Developer to unleash $1bn

By NEIL HARTNELL

A BAHAMIAN developer is aiming to unleash $1bn in new real estate within the next five to six years as it likened this nation’s high-end property market to Long Island’s upscale Hamptons community.

Matthew Marco, marketing director and licensed realtor at Bond Bahamas, told Tribune Business it is “very bullish” on the country’s real estate prospects given that he had “never received more responses to an e-mail blast in my 20 years in real estate” than the recent launch of the final unsold 14 lots at Balmoral.

Jason Kinsale, Bond Bahamas president, was Balmoral’s original developer through his Aristo Development firm, which is affiliated with the realtor. Mr Marco revealed

• Says: ‘Bahamas booming for foreseeable future’

• Eyeing $250m Love Beach launch for late 2024

• Balmoral lot reveal: ‘Most responses in 20 years’

that they plan to invest hundreds of millions of dollars in not just completing the Aqualina development at Cable Beach but other upcoming projects at Love Beach and Goodman’s Bay. He disclosed to this newspaper that some $250m will be invested in constructing Amaya, a Love Beach development featuring 40 residences priced between $4m and $12m, which is likely to launch towards the end of

2024 and target residents from high-end New Providence communities such as Lyford Cay and Old Fort Bay who are seeking to downsize.

And Mr Marco also confirmed that Mr Kinsale has acquired the Fairview property at Goodman’s Bay - a deal first revealed by Tribune Business last year. The property is currently being “land banked” with its value expected to appreciate further as a result of a GoldWynn

penthouses project that is viewed as driving real estate values in the area even higher.

“We’re very bullish. We have about $1bn in inventory from our projects over the next five to six years,” he told Tribune Business.

“Between Love Beach, Goodman’s Bay and Cable Beach, there’s a lot of good things happening. There’s just no more land left in New Providence.

Gov’t may give up ‘bit’ of taxes for gas margin rise

By NEIL HARTNELL Tribune Business Editor

THE Bahamas Petroleum Retailers Association’s (BPRA) vice-president yesterday revealed the Government may give up “a bit” of its gasoline tax revenues to facilitate a margin increase for dealers.

Vasco Bastian told Tribune Business that he is presently “the happiest I’ve ever been” over the 27-month negotiations with the Davis administration after Michael Halkitis, minister of economic affairs, disclosed on Friday that the Government was “tweaking

some proposals” in a hope to resolve the situation “within the next couple of weeks”.

Describing the potential resolution as a “two-for-one deal”, where the interests of motorists, business and gas station entrepreneurs were protected, the Association vice-president explained that it would result in a “small but significant” margin increase that dealers have been clamouring for as critical to their survival.

Mr Bastian, asserting that the industry can now “see some light at the end of the tunnel”,

Pintard: ‘Moment of truth’ on new FTX accusations

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Opposition’s leader last night warned that The Bahamas’ reputation as an international financial and business centre is in danger if the latest FTX claims are not investigated as “a matter of urgency”. Michael Pintard, demanding that the Prime Minister launch a “thorough” probe into accusations that the collapsed crypto exchange and its jailed founder, Sam Bankman-Fried, paid a total $675,000 to “entities affiliated with high-ranking Bahamian government officials and their families”, argued that failing to respond could see this nation “squander” multiple economic diversification opportunities. The emergence of these allegations, in a report by Robert Cleary, appointed by the US Department of Justice trustee to examine FTX’s collapse, is especially timed from The

$256m FTX properties to ‘hit market within 30 days’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

FTX’s $256m Bahamian property empire is set to “hit the market within the next 30 days” after five to seven local realtors were selected to handle their disposal.

Realtors spoken to by Tribune Business said the high-end international market for Bahamian real estate is more than capable of absorbing the one-time influx of 34 properties purchased by the collapsed crypto exchange, one going so far as to describe their impending listing-for-sale as a “drop in the bucket”.

All confirmed that FTX’s Bahamian liquidators, chiefly the PricewaterhouseCoopers (PwC) accounting duo of Kevin Cambridge and Peter Greaves, have recently started issuing confirmations to the Bahamian realtors selected to list, market and sell properties that represent a significant source of recovery for investors and creditors.

This newspaper understands that the high-end residential and commercial properties have been splitup between as many as five to seven realtors as the Bahamian liquidators seek

business@tribunemedia.net MONDAY, MAY 27, 2024

SEE PAGE B6

nhartnell@tribunemedia.net

in

years

properties over 5-6

Tribune Business Editor nhartnell@tribunemedia.net

SEE PAGE B5 SEE PAGE B9 SEE PAGE B4

MARIO CAREY

DAVID MORLEY

JASON KINSALE

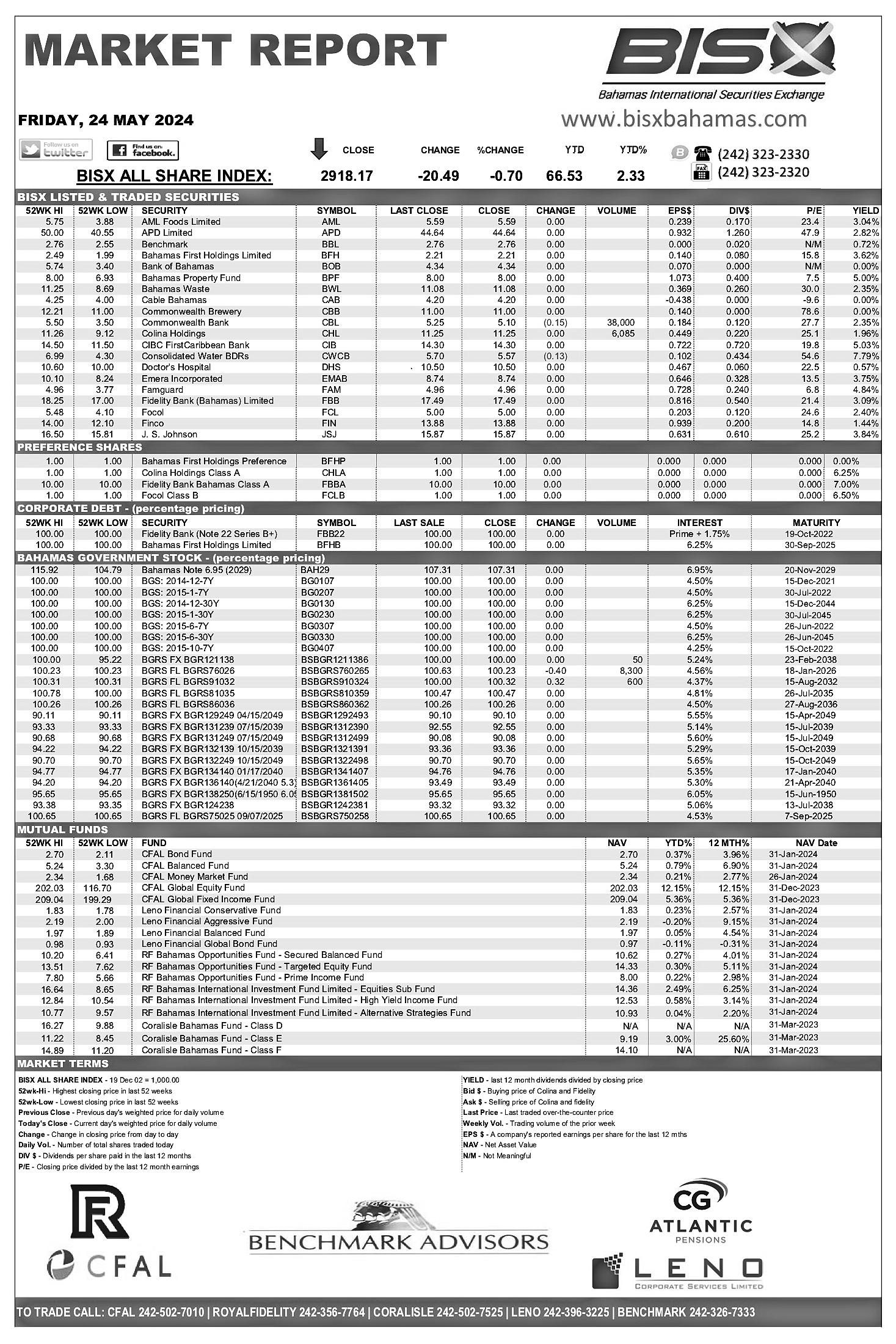

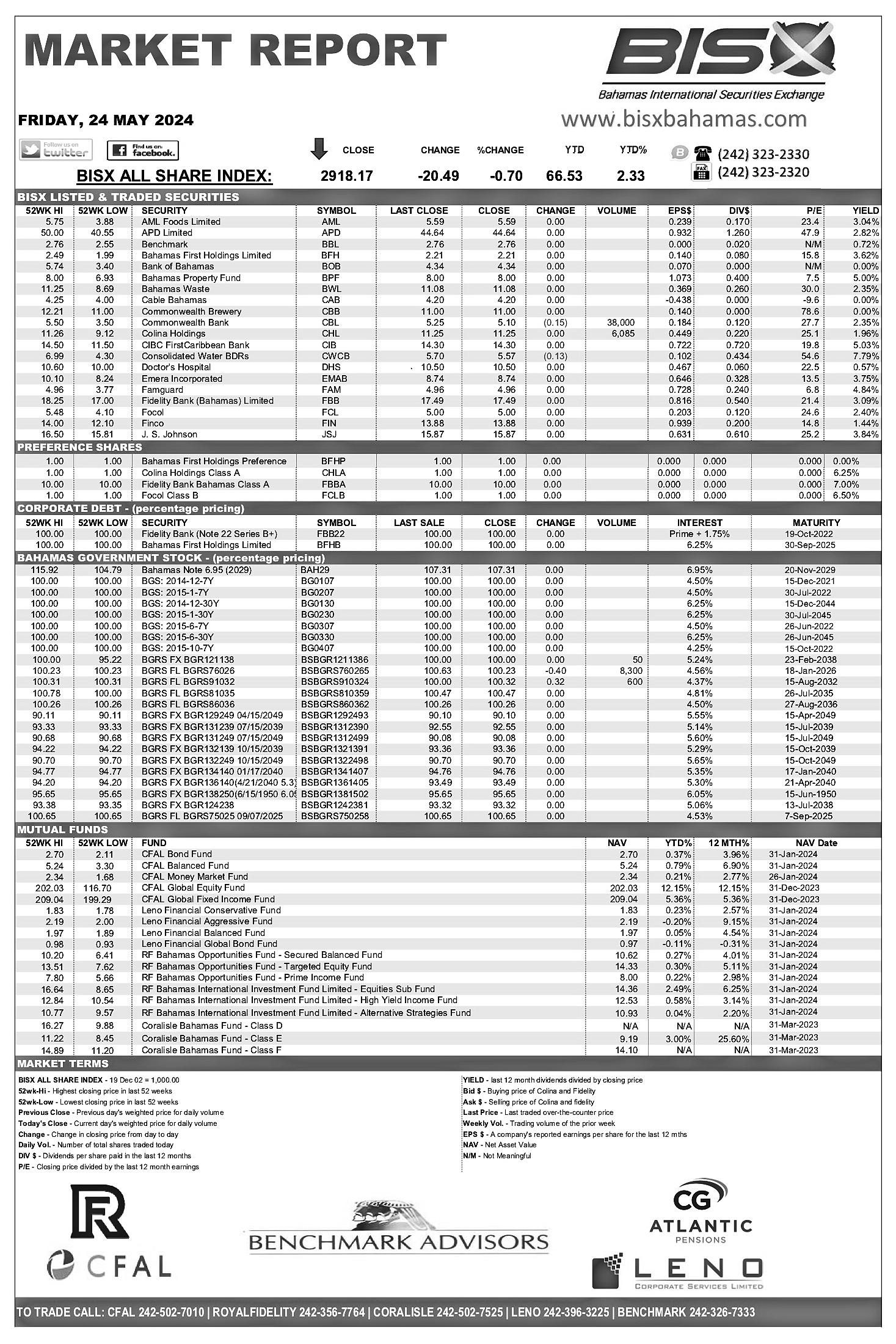

$5.90 $5.91 $5.90 $5.96

MICHAEL PINTARD

EMBRACE ESG GOALS TO SECURE CORPORATE FUTURE

ENVIRONMENTAL,

social and governance (ESG) criteria have become increasingly important in the business world in recent years. A company’s financial performance and operational efficiency are now influenced by ESG, which extends beyond compliance and corporate responsibility.

This article explores how ESG has played an important role in shaping modern business, incorporating the views of both this author and Prime Minister Philip Davis KC based on his recent pronouncements on the issue.

The financial impacts of ESG

A company’s bottom line is profoundly influenced by ESG factors. Research suggests companies with strong ESG practices often experience lower costs, improved risk management and enhanced brand reputation, leading to better financial performance.

As an example, adopting environmentally sustainable practices can result

Derek Smith By

Derek Smith By

in significant cost savings through increased energy efficiency as well as reduced waste generation. Social initiatives, such as those that promote diversity and fair labour practices, contribute to the satisfaction and productivity of employees. Maintaining a strong governance framework can reduce the risk of costly legal issues arising from non-compliance with regulations.

In this author’s June 1, 2023, article, entitled ‘How social responsibility is affecting financial institutions’, emphasis was placed on the necessity for companies to integrate ESG principles into their core strategies. It said: “Failure to integrate ESG principles into business operations may result in companies suffering reputational damage, a loss of customer confidence and a loss of value for their brands. In addition, an institution’s bottom line may be impacted by negative publicity related to environmental controversies, labour practices or governance issues.”

ESG and operational efficiency

An ESG strategy goes beyond minimising risks to capitalise on opportunities. Sustainable practices can help companies innovate and grow. Incorporating ESG principles can, for instance, lead to the development of new products and services that meet the growing demand for sustainability. Furthermore,

$1.2m physical therapy centre true family affair

By NEIL HARTNELL Tribune Business Editor

nhartnell@tribunemedia.net

THE development of

a $1.2m chiropractic and physical therapy facility on Baha Mar Boulevard has been described as a true family affair.

Dr Shantell Missick, founder of Dynamic Healing Wellness Centre, used the expertise and services provided by her husband, father and father-in-law to develop the newly-opened location after ever-growing patient demand and the need to offer complementary services resulted in the business outgrowing its previous location.

Practicing for over 14 years, and running her own

business for eight years come July, Dr Missick said: “I am truly overjoyed to be standing here and sharing this very special and personal accomplishment with so many of you.

“Having eight years under my belt in running my own practice, I’ve realised that it is truly by God’s grace and through the support of my family and my dedicated team members that makes serving the Bahamian community so gratifying. My number one priority is educating and helping persons achieve their optimal potential of health by empowering them to take charge and to make more conscious decisions.” Government officials, members of the business

and medical community, and friends and well-wishers gathered at Dynamic Healing Wellness Centre’s opening.

Senator Ronald Duncombe, speaking on behalf of Prime Minister Philip Davis KC, said: “Dynamic Healing’s mission resonates deeply with the nation’s commitment to the health and wellness of our people.

“Your dedication to educating and empowering individuals to achieve maximum health and quality of life through the management or elimination of physical, emotional or chemical stress on the nervous system is truly commendable. By unlocking the body’s natural ability to heal itself, Dynamic

efficient resource management can build operational resilience, particularly in industries prone to supply chain disruptions.

In another article, ‘Compliance amid rapid business change is key’, this author highlighted the correlation of operational benefits to ESG. The article said: “ESG metrics are directly related to performance. Compliance professionals must assist their companies with understanding this.”

Further: “To directly tackle the risk associated with ESG, corporate leadership must determine what success looks like, agree on a clear strategy and transparently embed accountability for sustainability analytics that is routinely monitored with reporting to leadership.” This underscores the importance of integrating ESG into the operational strategies.

Government’s posture

The Prime Minister has also been a vocal advocate for ESG. At the Institute of Internal Auditors Bahamas chapter’s most recent

conference, he said: “One of the most powerful ways that internal audits can strengthen organisations in 2024 is through an analysis of environmental, social and governance (ESG) activities.... In addition to supporting corporate governance and risk management, internal audits must also consider the interests of stakeholders.”

These comments mirror this author’s views on the need for proactive ESG adoption by all business partners. I am happy that focus is being placed on this most pertinent topic.

In short, the evidence is clear. ESG is not just a buzz word but a fundamental aspect of modern business strategy. Companies must proactively integrate ESG into their operations to ensure long-term success and resilience. The future belongs to those who embrace ESG principles and make them an integral part of their business ethos. It is important for businesses to conduct comprehensive

ESG assessments, set measurable goals and report progress transparently. As a result, they contribute to a sustainable future and position themselves to succeed in an ESG-conscious market.

Secure your company’s future by embracing ESG today.

• NB: About Derek Smith Derek Smith Jnr has been a governance, risk and compliance professional for more than 20 years with leadership, innovation and mentorship record. He is the author of ‘The Compliance Blueprint’. Mr Smith is a certified anti-money laundering specialist (CAMS) and the assistant vice-president, compliance and money laundering reporting officer for CG Atlantic’s family of companies (member of Coralisle Group) for The Bahamas, St Vincent & The Grenadines, St Lucia and Curaçao.

Healing is not just treating ailments, but deeply and most certainly, is transforming lives.”

Dr Hubert Minnis, former prime minister and Killarney MP, added: “As a doctor of many years, I can attest to what it means to offer health and healing to those in need of relief and pain management and elimination.

Dr Missick drew on significant support from her family. Architectural design services were provided by her father-in-law, Edward Missick, while her father, Gladstone Rolle, served

“Given the realities and stresses of daily life in The Bahamas, the provision of a range of chiropractic and physical therapies is essential. I also celebrate what this centre of healing and wellness will mean for the many Bahamians who will utilise your services and facilities.”

BDB partners to solve $2m cruise insurance challenge

THE Bahamas Development Bank (BDB) says it has teamed with Disney and a co-operative to help local tour operators meet the $2m liability insurance coverage demanded by the cruise lines.

The BDB, in a statement, said Bahamian tour operators and other vendors have for decades been excluded from offering their products and services to cruise passengers because they are unable to afford or gain access to the level of liability insurance coverage required by the lines.

However it added that,following extensive discussions with Disney Cruise Line (DCL), the BDB has launched “an

“Our efforts in connecting vendors with crucial liability insurance and development assistance is pivotal in ensuring that they have an opportunity to not only participate but thrive in business. This is a true reflection of BDB’s commitment to fostering economic growth and celebrating the rich culture of islands across The Bahamas.”

The BDB said it worked with potential partners, and met with possible vendors for the Disney Lookout Cay at Lighthouse Point

innovative insurance solution” that is beneficial for all parties. It added that this will “enhance the vitality of local businesses” while boosting the cultural offerings of cruise lines such as Disney Cruise Line. The BDB also said Bahamian vendors represented by the National Eco-Tour Operators Co-operative (NETO Co-op) will now be able to offer handmade crafts, island tours and other experiences to cruise passengers thanks to the proposed insurance solution. Nicholas Higgs, the Bahamas Development Bank’s managing director, said: “BDB is proud to work with Disney Cruise Line and NETO Co-op on this groundbreaking achievement and promote business innovation, expansion and local culture.

PAGE 2, Monday, May 27, 2024 THE TRIBUNE

RIBBON CUTTING

SEE PAGE B7 SEE PAGE B7

H. RUDY SAWYER NICHOLAS HIGGS JOEY GASKINS JR.

‘Dramatic improvement’ in Bahamas debt prices

By NEIL HARTNELL

THE Bahamas’ foreign currency bonds have enjoyed “a dramatic improvement” over the past year to boost its access to global markets at an affordable cost, a Cabinet minister has asserted.

Michael Halkitis, minister of economic affairs, told the weekly media briefing by the Prime Minister’s Office that improved investor outreach by the Ministry of Finance and its international adviser, Rothschild & Co, had potentially saved Bahamian taxpayers “tens of millions of dollars in terms of how our debt is trading”.

Data obtained from Germany’s Frankfurt stock exchange shows that The Bahamas’ outstanding $825m foreign currency bond, priced at 8.95 percent and due to mature in 2032, has seen a steady improvement in pricing and yields over the past 12 months. It is now only trading at a 1.83 discount to par value, while the yields demanded

MICHAEL HALKITIS

MICHAEL HALKITIS

by investors have dropped from the high teens to 9.4775 percent. The Government’s $300m bond, due for redemption in 2029 and carrying a 6.95 percent interest coupon, exhibited a similar trend. It is now trading at just a 10.35 percent discount to its par value, while yields have again dropped from the high teens to 9.6265 percent. Both bonds signal that The Bahamas’ creditworthiness has improved and the markets view its debt as a less risky investment.

Mr Halkitis credited the improvement to the Government and its advisers

doing a better job of informing investors, creditors and the wider international capital markets about The Bahamas’ post-COVID economic fundamentals and performance. This, in turn, was countering more negative assessments of the country’s prospects.

Recalling the situation some two years to 18 months ago, the minister said: “Government debt was trading at what some people were calling distressed levels, and there was a suggestion that we were in danger of defaulting. We felt at the time that those [bond] prices did not truly reflect what was happening in the economy.

“We went, I went, and did a lot of investor engagement, telling the story about what was happening in The Bahamas, our economy. You will have seen that the prices have improved dramatically. The yields, again, which is an indication of the price, the price has improved dramatically and a lot of people are very happy with that. A lot of investors.”

Mr Halkitis, signalling that the improved prices and yields have enhanced The Bahamas’ ability to go back to the international bond and capital markets if it needs to do so, and borrow at more affordable rates, added: “That investor engagement was very important.

“Because if people see your debt trading at very low levels, meaning nobody wants it, then when it’s time if you needed to go back and raise more money in the bond market you run the danger of the price being very high and the risk of nobody wanting it.”

Hiring Rothschild & Co, with its contacts and relationships with other international investors, and ability to speak their language, had been key to the Government’s drive “to do our best to change that concept and perception that there was something wrong with The Bahamas”. Mr Halkitis added that, “when buffeted by negative news, you have to get the story out”.

The minister asserted that The Bahamas has

made progress since the Davis administration came to office in “getting our fiscal house in order” by lowering the deficit, the Government’s borrowing requirements and reducing the debt-to-GDP ratio, although the latter was largely caused by the economy’s post-COVID reflation.

Speaking ahead of Wednesday’s 2024-2025 Budget presentation, he told Bahamians to “expect to see the positive trends continue” although the Government needed to maintain its fiscal “discipline” due to the economy’s vulnerability to external shocks such as global recessions and hurricanes/ climate change.

Tribune Business previously reported at the time of the mid-year Budget that 2023-2024 first half total revenue and tax collections, as a percentage of the full-year projection, were behind the 44.9 percent and 44 percent achieved during the prior year period featuring the six months to end-December 2022.

Water Corp advances $9m Exuma projects

By FAY SIMMONS Tribune Business Reporter

THE Water and Sewerage Corporation has unveiled $9m in infrastructure upgrades for Exuma that will result in 100,000 feet of water mains being installed by October this year.

Deirdre Taylor, the Corporation’s senior engineer, said the investment will expand the availability of potable water beyond central Exuma through the installation of water mains from Barraterre to Little Exuma.

She said: “The overall objective is to ensure that

all of Exuma is serviced with clean, potable, safe water. The overall price tag for the project is about $9.1m.

“At the end of the day, we would have installed over 100,000 feet of water mains, which is equivalent to about 17 miles. This includes 21,150 feet of six-inch mains, 6,500 feet of four-inch mains, and 5,000 feet of two-inch water mains.” Rowdy Boys Construction from Long Island has been contracted to install water mains from Stuart Manor to Barraterre, and to replace old water mains in Georgetown.

Ms Taylor said the project, which started in September 2023, has generated positive feedback from

residents tired of dealing with brackish water.

She said: “In Stuart Manor to Barraterre, 100 percent of the mains have been laid. Thirty percent of the testing is left to be completed, so that area is 95 percent complete. The estimated time for this area is July and the overall completion date is by September or October.

“The feedback has been very good. Especially in areas like Barraterre and Little Exuma, they have been pressing the Water and Sewage Corporation for years to have a supply of potable water.”

Bakerwick Construction has been contracted to install the water mains in Little Exuma, and will lay

45,000 feet of six-inch water mains and 1,000 feet of four-inch water mains. They have also been contracted to install 9,000 feet of twoinch mains in Hartsville.

Chester Cooper, deputy prime minister and minister of tourism, investments and aviation, who is also the MP for Exuma and Ragged Island, said the project is a “great development” as many residents have been waiting for over 50 years to have access to potable water.

He said: “I think the Water and Sewerage Corporation has done a tremendous job in bringing relief and tap water to Baraterre and Little Exuma, as well as repairing the Georgetown area.

This is phenomenal for the island and, certainly for 50 years, the people of Baraterre and the people of Little Exuma, where I am from, waited for running water and it’s finally here.

“Most people who live in New Providence or other areas of the country, who were born and grew up with water coming out of their tap, may not appreciate the magnitude of these projects. But this is truly a great development for Exuma and its people.

“The Government committed to ensuring that Family islands get the same level of support and utilities as other areas in the country enjoy. So the Bahamian people here in Exuma, the residents and the business

And, while government revenues may be up yearover-year, they were behind the full-year growth targets. VAT accounted for $47.2m, or more than half, of the $73m year-over-year growth in tax revenues to come in at $646m for the six months to end-December 2023. This accounted for more than half, or 55.2 percent, of the Government’s total tax revenues and was equal to 40.6 percent of the full-year target. However, while VAT revenues were up by 7.9 percent year-over-year, this growth rate has to hit a much greater 27 percent or $339m over the $1.252bn collected in 2022-2023 to hit this year’s target of $1.591bn. And full-year total revenue and tax collections must also expand by a much faster 16 percent if the Government is to achieve its $3.319bn revenue target for the full year. The Government’s April 2024 presentation to investors, which was referenced on Friday by Mr Halkitis, highlighted the

owners, are delighted that these areas are now coming into the fold with modern utilities.”

Mr Cooper said the level of development in Exuma has “outstripped” current infrastructure, so it was important that Water & Sewerage Corporation repaired the water mains in Georgetown where the majority of businesses are.

He said: “We have outstripped the level of infrastructure that we have on the island, and this is why it was particularly important that Water and Sewerage repair the water mains in the Georgetown area that is known for a significant level of leaks. This is where the heart of the business community resides.”

THE TRIBUNE Monday, May 27, 2024, PAGE 3

Tribune Business

nhartnell@tribunemedia.net

Editor

jsimmons@tribunemedia.net

SEE PAGE B7

Pintard: ‘Moment of truth’ on new FTX accusations

Bahamas’ perspective as it coincides with this jurisdiction’s renewed digital assets push through the recent tabling of the revised Digital Assets and Registered Exchanges Bill in the House of Assembly.

Mr Pintard told this newspaper that, if not addressed properly by the Government, the claims in Mr Cleary’s report could undermine not only The Bahamas’ digital assets ambitions but traditional financial services and other forms of business if this nation becomes perceived as an irresponsible jurisdiction.

Noting that the Opposition’s stance on FTX had been relatively reserved in the immediate aftermath of the crypto exchange’s collapse, so as “to make sure we were not unwittingly contributing to reputational damage for The Bahamas” and to prevent the Government portraying it as such, Mr Pintard said the Davis administration’s initial silence created “a vacuum” that was filled by speculation.

Keishla Adderley, the Prime Minister’s acting press secretary, on Friday declined to comment on

Mr Cleary’s report on the basis that it contained no specifics, and no identities or names of the “families”, “officials” and “entities” involved were mentioned.

However, Mr Pintard argued that it was “in our collective best interest” that the Government not leave another void when it comes to FTX. Renewing earlier calls for a bi-partisan parliamentary select committee to be appointed to investigate FTXs collapse, featuring members from both political parties, he argued that the Davis administration has an obligation to reply.

“The Government is duty-bound at the highest level to speak on the record directly to this matter,” Mr Pintard told Tribune Business. “They have absolutely no choice. Failure to do so put this administration and officials in a very bad light, particularly as they dodged questions earlier.

“This moment of truth arises once again for them to set the record straight and we hope they do just that to protect us from further reputational damage.... It’s in our collective best interest that the Prime Minister launches an investigation and speaks

candidly on the record on these matters.”

Voicing concern about the potential economic fall-out, Mr Pintard added: “It’s very important that we do not squander an opportunity to diversify the financial services sector and put ourselves in a position where we are seen globally as a responsible jurisdiction that has the capacity to not only attract but manage a whole range of businesses including the digital asset space.

“This is in our interest as a mature financial destination. If persons do not have confidence in us, it will not only impact our potential in the digital asset space but the entire reputation we have in the traditional financial services space. We must move with a sense of urgency to address these new revelations and the accusations that go with them. We don’t want to squander this opportunity.”

Mr Cleary’s report, filed with the Delaware Bankruptcy Court, in a section entitled “payments to and contacts with Bahamian government officials”, drew on evidence assembled by Nardello & Co, a global investigations firm that specialises in bribery and corruption-related matters,

plus Sullivan & Cromwell, the law firm working for FTX’s US chief, John Ray, to reach its conclusions.

“Sullivan & Cromwell and Nardello also found that the FTX group made several donations to entities affiliated with Bahamian government officials and their families,” Mr Cleary wrote. “For example, the FTX group sent $500,000 as a purported donation to an entity owned by relatives of a high-ranking Bahamian government official.

“In addition, the FTX group donated $175,000 to other entities affiliated with family members of high-ranking Bahamian government officials. Finally, Sullivan & Cromwell and Nardello’s investigation identified other contacts between the FTX group and Bahamian government officials.”

No names or identities were disclosed by the FTX examiner. However, there is no doubt that Mr Cleary, Mr Ray and their teams know who the “entities”, families and “officials” are as the report references that these details came from a Nardello report dated May 13, 2023, which is titled: ‘Issues concerning Bahamian insolvency proceedings involving FTX’.

Also mentioned as a source for the $675,000 payment information is a Sullivan & Cromwell report dated March 15, 2024, and described as a ‘Review of post-petition investigations for examiner’. The information in these documents and Mr Cleary’s report will also be available to the US Department of Justice.

The findings do not distinguish between Cabinet ministers/MPs and top civil servants in employing the term “official”. Nor do they say whether the

“government officials” are affiliated with the FNM or PLP. While FTX’s collapse occurred under the Davis administration, the crypto exchange first arrived in The Bahamas - and was licensed - under its Minnis predecessor.

Tribune Business research, using prior Supreme Court reports by FTX Digital Markets’ liquidators, shows the crypto exchange’s Bahamian subsidiary was incorporated on July 22, 2021, and licensed and registered to operate in The Bahamas under the Digital Assets and Registered Exchanges (DARE) Act on September 10 that year. That would have occurred under the Minnis administration just six days before the general election.

Former prime minister, Dr Hubert Minnis, could not be reached for comment yesterday but previously told this newspaper he could not recall seeing or dealing with any of FTX’s permit applications during his time in office. “They never reached us,” he said.

“They never came before any committee I chaired or sat on.”’

Mr Pintard, in a written statement issued last night, urged: “To protect the Bahamas’ reputation as a credible and legitimate place to do business, the Prime Minister must immediately agree to launch a complete and thorough investigation into these allegations of potential public corruption.

“Which companies received these monies, and who were the ultimate beneficiaries of the funds? What purposes were the monies paid out for? Did the senior government officials involved declare the conflict of interests? Were

these senior government officials in positions that directly or indirectly influence decisions impacting FTX, its competitors or the digital marketplace?

“Do the Bahamian courtappointed liquidators have access to this information regarding nearly $700,000 in ‘donations’ to companies affiliated with high-ranking Bahamian officials and their families? Have the Bahamian liquidators put the matter forward to the authorities for further criminal investigation?”

Mr Pintard urged the Prime Minister to “bring the same energy to investigating this matter as he has brought to investigations of alleged wrongdoing by Opposition members” in a thinly-veiled reference to the probes into the COVID-19 health travel visa and COVID-19 food programme.

“We anticipate that the necessary investigation will examine the activities of all public officials who had spheres of influence over decisions related to FTX, regardless of political affiliation, before and after the change in administration. Let the proverbial chips fall where they may,” Mr Pintard added.

“Let’s not forget that although the investigation and subsequent trial of now-convicted felon, Sam Bankman-Fried, uncovered a series of crimes that would also breach the DARE Act of The Bahamas, we have received no explanation for why those apparent breaches of Bahamian law were never thoroughly investigated and pursued.

“We must look past partisan politics and work collaboratively across the aisle with industry stakeholders to ensure that our legislative, regulatory and policy framework can build a robust and nimble digital assets industry that attracts only credible entities committed to sound business practices,” the Opposition leader added.

“The Prime Minister must ensure that the Bahamas government gets out front on the investigation and not be pressed to move by subsequent revelations from external sources. If the Davis administration shirks from its constitutional duty to protect the integrity of the jurisdiction from grave allegations of apparent misconduct by Bahamian public officials, the Prime Minister will yet again demonstrate to the Bahamian people and the global investment community that he and his Cabinet have neither the interest or the inclination to uphold the rule of law and the necessary standards of conduct in public life.”

PAGE 4, Monday, May 27, 2024 THE TRIBUNE

FROM PAGE B1

BAHAMAS TO HOST MAJOR REGIONAL CUSTOMS FORUM

THE Bahamas is set to host a major regional Customs conference for the first-ever time.

Ralph Munroe, comptroller of Bahamas Customs, confirmed that this nation will host the 46th annual conference of the Caribbean Customs Law Enforcement Council (CCLEC) this week.

“Scheduled to take place from Monday, May 27, to Friday, May 31, at the British Colonial Hotel, this conference will bring together customs officials, policymakers, industry experts and representatives from various regional and international organisations,” the Comptroller said.

He explained that it will provide a forum to share knowledge, best practices and innovative strategies to tackle the challengesand seize the opportunities - that lie ahead for customs administrations. The theme for the conference is ‘Transforming the customs

landscape to meet changing needs’.

The comptroller said that, since its establishment in 1989, the CCLEC has been key to co-operation and coordination among customs administrations throughout the Caribbean. CCLEC, which has 38 member countries and territories, has a mission to enhance and enforce customs laws, facilitate legitimate trade and ensure the safety and prosperity of member states.

The Comptroller said that, during the conference, participants will engage in panel discussions, workshops and presentations covering a wide range of topics. These will include the latest advances in customs technologies, strategies to combat smuggling and fraud, and measures to enhance border security while facilitating legitimate trade.

“By fostering a collaborative environment, we aim to equip our customs administrations with the tools and knowledge

needed to navigate the rapidly changing landscape of international trade,” Mr Munroe added.

He explained that in addition to facilitating training initiatives, CCLEC plays a crucial role in intelligence sharing and joint operations. “By

facilitating the exchange of information and co-ordinating efforts across borders, we strengthen our collective ability to detect and intercept illegal activities,” Mr Munroe added.

The Comptroller added that this approach has led to numerous successful

DEVELOPER TO UNLEASH $1BN IN PROPERTIES OVER 5-6 YEARS

“We wouldn’t be doing this if we didn’t believe in the market and what is happening here. We see The Bahamas booming for the foreseeable future, no question, and are putting our money where our mouth is.... We’re becoming the Hamptons of south Florida.

“People want waterfront, canalfront properties which are $100m in south Florida. Here we are one-third of that price. We’re still trading at a discount. The average person does not realise there’s still a lot of upside value here and it’s a nice place to live.”

Mr Marco said “in excess of $100m” has been invested in Balmoral’s build-out since the community’s development began in 2008, with some $250m set to be spent on both Amaya and Aqualina. The number of construction jobs these

projects will create has yet to be determined.

“That will be about 40 residences with three to four bedrooms from $5m to $12m,” he confirmed of Amaya. “That’s going to sell-out in a matter of weeks when we launch it at the end of this year. We’re in design mode right now. That will be targeted at Lyford Cay and Old Fort Bay families looking to downsize, and want the reduced maintenance of a condo, but still want to be out west; they don’t want to be in Cable Beach”.

No name or design has been agreed for the Fairview acquisition, Mr Marco said, adding: “Right now we’re land banking it. It’s something that was bought, but the value is only increasing because GoldWynn has done such an amazing job with their project.”

As for Balmoral, he explained that the

Government’s unveiling of its proposed $290m new hospital at Perpall Tract had acted as “the catalyst” to place the remaining 14 lots at the Sanford Drive gated community on the market. The lots, 11 single family and three multi-family, are carrying gross price points between $223,371 and $392,790.

“We held it for a while,” Mr Marco said of the 43-acre community’s final lot inventory. “There was so much demand when we started 15 years ago. There’s going to be a catalyst. The catalyst is the new hospital. We know that when that goes under construction we will see massive interest in Balmoral.

“We held tight, and now we’re going to market them. That [the hospital] was a big catalyst. If you have speculators out there looking for investment property there’s nothing better than having

senior doctors working at a hospital and looking for a nice place nearby to rent. There’s no better community than Balmoral.”

Asked about the market’s response to the marketing launch for the 14 lots, Mr Marco replied: “I’ve never received more responses to an email blast in my 20-year history in real estate. I certainly wasn’t expecting it. I knew I’d get interest but I wasn’t expecting it. We’re even considering building spec homes and renting them out. The inventory is non-existent and people want it.”

He argued that Balmoral compared favourably to similarly priced communities such as Sandyport and Charlotteville, and efforts to dispose of the remaining 14 lots will benefit from their location in

operations, resulting in significant seizures of contraband and the disruption of criminal networks.

He said CCLEC is committed to strengthening partnerships with regional and international bodies, and the conference will feature representatives

an established gated community that has an existing homeowners association, amenities and is located close to developments such as Baha Mar, GoldWynn and Cable Beach.

Besides residential real estate, Mr Marco said he and Mr Kinsale have also ventured into the commercial market. “Jason and myself, we bought two years ago a 100 year-old home on the corner of Prospect Ridge and Sanford Drive,” he added.

“It’s now the Skyline Corporate Centre and we’re getting a lot of interest in that. We launched it for rentals just recently and have been showing it a lot. We’ve been showing it to law firms, banks and for government offices. A couple of ministries have looked at it. There’s a shortage on the island of brand new office space.”

from the World Customs Organisation, INTERPOL, IMPACS and other stakeholders.

Mr Munroe said the theme of innovation will be central to the discussions.

“Embracing new technologies such as advanced data analytics, artificial intelligence and blockchain, we aim to enhance our capabilities and remain ahead of evolving threats,” he added.

“By leveraging these innovations, we can streamline customs processes, reduce trade barriers and create a more secure and prosperous Caribbean region.”

Revealing that Skyline Corporate Centre represents a $10m investment, Mr Marco said it features four buildings and 15,000 square feet with a rental price of $75 per square foot. Prospective tenants have looked at the possibility of renting all four.

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

THE TRIBUNE Monday, May 27, 2024, PAGE 5

RALPH MUNROE, comptroller of Customs (seated second from left), announced that The Bahamas will be hosting the 46th annual conference of the Caribbean Customs Law Enforcement Council (CCLEC) from Monday, May 27, to Friday, May 31, at the British Colonial Hotel. His executive team also attended the press conference.

Photo:Patrick Hanna/BIS

FROM PAGE B1

Share

news

your

$256m FTX properties to ‘hit market within 30 days’

to maximise the sales prices for the benefit of creditors and also to fulfill the terms of their agreement with John Ray, FTX’s US chief who heads the 134 entities currently in Chapter 11 bankruptcy protection in Delaware.

Matthew Marco, marketing director and licensed realtor with Bond Bahamas,

voiced optimism that the high-end market will have no difficulty dealing with an FTX-led surge in inventory as he confirmed the company is among those selected to sell those properties.

“I seriously think it’s a drop in the bucket. Everybody will forget about this in a few years,” he said of the FTX properties.

“There’s more than enough

people to buy this inventory at full asking price. There’s no discounting at all. We have a handful of listings that will go on the market within two weeks.”

Asserting that “it doesn’t take a lot to move the needle here”, Mr Marco cited as an example the 70,000 wealthy individuals and families potentially looking for new homes and jurisdictions as a result of

the UK’s upcoming changes to non-domicile tax laws and rules next year.

“If 0.1 percent decide they want to move to The Bahamas that’s 70 families,” he explained. “There’s not 70 properties here for them. We’re not Miami, New York or Toronto where you need thousands of people. You only need a handful of people to move the needle. That’s all it takes.”

Mario Carey, founder of Better Homes & Gardens Real Estate MCR Group, told this newspaper that disposing of the FTX properties will be more complex than a traditional real estate sale since the Bahamian liquidators are answerable to the Supreme Court and have a fiduciary duty to creditors to achieve the best possibly sales price.

“The process has been advanced. They’re moving in that direction where they went out to prime brokers,” Mr Carey said of the liquidators’ selection process that began in mid-February 2024. “I guess the properties will hit the market in the next 30 days.

“There are many things that we have to pay attention to. You’re going to get a lot of bottom feeders who think they can come in and get discounts. You will have property owners in some some communities who feel that deals will be cut that will devalue their properties.

“I think the market will absorb them without any issues because the demand is still strong. You will find wealthy owners will probably come into the market to protect themselves and protect their flock. If a guy can afford a $20m condo, he will come into the market and buy these assets. They can donate them to their children. It’s going to be an interesting end result. We’ve never seen this before - $270m of inventory hitting the market.”

David Morley, Morley Realty’s principal, made a similar prediction. “Two days ago we got an e-mail from the liquidators indicating they have selected us to represent them on one of

the commercial properties,” he told Tribune Business.

“We did not get everything we bid for.

“There was one of the Pineapple House properties, and the acreage at Blake Road and West Bay Street where they were going to build the headquarters. We also bid on Veridian Corporate Centre, and we were selected for Veridian Corporate Centre. Now we have to move forward trying to meet with them [the liquidators]. They want to see our terms of engagement and everything is subject to contract.

“It looks like they are moving forward, making decisions. We’ll see marketing of those assets very shortly. I would anticipate that, within two to three weeks, you will see marketing of those assets. There’s still work that has to be done in advance of marketing them.” This, Mr Morley said, included realtors completing listing agreements with FTX’s Bahamian liquidators.

“I think it’s going to help,” he added of the inventory influx. “There are people in the market waiting to possibly pounce on those assets, thinking they can pick them up for pennies on the dollar, when the liquidators have to prove to the court they’ve achieved the best possible price.

“For the residential stuff and the high-end side it’s going to help the market in adding inventory back to it. On the commercial side, I’m not that ambitious about it. I don’t think there’s as much demand on the commercial side as there clearly is on the residential side. At least we’re one step closer. The wait is almost over. Now we have some work to do.”

Another high-end realtor, speaking on condition of anonymity, agreed. “They are now appointing the agents for the FTX properties. It’s getting done. They’re getting close. I’m happy they are. It looks like I have a lot of work ahead of me,” he added. The Bahamian liquidators, in launching their request for “expressions of interest” from Bahamian realtors in mid-February, confirmed that a total

34 properties are being readied for sale. Of this number, close to half - 16 - are located in the highend Albany community in south-western New Providence, featuring a number of three to seven-bedroom condos and one separate residential dwellings. Of the remainder, eight are one-two bed condos located in the GoldWynn development on Goodman’s Bay, while another four units are in the One Cable Beach complex on Cable Beach. The final six properties include the Ocean Terrace gated residential condo building, with 16 units and leisure facilities, on West Bay Street, plus two residences in Old Fort Bay.

The balance consist of commercial real estate, including the 4,000 square foot Pineapple House; FTX’s former Bahamian head office at the Veridian Corporate Centre on Western Road; and undeveloped land on West Bay Street and Blake Road.

The 16 properties at Albany, 15 of which are condominiums, were bought at price points between $4.75m and $30m. The seven units acquired in the GoldWynn project at Goodman’s Bay were valued between $563,520 and $1.449m.

Four units, varying in value from $975,000 to $1.54m, were purchased in the One Cable Beach project. Some $26.34m was spent on acquiring multiple units at the Veridian Corporate Centre, with further outlays of $17.435m, $9m and $1.8m on property at Ocean Terrace, Old Fort Bay and Pineapple House respectively. Under the terms of the Bahamian liquidators’ agreement with Mr Ray, all 34 properties must fetch a price that is “equal to or greater than 80 percent” of their broker-appraised values. The deal stipulates that “the aggregate sale price with respect to each Bahamas property sold pursuant to the sale is equal to or greater than 80 percent of the price stated in a broker price opinion produced by a real estate broker licensed in The Bahamas”.

PAGE 6, Monday, May 27, 2024 THE TRIBUNE

FROM PAGE B1 CALL 502-2394 TO ADVERTISE TODAY! The Public is hereby advised that I, SHAVONNE CANDIS SMITH also known as SHAVONN CANDIS SMITH also known as SHAVONN HAYNES, of Nassau, The Bahamas, intend to change my name to SHAVONN CANDICE HAYNES If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Officer, P.O.Box N-742, Nassau, The Bahamas no later than thirty (30) days after the date of publication of this notice. INTENT TO CHANGE NAME BY DEED POLL PUBLIC NOTICE NOTICE is hereby given that DENICHA PETIT-HOMME of Marsh Harbour, Abaco, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas and that any person who knows any reason whyregistration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 27th day of May, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas. NOTICE NOTICE is hereby given that DIEUMENE SALOMON DORLEAN PIERRE-JEAN of Catto Street, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas and that any person who knows any reason whyregistration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 27th day of May, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas. NOTICE

$1.2m physical therapy centre true family affair

as lead contractor. The interior decorating was undertaken by her husband, Tavaree.

The 3,000 square foot building boasts one physical therapy and four treatment rooms, enabling the seven-member team of chiropractors and therapists to deliver rehabilitative services to thousands more patients.

BDB

Complete with a decompression table, the nature of this non-surgical spinal treatment benefits patients presenting with bulging, herniated or deteriorated discs. Through the stretching and relaxing of the spine, the negative pressure created allows the bulging or herniated material to move back into the disc while allowing for the movement of beneficial molecules jumpstarting

partners to solve $2m cruise insurance challenge

FROM PAGE B2

project, which is due to start welcoming passengers and cruise ships next month. The talks focused on the insurance coverage challenges they and others faced. Following these activities, BDB and NETO Co-Op are planning to sign a memorandum of understanding (MoU).

NETO Co-op was formed by a group of small business tour operators who provide nature, culture and heritage tours, but were facing huge challenges in meeting the cost of global liability insurance required to offer their experiences to cruise ship guests.

The limited liability cooperative now offers a discounted rate of at least 65 percent to members, and provides them with training and joint marketing initiatives. H. Rudy Sawyer, NETO Co-op’s president, said: “Our membership includes the ideal clients of BDB, and funding and business development are critical components to our members.

“Together with the Bahamas Development Bank, we can expand to other islands like Eleuthera, where Disney Cruise Line’s newest destination calls home, so that more small and medium-sized businesses focused on nature and culture tours, and the orange economy, can be successful.”

Joey Gaskins Jnr, Disney Cruise Line’s regional public affairs director, said: “As we prepare for the opening of Disney Lookout Cay at Lighthouse Point, we recognised that the question of global liability insurance would be a challenge for small business on Eleuthera.

“Searching for an affordable global liability insurance solution has been an ongoing challenge for cruise lines. We are delighted that with Disney Cruise Line’s support, BDB and NETO Co-Op have managed to solve this problem and make way for not only Eleuthera-based vendors but those on every island in The Bahamas.”

NOTICE ANVMB Participações Ltd. Incorporated under the International Business Companies Act, 2000 of the Commonwealth of The Bahamas. Registration number 209768 B (In Voluntary Liquidation)

Notice is hereby given that the above-named Company is in dissolution, commencing on the 23rd day of May A.D. 2024. Articles of Dissolution have been duly registered by the Registrar. The Liquidator is Mr. Alain Benvenuti, whose address is Av Cauaxi 370 Apto 191, Alphaville Industria, CEP: 06454-020, Barueri, Sao Paulo, Brazil. Any Persons having a Claim against the above-named Company are required on or before the 22nd day of June A.D. 2024 to send their names, addresses and particulars of their debts or claims to the Liquidator of the Company, or in default thereof they may be excluded from the benefit of any distribution made before such claim is proved.

the body’s natural healing response and reducing back pain.

“The most rewarding experience in practice has been helping persons shift from a life of pain and suffering to that of a higher quality of life, not only physically but in every dimension of their lives,”

Dr Missick said.

“I am very proud to be the only chiropractic and physical therapy facility in

the country to offer aquatic therapy with our on-site 25 foot pool. Our patients love the sheer convenience of having access to the pool as a continuation of their treatment without the need of splitting time across facilities in multiple locations and look forward to their sessions.”

The Centre uses other advanced technologies, including Insight Millennium Spinal Technology,

to determine the overall state of the central nervous system as it detects and pinpoints abnormal function in the spine undetectable by an x-ray. Meanwhile, the Postural Analysis System assesses a person’s posture for displaying any abnormalities, imbalances and underlying causes.

Dr Missick began her tertiary studies at the College of the Bahamas and graduated from Wingate

University in Charlotte, North Carolina, with a bachelor of science in biology. She graduated with a doctor of chiropractic from Life University in Atlanta, Georgia, and is a past president of the Bahamas Association of Chiropractic and current Bahamas representative to the International Chiropractors Association.

‘Dramatic improvement’ in Bahamas debt prices

FROM PAGE B3

Bahamian tourism industry’s post-COVID rebound by pointing to 360 percent growth in visitor arrivals between 2021 and 2023, which rose from 2.1m to 9.7m largely due to the continued expansion of the cruise industry.

And, while no dollar figures were provided, investors were informed that per capita visitor spending and the industry’s

economic impact continue to grow. Agreeing that “structurally increasing visitor spending is critical [to] underpin this momentum”, the presentation added: “The average amount of visitor expenditure per visitor has steadily increased since 2012, and was 29 percent higher in 2022 than in 2019 in real terms.”

As for economic growth, the Government’s investor presentation included the lower 2.6 percent real GDP

growth estimate for 2023 produced by the Bahamas National Statistical Institute (BNSI) and agreed that this nation’s pace of economic expansion is trending towards the 1.7

percent forecast over the medium-term (2024-2026) by the International Monetary Fund (IMF). That, though, is still above preCOVID rates.

MY ATTRIBUTES:

• 25yrs of Entrepreneurial & Corporate experience at senior management level

• Emotionally mature, logical thinker & strong problem solver

• Excellent communicator adaptable to any audience

• Experience in successfully leading large teams of 70+ people

• Years of experience in 7 figure budget prep, management & reporting

• Lead roles in national marketing campaigns from Product Development to Roll Out

• Holds professional Master’s Degree

Email me: 242workforce@gmail.com

Dated this 23rd day of May A.D. 2024. ALAIN BENVENUTI LIQUIDATOR LOOKING FOR A BOARD MEMBER FOR YOUR BUSINESS OR ORGANIZATION???

NOTICE INTERNATIONAL BUSINESS COMPANIES ACT, 2000

Gorda Cay Ventures Inc. (IN VOLUNTARY LIQUIDATION)

NOTICE IS HEREBY GIVEN that in accordance with section 138(6) of the International Business Companies Act, 2000, as amended, the winding up and dissolution of Gorda Cay Ventures Inc. is complete.

Kim D Thompson Sole Liquidator

Address: Equity Trust House Caves Village West Bay Street P O Box N-10697 Nassau, Bahamas

THE TRIBUNE Monday, May 27, 2024, PAGE 7

FROM PAGE B2

CALL 502-2394 TO ADVERTISE TODAY!

Nasdaq sets another record as Wall Street wins back earlier losses

By STAN CHOE AP Business Writer

U.S. stocks rose Friday in a bounce back from Wall Street's worst day since April.

The S&P 500 gained 36.88 points, or 0.7%, to 5,304.72 and won back all its losses from the prior two days. It eked out a tiny gain for the week, enough to extend its weekly winning streak to five, and is sitting just below its record set on Tuesday.

The Dow Jones Industrial Average rose 4.33 points, or less than 0.1%, to 39,069.59, and the Nasdaq composite gained 184.76, or 1.1%, to 16,920.79 and topped its all-time high set earlier this week.

Deckers Outdoor jumped 14.2% for the biggest gain in the S&P 500 after reporting stronger profit and revenue for the latest quarter than expected. The company behind the Hoka, Ugg and Teva brands also gave a forecast for revenue this upcoming fiscal year that was in line with analysts' expectations.

Ross Stores also lifted the market after leaping 7.8%. The retailer reported better profit for the latest quarter than analysts expected. That was despite its revenue only edging past expectations, as customers continue to hold back on purchases of non-essentials.

CEO Barbara Rentler said several challenges, "including prolonged inflation, continue to squeeze our low-to-moderate income customers' purchasing power."

Even though data on the overall, or macro, economy has been showing continued strength for spending by U.S. households, the numbers underneath the surface may not be as encouraging. "Walmart and Target are telling us that high income consumers are doing fine, but beginning to trade down," said Brian Jacobsen, chief economist at

G7 OFFICIALS MAKE PROGRESS BUT NO FINAL DEAL ON MONEY FOR UKRAINE FROM FROZEN RUSSIAN ASSETS

Annex Wealth Management. "The lower income consumer is struggling. Macro often focuses too much on the average and the average is skewed by the high-end household."

The market got a bit of a boost Friday from a report showing overall sentiment among U.S. consumers weakened by less in May than preliminary data had suggested. Perhaps more importantly, the report from the University of Michigan also said U.S. consumers' expectations for inflation in the coming year rose by less in May than earlier feared.

By DAVID McHUGH AP Business Writer

FINANCE officials from the Group of Seven rich democracies said they had moved toward agreement on a U.S. proposal to squeeze more money for Ukraine from Russian

TOURISTS gather near the New York Stock Exchange on May 16, 2024, in New York. Shares retreated in Europe and Asia on Friday, May 24, 2024, after unexpectedly strong reports on the U.S. economy raised the possibility that interest rates may stay painfully high.

Photo:Peter Morgan/AP

That could help stave off a vicious cycle where high expectations for inflation among U.S. households drive them to behave in ways that only make inflation worse.

Worries about stubbornly high inflation were behind this week's rocky trading, after indexes set records recently. The weakness began after the Federal Reserve on Wednesday released the minutes from its last policy meeting. It showed some officials talking about the possibility of raising rates if inflation worsens.

assets frozen in their countries. But the ministers left a final deal to be worked out ahead of a June summit of national leaders.

"We are making progress in our discussions on potential avenues to bring forward the extraordinary profits stemming from immobilized Russian sovereign assets to the benefit of Ukraine," the draft statement said, without providing details.

Despite the progress made at the the meeting in Stresa, on the shores of Lago Maggiore in northern Italy, a final decision on how the assets will be used will rest with the G7 national leaders, including U.S. President Joe Biden, next month at their annual summit in Fasano, in southern Italy. Host Finance Minister Giancarlo Giorgetti said that "progress has been made so far" but that there were "legal and technical issues that have to be overcome."

"It is not an easy task but we are working on it," he said at a news conference following the end of the meeting.

Ukrainian Finance Minister Serhiy Marchenko joined the finance ministers and central bank heads at their concluding session on Saturday. "I am satisfied with the progress," he told journalists afterwards. He said the G7 ministers "are working very hard to find a reliable construction for Ukraine."

Stocks fell further after reports on Thursday indicated the U.S. economy is stronger than expected. Such strength can actually spook Wall Street because it could keep upward pressure on inflation. That in turn could at least delay the Federal Reserve from giving relief to financial markets through cuts to its main interest rate, which is sitting at the highest level in more than 20 years. The Fed is trying to pull of the difficult feat of slowing the economy enough through high interest rates to stifle high inflation but not so much that it kneecaps the job market.

Goldman Sachs economist David Mericle pushed back his forecast for the Fed's first cut to rates to September from July, in part due to Thursday's reports on U.S. business activity and joblessness.

Treasury yields climbed this week on such concerns, but they were mostly stable Friday following the report on consumer sentiment.

The yield on the 10-year Treasury slipped to 4.46% from 4.48% late Thursday. The two-year yield, which more closely tracks

The U.S. Congress has passed legislation allowing the Biden administration to seize the roughly $5 billion in Russian assets located in the U.S., but European countries have a strong voice in the matter since most of the $260 billion in Russian central bank assets frozen after the Feb. 24, 2022, invasion are held in their jurisdictions.

Citing legal concerns, European officials have balked at outright confiscating the money and handing it to Ukraine as compensation for the destruction caused by Russia.

Instead, they plan use the interest accumulating on the assets, but that's only around $3 billion a year — about one month's financing needs for the Ukrainian government.

U.S. Treasury Secretary Janet Yellen is pushing for borrowing against the future interest income from the frozen assets. That would mean Ukraine could be given as much as $50 billion immediately. But the proposal has run into concerns from European members about the legal complexities, and about concerns that Russia could retaliate against the diminished number of Western companies and individuals who still have holdings in Russia, or against the Euroclear securities depository in Belgium where the bulk of the funds is held.

expectations for action by the Fed, was holding steady at 4.94%.

This week's bumpiness for stocks came despite another blowout profit report from Nvidia, which has rocketed to become one of Wall Street's most influential stocks amid a frenzy around artificial-intelligence technology. Fervor around AI had pushed some stocks to heights that critics called overdone, but Nvidia's eye-popping growth and forecasts for more suggest it could keep going.

Nvidia rose another 2.6% Friday, making it the biggest single force pushing the S&P 500 upward.

Elsewhere on Wall Street, Workday fell 15.3% despite reporting stronger profit for the latest quarter than analysts expected. The company, which helps businesses manage their people and money, gave a forecast for upcoming subscription revenue that fell a bit short of Wall Street's estimates. In stock markets abroad, indexes fell across much of Asia and Europe. Indexes sank 1.4% in Hong Kong, 1.3% in Seoul and 1.2% in Tokyo.

Russia has published a decree from President Vladimir Putin allowing confiscation of assets of U.S. companies and individuals as compensation for any Russian assets seized in the United States.

The ministers also discussed what to do about China's outsized, statebacked production of green energy technology, which the U.S. considers a threat to the global economy. The U.S. has imposed major new tariffs on electric vehicles, semiconductors, solar equipment and medical supplies imported from China. Included is a 100% tariff on Chinese-made EVs, meant to protect the U.S. economy from cheap Chinese imports.

The U.S. position has been that Chinese overcapacity is an issue not just for the U.S. but also for other G7 and developing countries. That's because China's selling of lowpriced goods threatens the existence of competing companies around the world.

The G7 is an informal forum that holds an annual summit to discuss economic policy and security issues. The member countries are Canada, France, Germany, Italy, Japan, the United Kingdom and the United States. Representatives of the European Union also take part, but the EU does not serve as one of the rotating chairs.

PAGE 10, Monday, May 27, 2024 THE TRIBUNE

STOCK MARKET TODAY

Derek Smith By

Derek Smith By

MICHAEL HALKITIS

MICHAEL HALKITIS