Long-term Gov’t paper recovery two years out - but no bad thing

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

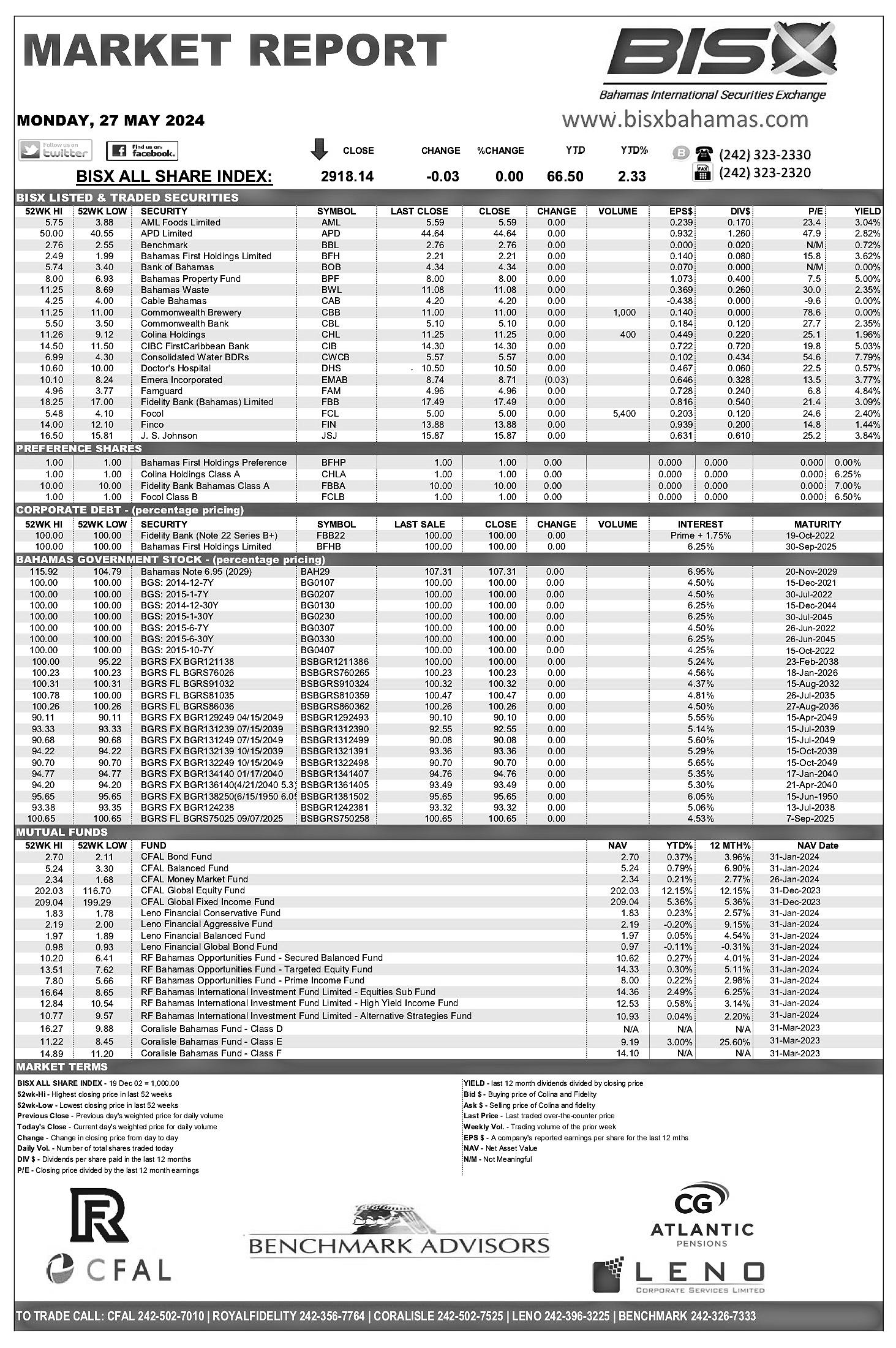

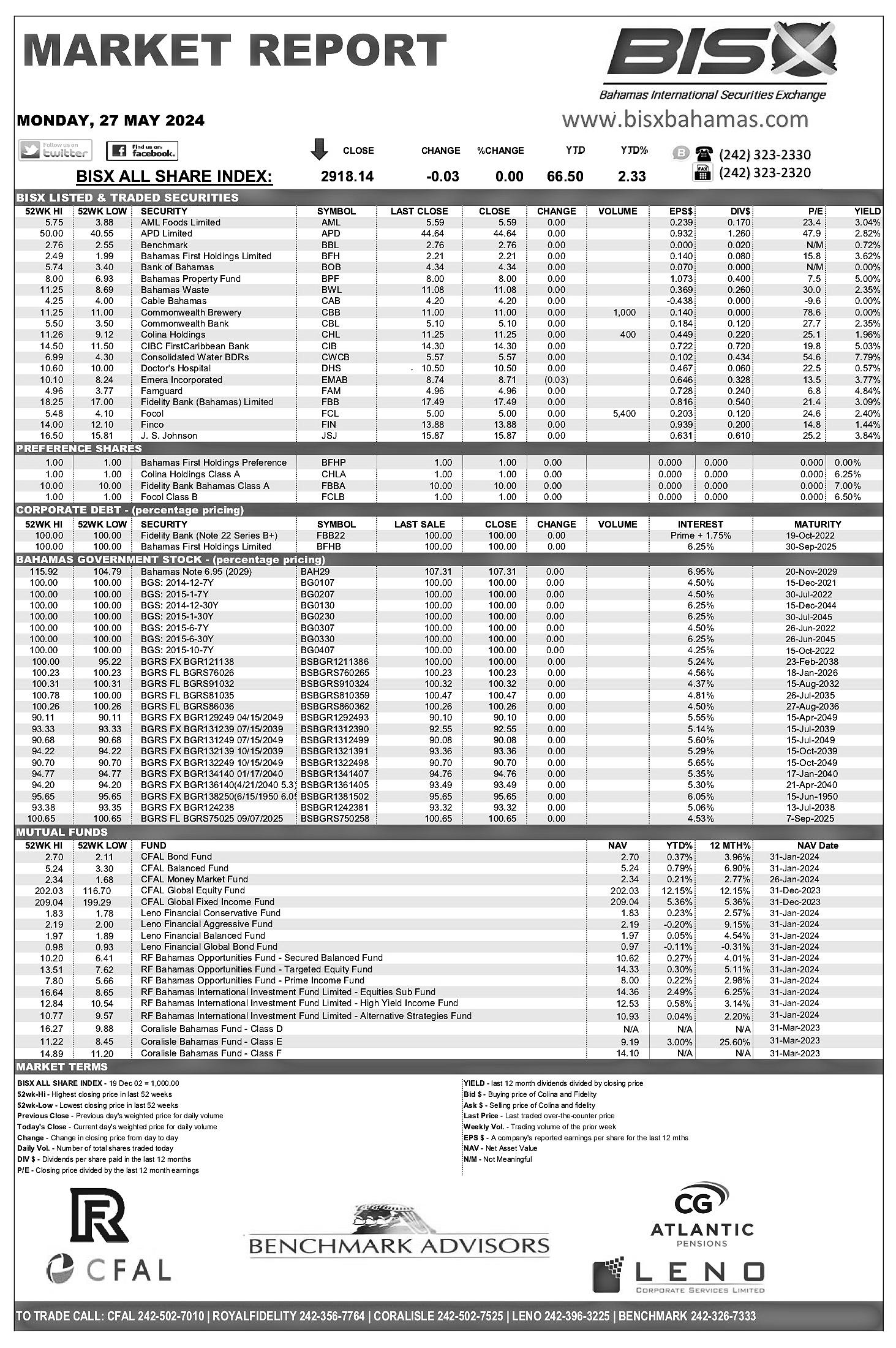

DEMAND for long-term

Bahamas government debt is unlikely to recover until after a 2026 general election but that is not necessarily a bad outcome, a senior banker predicted yesterday.

Gowon Bowe, Fidelity Bank (Bahamas) chief executive, told Tribune Business that local investor aversion to 20 and 30-year Bahamian dollar government bonds has imposed greater fiscal

Don’t ‘tax your way to success’, Gov’t urged

By NEIL HARTNELL Tribune Business Editor

BUSINESSES yesterday urged the Government not to “tax their way to success” in tomorrow’s 2024-2025 Budget, arguing: “There’s only so much you can wring out of a stone.” Ben Albury, the Bahamas Motor Dealers Association’s (BMDA) president, told Tribune Business he is hoping the Davis administration “leaves everything alone for now” and is not tempted to impose new and/or increased taxes on the private sector and consumers. While the Government has not signalled that it has such a plan, he pointed to the multiple boat registration and other fee increases introduced with last year’s Budget that were “not necessarily called a tax” plus the ever-increasing “red tape” that the private sector has to grapple with. Mr Albury, arguing that the Government should continue its pursuit of tax arrears as its “low-hanging fruit”, told this newspaper

that “through the roof” inflation and the ongoing cost of living crisis, plus the continued erosion and weakness of the Bahamian middle class, were further reasons why the 2024-2025 Budget should not seek to increase the tax burden. Pointing to Friday’s comments by Michael Halkitis, minister of economic affairs, that Bahamian economic growth is starting to “taper off” following the post-COVID reflation and revert to historical levels of 1-2 percent, the BMDA chief said of the Government: “I hope they’ve listened to that and are

PM demands OECD, EU join global tax treaty talks

THE Prime Minister yesterday renewed his demand for the groups that have frequently blacklisted The Bahamas to “join forces with the United Nations” and develop a global tax treaty fair to all countries, Philip Davis KC, addressing the fourth global conference on small island developing states (SIDS), called on the likes of the European Union (EU) and Organisation for Economic Co-Operation and Development (OECD) to be part of a global initiative rather than continuing to arbitrarily impose their own rules on nations such as The Bahamas and undermine their economies.

Recalling how the EU’s recent tax blacklisting threatened The Bahamas’ access to reinsurance markets, and to drive the price of catastrophe insurance coverage beyond the reach of many Bahamian businesses and households, he argued: “Another significant challenge we face as small island nations pertains to the financial systems that govern our recovery efforts.

“Recently, we have seen how blacklisting in international finance disproportionately affects our nations, particularly when it comes to insurance claims in the aftermath of disasters. Such punitive measures, often imposed without adequate representation or input from SIDS, only exacerbate our

“discipline” on the Davis administration, forcing it to be more transparent and accountable, while also benefiting taxpayers and the wider economy through reducing its borrowing costs.

He explained that the need to refinance almost 38 percent of its total Bahamian dollar debt during the current 2023-2024 fiscal year has imposed “guard rails”, which prevent the Government from engaging in reckless spending or other irresponsible financial actions, because doing so will undermine local investor

Abaco

confidence and potentially cause such rollovers to fail.

And, with Bahamian banks, insurance companies, pension funds and other Government bond buyers increasingly showing appetite for paper with maturities of five years or less, Mr Bowe told this newspaper that such trends are benefiting taxpayers because shorter-term debt typically attracts a lower interest coupon than the 20 and 30-year variety.

As a result, both the Government’s borrowing costs and debt service burden imposed on taxpayers are reduced.

Acknowledging that these results are slightly fortuitous, and there is likely “frustration” on the Government’s part through having to adapt to these market conditions, the Fidelity Bank (Bahamas) chief said this had “put the power where it should be” - in the hands

Chamber chief: ‘We’re all at risk’ on port uncertainty

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

ABACO’S Chamber of Commerce president is warning “we are all at risk” as she urged the Government to clarify if it has selected a private operator to take over Marsh Harbour’s commercial shipping port.

Daphne DeGregoryMiaoulis told Tribune Business the island will likely be without a properly-functioning shipping port for six to seven years post-Dorian as she voiced fears that, in its present condition, “we are nowhere near to passing” international security standards which could result in the facility being closed to commercial vessels.

Shipping industry sources, speaking on condition of anonymity, told this newspaper that

nothing has been heard since August/September last year on the bidding process launched by the Government to find private sector operators willing to finance, redevelop and manage both Marsh Harbour and the north Abaco port in Cooper’s Town. Fearing the “vulnerability” from Abaco’s key commercial shipping port not being “properly secured, managed and maintained”, Mrs DeGregory-Miaoulis said: “There has been no communication, nothing is going on. There has been no announcement.

“From the Abaco Chamber of Commerce standpoint, we really want to know what is the update. Are their bids being considered? Who are the bidders still in the game? Our most vulnerable points of entry, our marine ports, are left vulnerable.

“I understand recently that the US government came in and looked over the site, and I believe are making some proposals to assist with getting our ISPS certification. We are nowhere near to passing that standard. How can businesses expand, and how can businesses attract new business when we don’t have a secure port of entry for goods to come into the country?” Challenges in meeting international port standards were nothing new for Marsh Harbour even before Hurricane Dorian devastated much of the island. For the Government-owned and managed port failed its International Ship and Port Security (ISPS) “mock” inspection on June 18, 2019, sparking hasty action to ensure

Chamber chair calls for ‘tax code simplification’

By FAY SIMMONS Tribune Business Reporter

jsimmons@ tribunemedia.net

THE Chamber of Commerce’s chairman yesterday urged the Government to “simplify the tax code” and ease of doing business as he identified discrepancies in Business Licence filing requirements.

Timothy Ingraham, confirming that Bahamas Chamber of Commerce and Employers Confederation (BCCEC) members and the wider private sector are hoping tomorrow’s Budget excludes new and/or increased taxes, disclosed that some companies were asked to produce approvals from other government agencies that others did not have to in obtaining their Business Licences.

He added that there is still some confusion as to whether businesses are required to obtain a letter of good standing from the

National Insurance Board (NIB), as some were able to obtain a Business Licence via the Department of Inland Revenue’s online portal without uploading this document while others could not.

Others still had to obtain a letter of good standing from the Registrar General’s Department, which the Chamber chairman said can be a “tedious” process.

Mr Ingraham said: “It’s a bit unclear on that because some members

business@tribunemedia.net TUESDAY, MAY 28, 2024

nhartnell@tribunemedia.net SEE PAGE B4

SEE PAGE B5

NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

By

SEE PAGE B3 SEE PAGE B4 SEE PAGE B6

GOWON BOWE

DAPHNE DEGREGORYMIAOULIS

BEN ALBURY

$5.90 $5.91 $5.90 $5.96

TIMOTHY INGRAHAM

Welcome to the club

By CHRIS ILLING CCO @ ActivTrades Corp

There have never been so many in the club of the super rich. For the first time in history, 15 people in the world have assets of more than $100bn at the same time. The billionaires are benefiting from the hype around artificial intelligence (AI), the continuing high demand for luxury goods and from geopolitical shifts. Together, their net assets rose to $2.2trn this year. This corresponds to an increase of 13 percent. This means that assets have increased faster than

inflation and the level of stock market prices and indices. The total wealth of the super-rich accounts for a quarter of the wealth of the world’s 500 wealthiest people. The 15 super-rich include, for example, L’Oréal heiress Francoise Bettencourt Meyers (70); Dell founder Michael Dell (59); and Mexican billionaire Carlos Slim (84). They have all exceeded the $100bn mark in recent months. Bettencourt Meyers is the first woman in history to amass a twelve-figure fortune. Shares of her luxury cosmetics company, L’Oréal, jumped after the group recorded its best year since 1998. The Frenchwoman ranks 14th in the index with $101bn.

Carnival ‘blown away’ by GB cruise port interest

SENIOR Carnival Cruise Line executives yesterday said they have been “blown away” by the interest Bahamian bidders have shown in the retail and dining concessions at its new Grand Bahama port.

The cruise line, in a statement, said the latest round of Request for Proposals (RFP) seeking retail and restaurant tenants for Celebration Key attracted hundreds of responses from local businesses. Applications were submitted for opportunities including food trucks, an ice cream parlour, coffee shop, staff cafeteria and various retail stores.

Michael Dell is in 11th place with $113bn. Demand for AI-enabled devices has driven Dell shares to a record high. Last Friday, Dell shares rose by 6 percent, driven also by the recent success of the Nvidia record earnings report.

Carlos Slim, the richest person in Latin America, ranks 13th with $106bn. He benefited from the boom of the Mexican peso, which caused the shares of his corporate empire to skyrocket. Back in the club of the super-rich is the Indian Gautam Adani (61). He

had lost more money than anyone else in 2023 due to a short-selling attack related to a scathing report by Hindenburg research. Meanwhile, shares of his flagship Adani Enterprises have risen tremendously as global investors increasingly focus on Indian companies.

At the top of the richest people in the world is Bernard Arnault (75), architect and chief executive of the luxury goods group LVMH (Louis Vuitton, Christian Dior), with $222 bn, followed by Amazon founder Jeff Bezos (60) with $208bn and Tesla chief executive Elon Musk (52) with $187bn.

“We said from the beginning that we planned to curate a distinctly Bahamian dining and shopping scene, so we are thrilled with the interest we’ve received from Grand Bahamians eager to be part of creating the magical Celebration Key experience.”

Mr Piller said applications were reviewed for Bahamian flair, creativity, viability and, for food and beverage outlets, strong

“We have been blown away by the enthusiastic response we’ve received from Bahamian businesses, especially business owners and entrepreneurs in Grand Bahama,” said Bertrand Piller, Carnival’s senior manager for destination operations, concessions and business development.

food safety procedures. Finalists were selected based on their qualifications and alignment with the Celebration Key concept. The diversity of offerings throughout the project was also considered.

Finalists were then interviewed by a team from Carnival that is now contacting applicants to explore potential terms and conditions for ongoing business agreements. “We are currently in contract negotiations with several Bahamian businesses and hope to announce these partnerships very soon,” said Mr Piller.

After concluding contract discussions with selected retail and dining applicants,

JOB OPPORTUNITY

ACCOUNTS CLERK WANTED

The role involves:

• Preparing general ledger postings

• Account reconciliations

• Payables processing and vendor payments

• Customer billings and collections

• Clerical assistance and other administrative tasks Applicants should have the following attributes:

• 3-5 years’ experience in an accounting department

• •

• Good communications and team building skills

•

Please respond via email with copies of academic certifcates and two references to: portagency429@gmail.com

Carnival will assess the need for further RFPs to fill any remaining gaps in its shop and food and beverage line-up. The cruise line said it also plans to launch other RFPs in the future for the artisan and straw market vendors, food cart operators, car rentals and lockers.

Share your news

“There are so many ways for Grand Bahamian businesses, entrepreneurs and residents to be part of the Celebration Key experience, and to help us welcome millions of guests to this island paradise every year,” said Juan Fernandez, Carnival’s vice-president of destination operations.

“Even if applicants aren’t selected in one proposal cycle, we encourage them to keep applying for the many other opportunities across a range of categories and business types. An applicant that isn’t chosen for a retail shop or food and beverage outlet in this initial process may be a perfect fit for a retail kiosk, a spot in the artisan market or a food cart. Stay tuned for more opportunities we plan to announce later this summer.”

With its recentlyannounced $100m pier

extension, the now$600mCelebration Key destination will have 75 percent of outlets owned and operated by Bahamians when it opens in July 2025. Up to 70 restaurants and retail outlets of various sizes will be established. Besides the on-site retail or food and beverage opportunities, Carnival said there are multiple employment opportunities for Bahamians to work in tours and shore excursions, transportation and sub-contracting services.

More than 180 Bahamians are presently employed in construction at Celebration Key. The project is expected to generate more than 700 permanent jobs, including around 400 Bahamians hired directly by Carnival, to help welcome 2.2m guests each year to Grand Bahama starting in 2025.

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

PAGE 2, Tuesday, May 28, 2024 THE TRIBUNE

BERTRAND PILLER

Don’t ‘tax your way to success’, Gov’t urged

finished with taxation and things of that nature that may prohibit keeping any sort of stable growth.

“There’s a lot of fees and red tape, and a lot of things that have changed without necessarily calling it a tax. I hope they are mindful of where we are now, and they should be proud of the way we’ve rebounded and need to do whatever they can to protect that.

“I’m hoping they leave everything alone for now. I think revenue should be up. They’ve done a lot to go after tax delinquents and gaps, and have capitalised on a strong economy with strong tourism numbers and strong construction numbers,” Mr Albury continued.

“Hopefully they don’t try and tax their way to success. There’s only so much you can wring out of a stone. I guess we’ll know more as

they debate the Budget in the House and we’ll hope for the very best. They’ve worked hard to close a lot of the loopholes and go after a lot of delinquents. That’s the channel that should be the focus: People not paying real property taxes, NIB contributions, Business Licence fees.”

Warning that many in the private sector and consumers will be hard-pressed to cope with any new or increased taxation, Mr Albury added: “There’s a lot of low-hanging fruit to be tackled before we get into the business of raising taxes.

“Right now inflation is still killing people across the board.. shipping charges, fuel costs, everything is through the roof. I imagine a lot of families even with an improved economy are finding it hard to each week take care of their families and do what they need to do. There’s a big disparity

here. The middle class is not that strong any more.”

Philip Galanis, the HLB Bahamas accounting firm’s principal, yesterday told Tribune Business that the cost of living crisis is likely the “most intransigent” pressing problem that the Government faces but there is relatively little the Government can do about it given that - as a nation which imports all it consumes - this country brings in most of its pricing pressures from the outside.

“I’m hoping that we’re going to hear something about tax relief for people who are really hurting,” he said. “We’ve had a period of time when taxes and fees have gone up; Business Licences. There’s a lot of conversation in the public space about taxes and taxation...

“I don’t know what’s going to happen in terms of the national debt. I’m always concerned when the

debt is rising. I think that what we’re going to likely hear is that the economy is on the rebound. From where I sit with my clients and what I see generally, people are reporting better than average earnings, which is a positive thing.

“I don’t think there is any immediate action out there that will drive up the cost of living. The cost of living is the most intransigent thing that the Government has to deal with. A lot of that is oil-based, petroleum-based, so I don’t think there’s a lot the Government can do about that.”

Mr Galanis, who is also chair of the Bahamas Trade Commission, also expressed hope that some Customs duties and tariff rates will be reduced as part of an effort to enhance this nation’s trading regime and move to a more liberalised environment, and suggested that Bahamas Power & Light (BPL) and wider

PM DEMANDS OECD, EU JOIN GLOBAL TAX TREATY TALKS

vulnerabilities and hinder our recovery processes.

“This is not just a matter of financial policy but of justice and equity. Therefore, I call upon the OECD and the EU to join forces with the United Nations to formulate a global tax treaty that truly represents the interests of all nations, particularly those of us who are often left out of the conversation,” Mr Davis continued.

“This treaty should aim to provide a voice for SIDS, ensuring that our unique challenges and perspectives are acknowledged and addressed in global financial regulations. The OECD cannot give with one hand and take back with the other. True partnership requires consistent and fair support.

“Furthermore, the unfair financial practices imposed on Small Island Developing States by global institutions can be likened to a knee on our necks, restricting our growth and suffocating our recovery efforts. These practices are not merely bureaucratic hurdles; they are existential threats that impede our ability to breathe freely in the wake of disasters.

“Again I call on behalf of all SIDS to ‘take your knees off our necks’. We seek not just survival but the opportunity to thrive without these oppressive constraints.” The Prime Minister argued that nations such as The Bahamas must drive the fight against climate change themselves rather than waiting for support from developed nations that have been the major contributors to the problem.

“It will take a serious reckoning with the fact that the major polluters have reaped economic benefits while disproportionately

offloading environmental costs on to vulnerable nations like ours,” Mr Davis argued.

“Accountability mechanisms will also be key in operationalising the ‘Loss and Damage Fund’ established at COP 28. We have secured less than 1 percent of the estimated $400bn per year needed to assist the most severely impacted societies. It is more important than ever that we work together to operationalise this fund. No SID can do it alone.

“We must unite, because unity will be the key in unlocking concessional finance from the very creators of this most dire emergency. Climate and debt are twin crises, which we in the Caribbean know all too well. My nation has incurred billions in debt due to recovery efforts from climate-driven disasters and billions more are needed to meet climate change targets,” he added.

“We cannot, and should not, take this tremendous burden on alone while those who created this problem do the bare minimum to take accountability for the impact they have had on our nations.” His

energy sector reform will also be on the agenda.

“We’re moving very close to a general election, so the Government is going to have to do some things that create some excitement and create some movement where people feel it in their pocket books. So I think we’ll hear from that.”

Mr Galanis also backed the Government’s plans to introduce legislation accompanying the Budget that will give effect to the Qualified Domestic Minimum Top-Up Tax, which will levy a 15 percent corporate income tax on the profits of Bahamas-based companies which are part of multinational groups with an annual turnover exceeding 750m euros.

This will enable The Bahamas to fulfill the commitments it made when signing on to the G-20/ OECD global minimum corporate tax initiative.

Mr Halkitis last week said

the Government believed only around 50 Bahamasdomiciled entities will be caught by the new tax, which is projected to generate around $140m in annual revenue when implemented for a whole year.

“Our intent is to present the legislation with the Budget and allow the summer period between Budget time and when we go back to Parliament in mid to late September for consultation, and then we intend to bring that into effect,” Mr Halkitis said.

“We have been having a lot of consultation with the companies that fall into that range, and we don’t expect to see any negative fallout in terms of push back or exodus of business.” He added that “the wider business community” and “your sort of regular companies” will not be impacted by the legislation.

comments follow those of Ryan Pinder KC, the attorney general, who last week said of countries that fail to live up to their responsibilities: “Climate justice will come to them.”

Speaking at the Forum for Impact summit, he added that last week’s ruling by the International Tribunal for the Law of the Sea, which found countries have a duty to protect the oceans from climate change impacts, provides a foundation for the case where the International Court of Justice (ICJ) is being asked to determine if countries are legally bound to protect the Earth’s climate.

“This is where you force real impact and change in the climate crisis, preserving our future, reserving the future of blue economies the world over,” Mr Pinder

MY ATTRIBUTES:

said. “To make an impact, countries like The Bahamas must be forceful. To ensure sustainability of our ‘Blue Economy’ we must be felt and felt where it hurts most.

“We believe climate justice is what is required to have immediate change in our climate crisis, a climate crisis that jeopardises our human rights and our inherent ability to survive. The ‘Blue Economy’, and the ability to leverage it, requires attention to the climate crisis. They are fundamentally interrelated.

“The Bahamas offers unmatched opportunities in the ‘Blue Economy’, we also are the most vulnerable to the climate crisis. Collectively we must make an Impact against climate crisis to experience the impact from the ‘Blue Economy’.”

25yrs of Entrepreneurial & Corporate experience at senior management level

• Emotionally mature, logical thinker & strong problem solver

Excellent communicator adaptable to any audience

• Experience in successfully leading large teams of 70+ people

Years of experience in 7 figure budget prep, management & reporting

• Lead roles in national marketing campaigns from Product Development to Roll Out

Holds professional Master’s Degree

Email me: 242workforce@gmail.com

PAGE 4, Tuesday, May 28, 2024 THE TRIBUNE

FROM PAGE B1

FROM PAGE B1

LOOKING FOR A BOARD MEMBER FOR YOUR BUSINESS OR ORGANIZATION???

PHILIP DAVIS KC

Long-term Gov’t paper recovery two years out - but no bad thing

of investors, not the Ministry of Finance.

Pointing out that any failure to engage investors, and be transparent over the fiscal position, will only increase the Government’s “refinancing risk” in the present climate, Mr Bowe said: “They have a high volume of maturing debt for which they have to maintain confidence. It benefits the local markets and benefits them by increasing their fiscal transparency and reporting, and makes them earn their keep.”

The Government’s quarterly public debt bulletin for the final quarter of the prior 2022-2023 fiscal year showed that that, out of a total $6.868bn in Bahamian dollar debt featuring a mixture of bonds, Treasury Bills loans and bank overdrafts, some $2.598bn or almost 38 percent - more than one out of every three dollars - was due to mature during this current fiscal. Of that $2.598bn, some $1.561bn remains to be refinanced between April and June 2024, the Government’s own data shows. And, in the upcoming 20242025 fiscal year, the Davis administration has to refinance another $1.256bn of Bahamian dollar debt, equivalent to 18 percent of the total $7.002bn outstanding.

Given that much of this debt is only being refinanced, or extended, for between one to three years, it is paramount for the Government to maintain Bahamian investor confidence to successfully execute the required rollovers thus acting as something of a check on its

fiscal behaviour given the minimal appetite for longterm bonds.

“There have been spurts when you the life insurance companies and pension plans may grab a bit of it,” Mr Bowe said of 20 and 30-year government paper, “but, in general, for the last 24 to 36 months, two-and-a-half years, the long-term debt has been under-subscribed. Even the ten years is not seeing oversubscriptions.

“There are significantly more in the three to fiveyear paper. It certainly slows when you get to ten, 20 and 30 years. Those subscription levels have not recovered to high levels, and I don’t think that’s going to alter - in my viewfor 24 months.

“In reality, there’s a need for the Government to demonstrate continued fiscal discipline. To ensure the guard rails are maintained around election spending, I don’t think we’ll see any long-term [investor] appetite until we get through this election cycle. To be perfectly honest, I see it as a positive element, though it may be a bit frustrating from their [government] perspective because they are not used to it.”

While insurance companies and pension funds still need to purchase 20 and 30-year government paper, given their need to match long-term assets with liabilities, other local investors have shown a much-reduced appetite for such long-term debt in the aftermath of COVID19. The pandemic caused the national debt to soar to now-$11.7bn, and concerns emerged over the The

NOTICE

Bahamas’ elevated financing risk.

Recent government bond auctions highlight these trends. In the April 15, 2024, issuance, the $7m, 30-year tranche due to mature in 2054 was under-subscribed by more than $1m. Just $5.902m, or around 84 percent of the total amount sought, was raised.

However, on May 2, 2024, the $84m issue of one-year government debt securities was oversubscribed by almost $20m with $103.09m in bids received. The investor returns, though, were much lower than on the previous 30-year bond, with the interest rate standing at between 3.24 and 3.35 percent as compared to 6.59 percent on the longer-term variety.

This shows that Bahamas government bond buyers are opting for lower-risk, lower-yielding debt securities as opposed to the higher returns that can be achieved on the longer-term but riskier paper. Mr Bowe, confirming these rates, said the Government is benefiting from lower domestic borrowing costs at a time when the international capital market environment is against The Bahamas.

However, he argued that the Davis administration should use the resulting savings to “beef up” the sinking funds established to help meet repayment of the Government’s foreign currency bond issues when they mature rather than employ them for “spending on alternative uses”.

As for the more frequent rollovers and refinancing of government debt, Mr Bowe added: “The reality is that’s an inconvenience that we will happily endure.

IN THE ESTATE OF PRISCILLA LOUISE SCAVELLA also known as PRISCILLA SCAVELLA late of the Settlement of Gregory Town on the Island of Eleuthera one of the Islands of The Commonwealth of The Bahamas, deceased.

NOTICE is hereby given that all persons having any claims or demands against the above Estate are required to send the same duly certifed in writing to the undersigned on or before the 14th day of June, A.D. 2024, after which date the Executrix will proceed to distribute the assets of the deceased having regard only to the claims of which she shall then have had notice. AND NOTICE is hereby given that all persons indebted to the said Estate are requested to make full settlement on or before the date hereinbefore mentioned.

SAND DOLLAR LEGAL AND COMPLIANCE SERVICES CHAMBERS

Attorneys for the Executrix Skyline Drive, Lower Bogue Eleuthera, The Bahamas Telephone -(242)335-2105/ (242)805-2105 P.O. Box EL 27823 Email - info@sanddollarlegal.com

It allows for more frequent reviews of the fiscal performance, It requires them to be more communicative and engaged with the local market, and it allows for a look at the latest information and a greater appreciation for the continued discipline.

“While it may add a few hours to the work week in the year, ultimately it allows us to extend credit but with the appropriate level of due diligence we’d not normally have and more frequently. The fact the Government has to refinance more than $1bn on an annual basis means they truly have to ensure they are periodically reporting and updating the market” on a quarterly basis.

Warning that “failure to do so increases the refinancing risk” for the Government, Mr Bowe said it needed to adopt the disclosure practices of Bahamian publicly listed and traded companies who all have to provide financial reports to their shareholders on a quarterly basis. In return for the lower interest coupons, it needs to “demonstrate longer periods of fiscal discipline”. “I don’t think there’s any risk of default on the part of the Government,” he added, “but there are still issues with liquidity in making sure there are available funds ready for payment and government continues to have foreign currency obligations that continue to come due.

“There’s a fair amount of debt management necessary so having to come to the bond market frequently is a good thing because it keeps the information flowing. I would say, mischievously, it has put the power where it should be.

“The power sits in the hands of the bondholders where it should be, and the Government must maintain their confidence as opposed to long-term paper where it gets the funds without the same level of accountability in a regular basis. It has a benefit to the wider economy because of the lower debt service costs. It may not have been deliberately instituted that way but the consequences are positive.”

THE TRIBUNE Tuesday, May 28, 2024, PAGE 5

FROM PAGE B1

Abaco Chamber chief: ‘We’re all at risk’ on port uncertainty

it passed the requirements of the subsequent “actual” assessment.

Any failure could result in Marsh Harbour’s port being closed down, and ships transporting cargo between Florida and Abaco would have to discontinue their services. Such an outcome would likely send Abaco’s economy into a tailspin if it were to occur, given that the island - much like the rest of The Bahamas - imports most of what it consumes.

With its main port of entry closed, cargo freight would likely have to be sent first to Nassau before being transferred to smaller vessels such as mail boats for onward shipping to Abaco.

This would result in tremendous cost and shipping time increases, with the extra expense passed on to businesses and consumers in the absence of direct deliveries, undermining the island’s economic revival.

There is nothing to suggest that Marsh Harbour is in any imminent danger of failing an ISPS inspection, though.

And Mrs DeGregoryMiaoulis’ reference to US government officials ties in with the last update given by Jobeth Coleby-Davis, minister of energy and transport,

in January 2024 when she said the US embassy had partnered with the Government to upgrade the port’s security systems and plans. Still, one shipping industry source, speaking on condition of anonymity, said it was “shameful” that so little has been done to rebuild the Marsh Harbour port in the almost five years since Hurricane Dorian struck. They added that the Port Department officials at the security gate were still operating from the 20-foot container donated in the Category Five hurricane’s aftermath.

Confirming that “not a thing” has been heard on the bidding process since late summer/early fall 2023, they added: “It’s ridiculous. It really is. It’s just shameful that it’s been going on five years [since Dorian] and nothing has been done. The Arawak Port Development (APD) group was certainly the most qualified, and their proposal required no government financing. It was their own.”

As for the dangers posed by a possible ISPS inspection failure, the source said: “It’s only just a matter of time. The US would not have a lot to think about and could just shut Abaco down. It’s been five years.”

LEGAL NOTICE

Access Gateway Technology Solutions Inc.

Registration No. 173181 B

INTERNATIONAL BUSINESS COMPANIES ACT (No.45 of 2000) In Voluntary Liquidation

Notice is hereby given that in accordance with Section 138 (8) of the International Business Companies Act, No.45 of 2000, the dissolution of Access Gateway Technology Solutions Inc. has been completed, a Certifcate of Dissolution has been issued and the Company has therefore been struck off the Register. The date of completion of the Dissolution was 9th May. 2024.

Crowe Bahamas Liquidator

ISPS is a worldwide protocol implemented in the wake of the September 11 terror attacks. Designed to prevent a repeat of such atrocities, it mandated that every country upgrade security infrastructure and procedures around its major shipping ports and the vessels that use them. Tribune Business also previously reported that BISX-listed APD had submitted a bid to manage the Marsh Harbour port.

Mrs DeGregory-Miaoulis, meanwhile, said: “As a consumer the only group I have seen providing any measure of implemented security has been Tropical Shipping, which built their own secure facility so they can import goods that are not at risk for their customers.

“The condition of the port still remains no running water, no toilet facilities. It’s still sub-standard, barely scraping by in terms of security. Those are conditions that nobody should be working under. The RFP that was put out, nothing has been said. Where are they with that is what we want to know. The Government needs to provide us with an update.

“These are real concerns. When our ports of entry are not properly secured, managed and maintained we are all at risk.... As far as the

ports go it’s a real mess,” the Abaco Chamber president continued. “Even if they awarded a contract to do it and rebuild the port, that’s 12 to 24 months, so we’re looking at six to seven years post-Dorian before we can have an acceptable port of entry for our cargo and marine imports.

“That’s totally unacceptable. That does not support growth and redevelopment of one of the number one revenue-generating islands in the country as the Government just announced, and we’d like to have an update like all the other islands on where we stand with these ports of entry.”

Mrs Coleby-Davis, speaking in January, maintained that the process for the Marsh Harbour port “takes a bit more time” due to financial constraints, and the Government wanted to ensure whatever decision is made is in the best interests of Abaco residents.

She said: “It takes a little bit more time because we have to consider the financial model of what the proposals are recommending. But we also have to make sure we consider the island and the economic structure, and make sure that whatever is decided is a benefit to the community.”

LEGAL NOTICE

YoManE Inc.

Registration No. 197260 B

INTERNATIONAL BUSINESS COMPANIES ACT (No.45 of 2000)

In Voluntary Liquidation

Notice is hereby given that in accordance with Section 138 (8) of the International Business Companies Act, No.45 of 2000, the dissolution of oMan nc. has been completed, a Certifcate of Dissolution has been issued and the Company has therefore been struck off the Register. The date of completion of the Dissolution was 9th May, 2024.

Crowe Bahamas Liquidator

Tribune Business previously revealed that the Government is eyeing a combined $100m investment to transform Abaco’s two commercial shipping ports into facilities that meet global best practices and standards. The public-private partnership (PPP) tender documents for both the Marsh Harbour and Cooper’s Town ports revealed that bidders on the former must show they have combined equal capital and access to debt financing of “at least $60m”. For Cooper’s Town, the figure was slightly less at $40m in collective equity and debt funding.

Several sources, speaking to Tribune Business on condition of anonymity, described both figures as being on the high side. The sum sought for Cooper’s Town almost matches the $41m investment in its initial construction, which was completed by China Harbour Engineering Company (CHEC).

The tender documents, known as Requests for Proposal (RFPs), revealed that the Government wanted the ownership structure for both Abaco port PPPs to mirror that which was put in place for BISX-listed APD, operator of the Nassau Container Port.

For both the Marsh Harbour and Cooper’s Town ports, the RFPs stipulated that a combined 20 percent equity ownership will be “offered for sale to the general public” although it did not specify whether this will be via an initial public offering (IPO) or other method. The remaining 80 percent ownership interest was to be split evenly between the Government and winning PPP bidder, with each holding 40 percent. This split matches APD’s structure, where the Government and shipping industry each hold a 40 percent stake. Meanwhile, among the expansion opportunities identified at the Cooper’s Town port was a 120-slip marina together with international and domestic warehouses, although no such opportunities were identified at Marsh Harbour, which remains the island’s prime commercial shipping port and cargo point-of-entry.

Both RFP documents stated that each port will be leased to the winning bidder for a 25-year period, in an attempt to ensure they get a return on their upfront capital investment, with the Government wanting them to employ a workforce that is 80 percent Bahamian at a minimum.

NOTICE

NOTICE is hereby given that

ETHEN METAYER #21 East Beach Drive, Freeport, Grand Bahama, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 28th day of May, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE is hereby given that JOHN HOMIDAS of Miami Street, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas and that any person who knows any reason whyregistration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 28th day of May, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

LEGAL NOTICE

Spice Capital Trading Fund Ltd.

INTERNATIONAL BUSINESS COMPANIES ACT (No.45 of 2000) In Voluntary Liquidation

Notice is hereby given that in accordance with Section 138 (4) of the International Business Companies Act, (No.45 of 2000), that Spice Capital Trading Fund Ltd. (Registration no. 209816 B is in dissolution. The date of commencement of the dissolution is the 7th day of May, 2024. The Liquidator of the Fund is Crowe Bahamas and can be contacted at Harbour Bay Plaza, Shirley Street, Suite 587, P. O. Box AP-59223, Nassau, Bahamas. Email andrew.davies@crowe.bs. All persons having claims against the above-named company are required to mail and email their names, addresses and particulars of their debts or claims to the Liquidator before 6th day of June, 2024

Crowe Bahamas Liquidator

LEGAL NOTICE

NOTICE

INTERNATIONAL BUSINESS COMPANIES ACT (No.45 of 2000) In Voluntary Liquidation

Notice is hereby given that, in accordance with Section 138 (4) of the International Business Companies Act, (No.45 of 2000), FLR International Ltd. (the “Company”) is in dissolution.

The date of commencement of the dissolution is the 24th May, 2024 Guilherme Martins Pinheiro, is the Liquidator and can be contacted at Av. Delfm Moreira 830, AP101, Leblon, Rio de Janeiro, RJ CEP 22441-000, Brazil.

All persons having claims against the above-named company are required to send their names, addresses and particulars of their debts or claims to the Liquidator before 23rd June, 2024

Guilherme Martins Pinheiro Liquidator

PAGE 6, Tuesday, May 28, 2024 THE TRIBUNE

FROM PAGE B1

NOTICE