TUESDAY,

‘Sluggish’ Bahamas under performs region by 5%

By NEIL HARTNELL Tribune Business Editor

THE “sluggish” Bahamian economy’s growth under-performed its regional rivals by five percentage points over the decade to 2023 due largely to declining productivity and lack of “technological progress”.

The Inter-American Development Bank (IDB), in its just-released latest Caribbean Quarterly Bulletin, revealed that The Bahamas’ collective

economic growth rate of 9.3 percent for that period - even accounting for the devastating blows inflicted by the COVID-19 pandemic and Hurricane Dorian - paled when set against the regional average of 14.3 percent for the same period.

The report blamed The Bahamas’ under-performance on declining total factor productivity (TFP), which is described as a measurement of an economy’s technological progress, adding that this has been falling steadily ever since the 21st century began.

Put ‘all cards on table’ over banking reforms

By NEIL HARTNELL

A BAHAMIAN economics professor is urging that “all cards have to be on the table” for banking industry reform as he voiced fears the credit bureau’s launch has yet to lower interest rates for quality borrowers.

Rupert Pinder, assistant professor of economics at the University of The Bahamas (UoB), told Tribune Business in a recent interview that commercial banks must be refocused towards “more lending to the productive sector” of the economy so as to drive faster growth and greater job creation by the private sector.

Asserting that the sector continues to “over-emphasise consumer loans” at the expense of mortgage and business credit, he challenged how purchases of “a BMW or a Kia Sorrento add to capital accumulation” beyond the immediate transaction and satisfying the buyer’s needs.

And Mr Pinder, basing his assessment on personal experience, expressed disquiet that The Bahamas’ first-ever credit bureau “is not functioning the way it should” because, despite possessing information on the credit history of all local borrowers, this has seemingly yet to achieve one of the key reasons for its creation - a noticeable reduction in interest costs for those with an unblemished record.

He also warned Bahamians not to allow the banks to narrow the reform pressure to just a few specific issues, such as lowering or eliminating fees for lowincome persons with minimal bank balances, instead arguing that a much “broader” approach is required to assess all consumer concerns “across the board”.

Voicing concerns that the Central Bank is “missing out on opportunities to really help with some of the reforms needed in the banking sector”, Mr Pinder said:

Warning that the number of Bahamian firms “planning to innovate” is some 15 percent behind the Caribbean average, based on the Innovation, Firm Performance, and Gender (IFPG) survey conducted by Compete Caribbean in 2020, the IDB assessment added that there was also “a more pronounced trend” in this nation for small and medium-sized enterprises (SMEs) to innovate via new products, processes and structures.

However, it concluded that all is not lost for The Bahamas,

By NEIL HARTNELL Tribune Business Editor

A BAHAMIAN auto dealer yesterday revealed it will invest up to $500,000 in a new showroom and create “at least” five jobs for its newly-acquired Chinese brand despite “market saturation” concerns.

Fred Albury, Auto Mall’s principal, told Tribune Business the planned Wulff Road facility will house its MG Motor distributorship as it bids to exploit an anticipated Bahamian consumer “shift” to Chinese auto brands due to their lower price points.

Pointing to the improved quality of Chinese-manufactured vehicles, he disclosed that Auto Mall is targeting “a few hundred” MG new vehicle sales per year based on what rival dealership, Elite Motors, has achieved with its own brand, Changan, during the initial few months.

The sudden influx of Chinese vehicle brands, both electric and gasoline, into The Bahamas is occurring despite industry concerns that

Union chairman backs Vybz Kartel opposition

By ANNELIA NIXON Tribune Business Reporter anixon@tribunemedia.net

THE Trade Union Congress (TUC)

chairman yesterday backed the United Artist Bahamas Union’s (UABU) vocal opposition to dancehall artist, Vybz Kartel, staging a concert in The Bahamas.

Fred Munnings, pointing to “the murder situation” in The Bahamas, told Tribune Business he does not believe “a role model” like the Jamaican should be allowed into the country even though the latter’s murder conviction was overturned by the UK Privy Council after he had spent ten years serving a prison sentence. Jamaica’s appeal court has declined to retry the case.

Responding to the push back that the United Artist Bahamas Union is receiving over its threat to protest the concert’s approval, Mr Munnings added that just because the public may want it does not mean such an event is “in the best interest of the development of our country”.

“My understanding, from what I read and what I heard on the news reports, is that he was convicted of murder,” Mr

as despite long-standing workforce skills and access to finance shortcomings several initiatives supported by the Bahamian government “are starting to bear fruit” including the digitisation of public services via the MyGateway Internet portal. And there remains “a solid foundation” of firms that are either innovating, or planning to, that is higher than the Caribbean average.

But, with all projections signalling that The Bahamas is set to return to annual gross domestic product (GDP) growth rates of

the auto market is becoming oversaturated and that this could cause a slowdown following several years of strong post-COVID sales.

Ben Albury, the Bahamas Motor Dealers Association’s (BMDA) president, told this newspaper that there have been “internal discussions” among dealers over “market saturation” fears but he remains “cautiously optimistic” that 2025 will produce a repeat of the strong

between 1-2 percent following the COVID reflation, the IDB report revealed: “Cumulative growth over the last decade in The Bahamas has been 9.3 percent, compared to the regional

industry-wide sales enjoyed since 2022 and the emergence from the pandemic.

Echoing this outlook, Fred Albury said that while guarding against becoming “overly optimistic” he is forecasting that BMDA members will collectively sell between 2,500 to 2,700 new autos this year compared to the 3,000 deals generated in what he described as a “record” 2024.

“We’ve got some new brands coming into the market,” he revealed. “Elite has Changan, and we have taken on a brand of Chinese vehicles too, MG. We have vehicles coming in starting around the end of the month. We’re going to utilise our Wulff Road facility and set up a showroom there.

“We’re going to be spending probably $400,000-$500,000 on a showroom and facility over there at Wulff Road. There will definitely be some job additions. I would say at least five. There’s going to be a shift to Chinese brands because of the price points out they come

Consumer watchdog’s ‘huge’ three-fold complaints surge

By FAY SIMMONS

THE Bahamas’ consumer protection watchdog saw a “huge” three-fold increase in complaints against businesses for the 2024 full-year, its chairman revealed yesterday.

Randy Rolle, the Consumer Protection Commission’s head, said it received nearly 450 complaints from consumers in 2024 compared to the 151 submitted in 2023. Speaking to Tribune Business, Mr Rolle said the watchdog currently has a 70 percent complaint resolution rate and will be working alongside the Attorney General’s Office to resolve some outstanding cases. He attributed the increased volume of complaints to the Commission’s efforts to build consumer confidence their grievances will be addressed through resolving issues, adding that it does not show “favouritism” and will investigate claims against other government agencies.

“The last time I checked we had over a 70 percent success rate, and that number has been going up. We have been collaborating with other agencies. We have a number of cases that we are going to meet with the Attorney General’s Office on in the coming weeks. But the more amicable resolutions we have, the better it is for everyone,” said Mr Rolle.

“Consumers now know that not only are they able to make complaints, but it won’t fall on deaf ears. I think that’s the most important thing for them, and so we want to build on that relationship with them and are collaborating

Cruise port hails 27% visitors surge to 5.6m

NASSAU Cruise Port says it enjoyed a 27.3 percent, or 1.2m, year-overyear increase in passenger arrivals to 5.6m for 2024 as its top executive pledged: “Our success story is far from over.”

The Prince George Wharf operator, hailing its 2024 performance, said in a statement that this marks its second consecutive year of record-breaking growth and underscores continued global demand for cruise and Bahamian travel experiences. Pointing out that it welcomed 4.4m passengers in 2023, surpassing the previous year’s total of 3.2m with another 1.2m increase, Nassau Cruise Port said it greeted 61 percent of the estimated 9.1m total tourist arrivals in The Bahamas for 2024.

It added that this surge in visitors contributed directly to $2.6bn in annual tourism

revenues for The Bahamas, with a variety of industries and businesses - ranging from retailers and restaurants, to tour operators and artisans - benefiting from the influx of cruise passengers.

“We are incredibly proud to reach this significant milestone for the second year in a row,” said Mike Maura, Nassau Cruise Port’s chief executive. “This achievement is a testament to the hard work, dedication and collaboration of our talented team, our valued partners and the Bahamian people.

“We could not have reached this point without the unwavering support of our stakeholders, including the Government of The Bahamas, our cruise line partners, local businesses and the community at large. Together, we are shaping the future of Bahamian tourism, and I am excited

to see the continued growth of Nassau Cruise Port as a gateway to The Bahamas and a source of opportunity for all.”

Nassau Cruise Port said plans for further expansion and improvement include facilities that facilitate the transportation of passengers to areas of interest throughout New Providence; recreational family-oriented experiences; dining options; and sustainable practices. It added that these are expected to enhance the visitor experience and further elevate the port’s status as one of the leading cruise hubs in the region.

“Our success story is far from over,” Mr Maura added. “The future promises even more growth for The Bahamas and its residents, and more incredible authentically Bahamian experiences for our visitors from around the world.”

PM set to headline Business Outlook

THE Prime Minister will deliver the keynote address to lead off the 34th annual Bahamas Business Outlook conference that will feature five panel discussions on key economic issues.

The event, scheduled for January 16, 2025, under the theme ‘Prioritising inclusive, sustainable growth’, will be held at Baha Mar and feature a series of presentations by speakers including the top US and Chinese diplomats in The Bahamas.

Joan Albury, the Bahamas Business Outlook founder and president, said: “Our theme for 2025 has been chosen with great deliberation and the collaboration of key stakeholders. We believe that for The Bahamas to continue flourishing, we must ensure that each island and every citizen has the opportunity to benefit from the nation’s development.

“This means fostering economic opportunities that are accessible to all. This means implementing sustainable practices that can adapt to change. This means ensuring that the path to growth is both equitable and responsible.”

Besides the Prime Minister, speakers will include Yan Jiarong, Chinese ambassador to The Bahamas, who will focus on expanding trade. Leslie Lee Fook, founder of business intelligence and information and communications director at Aliv, will address artificial intelligence (AI), while Kimberly Furnish, chargé d’affaires at the US Embassy, will focus on ‘strengthening opportunities for foreign direct investment (FDI) in The Bahamas.

Other presenters are Nicholas Rees, chairman and co-founder of Kanoo Pays, who will address digital technology, plus Toni Seymour, chief executive of Bahamas Power & Light (BPL), who will tackle the

theme ‘Delivering quality, sustainable infrastructure’.

The five panel discussions are:

* ‘Creating a competitive investment climate through tax reform’, which is to be moderated by Hubert Edwards, principal, Next Level Solutions, and feature panellists Simon Wilson, financial secretary; Timothy Ingraham, chairman, Bahamas Chamber of Commerce & Employers Confederation (BCCEC), and Kevin Moree, partner, McKinney, Bancroft & Hughes.

* ‘Luxury tourism: Inclusive and sustainable’, which will be moderated by Royann Dean, managing director, Onwrd Advisors, and feature Latia Duncombe, director-general, Ministry of Tourism; Robert Sands, senior vicepresident, Baha Mar; Joy Jibrilu, chief executive, Nassau Paradise Island Promotion Board; and Felipe MacLean, chief executive, Sampson Cay Bahamas.

* ‘Culture as an economic powerhouse’, moderated by Rowena Poitier-Sutherland, founder of Bahamas Artist Movement, with panellists Yan Jiarong, Chinese ambassador to The

Bahamas; Amanda Coulson of TERN Gallery; Obafemi Pindling, managing partner, Pindling & Company; and Ian Ferguson, chief executive, Tourism Development Corporation.

* ‘Developing sustainable solutions for affordable housing’, moderated by Sonia Brown, principal, Graphite Engineering, with panellists Sharlyn Smith, principal, Sharon Wilson & Company, and Nick Dean, principal and director of risk management and resilency, Integrated Building Services (IBS).

* ‘Shaping a resilient adaptation plan’, moderated by Mark Daniels, principal of environmental services, BRON, with Dr Rhianna Neely-Murphy, director, Department of Environmental Planning and Protection (DEPP), and Rupert Hayward, founder and president, Blue Action Lab and Blue Action Ventures, and principal and director, Grand Bahama Port Authority. Registration is

FAMILY ISLAND BOOST FROM AIRLINE CAPACITY INCREASE

By FAY SIMMONS

A SENIOR tourism executive yesterday disclosed that smaller airline carriers are forecast to increase their seat capacity to the Out Islands during the 2025 first half. Kerry Fountain, the Bahama Out Island Promotion Board’s executive director, told Tribune Business this will provide improved access for stopover visitors.

He said Maker’s Air, which provides regular service from Florida to Andros, the Berry Islands,

Eleuthera, Andros, Cat Island, Exuma and Long Island, has nearly doubled the number of seats available between December 2024 and July 2025 compared to the same period last year.

“Maker’s Air is projecting 36,523 seats from December 2024 to July 2025, and if you look at December 2023 to July 2024, that was 20,000 so you can see they have nearly increased their capacity by 50 percent,” added Mr Fountain. Aztec Airways is also expected to increase its seat capacity to several Family Island destinations including Eleuthera, Exuma and Bimini. “Aztec Airways, in terms of growth by

SENIOR DOCTORS RENEW INDUSTRIAL PLEA TO GOV’T

By ANNELIA NIXON Tribune Business Reporter

THE union representing senior doctors at Princess Margaret Hospital (PMH) yesterday renewed its plea for the Government to swiftly address its outstanding grievances to prevent industrial action.

The Consultant Physician Staff Association (CPSA) again sought to increase the pressure to resolve what it alleges is a lack of proper health insurance, issues with ‘clocking in’, working with “aggressive patients” and failing to compromise regarding its industrial agreement.

“The Consultant Physician Staff Association (CPSA) is the sole bargaining agent for all consultant physicians in the public health sector. Our mission is to protect the interests of our patients and the profession, and to advance the cause of our membership,” the Association said in a statement.

“The industrial agreement between the CPSA and the Public Hospitals Authority (PHA) expired in 2021. Since November 2022, the CPSA has been negotiating with the PHA to no avail. In November 2024, the CPSA met with the Prime Minister and it was agreed that all outstanding matters in regards to the industrial agreement would be resolved.

“Unfortunately, the Prime Minister has not followed through with the agreed

MCDONALD’S IS THE LATEST COMPANY TO ROLL BACK DIVERSITY GOALS

By DEE-ANN DURBIN AP Business Writer

FOUR years after launching a push for more diversity in its ranks, McDonald’s is ending some of its diversity practices, citing a U.S. Supreme Court decision that outlawed affirmative action in college admissions.

McDonald’s is the latest big company to shift its tactics in the wake of the 2023 ruling and a conservative backlash against diversity, equity and inclusion programs. Walmart, John Deere, Harley-Davidson and others rolled back their DEI initiatives last year.

McDonald’s said Monday it will retire specific goals for achieving diversity at senior leadership levels. It also intends to end a program that encourages its suppliers to develop diversity training and to increase the number of minority group members represented within their own leadership ranks.

McDonald’s said it will also pause “external sur veys.” The burger giant didn’t elaborate, but several other companies, includ ing Lowe’s and Ford Motor Co., suspended their partic ipation in an annual survey by the Human Rights Campaign that measures workplace inclusion for LGBTQ+ employees.

airport that they fly to, their projected seat delivery, December 2024 through July 2025, compared to that same period, December 2023 through July 2024, is expected to increase,” said Mr Fountain. “They’re expected to increase their seat delivery to Governor’s Harbour by 21 percent; Marsh Harbour by 17 percent; North Eleuthera 16 percent; South Bimini; 8.3 percent; Rock Sound about 6 percent; Grand Bahama about 5 percent; Treasure Cay about 5 percent; and then Chubb Cay about 3 percent.”

Silver Airways has regular direct flights from the US to Abaco, Eleuthera, Bimini, Exuma, Grand

Bahama and New Provi-

dence, and is projected to bring in over 80,000 passengers from December 2024 to July 2025 despite its recent Chapter 11 bankruptcy protection filing in the south Florida courts.

Mr Fountain said the carrier’s Fort Lauderdale to Marsh Harbour route is expected to bring in over 30,000 passengers, while North Eleuthera to Fort Lauderdale is expected to bring in 28,000 passengers and Fort Lauderdale to Georgetown another 16,000 passengers.

Other Silver Airways routes such as Fort Lauderdale to Bimini are projecting 7,500 seats, and Orlando/Tampa to

ELEUTHERA UTILITY WOES REAR UP AGAIN IN 2025

Marsh Harbour a further 1,100 passengers each.

Silver Airways also introduced additional flights into Georgetown, Exuma, during the off-peak season, increasing frequency to six days per week from yesterday.

Silver Airways said previously its Chapter 11 bankruptcy filing ws to “secure additional capital and undertake a financial restructuring”. “We want to share an important step Silver Airways has taken to ensure a sustainable future for our company. Today, we voluntarily filed for Chapter 11 protection in the United States Bankruptcy Court for the Southern District

reverse osmosis plant had a power generation problem which caused water levels to deplete.

of Florida,” said the Silver Airways announcement.

“This decision will allow us to secure additional capital and undertake a financial restructuring that will strengthen our position as a competitive airline, ultimately benefiting you— our valued customers. We anticipate completing this process by the first quarter of 2025, emerging stronger and ready to continue serving you with the same dedication we’ve upheld for over 13 years.”

The airline maintained that during the proceedings all tickets will remain valid and operations will continue as usual.

course of action, and has referred the dispute back to the Ministry of Health and Wellness. The CPSA is deeply disappointed with the Government’s inability to negotiate this vital document to a mutually satisfactory conclusion, and looks forward to a productive conclusion to this long outstanding matter.

“Physicians in the public sector must manage patients in a system with a chronic lack of adequate medication and equipment, leading to sub-standard care for our population. The lack of specialist consultants in certain areas has led to physician burnout and patient clinic appointments being delayed,” the CPSA continued.

“Within the last few months, three physicians have been physically attacked by aggressive patients and threats of violence were made against other individuals in the department. In the aftermath of these unfortunate incidents, few interventions have been put in place by the institution. The CPSA has presented these concerns to PHA with the aim of improving the work environment for patients and other medical staff.

“The CPSA implores the Government of The Bahamas to swiftly come to resolve this long standing matter that has created serious challenges for our physicians so that we are not forced to take action that would be to the detriment to an already fragile healthcare system.”

By ANNELIA NIXON Tribune Business Reporter anixon@tribunemedia.net

ELEUTHERA residents and businesses yesterday demanded a major improvement in utility services after frequent water supply interruptions and power outages persisted into early 2025.

Leatendore Percentie said he wishes that in 2025 “we are in a position where we have utility companies that can operate and a plan with delivering a full product continuously”. He added that Bahamas Power & Light (BPL) and the Water & Sewerage Corporation should have a back-up plan for emergencies.

“If there’s a chance of an error, I mean, nothing’s going to be 100 percent, but there has to be some kind of anticipated back-up plan in case stuff hits the fan,” Mr Percentie said. “I expect that. But I’m saying we seem to have nothing. It’s almost as if we are trying to find a way down the road in the dark. That is what I feel with both BPL and Water & Sewerage.

“God forbid, what’s going to happen right now if there’s a fire in this community? Who will be held responsible? And that’s my biggest upset that I have, I think, is that these people, when they are directly responsible for adversely impacting the community, they’re not held accountable.

“If someone’s house burned down today and

NOTICE FLAMAR INVESTIMENTOS LTD.

Incorporated under the International Business Companies Act, 2000 of the Commonwealth of The Bahamas. Registration number 210701 B (In Voluntary Liquidation)

Notice is hereby given that the above-named Company is in dissolution, commencing on the 30th day of December A.D. 2024.

Mr. Marcelo Paglioli, whose address is R Santos Dumont 1234 PI Apt 802, Ed Julio Joao EB, Exposicao, CEP: 95084-390, Caxias Do Sul, RS, Brazil. Any Persons having a Claim against the above-named Company are required on or before the 29th day of January A.D. 2025 to send their names, addresses and particulars of their debts or claims to the Liquidator of the Company, or in default thereof they may be excluded from the beneft of any distribution made before such claim is proved.

Dated this 6th day of January A.D. 2025.

Marcelo Paglioli Liquidator

NOTICE INTERNATIONAL BUSINESS

there’s no water, who is going to pay for that? Has Water & Sewerage ever paid for not having water handy when they’re supposed to, as they were contracted to do in the community?

These are the questions I need answered for 2025. If not, we are just fumbling down the road literally, like a drunken sailor,” he added.

“And yesterday morning I got very, very upset because at this point in my life, I have basically given up on people and politicians, and I’m trying to focus on my salvation. And this is not the first Sunday of me making preparations because I’m part of a praise team and all of that. And this yesterday morning was not the first time in a month that I’m making preparations to go to church and I can’t shower because there’s no water.

“And I was given no notice that the water was going off. And that’s why I got very upset. And to me, right now, it seems as if that Water and Sewerage really is a product of the devil. And it’s trying to stop the spiritual awareness. That’s how deep I’m now thinking. And I’m just trying to focus on God. So, why are these entities trying to stop me from that?”

Mr Percentie’s comments came after the Water & Sewerage Corporation posted numerous updates in the Eleuthera Hotline WhatsApp group over the past few days. Early Sunday morning, a Water & Sewerage Corporation representative explained that a

“The R/O plant experienced a power generation issue during early morning hours, resulting in storage levels being depleted. Since then, this matter has been rectified. However, because of the storage levels being depleted overnight we are currently rebuilding our water reserves. Once water reserves reach the required levels; normal distribution will resume immediately on mainland North Eleuthera,” the Corporation added.

Yesterday, the Water & Sewerage Corporation addressed another interruption, linking this to an issue that occurred the week prior.

November, 2024 20

“Well, I’ve seen lines spark all over the island before, and we know a lot of it is saying that the lack of maintenance and this stuff is old,” Mr Percentie said. “Well, we need to update it. We need to maintain. And those are the things that BPL needs to step up on. Power goes off for five hours.

“They said we have to maintain this or maintain that, or the result of nonproduction is because this wasn’t maintained. I’m hearing those excuses. You know, my grandfather always said ‘It’s best to keep the cow in the gate because once the cow gets out the gate, it’s a lot harder to try to get a cow back inside the gate. So keep the cow in the gate.’ And we’re not keeping the cow in the gate.”

Up until the press time, BPL updated Tribune Business that “supply was only interrupted for a short time while the crew carried out repairs.” The reason behind the sparking lines was not found before press time. The Water & Sewerage Corporation did not respond before press time.

“The damaged part from last week in tandem with irregular power was the cause of the early morning disruption. Will implement a different means of operation until the part is repaired/ replaced to prevent similar occurrences. Sincerest apologies for the inconvenience this morning,” it added. A statement was then released explaining that North Eleuthera would experience reduced water pressure until 2pm. However, Mr Percentie was displeased that he was still not receiving water hours past the promised time. He also noted that BPL needs to better maintain its infrastructure to avoid problems after it was reported that a line was sparking in The Bluff.

Share your news

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

AUTO DEALER IN $500K INVESTMENT DESPITE ‘SATURATION’ CONCERNS

“The quality has improved tremendously. They’re good. They’re making big inroads in the Asian market. Based on what we’ve seen Elite do with the Changan brand in the first two months of operation, and they’ve done very well, I think the MG brand is good for a few hundred units per year.”

Fred Albury said the new jobs will likely be created in the service and parts departments, with Auto Mall already possessing the necessary MG Motors sales team. However, he added that his company and other businesses are finding it increasingly tough to recruit and retain workers for starting job positions.

“It has become difficult,” he added. “Right now, finding people to work is one thing. They want a job, but don’t want to work, especially at the lower end.

Dealing with car cleaners, drivers, we have difficulty finding people who will stick with it.”

Turning to the industry’s 2025 prospects, the Auto Mall chief told Tribune Business: “I thought that 2024 was going to see a slowdown because we’ve been busting wide open for 2022 and 2023, but 2024 was a record year out there for us and other dealers. I would like to think it’s probably a 10 percent increase over the year before industry-wide.

“I think 2025 is going to be reasonable. I’m not going to get overly optimistic. I think it’s going to be, at least for the first half, reasonable unless something dramatic happens. I feel it’s going to be a reasonable year. Last year was a record year. I think, all in all, probably new car sales for BMDA members represented 3,000 units. That does not include a couple of dealers who are not part of the BMDA.

“The used cars are still coming in in record numbers. I think it’s reasonable to say that 2,500-2,700 new vehicle sales will be the

forecast for 2025,” Fred Albury continued, “unless the new US administration does stuff to impact the export of vehicles from Asia. I would say that’s the only hiccup that might possibly happen.

“I don’t see anything to deter unless the bottom falls out. I’ve seen the reports in the US and China about this flu epidemic, but unless we have another COVID19 epidemic, our economy is doing pretty well. Tourism is doing well. I think it’s going to be a fairly reasonable year.”

Ben Albury, the BMDA president, who is also Bahamas Bus and Truck’s general manager, shared a similar outlook while disclosing industry concerns that sales may “taper off” in 2025 as consumer demand slows following several robust sales years.

“I think we’re looking pretty good. We’re pretty much on pace to have a similar year to last year,” he told this newspaper. “We do have some concerns. In our

discussions, we spoke about market saturation because we had a couple of good years.

“I guess that history teaches us that, typically, when you have a couple of good years you come to expect things to kind of taper off because the market is satisfied and you have to wait for vehicles to age more and people to pay off loans and come back into the market.

“That’s not scientific, and I haven’t seen it yet. Business is still really robust across the board. We’re cautiously optimistic and will be prepared for what is to come.” Industry sales figures for November and December 2024 are still awaited, but Ben Albury said he was confident BMDA members have collectively beaten full-year numbers for 2023.

“Up until October, we were very close to last year,” the BMDA chief disclosed. “Once we get all the figures in I think we will have slightly beaten 2023;

not by any great margin, but by about 3-5 percent. That would be guessing without two months of sales.

“I know November was extremely good for us personally, and December levelled off slightly. It’s a shorter month and people have got trips and gifts going on. But November was very, very strong. For me it was probably the second best month of the year.

“I’m really excited to see what it ends up at once we get all the numbers in for November and December. I think it will easily surpass 2023. I don’t think it will be by any significant amount. Right now things are moving along very, very well, but based on our internal discussions we are being cautiously optimistic.”

Recalling the postCOVID surge experienced by auto dealers, Ben Albury said both 2022 and 2023 represented “dramatic” improvements over the prior year with the latter representing the best

Union chairman backs Vybz Kartel opposition

FROM PAGE B1

Munnings said. “Well, if that is correct, that there’s some controversy about whether or not he should be released or not released, then I think until that is resolved we should not allow criminals into our country that are known criminals that are serving jail time.

“And if there’s controversy over his release, until that controversy has been

resolved, I think the Government of The Bahamas should not allow him into our country. That’s the first point. Secondly, a role model like him being convicted of a murder, realising the murder situation in our country, I totally agree that we should not allow him into our country.

“Young people say they want to take dope, too. Young people say they want to do all kinds of things that

NOTICE

INTERNATIONAL BUSINESS COMPANIES ACT, 2000

Aequitas International Strategies Fund Ltd. (IN VOLUNTARY LIQUIDATION)

NOTICE IS HEREBY GIVEN that in accordance with section 138(4) of the International Business Companies Act, 2000, as amended, Aequitas International Strategies Fund Ltd. is in dissolution.

The dissolution of the said Company commenced on 31 December 2024 when the Articles of Dissolution were submitted to and registered with the Registrar General in Nassau, The Bahamas.

The Sole Liquidator of the said Company is L. Michael Dean of Equity Trust House, Caves Village, West Bay Street, P.O. Box N 10697, Nassau, Bahamas.

L. Michael Dean Sole Liquidator

may not be in the best interest of the development of our country. Not only young people, a lot of people,” Mr Munnings said.

“So does that mean that we should just allow all and sundry to come into the country simply because a certain sector of the population said they want it? This is a known criminal who has questionable means of whether or not he should be on the streets. Convicted of murder.

“And, because he’s so popular among the young people, all the more reason why we should be very sensitive to allowing this kind of a role model into our country. I’m not saying that people should not be forgiven. I’m not saying that people should not be pardoned if they have paid their dues to society. However, in his case, there’s a controversy as to whether or not he should be released, according to what I read and according to what I’ve heard.”

Mr Munnings also backed the UABU’s comments stating that it is currently the only legal union that can participate

in the approval process of allowing foreign artists to work in the country. He added that he was present during a recent meeting with the Pia Glover-Rolle, minister of labour, and Howard Thompson, director of labour when the former confirmed that the legacy union, the Bahamas Musicians & Entertainers Union’s (BMEU), elections were not certified.

“On the point of the other union, there are outstanding matters related to that union with regard to their recent election and the election has not been certified, which means that that union should not be allowed to continue to function because it’s questionable whether or not they are legitimate,” Mr Munnings said.

“I was present in that meeting with the minister and the director of labour, and my impression is they acknowledge that there is a controversy and that the union’s recent election has not been certified. Therefore, they are not officially recognised at this time.

“The practice is, and has been for many years, that once an application has been made to The Bahamas Immigration Department for a work permit to be granted to an artist coming into the country, the

annual performance for 15 years since prior to the the global financial crisis and subsequent 2008-2009 recession

“Even if we did 5 percent more, 3 percent more, than we did in 2023 it’s still a huge accomplishment,” the BMDA president said of the industry’s 2024 performance. Let’s see what happens now the US election is over. That’s going to have some positive impact...

“Let’s hope the speculation on the saturation does not happen until next year, and maybe the economy is doing so well that it won’t slow down. Maybe the slow years we’ve had are catching up and people are ready to buy new vehicles.

“Financing is a huge factor in that. The banks are being aggressive and offering fantastic terms. The banks are lending, but some customers are experiencing a lot of red tape and frustration in getting everything in that they need. It’s still not as loose as it used to be.”

whether or not the artist is approved or disapproved.”

practice is that the legitimate union, which in this case will be the United Artists Bahamas Union, because the other one is in question, will be contacted to verify whether they had any objection to the permit being granted. That has been a practice for decades,” Mr Munnings added.

“So what the United Artists Bahamas Union is saying, since the other union is not officially functioning at this time, that inquiry should be made of the United Artists, and the United Artists should have an opportunity to voice its opinion on whether or not this artist, this particular artist, should be granted a work permit to come into the country. And that’s what has happened. They’re voicing their opinion.

“If the union disapproves of the artist coming into the country, that should weigh heavily on the decision that is made by the Government of the Bahamas. The union cannot approve or disapprove a work permit application. That can only be done by the Government of The Bahamas through the Immigration Department. But once the union is consulted and they disagree, or do not approve of a particular artist coming into the country, that weighs heavily on the decision

Mr Munnings added that if the BMEU was to be certified, both unions would have a say in the approval process. He said it was suggested that a committee made up of members from both unions be formed to “disapprove or approve any inquiries”.

“Unions have equal rights. What we have suggested to the Government is that a committee comprising of both unions be recognised by the Government for that body to disapprove or approve any inquiries,” he added.

“That has been suggested. It has been recommended. The Government, in a meeting with the Immigration officers, agreed with that concept. However, attempts to bring the two bodies together to come up with such a body.... the United Artists has always been in favour. The other union has not responded. And then, of course, they had the elections, and the elections are in question. Therefore, there’s only one union at the moment that’s officially recognised by the Government.”

“What we can say is that the United Artists have not been consulted and we are the only legitimate, recognised, registered union that relates to entertainment in the country today.”

Put ‘all cards on table’ over banking reforms

“I think the country, the policymakers really need to take a long and hard look at banking reform.”

Asserting that he is far from alone in his views, he hinted that the Government should adopt the more aggressive approach taken by Mia Mottley, the Barbados prime minister, and her stance towards the same Canadian banks that dominate the Bahamian commercial banking market.

“To me, banking is not what it should be in terms of its overall role in the development of the country,”

Mr Pinder added. “To me, banking is about financial intermediation. It’s providing a service where it’s a ‘go between’ between savers and borrowers. The savers

provide the resources for the borrowers.

“It’s profitable for the banks but, at the same time, they should contribute to the growth and development of our country. They’re falling down there. There is an over-emphasis on consumer loans. Consumer loans don’t necessarily add any value. What I’m finding is that they see themselves as the purveyors of consumer loans.

“They provide some consumer welfare, but don’t add any value to the economy in terms of capital goods and capital improvements. It doesn’t facilitate capital appreciation and accumulation. If we leave it up to the commercial banks, they’ll spend all their time at car shows,” he continued.

NOTICE

INTERNATIONAL BUSINESS COMPANIES ACT, 2000

EIFS Structural Asset Fund Ltd. SAC (IN VOLUNTARY LIQUIDATION)

NOTICE IS HEREBY GIVEN that in accordance with section 138(4) of the International Business Companies Act, 2000, as amended, EIFS Structural Asset Fund Ltd. SAC is in dissolution.

The dissolution of the said Company commenced on 31 December 2024 when the Articles of Dissolution were submitted to and registered with the Registrar General in Nassau, The Bahamas.

The Sole Liquidator of the said Company is L. Michael Dean of Equity Trust House, Caves Village, West Bay Street, P O Box N 10697, Nassau, Bahamas.

L. Michael Dean Sole Liquidator

NOTICE

INTERNATIONAL BUSINESS COMPANIES ACT, 2000 Honey Labs Inc. (IN VOLUNTARY LIQUIDATION)

NOTICE IS HEREBY GIVEN that in accordance with section 138(6) of the International Business Companies Act, 2000, as amended, the winding up and dissolution of Honey Labs Inc. is complete.

Kim D. Thompson Sole Liquidator

Address: Equity Trust House Caves Village West Bay Street P O Box N-10697 Nassau, Bahamas

International Business Companies

(No. 45 of 2000) In Voluntary Liquidation

Notice is hereby given in accordance

“How does a BMW or Kia Sorrento really add to capital accumulation? It’s a good import and, after it’s sold, that’s pretty much it as opposed to facilitating the expansion of the housing market, which creates direct and indirect jobs.”

Mr Pinder asserted that “the other side” of this is that lending activity in The Bahamas by the Canadian banks is “actually creating jobs in other countries because a lot of the loans are processed outside The Bahamas. It creates employment and, in some cases, economic activity outside the country” because these institutions have consolidated core back office functions in other Caribbean states.

Bahamas-based commercial banks have become increasingly focused on consumer lending, as well as fee income, ever since the 2008-2009 global recession resulted in the sector carrying credit arrears that peaked at around $1.2bnlargely due to delinquent and past due mortgage and business loans.

The challenges with repossessing and sellingoff distressed properties, coupled with the higher

interest rates and consumer loan security offered by liens/deductions taken out on borrower salaries, have driven the banking sector away from home and business loans - something that Mr Pinder and others believe has been to the detriment of the Bahamian economy and society.

“My ideas may seem a bit garbled, but the point I want to make is the Central Bank is missing out on opportunities to really help with some of the reforms needed in the banking sector,” the UoB professor told Tribune Business. “The focus cannot just be on digital transactions...

“Certainly, when you look at the kind of conversations being had in places like Barbados, it suggests I am not alone in my thoughts. There has to be some intervention in all of that to return the banks to their core focus. All the cards have to be on the table, particularly when you look at the historical anemic growth rates in the country of less than 2 percent.”

Mr Pinder argued that the external foreign currency reserves, which stood at $2.7bn at end-November 2024, were more than sufficient to support increased

LEGAL NOTICE

Magnolio Fund Ltd. Registration No. 211547 B

INTERNATIONAL BUSINESS COMPANIES ACT (No.45 of 2000) In Voluntary Liquidation

Notice is hereby given that in accordance with Section 138 (8) of the International Business Companies Act, No.45 of 2000, the dissolution of Magnolio Fund Ltd. has been completed, a Certificate of Dissolution has been issued and the Company has therefore been struck off the Register. The date of completion of the Dissolution was December 18th, 2024

Liquidator

Dated this 6th day of January 2025

lending and credit expansion. “One of the reforms I would like to see is more lending to the productive sectors,” he reiterated.

“I would also like to see the credit bureau really serve it’s intended focus, meaning lowering the transaction cost for individuals with good credit histories. The credit bureau, in my view, is not functioning the way it should. It should be lowering the transaction cost for customers that are relatively lower risk. I haven’t seen any evidence of it.

“I’ve had some experiences with the banks recently,” Mr Pinder continued. “I’m yet to see, when the banks are asking me to come in for credit based on a certain history, I don’t see any inclination for them to offer me lower rates. I was able to negotiate rates independently of the credit bureau based on my knowledge of certain things and how to leverage, but it had nothing to do with the credit bureau.

“The information generated by the credit bureau should be used to address the issues of information asymmetry, but that should be reflected in lower transaction costs. I think implicit in the function of the credit bureau we should see movement with respect to interest rates.” Mr Pinder also reemphasised his belief that the “oligopolistic market structure” of commercial banking in The Bahamas requires greater regulation of industry fees by the Central Bank. “I don’t see how that can be avoided,” he argued. “The only thing talked about so far

is greater fee transparency and discussions around the fees for banking accounts.

“There needs to be a more broader review of fees across the board, not just with respect to savings accounts. In fact, I wonder if people are reading very carefully and watching very carefully because I noticed it was rather clever how the banks shifted the conversation to where they would consider adjusting fees with respect to persons with lower bank balances rather than the conversation being broadened to look at fees generally.

“To me, that’s a low hanging fruit,” Mr Pinder added of bank fees. “There are so many other areas.. You look at fees on consumer loans, you look at fees on mortgage loans, fees across the board.” The Central Bank late last year required all its licensees with immediate effect to give consumers and the regulator 30 days’ and 60 days’ notice, respectively, of any planned fee adjustments.

Commercial banks, as well as the credit unions, money transmission businesses and payment services providers that fall under the Central Bank’s regulatory oversight, must now also “disclose or make readily available” the fees charged by rival institutions as well as reveal the anticipated revenue increase generated by adjusting charges.

The Central Bank directive applies to fees related to deposit accounts, credit facilities or any paymentsrelated transactions using cheques, credit cards, debit cards and digital wallets. It also requires its licensees to “provide customers with a schedule outlining the estimated or forecasted change in revenue associated with each varied fee or charge”.

LEGAL NOTICE

Crossroad Fund Ltd. Registration No. 209725 B

INTERNATIONAL BUSINESS COMPANIES ACT (No.45 of 2000) In Voluntary Liquidation

Notice is hereby given that in accordance with Section 138 (8) of the International Business Companies Act, No.45 of 2000, the dissolution of Crossroad Fund Ltd. has been completed, a Certificate of Dissolution has been issued and the Company has therefore been struck off the Register. The date of completion of the Dissolution was November 1st, 2024

Liquidator

International Business Companies Act (No. 45 of 2000) In Voluntary Liquidation

LEGAL NOTICE OF DISSOLUTION

International Business Companies Act (No. 45 of 2000) In Voluntary Liquidation

Notice is hereby given in accordance with Section 138 (8) of Business Companies Act, No.45 of 2000, the Dissolution of ORINOCO has been completed, a Certificate of Dissolution has been Company has therefore been struck off the Register. The date the dissolution was the

Notice is hereby given in accordance with Section 138 (8) of the International Business Companies Act, No.45 of 2000, the Dissolution of ORINOCO SPRINGS LTD. has been completed, a Certificate of Dissolution has been issued and the Company has therefore been struck off the Register. The date of completion of the dissolution was the 5th December, 2024.

Signed: MAPCIA KATHERINE GUERRERO PARADA Liquidator

Pursuant to the Provisions of Section 138 (8) of the International Business Companies Act 2000 notice is hereby given that the above-named Company has been dissolved and struck off the Register pursuant to a Certifcate of Dissolution issued by the Registrar General on the 10th day of December, 2024. of Hiteck Holding Co. Ltd.

Consumer watchdog’s ‘huge’ three-fold complaints surge

with other agencies as well.

We do not have favouritism.

We’ve had a couple of complaints against government agencies where we’ve written to the agencies seeking resolve for consumers.”

Mr Rolle said the Commission intends to continue its “aggressive” approach to complaint resolution while building relationships with businesses and consumers.

“I think the aggressive approach that we took, and the level of success that was achieved by the team in in being able to resolve a number of the complaints, has increased consumer confidence,” he said. “So the confidence level in the work that the Commission is doing is showing and, of course, it’s encouraging, and with the support of the Government we

intend to be as aggressive in 2025 and continue to foster and build more relationships with providers and consumers.”

Mr Rolle said shipping companies were the subject of the largest number of complaints, followed by beauty supply stores, contractors and grocery stores. He added that he is encouraged by the reduction in complaints about the

construction sector, which previously had the second highest volume.

The Commission chairman said consumers are becoming more forthcoming with complaints about businesses, and the watchdog will continue to educate them about their rights and strive for a 100 percent resolution rate.

“We are going to increase the daily consumer tips.

They have helped a lot and we’ve been able to avoid a number of stuff because people now understand their rights. People are making complaints about the things that they see that’s not right, as opposed to just accepting. People are asking questions, wanting answers, and that’s encouraging for us,” said Mr Rolle.

“There’s still a lot of people that complain about

‘SLUGGISH’ BAHAMAS UNDER PERFORMS REGION BY 5% PTS

FROM PAGE B1

median of 14.3 percent.

What explains this sluggish economic performance?

“Total factor productivity (TFP), which explains technological progress in an economy, has been a key factor explaining the lack of growth in the region.

The Bahamas has been no exception.... Bahamian

TFP peaked in the 1990s and, since then, has been slowly decreasing. There is a shared downward trend with Barbados and Jamaica, meaning that a significant part of the region has suffered a decrease in TFP over the last 20 years.”

The number of Bahamian firms deemed to be innovative by the Compete Caribbean survey was pegged at 54.4 percent - a ratio significantly higher than the Caribbean’s 38.9

percent average by some 15.5 percentage points.

Weak points, though, were identified elsewhere.

“For firms planning to innovate or seriously constrained to achieve innovation, the term ‘potentially innovative’ firms is used. The Bahamas is 15 percent behind the regional average in that regard (59.3 percent). Finally, non-innovative firms account for only to 1.3 percent of Bahamian firms,” the IDB report said.

“When comparing a representative innovative, or potentially innovative, Bahamian firm with a representative innovative, or potentially innovative, firm in the rest of the Caribbean region, the Bahamian firm is significantly more productive. However, a representative non-innovative Bahamian firm is slightly

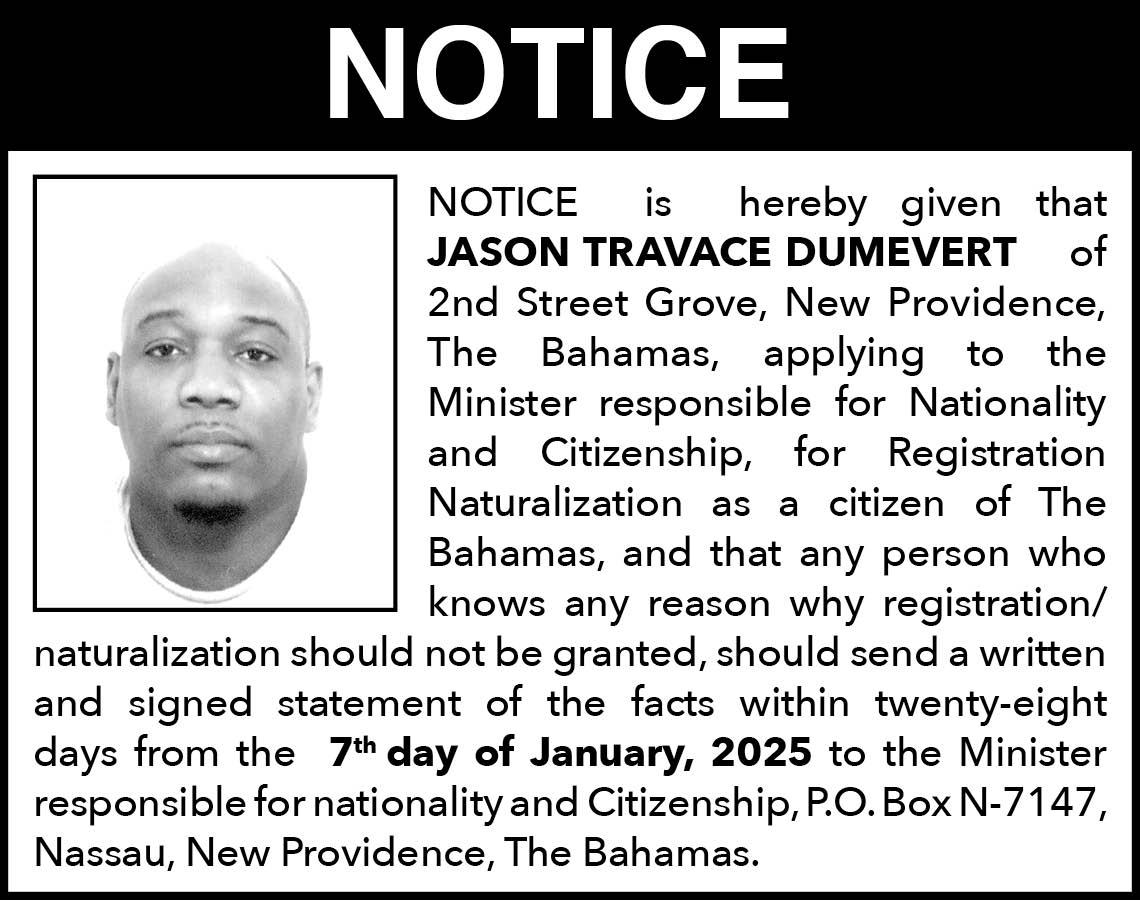

NOTICE is hereby given that PAULETTE JEAN BAPTISTE of #62 Cowpen Road, New Providence, Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 7th day of January, 2025 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

less productive than its peer in the region.”

The report defined “potentially innovative firms” as “those planning to innovate in the next two years or that identify at least one of the 14 barriers to innovation as major or very severe”. Unsurprisingly, given the Bahamian economy’s structure as a services exporter, some 94.1 percent of ‘innovative’ firms were found to be in this sector as opposed to the Caribbean average of 84.8 percent.

“As firms become less innovative, the share of services firms declines,” the IDB report said. “Larger firms play a crucial role in innovation, with the share of small and mediumsize enterprises (SMEs) decreasing as firms become more innovative - a trend

more pronounced in The Bahamas.

“Female-owned firms in The Bahamas account for 23.9 percent of innovative firms and 19.1 percent of potentially innovative firms, higher than the respective regional averages. However, the share of innovative firms led by women is lower in The Bahamas than in the region.”

When it came to obstacles to innovation, more than 60 percent of both ‘innovative’ and ‘potentially innovative’ Bahamian companies cited the local market’s size as being too small to justify the cost plus the lack of required skills and qualifications among the workforce. And almost three-quarters of companies deemed ‘innovative’ or ‘potentially innovative’ said they were unable to access

things so we want to build on the relationships and the collaboration with the other agencies, regulatory bodies, to get 100 percent satisfaction for consumers, to increase our presence, to keep increase our awareness, and to have more educational programmes and initiatives so the public is aware of their rights as consumers.”

external credit or financing sources. “It is clear that the two prevalent issues for Bahamian firms in terms of innovation are costs (implementation and financing) and skills,” the IDB assessment confirmed. “Firms trying to innovate report that they are constrained by lack of financial resources - 78.2 percent in The Bahamas versus 90.3 percent in the Caribbean.

“Around 72 percent of Bahamian firms, innovative and potentially innovative, are fully credit-constrained and 15 percent partially credit-constrained, coinciding with the regional average of 71 percent fully constrained and 9 percent partially constrained. Interestingly, only 19 percent of Bahamian non-innovative firms are fully credit-constrained versus 67 percent in the Caribbean.”

As for workforce development and skills, the report added: “Even though firms consider the qualification of employees a pervasive constraint, Bahamian workers are on par with the regional average for skilled workers as a proportion of the total workforce, with around a half of workers from all types of innovative firms being considered skilled.

“Ranking fourth is worker emigration at 29.8 percent and 41.1 percent of potentially innovative and innovative firms respectively. This phenomenon is of great importance considering that, since Bahamian workers are highly educated, their departure from the country could be associated with erosion in economic growth. This issue could be addressed by improving the quality of education and training, and, in the long-term, by attracting needed skills from abroad.”

However, sounding a positive note, the IDB assessment added: “There are a series of initiatives promoted and supported by the Bahamian government that are starting to bear fruit.” Besides the MyGateway platform, it also identified the support provided by the Small Business Development Centre (SBDC) to entrepreneurs and SMEs as further cause for encouragement.

“In The Bahamas, there is a solid foundation of companies that are either currently innovating, or planning to do so, at higher levels than the average Caribbean country. By implementing targeted and well-organised policies to eliminate current barriers to innovation and offering information and support services, the creativity of all Bahamian firms can be unlocked, allowing them to innovate and expand,” the IDB said.

“Expanding into what Bahamian firms believe to be the causes affecting workers’ skills, the most frequently mentioned is poor quality education and training by local institutions, which particularly affect potentially innovative firms (82 percent), followed by shortages of local professionals (roughly 66 percent) and lack of training in soft skills by local institutions (60.7 percent for potentially innovative and 68.4 percent for innovative firms).

NOTICE is hereby given that LEON LINDON TAYLOR of 146 Gladstone Terrace, Freeport, Grand Bahama, applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 7th day of January, 2025 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.