EIC Inside

Monthly news for EIC members Special issue

Once a thermal power plant has reached its maximum operational service life, operators will usually have to decide whether to modernise or decommission the facility. Ideally, modernising an aging power plant is more cost-effective and environmentally-friendly than adding new capacity to meet the consumer’s energy demands. A thermal power plant is designed to operate for 30-40 years and usually undergoes two types of aging: physical and technological. Physical aging occurs when equipment wears out over time because of high temperatures and pressures. Technological aging occurs when newer, better equipment renders older equipment less efficient and more costly to operate. Based on data within EICAssetMap, there are currently 466 operational thermal power plants in the Middle East. More than half of these operating thermal power plants (358) have been operating for 20 years or less while the remaining 90 have been operating for more than 30 years.

Outdated thermal power plants would usually face equipment degradation, unsustainable power losses and insufficient system automation. To ensure reliable and efficient operations, modernisation of thermal power plants is strongly recommended for aging thermal power plants. Power plant modernisation could also extend the operational lifespan and enhance the overall performance. In the context of coal power plants, modernisation can also play a crucial role in reducing emissions associated with coal combustion. By incorporating advanced technologies and optimising processes, it is possible to minimise environmental impact while maintaining power generation capacity.

To reduce environmental impact and improve air quality, countries like the United Arab Emirates, Saudi Arabia, Iraq and Iran have adopted several regulations on air quality and emissions to mitigate environmental issues caused by thermal power plants. We need to note that some of these aging thermal power plants ran on heavy oil and this type of power plant will require modernisation in order to improve environmental performance, according to the regulations set by governments. 20% of the thermal power plants operating in the Middle East are oil-fired and a third of these oil-fired power plants have been operating for more than 30 years. Operators will need to decide if an upgrade is economically feasible or if it is more economical to cease operations. We can take the Israeli Reading oil power plant as an example of a power plant which was initially built as an oil-fired plant but was then converted into a gas-fired plant to reduce the amount of pollution emitted by the plant. Recently, the Israeli Ministry of Energy announced that the plant will cease operations and will be converted into a reception site for subsea electricity cable and energy storage facilities.

Typically, a residual life assessment study will be done after 20 years of operations to assess the overall performance of the plant and future plans for the power plants are discussed based on the outcome of the assessment. Modernisation can be done in two ways: either a one-time, complete renovation that temporarily halts operations, or in multiple phases conducted during scheduled shutdowns. The process usually involves upgrading the turbines and boilers, installing advanced control systems and improving air pollution control systems. Many aging power plant units are equipped with ineffective turbines and boilers that can not keep up with the current energy demands. Installation of modern equipment would enhance the efficiency and reduce maintenance requirements. As technology advances, digitalisation and automation are rapidly adopted into power plant control systems to optimise plant operations and performance. This adoption into the control system enables operators to make a data-driven decision as this approach provides a realtime analysis on the overall performance of the power plant.

To see how a thermal power plant conducts its modernisation process, the Al-Mussaib thermal power plant would be a good example for a case study. The plant began operations in 1987 with a generating capacity of 1,200MW from four units. Electricity generation in the state peaked in the 1990’s but then declined significantly in the 2000’s from 9,000MW to less than 4,000MW causing nationwide power outages. Iraq’s National Development Strategy 2005-2007 outlined a plan to rehabilitate its power plants to restore their electricity generating capacity. Siemens was responsible for supplying the control and instrumentation systems, equipment and spare parts for steam turbine generators in the Al-Mussaib thermal power plant. As soon as the rehabilitation was completed in 2014, the plant underwent equipment upgrades for two of its four existing units. The capacity increased to 240MW and 200MW respectively after the upgrade. After the upgrades, maintenance works were conducted in a timely manner to ensure the operations ran without a hitch. The plant has been in operation for 37 years and through a scheduled maintenance programme, it is anticipated that its operational lifespan can be extended by up to 10 years.

EICAssetMap provides valuable information for those involved in the power industry. By offering data on production start dates, capacity and decommissioning status, it helps users make informed decisions about modernising or retiring aging power plants. The platform is a useful resource for anyone looking to stay up to date in the power generation landscape.

Aqilah Shahruddin, Energy Analyst – Operational Assets & Decommissioning aqilah.shahruddin@the-eic.com

Building on 40 years of energy leadership, ADIPEC 2024 returns under the theme Innovation, Action, Impact and once again, the EIC is proud to manage the UK Pavilion at what is arguably the world’s largest and most prestigious energy event.

Over the course of four days, ADIPEC will bring together more than 184,000 attendees from around the globe, including the world’s largest energy producers, governments, contractors and the critical supply chain, all focused on advancing innovative solutions across the entire energy landscape.

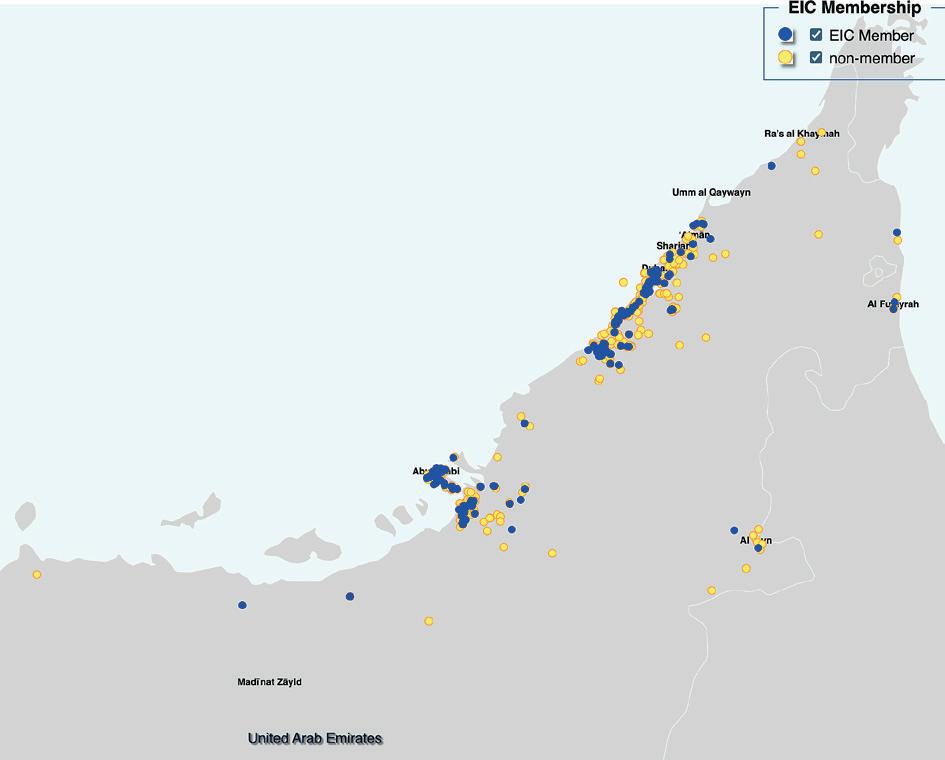

Since 2000, our International Trade team has been supporting UK companies at ADIPEC, which has grown from a biennial event to our largest pavilion worldwide, known for delivering tangible returns on investment. This year is particularly special as we celebrate the 20th anniversary of our UAE office, which continues to thrive while supporting our expanding membership across the region.

We are excited to have a presence in Halls 8, 12 and 14, proudly showcasing over 100 companies, including dedicated pavilions from Scottish Development International (SDI) and the Welsh Government. With several contractor briefings and a range of topical panel sessions, the UK Pavilion is once again primed to be a hive of activity.

This is an exciting time for the energy sector, especially in the Middle East, as the region leads innovation in both traditional and renewable energy. With global energy transitions accelerating, new technologies like hydrogen, digitalisation and decarbonisation are creating unprecedented opportunities for growth, collaboration and sustainability across the industry.

Our recently published Middle East OPEX Report highlights an abundance of opportunities across the region.

Whether it’s your first time at ADIPEC or you’re a seasoned veteran, we hope you enjoy the read. Be sure to stop by and visit the EIC team – we’d be delighted to welcome you.

Ryan McPherson

Regional Director, Middle East, Africa, Russia & CIS ryan.mcpherson@the-eic.com

The Abu Dhabi International Petroleum Exhibition & Conference (ADIPEC) takes place from 4-7 November in Abu Dhabi.

The EIC has been managing UK pavilions at ADIPEC for over 20 years, which has enabled us to witness its growth into one of the world’s most influential energy events as well as seeing how UK companies are leading the way by offering innovative products and services renowned worldwide for adding real value to projects and the local supply chain.

There are over 656 energy projects across all sectors under development in the Middle East region from 20242030 with an estimated CAPEX worth over US$1,008bn; ensuring that the Middle East continues to be a key area of focus for companies as we seek to maintain the UK supply chain’s position as a trusted and proven partner in the Gulf region.

We are delighted to announce that 2024 will see UK pavilions in three halls: Hall 8, Hall 12 and Hall 14, spread over 1,500 sq m of floorspace – the largest UK pavilion to date.

We are also thrilled to be welcoming back the Scotland Pavilion and Wales Pavilion in Hall 8 – hosting 26 and 13 co-exhibitors, respectively.

Located in a prime position at the centre of the exhibition halls, the pavilion is a constant hive of activity. The EIC invites its extensive network of contacts to the pavilion to develop bi-lateral trade through the following opportunities:

• VIP Pavilion tours with NOCs and IOCs, in previous years these have included ADNOC, ARAMCO, PDO and SABIC.

• Panel sessions on key topics across the energy sector including ‘Powering Up: Leveraging Digital Transformation and Artificial Intelligence to Achieve Energy Efficiency’ and ‘Clearing the Path: How to Unlock Critical Energy Infrastructure Projects’.

• One-to-one meetings between exhibitors and EPC contractors.

• Contractor presentations from the likes of Kent, McDermott, NMDC, Petrofac and Wood.

• An exclusive networking reception at the ALOFT Hotel, ensuring industry influencers and buyers from across the GCC can network with the UK Pavilion exhibitors in an informal setting.

With thanks to our Pavilion Sponsors:

UK Lounge Platinum

UK Lounge Gold

UK Lounge Silver

UK Lounge Bronze

UK Networking Reception Platinum

UK Networking Reception Gold

UK Networking Reception Bronze

UK Presentation Area Bronze

by Alice Kirker EIC Energy Researcher

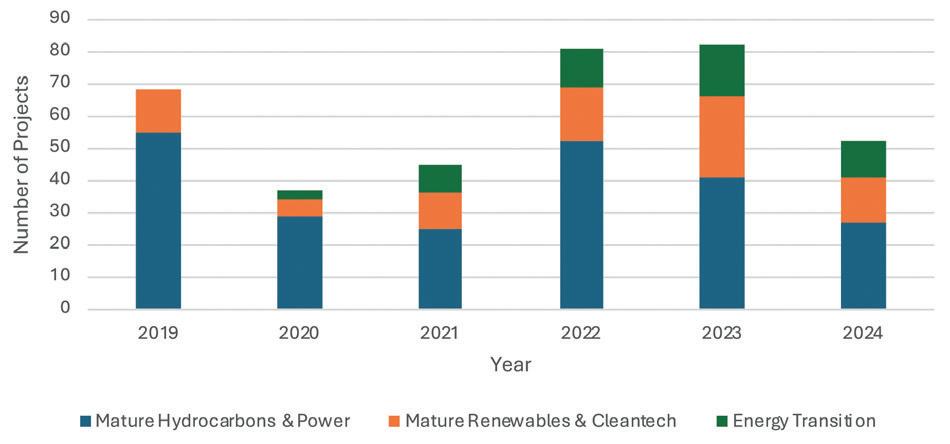

Projects announced up until September 2024 have indicated an upward momentum and are on track to catch up with the number of projects announced in 2023

1: New project announcements since 2019 in all sectors in the GCC. Source: EICDataStream

According to EICDataStream the projects announced in the GCC saw a large decline in 2020 compared to 2019, this is due to the impact of the COVID 19 pandemic and the concurrent decline of oil prices. The market recovery in 2021 indicates resilience and adaptability within the region. High oil prices have led to significant profit for national energy companies, providing additional support to the economy resulting in plenty of project investment from government bodies and corporate entities. The increase in energy transition and renewable projects announced since 2019 highlights the regions forward looking approach to clean energy and the energy transition.

The total CAPEX for projects in the GCC expected to come online by 2030 is US$644bn. Upstream projects claim the largest share at 26.76% of the CAPEX share while the lowest is energy storage projects with 0.18% CAPEX share.

Oil and gas projects dominate the landscape in the GCC with 66.52% of the total CAPEX, followed by 9.52% from power projects, 2.65% are transmission and distribution projects, 8.75% are renewable energy projects and 12.55% are energy transition projects.

Energy market overview (2024-2030)

Figure 3: Energy market overview (2024-2030) in the GCC in terms of potential CAPEX spend. Source: EICDataStream

Figure 3 shows that Saudi Arabia, UAE and Qatar each have economies that are highly reliant on the oil and gas sector. Therefore, despite the global energy transition, oil and gas will remain a crucial part of the global energy mix for many years to come.

The growing investment in renewable hydrogen and other emerging clean technologies shows that while this region relies heavily on oil and gas for its economy and energy security, the need to transition to lower carbon economies is also well understood.

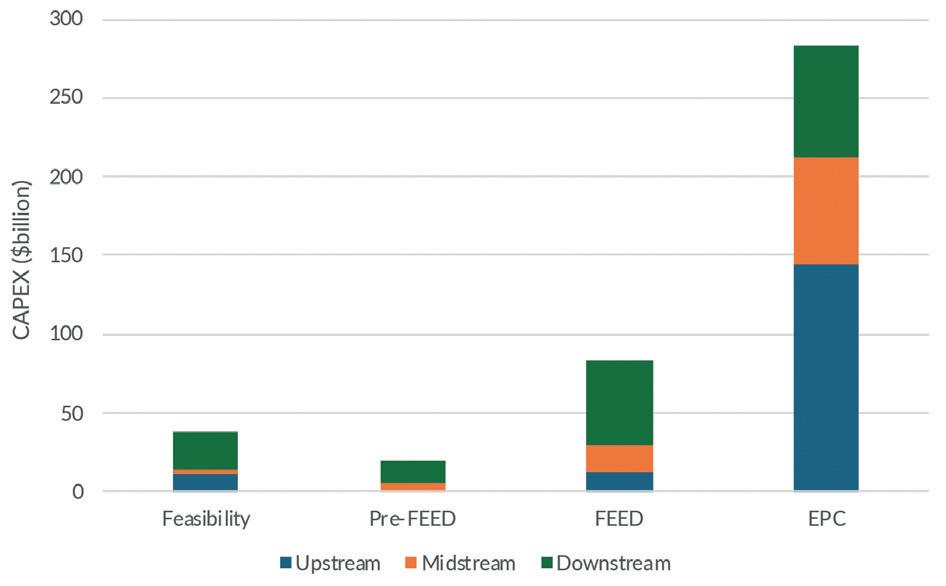

Figure 4: Opportunities for oil and gas projects to come online by 2030. Source: EICDataStream

The total estimated CAPEX for the oil and gas sector in the GCC is US$424bn with 248 projects to come online by 2030. These projects are currently progressing through early development phases, consisting of the conceptual design phase, feasibility phase, pre-FEED phase and FEED phase. Meanwhile, over US$282.39bn worth of projects are already advancing through the EPC stage, with US$47.92bn still in the tendering and bidding phase.

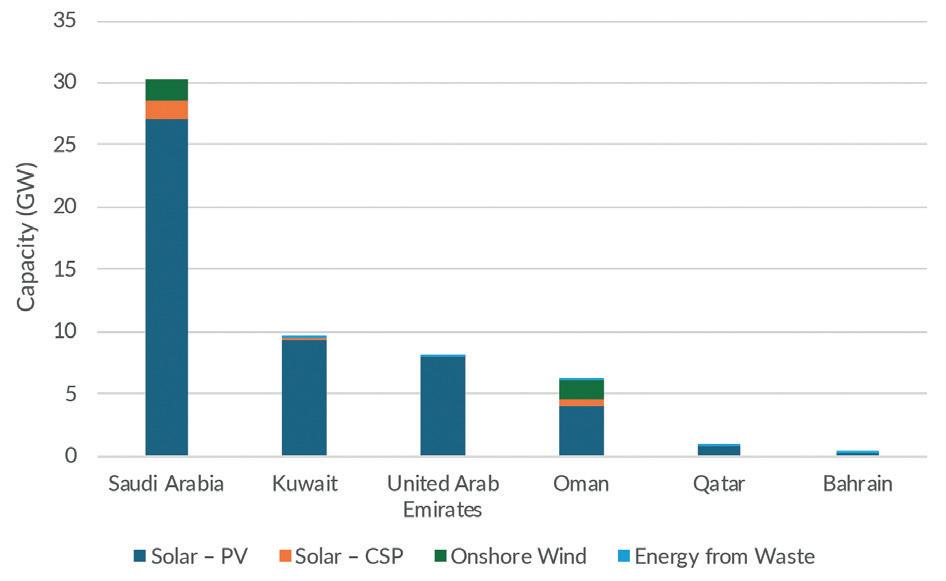

Figure 6: Renewable energy capacities (GW) in the GCC (2024-2030). Source: EICDataStream

The total capacity of renewable energy projects to come online between 2024-2030 in EICDataStream is 55.46GW, with 92% of this from solar projects. Saudi is leading with 30.4GW capacity, 54.8% of the total GCC capacity, supporting its target to transition to 50% renewable energy mix in domestic electricity by 2030. However, the current share is only at 3.2% so significant progression will be needed to reach this ambitious target. Oman is currently in a good position to reach its 2030 target of 30% renewable energy, requiring an extra 3GW of capacity which is within reach with the current capacity of announced projects.

Figure 5: Project updates in the oil and gas sector in the GCC. Source: EICDataStream

Jafurah Field Development Phase 4: Aramco is currently tendering an EPC contract for the Jafurah Phase 4 project. The work scope for the EPC contract is said to be similar to Jafurah Phase 3, which involves gas compression facilities. Ruwais LNG Liquefaction Plant: NMDC Group has been awarded the US$200m contract for marine dredging, involving removal of 15m3 of materials across a 15km channel with a width of 145m. ADNOC signed a 15-year long term Heads of Agreement with Indian Oil Corporation Ltd for the supply of 1mmtpa of LNG from Ruwais LNG Liquefaction Plant. Brownfield Development Long Term Agreement Programme: Saipem has been awarded two offshore contracts as part of its ongoing long-term agreement with Saudi Aramco. The combined value of these contracts is around US$1bn.

Figure 7: Power and renewables recent project updates in the GCC. Source: EICDataStream

NEOM Hasma Solar PV Plant: The project will have a capacity of 1.5GW and EPC is expected in March 2025.

Al Khairan IWPP Phase 1: The bids for the EPC package are currently being evaluated, bidders including: Sumitomo Corporation, JV; ACWA Power; GIC, Nebras Power, JV; AH Alsagar & Bros; TAQA; JERA and JV; Abdul aziz Al Ajlan Sons Co; China Power International New Energy Holding Ltd; Malakoff Corporation.

Al Sadawi PV Solar IPP – NTP Round 5: It is understood that the bidders have submitted their respective bids for the project. However, the list of bidders was not disclosed.

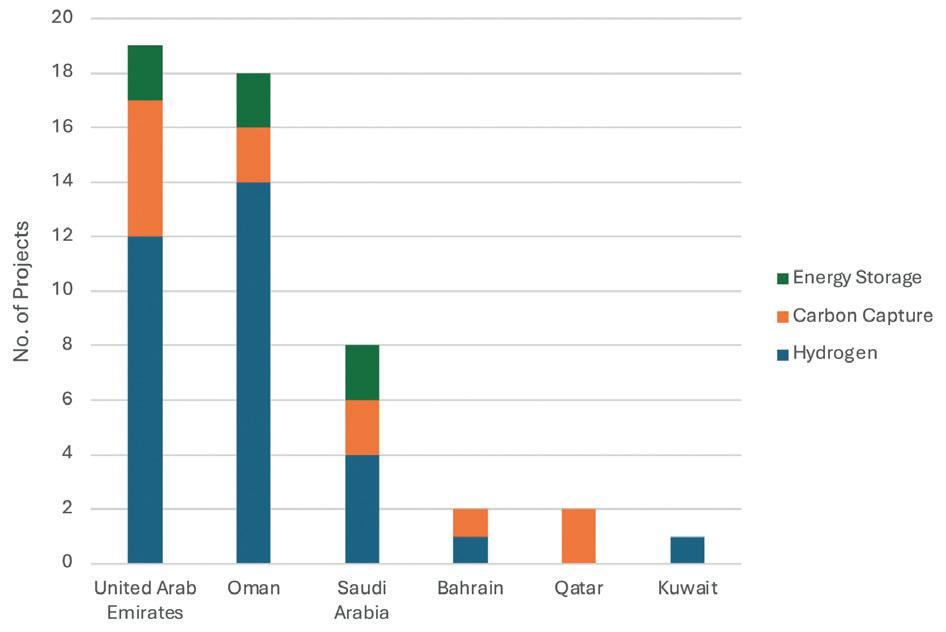

Figure 8: Current planned clean tech projects (20242030) in the GCC. Source: EICDataStream

The UAE leads with 19 new clean tech projects, Oman follows with 18 projects and Saudi with 8. In the GCC there are currently 31 hydrogen projects with 71% green hydrogen. Saudi has the most ambitious hydrogen target of 2.9mtpa by 2030, increasing to 4mtpa by 2035 and it is only third in terms of number of hydrogen projects under development. However, NEOM is the largest hydrogen project globally aiming to produce 650 tonnes of green hydrogen per day, making Saudi’s target achievable. Oman’s target of 1mtpa by 2030 is attainable with 14 announced projects. UAE has a target of 1.4mtpa by 2030 followed by a significant rise to 15mtpa by 2040, with 12 projects under development and online by 2030 this should be within reach.

Saudi plans to capture 44mtpa of CO2 by 2035. Jubail Industrial City CCS Hub will extract and store 9mtpa CO2 increasing to 44mtpa in the second phase and should be online by 2027, making Saudi likely to reach its target. Qatar targets 11mtpa by 2035. The Ras Laffan Carbon Capture project and Mesaieed QAFCO 7 Carbon Capture storage project will capture 4.3mtpa and 1.4mtpa respectively. Therefore, to reach the 11mtpa target more projects will need to be announced to be online by 2035. The UAE is likely to reach its target of 10mtpa of CO2 by 2030 with 5 projects expected to be online by 2030.

Jubail Industrial City CCS Hub: It is understood that three bidders have submitted their bids for the EPC contract for the project. The bidders are Saipem, Tecnimont and Larsen & Toubro. The technical bids are currently under evaluation.

Blue Horizons Hydrogen and Ammonia Project: KBR has been awarded the contract to supply blue ammonia synthesis loop technology for the project. The project will have a capacity of 3,000 metric tpd of ammonia. Wood has been awarded the pre-FEED contract.

Dhofar Green Hydrogen Plant – Actis and Fortescue: Hydrom signed agreement for the development of two green hydrogen projects located in Dhofar that are worth US$11bn. The first green hydrogen project will be developed by the consortium of EDF Renewables, J-POWER and Yamna. The project has moved to pre-FEED stage.

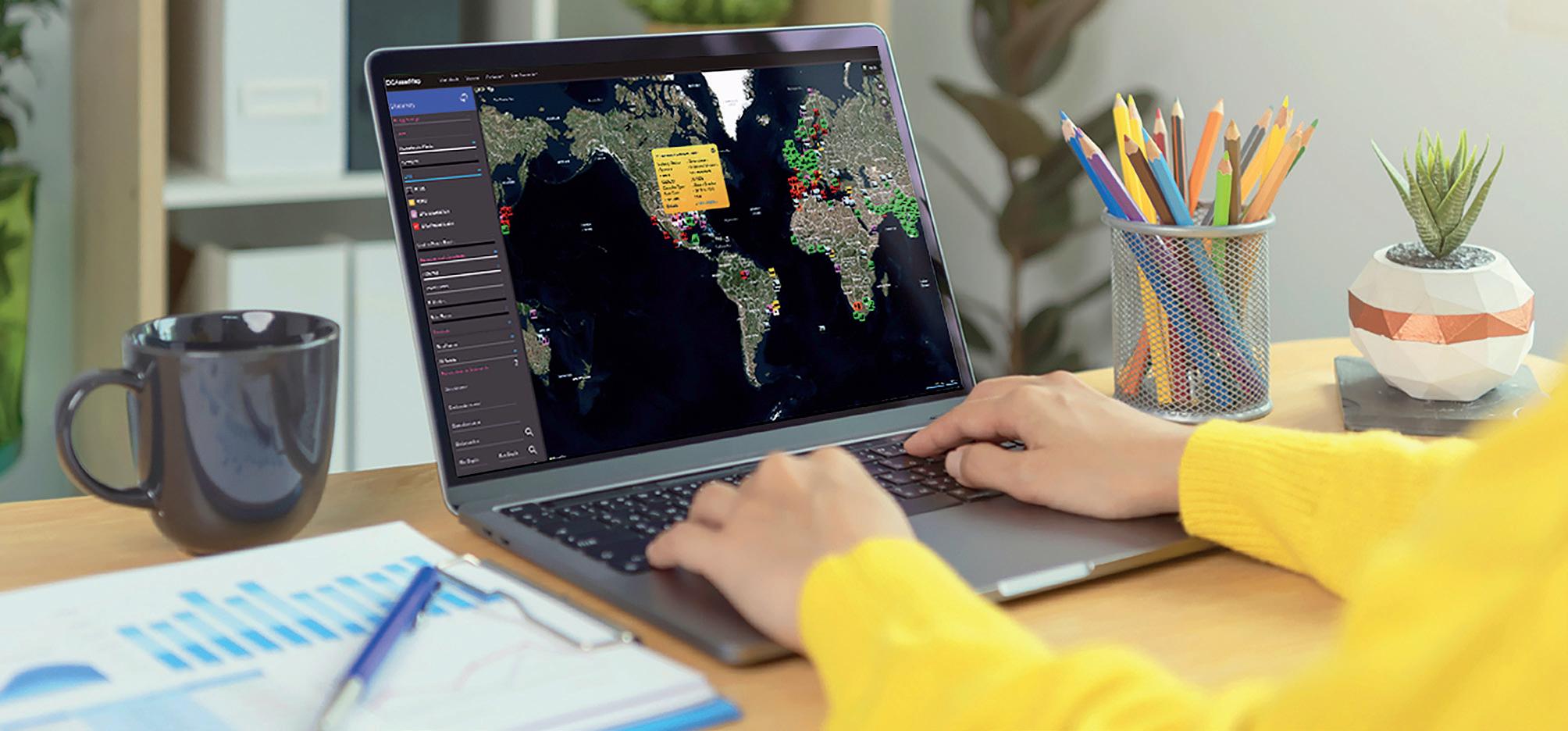

EICDataStream is the EIC’s leading project tracking database, containing information on energy projects from the inception stage all the way through to completion. Updated daily by expert analysts in London, Dubai, Kuala Lumpur, Houston and Rio de Janeiro, EICDataStream holds data on over 15,000 active and future CAPEX projects in all energy sectors across the world.

Operator: Wagner Sustainable Fuels Value: US$200m

Wagner Sustainable Fuels is developing a renewable liquid refinery in Brisbane, scheduled to begin construction in 2026. The facility will use LanzaJet’s Alcoholto-Jet (ATJ) technology and LanzaTech’s carbon recycling process. It is expected to produce 0.08 mtpa of SAF and 0.01 mtpa of renewable diesel (RD).

For information on these and more than 15,000 other current and future projects we are tracking please visit EICDataStream

Operator: Hokchi Energy Value: US$1.1bn

Hokchi Energy has received approval from Mexico’s CNH to develop the field in the shallow waters of the Salina Basin. The field development will require an investment of US$1.1bn and is expected online in 2028. The development of the area will entail the drilling of up to 15 development wells that will be connected to four fixed production platforms that will be linked to a FPSO.

Operator: Conexion Energia Value: US$2bn

The developer has secured US$480m in funding for the project. The funds were obtained through agreements with HSBC Hong Kong, Transelec and ISA Inversiones. The financing includes three loans of US$160m each.

Operator: RepAir Carbon Value: US$500m

RepAir Carbon and C-Questra have entered a partnership to develop a Direct Air Capture and Storage (DACS) project in Grandpuits. The facility will entail RepAir’s proprietary DAC technology which relies only on electricity and consumes 70% less energy compared to other DAC methods.

Operator: ExxonMobil Value: US$22.4bn

The project has entered the FEED stage which is expected to last 16 months. Two consortia are undertaking a competitive FEED, Technip Energies with JGC; and Saipem, CPECC and McDermott. One of the consortia will secure the EPC contract following completion of the FEED studies.

Operator: ACWA Power Value: US$1.2bn

ACWA Power has signed financing agreements for three solar PV projects Haden, Muwayh and Al Khushaybi located in the Makkah and Qassim Provinces, with production capacities of 2,000MW, 2,000MW and 1,500MW respectively. The agreements were signed with Buraiq Renewable Energy, Moya Renewable Energy Co and Nabah Renewable Energy Co.

Are you up to date on the latest project developments in the energy market? The EIC’s leading market intelligence database – EICDataStream – contains information on energy projects and associated contracting activity from the inception stage all the way through to construction and commissioning.

• Access details on over 14,000 CAPEX projects across all energy sectors

• Identify business opportunities and inform your business development strategies

• Explore a truly global database, updated daily by an international team of analysts

• Stay up to date with project developments, including information on tenders and awards

• Get insights into what your existing clients are doing and identify potential new clients

• Have a direct interface with analysts for local knowledge and insights

• Access insight and country reports with in-depth data on specific sectors and markets

EICSupplyMap maps the capabilities of supply chain companies that operate across all energy industries.

• These industries cover renewables, oil and gas, power, nuclear and energy transition technologies like energy storage, carbon capture and hydrogen.

• Identify the supply chain local to your region, giving you the opportunity to engage with potential new clients.

• Find the supply chain capability in eight regions, now covering the UK, Germany, UAE, Saudi Arabia, Malaysia, Singapore, US (Texas and Louisiana) and Brazil.

• An in-depth look at profiles of more than 8,800 energy sector supply chain companies.

• Make smarter decisions by targeting your offering to international developers/operators and contractors matching your capability with international energy projects.

To learn more about EICSupplyMap visit www.the-eic.com/MarketIntelligence/EICSupplyMap

with Diveena Danabalan Head of EIC Consult

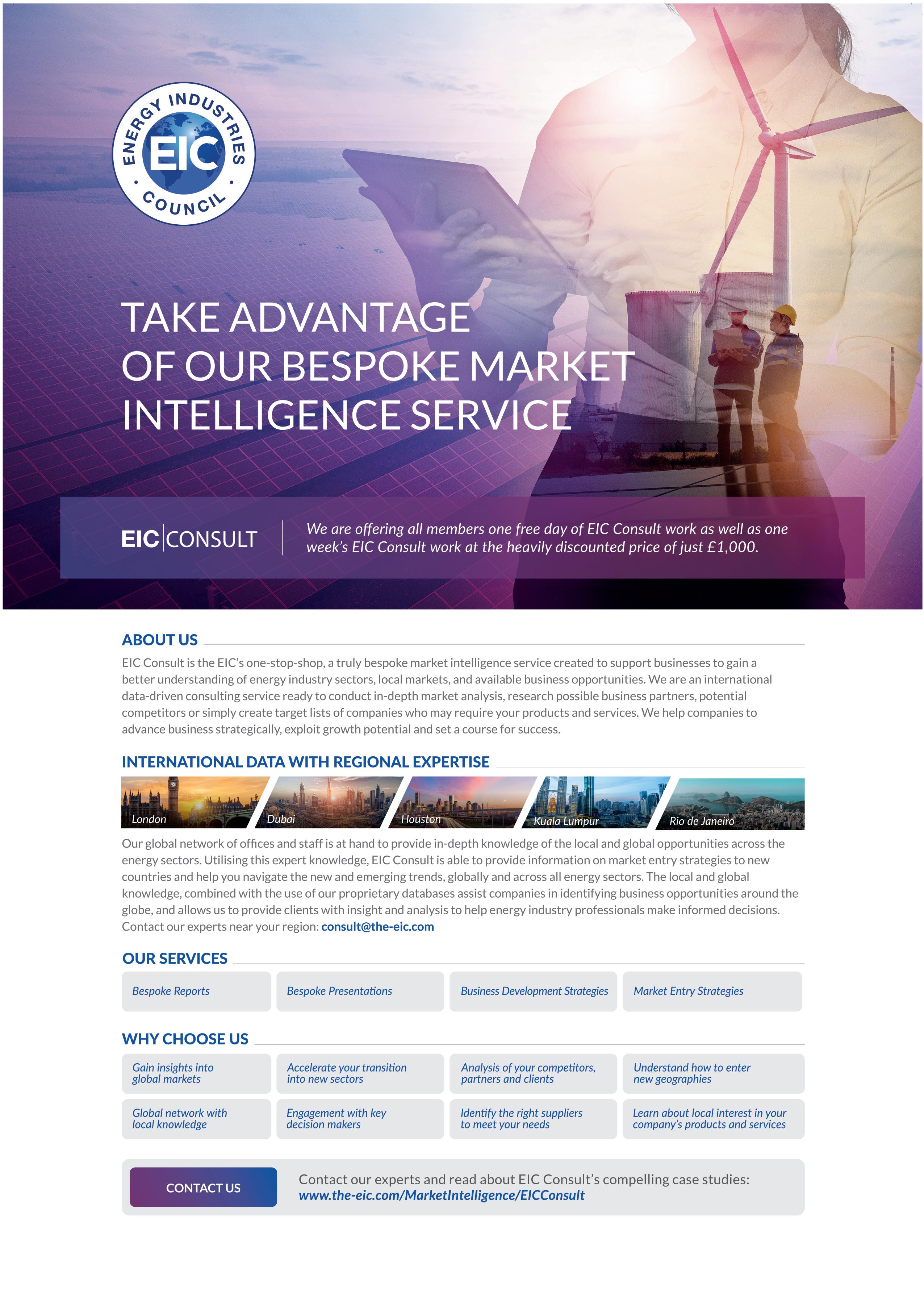

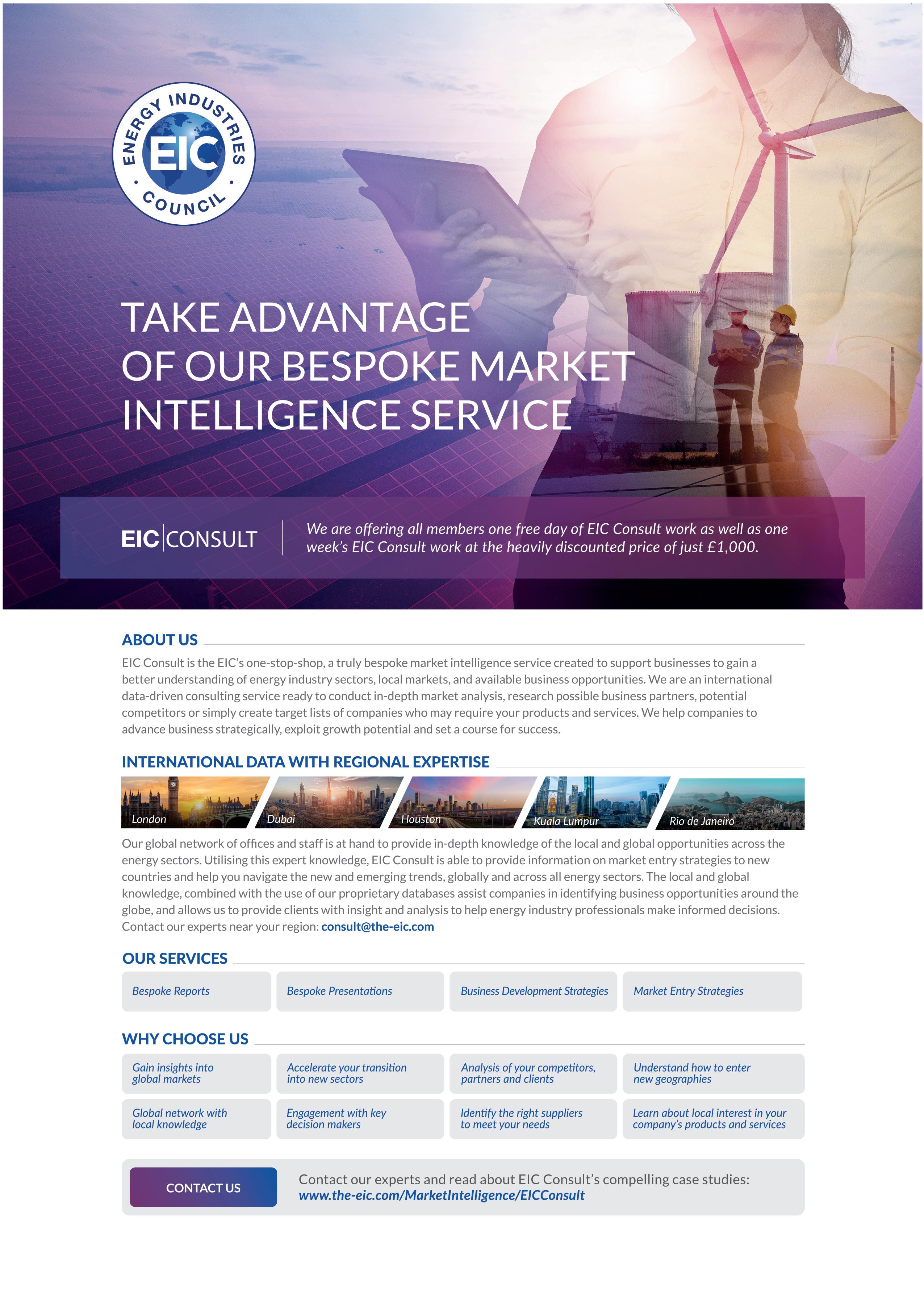

For over 80 years, EIC has delivered excellence in market intelligence through its award-winning databases: EICDataStream, EICAssetMap and EICSupplyMap. But you can take it a step further with EIC Consult, unlocking deeper, tailored insights into key markets and sectors that fit your business needs. Diveena, Head of EIC Consult, shares how EIC’s newest offering can drive success for your organisation.

Diveena, for those who aren’t aware of EIC Consult, or are new to EIC, tell us what the service offers for our members?

EIC Consult offers bespoke market intelligence, research and consulting services to the entire global energy supply chain. Staying true to EIC’s energy-agnostic approach, we work across all sectors – from oil and gas to renewables, nuclear and hydrogen. Our team of experts has a global reach operating in key energy hubs in Dubai, London, Kuala Lumpur, Houston and Rio de Janeiro.

As an EIC member, you can enjoy significant discounts on our services, including a free day of Consult to help jumpstart your partnership with us. Plus, for a limited time, we’re offering an exclusive discounted week of Consult work for just £1000 – an unbeatable offer to meet your strategic needs.

We also partner with a wide range of non-member companies – from government bodies to SMEs –delivering insights that serve as a powerful tool for navigating the everevolving energy landscape.

What are Consult’s core offerings?

Here’s a quick look at what EIC Consult brings to the table:

1 Market Insights: get the inside track on global energy trends, opportunities and challenges with our deep-dive market intelligence.

2 Custom Research: tailored to your needs – whether it’s project data, market forecasts, or competitor analysis, we deliver research that’s specific to your business.

3 Consulting Services: strategic advice at your fingertips, from market entry and supply chain opportunities to navigating complex regulations.

4 Global Reach: from Europe to the Americas to SE Asia, we provide regional insights that give you a truly global perspective.

5 Real Opportunities: stay ahead of the game with early leads on key contracts and project movements. Our confidence ranking and certainty analysis cuts through the noise, so you don’t have to. We do the heavy lifting – sorting through the data to deliver only what matters most.

Our real advantage? It’s all backed by our in-house data and expert team.

And why should companies choose to work with Consult?

Companies should partner with Consult because we’re driven by one goal: helping you uncover real business opportunities. Our track record speaks for itself – whether it’s guiding companies to successfully set up offices abroad, spotting untapped opportunities in new sectors, or providing neutral, expert insight for strategic planning. We’re here to fuel your success.

Can you give us an example of work that you’ve provided for a client and the outcome from it? You mentioned that there have been successes?

Absolutely. One of our top success stories this year features a global technology provider headquartered in Europe. The company turned to us for a comprehensive look at CAPEX and OPEX opportunities in the nuclear, CCUS and hydrogen sectors across the US and Canada, a clear view of their competitors, market entry requirements, local partners and marketing channels. Our tailored reports validated North America as the perfect market for them, leading to the exciting outcome of opening a new US office – a milestone we’re thrilled to have contributed to.

RMI clinic opens in Guyana capital to support offshore industry and local community

RMI, which specialises in saving lives and protecting the health and wellbeing of workers on remote and diverse sites across the world, has officially opened a new clinic providing medical services to offshore and onshore workers in Guyana.

The fully stocked clinic, opened in the capital city of Georgetown, is acting as a central in-country medical solution to the country’s rapidly expanding petroleum, construction and manufacturing industries.

Owned, managed and staffed by local Guyanese nationals, RMI’s clinic boasts a dedicated medical team comprising onsite doctors, nurses and medics. This team delivers tailored solutions to meet the demands of RMI’s offshore client’s and can offer a range of services including acute care, OEUK medicals, Liberian medicals, drug and alcohol testing, physical agility testing and more.

With RMI’s expertise, the centre will run to the highest clinical standards, employing 20 Guyanese medical professionals who are eager and determined to provide substantial care to the region.

The opening of this new clinic is a great step forward in providing essential medical services that will support Guyana’s growing industries.

Long transit times between the shore and clinical locations has put great strains on the operational continuity of these industries but we are confident that this new clinic will be a much welcome solution.

With our highly skilled staff in operation, the clinic will become a vital asset to organisations across Guyana, providing health and fitness screening solutions and working as a convenient triage centre in an ideal location close to industrial activity. This clinic will bring a vital service to the people of Guyana while simultaneously supporting the economic potential of the country.

Jules Rawles, Vice President Business Development, RMI

Founded in 2003 as a medical training company, RMI has become a bespoke solutions partner managing risk through medical, security and HSE services in complex environments around the world. The company has been providing medical services globally since 2006.

Saudi Arabia has a strategy to reach net zero by 2060 and is relying on modern, highly efficient gas-fired power plants in combination with CO2 capture and storage, to significantly reduce its emissions. Siemens Energy is supplying key power plant technologies that will provide almost 4GW to the Kingdom, and in addition has also entered a longterm maintenance contract for 25 years for the two power plants, with a total value of approximately US$1.5bn.

Taiba 2 and Qassim 2, two of the world’s largest, modern and efficient combined-cycle power plants, will be built in the western and central regions of Saudi Arabia over the next few years. Siemens Energy’s gas turbines (HL-class), in combination with steam turbines and generators, will generate approximately 2,000MW of electricity at each site. EPC and contracting partner for Siemens Energy is China Energy International Group.

The new power plants will provide additional energy for the country’s growing population and booming economy and replace parts of Saudi Arabia’s existing aging power plant fleet, some of which rely on oil as an energy source. The new plants will save up to 60% of CO2 compared with oil-fuelled power plants.

They will also be compatible with the Kingdoms’ energy strategy which calls for the construction of CO2 capture and storage facilities in the medium term, to enable a carbon-neutral energy supply.

Taiba 2 and Qassim 2 will initially be connected to the grid in simple cycle mode in 2026 and will be permanently operated as a combined cycle power plant one year later.

Siemens Energy is one of the world’s leading energy technology companies. The company works with its customers and partners on energy systems for the future, thus supporting the transition to a more sustainable world. With its portfolio of products, solutions and services, Siemens Energy covers almost the entire energy value chain – from power and heat generation and transmission to storage. The portfolio includes conventional and renewable energy technology, such as gas and steam turbines, hybrid power plants operated with hydrogen and power generators and transformers. An estimated one-sixth of the electricity generated worldwide is based on technologies from Siemens Energy. Siemens Energy employs around 99,000 people worldwide in more than 90 countries and generated revenue of €31bn (US$33.6bn) in fiscal year 2023.

NEW PRIMARY MEMBER

Apave

Apave TIV, 105 Al Rawabeh Building

Sheikh Zayed Road Al Quoz 1 PO Box 282229 Dubai, UAE

Contact Aubrey Alba, Communication Correspondent for Middle East & India, Apave Group

Telephone +971 4 330 6116

Email meenquiry.bue@apave.com

Web https://middle-east.apave.com/

Apave is present in the Middle East in over 6 countries, with more than 10 offices. With its inspection activities (regulatory and non-regulatory), training, consultancy and technical support, certification and testing and measurement, Apave covers all its customers’ risk management needs. This presence enables the company to mobilise the appropriate skills throughout the Middle East. Wherever you are, Apave is ready to meet your needs with tailor-made solutions.

NEW PRIMARY MEMBER

Atlas Copco

Technology House

Hemel Hempstead Industrial Estate Hemel Hempstead HP2 7DF UK

Contact

Stuart Breadon, Oil and Gas Sales Manager

Telephone 0800 181 085

stuart.breadon@atlascopco.com

Web www.atlascopco.com/en-uk/ compressors

Atlas Copco Compressors

With over 150 years of experience in compressed air and industrial gas solutions, Atlas Copco’s products meet the applications, process needs and specific requirements of the energy sector.

In addition to its range of air compressors, air dryers, N2/O2 generators, N2 boosters, coolers/ chillers, the company is also able to offer a range of CO2 screw, piston and centrifugal compressors with CO2 dryers for CCS applications and also for the oil and gas onshore/ offshore sectors.

Atlas Copco supplies containerised hydrogen compressors using piston and hydraulic booster technology to meet the mobility, refuelling and process/chemical industries.

Busch

Hortonwood 30

Telford

Shropshire TF1 7YB UK

Contact

Craig Johnston, Head of Market Management –Energy & Environmental

Telephone +44 (0)1952 677 432

Email craig.johnston@busch.co.uk

Web

www.buschvacuum.com/global/en/

Busch Vacuum Solutions is recognised as the market leader in industrial vacuum pump and overpressure solutions for the energy and environmental market segments.

Busch has extensive knowledge and experience in supplying innovative vacuum solutions into markets such as oil and gas, chemical, power, hydrogen, waste water, carbon capture and renewables.

Together with Pfeiffer under the umbrella of the Busch Group, Busch manufactures the widest range of vacuum and overpressure technologies, as well as leak detectors, for a wide variety of applications. Busch’s innovative solutions are tailored to meet client-specific requirements and industry standards.

43 New Street Port of Spain

100921

Trinidad and Tobago

Contact Sean Patience, Managing Director

Telephone +868 223 7447

Email sean.patience@cargotrinidad.com

Web https://cargotrinidad.com/

Cargo Consolidators Agency Ltd (CCA) has developed into a full service freight forwarding, logistics and consolidation company with three other members under its umbrella:

CCA Guyana Inc, Guyana. Fast Flow Inc, Miami, US. Action Worldwide Services, Houston, US.

22/2 Pakorn Songkhraorat Road

Tambon Map Ta Phut Amphur Muang Rayong Rayong 21150 Thailand

Contact Ekkapop Phienlumlert, Division Manager, Project Marketing & Business Development

Telephone +66 (0)3897 7800

Email ekkapop.p@pttgcgroup.com

Web https://gcme.co.th/

GC Maintenance and Engineering Company Limited (GCME) is a Thailand-based enterprise specialising in the provision of engineering and maintenance services, with a particular focus on project execution within the oil and gas, petrochemical and energy sectors. The company offers an extensive array of engineering solutions, including: conceptual design; front end engineering design (FEED); engineering, procurement, construction and commissioning (EPC); EPC management services (EPCm); project management consultancy (PMC); plant engineering services and manpower supply.

GCME also has expertise in plant inspection and maintenance, employing a team of highly skilled engineers who have consistently delivered excellence to esteemed clients across diverse industries. The company’s experience spans refineries, aromatics, olefins, gas processing, phenol, vinyl chloride monomer (VCM), polyvinyl chloride (PVC) and polylactic acid (PLA) facilities.

GCME’s unwavering commitment to professional excellence and industry-specific knowledge has established it as a distinguished leader in the engineering and maintenance sector.

Lot 6073 & 6074

1st & 2nd floor, Block 11

Kuala Baram Land District

Jalan Tudan, Bandar Baru Permyjaya

98000 Miri, Sarawak

Malaysia

Contact Kenny R Ngalin, Managing Director

Telephone 085 491 780

Email kenny@ovgroups.com

Web www.ovbhd.com

Ocean Vantage (OV) is a leading publicly listed Malaysian (Sarawakbased) energy and oil and gas services company, with a diverse portfolio spanning several key industry segments and expanding internationally.

OV, through its subsidiaries, provides comprehensive integrated solutions that address the varied needs of its clients from manpower supply, engineering, procurement, construction and commissioning, inspection testing, rope access services, renewable energy, habitat supply to production solutions.

Ocean Vantage is dedicated to delivering innovative, high-quality services that drive value and sustainability in the energy sector and beyond.

AIS, a global supplier of advanced manufacturing solutions, has announced the acquisition of GAP Plastics, a UK-based specialist in custom plastic injection moulding.

GAP Plastics serves a diverse range of industries including energy, cosmetics, glazing and textiles, and is known for its dedication to producing highprecision plastic components.

The acquisition of GAP Plastics marks a significant milestone for AIS as we continue to broaden our capabilities and market reach.

Andrew Bennion, CEO, AIS

Through this acquisition, AIS will integrate GAP Plastics’ advanced manufacturing technologies and processes into its existing operations. The combined expertise will allow AIS to provide an even broader range of solutions, while maintaining the high standards of quality and precision that both companies are known for.

GAP Plastics will continue to operate under its established brand name, with its current leadership and workforce remaining in place to ensure a seamless transition and continuity of service for its customers.

AIS is a global leader in the engineering and manufacture of a range of innovative protection products for the energy industry. The company serves a global clientele across a range of industries, with solutions that perform in the world’s most challenging environments.

UK-headquartered logistics and materials management company, ASCO, has completed a six-figure contract with Onslow Marine Support Base (OMSB) in Western Australia, supporting the offshore decommissioning sector, in particular utilising its radiation expertise.

As part of the contract, ASCO mobilised two radiation safety officers (RSOs) as well as NORM (Naturally Occurring Radioactive Material) and mercury monitoring and analysis equipment to the OMSB site.

The RSOs delivered onsite training for NORM awareness, and monitoring for various hazards such as benzene, H2S (hydrogen sulphide) with a particular focus on NORM and mercury.

The project was led by senior RSOs John Davidson and Robin Small, who together boast 25 years of expertise in the field. The RSOs helped to optimise the site, ensuring that supervised areas were set up correctly and any contaminated materials were properly managed and contained. The team enhanced OMSB’s management plans and risk assessments, ensuring top-tier radiation management and site safety operations.

Our work in the North Sea has the way in global decommissioning activity for a number of years now and we’re excited to bring that experience Western Australia.

ASCO has had a presence in Australia for more than 13 years, in Perth, Darwin and Dongara, but this contract represents the first time it has delivered NORM services in the southern hemisphere. The project demonstrates ASCO’s capability and establishes credibility in this segment, enabling ASCO to confidently invest to deliver further large-scale projects of this nature in Australia.

ASCO is predicting continued growth in the region as it maximises the opportunities of decommissioning Australia’s aging oil and gas infrastructure.

led decommissioning and experience to

DNV, the independent energy expert and assurance provider, has announced the conclusion of the first phase of DNV’s HVDC Standards joint industry project (JIP). The JIP was convened to identify deficiencies in standards for High Voltage Direct Current (HVDC) transmission systems.

Because of the expected growth of electricity demand as data centres expand and transportation and buildings electrify, paired with the influx of new renewable generation, the US electric grid requires expansion and modernisation. Implementing HVDC transmission is a viable method to increase the capacity, reliability and resilience of the system, but, as it has not been widely adopted, there is a lack of relevant standards.

In the first stage of the joint industry project a high-level survey was conducted to identify the standards and codes needed to implement HVDC transmission systems in the US. Four types of standards emerged as priorities: performance/grid code; manuals for regional transmission organisation (RTO) and independent system operators (ISO); utility interconnection manuals; and offshore design requirements. Some functionalities, such as active power control, reactive power control, fault ride-through, dynamic voltage control and frequency control, have been at least partially addressed in the existing US Grid Code (eg IEEE 2800-2022, FERC LGIA, NERC RSBES and relevant OATT). However, several other functionalities, including control modes, islanded operation and adaptive control are not covered. Even for those functionalities that are included in the US Grid Code, there remain significant gaps.

Over the next three years DNV and JIP partners, which include Atlantic Shores Offshore Wind, EDF Renewables, Equinor, Invenergy, National Grid Ventures, Ocean

Winds, PPL TransLink WindGrid, RWE, Shell and TotalEnergies, will delve deeper into the identified gaps, focusing primarily on the first three types of standards. These standards focus on setting formal electrical standards or rule makings for RTOs and utilities. This work will consist of three distinct phases, each roughly a year in length. During the first year, DNV, JIP participants, and an advisory committee will conduct a granular HVDC standards gap analysis and prioritise the relative importance of the identified gaps. In 2025 and 2026, study participants will establish and implement a plan to address the identified gaps. These recommendations will likely include proposals to initiate NERC SAR or IEEE PAR proceedings and updates to RTO rules and offshore wind solicitation requirements.

i

For more information: www.dnv.com

ICR Group, a global leader in maintenance and integrity solutions, together with its regional partners, has secured US$3.5m in contracts in the Middle East over the past six months.

ICR’s flagship brand, Technowrap, has been instrumental in driving growth in the Middle East. The increasing interest highlights the commitment to extending the lifespan of critical assets without the need to shut down.

Technowrap provides a long-term alternative to traditional steel replacement, often with a design life of up to 20 years. The quick application can significantly reduce downtime, leading to cost savings, while offering up to a 66% reduction in carbon emissions.

Technowrap is valued for its versatility and efficiency as it can be used to repair a wide range of infrastructure, including pipelines, pipework, tanks, vessels and structural components, both onshore and offshore.

ICR’s operations are supported by its Abu Dhabi office and strategic partner agreements, enabling local service delivery of the product range across the Middle East.

Recent projects in the Middle East have included work on offshore and onshore installations for operators and engineering contractors repairing pipelines, pressure systems and structures.

Notably, Technowrap has been used in a critical subsea repair project on a 48-inch pipeline, where its ability to withstand harsh conditions and extend the life of infrastructure is crucial. ICR also supports similar onshore pipeline repairs and is developing new products for 2025 to further enhance its offerings.

The proven reliability of our products and services positions ICR to enhance operational efficiency and protect critical infrastructure, all while minimising environmental impact.

Jim Beveridge, CEO, ICR

To further complement the Technowrap range, ICR also offers non-destructive composite inspection technique called INSONO. It has been developed to validate the condition and integrity of composite repairs, giving operators and regulators confidence in the application and long-term performance. The technology can detect anomalies in the bond line and interlaminar dis-bonds within composite repair material, supporting life extension.

Quickflange, permanent flange-topipe connectors, from 2” to 14”, is another core offering that addresses scenarios where traditional welding solutions are impractical due to hot work constraints or time limitations.

ICR is exhibiting at ADIPEC this year (4-7 November) stand 6210.

John Crane, a global leader in mission-critical flow-control technologies and a business of Smiths Group Plc, has been awarded a substantial, multi-year Gas Seal Management Programme (GSMP) contract from SK Advanced, a major producer and seller of propylene, located in Ulsan, South Korea.

John Crane already provides SK Advanced with its entire installed base of dry gas seals. These mechanical seals are critical pieces of machinery embedded within the heart of a wide variety of industrial processes, ensuring the safe and efficient flow of gas and preventing contamination.

The latest GSMP contract is to provide maintenance and refurbishment of these seals. Maintaining dry gas seals in the field can be difficult due to the harsh environments in which industrial processes operate. John Crane’s maintenance programmes help preserve and extend the life of equipment, increase reliability and avoid unscheduled down time, leading to better productivity.

The maintenance programme is gearing up to two significant turnaround events for SK Advanced. These are scheduled events where a process unit of the industrial plant is taken offline for maintenance, inspection and upgrades. For SK Advanced, 10 of its dry gas seals are scheduled for turnaround in 2024, and another 10 four years later, in 2028.

Propylene is an organic compound used widely in the packaging, consumer products and automotive industries. The global demand for propylene is expected to grow in the coming period driven by demand in key markets including the US, China and India.

With the changes proposed in the NSTA’s consultation on the draft OGA Plan to reduce UKCS GHG emissions, there is a strong case for the societal cost of carbon and potentially an individual asset marginal abatement cost to form part of the project economics for decarbonisation projects.

Graham Filsell, Asset Decarbonisation Lead, Kent

Kent and the Energy Institute have announced a new collaborative effort to create comprehensive guidelines for decarbonisation economics in greenhouse gas (GHG) emission reduction projects in the upstream oil and gas industries. This report will provide clear, actionable guidance to help the sector achieve its environmental goals.

The guidelines, prepared under the expert guidance of Graham Filsell, Kent’s asset decarbonisation lead, will focus on demystifying the economics of decarbonisation.

The scope of this study focuses on the UK North Sea upstream sector but is intended to serve as a basis for future research globally. The guidelines will address the following key objectives:

Demystifying decarbonisation economics: Provide clarity for energy professionals with limited exposure to project economics, such as environmental or sustainability managers.

Understanding carbon costs: Offer insights into how carbon costs are calculated and influenced by market forces, including societal costs.

Alternative metrics: Recommend non-standard metrics beyond NPV to ensure that decarbonisation goals are met, delivered as a technical note to the industry.

Justification of metrics: Articulate and justify the choice of both standard and non-standard metrics used.

Upstream O&G value chain: Focus on the upstream sector of the O&G value chain affected by decarbonisation and assess the potential to broaden the scope to the full value chain.

The interdisciplinary process to develop these guidelines will involve the collaboration of Kent’s environmental team, asset decarbonisation team and energy environment economic (E3) modelling and communications team:

Environmental team: Providing guidance on the UK Carbon Budget and other GHG regulations through comprehensive review and evaluation of regulatory risk levels.

Asset decarbonisation team: Maintaining up-to-date knowledge of industry legislation and best practices for decarbonisation, developing marginal abatement curves and incorporating regulatory risk to calculate the unavoidable abatement greenhouse value (UAGV).

E3 modelling and communications team: Guiding the valuation of GHG emissions and demystifying decarbonisation economics by estimating metrics to benchmark the UAGV.

This collaboration marks a significant step toward achieving the environmental objectives of the North Sea Transition Deal and ensuring that the UK North Sea upstream oil and gas sector can continue to operate with the lowest possible environmental impact.

i For more information: https://kentplc.com/

Mott MacDonald, the global engineering, management and development consultancy, has supported Holtec Britain to complete the first step of the generic design assessment (GDA) for its small modular reactor SMR-300 in record time.

The GDA is a voluntary process adopted by technology vendors to de-risk new nuclear reactor designs for future project stages. The process allows UK independent nuclear regulators – the Office for Nuclear Regulation, the Environment Agency and Natural Resources Wales – to assess the safety, security and environmental implications of new reactor designs and to provide the confidence that designs will meet the UK’s statutory regulatory requirements.

Mott MacDonald supported Holtec Britain throughout the GDA process to complete in 10 months – 15% faster than anticipated and as much as 65% faster than any previous GDA. Having previously supported Holtec Britain to secure a matchfunded £60m grant funding from the UK government’s Future Nuclear Enabling Fund for the GDA, Mott MacDonald has been providing safety, engineering, environmental and

regulatory support to Holtec Britain throughout the GDA process. The fully integrated team has participated in more than 200 engagements with the UK regulators to date.

The SMR-300 design will now enter the second step of the GDA process, which involves fundamental technical assessment by the UK regulators. This is the first ever two-step GDA, marking a major milestone towards Holtec Britain’s ambition of deploying a fleet of SMRs in the UK by 2050 to bring reliable and affordable electricity and heat to UK households, businesses and industrial users, with first operation planned for the early 2030s.

SMRs are nuclear fission reactors designed to be built at a smaller size, but in larger numbers than the world’s current nuclear fleet. They are cost competitive and considered to be more versatile, scalable, sustainable, financeable and efficient. With wider-ranging applications such as generation of industrial heat and hydrogen production, SMRs are well placed to help the UK government achieve its ambition of generating 24GWe of nuclear capacity by 2050.

Roughly the size of two football fields, with production capacity of 300MWe per unit, Holtec’s SMR-300 is a first-of-its-kind advanced SMR, offering safe, reliable and economical carbon-free power.

For more information: www.mottmac.com

NRL’s recruitment teams across the UK and internationally are celebrating being shortlisted for two Global Recruiter Awards.

Celebrating over four decades in the recruitment industry, NRL’s engineering solutions captured the attention of the judges to secure nominations for Best UK Overseas Operation and Best Large Recruitment Business.

Within the award submissions, NRL reflected on its commitment to compliance in the heavily regulated engineering sectors, as well as the innovative recruitment and mobilisation solutions it develops for clients across the UK and internationally. With 33% of colleagues across the NRL Group having worked within the business for more than a decade, the industry expertise accumulated and company ethos to never be complacent helps NRL to deliver large-scale recruitment campaigns for clients and tackle complex global compliance challenges.

With 17 award categories in total, the winners for each will be revealed at the industry awards ceremony on Wednesday 20 November at The Steel Yard, London.

For more information: www.nrl.co.uk

This is a huge stride forward. One of the reasons for the successful completion of the Step 1 GDA in record time is down to the team’s dedication and meticulous preparation. Mott MacDonald’s significant experience from previous GDAs and understanding of the UK context and regulatory expectation made this possible.

In 1979, Dr Michael R Oliver embarked on a journey that would redefine the landscape of valve manufacturing. Founded in a modest garage, Oliver Valves began with a vision to innovate and excel in engineering. Dr Oliver, a graduate mechanical and production engineer, developed the company’s inaugural range of needle valves, laying the cornerstone of what would become a global leader in the industry.

Over the past four and a half decades, Oliver Valves has transformed significantly, evolving from its humble beginnings to operate from four state-of-the-art facilities in Knutsford, Cheshire. The company’s footprint now extends across the globe, serving clients in approximately 50 countries and shipping its products worldwide.

Key milestones punctuate Oliver Valves’ journey of growth and achievement. In 1982, the British Gas Corporation’s approval of Oliver needle valves for gas transmission systems marked a significant endorsement of the company’s quality and reliability.

Subsequent milestones, such as the development of high-pressure instrument ball valves in 1985 and the establishment of international offices in Aberdeen, Houston, Kuala Lumpur, Singapore and Dubai in 1990, solidified Oliver Valves’ position as a global player.

A pivotal moment arrived in 2004 with the launch of Oliver Valves India, strategically enhancing the company’s supply chain capabilities and bolstering its presence in emerging markets. This expansion underscored Oliver Valves’ commitment to meeting global demand while maintaining the highest standards of engineering excellence.

Central to Oliver Valves’ success is its relentless pursuit of innovation. The company’s commitment to research and development has yielded groundbreaking products such as the Double Block and Bleed valves and the Twinsafe valve series, setting benchmarks for safety and performance in the industry.

Throughout its history, Oliver Valves has forged enduring partnerships that have contributed to its success. Partnerships with longstanding distributors such as AWC in the US and suppliers like Dupont have been integral to supporting Oliver Valves’ global operations and ensuring the delivery of high-quality products to customers worldwide.

Oliver Valves’ journey has been defined by innovation and excellence. As we commemorate 45 years, we look forward to building on our legacy and shaping the future of our industry.

Dr Michael R Oliver, Chairman, Oliver Valves

Under the stewardship of Dr Michael R Oliver, chairman and founder, Oliver Valves has cultivated a culture of integrity, customer focus and continuous improvement. His leadership has been instrumental in navigating the company through dynamic market landscapes and technological advancements, ensuring Oliver Valves remains at the forefront of innovation.

Looking ahead, Oliver Valves remains steadfast in its commitment to driving innovation and delivering exceptional value to its global clientele. As the company celebrates 45 years of achievements, it embraces new opportunities for growth and expansion, while staying true to its founding principles of quality, reliability and customer satisfaction.

OPITO, the global safety and skills organisation for the energy industry, has launched a new standard to ensure increased competency and safety around helideck activity, benefiting the global offshore workforce reliant on safe transfers to energy installations in an open sea environment.

The new Helicopter Administrator Workplace Competence Assessment standard complies with the best practice and requirements for helicopter administrators as detailed in the Civil Aviation Authority’s Civil Aviation Publication CAP 437: Standards for offshore helicopter landing areas (CAP 437).

It assesses the candidates’ knowledge and skills in providing administrative support required to safely operate the helideck and manage helicopter movements within their role in the workplace. The Helicopter Administrator Workplace Competence Assessment will be undertaken in the candidates’ workplace and consists of five units.

Created in conjunction with Offshore Energies UK (OEUK) and wider industry in response to a previous amendment to CAP 437, this standard follows the introduction of OPITO’s Helicopter Administrator Training standard, launched in March 2023.

During development of the new standard, OPITO and OEUK engaged closely with industry stakeholders, including Spirit Energy, Harbour Energy, HCA, bp, Repsol Resources UK, TAQA and TotalEnergies, to ensure employer needs were met.

Operating for over 50 years, OPITO is an industry-owned organisation that works with governments and industry worldwide. i

OsecoElfab’s new LoKr rupture disc represents the next generation of design and engineering in pressure relief technology. The innovative design enables a higher relief capacity across all sizes compared to other reverse acting discs. This maximises pressure relieving performance and safety without having to adapt piping.

The disk’s architecture has been refined and optimised to improve performance in three key areas: keeping pressure drops in relief lines to an absolute minimum, providing enhanced reliability and accuracy and being suitable for the widest range of pressures, temperatures and line sizes possible.

The reverse-buckling disk combines a dimple on the disk with an innovative knuckle on the holder to offer full-bore opening with exceptionally accurate burst ratings. This enables a higher flow rate on burst than previously possible. This higher free flow area allows plant managers to upgrade their pressure safety equipment with minimal disruption as there is no need to increase line sizes.

Since its initial launch in the US in 2022, the LoKr rupture disc has proven popular and is now improving plant performance in hundreds of installations across the country. With receiving the CE mark, the LoKr is certified under both the US ASME Code and European Pressure Equipment Directive, demonstrating its suitability for global installation.

Global cable and pipe seal manufacturer Roxtec is bolstering its industry and infrastructure team with the appointment of George Light as Data Centre Market Manager for the United Kingdom.

George joins Greater Manchesterbased Roxtec Ltd after spending the past 15 years running his own business in the international data centre industry. George brings a wealth of experience within the IT infrastructure, design and installation sphere. A strong communicator, he has closely collaborated with mechanical and electrical contractors and appreciates the time pressures and build phases that often require swift action to overcome any pressing issues.

We’re delighted to welcome George to Roxtec to drive growth in one of our key sectors. We’ve seen significant demand in data centres over the last 10 years and that is being supercharged by AI. As a result we’re already working with some of the biggest tech firms in the world across multiple projects in the UK and Ireland which George will be supporting.

Clive Sharp, Managing Director, Roxtec Ltd

In his new role, George will be responsible for expanding Roxtec’s product offering while working closely with design houses, mechanical and electrical engineers and data centre owners. The role will also involve identifying ambitious new business opportunities within larger scale data centres, where Roxtec’s products can be seamlessly integrated as part of the IT infrastructure. Additionally, he will nurture existing relationships and provide advice and support to ensure Roxtec’s clients continue to receive the highest levels of service for their project needs.

Roxtec’s cable and pipe seals have achieved a two-hour fire rating certification for use with Euroclad panels. They also offer bespoke solutions for underground pits and roof top entry points which provide users with the guarantee that they are protected from multiple hazards.

Roxtec was founded in Sweden in 1990 and is active in more than 80 markets worldwide.

Sonihull has announced the successful installation of its ATEX and IECEx approved ultrasonic antifouling systems on New Fortress Energy’s FSRU, the Energos Winter, in Brazil. Over the past six months, Sonihull worked closely with New Fortress Energy and provided them with a turnkey solution to protect the ship’s main circulating seawater system, seawater pipeline, filters, heat exchangers and turbo generator condensers from bio-fouling, scaling and build-up.

The company utilised 20 of its advanced Agitate Pro systems and for the regasification chambers, its ATEX and IECEx approved transducers were installed in hazardous zones, with control panels mounted within Ex d enclosures for optimal protection.

Sonihull is a pioneer in achieving ATEX and IECEx approval for ultrasonic antifouling systems, with over 220 certified transducers in operation globally. Its systems effectively prevent marine growth and scaling in various industrial applications, including heat exchangers, condensers, pumps, filters, pipes and cooling systems.

Sonihull looks forward to seeing the enhanced performance of the Energos Winter and continuing its collaboration with New Fortress Energy. i For

Testing front and backsheets according to IEC 62788-2-1:2023-08 can take a very long time. Some long-term tests involve 5,000 test hours and run for up to 30 weeks. There is currently an oversupply of PV modules on the market. To avoid bottlenecks in the future, it is crucial for manufacturers to understand and comply with this new standard and to have the front and back sheets tested early in the project.

Roman

Brück, Solar and Testing Expert, TÜV Rheinland

Since October 2023, photovoltaic (PV) modules need to meet new safety requirements in accordance with the revised IEC 61730-1 and -2 standards. The changes include electrical safety and fire safety under mechanical and environmental stress. One significant change is the use of front and backsheets. These are the covers of a PV module that protect the module from environmental influences such as moisture, dirt or mechanical stress, thus reducing the risk of short circuits or fires.

For module certification, it is now necessary to qualify the front and backsheets used in accordance with the IEC 62788-2-1:2023-08 safety standard. However, many front and backsheet manufacturers still have some catching up to do, which is delaying the overall certification of PV modules to the new standard.

WIKA supports the digitalisation of gas-insulated switchgear with the new model GD-20-W gas density sensor. The wireless device with integrated battery and radio module allows for easy integration into IIoT environments. The sensor communicates the values measured for gas density, temperature and pressure via the LoRaWAN® network protocol. The device also features an alarm function for the three parameters as well as for the battery status that signals, independent of the preset transmission cycle, that a limit value has been reached.

As a compact wireless device, the model GD-20-W is particularly suitable for retrofitting existing installations operated with SF6 gas or alternative insulating gases.

The installation and maintenance effort is low. The battery life is over ten years, depending on the measuring and transmission rate.

The sensor calculates gas density from the pressure and temperature values. It measures the pressure at 20°C with an accuracy of ± 0.2%. The device monitors gas density continuously and thus allows demand-driven asset maintenance.

i

Wood, a global leader in consulting and engineering, is advancing three carbon capture and storage (CCS) projects on the Norwegian Continental Shelf.

The company has successfully assessed the technical feasibility of the Trudvang, Luna and Havstjerne CCS projects, which combined can store up to 21m tonnes of CO2 annually, the equivalent of nearly half of Norway’s total CO2 emissions in 2023 (46.6m tonnes).

Wood’s comprehensive technoeconomic assessments – the method for evaluating the economic performance of technology – have laid the groundwork for sustainable CO2 transportation solutions, enabling the projects to progress to the next stage of development. The assessment included cutting-edge flow assurance simulations, development of CO2 specifications, specialised subsea field layouts and innovative marine loading and offloading solutions.

The CCS licenses are owned by Sval, Storegga and Vår Energi (Trudvang), Wintershall Dea and Total (Luna) and Wintershall Dea and Altera (Havstjerne). Wood’s technical experts from Stavanger, Sandefjord, Galway, Aberdeen and Reading are working together to deliver these scopes.

i For more information: www.woodplc.com

We want to use every opportunity to connect with our members, so please follow us on Twitter (@TheEICEnergy) and connect with us on LinkedIn –EIC (Energy Industries Council)

Below you’ll find a selection of some of the exciting EIC activities and useful industry information we’ve shared through our social media channels.

AEG Power Solutions (AEG PS), global provider of power systems and solutions for all types of critical and sustainable applications, has introduced a new range of uninterruptible power supply (UPS) systems, which feature a full IGBT architecture and industrial-grade build quality to provide a safe power backup to protect refining and petrochemical industries, transportation infrastructures, manufacturing and other critical businesses against all power disturbances.

EIC (Energy Industries Council)

The EIC Country Report: Kingdom of Saudi Arabia (KSA) offers a detailed analysis of market trends and opportunities in Saudi Arabia. Read the full report here https://lnkd.in/eTBksbGh

Protect 8 PLUS supports a standard three-phase input and is available as single-phase or three-phase output from 10 to 40 kVA, with 216 Vdc or 384 Vdc battery voltage. By the end of the year, it will also support 60 to 120 kVA in both configurations.

EIC (Energy Industries Council)

The new Middle East OPEX report shows that the region is set to invest US$75.63bn in renewable energy projects over the next five years. Visit https://lnkd.in/eTBksbGh

Thanks to its IGBT rectifier, the system offers a high input power factor of up to 0,99 and very low harmonic current rejection on the input side (THDi) which makes it a perfect fit in situations where the UPS is supplied by a generator set or to avoid harmonic perturbations of loads connected to the upstream busbar.

EIC (Energy Industries Council)

Bankable Energies is the must-attend event for 2025! Join us to explore the urgent shift needed to attract capital and accelerate projects. Register here https://lnkd.in/e6mnq3em

This results in substantial savings on the sizing of the upstream network. The bi-directional rectifier also enables several battery capacity tests feeding back into the grid without using the bypass line, requiring additional load banks or affecting the load.

With the Protect 8 PLUS, AEG Power

Moving into the winter months the Global Events and Campaigns team has been working on developing new events to support our members.

Following the success of our first European webinar at the beginning of October, focusing on hydrogen opportunities in the Netherlands with insights from RWE and proudly sponsored by Serimax, we move on to our upcoming Opportunities in Oil and Gas in Norway on 14 November and Opportunities in Offshore Wind in Germany on 6 February 2025. Members have free access to these webinars and can be booked online. Partnership packages are also available from £2,000+VAT. Please contact louise.donald@the-eic.com

Looking forward to the new year, we are delighted to announce some of the first speakers for the inaugural Bankable Energies that is taking place on the 26-27 February 2025. You can find the agenda as it stands online and you can join us as we bring together the global investment community, key project developers, policymakers and regulators to discuss the global shift needed to attract investment and drive projects forward. If you are interested in partnering with us for this event, get in touch to discuss how your company can get involved, with packages available from as little as £1,200+VAT. Visit our website for more details.

Energy Exports Conference is also moving forward with exhibition and sponsorship opportunities going fast.

Jo Campbell

We are looking forward to welcoming Bureau Veritas as our strategic partner for the 2025 edition of the conference. If you would like to find out more about how to take your company from local to global we have opportunities to suit every budget. This event will bring together projects from across the globe to showcase the opportunities to the UK supply chain.

If you are interested on any of our partnerships for any of our events get in touch with the team, global.events@the-eic.com to find out more.

Jo Campbell

Director of Global Events and Campaigns jo.campbell@the-eic.com

As we approach the end of another remarkable year, it was a privilege to showcase the energy supply chain’s finest at our recent EIC Regional Awards, honouring winners of the World Energy Supply Chain Awards (WESCAs) across 12 categories. Congratulations to all 33 finalists, particularly the night’s winners. The event ranks among the best in my 14 years here, and I extend my thanks to all who attended.

However, with oil prices dipping below US$70 for the first time since 2021 and OPEC+ revising its demand forecasts for 2024 and 2025, we stand at a crossroads. As renewable energy gains traction, the question remains: are we witnessing a pivotal shift toward more sustainable energy solutions or just a temporary market fluctuation?

Ryan McPherson

Regional Director, Middle East, Africa, Russia & CIS ryan.mcpherson@the-eic.com

Applications will open soon for Survive & Thrive IX, watch this space for more information.

As ADIPEC 2024 approaches, we are excited to host over 125 exhibitors in the UK pavilion. Across four action-packed days, we’ll feature industry panel sessions, contractor briefings and our first-ever welcome breakfast on 4 November, setting the tone for an exciting week at the world’s premier energy event.

Looking ahead, our Christmas cracker golf day is set for 12 December at the Abu Dhabi City Golf Club, promising a fantastic day of sport, networking and festive fun. Spaces are filling up fast, so don’t wait –secure your spot today.

Early next year, we’ll bring back our KSA and UAE Connect events, along with sessions in Kuwait, Oman and Qatar to keep you updated on regional developments.

Additionally, March 2025 will feature a trade delegation to Namibia and South Africa. The programme will identify current and future project opportunities, providing the chance to meet with key players and engage with prospective local partners and supporting organisations. For further details please contact internationaltrade@the-eic.com

Our GCC, CIS and Africa webinars will also be back early in the new year. Should you be unable to attend on the day, don’t worry as these are available to view on EICTV not long after the event. In addition, our EIC roundtables will continue, where I am always interested to hear about any topics that you may feel are worthy of wider discussion.

The recently published EIC Middle East OPEX report highlights that the region will see around US$1.2tn of CAPEX across the energy sectors between now and 2030 which gives a clear indication of the size of the opportunities. Although the region is seeing significant growth in the cleantech sector it should be recognised that 70% of the projected CAPEX will be seen in the oil and gas sectors.

ADNOC is acquiring a 35% stake in ExxonMobil’s planned blue hydrogen and ammonia facility in Texas, expected to be the world’s largest. Producing 1bn cubic feet of hydrogen daily and 1m tonnes of ammonia annually, it will cut carbon emissions by 98%. With final investment decisions by 2025 and operations starting in 2029, ammonia from the plant will be shipped to Europe and Northeast Asia, targeting markets focused on decarbonisation. This marks ADNOC’s growing role in hydrogen and carbon capture investments.

The UAE achieved just under 28% of clean energy in its energy mix in 2023, aiming for 30% by 2030. Major investments in solar and nuclear power, including the fully operational Barakah plant, have contributed to this progress. Renewable energy capacity grew 70%, reaching 6.1GW and further growth is expected, supported by projects like the Mohammed bin Rashid Al Maktoum solar park. The UAE’s strategy includes carbon capture and a national hydrogen strategy, with plans to invest Dh150-200bn by 2030, aiming for net zero emissions by 2050.

October 2024 was a significant month for EIC APAC, marked by our involvement in Clean Energy Transition Asia (CETA) 2024, held as part of the International Greentech & Eco Products Exhibition & Conference Malaysia (IGEM). CETA 2024 aimed to unite both public and private sector decisionmakers to propel milestones in the clean energy transition across the region. This platform facilitated dialogues between stakeholders in both the clean energy and hydrocarbons sectors, promoting a transition bridge strategy – a vision that advocates for a balanced, just and secure energy transition. The collaboration between EIC APAC and CETA was designed to generate meaningful progress and drive innovation, helping shape the future of energy across Asia through an inclusive and holistic approach.

Rounding off the month, the EIC APAC Regional Awards Gala Night 2024 will take place on Friday 29 November. Set against the backdrop of a Bollywood-themed evening, this highly anticipated event will bring together EIC members and supporters to celebrate the achievements of the year in a festive and elegant setting. Guests are invited to don their finest Bollywood attire and enjoy a night filled with entertainment, including live bands, an informal networking session, an awards ceremony, performances, a lucky draw and themed games. The highlight of the night will be the announcement of the EIC Regional Awards winners, recognising excellence within the industry.

Azman Nasir, Head of Asia Pacific azman.nasir@the-eic.com

Additionally, on 8 October 2024, EIC APAC hosted an informative webinar titled Offshore Wind in Asia Pacific: Insights into Japan’s Wind Market. The session featured presentations by Hazwani Izzati and Lim Xiao Shuen, both energy analysts at EIC APAC, who offered a deep dive into the current offshore wind energy market in the Asia Pacific region. Special emphasis was placed on the Japanese wind market, with the webinar serving as a platform to generate interest and momentum in the lead-up to Wind Expo Japan 2025, Japan’s largest wind energy trade show. The event will provide participants with key insights into the latest developments in wind energy technologies and market trends, while also underscoring Japan’s growing role in the offshore wind sector. Wind Expo has long been recognised as a vital hub for industry leaders, showcasing the latest innovations and fostering partnerships that drive the growth and development of the wind energy sector in Japan and beyond.

In November 2024, EIC APAC will be hosting two prominent events: the EIC APAC Networking Cocktail at the Offshore South East Asia Exhibition & Conference (OSEA) and the EIC APAC Regional Awards Gala Night 2024.

The EIC APAC Networking Cocktail is scheduled for the third week of November, coinciding with OSEA, which runs from 19 to 21 November 2024 at the iconic Marina Bay Sands in Singapore. With nearly five decades of history, OSEA is recognised as one of Asia’s largest and most influential offshore and marine showcases. EIC APAC’s Networking Cocktail aims to connect key stakeholders in the energy sector, offering a valuable platform for attendees to foster new partnerships, explore collaborative ventures and enhance business opportunities in the everevolving energy landscape.

Indonesia has awarded three oil and gas blocks in the first round of auctions this year. The Melati block, which includes both onshore and offshore fields with estimated resources of 4.7 Tcf of gas and 850 Mbbl of oil, was awarded to a consortium of Pertamina Hulu Energi, Sinopec and KUFPEC. The Central Andaman block was awarded to a consortium of Harbour Energy and Mubadala Energy. This block is estimated to hold 100 Mbbl of oil and 500 Bcf of gas. Additionally, the Amanah block with estimated resources of 50 Mbbl of oil and 450 Bcf of gas, was awarded to a consortium of Medco Energi and KUFPEC.

SK Earthon has been awarded the rights to explore and operate the Ketapu Cluster, an oil field located off the Sarawak coast by the Malaysian government. Under the agreement, SK Earthon will hold an 85% stake in the Ketapu Cluster as the operator, while PETROS will retain the remaining 15%. SK Earthon expects to commence crude oil and natural gas production from the Ketapu Cluster by 2031, following exploration and appraisal drilling to assess its commercial viability.

Now heading into November, as a reminder to all, the region has a great line-up of in-person and online events scheduled for members and non-members to attend. On 5 November 2024, the EIC will be welcoming its team of analysts to provide a virtual presentation covering the US Gulf of Mexico Decommissioning Market – if you or your team have yet to register for this event, do so today! In addition, in-person events are not the only events open to sponsorship. If you or your company are interested in profile raising opportunities such as promotional marketing opportunities, please click here and become an EIC Global Digital Supporter.

On 12 November the EIC will be joining Petrofac in-person at its offices as it provides a business briefing presentation. This event is only open to EIC members and has a very limited number of seats. If you are having issues with your registration, or have any inquiries, please contact adriana.romo@the-eic.com

If you are a non-member and would like to attend this event, please contact our membership team to learn how membership may benefit you and your company in addition to granting you access to events in our Business Briefing series navied.sadeghi@the-eic.com or madison.omalley@the-eic.com

Lastly, if you are not already part of our regional mailing lists and would like to stay updated on all thing’s regional events and regional energy news, please contact houston@the-eic.com for support. Members and nonmembers on our mailing lists are the first informed about new and upcoming events. Join us.

Amanda Duhon

VP & Regional Director, North & Central America amanda.duhon@the-eic.com

Market Update: US GoM Decommissioning Tuesday 5 November 2024