving, tufting machinery, auxiliary machinery and accessories

• Chapter 5 : Knitting and hosiery machinery, auxiliary machinery and accessories

• Chapter 6 : Embroidery machinery, auxiliary machinery and accessories

• Chapter 7 : Braiding machinery and accessories

• Chapter 8 : Washing, bleaching, dyeing, drying, finishing, cutting, rolling and folding machinery, auxiliary machinery and accessories

• Chapter 9 : Printing machinery, digital printing machinery, auxiliary machinery and accessories

ITMA has added one new category to its list of exhibit “chapters” for 2023 — Chapter 11, which is focused on machinery for textile reinforcement structures for composites. This brings the total number of chapters to 20 (See Table 1)

CEMATEX has also launched the Start-Up Valley, a new initiative featuring companies in early stages of developments “with new and game changing solutions and technologies to support and inspire innovation for the textile, garment and fashion industry.” Sixteen startups were selected by an expert panel from a pool of applicants. Successful companies received a grant to help cover the costs of exhibiting at the Start-Up Valley during the exhibition, and also are invited to participate in the Innovator Xchange, ITMA Sustainable Innovation Award and Innovation Showcase. See the March/April 2023 issue of TW for more information about these show features and other events and education offerings for participants during the 2023 exhibition.

“CEMATEX is excited to launch the Start-Up Valley initiative to attract innovative, young companies

• Chapter 10 : Garment making machinery, other textile processing machinery, auxiliary machinery and accessories

• NEW Chapter 11 : Machinery for textile reinforcement structures for composites, auxiliary machinery and accessories

• Chapter 12 : Laboratory testing and measuring equipment and accessories

• Chapter 13 : Transport, handling, logistics, storing and packing equipment and accessories

• Chapter 14 : Equipment for recycling, waste reduction and pollution prevention and accessories

• Chapter 15 : Software for design, data monitoring, processing and integrated production

• Chapter 16 : Colorants and chemical auxiliaries for the textile industry

• Chapter 17 : Equipment and products to ensure machinery and plant operations

• Chapter 18 : Services for the textile industry

• Chapter 19 : Research and educational institutions

• Chapter 20 : Fibers, yarns and fabrics

to ITMA 2023,” Maurer said. “As the largest textile technology exhibition attracting leading textile and garment manufacturers from around the world, ITMA offers start-ups a useful

Table 1

platform to put their innovations in front of a global audience, to find investors and collaborators, and to leverage industry connections and professional networks.”

Some of the more famous visitor attractions found in Milan include (clockwise from top left): The Galleria Vittorio Emanuele II shopping arcade; Santa Maria delle Grazie church (photograph courtesy of Marcin Bialek), which houses The Last Supper by Leonardo da Vinci; and the Duomo di Milano, Italy’s largest church.

Use the QR to visit Textile World ’s collection of ITMA 2023 exhibitor previews or TextileWorld.com/category/textile-world/itma/ Exhibitors, submit your ITMA 2023 press releases and images for online coverage to rsdavis@TextileWorld.com

Visitor registration is currently open. To encourage visitors to register ahead of time, ITMA is offering an early bird rate through May 7, 2023, on its website. Visitors may purchase a one-day pass for 40 euros and an eight-day pass for 80 euros. Students are welcomed June 10-14 at a discounted rate of 25 euros for a five-day badge.

Beginning March 8, registered visitors will gain access to ITMAcon-

nect, an online platform that connects visitors with exhibitors and industry partners to make appointments for in-person meetings during the show, as well as enable discussions before and after the event.

“Even before the COVID-19 pandemic, we have been exploring ways to add value to our participants in the digital space,” Maurer remarked. “We are excited that with the launch of ITMAconnect, we now offer the global textile

ITMA is owned by the European Committee of Textile Machinery Manufacturers (CEMATEX), an organization that represents Europe’s national textile machinery associations.

Ernesto Maurer, president of the Swiss Textile Machinery Association (Swissmem), currently is serving a four-year term as CEMATEX president.

T e x t i l e W o r l d recently had the opportunity to speak to Maurer about ITMA 2023.

TW : A lot has changed in the world since the last ITMA show held in Barcelona in 2019. Has the COVID-19 pandemic affected ITMA2023 at all in terms of planning and organizing the event?

Maurer : We are fortunate that the COVID-19 pandemic started after we had successfully completed ITMA 2019. Since ITMA is held every four

years, the pandemic has minimal impact on the organizing of the exhibition as preparations only intensify two years before the exhibition. By the close of our space application, many countries have lifted COVID-19 restrictions and companies are eager to take their business back on track. Nevertheless, the pandemic has a vast impact on the global economy and disrupted supply chains, which has affected our participants adversely. Despite this, we are grateful for the support of the industry which has helped us secure a strong participation rate for ITMA 2023.

TW : Barring any unforeseen issues, what is the outlook for the show in terms of exhibitors and visitors?

Maurer : We are very optimistic about the outcome of the exhibition, as every-

community enhanced opportunities that extend beyond the physical exhibition. We hope exhibitors will make full use of this online platform to keep their contacts engaged while generating new leads to grow their businesses.”

The show is open June 8-13 from 10 a.m. until 6 p.m. each day. On June 14, the show opens at 10 a.m. and closes at 4 p.m.

Located in the northwestern section of the Po Valley, Milan is the second-largest city in Italy with a population of approximately 1.3 million. The city is the main financial, industrial and commercial center of Italy, housing the Borsa Italiana — Italy’s main stock exchange — and the headquarters of major banks and corporations.

body — exhibitors, visitors and organizers alike — are really enthusiastic.

Our exhibitor promotions have yielded favorable response and virtually all exhibition space has been fully booked. Although we may not reach the number of exhibitors as in 2019, many exhibitors are booking more space. In terms of exhibition space, we have already surpassed the 2019 size, and this is what counts in the end.

Generally, the industry is looking forward to having face-to-face interactions again and we are positive that there will a good turnout of visitors from around the world, barring unforeseen circumstances.

TW : What are the areas of strength in technologies and markets for machinery?

Maurer : The world is pivoting to digital and there are also urgent demands for sustainable and circular solutions. Textile machinery that will help textile manufacturers transform digitally and automate processes to increase productivity will be in great demand. On the sustainability front, green technologies that reduce carbon footprint or use less water and energy are currently trending.

The pandemic has also spawned demand for machinery for the manufacturing of

The city has a long history as a fashion, clothing and textile producer and is widely recognized as one of the world’s fashion capitals, making it the perfect backdrop for a textile machinery trade show.

Famous must-see sights while in Milan include the Duomo di Milano, La Scala, and Leonardo da Vinci’s The Last Supper mural.

The Duomo di Milano,— or Milan Cathedral — took nearly six centuries to build. It is the largest church in Italy and the fifth largest in the world. The Duomo is dedicated to St. Mary of the Nativity and acts as the seat of the Archbishop of Milan.

Teatro alla Scala, or La Scala as it’s more commonly known, is an opera house opened in 1778. Throughout its history, many great operatic artists and singers have appeared at the

nonwovens, especially for hygiene and medical uses.

TW : Are there any emerging areas of interest for the textile industry?

Maurer : There are two broad areas the industry is interested in: digitalization and automation; and sustainability and circularity. These are the main forces shaping the future of manufacturing for many industries, including the textile and garment industry. Both digitalization and sustainability require a long-term commitment that reshapes the entire approach to business. At the same time, they need to have mind-changing inputs at a technological, as well as economical level. Increasingly, digitalization can be used as a powerful tool in the journey towards sustainable manufacturing.

TW Does the show’s Milan location offer any benefits in terms of international travel?

Maurer : A cosmopolitan city, Milan is a very popular

venue, which is still considered one of the leading opera and ballet theatres in the world. The La Scala Theatre Chorus, La Scala Theatre Ballet and La Scala Theatre Orchestra are all housed at the opera house.

For ITMA visitors interested in a little shopping during their time in Milan, the Galleria Vittorio Emanuele II is a can’t miss stop. This four-story double arcade connecting the Duomo and La Scala, is one of the world’s oldest shopping malls built between 1865 and 1877. Today, the arcade features a variety of luxury retailers, restaurants, cafés and bars.

The Last Supper, da Vinci’s late 15th century mural, can be found in the refectory of the Convent of Santa Maria delle Grazie in Milan. The painting has seen better days after

destination for exhibitions and conventions. As it has three airports, it is extremely wellconnected to Europe and the rest of the world. Participants can make the most out of their ITMA 2023 experience by combining business with leisure. They can also take the opportunity to explore nearby picturesque cities and towns, art and culture, and gastronomic delights.

TW : Are there any new show features visitors should be aware of?

Maurer : For this edition, we have value-added to the ITMA experience by introducing ITMAconnect, a one-stop sourcing platform and knowledge hub. The platform connects the global textile community before ITMA, and extends the engagement after the exhibition.

Our exhibitors will be setting up digital spaces to showcase their exhibits, and registered visitors will be able to learn more about these

enduring repeated damage, years of neglect and various restoration attempts over time, but it is still a very popular tourist attraction.

Traveling around Milan is easy thanks to the city’s extensive transportation system comprising an underground metro, trams, buses, link lines and taxis. The underground lines offer cheap and quick movement around the city, and bus routes follow the four metro lines M1, M2, M3, M4 as well as the most popular routes between the city center and outskirts. Bus service also runs all night on Friday and Saturday nights.

For more information about ITMA 2023, visit itma.com. T e x t i l e W o r l d will continue its pre-show coverage in the March/April 2023 issue complete with an A-Z exhibitor list and show floor plan.

products and schedule onsite meetings with them from March 8. With this platform, both exhibitors and visitors can plan their participation more effectively and be more productive during the exhibition.

Another new initiative is Start-Up Valley which spotlights companies in its early stages of development with game changing solutions. Sixteen companies have been awarded a CEMATEX grant to defray their participation costs. You can find out more about these start-ups and their innovative solutions from www.itma.com.

Last, but not least, we have expanded our index of products by introducing textile composites. Visitors will be able to source machinery for textile reinforcement structures for composites, auxiliary machinery and accessories.

TW : Please give a quick synopsis of ITMA 2023. Tell readers what to expect and why they should attend.

Maurer : ITMA 2023 will be the first major exhibition for the textile and garment industry to be held after the coronavirus pandemic. The industry is looking forward to the face-to-face interactions with their industry colleagues and customers in Milan.

The theme of ITMA 2023 is “Transforming the World of Textiles.” It is underscored by four trending topics: automation and digital future, advanced materials, sustainability and circularity, and innovative technologies.

Well-known as the launchpad for innovative products, you can expect many exhibitors to take advantage of the largest industry gathering to showcase the latest innovations from across the entire manufacturing value chain.

With greater emphasis on collaboration among various stakeholders, ITMA 2023 will present great opportunities for dialogues and sharing of knowledge among industry groups. TW

EEvery three years Belgium-based EDANA — the international association serving the nonwovens and related industries — and show organizer Palexpo bring together the entire nonwovens industry at the INDEX™ trade show. The event, with its unique nonwovens focus and highly vertical format, offers four intensive days of insights, networking and rewarding business activities, according to EDANA.

However, the pandemic seriously impacted the triennial schedule for INDEX with the March 2020 edition of the show eventually taking place in October 2021 after several postponements and rescheduled dates.

This left a decision to make about when to host future editions of the show. After polling stakeholders including EDANA members and exhibitors, it was determined that the show should remain on its previously announced schedule with the next editions taking place in 2023 and 2026.

“We have heard our key stakeholders’ voice, and the leading position of INDEX among global nonwovens exhibitions gives us full trust in the industry’s favorable response to both INDEX 23 and INDEX 26,” said Michael Staal Axelsen, chair of the EDANA board and CEO of Fibertex Personal Care.

Currently, organizers are getting ready for the 2023 edition, which will be held April 18-21, at its usual loca-

Based on favorable feedback from a stakeholder poll, INDEX™ 23 returns to Geneva in 2023 despite pandemic-related disruptions to last edition

TW Special Report

tion — Palexpo in Geneva. Dates for 2026 have yet to be announced.

The atypical show schedule makes it hard to predict visitor numbers, but organizers report they expect 2023 figures to be somewhere between 9,000 and 13,000 based on 2017 and 2021 attendance. The 2021 edition hosted 500 exhibitors with an additional 200 exhibitors participating via the show’s virtual platform.

Exhibits are organized into six groups: Filtration; Geotextiles & Civil Engineering; Hygiene & Cleaning; Medical: Infection Prevention; Transportation; and Packaging.

Alongside the exhibit floor, the show will host a seminar program focused on the topics of:

•Sustainable use of geosynthetics in mega projects in civil and environmental engineering;

•A look into the future of sustainable nonwovens;

•Nonwovens are essential for the mobility transition;

•Why nonwovens are indispensable in healthcare; and

The INDEX 23 awards will be presented to winners during the exhibition, and visitors will be able to view all nominated products from each of the six award categories in a dedicated space on the show floor.

In addition, INDEX 23 will continue to offer a virtual option for participants unable to visit Geneva in person. The tool allows visitors to watch presentations, as well interact with speakers, exhibitors and other participants.

The exhibition is open April 18-20 from 9 a.m. until 6 p.m., and on April 21 from 9 a.m. until 4 p.m. A fourday ticket is available for 100 euros ($110). No daily tickets will be available. Participation in the virtual event will be free to all.

“The three year-cycle provides an ideal frequency to keep the momentum and eagerness for visitors and exhibitors alike to live the unique INDEX experience, reconnect with their business contacts and rediscover Geneva’s scenery again,” said Magali Fakhry, exhibition director, Palexpo. “We are looking forward to welcoming them again in April 2023 …” TW

For more information about INDEX ™23 including details about the seminars, events and virtual options, please visit indexnowovens.com.

DDubbed by organizer JEC Group as the “festival of composites,” the annual trade show JEC World returns to the Paris Nord Villepinte Exhibition Centre, April 25-27, 2023.

JEC World is a global show attracting visitors from around the world to view what’s new in the composites arena. Established firms as well as startups join research and development personnel, scientists, academics and other experts to do business, share insights, learn and network.

The 2022 edition of the show hosted more than 1,200 exhibitors covering the entire composites value chain from raw materials through to end-users and integrators. More than 36,000 visitors are expected in 2023.

Some exhibits will be grouped in variety of regional and international pavilions to highlight regional or national expertise in composite technologies. In addition, JEC World is offering dedicated tours for the first time.

Besides exhibitor booths, attendees can visit special show displays including the 3D Printing Village,

Comprehensive composites showcase JEC World returns to Paris in April for the 2023 edition.

TW

Special ReportPlanets highlighting real-world composite applications in the Mobility and Industry sectors. The exhibits are designed to inspire and present current trends in the composites sector.

JEC World participants also can use the Business Meetings program to plan and organize meetings. The program offers team support preshow as well as a digital platform to connect industry buyers with JEC World exhibitors.

Across the three-day event, keynotes and conference sessions on two stages will present developments and innovations impacting the composites industry.

For the sixth time, JEC World will host the JEC Composites Startup

Booster, a competition designed to gain exposure for innovations in composites and advanced materials, and help startups grow their businesses. JEC World and its partners Airbus and Mercedes-Benz will select 20 finalists from the pool of applicants that will pitch their innovations during the show. Three winners will be selected after the pitches in Materials & Products; Process, Manufacturing & Equipment; and Sustainability categories.

Each year, JEC Group confers honors on deserving, cutting-edge projects that demonstrate the value of composite materials. The JEC Composites Innovation Awards will be presented during a ceremony on March 2.

The early bird rate for visitors who register for the event before March 1 is 55 euros ($60). The price increases to 85 euros ($92) after March 1. The “late bird” rate for attendees who wait to register on site is 110 euros ($120).

The show is open from 9 a.m. until 6 p.m. each day. TW

For more information about JEC World 2023 and to register, please visit www.jec-world.events.

TTe x t i l e W o r l d ’s annual review of textile investments highlights a broad-ranging investment horizon including what may be described as traditional textile investments — spinning, weaving, dyeing and finishing — as well as apparel and on to leather alternatives for sustainable automotive interiors.

A review of TW ’s 2022 “New Plant & Equipment, M&A” news section yields interesting insight into where investors see the future opportunities in the U.S. textile industry and what areas may possibly be reinvigorated in a post-pandemic world.

Well established textile companies continued to invest in 2022. Mauldin, S.C.- based Mount Vernon Mills announced that it has agreed to acquire Wade Manufacturing Co.’s yarn spinning and weaving facility located in Rockingham, N.C. The company stated that with the acquisition, Mount Vernon Mills will be vertically integrated from yarn production to finished fabric in certain

products and will be in greater control of the company’s supply chain.

“The Rockingham facility is a modern, cost-efficient operation with an experienced and stable workforce, making it a great fit as we increase the amount of control that we have over our yarn supply, weaving operations and overall costs,” said Bill Duncan, CEO, Mount Vernon Mills. “We are also proud to expand our footprint in the U.S. and build upon our made in America commitment and heritage.”

The company stated that initially, the Rockingham facility will produce open-end spun yarn for Mount Vernon Mills and woven greige goods for the company’s flame resistant (FR) products.

Spartanburg, S.C.-based Milliken & Company made two significant announcements this year leading off with the acquisition of one of the Frontier yarn plants located in Mayodan, N.C. The company said that this acquisition from Gildan will expand Milliken’s open-end yarn production for its protective fabrics, workwear,

government and defense, industrial, and napery textile business units.

Frontier Spinning Plant #3, which will be renamed the Two Rivers Plant as a nod to its dedicated team and the community it serves, will become a spinning hub for Milliken. Multiple Milliken textile plants throughout the Southeast will source their yarn needs from the Two Rivers Plant.

Milliken also announced a plan to expand operations at its Magnolia Finishing plant in Cherokee County, S.C. The company plans a $27.4 million investment that will create 75 new jobs. The expansion will include newly added production lines to increase manufacturing capacity. The facility specializes in workwear, military and FR apparel.

Additionally, Milliken launched a new polypropylene clarifier plant in Blacksburg, S.C., that will enhance access to the Millad® NX® 8000 additive for customers worldwide. This facility will enable Milliken to meet increasing demand for plastic additives and colorants well into the future.

Albemarle, N.C.- based Beverly Knits Inc. purchased the assets of Gentry Mills. The new business — Creative Dyeing & Finishing LLC — will continue to provide dyeing & finishing services to the textile industry. The operation complements the Beverly Knits group of companies — Creative Fabrics, Creative Ticking, Altus Finishing and Hemingway Sewing Solutions.

At the time of the announcement, Ron Sytz, CEO of Beverly Knits Inc. said: “A combination of factors led to the decision to invest and expand. We have been producing quality circular knit textile products for over 42 years in Gastonia, North Carolina. We feel that this is the right time to further expand our capabilities into dyeing and finishing of fabrics. This continues to support the re-shoring of textile production and to strengthen our

capability to produce goods ‘Made in the USA.’ With this addition, Beverly Knits companies have the ability to provide solutions from knitting all the way to a completed garment.”

The Creative Dyeing and Finishing operation will provide fabric dyeing, finishing, napping and printing services to the apparel, industrial and bedding markets.

Hemingway Sewing Solutions — a subsidiary of Beverly Knits, announced plans to establish operations in Williamsburg County, S.C. The company’s $3.3 million investment was slated to create 242 new jobs. Hemingway Sewing Solutions plans to manufacture a variety of textile products for brands including Purple Mattress, Indigo and Vapor Apparel, as well as the U.S. Department of Defense.

In other acquisition news, Faribault, Minn.-based brand Faribault Woolen Mill Co. — maker of handcrafted blankets, decorative throws, apparel and accessories — added cotton to its product line up with the acquisition of Brahms Mount, a Monmouth, Maine-based manufacturer of high-quality cotton blankets, throws and other textiles. Terms of the deal were not disclosed.

“This acquisition is a great extension of our strategic focus on building Made in USA jobs,” said Faribault Mill President and CEO Ross Widmoyer. Brahms Mount will continue its cotton product manufacturing in Maine and retain the current employee base.

As part of the acquisition, Faribault Woolen Mill Co. will rebrand as Faribault Mill to reflect the product offering expansion. A new line called The Brahms Mount Collection by Faribault Mill will launch later in the spring.

Piana Technology, the 439-yearold Italy-based textile company known for innovations within the fiber and nonwovens textiles markets, has gone live with a solar panel system at its nonwovens facility in Cartersville, Ga.

The facility specializes in verticallyand crosslapped nonwovens. Since 2016, the facility has manufactured a variety of intermediate products that are behind many of the common household products used today.

Piana partnered with Southern View Energy, a local solar electrical design and solar installation company, to carefully review the facility’s energy profile and pilot an installment project. The new 471 kiloWatt system is poised to supply more than 622,000 kiloWatt hours each year and avoid an estimated 460 tons of carbon dioxide per year, which is equivalent to 125 acres of trees. Although most of this energy will go towards the facility, on days where there is overproduction, energy will go back to the city of Cartersville for redistribution.

Fab-Con Machinery Development Corp. , is a manufacturer of textile finishing equipment that has relocated to Salisbury, N.C. The company announced a $5.3 million investment to relocate its headquarters and manufacturing operation to Rowan County. Serving the knitwear industry for more than five decades, Fab-Con designs, builds, and exports finishing machines for men’s, women’s, and children’s clothing, outerwear and underwear. Fab-Con has a global footprint that supports a major market share of more than 200 customers in Asia, and North, South, and Central Americas. This relocation will be the new home of the

company’s global headquarters in a 90,000 square-foot facility as well as its machine manufacturing, administration, and sales operations.

“By relocating to North Carolina, Fab-Con will be more competitively positioned to operate at a lower cost,” said Chris Snyder, vice president, FabCon Machinery. “Several recently obtained U.S. and E.U. patents have given us a strong competitive advantage over our competitors both domestically and internationally.” The new positions, including machinists and fabricators, have a combined average annual salary of $73,081, which exceeds Rowan County’s overall annual wage of $48,360. Once filled, these new jobs have the potential to create an annual payroll impact of more than $1.9 million for the community.

New York City-based Ferrara Manufacturing , a family-owned apparel manufacturer announced the launch of Ferrara Uniform. Ferrara Manufacturing produces garments worn on the runways of New York and Paris-as well as by American Olympians and the U.S. military. Located in Manhattan’s Garment District, Ferrara Uniform is a new division of the company focusing specifically on uniforms made in the USA.

With the addition of Ferrara Uniform, the company now is made up of three specialized divisions serving diverse markets — tailoring, uniforms, and protective garments. Ferrara Supply Co. was one of the first

federal partners to provide domestically madepersonal protective equipment (PPE) as part of the 2021 American Rescue Plan, and made millions of gowns and masks in the U.S. during the pandemic for the U.S. government.

Los Angeles-based BELLA+ CANVAS announced a $11.9 million investment to establish an advanced fabric-cutting facility in Wetumpka, Ala. The operation was to open in a portion of an 890,000square-foot building vacant since 2013, when Russell Brands departed from the Elmore County city.

BELLA+CANVAS produces clothing for the retail and wholesale markets, while also offering clothing design and manufacturing services. The company is known for its domestic manufacturing mission, the development of innovative new fabrics and its sustainability practices.

At the time of the announcement, Chris Blakeslee, president of BELLA+CANVAS, said, “We are thrilled to be part of the community and look forward to creating jobs and opportunities for many in Alabama.

“After a comprehensive search, we ultimately concluded that our new location in Wetumpka, Alabama was not only optimal to enhance our manufacturing footprint and technologically advanced operations levels, but also ideal in terms of support from the local government and access to great new team members.”

BELLA+CANVAS employs more than 1,000 people at a Los Angeles cutting facility it reports is North America’s most advanced, thanks to proprietary software and specialized cutting tables. The Wetumpka facility is expected to be modeled after this operation.

New York City-based Sentinel Capital Partners , a private equity announced the acquisition of L2 Brands, a designer, manufacturer, and marketer of custom apparel and headwear for the collegiate, destination and leisure, and corporate markets.

With a heritage dating back more than 30 years, L2 Brands has grown into a diversified business with a successful history of long-term profitable growth. L2’s two brands — League and Legacy — offer widely recognized lines of premium apparel and headwear.

“L2 has a three-decade reputation for offering leading brands, excellent customer service, and high-quality products,” said Sentinel Partner John Van Sickle. “Sentinel is excited to partner with L2 and its talented management team for its next chapter of growth.”

League was founded in 1991 and Legacy was launched one year later and has become the brand of choice in customized headwear and winter knits. These brands include more than 150 styles for men and women that are sold into the collegiate, destination and leisure, and corporate markets.

Dahlonega, Ga.-based RefrigiWear , a supplier of insulated work apparel for the cold chain, announced its acquisition of Samco Freezerwear Co. (Samco) . Founded in 1968, Samco is a provider of freezerwear, insulated industrial workwear, and other insulated industrial apparel and accessories for workers in the food-related cold chain.

“We are excited to welcome Samco to the RefrigiWear family. This acquisition will help us serve our customers with a broader range of choices,” explained Ryan Silberman, RefrigiWear CEO. “For us, it’s all about the customer and gaining capabilities to serve the ever-changing and demanding environments they face in the cold chain.”

Both companies offer a selection of products that keep workers warm and safe in temperature-controlled distribution and production facilities, which can sometimes operate in temperatures well-below freezing. RefrigiWear and Samco continue to operate under separate brand names with diverse product offerings for customers both small and large.

Michael Southard, managing director of Beachwood, Ohio-based Elvisridge Capital LLC, announced the acquisition of Glacier Outdoor Inc. (Glacier Glove). Based in Reno, Nev., Glacier Glove manufactures gloves and other apparel for the fishing and hunting industries. Glacier now joins Elvisridge Capital’s other fishing-related brands, Blackfin Rods and fishing line manufacturer BBS (FINS Fishing).

“Glacier fits well with our existing portfolio companies in this space,” Southard stated. “Our strategy will be to continue to add distribution points, as well as increase the speed and quantity of product development.”

Memphis, Tenn.-based Radians® — a manufacturer of personal protective equipment including Radwear ® high visibility apparel,

rainwear, hand protection, head gear, cooling products, heated jackets, workwear, N95 respirators and face masks/gaiters among other products —announced the expansion of its Memphis campus.

“We’re very happy that the new space is conveniently located next door to our Discover buildings and very close to our Distriplex headquarter buildings,” said CEO Mike Tutor. “The increase in space is significant because the expansion represents a 20 percent increase in Radians’ overall square footage, bringing our Memphis campus footprint to approximately eight acres under roof.”

According to Tutor, the expansion allows Radians to have more inventory in-house strengthening its supply chain capabilities and provides the needed space required for its growing warehousing operations and workforce.

“Our employees are ecstatic about

having a larger and more efficient workspace at Mineral Wells,” said President Bill England. “Thanks to our employees, sales team, large distributor networks, and product innovations, we have experienced explosive growth in multiple product lines. It was time for more space and resources to support this growth.”

Headquartered in Conover, N.C., furniture manufacturer Vanguard Furniture Company Inc. announced an investment of more than $5.9 million for an expansion of its upholstery manufacturing operations to Morganton, N.C.

“North Carolina continues to be the global leader for furniture manufacturing,” said North Carolina Governor Roy Cooper in a press release.

Vanguard Furniture is a manufacturer and marketer of high-end case goods and upholstery. It is a familyheld company, employing 680 asso-

ciates operating out of seven manufacturing facilities in Conover, N.C., and Hillsville, Va., with flagship showrooms showroom in High Point, N.C., and Las Vegas.

Sausalito, Calif.-based high-end furniture company Serena & Lily announced it will locate its first East Coast operation with a new $55 million, 1.2-million-square-foot distribution facility located at the Georgia International Trade Center in Effingham County, Ga.

“Our unmatched logistics infrastructure through air, land, and sea is an asset to any company that chooses to locate here,”said Governor Brian Kemp. “We are home to the nation’s fastest-growing port, and Georgia has established itself as the logistics hub of the Southeast. We are excited Serena & Lily chose Georgia to grow their business, and

we look forward to helping them reach markets all over the world.”

Sean Connelly, COO of Serena & Lily said, “With its proximity to the Port of Savannah and our East Coast customers, this facility will play an integral role in supporting our infrastructure network to shorten lead times and ultimately enhance our customer experience.”

Biotechnology company MycoWorks , a firm that specializes in mycelium-based materials as sustainable, luxury-quality leather alternatives, has announced plans to establish operations in Union County, S.C. The company’s $107 million investment will create 400 new jobs.

Established in 2013, MycoWorks’ patented Fine Mycelium ™ process produces materials including Reishi™ — a globally recognized breakthrough in materials science — that mimics the performance of animal leathers and lowers environmental impacts. The material offers creative solutions and new design possibilities for fashion and luxury brands while offering relief to supply chain constraints.

MycoWorks also announced its newest investor GM Ventures —the investment arm of General Motors Co. — and their long-term agreement to co-develop Fine Mycelium materials for potential use in a range of applications within automotive design. MycoWorks’ collaboration with GM marks the exploration of its entry into one of the largest end-use markets for leather and demonstrates the significant opportu-

nity to create more sustainable materials for the automotive space.

Hillside, N.J.-based technical textile manufacturer Ronald Mark Associates Inc. (RMA), a producer of custom resin and vinyl fabric formulations and technical services, announced a $13.5 million investment to establish a manufacturing operation in Tazewell County, Va.

“Ronald Mark Associates has selected the State of Virginia to expand their operations in advanced fabric coating. The progressive talent of Tazewell County is a perfect place to start, create, and produce infrastructure fabrics and technical textiles for our Ronald Mark customers,” said RMA President Michael Satz.

RMA has been marketing, distributing, and packaging PVC resin since 1971 and manufacturing vinyl films and technical textiles since 1979. RMA has positioned itself as an innovator and streamlined manufacturer in the flat roof membrane market as well as critical proprietary fabrics for infrastructure.

St. Louis-based Baldwin Technology Co. Inc. has announced the installation of its state-of-the-art TexCoat G4 finishing system

Using Baldwin’s cost-efficient and highly sustainable spray finishing technology, Graniteville Specialty Fabrics will be able to increase production efficiency, and minimize chemical and water waste.

Based in Graniteville, S.C., Graniteville Specialty Fabrics produces coatings and coated fabrics that are resistant to water, fire, ultraviolet rays and weather for the military, marine and tent markets, among other markets. The company excels in developing and sourcing custom coatings, and creating specialized technical solutions to meet specific, and often unique, end-user requirements. The installation of Baldwin’s TexCoat G4 is part of a major facility upgrade to maximize production efficiency and capacity in the durable water-repellent finishing and coating line to meet growing customer demand for advanced engineered products.

“We are pleased to be a key partner in Graniteville Specialty Fabrics’ modernization project,” said Rick Stanford, Baldwin’s vice president of Global Business Development, Textiles. “The team reached out to us, and it was clear that the TexCoat G4 was the right tool to help them minimize waste and increase productivity.”

New York City-based Victor Capital Partners announced that an affiliate has entered into a definitive agreement to sell PrimaLoft Inc. to Compass Diversified . PrimaLoft is a developer of advanced insulations and fabrics that global brands use to deliver high performance and comfort while also reducing impact on the environment. Based in Latham, N.Y., PrimaLoft technologies are integral components that balance innovation, performance, and sustainability, and have been widely adopted in the finished products of over 950 brands.

Victor Capital acquired a majority interest in PrimaLoft in 2017 in partnership with the management team, which maintained a significant investment in the business.

The more than 950 global brand partners of PrimaLoft include outdoor brands Patagonia, Helly Hanson, LL Bean, and Arc’teryx; athletic brands Nike, Adidas, lululemon and Athleta; fashion/lifestyle brands Polo Ralph

Lauren, Stone Island, J.Crew and Prada; and home goods brands The Company Store and Boll & Branch. PrimaLoft also offers a licensing program, providing its technologies and branding to an expanded set of nonwoven and other textile markets.

Cleveland-based Avient Corp. completed its purchase of the protective materials business of DSM (including the Dyneema ® brand), which will now be called Avient Protective Materials and reported within the company’s Specialty Engineered Materials segment.

“With the addition of the Protective Materials business, we have significantly increased the size of our fastest growing platform and firmly established Avient as a leader in the advanced composites space,” said Chris Pederson, president, Specialty Engineered Materials, Avient.

The foundation of Avient Protective Materials is the renowned technology and globally admired brand of Dyneema, the World’s Strongest Fiber ™ . The ultra-lightweight specialty fiber is 15 times stronger than steel and is used in demanding applications, such as ballistic personal protection, marine and sustainable infrastructure, renewable energy, industrial protection and outdoor sports. The business includes six production facilities, four research and development centers and approximately 1,000 employees located around the world.

Bast Fibre Technologies Inc. (BFT) , a manufacturer of premium natural fibers, completed its purchase of Georgia-Pacific’s Lumberton Cellulose LLC . The Lumberton, N.C., site is a highly automated state-of-the-art manufacturing facility with approximately 25 employees that will now operate under the new name of BFT Lumberton.

BFT plans to significantly expand capacity to over 30,000 metric tons

per year, establishing BFT Lumberton as one of the largest fully integrated natural fiber processing parks in North America.

“As changes in consumer preferences and single-use plastics legislation drive demand for alternatives to synthetic fibers, consumer brand companies are seeking to manufacture products using fiber with minimal ecological impacts,” said BFT President Jim Posa. “The BFT Lumberton plant will produce all-natural, clean, soft, compostable fibers that are capable of displacing synthetics fibers in many nonwoven and textile applications and will bring valuable cleantech sector jobs to the local community.”

In addition to the planned capacity increase, the acquisition of the Lumberton facility diversifies BFT’s natural fiber offerings allowing entry into complementary product categories for cosmetic cotton, filtration, hygiene, and other nonwoven applications.

FyberX Holdings, a developer of technology to process raw agricultural biomass into refined natural fibers, will invest $17.5 million to establish its U.S. headquarters and production operation in the former Kinderton Distribution Center building in Mecklenburg County, Va. The new facility will process hemp and other agricultural products, producing fibers to supply the textile industry, and will create 45 new jobs.

“Industrial hemp fiber has great potential in Virginia, and FyberX can unlock that potential and create a sustainable market for the Commonwealth’s hemp producers, with its investments into the processing infrastructure for this crop,”said Secretary of Agriculture and Forestry Matthew Lohr.“I commend FyberX for their bold vision and commitment to bringing this needed infrastructure to Southern Virginia.”

“Southern Virginia is strategically positioned to play a vital role in unlocking the economic potential of industrial hemp fiber in a variety of markets including textiles, construction, packag-

ing, automotive, and bioplastics,”said Ben Young, FyberX CEO.

FyberX was founded in 2019 to build the foundational infrastructure required to process raw agricultural biomass into refined natural fibers, creating more environmentally friendly manufacturing solutions. The company focuses on industrial hemp sources in the United States. and will use its technology to process hemp for use in sustainable replacements for the textile, packaging, and construction industries.

The year 2022 was a healthy year for textile investment and the preceding announcements are just a snapshot to illustrate the breadth of interest in U.S. textile investment. There were many additional investments in fiber though finishing — like the investment in retrofitting at TSG Finishing’s plant in Hickory, N.C.

Still many other investments go unreported because of privacy requests and the competitive nature of the business.

TW editors try to report what they can, and if textile investment is of particular interest, keep an eye on T W ’s “New Plant & Equipment, M&A” section under the news menu on TextileWorld .com.

Let’s see if 2023 — an ITMA year — shows continued growth and strength. TW

Stein Fibers LLC,Albany,N.Y., has purchased the North American fiber operation of Fibertex Corp. The combined operation will benefit both companies and expand the North America fiber product portfolio.

“I am excited to partner with the Stein Fibers organization,which shares the same core values and believe the combination will provide an opportunity to grow our relationships with both customers and suppliers.”

“We are truly excited to work with Ernest as Fibertex and Stein Fibers have similar histories rooted in a deep family commitment to the textile industry that has stretched generations,”said Stein Fibers’ COO Robert Taylor.

Kraig Biocraft Laboratories Inc., Ann Arbor,Mich.,reports it has delivered the first two hybrid-cross Dragon Silk™ silkworm strains to its third-party production partner in Vietnam.The current issue limiting large-scale production is robustness of the silkworms in a large-scale production environment.The new hybrid strains were developed to address this hurdle and combine the mechanical performance of the company’s original Dragon Silk worms with the size and robustness of native production silkworm strains.

“Work with our production partner in Vietnam has accelerated the identification of challenges and opportunities in scaling up production to metric tonnage

MMI Textiles,Brooklyn,Ohio, recently inked an agreement with Milliken & Company to supply Milliken Tegris® thermoplastic composite fabric.Tegris is a lightweight,but stiff material design to protect from blasts and projectiles.It also is suitable for plate carriers and belt applications.

MMI is positioned as a Tegris expert and can now offer the material at quantities previously unavailable.

“Being able to offer Tegris and partner with a leader in the textile industry like Milliken further illustrates MMI’s commitment to provide innovative products to the end customer,especially those that protect our warfighters,”said Joey Smith,MMI’s director of business development.

Germany-based Trützschler

Card Clothing (TCC) reports it will invest 12 million euros to expand its Neubulach,Germany,card clothing production facility.Production,warehouse and offices will be upgraded, which will expand the range of services offered at the site.The company has seen increased demand for its card clothing products that are used in carding processes in nonwovens as well as spinning applications.

Bangkok-based nonwovens company Avgol® has announced an investment in a new high-speed, high-capacity flexible multiple beam Reicofil 5 line for its Mocksville,N.C.,

levels,”said Jon Rice,COO,Kraig Biocraft Laboratories.

Israel-based Nilit recently introduced a version of its SENSIL® EcoCare recycled nylon 6,6 that is produced at its North American facility in Martinsville,Va.,using only U.S.materials.SENSIL EcoCare is made using post-industrial recycled nylon 6,6.According to the company, its recycling process retains the properties of virgin fiber for highquality nylon fibers and yarns.The new yarns are compliant with the Berry Amendment as well as the United States-Mexico-Canada Agreement and Dominican Republic-Central America Free Trade Agreement rules. TW

plant.The line,supplied by Germanybased Reifenhäuser Reicofil GmbH & Co.KG,is the sixth line in Mocksville.

“The addition of this new line enables us to have even greater production capacity,delivering component materials that are Made in America and offering more sustainable options for the growing North America market and around the world,”said Avgol CEO Tommi Bjornman.“This additional new line also enables the Mocksville facility to deliver additional meltblown nonwovens,ensuring we have extra capacity to meet market demand.

In other company news,Avgol was recently honored for the first time with a Supplier Excellence Award from Procter & Gamble (P&G) as a notable and valuable supplier to the company’s Baby Care business unit. TW

TTo loosely quote Marcus Aurelius, “Looking back over the past, one can foresee the future.” This same idea applies to fiber research and development. For insight on where fiber developments might go in the future, the best indicator is the past. There is no crystal ball and no way to truly predict the future, only a “guess-o-meter.” But the past suggests possible future direction. Some developments are more near-term and less of a leap of faith, while some other developments are longer-term projects that may or may not come to fruition.

The distance between a great idea and commercialization is very long and unfortunately there is a lot of opportunity for things to go wrong.

Sometimes, the greatest ideas just don’t pan out.

If we compare the fiber industry of today to that of 20 to 30 years ago, not much has changed. Today, polyester is still king and poly/cotton blends are still woven and knit into fabrics. Some 20 to 30 years ago, perhaps people thought everyone would be wearing nonwovens in a few decades and that hasn’t happened yet, although it still eventually could. Obviously, research and development is ongoing and things that are in development today will change the face of the industry in the next few decades. But it’s important to remember that change is slow and in probably the next 20 to 30 years things that are important now are still going to be important in the fiber industry.

Also, the big developments that have taken place have mostly been on the margins. If history is a straight line — and of course it never is — but if the future is like the past, then the margins are where most of the new developments will remain.

If that’s the case, then why focus on those innovations? The answer is because that’s where the money is. Even if a company is working on a development that is going to remain in the margins, it’s where producers can make money instead of competing solely on price and volume. It’s one of the reasons why companies chase innovations and new developments.

There also is always the dream that not only can research create something that is profitable, but perhaps it will result in a “new polyester” that fundamentally changes the industry. Polyester has been king for decades, but it didn’t exist 100 years ago, and change will happen eventually.

Bicomponent fibers are not new, but one of the still untapped uses is in binder fiber applications. There is new technology coming online that will allow for expanded performance of binder fibers. People are fairly familiar with standard binder fibers. With new polymer developments, there are new melt temperatures available to tailor the fiber to the application. The ability to chose between an amorphous or a crystalline binder also can better tailor a product to do the job that’s needed.

In addition, one newer possibility is a binder that will bond the fabric together initially and then at whatever time is needed for the application, the bonds may be released. Those are potentially near-term possibilities in binder fiber innovations.

Taggant technologies are another currently available bicomponent technology that is underutilized and there is a lot of value in these type of

fiber technologies. An identifier like a 2D barcode can be created, or materials can be used that light up the fiber when viewed using different wavelengths of light.

A 2D barcode provides a lot of information where forensic approach of sorts is required to determine the cross section and extract the information in the barcode. In comparison, a tag that is revealed using a certain wavelength of light is more of a simplistic, binary technology that only identifies the fiber if it’s present. There’s not a whole lot of information in this type of tag, but it can be useful in certain applications such as a point-of-sale scan.

It’s possible in the future some sort of taggant technologies may be required in order to have downstream accountability. Such applications offer a way to extend bicomponent technology beyond where it is today.

Using a DNA additive is a newer approach to these taggant technologies. DNA can be inserted into a fiber now that contains a lot of information similar to the 2D barcode. One advantage of using DNA is extracting the information is more straightforward and forensic methods aren’t necessary. This technology is not cheaper, but a more straightforward way of embedding lots of information into a fiber.

Beyond taggants, splittable fibers also offer some expansion possibilities for bicomponent fibers in the market. When producing spun yarns, microfibers pose a problem in the carding machine. However, with control of the cross section of a bicomponent fiber, the splittability of the fiber also can be controlled,

which offers a way to incorporate microfibers into spun yarns. The splittability property is important because carding processes are all different, and the design and application may require a different mix of splittable microfibers and nonmicrofibers. With all of the different cross sections that can be produced in combination with the many different types of polymers available, it is possible to manufacture a really broad range of splittable fiber.

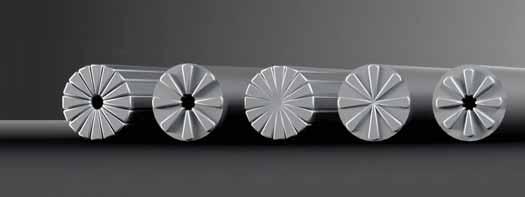

Cardable, splittable bicomponent fibers include (See Figure 1):

•Hollow;

•Hollow partial wrap;

•Standard;

fiber mix to carry all the fiber through the process. But this technique allows microfibers to be blended in spun yarns. This expansion of bicomponent fiber applications may require some additional downstream work, but it’s a fairly low hanging fruit that is available and ripe for development in the short-term.

Another short-term development on the fiber future “guess-o-meter” is environmentally advantaged fibers. The term “green” fiber can mean many different things, and there is much more to “green” fibers than just sustainability or carbon dioxide mitigation including microplastic concerns, toxicity and landfill issues. Different fiber technologies address different environmental concerns and the term environmentally advantaged is a fitting term to use to cover many scenarios.

One of the first things that is already underway is an expanding role for natural fibers. It’s clear from a consumer’s point of view that these fibers are greener than a plastic. However, despite demand, natural fibers are not 100-percent of what is used in textiles because they don’t deliver the properties that polyester in particular delivers.

•Standard partial wrap; and

•Hollow full wrap.

With a range of splittabilities, it’s possible to tailor a fiber to a process and card a blend where the bicomponent fibers split during carding. The caveat is that there has to be some non-splittable, non-microfibers in the

For use of natural fibers to expand much more than it has already, there may need to be some work done to chemically modify the fibers to expand their property envelope. Also, at some point in the future, there will be a debate about whether to use our land to produce something that isn’t food. Producers of polylactic acid (PLA) fibers already have seen some push back on the polymer because they are using corn and are therefore consuming some of the food supply. So, the expansion of natural fibers may hinge on the question “fibers or food?” Ultimately the battle —if it is even a battle —between natural and synthetic fibers is going to be one that is potentially limited by the evolution of plastics. There is a lot of

work taking place in the plastics industry to address some of the environmental problems that plastics present, and solutions are becoming compelling. Not many of the solutions are cost effective yet, but at least technologically there are a lot of answers to environmental issues. The speed of development and the ultimate cost of new solutions may very well may limit the impetus to focus more on natural fibers.

One newer technology developed in the plastics industry that delivers a lot of bang for the buck is degradation enhancing additives (DEAs). CiCLO® is one such technology offered by Intrinsic Advanced Materials, a joint venture between Intrinsic Textiles Group and Parkdale Advanced Materials. There are other technologies in the market, and they work in basically the same way. When DEAs are added to just about any plastic, the material will degrade in a microbe-rich environment in two to three years and not in 200 or 300 years.

One of the appealing things about these technologies is the relative low cost compared to biopolymers, which are often sought after to solve environmental issues. Biopolymers offer a lot of technical advantages, but none of them is cheap. DEAs are relatively low cost and can be put into a product right away. Another big advantage is that biopolymers require a significant sacrifice in properties in the application or processing, or both. DEAs allow an environmental benefit at low cost, quickly with essentially no sacrifice in properties. In addition, some biopolymers require composting to degrade, and DEAs allow a fiber to degrade in any microbe-rich environment without requiring composting.

One drawback is that the degradation may not occur as fast as it does in some of the other polymers such as PLA. But there is a compelling proposition for the use of DEAs when comparing a product that degrades quickly but is expensive and costs a lot in terms of properties versus a fiber with DEAs that doesn’t degrade right away, but

degrades in a couple of years versus centuries and the technology exists today. DEAs likely will become an important technology in a fairly short amount of time.

Polyethylene furanoate (PEF) is a new biopolymer being developed primarily by Avantium in the Netherlands, among other companies. PEF is an exception in the biopolymer world because choosing biobased ingredients does not mean sacrificing fiber properties as it does with other biopolymers.

Fully biobased polyethylene terephthalate (PET) is not yet a reality because biobased ethylene is an available feedstock, but the terephthalate part is really tricky. In PEF, the furanoate monomer —2,5-furandicaboxylic acid —combines with biobased ethylene glycol to make a polymer that is very similar to PET, but the furanoate monomer also is biobased so the resulting PEF polymer is 100-percent biobased. The fiber has some natural degradability, but is not spontaneously biodegradable, which is useful because many applications require durability. PEF is inbetween the two extremes —it doesn’t degrade right away, but it can be made to degrade if necessary. The fiber properties are comparable to polyester, but the fiber is biodegradable in the medium-term and may be

recycled in typical PET recycling streams, which is a significant advantage. Another upside is that PEF may be produced in an existing PET plant. The reaction kinetics are different, but fundamentally, manufacturers just need to swap the terephthalate monomer for the furanoate monomer. In addition, PEF in particular would be a good polymer to use in combination with DEAs.

One drawback to PEF is its cost. This is due in part to the fact that it’s early in the development stage, so the price will come down. Avantium has shared projections for the cost, and it is predicting that with scale the price will be comparable to PLA, maybe a little higher. But that is a significant premium, which has frankly hampered the adoption of PLA in mass markets.

On the price front, there are other reasons to believe the cost will get to an acceptable level. Some research is taking place to develop a polymerization process that may cut the cost of making PEF to about 20 percent of what it is now. In addition, the oxygen barrier of PEF is fantastic. This property means nothing in fibers, but is very important in the plastic bottle market. Coca-Cola, among other companies, is investing a lot of money to develop bioplastic bottles, which will drive the development of PEF.

The other option is to make a 100percent biodegradable PET, which can be done, but it’s expensive and despite large investments that nut has not yet been cracked. And with the property differences in mind, PEF has a chance to be the winner over biodegradable polyester. If it is, the volumes will be enormous and the cost will be driven down. PEF is a fiber to watch. The research is not quite there yet, but the first pilot scale plant is in the works.

Polyhydroxy alkanoates (PHAs) is another class of biopolymers that bears watching. They are still not quite ready for prime time as a textile fiber, but the technology is getting closer to commercialization. PHAs have many advantages over some other materials. They are 100-percent biobased and are spontaneously biodegradable. As previously mentioned, it’s an advantage that PEF has some durability to it — that’s something that will be desired in many applications. But there are other applications where spontaneous degradability is important. Anywhere there are microbes, PHAs will degrade. That doesn’t mean it will degrade hanging in the closet. But when left on the ground, degradation is quick; and the polymer is also marine degradable, which makes it a promising solution to the marine plastics and microplastics issues. PHAs are likely to be available at relatively low cost at scale — possibly even cheaper than polypropylene, which is a tremendous advantage over other biopolymers. PHAs also can be made

from just about any biomaterial or carbon dioxide so sugars from corn or other food sources are not impacted. Factories can even use carbon dioxide captured by a scrubber on a smokestack as the raw material for a PHA — how green is that? PHAs are not quite there yet in terms of processability, but this is chemistry base that has wide tailorability. There are many ways to tailor the properties of the polymer, and this, plus the compelling environmental advantages, will hopefully drive development forward to a solution.

Chemical recycling also is potentially a big deal in the environmentally advantaged fibers category. Years ago, BASF looked into depolymerizing nylon. Back then, it wasn’t an environmental issue, it was more cost-driven research, but the company determined it was cost prohibitive. It’s interesting to see renewed activity in this area today. Polyester and polypropylene recycling plants are being built many places in the world now, and it’s hard to imagine that kind of capital would be invested unless it was going to be a profitable endeavor.

Chemical recycling also eliminates downcycling so conceivably a polyester can be recycled eternally.

There is a debate about recycling versus using biopolymers because recycling seems so simple —it’s just a mechanical process —and biopolymers seem more exotic and advantageous. But in terms of delivering an environmental advantage,

recycling, in the right context, can be more powerful than a polymer that easily degrades. In the future, there will be a lot more focus on chemical recycling efforts.

There are things that can be done with fibers and textiles that haven’t been adequately developed yet, including electrical applications. Electrically functional apparel — adding wires to textiles —has been in development for some time, but it hasn’t yet taken the industry by storm. But innovation is ongoing, and it is likely the challenges will be resolved.

More so, electrically activated substrates hold a lot of promise and could be very useful. Think about an electrical stimulus activating motion in a substrate, for example. Or other types of activation include photovoltaic textiles that may be useful in garments, window blinds or roofing substrates. Such technologies also could be used to create foldable or rollable display screens that would eliminate the need for a separate projector. This sort of technology is not something that could be produced tomorrow – a lot of work and investigation would need to go into how exactly it would work – but materials are available that are appropriate for the job, and there is enough value there that the research is worthwhile.

Textiles also can be conductors. There is one naturally conductive polymer, a polyaniline, that has limited conductivity. But the fact that it exists suggests that there could be development work done to create a more conductive fiber that is more valuable than the currently available polyaniline.

Conductive fibers also can be created using conductive additives such as carbon nanotubes, or by using vapor deposition technologies.

Carbon nanotubes may be used to produce a yarn that is more conductive, but what’s most interesting is that single wall carbon nanotubes are not just conductive, they are super conductors. If these microscopic car-

bon nanotubes could be embedded in a matrix of polyester, for example, and it was possible to make something with practical length, these new materials could offer a lot of value as super conductors.