$5.25 $5.29 $5.46 $5.92

$5.25 $5.29 $5.46 $5.92

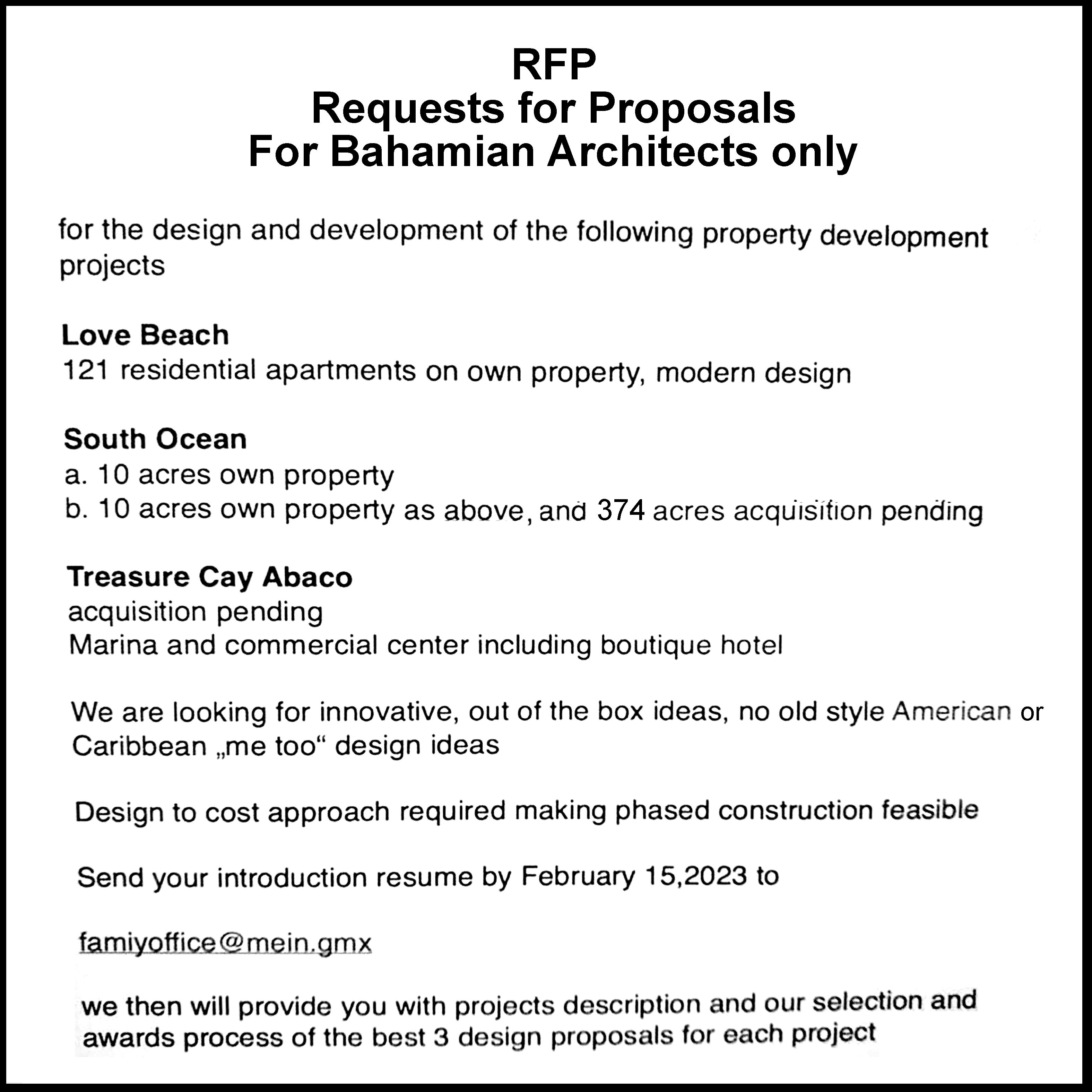

A CONTROVERSIAL Austrian is moving to draw Albany’s principal investor into a multi-million dollar legal battle over his rival bid to acquire the neighbouring South Ocean resort property.

Documents obtained by Tribune Business reveal that Dr Mirko Kovats, a Lyford Cay homeowner with permanent resident status in The Bahamas since 2017, has gained a US judge’s approval to serve subpoenas on the Tavistock Group in a bid to uncover any communications with the Government over his own South Ocean development plans.

• Move to draw main developer into South Ocean dispute

• Controversial investor: Why ‘renege’ on my agreement?

• Confirms 384-acre property caught in legal action ‘halt’

Tavistock Group is the primary vehicle for multiple worldwide investments by Bahamas-based billionaire, Joe Lewis, and is Albany’s principal developer. The two properties are south-west New Providence neighbours, and Dr Kovats

• ‘More powerful tool’ against deadbeat landlords

• ‘Power of sale’ to come before rent garnishing

says he is seeking to uncover why South Ocean’s current owner would “renege” on a purported 2014 deal to sell the 384-acre site to himself,

SEE PAGE B4

BAHAMASAIR’S

weekly jet service to Cape Haitien has been “leaving full every time” even though service to the country’s capital has been suspended from January 28, its managing director revealed yesterday.

Tracy Cooper told Tribune Business the increasing instability and deteriorating security situation in Portau-Prince had upended the national flag carrier’s Haiti business model to the extent that flights to the northern coastal city are departing with 98 percent average load factors (passenger capacity).

The demand has forced Bahamasair to deploy one of its 138-seater jets to the route, marking a reversal from when Portau-Prince would have been the prime destination and merited such capacity. The airline suspended services to the Haitian capital one day after it was reported that five Bahamians from Bahamasair were unable to leave Port-au-Prince’s

airport due to protests by police force members over gang-related killings of their comrades.

“We have suspended flights into Port-au-Prince,” Mr Cooper confirmed to this newspaper. “We did our last flight on January 28. Then the suspension went into February and it will stay in place until we can see a better situation in Port-au-Prince. But we have seen this trending for a while.

“What we were seeing is that persons were not travelling to Port-au-Prince; they were travelling more to Cape Haitien for a while.” As a result, Bahamasair had

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netTHE MINISTRY of Finance’s top official says business tenants must accurately identify their landlord to prevent 10-15 percent of real property tax bills from being returned annually to the Government without payment.

Simon Wilson, the financial secretary, also sought to reassure companies leasing their premises that the Government was likely to deploy a “more powerful tool” than garnishing their rental payments in cracking down on commercial landlords delinquent in their real property tax payments.

Many businesses have voiced concern this potential intervention in the landlord-tenant

relationship could leave them in breach of lease agreement obligations when it comes to rental payments, but he revealed the Department of Inland Revenue will likely first turn to enhanced “powers of sale” granted in the Real Property Tax amendments that passed with last May’s Budget.

THE GOVERNMENT’S latest fiscal forecasts yesterday provoked contrasting reaction, with a governance reformer saying he “truly loves” the growth focus but the Opposition’s finance spokesman pointing to “credibility problems”.

Hubert Edwards, the Organisation for Responsible Governance’s (ORG) economic development committee head, told Tribune Business that the Davis administration’s concentration on expanding the Bahamian economy as the primary means of solving

the nation’s ills was “the right direction which needs to be followed”.

While acknowledging that the Government’s growth and fiscal targets were ambitious, he added that they “need to be” given The Bahamas’ economic challenges. The ORG chief also said the private sector, in particular, needs to understand how the forecasts were derived and emerge with “a clear message” from the Fiscal Strategy Report 2022 debate - supposed to begin in the House of Assembly today - so it understands the part it has to play.

SEE PAGE B7 SEE PAGE B9

There is no doubt that remote working will continue to grow. With remote work becoming a significant business practice, it has quickly risen to the top of many executives’ agendas and become a vital component of talent attraction, employee retention and staff satisfaction.

According to Deloitte & Touche’s Global Remote Work Survey, “over 80 percent of organisations have implemented some form of remote work policy”.

The term telework (remote work) refers to the use of information and communications technology (ICT) to perform work outside of the employer’s location. It is important to note that although telework can refer to mobile working from anywhere other than an office, it is most common

Derek Smith Byto work from home. Working from home, also known as telework from home, is the focus of this article.

Assessment of the risk

In order to fully benefit from remote and hybrid work, and to minimise

potential risks, companies must establish a clear understanding of their corporate risk tolerance and then determine which safeguards must be put in place to enable this while balancing risks. Working across functions and taking a broad view is essential when embedding a successful remote working model. A holistic approach to building a compliant and operational workforce strategy will require working with your leadership and co-ordinating across all stakeholders (tax, compliance, global mobility, talent, human resources, payroll, legal, data privacy and technology) to articulate and align priorities. The following two steps can help you get started.

* Assess your human capital risks. This assessment should be quantitative and

not merely anecdotal. Analyse and identify compliance risks and downstream impacts (tax, payroll and rewards). In the end, an effort will be made to use the key findings to develop policies and processes that will help manage long-term risks.

* Know employee jurisdictional locations. Keeping track of employee locations, what they do, and how much time they have been doing it for is imperative for any company. Persons working under the radar in new and different jurisdictions face significant tax, corporate responsibility and Immigration issues.

Maintain a long-term talent strategy According to the article, Building a game changing talent strategy, which was published in the Harvard Business Review: “The best

talent policies respond to changing conditions on the ground, and to cultural differences across the globe.”

Potential strategic touch points include, but are not limited to, talent reviews and succession planning, networking and collaboration tools, and prioritising leadership behaviours that matter.

Conclusion In short, remote work and new ways of working can greatly enhance a company’s focus on its staff, agility, resilience and sustainability. In parallel, leaders are beginning to recognise the importance of a balanced approach. To prevent a variety of significant risks for both employees and employers, certain controls should be implemented. Implementing strategic enablement strategies aligned with a

company’s enterprise and business goals is an important aspect of making remote work successful.

• NB: About Derek Smith Jr

Derek Smith Jr. has been a governance, risk and compliance professional for more than 20 years. He has held positions at a TerraLex member law firm, a Wolfsburg Group member bank and a ‘big four’ accounting firm. Mr Smith is a certified anti-money laundering specialist (CAMS), and the compliance officer and money laundering reporting officer (MLRO) for CG Atlantic’s family of companies (member of Coralisle Group) for The Bahamas and Turks & Caicos.

AN EXUMA busi-

nessman yesterday said

The Bahamas must do better at maintaining its

infrastructure after a $34m contract was signed to upgrade the island’s international airport Ramon Darville, Darville Lumber’s general manager, told Tribune Business “it does not make any sense” to spend such money on

Exuma International Airport if the facility does not receive annual maintenance once the work is completed.

He spoke after Ministry of Works yesterday awarded Bahamas Hot Mix (BHM) a $34.245m contract for airside construction

works at the airport, which includes rehabilitation works for aircraft aprons, taxiways and the runway; new taxiway installation; fencing and drainage; lighting and electrical; navigational aids and runway markings.

Mr Darville said: “I don’t know how many people they intend to hire for this project, but we definitely need to keep some of them on for maintenance after the work is done. That’s all I’m going to say. If you are going to spend $34m, but five years later you have nothing......

“We have a lot of planes coming in here and the airport was getting very crowded. With this new airport we will have a lot of people coming down here now. We have a lot of second homeowners coming in and a lot of tourists. This is a big boost for the island, and now we also are expecting British Airways to come in here, too, along with Delta and American Airlines.”

O’Brian Strachan, owner/ operator of Strachan’s Service Station, said of the $34m contract award: “They have to get it started now, or else it is just talk. This is good news if this contract is going to start. We need to get this airport moving; we need to get this started. We’ve needed this airport for a while now. This island has outgrown this old airport a long while ago, and this new airport

is a great enhancement for the island.”

The Hon. Alfred Sears, Minister of Works and Utilities, led the signing ceremony in the conference room of the Ministry of Works and Utilities (MOWU) JFK. Among others, the contract includes pavement rehabilitation works for apron, taxiways and runway, new taxiway installation, fencing and drainage, lighting and electrical, navigational aids and runway markings.

Representatives from various agencies attended the ceremony including Luther Smith and Reginald Saunders, Permanent Secretaries; George Hutcheson and Dr. Kenneth Romer, Directors; Charlene Collie, project engineer and members of the Project Execution Unit of the MOWU; officials from the MOWU, the Inter-American Development Bank (IDB), the Ministry of Tourism and Aviation (MOTIA), the Ministry of Finance, Integrated Building Services, the Department of Aviation, the Airport Authority and the Civil Aviation Authority.

The contract awarded to Bahamas Hot Mix is part of the Government’s drive to upgrade airport infrastructure throughout the Family Islands. The airports at North Eleuthera, Marsh Harbour and Treasure Cay, Abaco, are also scheduled to receive upgrades as part

A PAYDAY lender yesterday said it has developed the staff and infrastructure necessary to expand into providing private sector employees with credit.

Ruthie Knowles, Easy Payday’s general manager, said the adoption of new technology has enhanced the company’s loan processing capabilities such that it can now move beyond extending credit only to public sector workers. She said: “We have been turning down customers from the private sector for years, but we now have the infrastructure in place. We have well-trained staff and have invested in a new

loan platform that can adequately service an increased loan volume.”

The lender offers loans up to $30,000 for government employees, and $5,000 for privately-employed individuals with a minimum five-year employment record with their current employer. Ms Knowles indicated that the loan limit for private employees may increase as the company develops this business line.

She said: “Over time we will update policies on the current credit limit and loan term. During this initial introduction, we are seeking to assist persons who have been stable with one employer for at least five years.”

Felanique Capron, an Easy Payday employee,

of efforts to improve air transport connectivity and the flow of tourists to the Family Islands while also making critical infrastructure assets climate resilient.

Besides improving operating procedures, safety management, emergency response plans and the Bahamas Airport Authority’s internal capabilities, the redevelopment works will also raise the selected airports to International Civil Aviation Organisation (ICAO) standards.

Alfred Sears KC, minister of public works and utilities, said at the Hot Mix contract signing that the works are being financed with an Inter-American Development Bank (IDB) loan. “The Family Island air transport infrastructure is in need of improvements to comply with international aviation standards, and to achieve a resilient stock of infrastructure against climate change,” he said.

“The IDB supports this improvement process given the bank’s experience in air transport infrastructure.” Mr Sears said Exuma International Airport was in need of investment and requires a wide range of upgrades. He added that security deficiencies, including visual aids, lighting and marking, mobile equipment, the layout of the runaway, apron and taxiways, impose a risk to the

said the major distinction between Easy PayDay and traditional lending institutions is the customer service and one-hour turnaround. She said: “Our customer service is superb, as well as the turnaround time. Based on the feedback from customers, our turnaround time is amazing. Our loans are quick, fast and easy.” Easy PayDay has been operating since 2004, and participates in various philanthropic activities. Ms Knowles said: “Easy PayDay has a foundation that makes annual donations to various charitable organisations, and some individuals that meet our policy criteria.

“Last year, December, we also donated computers and printers to two schools. Currently, we are in the process of donating building supplies to renovate a building on a Family Island to be used as a computer lab for students.”

FTX’s Bahamian liquidators will next Wednesday seek US legal recognition that will enable them to conduct investigations and pursue the local subsidiary’s assets held in the United States.

Brian Simms KC, the Lennox Paton senior partner, and PricewaterhouseCoopers (PwC) accountants, Kevin Cambridge and Peter Greaves, on Saturday filed legal documents confirming their bid for Chapter 15 status is to be heard before Delaware Bankruptcy Court judge, John Dorsey, on February 15.

Obtaining recognition as a so-called “foreign main proceeding” under US bankruptcy law is a vital first step in the trio’s efforts to take control of, and

protect, assets that belong to FTX Digital Markets, the collapsed crypto exchange’s former Bahamian subsidiary, and its creditors/ investors.

In particular, gaining such recognition will give the Bahamian liquidators standing to begin negotiations with the US Justice Department over the $143m seized by the latter from FTX Digital Markets’ accounts held at two US banks. It will also give the trio’s bid to track and trace other assets full legal force, as the two banks holding the $143m - Silvergate and Moonstone - both declined to hand the funds over to the liquidators without a supporting order from the US courts.

The Bahamian liquidators, in their legal documents, asserted that Chapter 15 recognition was vital “to protect FTX Digital, its creditors and other parties” as well as “preserve

the value of assets” belonging to the failed crypto exchange and its former clients and creditors.

Asserting that they have “demonstrated that there is a material risk that FTX Digital will suffer irreparable harm” without Chapter 15 recognition, the trio submitted a proposed recognition order to the Delaware court that - if granted - will see “all of the property of FTX Digital within the territorial jurisdiction of the US entrusted to the joint provisional liquidators, and the joint provisional liquidators are appointed as the exclusive representatives of FTX Digital”.

“The joint provisional liquidators are hereby authorised to examine witnesses, take evidence and seek the production of documents concerning the assets, affairs, rights, obligations or liabilities of FTX Digital to the full extent

provided to a debtor-inpossession,” the proposed Order states.

A major potential obstacle to Chapter 15 recognition was removed by the Bahamian provisional liquidators’ co-operation deal with FTX US chief, John Ray, and his team, which ended two months of hostilities during which the latter sought to impugn The Bahamas’ reputation and integrity - including that of the Government, Securities Commission and liquidators - in what seemed to be an effort to ensure Delaware took control of the crypto exchange’s global winding-up.

The two sides’ agreement obliges each to seek judicial recognition and approval of the agreement in their respective Bahamian and Delaware courts, and one aspect involves a commitment by Mr Ray and his team not to oppose the bid for Chapter 15 recognition.

The US Justice Department, in legal filings seen by this newspaper, is arguing that it was entitled to seize the $143m held at the US banks because they - and FTX Digital Markets - were not covered by any freeze or stay as they were outside the Chapter 11 bankruptcy protection proceedings.

“The United States has seized..... approximately $56m in US currency and 87 million euros from accounts at Moonstone Bank and Silvergate pursuant to judicially authorised seizure warrants issued in the southern district of New York,” the Justice Department said.

“The debtor [FTX Digital Markets] has asserted an interest in some or all of the seized assets. The automatic stay does not apply to the US actions, however, because the seized assets are not property of any bankruptcy estate as this is a Chapter 15 case. Even if

there is an automatic stay in place, the seizures were permissible because they would be governed by the criminal and/or police or regulatory power exceptions to the automatic stay.”

Tribune Business previously reported that FTX Digital Markets had more than $93m on deposit with Silvergate Bank, an institution well-known for providing services to the crypto and digital assets industries, with the remaining near-$50m balance held at the 26th smallest bank in the US, Moonstone Bank.

The latter is headed by Jean Chalopin, also chairman of Lyford Cay-based Deltec Bank & Trust. The Bahamian bank has repeatedly denied any ties to Moonstone, asserting that the only connection is the common shareholdings of Mr Chalopin.

GRAND Bahama Port Authority (GBPA) licensees are “reluctant” to see the Government take over responsibility for Freeport’s governance, the island’s Chamber of Commerce president says.

James Carey, speaking after this newspaper reported that the Davis administration is exploring its options for causing change at the GBPA, which could include a return of the latter’s quasi-governmental and regulatory functions to Nassau, said licensees he had spoken to instead want the Port Authority to become more active.

“Right now, the licensees don’t have a definitive position because everything is

still up in the air,” Mr Carey said. “I shouldn’t call this a consensus, but some of the licensees I have spoken with, generally they give the consensus that while they want things to happen and want the GBPA to be more proactive in making things happen, there’s a reluctance for the government to take over.”

Rupert Hayward, grandson of former GBPA co-chair, Sir Jack Hayward, subsequently pledged “an ambitious masterplan for change” to create “thousand of jobs” in Freeport as he backed efforts “to reimagine and revolutionise” Freeport’s quasi-governmental authority.

“I like how he (Mr Hayward) is affable to working with the Government, but he is not suggesting giving up the GBPA,” Mr Carey said. “I didn’t read into it that he is giving up

the GBPA, through sale or through any other way. Essentially he is saying to the government to ‘let’s work together’.” “I can’t imagine that he is bluffing unless this thing has been happening in the background for quite a while,” the GB Chamber chief added of Mr Hayward’s “master plan”. “I can’t imagine a plan of any consequence being put together so quickly. Because there is going to be a hell of a lot that has to be put into it, from legalities to all of the niceties, because there is a lot of stuff that has to be done. So I can’t imagine anything being put together so quickly.”

While providing no specifics, Mr Hayward told this newspaper he has already submitted “a new partnership” proposal that “can attract billions of dollars in investment [and] create

thousands of jobs” for Freeport and the wider Grand Bahama to the Davis administration.

The Government is presently examining whether change at the GBPA is best achieved through either a private buyer acquiring the Hayward and St George families’ ownership interests, the Government doing itself or the regulatory and quasi-governmental powers being devolved back to Nassau.

Mr Hayward’s statement indicated he is seeking to restructure the GBPA and its relationship with the Government such that the latter has more say over Freeport’s running

and future through “a true Public-Private Partnership” that represents the interests

of all parties including city residents and GBPA licensees.

ditching him in favour of a rival agreement with Albany’s investors.

The Austrian’s filings detail how he has been able to “halt” Albany’s plans to develop South Ocean, one of New Providence’s last remaining large-scale resort parcels, by initiating legal action currently before the Bahamian Supreme Court against the property’s current owner/vendor, the Canadian Commercial Workers Industry Pension Plan (CCWIPP).

“I have been able to halt the purchase and development of the property [South Ocean] by the Tavistock Group... for the time being by the filing of the legal action against the Canadian pension plan and its trustees,” Dr Kovats alleged in a January 13, 2023, filing with Florida’s middle district court.

Setting out the rationale for seeking to serve subpoenas, he claimed: “I believe it would be relevant to this

litigation to discover what, if any, communications Tavistock Group may have had with the Canadian pension plan such that it would renege on the purchase agreement that Bahamas Island Consortium had with it, and eventually lead to the agreement that was subsequently entered into between the Canadian pension plan, Tavistock Group and the other joint venture partners more recently to develop the South Ocean property.

“I believe that the Tavistock Group may have been in communications with the Bahamian government such that they [the Government] have linked the approval of the Treasure Cay property development with demands on me to scale back on my development plans for the South Ocean property to benefit and accommodate the Tavistock Group-owned Albany development.”

Dr Kovats’ conspiracylaced inference was not supported by any evidence.

The reference to Abaco’s Treasure Cay property alludes to the Judicial Review action, which he has already launched against the Government seeking an extraordinary $3.127bn in damages after it refused to grant the necessary approvals for that separate acquisition.

The Austrian is alleging that the Government is linking the two resort disputes together rather than treating them as separate issues. He claims that he has already slashed the size of his proposed South Ocean development by 60 percent, from 1,600 rooms to 640, “in order to accommodate” Albany.

US magistrate judge, Daniel Irick, granted Dr Kovats’ bid to serve the subpoenas on Tavistock Group on February 1, 2023, although he left the door open for the latter to subsequently challenge his order. The action was initiated in Florida’s middle district court on the basis that

Tavistock Group is domiciled there.

Multiple sources have suggested that the Austrian investor often resorts to strong-arm legal tactics in a bid to obtain leverage in business disputes. He is alleging that a $70.5m deal to purchase South Ocean was agreed with CCWIPP on June 25, 2014, but that the Canadian pension fund subsequently breached a binding sales agreement by failing to consummate the deal.

Documents included among Dr Kovats’ Florida legal filings show South Ocean was subsequently placed back on the market, and advertised for sale, on March 28, 2017, by CBRE, the international real estate firm. Greg Cottis, the Austrian’s Bahamian attorney, submitted an “as is” offer to acquire the project for $21.25m, a sum almost 70 percent less than what he offered in 2014, on the April 28, 2017, bid deadline.

However, it apparently took Dr Kovats more than three years to find out his offer had been unsuccessful. He wrote to Paul Weimer, CBRE’s senior vice-president, on Friday, June 19, 2020, saying: “Having asked several times, but I never give up. Any news regarding acquisition? As you know, always interested. Let me knew.”

This drew a terse response from Mr Weimer, who said simply: “Albany owns it, OK, now.” Dr Kovats, though, in his January 2023 legal filings questioned why CCWIPP had ultimately ditched him for a new deal with Albany/ Tavistock Group when he had beaten the latter out to be selected as preferred bidder in 2014.

“At the time of the original bidding for the South Ocean property in 2014, one of the competitive bids

came from a joint venture between the Tavistock Group, which developed Albany, and Och-Ziff, the hedge fund and asset manager with over $40bn in worldwide assets,” the Austrian alleged. “As previously advised, my bid through Bahamas Island Consortium was selected as the preferred bidder, leading to the purchase agreement which the Canadian pension plan reneged on.”

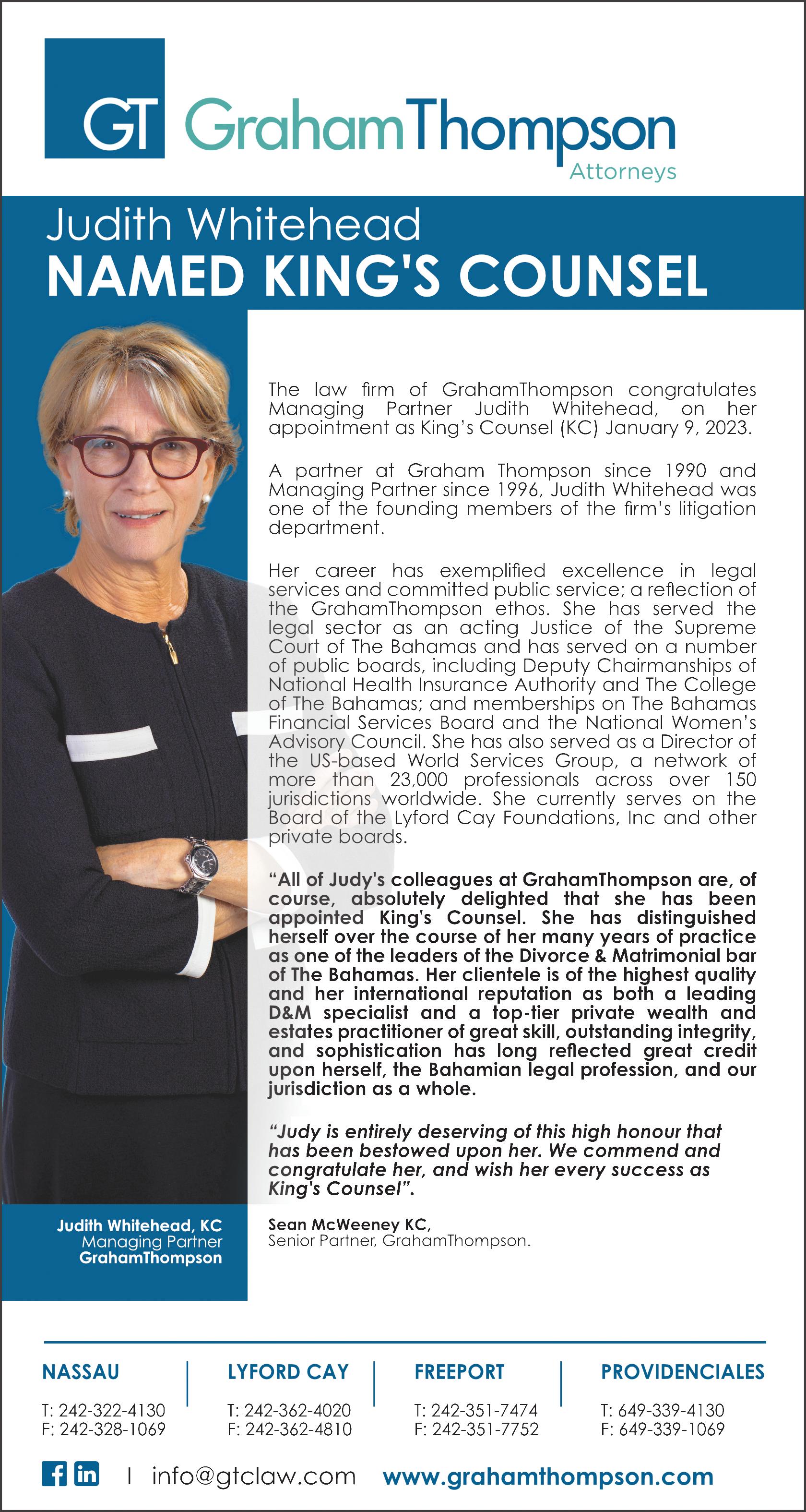

CCWIPP, which is being represented by Graham, Thompson & Company, sought to have Dr Kovats’ action struck out on the basis it was “frivolous, vexatious and amounts to an abuse of the process of the court” because there was never any legally binding sales contract between the two for South Ocean. However, acting justice Tara Cooper-Burnside declined to do so and the matter is now headed for a full trial on the claim’s merits.

The concern here for The Bahamas is that prime tracts of real estate, extremely valuable for driving future resort development, investment and job creation, face being potentially tied-up for years in expensive, time-consuming court fights. The Canadian pension fund, which took over South Ocean after Ron Kelly defaulted on his loan repayments, then closed it in 2004 has been seeking to exit its last remaining Bahamas resort investment for almost two decades.

Besides Tavistock Group and Mr Lewis, Albany’s principals also include golfers Ernie Els and Tiger Woods, and singer Justin Timberlake. The Tavistock Group subpoena is merely the latest stop in Dr Kovats’ subpoena tour, which has already taken him to the Delaware and south Florida courts. In the latter, he has also persuaded a judge to approve subpoena service on Southern Cross and its affiliates, the group owned

by Australian golfer, Greg Norman.

by Australian golfer, Greg Norman.

And, in Delaware, he is seeking to obtain evidence from CBRE and Electra America, the failed Grand Lucayan purchaser. The latter, through, its attorneys, indicated in February 1, 2023, court filings that it also intends to provide documents in response to Dr Kovats’ request. This newspaper, though, was told that Albany and its principals have not walked away from the deal, and are instead watching and waiting to see how the legal battle with the pension fund plays out.

Dr Kovats has attracted controversy in Austria throughout his business and investing career, despite building his publicly-listed industrial group, A-Tec Industries, into a conglomerate that once featured over 70 companies and more than 10,000 employees, with turnover pegged at more than one billion euros.

Numerous companies he was involved with early in his business career became insolvent, and Dr Kovats has faced numerous civil lawsuits during his business career, being criminally indicted twice. He was sentenced to six months’ probation in 2000 by the Vienna High Court over the bankruptcy of a nightclub he had invested in. Dr Kovats was also charged over another nightclub insolvency in 2007, although he was never convicted.

Tribune Business’s own research also found that Dr Kovats and a fellow executive were fined by Austrian regulators in 2012 for providing misleading information to the capital markets, thus harming investors. Following a two-year period of turbulence that began in 2011, A-Tec moved to restart business activities in 2013, after undergoing a reorganisation.

Notice is hereby given, in accordance with Section 218 (1) of the Companies (Winding Up) Amendment Act, 2011 that the above-named Company is in dissolution, which commenced on the 25th day of January A.D. 2023. The Voluntary Liquidator is Dwain Wallace of the Eastern District of the Island of New Providence one of the Islands in The Commonwealth of The Bahamas. All persons having claims against the above-named Company are required to send their name, address and the particulars of their debts or claims to Whiteleaf Law Chambers, 83 Dowdeswell Street, New Providence, The Bahamas to the attention of the Voluntary Liquidator of the Company on or before the 18th day of March A.D. 2023 or, in default thereof, they may be excluded from the benefit of any distribution made before such debts are proved.

Dated this 6th day of February A.D. 2023

Dwain Wallace VOLUNTARY LIQUIDATORThe global economy has been on a roller coaster ride since the start of 2020. First, we had COVID and the lockdowns, with economic activity almost coming to a standstill. Then came the euphoria of the reopening, which followed the success of the global vaccination programme. However, it was not long before inflation appeared on the radar of policymakers.

After decades of price stability, double digit inflation returned to developed economies, caused by supply chain bottlenecks, excessive pandemic-era savings and a very tight labour market. The return of this old foe forced central banks to sharply raise interest rates. Against this background, and with the added headwinds of the war in Ukraine, most analysts expected the modest economic expansion of 2022 to give way to a recession in 2023.

However, the prospects of a recession in Europe and the US now seem less likely. There are several reasons for this optimism.

These include China’s abandonment of its unsustainable zero-COVID policy; the stabilisation of inflation and expectations of less hawkish central banks; falling energy prices in Europe; and the positive impact of President Joe Biden’s Inflation Reduction Act on US economic growth.

With the end of its ‘zero COVID’ policy, China reopened for business. This was a development that surprised many and had a positive impact on international trade. Additionally, the country’s abandonment of ‘zero COVID’ demonstrates a commitment to long-term economic stability, which will help to further strengthen the global economy.

Inflation is a major concern for policymakers, and central banks reacted to its return by implementing restrictive measures, such

as halting asset purchases and increasing interest rates. These policies have since delivered the desired results, slowing down the rise in consumer prices.

As a result, the interest rate-hiking drive of the past 12 months is likely to come to an end by the summer, earlier than previously expected. This pivot will stimulate economic growth, as lower interest rates make it easier for individuals and businesses to borrow money and invest in the economy.

Energy prices play a significant role in the global economy, and steep rises increase the cost of goods and services, leading to inflation and a slowdown in economic activity. With Russia’s invasion of Ukraine, energy prices in Europe reached historical maximums, threatening the economic stability of the continent. However, a mild

PUBLIC NOTICE OF INTENDED APPLICATION FOR A GRANT OF LETTERS OF ADMINISTRATION

IN THE SUPREME COURT

PROBATE DIVISION

In the Estate of CAROLIE LEGORIA WILSON, late of Providenciales, in the Turks and Caicos Islands, deceased.

NOTICE is hereby given that I BRENDALEE LUTISHA

MATTIO of Venetian West, in the Western District of New Providence one of the Islands of the Commonwealth of the Bahamas will make application to the Supreme Court of the Bahamas after the expiration of fourteen days from the date hereof, for a grant of Letters of Administration of the real and personal Estate of CAROLIE LEGORIA WILSON late of Providenciales, in the Turks and Caicos Islands, deceased.

BRENDALEE LUTISHA MATTIO

Intended Applicant

winter lent a helping hand and energy prices started to fall and are now below preinvasion levels. This will help to mitigate the risk of a recession and boost the economic prospects of the old continent for 2023.

The Inflation Reduction Act (IRA) is a deceptively named piece of legislation. Its main purpose is not to reduce US inflation, but to stimulate growth by investing and subsidies,

mainly in the renewables sector. The Act’s deployment is expected to provide a shot of adrenaline to the US economy, promoting sustainable growth and having a positive impact for years to come.

However, despite the improved outlook, dark clouds still linger on the horizon. The war in Ukraine continues to generate geopolitical instability, and could trigger

further volatility in energy and food prices. Labour markets across the western world remain extremely tight, pushing up salaries and feeding inflation. Finally, globalisation as we have known it for the last 30 years is over. International trade shrunk and protectionism is on the rise. And this rise in protectionism is perhaps the greatest medium-to-long-term threat to global prosperity.

available online on the Electronic Recruitment Application (ERA) located on the following website: https://bs.usembassy.gov/embassy/jobs

amendments that passed with last May’s Budget.

Clause nine of those reforms expands “the power of sale for all tax arrears” to every property category apart from owneroccupied homes beneficially owned by Bahamians, thus giving the Government the ability to sell underlying real estate asset to recover real property tax debts if the relevant taxpayer proves reluctant to pay or settle.

Asked about tenant fears related specifically to the “garnishing” of rent to recover a landlord’s property tax debts, Mr Wilson replied: “Why should the Government do that when it can sell the property? Why garnish the rent to the landlord if we can sell the underlying property?

“Yes, we have that provision [rent garnishing] in law, but that was passed into law prior to us simplifying the sales provision in the Property Tax Act. We know we have a more powerful tool, which is the power of sale. If there is someone who is reluctant or does not want to pay property tax, why would the Government want to garnish the rent to

the landlord if it can simply sell their property?”

The Davis administration earlier this year requested that all businesses provide the real property tax assessment number for the building from which they operate even if they are merely tenants, while warning that failure to do so could delay or impact the processing of Business Licence renewal submissions.

The joint objective of the Ministry of Finance and Department of Inland Revenue was two-fold - to boost both Business Licence and real property tax revenue. By better matching business tenants to their commercial landlords, the tax authorities’ goal is to detect those among the latter who lack the necessary Business Licence for the activities they are conducting and thus clamp down on such tax dodging.

Companies were assured their landlord’s existing real property tax arrears will not impact Business Licence renewals. And, if the latter proved uncooperative in providing the relevant property tax assessment number, the Department of Inland Revenue reassured that a name and location/address of the tenant’s business is

sufficient to cross-reference with the property tax roll.

“That’s where this confusion about the Business Licence doesn’t make any sense,” Mr Wilson added.

“All we want to do us update our registry and tax roll. Between 10-15 percent of property tax bills issued are returned because we don’t know who the owner is. That’s our concern. Our message is we have a range of tools. The garnishing provision is indirect. Why use the indirect approach if we have the power to do it directly now?”

The financial secretary’s comments will likely cause some relief for business tenants worried about the implications for their landlord relationships if the Government moves to seize all, or a portion, of their rental payments to settle real property arrears.

Mark A Turnquest, president of the 242 Small Business Association and Resource Centre, told Tribune Business the Government needs to “bite the bullet” and deal directly with the delinquent taxpayer - the landlord - rather than bring tenants into the middle of their dispute.

“We don’t want to be between the Government and taxpayers,” he said.

“It’s very difficult right now to operate a business because of the light bill hike, minimum wage increase and resulting NIB contributions increase. We’re too busy trying to stay in business. There’s too much red tape, and some of my members and clients are indicating that landlords are not receptive to this.

“If they have to give some of their rent to the Government, some of the landlords are indicating they will find them in violation [of their rental agreements]. They are not saying it explicitly, but that’s their posture. They said that implicitly. The 242 Small Business Association’s stance is not to get the small businesses involved with the Government’s tax collection and policies when it comes to property tax payments.

“Some are saying the landlord is implying indirectly they’ll kick them out,” Mr Turnquest added over the possibility of “garnishing” rents. “The legal agreements are between the landlord and the tenant. The landlord will tell the tenant right now: I ain’t pay the Government, and don’t want you to be taking rent to pay the Government. You can leave’. That’s the position for at least 40

percent of our members indirectly.” While acknowledging that his members and clients had encountered few problems obtaining property tax assessment numbers from landlords, Mr Turnquest continued:

“What the Government needs to do is directly do what it has to do with the taxpayer, the owner of the taxable building, and go directly to the landlord and deal with them directly.

“When the landlord is going to kick them out, who is going to help them?

The Government needs to what it has to do, bite the bullet, use its legal powers and deal directly with the landlord. The Government should never be putting the burden on the small business owners right now

because we are dealing with too much.

“We have problems with inflation, National Insurance Board increase from our employers contribution because salaries went from $210 to $260, so we don’t need any additional stress. So the Government should deal with the landlord and put them in court rather than putting small businesses in the middle of this.”

The 242 Small Business Association and Resource Centre is seeking a “seat at the table” with the Government so their concerns can be heard, while also assisting with any initiative the Government is trying to accomplish in addition to lobbying for the implementation of a Small Business Act.

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

already prior to the suspension reduced seat capacity to 50 on the Port-au-Prince route while allocating the 138-seat jet to the northern coastal city.

“Flights are going relatively full,” Mr Cooper said.

“From December, they’ve had 98 percent load factors, leaving full every time. What we have done is taken Port-au-Prince and moved it to Cape Haitien. Back in the day Port-au-Prince was the premier route, but definitely no more, especially at the moment.”

The Bahamasair chief also disclosed that the national flag carrier is actively seeking to lease another jet to help service proposed new routes to Caribbean destinations, Antigua & Barbuda and Barbados, which could launch during summer 2023.

Confirming the plan, and that governments in

both those nations had approached Bahamasair about starting service, Mr Cooper said: “We’re looking at... it wouldn’t be anything in the first quarter. If we do anything it will probably be in the summer.

“Flights would start from The Bahamas, go to Florida and go down into the Caribbean. The reason why is that we probably have to acquire another aircraft to make it all work. We’re actively doing that now.”

Mr Cooper said Bahamasair hopes to catch, then surpass, its pre-COVID record performance of 2019 during 2023 while also meeting the Government’s expectations in terms of cutting the taxpayer subsidies that the airline receives.

“We did relatively well for the Christmas period. We met expectations as related to our Budget,” he told this newspaper.

“For Christmas, for the US flights, we were having over 80 percent load

INTENT TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, JEAN ROMMEL AUGUSTIN of New Providence, Bahamas, intend to change my name to JEAN ROMMEL DEROUILLERE If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Officer, P.O.Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice.

NOTICE is hereby given that SEAN MAC LOUISIUS of Washington Street, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 6th day of February, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE is hereby given that WILDES LOUISDOR of Carmicheal Road, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 6th day of February, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE is hereby given that SHAMIKA LAUREN RUSSELL of P.O. Box EE-15052 #23 Corolita Lane, Culmer’s Vill, New Providence, Bahamas is applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 30th day of January 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

factors. December 2019 and December past were comparative. The months before were still slightly below the COVID numbers so we expect that in 2023 we will be matching 2019’s highs.”

Describing the deputy prime minister’s forecast that 2023 tourist arrivals will hit the eight million mark, a 14 percent jump on last year’s numbers, as “very interesting”, Mr Cooper continued: “We are feeling the expectation of the fact that as well we think that it will be a better year. Right now we’re saying we’re reaching for the comparative numbers from 2019.

“2019 was the best year we’ve had, and we’re trying to reach there and move on. The projections from the Ministry of Tourism are quite encouraging.” Bahamasair also relies heavily on citizens and residents travelling, which contributed heavily to the airline’s December showing.

“Bahamians were doing a lot of the Santa Claus stuff in December,” Mr Cooper said. “Based on that, we expect that Bahamasair has recovered as the travelling Bahamian market has recovered. The numbers the Ministry of Tourism is talking about are tourists and, combined with the fact there were healthy Bahamian movements in December, we see that 2023 is going to be good. 2022 wasn’t bad; we just didn’t hit 2019 numbers, but are moving in the right direction.”

Mr Cooper said Bahamasair was now finalising its budget numbers and forecasts for the 2023-2024 financial year, which begins on July 1 in line with the Government’s fiscal year.

The national flag carrier is due to receive a $32m taxpayer subsidy in the current 2022-2023 period, according to last May’s Budget, with this number projected to shrink to $21m next year and to $19m in 2024-2025.

“With the new budget numbers for 2023-2024 we intend to reduce the amount of subsidy needed from the Government,” Mr Cooper added. “We’re not finished with the budget yet, it will probably be finalised some time in March. Needless to say we hope it

will be to the Government’s expectations. We know what the Government is looking for and will try to make that.

“Domestic travel is always a little bit behind the international. In a lot of locations the population is not enough to drive key flows, and we’re doing flights more from a transportation standpoint. The domestic market tends to be a bit lower. We tend to see, according to what time of year it is, anywhere from 50-60 percent load factors.”

INTENT TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, JULIAN PURSUSE FORBES of Grand Bahama, intend to change my name to JULIAN PURSUSE MCKENZIE If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Officer, P.O.Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice.

The Fiscal Strategy Report shows the Davis administration is betting that growing The Bahamas to a $16bn-plus economy, based on nominal annual gross domestic product (GDP), will be sufficient to drive the necessary revenue growth that will finance the forecast increase in government spending as well as generate an annual Budget surplus of more than $200m for the three years from 2024-2025 onwards.

This will also enable the Government to avoid imposing new and/or increased taxes, and there was no mention of any such measures in the Fiscal Strategy Report, with the revenue-side focus placed almost entirely on compliance, enforcement and cracking down on tax cheats and bill duckers. The GDP increase is also essential to cutting the country’s debt-to-GDP ratio from the present 85.8 percent to 67.1 percent by 2026-2027.

However, this will only become reality if the Bahamian grows by 20.9 percent in nominal GDP terms between this fiscal year and 2026-2027. This would take economic output from

HUBERT EDWARDS$13.236bn to $15.996bn, an increase of more than $2.7bn over four years, using a measure that does not strip out the impact of inflation.

“That is positive thinking, and is certainly the way we need to think,” Mr Edwards told Tribune Business yesterday. “I truly love the direction, no question about it. After the debate, I would expect we would walk away with sufficient information to understand why they are projecting the numbers they are projecting, and there’s a very clear message to be embraced by the private sector.

“This level of growth will not be driven by the public sector. There needs to be an

unequivocal message that the private sector can go out and embrace in its planning. If we have any uncertainty over this, what is going to be driving this, if there are taxes in the background, it could impact investment decisions. If there’s uncertainty, persons will sit back and wait until they have a clearer view. We’re looking forward to getting a very clear view of how this is going to transpire.”

Mr Edwards said there were several things that “jump out when you drill down” into the Fiscal Strategy Report’s numbers. The Government is forecasting that it will grow its revenues by some 43 percent to over $4bn during the next four years - a $1.2bn increase, and a near-$1.4bn rise compared to the $2.609bn collected in 2021-2022.

He pointed out that the magnitude of the increase, especially in percentage terms, which is designed to achieve a 25 percent revenue-to-GDP ratio, suggests “some tax treatment taking place” or some measures in fees to help drive the Public Treasury’s income beyond gross domestic product (GDP) growth.

And the economic growth projections themselves

were also ambitious given that they “outstrip our historical growth rates of anywhere up to 2 percent”.

The Fiscal Strategy Report acknowledged International Monetary Fund (IMF) growth forecasts showing that GDP expansion in real terms, which strips out inflation, will drop back to its long-run average of 1.9 percent and 1.6 percent, respectively, in 2025 and 2026.

Mr Edwards said some of the growth areas targeted in the report focus on areas such as energy, workforce skills and productivity and the ease of doing business - all areas that require fundamental reform, with an impact that could lag. And it was also difficult to determine how the so-called “transformation sector” will deliver the forecast $800m growth between this fiscal year and 2026-2027. The “transformation” sector was said to include total output from industries such as “manufacturing, construction, agriculture, forestry, fishing, mining, gas, water, quarrying and electricity production” by the Fiscal Strategy Report.

Meanwhile, Kwasi Thompson, the Opposition’s finance spokesman,

yesterday argued that the revenue projections were “unrealistic” as he criticised the Davis administration for again changing its fiscal forecasts. “They have been inconsistent in the first Fiscal Strategy Report they presented, they have been inconsistent in the last Budget presentation, and been inconsistent in the second Fiscal Strategy Report,” he told Tribune Business

“They keep changing the goal posts, and that creates credibility problems for them.” Mr Thompson, in a statement, also said the Government will “destroy the middle class” with tax and spend policies designed “to squeeze every dime possible” from working Bahamians.

“The Davis administration’s ‘tax and spend policy’, articulated in their latest Fiscal Strategy 2022, will destroy the middle class,” he argued. “The PLP government’s $1.2bn in additional revenue projections make it clear that they intend to squeeze every dime possible from the middle class.

“They fully expect the poor and middle class to pay $1bn more in VAT, more real property tax,

FROM PAGE B2

operation and compromises new air traffic demand.

“The airports face challenges to meet the ICAO safety and security standards, and to respond to events related to climate change. Such events require action in order to maintain certification by the Bahamian Civil Aviation Authority, to guarantee safety for passengers and crew, and keep the operation of this transport mode.

Delayed implementation of these measures could also have an adverse impact on

future traffic flows and the economy,” Mr Sears said.

“For the country to have a strong market presence in the competitive Caribbean tourism industry, it is crucial that the island gateway airports offer the highest possible level of safety and quality of aviation infrastructure and services. The need for these improvements are evident according to traffic demands, various analyses performed having identified and prioritised these required investments, and the revenues and costs expected from each airport.”

Redevelopment work is expected to begin on Cat Island’s New Bight airport shortly, while Grand Bahama International Airport’s rehabilitation will take the form of a publicprivate partnership (PPP) arrangement that is supposed to be announced shortly. Emergency paving will be undertaken at the North Eleuthera airport before redevelopment begins.

Integrated Building Services (IBS), led by Nick Dean, is the contractor for the airside works, construction and contract

administration of the works at North Eleuthera. Charlene Collie, project engineer, said designs for the airport in North Eleuthera are expected to be completed within the 2023 third quarter with the aim of launching a bidding process for the work before year-end 2023.

Ms Collie said the Ministry of Works and Utilities is aware of daily “challenges” on the North Eleuthera runway. She indicated that the remedial works for Eleuthera will last around three to four years while major infrastructure works are undertaken.

“Eleuthera is slated to have a new runway further to the right of the existing runway. The existing runway will convert into a parallel taxiway with several taxiways joining runway to apron. That’s all under design for the second quarter of 2024 earliest,” she said.

Dr Kenneth Romer, the Ministry of Tourism’s acting aviation director, said Exuma is poised to become the hub for the central and southern Bahamas, and there have always been “very aggressive” plans to ensure it is properly

more fees and more Customs Duty to fund their expansion of government spending and their extravagant ways.” Pointing to the Government’s revenue enhancement report, which called for $90m in extra fee income, Mr Thompson also called for it to curtail spending.

“The Davis tax (so they can) spend policy plans will make life even more expensive and even more difficult for the middle class and for struggling Bahamians,” he added. “While Davis and his team are seeking to force the middle class to sacrifice and pay more, they demonstrate every day that they are not seeking to cut back and make the same sacrifice they are asking of the Bahamian taxpayer. The Government is seeking to get more from those who have less.

“They simply without good reasons decide to increase the revenue projections so that they could increase the spending projections. They are intent to squeeze some more from the poor and middle class to allow them to spend more.”

developed both on the airside and the landside.

“Exuma is one of the islands that has exceeded pre-pandemic airlift and pre-pandemic seat capacity levels. Exuma is on the rise, and investment in the infrastructure further supports our mandate to increase tourism,” he added.

The Board of Directors and Executive team of the Coralisle Group Ltd , are pleased to announce that Annastasia Francis, Vice President, has been appointed Executive Vice President & General Manager of CG Atlantic Medical & Life Annastasia assumed this role effective January 1, 2023, following Lynda Gibson’s retirement on December 31st, 2022

Annastasia has worked in the insurance industry for more than 23 years She joined CG Atlantic Medical & Life on Jan 3 2006 and has held several positions including Operations Manager & Director of Operations and most recently her appointment to Vice President of Health in 2020 Annastasia holds an MBA with a concentration in Actuarial Science, BA in Statistics She also attended Executive Education Courses at MIT Sloan and the Institute of Directors in London

We are confident that Annastasia possesses the expertise and commitment to meet the challenges of the Executive Vice President & General Manager role and believe her experience with our strategy and culture will allow her to manage and build on our growth and success

We congratulate Annastasia Francis as she assumes her new role