THE FIFTH ESTATE Review

DECEMBER 2024

Buildings as Batteries Buildings as Batteries

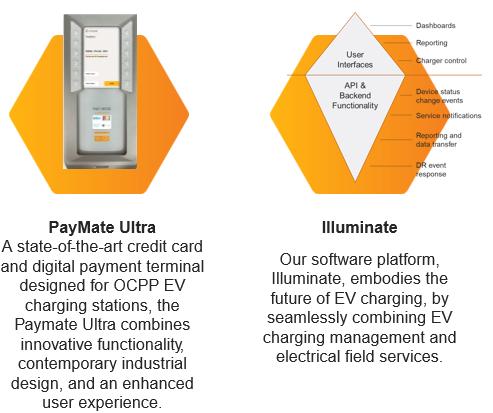

Your full service EV Charging implementation partner

At JET Charge, we manage the full cycle of EV charging infrastructure, from delivery right through to operations. This provides a seamless, fully integrated solution, ensuring all your EV operations run smoothly and safely every day.

With over 20,000 chargers and accessories delivered, we have the hands-on knowledge to anticipate potential issues and proactively manage them, mitigating operational risk for your business.

From the moment you contact us, we’ll work with you to design, procure, deploy and integrate an e cient and safe EV charging system.

EV chargers install 12,000+ 15,000+ 10+ years

Get set, go!

Fully customised EV charging solutions

With highly trained network of 250+ EV charging technicians in every state of Australia and New Zealand, JET Charge serves all locations and operations in Australasia.

Welcome to the first issue of our new magazine TFE Review.

In a world of fast headlines and endless social media, we’ve decided to flip the switch to thoughtful deep dives and curated cross section of the structural changes and opportunities underway in some of the most exciting sectors in this industry we’re all part of.

This first edition of TFE Review shares the thrill of discovery from our Buildings as Batteries masterclass in late August. Presenters and audience were as one, exploring how the built environment can be key to the net zero transition.

It’s a complex evolution of electric cars and trucks, giant solar panels on industrial scale roofs, big (physical) batteries that promise generous value to customers and shareholders alike –and the business cases that make the ambitions stack up.

We’re just at the start. So many things are still in the lab, or fresh out and struggling to find scale. Those who make it are sitting on huge potential rewards that will also benefit the rest of us – and this planet.

A perfect win-win scenario. Getting there needs us to work as one and the connections made on the day between potential new partners were among the most satisfying outcomes for us. Certainly the appetite to pursue this new strand of opportunities for the property sector is huge.

According to the results of a major survey from Procore and the Property Council of Australia published in October this year, this is an industry set for major investment and change. An enormous 92 per cent of respondents to the survey said that integrating renewable energy into their properties was either “very” or “moderately” important. And 74 per cent said they were getting set for action.

How that happens – and making the business case stack up – is what made Buildings as Batteries so exciting.

We hope we’ve captured some of the frisson we experienced in the room and hope you enjoy the reading.

Huge thanks to our event sponsors ADP and Dexus and our advertisers Jet Charge and ADP.

Editor and Publisher

The Fifth Estate

Big buildings consume enormous amounts of energy, but they are also one of the best ways to slash greenhouse gas emissions, slash energy costs for owners and help decarbonise the grid. If Australia’s property owners manage their time of use of energy, it could produce a template for the rest of the world to follow.

Say you’re a building owner and you’re concerned about global heating and the climate crisis. You would certainly not be alone. To do your bit, you’d want to eliminate greenhouse gas (GHG) emissions from your building’s operations. If you were like most sophisticated property owners, you would start by cutting your building’s energy use through efficiency improvements.

You might put solar panels on the roof. You would probably sign a contract for “green” electricity and then electrify all your building’s plant and equipment. If you

wanted your building to be certified as net zero (and why not?), you’d purchase certificates or credits to “offset” the remaining emissions that your building is responsible for.

And then, your job would be done. You could relax. Crisis averted!

But it wouldn’t be, of course.

Even if every building on Earth followed that path, the massive decarbonisation challenge would persist.

Many building owners are committed to making their buildings net zero. But only a very small proportion delve deeper and ask whether their pathways to decarbonisation could be more impactful, or if they could improve their investment returns.

Only very few building owners discover how their pathways to decarbonisation could be more impactful and how they can improve their investment returns

Buildings (of all types) collectively use more than 50 per cent of the electricity generated in Australia, and at peak times they can demand more than 80 per cent. This is both a problem and an opportunity.

It’s a problem because most people don’t think of buildings as participants in the electricity market –they use electricity without regard for the system components.

And it’s an opportunity because if demand for electricity can be mobilised and coordinated to prioritise clean and cheap renewable electricity over dirty and expensive fossil fuel generation, buildings will smooth Australia’s path to a fully decarbonised energy system.

This can also provide a template for decarbonising the built environment globally.

The nature of electricity generation has changed dramatically over the past 15 years, but the market has not kept up.

Prior to 2010, variable renewable energy (VRE) from sources such as wind and solar accounted for only a tiny fraction of 1 per cent of supply on the national electricity market (NEM).

Over the month of October 2024, VRE, including rooftop solar, has supplied 40 per cent.

We need to coordinate electricity demand so buildings can smooth Australia’s path to a fully decarbonised energy system

What this means is that the building operator can potentially double their demand for electricity when it’s free and cut demand to almost nothing when it’s expensive

In the past all the Australian Energy Market Operator (AEMO) had to do to maintain balance in the system was monitor demand and then call on generators to ramp generation up and down to match it.

For the most part, that was done with price. If there was a need for more generation, higher bids were accepted. If the need was for less, only lower bids were accepted.

It was slightly more complicated than that but essentially since the 1950s, crude off-peak tariffs have incentivised demand from things like off-peak hot water systems, streetlights and certain industrial processes.

Now, of course, much of the generation rises and falls with the wind and the sun.

It’s not simply a matter of calling for more or less generation to meet demand – the wind and the sun simply will not obey.

And because AEMO can’t control the demand side either, its price signalling is becoming less and less effective. The wholesale price of electricity is now typically the inverse of the wind and solar generation output: When there’s an oversupply the price crashes, and when there’s a shortage the price goes through the roof.

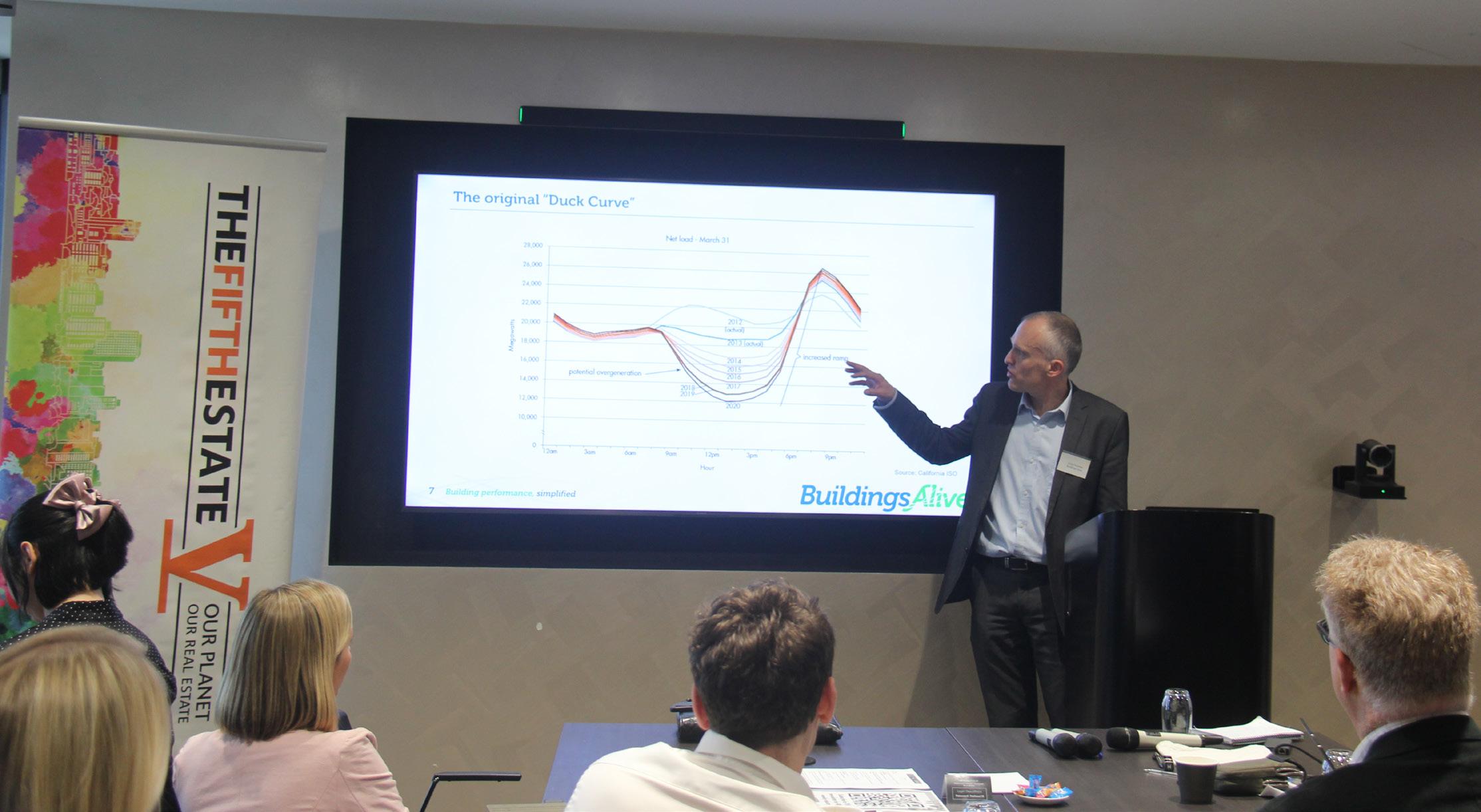

This is illustrated in figure 1 for the entire 2023 calendar year, which also shows the extraordinary level of forced “curtailment”.

This is essentially the mechanism that AEMO uses in addition to price to stop unwanted electricity generation entering the market.

Curtailment, while necessary to maintain the stability of the system, is renewable energy going to waste. As can be seen in the graph, the quantity of waste is enormous.

Investment in battery energy storage system (BESS) is skyrocketing in Australia. Homeowners with rooftop solar panels are choosing to install batteries rather than see their excess solar go to the grid virtually for free.

At the other end of the spectrum, massive grid-scale BESSs are being installed to take advantage of the NEM’s highly predictable patterns – prices being extremely low during the day and rising sky-high during the morning and evening, as illustrated in the graph.

The purpose of a battery is to allow consumption of electricity to occur at times that are different to when it’s generated. We should not just think of batteries

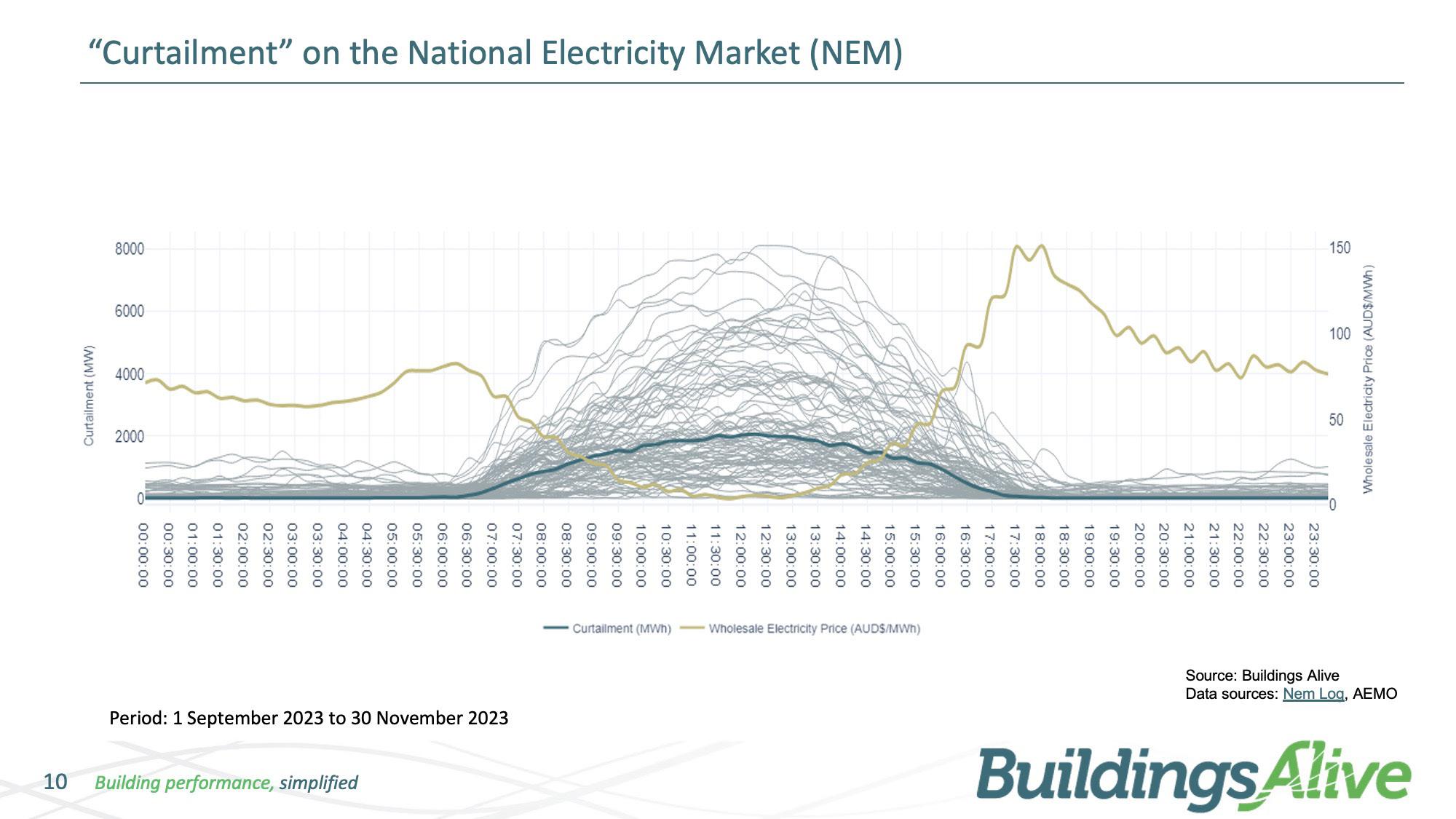

as containers storing electricity as chemical energy. A building will function as a battery if it performs work at one point in time and avoids doing the same job at another. Take the simulation below. In this illustration, the building has three energy-management assets: a thermal energy storage system (TESS), a conventional BESS, and a heating, ventilation and air conditioning (HVAC) system.

The building operates as a battery, charging and discharging as follows:

• From about 10am the HVAC system works harder than it would otherwise need to (for example by providing additional cooling, heating and/or fresh air for occupants).

• Once temperatures and air quality are at their appropriate limits, the BESS is charged from the grid and the TES is heated/cooled by the building’s refrigeration plant.

• By early afternoon, refrigeration plant is locked out and a comfortable indoor environment is maintained, initially by taking advantage of temperature bands (helped by insulation and the building’s thermal envelope).

• Later in the afternoon through to early the next morning, the TES is discharged to maintain thermal comfort conditions as needed and the BESS provides other building services including lighting, ventilation and vertical transportation.

Early the next morning most of the remaining energy in the TES and BESS is discharged to maximise the building’s capacity to draw energy from the grid again, and then the cycle is repeated.

In real life, the building’s control systems would modulate based on the real time and forecast price of electricity, the thermal conditions and requirements of building occupants, and the real time and forecast GHG emissions intensity of the electricity coming from the grid.

Unlike electricity retailers who have to assume a typical demand profile for a building and hedge their commercial risk in order to provide fixed pricing, the building owner has the opportunity to profit from the highly predictable wholesale market (as large-

scale battery operators do) and hedge price risk with physical load management. What this means is that the building operator can potentially double its demand for electricity when it’s free and cut demand to almost nothing when it’s expensive.

The net impact of operating a building this way is far fewer GHG emissions because overwhelmingly the electricity that’s being consumed is coming from renewable sources. This provides the owner with investment returns that outstrip those available to conventional battery operators, and a genuinely impactful decarbonisation pathway.

Craig Roussac is co-founder and chief executive of Buildings Alive.

The Green Building Council of Australia’s chief impact officer

Jorge Chapa joined Australian Sustainable Built Environment Council chief executive office

Alison Scotland and Buildings Alive’s Craig Roussac on a panel to discuss the policies for industry and government we need. Tina Perinotto editor of The Fifth Estate moderated the session.

According to Jorge Chapa, Craig Roussac has helped define what makes a good grid-interactive building in existing structures.

This was now a top priority for the industry and the Green Building Council of Australia (GBCA). “Matching renewable generation with consumption will be crucial in the next decade,” he said

And against all the odds, the grid was decarbonising faster than was expected.

The next update of the GBCA’s Green Star rating tool would address this, along with a leadership challenge, designed to reward those using Roussac’s techniques, he said.

But it’s not an easy task, Roussac said.

“Building owners aren’t energy companies. There are many distractions, but I’ve never seen such as huge commercial opportunity go to waste.”

So who are the experts and what are the skills needed to communicated to property owners?

What helps, said Roussac, is to communicate to stakeholders that “we’re doing the right thing with your money, saving energy and helping the environment.

“So just helping the environment…a lot of investors go, yeah, that’s nice, but actually, what are you doing about our money?

“So drawing the connection between lower carbon and lower costs is a new line that we should use – not save energy, because it depends on what energy? If you can buy energy at negative costs, saving it doesn’t make any sense.

“So we need NABERS, we need the Green Building Council, we need these things to really help communicate the good work that then people will do.

But it’s hard to get the attention at the board level.

Stakeholders need to be told that “we are doing the right thing with their money, saving energy and helping the environment.”

This requires help from bodies such as NABERS and the Green Building Council of Australia “to help communicate the good work people are doing.” Despite this, it is hard to get attention at the board level, he said.

Ben Waters from Presync wanted to know if the current renewable energy target was fit for purpose because it says that coal plus renewable electricity certificates equates to “renewable electricity”.

Roussac said no, it was designed before this was an issue and by 2030, we will have a new one which will need to look at interval energy, the physical reality of the situation.

“We can’t just make stuff up, which is what we are doing now. Once upon a time it didn’t matter and full credit to anyone involved with NABERS or whatever, but for the last 10 or 15 years it’s been emerging as a thing and we still have the old tools that were designed 25 years ago.

“We need to change them and there’s going to be an opportunity for someone to make an enormous amount of money.”

Gavin Dietz, previously CEO at Wattwatchers, asked if the new Australian Accounting Standards Board reporting framework expected to come in early in 2025 will make a difference.

Unless the framework had granular policies such as measuring emissions at intervals of 15 minutes to 30 minutes, it was unlikely to “have the desired effect,” Roussac said.

“We need a premium approach. Many tech companies are already smart about this, focusing on time matching and shifting loads in data centres. They’re 20 years ahead of this industry.

“Regulations, aside from the EU, suggest Australia might have a guaranteed origin system to replace the Renewable Energy Target by 2030, but we need it sooner because people are investing in renewables as we want them to.”

“We know that solar panels don’t work at night; we know that. Let’s not pretend… and let’s not tell ourselves nice comforting things – and let’s make some money out of it because you can”

Chapa said that the financial accounting standards would in theory will drive what Roussac wants, but current carbon accounting methods such as the greenhouse gas accounting protocol “haven’t fully recognised this issue.”

“They’ve consulted on it but haven’t figured out how to manage it effectively.”

“Various standards are emerging…eventually, we’ll move from a global or yearly net perspective to a more granular one.”

While infrastructure and calculation methods aren’t there yet, greenhouse gas accounting protocols and other initiatives are taking this into consideration, Chapa added. “No one has fully committed to it yet, but they’re all considering it.”

Simon Carter, head of ESG for industrial property owner ESR, said there is a lot of talk about the grid decarbonising and people saying “Don’t worry about that, the grid will take care of it.

“It seems to be quite a prevalent assumption. I’m hearing it all over the place. Is that a big mistake? And you are you going to call greenwash with the AEMO scenarios there? And is part of this equation, to really challenge those decarbonisation curves for grid electricity. Do you strongly believe it could end up very different?

Roussac said: “I strongly believe that we shouldn’t just assume something will happen because someone said it would, like 82 per cent renewables by 2030. It would be nice if it happened, but why is it going to happen?” I would call greenwash on anything that [misdirects].

“We know that solar panels don’t work at night; we know that. Let’s not pretend… and let’s not tell ourselves nice comforting things – and let’s make some money out of it because you can.”

Alison Scotland, who heads the Australian Sustainable Built Environment Council gave a high level view of various sectors in the built environment.

“For example, NABERS doesn’t currently reward great interoperability. It needs to encourage work on thermal shells because the best energy savings come from the energy you don’t need.”

Scotland added that education on efficient design was a huge part of the market that NABERS is focused on.

The country had a “broad spectrum of capacity and capability.”

“The best energy markets are holistic and look at the whole package. I’m excited about the potential to modify this market into something more holistic.

“Work is being done with the Property Council, ACOSS (the Australian Council of Social Services), the Energy Efficiency Council, and the AI Group to inform policymakers about the national energy market [on] how we change it from a set of rules to something that operates holistically.”

READ MORE HERE

Jet Charge’s Geof

Alexander came to the EV charging industry from the fast growing fintech industry but he’s found this sector can give fintech a run for its money in terms of rapid change. His presentation was a whirlwind tour of the promises on offer to decarbonise transport and the impact this could have on the grid’s transition.

The Melbourne based company has been growing significantly in the past five years and now had around 170 staff.

“We cover everything from residential to large bus and truck installations,” Alexander told the audience.

The exposure to a big range of work had given the company “a lot of expertise” to assess what was is needed on various sites, which typically vary significantly.

It’s been involved in a lot of different areas from fleets, to charging infrastructure for buildings, including the trial of 60 EV trucks outlined separately by Team Global Express’s ESG project manager Summer Steward.

“The TGE experience was a really big project for us

and it used a lot of our different capabilities and functions,” he told the audience.

But it’s not a public charge point operator. “You won’t see us competing with Everty,” he said, nodding to the company’s founder Carola Jonas who was also in the audience.

The company’s brand might appear on many charging stations “but that’s often because we’ve either manufactured them or we maintain them.”

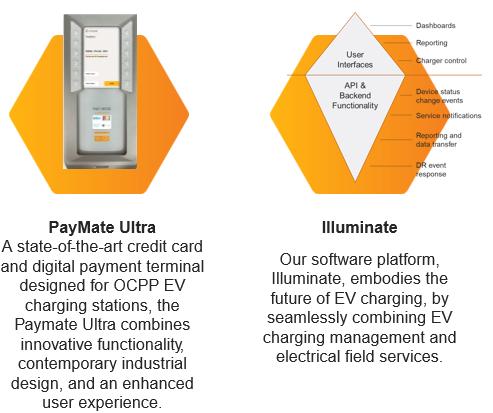

It distributes hardware and manufactures its own AC charger, ChargeMate, which makes up around 3000 of the 12,000 chargers it’s installed to date. But it’s largely agnostic about what products to use.

“We’ve built our own software stack which gives us a lot of flexibility to control what we do when we do complex projects.”

On top of that is the company’s values to be an advocate for the industry.

“Tim [Washington] and Ellen [Liang, a co-founder along with Jay Robinson] are everywhere when EVs are mentioned.

“So it’s really important for us that we are out there advocating for this change.”

Among the company’s major objectives is load management in a building, “and that’s our core product.”

“We do sell it into residential but what we’ve seen on that front is the market is getting very competitive and commoditised around AC charging.”

There’s a lot of low-cost competition from China.

Introducing JET Charge+

As you transition your fleet to EVs it’s a challenge to keep multiple cars fully charged, especially when they’re garaged at employees’ homes. JET Charge+ is a one-stop charging subscription service that covers all your charging needs with a single monthly payment, enabling simplified home charging for employees.

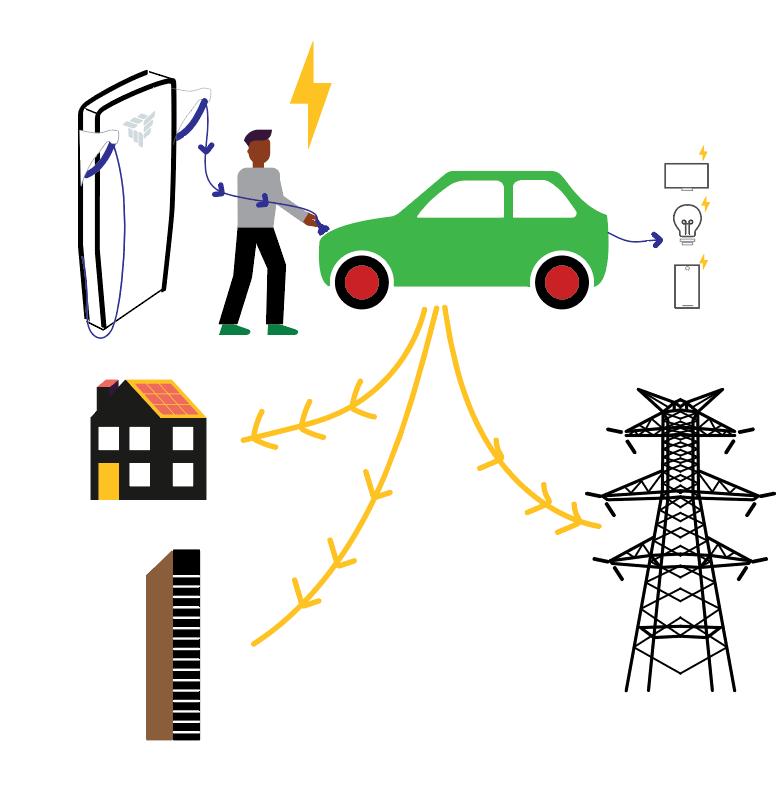

Power goes in, power comes out.

V2H VEHICLE TO HOME

V2B VEHICLE TO BUILDING

V2L VEHICLE TO LOAD

V2G VEHICLE TO GRID

We’re the only Australian EV charging organisation with vertical technology stack developed based on OCPP standards. We have a laser focus on controlling core technology, capabilities and customer experience, executed through our in-house capabilities of hardware design and software development.

A big need he said was to streamline the experience for EV owners. One big change on the way is the need for credit card facilities for charging.

“There is a requirement now for all government funded public charging to have a credit card payment option, because at the moment, if you’re an EV driver, you probably have a folder on your phone which has 10 or so different apps that you need to use to authenticate to pay for different charging sessions.”

The UK had already mandated this. “In Australia, that’s the case for government funded chargers, but it will start to roll out more broadly.”

This makes the software stack all the more important for the company Alexander said, “to connect it all together.”

“The strongest part, and one of the biggest challenges with EV charging at the moment, is reliability and uptime. So if you are going to a site, you’ve got the kids screaming in the back, you want to know that it works”

And that’s a challenge at the moment given the current level of maturity of the industry and the mix of technology and standards.

Among one of the company’s biggest achievements its part in in building the EV superhighway, a globally recognised achievement that means an EV driver can go from Perth to Kununurra.

It was a big project for the company, requiring a “real mix of hardware and software installation, he said.

Back at a more domestic level Alexander said that 80 per cent of charging today occurs in the home, and it’s likely to stay that way.

Public charging will be similar to filling an ICE (internal combustion engine) car and it can be either fast or slow.

At Woolworths at North Parramatta though the charging station for the first few weeks was the busiest “probably in the southern hemisphere.”

Given it isn’t the wealthiest area in Sydney it was perplexing – until the research came through.

READ MORE HERE

Once upon a time, the energy system was mostly a linear supply chain from power plant to power point, with a mass of poles and wires and substations in between.

The emerging energy future is looking very different, according to Melissa Doueihi, head of strategy and innovation, Endeavour Energy and Jason Layt, acting head of decarbonisation and customer strategy, AGL.

In a discussion moderated by Alison Scotland, chief executive of the Australian Sustainable Built Environment Council, both Melissa Doueihi and Jason Layt highlighted the major shift that’s seeing neighbourhood scale become the new marketplace for creating and distributing wattage.

As an operator of poles, wires, streetlights and substations, Endeavour Energy is preparing for rapid change in its core patch of Western Sydney and surrounds. Doueihi said it is already thinking about precinct-scale innovation with some of the big industrial asset owners such as Goodman.

“We need renewable energy zones,” she said.

Endeavor is part of a consortium that is building a sizeable renewable energy zone in the central west of NSW.

The key to unlocking the opportunity is distribution, something Doueihi said is not being sufficiently considered. [This can be seen in policies at both federal and state level where the problem of how to shift energy beyond traditional poles and wires persists.]

As Doueihi noted, there are a lot of resources sitting on rooftops, and there needs to be more focus on how the distribution network can help unlock that to support the national transition in a cost-effective way.

Retailers are of course a big part of that equation, and

Jason Layt said it is something AGL is already looking at. Distributed energy resources bring with them a lot of opportunity, and a vast amount of complexity, including working out how to match supply with demand and how to assign pricing properly.

“Ultimately, I think the way that we use energy has to change,” Layt said.

We have had generations who grew up reaping the benefits of cheap, reliable electricity underpinned by fossil fuels, however, the externalities that came alongside that are no longer supportable. Layt said getting the last percentage of organisations in the economy to recognise the need for transformation is difficult – but we are on the right track.

“It’s going to take a whole of industry effort to get to the end picture.”

One of the challenges is that those who have the most roof space available for installing PV – industrial and logistics property owners among them – aren’t seeing the value in producing more energy than they need.

If these buildings can become mini generators for a larger tranche of nearby buildings though, then we are moving towards that distributed renewable grid

Right-sizing PV to match the building load is sensible from a development costs efficiency perspective, where the thinking is only about the individual site.

If these buildings can become mini generators for a larger tranche of nearby buildings though, then we are moving towards that distributed renewable grid.

This is the kind of thinking behind Endeavour’s perspective on the role of industrial asset owners in Western Sydney such as Goodman. Doueihi believes there is probably also a role for government in enabling local energy systems to emerge.

For AGL this kind of picture brings up the pricing conundrum. How does the energy get priced?

What kind of contract model for customers would be needed?

Rooftop PV can provide a massive share of the national energy supply – however, the times of day it is pumping out the electrons is only part of the time consumers demand supply.

So, ensuring a good fit between supply and demand will also spotlight the value proposition for battery storage too, which is an area where AGL is actively working with customers.

There could be rethinks also around time of use pricing as part of moving the demand needle, because as both Layt and Doueihi pointed out, changing the way energy users behave is a crucial element in the mix.

New contract models for customers that find a middle ground between conventional Green Power arrangements and the long-term lock-in of a corporate PPA may also be part of the emerging future.

Two factors that are not yet part of the general energy discourse that may throw a spanner in the works also need some serious thinking.

One is data centres and their massive energy demand, which is set to increase as more of us engage with the AI tools that are suddenly everywhere.

According to Doueihi, the energy market projections produced by bodies like Australian Energy Market Operator do not adequately consider how this affects short, medium and long term demand projections.

Even the big operators like Transgrid are still yet to work out what it means for their business and operations planning.

“This is a conversation and a solution that needs to be had across the whole value chain,” she said.

This is going to require the full spectrum of tools: policy, commercial models, technology, engagement by those who have the roof space and behaviour change on the part of energy users

and how to plug them in and make them both an energy provider as well as an energy consumer in the district energy grids notion is still just a concept bubble.

There are a lot of resources sitting on rooftops, and there needs to be more focus on how the distribution network can help unlock that to support the national transition in a cost-effective way

The second factor is that enabling technologies including storage, demand response platforms and microgrid systems are still evolving.

Similarly, the role of EVs in the energy mix is somewhat opaque, as uptake has not progressed as expected

As Layt observed, electricity is a “real time commodity”, so we need to find ways to shift surplus energy generated during the day to be used for peak demands at night.

This is going to require the full spectrum of tools: policy, commercial models, technology, engagement by those who have the roof space and behaviour change on the part of energy users.

The days of coal-fired cheap, reliable energy are behind us – the bold new adventure of reliable, secure, distributed, decarbonised energy awaits.

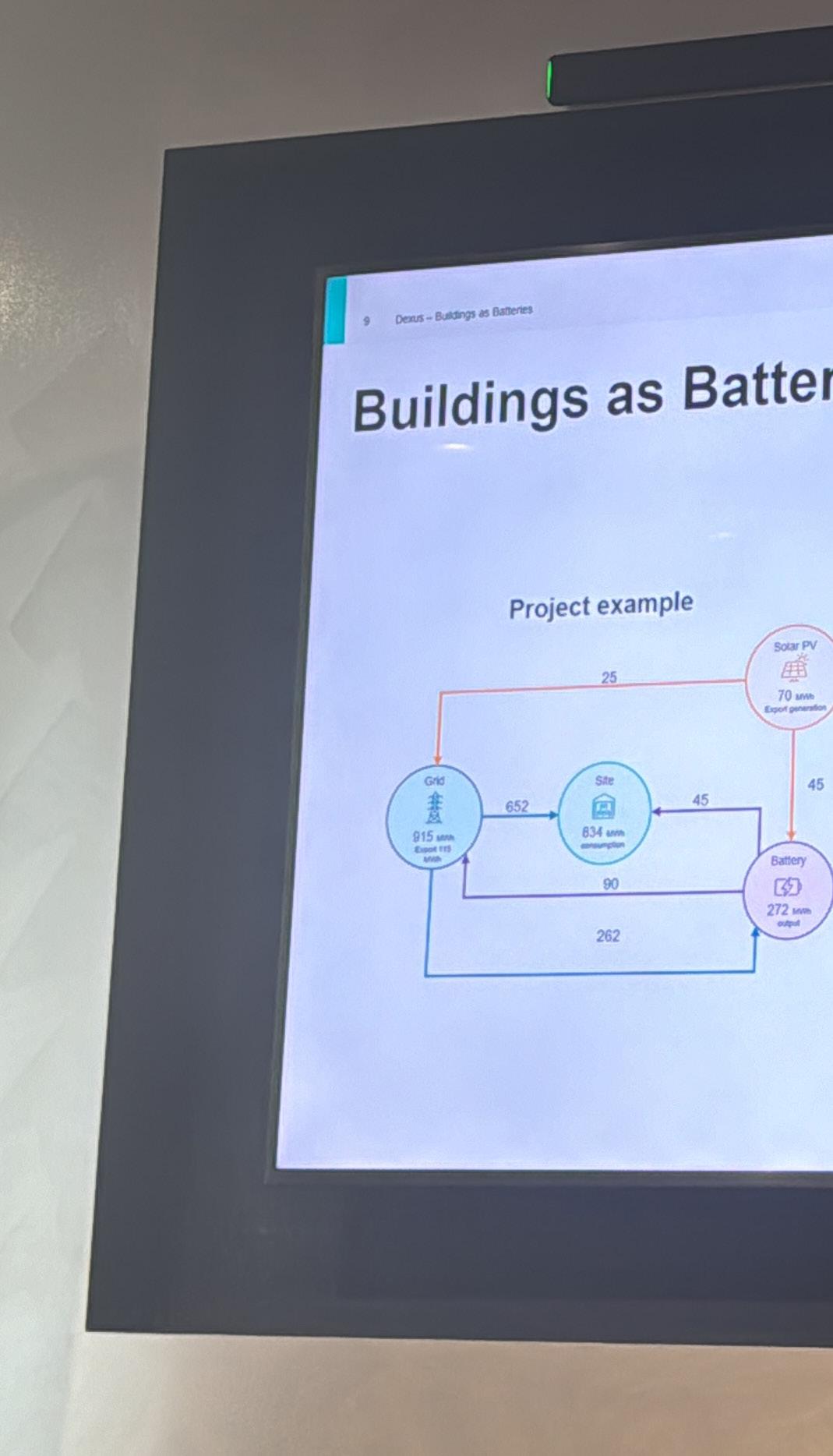

Earlier this year Dexus announced plans to install commercial grade storage batteries linked to rooftop solar panels in all new industrial property facilities – “paving the way for a new industry standard”. This article sums up a presentation by Jacob Clark, development manager at Dexus, at the Buildings as Batteries masterclass.

How batteries offer owners and customers enormous opportunities to take part in the net zero transition

Dexus committed to climate action as a priority in its sustainability strategy, and as part of its development pipeline plans to implement this initiative across more than 1 million square metres of industrial gross lettable area over the next few years. Equal to the size of 40 Melbourne Cricket Grounds.

The battery program is projected to remove around 27,450 tonnes of carbon emissions from the atmosphere every year, the equivalent of removing around 6500 petrol-powered cars from Australia’s roads.

For a typical 20,000 square metre facility this represents an average annual $92,000 saving and a reduction of 549 tonnes of carbon emissions a year.

The first tranche of battery infrastructure, which is linked to solar panels, will be an integral part of industrial projects at Dexus’s Horizon 3023, a 127-hectare master planned industrial estate in Melbourne’s western growth corridor, with the first battery spec build to be completed in early 2025.

The case for solar is clear. Energy costs have increased significantly over the past few years and by installing solar panels connected to batteries in our warehouse base builds we help customers reduce their energy costs and carbon footprints, while also future proofing our portfolio for the long term.

There has been an enormous take up of solar globally and in Australia the rapid and ever increasing supply of solar been evident.

To paint the picture. In 2004, only one gigawatt of solar was deployed worldwide. In 2010, one gigawatt was deployed in a single month and by 2023 it took just a single day.

On current estimates, there will be 550 gigawatts of solar deployed this year. That is the equivalent of all the solar energy generated in 2004 being generated twice a day in 2024.

That has created problems as Australia’s transmission grids are currently ill-equipped to receive this amount of energy.

Solar energy is often generated at the wrong time –in the middle of the day when peak demand is at its lowest and when wholesale energy prices can drop to negative.

Additionally, the expected exponential growth in data centres, the advent of AI and accelerated transition to renewable energy sources will further increase the burden on the grid in its current state, requiring significant private and public investment into the upgrade of existing grid infrastructure.

That’s where batteries come in, to solve this compounding problem

A battery provides what is called frequency control ancillary services that help the energy market operator to keep the frequency of the grid stable and prevent abundant solar curtailment.

Tenants of buildings with batteries can make use of wholesale market arbitrage by buying wholesale energy when it is cheaper and selling it through discharging it when the price is higher, generating an additional revenue stream.

Demand change management batteries can be used to reduce the site’s peak load thereby reducing incurred demand changes (sometimes referred to as “peak shaving”).

Customers who use batteries and solar can reduce energy costs by 15-20 per cent and achieve a payback period of five to seven years. Savings would be expected to be significantly higher if a warehouse is designed for net zero energy consumption

Finally, there is network tariff arbitrage. If a site has a network time of use tariff, the battery can be used

to charge using cheaper off-peak energy and discharge during more expensive peak energy tariff periods.

We find that customers who use batteries and solar can reduce energy costs by 15-20 per cent and achieve a payback period of five to seven years. Savings would be expected to be significantly higher if a warehouse is designed for net zero energy consumption.

It is important to remember that for tenants, rent makes up only 5-7 per cent of their overall cost base and they are very focused on reducing their other expenses, of which energy and power is usually a significant component.

We find customers are willing to pay a higher rent if they have access to a modern warehouse that will allow them to reduce other overheads, particularly in well located areas.

However, Dexus’s focus on sustainability in industrial extends a lot further than just solar. We are building sustainable warehouses that are flexible and designed to meet the ever-evolving needs of tenants over 30 or 40 years.

READ MORE HERE

Willow Aliento

If we want to quickly decarbonise – and we must – connecting all the dots that converge in buildings, transport, infrastructure and human settlements is essential. Alex Sear, director, electrification and ESG, at ADP Consulting tackled this topic in his presentation at the Buildings as Batteries masterclass.

“Energy retailers also need to come to the table with incentives, such as some type of “kickback for wellperforming commercial customers”

- Alex Sear

EV charging can become demand response charging, pools can act as thermal storage – even fire tanks have been leveraged for thermal storage by some asset owners. Creative thinking, it appears, is one of the most effective resources available to us!

Photo: City of Stonnington.

According to Alex Sear, director (electrification and ESG), ADP Consulting there are flagship megatrends coming our way: climate change, the energy transition, AI technology, information, the Internet of Things, electrification, the transport revolution, growing demand for digital services, corporate targets and carbon reporting.

These will shape the agenda for existing buildings and open opportunities for the property sector to deal with the collective negative impact urban assets have on the planet, its atmosphere and the climate.

Into the mix throw renewable energy sources – sunshine and wind. And it’s well-established the sun doesn’t shine at night and the wind doesn’t always blow, so the challenge is matching up the resources with all the uses people have for energy.

“Basically, most components we’ve got in our buildings are programable at their own level.”

Operations can be automated, set points changed, variable speed drives retrofitted. Individual load management systems can be brought into play, especially for things like lighting, chillers, lifts, metering and switchgears. Real time energy usage data can be made available, and all this kit together with a building management system (BMS) means demand response energy management can be implemented.

When this intelligence is collectivised, and shown against geography, things start to get really interesting

“There’s that big data centre that normally operates through the night, but we’ve also got all of these other uses that we’ve got to match these profiles to,” Sear said.

Shifting demand or storing energy for later use are well-established ways to help match things up. They are not, however, the answer to everything.

The Internet of Things can play a useful role, Sear said.

The BMS itself can become a much more nimble tool, Sear explained.

They can detect faults, and they can already program sequences that automate a building to run on predictive weather algorithms.

“So, it’s not a big, big stretch to change it to predictive grid emissions.

“You can change them remotely, and they’re all connected to the internet, of course.”

Add one of the emerging analytics platforms and the massive reams of data from a BMS and building systems can be streamlined and used to inform business decisions and reporting.

When this intelligence is collectivised, and shown against geography, things start to get really interesting.

Demand for heating is dominant in the south east of Australia, and there’s demand for cooling energy the further we move north. If this is considered in the context of the grid, then load shifting and demand response at the regional scale can be achieved through how individual buildings are programed in real time, Sear said.

Next in line at the megatrend intersection is electrification, and the growing retrofit momentum to swap out all things gas for all things electric. This includes boilers switched for heat pumps and gas stoves replaced with induction.

This sounds fairly straightforward except, as Sear pointed out, the main things being replaced provide heating, and demand is greater in the winter, which is when solar is generally producing less wattage.

The time of use also plays into this. In Melbourne, for example, heating buildings in the early morning before people show up is standard practice. This is not the time of day when solar output is substantial.

Load shifting and heating the building later in the day isn’t going to cut it, so Sear explained that some form of storage, whether battery or thermal is going to be important in those retrofit projects.

One easy win is for asset owners or managers to speak to the BMS operator, the facilities manager and an engineer and find ways to “shift a few things around”. This might include refining the heating and cooling strategy, the air supply levels and the timing of heating hot water.

EV charging can become demand response charging, pools can act as thermal storage – even fire tanks have been leveraged for thermal storage by some asset owners. Creative thinking, it appears, is one of the most effective resources available to us!

Behaviour and operational changes are the easy wins – like simply turning things off. It’s working for the industrial sector, Sear noted.

Proposals to expand the Commercial Buildings Disclosure regulations to cover more asset types such as warehouses, shopping centres, data centres and hotels is going to move the goalposts even further

EVs in a grid to vehicle and vehicle to grid arrangement is something that has major potential to provide battery storage that can supplement meeting morning loads in commercial buildings.

We are not there yet, but it’s possible, Sear said.

Another big lever is improving the building envelope. But this is a lever most choose to ignore.

“The sad thing is, improving a building envelope is really, really expensive, and it doesn’t get up on many jobs. I’ve only managed to get it up on like, two jobs,” Sear said. “It’s not like an LED lighting (retrofit) where it’s changed next day.”

The final lever is storage, again, often expensive and somewhat tricky, whether retrofitting phase change materials, batteries or thermal storage.

Many buildings have been designed to take advantage of the cheap power available in the middle of the night, a legacy of the coal fired generators not being able to easily turn down their output during the hours most of us are asleep.

Solutions also need to be fit for purpose. Commercial offices have to manage morning loads. Manufacturing can adopt behaviour changes quite successfully and logistics and warehousing have their massive roof space for PV.

The tough nut is data centres. This is where districttype solutions such as heat sharing from the data centre to other buildings might work, Sear explained.

The pointy end of reporting is coming

Mandatory reporting of carbon is on the way and it’s going to have a major effect across all the big corporates, according to Sear.

Proposals to expand the Commercial Buildings

Disclosure regulations to cover more asset types such as warehouses, shopping centres, data centres and hotels is going to move the goalposts even further.

NABERS has already credited as a big success factor in Australia’s claim to having some of the world’s best buildings. Now the new regime requiring reporting of scope 1 and scope 2 emissions, which makes gas use visible, is “going to change the game”, Sear said.

Proposals to expand the Commercial Buildings Disclosure regulations to cover more asset types such as warehouses, shopping centres, data centres and hotels is going to move the goalposts even further.

The sweetener is the amount of funding made available at state and federal levels for positive initiatives such as installing batteries.

According to Sear the energy retailers also need to come to the table with incentives, such as some type of “kickback for well-performing commercial customers.

“At the moment, we do all of these electrification case studies and these NABERS improvement case studies. We always get there. We get their energy bills, and they’re on a standard off peak, on peak tariff, and they’re not actually seeing any of these benefits.” Sear said.

Ultimately, all the different pieces need to be brought together in one holistic push for change.

Sear summed it up – we need cheaper batteries; we need the benefits of electrification and energy efficiency and demand management to be shared. We need people from the generators to come together.

More solar is needed in the market and hopefully electricity rates become cheaper.

We then end up with less carbon going into the atmosphere, and that’s a benefit we all get to share.

NABERS has already credited as a big success factor in Australia’s claim to having some of the world’s best buildings. Now the new regime requiring reporting of scope 1 and scope 2 emissions, which makes gas use visible, is “going to change the game”

In Melbourne, for example, heating buildings in the early morning before people show up is standard practice. This is not the time of day when solar output is substantial.

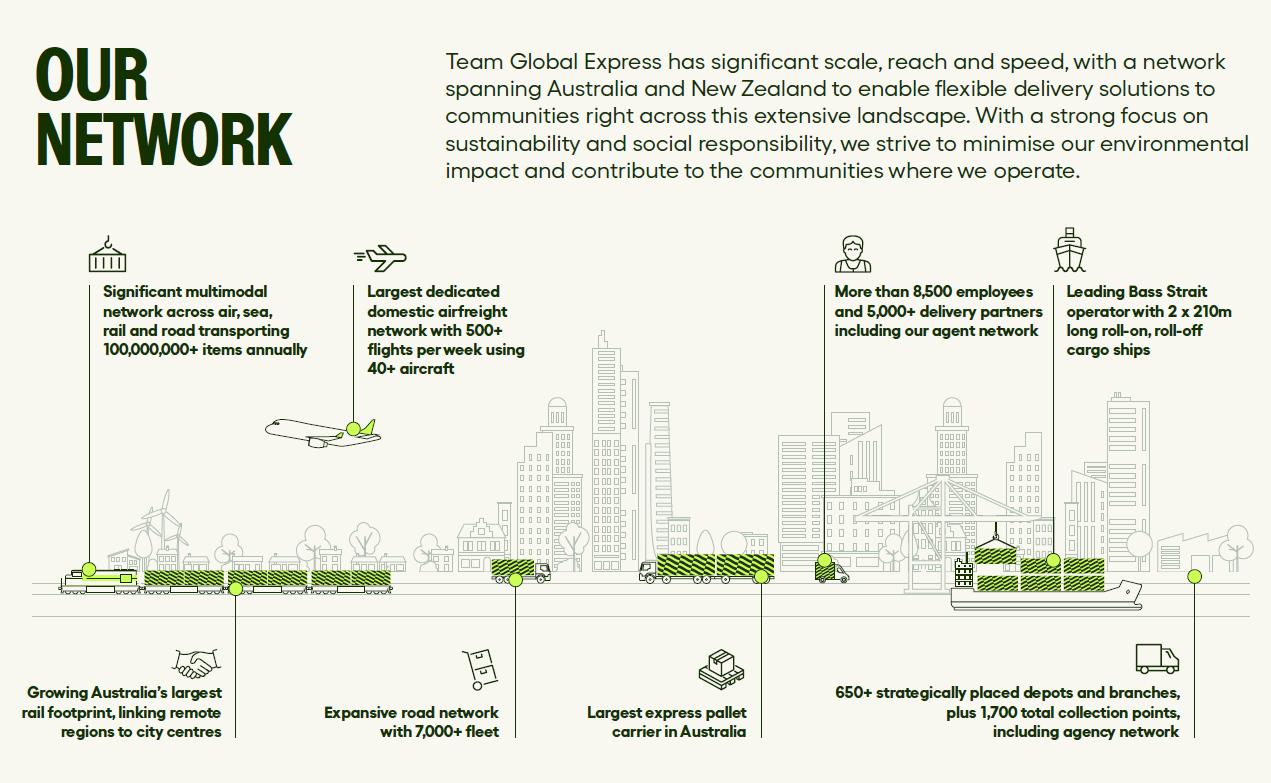

When Summer Steward, project manager – ESG at Team Global Express presented at The Fifth Estate’s Buildings as Batteries event in August, the audience kept the questions flowing. What the audience found particularly engaging was the company’s trial of 60 electric trucks, funded to near-50 per cent by the Australian Renewable Energy Agency in a project worth around $60 million overall.

What happened when a giant logistics player trialled 60 EV trucks

From the little known Bungarribee on Sydney’s fringes, near Eastern Creek the home of supercars, TGE (previously Toll), has been retrofitting its 10 year old depot with electrification technology to manage the trial.

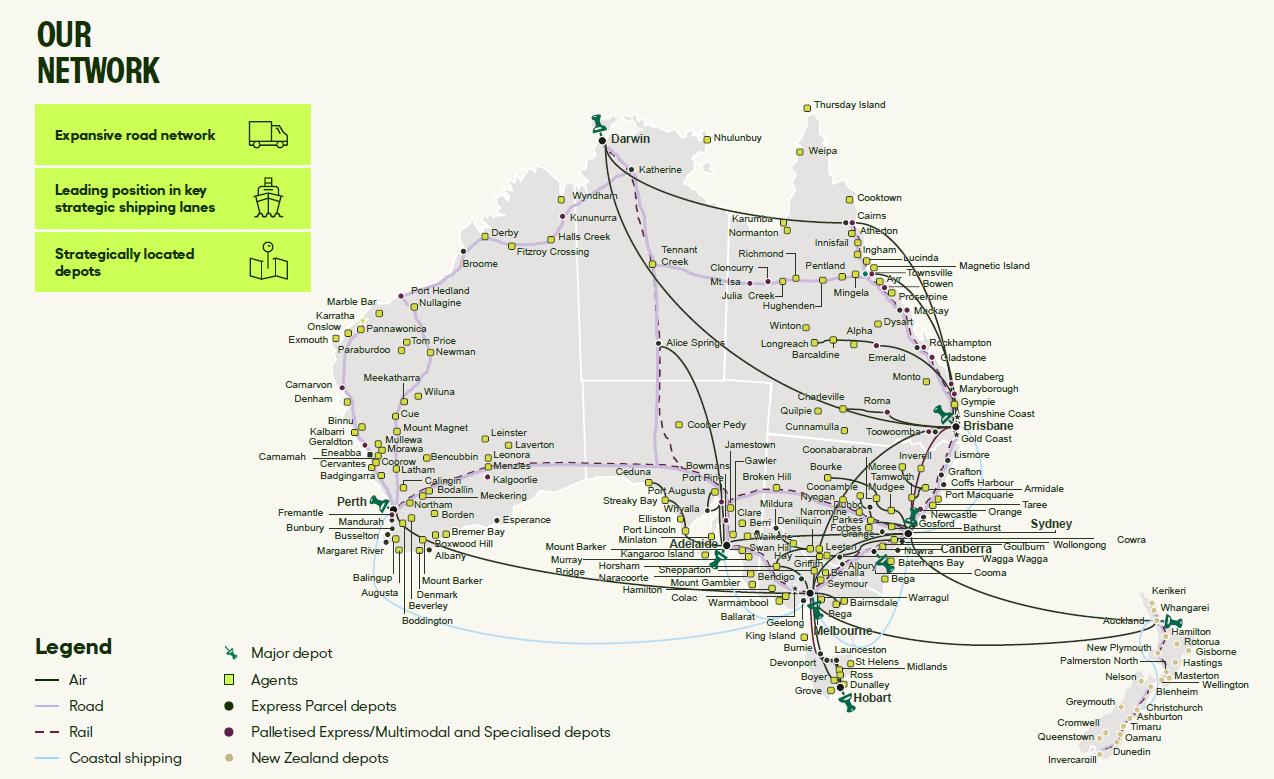

Steward, project manager for the giant logistic company, kicked off with a broadbrush view of the kind of infrastructure that’s needed in a modern economy to shift the enormous quantities of goods – from manufacturer, to retailer and to customers – that we now take for granted.

The company’s assets include more than 7000 fleet vehicles, more than 40 planes, cargo ships and more than 650 depots and branches throughout Australia. In total there’s about 147 leases to manage, she said.

“Our network spans rural and urban areas, including small rural sheds and bays within larger systems. We’re focused on reaching rural areas and decarbonising our multimodal network, which includes various equipment types.”

The sustainability goals are ambitious. They include net zero by 2040 (scope 1 and 2), 30 per cent emissions reduction for scope 1 by 2030 (including trucks and parcel movements), and 75 per cent renewable energy-powered facilities by 2025 for scope 2 emissions.

But it’s the story of how the company’s 60 electric trucks that stole all the thunder on the day.

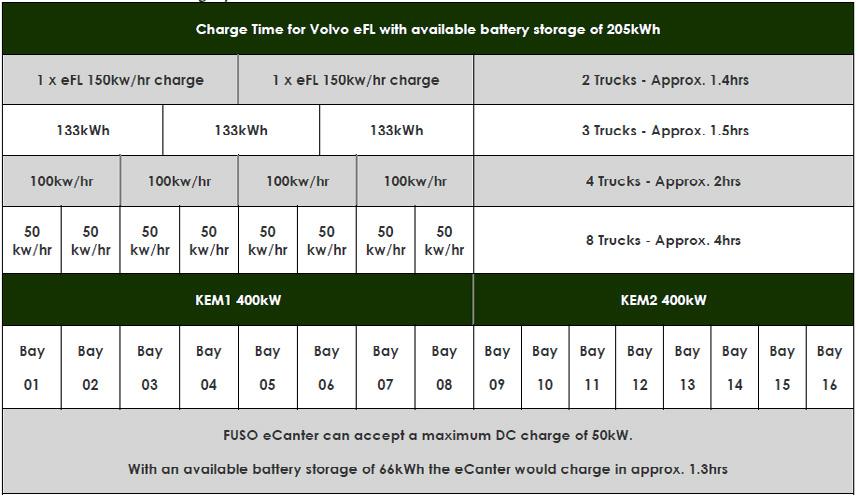

The project is funded by ARENA’s Driving the Nation Fund and it’s to support and demonstrate large-scale

BEV (or battery electric vehicle as opposed to fuel cell or plug in hybrid EVs) technology.

The key objective is to see how these trucks can integrate into regular fleet operations and provide “meaningful insights to the broader heavy vehicle industry”.

Steward said the company had three main sustainability pillars, but for the masterclass she would focus on its key sustainability programs around its fleet, decarbonisation, smarter drivers, and smarter facilities.

“Solar energy is a big part of this, with both our company and landlords installing solar panels on facilities.

“We’re trialling electric vehicle trucks and exploring low rolling resistance tyres, energy-efficient specifications, aerodynamics, and smarter fuels. While

electrification is a major focus, we’re also considering other fuel types and equipment.”

Steward said the company’s future facilities will need to consider the infrastructure and power capacity to accommodate electric charging and other potential energy sources.

“If we don’t fully electrify, alternative fuels might require different storage and transfer regulations. For example, hydrogen storage could be an option.”

The job of converting to electric trucks is not for the fainthearted.

need for “smarter planning” – especially when no one knows what future regulations might include.

“This includes route and network optimisation and higher productivity vehicles. Our multimodal network includes planes, ships, and trains, offering greener, low-emission solutions.”

And there was the question of timing.

“I challenge people to consider if urgent delivery is necessary.

“Can we opt for a less emission-intensive method that takes six days but costs less? That’s the thing I put back to people I talk to, and I sit in on our customer presentations because everyone has a huge emphasis on ESG. It’s a different way of thinking. People aren’t

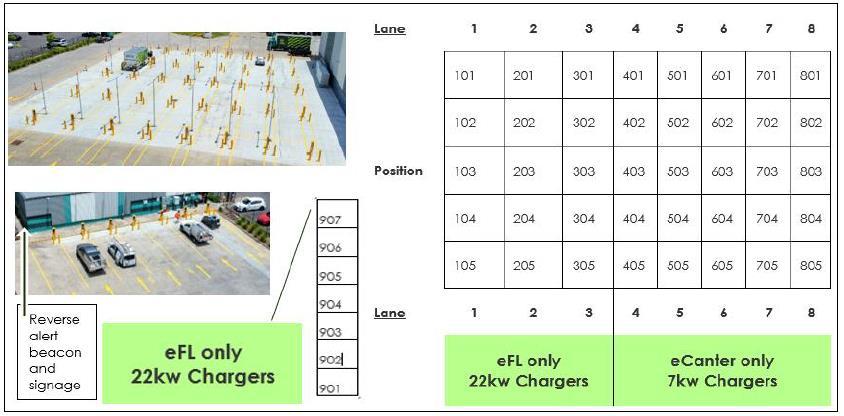

Stewart said it required digging up concrete, running new power cables and cable trays. There was also the matter of winching 22 cables through ceilings while operations continued.

“This process is time-consuming and impacts operations. We need to think differently about setting up facilities, such as using accessible facilities, cable trays, and trenching systems that allow easy changes.”

Converting to electric trucks required digging up concrete, running new power and cable and trays, and winching 22 cables through ceilings while operations continued

Steward also shared lessons learnt that might apply to other large scale electrification projects, such as the

there yet, but it’d be great if we were.” Steward said she personally enjoyed the Depot of the Future project at Bungarribee.

“I like sheds. I like trucks. So, I was excited to come in and play with this project.”

“We’ve made significant progress at the Bungarribee depot. We had the space and power capacity, and after shifting some business car parks, we installed charging stations. The operation is ideal, with trucks going out daily and returning to base to charge overnight.”

The installation includes “an 8 m x 5 m, 40 bay AC slow charging grid, with seven additional chargers on the side.

READ MORE HERE

Team Global Express is a logistics solutions company, owned by Allegro Funds, Australia’s most awarded transformation and turnaround equity firm.

Industrial tenants have particular needs as they increasingly head towards decarbonisation in industrial properties. How do they, and their landlords, rise to the challenge?

Simon Carter, head of ESG for industrial landlord ESR Australia and NZ, and Summer Steward, project manager – ESG for Team Global Express, took to the stage at Buildings as Batteries to unpack some of the issues they each faced from opposite sides of the fence.

Moderator Alison Scotland of the Australian Sustainable Built Environment Council (ASBEC) started the session with a probe into the issue of split incentives in industrial property – where the owner may pay for infrastructure but the major benefit accrues to the tenant.

So far, said Steward, the discussion has largely been limited to who pays for power and who gets the benefits of solar. But going forward, there are more ambitious goals to be considered.

Carter said his company was a relatively new brand to the market. It recently integrated with LOGOS, through which it gained Team Global Express as a “significant customer”. The company now manages $30 million assets under management and a further $18 billion in the development pipeline, “so we’re aggressive in the market and certainly surfing the big INL boom at the moment.”

In terms of chasing net zero goals, around 99 per cent of ESR’s emissions are either upfront embodied carbon, of which about 97 per cent are concrete or steel, or tenant energy, both of which are scope 3. “Scope 1 and 2 really don’t feature for us … 100 per cent of our landlord-controlled electricity is green power, but it’s not a large amount.”

“For us, net zero is a game of scope 3. So we need to collaborate with our customers in ways that probably don’t happen in other sectors. There’s a lot of talk about green leases. I’m a little bit cynical about green leases. A lot of people seem to think they’re magic wands. You’ve got to be willing to enforce them to work. But what does work is a really attractive proposition for customers, which we, like our peers, have been actively working on.

“We need to collaborate with our customers in ways that don’t happen in other sectors … There’s a lot of talk about green leases, but they need to be enforced to work”

Despite a solar partnership with Energy Bay, Carter said ESR was currently challenged by not fully knowing what its customers’ charging demands would be at its sites or elsewhere.

“[We] have been actively honing our proposition for customers to try and deploy as much solar as possible. And one of the really interesting challenges there is the uptake of EVs, because many of our customers don’t know what they will be charging at our sites in the future.

“There’s an awful lot of assumptions circulating around the space. Will they necessarily be charging at our sites, or will they be charging at their own purpose built hubs?”

These are important questions because charging requirements transform the energy needs of what are essentially sheds “with racking and some forklifts and lights”.

It’s a “big, interesting challenge” said Carter. “This uncertainty affects how we size our solar systems. The energy requirements are changing, and we need clarity on charging needs.”

Steward added that sites might not be able to fit trucks or could be expensive to retrofit, so it’s always cheaper to charge “back at base.”

It was important to note that the new National Construction Code standard now required industrial roofs to be able to support solar panels. In the past they’ve been flimsier and not able to support the weight.

“The challenge is the size of your electrical infrastructure,” said Carter. “Our rooftops, even with one megawatt system … has a lot more roof space.”

Steward said that without the Australian Renewable Energy Agency (ARENA) funding they received, her company would not have embarked on the trial. The costs for EV trucks are roughly double those for diesel trucks.

Future projects needed to make business sense and be “affordable, practical and feasible.”

While EV trucks lose payload, they were generally faster and featured regenerative braking, she added. Performance often also depended on the driver and how much weight the vehicle carried.

Carter said that that while he has yet to reject a tenant who wanted gas, his company was thinking more about the net zero transition. The challenge tended to be not so much whether the tenant wanted solar, but whether the landlord owned enough solar.

Landlords also needed to consider embodied carbon, and now with heavy vehicles and bigger, thicker concrete stands, that was another emerging problem.

Bevin Liu

The shift to decarbonise the transport sector is ramping up with a mix of new technologies for electric charging and government policies boosting their net zero transition policies.

For instance in Queensland Brisbane Metro buses can now charge in six minutes, via a wireless overhead charging system known as a pantograph. There’s nitrogen flash battery fire suppression systems emerging from Chinese technology and bi directional charging moving from concept to reality.

In Barcelona even the braking systems on high speed trains are generating energy for train stations as well as surrounding areas.

In Australia, state and territory government policies are

encouraging the shift to low carbon transport across the country.

The National Transport Commission’s assessment of electric buses in Australia indicates that New South Wales is in the lead, with the state’s goal to electrify its entire fleet of over 8000 buses by 2047.

Victorian and the Queensland governments will start to replace their ageing diesel buses with zero emission buses from 2025.

The federal government’s Department of Climate Change, Energy, the Environment and Water released its first National Electric Vehicle Strategy this year to support state government uptake. However, industry groups said the strategy lacked direction and support

for heavy vehicles compared to passenger vehicles.

One significant barrier is that EV buses cost about twice that of diesel buses, the NTC report says, but notes that payback can come from operational savings on fuel.

Another option to defray the big investments required for EV transition are partnership models, where bus operators can partner with electricity organisations “to help manage the increasing loads on the energy grid and potentially allow operators to upload excess energy during the day (solar power) to the grid.”

And there is also the option to lease buses.

Electric trucks and buses as a service

Companies such as Zenobē, a fleet electrification specialist, are working with supermarket giant Woolworths to develop Australia’s “first electric vehicle as a service (EVaaS) charging hub model” according to the company’s Australia New Zealand country director Gareth Ridge. The $19 million charging hub will service 60 EV grocery home delivery trucks that Woolworths will lease from Zenobe.

Elsewhere Team Global Express (previously Toll) is trialling 60 EV trucks at its Bungarribee facility, with equal funding from the Australian Renewable Energy Agency’s Driving The Nation Fund, which in 2022 was doubled to $500 million to support the nation’s shift of transport to EVs. The program includes:

• $39.3 million to deliver 117 EV chargers on key highways

• $80 million (co-invested with state and territory government) to fund hydrogen refuelling networks on key freight routes

• $60 million to support EV charging infrastructure at automotive dealerships and workshops

• $70.7 million on projects to reduce Australia’s road transport emissions

ARENA has also announced a further $100 million in funding with $29.6 million to freight company Linfox and $9 million to Toll to help them decarbonise their truck fleets.

If you’re on any form of social media, you could be forgiven for thinking electric vehicles burst into a fireball the second you plug them into charge.

This misconception is now so widespread that it’s impacting consumer confidence. A recent NRMA poll found 44 per cent of respondents were not considering buying an electric vehicle because of fire safety concerns.

It’s also impacting the charging infrastructure sector. Almost on a weekly basis I hear from a charging provider or body corporates asking for help because an EV charging installation has stalled. These emails often start with “someone on the owners committee heard charging causes EVs to catch fire and it could burn down the building”.

Sensible discussion has been lost in the online clickbait, so here are some data-driven facts.

EV FireSafe receives funding from the Australian Department of Defence to research EV battery fires and emergency response. Most of our team are operational firefighters, and we also have a qualified risk assessor and fire investigator.

For every electric car, bus, truck, boat, train or aircraft battery fire that occurs globally, we look for the answers to around 28 questions, including what caused the fire to occur, how was it managed, did a secondary ignition occur, date, location and model.

We’re not able to capture every incident globally –there are only a small number of countries that track

There are myriad misconceptions about EVs and fire risks. Here is what the evidence tells us so far and how to minimise risk.

their national data – but we have a subset of the total number from which we can draw early learnings. At the time of writing, we’ve been able to study and verify battery fires – known as thermal runaway – in 612 plugin electric cars, 13 electric trucks and 33 electric buses, worldwide.

Leading causes of these fires are road traffic collision, submersion of a battery pack in salt water for an extended period (think major flooding events), a fault in battery cells during the manufacturing of the pack, or the EV was impacted by an unrelated fire that spread to the vehicle such as a garage fire.

There is very little reliable data on this, but it’s the question everyone wants an answer to.

The only data we trust is from the Norwegian Fire Department, which recorded 33 EVs on fire, compared to 704 internal combustion engines (ICE) fires in 2022.

The Swedish Civil Contingencies Agency recorded 81 EVs on fire, compared to 656 in the years 2018-2022. We must bear in mind that this does not take into account the age or mileage of the vehicles, or their maintenance records.

And, for emergency responders, the comparison is largely irrelevant; EVs pose new challenges that require new tactics and techniques for safe and effective emergency incident management.

What role does EV charging play in battery fires? It’s a really important point that a normally operating,

undamaged electric vehicle that is connected to an electrically compliant charging unit that has been installed to electrical standards by a qualified person, CANNOT cause a battery fire.

There are multiple safety checks that take place when you plug an EV into charging, kind of like a “handshake: between the vehicle’s systems and the charging unit; this is the ‘clunk, clunk’ noise you hear when you first connect the two.

If faults are detected, the charge is rejected, meaning no flow of power from the unit to the car.

But around 15 per cent of incidents on our database occur while the EV is connected to charging. Why? Because the EV has suffered damage prior to being connected.

A really good example of this is following natural disasters. In 2022, Hurricane Ian caused widespread saltwater flooding in Florida, USA, for several weeks. Up to 3000 EVs were submerged in a storm surge that also swept many vehicles away, causing additional impact damage.

Many Floridians left their EVs in the garage when they were evacuated, often still connected to their home charger. The power grid went down, storm surge came through, and battery packs were submerged for an extended period in salty water, which is known to corrode battery cells and also form a conductive path when the battery pack dries out again.

When the power grid went back up, some EVs received a ‘kick’ of power from charger that led to battery fire.

READ MORE HERE

Ben Waters, Presync

Australia used to have cheap electricity, but it was the dirtiest in the developed world. In future Australia will have cheap electricity that’s close to 100 per cent renewable. That’s at least a decade away, but for a preview of the future see South Australia. We have a messy decade of transition ahead, and energy costs will be high for those not engaging with new approaches to energy management and energy procurement.

changing the timing of their electricity use. Whether driven by cost or by emissions reduction goals, the answer is the same. Electricity prices are lowest when the grid renewable content is highest.

Renewable electricity is cheap, so you can cut your bills by shifting consumption to times of the day when the grid is green.

Renewable electricity is cheap, so you can cut your bills by shifting consumption to times of the day when the grid is green

There are two relevant megatrends to consider: the decentralisation and the decarbonisation of energy. We need to transform a centralised system designed in the 1950s, with generation where the coal was, to a much more decentralised system, where individual buildings can be power stations and play their part in the grid. This is like moving from mainframe computing to the internet of energy.

Buildings can be an active participant in the energy transition, but conventional attitudes to energy management and energy procurement may stand in the way of achieving this potential.

As always for buildings the first step is energy efficiency, followed by locally generating as much of the building’s energy as possible. But beyond these, buildings can assist the grid by

We know solar and wind are the cheapest forms of new generation, even firmed, so they aren’t what’s made our electricity very expensive since 2022. That’s about geopolitics and international fossil fuel prices, and this affects us because we rely so heavily on often-unreliable fossil generation to fill the gaps when there isn’t enough renewable generation, notably just after the sun sets and before it rises.

The price of electricity changes every five minutes, but hardly any electricity users get to see the real price. Our retailers “shield” us from this complexity using the old peak/off-peak model. Traditionally prices were higher during the working day and lower at night. With the continued roll-out of solar on the demand

side, and of solar farms on the supply side, prices are increasingly depressed on sunny days, with negative prices now common in the middle of the day. This has implications for future electricity costs. First, the traditional peak/off-peak model of pricing is now meaningless as we are starting to see off-peak prices exceed peak prices.

Second, the value of exported local solar generation continues to decrease, which should encourage shifting of discretional loads to daytime and the use of storage to capture excess solar generation.

Third, the value of non-solar renewable grid generation increases. Where there is discretion available to adjust the timing of consumption it’s advisable to operate plant and equipment primarily during daylight hours.

Clearly this will only work if more electricity users see the real price of electricity. Being on a flat price or peak/off-peak pricing prevents the market’s price signal reaching electricity users. Accessing the real price of electricity particularly makes sense for offices and other buildings with daytime heavy consumption, as prices are already low or negative in the middle of the day for much of the year.

Some businesses are already exposed to the wholesale price, usually alongside inexpensive, long term offtake from a mix of new renewable projects for up to 10 years.

READ MORE HERE

Thank you