Qatar has established a goal of augmenting its annual liquefied natural gas (LNG) production from 77m tonnes per annum (mtpa) to 126 mtpa by the year 2027. The North Field Expansion project, comprising North Field East (NFE) and North Field South (NFS), is a significant endeavour aimed at enhancing Qatar’s liquefied natural gas (LNG) production capacity. The project is divided into two distinct phases, with phase 1 currently underway, targeting a production capacity of 110m tonnes per annum by 2025. Phase 2, set to be completed by 2027, will further increase the capacity to an impressive 126 mtpa.

The North Field Expansion project involves the construction of new liquefaction trains and offshore facilities, essential components for efficiently transforming natural gas into LNG. To execute this ambitious initiative, a joint venture has been formed between QatarEnergy and renowned energy companies TotalEnergies, ExxonMobil, ConocoPhillips, Eni and Shell. The primary objectives of this expansion project are to bolster Qatar’s LNG production capabilities, stimulate its economy and solidify its position as the foremost LNG exporter globally. By significantly increasing LNG output, Qatar aims to capitalise on the rising demand for natural gas and establish itself as a pivotal player in the international energy market. Through the implementation of the North Field Expansion project, Qatar is poised to secure long-term economic benefits, enhance its energy infrastructure and sustain its position as a key supplier of LNG to the world.

In June 2022, QatarEnergy and China Petroleum & Chemical Corporation (Sinopec) inked a 27-year sale and purchase agreement (SPA) for the provision of 4m tonnes per annum of liquefied natural gas to China. The contracted LNG volumes will be sourced from QatarEnergy’s North Filed East LNG expansion project and transported to Sinopec’s receiving terminals in China, in accordance with the terms specified in the SPA. Moreover, in November 2022, QatarEnergy and ConocoPhillips affiliates signed two long-term LNG sale and purchase agreements for the delivery of up to 2m tonnes per annum of LNG from Qatar to Germany. The delivery of the LNG is expected to commence in 2026. The LNG volumes will come from QatarEnergy and ConocoPhillips joint ventures that have stakes in Qatar’s North Field East and North Field South projects. Most recently, in June 2023, QatarEnergy concluded a 15-year supply deal for liquefied natural gas with PetroBangla, the state-owned entity of Bangladesh. Under this agreement, 1.8m tonnes of LNG will be supplied annually, commencing in 2026.

These strategic agreements demonstrate QatarEnergy’s expanding presence in the global LNG market and its commitment to establishing enduring partnerships with significant energy stakeholders. By harnessing Qatar’s substantial LNG reserves and infrastructure, these agreements contribute to the sustainable supply of LNG while fostering robust trade relationships between Qatar and prominent importers such as China, Germany and Bangladesh. QatarEnergy has demonstrated its commitment to developing major energy projects by taking the final investment decision (FID) for the North Field East project in 2021. This significant milestone was announced alongside the award of the EPC contract for Package 1. Signed by Chiyoda Corporation and Technip Energies, the contract marks a crucial step in the development of the NFE project. The main scope of the EPC contract is the construction of four mega LNG trains with a capacity of 8m tonnes per annum each. These facilities will be located within Ras Laffan Industrial City. Building on this success, QatarEnergy has recently awarded a significant engineering, procurement and construction (EPC) contract worth US$10bn to a joint venture of Technip Energies and Consolidated Contractors Company (CCC) for the North Field South project. The project involves constructing two LNG mega trains, each with a capacity of 8 mtpa.

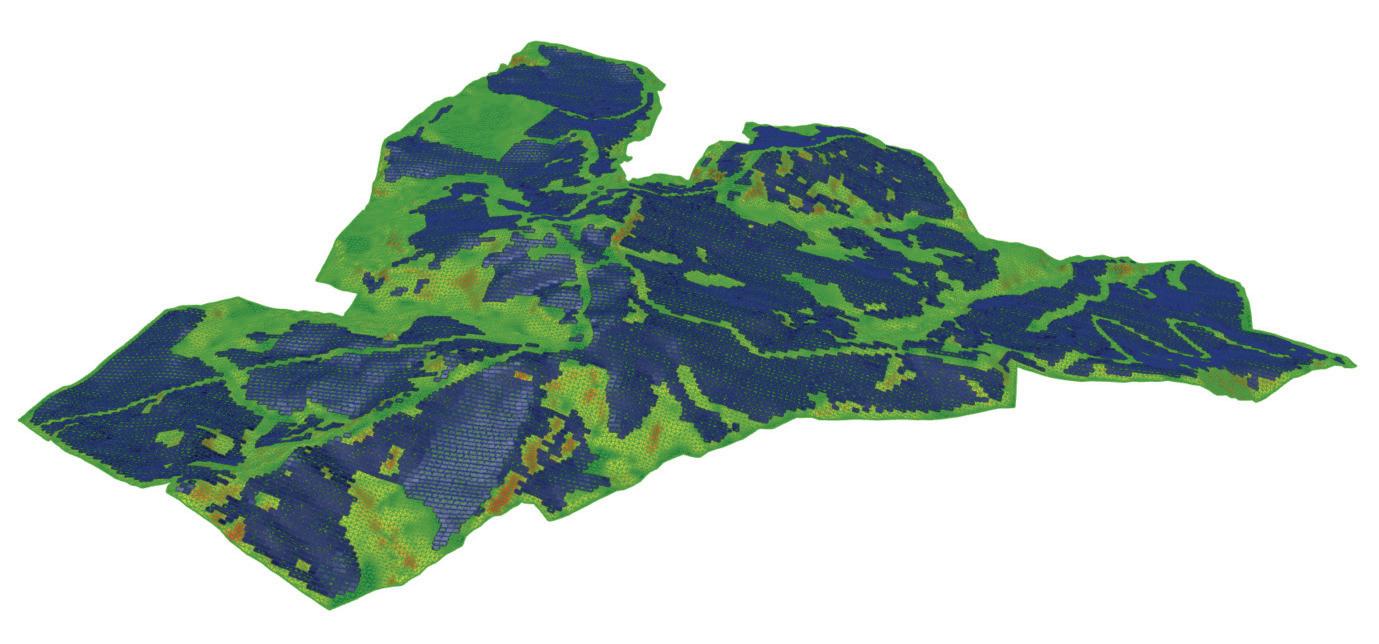

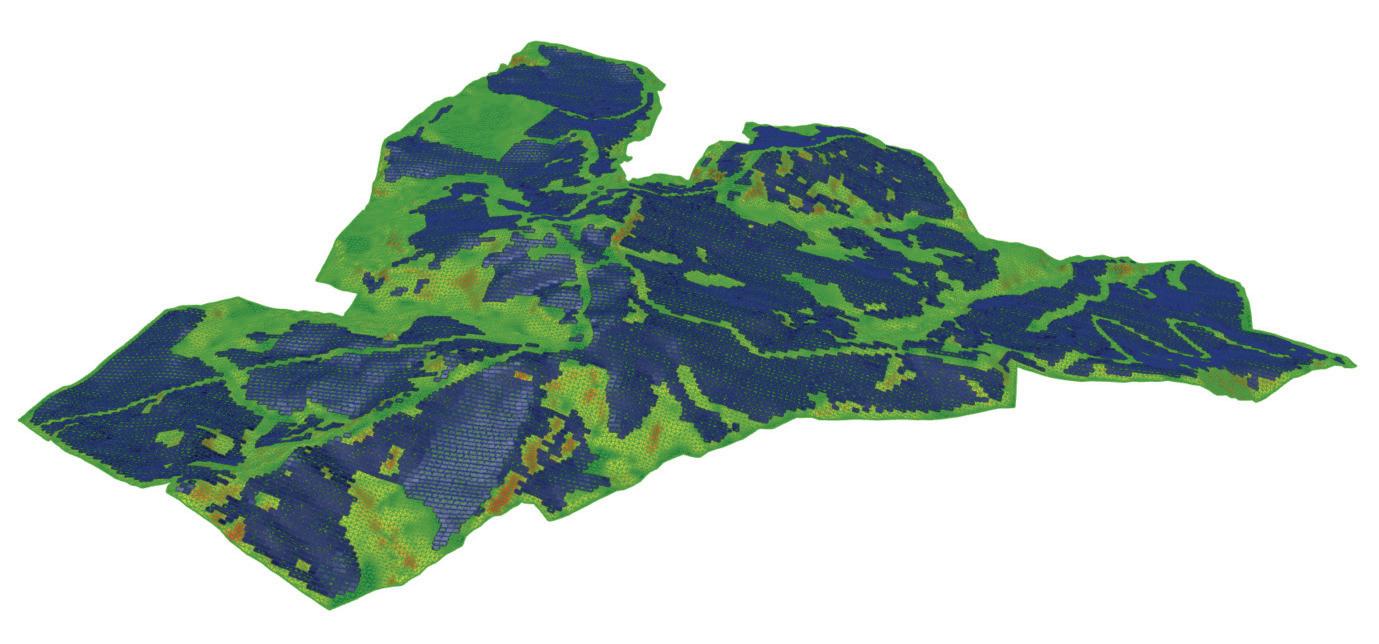

Qatargas undertook the development of the North Field Production Sustainability (NFPS) compression project. This significant endeavour is closely linked to the ongoing North Field Expansion project and aims to enhance regional production sustainability and efficiency. The NFPS compression project encompasses the construction and installation of multiple offshore compression platforms, along with associated flare towers and living quarter platforms. These platforms, estimated to weigh between 20,000 to 40,000 tonnes each, will be strategically positioned in the North Field to optimise production operations.

These critical elements are essential for the overall success and seamless integration of the NFPS compression project. By implementing advanced compression technology, Qatargas aims to maximise the utilisation of the North Field’s vast natural gas resources while ensuring sustainable production practices. The project’s comprehensive scope demonstrates Qatargas’ commitment to innovation, environmental stewardship and the region’s long-term economic viability. The NFPS compression project is a testament to Qatargas’ expertise in the energy sector and its dedication to meeting the growing global demand for natural gas.

Faiz Halim Energy Analyst – All Sectors (Middle East & North Africa) faiz.halim@the-eic.com

The celebrations of the EIC’s 80th anniversary continue with the forthcoming Walkathon. This will start overnight on 15 August in London and continue until 80km are covered. This is not only a fantastic opportunity for our staff and member companies to come together as a team but also to help a cause that is close to our hearts – supporting the National Trust in planting 20m trees across the UK by 2030. Any charitable donations towards this worthy objective, large or small, can be made through the EIC’s Just Giving page www.justgiving.com/page/eic80for80?utm_term=3zJdkwa4v

The seventh edition of the EIC Survive & Thrive Insight Report has been published. We interviewed 96 member companies for the report this year, our biggest yet, 50% up on last year. You’ll find the stories featured at the end of each Inside Energy issue. To read the full report visit www.the-eic.com/MediaCentre/Publications/SurviveandThrive

This edition’s sector analysis has been produced by Faiz Halim, EIC’s energy analyst for the Middle East & North Africa. The article dives into the efforts by the Qatar government to expand and fortify the country’s gas sector. Qatar intends to augment its annual liquefied natural gas (LNG) output from 77m tonnes per year to 126m by 2027.

As a guest editorial, we welcome Ian Griffiths, CEO of EIC member company Steel Dynamics Group. Among other things, Ian discloses Steel Dynamics’ work, the role of stainless-steel providers in the energy transition and how the company has been preparing for it while investing in sustainability.

Don’t forget to check the member’s news and spotlight on technology pages, where you’ll discover the offerings and developments of Actavo and Harting.

Last but not least, readers can keep up with the latest trends of the international energy industry with regional comments from our directors in Europe, the Americas, Asia Pacific and the MENA region, as well as news from our global members.

Léliam de Castro, Head of Marketing and Communications leliam.castro@the-eic.com

Why did you become an EIC member?

What has your experience been so far?

As we are a project led organisation, we initially joined EIC for the EICDataStream project tracking database, this contains information on energy projects from inception through to completion. This proved to be incredibly useful and something that we still use today. We have been members for three years and as time has progressed we have gained more and more from our membership including participating in a round table around the journey to net zero, developing valuable relationships with other EIC members, being shortlisted in the EIC’s national awards and latterly judging them.

What are the synergies between Applica and the EIC?

We have found that the EIC has an incredible knowledge and intelligence of the energy market and has a complete focus on this sector, just like Applica. This level of understanding enables the EIC and Applica to add real value to the needs of clients.

Where would you like to see Applica and the EIC in the next 80 years?

Building and maintaining strong, high quality relationships and understanding that the industry and technology is central to what we do.

I would like to see Applica and the EIC remain focused on these areas with a dedication to embracing the technology to reach net zero.

About Applica

Applica resources projects globally for companies integral to energy transition.

The team at Applica is people-centric, diligent, agile and innovative. Great people who strive for excellence are essential to what the company does. Consistent, high-quality training is central to its culture.

Applica’s head office, based in Manchester, acts as its global recruitment hub. It has businesses registered in both Houston and Stavanger to support the energy markets of North America and Scandinavia and has solutions in place to support Europe and Asia.

Applica prides itself on developing long-term relationships with clients and contractors. This approach combined with in depth technical knowledge of the energy industry ensures that Applica always provides a holistic solution.

Why did you become an EIC member?

What has your experience been so far?

Being a SME organisation, the help and support that membership bodies such as EIC provide is extremely valuable. EIC has assisted asset55 in growing our presence in the industry, increasing brand awareness and helping share our growth as an independent company. Although we have only been a member with EIC for less than a year, our experience with EIC has been fantastic. From regular one-to-ones, to assistance in exhibitions and conferences, press releases, social media, EICDataStream, promotion of news and thought leadership pieces – EIC goes out of its way to assist asset55 in any way it can.

The quality of what EIC has to offer is also highly regarded by asset55. With regards to events, whether it be its own regional events or pavilions at the grander international events – EIC offers a range of great options that contribute to our overall goals in regards to the event. Its publications and reports are also top quality, offering insight into the other members’ news and keeping the industry up-to-date.

What are the synergies between asset55 and the EIC?

As previously mentioned, asset55 is an SME organisation and the synergy lies in EIC’s ability to promote awareness of asset55 in the industry while assisting other industry members to discover beneficial opportunities with us and what we have to offer.

EIC has given us a platform to assist in telling our story, an example being its Survive and Thrive report, where it has allowed us to tell our story to a wider audience in the industry with the possibility of an award – giving recognition to the wonderful team at asset55.

Where would you like to see asset55 and the EIC in the next 80 years?

In 80 years, I would like to see the asset55 team grow in size, with the ability to offer more and more software based off the expertise and experience of industry engineers and our in-house software developers – to help improve efficiency, productivity and safety in the industry.

With regards to EIC, in 80 years, I hope to see its membership grow along with its diverse range of opportunities available to assist its members in marketing based activities, brand awareness, business development and sales.

About asset55

At its core, asset55 is a software engineering technology company, bringing together highly experienced industry engineers combined with leading software developers to drive real and positive change within the energy sector. Aligned across two divisions, Operations and Projects, asset55 enables change through a portfolio of execution specific software, which share two common traits – improving safety and improving productivity to its clients.

Established in 2012, asset55 has grown organically to become a leading and trusted provider of SaaS technology to the energy sector while maintaining clear objectives to support its customers on critical operations to ensure that it goes above and beyond expectations on delivery and execution of its services.

Why did you become an EIC member?

What has your experience been so far?

I was honoured to be invited to join the EIC and more than happy to accept the invitation. I accepted the invitation because of EIC’s strong reputation in the industry, the high-quality pedigree of the other members and the opportunity to network with industry peers. My experience has been great thus far and has exceeded my expectations. I really appreciate the level of guest speakers at the quarterly meetings and the insightful ideas and market conditions that are discussed.

What are the synergies between McDermott and the EIC?

I think the synergies and mutual benefits are strong. As a top-tier EPC company, I like to believe that McDermott can offer our own insights on market conditions and the state of the industry. I also feel like that as a client to many of the vendors that are EIC members, that gives fellow EIC members an opportunity to network with McDermott supply chain management personnel, to demonstrate value and explain their unique capabilities. In return, EIC provides McDermott insightful views on industry trends and facilitates relationship building with potential McDermott clients.

Where would you like to see McDermott and the EIC in the next 80 years?

I suppose I’d like to see both McDermott and EIC at the forefront of the industry, still leading the way, having made a successful transition into whatever is coming next in the energy industry.

McDermott is a premier, fully-integrated provider of engineering and construction solutions to the energy industry. Its customers trust its technology-driven approach engineered to responsibly harness and transform global energy resources into the products the world needs.

From concept to commissioning, McDermott’s innovative expertise and capabilities advance the next generation of global energy infrastructure –empowering a brighter, more sustainable future for us all. Operating in over 54 countries, McDermott’s locally-focused and globally-integrated resources include more than 30,000 employees, a diversified fleet of specialty marine construction vessels and fabrication facilities around the world.

How has the EIC helped you through the years? Any interesting stories to tell?

Initially the EIC helped us to prioritise certain sales focuses by utilising the projects database, by researching certain CAPEX s, allowing us to understand the market opportunities for us as a company, which companies to focus on and in which markets.

We then started to attend EIC organised networking events, both nationally and internationally, which gave us valuable insights as to what our peers are doing and working on in the various focus industries we are following. Then the natural progression was for us to be more involved in the international expo events. With the EIC offering support to take part from the organisational to stand design, it allowed us as a company to focus on the sales element at such events and lead creation and progression.

The EIC has evolved into an organisation that supports the growth or our international business and we are really grateful to have been associated for over two decades.

What are the synergies between Weidmüller and the EIC?

International and national presence, in key markets, striving to support industries in the growth of energy transition.

Where would you like to see Weidmüller and the EIC in the next 80 years?

Great question. I would like to see Weidmüller and the EIC continuing to be leading industry peers to the energy transition markets. We both have different but important roles, with Weidmüller offering its unique engineering expertise to create solutions that positively impact the market trends, and the EIC continuing to support companies like Weidmüller, with expert guidance, market intelligence and networking platforms to grow our global presence.

About WeidmüllerIn today’s process industry, plant availability, modularisation and digitalisation are among the most important factors for being competitive in the international market. Klippon Engineering is the internationally renowned partner of the Weidmüller Group in the field of process engineering. It combines over 60 years of engineering expertise with the knowledge and experience of its specialists and strategic partnerships in the process industry.

The company’s globally operating network focuses on the development and supply of products, solutions and systems that extend the service life of your plants, increase your production efficiency, reduce investment costs and enhance safety – always in accordance with the latest internationally recognised certifications and standards.

Operator: EDF

Value: US$18.75bn

The EDF Group has filed requests for authorisations to build its first pair of 1650MW EPR2 reactors at the Penly Nuclear Power Plant. EDF is planning a total of three pairs of EPR2 reactors, the first at Penly, the second at Gravelines and the third at either Bugey or Tricastin.

Operator: Hynfra PSA

Value: US$2bn

Hynfra PSA and Fidelity Group have partnered to build a green ammonia plant in Jordan. The plant, located in the Aqaba Special Economic Zone, aims to produce up to 200,000 tonnes of green ammonia annually.

Operator: LOKEN Sdn Bhd

Value: US$100m

Toyo Engineering & Construction has been awarded a pre-FEED contract for the proposed SAF plant which would be the first in Malaysia. The pre-FEED study will determine the project’s commercials and ensure it is aligned with the intended plant capacity.

Operator: Woodside

Value: US$7.2bn

A final investment decision has been reached on the project. Hyundai Heavy Industries has been awarded the EPC contract for the FPU vessel which is planned for delivery in April 2027. Cosco Shipping Heavy Industry has been awarded a FEED contract by SBM Offshore for the FSO.

Operator: Xlinks

Value: US$5bn

Between 14 July and 14 September 2023, a geophysical survey will be conducted in UK waters. The survey is being conducted by GEOxyz using the vessel Geo Ocean VI. Research suggests that Xlinks will secure financing for the development in 2025.

Operator: Corio Generation

Value: US$1.5bn

DORIS has been awarded the frontend engineering design (FEED) contract for the project’s electrical and communications system to grid connection, array and export cabling and all components of the fixed offshore substation foundation and topsides structures.

For more information on these and the 13,500 other current and future projects we are tracking please visit EICDataStream

EICSupplyMap maps the capabilities of supply chain companies that operate in the wider energy industry. These industries cover renewables, upstream, midstream, downstream, power, nuclear, energy storage and the potential and proven capabilities in carbon capture and hydrogen. After successfully mapping the UK market, EICSupplyMap now covers the United Arab Emirates, Malaysia, Texas/US and Brazil.

• Identify the supply chain local to your region, giving you the opportunity to engage with potential new clients.

• Find the supply chain capability in five regions, now covering the UK, UAE, Malaysia, Texas/US and Brazil.

• An in-depth look at profiles of more than 6,000 energy sector supply chain companies.

• Make smarter decisions by targeting your offering to international developers/operators and contractors matching your capability with international energy projects.

www.actavo.com/industrial/

Company wins special Fleet Technology Trophy for second year running.

Actavo has secured four prestigious, internationally recognised awards in acknowledgement of its work in health and safety, at the annual Health and Safety Awards organised by the Royal Society for the Prevention of Accidents (RoSPA) in the UK.

Three of the RoSPA awards recognise Actavo for its longterm achievements in health and safety, including its road safety strategy across its industrial, PDC and network and in-home divisions.

Actavo Industrial Solutions UK has been awarded the RoSPA Order of Distinction Award following 19 consecutive years of achieving Gold awards.

Actavo Network & In-Home achieved three awards including: the RoSPA President’s Award, which recognises the company’s achievement of winning the Gold Award for 12 consecutive years; the RoSPA Fleet Safety Gold Medal, in recognition of seven consecutive years of Gold Awards; and the RoSPA Fleet Safety Technology Trophy, which recognises Actavo’s road safety strategy and excellence in managing occupational road risk. This is an industry specific award, which Actavo has now been awarded for the second year running.

Organisations receiving a RoSPA award are recognised as being world-leaders in health and safety practice. Every year, nearly 2,000 entrants vie to achieve the highest possible accolade in what is the UK’s longest-running H&S industry awards.

The annual awards are categorised by different levels of achievement: Merit, Bronze, Silver and Gold, as well as long-term awards that recognise companies for achieving Gold awards for multiple consecutive years.

Actavo is honoured to have once again received this recognition from the Royal Society for the Prevention of Accidents. RoSPA awards are widely recognised as being among the foremost international accolades in the health and safety sector. Safety is our number one company value, and these awards are an acknowledgement of that culture and of our long-term track record of excellence in this area.

Brian Kelly, Group CEO, ActavoAccidents at work and work-related ill health don’t just have huge financial implications or cause major disruption – they significantly impact an individual’s quality of life. That’s why good safety performance deserves to be recognised and rewarded. We are thrilled that Actavo has won these RoSPA awards and would like to congratulate them on showing an unwavering commitment to keeping their employees, clients and customers safe from accidental harm and injury.

Julia Small, Achievements Director, RoSPA

www.harting.com/UK/en-gb

Connectors also speed up the construction of hugely beneficial energy storage modules, which allow companies to maintain an uninterrupted power supply and save on energy costs by using delayed load usage.

As demand continues to increase, storage system providers need to connect several cells. The Han S® is specially designed to meet this need, providing safe connections for the assembly of battery storage modules in large quantities with maximum safety. The design meets all technical requirements and is based on the latest standard UL 4128 for stationary energy storage systems.

Han S® also simplifies servicing and maintenance. If an energy storage module cell shows a drop in performance, the respective management system can switch it off and have it replaced.

To do so, the Han S® interfaces of the adjacent modules are simply turned to the locked state to make room for the switch-out. This procedure can be done without interrupting the energy storage functions of the neighbouring modules.

Han S® is the first high-current battery connector that meets the relevant UL and railway standards for stationary energy storage systems. Among others, it fulfils the requirements of UL 4128 for connectors in electrochemical battery system applications, UL 1973 for batteries in stationary applications and UL 9540 for energy storage systems and accessories. The range is also shock and vibration proof according to the relevant railway standards. To learn more, please visit: www.harting.com/UK/en-gb/connector-battery-storage

23753 Community Street West Hills Los Angeles CA 91304 US

Contact Peter Petyt, CEO

Telephone +1 818 821 4478

Email peter@4rivers.legal

Web www.4rivers.legal

4 Rivers is a third-party funding advisor and brokerage which originates claims either directly from claimants or through law firms.

The company helps to structure claims so that the chances of them securing funding are substantially better than if 4 Rivers was not involved. Its methodology is the result of many years of corporate finance experience where businesses and projects were prepared and presented to funders.

The low acceptance rate of thirdparty funders mirrors that of the venture capital and private equity arenas. An advised proposition may be 20 times more likely to succeed than a non-advised one.

4541 S 700 E, STE 25 Salt Lake City Utah 84107 US

Contact

Shahriyar Majlesein, CEO

Telephone +1 385 265 1707

Email shahriyar.majlesein@cec.ltd

Web www.cec.ltd

Established in 2015, Citadel Engineering Company (CEC), a recognised trademark, has redefined the engineering field, particularly with its innovative global grain trading services. Today, CEC is among the rapidly growing testing, inspection and certification (TIC) organisations in the industry, offering a comprehensive range of services including engineering, inspection, calibration, certification and training. Spanning across four regions, CEC operates five business segments, with operational bases in countries from the UK to the UAE and strategic alliances in China and India. Additionally, CEC has offices in Mozambique and Guyana, as well as a facility in Iraq.

CEC serves as the parent organisation for a host of subsidiaries. Great Citadel, a key partner of Emerson, ABB and Honeywell, is a leading supplier in the Middle East. CECB, another subsidiary, is a certification body accredited by UKAS. Citadel Academy delivers accredited professional training. The newest member of the CEC group is Citadel Scientific Company, which concentrates on renewable and green energy.

Rua Teófilo Otoni 63/11º andar – Centro Rio de Janeiro

RJ, Brazil, 20090-080

Contact Bruno Ghiatã, Sales VP

Telephone +55 21 2240 1300

Email bruno.ghiata@infotecbrasil.com.br

Web www.infotecbrasil.com.br

Infotec Brasil is a company specialising in services, processes and people outsourcing (BPO), with more than 35 years of experience and more than 500 projects delivered.

The company takes care of client’s operational efficiency, combining specialised people, best practices, technology and assets.

Its methodology delivers optimised processes, risks reduction and more competitive costs.

Infotec Brasil’s main cornerstones are ethics, respect for the environment and maximum operational security.

6 Tagore Drive

#04-05

Singapore 787623

Contact Chris Holmes, Business

Development ManagerTelephone +65 9759 7970

Email chris.holmes@ippgrp.com

Web www.ippgrp.com

IPP Scomark is regarded as one of the primary leaders in the supply of piping products. Backed by its Global Group of companies, it is your key contact for all pipes, fittings and flanges.

IPP is one of the largest manufacturers, stockholders and fabricators of all piping products ranging from carbon steel, LTCS, HYCS (with and without cladding), stainless steel, duplex, super duplex, 6% moly and high nickel alloys.

The company specialises in providing the energy industry with proven products that stand up to the most hostile, high pressurehigh temperature conditions; right through to innovative sustainable future developments within nuclear, hydrogen and carbon capture.

IPP Scomark’s strategic global office locations keeps it close to its clients, enabling the company to respond and deliver on very short lead times, regardless of time zone.

Bollin House Riverside Park Wilmslow Cheshire SK9 1DP

Contact Simon Calvert, Business Development Manager

Telephone +44 (0)1625 537 555

Email scalvert@leap29.com

Web www.leap29.com

For over 20 years, Leap29 has been helping businesses advance by providing reliable recruitment and employment management support.

It operates from seven global offices around the world and works with businesses across the engineering sector, including renewable energy, oil and gas, construction, pharmaceuticals, FMCG and IT. Leap29 offers tailored solutions to meet your requirements, whether you are looking to recruit hard to find experts or need compliant PEO employment management support, the company can be your trusted partner, no matter the location.

Level 3A, Menara RKT 36 Jalan Raja Abdullah Off Jalan Sultan Ismail 50300

Kuala Lumpur

Contact Faezah Jeman, General Manager of Corporate Planning & Business Development

Telephone +603 2715 2303

Email faezah.jeman@redtechoffshore.com

Web www.redtechoffshore.com

Redtech Offshore was founded in 2014 with accumulatively more than 30 years of experience providing upstream services and offshore construction.

From planning to execution, Redtech Offshore commits to deliver projects safely, on time and cost-efficiently with its mantra: ‘your partner in value creation, we ensure added value in every project, at all levels of the supply chain.’

THURSDAY 19 OCTOBER 2023

#NAD2023

Hosted by Dame Joanna Lumley

ABB is collaborating with Lhyfe, a pioneer in the production of renewable hydrogen and Skyborn, a global leader in renewable energy, to jointly realise and optimise one of Europe’s most ambitious renewable hydrogen projects, SoutH2Port.

The project is to be located in close proximity to Skyborns’ 1GW offshore wind farm Storgrundet in Söderhamn, Sweden, where Skyborn and Lhyfe recently entered a sales purchase agreement with Stora Enso for an industrial property of around 40 hectares. Fully operational, SoutH2port is expected to produce about 240 tons of hydrogen per day.

As part of the memorandum of understanding signed between the companies, ABB will apply critical expertise to optimise the integration of the hydrogen and electricity production across the entire ecosystem including automation, electrical and digital technologies and drive the development of scalable, commercial energy transition projects in and around the region. The aim is to explore opportunities to tie-in Power-to-X conversion technologies turning renewably sourced electricity into carbon-neutral energy carriers, such as hydrogen, and storing the energy.

The new plant will support the decarbonisation of the Swedish energy system, either directly with hydrogen supply or by further downstream production of refined fuels such as methanol, sustainable aviation fuel or ammonia –contributing to the government’s plans to become the world’s first fossil-free welfare country by 2045.

Amarinth, a world-leading, net-zero designer and manufacturer of low lifecycle cost centrifugal pumps and associated equipment, primarily for the offshore and onshore oil and gas industries; nuclear and renewable energy generation; defence; desalination; process and industrial markets, has signed PE Energy Ltd, based in Nigeria, as a West African agent and approved certified service provider.

Amarinth has developed a strong market presence for its pumps in Africa, spearheaded by its regional manager Ejiro Erivona, based in Nigeria. In this agreement, signed between Chris Ryan, sales director of Amarinth and Daere Akobo, founder and group managing director of PE Energy, during a visit by PE Energy to Amarinth’s head office in Rendlesham, UK, PE Energy will deliver local marketing and sales support to the West African region and become an approved certified service provider following a training programme delivered by Amarinth.

The new partnership will enable oil and gas organisations in the region to benefit from local expertise and skills in both commissioning and maintaining Amarinth API 610 and API 685 horizontal, vertical and in-line pumps and also when replacing or refurbishing obsolete pumps from other OEMs, particularly where the original pump manufacturer has gone out of business. This will further boost in-country value, with oil and gas organisations being able to select high-quality, qualified local suppliers to fulfil these requirements.

In the latest sign of its progressive shift to more sustainable products, Atlas Copco has expanded its portable electric product portfolio to include an all-new battery driven portable screw air compressor. The B-Air 185-12 is the first of its kind within the global industrial marketplace and represents a major milestone in Atlas Copco’s roadmap towards a sustainable future.

The B-Air 185-12 features 5-12 bar of pressure, a stable flow rate of 5.43.7m3/min and 55kWh battery storage capacity. With power delivered from its onboard power pack, in operation a fully charged unit is independent of the need for fuel or a local power source to plug into, and has the capability to perform for up to a full typical work shift. In turn, it provides both portability and productivity for those working on sites where regular access to electricity is not practical. Making the switch from an internal combustion engine (ICE) to electric motor brings with it a host of benefits, including less downtime and maintenance requirements. Due to having far fewer moving (and therefore wearing) parts compared to a diesel powered unit, the electric B-Air 185-12 only needs to be serviced every 2,000 hours, as opposed to 500 hours for a typical ICE powered unit. The machine’s state-of-the-art variable speed drive (VSD) and permanent magnet motor drives down the total cost of ownership, automatically adjusting the motor speed to match air demand in real-time and increasing energy efficiency by up to 70%.

Through Atlas Copco’s rigorous testing process, which includes rapid aging testing under harsh conditions and climactic chamber testing, the B-Air 185-12 has been proven to perform optimally even in the most extreme of climatic conditions – ranging from +45°C (+113°F) to a glacial -25°C (-13°F); and 4,500 metres (14,764ft) above sea level.

The unit is also designed to excel in densely populated urban areas where emission and noise pollution are tightly restricted, thanks to it producing no local emissions and having low noise levels. The quiet nature of the compressor enables operators to work without noise distraction, enhancing both productivity and safety.

The B-Air 185-12 was first unveiled at the recent Atlas Copco Journey to a Sustainable Future event in Antwerp, Belgium. The company gathered senior business leaders from across the industry to discuss how best to tackle the transformation to a climate friendly, low-carbon future.

Atlas Copco is proud to be committed to our industry’s fight against climate change by developing the first batterydriven screw compressor. The B-Air 185-12 is a tangible symbol of our commitment to delivering real-world solutions to help our customers and their customers adopt a more sustainable way of working.

Bert Derom, President, Portable Air Division, Atlas Copco

The new battery-powered unit marks a vital step in the electrification of Atlas Copco’s product offering, and is just one of many developments the company currently has in store to deliver sustainable solutions to its customers. The unit came to life thanks to the long-term partnership with Perslucht Wilda, Atlas Copco’s distributor in the Netherlands for more than 40 years. During the event it was also announced that Dutch infrastructure company Van Doorn made history by purchasing the first B-Air unit.

The B-Air 185-12 is scheduled to go into production in September, using a compact and modular concept with multiple autonomy variants.

Intertek, a leading total quality assurance provider to industries worldwide, is proud to bring back the Intertek Moody brand, harnessing its global, industryleading recognition and honouring Intertek’s founding pioneers by remembering the powerful engineering-based legacy that Moody represents.

As companies plan a significant step-up in their investments inside the world of energy, reflecting the increase in global energy demand, elevated concerns around energy security and the need to bring renewables to scale, this is resulting in increasingly complex operational and supply chain risks.

In light of this heightened complexity, Moody’s proven engineeringbased inspection capability brings complete peace of mind, helping to mitigate these risks, meaning that corporations are able to benefit from its cutting-edge quality, safety and sustainability solutions.

Intertek Moody delivers in-depth expertise and local knowledge on a global scale. Its business is built on providing assurance, reducing risks through pioneering innovations such as RiskAware, and ensuring first-class integrated services such as inspection, expediting, technical resource solutions and project management assistance.

The Moody heritage provides a foundation of experience and technical expertise that is perfectly aligned with the needs of its global customers as they overcome challenges and seize growth opportunities within the quickly evolving and fast-paced energy and infrastructure industries.

Established in 1911 in New York US, Moody Engineering Co initially focused on electrical engineering and construction. The company quickly moved into the oil and gas industry during the 1920s offering inspection and technical services. Today, with offices in more than 60 countries and operations in more than 100, Intertek Moody has an unrivalled reputation for helping power the largest, most complex energy and infrastructure projects around the world.

Intertek re-ignites prestigious Moody brand as growth opportunities in the world of energy accelerate

Johnson Matthey (JM), a global leader in sustainable technologies, and Hystar, a Norwegian high-tech hydrogen company, have signed a three-year strategic supply agreement to ramp up renewable (green) hydrogen production. This delivers on JM’s published milestone of winning at least two strategic partnerships in hydrogen technologies by the end of 2022/23.

JM will supply membrane electrode assemblies (MEAs), key performancedefining components for electrolysers, as part of Hystar’s commercialisation ramp-up. This represents the next step in the collaboration between the two companies which began in 2021, focused on electrolyser stack development and manufacturing scale-up, using the components provided by JM and Hystar’s patented cell design.

As part of the ongoing collaboration, JM will supply MEAs for the Hystar PEM electrolysers to be used in the HyPilot project in Norway. The HyPilot project will verify Hystar’s patented PEM technology under realistic field conditions, in collaboration with industry leaders Yara and Equinor, with end market demand driven by the trends in food production and energy security.

As part of the project, Hystar will deliver a complete, autonomous, containerised PEM electrolyser with a hydrogen production capacity of up to 745kg/day.

Hystar’s recent test results show the company already exceeds the Clean Hydrogen for Europe 2030 targets for clean hydrogen production. Hystar and JM will work in partnership to continue improving the performance of Hystar’s electrolysers and design circularity principles into the system.

Both partners will continue the collaboration to enable further scale up and automation for Hystar’s planned multi GW production line, which is expected to be operational by 2025.

Johnson Matthey is a global leader in sustainable technologies, catalysing the net zero transition. With over 200 years of sustained commitment to innovation and technological breakthroughs, it improves the performance, function and safety of its customers’ products. The company’s science has a global impact in areas such as low emission transport, energy, chemical processing and making the most efficient use of the planet’s natural resources.

i

For more information: www.matthey.com

Kent has been appointed as the front-end engineering design (FEED) contractor for Grenian Hydrogen’s six electrolytic hydrogen projects.

Under the UK Government Department for Energy Security and Net Zero (DESNZ) Net Zero Hydrogen Fund and Hydrogen Business model, Grenian Hydrogen, a joint venture between Progressive Energy, Statkraft and Foresight, has been awarded funding to further develop six green hydrogen projects within the HyNet cluster in North West England and North Wales.

Kent was awarded a single FEED study in April 2023 to cover all six sites to develop the projects to an AACE class 3 estimate such that related final investment decisions can be made to progress each of the projects to execution.

The projects will all incorporate PEM electrolysers with Kent as the FEED contractor incorporating the OEM technology design into complete hydrogen production, storage and delivery facilities.

The projects, ranging from 10MW to 30MW green hydrogen production for 100% fuel switching or blending, will be co-located at six different sites, the Protos Energy Park and at large manufacturing plants in St Helens, Stretford, Middlewich and Winnington.

Kent is a privately-owned international integrated energy services partner backed by Bluewater. Founded in 1919 as a small family company in Ireland, Kent is now a 12,500-strong client-centric global business. It delivers sustainable and innovative engineering services and project delivery solutions for the oil and gas, chemical, renewables and low carbon industries.

For more information: https://kentplc.com/

This cluster of projects is a huge step forward for the future viability of green hydrogen, and we are proud to play our part.

Matt Wills, Market Director Low Carbon, Kent

Odfjell Ship Management is to start the digitalisation of its fleet using a digital logbook system from Kongsberg Digital. The traditional hand-written logbook onboard a vessel is a vital reporting tool for the crew, stating their course, actions and engine status. Though an essential daily task for the officers onboard, reporting in the logbook is also timeconsuming, making the officers spend critical time reporting during a voyage.

We are happy to welcome Odfjell onboard for their digitalisation journey, and we look forward to a close and great collaboration.

Christopher Bergsager, VP Growth Digital Ocean, Kongsberg DigitalTo optimise the crew’s efficiency and reduce administrative tasks, Odfjell Ship Management has started its digital voyage by installing Kongsberg Digital’s K-fleet digital logbook system. The digital logbook collects data from ship systems into a central data storage. It enables easy recording of event-based data related to navigation, engine, oil record book, garbage handling, port calls and other operational activities defined by the logbooks being supplied.

Kongsberg Digital provides industrial software to heavy asset industries, the maritime industry included. Through the vessel-to-cloud infrastructure

Vessel Insight, data is gathered from the vessel’s sensors and systems to provide actionable insight from the analysis of operational vessel data. The consistent and standardised way of collecting data through Vessel Insight enables quality reporting, empowers transparency and allows in-depth analysis to optimise vessel and fleet performance.

Mott MacDonald, the US$2bn global engineering, management and development consultancy has announced a significant milestone in its international renewable energy efforts. The company has successfully supported Hibiki Wind Energy Co Ltd and syndicated lenders to achieve financial close on the Kitakyushu Hibikinada offshore wind farm project – a state-ofthe-art offshore wind farm in Japan.

Hibiki Wind Energy Co Ltd is backed by major Japanese electricity utility companies, including Kyuden Mirai Energy (a subsidiary of Kyushu Electric Power Co Inc) and J-Power (Electric Power Development Co Ltd).

The 220MW offshore wind farm project will generate clean electricity for more than 175,000 Japanese homes. This landmark project represents a major step forward in Japan’s energy transition and highlights how international collaboration has a key role to play in securing a more sustainable future.

The announcement of this project follows a recent agreement between the UK and Japanese governments to strengthen collaboration efforts on offshore wind energy. The UK is already a global leader in this field, while Japan possesses immense untapped potential to expand its own offshore wind capacity. The partnership between Mott MacDonald and Japanese companies embodies the culture of collaboration and shared expertise envisioned in the agreement.

Mott MacDonald has led the engineering development of large complex offshore wind projects since the inception of the industry, including some of the UK’s first offshore wind developments. This experience and the ongoing growth in renewables globally, means that it is well-placed to support emerging and pioneering projects in the Japanese market, including engineering leadership for Japan’s first four offshore wind farm projects.

NanoSUN Ltd, the Lancaster, UK based producer of the world’s first mass-produced mobile hydrogen refuelling station is delighted to announce the appointment of Neil Tierney as managing director and chief executive officer.

Neil’s impressive journey is marked by the leadership of a series of successful ventures. Always focused on the customer, Neil has secured substantial investment capital and has proven himself as a visionary leader in the cleantech business world.

Neil is driven by a passion for sustainability and innovation. He founded ONZO, a home energy management company that was later acquired by SSE and GEO. He also played a pivotal role in the growth and success of Allbirds, a net-zero apparel company. In addition, Neil has also made significant strides within the transport sector and has demonstrated a commitment to sustainable mobility solutions through his involvement with UBCO and PURE Electric, focusing on lightweight electric vehicles.

Neil’s expertise in building brands was recognised by ICF Next, a top10 global agency that acquired his company, The Future Customer.

From this invaluable experience comes a deep understanding of company strategy and market expansion which Neil now brings to NanoSUN.

Under Neil’s leadership, NanoSUN is poised to deliver on its mission of accelerating the adoption of hydrogen as a transportation fuel. His strategic acumen, combined with his passion for sustainability, positions him perfectly to guide the company in helping achieve a greener and more prosperous future.

The company and its international distribution partners are unlocking easy access to onsite green hydrogen at scale to fuel transport and industrial processes. This role is the next logical step for me in climate and clean tech.

Neil Tierney, CEO, NanoSUNNanoSUN is a world-leading, awardwinning, engineering company focused on the development, manufacture and commercialisation of mobile hydrogen refuelling solutions for use within the transportation industry.

For more information: www.nanosun.co.uk

Marking another year maintaining the Carbon Neutral International Standard across its operations, the NRL Group is celebrating achieving a further 7% reduction in carbon emissions across a wider reporting scope thanks to continued improvement efforts.

Formally reviewed by the independent not-for-profit organisation One Carbon World each year, recent analysis of 2022 business operations saw more improvements in addition to the previous year’s 27% reduction. Since partnering with One Carbon World to calculate carbon emissions, the business has now successfully reduced emissions by 31.5% compared against 2020 figures.

An important measurement to gauge impact, carbon footprint per employee identified significant improvement, recorded as 1.46 tonnes CO2e per employee per year, representing a 29.4% reduction per person.

The NRL Group’s approach to become carbon neutral was implemented through two initiatives, a group wide focus on how to effectively reduce carbon emissions and investment in carbon credits to support global initiatives designed to tackle climate change.

Central to their impact has been volunteer carbon champions working in their branches, identifying practical and long-term changes that can be implemented to leave a lasting legacy, including switching to more sustainable suppliers. Included in the support provided by One Carbon World are suggestions as to how emissions can be further reduced in key areas such as energy consumption, together with adopting company-wide changes such as electric and hybrid company vehicles and reducing road travel.

Securing the Carbon Neutral International Standard certification also means the NRL Group can reaffirm its commitment to the United Nation’s Carbon Neutral Now initiative, an important movement that is challenging climate change across the globe.

The NRL Group provides the people that play an integral role on major projects across a range of critical sectors including renewable energy, power generation and infrastructure. From humble beginnings at Sellafield in 1983, today’s diverse global Group supplies a range of innovative recruitment resourcing, outsourcing and languages services. Technical contracting businesses also provide non-destructive testing (NDT) and rail services in safetycritical environments.

i

For more information: www.nrl.co.uk

Synaptec Ltd, the Scottish supplier of passive electrical monitoring systems for power networks, has received a substantial order from Proserv, the global controls technology leader, for sensor system assemblies.

These will be integrated into Proserv’s ECG™ cable monitoring system for deployment on a major offshore wind farm to assess the condition and integrity of inter-array cables.

This year marks the 20th anniversary of Rollstud Middle East. It is celebrating 20 years of leadership and innovation.

Rollstud prides itself on continually improving its services and the quality of its bolting products and is looking forward to the future and all the possibilities.

Synaptec’s unique sensor technology provides remote and passive measurement of electrical and mechanical properties at a myriad of points within wind turbine arrays. The ECG system incorporates these measurements with other sensor data, providing the wind farm operator with real-time insights into the health and performance of the cable infrastructure.

i

For more information: www.proserv.com

The company is committed to enabling sustainable decisions by its customers and to driving sustainability in its operation, products and community. Rollstud thanks all its clients for their support over the years and looks forward to its next chapter.

i For more information: www.rollstud.com

Our ECG system is fast being recognised as the essential tool for the management of offshore wind farm cables. Davis Larssen, CEO, Proserv

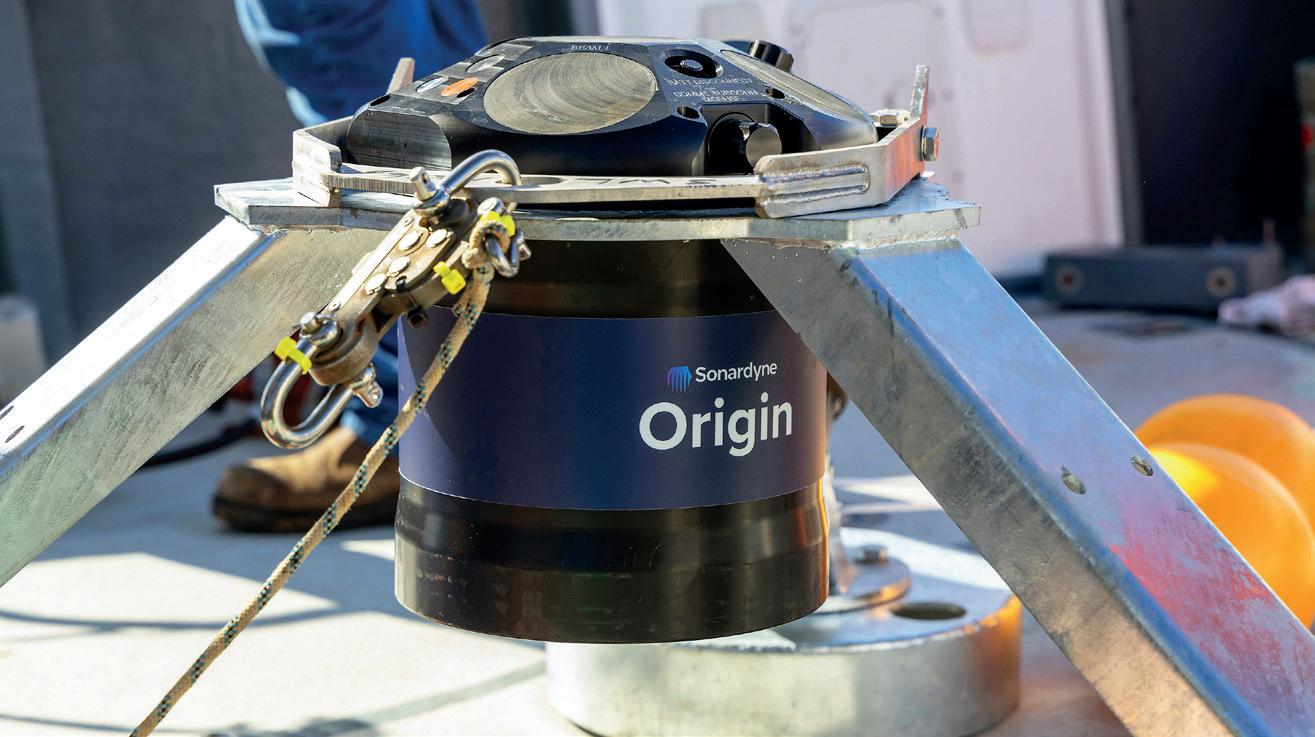

Marine technology company

Sonardyne has launched its new Origin Acoustic Doppler Current Profilers (ADCPs). RS Aqua has been appointed as the UK reseller for the new Origin 600 ADCP.

The Origin 600 sets new standards for intelligent ADCP data. It is the first ADCP to include an integrated acoustic modem and advanced onboard Edge processing – enabling remote access to all core features and giving high quality, intelligent data in near real-time.

We welcome RS Aqua as the UK reseller of Origin 600 and know the product will benefit their customers and business portfolio for years to come.

Michelle Barnett, Manager,It also delivers new and exclusive highfidelity data formats, while its ability to link to other external sensors allows you to get the most out of a single device deployment and the data generated.

Portsmouth-based RS Aqua has supported the UK marine industry for over 40 years. Its depth of knowledge and experience of supporting customers across a variety of sectors makes them an ideal choice as a Sonardyne reseller.

Through investment in people, technology and footprint, Sonardyne has built one of the most capable, dynamic and responsible businesses in the marine technology space. As a vertically integrated company with everything under one roof, together with its trusted supply chain and strategic partners, it can tackle your subsea project in ways no other solutions provider can.

Spirit Energy, with the support of majority shareholder Centrica Plc and Stadtwerke München GmbH (SWM), has been granted a carbon storage licence by the North Sea Transition Authority (NSTA). This represents a further step towards its net zero vision of repurposing the North and South Morecambe gas fields for carbon capture and storage.

The announcement places the companies at the forefront of the decarbonisation efforts in the UK, with the MNZ (Morecambe Net Zero) Cluster having the potential to be one of the UK’s biggest carbon storage hubs.

It will be able to store up to a gigaton of carbon dioxide – the equivalent of three years’ worth of current UK CO2 emissions. It could initially store above 5MTPA of CO2, scaling in time to 25MTPA. The MNZ cluster will be able to accept CO2 transported by pipeline, ship and rail.

In April, Spirit Energy submitted a qualifying Expression of Interest for the MNZ Cluster to be considered as part of the Government’s Track 2 CCUS Cluster Sequencing process. The Cluster’s carbon stores will provide long-term access to a sustainable carbon storage solution for the UK’s carbon-intensive industries, helping tackle its emissions while still supporting the many thousands of reliant jobs across the UK.

i

For more information: www.spirit-energy.com

TÜV Rheinland has updated its certification programme for hydrogen. In doing so, the testing service provider has implemented the latest developments and requirements of the market. For example, the standard now incorporates supplementing directives 2018/2001 of the European Union’s Renewable Energy Directive II. In addition, TÜV Rheinland took into account new emission limits and extended the product scope to hydrogen derivatives (e.g. ammonia, methane and methanol) when certifying according to the standard. Launched almost two years ago under the name H2.21, the TÜV Rheinland standard aims to promote the use of hydrogen as an energy carrier by making transparent how the hydrogen was produced. The standard is internationally applicable. The production of hydrogen is highly energy intensive and is conventionally based on fossil energy carriers. Therefore, only the sustainable production and application of hydrogen has the potential to displace fossilbased energy carriers and consequently reduce greenhouse gases.

TÜV Rheinland stands for safety and quality in almost all areas of business and life. The company has been active for more than 150 years and is one of the world’s leading testing service providers. TÜV Rheinland has more than 20,000 employees in over 50 countries and generates annual sales of around €2.1bn. TÜV Rheinland’s highly qualified experts test technical systems and products around the globe, accompanying innovations in technology and business, training people in numerous professions, and certifying management systems according to international standards.

We want to use every opportunity to connect with our members, so please follow us on Twitter (@TheEICEnergy) and connect with us on LinkedIn –EIC (Energy Industries Council)

Below you’ll find a selection of some of the exciting EIC activities and useful industry information we’ve shared through our social media channels.

Join us for EIC CONNECT Energy USA 2023! Unlock the power of connections and expand your network at this exciting event. More information at http://bit.ly/44qgRRN

Go to EICTV to see GCC Energy Market and Project Update 10: it will provide you with an insightful update on the energy market. Watch it at http://bit.ly/3XU71Fe

The EIC is hosting a Walkathon on 15 August in London to celebrate our 80th Anniversary. To support our efforts, please visit https://lnkd.in/eb6J7Fgz and contribute.

23 August

23 August

Business

23 August

23

ADIPEC

23

23

23

24

29

29

5 September Business Presentation

in Rio: LNG Projects in Brazil Rio de Janeiro

5 September Overseas Exhibition

Offshore Europe 2023

Live, Aberdeen

5 September Overseas Exhibition Gastech 2023 Singapore Expo

6 September Management Course

12 September Corporate Entertainment Pre-OGA Networking Cocktails Kuala Lumpur

13 September Overseas Exhibition

Oil & Gas Asia (OGA) 2023

Kuala Lumpur Convention Centre, Malaysia

13 September Business Presentation

South America EICDataStream

Steel Dynamics is a part of a group of companies including Offshore Stainless Supplies Ltd, P&P Non Ferrous and Bornmore Metals, that offers customers across various industries a one-stop-shop for materials and processing.

Why we joined the EIC

We joined the EIC to be connected to like-minded companies driving the UK towards the net zero target by building a more sustainable future. The supply chain has a significant responsibility in driving sustainability, from the industries we support and supply into, to our internal practices we implement.

Steel Dynamics Ltd is one of the UK’s leading stainless steel stockholders and processers to the nuclear industry and other high integrity sectors

With continuous investment in machinery, stock, people and processing, the company continues to provide European origin high-quality stainless steel into these sectors. Due to the benefits and properties of this material, including high strength, durability and resistance to corrosion, this is being heavily used in the processing, storage and transport of hydrogen and carbon capture.

The hydrogen and carbon capture sectors are critical to the global effort to reduce carbon emissions and combat climate change

These sectors require high-quality stainless steel that can withstand extreme temperatures and corrosive environments. We are already involved in supplying stainless steel into hydrogen projects in the UK and the use of hydrogen as a clean and renewable fuel is gaining momentum. Diversification within the industry is important as we look up and down the supply chain. As the world transitions to a low-carbon economy, there will be a growing demand for materials and services that can support this transition.

The skills needed to support this diversification are out there and we are seeing this diversification with the stainless steel we are supplying to our customers. Customers from oil and gas sectors to cryogenic vessel manufacturers are demonstrating their versatility and adaptability to hydrogen.

Nuclear power will play an important role in achieving net zero emissions and creating a sustainable energy future This low-carbon energy source produces electricity without emitting greenhouse gases. While renewable energy sources like wind and solar are essential for reducing greenhouse gas emissions, they are not enough to meet the world’s growing energy needs. Nuclear power will provide a reliable source of baseload power that can complement renewable energy sources and help to reduce greenhouse gas emissions.

Steel Dynamics holds ISO9001, ISO14001, ISO45001, AS9100 Rev D, Cyber Essentials plus and EN1090 Ex Cl 4 accreditations. But our strength in nuclear power is due to our commitment to the ISO 19443 standard we hold.

We have implemented the ITNS (Important To Nuclear Safety) ISO 19443 ensuring our products and processes are of the highest quality to support nuclear new build and decommissioning. This has allowed the company to become a leading supplier of stainless steel material to the nuclear industry, providing critical components for nuclear power plants and other nuclear applications.

Our decision to open a 100,000 sq ft stainless steel facility therefore making room for a 40,000 sq ft carbon steel facility with nuclear in mind is a testament to the company’s commitment to the nuclear industry.

The new facilities will allow us to expand capacity and raise the standard of carbon steel processing to ISO19443.

We have designed a concept called Total Service Concept (TSC) to reduce waste and inefficiencies in the supply chain and effectively sell our customers less metal. The TSC approach is a testament to Steel Dynamics’ commitment to sustainability and responsible business practices.

The TSC approach is based on the principle of reducing waste and inefficiencies in the supply chain. Steel Dynamics has implemented several initiatives under the TSC approach to achieve this goal. These include a comprehensive stock management system to ensure customers have the right amount of metal at the right time.

This system helps to reduce waste by minimising excess inventory and ensuring that customers only order what they need. Another part of TSC is offering bespoke solutions to customers.

The aim of this being to reduce waste by ensuring that customers receive the exact metal they need for their specific applications.

The TSC approach offers several benefits to our customers. These benefits include:

• Cost Savings.

The TSC approach helps to reduce waste and inefficiencies in the supply chain, which can lead to cost savings for customers.

• Environmental Sustainability.

The TSC approach helps to reduce waste and promote environmental sustainability by minimising excess stock and reducing the amount of metal used.

• Improved Efficiency.

The TSC approach helps to improve efficiency in the supply chain by ensuring that customers receive the right amount of metal at the right time.

Reducing our carbon emissions is only one part of the sustainability framework and as well as the company’s strong commitment to the environmental aspect, social and governance must also be considered when driving a more sustainable future.

We have implemented a comprehensive ESG sustainability framework to guide our operations.

The company’s framework is based on three pillars: environmental sustainability, social responsibility and corporate governance.

Steel Dynamics has implemented several initiatives under each of these pillars to ensure that its operations are sustainable and responsible.

We have recognised the importance of our people as part of the social sustainability. Our commitment to our employees growth, development and wellbeing not only benefits the individuals but also contributes to the growth and success of the company as a whole.

The engineering industry, like many other industries, is facing a skills shortage. This makes it even more important for companies like ours to invest in their employees and provide opportunities for growth and development as well as showing we are driving a sustainable future. By doing so, the company can attract and retain top talent, ensuring that it has the skilled workforce it needs to succeed.

Our commitment to our people can take many forms, including training and development programmes, mental health first aiders, private healthcare, cost of living benefits packages and a positive work environment. By investing in its employees, we can create a culture of excellence and innovation, where employees are motivated to perform at their best and contribute to the company’s success.

Strengthen your brand in global markets with the support of the EIC’s International Trade team. The International Trade team manages UK and EIC pavilions at some of the largest and most influential energy events across the world.

In addition to this we also run a series of trade delegations which can be particularly beneficial for companies trying to break into a new export market.

See below listing of the current events we have planned for 2023 and 2024, along with a guide price at each, to support in your budgetary planning.

Camilla Tew, Director, International Trade camilla.tew@the-eic.com

The UK and Europe team has had a busy summer with a great variety of live and webinar based events.

We were delighted to host our first virtual solar event on 12 July – Sustainable Scalable Solar Power – giving attendees a chance to find out more about the UK’s solar projects and opportunities available to the supply chain. This webinar heard from Lightsource bp, Low Carbon, YLEM Energy, Pegasus Group and EIC, as speakers discussed scaling up the use of solar power to a more sustainable energy system.

If you missed last months webinar, please feel free to revisit the discussions which can be viewed on EICTV www.the-eic.com/EICTV

On 13 July EIC and Mott MacDonald partnered together in London to host Beyond Hydrogen – What’s Next? This event explored the supply chain dynamics and the immense potential for growth beyond the current hydrogen economy, including green hydrogen, e-fuels, sustainable aviation fuel and storage terminals. We were also delighted to carry on these important discussions, as we hosted a round table with speakers and financial institutions.

As more cutting-edge nuclear technology emerges across the UK and Europe, EIC and NDA partnered together to deliver a webinar on 19 July. This was a great opportunity to engage with an audience of 80+ as speakers showcased their advancements in nuclear technology and the vital role this is playing in the transition to a low carbon economy.

Jo CampbellThis month EIC is celebrating our 80th anniversary by hitting the streets of London to raise money for the National Trust by walking 80km in a day. We would appreciate any donations from the industry with all proceeds going to The National Trust to support its tree planting programme. To show your support, please head to our Just Giving page https://www.justgiving. com/page/eic80for80?utm_term=3zJdkwa4v

There is still time to book to attend some of our August events throughout the UK. On 23 August ETZ and EIC will be holding a Masterclass on Green Hydrogen in Aberdeen. Digital Transformation: Making the Difference, hosted by Petrofac in Aberdeen on 29 August and Energising The Humber: Humber’s Renewable Energy Revolution on 31 August.

September: register to attend any of our forthcoming events

Offshore Europe 5-8 September, Aberdeen

The Power of Collaboration (Day 1)

Navigating Net Zero (Day 2)

Decarbonising Oil & Gas (Day 3)

Skills (Day 4)

Celtic Sea: Floating into a New Energy Era

Tuesday 26 September, Cardiff

From Waves to Watts: Exploring Marine Energy

Thursday 28 September, Liverpool

With summer now well underway it provides an opportunity for many of us to recharge the batteries ahead of what always proves to be a busy second half of the year. This has been echoed through our recent roundtables and webinars where it appears that the majority of you are forecasting a busier second half of the year, where hopefully we will see several of the long-awaited projects across the region finally announced.

In my previous update I mentioned that I was interested to where you thought we should take the next EIC Connect in the region having already undertaken three in this calendar year (Oman, UAE and Baku). I am pleased to say that we are currently looking into hosting our first physical Kingdom of Saudi Arabia (KSA) Connect, which we hope to launch in the coming weeks. As we build up to this by the time we go to press we should have announced our first KSA Contractor Briefing scheduled to take place in September 2023, please check our website for further details. We have one further Connect event which we are currently in discussions over.

In addition to our regular Africa and GCC Market Update webinars, we are pleased to announce a CIS Market & Project Update taking place on 29 August 2023. This region is growing in importance for several of you, where it is our pleasure to place this in the spotlight and highlight several of the key projects that may be of interest to your organisation.

Our Regional Awards will take place in Dubai on 14 September, where not only did we have a record level of entrants within this year’s Survive and Thrive publication, the year has also seen a record number from across our regions, so expect a large number of winners on the night.

Investment in clean energy is set to reach US$1.7tn this year, outpacing spending on fossil fuels, as countries look to address potential energy shortages, according to the International Energy Agency. Global energy investments in 2023 are projected to reach US$2.8tn, with more than 60% allocated for clean technologies, including renewables, electric vehicles, nuclear power and heat pumps. It would be interesting to understand to what extend this is impacting your own business and subsequent sales pipeline.

A final reminder that ADIPEC will take place slightly earlier this year from 2-5 October 2023 due to COP28 taking place in the UAE in November. Being a month earlier please expect this to be hotter than usual.

Ryan McPherson Regional Director, Middle East, Africa, Russia & CIS ryan.mcpherson@the-eic.comKuwait Oil Co (KOC) is planning to pump nearly US$43bn into new oil projects in the next five years to expand production by nearly 200,000 barrels per day. The crude oil production capacity of the OPEC member currently stands at around 2.8m bpd and is expected to reach 3m bpd after 2025.

Omani authorities have awarded a US$6.7bn deal to build the world’s largest green hydrogen plant in Duqm. The award was secured by a consortium led by South Korean steelmaker Posco Group including Samsung Engineering and two other Korean state-run power companies as well as French energy major ENGIE and Thailand’s national petroleum company, PTTEP. Oman is planning to build one of the largest green hydrogen plants in the world in a move to make the oil-producing nation a leader in renewable energy technology. Construction is scheduled to start in 2028 in Al Wusta governorate on the Arabian Sea. It will be built in stages, with the aim to be at full capacity by 2038, powered by 25GW of wind and solar energy.

Please go to page 26 to see upcoming events around the world

On 19 July, EIC APAC hosted the second session of the Singapore Meet the Energy Players series at a member’s office in Singapore. The event was well attended by both members and nonmembers. This was followed by the Meet the Energy Players session in Indonesia in conjunction with Indonesia Petroleum Association Conference & Exhibition (IPA). We hosted a cocktail reception at our exhibition space at the conference, where we invited key energy players in Indonesia to network with EIC regional members. We had an attendance of close to 100.

Azman Nasir

EIC APAC also organised a webinar in mid-July on Opportunities in Indonesia’s Energy Sector. This webinar was organised as a precursor to IPA and provided insights into the Indonesian energy sector. A second webinar was held at the end of July on Energy Opportunities in the US Market as a precursor to the launch of the US country report.

In September, we are organising the EIC APAC Energy Conversations 2023 from 13-15 September 2023 at the Kuala Lumpur Convention Centre co-located with the 19 th Asian Oil, Gas & Petrochemicals Engineering Exhibition (OGA). EIC APAC has been selected as the official conference organiser. This conference is aimed at promoting focused conversations to encourage higher participation of Asian oil and gas companies to participate more aggressively in the energy transition, to exchange and share the latest concepts and approaches by international, regional and local companies on the solutions available in order to collectively achieve targets in net zero carbon emissions by 2030 and 2050 and to discuss solutions in the decarbonisation of oil and gas operations.

We are inviting experts from key local players such as PETRONAS, TNB, Sarawak Energy and Shell Malaysia, alongside regional national oil companies (NOCs) and other companies from Thailand, Indonesia, South Korea, India, Philippines, Taiwan and Vietnam; included also are international OEMs and MNCs such as Siemens, Wärtsilä, General Electric, Schneider and ABB, to speak on their topic of choice and network with the energy solutions providers who are our local members. We are also hosting business matching activities and will organise plenty of networking opportunities to benefit all the delegates.

Azman Nasir Head of Asia Pacific azman.nasir@the-eic.comBeach Energy has connected the Thylacine North 1 and 2 development wells to the Otway gas plant. The two wells are now delivering additional gas into the Australian East Coast gas market. As of May 2023, four of the six Otway development wells that were drilled as part of the major drilling campaign are now connected and have increased well deliverability for the Otway gas plant. Beach Energy is now reviewing its approach on connecting the last two wells.

It is reported that Shell is moving forward with the development of the project with start-up still targeted to be achieved in Q4 2023. Sapura Energy has installed the brownfield integrated module on the existing F23 platform that will be handling the producing gas. Work currently being conducted is the installation of the fibre optic cable between the F23 and Timi platforms. Phase 2 installation of the fibre optic cable between the F23 and Timi platforms is also ongoing.

Nepal and Bangladesh will finalise the investment modalities for the 683MW Sunkoshi 3 hydropower project and the two countries are looking forward to establishing a joint entity for the construction of the project. Nepal has provided Bangladesh with reports on the feasibility study and environmental impact assessment.

June began with the muchanticipated 2023 Energy Exports Conference (EEC). With over 1,700 registered attendees, forty exhibitors, eight hundred registered companies and over sixty speakers, EEC 2023 was held in Aberdeen, UK from 6-7 June.

I personally had the pleasure of attending EEC 2023 and moderating the Opportunities in the USA panel during the first day of the conference and the Opportunities in Brazil panel alongside speakers Tony Appleton, Offshore Wind Director, Burns & McDonnell; EIC’s very own Pietro Ferreira, Senior Regional Analyst, America; Katherine Zimmerman, Decarbonization Director, America, wood and Carlos Arentz, Director of Innovation and Industrial Technology, Acelen. I would like to extend a special thank you to these speakers for donating their valuable time and participating in a conversation around opportunities in the US covering offshore wind and carbon capture and opportunities in Brazil covering decommissioning, offshore wind and oil and gas. Beyond moderating a panel, I also had the opportunity to serve as a host for one-to-one networking meetings.

14

As June concluded, our region hosted its third event in the 2023 North & Central America Membership Open Day series. On 20 June 2023, we were joined by member company Core Group Resources. During this two-hour event, EIC members and non-members had the opportunity to hear a market overview of the region, network, win an EIC country report and hear a business presentation from the EIC member Core Group Services covering its services and its valuable relationship with the EIC and its membership. If any members in our region would like to participate in this series in 2024 or would like further information on how to attend the next Membership Open Day, please contact adriana.romo@the-eic.com

Amanda Duhon VP & Regional Director, North & Central America amanda.duhon@the-eic.com

Amanda Duhon VP & Regional Director, North & Central America amanda.duhon@the-eic.com

The US has formally launched the National Clean Hydrogen Strategy and Roadmap, a broad framework developed by the country’s Department of Energy (DoE) for accelerating the various uses of clean hydrogen to enable it to contribute with decarbonisation goals across multiple end-use sectors in the future. The strategy is seen as a fundamental component for achieving a carbon-free grid by 2035 and a net zero emissions economy by 2050.

A group of eight northeastern US states, in a letter to the DoE, are asking for federal support to establish a collective effort aimed at planning interregional electrical transmission expansions and upgrades. The states are seeking to strengthen system reliability and facilitate a quicker and more affordable transition to a clean energy future.

Please go to page 26 to see upcoming events around the world

Join EIC South America for the upcoming Breakfast in Rio with PetroReconcavo, ENP and ABPIP who will present onshore E&P opportunities. Discover the immense potential and advantages of onshore exploration and production with industry experts.

In June, we hosted Breakfast in Rio featuring TotalEnergies and Halliburton as speakers. “The temperature in Brazil is something different,” was a quote by Jean-Baptiste Dupuy, operations director at TotalEnergies. He added that in 2020 the E&P sector brought investment of about US$4m, but is now seeing an average of US$8m per year with US$12m per year expected over the next four years. TotalEnergies has been making significant strides in exploration and production activities in Brazil, particularly with the Lapa South-West project. As the operator with a 45% stake, in partnership with Shell (30%) and Repsol-Sinopec (25%), Total Energies is driving the development of this project in the Santos Basin. The project involves the connection of three wells to an existing FPSO, with production start-up anticipated in 2025. This will lead to a substantial increase of 25,000 barrels of oil per day, ultimately reaching a total production of 60,000 barrels per day.