2024 Homeownership Supplement

announced a $250,000 investment in 2023 for a pilot program with of Atlanta to cover the cost of tax increases for qualified homeowners. This investment earlier commitments focused

legacy resident retention including

$500,000 to the Atlanta BeltLine’s Resident Retention Program, to the Atlanta Neighborhood Development Partnership’s “Closing Gap” affordable housing plan

$100,000 to HouseProud Atlanta support senior residents with repairs.

support renters, the Rocket Community Fund also announced a investment with the Atlanta Volunteer Lawyer’s Foundation to renters from illegal eviction.

TITLE SPONSOR:

Neighbor to Neighbor, we with thousands of families, learning about their concerns, challenges and fears related to

housing stability in Atlanta,” said Laura Grannemann, Executive Director, Rocket Community Fund. “These investments respond directly to those concerns, addressing rising property taxes and eviction increases. We are thrilled to work with partners to promote safe and stable housing for all.”

The Rocket Community Fund also supports the Rocket Wealth Accelerator program in Atlanta, as well as Detroit, Cleveland and Milwaukee. The Rocket Wealth Accelerator connects clients with coaches who help them improve their financial literacy, build credit and grow generational wealth – all crucial steps towards long-term stability. In Atlanta, the Rocket Wealth Accelerator is managed by LISC and Atlanta Center for Self-Sufficiency.

PLATINUM SPONSOR:

Between all these investments, Rocket Community Fund has invested more than $2.5 million to the Atlanta

community in the last year and a half – and they are going to keep investing as they learn more about the city’s unique needs.

It’s an approach that is winning praise from Atlanta Mayor Andre Dickens, who said “Our vision of ‘one city with one bright future’ can only be achieved through collaborative partnerships that prioritize our most critical needs, like stable and secure housing. I am grateful to the Rocket Community Fund for their commitment to fostering the equity and economic inclusion of Atlantans.”

For more information about Rocket Community Fund’s work in Atlanta and across the nation, visit RocketCommunityFund.org.

GOLD SPONSORS:

theatlantavoice.com • June 21 - 27, 2024

Supporting the Homeownership Journey

Strength in Working Together

As the leading large bank lender to African Americans Wells Fargo understands that our strength comes from working together across the country to achieve racial equity in homeownership.

Our close collaboration with prominent African American civil rights organizations, real estate trade groups, and housing counseling agencies helps bring home buying information and resources to more communities.

At Wells Fargo we also continue to optimize our teams to better serve you and help you create a home buying journey that is right for you and your family.

Scan to learn more about our Home Lending Priorities

BY EWUNIKE BRADY Head of the Home Lending African American Segment

Tfor Wells Fargo

he homeownership journey is just that – an ongoing process that doesn’t simply start and end when you get the keys to your first home. In my role as the Head of the African American Segment with Wells Fargo’s Home Lending Diverse Segments team, I am responsible for creating and implementing strategies to address the disparity in wealth and homeownership that we face as a nation, with a specific focus on advancing Black homeownership. We are deeply committed to working hard to close the gap and create a more inclusive housing system. One way to do this is through education. In this year’s publication, we explore opportunities to build the knowledge and leverage the tools available to help provide confidence and support at each stage of homeownership.

We start with a spotlight on an exciting new partnership that underscores Wells Fargo’s commitment to Historically Black Colleges and Universities (HBCUs) and the importance of laying a strong foundation of financial literacy on the path to future homeownership. The “A Different World tour,” visiting HBCUs throughout the country this year, aims to raise awareness and enrollment for HBCUs. Wells Fargo’s sponsor-

ship celebrates HBCU culture and helps us offer college students helpful resources about scholarships, career opportunities, and building generational wealth.

Next, an interview with HomeFree USA shares the importance of getting prepared to buy a home before you’re ready to make an offer. Ensuring you’re ready to take such a huge financial step is easier with the information you need. We round out this series with a focus on two topics that face those who already own a home. The first provides advice to help homeowners keep their home if they are facing financial hardship; the second outlines the importance of passing along assets, including real estate, to build generational wealth for future generations. We hope this information provides a helpful framework for wherever you or your loved ones are on the path of homeownership. We’re proud to collaborate with industry, governmental, and local stakeholders in markets across the country to do what we can to address the racial homeownership gap and look forward to continuing this important work together.

June 21 - 27, 2024 • theatlantavoice.com Sponsored Content

Information is accurate as of the date of printing and is subject to change without notice. Wells Fargo Home Mortgage is a division of Wells Fargo Bank, N.A. © 2023 Wells Fargo Bank, N.A. NMLSR ID 399801 AS5759580 Expires 04/2024

Ewunike Brady, Head of the Home Lending African American Segment for Wells Fargo

Top 5 Things to Consider Before Buying a Home

SPONSORED BY JPMORGAN CHASE & CO.

Homeownership has long been a reliable and valuable investment for many Americans. The Black homeownership rate in the U.S., however, stands at just 44% - the lowest among all racial groups according to the National Association of Realtors. [or use this data: A lack of access to credit, a lack of understanding about the homebuying process, and coming up with the upfront cash needed for a down payment and closing costs are among the barriers many Black Americans face on their journey to homeownership. That’s why it’s important to consider your options and seek out resources to help navigate the homebuying process.

For National Homeownership Month, Marsha Johnson, Community Home Lending Manager for Georgia and North Florida, shared five important things to consider before purchasing a home.

Advisor to understand the options that may work for you.

3. Evaluate loan options and shop around.

1. Come prepared and don’t stress about rates.

The best time to buy a home is when you’re financially ready. Worry less about the current economic environment and more about your own preparedness for homeownership, including fully knowing and understanding your financial situation, debt level, credit score, savings and investment positions.

2. Save for a down payment.

A down payment is what you pay upfront toward the cost of your new home; it’s the difference between your mortgage amount and your purchase price. The more you can put down, the less you’ll be borrowing from a lender. However, it is a myth that you must put down 20% of the purchase price—low down payment loan options are available—in some cases, as low as 3%. Keep in mind that if you put less than 20% down, you may be required to pay private mortgage insurance. Make sure to speak to a Chase Home Lending

There are many different types of home loans available, and having an experienced Chase Home Lending Advisor on your side can help you make the right decision for you. Here are the most common types of loans:

· A conventional loan typically calls for a higher credit score to qualify and can be accessed through private lenders, including banks, credit unions, and mortgage companies.

· An FHA loan is backed by the federal government. These loans can help potential buyers with lower credit scores who wish to keep their down payment costs low. Buyers using an FHA loan are required to pay monthly mortgage insurance premiums, regardless of the down payment amount.

· A VA loan is a mortgage the U.S. Department of Veterans Affairs offers to servicemembers, veterans and surviving spouses. VA loans can have favorable terms, including no down payment.

· Your financial institution may also offer additional loan options. An example is Chase’s DreaMaker mortgage, which has

flexible credit guidelines and requires as little as 3% down.

Lastly, no matter the loan type you chose, it’s important to shop around for the best offer, both in terms of rate and other fees you may have to pay. All lenders and mortgages are not the same. For instance, did you know that, on average, homebuyers save more in mortgage fees with a bank like Chase, compared to a non-bank?

4. Use tools to help.

It’s important to look into the financial resources available to help you purchase a home. Chase offers a homebuyer grant of up to $7,500 to buyers purchasing homes in eligible areas. These grants are offered in low- to moderate-income communities and neighborhoods that are designated by the U.S. Census as majority-Black, Hispanic and/or Latino. The grant can be used to lower the interest rate and/or reduce closing costs or down payment. You can check grant eligibility online with the Chase Homebuyer Assistance Finder and also discover other financial assistance that may be available. For added confidence during the closing process, Chase also offers a Closing Guarantee, which promises an on-time closing for eligible customers in as soon as three weeks,

or the customer will receive $20,000 (for a limited time through July 27, 2024) if they qualify. The closing guarantee helps buyers close quickly, which can be very helpful in a competitive market.

5. Get educated.

Buying a home can be the achievement of a lifetime, but being able to sustain homeownership over time is equally, if not even more, important. For the best chances of success, homebuyers should not only get educated about the buying process, but also understand the ins and outs of homeownership after the home is purchased. Chase’s Beginner to Buyer podcast and its Homebuyer Education Center offers tips and firsthand experiences on homebuying, selling, and ownership.

Homeownership offers many benefits beyond just a place to live—it’s a time-tested way to start building personal and generational wealth. That’s why it’s never too early to start working toward your dreams of homeownership. After all, it’s an investment in your future.

theatlantavoice.com • June 21 - 27, 2024 Sponsored Content

Marsha Johnson, Community Home Lending Manager for Georgia and North Florida.

From closing to legacy: Holistic support for homeownership

SPONSORED CONTENT PROVIDED BY THE COMMUNITY FOUNDATION FOR GREATER ATLANTA

For the past several years, the Community Foundation for Greater Atlanta (the Foundation) has focused our efforts on four systems that were raised as critical areas of need in Metro Atlanta, one of which is Housing and Neighborhoods. This National Homeownership Month, we’re focused not only on supporting residents who are interested in becoming a homebuyer for the first time, but also on legacy residents looking to remain in their home, and in their community.

Homeownership provides access to equity and the opportunity to create generational wealth, and it is important that homeowners take steps to preserve their investment and ensure they are able to realize the full benefit of the equity their investment offers. Homeowners in Metro Atlanta can apply for the Homestead Exemption once their new home purchase is complete, and should do their best to stay on top of home repairs and maintenance to prevent a buildup of expenses. To protect the long-term impact of their investment, homeowners should also ensure their title remains clear when the time comes for their house to pass to the next generation.

Many homeowners are familiar with the basic process of estate planning. The homeowners named on the deed of the house create a will indicating who will inherit the property. Complications arise, however, when there are multiple beneficiaries named in the will. If done incorrectly, this type of will creates a situation called ‘heirs’ property’, or ‘tangled title’. Since there are now multiple owners of the property, each decision around the home becomes significantly more complicated, requiring approval from all heirs. Similarly, if there is no will created in the first place, it can be very difficult for heirs to demonstrate their ownership of the home.

Having a tangled title to a house can lead to a myriad of issues, creating both formalized barriers and informal complications. Resolving heirs’ property is a complex legal process, generally requiring the support of qualified legal professionals with expertise in this area. The process can take as long as months or even years, and its success is dependent on the dedication of all heirs to resolving the issue. Organizations like Georgia Heirs Property Law Center provide necessary expertise and support in this area, and serve as a critical resource to preserving homeownership.

Once a homeowner holds clear title to

their property, there are a number of resources that are focused on allowing legacy homeowners to remain in their home. Homeowners can access support for home repair through organizations like HouseProud Atlanta, Meals on Wheels Atlanta, Rebuilding Together Atlanta, and many of the local Habitat for Humanity affiliates. Invest Atlanta will be launching a property tax relief program later this year in addition to their Owner-Occupied Rehab Program. For legal support outside of heirs’ property issues, Atlanta Legal Aid has been providing excellent support for nearly 100 years in Metro Atlanta.

The Foundation is proud to work with such incredible organizations in Metro Atlanta, as we know this crisis cannot be solved by any one organization alone. The Foundation continues to support housing needs through traditional grants and impact investments in the form of low-cost and 0% conditional loans, as well as through the leverage of our other forms of capital.

At the Foundation, we believe that supporting affordable homeownership requires a holistic approach, as well as partnership with the many wonderful organizations working to advance affordable housing in Metro Atlanta. Together, we are confident that we can continue to reduce the racial homeownership gap and ensure legacy homeowners can remain in their homes.

In 2022, Atlanta was selected as one of eight cities around the country to receive $7.5 million in funding from Wells Fargo Foundation through the WORTH initiative to support a coalition of partner agencies working to reduce the racial homeownership gap in Metro Atlanta. The Foundation is honored to serve as the lead agency and fiduciary for the initiative. Our collaborative developed five overarching strategies to address this critical area of need, capitalizing on the experience and expertise of each partner agency to amplify impact for the Metro Atlanta community. One strategy launched last fall is the Homeownership Urban Blueprint (the HUB), led by the Urban League of Greater Atlanta. Potential homebuyers can visit the HUB to find agencies providing services for each stage of the homeownership journey, and vendors can list their services and events in one common space.

June 21 - 27, 2024 • theatlantavoice.com

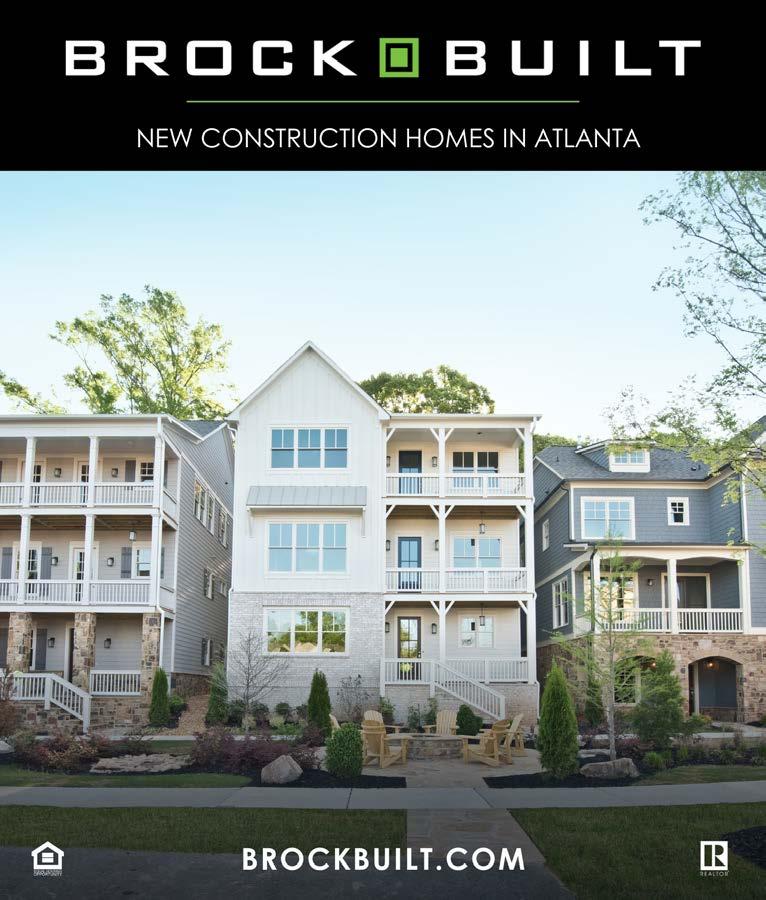

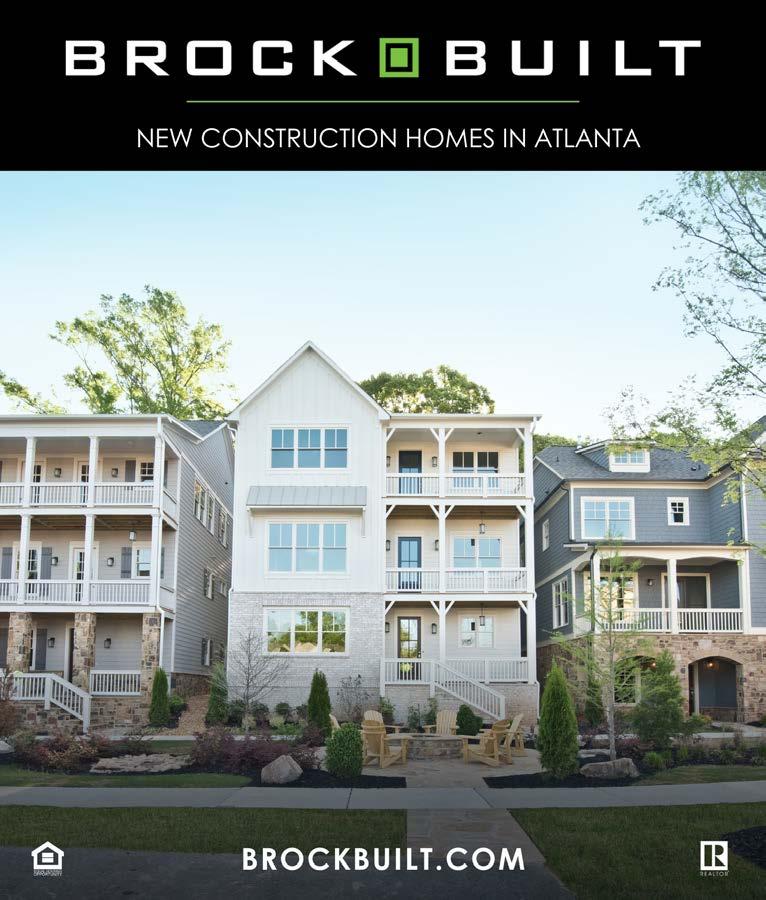

229 Peachtree St NE, Ste 705 Atlanta, Georgia 30303 www.andphomes.org Ready for Homeownership? For more than 33 years, ANDP and its partners have been working to provide access to affordable housing and close the homeownership gap. With our partners we develop new and newly renovated homes priced affordably to low- and moderate-income families in Atlanta and beyond. To help achieve the dream of homeownership, ANDP also provides access to down payment assistance to qualified homebuyers. To learn more, visit www.ANDPHomes.org Come see us June 29, 2024 at Super Saturday. Details: https://ulgatl.org/super-saturday/ Home pictured above was developed by partner Fortas Homes. See listing of available homes and those coming soon at www.andphomes.org.

Sponsored Content

How to Make Homebuying Easier and Less Expensive

BY ZERLINE HUGHES SPRUILL

Purchasing a home is the ultimate goal for many U.S. households. The thought of choosing to paint rooms any color under the rainbow, hammer nails into the walls to hang favorite photos and art pieces, and simply having a safe space that doubles as a personal investment is shared by many.

In pricey markets including the DMV area, many think the prospect of becoming a homeowner is far-fetched. Rising home prices, increasing interest rates and the harsh reality of real estate race disparities can be discouraging setbacks. Luckily, homebuying guidance and preparation can turn those obstacles into homeownership opportunities, according to Milan Griffin, Chief Operating Officer of HomeFree-USA. HomeFree-USA, in collaboration with lending partners like Wells Fargo, are helping renters become homeowners.

“When people are ready to start the homebuying process, they usually call a realtor or loan officer first, instead of a HUD-certified

Homeownership Advisor,” said Griffin. Doing so, hurts homebuyers by limiting their access to money-saving mortgage programs and increases the likelihood of loan denial. There are so many things’ people don’t know about the process,” Griffin added. “Homebuyers get stuck because they are overwhelmed with the amount of required paperwork, lender requirements, programs, steps, etc.

Homeownership Advisors make the process easier by helping homebuyers overcome the four biggest obstacles to homeownership – credit, debt, savings, and downpayment.

“Studies show Black mortgage applicants are denied a mortgage 84% more often than white applicants. Credit is the biggest barrier to approval but it’s not just a low score holding buyers back. Surprisingly, we see buyers who come to HomeFree-USA with a 700-credit score after being denied for a mortgage because their debt is too high. A quick financial review with a Homeownership Advisor, before meeting with a loan officer, helps to ensure buyers are truly ready for mortgage approval.

Ninety-six percent of buyers that HomeFree-USA refers to lenders are approved the first time.”

“When homebuyers go straight to realtors, they run the risk of being connected to one lender instead of being presented with additional mortgage options. Starting with homeownership guidance positions

buyers to research, qualify for, and access affordable loan and downpayment programs many don’t know exist. More options mean bigger savings and money to cover expenses as a new homeowner. HomeFree-USA members secure an average of $18,000 in downpayment assistance.”

Founded 30 years ago by her parents, Marcia and Jim Griffin, CEO and Co-CEO respectively, HomeFree-USA is a nonprofit organization created to build the foundation to close the wealth gap by educating and developing financially-prepared, sustainable homeowners. Approved and certified by the U.S. Department of Housing and Urban Development (HUD), HomeFree-USA offers an array of services including step-by-step homeownership guidance, foreclo -

sure prevention counseling, property development, neighborhood revitalization, and training for emerging real estate developers.

HomeFree-USA’s Center for Financial Advancement (CFA) provides financial education and recruitment for HBCU students.

Thanks to partners like Wells Fargo, 12,000+ students from 15 HBCUs have learned the tenants of credit, homeownership, and leadership while accessing internship opportunities in the mortgage and real estate finance industry.

Wells Fargo’s latest effort to help homebuyers is its Homebuyer Access Grant totaling $10,000 [https://sites.wf.com/accessgrant/].

For those eligible, repayment is not required, and the grant can be combined with additional programs. For this and most grants, housing counseling is required to qualify.

Affording a Home Today’s housing market is expensive. A recent Forbes Magazine article [https://www.forbes.com/ advisor/mortgages/real-estate/ median-home-prices-by-state/], shows the median home prices by

state. Despite the fact that home prices and interest rates may seem prohibitive, Griffin says that should not deter those considering homeownership.

“When it comes to high-priced markets, like D.C. and Atlanta, there’s still opportunities to purchase a home,” she said. “When you speak to a Homeownership Advisor, they will strategize ways to reduce debt and suggest downpayment programs to boost your buying power. Even those receiving a Housing Choice Voucher (formerly known as section 8), can use it to buy a home and receive monthly assistance to meet homeownership expenses.

For more information on HomeFree-USA’s homebuying program, visit https://homefreeusa.org/ homeowners/ or call 855-4934002.

theatlantavoice.com • June 21 - 27, 2024

Sponsored Content

Milan Griffin and HomeFree-USA partner with Wells Fargo to increase diversity and inclusion for both homebuyers and mortgage industry employees. (Photo courtesy of HomeFree USA)

In February 2023, Rocket Community Fund

Tto Neighbor program in Atlanta. Neighbor to Neighbor is a doorto-door canvassing campaign to connect residents with resources and identify critical community issues. The Partnership for Southern Equity and the Atlanta BeltLine Partnership led the effort, which collected more than 16,300 responses from residents across 20 Atlanta neighborhoods throughout 2023.

Rocket Community Fund’s Commitment to Atlanta

Rocket Community Fund’s Commitment to Atlanta

he Atlanta area has grown rapidly in recent years and is now the sixth-largest metropolitan region in the United States. This increase in population is driving increased housing costs and property taxes. Rocket Community Fund, the philanthropic partner of Rocket Mortgage, is committed to simplifying complex and inequitable systems to ensure that every American has access to stable, healthy housing. In Atlanta, this commitment has led to more than $2.5 million in investments focused on housing stability.

Getting to Know our Atlanta Neighbors

In February 2023, Rocket Community Fund launched its flagship Neighbor to Neighbor program in Atlanta. Neighbor to Neighbor is a door-to-door canvassing campaign to connect residents with resources and identify critical community issues. The Partnership for Southern Equity and the Atlanta BeltLine Partnership led the effort, which collected more than 16,300 responses from residents across 20 Atlanta neighborhoods throughout 2023.

According to Neighbor to Neighbor data, 76% of homeowners surveyed expressed concern about paying current year property taxes and 79% of respondents expressed concern about potential property tax increases. Neighbor to Neighbor data also showed the impact of rising costs on renters, with 36% of respondents worried about eviction due to rising rents. This number increases to 51% for renters who have lived in Atlanta for 11-19 years.

Our Commitment to Homeowners and Renters

According to Neighbor to Neighbor data, 76% of homeowners surveyed expressed concern about paying current year property taxes and 79% of respondents expressed con-

In response to Neighbor to Neighbor data, Rocket Community Fund

cern about potential property tax increases. Neighbor to Neighbor data also showed the impact of rising costs on renters, with 36% of respondents worried about eviction due to rising rents. This number increases to 51% for renters who have lived in Atlanta for 11-19 years.

announced a $250,000 investment in March 2023 for a pilot program with the City of Atlanta to cover the cost of property tax increases for qualified homeowners. This investment followed earlier commitments focused on legacy resident retention including $500,000 to the Atlanta BeltLine’s Legacy Resident Retention Program, $250,000 to the Atlanta Neighborhood Development Partnership’s “Closing the Gap” affordable housing plan and $100,000 to HouseProud Atlanta to support senior residents with home repairs.

Our Commitment to Homeowners and Renters

To support renters, the Rocket Community Fund also announced a $300,000 investment with the Atlanta Volunteer Lawyer’s Foundation to protect renters from illegal eviction.

In response to Neighbor to Neighbor data, Rocket Community Fund announced a $250,000 investment in March 2023 for a pilot program with the City of Atlanta to cover the cost of property tax increases for qualified homeowners. This investment followed earlier commitments focused on leg-

“Through Neighbor to Neighbor, we spoke with thousands of families, learning about their concerns, challenges and fears related to

Everyone Deserves A Safe And Stable Home

The mission of the Rocket Community Fund is to simplify complex and inequitable systems to ensure that every American has access to stable, healthy housing.

out more about our work at RocketCommunityFund.org.

housing stability in Atlanta,” said Laura Grannemann, Executive Director, Rocket Community Fund. “These investments respond directly to those concerns, addressing rising property taxes and eviction increases. We are thrilled to work with partners to promote safe and stable housing for all.”

acy resident retention including $500,000 to the Atlanta BeltLine’s Legacy Resident Retention Program, $250,000 to the Atlanta Neighborhood Development Partnership’s “Closing the Gap” affordable housing plan and $100,000 to HouseProud Atlanta to support senior residents with home repairs.

To support renters, the Rocket Community Fund also announced a $300,000 investment with the Atlanta Volunteer Lawyer’s Foundation to protect renters from illegal

The Rocket Community Fund also supports the Rocket Wealth Accelerator program in Atlanta, as well as Detroit, Cleveland and Milwaukee. The Rocket Wealth Accelerator connects clients with coaches who help them improve their financial literacy, build credit and grow generational wealth – all crucial steps towards long-term stability. In Atlanta, the Rocket Wealth Accelerator is managed by LISC and Atlanta Center for Self-Sufficiency.

“Through Neighbor to Neighbor, we spoke with thousands of families, learning about their concerns, challenges and fears related to housing stability in Atlanta,” said Laura Grannemann, Executive Director, Rocket Community Fund. “These investments respond directly to those concerns, addressing rising property taxes and eviction increases. We are thrilled to work with partners to promote safe and stable housing for all.”

The Rocket Community Fund also supports the Rocket Wealth Accelerator program in Atlanta, as well as Detroit, Cleveland and Milwaukee. The Rocket Wealth Accelerator connects clients with coaches who help them improve their financial literacy, build credit and grow generational wealth – all crucial steps towards long-term stability. In Atlanta, the Rocket Wealth Accelerator

Between all these investments, Rocket Community Fund has invested more than $2.5 million to the Atlanta

community in the last year and a half – and they are going to keep investing as they learn more about the city’s unique needs.

is managed by LISC and Atlanta Center for Self-Sufficiency.

Between all these investments, Rocket Community Fund has invested more than $2.5 million to the Atlanta community in the last year and a half – and they are going to keep investing as they learn more about the city’s unique needs.

It’s an approach that is winning praise from Atlanta Mayor Andre Dickens, who said “Our vision of ‘one city with one bright future’ can only be achieved through collaborative partnerships that prioritize our most critical needs, like stable and secure housing. I am grateful to the Rocket Community Fund for their commitment to fostering the equity and economic inclusion of Atlantans.”

It’s an approach that is winning praise from Atlanta Mayor Andre Dickens, who said “Our vision of ‘one city with one bright future’ can only be achieved through collaborative partnerships that prioritize our most critical needs, like stable and secure housing. I am grateful to the Rocket Community Fund for their commitment to fostering the equity and economic inclusion of Atlantans.”

For more information about Rocket Community Fund’s work in Atlanta and across the nation, visit RocketCommunityFund.org.

June 21 - 27, 2024 • theatlantavoice.com

Find

Sponsored Content

The Atlanta area has grown rapidly in recent years and is now the sixth-largest metropolitan region in the United States. This increase in population is driving increased housing costs and property taxes. Rocket Community Fund, the philanthropic partner of Rocket Mortgage, is committed to simplifying complex and inequitable systems to ensure that every American has access to stable, healthy housing. In Atlanta, this commitment has led to more than $2.5 million in investments focused on housing stability. In February 2023, Rocket Community Fund launched its flagship Neighbor to Neighbor program in Atlanta. Neighbor to Neighbor is a doorto-door canvassing campaign to connect residents with resources and identify critical community issues. The Partnership for Southern Equity and the Atlanta BeltLine Partnership led the effort, which collected more than 16,300 responses from residents across 20 Atlanta neighborhoods throughout 2023. According to Neighbor to Neighbor data, 76% of homeowners surveyed expressed concern about paying current year property taxes and 79% of respondents expressed concern about potential property tax increases. Neighbor to Neighbor data also showed the impact of rising costs on renters, with 36% of respondents worried about eviction due to rising rents. This number increases to 51% for renters who have lived in Atlanta for 11-19 years. In response to Neighbor to Neighbor data, Rocket Community Fund announced a $250,000 investment in March 2023 for a pilot program with the City of Atlanta to cover the cost of property tax increases for qualified homeowners. This investment followed earlier commitments focused on legacy resident retention including $500,000 to the Atlanta BeltLine’s Legacy Resident Retention Program, $250,000 to the Atlanta Neighborhood Development Partnership’s “Closing the Gap” affordable housing plan and $100,000 to HouseProud Atlanta to support senior residents with home repairs. To support renters, the Rocket Community Fund also announced a $300,000 investment with the Atlanta Volunteer Lawyer’s Foundation to protect renters from illegal eviction. “Through Neighbor to Neighbor, we spoke with thousands of families, learning about their concerns, challenges and fears related to housing stability in Atlanta,” said Laura Grannemann, Executive Director, Rocket Community Fund. “These investments respond directly to those concerns, addressing rising property taxes and eviction increases. We are thrilled to work with partners to promote safe and stable housing for all.” The Rocket Community Fund also supports the Rocket Wealth Accelerator program in Atlanta, as well as Detroit, Cleveland and Milwaukee. The Rocket Wealth Accelerator connects clients with coaches who help them improve their financial literacy, build credit and grow generational wealth – all crucial steps towards long-term stability. In Atlanta, the Rocket Wealth Accelerator is managed by LISC and Atlanta Center for Self-Sufficiency. Between all these investments, Rocket Community Fund has invested more than $2.5 million to the Atlanta community in the last year and a half – and they are going to keep investing as they learn more about the city’s unique needs. It’s an approach that is winning praise from Atlanta Mayor Andre Dickens, who said “Our vision of ‘one city with one bright future’ can only be achieved through collaborative partnerships that prioritize our most critical needs, like stable and secure housing. I am grateful to the Rocket Community Fund for their commitment to fostering the equity and economic inclusion of Atlantans.”

Getting to Know our Atlanta Neighbors Our Commitment to Homeowners and Renters For more information about Rocket Community Fund’s work in Atlanta and across the nation, visit RocketCommunityFund.org.

its flagship Neighbor

launched

theatlantavoice.com • June 21 - 27, 2024

Five Strategies to Grow Black Homeownership

BY ANTOINE M. THOMPSON

In 1865, over 159 years ago, the U.S. eliminated or outlawed slavery in the U.S. with the passage of the 13th Amendment to the U.S. Constitution. One of the promises and pledges to freed slaves was that each would receive 40 acres and a mule. This commitment would help former slaves with building a home, raising a family and growing wealth through land ownership and entrepreneurship. While some Black Americans were able to receive land in the 1860s and 1870s, unfortunately, many former slaves nor their descendants ever received land. In fact, many Black Americans that were given land were chased off their land with force and brutality from the Ku Klux Klan (KKK) and other white supremacy organizations.

Still to this day the dream of land and homeownership continues to be elusive for Black Americans from slavery, post slavery, the Jim Crow Era, the Civil Rights Era to the present. Whether it was the trick bag of sharecropping, land contracts, subprime loans, eminent domain policies or outright redlining of Black neighborhoods by banks and government organizations, it should not come as a surprise that there continues

to be a persistent 30-point racial gap in homeownership rates in the U.S. Racial disparities in homeownership is at the core of wealth inequality in this country, you can’t separate the two. America is anchored in home and land ownership, always has been, always will be. In fact, for many years, only white men that owned property could vote in the U.S. Below are several strategies to help grow Black homeownership in the U.S.: Federal

Student loan forgiveness for purchasing a home. African Americans are disproportionately impacted by student loan debt forcing many to forgo homeownership. A program that addresses this disparity and forgives student loan debt would help many Black Americans achieve their homeownership dreams.

Create down payment assistance and federal Housing programs for Black descendants of slavery. Currently there are initiatives and dedicated federal housing and mortgage lending programs and incentives for Native Americans, similar efforts should be established for Black Indigenous People of Color (BIPOC), those that are descendants of slaves in America.

Create federal and state homeownership zone programs in communities with persistent low rates of Black homeownership especially in formerly redlined communities. Intentional efforts to invest in rehabilitation of existing homes, coupled with infill housing, funding for homebuyer education, downpayment and closing subsidies, special purpose mortgage credit programs, energy efficiency grants, and property tax incentives would have a huge impact on increasing Black homeownership.

Lower mortgage interest rates despite

the current historically low rate of Black unemployment in the U.S., high mortgage interest rates are limiting the potential for increasing the growth rate of Black homeownership. According to data from Freddie Mac, there are over 2 million mortgage/credit eligible potential Black American homebuyers in the U.S.

Increasing the number of Black Real Estate Agents, Appraisers, Loan Officers and Underwriters the housing ecosystem sorely lacks diversity. Underrepresentation in these key professions plays a major role in housing discrimination, redlining, bias in mortgage lending, and the undervaluing of properties owned by Black Americans. It’s important to note that Juneteenth and homeownership month are in the same month. Hopefully, one day, the promise of land and home ownership will be realized equally and equitably for Black Americans.

Antoine M. Thompson is a housing policy expert, President of the Black Housing Policy Network (BHPN), Licensed Real Estate Agent with EXP Realty Group, former National Executive Director of the National Association of Real Estate Brokers (NAREB). He is a former NYS Senator and former Buffalo City/Common Council Member.

Connecting With The Next Wave Of Homeowners

BY JEN JACOBSEN Wells Fargo Corporate Communications

For many Black families, Thursday night in the late 80’s and early 90’s meant gathering around the TV to watch A Different World. This iconic series, inspired by student life at historically Black colleges and universities (HBCUs), was a cultural force that continues to influence Black audiences, in part because of its honest portrayal of social and political issues.

This year, the show’s cast is reuniting for the “A Different World (ADW) Tour” and visiting select HBCUs. Their goal: raise awareness and enrollment for HBCUs nationwide using the star power and cultural impact of the show. Inspired by this goal and building on a commitment to HBCUs and the Black community, Wells Fargo stepped up as the premier financial partner of the tour to celebrate HBCU culture and offer helpful resources about scholarships, career opportunities, homeownership and building generational wealth.

“It’s so important to lay a strong

foundation of financial literacy during the formative college years,” shares Dewey Norwood, Wells Fargo Senior Lead Diversity & Inclusion Consultant, Enterprise HBCU Strategy. “Investing in HBCUs and organizations that support them is essential at Wells Fargo, and working with the A Different World cast and tour team aligns with our ef-

forts to make a meaningful impact with students, alumni and community supporters of HBCUs.”

This spring, the Wells Fargo team was on-site for the tour events in Washington D.C., hosted by Howard University. The first event was a reception held at the Black, women-owned Salamander Luxury Hotel where student DJ Madyson Pat-

terson (aka DJ Wild Child) set the tone for the event and guests enjoyed food created by James Beard Award winner chef Kwame Onwuachi. Attendees included ADW cast members and staff from the tour, Wells Fargo employees, and partners in the Diverse Segments space, such as HomeFree USA, the Mortgage Bankers Association,

and Bowie State University student mentees from a university leadership program.

“The reception was a great way to kick off this stop of the ADW tour,” emphasized Ewunike Brady, Head of the Home Lending African American Segment for Wells Fargo. “Seeing HBCU students and future leaders alongside the partners that we work so closely with to help empower Black communities and close the homeownership gap was truly inspiring.”

The next day, the “Hillman Takeover at Howard” began at midday and included music, swag giveaways, and more as students lined up for hours to enter the auditorium. That evening, with a packed house, the ADW cast held a panel discussion covering a wide range of topics and student questions.

“Our commitment to this tour demonstrates the significant impact that we know homeownership makes for the future success of Black Americans,” emphasizes Brady. “We’re proud to be part of this community of partners working together to inspire future generations – to celebrate our past and build for tomorrow.”

June 21 - 27, 2024 • theatlantavoice.com

Content

Sponsored

The Wells Fargo team was on-site for the tour events in Washington D.C., hosted by Howard University.

A Greater

Buying a home can be overwhelming, but with Bank OZK, it doesn’t have to be.

Ease the stress of financing your next home by working with a partner invested in you. Our experienced home loan specialists are here to deliver exceptional service, competitive rates and a convenient application process.

Because we know your dream home isn't just another house. It's a future filled with even greater possibilities. Greater awaits Apply online for a home loan today!

theatlantavoice.com • June 21 - 27, 2024

NMLS# 464037

Southern First Offers Dream Mortgage to Help Buyers Achieve Homeownership

BEAU WHITE

Regional Mortgage Executive, SVP

Southern First’s mission is to impact lives in the communities we serve, and one of the most impactful and wealth-building events in a person’s life is becoming a homeowner. However, many buyers encounter obstacles such as a lack of funds for a down payment, lack of access to credit, or lack of information about the homebuying process necessary to begin the path to homeownership. With this in mind, Southern First created a mortgage product that makes it easier for everyone in the communities we serve to achieve their homeownership goals.

The Dream Mortgage* is serviced by Southern First and offers up to 100% financing up to $550,000 with competitive rates, no down payment, and no mortgage insurance required.

Homes in Low to Moderate Income Tracts or Majority Minority Census Tracts are eligible for the Southern First Dream Mortgage. Properties located outside of eligible census tracts within the Southern First market area may also qualify if the borrower(s) who reside in Cobb County earn less than $88,479 or if the borrower(s) who reside in Dekalb or Fulton County earn less than $80,959.**

Many people think they don’t have what is needed to purchase a home, but what you think you need and what you actually need may be very different. It’s never too early

to reach out to a lender to understand your options. You may be able to buy sooner than you think, or if you need time to prepare, an experienced lender can provide strategies to help you plan for a future purchase.

At Southern First, our team is passionate about helping people achieve their dreams of homeownership. Our mortgage experts are committed to building long-term relationships and providing you with access to information and loan programs to fit your needs.

If you have any questions about the Dream Mortgage or other mortgage loans, please don’t hesitate to reach out to our team of experts at 877-679-9646 or southernfirst.com/ mortgage. We would be honored to help you get into your next home.

Member FDIC and Equal Housing Lender. // *Loan originations are subject to underwriting and credit approval. Other terms, conditions, and certain fees may apply. The Dream Mortgage Program is a Special Purpose Credit Program designed to expand access to credit for underserved borrowers (low to moderate income and minorities) or locations, which are subject to change without notification. Applications are subject to underwriting and credit approval; additional terms and conditions may apply. Not all applicants will qualify. ** Sources: 2020 Census Data with 2020 ACS-5 Updates and Interim 2024 FFIEC Updates.

Take your next step to home sweet home

Up to 100% Financing

Choose from no or low down payment options with competitive interest rates and terms

Variety of Loan Products

Multiple loan options to choose from including conventional, FHA, VA, and USDA loans

Mortgage Lending Experts

Providing personalized guidance to help you find the right mortgage to fit your budget * *

*Loan originations are subject to underwriting and credit approval. Other terms, conditions and certain fees may apply.

Scan to get started

June 21 - 27, 2024 • theatlantavoice.com Sponsored Content

Beau White Regional Mortgage Executive, SVP

Affordable for Who? Atlanta Housing’s Mission to Make Homeownership an Accessible Dream

BY TERRI M. LEE President and Chief Executive Officer, Atlanta Housing

Atlanta Housing (AH) is in the business of solving big problems. As Georgia’s largest housing authority and one of the nation’s most substantial, we are emerging as a global beacon in tackling one of humanity’s most urgent dilemmas: affordable housing.

As housing prices remain high, and interest rates continue to rise, the dream of homeownership has become an increasingly elusive goal for many. For families with low to moderate incomes, this dream can seem almost insurmountable. The housing crisis calls for immediate and compassionate action, and Atlanta Housing is at the forefront of this charge. AH is taking bold strides to make the American Dream of homeownership a reality by equipping individuals with the necessary tools, resources, and funding to climb the ladder of economic mobility.

As we continue to encourage homeownership as an affordable housing solution, the ever-relevant question posed by the late Atlanta Housing Commissioner James Allen, “Affordable for who?” continues to guide our actions. While 96% of Atlanta Housing households are classified as either extremely or very low-income, with 75% earning less than $30,650 per year, our down payment assistance program extends its reach to families earning up to 80% of the Area Median Income (AMI), or $81,651 per year. This approach allows us to extend our hand to teachers, public servants, police officers - the very pillars of our society, making homeownership a tangible reality for everyday Atlantans.

We are expediting the development of AH-owned land across our city to foster robust, diverse communities, including University Choice Neighborhood, Englewood, Civic Center, Bowen, Thomasville Heights, and Mechanicsville. We are infusing these neighborhoods with affordable rental and homeownership opportu -

nities. As we strategically invest in these neighborhoods, we are unwavering in our commitment to ensure that buyers and renters have access to amenities, services, and quality schools.

As we recognize June as Homeownership Month, I am proud to shine a light on one of Atlanta’s best tools, the AH Down Payment Assistance Program. As AH’s CEO, I am steadfast in my determination to instill a renewed sense of purpose and a culture of urgency within Atlanta Housing to play our part in what City of Atlanta Mayor Andre Dickens refers to as the ‘group project’ of propelling Atlanta forward. With the support of our affordable housing partners, Atlanta Housing will strive to ensure that the wealth-building potential of homeownership is within reach. That is my pledge.

theatlantavoice.com • June 21 - 27, 2024 Sponsored Content

Terri M. Lee, President and Chief Executive Officer, Atlanta Housing

Fostering Partnerships for Increased Homeownership

BY PAT EVANS Director of Homeownership Programs, Atlanta Housing

Understanding that homeownership is the single most powerful strategy for closing the economic gap in our communities, Atlanta Housing is committed to addressing the urgent challenge of housing affordability with a compelling approach to expand access to homeownership. Through our Down Payment Assistance (DPA) Program, Atlanta Housing works with lenders to provide subsidy loans, which are fully forgiven when the homeowner occupies the property as their primary residence for 10 years. Eligible first-time homebuyers can receive up to $25,000. To date, the program has collectively helped over 1,900 families and funded more than $30 million in down payment assistance.

Equally important to the financial assistance, the DPA Program ensures that participants receive educational resources and counseling on responsible homeownership. Our participants take a mandatory 8-hour homebuyer education session from a HUD-approved provider and receive programmatic counseling support from our lender relationships. The result? A foreclosure rate of less than 2% among AH Down Payment Assistance (DPA) recipients—a testament to the effectiveness of our comprehensive approach. We are committed to setting up DPA recipients for long-term success, empowering them to buy their first home, stay in that home, and positively shape their communities.

It’s incredible to see how far we’ve come. In the early years, the AH DPA program served about 30 loans per year. Today, that number has grown to approximately 240 loans annually, representing an investment of approximately $5 million each year. This significant growth is largely due to the strong relationships we’ve cultivated with lenders. We view lenders as our customers, while the borrowers—our DPA recipients—are the ultimate beneficiaries.

Initially, we faced a prevalent stigma among lenders that assistance programs were too cumbersome and bureaucratic. To counter this, we aligned our program with mortgage industry lending standards, formalized our underwriting decisions, and adopted a customer-focused approach. We believe this exceptional service has fostered allegiance from lenders. Today, we have a ‘village’ of over 90 loan officers working with more than 40 lenders, many of whom have championed our program

Pat Evans, Director of Homeownership Programs, Atlanta Housing

Pat Evans, Director of Homeownership Programs, Atlanta Housing

even as they moved to new companies.

We now offer guidance to other public housing agencies on expanding their homeownership assistance programs, and our advice is simple: make sure you have a comfortable pair of shoes! In the early years, we tirelessly promoted the program with a passion for our mission and a hands-on marketing approach. My small, dedicated team frequented community events to connect with stakeholders who shared our vision of empowering people to achieve homeownership and build generational wealth. Our progress would not be possible without these community partners, who speak positively of us in rooms we are not yet in.

Looking ahead, we are incredibly optimistic about the future. Our team’s dedication has always been unwavering and we are more prepared than ever to propel our program to new heights, creating a more inclusive future for homeownership in Atlanta.

June 21 - 27, 2024 • theatlantavoice.com

Sponsored Content

The Dream of Homeownership: Atlanta Housing’s Innovative Path Forward

BY TERRI M. LEE President and Chief Executive Officer, Atlanta Housing

BY TERRI M. LEE President and Chief Executive Officer, Atlanta Housing

Atlanta Housing is in the middle of a transformational journey, using quality housing as a springboard to empower families, catalyze economic independence, and lay the groundwork for future generations. Yet, in the face of a turbulent housing market, particularly for communities of color in Atlanta, this mission is no small feat.

The echoes of history reverberate through our nation’s communities of color, where homeownership has been barricaded by redlining, discriminatory lending practices, and systemic inequities. These scars have etched a racial wealth gap into our society that persists today. Despite Atlanta’s relative success compared to other major cities, the National Association of Realtors’ 2022 Snapshot of Race and Home Buying in America Report paints a stark picture: homeownership rates among Black households languish at 43%, significantly lower than their white counterparts (72.1%), and even lower than a decade ago. This chasm has profound implications, as homeownership is a linchpin of wealth accumulation and economic stability.

Atlanta’s rapid population growth, fueled by a burgeoning job market, only amplifies the urgency of addressing these disparities. Since the onset of the pandemic in early 2020, Metro Atlanta’s job base has swelled by 5.4%, ranking fifth highest in the nation. This influx of new residents has stoked the flames of housing demand, igniting some of the fastest-rising rents in the country. As a result, low- and middle-income families, including young people, are caught in the crossfire as housing costs skyrocket for both renters and prospective homeowners.

The affordability crisis in Atlanta is a shared burden. Individuals find themselves unable to save for a down payment. The Urban Institute reports that over the past three decades, fewer young adults are striking out on their own, choosing instead to live with parents or roommates due to economic constraints. This trend is a clarion call for targeted interventions to make homeownership accessible for all.

At Atlanta Housing, we heed this call. Our Down Payment Assistance Program (DPA), established in 2005, is a testament to our commitment. This initiative has transformed the dream of homeownership into reality for over 1,900 families, investing more than $30 million in down payment assistance to provide a lifeline to those who might otherwise be shut out of the housing

market. This program not only paves the way to homeownership but also fortifies stability, as evidenced by our DPA recipients’ foreclosure rate of less than 2%.

Our mission to bolster homeownership for low- to moderate-income families is underpinned by robust community partnerships, outreach initiatives, and homebuyer education. In collaboration with HUD-approved homebuyer education counseling providers, we champion potential homebuyers in their journey to become credit and mortgage ready. Financial literacy is a cornerstone of this effort, as data reveals that credit, savings, and understanding the homeownership process are formidable barriers to purchasing a home. We join forces with community stakeholders to demystify the homebuying process and foster comprehensive support systems that empower individuals and families, thereby widening the gateway to homeownership opportunities. The agency is also ramping up outreach and home buying education for voucher participants teetering on the brink of transitioning from subsidized tenancy, with the aim of charting a clear pathway to self-sufficiency and potential homeownership.

Tackling housing disparities demands more than just financial assistance. Our innovative strategies, such as a new modular construction initiative and building affordable for-sale homes, bear witness to our commitment to crafting equitable housing solutions. In our current homeownership

pipeline, AH is primed to financially close on the creation of 144 affordable homes and 341 market homes in Atlanta within the next two fiscal years, while continuing to service over 200 households with down payment assistance annually.

Our partnerships with the City of Atlanta, Invest Atlanta, and an expanding roster of affordable housing partners, facilitators, and developers are the lifeblood of our efforts to expand housing availability. Together, we can spearhead the change needed to surmount both real and perceived challenges in the housing market. These collaborations enable us to pool resources and expertise, ensuring that our initiatives leave a lasting and sustainable impact.

The work we do at Atlanta Housing transcends the provision of shelter. It’s about forging opportunities for economic mobility, nurturing stable communities, and laying a foundation for future generations. The challenges are formidable, but our resolve is unwavering. By harnessing partnerships, championing financial literacy, and innovating in our approach to affordable housing, we can help more Atlantans realize the dream of homeownership. This is our charge—to uplift people, to empower families, and to illuminate a brighter future for our city.

theatlantavoice.com • June 21 - 27, 2024

Sponsored Content

Terri M. Lee, President and Chief Executive Officer, Atlanta Housing

Three homes financed with Atlanta Housing Down Payment Assistance. Photo submitted

June 21 - 27, 2024 • theatlantavoice.com

Content

Sponsored

theatlantavoice.com • June 21 - 27, 2024 Developing Affordable Housing For The Past 35 Years SUMMECH Community Development Corporation, Inc. www.summechcdc.org (404) 524-5465 633 Pryor St. SW Atlanta, GA 30312

Sponsored Content

Legacy of Hattie B. Dorsey continues to impact Atlanta’s affordable housing

Hattie B. Dorsey, ANDP’s founding President and CEO. Hattie passed a week before her 85th birthday. Hattie was a tireless pioneer and advocate for affordable and mixed-income housing in Atlanta and beyond. Her tenacity, vision, and leadership laid the groundwork for ANDP’s 33-year history of providing affordable housing options to thousands of metro Atlantans.

Hattie broke gender and race barriers throughout her career, including roles with the U.S. Department of the Interior, Mayor Ivan Allen, U.S. Representative Charles Weltner, the NAACP Legal Defense Fund, and as the executive director of Stanford Mid-Peninsula Urban Coalition. In the 1970s and 80s, Hattie began to solidify her life’s purpose — affordable and mixed-income housing as a strategy to build families

and communities.

In 1984, Hattie returned to Atlanta and was named Vice President at the City’s Atlanta Economic Development Corporation (AEDC) – known now as Invest Atlanta – and was involved with increasing minority participation during the redevelopment of Hartsfield Airport. She leveraged her position at AEDC to win hearts and minds to address declines she witnessed in the neighborhood she grew up in and others impacted by decades of systemic racism in highway placement, housing delivery, and other systems. With help from Shirley Franklin, the Neighborhood Development Department at AEDC was created. Her life’s passion was beginning to bloom. Soon after, Atlanta Mayor Maynard Jackson announced the merger of AEDC’s Neighborhood Development Department and the Chamber of Commerce’s Hous -

ing Resource Center to form ANDP.

As the founding President & CEO of ANDP, Hattie devoted 15 years to supporting the growth of the CDC network and the broader affordable and mixed-income housing ecosystem. Her efforts resulted in coordinating over $15 million in capacity-building funding for 20 regional CDCs. In 1998, she led the establishment of ANDP’s U.S. Treasury Certified Development Financial Institution (CDFI) subsidiary. She piloted innovative public-private partnerships and was recognized as a champion for mixed-income housing. Her work laid the foundation for not only ANDP’s work today but also for an array of housing and community-focused efforts. After retiring from ANDP, she continued her work with passion on boards, as a consultant, advocate, and mentor.

Atlanta’s current housing renais -

sance is, in many ways, directly attributable to the seeds Hattie planted decades ago. While we mourn Hattie’s passing and hold her daughter Michelle and extended family in our hearts, we also pause to reflect on her incredible journey and legacy.

I am personally so grateful and thankful for Hattie’s extraordinary life.

John O’Callaghan President & CEO

Atlanta Neighborhood Development Partnership, Inc

June 21 - 27, 2024 • theatlantavoice.com The past and present Staff and Board of Directors of ANDP are heartbroken to learn of the passing of ANDP’s founding President and CEO, Hattie B. Dorsey. Hattie was a tireless pioneer in the affordable housing sector in Atlanta and beyond. Her tenacity, leadership, and vision laid the groundwork for ANDP’s 33-year history of providing affordable housing options to thousands of metro Atlantans. While we mourn her passing and hold her daughter Michelle and extended family in our hearts, we also pause to reflect on Hattie’s incredible journey and legacy. www.andpi.org/hbdlegacy Remembering an Atlanta Affordable Housing Pioneer 229 Peachtree St NE, Ste 705 Atlanta, Georgia 30303 www.andpi.org Hattie B. Dorsey May 31, 1939 - May 25, 2024

Stay in touch! Scan to subscribe to our newsletter www.theatlantavoice.com Visit us online:

5 Reasons Why Renters Struggle to Transition to Homeownership

JENNINE HUNTER, NMLS# 1780411

JENNINE HUNTER, NMLS# 1780411

ucbi.com/team/jennine-hunter

AVP, Mortgage Loan Originator

Fear

The first reason why renters struggle to transition to homeownership is fear. They believe they will be rejected due to income, credit, down payment, job history, or, possibly, criminal background. But in many situations, this isn’t true. The key to finding out where you stand is to talk with a housing counselor or mortgage professional who can help you achieve your dream of homeownership. I’m currently working with a couple who had been renting for years until the home was sold out from under them. They were apprehensive about purchasing due to their debt—student loans, car payments, and credit cards. We began the process three months ago, and this weekend, they are going under contract for their new home! If they

had continued to operate in fear, they would have continued to rent and never built wealth for their family. Talk to someone!

Credit

As mentioned before, the “fear” of needing a credit score over 700 prevents many renters from purchasing. A little-known secret is that all government loans only require a credit score of 580 to get started! Most renters want to clean up their credit on their own or through a credit repair provider—neither of which can get them mortgage credit ready. The best way is to find a housing counselor or mortgage lender who can advise how to improve your credit to help you qualify for the programs—Conventional, VA, FHA, and USDA. I provide many of my renters with a credit plan that tells them the timeframe and cash needed to achieve their optimal mortgage credit score. All of those buyers have achieved homeownership.

Purchase Price and Interest Rates

In Metro Atlanta, the average sales price is between 350k and 400k. Many renters struggle because they remember when those same homes cost 100–200k or less. Unfortunately, the area has only continued to grow and gain popularity. Atlanta sits at the intersection of three interstates, it’s now called the Hollywood of the South, and huge data centers are being built. All this growth is going to bring an increase in purchase prices, and on top of that, we’re in a housing shortage. As far as interest rates, we’re in a normal rate environment with 6–8%. Most renters want to argue about a 6% rate on a home mortgage—but what they don’t realize is that the mortgage interest is tax-deductible, and they’re already paying 100% on a rental lease without that mortgage deduction. Not to mention the high interest rates on their credit cards and car notes—most of which are in the double digits. If you don’t believe me—check the rates on those cars and cards and let’s have a conversation!

Social Media

Finally, social media and regular media are telling renters that now is not a good time to buy. Unfortunately, a lot of the influencers are not real estate professionals, and they’re making general statements based on their views and not a renter’s actual current financial status. Because these individuals are celebrities or have a large following, renters are taking their views as truth and not taking the time to research and verify if the advice is relevant to their situations. Again, let’s talk!

I’ve highlighted several struggles that many renters have experienced—but you must have the courage to face those fears and move into homeownership. Don’t let it scare you into renting forever. Some renters have already been priced out of the market by waiting too long—and more are soon to follow.

theatlantavoice.com • June 21 - 27, 2024

Sponsored Content © 2024 United Community Bank | NMLS #421841 | Mortgage products and services are offered by United Community Bank. We are an approved seller/servicer for the Federal National Mortgage Association (Fannie Mae) and the Federal Home Mortgage Corporation (Freddie Mac). Normal credit criteria apply. Not all borrowers will qualify. This is not a commitment to lend. Subject to normal credit underwriting criteria. Offer subject to change without notice. More Options to Get You Home Learn more at ucbi.com/PATH Did you know? The net worth of US homeowners is 40 times more than renters. Build your own wealth and lay a foundation for your children. Our experts are here to match you to the mortgage that will get you home.

Pass it on: A Plan for Transferring Wealth to the Next Generation

SUBMITTED BY WELLS FARGO ADVISORS

SUBMITTED BY WELLS FARGO ADVISORS

Alife of hard work and sacrifice offers the opportunity to leave a legacy that lifts up not only your family, but your community. There are important considerations as you approach financial planning to transfer wealth to future generations.

Creating an estate plan is a foundational step. While it can seem intimidating, a team of trusted professionals, including a financial advisor, estate planning attorney, and accountant, can ask the right questions and help you avoid potential pitfalls.

“Developing an estate plan is about taking control. You are directing how the assets you have accumulated over your lifetime are passed on to the people and organizations that you care about,” says John Ripoll, Senior Vice President for Wells Fargo Advisors.

Your situation’s complexity will determine which documents your plan requires; however, these five are often included in an estate plan:

A will provides instructions for dis-

tributing your assets to your beneficiaries when you die. In it, you name a personal representative (executor) to pay final expenses and taxes and distribute your remaining assets.

A durable power of attorney lets you give a trusted individual management power over your assets if you can’t manage them yourself. This document is effective only while you’re alive.

A health care power of attorney lets you choose someone to make medical decisions for you if you are unable to communicate your wishes, or don’t have legal capacity to make treatment decisions for yourself.

A living will expresses your intentions regarding the use of life-sustaining measures if you are terminally ill. It doesn’t give anyone the authority to speak for you.

By transferring assets to a revocable living trust, you can provide for continued management of your assets during your lifetime and after your death — possibly for generations to come.

Establishing a plan is only the beginning. Significant life events are likely to call for changes to your plan.

Ripoll explains, “It’s important to reg-

ularly review your plan to ensure it continues to meet your needs. You want to consider whether your estate planning documents, asset titling, and beneficiary designations have been coordinated to allow your assets to be distributed according to your wishes. A regular review of who you have named as agent, executor, guardian for minor children, and trustee is important to ensure those named are still willing and able to serve when needed.”

Investment and Insurance Products are:

• Not Insured by the FDIC or Any Federal Government Agency

• Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

• Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC, Member SIPC, a registered broker-dealer and non-bank affiliate of Wells Fargo & Company. ©2019-2023 Wells Fargo Clearing Services, LLC. All rights reserved.

Black Women Lead the Charge in Homeownership Surge

BY STACY M. BROWN

Areport released on Feb. 17 by the National Association of Real Estate Brokers (NAREB) revealed that African American women have emerged as trailblazers in Black homebuying, collectively making significant strides in education, employment, and entrepreneurship.

The NAREB’s 2023 Women Investing in Real Estate (WIRE) report revealed a 5.6% increase in homeownership among Black women between 1990 and 2019. During the pandemic, Black women aged 45–54 and those over 75 experienced the most significant growth, with a 2.9% increase. Even in the initial stages of the pandemic, when homebuying slowed, Black women outperformed their male counterparts.

“With the rise of Black women buying homes, there is hope for the future. Homeownership is a testament to the resilience and strength of Black women, contributing to closing the racial wealth gap and creating paths toward long-term financial stability and a legacy for their families,” Dr. Courtney Johnson Rose, president of NAREB, expressed in a news release.

“The upward trajectory of Black female homeownership embodies the resilience and determination to overcome historical challenges and pave the way for social and economic progress,” Dr. Rose added.

Further highlighting the positive trend, the WIRE report shows Black female homebuyers rebounding faster and consistently outpacing

their male counterparts during the economic recovery from the pandemic. The data underscores Black women’s growing status and strength in American society.

NAREB plans to celebrate the accomplishments of Black women during its 2024 MidWinter Conference in Charlotte, North Carolina, from Feb. 28 to March 2. On March 1,

Dr. Rose, Charlotte Mayor Vi Lyles, and Wells Fargo EVP Georgette Dixon will participate in “A Fireside Chat with Women of Impact” at the Marriott Charlotte City Center.

“I’m looking forward to sharing my story, the triumphs and challenges, as well as hearing from my esteemed colleagues as we go on to discuss what’s next for women leaders and

entrepreneurs,” Dixon said. “Wells Fargo is excited to be a leader in this space of supporting women’s empowerment with a variety of programming through organizations like NAREB and the Women’s Business Enterprise National Council (WBENC).”

The WIRE report documents the economic gains that have laid the foundation for Black women’s success, representing women of the nation’s population, 52% of the nation’s American population, and 12.5% of all women. Furthermore, statistics reveal that 63.4% of African American women over 16 are active in the labor force, with 89.3% having graduated high school or its equivalent.

In entrepreneurship, Black women have made remarkable strides, with businesses owned by Black women growing by 50% between 2014 and 2019. In 2021, 17% of Black women were starting a new business, surpassing white women and men.

The real estate industry is also witnessing a positive trend toward diversity, with an increasing number of Black women carving a niche for themselves. Dr. Rose emphasized the ongoing need for mentorship programs and targeted educational resources to eliminate barriers for underrepresented groups.

In response to the WIRE report, NAREB will also host a one-day event for Black women in real estate and finance as part of their annual convention on July 3, in New Orleans, Louisiana, continuing their commitment to fostering inclusivity and empowerment in the industry.

June 21 - 27, 2024 • theatlantavoice.com Sponsored Content

African American women have emerged as trailblazers in Black homebuying, collectively making significant strides in education, employment, and entrepreneurship. iStock.com/fizkes

John Ripoll, Senior Vice President for Wells Fargo Advisors

Take Initiative On Your Journey To Homeownership

The Homeownership Wealth Initiative is a revolutionary partnership between Goodwill Industries of North GA, the National Black Empowerment Council, and Rocket Community Fund designed to support Atlanta residents with the knowledge and resources needed to achieve homeownership and build generational wealth. Developed by Rocket Mortgage, the program offers comprehensive homebuyer education through a newly designed homeownership curriculum featuring 10 instructor led-courses covering topics such as:

• Budgeting

• Tactics for improving credit score

• Getting pre-approved for a mortgage

• Securing a mortgage

• Effective home search strategies

• Available down payment assistance options

• ...and more!

To learn more about the Homeownership Wealth Initiative, scan the QR Code or connect with Goodwill of North GA at www.GoodWillNG.org/news/Rocket-Community-Fund

theatlantavoice.com • June 21 - 27, 2024

Know Your Rights as a Homebuyer and Homeowner

BY ZERLINE HUGHES SPRUILL

When it comes to Miranda laws, you have a right to remain silent. But when buying or selling a home, silence is not golden.

From prospective buyers, and homeowners looking to refinance, to heirs getting the family’s property appraised, knowing your rights will give you peace of mind and decrease the anxiety that comes with homeownership.

Everyone has the right to live in housing that is free from discrimination, and federal and local governments are poised to protect homeowners when all signs point to housing discrimination.

The Equal Rights Center, a watchdog organization that identifies discrimination in housing, employment, and public accommodations in the DMV and nationwide, says signs of housing discrimination when paired with a realtor or meeting with a lender can including the following:

• “A realtor only shows you homes in certain neighborhoods, even though you expressed an interest in other neighborhoods within your budget.

• A bank or mortgage broker steers you to a particular loan product—for example, an FHA loan—without knowing your financial qualifications.

• A bank or mortgage broker denies your loan application or offers you less favorable terms because you are on or about to take maternity leave.

• A realtor, bank, or mortgage broker provides you with bad customer service—for example, they ignore you or send repeated requests for the same information.

• A real estate agent, lender, or insurance company tells you that they simply do not sell, lend, or insure houses in the

neighborhood where you’re interested in living.”

When it comes to lending, people of color are more likely to get worse terms, higher interest rates, and varied information about conventional loans, according to Fannie Mae Advisor, Tamara Newman. Client choices may be restricted by real estate agents based on assumptions, so be assertive and be ready to call out your agent or call on an advocate.

Another prospect to watch for is appraisal discrimination, which is when a Black homeowner’s property is categorically undervalued because it is either located in a Black neighborhood, owned by a Black person, or is thought to be owned by a Black person based on the home’s decor, like photographs and art. This type of discrimination is recognized by the FHA and it has established a hotline for homeowners to report this illegal tactic, according to HUD Assistant Secretary and FHA Commissioner

Julia Gordon.

“Appraisal bias has been a problem for as long as there’s been a housing market,” she told The Washington Informer. “We know that even after redlining was declared illegal by the Supreme Court, the appraisal industry for many years–and up through this day–often values homes lower if they are in a community of color.”

As a result the Interagency Task Force on Property Appraisal and Valuation Equity (PAVE) was created in 2021 to combat bias in home appraisals which is made up of 13 federal agencies and offices.

President Lyndon Johnson signed the Civil Rights Act of 1968, seven days following the assassination of Rev. Dr. Martin Luther King, Jr. The legislation expanded on the Civil Rights Act of 1964 and Title VIII of the Act is known as the Fair Housing Act of 1968 which protects people from discrimination related to the sale, rental, and financing of housing based on seven federally protected classes: race, color, national origin, religion, sex (including gender identity and sexual orientation), familial status, and disability.

In addition to those seven classes, in Washington, D.C., it is illegal to discriminate based on: age, marital status, sexual orientation, gender identity and expression, source of income, status as a victim of domestic violence, sexual assault, or stalking, family responsibilities, political affiliation, personal appearance, matriculation, place of residence or business, sealed eviction record, or homeless status.

In Maryland, additional protections include: marital status, sexual orientation, gender identity, source of income.

Fair housing laws prohibit the following activities in relation to housing-related transactions: Refusing to rent or sell on the basis of

someone’s membership in a protected class, including refusing to rent to an applicant because they use a housing voucher.

Applying discriminatory terms and conditions on the basis of someone’s membership in a protected class, like when a larger security deposit is required because a family has children.

Advertising a discriminatory preference, including posting “perfect apartment for a mature couple.”

Misrepresenting availability on the basis of someone’s membership in a protected class, including telling a Black prospective tenant that there are no apartments available, but telling a white prospective tenant that there is availability.

Blockbusting which refers to how real estate professionals would play on White homeowners’ racist fears by telling them that Black residents would soon be moving into the neighborhood in order to pressure White homeowners to sell their homes for below market value.

Steering, which is when a housing provider guides a prospective tenant or buyer toward or away from certain neighborhoods or homes based on their membership in a protected class.

Harassment, threats, intimidation, or coercion.

Retaliation including trying to evict a tenant for filing a housing discrimination complaint against the landlord.

Any other conduct which makes unavailable or denies dwellings like not providing a tenant with accessible parking or reasonable accommodation or modification.

If you think you may be experiencing a form of housing discrimination, contact the following:

FHA Housing Discrimination Hotline (800) 669-9777

June 21 - 27, 2024 • theatlantavoice.com Sponsored Content

iStock.com/FabioBalbi Revitalizing and rebuilding communities, one neighborhood at a time. www.apdurban.com

VA issue temporary policy changes on home loan buyer-broker fees

BY PHIL HALL WRE News

The U.S. Department of Veterans Affairs (VA) issued a circular announcing a temporary policy change that will enable borrowers using the VA home loan program to pay certain real estate buyer-broker fees when purchasing a home.