ORG UNVEILS BLUEPRINT FOR FAIRER GLOBAL TAXATION RULES

LAST month, the Organisation for Responsible Governance (ORG) was among civil society stakeholders invited by the United Nations (UN) to provide substantive recommendations regarding the establishment of a UN Convention on International Tax Co-operation.

As those discussions unfold, ORG’s proposals offer a pathway to a more just and sustainable global economic landscape. Rooted in principles of transparency, accountability and fairness, ORG’s vision embodies the potential for profound change on a global scale.

At the core of ORG’s submission to the UN ad-hoc committee on International Tax Co-operation lies a profound understanding of the interplay between fiscal responsibility and tax reform. Our recommendations outline a framework designed to foster inclusivity and transparency, while combating tax avoidance and evasion. From advocating for the equitable treatment of Small Island Developing States (SIDS)

such as The Bahamas to promoting consistency in taxation standards, ORG’s proposals seek to redefine the foundations of international fiscal governance. Central to ORG’s stance is the imperative to safeguard the economic interests of nations such as The Bahamas, acknowledging their unique challenges and contributions to the global economy. We advocate for a shift towards low-tax jurisdictions that uphold equity and transparency, accompanied by efforts to empower civil society, enhance stakeholder engagement and bolster national capacity to meet global tax standards.

The significance of ORG’s recommendations extends beyond national borders, touching upon fundamental principles of fairness and equity in economic development. By advocating for a global taxation framework that respects the diversity and needs of all nations, ORG seeks to shape a future where economic prosperity is synonymous with inclusion and accountability. As the world confronts the realities of tax

evasion, fiscal instability and unequal growth, ORG’s recommendations offer a road-map for change. We envision a world where global tax co-operation fuels the financing of essential public services, supports development initiatives and bridges the gap between nations. Taxation, in this vision, becomes a tool for empowerment, enabling countries to pursue their own paths to prosperity within a framework of global solidarity. The inclusion of ORG’s recommendations in the discourse at the UN committee reflects the vital role of civil society in shaping global policies. It underscores the potential of local stakeholders to influence international relations and drive meaningful change.

As the international community considers these proposals, it stands at a pivotal moment, poised to embrace a future marked by greater equity, transparency and co-operation. The road to a fairer global tax system is undoubtedly complex, but the time to act is now.

Let us come together as a nation to advocate for a

tax framework that prioritises equity, transparency and co-operation. By doing so, we can pave the way for a brighter and more prosperous future for all Bahamians.

Key Highlights:

* Fostering inclusive and sustainable growth: ORG underscores the potential of a UN Convention on global taxation to drive inclusive and sustainable economic and social development by combating tax avoidance and evasion, thus ensuring that multinational corporations and wealthy individuals contribute their fair share.

* Emphasising fiscal responsibility alongside tax reform: The recommendations highlight the necessity of adopting fiscal responsibility and comprehensive fiscal reform, guided by principles of accountability, compliance and transparency, to ensure the effectiveness of tax policies.

* Advocating for the equitable treatment of SIDS: ORG calls for special consideration and equitable treatment within the global taxation framework for Small Island

Realtor launches own firm

A BAHAMIAN real estate broker yesterday announced the launch of his own firm with a pledge to set new standards in customer service.

Tim Rodland, founder, chief executive and broker for Rodland Real Estate, said in a statement: “Demand for the island lifestyle remains steadfast. There’s a need, which Rodland Real Estate aims to fill, for a brokerage whose professionals provide not just world-class service but serve as connectors and guides to The Bahamas. “We are not a traditional brokerage; we are a creative marketing company that specialises in luxury real estate and our service extends beyond closing and contracts. With Rodland Real Estate, you can rely on a trusted team of advisors and support for life.”

Rodland Real Estate will operate throughout The

Bahamas, specialising in luxury communities including Lyford Cay, Old Fort Bay, Ocean Club Estates, Sandyport and Cable Beach, as well as private islands.

Among the services it will offer is a private members portal that will “merge the concept of a private members club and real estate”. Rodland Real Estate said it will allow select buyers and sellers to gain access to off-market properties via a password-protected private members portal.

The company added this will give buyers and sellers, “who value discretion above all else”, access to a private and secure virtual lounge where they can view and browse off-market properties not listed on the real estate industry’s Multiple Listing System (MLS). Listings on Rodland Real Estate’s portal will start above $2m.

Developing States (SIDS) such as The Bahamas, taking into account their unique vulnerabilities to climate change and economic challenges.

* Promoting transparency and consistency: The organisation stresses the importance of transparent and consistent application of global tax standards, ensuring that countries such as The Bahamas are not unfairly penalised by external regulatory actions.

* Safeguarding local economic advantages: ORG advocates for the protection of local advantages and the promotion of economic opportunities in The Bahamas, ensuring that global tax reforms do not impede the nation’s ability to attract foreign investment or harm its economic sectors.

* Supporting lowtax jurisdictions with accountability: The recommendations encourage transitioning towards low-tax jurisdictions in a manner that upholds equity, transparency and accountability, highlighting the need for responsible tax incentives and exemptions.

* Incentivising community development through

civil society: ORG suggests that the convention should encourage investment in civil society organisations to bolster community-level development and sustainable economic growth throughout The Bahamas.

* Strengthening stakeholder engagement: The document calls for meaningful engagement and participation of all stakeholders, including governments, private sectors, civil society and international organisations, in the development and implementation of global taxation regimes.

* Enhancing capacity building and technical assistance: ORG emphasises the need for capacity building and technical assistance for countries such as The Bahamas to enhance their compliance with global taxation standards.

* Upholding good governance principles: Finally, ORG insists that the convention must adhere to principles of good governance, such as equity, transparency, accountability and responsiveness, to ensure fair and effective taxation policies.

BAHAMAS Realty has appointed Holli Miller to its sales team. Born and raised in Nassau, and educated in Miami at Florida International University, the realtor says she has already introduced “innovative marketing strategies”. “I’m super pumped about helping clients find what they’re looking for, whether it’s their dream home or a piece of land to build on,” Ms Miller said

in a statement. “The Bahamas has tons of beautiful properties to choose from. I enjoy taking on the new challenges in this everchanging field.” “We are delighted to have Holli join the sales team,” says Michelle Martinborough, Bahamas Realty’s chief operating officer. “Holli introduced innovative marketing strategies and we’re confident she’ll be a great addition to the team.”

Minister: Cabinet to examine Out Island renewable choices

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.netA CABINET minister says several companies have been selected to provide renewable energy solutions on the Family Islands although she did not name them.

Jobeth Coleby Davis, minister of energy and transport, said Bahamas Power & Light (BPL) has faced many “challenges” due to aged Family Island infrastructure making it critical for the Government to complete the Request for Proposal (RFP) process for renewable energy generation.

She said several unnamed entities have been selected to provide such solutions on various Family Islands and the proposals will now be presented to Cabinet for evaluation. “We’ve had a lot of challenges, mainly in our Family Islands because we are dealing with a lot of equipment that has aged. And so that’s why it’s been a great deal, and important for the Government to make sure we get out those requests for proposals like we’ve done on the Family Islands,” Mrs Coleby-Davis said. “That has closed. We have awarded a number of companies various islands. We are now at the place where we are presenting that back to Cabinet based

on the evaluation, and then we will be advancing the conversation in terms of what the timelines are. And this would greatly assist Family Islands to take that pressure.”

Residents in South Andros and Mangrove Cay said last week they were at their breaking point with 24-hour electricity outages that affect other utilities and Internet service.

Mrs Coleby-Davis said BPL is working to ensure technical teams complete maintenance on Family Island sites, and while it is “unfortunate” residents must deal with those conditions they are trying to “eliminate” the issue.

She said: “In the short to medium-term, we just are making sure that our

Straw vendor chief warns crime alert fall-out persists

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.netA LEADING straw vendor yesterday voiced fears that the continuing fall-out from recent US and Canadian crime alerts could drive more Royal Caribbean visitors to its $165m Paradise Island project.

Rebecca Small, president of the Straw Business Persons Society, said downtown Nassau vendors are still suffering sales declines due to the cruise lines advising passengers not to venture outside of the Nassau Cruise Port.

Speaking to Tribune Business, Ms Small who attended Royal Caribbean’s Paradise Island groundbreaking earlier this week, raised concerns that its Royal Beach Club will be marketed as a safer alternative to venturing into downtown Nassau.

She said: “One of the concerns we have at this time is that the cruise lines are still telling the people that they have to be very cautious, very careful when they leave the port. And we could see that in the Straw Market. That is not an exaggeration. It’s a fact. There is a drop.

“My main concern is if the cruise lines are still

telling the tourists to not frequent downtown or the Straw Market because you’re going to be robbed, then the question remains: What are they going to tell them when they open up [the Royal Beach Club] and people are going over there? Is that going to be considered more safe than coming into Nassau?”

Ms Small said that, although The Bahamas has seen record-breaking cruise ship arrivals, the numbers have not translated into dollars for straw vendors who have seen a “decline” in sales. She said her members often close their businesses early due to low foot traffic, while other downtown businesses are also feeling the effect of the crime alerts and close their stores early.

“We have seen a decline. You find days where a lot of the vendors leave early because, when the flow of tourists is very low or hardly any tourists, the vendors would pack early and leave. So that’s why you would see a lot of the shops in the market closed,” Ms Small added.

“It’s not only that. Downtown closes early. The downtown stores are feeling the repercussions of the cruise lines still telling those tourists it’s not safe.” Ms Small argued that although

new activities will be a welcome addition to Bay Street, it is more important to ensure that tourists feel welcome to explore Nassau and not be frightened by cruise line warnings

“We’ve been told by the tourists that cruise lines have advised them to shop within the port. So it’s a big concern for us that they stop issuing these warnings, and then the guests will feel less frightened to explore,” she added.

Richard Thompson, owner of the Discover Nassau Town and Atlantis tour, said he frequently reassures visitors that the Bahamian capital is a safe place despite what they may have heard from travel advisories. He said his business has not been affected as severely due to the majority of tours being pre-arranged through travel agents prior to guests arriving in The Bahamas. “I’ve had people with this advisory, and I’ve had to kind of reassure them that it’s safe,” Mr Thompson. “Despite what the United States puts on us, it’s a safe place. I think it affects not so much the tour companies, but I think it affects the taxi drivers. “We have pre-arranged tours, so when people come here, they already have us booked and they already

technical team get on the ground and do as much of the maintenance work as needs to be done on whatever repairs are necessary, and it’s unfortunate that we have those situations but we’re trying our best to make sure we eliminate them.”

For New Providence, Mrs Coleby-Davis said additional power generation should be brought on board by June or July to meet peak summer demand. “I believe that there has been a lot of review based on the last summer demand for us to make sure that we have enough generation to support the demand that we saw last summer,” she said. “So expect that would be increased by a few percentages. And so we’re looking

pre-paid for the tour. So it won’t affect us that much as people just walk in off the ship.”

Mr Thompson added that the upgrades made to downtown Nassau lately have been a “marked improvement”, and pushed for more booths to be added to the port area so that vendors selling cigars would have a more “professional” area to work out of instead of “harassing” visitors as they leave the cruise port.

He said: “The change is good. It’s a marked improvement and it can be cleaned up a bit more, especially with those guys on the port side selling cigars and harassing the tourists.. I think they can clean it up a bit more and make it more professional. Make them find a booth or something they can work from instead of harassing the people as they come off the ship into the streets.”

to bring on some more generation. Hopefully, we’re able to bring that on in time for when we see the peak load in the summer, and that we’ll be able to support and compensate for where we have maybe some shortfalls. “We should be bringing on some more generation.. I’m thinking it’s going to be probably around June, July and that should be able to support and help us with where the demand is.”

Mrs Coleby-Davis maintained that BPL is working “round the clock” to lower consumer bills for the summer and the “coming year or two”. She said: “We’re working round the clock to see more support in terms of power bills being lowered for

the summer, and into the coming year or two. I’m not quite sure the timeline to where we are with that, but I’m hoping that it comes in place by summer of this year so that consumers can feel that they have a better summer in terms of their bill and in terms of supply reliability.

“So we’re working really well. BPL has doing a lot of work in terms of making sure they bring some stability and efficiencies in place, and so I think they’re on track. Sometimes you have instances where situations will go as planned, but we have been working around the clock to give consumers a better product.”

North Eleuthera ‘outgrew airport over 30 years ago’

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.netTOURISM executives yesterday said North Eleuthera’s economy “outgrew the airport over 30 years ago” following the deputy prime minister’s pledge that its multi-million transformation will soon begin.

Garnell Durham, manager at the Other Side, said: “Honestly, we’ve outgrown that airport about 30 years ago. The area is not comfortable, especially in areas where guests have to be ticketed, and then they still have to stand outside when there are multiple flights checking in because the airport can’t hold the people. “They have put in waiting areas in but, after they get in the back, there’s nothing

for them to do but watch TV in the waiting area. The work that they have done.. I look at it from a temporary basis. They just put that together now until they get a new airport.” Ms Durham said her resort advises guests to depart for the airport at least two hours ahead of flight time due to the high volume of passengers, but added that most guests do not complain about the conditions they face due to being repeat visitors who are aware of the conditions. First-time visitors, however, often complain about the cramped setting and high traffic. She said: “It gets really busy, and we tell our guests they have to leave two hours ahead of time. We explain that they have to

DPM: Bahamians will gain Royal Caribbean PI shares

been formed, the National Investment Fund, and that will own the business. So we have equity ownership in the business and all of the amenities that will be offered will be Bahamian-owned.”

That seemed to suggest a departure from the initial plan. The latter would see the Government’s equity stake in the project based on the value of the four Crown Land acres it is contributing to the 17-acre Royal Beach Club located on the western end of Paradise Island in the vicinity of Colonial Beach.

Once that land was appraised, and its value calculated, the balance of the 49 percent Bahamian equity stake is to come from an initial public offering (IPO) of shares

are going through the process of creating packages that are comparable to Starlink, and it will be on the wireless side of our business.

“So we are assimilating the product, the service and the feedback that is coming from the customers, so we are not rolling over and playing dead, that’s for

to Bahamian investors. The structure is thought likely to mirror that of the Nassau Cruise Port, where an investment fund was created to hold the collective 49 percent Bahamian interest in that project, and shares in the fund issued to local investors.

Mr Cooper’s statement yesterday signals that the IPO plan has not been abandoned, and it appears that the National Investment Fund will be the vehicle to issue/offer shares to investors. Neither the Prime Minister’s Office nor Royal Caribbean responded to Tribune Business requests for comment yesterday.

Mr Davis had also referred to the Fund in his remarks at the Heads of Agreement signing with Royal Caribbean, stating: “It is anticipated that

sure.” This did not convince the attendee who asked the earlier question, as he replied that customers “can juts go online and purchase the thing” from Starlink “and it’s there”. They contrasted this with the “typical experience” with Cable Bahamas and Aliv, which saw customers have to call a central office, sometimes take several attempts to get through,

PDI Paradise Ltd will hold at least 51 percent of the shares in the Royal Beach Club, with the remaining shares being allocated to the National Investment Fund for the benefit of the Bahamian people.” PDI Paradise Island is a Royal Caribbean vehicle

Mr Cooper also said 1 percent of the Royal Beach Club’s revenues will be placed in the Tourism Development Fund. Combined with the 49 percent ownership stake, he added that this means Bahamians will receive 50 percent of the project’s revenue. “The Government through the National Investment Fund will hold equity, ensuring that 49 percent of this endeavour is owned by Bahamians,” Mr Cooper said. “One of the highlights I wish to share is that 1 percent of

and then receive an installation date “sometime in the future” which required the prospective client to be at home. He questioned why Aliv and Cable Bahamas could not implement a system where “you pick up the box, plug it in and you’re good to go”.

Ms Sands, in reply, admitted: “We’re not there yet but we are looking at means of getting the wireless products to our customers at a faster rate; like you said, order online and it’s delivered. We are looking at that. Unfortunately, we do not have stores on every island. We are looking at that to have a means if someone orders through our business solutions line that we can ship the device over to you.”

The Cable Bahamas executive also argued that

gross revenue derived from this establishment will go towards the Tourism Development Fund.

“The Tourism Development Fund is an offshoot of the Tourism Development Corporation, designed specifically for empowering Bahamians in tourism-related entities. And let me put this 1 percent in perspective. “If Bahamians own 49 percent of this venture, and if we’re getting 1 percent of gross revenues, in the final analysis, we will be getting more than 50 percent of the earnings from this investment here. And I would only say that today after the documents have all been signed, sealed and delivered.”

The Royal Beach Club is forecast to generate 200 direct jobs, and the Prime Minister said: “Local

“Starlink does not have a customer service team in The Bahamas to help you when you have a problem” and that, while all customer payments to the satellite provider are exported outside the country to the US, those to the BISX-listed communications provider remain here.

“When you talk about keeping staff employed and laying people off, that’s it right there,” Ms Sands said. Starlink, though, has been particularly popular when it comes to providing Internet connectivity and service in remote Family Islands that are not covered by BTC and Cable Bahamas/Aliv infrastructure.

Regulators have already rejected Cable Bahamas’ renewed concerns that it is competing on an “unlevel playing field” against Starlink.

The Utilities Regulation and Competition Authority (URCA), in unveiling feedback to the consultation on its draft annual plan for 2024, disclosed that the BISX-listed communications provider

businesses will see their share of opportunities as well. There will be Bahamian boutiques creating avenues for small business ownership.

“And I am pleased to announce that this project also encompasses a joint venture with a Bahamian-owned entity for the operation of a water taxi business. This venture will provide transportation options for guests of the Royal Beach Club, as well as other attractions in Nassau Harbour, enhancing accessibility while creating additional avenues for economic growth within our community.

Mr Davis, meanwhile, also dismissed fears that Royal Caribbean’s beach club will suck passengers away from Bay Street businesses and Bahamian tours, maintaining he is “not concerned about any loss of business in any other side of the town” as there will be “sufficient” visitors for all.

He added that there are not enough attractions for visitors to enjoy, and the Royal Beach Club will enhance the activities available to guests and entice more of them to leave their ships.

“Ultimately, this project will largely be run by Bahamians, owned by the Bahamian people and supported by Bahamian businesses. When we talk about the need to ensure that major tourism projects are primarily for the benefit of the Bahamian people, these are the kinds of opportunities that we are talking about.”

is “unconvinced” that it is receiving regulatory treatment comparable with that enjoyed by Elon Musk, the Tesla and Twitter (X) magnate’s, new market entrant.

“The Cable Bahamas group believes satellite regulation must be equitable and comparable to the telecommunications regulatory regime. The Cable Bahamas group added that it is unconvinced that the playing field is level for the Cable Bahamas group,” URCA revealed of the company’s stance. Cable Bahamas based this on how much Starlink is paying to URCA for its annual class licence, and queried how much the satellite Internet provider is contributing to the regulator’s budget in percentage terms. It also challenged if “an initial licence award fee was charged and paid for the granting of a licence”, and added that a spectrum-based service was equivalent to introducing a new cellular mobile operator. URCA, in reply, said Starlink’s licence restricts

it to providing broadband Internet services and it is not permitted to offer mobile services in conformity with a policy that restricts the sector to just two operators - Aliv (Cable Bahamas) and the Bahamas Telecommunications Company (BTC).

“Regarding satellite regulation and the specific inquiries raised, URCA clarifies that Starlink currently provides broadband Internet services at fixed locations in The Bahamas but is not licensed for voice telephony or traditional mobile services,” URCA added.

“The licence conditions imposed on Starlink align with

Don’t ‘erode’ public worker benefits in pension reform

“The introduction of the Public Service Contributory Pensions Fund, without proper consultation and consideration of its impact on existing funds like the BEPF, risks destabilising the financial security that our members have worked diligently to build.”

The BALPA president added that it was paramount the Government “safeguard the interests and financial security” of all public sector workers already enrolled in existing pension schemes, and said: “These measures should ensure that the introduction of the new fund does not erode the benefits or contributions of existing members.”

He also urged the Government to “conduct a thorough impact assessment” on how switching workers who have been enrolled in a pensionable position for less than eight years to the Public Service Contributory Pensions Fund will impact existing pension plans legally and financially.

And, calling for better transparency and communication, as well as an “inclusive consultation process”, Mr Johnson wrote: “We urge the Ministry of Finance to initiate a comprehensive and inclusive consultation process that involves all stakeholders, including representatives from the Bahamas Airline Pilots Association and other affected parties........ “Enhance transparency and communication throughout the reform process. Regular updates and clear information should be provided to all stakeholders, ensuring that everyone is fully informed and able to participate in meaningful discussions about the future of their retirement savings.”

Tribune Business previously revealed how pensions for thousands of Bahamian public sector workers are poised for a major shake-up in a bid to tackle “alarming” unfunded liabilities that could impose a $3.5bn burden on taxpayers come 2030. Simon Wilson, the Ministry of Finance’s financial secretary, told Tribune Business earlier this month that these pension liabilities represent “the top risk” to the stability of the Government’s finances and need to be “dealt with as soon as possible” to reduce the threat that taxpayers will increasingly be called upon to plug this multi-billion dollar hole.

The Pensions Bill 2023 is intended to end the present ‘pay-as-you-go’ pension

scheme enjoyed by the Government’s near-20,000 existing civil servants through requiring them - for the first time - to contribute to financing their retirement from their own salaries.

The Bill, if enacted as is, will create the contributory pension scheme called the Public Service Contributory Pensions Fund. Its members will include all new civil service hires after it is passed by Parliament, and becomes law, once they have completed their sixmonth probation, while all existing public officials who have held pensionable positions for less than eight years will also be transferred to the contributory plan.

Civil servants in pensionable positions for more than eight years can voluntarily choose whether to join the contributory scheme or retain their current arrangements. The mandatory contribution rate has been set at 3 percent of a plan member’s monthly salary, with the Government making a matching 3 percent payment. Workers can also choose, on their own accord, to raise the contribution rate for their portion to a maximum 10 percent although this will not be matched by the Government. The Public Service Contributory Pensions Fund will be overseen by a Board, which will appoint an independent investment manager, fund administrator and custodian to manage and safeguard pension plan assets.

Membership in the Public Service Contributory Pensions Fund will not be

confined just to central government civil servants. For new and newer employees at state-owned enterprises (SOEs), and what are described as ‘Approved Authorities’ in the Bill, will also participate in the scheme if the legislation is passed as currently laid out, which means thousands will be impacted.

Those who join these ‘Authorities’ after the Bill is passed into law, and becomes an Act, or who have been employed for less than eight years will automatically join the contributory plan. Again, those who have been employed for more than eight years can elect to participate voluntarily, with the ‘Authorities’ involved including the likes of the Central Bank, Bahamasair and the Public Hospitals Authority (PHA).

The list of ‘Approved Authorities’ features the National Insurance Board (NIB); University of The Bahamas; Bahamas Agricultural and Industrial Corporation (BAIC); Hotel Corporation of The Bahamas; Water and Sewerage Corporation; Bahamas Development Bank; Bahamasair Holdings; the Royal Bahamas Defence Force; Bahamas Maritime Authority; and the Public Hospitals Authority (PHA).

Others named in the Bill include the Hospitals and Health Care Facilities Licensing Board; National Museum of The Bahamas; the Airport Authority; National Art Gallery of The Bahamas; Nassau Airport Development Company (NAD); Bahamas Mortgage Corporation;

Insurance Commission of The Bahamas; Utilities Regulation and Competition Authority (URCA); Sports Authority and National Training Agency. Rounding out the list are the Bahamas Public Parks and Beaches Authority the National Health Insurance (NHI) Authority; Bahamas Agricultural Health and Food Safety Authority; Aircraft Accident Investigation Authority; National Crime Intelligence Agency; Civil Aviation Authority; and Bahamas Air Navigation Services Authority.

The Ministry of Finance, explaining the background to the proposed legal reforms, revealed that financing the current system will increase the annual burden imposed on Bahamian taxpayers by 32.7 percent or $54m over the next six years as growing numbers of civil servants retire and become pensioneligible. The yearly funding bill is forecast to grow from $165m at present to $219m by 2030.

Civil service pensions are currently 100 percent financed by taxpayers through the annual Budget, and the Ministry of Finance said: “During the past two years, the Government’s mission has been to

prioritise the containment of growth in relation to pension liabilities, aimed at reducing the burden on public sector finances. Currently, the Government carries an unfunded liability of more than $2bn.

“Pension consultant, KPMG Advisory Services, conducted a pension reform feasibility study on the Government’s pension scheme in 2013 which was revised in 2022. This study estimated pension liabilities for public sector employees would accumulate to $2.2bn between 2013 and 2020, and projected an increase to $3.5bn by 2030.”

As for annual payouts to civil service retirees, the Ministry of Finance added: “Future cash outflows are also projected to increase significantly, from

approximately $165m currently to $219m by 2030 - including both pension payments and gratuities.

“In addition, Government-owned corporations have similar defined benefit pensions with annual cash outflows of approximately $10m. Given these alarming statistics, measures must taken to provide a sustainable solution to bring about reforms to the public sector pensions plan.” Pension payments for the current 2023-2024 fiscal year were estimated at $134.744m, with gratuities adding a further $33.776m, to bring the total taxpayerfunded outlay to $168.52m. The latter figure is forecast to steadily increase to $173.44m in 2024-2025, and then to $175.413m the following fiscal year.

to earn more than $195m from real property taxes in the current fiscal year, while the 10 percent VAT levied on completed sales and their conveyances is projected at around $319m. Together, these two revenue streams alone are predicted to generate more than $500m or half a billion dollars.

Given the industry’s importance to its fiscal health, the Government almost without fail tinkers with the real estate taxation and regulatory regime in the annual Budget, adjusting tax rates via reforms to the VAT Act and Real Property Tax Act while also also seeking to close loophole, improve administration and collection, and crack down on avoidance and evasion.

“My position on that is I look at it from the international investor’s perspective,” Mr Morley said of the annual changes that the private sector and its clients must adapt to. “I wish they would create some consistency for a period of time - maybe only adjust things every five years.

“But is seems like every year or every other year it’s always tinkered with, and investors get worried over how much it costs them to sell. For consistency

in international investment in The Bahamas it would be nice to have some continuity.”

Mr Morley said the data obtained by his firm from the MLS, which he estimated probably captures around 75 percent of all BREA members’ active listings, will hopefully persuade the Government against changing the real estate tax regime in the upcoming 2024-2025 Budget that will be unveiled during the final week in May.

“Hopefully they’ll keep the system in place,” he told Tribune Business. “Hopefully statistics like this make them realise there’s a tremendous amount of contracted sales in the pipeline to benefit from, and they don’t cut off their nose to spite their face. Let’s keep the faucet open.” Morley Realty, in its analysis of the MLS data, wrote: “The Bahamas real estate market in the first quarter of 2024 continues to show signs of growth in its changing market. Reflecting on the past year, a majority if not all five of the islands have had increases in both demand (contracted and completed sales) and inventory (new listings).

“Although new listings continue to outpace contracted and completed sales

in volume, certain markets are witnessing larger spikes in buyer demand to balance these figures out. With these changes in The Bahamas real estate market, one can expect the median days on the market, list-to-sale price ratio and sales prices to be affected.”

Despite the doubling and tripling of new listings and contracted sales, respectively, for the 2024 first quarter, completed sales across the five marketsNew Providence, Grand Bahama, Abaco, Exuma and Eleuthera - “experienced an average decrease of 5.3 percent” for the three months to end-March this year.

“While this is the case, when looking at these markets quarter-over-quarter, we begin to see some differences amongst the five islands,” Morley Realty said. “For home contracted sales quarter-over-quarter, the data tells us that only the Eleuthera, Grand Bahama and New Providence markets witnessed increases.

“In contrast, year-overyear comparisons show that all islands experienced increases in contracted home sales. Conversely, all five islands experienced increases in contracted land sales. Despite the continued

uptrend in new listings, it is encouraging to see contracted sales following suit.

“With new listings having surged over the past year, we begin to see decreases in some of the markets. While there are some decreases quarter-overquarter when looking at both land and home markets, Abaco, Eleuthera and Grand Bahama experienced increases,” the realtor’s report added. “For the inventory of homes, Exuma is the only island to experience decreases while, for land, all islands experienced increases except New Providence when comparing the 2024 first quarter to the fourth quarter of 2023.”

New Providence was said to have enjoyed “the highest volume” in new home listings for the past two years in the 2024 first quarter, with a 147 percent jump to 195 compared to the same three-month period in 2023. When benchmarked against the 2023 fourth quarter, this amounted to 7.7 percent growth.

“The New Providence homes market, like many other islands, maintained consistency with the third and fourth quarter of 2023,” Morley Realty said. “While completed sales decreased by 30.9 percent

year-over-year, there was a 23.7 percent increase from the 2023 fourth quarter.

“Contrastingly, contracted sales surged by 142 percent year-over-year, and 31.1 percent from the 2023 third quarter, marking the 2024 first quarter as the quarter with the highest contracted sales volume in the past two years.” Contracted home sales in New Providence totalled 80 during the 2024 first quarter, based on data from the MLS, while completed sales stood at 47.

As for undeveloped property, the realtor added of the MLS data: “The New Providence land market experienced a significant surge in demand. While the volume of completed sales increased by 18.2 percent year-over-year, it decreased by 7.1 percent from the 2023 fourth quarter, remaining fairly consistent with 2023.

“In contrast, the volume of contracted sales saw a drastic year-over-year

increase of 360 percent and a 142 percent increase from the 2023 fourth quarter. For the first time in two years, new listings didn’t increase quarter-over-quarter but instead dropped by 30.4 percent. However, yearover-year, the volume rose by 40.3 percent. This marks the first instance of contracted sales having a higher volume than new listings in the past two years.” New listings and land sales on New Providence stood at 87 and 92, respectively, for the 2024 first quarter, while completed sales reached 26. “With the increase in the inventory of both land and homes, buyers are provided with more selection and demand should follow shortly. With more inventory, this may result in an increase in days on the market, a decrease in the list-to-sale price ratio, and a shift toward lower median sale prices.”

because there are a lot of international flights coming in and it can get kind of crazy, so the earlier you reach, the better for you.

“Guests don’t really complain about flight availability. And a lot of the guests have been here before, so they are used to the airport itself and they won’t complain so much about it. Someone who is coming for the first time may complain that it is small and very caustic.

“There’s not that much space to walk at all, especially in the mornings and during the weekends when we have all of these international flights coming in almost at the same time. It is chaos at that airport.”

Chester Cooper, deputy prime minister and minister of tourism, investments and aviation, told last week’s Harbour Island Business Outlook conference that a new terminal building for North Eleuthera is “going to be well out of the ground by the end of this year”.

He acknowledged the area’s “long suffering” due to inadequate airport facilities that have failed to keep

pace with tourism and the wider economy’s growth. Besides the new terminal, which is scheduled to be completed towards the end of 2025, he added that “airside” works involving upgrades to North Eleuthera airport’s runways, plane taxi ways and aprons in a bid to relieve aviation traffic congestion will have “shovels in the ground” by the 2024 fourth quarter.

Ms Durham said she has “hope” that North Eleuthera’s airport will be rebuilt or renovated with placement further from the main road as the location has become a busy spot that impedes traffic. She added: “We hope that they would start building a new airport because where the airport is located it needs to be removed. It’s too close to the main street. It’s on the main road when you are going to Harbour Island so it’s a busy spot. Especially when a flight is coming in, drivers have a hard time passing by because people are parked as there’s no off-road when you go to the airport. “So even if they are putting it in the same location they should put it further back.”

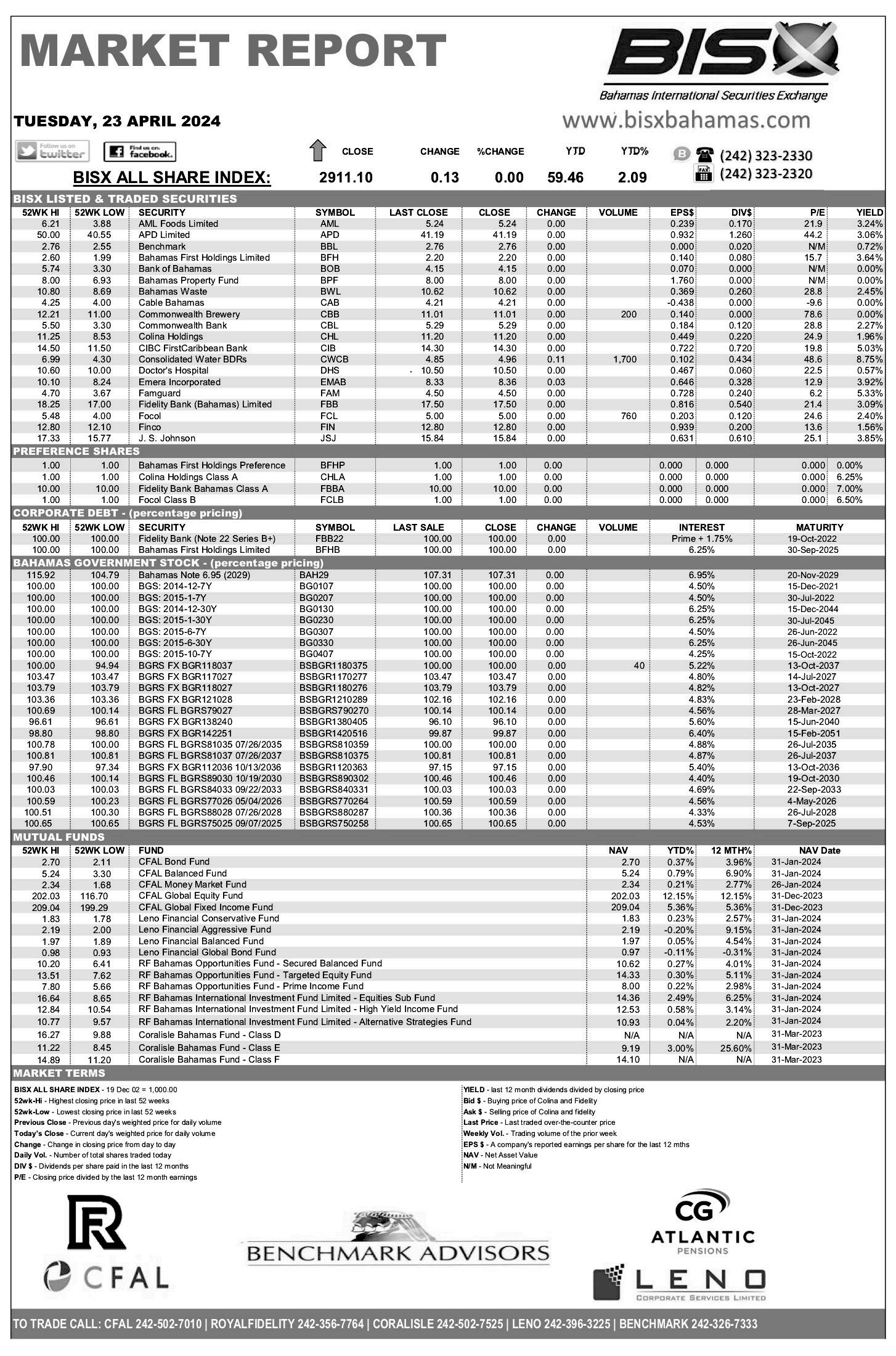

Wall Street rallies again to erase more of April's losses

By STAN CHOE AP Business WriterU.S. stocks rallied for a second straight day Tuesday to blunt the blow of what's been a rough April.

The S&P 500 climbed 1.2% and pulled further out of the hole created by a sixday losing streak. The Dow Jones Industrial Average rose 263 points, or 0.7%, and the Nasdaq composite jumped 1.6%.

A weaker-than-expected report on U.S. business activity helped support the market, which remains in an awkward phase. The hope on Wall Street is for the economy to avoid a severe recession, but not to stay so hot that it keeps upward pressure on inflation.

The preliminary report from S&P Global released Tuesday seemed to hit that sweet spot. Treasury yields eased in the bond market, and stocks added to gains immediately after its release.

A flood of earnings reports also dictated much of trading, highlighted by a slew of companies that topped analysts' expectations.

GE Aerospace flew 8.3% higher after it raised its profit forecast for the full year, in addition to beating expectations for first-quarter earnings. Kimberly-Clark gained 5.5% after the maker of Huggies, Kleenex and Kotex also raised its earnings forecast for the full year. General Motors revved up by 4.4% after citing sales of pickup trucks and other higherprofit vehicles. Danaher rose 7.2% after pointing to strength in its bioprocessing and molecular diagnostics businesses.

They helped overshadow an 8.9% drop for Nucor after the steelmaker fell short of forecasts for both profit and revenue.

MSCI, whose investment indexes guide much of the industry, fell 13.4%

after reporting weaker revenue growth than expected. Invesco sank 6.4% after falling short of expectations for both earnings and revenue.

JetBlue Airways lost 18.8% despite topping expectations for the latest quarter. Its forecasts for upcoming revenue came up short of what some analysts expected, and it said competition in Latin America could weigh on its results.

All told, the S&P 500 rose 59.95 points to 5,070.55.

The Dow gained 263.71 to 38,503.69, and the Nasdaq composite jumped 245.33 to 15,696.64.

The market's main event may have arrived after trading finished for the day.

Tesla reported its results for the first three months of the year, becoming the first to do so among the "Magnificent Seven" stocks that accounted for most of last year's gains for the S&P 500.

Expectations are high for each of the "Mag 7" after

they rocketed to big gains in 2023, and they'll need to at least match them to justify their prices.

Several had been leading the recent decline for the broader market, which saw the S&P 500 fall as much as 5.5% in April. "This underscores the importance of earnings in the next two weeks, which will be dominated by the Mag7, and the risk that disappointing results may accelerate the sell-off," according to Barclays strategists led by Stefano Pascale and Anshul Gupta.

With skeptics still calling the broad stock market too expensive, criticism would ease only if companies were to produce higher profits or if interest rates were to fall. The latter has been looking less likely.

Top officials at the Federal Reserve warned last week they may need to keep interest rates high for a while in order to ensure inflation is heading down to their 2% target.