5 minute read

3Q FY 2021 Results Bella CASA delivers an astounding 39% sales growth and 60% net profit growth

3Q FY2021 results Bella Casa delivers an astounding 39% sales growth and 69% net profit growth

Bella Casa, a leading emerging markets company in the fashion industry, announced its financial results for the quarter and nine months ended December 31, 2020. FINANCIAL OVERVIEW 3QFY21 FINANCIAL PERFORMANCE SUMMARY: ● 3QFY21 consolidated constant currency sales increased by 39% YOY to Rs 53.68 Cr. - a business sales growth of 39% YOY, maintaining the same level of operating profitability. - International business sales growth of 33% YOY, on a constant currency basis ● 3QFY21 consolidated constant currency EBITDA increased by 38 % YOY to Rs 6.3 Cr. ● 3QFY21 consolidated net profit and EPS (without exceptional items) increased by 69% YOY to Rs 4.01 cr and Rs 3.5 per share, respectively. ● The board has declared an interim dividend of 6 % (INR 60 paisa per share) CEO’s COMMENTS Commenting on the financial performance of 3Q FY2021, Mr Saurav Gupta, CEO, said: “During the third quarter of the fiscal year 2021, we have delivered competitive and profitable growth, while continuing to make healthy investments in marketing and creating new capacities. This quarter was our best third quarter ever, and we believe that the worst is behind us. Our comparable sales increased by 39% while EBITDA growth was robust at 38%, in constant currency terms. Going forward, as the market conditions improve even further, we will focus on the new product launches and enhanced distribution to build on the growth momentum. Overall, we are relentlessly focused on becoming more agile, increasing the pace of innovations, enhancing our go-to-market approach, and will continue to outperform the market and deliver industry-leading returns.” KEY HIGHLIGHTS/FUTURE PLANS ● Historically, the best third quarter for Bella Casa since its inception. ● Volume growth in line with plans for capacity expansion and new market penetration ● Innovation led to market outperformance, and the company plans to capitalise on this momentum in the upcoming quarter.

Advertisement

MARKET REPORT

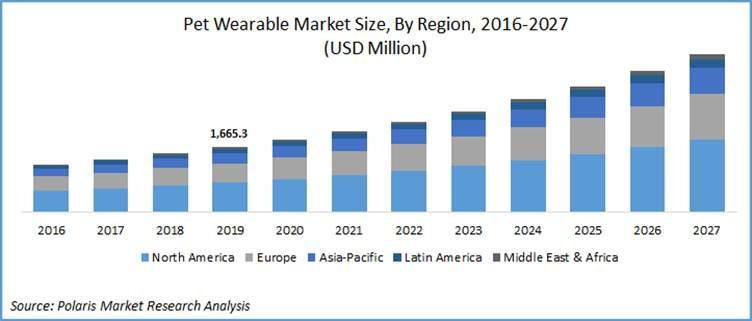

Pet Wearable Market Size Worth $3.9 Billion By 2027 | CAGR: 11.6%

The global pet wearable market size is expected to reach USD 3.9 billion by 2027 according to a new report published by Polaris Market Research. The report “Pet Wearable Market Share, Size, Trends, Industry Analysis Report, By Product (Smart Collars, Activity Trackers, Pet Emotion Sensors, Smart Vests, Smart Cameras, and Smart Harnesses), By Technology (GPS, RFID Devices, Bluetooth, and Sensors); By Application (Identification & Tracking, Medical Diagnosis & Treatment, Behavior Monitoring & Control, Safety & Security, and Facilitation), By Regions; Segment Forecast, 2020 –2027” gives a detailed insight into current market dynamics and provides analysis on future market growth. Veterinary wearables are the wireless devices enabled with technology to transfer medical and wellness data of an animal or pet on a real time basis. The ecosystem of wireless technology is created via web enabled hardware devices with the owner’s smart phone, also known as “internet of things” to enable data transmission. Through this IOT system the key health metrics of the wearer are analyzed through analytics software. Data from these wearable devices are extremely helpful in analyzing performance of pet/animal, be it racing horse completion or dog’s sniffing capability to bomb squad team or any other racing competitions. These embedded wearables capture the daily routine activities, food habits, sleep and breathe patterns, activity levels and calories burned in different time intervals under different parameters, heart rate activity and fear and fight responses under strained environments. Above metrics are

useful integral points to identify performance of pets/animals to categorize them into low, optimal, and high performers. The prominent factors impacting the growth of Pet Wearable include surge in pet population & concerns regarding livestock health, increasing usage of recent technologies in pet tracking devices such as internet of things & artificial intelligence, need to contain animal poaching of endangered animals, and rising spending trends of pet owners, particularly in high income countries. As per the statistics published by the Association for Pet Obesity Prevention (APOP), in 2018, there were approximately, 60 and 56 per cent dogs and cats were obese or doesn’t had sound health metrics. Market participants such as Dindog Tech S.L, SwineTech, Halter, Omnia Technologies, Eureka Technology, Whistle Labs LLC, Furbo, Vence, Allflex USA Inc., Piavita, Wagr, PetPace, Invoxia, Pawbo Inc., Avid Identification Systems, Inc., GIBI Technologies, Dog Tracker Nano, Jiobit, Garmin, Petzilla, Petcube, Datamars Inc., FitBark, Intervet Inc., Invisible Fence, Konectera Inc., Tractive GmbH, Link AKC, Motorola, Nuzzle, Num’Axes /EYENIMAL, KYON, Scollar, Doctra, Petnet, Trovan Ltd., and Felcana are some of the key players operating in the global market. Industry stakeholders in the market are focusing on innovative technologies such as AI and IoT to become a recognizable player in the already crowded marketplace. For instance, Taiwan based Borqs Technologies, Inc., engaged in the development of software products in IoT space introduced mobile based tacking solution “BeSmartTrack” to track and trace pets/animals. With this, the company wants to establish itself to be global technology provider across the globe. Moreover, recently, Chinese startup “Megvii”, is using AI for facial recognition, expanding beyond humans, and started using it for pets via their unique nose print. App has an accuracy rate of 95 per cent and has re-united around 15 thousand abandoned pets with their owners in China. View More Information About Pet Wearable Market @ https://www. polarismarketresearch.com/ industry-analysis/pet-wearablemarket/request-for-samples Polaris Market Research has segmented the pet wearable market report on the basis of product, technology, application and region Pet Wearable Product Outlook (Revenue – USD Million, 2016 – 2027) • Smart Collars • Activity Trackers • Pet Emotion Sensors • Smart Vests • Smart Cameras • Smart Harnesses Pet Wearable Technology Outlook (Revenue – USD Million, 2016 – 2027) • GPS • RFID Devices • Bluetooth • Sensors Pet Wearable Application Outlook (Revenue – USD Million, 2016 – 2027) • Identification & Tracking • Medical Diagnosis & Treatment • Behavior Monitoring & Control • Safety & Security • Facilitation Pet Wearable Regional Outlook (Revenue – USD Million, 2016 – 2027) • North America • U.S. • Canada • Europe • France • Germany • UK • Italy • Spain • Netherlands • Austria • Asia Pacific • China • India • Japan • Malaysia • South Korea • Indonesia • Central & South America • Mexico • Brazil • Argentina • Middle East & Africa • UAE • Saudi Arabia • Israel • South Africa