Fund manager to be ‘little more defensive’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A BAHAMIAN investment bank plans to be “a little more defensive” in 2024 with its stock picks as it targets close to $20m annual asset growth in its main equities investment fund.

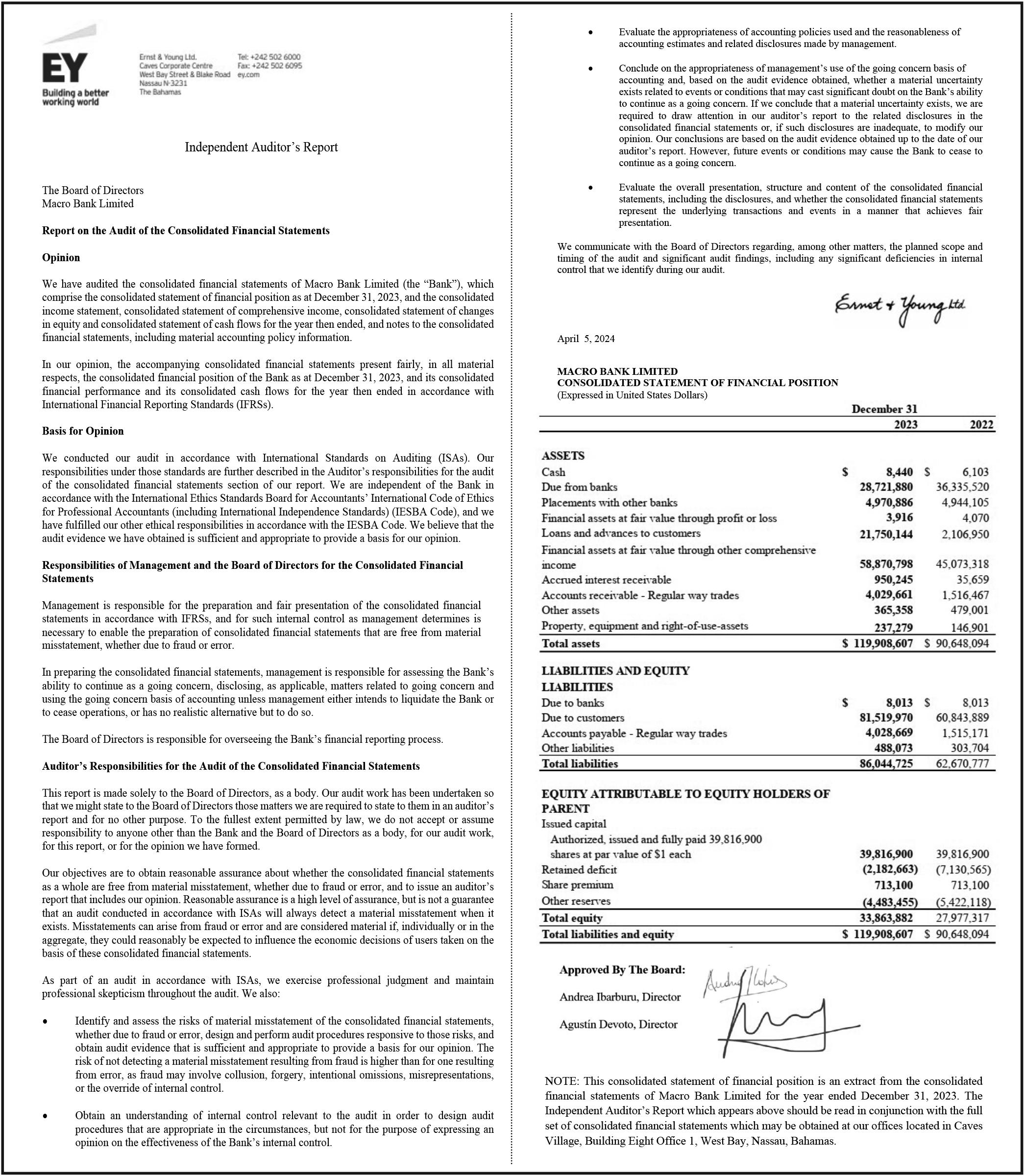

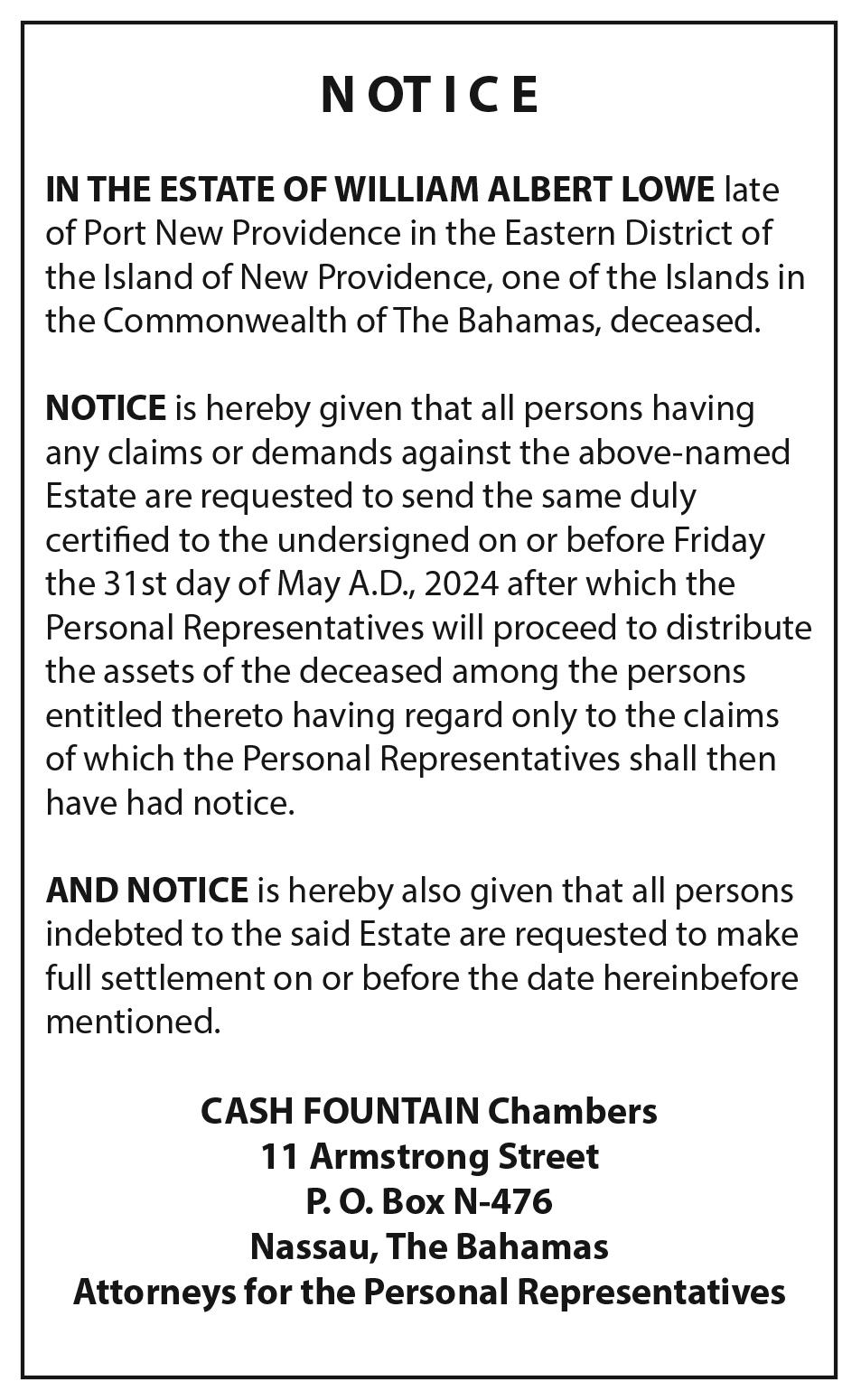

David Slatter, RF Bank & Trust (Bahamas) vice-president of investments, told Tribune Business that expectations of slower Bahamian economic growth as the postCOVID revival peters out means he will focus more on “solid dividend payers” and stocks that “can weather an economic downturn” when he makes equity investments for its fund family this year. The Targeted Equity Fund, which is its Bahamian dollar-denominated fund most weighted towards equity investments in stocks and shares, saw its net asset value (NAV) increase by 5

percent last year with further improvement - albeit slightanticipated in 2024.

Mr Slatter told this newspaper that the Targeted Equity Fund had enjoyed a “slow start” to the year, with its NAV up by just 1.36 percent for the first quarter, but he pointed out that maintaining this growth rate over the next three quarters will translate into an approximate 5.4 percent increase for the full year.

That, RF’s investment chief added, would be “a little bit better than last year but not the same growth as previous

years” with the Targeted Equity Fund having averaged annual 10.6 percent NAV growth over the past nine years. Mr Slatter is hoping to move closer to that average in 2024, forecasting up to 7 percent growth for an investment fund that presently has $121m in assets under administration.

“That’s growing nicely,” he told Tribune Business. “It’s primarily Bahamian exposure. We have a small amount of international exposure, 5 percent, and 95 percent local. We do have a private equity

position of around 8 percent of the portfolio. That means if 13 percent of the portfolio is in private equity and US dollars, 87 percent is in Bahamian dollars.”

Revealing that he plans to reduce the weighting of the Targeted Equity Fund’s largest Bahamian holdings, Mr Slatter added: “The largest positions, and they’ve come

‘Business booming’ but hotels eye year-round tourism switch

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

BOUTIQUE Eleuthera resorts yesterday asserted that “business is booming” amid growing pressure for a switch to year-round tourism and halt to many properties closing during late summer and fall.

Realtors yesterday

hailed Eleuthera’s “turbo charged” real estate market and revealed they are now dealing with “real buyers” for major land parcels as opposed to the pre-COVID speculators.

Dean Spychalla, general manager at Pineapple Fields, told the Eleuthera Business Outlook conference that the resort’s revenues are $100,000 ahead of projection for present financial year-to-date as he credited COVID with providing a totally new “repeat visitor” model for Family Island hotels. “Pineapple Fields is doing quite well,” he told attendees.

“This fiscal year we are already, and we’re a small hotel; we’re $100,000 ahead of projected revenue for the fiscal year with our history forecast. What do I mean by that? That means in the books, and future reservations on the books through the end of the fiscal year, so we’re $100,000 ahead of budget now with months to increase that.

“So we’re looking quite good. From a business point of view, revenge travel is over, but I think this concept of persons because of COVID experiencing smaller resorts due to the social distancing requirements has kind of created a new market.

“People that didn’t go to these kind of islands in

A CABINET minister yesterday revealed that American Airlines threatened to pull out of its Governor’s Harbour route expansion if $6m in airport upgrades were not completed within two months.

Clay Sweeting, minister of works and Family Island affairs, told the Eleuthera Business Outlook conference he had barely been appointed to his new Cabinet position when he received a November 2023 phone call warning that the US carrier would back away from flying directly to Governor’s Harbour three times a week from Miami if the airport improvements were not completed by January 27.

He disclosed the drama in answering a question from Kerry Fountain, the Bahamas Out Island Promotion Board’s executive director, who queried when upgrades would be carried out to another of Eleuthera’s airports at Rock Sound. Until this happened, Rock Sound will remain rated ‘tier two” by US aviation regulators, which serves as a deterrent to airlines such as Maker’s Air offering more frequent service.

“I think that sometimes people look at number two and not what the potential is,” Mr Sweeting replied. “So the tier level really doesn’t matter to me because Governor’s Harbour is tier two, too. I don’t know if you knew that they only moved it to tier one when I agitated a little bit.

“So I got a phone call in November. They said: ‘Look, American said if that airport isn’t done by January 27, they will pull out’. So being the new minister of works, that’s how

John Christie, HG Christie’s president and broker, told the Eleuthera Business Outlook conference that the property market throughout the island, as well as Harbour Island and Spanish Wells, is set to remain strong with realtors now “running out of inventory” in its international segment.

Disclosing that Spanish Wells in particular is “shooting up, shooting up”, and that “we haven’t seen the top of it”, he added: “I think we all know, everyone in the business knows, ‘Turbo

7,

Mr Gaskins said: ‘We will be opening with an allBahamian leadership team, so everyone from island director to every manager on site will be Bahamian and we’re very, very proud of that. We have maintained an 80 percent balance By

are fine. We’re looking at substantial completion in a couple of days and opened to guests fully in June 2024.” He added that the project will open with an “all Bahamian leadership team”, and the development has maintained an 80 percent Bahamian staff in accordance with its Heads of Agreement obligations.

business@tribunemedia.net FRIDAY, APRIL 19, 2024 American threatened Eluethera growth if airport not enhanced By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net Disney’s Eleuthera port to receive first

DISNEY Cruise Line’s Lighthouse Point destination will open to its first vessel call on June 7 with the project

substantially

a couple

days”. Joseph

cruise line’s

first sailing

vessel June 7

expected to be

completed “in

of

Gaskins, the

regional public affairs director for The Bahamas and Caribbean, told the Eleuthera Business Outlook conference: “Our

is on June

so the first ship will arrive at Lighthouse Point alongside on June 7, hoping that the weather and the seas

SEE PAGE B4

FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

B4 SEE PAGE B5

charged’ Eleuthera properties get ‘real buyers’ By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net SEE PAGE

SEE PAGE B5 SEE PAGE B6 CLAY SWEETING

DAVID SLATTER

$5.85 $5.92 $5.96

JOHN CHRISTIE

$5.80

Achieving workplace harmony with spouse

Many married couples work together in their business, with one spouse sometimes working for no pay or benefits. Often your spouse is a co-owner of the business, and working together is unavoidable.

Research, and observation, suggests there are clear advantages and disadvantages to classifying your spouse as an employee.

This week’s article provides some tips on how to navigate this scenario when it becomes unavoidable.

FERGUSON IAN

1. Hire to add complementary skills to the business. For example, your spouse may be great with the numbers or dealing with clients or sales. Hiring a spouse just to give them something to do is not usually a good reason. And if your spouse has the same skills as you do, why hire? You will most likely end up stepping on each other’s toes.

2. Have a clear division of labour. Be clear to each other, employees, customers and suppliers as to who does what. You may even

want to write up and agree on formal job descriptions. Also, be realistic about qualifications. Of course, this can be a sensitive area to discuss, but better to work through it sooner rather than later.

3. Set clear boundaries around work and personal time. No one wants to be at the beach on a weekend discussing next year’s strategic plan. Establish a time - 6 pm, or weekends and vacations - where there are no work discussions, but just enjoying each other’s company.

4. Set a time limit on the employment relationship, and agree to revisit it at that point. It is better to sit down and agree to dissolve the business relationship before it gets to the point where the marriage is in trouble.

5. If your spouse is not your only employee, do your best to avoid favouritism or taking advantage of your spouse. Pay them what they are worth and only what they are worth. Everyone is watching.

6. Agree to give each other periodic feedback

But first, set ground rules for feedback, and learn the skills of giving and receiving feedback.

a talent management and organisational development consultant, having completed graduate studies with regional and international universities. He has served organisations, both locally and globally, providing relevant solutions to their business growth and development issues. He may be contacted at tcconsultants@ coralwave.com

Carnival’s $600m GB project names personnel executive

CARNIVAL has appointed Grand Bahamabased executive, Shurmon Clarke, as human resources manager for its $600m Celebration Key project.

Ms Clarke, who has nearly two decades of experience in human resources management and quality control operations, said: “For me, it’s all about the impact on the community. The people that will be hired, the homes we will impact, the Grand Bahamians who will have an opportunity to upgrade their skills and gain invaluable experience working at this fantastic development.

“In particular, I am looking forward to seeing many Grand Bahamians who left the island to seek employment elsewhere coming back to work or operate businesses at Celebration Key.” The Grand Bahama port destination has been billed as the largest project

of its kind ever undertaken by Carnival. The cruise line recently announced a $100 million increase in its investment to facilitate the pier’s extension, taking the initial phase of Celebration Key to two cruise ship berths. This is projected to help generate more than 700 permanent jobs, including the 300 Bahamians hired directly

by Carnival to help welcome 2.2m guests per year to Grand Bahama starting in 2025.

Carnival Corporation has pledged to work directly with businesses whollyowned and operated by Bahamians so that they comprise at least 75 percent of the outlets at Celebration Key. This represents up to 70 restaurant and retail outlets of various sizes.

Ms Clarke, who focuses on employee training, leadership development, coaching, career development and talent management, said of the response by Grand Bahamians: “The reaction has been good and continues to gain momentum. There is a lot of interest in the various roles on offer, and the entrepreneurial opportunities that Carnival is creating as well,” she said.

“This project is so significant for the Grand Bahama

economy. I think as the construction phase progresses, more and more people will realise that there may be an opportunity here for them.

The financial injection this will create for vendors, retail operators and food and beverage providers, not to mention spin-off businesses around the port, will be tremendous.

Before joining Carnival, Ms Clarke held executive positions with a major industrial company in Grand Bahama. She managed all aspects of human resources, including compliance, corporate structure, health and wellness, compensation, benefits and employee relations. She also developed on-site training courses, recruited and trained new talent, coached and mentored employees and developed an ambitious internship programme.

“Shurmon will play a fundamental role in ensuring a positive and rewarding employee experience, and we could not be more pleased to have her join the team,” said Michelle McGregor, Carnival’s director of operations for its Bahamas Cruise Destinations.

“We’re thrilled for her to lead our recruitment efforts on building the talented teams at Celebration Key. Her impressive skill-set, deep knowledge of Grand Bahama and its people, and commitment to training and development will be absolutely crucial to making Celebration Key a success.”

Share your news

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 3221986 and share your story.

PAGE 2, Friday, April 19, 2024 THE TRIBUNE

SHURMON CLARKE

DOCTORS URGES TAX BREAKS FOR FAMILY ISLAND INVESTMENTS

DOCTORS Hospital’s chief financial officer yesterday argued that tax breaks and other “incentives are critical” to encouraging the private sector to invest in Family Islands where they may incur losses.

Dennis Deveaux told the Eleuthera Business Outlook that enabling companies to deduct and write-off Family Island losses against taxes such as Business Licence fees, real property tax and work permit fees could incentivise them to expand beyond Nassau.

He said: “We remain committed to supporting the Government of the day in whatever it is that we can do to help the state of healthcare in the country but, tangibly, the first thing would be to look at the tax regime that burdens New Providence-based companies and tying that into their investment policies on islands like Eleuthera.

“Is there an opportunity to claw back on our Business Licence, our real property tax, our remittances for work permits tied to the financial performance or losses? For businesses that invest in Eleuthera, we have a $100,000 loss [as an example]. Is there an opportunity to have a claw back or

an offset against our losses as we invest and take risks in specific development zones, like Eleuthera, a claw back on taxes?”

Mr Deveaux added that the Government can also incentivise private participation through entering public-private partnerships (PPPs) for services it cannot deliver such as dialysis to residents of a Family Island. He said: “The second thing, then, is supporting there being a market for our services. Committing in the form of the most basic form of PPP that the Government commits to purchase services that it itself cannot deliver.

“The government acting as beyond NHI, it pays for services that are critical. It doesn’t mean that the public investments need to be stopped. But there are certain services that are either outside of the planning capacity of the Government or they fall into a specialist area of care - for example, dialysis services. The Government committing to be a payer for dialysis services certainly would cause us to think about that investment differently. “

Mr Deveaux said that populations in Family Island settlements such as Rock Sound have doubled in the past decade, creating a need for increased medical services. He added that policymakers can create ways to “accelerate” sustainable investments.

CABLE EYES $9M FIBRE BOOST FOR ELEUTHERA

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

CABLE Bahamas yesterday said it is assessing a $9m subsea cable investment as it aims to make its Eleuthera infrastructure more resilient.

Tracey Boucher, its vice-president of engineering and technology, told the Eleuthera Business Outlook conference that one of the major challenges the group faces in Eleuthera is frequent damage to its aerial fibre lines due to traffic accidents or tree trimmings that lead to outages in various communities.

At present, she said the best Cable Bahamas can do is work on reducing the average repair time so the company is looking into infrastructure upgrades. “Our major challenge in Eleuthera as it relates to connectivity is the constant fibre breaks, and the

constant power outages that damage equipment that’s out in the plant,” Ms Boucher said. “Eleuthera, in particular, it’s very long…and we have a fibre cable that runs from north to south over the air and constantly from traffic accidents, or tree trimmings, those fibre cables gets cut. When those cables get cut, we lose connectivity to a segment of Eleuthera in various communities.

“As of late, we find that happening more and more constant than it was before, so the outages have became a little bit more frequent. At best right now we can quite quickly reduce the mean time to repair. But that’s not exciting and that’s not encouraging.” Ms Boucher said Cable Bahamas is looking to “harden” the fibre cable infrastructure by trenching across the length of the island and installing conduits, as well as running subsea fibre cables from

Eleuthera to Nassau or Norman’s Cay.

She said: “We have explored running that fibre cable from north to south underground and, in order to do that, there’s some investment that has to be made. We have been exploring partnerships with the public and private sector to partner, and harden that infrastructure by trenching from north to south underground, putting in conduits and installing the fibre cables just to reduce the amount of time those fibres get broken by some accidental causes.

“We’re also exploring and looking at adding resilience to the island of Eleuthera. And when I say resilience, that’s subsea fibre from Eleuthera to Nassau. Currently we are going from Eleuthera to Grand Bahama. We were looking at putting another cable in the sea from Eleuthera to Nassau or Exuma because we currently have subsea infrastructure at Norman’s

Cay, so we might take that path based on the environmental approvals we get.”

Ms Boucher said the infrastructure upgrades will be discussed in Cable Bahamas’ upcoming budget, and the company is looking for investors to provide capital contributions for the $9m in upgrades needed for the island.

The Doctors Hospital finance chief said: “We remain committed. We recognise that there is a need. There’s a need above what the existing capacity is on the island. And I think we are open to helping the policymakers think about things that would cause us to accelerate our investment. It’s quite likely that we must do something. “I think what we’re wrestling with is the question of sustainability. Rock Sound, in the south part of Eleuthera, having doubled its population over the last ten years now reaches a critical mass for an organisation like us to maybe come on top of existing providers with a service. But I think we remain open to those kinds of very tangible and fruitful conversations, ultimately, that cause us to think of our investment decision differently.

She said: “So we have planned in our upcoming budget cycle, which is July of this year pending approvals, to lay that subsea fibre and that will harden the infrastructure in terms of adding that layer of resiliency for connectivity.

“So in the event, when we do have a fibre break, at any point along that cable span, the traffic will take the other route of the island. So it’s a huge investment and we also looking for investors to provide some capital contributions

“We are looking for models that are sustainable. Sustainability has two fronts. The first one is confidence in the initial investment. That’s an outlay of cash. And then who are the subscribers or users of your service once you’re on the ground, and ensuring that there’s a revenue base to ensure that that service can operate and perhaps even expand beyond your initial investment.”

to help us harden the infrastructure in Eleuthera.

“To run that cable from north to south, and that’s from Tarpum Bay to North Eleuthera airport, that in itself is about $3.5m. To run the subsea fibre cable from Tarpum Bay, further down into the south,\ to Nassau, it’s another $3m. And to run back to Norman’s Cay is another $2.5m. So we’re just exploring the most efficient, cost effective way to make it happen.”

THE TRIBUNE Friday, April 19, 2024, PAGE 3

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

American threatened Eluethera growth if airport not enhanced

the airport got done so quickly. Because if that wasn’t done by January 27, American Airlines travelling to Governors, what you now know as their three flights a week, would have never happened. So sometimes things have to be done like that.”

Mr Sweeting pledged that Rock Sound’s airport will

be upgraded, adding that an assessment had been conducted and a price tag subsequently developed for essential runway repairs. However, he warned that the improvements will not be to the same level as Governor’s Harbour’s Airport unless a major airline such as American makes a commitment to use it frequently.

is strong, and if you feel like you can sell the property at the end of the day, you are much more willing to buy.”

He added: “We will do some upgrades there. I can’t promise that it will be to a level of Governor’s unless we have a commitment from an airline. Then we can have that discussion because you’re looking at how the Government will return its money, not necessarily direct to pocket but throughout our investment through the constituency or in South Eleuthera.

“So we are continuing to discuss, and if we can get some commitment I’m sure that we have room maybe for more expansion than just a renovation”. Mr Sweeting explained his main concern lies with the runway, which has already been assessed and priced for repair

He said: “Rock Sound does need some upgrades.

The main concern for me is the runway. We’ve already had it assessed. We got a quote on what it would cost to redo the runway. The challenge for government, I think, is finding a way to…

“We have three international airports in Eleuthera and, at one point they wanted to close one and amalgamate it with another. And I say you must not want

Bahamian home buyers and long-term renters.

more together and living as kind of a village.”

me to get reelected next time… But I think we have to find ways, and sometimes government looks at more elaborate plans, which are more costly, instead of functionality. We had a Cabinet paper this week that spoke about the development of airports and which ones need development and whatever.” that the Eleuthera market and Harbour Island market has been what I call turbo charged for the past four years since COVID. “We were doing well, going like this but doing well, and COVID came along and its really supercharged the market. We’re seeing record prices everywhere and Harbour Island prices are going crazy. The number one thing that’s really good is people like us, we’ve been in the business a long time, and know real estate can be slower.

“If you bought a piece of real estate, you didn’t know when you might be able to sell it but now, because the market is so good, people are coming in and see they’re going to have to fight to get their properties. They’re going to have to fight over this one and that one. They know the market

Mr Christie’s analysis was echoed by Mark Hussey, a Governor’s Harbourbased agent with Damianos Sotheby’s International Realty, who told the Outlook that realtors have been dealing with “real buyers” in the four years since COVID struck. This, he added, has resulted “in nearly all” of the former Club Med site being sold, while another developer has held “favourable talks” with the Government over developing a 173-acre parcel for a golf course. “I’ve been in the real estate game for 20 years, and I’ve never seen a market such as Eleuthera thriving,” Mr Hussey said.

“In the last ten years, there were a lot of buyers and

developers for Eleuthera who wanted to buy a lot of acreage, but a lot of them didn’t really have the money or capital to finance it.

“They came in and were selling this dream to other players, and then COVID came along. Since COVID came along we’ve found real buyers. We’ve had more billionaires that have come in and purchased large tracts of land. They have a masterplan that they are doing with the Government at the moment.

“I just recently sold 173 acres, and the developer of that is looking to do a golf course. We met with the Government as well. It looks very favourable. We sold, in the last four to five years, nearly all of the Club Med land. There is another plan in place for that. I’ve seen a lot of very wealthy people come in,” he continued.

“I think the Spanish Wells market is very active. Harbour Island, as we all know, is over-developed and over-priced, but it’s selling. There’s a market for that as well. I think a lot of those wealthy people are gravitating back to Governor’s Harbour. It’s a little more affordable, you get a sense of community, and the people are a little bit

Mr Hussey, as an example, said beachfront property in Harbour Island that was acquired for $2m some 20 years ago may now be priced at $14m. “It’s been priced out of the market,” he added. “The people trying to buy in the Harbour Island market can’t buy into that now, so they are gravitating and heading back to Governor’s Harbour, Tarpum Bay and even North Eleuthera where it is more affordable.

“They can buy a bigger piece of land and get the same sort of house or development versus spending $30m in Harbour Island. I think it’s outgrown itself, and we’re seeing the push and move back into Governor’s.” Mr Christie added that Briland, which “used to be quaint”, is now seen as “busy, busy” by Family Island standards, and buyers are looking elsewhere for the typical Out Island lifestyle.

Despite the upward pressure in real estate prices, both Mr Hussey and Mr Christie argued that affordable options remain for Bahamians in both Eleuthera and the wider Bahamas. The HG Christie chief listed Rainbow Bay and Eleuthera Island Shores as two communities

where Bahamians can acquire relatively inexpensive lots, noting that the island was attracting many Nassau residents including retirees.

Mr Hussey, meanwhile, said: “If you from Eleuthera Shores to Rainbow Bay you can buy a lot in that area from $5,000 to $100,000 It’s a sliding scale depending on whether it’s waterfront or a hilltop with a view. As you come down from the north to Governor’s, you can buy a lot for $150,000 with a view or on a hill. So it’s not out of reach for local Bahamians.” Eleuthera Business Outlook attendees yesterday voiced renewed concerns that the island, along with other Family Islands enjoying major investment inflows and development, is facing a “housing crisis” due to Bahamians being priced out of the property and long-term rental market and a shortage of accommodations as landlords increasingly convert their properties to Airbnbs.

As a result, there are fears there is insufficient inventory to properly house both the construction and full-time workers that investors will require for their projects to succeed. But Clay Sweeting, minister of works and Family Island Affairs, who was the conference’s keynote speaker, argued that “it’s not a housing crisis; it’s a housing opportunity” with the Government and private sector needing to solve the issue together.

And Mr Hussey yesterday suggested that Eleuthera families who are “land rich” use some of their landholdings to address this need by developing affordable, or lower income, housing targeted at

“I think the land owned by these local families, there needs to be some way of copying what Sir Franklyn Wilson did in Nassau in building these low cost communities so people from Nassau can come here and live, and be part of these developments and the growth of Governor’s Harbour or Eleuthera,” he added.

Citing an example of what could be done, Mr Hussey pointed to a 40-acre tract of land located near the French Leave property in Governor’s Harbour. The site was subdivided into 40 lots, with those sized at half an acre priced at $55,000, and others for three-quarters of an acre costing $74,000. He added that around 37-38 of the lots were sold to Bahamian purchasers originating mainly from Nassau.

“I believe there are 600 houses in Governor’s Harbour on Airbnb, which is phenomenal when five years ago it was probably 150,” Mr Hussey said. He added that the development of commercial storage units represents a major opportunity for Eleuthera real estate investors if they can acquire land at a price which ensures they will earn a reasonable return.

“People hoard things and there’s nowhere to put it,” the realtor said. “People coming here, there’s nowhere to rent long-term. There’s no housing, no duplexes, trlplexes. There’s no commercial space to rent. There’s quite a lot of opportunity for people to come in, build inexpensive commercial properties, rent and lease them out, and get good income from that.”

PAGE 4, Friday, April 19, 2024 THE TRIBUNE

FROM PAGE B1 FROM PAGE B1

‘Turbo charged’ Eleuthera properties get ‘real buyers’

Legal Notice NOTICE DUELO HOLDINGS LTD. NOTICE IS HEREBY GIVEN as follows: (a) DUELO HOLDINGS LTD. is in voluntary dissolution under the provisions of Section 138 (4) of the International Business Companies Act 2000. (b) The dissolution of the said Company commenced on the 18th day of April 2024. (c) The Liquidator of the said Company is Delco Investments Limited of Deltec House, Lyford Cay, P.O. Box N-3229, Nassau, Bahamas. Dated this 19th day of April A.D. 2024. Delco Investments Limited Liquidator Legal Notice NOTICE Seba Asset Management Ltd. NOTICE IS HEREBY GIVEN as follows: (a) Seba Asset Management Ltd. is in voluntary dissolution under the provisions of Section 138 (4) of the International Business Companies Act 2000. (b) The dissolution of the said Company commenced on the 18th day of April 2024. (c) The Liquidator of the said Company is Delco Investments Limited of Deltec House, Lyford Cay, P.O. Box N-3229, Nassau, Bahamas. Dated this 19th day of April A.D. 2024. Delco Investments Limited Liquidator NOTICE BAHAMAS WASTE LIMITED Invites all Shareholders to attend its ANNUAL GENERAL MEETING On Wednesday May 22, 2024 Admittance will start at 5:30 pm National Tennis Centre Upstairs Meeting Room Queen Elizabeth Sports Centre Oakes Field, Nassau Bahamas All AGM Materials will be sent via email by Bahamas Central Securities Depository (BCSD) by April 19th, 2024. N O T I C E SKY INFINITY FAMILY LIMITED N O T I C E IS HEREBY GIVEN as follows: (a) SKY INFINITY FAMILY LIMITED is in voluntary dissolution under the provisions of Section 138 (4) of the International Business Companies Act 2000. (b) The dissolution of the said company commenced on the 16th April, 2024 when the Articles of Dissolution were submitted to and registered by the Registrar General. (c) The Liquidator of the said company is Bukit Merah Limited, The Bahamas Financial Centre, Shirley & Charlotte Streets, P.O. Box N-3023, Nassau, Bahamas Dated this 19th day of April, A. D. 2024 Bukit Merah Limited Liquidator N O T I C E HUANGW FAMILY INVESTMENTS LIMITED N O T I C E IS HEREBY GIVEN as follows: (a) HUANGW FAMILY INVESTMENTS LIMITED is in voluntary dissolution under the provisions of Section 138 (4) of the International Business Companies Act 2000. (b) The dissolution of the said company commenced on the 16th April, 2024 when the Articles of Dissolution were submitted to and registered by the Registrar General. (c) The Liquidator of the said company is Bukit Merah Limited, The Bahamas Financial Centre, Shirley & Charlotte Streets, P.O. Box N-3023, Nassau, Bahamas Dated this 19th day of April, A. D. 2024 Bukit Merah Limited Liquidator

‘Business booming’ but hotels eye year-round tourism switch

the past are now doing so. They’ve done it once, so I think we’re going to get repeat business as a result of that. Persons that used to go to these big resorts, after having experienced this and, in some cases in the slower season enjoyed splendid isolation, because that’s what it is, say: ‘It was pretty nice. I’m not going to go to Atlantis again’.”

Mr Spychalla, who urged Eleuthera and other Family Island resorts to “capitalise” on this trend, was backed by other hotel operators in his assessment of tourism’s current strength. “ Keyron Smith, president and chief executive of the One Eleuthera Foundation, which operates the Retreat hotel property, said occupancy rates are now near-double what they hit during the COVID lows.

“I would say that business is booming at this time on the island of Eleuthera,” he added. “I would say that from over the last year or two we have seen a significant increase in our bookings, just stable

visitors, so I would say pretty much Eleuthera is on the rise and we are definitely in a renaissance. “For the most part, I would say we have got a lot of stable visitors that come in through Rick Sound. So in terms of our forecast, I will say on average during COVID our bookings or occupancy rate would have dropped to between 24-26 percent. Since then we increased to about 33 percent, and now we’re on par to increase to about 44 percent for occupancy rates this year.”

Asked by debate moderator Kerry Fountain, the Bahamas Out Island Promotion Board’s executive director, as to what he sees as the greatest impediment to hotel industry growth, Mr Smith replied: “I think the biggest challenge, and I think a lot of people are seeing it especially with all this development going on, is going to be human resources. “It’s going to be hiring. It’s also in relation to attracting the right talent to help you grow your business, so to dive into it I

think there is a great need for training and development. If we’re going to grow the tourism industry in Eleuthera, we’re definitely going to have to focus on developing the human resources.”

Patrick Nolan, Belmont House’s director and general manager, told the same panel discussion that the tourism business has “gone from strength to strength” since emerging from the COVID lockdowns and border closures that blighted 2020 and 2021. “Business has been after COVID, which was obviously a terrible time for everybody, things picked up right away,” he said. “I think the Eleuthera model, and the type of destination that it is, which is remote, local and accessible, was the perfect solution for a lot of people who also wanted to travel and didn’t want to be in a big resort-type environment and have you.

“Certainly for us in central it was a good opportunity and business has been incredible as Keyron said. We’ve gone from strength to strength since

Disney’s Eleuthera port to receive first vessel June 7

between Bahamian and foreign workers throughout the life of the project, as we’ve committed to.”

With construction nearing completion, Mr Gaskins said there are currently more than 600 Bahamians employed on site - more than three times the amount set out in the Heads of Agreement. They have received over 5,800 hours of professional training to prepare them for future jobs.

He said: “We promised 120 construction jobs. We more than tripled that and we currently have 600 Bahamians working on site right now to finish up this project.

“Along with the amount of employees, we’ve not just used this opportunity to give them a job. But we put in more than 5,800 hours of training for these construction workers. So everything from OSHA 10 to safety, first aid, CPR, we’re preparing them for their next gig.”

Mr Gaskins said the project will use less than 16 percent of the 900 acres acquired from private owners at the southernmost point of Eleuthera. Disney donated 25 percent or 192 acres to the Government and will leave 59 percent undeveloped, with a commitment to future expansions not exceeding 20 percent of the property.

He said: “We bought 900 acres of private property on the southernmost tip of the island; 25 percent of that acreage, we are donating back to the Government and the people of the Bahamas - 192 acres. Fifty-nine percent of that acreage will remain undeveloped and untouched. “And at this point, I can confirm that although we committed to 16 percent development on the property, we are coming in at less than 16 percent development. So it is a very low impact development. At the end of the day, though, if we intend to expand over the next few years, we’ve committed to not developing over 20 percent of the property.”

2021.” As for the sector’s greatest challenge, Mr Nolan replied: “We need to educate folks in exactly what needs to be done, attention to detail and giving people what they expect at the end of the day. The folks that are coming here are our biggest possible market.”

He was echoed by Mr Spychalla, who described it as “meeting the expectations of our guests”. However, Heather Carey, his predecessor as Pineapple Fields’ general manager, said her experience last year strongly suggests that Bahamian resorts and tourism operators need to abandon the long-established practice of closing during the fall which coincides with the hurricane season’s peak.

“Last year when I was general manager at Pineapple Fields, historically as many hotels and restaurants do here, they have always closed for six, eight, ten weeks at the end of the summer,” she said. “So I was sitting with my staff. We had a few calls that showed interest.... We decided at the last minute

on September 1 that we would not close on the 15th, and we would stay open for the entire duration.

“We managed our renovations building by building so we would not impede the guest experience. We did not heavily discount our summer rates, and we did about 10 percent of our annual revenue in those six weeks. We had periods that we were sold out and people begging to come in. Other hotels were closed. Sadly, so many restaurants also closed. I see there’s an opportunity.”

Ms Carey said many guests during that fall 2023 period came from Nassau, including business persons who were unable to visit during peak tourism season due to a lack of accommodation. Numerous visitors also came from south Florida in an effort to escape that state’s packed beaches.

“There’s definitely an opportunity to have yearround tourism and we have to revise the model we have been using for so long,” she argued. “Restaurants need to stagger, and even open with a limited menu.

I think there’s an opportunity now with the growth of Eleuthera, and my staff were very happy to make a lot more tips than they might have had we closed. It’s something to consider.”

Mr Fountain, in reply, said the “stop and start” and seasonal nature of Bahamian tourism could influence airlines to “cut down on the frequency” of their routes to The Bahamas. “The days, honestly, of shutting down around the end of August and reopening in mid-November, we need to take a look at that,” he added.

He was backed by Mr Smith, who said: “One of the things we’re seeing in Eleuthera is we’re going to have to change the way we do business. We’ve experienced it as well. We would have closed earlier, schedules would have been different, but with things picking up and the type of tourism having changed so much we have to change the way we do business.

“We know the impact on lifestyles, but we have to change the way we do business as soon as possible.”

Mr Gaskins said Bahamians will continue to have access to Lighthouse Point and can enter from the public beach or the front gates with a governmentissued identfication.

LIGHTHOUSE POINT

He said: “Citizens and residents of The Bahamas will continue to have access to this site. We know how special Lighthouse Point Beach is for everyone. And so whether you come around on the public beach

or right through our front gates, as long as you have a government-issued ID you will be able to access that site. And over the next few weeks, we will be informing the community about what that access looks like.”

THE TRIBUNE Friday, April 19, 2024, PAGE 5

FROM PAGE B1 FROM PAGE B1

NOTICE 2023 Annual Report

are pleased to announce that The Company will be placing its 2023 Annual Report on its Website, and it will be possible for you to view the report online at www.bahamaswaste.com, by April 19th, 2024. The presentation of the information online replaces the mailing of the physical copies of the Annual Report to shareholders. PUBLIC NOTICE IN THE VOLUNTARY LIQUIDATION OF CARRIER EQUIPMENT LTD. NOTICE OF FINAL GENERAL MEETING TAKE NOTICE that the Liquidator of CARRIER EQUIPMENT LTD. (In Voluntary Liquidation), Mr. Philip B. Stubbs, shall hold a FINAL GENERAL MEETING of the 75 Village Road, Suite No. 5, Nassau, The Bahamas on Tuesday 21 May 2024 at 11:00 am AND FURTHER TAKE NOTICE THAT Company prior to its dissolution. Philip Stubbs Philip B. Stubbs Liquidator

We

Fund manager to be ‘little more defensive’

down materially over time, is Fidelity Bank (Bahamas) at 14 percent of the portfolio and Doctors Hospital at 14 percent. My objective is to get those positions below 10 percent of the portfolio, not by by selling but by growing the portfolio.”

The Targeted Equity Fund’s other major Bahamian equities holdings include Finance Corporation of The Bahamas (FINCO), which accounts for 8 percent of its portfolio, while FOCOL Holdings and Colina Holdings (Bahamas) each have a 7 percent weighting and Cable Bahamas some 6.5 percent.

By DEE-ANN DURBIN AP Business Writer

BOOMING sales of cold drinks at Starbucks have created a problem: growing amounts of plastic waste from the single-use cups that Frappuccinos, Refreshers, cold brews and other iced drinks are served in.

“We have all of the main equities in BISX in the fund to some extent,” Mr Slatter said. “We get diversification across industries, diversification across growth potential and we get diversification of dividend streams. “We expect the performance [of the Targeted Equity Fund] to be below the long-term average but somewhere in that 5-7 percent range. It’s not terrible, it’s not exceptional. We’ll have the NAV, assets under administration, grow by appreciation of the share price and through dividend income.”

He estimated that 6 percent growth, and an improving performance, will add some $7m to the

The coffee giant said Thursday it plans to alleviate some of that waste with new disposable cups that contain up to 20% less plastic. The cups are set to be rolled out to stores in the U.S. and Canada starting this month. Amelia Landers, Starbucks' vice president of product innovation, said the Seattle-based company spent the last four years developing the new containers. Engineers tested thousands of iterations to

assets under administration.

Targeted Equity Fund’s assets under administration by year-end with further expansion driven by dividend earnings and new subscriptions. “My expectation is we can get above $140m this year as far as assets under administration,” Mr Slatter told Tribune Business. “That’s this combination of returns on the existing portfolio and new inflows from subscriptions.” RF Bank & Trust’s Secure Balanced Fund, which features a mix of equity and fixed income investments for the more cautious investor, is also expected to generate improved returns albeit again below its historical average.

see how much plastic they could remove while still making the cup feel sturdy. "We feel like it's industryleading," Landers said. "It's the best expression of a cold plastic cup."

Starbucks says Frappuccinos and other cold drinks now account for 75% of its U.S. beverage sales, up from 37% in 2013. The company estimates the new cups will keep more than

“Historically over the last nine years it has averaged over 7 percent per annum,” Mr Slatter added, “7.2 percent for the last nine years. Last year it was up 4-5 percent. My expectation here would be close to 5-6 percent this year. I think what you’ll see is that, as the fixed income portfolio’s performance improves, that will help bring the Secure Balanced Fund’s performance closer to the Targeted Equity Fund’s. “We’ll be looking at 5-7 percent by virtue of the fixed income portfolio for the Secure Balanced Fund improving, and the difference between the Secure Balanced Fund and the Targeted Equity Fund being less. It’s over $150m in

13.5 million pounds of plastic out of landfills each year.

In total, if you consider the other funds, we have in excess of $800m in assets under administration.

“We expect a good year. Not quite historic averages but still much better than having money sitting in fixed deposits in the bank earning nothing. I think investors will get good returns; not the great results of the last nine years but good returns. We’ll continue to track the portfolio to squeeze out as much returns as possible.”

With The Bahamas having regained the economic output lost to COVID, its economic growth rate is forecast to dip to 2.3 percent in 2024a level slightly higher than

historical averages but nowhere near the 14-plus percent seen in the pandemic’s aftermath.

Noting that slower economic growth may impact equity earnings, Mr Slatter added: “I’m really going to be looking for solid dividend plays in the equities market, and a little more defensive in nature; investments that can weather an economic downturn. I will be looking less at growth stocks and more at dividend players and industries that have historically been durable during slowing growth. Industries not susceptible to a slowing economy like growth stocks.”

Producing the tumblers also requires less water and creates fewer carbon emissions, a leading cause of climate change, it said. Starbucks made other changes as part of the redesign. The new cold cups feature raised dots near the bottom, so baristas – including those with impaired vision – can quickly feel with the swipe of a thumb which size cup they're holding. And the 12-ounce cup — that's the "tall" size in Starbucks lingo — is shorter and wider to accommodate the same-size lid as larger cups. Landers said the new cups are part of a sustained sustainability push at Starbucks. The company adopted strawless lids in 2019. Last year, it said it would accept customer-provided cups for drive-thru and mobile orders in the U.S. and Canada.

The company plans to roll out a reusable cup program at thousands of stores in Europe, the Middle East and Africa by next year. Under the program, customers will pay a small deposit when they buy a hot or cold drink in a specially designed cup that can be used up to 30 times. They will get the deposit back when they return the cup to a store.

PAGE 6, Friday, April 19, 2024 THE TRIBUNE

FROM PAGE B1

BOOMING COLD DRINK SALES MEAN MORE PLASTIC WASTE. SO STARBUCKS REDESIGNED ITS CUPS Independent auditors’ report To the Shareholder of Santander Bank & Trust Ltd. Report on the audit of the financial information Our opinion In our opinion, the financial information of Santander Bank & Trust Ltd. (the Bank) as at December 31, 2023, is prepared, in all material respects, in accordance with the basis of preparation as set out in Note 1 to the financial information. What we have audited The Bank’s financial information comprises: the statement of financial position of the Bank as at December 31, 2023. Basis for opinion We conducted our audit in accordance with International Standards on Auditing (ISAs). Our responsibilities under those standards are further described in the Auditors’ responsibilities for the audit of the financial information section of our report. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion. Independence We are independent of the Bank in accordance with International Code of Ethics for Professional Accountants (including International Independence Standards) issued by the International Ethics Standards Board for Accountants (IESBA Code). We have fulfilled our other ethical responsibilities in accordance with the IESBA Code. Emphasis of Matter - Basis of preparation We draw attention to Note 1 to the financial information, which describes the basis of preparation. The financial information is prepared to comply with the requirements of the Bank’s regulator. As a result, the financial information may not be suitable for ano ther purpose. The financial information does not comprise a full set of financial statements prepared in accordance with IFRS Accounting Standards Our opinion is not modified in respect of this matter. Responsibilities of management and those charged with governance for the financial information Management is responsible for the preparation of the financial information in accordance with the basis of preparation as set out in Note 1 to the financial information and for such internal control as management determines is necessary to enable the preparation of financial information that is free from material misstatement, whether due to fraud or error. In preparing the financial information, management is responsible for assessing the Bank’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Bank or to cease operations, or has no realistic alternative but to do so. Those charged with governance are responsible for overseeing the Bank’s financial reporting process. Auditors’ responsibilities for the audit of the financial information Our objectives are to obtain reasonable assurance about whether the financial information as a whole is free from material misstatement, whether due to fraud or error, and to issue an auditors’ report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with ISAs will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered mater ial if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of this financial information. As part of an audit in accordance with ISAs, we exercise professional judgment and m aintain professional scepticism throughout the audit. We also: Identify and assess the risks of material misstatement of the financial information, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain aud it evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opini on on the effectiveness of the Bank’s internal control. Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management. Conclude on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Bank’s abil ity to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditors’ report to the related disclosures in the financial information or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditors’ report. However, future events or conditions may cause the Bank to cease to continue as a going concern. We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit. Other Matters The Bank has prepared a separate set of financial statements for the year ended December 31, 2023 in accordance with IFRS Accounting Standards, on which we issued a separate auditors’ report to the Shareholder dated 2024. This report, including the opinion, has been prepared for and only for the Shareholder, in accordance with the terms of our engagement letter and for no other purpose. We do not, in giving this opinion, accept or assume responsibility for any other purpose or to any other person to whom this report is shown or into whose hands it may come save where expressly agreed by our prior consent in writing. Chartered Accountants Nassau, Bahamas April 2024 Santander Bank & Trust Ltd. (Incorporated under the laws of the Commonwealth of The Bahamas) Statement of Financial Position As at December 31, 2023 (Expressed in thousands of Euros, except for share amounts) 2023 2022 € € ASSETS Cash and due from banks Demand - Group 769 1,277 - Others 223 207 992 1,484 Time - Others 46 48 - Group 261,068 79,299 Total cash and due from banks 262,106 80,831 Mortgage securitization bonds - 16 Foreign currency forward contracts 136,017 111,076 Loans 583 228,670 Intangible assets 6 27 Other assets and receivables 527 392 Right-of-use asset 263 155 Total Assets 399,502 421,167 LIABILITIES Due to Group entities Demand deposits 90 970 Time - 41,032 Foreign currency forward contracts 7,517 1,429 Other liabilities 654 393 Total Liabilities 8,261 43,824 EQUITY Share capital Authorized, issued and fully paid: 10,000 ordinary shares of €75.79 each 758 758 Additional Contributed Capital 310,000 310,000 Reserve for foreign currency translation (10,004) (10,004) Retained earnings 90,487 76,589 Total Equity 391,241 377,343 Total Liabilities and Equity 399,502 421,167 These financial statements were approved by the Board of Directors on 5 April 2024 and are signed on its behalf by: Director Director Note to the Financial Information December 31, 2023 1. Basis of preparation The accompanying financial information is an extract from financial statements as at December 31, 2023 and for the year then ended, which have been prepared in accordance with IFRS Accounting Standards as issued by the International Accounting Standards Board and is used to submit to The Central Bank of The Bahamas. The auditors’ report included herewith should be read in conjunction with the full set of financial statements, which can be obtained at ’s office located at Caves Corporate Centre, Building A 1st Floor, West Bay Street and Blake Road, Nassau, Bahamas. Santander Bank & Trust Ltd. (Incorporated under the laws of the Commonwealth of The Bahamas) Statement of Financial Position As at December 31, 2023 (Expressed in thousands of Euros, except for share amounts) 2023 2022 € € ASSETS Cash and due from banks Demand - Group 769 1,277 - Others 223 207 992 1,484 Time - Others 46 48 - Group 261,068 79,299 Total cash and due from banks 262,106 80,831 Mortgage securitization bonds - 16 Foreign currency forward contracts 136,017 111,076 Loans 583 228,670 Intangible assets 6 27 Other assets and receivables 527 392 Right-of-use asset 263 155 Total Assets 399,502 421,167 LIABILITIES Due to Group entities Demand deposits 90 970 Time - 41,032 Foreign currency forward contracts 7,517 1,429 Other liabilities 654 393 Total Liabilities 8,261 43,824 EQUITY Share capital Authorized, issued and fully paid: 10,000 ordinary shares of €75.79 each 758 758 Additional Contributed Capital 310,000 310,000 Reserve for foreign currency translation (10,004) (10,004) Retained earnings 90,487 76,589 Total Equity 391,241 377,343 Total Liabilities and Equity 399,502 421,167 These financial statements were approved by the Board of Directors on 5 April 2024 and are signed on its behalf by: Director Director Note to the Financial Information December 31, 2023 1. Basis of preparation The accompanying financial information is an extract from financial statements as at December 31, 2023 and for the year then ended, which have been prepared in accordance with IFRS Accounting Standards as issued by the International Accounting Standards Board and is used to submit to The Central Bank of The Bahamas. The auditors’ report included herewith should be read in conjunction with the full set of financial statements, which can be obtained at ’s office located at Caves Corporate Centre, Building A 1st Floor, West Bay Street and Blake Road, Nassau, Bahamas.

NETFLIX NOW HAS NEARLY 270 MILLION SUBSCRIBERS AFTER ANOTHER STRONG SHOWING TO BEGIN 2024

By MICHAEL LIEDTKE AP Technology Writer

NETFLIX gained another 9.3 million subscribers to start the year while its profit soared with the help of a still-emerging expansion into advertising, but caught investors off guard with a change that will make it more difficult to track the video streaming service's future growth.

The performance announced Thursday demonstrated that Netflix is still building on its momentum of last year, when a crackdown on free-loading viewers relying on shared passwords and the rollout of a low-priced option including commercials revived its growth following a post-pandemic lull. The strategy resulted in Netflix adding 30 million subscribers last year — the second largest annual increase the service's history.

Netflix's gains during the January-March period more than quadrupled the 1.8 million subscribers that the video streaming service added at the same time last year, and was nearly three times more than analysts had projected. The Los Gatos, California, company ended March with nearly 270 million worldwide subscribers, including about 83 million in its biggest market covering the U.S. and Canada.

Investors increasingly are viewing Netflix as the clear-cut winner in a fierce streaming battle that includes Apple, Amazon, Walt Disney Co. and Warner Bros. Discovery — a conclusion has caused its stock price to more than double since the end of 2022.

Netflix's shares dipped more than 5% in extended trading, despite the strong financial showing.

In a video meeting with analysts, Netflix co-CEO Greg Peters said management believes the company's financial growth has become more meaningful to watch than quarter-to-quarter fluctuations in subscribers.

"We think this is a better approach that reflects the evolution of the business," Peters said.

The company still intends to give annual updates on total subscribers. That plan indicates Netflix is trying to get investors focus on long-term trends rather than three-month increments that can be affected by short-term factors such as programming changes and household budgetary pressures that cause temporary cancellations, said Raj Venkatesan, a business administration professor at the University of Virginia who studies the video streaming market.

Now that Netflix has been cracking down on password sharing for more than a year, management also likely realizes it has reaped most of the subscriber gains from those measures and recognizes it will be more difficult to maintain that momentum, eMarketer analyst Ross Benes said.

"They are quitting while they are ahead by no longer reporting quarterly subscriber numbers," Benes said.

Netflix's renewed subscriber growth has been coupled with a sharper focus on boosting profit and revenue — an emphasis that has led management to be more judicious about its spending on original programming and regularly raising its subscription prices.

But Netflix surprised investors by disclosing in a shareholder letter that it will stop providing quarterly updates about its subscriber totals beginning next year, a move that will make it more difficult to track the video streaming service's growth — or contraction. The company has regularly posted its quarterly subscriber totals since going public 22 years ago.

THE TRIBUNE Friday, April 19, 2024, PAGE 7

THE NETFLIX logo is shown in this photo from the company’s website, in New York, Feb. 2, 2023. Netflix reports their earnings on Thursday, April 18, 2024. Photo:Richard Drew/AP

THE NEW York Stock Exchange is seen, through a window guard, on Tuesday, April 16, 2024 in New York. Wall Street drifted toward gains as more corporate earnings come in, giving investors a break from fretting about if and when the Federal Reserve might cut interest rates.

Morgan/AP

Wall Street drifts to a mixed finish as yields tick higher

By STAN CHOE AP Business Writer

U.S. stock indexes

drifted to a mixed finish on Thursday in a quiet day of trading.

The S&P 500 fell 11.09 points, or 0.2%, to 5,011.12 after flipping between small gains and losses through the day. The drop was slight, but it was still enough to send the index to a fifth straight loss. That’s its longest losing streak since October, and it’s sitting 4.6% below its record set late last month.

The Dow Jones Industrial Average edged up by 22.07 points, or 0.1%, to 37,775.38, and the Nasdaq composite slipped 81.87, or 0.5%, to 15,601.50.

Equifax dropped 8.5% for one of the market’s bigger losses after it reported weaker revenue for the latest quarter than analysts expected. High interest rates are pressuring its mortgage credit inquiry business.

The only stock to fall more in the S&P 500 was Las Vegas Sands, which sank 8.7% even though it reported better results than expected. Analysts said investors may be worried about competition the casino and resort company is facing in Macau.

Helping to offset those losses was Elevance Health, which climbed 3.2% after raising its profit forecast for the full year. Genuine Parts jumped 11.2% for the biggest gain in the S&P 500 after the distributor of automotive and industrial replacement parts reported stronger profit than analysts expected. It also raised its range for forecasted profits over the full year.

Stocks broadly have been struggling recently as yields in the bond market charge higher. They’re cranking up the pressure because investors have largely given up on hopes that the Federal Reserve will deliver many cuts to interest rates this year.

Yields climbed a bit higher after more reports on Thursday showed the U.S. economy remains stronger than expected.

One report said fewer workers applied for unemployment benefits last week than economists expected. It’s the latest sign that the job market remains solid despite high interest rates. That resilience “continues to generate a solid flow of paychecks to keep fueling consumer demand,” according to Carl Riccadonna, chief U.S. economist at BNP Paribas. His team is forecasting the U.S. economy grew at a faster rate in the first three months of the year than other economists generally.

Another report on Thursday said growth in manufacturing in the mid-Atlantic region accelerated sharply, when economists were expecting a contraction.

A third report said sales of previously occupied U.S. homes didn’t fall by quite as much last month as economists expected.

Similar such data, along with a string of reports showing inflation has remained hotter than forecast this year, pushed top Fed officials to say recently they could hold interest rates high for a while.

It’s a letdown after the Fed earlier had signaled three cuts to interest rates could be possible this year.

But Fed officials have been adamant they want to be sure inflation is heading down toward their 2% target before lowering the Fed’s main interest rate from its highest level since 2001.

Lower rates would juice the economy and financial markets, but they could also give inflation fuel to reaccelerate.

Traders are now forecasting just one or two cuts to rates this year, according to data from CME Group, down from expectations for six or more at the start of the year.

In the bond market, the yield on the 10-year Treasury rose to 4.63% from 4.59% late Wednesday. The two-year Treasury yield, which moves more closely with expectations for Fed action, rose to 4.98% from 4.94%.

The hoped-for upside on Wall Street of a strong economy that’s keeping interest rates high is that it could also drive strong growth in profits. Companies will need to deliver such strength in order to justify the run stock prices have been on since late October, setting records along the way.

The recent drops for stock prices have made them look less expensive, but they won’t look cheap unless either prices fall further or profits jump higher.

Alaska Air, the carrier that suffered a midflight blowout of a door plug on a Boeing aircraft in January, rose 4% after it projected better profits for the current quarter than analysts expected.

Ally Financial jumped 6.7% after reporting stronger earnings for the latest quarter than Wall Street had forecast.

Ibotta, a Walmartbacked digital company that offers customers cashback rewards and rebates on grocery brands ranging from Nestle to Coca-Cola, soared 17.3% in its first day of trading.

In stock markets abroad, indexes rose modestly across much of Europe and Asia. South Korea’s Kospi was a standout. It jumped 2% to help lead markets worldwide.

PAGE 10, Friday, April 19, 2024 THE TRIBUNE

STOCK MARKET TODAY

Photo:Peter