Atlantis challenged: ‘What’s wrong with Wendy’s on PI?’

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

WENDY’S attorneys yesterday asserted that Atlantis cannot dictate all that happens on Paradise Island even though it may view the fastfood restaurant as “not up to snuff”.

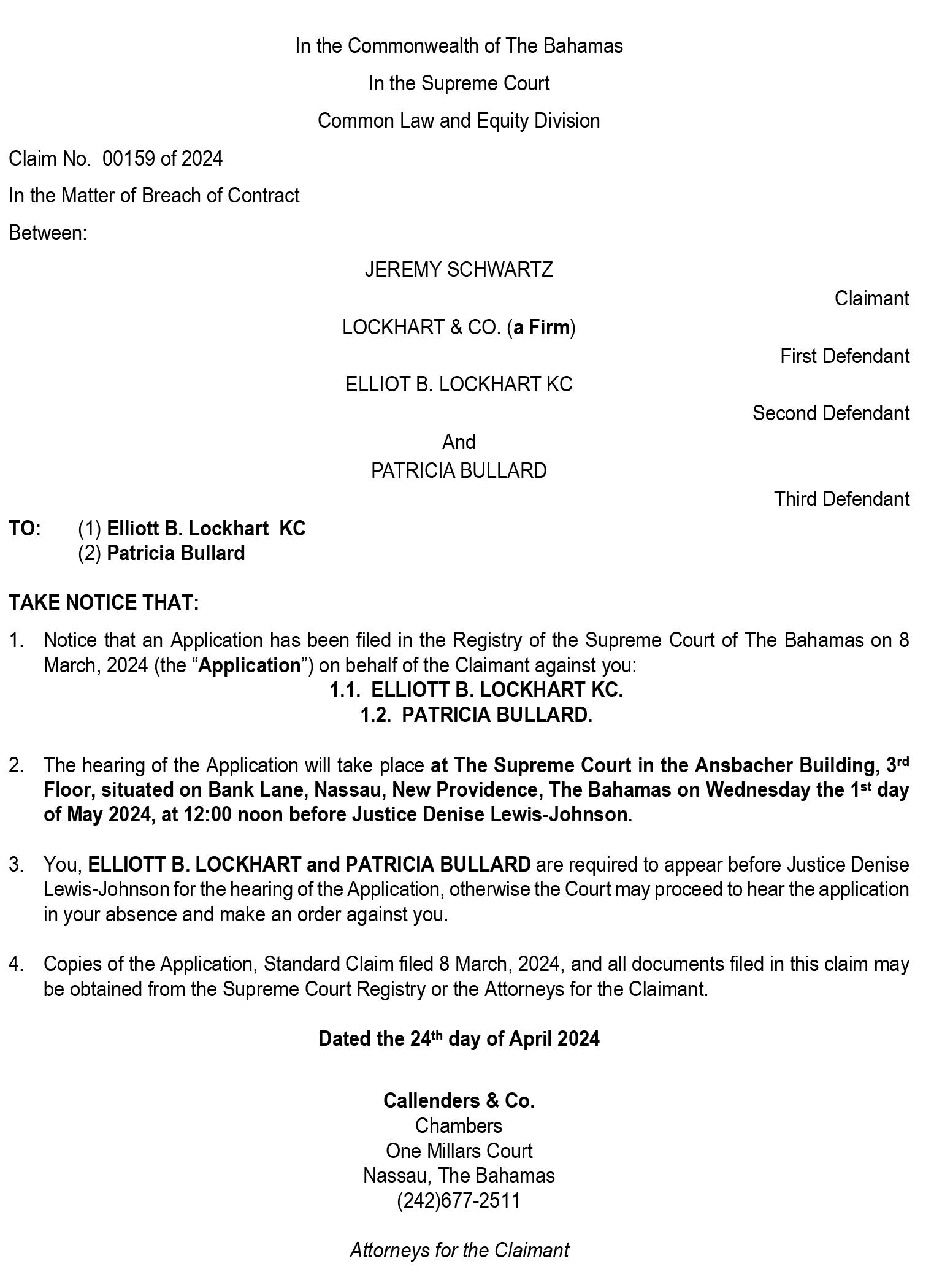

Gail Lockhart Charles KC, representing Psomi Holdings, the entity spearheading development of the combined Wendy’s/Marco’s Pizza restaurant at Paradise Island’s former Scotiabank branch, effectively told the Subdivision and Development Appeals Board hearing that the Paradise Island mega resort, other properties and high-end homeowners have adopted a snobbish attitude towards its planned presence.

Speaking as Atlantis and other resorts, including the likes of Paradise Landing, Comfort Suites and the Four Seasons Ocean Club launched their bid to overturn the site plan approval granted by the

Town Planning Committee, she argued that detractors will continue to “heckle” Wendy’s and its local franchise, Aetos Holdings, regardless of what they do.

Mrs Lockhart-Charles said:

“Atlantis doesn’t feel that Wendy’s is up to snuff. Atlantis feels that Wendy’s is going to somehow detract from their brand. Atlantis does not own Paradise Island, formerly called Hog Island. Paradise Island has private property up for sale. Any Bahamian, any non-Bahamian with

permission can purchase land on Paradise Island.

“It’s not up to one developer, even though they may be a large one, but they cannot say this our land and you can’t come here. You can buy a business here, but you can’t operate here unless we feel that your brand is up to snuff with what we think we’re doing. That’s not democracy. That’s not even constitutional, and certainly nowhere in the law.”

Mrs Lockhart-Charles argued that Atlantis and

“whoever else” had ample opportunity to themselves purchase the former Scotiabank branch location and control what type of business can operate there, but they failed to act. As a result, she said they cannot now turn around and seek to “curtail” a Bahamian landowner and developer from operating a business on its property. She said: “Atlantis and whoever else had every opportunity to buy this property if they wanted to tie it up. If they wanted to feel like what’s going to happen, there is what they want, they should have bought it. They didn’t buy it. And now they cannot curtail a land owner, a Bahamian developer, a Bahamian business, from operating on their land that they pay good money, and a lot of it, to purchase “That land commanded the price that it did because it was land that was in an area that is permitted for commercial

Mitchell demands halt to cemetery’s appeal

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

A CABINET minister was yesterday revealed to have intervened on behalf of his constituents over a planning appeal involving a proposed 13-acre Bernard Road cemetery that is heavily opposed.

and Fox Hill MP, wrote to the Subdivision and Appeals Board on February 19, 2024, urging that the appeal be dismissed “and the status quo maintained” on the basis that permitting the project would devalue nearby properties and disturb his constituents’ way of life.

generated by the cemetery, he added that the Government is also “in the early stages” of using its compulsory powers under the Acquisition of Land Act to purchase either the entire property or “pieces and parcels” of it.

Sarkis defeats CCA’s bid to dismiss $2.25bn claim

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

SARKIS Izmirlian’s $2.25bn fraud and breach of contract claim against Baha Mar’s Chinese contractor was yesterday cleared to proceed to full trial before a New York court this August.

The Cable Beach mega resort’s original developer saw the main elements of his case survive China Construction America’s (CCA) appeal with the New York State Supreme Court’s appellate division finding there are “issues of fact” that must be determined via a full hearing.

In particular, the New York appeals court said a trial is needed to determine whether CCA and its parent, China State Construction and Engineering Corporation (CSCEC), both of which are owned by the Beijing government, “diverted resources” to the now-British Colonial’s acquisition and sent 700 construction workers home despite fears - concealed from Mr Izmirlian - that they would miss Baha Mar’s completion target.

Mr Mitchell’s intervention, which was sent to the Appeals Board’s now-former secretary,

Fred Mitchell, minister of foreign affairs, PLP

Fred Mitchell, minister of foreign affairs, PLP

Asserting that roads in the area would be unable to handle the increase in vehicle traffic

chairman

PM: Bill’s ‘flexibility’ to end GBPA’s energy regulation

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Prime Minister yesterday confirmed that the Electricity Bill 2024 provides “the flexibility” to remove the Grand Bahama Port Authority’s (GBPA) ability to regulate the energy sector in Freeport.

Speaking to journalists, Mr Davis was asked if the legislation set to be debated by the House of Assembly next Wednesday “intends to take away the authority for Freeport energy from the Grand Bahama Port Authority and give it to URCA” (the Utilities Regulation and Competition Authority) based on provisions in the Bill.

Replying, the Prime Minister affirmed: “That flexibility exists in the Bill.” His words affirm that Tribune Business’s initial analysis of the Bill and its contents were correct, as it had been informed that the Government appeared to have found “a sneaky way to circumvent the Grand Bahama Port Authority (GBPA)” and its regulation of utilities in Freeport via powers bestowed by the Hawksbill Creek Agreement.

The Bill, which treats Grand Bahama as a Family Island, appears to make the Grand Bahama Power Company the “approving authority” for anyone

SEE PAGE B4

By NEIL HARTNELL

told Tribune Business it was “very worrisome” that the Electricity Bill 2024, which is set to be debated in the House of Assembly next week Wednesday, “sidelines” the Utilities Regulation and Competition Authority (URCA) by preventing it from having any

And the appeals court also agreed that Baha Mar’s original developer had supplied sufficient evidence that CCA’s “misrepresentations” resulted in him spending millions of extra dollars to ramp up operations to prepare for the planned opening, including taking guest bookings, even though he had “some sense” his Chinese partners were “not telling the truth” about the construction progress.

However, while the New York appeals court found for Mr Izmirlian and his BML Properties vehicle on the main issues, yesterday’s

business@tribunemedia.net FRIDAY, APRIL 26, 2024

Opposition leader fears Bill ‘guts URCA’s BPL oversight’ THE Opposition’s leader yesterday accused the Government of “gutting URCA’s oversight” with planned energy regulation reforms that the Prime Minister said could lead to BPL’s break-up. Michael Pintard

influence over the rates charged by Bahamas Power & Light (BPL) and other utility-scale energy providers for a three-year period. Recalling the fall-out from last year’s “glide path” strategy, which saw BPL hike its fuel charge by

Tribune Business Editor nhartnell@tribunemedia.net SEE PAGE B3

SEE PAGE

B4

SEE PAGE B3

SEE PAGE B8

MICHAEL PINTARD

IZMIRLIAN FRED MITCHELL $5.80 $5.85 $5.92 $5.96

SARKIS

NIB RATE RISE SET TO CUT DEFICIT BY $27M

By

THE National Insurance Board (NIB) yesterday forecast that the upcoming contribution rate increase on July 1 will cut 2024’s loss by 41.5 percent or some $27m.

Dr Tami Francis, the social security system’s deputy director with responsibility for New Providence and actuarial services, told the Prime Minister’s Office’s press briefing that the all-in 1.5 percentage point contribution rate rise was “very necessary” to start NIB on the path to a more sustainable future.

“This year the deficit will be, if there was no increase, around $65m,” she said, referring to the amount by which NIB’s benefits and other expenditure will exceed contribution and investment income. “However, with the upcoming increase from July 1, our

deficit will be reduced to about $38m. So that’s a $27m reduction.

“We can see the contribution rate increase is something that is very, very necessary, and we are on the way to sustainability of the Fund.” Much more, though, is required before that happens.

NIB’s 11th actuarial report called for a two percentage point increase in contribution rates to be implemented by July 1, 2022, with subsequent further hikes enacted every two years until 2036 to secure the social security system’s long-term financial sustainability. If implemented, that would have taken NIB’s total contribution rate to 25.8 percent by 2036.

“An increase of the contribution rate by 2 percent (over the existing 9.8 percent) every two years starting on July 1, 2022, and ending on July 1, 2036, could restore the short and medium-term

financial sustainability of the scheme,” the last actuarial report said.

“Starting in 2029, the required annual contribution rate to pay for all expenditures becomes the pay-as-you-go (PAYG) rate. As an illustration, the contribution rate will have to increase from 9.8 per cent to 16.9 per cent in 2029, and will reach 32.3 per cent in 2078.”

The 1.5 percentage point contribution rate increase set to take effect on July 1, which will take the all-in rate from 9.8 percent to 11.3 percent, is to be split evenly between employer and employee. The former will their rate rise from 5.9 percent to 6.65 percent, while that for workers will shift from 3.9 percent to 4.65 percent. The rates for self-employed and voluntary insureds will go to 10.3 percent and 6.5 percent.

Ms Francis said the average return on investments for NIB was around 4.1 percent while Heather

Maynard, its acting director, said around 300 employers had been taken to court over their delinquency in failing to pay contributions on behalf of employees. This number was said to represent a 12.1 percent increase.

“We understand that an increase is never favourable, and we continue to exercise all due diligence to preserve the sustainability of the Fund,” Ms Maynard added. She said other reforms, besides contribution rate rises, were being explored with the social security system’s administrative costs having “remained consistently under 20 percent of total costs for almost a decade”.

NIB currently pays more than $27m per month to its 45,000 pension beneficiaries, and Ms Maynard said that despite at present having the 14th lowest contribution rate in the Caribbean it offers more benefits than 16 of the region’s 19 other countries.

Tribune Business previously reported that COVID-19 has left NIB facing an “uphill lift” to recovery after plunging the nation’s social security system into a $240m loss at the pandemic’s peak.

NIB’s 2021 annual report, the latest on record after being tabled in the House of Assembly, revealed that the pandemic both accelerated and deepened its existing woes by causing the social security system to incur losses of $51.1m for that year following $188.6m worth of ‘red ink’ in 2020.

The combined $239.7m loss, the report revealed, drove NIB’s reserve fund below the $1.5bn mark at year-end 2021 as a consequence of the surge in unemployment and other benefits paid out to support jobless Bahamians and their families during the peak of COVID lockdowns and other restrictions. This marked a more than $200m drop from the $1.7bn-plus levels they had attained from 2017 to 2019.

The 2020 annual report, also tabled in Parliament, said that year saw “the largest gap between contributions and benefits” since NIB began operations some 50 years ago in 1974.

With COVID at its peak, the value of unemployment benefit claims payments surged more than sevenfold from $16.3m in 2019 to $107.7m in 2020.

The number of persons receiving benefits also increased more than

six-fold, jumping from 7,117 in 2019 to 44,182 a year later, due to business closures and employee furloughs in tourism-related businesses and other ventures due to border closures, travel restrictions and other measures.

“In 2021, it was clear that NIB’s road to recovery would be an uphill lift,” the annual report said. It was also when the results of NIB’s latest actuarial review, examining its solvency and ability to meet projected future benefit payments to the Bahamian people, revealed that “if no pension reform is implemented the Fund is projected to be depleted in 2028”.

That analysis was conducted in 2018, when NIB had some $1.74bn in reserves and before they were depleted by COVID19 to less than $1.5bn. The pandemic’s financial impact has thus made the need for financial reform at NIB that much urgent and greater, hence the Davis administration’s decision to raise the contribution rate by a total 1.5 percentage points from July 1, 2024.

For pension benefits alone, which increased by 9.2 percent year-overyear in 2021, growing from $258.841m to $282.585m, exceeded both that year’s $260.275m gross, and $257.687m net, NIB contributions by workers, employers and the self-employed.

PUBLIC NOTICE

INTENT TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, GERON MICAH DORSETT of Millennium Gardens, Nassau, The Bahamas intend to change my name to MICAH HEZEKIAH ISRAEL. If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Offcer, P.O.Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice.

PAGE 2, Friday, April 26, 2024 THE TRIBUNE

Tribune Business Editor nhartnell@tribunemedia.net

NEIL HARTNELL

Mitchell demands halt to cemetery’s appeal

Carol Martinborough, surfaced at the pre-hearing for the appeal against the Town Planning Committee’s 2018 rejection of James Bain’s application to build the cemetery on 13 acres of vacant land he owns near Bernard Road’s Budget convenience store.

“I wish to register the interest in the above captioned matter and urge that the appeal be dismissed and the status quo maintained,” said Mr Mitchell.

“The use of the land for a cemetery is not supported by

most constituents in the area. The roads in the area do not, and cannot, support the additional commercial traffic, and given the experience of Woodlawn [Gardens], the increased nuisance to residents would be exponential, displacing and devaluing their properties and disturbing their quiet enjoyment.”

“In addition, the Government is in the early stages of exercising its powers under the Public Acquisition Act to [acquire] the land in question or pieces or parcels therein”

Prior to reading the e-mail during the hearing, Dawson Malone, the Subdivision

and Development Appeal Board’s chairman, said there are still cases regarding the property pending in the Supreme Court and, during the Board’s last site visit, they noticed ongoing construction at the site.

He said: “When we had the site visit on the last occasion we noticed the number of locations… there was some construction there. And it came to our attention that there was some Supreme Court matters pending and, subsequent thereto, we received an e-mail correspondence from minister Fred Mitchell.”

Khalil Parker KC, attorney for the developer, suggested that as the matter is a land dispute a representative of the Attorney General’s Office should appear for the appeal hearing. The cemetery proposal sparked considerable protest from area residents when it surfaced in 2018, culminating in a well-attended public hearing at LW Young Junior High School where concerns were voiced.

Among the chief fears were that traffic would increase, while the value of properties in the area would decline. Residents were also

Sarkis defeats CCA’s bid to dismiss $2.25bn claim

FROM PAGE B1

verdict was not a comprehensive victory for the Lyford Cay resident. For CCA succeeded in persuading the court to dismiss the claim for lost profits by Baha Mar’s original developer as a result of his ousting from the project’s ownership.

It also rejected Mr Izmirlian’s assertion that CCA did not engage in “good faith and fair dealing”, although its rationale was that this claim duplicates his “breach of contract” assertion. And the Chinese state-owned contractor also enjoyed success in having its counter-claim restored over two alleged breaches of the investors’ agreement between itself and Mr Izmirlian.

This breach was purportedly caused by Baha Mar’s original developer filing for Chapter 11 bankruptcy protection in the US without CCA’s permission. However, the New York appeals court dismissed CCA’s claim that Mr Izmirlian further breached their investors’ agreement by loaning money through his private vehicle, Granite Ventures, to finance Baha Mar’s expenses during the Chapter 11 bankruptcy protection period.

Still, Baha Mar’s original developer is likely to be the happier of the two parties as the core of his $2.25bn claim has survived CCA’s bid to throw it out. “The motion court properly denied summary judgment dismissing plaintiff’s [Mr Izmirlian] breach of contract claim,” the appeals court said of the initial ruling by Judge Andrew Borrok.

“Issues of fact exist as to whether the representatives of defendant CSCEC Bahamas (CCA) failed to act in the best interests of the company by diverting resources to other projects and authorising the removal of 700 workers from the project

as it was nearing its deadline, despite concerns about meeting that deadline, which they did not communicate to the company.

“It does not matter that the focus of the investors’ agreement is not construction management, as the CSCEC Bahamas representatives were required to act ‘at all times’ in the company’s best interests.” The “resource diversion” involves CCA allegedly sending funds, workers and materials to its newlyacquired British Colonial resort, the precursor to the $200m development of The Pointe on adjacent land. Judge Borrok, in his original verdict on May 25, 2023, said the evidence also showed Tiger Wu, CCA (Bahamas) executive vicepresident, approved some 700 Chinese construction workers leaving the Baha Mar work site between December 2014 and February 2015 “despite knowing that those workers may have helped the project reach the substantial completion date on time”.

As a result, CCA had “disingenuously” informed then-prime minister, Perry Christie, that the Cable Beach mega resort would meet its March 27, 2015, completion date. Mr Wu allowed the workers to leave “with the express purpose of causing CCA to stop work” so the contractor would have leverage over Baha Mar to demand it be paid more money.

Meanwhile, in yesterday upholding the decision not to dismiss Mr Izmirlian’s fraud claims, the appeals court asserted: “Fact development has not created a basis to modify this legal determination. Issues of fact exist with respect to justifiable reliance.

“Evidence was presented that plaintiff, which had day-to-day responsibility for [Baha Mar], relied on

defendants’ misrepresentations by taking reservations, preparing for opening and refraining from seeking additional financing or labour.

“Evidence was also presented that, although plaintiff had some sense that defendants [CSCEC/ CCA] were not telling the truth, it lacked the ability to definitively verify their claims – especially in view of defendants’ apparent concealment of information.”

But, while Judge Borrok had ruled Mr Izmirlian could seek to recover lost profits as a result of his ousting, the New York State Supreme Court took a different view.

“The request for lost profits damages should also have been dismissed because the parties did not contemplate liability for lost profits at the time of contracting,” it said, finding for CCA on this issue.

“It is not enough that CSCEC Bahamas expected that the project would make money, as that is not the same thing as expecting to be held liable for lost profits... Section 11.10 of the investors agreement expressly waived consequential damages, notwithstanding ‘[a] nything herein contained, and anything at law or in equity, to the contrary’.”

David Bones, the expert hired by Mr Izmirlian’s BML Properties, estimated that the latter had lost its entire $830m investment in Baha Mar. This included tangible and intangible assets, including land and leased facilities, improvements, personal property, contracts, approvals, hotel assets, intellectual property, intangible personal property, casino operations and licence, and cash.

CCA, by contrast, received a further $700m to complete Baha Mar’s construction. However, this discrepancy failed to impress the New York appeals court, even though it rejected CCA’s assertions that the

claims by Mr Izmirlian should be dismissed. These were not released by the Supreme Court proceedings in The Bahamas that woundup the original Baha Mar because he was not a party to that case.

The Chinese contractor fared better, though, on other elements of its counter-claim. “CSCEC Bahamas’ counterclaim for breach of section 4.7 of the investors agreement should not have been dismissed. There is evidence in the record of at least one unanswered request for books and records in a March 13, 2015 letter, which was reiterated in March 25 and May 6, 2015 letters.

“Although the company [Baha Mar] was not obliged to create new documents in response to this request, it should have had some existing documentation responsive thereto. Issues of fact exist also exist as to whether the company’s failure to provide this information caused CSCEC Bahamas damages, as it

concerned the project would impact the water table and increase flooding in the area.

The 13.504 acres of vacant land owned by James Bain is situated near the Budget Convenience store, east of Sands Addition and just past the 700 Wines and Spirits liquor store heading east.

Attorney Bjorn Ferguson, an opponent of the proposed cemetery, told this newspaper at the time: “We’re just happy that the [Town Planning] committee gave weight to the relevant factors and arrived at the right conclusion. We would greatly appreciate consideration

could have taken steps to mitigate if it had evidence of financial mismanagement.”

CSCEC and CCA held $150m worth of preference shares in Baha Mar prior to the Chapter 11 move. And while Judge Borrok had dismissed CCA’s claims that Mr Izmirlian breached their investors’ agreement by filing for Chapter 11 bankruptcy protection in the US without the contractor’s permission, the appeals court reversed this.

“CSCEC Bahamas’ counterclaim for breach of section 4.8(g) of the investors agreement also should not have been dismissed. It is undisputed that plaintiff breached this provision by filing for reorganisation without CSCEC Bahamas’ consent, and issues of fact exist as to whether CSCEC Bahamas was damaged as a result.”

The final word in the appeals court ruling, though, went to Mr Izmirlian. Judge Borrok, in his original decision, wrote: “Finally, the defendants argue that BML Properties breached Section 4.8 (1) of the investors agreement by causing Baha

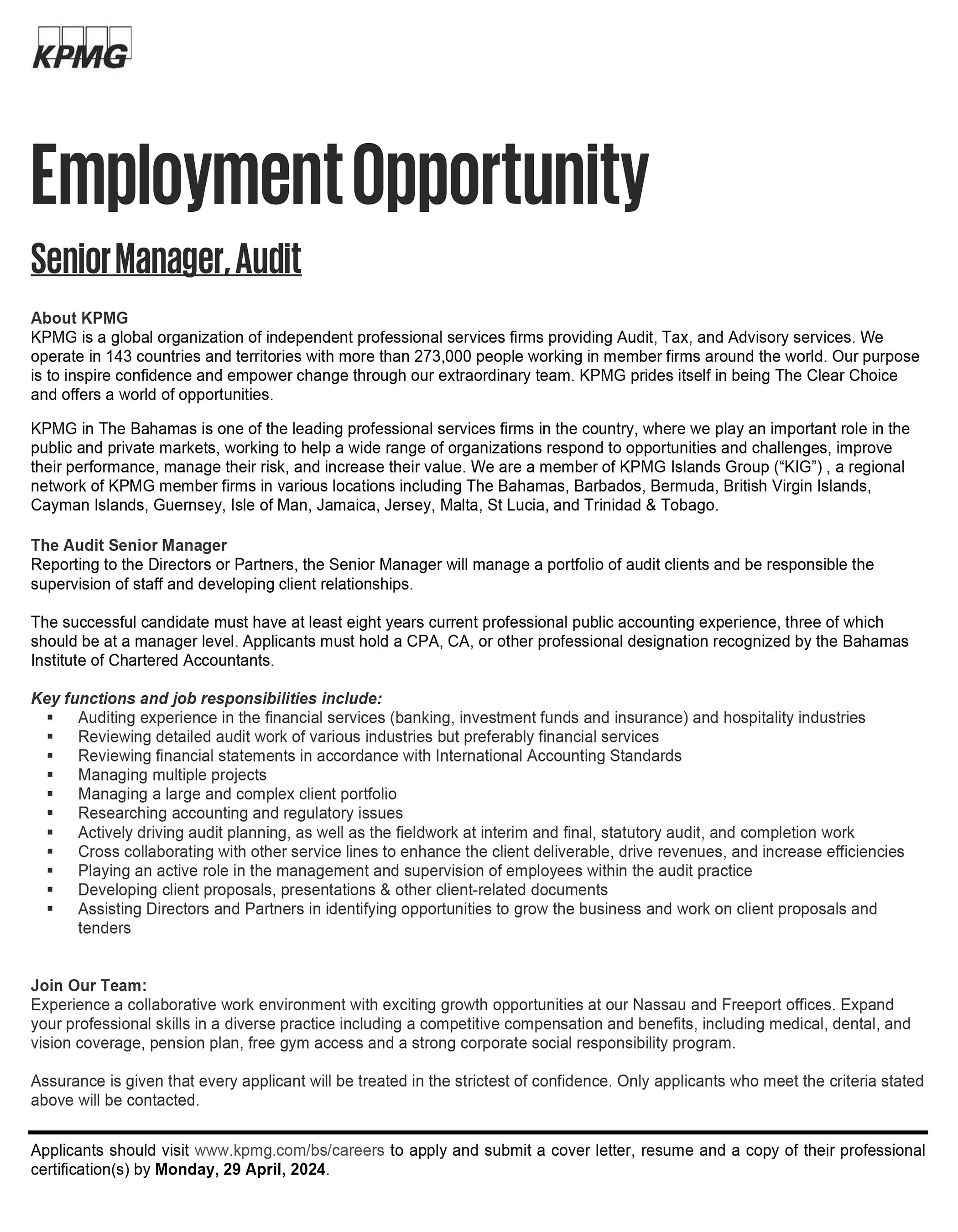

We’re hiring! Tax Manager

being given to adding more green and recreational space in our community.

“The children in the affected communities are forced to play in the streets due to the lack of green and recreational space. We would fully endorse developments that included these considerations. We do understand that a developer has a right to develop his land but his development cannot negatively impact the community. It should provide a positive impact to the community and society at large.”

Mar to procure a loan outside of the regular course of business. However, the record facts establish that the loan was both necessary to continue the ordinary course of business and on terms favourable to Baha Mar.”

“Among other things, the interest was payable in kind, there was no prepayment penalty, Baha Mar could avail itself of better financing without penalty if another lender emerged, and the term of the loan was sufficient to allow restructuring of business while in Chapter 11. The loan came just days after the Baha Mar Board discussed at a June 24, 2015, meeting that Baha Mar’s financial situation was worsening.”

The New York appeals court agreed, finding: “CSCEC Bahamas’ counterclaim for breach of section 4.8 (1) of the investors agreement was properly dismissed, as there is no evidence that the subject loan damaged CSCEC Bahamas in any way.

The successful candidate will have the opportunity to use their experience in accounting and taxation to provide compliance and consulting services to partners from various jurisdictions, corporations and individual clients. The incumbent must be experienced with the tax consulting process and have the professionalism necessary for the effective diagnosis, development, and implementation of solutions for our clients’ tax needs. They will be responsible for a portfolio of clients on a day-today basis which will include planning, management of the team including review of work, liaison with key client staff and the management of the reporting process.

Essential Functions: management of the team, allocation of resources, reviewing subordinates’ work and reporting advisor and subject matter expert by pursuing creative tax strategies making and to assist with the drafting of complex, well-structured communications in accordance with standard policies and procedures region as necessary clients

developing capabilities, recruitment, training, competitor analysis and managing quality and risk

Minimum Qualifications and Experience: credentials

Why Deloitte?

to:

and driven by our purpose, to make an impact that matters. and development. management experience. and opportunities for mobility across projects, businesses, and borders. needs including our well-being subsidy, paid leave, and YouTime. fairness, development, and well-being; foster an inclusive culture and embrace employment regardless of their background, experience, ability or thinking style.

THE TRIBUNE Friday, April 26, 2024, PAGE 3

FROM PAGE B1

Talent Deloitte Ltd. 2nd Terrace West Centreville Nassau N-7120 Bahamas

PM: Bill’s ‘flexibility’ to end GBPA’s energy regulation

submitting a proposal to supply electricity to the public on the island.

The Bill states that any approvals by such an “authority” must also be given the go-ahead by URCA, and it was suggested this was a neat way of circumventing the GBPA’s utilities regulatory authority in Freeport and transferring it to URCA via GB Power Company.

It thus appears the Government is eyeing a further way to squeeze the GBPA, and erode and strip it of its ability to regulate utilities in the Port area, with tensions already inflamed by the Government’s demand that the GBPA pay $357m to reimburse it for costs incurred in providing public services in Freeport over

and above the tax revenues generated by the city.

Mr Davis said he yesterday received an “update” on the progress the Government is making with its demand, as the attorneys for both sides were due to meet this week to see if a last-minute compromise or settlement can be reached. In reality, they are also likely to be finalising the arbitration process and affirming who will be selected as arbitrators.

“The process is moving,” the Prime Minister added. “I think the lawyers are meeting. I got an update earlier that they are talking, and we will see what happens. If there’s no concrete way forward we’ll continue the process as ordained by the agreement that exists between us.” When asked what that will involve, he

replied: “That’ll look like arbitration.” The Electricity Bill, meanwhile, explicitly states that it applies to Freeport and Grand Bahama Power Company even though the latter’s 2016 Supreme Court action, where it sought an injunction to prevent URCA “from regulating, or seeking to exercise licensing and regulatory authority” over it, remains live.

GB Power’s action is founded on the basis that, as a GBPA licensee, it is licensed and regulated by the latter via the Hawksbill Creek Agreement - and not by URCA and the Electricity Act 2015.

It is arguing that the existing Electricity Act’s sections 44-46, which give URCA the legal right to licence and oversee energy providers, “are inconsistent, and conflict with, the rights and

privileges vested in [GB Power] and the Port Authority” by the Hawksbill Creek Agreement.

GB Power’s statement of claim argues that itself and the GBPA “have been vested with the sole authority to operate utilities”, including electricity generation and transmission and distribution, within the Port area until the Hawksbill Creek’s expiration in 2054. Cable Bahamas, too, also has a separate legal action contesting URCA’s jurisdiction and authority to regulate its Freeport subsidiary.

Michael Pintard, the Opposition’s leader, yesterday predicted to Tribune Business that the Government will likely run into “significant resistance” from the GBPA, GB Power and others if the Bill seeks to impose URCA’s regulatory authority on the Freeport

energy sector especially given that outstanding litigation has not been resolved.

“To the best of my knowledge, the Government went down this road previously to assert that URCA had the oversight authority in the Port area,” Mr Pintard said.

“I know that caused significant resistance by attorneys on behalf of the GBPA.

“I am confident that the Government is likely to be met with the same resistance if it is taking a decision to proceed with reconfiguring what the arrangement is in Freeport. GB Power is not regulated by URCA. URCA does not provide that oversight. That’s an old argument that has not been resolved. I would leave it to the courts to determine that.

“This is not an administration given to reasonable conversations with stakeholders and trying to be

transparent on what they plan to do, and have reasonable conversations with them rather than carrying on like a bull in a china shop. That’s what this administration is doing.”

James Carey, the Grand Bahama Chamber of Commerce president, told Tribune Business that URCA officials had met with him several weeks ago and expressed that they were eager for the legal battle with GB Power to end so they can take over utilities regulation in Freeport. “I’d had a visit from URCA several weeks ago and they were waiting for the [legal] process to complete because they were anxious to participate here,” he said. “URCA must have known this Bill was coming although they made no reference to it. Legislation is not drawn up overnight.”

still remained at around $180m at end-2023.

163 percent over an eightmonth period to summer 2023, he added that this provision threatens to leave households and businesses exposed to further predatory price hikes with no ability for the regulator to intervene.

The new Electricity Bill’s “objects and reasons” section, meanwhile, reveals that the likes of BPL and all other entities designated

as “public electricity suppliers” will enjoy a “transition period of three years” after the legislation becomes law when URCA cannot intervene with the tariff rates or prices that they charge Bahamian households and businesses.

They will, though, have to use that time to prepare a “comprehensive review” of their prices. And a similar provision was contained in the existing Electricity Act 2015, which stipulated that URCA could not alter or

interfere with the electricity tariff rates set in the contract PowerSecure had to manage BPL for five years.

That contract was subsequently terminated by the Minnis administration, in which Mr Pintard was a Cabinet minister, but the clause was not changed. “URCA shall for a period of five years adopt and apply the tariff rate for electricity supply services by BPL contained in the initial management contract with the

system operator,” the present Act states. Nevertheless, Mr Pintard’s fears came as Prime Minister Philip Davis KC yesterday confirmed that the Electricity Bill 2024 “could” permit BPL to be split, or broken up, into three separate entities responsible for generation, transmission and distribution, and billings, collection and back office functions.

Asked by journalists yesterday whether the stateowned energy monopoly faces being broken up, Mr Davis replied: “It could be. The allows for that.” Tribune Business reported yesterday that the Electricity Bill effectively facilitates this by creating a foundation for private-public partnerships (PPPs) that the Government hopes will rescue the ailing state-owned energy monopoly by attracting private capital and expertise.

The Bill’s section nine, three (c) details new clauses on page 15 that allow BPL to “incorporate one or more” 100 percent-owned subsidiaries or joint venture companies, the latter partowned by the Government, to which it is able to transfer “functions and assets”.

And these newly-formed entities are also permitted by the new Bill “to enter into a management contract with a system operator to perform any or all of the functions of BPL”. This appears to creating the legal basis for the potential break-up of BPL into separate functions, and the outsourcing of the management of those functions to private sector companies and investors.

Prompted earlier about the potential splitting of BPL’s various functions, Mr Davis replied: “It is designed to bring efficiencies that we could afford to bring to the country at this time. It is designed to ensure they can

accommodate.. It is a legal construct to ensure it can accommodate and give the Government flexibility to do what it thinks is right for the Bahamian people.”

Mr Pintard, though, while acknowledging he had only made a “cursory” assessment of the Electricity Bill and accompanying Natural Gas Bill 2024, which is designed to create oversight regime for BPL’s planned switch to cleaner, more sustainable and potentially cheaper liquefied natural gas (LNG) fuel for generation, said the legislation appeared to confirm suspicions as to the Government’s energy reform plans.

Arguing that the Davis administration has failed “to apprise” BPL staff, the Opposition and wider Bahamian public of its plans, he added that it was seemingly seeking to outsource the energy utility’s functions to private sector partners who will provide management services via PPP agreements in a bid to enhance efficiencies, reduce energy costs to consumers, and attract fresh investment to upgrade its infrastructure.

Mr Pintard asserted that the Government is doing this “without the benefit of competitive bidding”, which would help ensure it secures the best possible partners and deals, and also failing to clarify its ultimate objectives for BPL and the energy sector.

And he argued that the Government cannot be trusted on energy reform given its alleged mishandling of the BPL fuel hedge it met in place upon taking office; the subsequent hikes in electricity bills to reclaim unrecovered fuel costs of between $90m-$110m; and questions over whether the monies raised were used to extinguish this debt as the Government’s loan to BPL

“What is very worrisome about this is that they are gutting the oversight of URCA. They [BPL] should not be empowered for a three-year period of time,” he told Tribune Business of the period during which URCA cannot intervene with BPL’s tariffs. “This sidelining of URCA is a major problem; to impose rates on folks that are already struggling beneath these rates for regular service.

“This is not an administration you want to empower to extract more funds from a consumer base already under pressure and a business community carrying an undue burden from policymaker decisions.”

Mr Pintard also challenged how the Government plans to address BPL’s $500m in legacy debt and liabilities now that the previously-agreed financing mechanism, the Rate Reduction Bond Act, is to be repealed as no alternative has been put forward to replace it.

“The Davis administration, this is what they are doing in every sector,” Mr Pintard said of the planned energy reforms. “They are the poster child for bad governance. At a minimum, if there is a compelling reason, lay it out to the public. They have failed to do that.

“The suspicion is that the legislation was written for them by those they are going into business with. This is a clear case of the tail wagging the dog. It means the Government is not in charge of this entire process, which is why they are unable to lay out a vision and clear message, and explain why there will be one entity for generation, one entity for transmission and distribution, and one left with the Government.”

PAGE 4, Friday, April 26, 2024 THE TRIBUNE

FROM PAGE B1

Opposition leader fears Bill ‘guts URCA’s BPL oversight’ FROM PAGE B1 JOB OPPORTUNITY Little Switzerland, the chain of luxury jewelry and watch stores across the Caribbean is looking for a Sale Supervisor Diamonds for the Nassau store. This role will be responsible for the rapidly growing Diamond department including person and Store sales, Merchandising, Store Presentation, Inventory, and team training. Must have experience and success in personally selling high end, luxury products, and currently authorized to work For immediate consideration, Please send resumes to HR@littleswitzerland.com with “Sales Supervisor, Diamond” in the subject line.

Wall Street falls on double dose of disappointing economic data, as Meta sinks

By STAN CHOE AP Business Writer

WORRIES about a potentially toxic cocktail combining stubbornly high inflation with a flagging economy dragged U.S. stocks lower on Thursday. A sharp drop for Facebook's parent company, one of Wall Street's most influential stocks, also hurt the market.

The S&P 500 fell 0.5% and sliced some of the gain off what had been a big winning week. It looked to be heading for a much worse

loss in the morning, when it tumbled as much as 1.6%.

The Dow Jones Industrial Average dropped 375 points, or 1%, after earlier falling 700 points. The Nasdaq composite sank 0.6%.

Meta Platforms, the company behind Facebook and Instagram, dropped 10.6% even though it reported better profit for the latest quarter than analysts expected. Investors focused instead on the big investments in artificial intelligence Meta pledged to make. AI has created a frenzy on Wall Street,

N O T I C E

International Business Companies Act (No. 45 of 2000)

TELOSTAT ADMINISTRATION LTD.

Registration No. IBC 204220 B

Pursuant to the provisions of Section 138 (8) of the International Business Companies Act, 2000 notice is hereby given that TELOSTAT ADMINISTRATION LTD. has been dissolved and struck off the Register of Companies with effect from the 20th day of March, 2024.

Galnom Ltd. Liquidator

N O T I C E

International Business Companies Act (No. 45 of 2000)

Coco Cabana Ltd.

Registration No. IBC 207376 B

Pursuant to the provisions of Section 138 (8) of the International Business Companies Act, 2000 notice is hereby given that Coco Cabana Ltd has been dissolved and struck off the Register of Companies with effect from the 28th day of March, 2024.

Galnom Ltd. Liquidator

but Meta is increasing its spending when it also gave a forecasted range for upcoming revenue whose midpoint fell below analysts' expectations.

Expectations had built high for Meta, along with the other "Magnificent Seven" stocks that drove most of the stock market's returns last year. They need to hit a high bar to justify their high stock prices.

The entire U.S. stock market felt the pressure of another rise in Treasury yields following disappointing data on the U.S. economy. The report

undercut a central hope that's sent the S&P 500 to record after record this year: The economy can avoid a deep recession and support strong profits for companies, even if high inflation takes a while to get fully under control.

That's what Wall Street calls a "soft landing" scenario, and expectations had grown recently for a "no landing" where the economy avoids a recession completely.

But Thursday's report said the U.S. economy's growth slowed to a 1.6% annual rate during the first

three months of this year from 3.4% at the end of 2023.

That was weaker than expected and would have been disappointing by itself.

Making it worse for financial markets, the report also said inflation was hotter during the three months than economists forecast. That could tie the hands of the Federal Reserve, which typically juices sluggish economies by cutting interest rates.

Thursday's economic data will likely get revised a couple times as the U.S. government fine-tunes the numbers. But the

lower-than-expected growth and higher-than-expected inflation is "a bit of a slap in the face to those hoping for a 'no landing' scenario," said Brian Jacobsen, chief economist at Annex Wealth Management.

"Things can change a lot from one quarter to the next, so it's too early to say the Fed has failed, but this doesn't help their cause."

Underneath the surface, the economic report may not have been as bad as initially thought. Much of the slowdown was due to a rise in imports and other factors that can swing sharply and quickly. The main engine of the economy, spending by U.S. households, remained relatively solid.

That helped blunt the worry caused by the report, helping markets to pare their morning losses, but it did not erase the threat.

THE TRIBUNE Friday, April 26, 2024, PAGE 5

STOCK MARKET TODAY

Microsoft quarterly profit rises 20% as tech giant pushes to get customers using AI products

By MATT O'BRIEN AP Technology Writer

MICROSOFT on Thursday said its profit rose 20% for the January-March quarter as it tries to position itself as a leader in applying artificial intelligence technology to make workplaces more productive.

The company reported quarterly net income of $21.93 billion, or $2.94 per share, beating Wall Street expectations for earnings of $2.82 a share.

The Redmond, Washington-based software maker posted revenue of $61.86 billion in the period, its third fiscal quarter, up 17% from the same period a year ago.

Analysts polled by FactSet expected Microsoft to post revenue of $60.86 billion for the quarter.

Microsoft doesn't spell out how much money it makes from AI products, including its flagship Copilot chatbot that can compose documents, write code or generate images. But it has infused the technology into its main lines of business, such as cloud computing contracts and subscriptions for its email and other online services.

Quarterly revenue from Microsoft's cloud computing business segment grew to $26.7 billion, up 21% from last year's January-March quarter. Revenue from the company's productivity services – such as its Office line of products – rose 12% to $19.6 billion.

spreadsheets.

Gartner analyst Jason Wong said many of Microsoft's customers have shown a strong interest in giving generative AI a try but don't all have a solid plan for a practical use that justifies the cost. "It's still very early," Wong said.

Microsoft's generative AI products rely heavily on its multibillion-dollar investments in business partner OpenAI, the maker of ChatGPT. Microsoft also unveiled a new set of leaner homegrown AI language models called Phi-3 earlier this week and has been partnering with other startups — such as France's Mistral — to offer a variety of AI systems through Microsoft's Azure cloud computing platform. Some of those partnerships are under regulatory scrutiny in Europe and the U.S. over concerns they might thwart competition in the AI industry.

NOTICE

NOTICE is hereby given that

MIKE DOREUS of Mackey Street Nassau, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 17th day of April 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE

NOTICE is hereby given that

CHIJIOKE MARSHAL NGOBIDI of 3rd Terrace Centerville, Nassau, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 26th day of April 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE

NOTICE is hereby given that KETLINE PIERRE of P.O. Box EE16373 Zimbabwe Avenue, Elizabeth Estate, Nassau, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 19th day of April 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE

NOTICE is hereby given that ERMANTIDE SMITH of Washington Street, off Balfour Avenue, Nassau, Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 19th day of April, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE is hereby given that MANISKA DULCIO of Pinecrest, East Street South, Nassau, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 19th day of April 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas. NOTICE

PAGE 6, Friday, April 26, 2024 THE TRIBUNE

Businesses pay Microsoft $30 per employee each month to add Copilot to a workplace subscription for its package of services that includes email and

Fred Mitchell, minister of foreign affairs, PLP

Fred Mitchell, minister of foreign affairs, PLP