THE 49 percent Bahamian ownership in Royal Caribbean’s $165m Royal Beach Club project no longer appears to involve an initial public offering (IPO) to local investors, it was revealed yesterday.

Prime Minister Philip Davis KC, speaking at the Heads of Agreement signing for the cruise line’s latest Bahamian destination, revealed that the minority equity stake will now be held by the Government through the National Investment Fund that was legislated in 2022 to replace the sovereign wealth fund.

Confirming that PDI Paradise Ltd, a Royal Caribbean subsidiary, will own the majority 51 percent equity interest, he said: “This project is a partnership between the Bahamian government, the Bahamian people and Royal Caribbean Cruise Lines. “And that partnership is 51 percent Royal Caribbean Cruise Lines and 49 percent Bahamian government. A new vehicle has been formed, the National Investment Fund, and that will own the business. So

Turning the tide hope on Moody’s deficit analysis

By

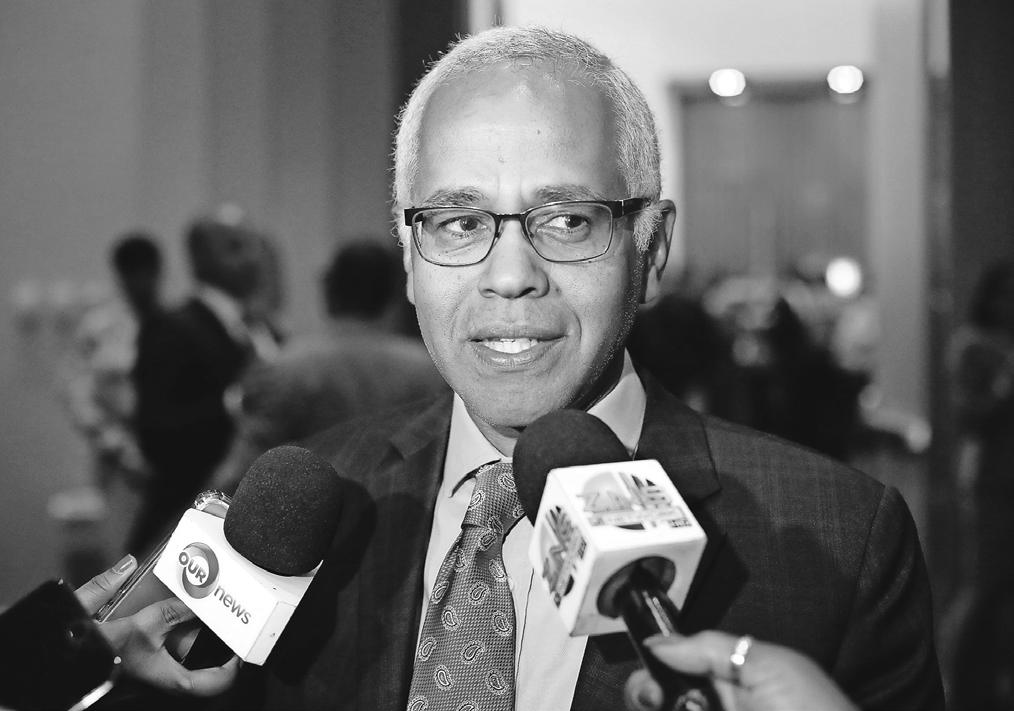

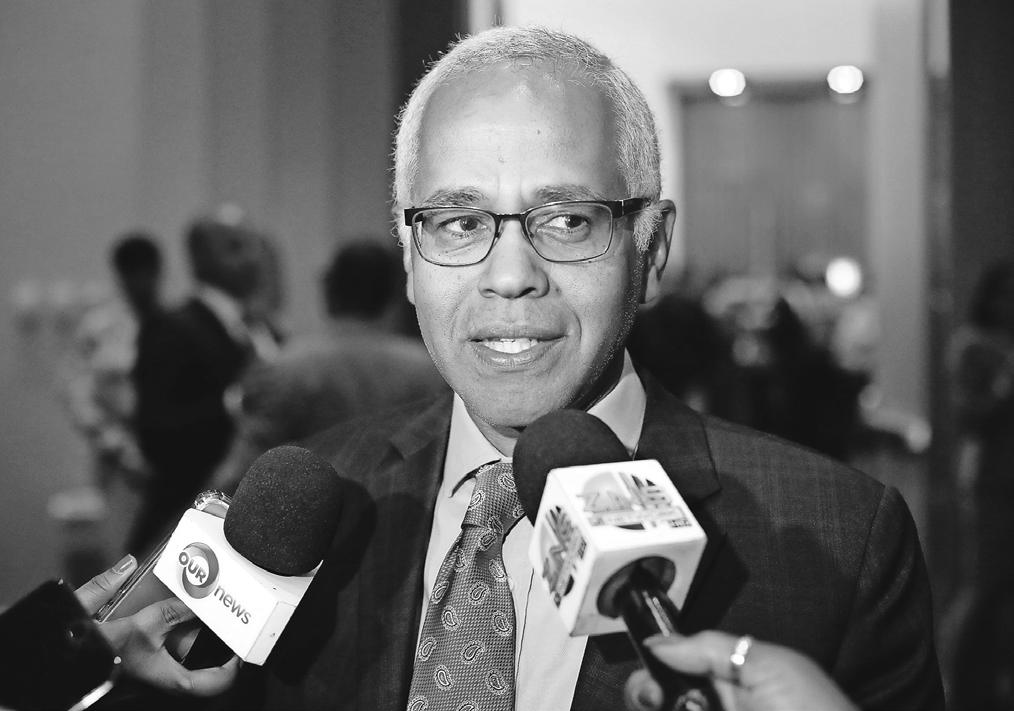

MOODY’S upbeat analysis of The Bahamas’ fiscal consolidation efforts could mark the turning of the tide in easing the debt burden on taxpayers, a governance reformer argued yesterday.

Hubert Edwards, the Organisation for Responsible Governance’s (ORG) economic development committee head, voiced optimism to Tribune Business that the rating agency’s forecast of just a $44m overshoot for the 2023-2024 fiscal deficit will boost The Bahamas’ creditworthiness and improve its access to lower-cost financing on the international capital markets.

Describing the Government’s access to reasonably-priced financing as one of its greatest fiscal challenges post-COVID, he added that any stabilisation or reduction in interest costs associated with foreign currency borrowing will lower the pressure on Bahamian taxpayers to service this debt.

Acknowledging that Moody’s prediction of a $174.67m deficit for this fiscal year, equal to 1.2 percent of gross domestic product (GDP), marks a major change from previous estimates by the likes of the International Monetary Fund (IMF), Mr Edwards told this newspaper that Bahamians have to trust that the rating agency’s analysts have done their “homework”.

“When Moody’s puts out information you obviously have to take it as they have given it,” he said. “In this instance we have to give respect to that. They have clearly received information from the Government which suggests there has been a moving of that projection compared to what was previously said by the IMF and other parties.

ELEUTHERA’S Chamber of Commerce president yesterday warned “we will fail” unless community-based businesses and the societies they support match the product offered by “high-end” resort investments. Thomas Sands, who renewed his pleas to Cabinet ministers at the island’s recent two Business Outlook conferences for a package of tax breaks and investment incentives specifically targeted at existing businesses, told Tribune Business that this was vital to ensuring Family

Island communities keep pace with rapid growth and development.

NASSAU Cruise Port’s top executive yesterday said early 2024 performance is already beating prior year comparatives that “blew the socks off” pre-COVID records set in 2019.

Michael Maura, the Prince George Wharf operator’s chief executive, said the $300m investment in the port’s facilities has created more “opportunity” and activities for cruise ship passengers.

“Our numbers are exceeding 2023, same period, which obviously has blown the socks off the record year 2019. Nassau has returned to being in a very strong demand position, and we see it both in hotel but also cruise,” he said.

“Obviously, when you invest in infrastructure, no different than building a new runway, it creates opportunity for more airlift coming in. For us, more sealift coming in

“I would say that just as important as it is to rejuvenate downtown Nassau, and support the investment that’s taken place at the port, Eleuthera needs the same type of incentives and concessions to make sure that the product as people walk out the gate into the community is up to par,” Mr Sands told this newspaper of his call for a concessions package.

“It’s needed for Nassau, it’s needed for here. Given the

Otherwise, he warned, The Bahamas will be in danger of creating a two-speed society where many residents and communities are left behind and unable to benefit from major investment inflows. He added that signs of such marginalisation are already emerging with “disgruntled communities”, Bahamians unable to afford to live on their home islands, and some areas that are “falling apart”.

when we built the new pier, as well as extending.” Speaking to reporters at the groundbreaking of Royal Caribbean’s Paradise Island Royal Beach Club, Mr Maura said the cruise port is seeing “very strong” commitments. Royal Caribbean is expected to surpass its 2.5m passenger target for 2024 “We’ve got very strong commitments. Talking with Royal today, they had been speaking about the 2.5m that they’re going to climb to, and they’re going to surpass that number. So we’re thrilled to death,” Mr Maura added.

He said the cruise giant will have to advertise its new Royal Beach Club destination in The Bahamas to recover its $165m investment, which is a “win-win” for everyone.

investment that’s taking place, we need the experience in the communities that people engage with to meet the same service levels and attention levels, otherwise we will not be able to deliver to the client base that is going to come as a result of the rapid growth. We won’t meet the expectations and will fall short in the product offering.”

While the Government, and agencies such as the Small Business Development Centre (SBDC), Bahamas Development Bank (BDB) and Bahamas Agricultural

business@tribunemedia.net TUESDAY, APRIL 23, 2024

NEIL

Tribune Business Editor nhartnell@tribunemedia.net

SIMMONS

SEE

HARTNELL

Nassau Cruise Port beats ‘blow the socks off’ year By FAY

Tribune Business Reporter jsimmons@tribunemedia.net

PAGE B6

and Industrial Corporation (BAIC) Bahamas ‘will fail’ if growth outpaces local communities By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net SEE PAGE B4 A BAHAMIAN entrepreneur yesterday asserted “it’s easier to navigate a black hole” than the Government’s Crown Land policies as he demanded that Royal Caribbean’s Paradise Island deal be fully disclosed. Toby Smith, who is still battling the Government in the courts over his own Paradise Island project, told Tribune Business that the Davis administration must unveil both the Heads of Agreement as well as the revised Crown Land lease for the cruise line’s $165m Royal Beach Club so Bahamians can decide if the outcome “is best for The Bahamas”. Tribune Business understands that Royal Caribbean’s revised Crown Land lease is for four acres, rather than the original seven, thus extracting the cruise line from a three-acre parcel that is boundup in Mr Smith’s legal action against the Government. PI entrepreneur hits at Crown Land ‘black hole’ By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net SEE PAGE B4 SEE PAGE B3 Bahamian ownership in RCL project alters By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net • Urges Royal Caribbean lease disclosure • And Heads of Agreement’s public release • Asks Gov’t: ‘What do you have to hide?’ • Still 49%, but no IPO to investors • National Investment Fund to hold • 200 jobs in $165m PI Beach Club HUBERT EDWARDS MICHAEL MAURA THOMAS SANDS FROM left are Director of Investments Phylicia Woods Hanna, Royal Caribbean International Chief Product Innovation Officer Jay Schneider, Minister of Health and Wellness Dr. Michael Darville, Royal Caribbean Group CEO Jason Liberty, Prime Minister Philip “Brave” Davis, Royal Caribbean International President & CEO Michael Bayley, Deputy Prime Minister and Minister of Tourism Investments and Aviation Chester Cooper, Minister of Energy and Transport JoBeth Coleby-Davis, President and General Manager of Royal Beach Club and Royal Caribbean International Bahamas Philip Simon and Royal Caribbean Group Vice President of Government Relations Russell Benford during the groundbreaking ceremony for the Royal Beach Club on western Paradise Island at the site on April 22, 2024. Photo:Dante Carrer (BAHAMAS) LIMITED. INSURANCE BROKERS & AGENTS INSURANCE MANAGEMENT $5.80 $5.85 $5.92 $5.96

ORG UNVEILS BLUEPRINT FOR FAIRER GLOBAL TAXATION RULES

By the Organisation for Responsible Governance

LAST month, the Organisation for Responsible Governance (ORG) was among civil society stakeholders invited by the United Nations (UN) to provide substantive recommendations regarding the establishment of a UN Convention on International Tax Co-operation.

As those discussions unfold, ORG’s proposals offer a pathway to a more just and sustainable global economic landscape. Rooted in principles of transparency, accountability and fairness, ORG’s vision embodies the potential for profound change on a global scale.

At the core of ORG’s submission to the UN ad-hoc committee on International Tax Co-operation lies a profound understanding of the interplay between fiscal responsibility and tax reform. Our recommendations outline a framework designed to foster inclusivity and transparency, while combating tax avoidance and evasion. From advocating for the equitable treatment of Small Island Developing States (SIDS)

such as The Bahamas to promoting consistency in taxation standards, ORG’s proposals seek to redefine the foundations of international fiscal governance. Central to ORG’s stance is the imperative to safeguard the economic interests of nations such as The Bahamas, acknowledging their unique challenges and contributions to the global economy. We advocate for a shift towards low-tax jurisdictions that uphold equity and transparency, accompanied by efforts to empower civil society, enhance stakeholder engagement and bolster national capacity to meet global tax standards.

The significance of ORG’s recommendations extends beyond national borders, touching upon fundamental principles of fairness and equity in economic development. By advocating for a global taxation framework that respects the diversity and needs of all nations, ORG seeks to shape a future where economic prosperity is synonymous with inclusion and accountability.

As the world confronts the realities of tax

evasion, fiscal instability and unequal growth, ORG’s recommendations offer a road-map for change. We envision a world where global tax co-operation fuels the financing of essential public services, supports development initiatives and bridges the gap between nations. Taxation, in this vision, becomes a tool for empowerment, enabling countries to pursue their own paths to prosperity within a framework of global solidarity. The inclusion of ORG’s recommendations in the discourse at the UN committee reflects the vital role of civil society in shaping global policies. It underscores the potential of local stakeholders to influence international relations and drive meaningful change.

As the international community considers these proposals, it stands at a pivotal moment, poised to embrace a future marked by greater equity, transparency and co-operation. The road to a fairer global tax system is undoubtedly complex, but the time to act is now. Let us come together as a nation to advocate for a

tax framework that prioritises equity, transparency and co-operation. By doing so, we can pave the way for a brighter and more prosperous future for all Bahamians.

Key Highlights:

* Fostering inclusive and sustainable growth: ORG underscores the potential of a UN Convention on global taxation to drive inclusive and sustainable economic and social development by combating tax avoidance and evasion, thus ensuring that multinational corporations and wealthy individuals contribute their fair share.

* Emphasising fiscal responsibility alongside tax reform: The recommendations highlight the necessity of adopting fiscal responsibility and comprehensive fiscal reform, guided by principles of accountability, compliance and transparency, to ensure the effectiveness of tax policies.

* Advocating for the equitable treatment of SIDS: ORG calls for special consideration and equitable treatment within the global taxation framework for Small Island

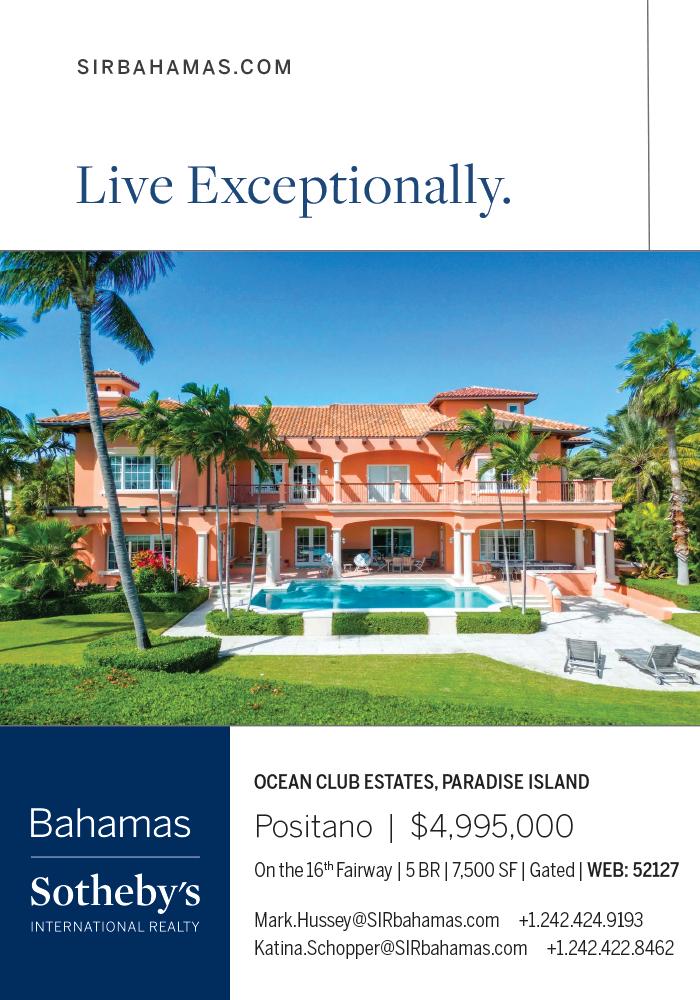

Realtor launches own firm

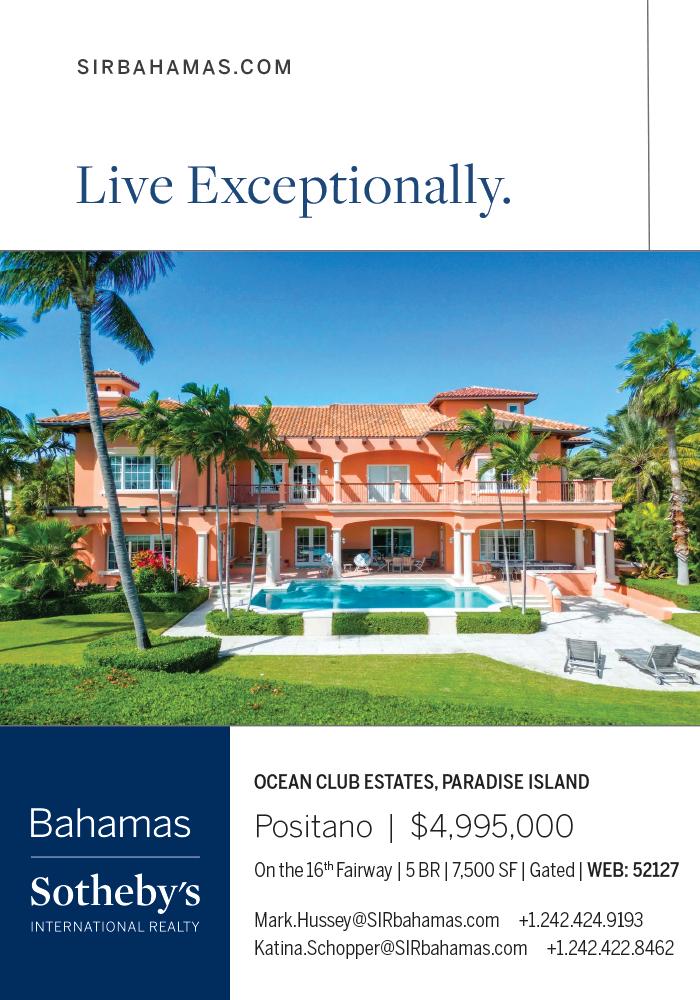

A BAHAMIAN real estate broker yesterday announced the launch of his own firm with a pledge to set new standards in customer service.

Tim Rodland, founder, chief executive and broker for Rodland Real Estate, said in a statement: “Demand for the island lifestyle remains steadfast. There’s a need, which Rodland Real Estate aims to fill, for a brokerage whose professionals provide not just world-class service but serve as connectors and guides to The Bahamas.

“We are not a traditional brokerage; we are a creative marketing company that specialises in luxury real estate and our service extends beyond closing and contracts. With Rodland Real Estate, you can rely on a trusted team of advisors and support for life.”

Rodland Real Estate will operate throughout The

Bahamas, specialising in luxury communities including Lyford Cay, Old Fort Bay, Ocean Club Estates, Sandyport and Cable Beach, as well as private islands. Among the services it will offer is a private members portal that will “merge the concept of a private members club and real estate”. Rodland Real Estate said it will allow select buyers and sellers to gain access to off-market properties via a password-protected private members portal.

The company added this will give buyers and sellers, “who value discretion above all else”, access to a private and secure virtual lounge where they can view and browse off-market properties not listed on the real estate industry’s Multiple Listing System (MLS). Listings on Rodland Real Estate’s portal will start above $2m.

Developing States (SIDS) such as The Bahamas, taking into account their unique vulnerabilities to climate change and economic challenges.

* Promoting transparency and consistency: The organisation stresses the importance of transparent and consistent application of global tax standards, ensuring that countries such as The Bahamas are not unfairly penalised by external regulatory actions.

* Safeguarding local economic advantages: ORG advocates for the protection of local advantages and the promotion of economic opportunities in The Bahamas, ensuring that global tax reforms do not impede the nation’s ability to attract foreign investment or harm its economic sectors.

* Supporting lowtax jurisdictions with accountability: The recommendations encourage transitioning towards low-tax jurisdictions in a manner that upholds equity, transparency and accountability, highlighting the need for responsible tax incentives and exemptions.

* Incentivising community development through

civil society: ORG suggests that the convention should encourage investment in civil society organisations to bolster community-level development and sustainable economic growth throughout The Bahamas.

* Strengthening stakeholder engagement: The document calls for meaningful engagement and participation of all stakeholders, including governments, private sectors, civil society and international organisations, in the development and implementation of global taxation regimes.

* Enhancing capacity building and technical assistance: ORG emphasises the need for capacity building and technical assistance for countries such as The Bahamas to enhance their compliance with global taxation standards.

* Upholding good governance principles: Finally, ORG insists that the convention must adhere to principles of good governance, such as equity, transparency, accountability and responsiveness, to ensure fair and effective taxation policies.

Bahamas Realty adds to sales team

BAHAMAS Realty has appointed Holli Miller to its sales team. Born and raised in Nassau, and educated in Miami at Florida International University, the realtor says she has already introduced “innovative marketing strategies”.

“I’m super pumped about helping clients find what they’re looking for, whether it’s their dream home or a piece of land to build on,” Ms Miller said

in a statement. “The Bahamas has tons of beautiful properties to choose from. I enjoy taking on the new challenges in this everchanging field.”

“We are delighted to have Holli join the sales team,” says Michelle Martinborough, Bahamas Realty’s chief operating officer. “Holli introduced innovative marketing strategies and we’re confident she’ll be a great addition to the team.”

PAGE 2, Tuesday, April 23, 2024 THE TRIBUNE

HOLLI MILLER TIM RODLAND NOTICE IN THE ESTATE OF EUNICE EMMA GERTRUDE PYFROM, late of Ridgeland Park West, in the Southern District of the Island of New Providence, one of the Islands of the Commonwealth of The Bahamas, deceased. NOTICE is hereby given that all persons having any claim or demand against the above Estate are requested to send their names, addresses and particulars of the same duly certified in writing to the undersigned on or before “13th June, A.D., 2024”, and if required, to prove such debts or claims, or in default be excluded from any distribution; after the above date the assets will be distributed having regard only to the proved debts or claims of which the Administrator shall have had Notice. AND NOTICE is hereby also given that all persons indebted to the said Estate are requested to make full settlement on or before the date hereinbefore mentioned. Dated the 16th day of April, A.D., 2024. NATHANIEL DEAN & Co. CHAMBERS Attorneys for the Administrator 55 Rosetta Street, Palmdale New Providence, The Bahamas (A.16, 23, 30)

EX-MINISTER BACKS GOV’T OVER BPL PPP OVERHAUL

A FORMER Cabinet minister yesterday backed the Davis administration’s efforts to secure outside investor capital and expertise for Bahamas Power & Light (BPL) via a publicprivate partnership (PPP) model.

Dionisio D’Aguilar, now back as Superwash’s principal, and an ex-minister of tourism and aviation, said the state-owned energy monopoly would “absolutely” benefit from private sector management given that it is already burdened by $500m in debt and other liabilities and needs fresh investment of the same magnitude - taking its total needs to $1bn.

Speaking to reporters yesterday, Mr D’Aguilar said the Government does not have sufficient financing itself to make the necessary

transformation. He added that several PPP projects, such as the Nassau Cruise Port and Nassau Airport Development Company (NAD), have been successful and governments should continue to follow this approach.

“You need private investment in these companies to provide them with sufficient capital in order for them to reinvent themselves. This age-old model of trying to use taxpayer money to fix the power company, fix the water company, fix the airports, fix the ports, there’s just not sufficient money in the Treasury to do that,” Mr D’Aguilar said.

“So you’ve got to be creative and innovative, and bring people in who can bring capital, bring people in who can operate them, and the Bahamian people will be the beneficiary of this. Look at the projects that we’ve done. We’ve done Nassau Cruise Port successfully, we’ve done the commercial

port, Arawak ports, that works very well. We’ve done the dump that works very well.

“We did Lynden Pindling International Airport; that’s going very well. So when we do these projects, we’re very proud of them. They all look wonderful, they operate beautifully. And so that’s why I think we’ve got to continue with this model. Obviously, tweaking the model in order to allow Bahamians to invest and to get a return from investing in these projects.” Mr D’Aguilar also supports PPPs for the renovation of Family Island airports, which have fallen into a “dilapidated state” due to a lack of maintenance. He said the Nassau Cruise Port was largely

PI entrepreneur hits at Crown Land ‘black hole’

FROM PAGE B1

Given that he and the cruise line are no longer competing for the same Crown Land parcel, Mr Smith challenged the Government to “concede” the legal battle and allow his Paradise Island Lighthouse and Beach Club Company’s $2m project to proceed and become Royal Caribbean’s neighbour by performing the lease agreed under the Minnis administration.

Asserting that “the gloves are off”, amid frustration at the cruise line’s progress while his own project remains stymied, the Bahamian entrepreneur played on Chester Cooper, the deputy prime minister, agreeing that the Government’s Crown Land policies towards tourism developments are “a black hole”.

An attendee at last Friday’s Harbour Island Business Outlook conference came up with this description, stating: “It seems to be a black hole where you cannot get information as to the status of Crown Land, and it may take years and years and years before you hear anything about Crown Land.”

In response, Mr Cooper replied: “I thing you have described it fairly, quite frankly, but I would invite you, if it’s a tourism-related project, I invite you to reach out to me and we will see how we might shepherd the process, but this is an area of active work and refinement that falls in the area of the ministry responsible for lands [the Prime Minister’s Office] and we can talk more about it in due course”.

Whether Mr Smith has a valid and legally binding lease for five Paradise Island Crown Land acres, split into two separate parcels and which it took eight

years to negotiate, lies at the heart of his ongoing legal dispute with the Government. “It would be easier to navigate around a black hole than it would with this crew,” he blasted of his predicament.

“Minnis and Davis are just alike. They are all alike, controlling the Crown Land to dispose of it as they please with zero consultation with Bahamian citizens. They’re doing absolutely nothing to fix it unless you are a foreign investor. None whatsoever. That’s the epitome of government processes throughout these administrations in marginalising Bahamians with viable resources to pursue ownership of the tourism product.

“He’s [Mr Cooper] agreeing it’s a black hole, but it’s more than that,” Mr Smith continued. “It’s the big run around. They say come and participate, and when you do they put you on this merry go-round. He told me to come with proof of financing to the Prime Minister, which I did five times. “It’s an insult to Bahamians that, pre-election, this government said they would cancel any lease done on Paradise Island with Royal Caribbean and now apparently they can’t get enough of Royal Caribbean.” Mr Smith was referring to assertions made by Philip Davis KC, when leader of the opposition, that he would not honour any lease agreement with the Minnis administration for the Royal Beach Club. Tribune Business records show that Mr Davis, in 2020, went on record saying that he will “cancel” Royal Caribbean’s lease because its Paradise Island destination would be “enormously impactful” to downtown Nassau, including Bay Street merchants and all

other sectors that rely on the cruise industry for their livelihoods.

However, Mr Davis and his party’s position slowly but surely shifted upon being elected as Prime Minister and the Government, respectively. Ultimately, Mr Davis said their stance altered because the Supreme Court, now backed by a majority Court of Appeal ruling, determined that Mr Smith did not have a legally enforceable Crown Land lease for the two and three-acre parcels - something the latter still disputes.

The two sides’ legal battle is now headed to the Privy Council. As for the Royal Beach Club itself, Mr Davis said the Government’s position changed because it was able to secure far better terms than its Minnis predecessor, especially through the 49 percent ownership stake in the project that will be held by Bahamians (see other article on Page 1B).

“Let them publish their Heads of Agreement they have just signed so Bahamians can make informed decisions as to whether this is best for The Bahamas and is this best for Bahamians,” Mr Smith demanded. “If it’s so brilliant they’ll wish to publish it for praise. If they’ve done something that’s good, show us why it’s so good. “You promote yourselves as transparent and accountable, and now we’re calling on you to show that you’re doing exactly that. I’m going on record to request it formally for the Government and Royal Caribbean to put it in the public domain. What do you have to hide?”

Mr Smith then also urged the two sides to reveal the revised Crown Land lease that excludes the three-acre parcel subject

successful due to the $330m in investment not funded by “taxpayer money”. “So the Government owns and operates 30 airports, and if you look in the Budget, the funding is never sufficient to look after those airports. So over time, they fall into a dilapidated state. The only way we can fix this problem is to do public-private partnerships, where you add private sector money to the airports, and bring in operators and you get it renovated, upgraded, it’s just going to take so much money,” Mr D’Aguilar said. “[The Nassau Cruise Port] cost $330m to renovate and to upgrade. Not $1 of taxpayer money was used to do that, and that is why it’s so successful. The Government of The Bahamas just does not have sufficient funding to upgrade all of its airports and ports, so it has to merge itself, bring the asset, the private sector money to make this beautiful project.”

to his legal dispute. “If the Government and Royal Caribbean have devised another Crown Land lease, then publish that, too, and make it public,” he said. “Since the current Prime Minister was so worried about the last one, I honestly challenge him to publish any additional one. Let the public know.” Tribune Business previously revealed that the Minnis administration effectively gave Royal Caribbean a minimum 150-year lease over seven Crown Land acres on Paradise Island.

The original lease, which has now been replaced, gave the cruise giant an initial 25-year extension plus “no less than four additional options”. All these “options” were 25 years in length, meaning that when they were added to the original 25-year lease, Royal Caribbean could have exercised its rights to potentially occupy that land for one-and-half centuries. The agreement, which was executed on May 25, 2021, also committed Royal Caribbean to paying an annual $140,000 rent to the Government for use of land

that it holds in trust for the benefit of the Bahamian people. Over a 25-year lease, this amounted to $3.5m in total rental income with VAT at 10 percent contributing a further $350,000 to the Public Treasury.

These sums paled when set aside the extra $26m in annual visitor spending that the Royal Beach Club is projected to generate, a figure that rises to $650m when extended over the initial 25-year lease term. Royal Caribbean previously said its Paradise Island investment will boost overall visitor spending by $1bn over a ten-year period, although it is uncertain where this impact falls.

The terms of Royal Caribbean’s revised Crown Land lease have not been disclosed. Mr Smith, meanwhile, called on the Government to honour the lease and allow his project to proceed given that he and the cruise line are no longer competing for the same three acres that were ‘double dealt’ by the Minnis administration.

“So far it’s one-nil to the foreign investor over the Bahamian again,” he argued. “I think that the Government and Royal Caribbean should both concede in writing and allow

Mr D’Aguilar argued that airports are “critical” for Family Islands, and there is a need for more avenues to funnel private sector funds into public infrastructure projects. He said: “Airports are absolutely critical. Of course, you’ve got Exuma, which I believe is under renovation. You got Bimini, they’ve started to do some work. Then you’ve got North Eleuthera, which is hugely busy and nothing’s happening there. But, as I say, these things take tens of millions of dollars to fix and the Government of the Bahamas simply does not have the funding to do all of these airports.

“That’s why it’s got to merge. You know, there’s $8bn Bahamian dollars sitting in the bank getting zero percent interest so you’ve got to figure out how to get that money invested in our infrastructure projects to bring a return to the Bahamian people.”

Paradise Island Lighthouse and Beach Club to proceed with precisely what Chester Cooper is asking of Bahamians with the tourism product.

“The Government could at any time concede and allow my viable product to market. However, they’d rather see Bahamian taxpayer money used to fight me at the highest level of the Privy Council. I challenge Mr Davis to shift the trend and allow our development to thrive. He had given me his word he would do, prior and post-election, adding that his word is his bond when asked to put his support in writing.

“It’s certainly a ‘black hole’ for Bahamians, but when it’s a foreigner negotiating it’s crystal clear: How much Crown Land do you want, and when do you need it by? How long did Royal Caribbean have to wait compared to my eight years asking for a lease?”

Mr Davis previously said that, in the absence of a valid and binding Crown Land lease as determined by the courts, Mr Smith must “reapply” for the necessary approvals for his beach break-type destination that also involves restoration of Paradise Island’s lighthouse.

THE TRIBUNE Tuesday, April 23, 2024, PAGE 3

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net DIONISIO D’AGUILAR NOTICE IN THE ESTATE OF MARIANTHI BERDANIS late of Watercolour Cay No. 28 Sandyport Subdivision, Western District, New Providence, The Bahamas, deceased NOTICE is hereby given that all persons having any claim or demand against the above Estate are required to send the same duly certified in writing to the Undersigned on or before 10 May, 2024 after which date the Executors will proceed to distribute the assets having regard only to the claims of which the Executors shall then have had notice and will not, as respect to the property so distributed, be liable to any person of whose claim the Executors shall not then have had notice AND NOTICE is hereby given that all persons indebted to the said Estate are requested to make full settlement on or before the date herein before mentioned. KING & CO., Attorneys for the Executors, Olde Towne Marina, 2nd Floor, Sandy Port, Nassau, Bahamas. (Attention: Monique R. Cartwright)

Bahamian ownership in RCL project alters

we have equity ownership in the business and all of the amenities that will be offered will be Bahamian-owned.”

The ownership structure unveiled by the Prime Minister appears to be a departure from what was previously envisaged. Under the prior plan, the Government’s equity stake in the project was to be based on the value of the four Crown Land acres it is contributing to the 17-acre Royal Beach Club located on the western end of Paradise Island in the vicinity of Colonial Beach.

Once that land was appraised, and its value calculated, the balance of the 49 percent Bahamian equity stake was to come from an IPO of shares to Bahamian investors. The structure was thought likely to mirror that of the Nassau Cruise Port, where an investment fund was created to hold the collective 49 percent Bahamian interest in that project, and shares in the fund issued to local investors.

It is unclear why there appears to have been a departure from that structure, and no explanation was given yesterday for the apparent change. It now means that the Bahamian people will benefit from this interest via the Government, and the National Investment Fund, rather than as investors owning shares directly or indirectly. Chester Cooper, deputy prime minister and minister of tourism, investments and aviation, said 1 percent of the Royal Beach Club’s revenues will be placed in the Tourism Development Fund. Combined with the 49 percent ownership stake, he added that this means Bahamians will receive 50 percent of the project’s revenue. “The Government through the National Investment Fund will hold equity, ensuring that 49 percent of this endeavour is owned by Bahamians,” Mr Cooper said. “One of the highlights I wish to share is that 1 percent of gross revenue derived from this establishment will go towards the Tourism Development Fund.

The Royal Beach Club is forecast to generate 200 direct jobs, and the Prime Minister said: “Local businesses will see their share of opportunities as well. There will be Bahamian boutiques creating avenues for small business ownership.

“And I am pleased to announce that this project also encompasses a joint venture with a Bahamian-owned entity for the operation of a water taxi business. This venture will provide transportation options for guests of the Royal Beach Club, as well as other attractions in Nassau Harbour, enhancing accessibility while creating additional avenues for economic growth within our community.

“The Tourism Development Fund is an offshoot of the Tourism Development Corporation, designed specifically for empowering Bahamians in tourism-related entities. And let me put this 1 percent in perspective. “If Bahamians own 49 percent of this venture, and if we’re getting 1 percent of gross revenues, in the final analysis, we will be getting more than 50 percent of the earnings from this investment here. And I would only say that today after the documents have all been signed, sealed and delivered.”

“Ultimately, this project will largely be run by Bahamians, owned by the Bahamian people and supported by Bahamian businesses. When we talk about the need to ensure that major tourism projects are primarily for the benefit of the Bahamian people, these are the kinds of opportunities that we are talking about.”

The identities of the project’s demolition and main contractors were not released yesterday, although they were said to be Bahamian, while no further details were provided on the contract for the water taxi business. These specifics

will be released shortly, this newspaper was told. Mr Davis, meanwhile, also dismissed fears that Royal Caribbean’s beach club will suck passengers away from Bay Street businesses and Bahamian tours, maintaining he is “not concerned about any loss of business in any other side of the town” as there will be “sufficient” visitors for all.

He added that there are not enough attractions for visitors to enjoy, and the Royal Beach Club will enhance the activities available to guests and entice more of them to leave their ships.

“There will be sufficient visitors at our port on any given day, and the island itself cannot accommodate all of the tourists that are coming in by cruise line, so we are creating other attractions,” Mr Davis said.

“The challenge with having people on Bay Street or elsewhere are attractions, and there’s a need to be able to create more attractions to lure the passengers off the ship. This will be one of them, to which Bahamians will be benefiting.

“[We will] improve other offerings, like the 66 Steps, the Water Tower and the other heritage sites, improving the Clifton Heritage site, because you’re not going to get the cruise passengers off the cruise ship if there’s

BAHAMAS ‘WILL FAIL’ IF GROWTH OUTPACES LOCAL COMMUNITIES

nothing to see. This will be one of them. I’m not concerned about any loss of business in any other side of the town because of this venture because there’ll be sufficient passengers.”

Mr Cooper said that while the Royal Beach Club will accommodate 2,700 to 3,000 guests per day, more than 27,000 visitors arrive at Nassau Cruise Port daily. He added that the project will help to “deepen” the tourism product. “2023 was a banner year with almost ten million arrivals, and the challenge of having a record year is beating it,” Mr Cooper said. “So we are looking forward to this project, helping to enhance the product even more.

“We’re looking forward to Royal Caribbean bringing its two million already committed and booked to Nassau Cruise Port in 2024. But overall, as our Prime Minister mentioned, we’re looking to deepen the product and create more experiences. This is one of those experiences that we are creating.

“We are encouraging Bahamians to invest in tourism, invest on Bay Street, and we have begun this process by creating incubation centres to create more authentically Bahamian goods to be accessed by our guests. But this has a positive outcome,” he added.

“One of the biggest complaints from our guests is not enough to do in Nassau and, as the Prime Minister mentioned, whilst they may accommodate 2,700 or 3,000 a day, we have arriving at Nassau Cruise Port some 27,000 a day, so there’s a lot more opportunity for Bahamian entrepreneurs to engage and to participate.”

Jason Liberty, Royal Caribbean’s group president and chief executive, said the volume of guests visiting a destination can outgrow the experiences available, and projects such as Royal Caribbean’s Royal Beach Club will help keep guests engaged and attract new visitors.

He said: “Because of the attraction to The Bahamas, and so many people wanting to come to The Bahamas, those volumes can sometimes outgrow the experiences and I think our vision in our partnership here is to put this Beach Club in place to enhance the experiences which we know will make our guests happier, which is going to get them to return more often, but it’s also going to bring new consumers here to The Bahamas. And so we have to be thoughtful as volumes grow that we’re also able to have the experiences that they desire”

all focus largely on the needs of entrepreneurs and startups, Mr Sands said there was a glaring gap in providing existing businesses with the financing and technical assistance they need to grow and expand.

He added that developing, and offering, such a package of incentives was critical “to empower local communities that have stayed the course for many years within the economy” and create “a level playing field” for enhanced participation by Bahamian companies.

This, in turn, will help to “stop the leakage” of foreign direct investment (FDI) dollars back out of The Bahamas and keep more external currency circulating in the economy for the benefit of local and

Family Island communities. “Let’s say there’s $100m,” Mr Sands said. “There’s always a certain percentage that gets spent within the country.

“Although significant, you’re going to lose a percentage of that. If you have contractors coming in and going out, their employees here for the short-term, those monies go back outside the country and only a limited percentage stays within the country. “We want to encourage much more of it to remain for the growth and development of local communities. The more we retain, the more value that tourist dollar and FDI project dollar has to the Bahamian people and to the country.” Mr Sands said community-based businesses in the Family Islands are not only “carrying the commerce

side” but supporting social enhancement such as the provision of ambulances and church buildings. “These businesses have done this for generations. We have to strengthen them or else otherwise we become more of a drain on the public purse,” he added.

“I think the lack of planning and taking care if communities, when we look at some of the Family Islands where development got ahead of communities, we are seeing a lot of people who cannot afford to live there. We are seeing disgruntled communities in some instances, and we are seeing in some cases communities that are falling apart around high-end investment because they cannot grow with it.... “If we cannot offer the service level and experience of the brands that are

investing, at some point they will decide they cannot continue,” Mr Sands warned. “If we get to that point, we will fail. The Bahamas cannot afford any more failures. We cannot afford any of them.”

FROM PAGE B1 FROM PAGE

The Eleuthera Chamber chief said that, to prevent this, it was critical to properly prepare and support existing Bahamian-businesses so that they “service our tourists” at the same level as the resort industry and “bring the community along” with them.

“The point is there is opportunity,” Mr Sands added. “There is a chance to learn from the past, but we have to get it right. It’s important to bring businesses and the community along, and we make it sustainable in the future. I hope we’ll get some action on it.”

“The groundbreaking on PI today, and the $165m going into that project, and the fact that Royal - to recover their investment - is going to have to advertise and market and promote our Nassau and our Bahamas to get people to want to come and experience, that is a win for all of us,” Mr Maura said. “I’m excited and I’m upbeat. I think the future is tremendously bright.”

Mr Maura said the Royal Beach Club will provide activities for some of the millions of passengers the Nassau Cruise Port welcomes annually, many of whom wander Bay Street looking for entertainment.

He added: “I think there’s a lot of opportunity, as both the Prime Minister and deputy prime minister spoke about, and that we have to have more experiences available throughout New Providence because when you’re getting, let’s say three million people from Royal and another, say three-and-a-half million

from everybody else, that’s six-and-a-half million people looking for something to do.

“They’re literally parked hundreds of feet away from downtown. We have millions and billions of dollars in ground transportation, and marine transportation infrastructure, to support our guests and visitors doing something in and around New Providence. So again, the future is very, very bright, very exciting.”

Mr Maura added that feedback about Nassau Cruise Port’s renovation from guests has been “fantastic”, and repeat visitors have been impressed with the changes.

He said: “The average is that one out of every two cruisers are repeat cruisers. So, more often than not, you’re hearing: ‘Wow, when did you do this?’ because they have been here before, but their recollection was the old Festival Place and what we had before. So they’re excited, they’re impressed. The feedback been fantastic.”

PAGE 4, Tuesday, April 23, 2024 THE TRIBUNE

FROM PAGE B1

B1 Nassau Cruise Port beats ‘blow the socks off’ year IN THE ESTATE OF MICHAEL MERVIN KEMP late of Tower Heights off Eastern Road in the Eastern District of the Island of New Providence, one of the Islands of The Commonwealth of The Bahamas. Deceased. NOTICE is hereby given that all persons having any claims against the above-named Estate are required on or before the 15th day of May A. D., 2024 to send their names and addresses and particulars of their debts or claims to the undersigned in writing or in default thereof they will be excluded from the benefit of any distribution AND all persons indebted to the said Estate are hereby requested to pay their respective debts to the undersigned on or before the date above mentioned. AND NOTICE is hereby also given that at the expiration of the time period above mentioned, the assets of the late MICHAEL MERVIN KEMP will be distributed among the persons entitled thereto having regard only to the claims of which the Executors shall then have had notice in writing. Dated this 16th day of April A. D. 2024 Roberts, Isaacs & Ward, Unit No.2, Cable Beach Court Professional Centre, 400 West Bay Street, Nassau, Bahamas NOTICE The Public is hereby advised that I, PAULETTE MARIA EWING of Nassau, The Bahamas intend to change my name to PAULETTE MARIA FORBES-EWING. If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Officer, P.O.Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice. INTENT TO CHANGE NAME BY DEED POLL PUBLIC NOTICE

TURNING THE TIDE HOPE ON MOODY’S DEFICIT ANALYSIS

FROM PAGE B1

“If that [$174.67m] is the number it’s a good thing to come in under $200m and only $44m out of whack with what was targeted. Earlier this year, based on

the information that was reported it would appear we were on a path to a much larger deficit number. If this is where it’s going to be at the end of the day, that’s extremely positive.”

Moody’, in its latest update on The Bahamas released on Friday, forecast that improved revenues and “spending restraint” will contain the deficit for the 2023-2024 fiscal year to a

sum equivalent to just 1.2 percent of gross domestic product (GDP).

If that projection turns out to be accurate, the GFS deficit will be only slightly higher than the $131m, or

0.9 percent of GDP, that the Davis administration targeted when unveiling its Budget last May. The rating agency’s latest 1.2 percent deficit forecast, based on that Budget, is equal to $174.67m or a near-$44m overshoot if it holds and comes true.

And Moody’s also shrugged off the fact that the Government’s fiscal deficit, which measures by how much its spending exceeds revenue and further grows the $11.5bn national debt, was almost double the full-year target at $258.7m half-way through the 20232024 Budget year. Despite the excessive ‘red ink’, it asserts that there are “signs of fiscal consolidation”.

Mr Edwards voiced optimism that Moody’s assessment will alter perceptions of, and attitudes, towards The Bahamas in the international credit markets where the country’s outstanding foreign currency bonds have attracted double-digit yields and risk premiums since 2021. If these drop as a result, it could pave the way for this nation to once again access the global markets at reasonable costs.

“I think what it says is the Government is getting some things right in terms of revenue or its making some decisions to contract its expenditure,” he told Tribune Business. “We have to see whether or not this is something that is sustainable, but the fact the likes of Moody’s made such a statement, the hope is this information filters out positively to impact the credit markets and we can start to see a shift in the creditworthiness of the country.

“This is where the problem is today. We have to start to get to the place where we see the cost of debt coming down; the prices that we are charged on external borrowing need to be positively impacted. I think the statement by Moody’s will go a fair way in nudging us in this direction.

“We have seen positive developments before without the market responding, and I’m hoping this time around it will be different and the country will get a lot more savings on its debt. There could really be significant debt savings.”

Debt servicing costs, or interest, paid on the Government’s debt is the single largest line item in the 20232024 Budget, standing at $612.726m. This figure represents 19.9 percent, or almost $1 out of every $5 spent by the Government on its fixed (recurrent) costs, thereby not only representing a major drain on taxpayers but sucking away monies from critical public services such as education and health.

“If we can realise savings from that point of view, and

also open up the market, it makes it easier for the Government to secure funding and that is going to augur well for the country in a broader sense,” Mr Edwards said. “I think one of the biggest benefits we can gain in the near-term is to see the premium we are currently paying on the debt start to reduce because that’s going to open up significant headroom and create greater flexibility in terms of policy decisions. It’s really, really critical.”

Mr Edwards said that with the Bahamian economy’s post-COVID reflation now complete, it was likely to revert to historical GDP growth rates of less than 2 percent per annum, making it even more vital to speedily get this nation’s fiscal house in order.

“If it’s at all possible we can secure gains on the expenditure side for debt, and create a more favourable environment for the Government to secure it’s funding, it will be more beneficial to the country,” he added. “Hopefully we will see S&P [Standard & Poor’s] come out with a similar statement, and it pushes the IMF to again look at those projections.

“If we get some positive statements coming in close to each other that could give us a really positive boost in the credit markets. We’re just hoping that the direction indicated by Moody’s statement holds because that will be good for the Government and the country. Anything above is not in our interests, but we should hopefully come in within that $44m range and continue the trajectory we’re on.”

Mr Edwards reiterated his belief that the $131m, or 0.9 percent of GDP, deficit target set out in last May’s Budget “was always not going to be met” since it was too ambitious. He added: “The big factor now is the extent to which we reduce the deficit and that the trajectory built into these projections continues to move downwards,” he added.

“That would be really positive, and would be a big boost for the circumstances of the country. There is no overarching need at this point in time to hit that $131m target, there’s no overarching need to speed up a balanced Budget. There needs to be a clear demonstration that plans in place are being achieved, that we are going in the trajectory forecasted.

“As long as we continue to do that the market must respond to the fact that strategic plans have been put in place, discipline is being adhered to in terms of what we said would happen... The country needs it badly.”

PUBLIC NOTICE

The Public is hereby advised that I, ALEX OSCAR SAWYER of Nassau, The Bahamas intend to change my name to ALEX OSCAR SAWYER DARVILLE If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Officer, P.O.Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice. INTENT TO CHANGE NAME BY DEED POLL

PAGE 6, Tuesday, April 23, 2024 THE TRIBUNE