Aviation ‘stability’ threat over exam requirement

By NEIL HARTNELL Tribune Business Editor

PILOTS are voicing fears that “the stability and efficiency” of Bahamian aviation will be “undermined” if regulators press forward with plans to mandate they pass an exam for which many are ill-prepared.

The Bahamas Airline Pilots Association (BALPA), in a letter to Alexander Ferguson, the civil aviation directorgeneral, says it “strongly urges” the regulator to delay rolling-out the new ‘air law examination’ that all pilots and airmen must take and pass if their relevant licences are to be issued or renewed.

The exam requirement took effect on Saturday, June 1, but BALPA and other pilots and aviation operators are warning that there has been inadequate

time to prepare while the guidance notes and material provided by the Civil Aviation Authority of The Bahamas (CAAB) on the nature and type of questions that will be asked have been branded “incredibly vague”.

As a result, BALPA and others are voicing concerns that many pilots and air crew will struggle to pass the test and obtain renewal/issuance of their licences. This, they fear, could result in pilot

shortages and worsen the existing four-month delays presently encountered in upgrading licences and ratings, leaving the Bahamian aviation sector undermanned and unable to provide the frequency of services required.

BALPA’s Jamal Gray, in the Association’s letter to Mr Ferguson, said the group was “deeply disappointed not to have been consulted” on the exam’s development and roll-out. Some aviation sources

suggested that the new exam had resulted from the recent US Federal Aviation Administration (FAA) audit of The Bahamas’ safety and regulatory regime, although this was disputed by other contacts.

Confirming that the regulator is pressing ahead, its website states: “Effective June 1, 2024, the Civil Aviation Authority of the Bahamas will be implementing a mandatory air law examination for all airmen seeking initial and renewed licences.

“This examination aims to enhance aviation safety standards by ensuring a comprehensive understanding of aviation regulations and protocols. Bookings for the exam will commence in early May 2024. Please make the necessary arrangements at your earliest convenience

Sebas: Growth woes lead to Aeropost’s Bahamas closure

By NEIL HARTNELL and Fay Simmons Tribune Business Reporters

SEBAS Bastian last night said his Aeropost logistics business is closing its Bahamas operations because this is the only one of its 30-plus territories “where we did not experience material growth”.

The Island Luck cofounder, in a messaged reply to Tribune Business inquiries, confirmed the decision “was not made lightly” but added that the shipping and freight forwarding provider had elected to deploy resources away from jurisdictions

“not aligning with our projections and goals” following its early 2024 switch to a new business model. Disclosing that The Bahamas operation has

Opposition: $437m revenue increase ‘does not add up’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Government’s forecast $437m revenue jump for the upcoming 2024-2025 fiscal year represents an increase eight times’ greater than the pace of economic growth according to Budget numbers.

Data published with last Wednesday’s Budget shows that the $3.537bn total revenue projected for the upcoming fiscal year that begins on July 1 is a 14 percent year-over-year increase on the $3.1bn outturn for the current 2022-2023 period that was unveiled by Prime Minister Philip Davis KC on Wednesday.

Revenues are typically a function of economic growth and activity, especially given a Bahamian tax system heavily reliant on consumption. The fact that the Government’s income is forecast to grow at a rate more than eight times’ faster than gross domestic product’s (GP) predicted 1.7 percent real expansion has already attracted the Opposition’s attention, and it is arguing: “The numbers don’t add up.” “What we need to take into account is the actual numbers instead of what they say,” Kwasi Thompson, the Opposition’s finance spokesman, told Tribune Business “The actual numbers, as

‘Live up to promises’ on CLICO compensation

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Government was yesterday urged to “live up to its promises” to fully compensate CLICO victims after zero funds were allocated for this in next year’s Budget and successive fiscal years.

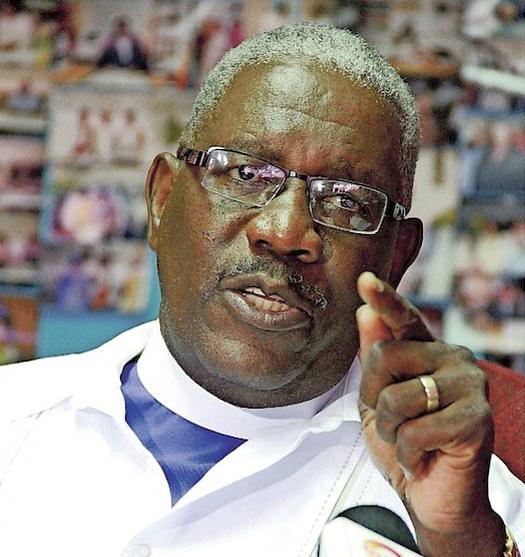

Bishop Simeon Hall, himself a victim of the insolvent life and health insurer’s collapse more than 15 years ago, told Tribune Business that while he “can understand the scarcity of funds” available to the Government it still needed to fulfill its commitment especially since weak to non-existent regulation played a large part in CLICO’s failure. He spoke out after the 2024-2025 Budget, tabled in the House of Assembly last week, revealed that the Government has allocated not a single cent to the payment of “CLICO obligations” in the upcoming fiscal year or the 2025-2026 and 2026-2027 Budget cycles.

This newspaper understands that CLICO victims last received a payout from the Government almost two years, and materials accompanying last week’s Budget show none of the $3.8m allocated for compensation during the current 20232024 fiscal year had been paid out as at end-March 2024. The last Christie administration, in the 2016 mid-year Budget, agreed and committed the Government to a plan where all surrendered life insurance policies, death benefits, medical claims and staff pensions would be paid in full.

business@tribunemedia.net MONDAY, JUNE 3, 2024

SEE PAGE B6

nhartnell@tribunemedia.net SEE PAGE B10 SEE PAGE B4 SEE PAGE B7

SEBAS BASTIAN • Pilots: New air law test guidance inadequate • Association ‘strongly urges’ mandate delayed • Fear rash of failures will cause pilot shortage $5.90 $5.91 $5.74 $5.74

BISHOP SIMEON HALL

BANKING SECTOR MAINTAINS STABLE, LITTLE GROWTH TREND

By NEIL HARTNELL

BAHAMIAN employment in the banking sector increased modestly at the expense of expatriates in 2023 although the industry’s overall economic impact largely remained flat year-over-year.

The Central Bank, unveiling its annual survey of the financial services industry’s wider contribution to the Bahamian economy, said total local jobs across the domestic and international banking sectors increased by 38 compared to 2022 to take the total to 3,487. By contrast, expatriate jobs declined by 21 to 787 yearover-year, for an overall net gain of 17 posts.

The banking industry regulator said the sector, and wider financial services industry, had seen only “incremental growth” in 2023 as the international side continued to face global regulatory and compliance pressures. It indicated that The Bahamas’ new business and client prospects in Latin America continue to be offset by the “continued re-domiciling of clients to Europe”.

And, despite the modest employment gains, the Central Bank said banking

sector assets declined by 8.2 percent to around $127.2bn during 2023. “In particular, the reduction in international banks’ balance sheets overshadowed the gains in domestic banks’ assets. In contrast, fiduciary assets increased by 6.5 percent to $295.3bn,” the regulator said.

“Further, in the securities industry, indications are that net asset value registered healthy gains in 2023. With regard to credit unions, assets expanded, led by a rise in liquid investments and an increase in deposits held with the Credit Union League. Meanwhile, onshore insurance operations featured constrained balance sheet trends relative to prior year.”

The total number of licensed banks and trust companies in The Bahamas continued to slowly decline, dropping by five to 197 at year-end 2023 following a drop of 12 in 2022. “Total domestic assets within the local banking sector firmed by 2.2 percent to $11.7bn in 2023, albeit lower than the 4.2 percent expansion a year earlier and the 2.4 percent average annual growth rate of the last five years,” the Central Bank said.

“Conversely, total assets of the international banking sector declined further

by 8.2 percent to $107.9bn vis-à-vis the 8.9 percent reduction in the previous year and the 6.7 percent average annual decrease over the last five years.

“In 2023, total employment within banks and trust companies grew by 17 (0.5 percent) to approximately 3,681 persons, a turnaround from the 1.2 percent reduction in 2022. An analysis by nationality showed that Bahamian positions rose by 38 (1.1 percent) to 3,487, contrasting with nonBahamian positions which declined by 21 to 194,” the regulator continued.

“As a result, the ratio of employed Bahamians to non-Bahamians in the banking sector firmed by six basis points to 94.7 percent from 94.1 percent in the previous year.... During the year, total expenditure in the banking sector increased by $78.9m (10.1 percent) to $856.9m, surpassing the 0.9 percent growth in the previous year and the annual average spending gain of 0.6 percent over the last five years.

“Contributing to this outturn, total operational costs expanded by $70.3m (9.1 percent) to $839.3m, extending last year’s 1.7 percent growth. Notably, non-staff administrative costs rose by $38.1m (10.3 percent) to $408.1m,

exceeding the 3.8 percent gain in the prior year. In addition, salaries grew by $17.2m (5.6 percent) to $321.4m, a reversal from the 3.1 percent decline in 2022.

“Further, government fees advanced by $14.7m (15.7 percent) to $107.9m, led by gains in company registration fees of 32.7 percent and license fees of 26.9 percent. Further, expenditure on staff training firmed by $0.4m (22.8 percent) to $2m, albeit a sharp moderation from the 51.6 percent increase a year earlier.”

Breaking down banking industry salaries, the Central Bank found: “With regard to compensation, movements in average base salaries varied across the banking sectors. Specifically, the average salary for the domestic banks appreciated by $3,295 (5.6 percent) to $62,271 per annum.

“However, average compensation in the international sector decreased by $3,345 (2.8 percent) to $115,264 per annum, owing in part the closure of a public bank. Expenditure growth in the domestic banking sector persisted, contrasting with the retrenchment in the international sector. In the domestic banking sector, aggregate expenditure grew by 14.2 percent to $644.1m

in 2023, after stabilizing at $563.9m in 2022.

“In the international banking sector, total expenditure fell by 0.6 percent to $212.9m following a 5.5 percent fall-off in 2022 and a 3.7 percent annual average decline over the preceding five-year period. Operational outlays decreased by 0.8 percent to $210.1m, although lower than the 5.4 percent decline in the preceding year and the annual average of 3 percent.”

As for the wider financial services industry’s total contribution to the Government, the Central Bank said: “Preliminary figures on financial sector performance revealed that total taxes and fees received by the Government grew by $11.9m (7.2 percent) to $177.6m during 2023.

“Underlying this development, transactional taxes on local intermediation activities rose by 9.9 percent to $106.9m on account of a 28.9 percent increase in the collection of insurance premium tax and a 12.2 percent rise in the collection of stamp tax on other banking transactions. In an offset, taxes on mortgages contracted by $5.7m to $5.4m in 2023. “In addition, licence and registration fees rose by $2.3m (3.4 percent) to $70.7m owing to a 4.1 percent gain in collections from banks and trust companies and a 1 percent uptick in receipts from international business companies. Meanwhile, other fees received from insurance companies, brokers, and agents stabilized at $0.4m relative to the previous year.”

PAGE 2, Monday, June 3, 2024 THE TRIBUNE

Tribune Business Editor nhartnell@tribunemedia.net

‘Mean business’ over 40% uninsured cars

By NEIL HARTNELL

A “SHOCKING” 30-40 percent of the vehicles on Bahamian roads are either uninsured or not properly covered, a lead insurance broker has estimated, as he backed the Government’s bid to overhaul traffic laws.

Bruce Ferguson, the Bahamas Insurance Brokers Association’s (BIBA) president, told Tribune Business he hopes the authorities now “mean business” and that the Road Traffic Act reforms tabled alongside the Budget do not become another one of “many false dawns” as has occurred in the past.

Emphasising the industry’s support for efforts to crack down on rogue uninsured drivers, and boost safety on the roads, he added that the private sector has had “some gung ho meetings” with the Road Traffic Department on the issue in the past only for the effort to ultimately lose momentum, stall and “go quiet”.

Proposed amendments to the Road Traffic Act, due to take effect from January 1, 2025, if passed into law, will require that insurance policies be valid for at least a further six months in order for a vehicle to be licensed by the Road Traffic Department.

This is designed to deter persons from obtaining a short-term “cover note” from Bahamian insurers so that they can pass t he Road Traffic Department inspection and licence their vehicle without paying the full comprehensive or third-party premium. They then fail to pay the balance, and the coverage lapses or is cancelled, resulting in such persons driving for the rest of the year without insurance.

Mr Ferguson, who said most if not all Bahamian auto underwriters have already stopped issuing “cover notes”, told this

newspaper of the proposed reform: “Personally I think that’s a very good thing because obviously it’s been abused for a very long time where people obtain a cover note, get their vehicle licensed and let the cover note lapse, and be without cover for the rest of the year.

“Most carriers... Bahamas First, our biggest carrier, doesn’t issue them at all any more. It’s all down to control and discipline. We as insurance brokers make sure that until the premium is paid in full that no documents are given to the client.

“The only exception is if you’re bringing a vehicle in, and need to get it off the dock. We’ll issue third party until they get it through Customs and inspected, and then issue comprehensive. As far as that change is concerned, it can only be a good thing,” Mr Ferguson continued.

“The insurance industry supports that, and if we can reduce the amount of uninsured drivers out on the road, that’s a win-win for everybody - insurers and the public - and anyone who’s car is damaged by an uninsured vehicle.”

The proposed Road Traffic Act reforms also mandate that vehicle owners report cancellation of their vehicle’s insurance certificate to the Road Traffic controller within five days of this occurring. The certificate must be handed to the insurer, and a reason given for the cancellation.

The insurer must issue a notice of cancellation to the controller within 48 hours of the certificate of insurance being cancelled. Failure to comply could incur a fine not exceeding $2,500 or a three-month prison sentence for the vehicle owner and a fine up to $5,000 for the authorised insurer.

Mr Ferguson said he believes the Bahamian insurance industry already complies with this requirement. “I believe that’s done now,” he said. “As far as our existing cancellations are concerned, we do that anyway. Whether anything comes of that is another matter....

“The insurance industry has been pushing for upgrades to the Road Traffic Act for many years now, and there have been many false dawns unfortunately. Let’s hope this time they mean business, and this is not another initiative put back on the shelf and quietly gotten rid of.

“That’s what’s happened in the past. We’ve had some gung ho meetings with the Road Traffic Department, and then everything goes quiet. There’s a drastic need for a new Road Traffic Act so that we don’t have to work out which of the 15-20 amendments to the Road Traffic Act are the ones that apply.”

Mr Ferguson told this newspaper that presently clients are facing “a lot of confusion” caused by police officers providing the wrong information, especially at the scene of traffic

accidents. “Enforcement is the massive thing here,” he said. “You can pass as many laws as you want, but if they are not rigorously enforced there’s no point.”

The BIBA president said fines for driving without insurance are still relatively low and, as a result, persons are tempted to take the chance and drive without. He added that the Royal Bahamas Police Force needs to repeat the enforcement he witnessed recently on a visit to Freeport,

where officers were stopping vehicles and checking if they had valid insurance certificates at almost every roundabout. Asked how many uninsured and inadequately insured vehicles are presently on Bahamian roads, Mr Ferguson replied: “There’s an awful lot. I would say 30-40 percent, which is a shocking amount in this day and age where, in other countries, police sit in their vehicle and work out

who has insurance and who doesn’t.”

That would involve equipping the Royal Bahamas Police Force with hand-held scanners the size of cell phones, so they could randomly scan vehicle licence plates. This would then give them access the Road Traffic Department database and they would know whether a vehicle’s insurance is active or has expired.

THE TRIBUNE Monday, June 3, 2024, PAGE 3

Tribune Business Editor nhartnell@tribunemedia.net

SEBAS: GROWTH WOES LEAD TO AEROPOST’S BAHAMAS CLOSURE

“a lean team”, he added that Aeropost is seeking to minimise the impact on affected employees by transferring around half - four - to other affiliated businesses within the group. Only four to five workers will be “furloughed”, which likely means terminated or made redundant.

Mr Bastian did not delve into why The Bahamas appears to be Aeropost’s only non-performing territory after the imminent closure was announced to clients on Friday via e-mail blast and an announcement posted on the company’s website.

However, he confirmed:

“We at Aeropost have made the difficult decision to cease our operations in The Bahamas. This choice was not made lightly, as we have deeply valued the opportunity to serve thousands of customers in this region over the past years.

Our commitment to fulfilling the shopping and cross-border needs of our Bahamian customers has always been at the forefront of our efforts.

“Despite our best efforts, The Bahamas remained the only market among the 30-plus countries we

operate in where we did not experience material growth. This stands in contrast to the overall success and expansion Aeropost is experiencing globally.

“As we are currently enjoying record growth due to our strategic partnerships and logistics services, particularly with our Asian distributors, it became imperative to focus our resources and efforts on markets where we are seeing significant and sustainable growth.”

Mr Bastian said Aeropost had earlier this year switched its focus from operating an e-commerce platform to becoming a “pure” international shipping, freight forwarding and cross-border courier style operation, which required it to examine performance in all jurisdictions where it as a presence.

“At the beginning of this year, we strategically pivoted from operating a marketplace to becoming a pure logistics technology company. This transition has already led to a recordbreaking second quarter, underscoring the effectiveness of our new direction. Consequently, this necessitated a reevaluation of our operations in regions where

growth was not aligning with our projections and goals,” he explained.

“In The Bahamas, we operated with a lean team, and we are committed to supporting our employees during this transition. Four of our team members are being redeployed to affiliate businesses within our group of companies, while only four or five individuals will be furloughed.

“We remain grateful for the support and loyalty of our Bahamian customers and partners over the years. We believe this decision, while challenging, will ultimately allow us to strengthen our primary markets and continue delivering exceptional logistics solutions globally.”

Aeropost, in a notice to its Bahamian customers, warned that all packages and shipments destined for The Bahamas must arrive at its Miami warehouse by June 14 - in 11 days timeotherwise they will not be processed for delivery. If that deadline is missed, clients will have a further 14 days to June 28 to request that the item be returned to the seller, after which all remaining goods will be destroyed.

“After careful consideration, we have made the difficult decision to close our operations in The Bahamas. We are grateful for the opportunity to have served thousands of customers in The Bahamas, fulfilling their shopping and cross-border needs over the past years,” Aeropost said.

“All packages that arrive at our Miami warehouse by this date [June 14] will be shipped to The Bahamas and available for pickup at our main warehouse located at 106 University Drive, Thompson Boulevard. After June 14, any incoming orders will no longer be processed for delivery to The Bahamas.

“If your order arrives in Miami after June 14, you will have the option to request a Return Merchandise Authorisation (RMA) from the seller, and we will return the item for you. This request must be submitted by June 28. After this date, any unclaimed items will be deemed abandoned and will be destroyed

“We understand that this may cause inconvenience and apologize for any disruption it may cause. Our customer service team is here to assist you with any questions or concerns during this transition. We appreciate your business and look forward to serving you in other markets.”

Mr Bastian, who is The Bahamas’ non-resident ambassador to Central

America, unveiled ambitions for Aeropost to become an “Amazonlike” presence among 60m consumers across the Caribbean, Latin American and Central American region when he confirmed his acquisition of the e-commerce platform in early December 2021. He raised nearly $19m from investors to finance the Aeropost acquisition via Click Partners LP, a British Virgin Islands (BVI) domiciled limited partnership described in promotional material as a “digital, e-commerce, logistics and operations expert”.

It was initially designed as a vehicle that allowed small businesses to sell their products online through its portal while offering “the lowest bar” to market, offering direct selling as well as acting as a middleman between other vendors and consumers in 39 territories which, at that point, included The Bahamas.

The abrupt closure of Aeropost’s Bahamas operations comes less than eight months after the company confirmed its expansion into freight forwarding services via a sales tax-free US address. It launched its Aeropost Courier arm, known as Click to Collect, to offer freight forwarding services and allow Bahamian shoppers to ship goods acquired from US online stores as well as Aerospace’s online marketplace.

Aeropost said that besides its sales tax-free US address it would also provide weight-based shipping; advanced order tracking; a simplified returns process; secure transactions; multiple payment options, including Visa, Mastercard, American Express and PayPal; and a ClickBox smart parcel locker pick-up at more than 20-plus locations, including 24-hour package pick-up at all Esso locations.

The Bahamian unit operated two hub locations - one on Carmichael Road and the other on Thompson Boulevard. Smart parcel lockers were placed throughout Nassau, including at Boyd Road, Cable Beach, Carmichael Road, Charles Saunders Highway, Mall at Marathon, Robinson Road and Wulff Road and East Street, to give persons more convenience in picking up their shipments. Those lockers were also available at eight Esso service station locations: Faith Avenue, Oakes Field Road, South Beach, East Street and Soldier Road, Village Road, Mackey Street, Blue Hill Road, East Bay Street and Fox Hill Road. In August 2023, Aeropost Bahamas added a ClickBox smart locker location at the University of The Bahamas’ Oakes Field Campus.

PAGE 4, Monday, June 3, 2024 THE TRIBUNE

FROM PAGE B1

BET ON THE RIGHT HORSE

By CHRIS ILLING

One price jump chases the next at Nvidia and, within just over a week, the company gained around $500bn in value and is now valued at more than $2.8trn. That is worth more than Meta, Tesla, Netflix and IBM combined. After the publication of the quarterly figures, Nvidia shares moved to new record highs last week.

OpenAI released its latest model GPT4o, which can process text, image and audio in real time, plus gain the ability to interact with its environment in a human-like manner. Google followed suit a day later. The speed of innovation in the artificial intelligence (AI) field seems to continue unabated.

The AI boom is not stopping. But the competitive pressure between companies with similar products is also becoming increasingly stronger. And many companies in the AI space are overvalued and will face a market correction if investors start to prioritise actual results instead of future growth prospects.

We can look at three main dimensions of AI:

The infrastructure (Nvidia’s

domain); the base models (OpenAI’s domain); and the applications. Nvidia is dominating in their field with an estimated market share of more than 80 percent. But established companies such as Intel, Apple and Google are working on innovative products as well as new start-up companies. It remains to be seen how much market share Nvidia will be able to retain in the future. Given the significant cost of training state-of-the-art models, there is a tendency towards only a few vendors regarding the base models. These include Microsoft and OpenAI, Meta and Google, and this might lead to the creation of an oligopoly. In the third level, the area of applications, the market is currently still wide open. Many start-ups are in the running to bring AI-based products to the market. The strategy for success is most likely to be a clear vertical focus in which, in addition to

BTC HIT BY ‘SABOTAGE ACT’ IN NORTH ELEUTHERA

THE BAHAMAS Telecommunications Company (BTC) says it fell victim to “an act of sabotage” that knocked out all mobile, Internet and landline services to North Eleuthera customers on Friday.

The carrier, in a statement, gave no details on the nature of this “sabotage” other than to say it had impacted key network infrastructure and the Royal Bahamas Police Force was conducting a full investigation.

BTC said its technical teams on Friday were “working to assess the damage and restore services as quickly as possible”. The carrier’s legacy network has, in the past, been struck by repeated copper theft that has temporarily knocked-out its communications services.

“We condemn any unlawful actions that disrupt critical telecommunications services relied on by residents and businesses,” BTC said. “We appreciate our customers’ patience as we work to resolve this issue. Updates will be provided on BTC’s social media channels as more information becomes available. We remain committed to delivering reliable communications services across The Bahamas.”

Elsewhere, BTC’s immediate parent, Cable & Wireless Communications (C&C), affirmed that it is prepared across all the territories in which it operates for a busier-than-normal Atlantic hurricane season.

“We have been operating in the Caribbean for more than a century and we have that experience, we are well equipped, and we stand ready to respond to any eventuality. Over the last few weeks our teams have been conducting simulation exercises and strengthening the networks, so we are

once again leaving nothing to chance,” said Inge Smidts, C&W’s chief executive.

The US National Hurricane Centre’s (NHC) outlook for the season, which spans from June 1 to November 30, predicts an 85 percent chance of an abovenormal season, a 10 percent chance of a near-normal season and a 5 percent chance of a below-normal season, with between 17 to 25 total named storms with winds of 39 miles per hour or higher.

C&W Communications said it has been investing in robust network infrastructure and redundancy measures to ensure the resilience of its telecommunications networks during extreme weather conditions. This includes the deployment of back-up power systems, hardened network facilities and strategic network routing to mitigate the impact of service disruptions.

“As the leading telecoms provider in the Caribbean, we know our communities are depending on the connections we provide, especially during those critical moments, so our priority is to safeguard the connectivity of our customers and support the resilience of the communities we serve,” added Ms Smidts.

“We remain committed to delivering reliable communication services and standing by our customers during times of need. While we are hopeful that no customers will be impacted during this year’s hurricane season, we must also ensure that we are ready to face that reality and we are prepared to respond.”

the integration of AI models, a deep understanding of the market and integration with customers are key factors. We are heading for a future where AI will touch every human life, every unit of every company worldwide, every single day. The savvy investor will pick the right company to invest in.

THE TRIBUNE Monday, June 3, 2024, PAGE 5

CCP @ ActivTrades Corp

‘Live up to promises’ on CLICO compensation

Tribune Business sources, speaking on condition of anonymity, confirmed that around $10m remains to be paid out to hundreds who surrendered their policies.

Simon Wilson, the Ministry of Finance’s financial secretary, could not be reached for comment before press time last night. However, it is thought likely that the Government, given its still-strained fiscal position, has decided to conserve cash and wait for Trinidad to pay the agreed $110.827m settlement to CLICO (Bahamas) and its liquidator.

That sum was offered by liquidators for the Bahamian insurer’s Trinidad-based parent, CL Financial, and Sir Ian Winder, the Supreme Court’s chief justice, last year gave Craig A. ‘Tony’ Gomez, the Baker Tilly Gomez accountant and principal, the go-ahead to accept it in his capacity as CLICO (Bahamas) liquidator.

The nine-figure sum represents a settlement of CLICO (Bahamas) claim against its Trinidadian parent. CL Financial had guaranteed $58m, or 79.5 percent, of the monies its Bahamian subsidiary

had advanced to another group entity, CLICO Enterprises, which subsequently defaulted on the loan repayments. Mr Gomez thus argued that CLICO (Bahamas) was a secured creditor of CL Financial. However, not a cent of the $110.827m has yet been received from Trinidad.

The timing and amount of any payout depends on CL Financial’s liquidators, and the Trinidad courts, and neither Mr Gomez nor anyone in The Bahamas has control of this. As a result, it could be months and even some years yet before all or part of this money is paid out and received in The Bahamas.

Bishop Hall told Tribune Business that he personally knows “of several families where the CLICO policyholder died and never received a cent” as he called on the Government, which is continuous even though administrations change, to live up to the commitment made by the last Christie administration that has carried through into its Minnis and Davis successors.

He argued that the Government shoulders an extra obligation to CLICO victims given that, through the then-Registrar of Insurance and other regulators, it had

the responsibility of protecting Bahamian citizens and their life savings/retirement investments from such corporate failures.

“Oh boy. That is very disappointing. That is very disappointing. That is so disappointing,” Bishop Hall replied, when informed by Tribune Business that no funds for further payouts have been allocated in the Government’s Budget. “It is the Government who allowed it to happen. They should have protected the policy holders. They should have protected the small man who invested his couple of dollars.

“I got most of my money. I didn’t get every cent but I feel bad for those that did not get anything. I got twothirds of my money back but what about the man down the street depending on it? The Government needs to do a better job of protecting Bahamian citizens from unscrupulous institutions.

“I can understand that it’s a tight Budget and there is a scarcity of funds. I can understand that, but I think the Government shares in this by not protecting the policy holders more than it did. It shouldn’t have happened. That’s how I feel. I think the Bahamian policy

holders should call on the Government to live up to its promise.”

Mr Wilson told Tribune Business in June 2023 that the Government had slowed down payouts to former policyholders because the Government is hoping to “shortly make a major announcement on CLICO”.

He declined to go into details at the time on the basis it would be premature to do so, but said: “I think we should be in a position to make a major announcement on CLICO shortly. I just want to be cautious and not move prematurely. That’s one of the reasons we’ve slowed down the payouts.” It is thought that Mr Wilson was referring to the settlement from CL Financial.

Bishop Hall, though, argued that many CLICO policyholders yet to be fully or partially compensated cannot wait on Trinidad.

“I know of several persons patiently waiting to get something out of CLICO,” he said. “I pray that the Government can find the money to keep that promise. And let’s pray that the money from Trinidad comes eventually.

“I know several families where the CLICO

policyholder has died and they never received a cent of their money. I get perturbed when institutions that have a licence to operate from the Government could rob the poor and bilk the weak. This what causes some people to look at socialism.”

Bishop Hall added that “just last week” he contacted his MP for South Beach, Bacchus Rolle, to inquire whether he knew what was happening with CLICO compensation as he himself continues to receive calls from other victims about the situation.

He also questioned why The Bahamas appears soft on corporate, or white-collar, crime, and suggested Bahamians are “too passive” when wronged. “The man on the street does all kinds of things; he steals, he murders and we come down hard on him, but what about corporate institutions that exploit people?”

Bishop Hall asked.

“I think we’re too passive. Other parts of the Caribbean have been agitating and protesting. We’re too passive. I think I go just five to six people to go with me to Bay Street some years ago when we were protesting over this.

“Bahamians tend to be too passive and laid back. Some of them cover up their laziness by saying God will protect me, but human beings need to do the work. God works through human instruments.”

Arguing that foreign investors should be made to set a portion of their resources aside in escrow, so as to compensate Bahamians when their ventures collapse and they flee the jurisdiction, Bishop Hall said of the present CLICO situation: “I don’t know how to feel about this but pray that Trinidad comes through with something and the Government can redeem itself.

“What about Angie down the road, Uncle Lou in Andros not getting anything? Let’s pray something happens. If it takes four to five more years we may not be there. It’s capitalism. Rugged capitalism can sometimes be un-Christian but that’s what we live with. Policyholders should have some recourse by which they recoup their savings.”

PAGE 6, Monday, June 3, 2024 THE TRIBUNE

FROM PAGE B1 ADVERTISE TODAY! CALL THE TRIBUNE TODAY @ 502-2394

OPPOSITION: $437M REVENUE INCREASE ‘DOES NOT ADD UP’

reported, was that at nine months we are behind in revenues. The numbers reported were that we are behind in VAT receipts.

“If we are behind in this year’s projections, and our economic growth next [fiscal] year is not to exceed this year’s economic growth, what makes us believe our revenues will exceed this year’s revenues? It does not add up. They have not explained it. The law requires them to explain it. The people deserve an explanation.

“Let us not listen to what they say but look at what the actual numbers report. The actual numbers do not report that we are going to make next year’s projections.” Mr Thompson, who served as minister of state for finance in the Minnis administration, argued that both the 2024-2025 forecasts and projections for the current fiscal year pose a threat to the Government’s credibility.

“It again boils down to the credibility of the Government; credibility with its people, credibility with its investors and credibility with the international community,” the east Grand Bahama MP added. “The Government does a disservice when it makes these statements and does not abide by these statements. The fiscal responsibility clauses were put in the law for a reason.

“The Government must not be credible just with its people but must be credible with investors and with the international community. They have, unfortunately, done away with our credibility.” Simon Wilson, the Ministry of Finance’s financial secretary, could not be reached for comment before press time last night.

However, Michael Halkitis, minister of economic affairs, last week dismissed such concerns and turned the tables on the Opposition. He accused Mr Thompson and FNM leader, Michael Pintard, of being proven wrong on every fiscal-related statement they have made and asserted that neither himself nor the Government “place any stock” in what the Opposition have to say.

Sometimes, though, the Budget communication is more notable for what it does not say rather than what it does. The Prime Minister last Wednesday touted the Government’s revenue performance while disclosing that it is projected to receive more than $900m in revenue during the 2023-2024 fiscal year’s final quarter to take the full 12-month outcome to $3.1bn.

That, though, is more than $200m below the $3.316bn target set in last year’s Budget despite revenue for the first nine months to end-March 2024 having risen by $112.4, or 5.4 percent, year-over-year.

And that revenue growth rate, as well as the 9 percent and 8 percent growth paces for current and yearend income unveiled by the Prime Minister, are also behind the 14 percent jump needed to hit 2024-2025’s goal. This newspaper also previously reported that VAT, which accounts for 43 percent of tax revenues, needed to grow 27 percent or $339m over the $1.252bn collected in 2022-2023 to hit this year’s target of $1.591bn.

Materials released with the Budget communication show that the Government was almost $600m behind the full-year $1.591bn target for VAT with just three months to go. And, for the upcoming 2024-2025 fiscal year, the Government will have to hit its $437m total revenue increase despite a year-over-year decline in VAT revenues - its main income source - compared to 2023-2024 projections.

The Davis administra tion is forecasting that it will earn $1.516bn in VAT during the 12 months to end-June 2025, which is a more than a $70m or 4.3 percent decline compared to this year’s $1.591bn fore cast. This decline, though is forecast to be more than offset by $100m year-overyear increases in ‘taxes on international trade and transactions’ and ‘taxes on the use and permission to use goods’.

Several observers, though, have questioned the divergence between increasing trade taxes (import duties) and declin ing VAT, arguing that both are consumption-based and should therefore being moving in the same direc tion. They also queried the higher revenue forecast given that economic growth in 2024-2025 is projected to be relatively flat and in the absence of any major reve nue-raising measures.

The Prime Minister last Wednesday said the esti mated $140m impact from levying the 15 percent cor porate income tax on an estimated 50 Bahamasdomiciled companies, which are part of multina tional groups generating more than 750m euros in annual turnover, will not be fully seen until the 20252026 fiscal year which is more than 12 months away.

“A draft of the legisla tion is expected to be tabled along with the 2024-2025 Budget,” the latest Fiscal Strategy Report said of the corporate income tax leg islation. “Early estimates of the additional revenue yield to be generated from this new tax is set at $140m. However, the medium-term forecasts do not include these amounts.”

The Fiscal Strategy Report added that the Davis administration believes a combination of economic growth, com bined with more rigorous tax enforcement and rev enue collection initiatives, will enable it to hit its 25 percent revenue-to-GDP target by 2025-2026 even though its projections do not include any potential earnings from blue carbon credits.

Mr Halkitis recently said there were sugges tions that the Government could earn $900m per year from monetising its sea grass and mangrove carbon sinks, but the report added: “Projections remain policy neutral for the anticipated positive contributions from the proposed commerciali sation of The Bahamas’ blue carbon credits and the implementation of the Qualified Domestic Mini mum Top-Up Tax.”

Meanwhile, the Prime Minister, in stating that there would be a “60.6 percent decrease in the deficit outturn from the previous fiscal year, 20222023”, effectively pegged the full-year deficit for the 12 months to end-June 2024 at $210.63m. This is at the top of the 1-1.5 percent of

THE TRIBUNE Monday, June 3, 2024, PAGE 7

GDP range given by the Government.

FROM PAGE B1

GN-3062-B

KWASI THOMPSON

PAGE 8, Monday, June 3, 2024 THE TRIBUNE GN-3042

A Chinese spacecraft lands on the moon’s far side to collect rocks in growing space rivalry with US

BEIJING Associatted Press

A CHINESE spacecraft landed on the far side of the moon Sunday to collect soil and rock samples that could provide insights into differences between the less-explored region and the better-known near side.

The landing module touched down at 6:23 a.m. Beijing time in a huge crater known as the South PoleAitken Basin, the China National Space Administration said. The mission is the sixth in the Chang'e moon exploration program, which is named after a Chinese moon goddess. It is the second designed to bring back samples, following the Chang'e 5, which did so from the near side in 2020.

The moon program is part of a growing rivalry with the U.S. — still the leader in space exploration — and others, including Japan and India. China has put its own space station in orbit and regularly sends crews there.

The emerging global power aims to put a person on the moon before 2030, which would make it the second nation after the United States to do so.

America is planning to land astronauts on the moon again — for the first time in more than 50 years — though NASA pushed the target date back to 2026 earlier this year.

U.S. efforts to use private-sector rockets to launch spacecraft have been repeatedly delayed.

NOTICE

NOTICE is hereby given that PHILIPPE MICKEL SAHNOUNE of P.O. Box CB13639, #576 Parrot Close, Serenity, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas and that any person who knows any reason whyregistration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 3rd day of June, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that DWIGHT GLEN KENNEDY of #27 Bishop Street, Nassau Village, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas and that any person who knows any reason whyregistration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 3rd day of June, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

Last-minute computer trouble nixed the planned launch of Boeing's first astronaut flight Saturday.

Earlier Saturday, a Japanese billionaire called off his plan to orbit the moon because of uncertainty over the development of a mega rocket by SpaceX. NASA is planning to use the rocket to send its astronauts to the moon. In China's current mission, the lander is to use a mechanical arm and a drill to gather up to 2 kilograms (4.4 pounds) of surface and underground material over about two days. An

module that is

moon. The container will be transferred to a

capsule that is due to return to Earth in the deserts of China's Inner Mongolia region about June 25.

THE TRIBUNE Monday, June 3, 2024, PAGE 9

atop the

take the

metal vacuum

another

ascender

lander will then

samples in a

container back to

orbiting the

re-entry

GN-3062-A

AVIATION ‘STABILITY’ THREAT OVER EXAM REQUIREMENT

to avoid any delays in your licensing process.”

In a likely response, or anticipation, to industry concerns and criticisms, the Civil Aviation Authority of The Bahamas has issued a six-page “frequent answers and questions” document which says pilots and others can re-take the exam up to four times should they fail the initial attempt.

As to what will happen to a pilot’s ability to be licensed and operate in The Bahamas if they fail all of these, the regulator added: “The Civil Aviation Authority of The Bahamas at their discretion will have the right to evaluate your ability to continue to hold an airman licence issued by The Bahamas and... may require further knowledge and skill testing to establish your fitness to hold such airman licence.”

Mr Gray, writing on behalf of BALPA, which represents Bahamasair’s pilots, told Mr Ferguson: “I am writing to you.... to express our concerns regarding the upcoming implementation of the new air law exam. While we understand and appreciate the need for regulatory updates to ensure the highest standards of aviation safety and compliance, we are deeply disappointed that the principal users of the aviation community have not been consulted during this process.

“The lack of consultation has resulted in several significant issues that we believe could negatively impact both pilots and aviation companies alike. One of our primary concerns is the inadequate preparation time and resources provided for the new exam.

“Unlike the FAA exams, which are accompanied by readily available study materials, instructional courses and a comprehensive bank of possible questions and answers, the new air law exam has left many pilots scrambling to prepare with insufficient resources. In some instances, individuals have had only a few weeks to prepare, which is far from adequate.”

Setting out BALPA’s concerns, Mr Gray wrote: “The current system essentially requires those taking the test to serve as both teacher and student, a situation that is neither practical nor fair. This is particularly concerning given the already lengthy validation process for new licences or type ratings, which can take up to four months.

“During this period, pilots often experience significant financial strain due to the lack of earnings, and taxpayers bear the burden of non-productivity costs in some instances. Introducing a new exam without proper preparation and support will only exacerbate these issues.

NOTICE is hereby given that CHIMITE FRANTZ POMPILUS of Fire Trail Road, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas and that any person who knows any reason whyregistration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 3rd day of June, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

“Furthermore, we are concerned about the potential delays in the validation process that the new exam could introduce. At the end of an upgrade training event, pilots already face a four-month waiting period. Adding the requirement to prepare for and pass a new air law exam could extend this period even further, creating additional financial and operational challenges for both pilots and aviation companies.

“It is important to note that many of our pilots have held licences issued by Bahamian authorities for over 30 years, and have operated safely and effectively without incident. The sudden implementation of this new exam, without proper consultation and preparation, risks undermining the stability and efficiency of our aviation community.”

One aviation source, speaking on condition of anonymity, told Tribune Business that pilots are currently waiting up to four months after they pass the relevant test for their licences and ratings to be upgraded “so they can fly”. They added that this has already led to pilot shortages, and there are fears that the new ‘air law’ exam and the inability to properly prepare could result in failures and exacerbate this.

“This is a huge, huge issue. It’s going to tremendously impact the

aviation industry until it is resolved,” the source said. “They say it’s all on the website, but all the annexes are not there and the training material is not on the [Civil Aviation of The Bahamas] website. What we have looks like a syllabus for someone to prepare a course, not a study guide. It’s a syllabus for a training facility and they expect you to figure it out.

“They’re making you the candidate, the teacher and student all in one. I don’t know of any lawyer who will take a law exam without being prepared. And it’s summer. Where are we going to get the time to study from? The biggest problem is that they’re asking you to sit this air law exam and are not giving you enough time. They said that this is one of the FAA audit findings.”

Tribune Business was told that the new ‘air law’ exam, and the associated concerns and fears of the potential consequences, are being widely discussed by Bahamian pilots in social media chat groups that have 130-plus members. This newspaper understands that taking legal action over the matter has been discussed.

“The general aviation pilots and private pilots are following behind the Association,” one contact added. Asked about possible legal action, they added: “I know that’s what they were

working towards. I don’t know how far that process got.” Paul Aranha, principal of Trans-Island Airways, told Tribune Business that while concerns over the $250 per exam fee and the time granted to prepare were exaggerated, the pilot and aviation community does have a legitimate concern over the quality of preparatory material provided by the Civil Aviation Authority of The Bahamas.

And, while backing the ‘air law’ exam concept in principle, he added that its implementation and execution by the regulator could have been better. “The problem with the exam is the guidance they’ve given is not overly extensive; it’s overly vague,” Mr Aranha told this newspaper.

“Typically, in most countries, you do not go and simply walk in and take an exam. There are practice exams or courses you take to help you.” In this case, he added that Civil Aviation Authority of The Bahamas has only provided pilots and the industry with an 88-page document that contains no details, seems only to list headline topics, and “is incredibly vague”.

“Everyone has a legitimate reason to be uncomfortable, but I think the premise is correct,” Mr Aranha said of the ‘air law’ exam. “I don’t think it’s unreasonable. I just don’t like the fact that when you go to take the test you don’t know what it looks like.

“We’re very much on the side that the test is good, or the basis of the test is good, but I think it’s challenging for people to take the test having no idea what the test looks like and properly prepare. Trans-Island Airways is confident all of its pilots are more than prepared to take the test but, for the industry as a whole, it would be better to have more practice material and guidance.

it’s line with other jurisdictions in aviation.”

However, Mr Gray, on behalf of BALPA, told Mr Ferguson: “In light of these concerns, we strongly urge you to delay the rollout date for the new air law exam. We believe it is crucial to engage with the principal users of the aviation community to ensure that any new regulations do not negatively impact the very individuals responsible for transporting passengers and cargo throughout our archipelago.

“By working together, we can develop a more effective and supportive implementation plan that upholds the highest standards of aviation safety and compliance without placing undue burdens on our pilots and aviation companies.... We are optimistic that through open dialogue and collaboration, we can address these concerns and achieve a positive outcome for all stakeholders involved.”

The Civil Aviation Authority of The Bahamas, in anticipating industry questions, said:

“Unfortunately, no, there are no sample exams.” It did detail the type of questions that will be asked, but directed pilots and air crew to the 88-page syllabusalready deemed inadequate by the industry - for guidance on the nature of the questions and their content. Failure to take the exam will result in licence revocation or suspension.

“Pilots must have a thorough understanding of aviation law to operate aircraft safely, comply with regulations and ensure legal compliance during flights,” the Civil Aviation Authority of The Bahamas said of the justification for the exam.

“I support the premise of the test, and am confident our pilots are ready to take it, but we are understanding that some people have their hesitations about it and we feel that it would have been better if there had been more material and practice tests as found in other jurisdictions but feel confident

“The examination will not necessarily improve your flying skills, but it will improve your knowledge of aviation in The Bahamas and will make you a more proficient and efficient airman in terms of requirements, obligations and rights you as an airman have when operating in The Bahamas.”

NOTICE

NOTICE is hereby given that RENALDO CARLES GEORGES of Jerome Avenue, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas and that any person who knows any reason whyregistration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 3rd day of June, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that DENICHA PETIT-HOMME of Marsh Harbour, Abaco, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas and that any person who knows any reason whyregistration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 27th day of May, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

Citizenship, for registration/ naturalization as a citizen of The Bahamas and that any person who knows any reason whyregistration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 27th day of May, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

PAGE 10, Monday, June 3, 2024 THE TRIBUNE

FROM PAGE B1 NOTICE is hereby given that YVES PHILOGENÉ of P. O. Box N-1048, #6 Lincoln Blvd., New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas and that any person who knows any reason whyregistration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 3rd day of June, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE is hereby given that DIEUMENE SALOMON DORLEAN PIERRE-JEAN of Catto Street, New Providence, The Bahamas is applying to the Minister responsible for Nationality and

NOTICE

NOTICE

NOTICE

THE TRIBUNE Monday, June 3, 2024, PAGE 11

FORUM’S FOCUS TO BUILD SUSTAINABLE ECONOMY

THE third annual Forum for Impact (FFI) conference, held last week in Grand Bahama, focused on building sustainable tourism, financing innovation and the Caribbean’s blue economy.

Under the theme ‘Building for the future in the Blue Economy’, the group of international investors hosted stakeholders and executives working in the climate and blue economy space to discuss key issues and opportunities that are emerging within the sectors.

James Farrah, Six Senses’ head of development for the Americas, said: “Six Senses is very proud about our planned project in Grand Bahama, and the Forum for Impact was a great opportunity to spend time with those who share our values on sustainable investing.

“Interest in our discussion shows the local community really cares about projects on the island.

I truly enjoyed my time this week and can’t wait to come back to Grand Bahama.”

Madhvi Shukla, development manager for Weller Development Partners, emphasised the positive impact more sustainable development will have on the region.

“Sustainable tourism is bridging the gap between travellers looking for authentic experiences and investors who want to make long-term meaningful social impact,” Ms Shukla said, addressing the opening of FFI.

“Both communities are realising the value in preserving destinations and cultures, ensuring enriching experiences for all, while recognising the importance of securing future travel through responsible stewardship of our

planet’s natural and cultural resources.”

Weller’s Six Senses Resort development for Grand Bahama is on schedule for a 2026 opening.

The three-day FFI forum was held at various locations throughout Grand Bahama, including Pelican Bay Resort, Garden of the Groves, WASUM Medical School and Coral Vita.

Speaking to the Davis administration’s focus on supporting and developing The Bahamas’ blue economy, Michael Halkitis, minister of economic affairs, said: “The blue economy is important because so much of our economy is built on tourism.

“Tourism’s success is dependent on our marine environment. Our coastline and white sand beaches are the prime real estate of our islands. Our mangroves and coral reefs serve as nurseries and habitats for the many marine species that feed us and provide the world’s best snorkelling and diving experiences.”

Forum for Impact cofounder, Michael Mehaan, said: “Historically, it’s been bringing investors to the region to highlight what The Bahamas is doing. In the future, we’re trying to bring The Bahamas to some of these other places, like Europe, London, Vienna, to kind of highlight all the great things that are happening here.

“The purpose is to really engage the unengaged in impact and promote economic development in the regions of which we operate.” Mr Farrah added: “This really drives it home for investors; that there’s a big difference between sustainable and unsustainable investment, and how that promotes economic development in our economy and creates jobs for the region.

“So, this is the idea - we want to focus on sustainable jobs, sustainable business and sustainability.”

THE TRIBUNE Monday, June 3, 2024, PAGE 13

ATTENDEES

the

at

Forum for Impact participate in a panel discussion during opening sessions of the three-day forum.

Photo:Alfred Anderson/Barefoot Marketing

MADHVI SHUKLA, development manager for Weller Development Partners, speaks during the opening session of Forum for Impact on Grand Bahama.

ADVERTISE TODAY! CALL THE TRIBUNE TODAY @ 502-2394

L to R: Forum for Impact co-founder, Michael Mehaan; Madhvi Shukla, development manager for Weller Development Partners; Michael Halkitis, minister of economic affairs; James Farrah, Six Senses head of development for the Americas.