4 minute read

FINANCE

FINANCE Consumer proposals are an option for major debt loads

by Martin Dunphy

Advertisement

When faced with seemingly unsurmountable debt, insolvent B.C. residents choose consumer proposals over bankruptcy more than half of the time. Photo by Ehud Neuhaus/Unsplash.

It’s no secret that Canadians have been struggling nancially because of the coronavirus pandemic, especially those in the low- to middle-income tax brackets.

And the new year isn’t bringing much relief for many. A combination of postholiday bills coming due, deferred-payment programs for mortgages and credit-cards possibly ending, and even repayments of (and paying taxes on) federal nancialsupport programs like the Canada Emergency Response Bene t (CERB) might start weighing heavily on the minds of many.

Equifax Canada reported last November that about 900,000 Canadians had taken advantage of mortgage deferrals and about 1.2 million had put o creditcard payments under programs o ered by banks and other lending institutions.

Although those deferrals should not affect credit ratings, the bills will still have to be paid.

Results from a January 18 Ipsos poll conducted on behalf of MNP Ltd., a national insolvency-services company, found that almost 30 percent of Canadians are insolvent, meaning that they cannot meet all of their monthly nancial obligations. When those who are only about $200 or less away from that status are added, that gure jumps to almost half of Canadians.

Many nancial experts advise those on the brink of nancial crisis to create a strict monthly budget, pay o debts as quickly as possible, and avoid using credit. ose and others who might also be holding on to limited nancial resources for fear of future hardships should probably take advantage of free credit-counselling services, such as those offered by the Credit Counselling Society.

For those who are in a serious nancial situation, where no way out is seen and creditors are in contact for repayment, there are options.

One is consolidation of personal debts into one loan with a consistent interest rate and set monthly payments. is can provide peace of mind by allowing debtors to concentrate on a single creditor, although the debts will all still have to be repaid, and interest still accrues.

Another option is declaring personal bankruptcy, which is a relatively drastic measure that would probably see liquidation of most assets for distribution to creditors. is is usually done with the assistance of a licensed insolvency trustee (LIT) or with the help of the federal O ce of the Superintendent of Bankruptcy Canada (OSB). en there are what are known as “consumer proposals” to creditors, which is a legally binding but less onerous option to insolvency—again, done with the assistance of an LIT—that involves making offers to your creditors to pay o debts less than $250,000 within a xed period (not to exceed ve years). Some proposals may include only a percentage of what is owed.

Consumer proposals are led with the OSB, and creditor payments, lawsuits, and wage garnisheeing are all stopped at that point. en creditors have 45 days to accept or reject the proposal.

Lana Gilbertson, a Vancouver LIT and senior vice president of MNP Ltd., told the Straight in a phone interview that “more people in B.C. le proposals than bankruptcies” and that MNP o ers a free consultation to consider all options. “It could be a one-hour meeting or a series of meetings.”

Almost as important as a plan to get out from under a crippling debt load, Gilbertson said, is the peace of mind that comes with that.

“To be honest, that feeling of relief starts as soon as they know their options. A common thing that I hear is that they’re not sleeping; they’re racked with worries.”

Once a proposal is worked out, Gilbertson said, much of that worry is gone. “ ey are grateful and they feel like they have a new lease on life.” g

January 28 – February 4 / 2021

4 COVER

Vancity’s new president and CEO, Christine Bergeron, is trying to implement an audacious goal: a carbonneutral loan portfolio. By Charlie Smith Cover photo by Shimon Karmel

5 STYLE

Vancouver’s Tamara Taggart and an apparel company teamed up to tackle a sexist term used to discredit women’s COVID-19 concerns. By Craig Takeuchi

7 REAL ESTATE

Reverse mortgages enable people 55 years of age and older to borrow up to 55 percent of the value of their property. By Carlito Pablo

11 ARTS

Composer Njo Kong Kie has created a multimedia cry of protest for workers, set to the poetry of a former Foxconn employee in Shenzhen. By Charlie Smith

e Start Here 13 CANNABIS 15 CLASSIFIEDS 14 CONFESSIONS 2 FINANCE 8 FOOD 6 HEALTH 10 LIQUOR 12 MUSIC 13 PSYCHEDELICS 14 SAVAGE LOVE

Vancouver’s News and Entertainment Weekly Volume 55 | Number 2763

1635 West Broadway, Vancouver, B.C. V6J 1W9 T: 604.730.7000 F: 604.730.7010 E: gs.info@straight.com straight.com CLASSIFIEDS: T: 604.730.7060 E: classads@straight.com

SUBSCRIPTIONS: 604.730.7000

DISPLAY ADVERTISING: T: 604.730.7020 F: 604.730.7012 E: sales@straight.com DISTRIBUTION: 604.730.7087

EDITOR Charlie Smith

SECTION EDITORS

Mike Usinger (ESports/Liquor/Music) Steve Newton SENIOR EDITOR Martin Dunphy ASSOCIATE EDITOR John Lucas (Cannabis)

STAFF WRITERS

Carlito Pablo (Real Estate) Craig Takeuchi SOLUTIONS ARCHITECT Je Li ART DEPARTMENT MANAGER Janet McDonald e Online TOP 5

Here’s what people are reading this week on Straight.com.

1 2 3 4 5

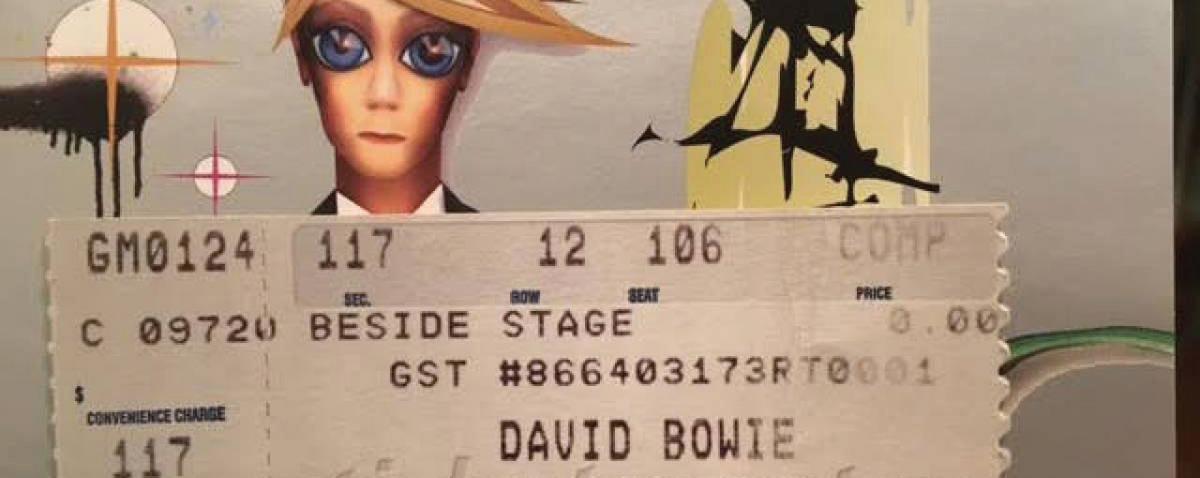

David Bowie’s final concert in Vancouver was a real doozy.

COVID-19 in B.C.: Province at precarious point; several vaccine delays.

Two Whistler restaurants and one in Vancouver have COVID-19 exposure events.

Host of makeshift Vancouver nightclub hit with $2,500 in COVID fines.

Rosemary Manor may be Vancouver’s most affordable condo building.

@GeorgiaStraight

GRAPHIC DESIGNER Miguel Hernandez PRODUCTION SUPERVISOR Mike Correia PRODUCTION Sandra Oswald

ADVERTISING REPRESENTATIVES

Glenn Cohen, Catherine Tickle, Robyn Marsh, David Pearlman CONTENT AND MARKETING SPECIALIST Rachel Moore CIRCULATION MANAGER Giles Roy CREDIT MANAGER Shannon Li ACCOUNTING SUPERVISOR Tamara Robinson