$5.30 $5.31 $5.37 $5.38

ArawakX ‘to be reported’ to police amid $4m insolvency

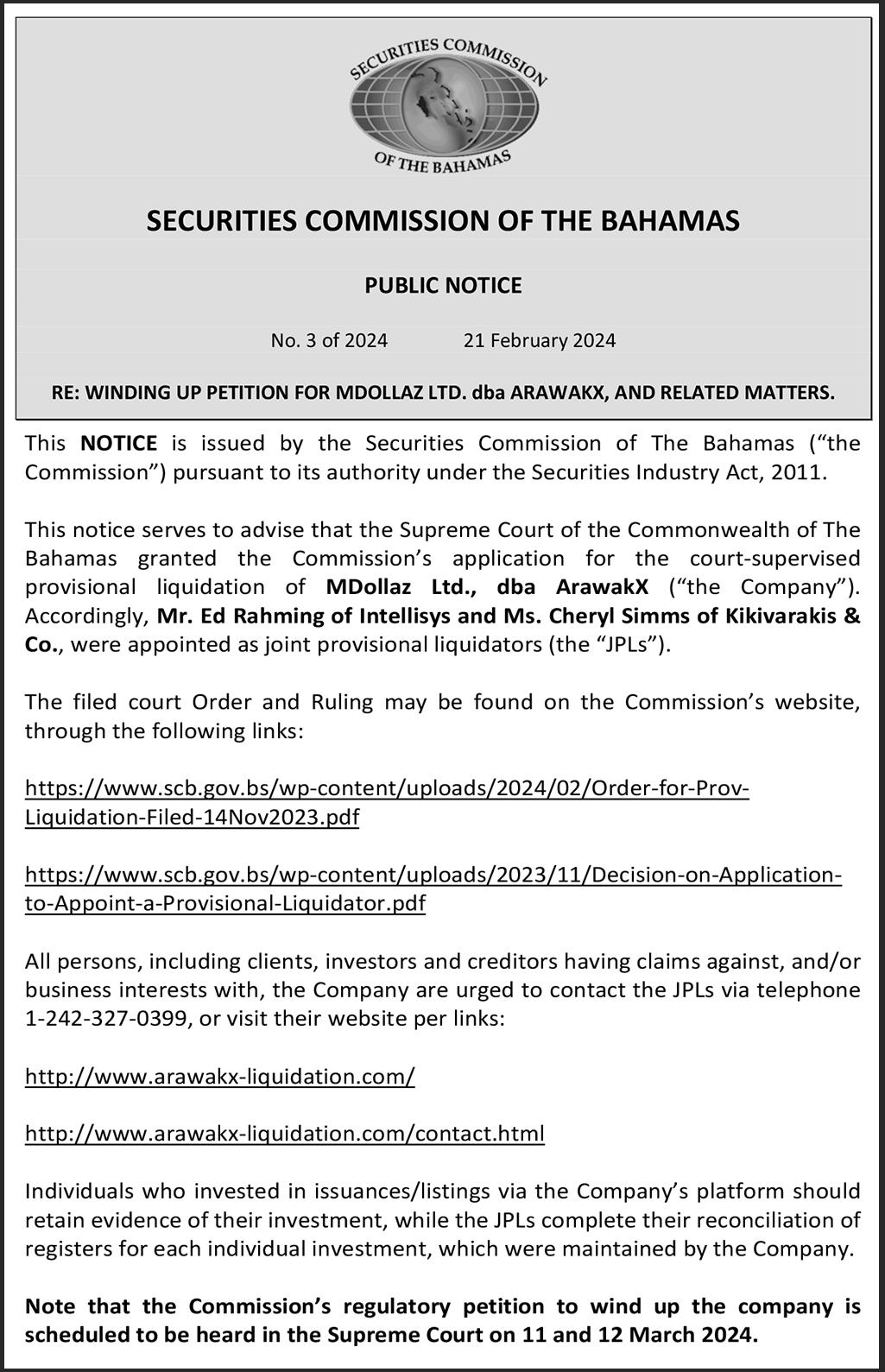

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netTHE Bahamas’ first-ever crowd funding platform is suffering from a near-$4m insolvency, its provisional liquidators have asserted, as they prepare to report “multiple criminal infractions” to the police.

Ed Rahming, the Intelisys (Bahamas) principal, and Cheryl Simms, the Kikivarakis and Company accountant, in their February 22, 2024, report to the Supreme Court revealed that ArawakX’s insolvency has almost doubled from the Securities Commission’s initial $2m estimate after they wrote-off more than $1m in assets listed on its balance sheet.

This leaves the platform and its parent, MDollaz Ltd, with just $508,665 in assets to cover $4.474m in total liabilities, thereby producing a $3.965m deficit with the provisional liquidator duo warning this gap is only likely to increase since “significant sums [are] owed to third parties”.

Mr Rahming and Ms Simms said it was also impossible to cure MDollaz/ ArawakX’s “criminal violation” of

• Supreme Court told $2m hole has doubled

• Just $500,000 assets to cover $4.74m liabilities

• 16 breaches of Securities Act are alleged in report

• Public offering ‘against company’s own rules’

the Securities Industry Act as a result of the unauthorised public offering that persuaded 134 investors to inject capital into the crowd-funding platform. Those investors are now in peril of losing much, if not all, of their investment as the provisional liquidators have received a legal opinion saying they should be treated as unsecured creditors (see other article on Page 1B).

The duo’s report also alleged there was “substantial commingling” of funds belonging to ArawakX itself and those entrusted to it by investors in the share issues it facilitated. The latter should have been held separately by the crowd-fund platform, which would have been acting in a trustee or fiduciary capacity, but Mr Rahming and Ms Simms are alleging that “over $1m of fiduciary cash was used on company expenses”. Their first Supreme Court report identified no fewer than 16 purported breaches of the Securities Industry Act, its accompanying regulations and rules by ArawakX, whose principals are D’Arcy Rahming senior, the former Bahamas International Securities Exchange (BISX) chief operating officer, and his son, D’Arcy junior.

The alleged violations, according to the provisional liquidators, ranged from failing to safeguard, segregate and maintain proper controls to secure client funds; not obtaining Securities Commission approval for Board and corporate governance changes; and not paying distributions to investors on time or returning

SEE PAGE B4

More than 100 investors at risk of losing crowdfund investment

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netA FORMER Colina Insurance Company chief and at least 115 fellow investors are in peril of losing most, if not all, their combined $2.4m-plus investment in the insolvent ArawakX crowd-funding platform.

Ed Rahming, the Intelisys (Bahamas) principal, and Cheryl Simms, the Kikivarakis and Company accountant, in their February 22, 2024, report to the Supreme Court in their capacities as provisional liquidators disclosed legal opinions finding that James Campbell and his

investment vehicle, PJ Enterprises, are unsecured creditors for much of their $1.619m investment.

They were also informed that the majority of other investors who acquired shares in ArawakX, some 115 of 134 persons, should definitely be treated as unsecured creditors after parting with a collective $817,712 to purchase equity stakes in the crowdfunding platform. Given that ArawakX already has a near-$4m solvency deficiency, which is likely to only increase, prospects of substantial recovery appear bleak.

SEE PAGE B6

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netmatches exactly the number given by Geoff Fulton, chairman of Maritek Bahamas, for his Chrysalis project.

Mr Fulton said then that he planned to segment the 14,720-acre parcel into two, featuring a 11,720-acre environmental preserve

SEE PAGE B6

Liquidators ‘blocked as ArawakX set up similar operation in US’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netARAWAKX’S provisional liquidators have accused the crowd-funder’s principals and owner of its website of colluding to deny them control of the platform while setting up a similar US-domiciled operation. Raynard Rigby KC, attorney for Ed Rahming and Cheryl Simms, in separate February 2, 2024, letters demanded that D’Arcy Rahming senior and his son, D’Arcy junior, together with California-basedCloudPro, “immediately deliver to them the password(s) and other credentials” his clients need to assume control of the ArawakX platform as well as restore “the functionality” that was removed.

The Baycourt Chambers principal’s letter also revealed how Mr Rahming, the Intelisys (Bahamas) principal, and Ms Simms, the Kikivarakis and Company accountant, met with Mr Rahming senior and others on January 18, 2024,

to voice their concerns and suspicions that ArawakX assets were use to finance the creation of a US company whose website is “a duplicate” of the Bahamian crowd-fund platform.

“We are instructed that at a meeting held with you (and others) by the joint provisional liquidators on January 18, 2024, the joint provisional liquidators shared with you their findings that the assets of ArawakX were used to fund the start-up and operations of a US-based company called Local Investment Hub (LIH),” Mr Rigby told Mr Rahming senior in a letter copied to both his son and their attorney, Khalil Parker KC.

“It appears from the records obtained that you and D’Arcy Rahming junior are noted as officers of LIH. The joint provisional liquidators also discovered that the assets of ArawakX were used to fund the operations of LIH.

“It was also brought to your attention that LIH’s website is a duplication of the website used

AG: It’s time to scrap blacklists that have cost Bahamas millions

ATTORNEY General Ryan Pinder said that blacklisting could have cost The Bahamas tens of millions of dollars a year and again called for the UN to abolish the practice.

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net RYANSpeaking at the Bahamas Financial Services Board’s (BFSB) Financial Crime Enforcement Across Borders seminar last week, Mr Pinder advocated for the United Nations to design an international tax policy that does not discriminate against small island states. He said in one year alone blacklisting could have cost The Bahamas more than $61m.

He said: “The United Nations is the appropriate body to design and build a truly equitable and inclusive international tax administration architecture, with equal-footed representation.

“The OECD cannot declare legitimacy for developing ‘universal outputs’ while decision-making and membership remain exclusive. We need a clean and balanced slate.

“The United Nations must now direct international tax policymaking as it has customarily been a more inclusive body for developing countries concerning international taxation.”

Mr Pinder said that blacklisting presents many challenges to the development of The Bahamas including financial diversion, being labelled as a high-risk jurisdiction and facing disaster recovery limitations.

He explained that penalties and costs from blacklisting has diverted $35m in 2000, which is

$61,931,300 in 2023 when adjusted for inflation. He said: “Penalties and new costs from blacklisting divert funds away from essential areas, totalling $35,000,000 in 2000 when The Bahamas was first blacklisted, $61,931,300.81 in 2023 factoring in inflation of the USD, affecting crucial development initiatives. This doesn’t account for the years since 2000.

“The risk profile of The Bahamas is increased to high when we are placed on adverse listings. The impact of this on the financial environment results in job losses, reduced financial institutions and foreign investment, penalties such as withholding taxes and time-consuming procedures for opening bank accounts, impacting the stability of the financial sector.

“As a Small Island Developing State (SIDS), low-lying nation and big ocean country, The Bahamas faces vulnerability to natural disasters. Blacklisting hampers access to international finance for instance from international insurers for disaster recovery, affecting multiple human rights, including the right to life, adequate housing, water and sanitation, food, health, work, livelihood, and the rights of displaced persons.”

He called for the abolition of blacklists as a punitive measure for global tax infringements and said the practice caused “extraordinary economic damage” on small developing countries. He said: “One area that we think must be included in the UN convention is

BANK: ‘STRONG COMPLIANCE’ FROM FINANCIAL INSTITUTIONS

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.netvices Board’s (BFSB) Financial Crime Enforcement Across Borders seminar last week, <zf”webkit-standard”>Karen Rolle, Inspector in the Bank Supervision Department at Central Bank, shared some of the findings of the regulator’s on-site examinations.

She said: “As we conduct our supervision of the financial sector that falls under our remit, we have been seeing steady improvements in terms of how the industry has been

addressing alleviating identified findings from our onsite examination process “It is a pleasing result to see in terms of directors issuing less directive, so that means there’s a strong level of compliance or customer compliance by the industry.”

She said that while other sectors need to “step up their game” in terms of reporting, the banking sector has shown “steady improvement”. “In terms of timeliness of reporting, we see much improvement, particularly as it relates to the banking sector. Some of the other sectors need to step up their game but certainly as it relates to the banking sector, we see steady improvement towards meeting our benchmark,” she said. Ms Rolle also noted that remediation measures should be embedded into the management process so

that it can be effective and sustainable.

She said: “There is still a need for institutions to have to be mindful in terms of once you have remediated an identified issue, Central Bank wants to ensure that remediation is embedded in your process, and it’s effective.

“We want to make sure that sustainable and it’s certainly embedded as part of the management practices and controls.”

She added that the regulator will continue to place a “strong focus” on AML/ CFT as they conduct their onsite examinations and will access and provide feedback to institutions on the recovery plans they submitted last year.

She said: “Last year and continuing this year there is certainly a strong focus on AML supervision and onsite examination process. As part of our on-site examination, you will

the use by multilateral organisations of blacklists to enforce their self-proclaimed global standards. We question the utility of blacklists considering the extraordinary economic damage it implores on us small developing countries. Countries like The Bahamas make up the vast majority of blacklisted countries, former colonies of European imperialists.

“We will advocate for a global position to be included on the use of blacklisting as an enforcement mechanism on global tax standards. We believe their use should be abolished given the fundamental breaches of human rights including our right to development.”

definitely see an element of AML focus there.

“Last year, we will have asked institutions to submit their recovery plan. So, our focus is really to get to the assessment of those recovery plans and provide feedback from institutions I remember institutions have been asking us for feedback to the institutions.”

Share your news

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 3221986 and share your story.

Job Summary:

The Compliance Assistant is responsible for providing support for the implementation and administration of the Financial Crime Risk Management Program of Fidelity Bank (Bahamas) Limited.

Bank.

• Utilize risk-based tools and monitoring systems to identify and report on any unusual or suspicious activity.

Requirements/Qualifications:

• Possess an Associate Degree in Business Administration, Law & Criminal Justice, Banking & Finance, or related field OR BIFS Certificates in Anti-Money Laundering & Compliance Systems (Introduction and Intermediate).

• Employed a minimum of two (2) years in the financial services industry.

• Knowledgeable of Know Your Customer (KYC) compliance requirements.

• Proficient in Microsoft Office Suite, in particular Excel, Word and Outlook programs.

• Possess good written and verbal communication skills.

• Detail-oriented.

• Able to multi-task and meet stipulated deadlines

• Able to maintain strong working relationships.

ARAWAKX ‘TO BE REPORTED’ TO POLICE AMID $4M INSOLVENCY

investor monies from failed crowd-fund issues.

However, the most serious allegation concerns MDollaz/ArawakX’s “public offering” which was held even though the company’s own Memorandum of Association stipulated that “the company shall be a private company and, accordingly, no shares nor any class of shares of the company shall be offered to the public for subscription”.

“The joint provisional liquidators have found that the company is insolvent, having a net deficit of $3.965m with significant sums owed to third parties,” Mr Rahming and Ms Simms told the Supreme Court. “This amount is likely to increase after further investigation by the joint provisional liquidators and a creditor adjudication process.

“It is our view that the company has no viable prospects of continuing as a going concern.” Describing the findings from their investigation as “very serious”, the duo said they had chosen to “highlight two”, and added: “We found the commingling of company cash with fiduciary cash as a matter of course at the company. We found that over $1m of fiduciary cash was expended on company operational expenses.

“The Company conducted a ‘public offering’ without seeking the approval of the Securities Commission of The Bahamas. This finding is irremediable and consists of multiple criminal infractions which will be reported

to the Royal Bahamas Police Force.” Providing more details on the public offering, which raised $817,712 from 134 investors including some foreigners, the provisional liquidators alleged: “Our review found that the company held a ‘public offering’ of its shares in contravention of Section 97 of the Securities Industry Act.

“Given the number of investors, the marketing materials shared with potential investors, and repeated comments of an organised ‘white gloved’ treatment of targeted investors in issuers, it is our view that this was a ‘public offering’. One hundred and thirty-four subscribers were found to have signed subscription agreements with the company.

“No approval was sought from the Securities Commission for the ‘public offering’ of company shares or the subscribers. The cash provided by the subscribers was spent by the company and no share certificates were issued... The joint provisional liquidators will provide their findings on the ‘public offering’ to the Royal Bahamas Police Force.”

The Rahmings have previously vehemently denied, and rejected, all concerns and allegations of wrongdoing in relation to how MDollaz and ArawakX were operated and managed. D’Arcy senior, in a September 27, 2023, affidavit filed with the Supreme Court, asserted: “For the avoidance of doubt, the respondent rejects that it is insolvent in the sum of at least $2.4m.

“The respondent is not the subject of any financial claims or demands as at the date hereof. The respondent also denies that it has committed breaches under the ‘Securities Industries Act that warrant criminal penalties’.”

However, the provisional liquidators’ report supports the initial Securities Commission findings that persuaded Sir Ian Winder to approve and order the duo taking control of ArawakX in early November last year. Their findings will now be used as evidence by the Bahamian capital markets regulator to push for the crowd-fund platform’s full wind-up during a two-day Supreme Court hearing set for March 11-12.

“Given the issues found at the company and summarised above, we support the winding-up petition of the Securities Commission of The Bahamas,” Mr Rahming and Ms Simms wrote. “Applying for the liquidation of the company to be placed under the supervision of the court is in the public’s best interest.

“It will permit the joint provisional liquidators to continue with their investigations, address the reconciliation of the issuers’ capital raises, assess asset recovery options including what company assets can be sold while ensuring no claims can be brought against the company without the leave of the court...

“In assessing the best interest of the clients and creditors, the joint provisional liquidators have sought to balance the overall cost and negative fallout of winding0up the company against the risk of allowing it to continue to the detriment of even more parties. It is our view that the overall cost and fall-out of the winding-up of the company is less than the negative impact of allowing the company to continue its operation.”

The provisional liquidators warned that it is “too early to predict the likely eventual return to customers and creditors” from efforts to recover and

realise ArawakX’s assets, although the extent of the near-$4m solvency gapand the fact it is likely to increase - means many will probably incur significant losses.

Turning to the four crowd-funding issues that were successfully completed via ArawakX’s platform, the Supreme Court was informed that only one - the first, concluded by Pinnacle Franchise Brands, the Red Lobster franchisee - was provided with its share register, which showed some 868 investors had acquired a collective 74,054 shares for a total $90,384 outlay.

The other three - Tropical Gyros (Chef Kevin Culmer), Footcare Rx (Dr Daniel Johnson), and Nassau Gas & Tanks, whose principal is Mark Newell - have yet to receive their share registers. “There are discrepancies with the share registers - investors are missing on the registers, etc,” the provisional liquidators alleged. “We found irregularities with the four completed issuer raises.

“Investors have not received their share certificates, and the Issuers were assessed additional fees by the company not shown in their listing agreement. We have started a verification/reconciliation process for one issuer to ensure completeness of its share register and will undertake a similar exercise for the remaining issuers.

“Upon completion of this exercise, we will provide the updated share registers to the Bahamas Central Securities Depository to act as the registrar and transfer agent for the issuers.” For Tropical Gyros, some 30,236 shares were acquired by investors with an outlay of $218,193; some $190,346 was spent on 24,064 FootCare RX shares; and $122,287 invested in 14,830 shares in Nassau Gas.

While adding the caveat that they have had limited time in which to conduct their investigations, given that they have only been in place for just over three months, the ArawakX provisional liquidators added: “We found that pertinent books and records were missing for all the years the company was in operation. For example, professional indemnity insurance was

not obtained for two of the three years in operation... “The joint provisional liquidators found that an affiliated company, Mdollaz Technology Ltd, was used in the operation of the company (MDollazLtd/ArawakX) for over two years. This company was not regulated by the Securities Commission. Mdollaz Technology Ltd is to be a subsidiary of the company but the shares were not transferred to the company.”

When they were appointed, Mr Rahming and Ms Simms said they found ArawakX with just over $10,000 in its bank accounts with MDollaz Ltd holding $7,993 and MDollaz Technology Ltd possessing $2,437. A $140,000 certificate of deposit was held with the Bahamas Development Bank, but this has yet to be transferred to the duo’s control.

“We were informed that due to delays experienced in opening the bank accounts at Bank of The Bahamas in the name of MDollaz Ltd, the company decided to have MDollaz Technology Ltd open bank accounts at Bank of The Bahamas and use those bank accounts to conduct the business of the company,” the provisional liquidators said.

“We understand that MDollazLtd was awaiting an operating licence from the Securities Commission in order to open the bank account and MDollaz Technology Ltd, which is not regulated by the Securities Commission, did not have this requirement.”

The duo alleged that there was “significant commingling” of funds provided by investors to purchase shares in the multiple crowd-funding issues that took place on the ArawakX platform with the company’s own cash and revenue/ income streams - something that should not have occurred.

“We found significant commingling of the company’s cash with fiduciary cash in the bank accounts of MDollaz Technology Ltd,” the provisional liquidators said. “We found that a total of approximately $1m of fiduciary cash went into the fiduciary account and $100,000 of fiduciary cash went into the general operations account.

“Approximately $1m of fiduciary cash was then disbursed from the two bank accounts for company operational expenses.” Mr Rahming and Ms Simms alleged that similar happened with the Bank of The Bahamas accounts in MDollaz/ArawakX’s name.

“We found that a total of approximately $38,000 of fiduciary cash went into the general operations account and approximately $367,000 of fiduciary cash went into the fiduciary account. Approximately $91,900 of the fiduciary cash was disbursed for company operational expenses,” they asserted.

When it came to asset write-offs and write-downs, the provisional liquidators said they have taken a 100 percent provision against $51,159 in accounts receivables said to be due to ArawakX plus a combined $155,000 in deposits and pre-paid expenses.

“From our review we saw no evidence of the company having filed the required VAT returns with the Department of Inland Revenue (DIR), and therefore those documents will be submitted as we seek settlement of this balance from the DIR,” Mr Rahming and Ms Simms said, referring to a $35,369 VAT receivable.

“Fixed assets, which represent IT infrastructure, furniture, equipment computers land and buildings, have a carrying value in the accounting records of $351,958. Through our review of these assets, we have assessed a liquidation value of $322,867....

“We noted that the company recorded a financial deficit of $2.909m,” the provisional liquidators continued. “Through our review of the collectability of the assets we recorded a total provision of $1.014m and adjusted the ‘due to Bank of The Bahamas’ balance to reflect its present balance, thereby increasing the company’s deficit to $3.965m

“It should be noted that we have not issued any request to creditors for the submission of their proof of debt in respect of amount owing to them, and therefore we anticipate that the amount recorded will be adjusted and may result in an increase in the financial deficit.”

EARLY BIRD CATCHES THE WORM

The AI hype and recent quarterly figures have given Nvidia the highest increase in value in Wall Street history. A whooping increase of $277 billion in one day.

The market value of the semiconductor specialist moved to the two trilliondollar mark on Friday.

Over the past decade, financial markets have undergone an extraordinary development. The last few years have been marked by global economic challenges, a pandemic, geopolitical crises, inflation, interest rates and fears of recession, which have put global markets in a real predicament.

However, during this tumultuous action, some stocks have proven to be true high-flyers, not only delivering above-average

returns, but also demonstrating resilience and the potential for long-term gains. Let’s take a look at some of the best stocks during the last ten years that have rewarded investors with impressive price gains. These are stocks that have delivered outstanding results during a decade of change and uncertainty.

1. Nvidia: The share price on March 1, 2014, was $4.49. Last Friday it hovered at around $800. An increase of approximately 15900 percent. NVIDIA Corporation is a leading manufacturer of IT hardware that develops, manufactures, and

sells graphics and media communications processors and software for personal computers, workstations, and digital entertainment platforms.

2. Advanced Micro Devices (AMD) increased from $3.70 to last Friday of around $176. This is the second place and an increase of 4656 percent. AMD is one of the world’s largest chip manufacturers, producing processors, graphics cards, and chipsets for computers, game consoles, and telecommunications equipment. The company holds over 4500 patents and competes with

competitors such as Intel, NVIDIA, and IBM.

3. Broadcom (AVGO): beginning of March 2014 was traded at around $62 and last Friday hovered at around 1300. (1996 percent increase). Broadcom Corp is a leading manufacturer of integrated circuits and network adapters used for data transmission. The

company divides its operations into three segments that address the needs of end users, devices, and infrastructure. 4. Tesla. Within ten years the share price went from $14 to $195 which calculates to an impressive increase of 1292 percent. The company offers a range of electric vehicles from sports cars to

sedans and off-road vehicles, with the peculiarity being that all models are emission-free. Tesla Motors is considered a pioneer in the production and marketing of environmentally friendly vehicles.

5. Apple was founded in 1976 and had a seed capital of $1760. Ten years ago, the share price was at 19$ and now is at approx. $186. Almost 900 percent increase. The product portfolio ranges from PCs (iMac) and media players (iPod) to mobile devices such as the iPhone and iPad, all of which have achieved cult status. However, the iPhone has become Apple’s most important product, accounting for over 50 percent of the company’s total revenue.

The early investor would have reaped some tremendous results.

TAIWAN GIANT CHIPMAKER TSMC OPENS FIRST PLANT IN JAPAN AS PART OF KEY GLOBAL EXPANSION

By YURI KAGEYAMA AP Business WriterCHIP giant Taiwan Semiconductor Manufacturing Co. opened Saturday in an official ceremony its first semiconductor plant in Japan as part of its ongoing global expansion.

"We

The company's

founder Morris Chang, was also present. This comes as Japan is trying to regain its presence in the chip production industry. The Japan Advanced Semiconductor Manufacturing, or JASM, is set to be up and running later this year. TSMC also announced plans for a second plant in Japan earlier this month, with production expected to start in about three years. Private sector investment totals $20 billion for both plants. Both plants are in the Kumamoto region, southwestern Japan. Prime Minister Fumio Kishida sent a

congratulatory video message, calling the plant's opening "a giant first step." He stressed Japan's friendly relations with Taiwan and the importance of cutting-edge semiconductor technology.

Japan had previously promised TSMC 476 billion yen ($3 billion) in government funding to encourage the semiconductor giant to invest. Kishida confirmed a second package, raising Japan's support to more than 1 trillion yen ($7 billion).

Although TSMC is building its second plant in the

U.S. and has announced a plan for its first in Europe, Japan could prove an attractive option.

Closer to Taiwan geographically, Japan is an important U.S. ally. Neighboring China claims the self-governing island as its own territory and says it must come under Beijing's control. The long-running divide is a flashpoint in U.S.China relations

The move is also important for Japan, which has recently earmarked about 5 trillion yen ($33 billion) to revive its chips industry.

Four decades ago, Japan dominated in chips, headlined by Toshiba Corp. and NEC controlling half the world's production. That's declined lately to under 10%, due to competition from South Korean, U.S. and European manufacturers, as well as from TSMC.

The coronavirus pandemic has negatively affected the supply of electronic chips, stalling plants, including automakers, with Japan almost entirely dependent on chip imports. This has pushed Japan to seek chip production in pursuit of self-sufficiency.

Sony Semiconductor Solutions Corp. — wholly owned by Sony Corp. — Denso Corp. and top automaker Toyota Motor Corp. are investing in TSMC's Japan plant, with the Taiwanese giant retaining an 86.5% ownership of JASM. Once the two plants are up and running, they're expected to create 3,400 high-tech jobs directly, according to TSMC. Ensuring access to an ample supply of the most advanced chips is vital with the growing popularity of electric vehicles, as well as artificial intelligence.

More than 100 investors at risk of losing crowdfund investment

Raynard Rigby, the joint provisional liquidators’ attorney, in a January 29, 2024, legal opinion on Mr Campbell’s standing in the liquidation indicated it was possible that the collective $279,767 in loans advanced by the ex-Colina boss to ArawakX could achieve a higher ranking that ‘unsecured creditor’ in the queue waiting to recover assets. Unsecured creditors are typically at the back, or last in line.

“We have no information in respect to whether these sums were in fact advanced by PJ Enterprises and/or repaid by MDollaz Ltd,” Mr Rigby wrote, the latter name referring to ArawakX’s immediate parent company.

And, while the January 31, 2022, loan agreement gave it “priority over all unsecured creditors and all shareholders” in the event ArawakX was dissolved or wound-up, Mr Rigby again wrote: “We have not been provided with a duly executed floating charge/

debenture by the company unto PJ Enterprises.” That agreement was for the first of three loans, and was worth $162,010.

The majority of Mr Campbell’s ArawakX investment was $1.34m used to purchase “zero coupon convertible notes” on MDollaz Ltd. These notes could be converted to 2,279,819 ordinary shares, equal to 22.798 percent of the crowd-fund platform’s total equity, but he elected to convert just one note and the shares were never distributed.

Mr Rigby, concluding his analysis, said: “MDollaz Ltd appears to owe to PJ Enterprises the borrowings under the short-term [loan] agreements... It may be open to PJ Enterprises to argue that its short-term loans were secured loans pursuant to a floating charge. PJ Enterprises may not be a secured creditor if the floating charge was not perfected.

“In respect of the [convertible notes], this appears not to be intended to create a security charge over

MDollaz Ltd’s assets. The terms allow for the coupon to be converted into shares and for payment to rank ahead of preference and ordinary shareholders. In this regard, PJ Enterprises is likely an unsecured creditor.”

Mr Rigby also found that the 134 investors who paid a collective $817,712 to acquire ArawakX ordinary shares, via subscription agreements, in what his joint provisional liquidator clients are alleging was an illegal public offering that violated the Securities Industry Act and represents a “criminal infraction”, should also largely be treated as unsecured creditors - except for one group. Asserting that the resolution increasing ArawakX’s number of ordinary shares, so as to facilitate the buy-in by extra investors, was “invalid”, the Baycourt Chambers chief said the crowd-funding platform’s number of shares remained at the original 5,000 divided equally between its two principals, D’Arcy Rahming

senior and his son, D’Arcy junior.

“Based on the foregoing it is our considered opinion that the 134 subscribers are not shareholders of MDollaz Ltd,” Mr Rigby wrote. “For completeness, we do not deem the shareholders/subscribers to be preferred creditors.”

Mr Rahming and Ms Simms, dividing the unsecured creditors into categories, said any of the 19 former ArawakX staff who received shares in the company in exchange for unpaid salaries will be treated as preferential creditors. Otherwise, all of the other 115 will be unsecured creditors. The latter include 63 investors who paid a total $208,316 to acquire shares in the crowd-fund platform, plus another 32 who were on a payment plan and had paid a combined $81,398. The provisional liquidators said they still have to determine the status of 17 investors, nine of whom are foreign and others related to the company’s vendors.

PROJECT’S 15,000 ACRES FOR SALE OVER ‘FAILURE TO PAY’ PROPERTY TAX

FROM PAGE B1and 3,000 acres for development. Pledging that Chrysalis will be “light on the land”, he added that the concept will be based on the cottage resorts he has developed in Canada under the Great Blue Resorts brand.

Mr Fulton said Chrysalis will create a “transformative experience” even though he, too, did not yet possess all the necessary government approvals to proceed. His project seeks

to create a community of 1,000 modular, alreadybuilt, homes divided into clusters of 25-100 properties whose parts just need to be shipped to The Bahamas. Activities such as boating and fishing will feature prominently. “The anticipated market we’re driving for is not the economic elite because the modular structures we’re looking at maybe reflect owners, people who are sensitive to nature and want to interact with Long Islanders,” he

added. “They learn as much from Long Islanders as you do from them, and maybe more.

“They’re here to learn from you, not show you otherwise.” Suggesting that Chrysalis residents will be interested in buying from local producers and farmers markets, Mr Fulton said: “The concept is that the resort will be inclusive, not exclusive. The owners will engage with the wider community, go shopping, get

However, the one secured creditor that possesses the necessary stamped and recorded charge over ArawakX’s assets is the Government-owned Bahamas Development Bank (BDB). It advanced a $378,343 loan to the crowdfunding platform to enable it to acquire its software, equipment and furniture, some $140,000 of which was used to meet the Securities Commission’s capital and operational requirements.

“The loan is secured by a first mortgage over the company’s land and building, a chattel mortgage over various computer equipment and the crowdfunding software (Tagpay) purchased with the loan proceeds,” Mr Rahming and Ms Simms wrote.

“Through our examination we determined that the land and building, which represents the shareholders’ [the Rahmings’] contribution to the company in exchange for their shares, were not conveyed to the company. The company’s computers, land and

currencies and a Canadian airline.

building are pledged to the BDB as collateral for the loan payable.” The BDB on December 12, 2023, demanded repayment of the now-delinquent loan. “We write to formally demand that the sum of $373,125.39, being principal due and unpaid on the said loan in the amount of $331,803.60 together with interest accrued and unpaid on the loan to the December 2023 in the amount of $41,189.79, and late fees in the amount of $132.00 be paid within 14 days,” wrote Keri Sherman, an attorney with Alexiou, Knowles & Co. “Be advised, therefore, that in the event you shall fail to satisfy your/the company’s indebtedness to our client within 14 days of receipt of this letter, we have been instructed to commence legal proceedings against you in the Supreme Court for possession of the property secured by the mortgage and recovery of the sums due, together with interest thereon and legal costs.”

employment on the island.

their own supplies and get to know people.”

The adjacent Salinas project, being pursued by Diamond Crystal Properties, is a separate development that is not impacted by the Department of Inland Revenue notice. Diamond Crystal Properties is controlled by the Toronto-based Hamilton Group, which has investments in traditional equity stocks; residential resort communities; crypto

It is headed by its president, David Young, who partnered with Mr Fulton on an effort that started almost 20 years ago in 2004 to secure the former Diamond Crystal property. They endured legal battles in the Bahamian and US courts to affirm their ownership, and are understood to have ultimately decided to develop separate projects as neighbours.

The Diamond Crystal site was, almost four decades ago, the main driver of Long Island’s economy, providing the biggest source of

Diamond Crystal opened its plant in the 1970s and, after it closed due to its US parent filing for bankruptcy, was taken over by World Wide Protein (Bahamas), a shrimp farming company. That venture, too, failed with the shrimp farming closing after several years of operations in the mid-1980s. World Wide Protein is understood to be the predecessor to Maritek Bahamas. The loss of economic activity and employment opportunities has contributed to the steady depopulation of Long Island ever since.

by ArawakX. You were also informed of the fact that the website used by ArawakX remains inaccessible by the joint provisional liquidators.”

Mr Rahming and Ms Simms, the day after their January 18, 2024, meeting with Mr Rahming senior demanded that he provide details on all business transactions conducted by ArawakX, MDollaz Ltd and their affiliates in the US, along with details on any US bank accounts and “a copy of the Brickell office lease agreement that may be in the name of LIH”.

They, via Mr Rigby, warned that failure to respond by 12pm on February 5, 2024, would result in the provisional liquidators seeking the “intervention” of the Supreme Court. No reply was received by that date, with Mr Rigby’s letter also revealing that the

provisional liquidators were struggling to gain access to, and control over, the online ArawakX platform.

“Their efforts have proven fruitless as you and CloudPro refused to allow them the level of access and control requested,” he alleged. “The joint provisional liquidators have formed a view that CloudPro and TradeX Worldwide (affiliated companies), acting in concert with you or others, have intentionally refused to grant the joint provisional liquidators access and control to the aforesaid website.

“The joint provisional liquidators are also of the view that functionality of the crowd funding platform on the website was removed by CloudPro and yourselves. In this regard, the joint provisional liquidators require that you immediately deliver to them the password(s) and other credentials to allow the joint provisional liquidators

NOTICE

NOTICE is hereby given that RENALDO OSCAR of Hanna Road, New Providence, Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 19th day of February, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that VILIO JOSEPH of #17 Blueberry Hill, New Providence, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 26th day of February, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that WANIKA KIANNA GUILLAUME of Malcom Road off East Street South, Nassau, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 26th day of February, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

to access and control the website and crowdfunding platform and that you return forthwith all of the functionality of the crowdfunding platform that was removed.”

Mr Rigby continued:

“The joint provisional liquidators have formed a provisional view that you are using LIH’s website to trade and carry on certain activities that are identical in the main to those carried on by ArawakX. “You are further warned that any activity by you on the website is strictly prohibited due to the Order of the Supreme Court and that, should the joint provisional liquidators so discover that trading or other such or similar activity was conducted post the appointment of the joint provisional liquidators, such conduct will be shared with the court.”

And, in closing, Mr Rigby also demanded further details on a $50,000

wire that was sent to an ArawakX bank account at Chase Bank in New York.

The first report to the Bahamian Supreme Court by Mr Rahming and Ms Simms, to which Mr Rigby’s letter was attached, revealed that the first-ever Bahamian crowd-funder did not own its website or platform.

“The joint provisional liquidators found that the company’s website and crowdfunding platform are owned by CloudPro, a cloud application development company,” they wrote. “It appears that the development costs for the crowdfunding platform are not realisable and that over $1m in development costs are currently owed by the company.

“CloudPro refused to provide us with control of the website. We requested that CloudPro place an announcement of the provisional liquidation on the website but CloudPro refused stating that it would

PUBLIC NOTICE

INTENT TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, ADDISON WILFRED CLARKE of #146 Market Street, New Providence, Bahamas, intend to change my name to EDISON WILFRED CLARKE. If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Officer, P.O. Box N-742, Nassau, The Bahamas no later than Thirty (30) days after the date of publication of this notice.

NOTICE

NOTICE is hereby given that KENLY ESPERANCE of Augusta Street #69, P.O. Box N-940, Nassau, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 26th day of February, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

have to be paid outstanding billings owed to it before it could provide any services.

“The crowd-funding platform is based on the website. We were provided with administrative credentials for the crowdfunding platform, and we were provided with all the company’s data on the platform. However, we were not provided with control of the crowd-funding platform,” Mr Rahming and Ms Simms continued.

“We were advised by CloudPro and by the principals of the company that the platform was licensed for use to the company and was not owned by the company. CloudPro advised that it was owed monies by the company and provided 14 invoices for $50,000 each [total $700,000] for services between October 2022 and November 2023.

“The joint provisional liquidators requested the agreement between the company and CloudPro, and were informed by Mr [Doug] Kryzan (its chief executive) that there is no agreement. Mr Kryzan indicated to the joint provisional liquidators that

there was, however, a purchase agreement dated January 1, 2023, signed by Mr Rahming senior. However, the purchase did not materialise.”

Mr Rahming and Ms Simms revealed that the purchase price involved was $2.209m. Mr Rigby, on their behalf, wrote to Mr Kryzan on February 2, 2024, in similar terms to the letter sent to Mr Rahming senior, demanding that his clients be given the passwords and log-in credentials that will enable them to take control of the ArawakX website and also to restore its functionality.

“You are further put on notice that should you not co-operate the joint provisional liquidators will seek an order from the Supreme Court to commence proceedings in California, USA, to compel you to deliver the requested information,” Mr Rigby told Mr Kryzan. “We trust that this step will not be necessary and that you will co-operate with the work of the joint provisional liquidators.” No reply has been received from CloudPro.

NOTICE

NOTICE is hereby given that

MARIE EVELYNE PAULIN of Marsh Harbour, Abaco, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twentyeight days from the 26th day of February, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

SOME ARIZONA CUSTOMERS TO SEE MONTHLY FEES INCREASE FOR ROOFTOP SOLAR, ADVOCATES CRITICIZE RATE HIKE

PHOENIX

Associated Press

ABOUT 1.4 million customers in Arizona will be paying more for electricity now that regulators have approved a rate hike proposed by the state's largest utility, and an extra fee for customers with rooftop solar systems is prompting more criticism.

The average monthly bill for Arizona Public Service Co. residential customers will increase by about $10 to $12 starting in March, and those with solar panels will be on the hook for an extra $2.50 to $3 per month under the changes adopted by the Arizona Corporation Commission following an hourslong hearing Thursday.

A few dozen people spoke during the meeting and more than 2,000 people had submitted written comments over the months leading up to the decision.

Commission Chair Jim

O'Connor told reporters Friday that he and three Republican colleagues approved the new rate plan without knowing the exact impact it would have

on customers since it was projected to be "in the ballpark" of about 8%. O'Connor reasoned that the margin of error was too small to delay voting for another day. Arizona Public Interest Research Group Education Fund is requesting the commission reconsider the approval and require utility executives to appear before the commission and declare under oath the exact projected impact of the rate hike for all classes of customers.

"Comprehensive data should be entered into the docket, and APS executives should be sworn in before they speak," Diane Brown wrote in her appeal for the nonprofit group. "The commission failed to ask the questions necessary to ensure they had adequate and complete data before voting on the entire rate plan."

Parties in the rate case — which began nearly two years ago — have include labor unions, citizens groups, renewable energy advocates and public schools.

Utility officials have said that the rate increase is necessary to ensure reliable and resilient service to customers who live in 11 of the state's 15 counties. The increase is aimed at helping the utility recoup expenses it incurred in prior years to expand infrastructure.

The increase provides the utility with a return on equity of 9.55%, the Arizona Republic reported. APS President Ted Geisler has argued that a return of at least that much was needed to reassure creditors

and lenders on whom APS relies, as the utility's credit rating and profitability have faltered.

"We need immediate and sufficient rate relief," Geisler said. "We must continue to rely on lenders to fund the grid investments necessary."

Commissioner Anna Tovar, a Democrat, cast the lone dissenting vote. She said she couldn't "support something that costs customers more."

Commissioner Lea Marquez-Peterson also

expressed hesitation but voted in favor of the rate plan, saying it was critical for APS to be able to make infrastructure investments.

Michael O'Donnell, a vice president at Sunsolar Solutions in Peoria, wrote in a note to The Republic that it was "truly outrageous" that the commission would come up with a new charge targeting only solar customers that neither the utility nor any other party in the case had asked for. He said customers with solar panels have been

IN this Sept. 30, 2011, file photo, solar panel installation continues at a rapid pace at the Mesquite Solar 1 facility under construction in Arlington, Ariz. About 1.4 million customers in Arizona will be paying more for electricity now that regulators have approved a rate hike proposed by the state’s largest utility. The average monthly bill for Arizona Public Service Co. residential customers will increase by about $10 to $12 starting in March. Photo:Ross D. Franklin/AP

paying about $80 per month on average to be connected to the grid. He estimated the same customer might be paying $120 a month for the same service after the rate increases.

The utility has said that solar customers don't pay the full costs of service provided to them, with those costs overwhelmingly focused on transmission lines, generating stations and other infrastructure, not the actual energy produced. An even larger solar surcharge was adopted less than a decade ago by a prior commission but was revoked in 2021.

Tax-free status of movie, music and games traded online is on table as WTO nations meet in Abu Dhabi

By JAMEY KEATEN Associated PressSINCE late last century and the early days of the web, providers of digital media like Netflix and Spotify have had a free pass when it comes to international taxes on films, video games and music that are shipped across borders through the internet.

But now, a global consensus on the issue may be starting to crack.

As the World Trade Organization opens its latest biannual meeting of government ministers Monday, its longtime moratorium on duties on e-commerce products — which has been renewed almost automatically since 1998 — is coming under pressure as never before.

This week in Abu Dhabi, the WTO's 164 member countries will take up a number of key issues: Subsidies that encourage overfishing. Reforms to make agricultural markets fairer and more eco-friendly. And efforts to revive the Geneva-based trade body's system of resolving disputes among countries.

All of those are tall orders, but the moratorium on e-commerce duties is perhaps the matter most in play. It centers on "electronic transmissions" — music, movies, video games and the like — more than on physical goods. But the rulebook isn't clear on the entire array of products affected.

"This is so important to millions of businesses, especially small- and medium-sized businesses," WTO Director-General Ngozi Okonjo-Iweala said.

"Some members believe that this should be extended and made permanent.

Others believe ... there are reasons why it should not."

"That's why there's been a debate and hopefully — because it touches on lives of many people — we hope that ministers would be able to make the appropriate decision," she told reporters recently.

Under WTO's rules, major decisions require consensus. The e-commerce moratorium can't just sail through automatically. Countries must actively vote in favor for the extension to take effect.

Four proposals are on the table: Two would extend the suspension of duties. Two — separately presented by South Africa and India, two countries that have been pushing their interests hard at the WTO — would not.

Proponents say the moratorium benefits consumers by helping keep costs down and promotes the wider rollout of digital services in countries both rich and poor. Critics say it deprives debt-burdened governments in developing countries of tax revenue, though there's debate over just how much state coffers would stand to gain.

The WTO itself says that on average, the potential loss would be less than one-third of 1% of total government revenue.

The stakes are high. A WTO report published in December said the value of "digitally delivered services" exports grew by more than 8% from 2005 to 2022 — higher than goods exports (5.6%) and otherservices exports (4.2%).

Growth has been uneven, though. Most developing countries don't have digital networks as extensive as those in the rich world. Those countries see less need to extend the moratorium — and might reap needed tax revenue if it ends.

South Africa's proposal, which seeks to end the moratorium, calls for the creation of a fund to receive voluntary contributions to bridge the "digital divide."

Consumers are increasingly pushing back against price increases — and winning

By CHRISTOPHER RUGABER AP Economics WriterINFLATION has changed the way many Americans shop. Now, those changes in consumer habits are helping bring down inflation.

Fed up with prices that remain about 19%, on average, above where they were before the pandemic, consumers are fighting back.

In grocery stores, they're shifting away from name brands to store-brand items, switching to discount stores or simply buying fewer items like snacks or gourmet foods.

More Americans are buying used cars, too, rather than new, forcing some dealers to provide discounts on new cars again.

But the growing consumer pushback to what critics condemn as price-gouging has been most evident with food as well as with consumer goods like paper towels and napkins.

In recent months, consumer resistance has led large food companies to respond by sharply slowing their price increases from the peaks of the past three years. This doesn't mean grocery prices will fall back to their levels of a few years ago, though with some items, including eggs, apples and milk, prices are below their peaks. But the milder increases in food prices should help further cool overall inflation, which is down sharply from a peak of 9.1% in 2022 to 3.1%.

Public frustration with prices has become a central issue in President Joe Biden's bid for re-election.

Polls show that despite the dramatic decline in inflation, many consumers are unhappy that prices remain so much higher than they were before inflation began accelerating in 2021.

Biden has echoed the criticism of many leftleaning economists that corporations jacked up their prices more than was needed to cover their own higher costs, allowing themselves to boost their profits. The White House has also attacked "shrinkflation," whereby a company, rather than raising the price of a product, instead shrinks the amount inside the package. In a video released on Super Bowl Sunday, Biden denounced shrinkflation as a "rip-off." Consumer pushback against high prices suggests to many economists that inflation should further ease. That would make this bout of inflation markedly different from the debilitating price spikes of the 1970s and early 1980s, which took longer to defeat. When high inflation persists, consumers often develop an inflationary psychology: Ever-rising prices lead them to accelerate their purchases before costs rise further, a trend that can itself perpetuate inflation.

"That was the fear — that everybody would tolerate higher prices," said Gregory Daco, chief economist at EY, a consulting firm, who notes that it hasn't happened. "I don't think we've moved into a high inflation regime."

Instead, this time many consumers have reacted like Stuart Dryden, a commercial underwriter at a bank who lives in Arlington, Virginia. On a recent trip to his regular grocery store, Dryden, 37, pointed out big price disparities between Kraft Heinz-branded products and their store-label competitors, which he now favors.

Dryden, for example, loves cream cheese and bagels. A 12-ounce tub of Kraft's Philadelphia cream cheese costs $6.69. The

government aid, making it easier for them to pay the higher prices.

Still, some decried the phenomenon as "greedflation." And in a March 2023 research paper, the economist Isabella Weber at the University of Massachusetts, Amherst, referred to it as "seller's inflation."

Yet beginning late last year, many of the same companies discovered that the strategy was no longer working. Most consumers have now long since spent the savings they built up during the pandemic.

store brand, he noted, is just $3.19. A 24-pack of Kraft single cheese slices is $7.69; the store label, $2.99. And a 32-ounce Heinz ketchup bottle is $6.29, while the alternative is just $1.69. Similar gaps existed with mac-and-cheese and shredded cheese products.

"Just those five products together already cost nearly $30," Dryden said. The alternatives were less than half that, he calculated, at about $13.

"I've been trying private-label options, and the quality is the same and it's almost a no-brainer to switch from the products I used to buy a ton of to just the private label," Dryden said.

Alex Abraham, a spokesman for Kraft Heinz, said that its costs rose 3% in the final three months of last year but that the company raised its own prices only 1%.

"We are doing everything possible to find efficiencies in our factories and other parts of our business to offset and mitigate further price increases," Abraham said.

Last week, Kraft Heinz said sales fell in the final three months of last year as more consumers traded down to cheaper brands.

Dryden has taken other steps to save money: A year ago, he moved into a new apartment after his previous landlord jacked up his rent by about 50%. His former apartment had been next to a relatively pricey grocery store, Whole Foods. Now, he shops at a nearby Amazon Fresh and has started visiting the discount grocer Aldi every couple of weeks.

Samuel Rines, an investment strategist at Corbu, says that PepsiCo, Kimberly-Clark, Procter & Gamble and many other consumer food and packaged goods companies exploited the rise in input costs stemming from supply-chain disruptions and Russia's invasion of Ukraine to dramatically raise their prices — and increase their profits — in 2021 and 2022.

A contributing factor was that millions of Americans enjoyed solid wage gains and received stimulus checks and other

Lower-income consumers, in particular, are running up credit card debt and falling behind on their payments. Americans overall are spending more cautiously. Daco notes that overall sales during the holiday shopping season were up just 4% — and most of it reflected higher prices rather than consumers actually buying more things.

As an example, Rines points to Unilever, which makes, among other items, Hellman's mayonnaise, Ben & Jerry's ice cream and Dove soaps. Unilever jacked up its prices 13.3% on average across its brands in 2022. Its sales volume fell 3.6% that year. In response, it raised prices just 2.8% last year; sales rose 1.8%.

"We're beginning to see the consumer no longer willing to take the higher pricing," Rines said. "So companies were beginning to get a little bit more skeptical of their ability to just have price be the driver of their revenues. They had to have those volumes come back, and the consumer wasn't reacting in a way that they were pleased with."

Unilever itself recently attributed poor sales performance in Europe to "share losses to private labels." Other businesses have noticed, too. After

their sales fell in the final three months of last year, PepsiCo executives signaled that this year they would rein in price increases and focus more on boosting sales.

"In 2024, we see ... normalization of the cost, normalization of inflation," CEO Ramon Laguarta said. "So we see everything trending back to our longterm" pricing trends.

Jeffrey Harmening, CEO of General Mills, which makes Cheerios, Chex Cereal, Progresso soups and dozens of other brands, has acknowledged that his customers are increasingly seeking bargains.

And McDonald's executives have said that consumers with incomes below $45,000 are visiting less and spending less when they do visit and say the company plans to highlight its lower-priced items.

"Consumers are more wary — and weary — of pricing, and we're going to continue to be consumer-led in our pricing decisions," Ian Borden, the company's chief financial officer, told investors.

Officials at the Federal Reserve, the nation's primary inflation-fighting institution, have cited consumers' growing reluctance to pay high prices as a key reason why they expect inflation to fall steadily back to their 2% annual target.

"Firms are telling us that price sensitivity is very much higher now," Mary Daly, president of the Federal Reserve Bank of San Francisco and a member of the Fed's interest-rate setting committee, said last week. "Consumers don't want to purchase unless they're seeing a 10% discount. ... This is a serious improvement in the role that consumers play in bridling inflation."