‘Pressure cooker’ race to meet audit deadlines

By NEIL HARTNELL and FAY SIMMONS Tribune Business Reporters

BAHAMIAN accountants and many companies were yesterday said to be caught in “a pressure cooker environment” as they race to meet imminent Business Licence and regulatory audit deadlines.

Pretino P. Albury, the Bahamas Institute of Chartered Accountants (BICA) president, in a written response to Tribune Business inquiries said the profession is “overworked and stretched thin” as it bids to meet the June 30 target for large companies who gained an extension for their Business Licence audited financials as well as deadlines imposed

By NEIL HARTNELL

Business Editor

NASSAU’S main commercial shipping port says the “serious” challenge created by deteriorating harbour breakwaters may not be tackled until end-2024 at earliest as the Government ramps up Budget funding.

Dion Bethell, Arawak Port Development Company’s (APD) president and chief financial officer, told Tribune Business in a series of written answers that it had been informed by the Government that repairs are unlikely to begin before this year’s fourth quarter or early 2025 amid plans to access the necessary financing via

by the likes of the Central Bank and Securities Commission.

Describing accountants and their corporate clients as being “in a race against time” to escape the possibility of Department of Inland Revenue (DIR) fines, he added that there remains “a call for understanding and flexibility” from the tax authorities regarding the submission of audited

an Inter-American Development Bank (IDB) loan.

“The Government of The Bahamas has indicated their commitment to the repairs of the breakwater through a loan from the IDB,” he confirmed. “In our most recent communication on this matter we have been advised that work may not get underway until the 2024 fourth quarter or 2025 first quarter.

“We remain hopeful. As global warming and climate changes continue to rise the problem remains serious as we continue to experience adverse conditions in our channel related to an improperlyfunctioning break water system.”

The Government, in its 2024-2025 Budget, has

financials for companies with annual turnovers exceeding $5m.

However, John Williams, the Department of Inland Revenue’s communications chief, yesterday told this newspaper that - while a few companies have requested and been granted extensions - for the most part $5m-plus turnover businesses have been doing “very

signalled that it plans to invest $17m over the next two years in improving Nassau harbour’s defences against adverse weather such as hurricanes and the fall-out from climate change.

Some $12m, of which $5m is due to be spend in the upcoming fiscal year, has been allocated to “construction of breakwaters at Junkanoo Beach

well” in supplying audited financials on time. He encouraged firms that require an extension to reach out to the agency and ensure they are in compliance and can receive their Business Licences. Mr Williams said: “There have been a few persons requesting extensions simply because, maybe, they were not able to get the proper access or getting used to the new system or just unable to log in.

“But they have been actually doing very well with regard to that, too. We want more to come in, you know, because at the end of the day we want everybody to be compliant and do everything that they have to do but, as I said, everything is flowing quite well on the Business Licence side.”

Long Wharf”. And a further $5m, of which $2m is earmarked to be spent in the 2024-2025 fiscal year, is dedicated to funding “nearshore works at Junkanoo Beach Long Wharf”.

BISX-listed APD last year warned that repairs to Nassau harbour’s breakwaters were becoming

Controversial contracts gain $6.75m financing

By NEIL HARTNELL

THE Government will spend a combined $6.75m in the upcoming 2024-2025 fiscal year on two maritime contracts that are central to a whistleblower’s lawsuit and have drawn Opposition scrutiny. Data released with last week’s Budget presentation reveals that the Davis administration is allocating $3.15m to complete the

“online portal to enhance revenue collection at the Port Department” plus $3.6m, the first in a series of ongoing annual payments involving the same sum, for “maintenance and upkeep of navigation aids for the Port Department”. Both contract awards, said to have been made in early 2023, are seemingly only being financed to a large extent for the first time in the 2024-2025 Budget - more than an entire fiscal year later. The

online portal contract, which was awarded to DigieSoft Technologies, is given a project start date of March 1, 2024, and was forecast to cost $3.355m.

However, the Budget details released last week show some $590,000 in “cumulative expenditure” as having been incurred. This is understood to be the anticipated outlay, or spend, on the online portal contract during the final

Tourism arrivals up 12.4% despite April stopover fall

HIGHER spending air

visitors declined narrowly in April likely due to the peak Easter holiday weekend falling at end-March, it was revealed yesterday, as total arrivals year-to-date jumped 12.4 percent.

The Central Bank, unveiling its monthly economic developments report for April, disclosed that The Bahamas received

a total 3.9m visitors during the first four months of 2024 led largely by the volume-driven cruise industry. Higher-yielding stopover visitors, who typically spend 28 times’ more in-country than their cruise counterparts, were said to have “held steady” at 700,000 arrivals for the period.

“Initial data revealed that the tourism sector continued to register healthy gains during the review month. This reflected

expected expenditure paced strength in the highvalue added air segment and expanded volume in the sea component, due to sustained demand for travel in key source markets and ongoing marketing efforts,” the Central Bank said.

“Official figures provided by the Ministry of Tourism indicated that total visitor arrivals rose to 910,000 in April compared to 870,000 a year earlier. The dominant sea segment

firmed to 750,000 visitors from 690,000 passengers in the comparative 2023 period. However, the high value-added air component edged down to 160,000 visitors from 170,000 in the prior year.

“A disaggregation by major port of entry showed that total arrivals to New Providence expanded by 10.4 percent to 400,000 visitors. Underlying this development, sea

‘So bureaucratic’: Registered agents caught up in VAT evasion crackdown

By NEIL HARTNELL Tribune Business Editor

BAHAMIAN registered agents and offices must starting this year submit annual declarations on all their corporate clients’ real estate deals and holdings as part of a crackdown on VAT evasion. Attorneys and financial services executives yesterday voiced alarm over planned reforms to the VAT Act that they argue are “so bureaucratic”, will “overly burden” registered agents given their existing regulatory obligations, and effectively amount to government agencies “abdicating their responsibilities”. They spoke out when approached by Tribune Business over previously little-noticed legal changes that were tabled with last week’s Budget, which mandate that - starting in 2024 - law firms, financial and corporate services providers and all others acting as registered agents must submit an annual “real

property declaration” on all their corporate clients. This declaration must be submitted regardless of whether they are Companies Act entities or International Business Companies (IBCs), according to the VAT (Amendment) Bill 2024. The reforms are designed to tighten the regulatory net and prevent the evasion/avoidance of VAT due on high-end real estate sales worth over $1m - a revenue stream that the Prime Minister last week said has under-performed. The “real property declaration”, which will be legally required through inserting a new section 47B into the VAT Act, mandates that all corporate entities must notify their registered agent within 15 days of a real estate transaction closing regardless of whether they are buyer or seller.

Then the registered agent, or the Registrar General if a company has no such agent, must “submit a declaration” to

business@tribunemedia.net TUESDAY, JUNE 4, 2024

But, according to Mr Albury, the accounting profession and its corporate clients are feeling the strain. And, when it comes to the latter, this is not confined

Tribune Business Editor nhartnell@tribunemedia.net

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net SEE PAGE B4 SEE PAGE B3

nhartnell@tribunemedia.net SEE PAGE B4

‘serious’ Nassau

Port’s

harbour concern eyes year-end repairs

Tribune

nhartnell@tribunemedia.net SEE PAGE B5

SEE PAGE B5

P. ALBURY $5.90 $5.91 $5.74 $5.74

MICHAEL PINTARD

PRETINO

SCOTIABANK TO ‘PRIORITISE’ ELECTRONIC BANKING DRIVE

SCOTIABANK’S top Bahamas executive says it will continue to “prioritise” its digital financial services drive as part of a fourpronged strategy aligned with its global parent’s vision.

Roger Archer, Scotiabank Bahamas’ managing director, said the 67 yearold bank’s strategy includes making it easier for clients to do business with it, strengthening staff skills and delivering sustainable, profitable revenue growth. This comes after the bank’s 2023 profits hit their highest level in a decade, aided by both asset and deposit growth, coupled with improved efficiency and credit quality.

The new strategic focus stems from Scotiabank’s new global strategy, which was presented to local executives by the bank’s recently-appointed global chief executive, Scott Thomson, during his recent visit to the Caribbean.

“We will continue to prioritise digital transformation to support the evolving needs of our clients,” said Mr Archer.

He added that the bank’s investment in digital platforms and technology has paid off, with more than

79,000 Bahamian clients enrolled in online and mobile banking. Some 99 percent of total transactions are now conducted using electronic and digital channels.

“We are investing in digital platforms and technology to enhance the banking experience for our clients. We have upgraded our entire fleet of ABMs (automated banking machines) across the network, which include the deployment of 33 Intelligent Deposit machines (IDMs) at all branch locations, and introduced a secondary drive-through IDM at our recently renovated Wulff and Jerome sales centre,” Mr Archer said.

“Our transition to IDMs has modernised the local banking convenience and accessibility, and clients have been providing us with positive feedback as we continue to enhance our offerings in this regard.”

Mr Archer said Scotiabank’s new digital collaboration tool, Scotia Access, will transform the way some clients interact with the Bank. It allows customers to communicate with their assigned

relationship officer through the Scotia Mobile app.

Scotiabank Bahamas will also continue its focus on community development and employee welfare. Its initiatives include hosting financial education seminars, supporting environmental preservation efforts and promoting diversity and inclusion.

“We recognise the importance of investing in the Bahamian people and fostering a culture of inclusivity. Our efforts extend beyond banking to supporting education, environmental conservation and social welfare,” added Mr Archer.

“Our strategic focus on innovation, service excellence and community impact has positioned us for sustainable growth. As we navigate the future, we remain dedicated to exceeding client expectations, driving economic resilience and making a positive impact on society.”

RF Group’s Caribbean private credit link-up

A BAHAMIAN-headquartered investment house has been named as a Caribbean distribution partner for eCapital Corp, a finance company that focuses on supplying private credit to small and medium-sized firms.

RF Group, which operates as RF Bank & Trust in The Bahamas, said the partnership with the technology-driven specialist finance provider will help to provide quality investment opportunities and empower

investors across The Bahamas and wider region.

Founded in 2006, eCapital focuses on offering working capital solutions to small and medium-sized businesses in the US, UK and Canada. With thousands of clients financed through factoring (accounts receivables) and assetbased lending facilities, eCapital is said to offer a proprietary fintech (financial technology) platform designed to accelerate companies’ access to capital.

“We are excited about the opportunity to introduce eCapital’s private credit investment opportunities to the Caribbean market,” said Michael Anderson, RF Group’s president. “This partnership aligns perfectly with our goal to offer new and quality investment avenues to our clients, enabling them to diversify their investments and build their wealth.”

Factoring and assetbased lending play aid business growth by providing immediate access to cash while mitigating credit risks. RF Group said eCapital offers investors exposure to private credit, uncorrelated returns to the broader market and diversification benefits compared to traditional fixed income investments.

“Our team is proud to partner with RF Group,”

said Marius

chief executive of eCapital. “This collaboration highlights our unwavering commitment to expanding our reach and providing exceptional investment opportunities. Together, we are ready to leverage our expertise and resources to empower investors and drive financial success in the Caribbean and beyond.”

Eleuthera project honours 40 founding home buyers

AN Eleuthera-based resort community has honoured its founding members during a recent weekend-long event held in Palm Beach, Florida, from May 17-19.

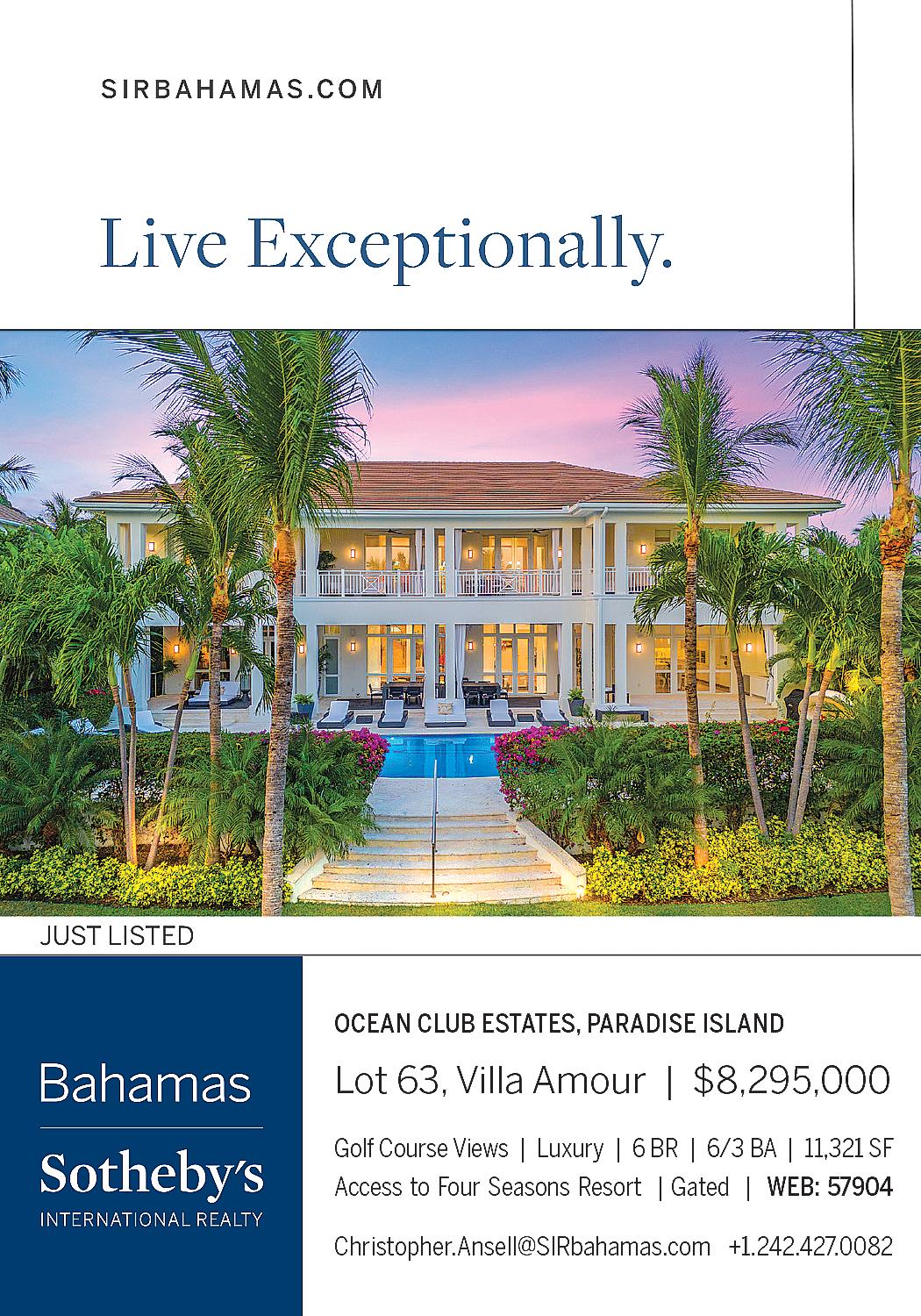

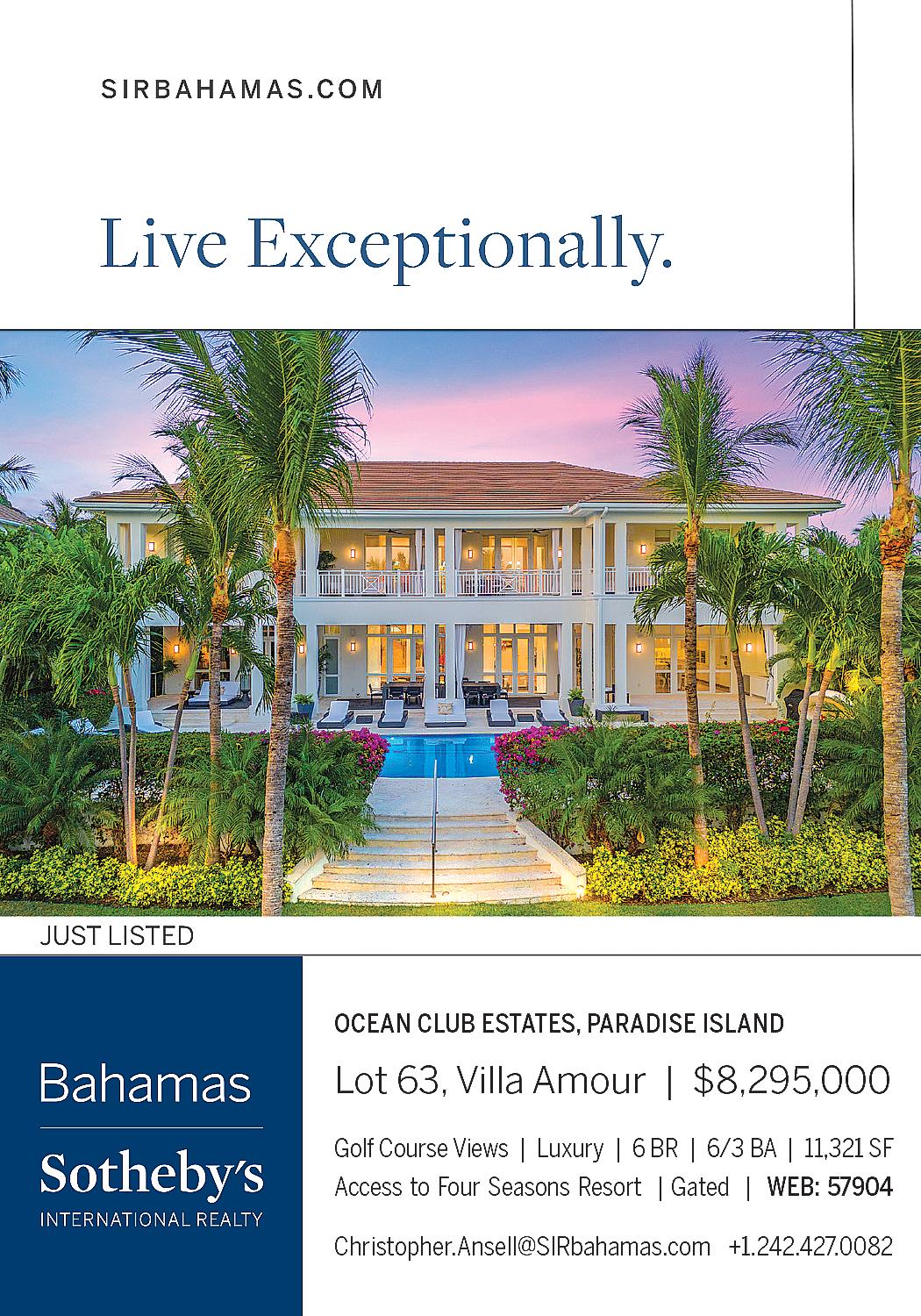

Jack’s Bay, the 1,200acre club and residential community currently under development, said it celebrated the group who purchased the first beachfront and ocean view homesites at the property, which were priced from $1.5m to $3m and sold out in just a few months.

Guests from IMI Worldwide Properties, Jack’s Bay, Nicklaus Design and the 40 founding members gathered at The Ben Hotel for a welcome dinner, golf, shopping, a boat excursion, and an evening at the residence of Mike Collins, founding partner and chief executive of IMI.

Others in attendance included Sir Franklyn Wilson and Lady Sharon Wilson; Brett and Amy Quigley; Claude and Deborah Lemieux; Andy and Wendy O’Brien; Chad and Ashleigh Goetz; Tommy and Shawn Turnquest; Doug and Kathi Maslo; Robi and Kajal Das; Blue Crump; Scott and Lynn Ziegler; John and Lisa Unger; Pat and Candy Cerjan; and Jonas and Maura Mikals.

“We hosted this celebration to demonstrate our gratitude to the founding

members who are investing in the future of Jack’s Bay and South Eleuthera,” said Tommy Turnquest, Jack’s Bay’s chief executive.

“We wanted to provide owners with a real, tactile sense of what’s to come and a sense of the lifestyle they will enjoy at Jack’s Bay. From golf to dining, entertainment to boating, we covered it all last weekend. The team is looking forward to welcoming our first residents this fall and continuing our sales process with the newly-introduced 2024 residential collection.”

That features 12 Atlantic Club Cottages and the first phase of the Nicklaus Village Residences, both designed by RAD Architecture, and 24 residences around the Tiger Woods Playground golf course.

Buyers will be able to choose between four-bedroom or six-bedroom fully furnished Atlantic Club Cottages, which range from

2,264 to 4,202 square feet in size. The four-bedroom cottages will start at a price just under $3m, and the six-bedroom cottages under $4m. These 12 cottages surround the Atlantic Clubhouse and each feature a covered outdoor terrace and pool. The first phase of the 24 twobedroom, three-bedroom and four-bedroom residences adjacent to the Tiger Woods Playground course will launch in fall 2024. The first phase at Jack’s Bay is scheduled for completion in late 2024, including the Atlantic

the 24 residences adjacent to the Tiger Woods Playground course.

PAGE 2, Tuesday, June 4, 2024 THE TRIBUNE

Silvasan,

Clubhouse and pool, Spa Village, four of the Atlantic Club Cottages, and groundbreaking on the Nicklaus Village and

LEADERS from Scotiabank’s English Caribbean region on stage during a global strategy summit hosted by Scott Thomson, Scotiabank’s global chief executive.

L to R: Scotiabank Bahamas executives Roger Archer, managing director; Na-amah Barker, director of retail banking; and Greg Stuart, director, corporate and commercial banking, share a photo with Scott Thomson (second left), the bank’s global chief executive, during his recent visit to the Caribbean.

MICHAEL ANDERSON

FROM L to R: Mike Collins and Tommy Turnquest Lady Sharon Wilson and Sir Franklyn Wilson.

BTC: ELEUTHERA SABOTAGE WAS AN ‘EXTORTION’ ATTEMPT

THE Bahamas Telecommunications Company (BTC) yesterday asserted that its fibre optic cables serving Eleuthera were deliberately cut in a bid to extort money from it over a land dispute.

The carrier, in a statement, said it expected all mobile, TV, Internet and fixed-line voice services in impacted areas across Eleuthera to be restored within the next 24 hours after they were severed last Thursday by what it alleges is an act of sabotage.

Stephen Coakley-Wells, BTC’s director of legal and government affairs, and corporate secretary, said the near five-day service disruption stems from a dispute as to who owns the property where BTC’s fibre optic cable infrastructure makes landfall in Eleuthera.

The property in question is located close to the island’s iconic Glass Window Bridge, but Mr Coakley-Wells said a person - who he did not identify - had recently claimed that they own this land and are demanding that BTC pay them compensation for its use.

BTC said this person had failed on multiple occasions to provide it with documents

STEPHEN COAKLEY-WELLS

STEPHEN COAKLEY-WELLS

proving their ownership of the land but, within the past month, supplied copies of a purported Crown Land grant dated May 3, 2024. They are now said to be demanding compensation from BTC for past use of the land, even though the Crown grant - if valid - only confirms they have ownership and legal title for just a month.

BTC said this person had frequently threatened to cut its fibre optic cables unless monies were paid, adding that it was “reliably informed” this threat was carried out last Thursday.

“For decades, the landing point of BTC’s sub-sea fibre optics cable has been on a

property in North Eleuthera in the vicinity of the Glass Window Bridge,” Mr Coakley-Wells said.

“Recently, an individual claiming to be the owner of this property has demanded compensation from BTC for the use of the property. In multiple discussions with this individual, BTC requested evidence of ownership of the land, which the individual was unable to produce.

“The individual has now provided BTC with photographic copies of what purports to be a Crown grant of the property dated May 3, 2024, and is now demanding immediate payment for the prior years that the equipment has been on the property from BTC, despite the fact that the individual’s ownership of the land by virtue of a Crown grant, if valid, only arises from the date that the Crown grant was issued.”

Mr Coakley-Wells continued: “In an attempt to extort compensation from BTC, the individual has repeatedly threatened to willfully and intentionally sever BTC’s fibre optics cable on the property. BTC is reliably informed that the individual carried out this threat

last Thursday, interrupting BTC’s service in North Eleuthera and surrounding areas.

“We appreciate the public’s patience and understanding as we work to swiftly resolve this unacceptable disruption caused by the individual’s actions.”

And BTC is seemingly not the only carrier impacted, as Cable Bahamas revealed that its TV, Internet and fixed-line voice services to south Eleuthera, as well as Aliv’s mobile offering, had been disrupted by what it described as “sabotage”.

While it did not explicitly say so, the BISX-listed communications provider appeared to be referring to the same incident as BTC. Both carriers share network facilities and infrastructure to help maximise efficiencies, and reduce costs, in delivering services to consumers, and fibre optic cables are often included in these deals.

“Cable Bahamas wishes to inform the public of an ongoing service disruption affecting our valued customers in southern Eleuthera, particularly areas south of the Glass Window Bridge. Our preliminary assessment indicates that this

unfortunate incident may be a result of sabotage,” Cable Bahamas said in a statement yesterday.

“We have promptly engaged local law enforcement and security agencies to investigate this matter thoroughly. Security measures have been escalated across our network to prevent further incidents, ensuring the integrity and reliability of our services.

“Our technical teams are on the ground in Eleuthera, working diligently to restore connectivity. We have deployed additional resources, including emergency response units and technical specialists, to expedite repair works. We are making every effort to minimise downtime and expect to resume full services as quickly as possible,” it added.

“Cable Bahamas understands the critical importance of our services to residents, businesses,and emergency services. We deeply regret the inconvenience caused and are committed to restoring reliable communications to the community of Eleuthera.”

Mr Coakley-Wells, speaking on behalf of BTC, said:

Gov’t launches voluntary tax compliance initiative

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemdia.net

THE Ministry of Finance yesterday launched a weeklong exercise to assist companies in becoming voluntarily complaint with the taxes and fees owed to various government agencies.

Commander Bertram Bowleg, chairman of the Government’s Maritime Revenue Enhancement Task Force, said the move will serve as an educational exercise and offer assistance to business owners who are not complaint with agencies such as the Department of Inland Revenue, Bahamas Customs, the National Insurance Board (NIB) and the Port Department.

He explained: “The exercise is geared towards educating business operators in regards to operating a legitimate business. We have business operators who are operating. However, some of them have a step that is missing.

“Either they are not paying NIB for themselves or not paying NIB for their clients. Their Business Licence expired for a

couple of years and they can’t get it because they’re not paying Customs duties or not paying NIB.

“So, we are bringing all the agencies together to ensure if you have a problem with NIB, Inland Revenue, Customs or Immigration you can see them and, before you leave the exercise, we can get your problem solved 80- 90 percent.”

Commander Bowleg said that, after this initiative closes, his unit will begin door-to-door visits to ensure companies pay outstanding fees or expired Business Licenses or risk facing penalties, legal action or the threat of being shut down.

He said: “Just like we do in the Family Islands we are going to hit the street and we come to every business. We knock on your door and come with all the organisations. So if we come to your business and you are not up-to-date with NIB or Inland Revenue, we give you a chance to pay that right there.

“We are doing the voluntary exercise because, when we come to your door, we have already given you the chance to come in

TOURISM ARRIVALS UP 12.4% DESPITE APRIL STOPOVER FALL

FROM PAGE B1

passengers grew by 18.5 percent to 300,000. However, air traffic declined by 7 percent to 100,000 from a year earlier,” the regulator continued.

“Further, total arrivals to Grand Bahama rose by 1.5 percent to 47,108 relative to the previous year. Contributing to this outturn, arrivals by sea grew by 2.3 percent to 42,015 compared to 2023. Conversely, air traffic decline by 4.4 percent to 5,093 vis- à-vis the same period last year.

“Providing some offset, total arrivals to the Family Islands decreased slightly by 0.4 percent to 400,000 vis-à- vis the preceding year as sea and air passengers measured 377,190 and 33,931 respectively.”

Assessing tourism’s strength for the first four months of 2024, the Central Bank added: “On a yearto-date basis, total arrivals strengthened by 12.4 percent to 3.9m visitors relative to the comparable 2023 period. Sea arrivals rose by 14.4 percent to 3.3m while air traffic held steady at 700,000.

“The most recent statistics provided by the Nassau Airport Development Company (NAD) indicated that total departures in Aprilnet of domestic passengers - also decreased by 0.3 percent to 151,591 vis-à- vis the comparable 2023 period.

“Specifically, non-US departures declined by 9.8 percent to 20,026. However, US departures grew marginally by 1.3 percent to

131,565. On a year-to-date basis, total outbound traffic advanced by 8 percent to 596,086 on account of a rise in both US departures by 9 percent to 509,279, and non-US departures by 2.1 percent to 86,807,” the regulator said.

“In the short-term vacation rental market, data provided by AirDNA showed that in April total room nights sold declined by 5.5 percent to 53,588 when compared to the same period last year. Correspondingly, the occupancy rate for entire place listings reduced to 47.9 percent from 56.4 percent a year earlier, while the occupancy rate for hotel comparable listings decreased to 45.8 percent from 53.5 percent in 2023.

“Meanwhile, price indicators revealed that the average daily room rate (ADR) for both entire place and hotel comparable listings moved higher by 3.8 percent and by 5.5 percent to $692.54 and $197.02, respectively.”

The Central Bank added that average consumer price inflation, a measured by the All Bahamas Retail Price Index, was slashed by more than half for February 2024 as it came in at 2.5 percent compared to the prior year’s 5.8 percent. It also left its economic outlook largely unchanged from that of previous months.

“The domestic economy is expected to expand at a moderated pace in 2024, bolstered by ongoing gains in the tourism

and you didn’t, so then you will probably get served and have to go to court. So I implore the Bahamian people to take advantage of this because if they don’t, and we come to your door and your fees are not upto-date or your Business Licence is expired, you will get shut down.”

Commander Bowleg explained that his unit has already conducted this exercise on five Family Islands and will continue to educate businesses before conducting door-to-door visits.

He said: “We have been going to all the islands and there are some loopholes. People are saying ‘oh, I didn’t know that I supposed to pay this or do that’. So after doing five islands we decided to go to New Providence and do an educational exercise before we actually go out into the field and actually knock on the door of your business and ensure you are compliant.

“So this is a voluntary compliance so that business can come in and, whatever area they are not compliant in, we can help you get there.” Commander Bowleg said many selfemployed persons either

industry and other areas of the real sector,” the Central Bank said.

“In addition, new and ongoing foreign investment projects are anticipated to provide support to the construction sector and aid economic growth. However, downside risks to tourism remain, predominantly related to exogenous factors such as geopolitical tensions and heightened global oil prices, which could disrupt travel sector activity....

“With regard to the labour market, employment conditions are expected to continue to improve with additional job gains primarily in the construction and tourism sectors.

In terms of prices, inflation is projected to maintain its downward trajectory, as global oil prices taper off” even though global oil price uncertainty, supply chain shocks and the wars in Ukraine and the Middle East remain risks.

“Nevertheless, the environment should encourage a rise in lending to the private sector. Further, external reserves are forecasted to remain robust for the rest of year, although a modest reduction is likely, given the anticipated growth in domestic credit,” the Central Bank said.

“Nonetheless, external balances should remain more than sufficient to maintain the Bahamian dollar currency peg, while foreign exchange market conditions are projected to stay at healthy levels supported by tourism inflows and other private sector activities.”

do not pay NIB contributions for themselves or have incorrectly listed themselves as an employee and not the owner.

He added that there is no statute of limitations on government arrears, and persons who are behind on their NIB contributions can obtain their balance and be placed on a monthly payment plan.

Commander Bowleg said: “A lot of issues we have with self-employed persons is they sometimes don’t pay their own NIB, or they pay NIB but they have themselves registered as an employee and not an owner.

“Businesses can get a payment plan. We have been discovering persons who have not been paying their contributions for up to five years. When you come in NIB will tell you what your entire bill is and they will give you a payment plan. There’s no statute of limitation on government revenue, so you have to still pay it, but they can put you on a payment plan that you can handle every month.”

Commander Bowleg added that some businesses have been unable to get their Business Licences renewed as they collect their goods from Bahamas Customs with a promissory note and did not pay,

“We estimate that all landline, mobile and television services will be fully restored across impacted areas within the next 24 hours....

“We remind the public that it is unlawful and a punishable offence to intentionally damage or destroy essential telecommunications equipment. Such acts pose a serious national security risk to the country by disrupting vital communications.

“BTC maintains a number of contractual arrangements with property owners pertaining to the use of private land to secure critical BTC’s equipment on every single island in the country. BTC is well aware of its responsibility to adequately compensate these property owners for the use of their property, and complies with its contractual and regulatory obligations,” he added.

“BTC remains committed to providing reliable telecommunications services across The Bahamas and continues to engage diligently with all relevant stakeholders to prevent future attempts to sabotage BTC’s equipment.”

leading to them not obtaining a Tax Compliance Certificate (TCC). He said: “Businesses have been bringing stuff in and Customs have been releasing it on a promissory note. Then the Customs duty is not paid. So we tried to educate them on this because, if you get a promissory note, you have to still pay those bills. If you don’t pay your duty you won’t get your TCC so you can’t get your Business Licence. “We are trying to make sure they follow every step so, when the Task Force comes to your organisation or business, all the boxes are ticked and you are good to go.”

THE TRIBUNE Tuesday, June 4, 2024, PAGE 3

‘SO BUREAUCRATIC’: REGISTERED AGENTS CAUGHT UP IN VAT EVASION CRACKDOWN

the VAT comptroller by December 31 every year on all their corporate clients’ real estate dealings over the previous 12 months.

“The declaration shall include whether or not the company holds or has sold, transferred, assigned or otherwise disposed of an interest in any real property over the last 12 months,” the Bill stipulates. The declaration must also include “the nature of the company’s interest in, and other particulars as prescribed by the comptroller of all real property” bought and sold that year.

And, finally, the “declaration” must also supply “particulars as prescribed by the comptroller of all changes in the legal or beneficial interest of any of the shares” in domestic companies or IBCs over the prior 12 months. This appears designed to prevent persons evading VAT on real estate sales by transferring the subject property’s ownership to a company, then

selling the latter’s shares to the purchaser. The Government has for more than two decades sought to plug such loopholes, but Michael Halkitis, minister of economic affairs, last week said it suspected that wealthy home buyers and their advisers are using sophisticated company structures, including the “layering” of trusts and entities domiciled in other jurisdictions, to avoid paying tax on multimillion dollar properties. The Prime Minister, in his Budget communication, revealed that the Government had at end-March 2024 received just $15.1m of its $190.3m full-year target for VAT levied on real estate deals worth $1m and over. The initial figure amounted to just 8 percent of the total, and Philip Davis KC said it was inconsistent with the volume of permanent residency and international persons landholding permits being issued.

Reaction to the “real property declaration”,

which places the regulatory burden and compliance burden on law firms, financial and corporate services providers and others who act as registered agents, was decidedly mixed. One attorney said the move “narrows the margin” to a land registry and system of registered land, which would solve the Government’s concern by acting as a one-stop shop deal repository.

“Wow,” exclaimed Thomas Dean, attorney and partner at the Dupuch & Turnquest law firm, when told of the reforms. “It’s going to be an extra cost for the client and going to be extra work for the attorney, but in any event if the carriage of the transaction is done as it’s supposed to be done those documents will be filed in time anyhow.

“That eliminates the loophole of attorneys and their client purchasers holding documents that are not necessarily stamped. It’s a move, but another financial responsibility that the client has to bear. That means for every company

that holds land, every year you are going to submit a declaration of real property. It seems like it’s across the board.

“It’s narrowing the margin of not having a registered land system and a land registry. This is geared towards the collection of taxes. It would be easier if they had a registered land system. That alone would let you know where we are. Once again it’s turning the registered agent or registered office into a government reporter, auditor and collection agent.”

Paul Moss, president of Dominion Management Services, which also acts as a registered agent, described the proposed reforms as unnecessary and a further impediment to The Bahamas’ ease of doing business as he called on the Bahamas Financial Services Board to “object” to the real property “declaration”.

“That is so bureaucratic. It’s nonsense. It’s foolishness,” he told Tribune Business. “Ninety-nine point nine (99.9) percent

CONTROVERSIAL CONTRACTS GAIN $6.75M FINANCING

three months of the present 2023-2034 Budget year, which would take the total spend to $3.74m and imply a slight cost overrun as no funding has been allocated beyond 2024-2025.

Meanwhile, the contract for the maintenance of navigational aids in Nassau and other harbours, which was awarded to Adolpha Maritime Group, is shown as having a start date of January 23, 2023, although there is no indication that any funding has been provided for this to-date. The $3.6m annual allocation is in line with the previously cited $3.57m price tag.

Antoinette Thompson, the former top civil servant in the then-Ministry of Transport and Housing, cited both contracts for procedural irregularities in her lawsuit filed against the Government last year. They have also been the subject of controversy since last year’s Budget debate when Michael Pintard, the

Opposition’s leader, challenged whether the awards breached public procurement laws then in existence. Both Prime Minister Philip Davis KC and Jobeth Coleby-Davis, minister of energy and transport, have vehemently rejected Mr Pintard’s assertions and strenuously defended both the DigieSoft Technologies and Adolpha Maritime Group contract awards. However, Mr Pintard yesterday told Tribune Business that the Opposition has subsequently gained “useful information” that will enable it to “crosscheck” the Government’s statements on both companies. He also questioned whether it was appropriate for the Government to proceed with executing both contracts given that they featured heavily in, and are central to, Ms Thompson’s legal action. “Since our last discussion about the two companies you have asked about...., the Opposition has been

able to obtain useful information that would enable us to ask crucial questions, relative to both companies, and to cross-check claims made by minister Jobeth Colby-Davis and the Prime Minister in the House of Assembly when addressing this issue,” Mr Pintard said via e-mail reply.

Later contacted by Tribune Business, Mr Pintard said the DigieSoft and Adolpha contract awards were “a critical issue to have publicly aired to the extent that the law permits given the fact these are matters that are” the subject of Ms Thompson’s lawsuit and therefore “sub judice”.

Asked why he thought the Government had now moved to fund these contracts, the Opposition leader replied: “I have no idea what motivated them at this time. For me, the more important question is, why not do it previously, which would be one, and secondly, is it appropriate to do so given the odium

that surrounds this matter and that it’s a matter which is being litigated.”

The Bahamian marina industry has constantly complained that forcing the closure of its own online portal, which was set up to collect due government fees and taxes from visiting boaters and expedite their clearance into The Bahamas, has hurt the sector for almost two years given that the DigieSoft replacement has yet to emerge.

Mr Pintard said: “I think the conclusion has been that the alternative the Government has promised, and the benefits from the alternative, have not emerged and what motivated them to change if they were not willing or able to execute.”

Peter Maury, who headed the Association of Bahamas Marinas (ABM) when it was asked to pull its own SeaZ Pass portal, again yesterday lamented why Bahamian taxpayers are having to spend possibly $3.74m on the DigieSoft

of the companies under our jurisdiction are not companies dealing in real estate that way. They’ll be dealing in financial transactions, not real estate transactions.

“They’ve over-burdening the registered offices and agents who are already over-burdened with all these filings for beneficial ownership, the common reporting standard (tax information exchange) and CESRA (economic substance reporting).....

I don’t know what to say. This country is getting very bureaucratic.”

Mr Moss argued that the “real property declaration” is unnecessary if the Department of Inland Revenue (DIR) were to properly perform its job.

He asserted that it already has everything necessary to pursue VAT real estate evaders as, when obtaining a real property tax assessment number, all land and building owners have to submit their identities, contact details and other information.

portal when the private sector had previously supplied exactly the same solution for fee.

The Ministry of Finance mandated that the SeaZ Pass portal be shut down in October 2022 amid a dispute over whether the portal’s payment provider, Omni Financial Services, had remitted the full $5m sum collected to the Public Treasury. Mr Maury said he had yet to be notified that any funds were not passed on, and said the portal’s loss had sent the ease of entering this nation for visiting boaters backwards.

“It’s terrible. I had a 160-foot yacht’s captain complaining about it last week,” he told Tribune Business. “It’s ridiculous. It’s insane what’s happening. They are spending $3.355m to do something we did for free. It cost them nothing. They were supposed to use some of the money we collected to put back into navigational aids [the Adolpha contract].

“They were supposed to relaunch the portal and they haven’t. They haven’t attempted anything. I don’t know that it even matters

GameStop leaps as investor known as ‘Roaring Kitty’ indicates he holds a large position in the stock

By MICHELLE CHAPMAN AP Business Writer

SHARES of GameStop soared Monday following speculation that the man at the center of the pandemic meme stock craze owns a large number of shares of the video game retailer that may be worth millions.

GameStock's volatile stock ended the day with a 21% gain after earlier being up as much as 75%.

Keith Gill, better known as "Roaring Kitty" on social media platforms YouTube and X, also goes by the name Deep F- - - - - - Value on Reddit. Late Sunday, the Reddit account shared a screenshot in the r/SuperStonk forum that people are speculating could be an image of the shares and call options Gill holds in GameStop. The image showed that Gill may hold 5

million shares of GameStop that were worth $115.7 million as of the closing price on Friday. The screenshot also showed 120,000 call options in GameStop with a $20 strike price that expires on June 21. The call options were bought at around $5.68 a piece.

In addition, Gill's account on X posted a picture of a reverse card from the popular game Uno on Sunday

night. There was no text accompanying the image. This latest activity comes about three weeks after Gill appeared online for the first time in three years, spiking the price of GameStop at the time. In May, the "Roaring Kitty" account posted an image on X of a man sitting forward in his chair, a meme used by gamers when things are getting serious.

The post on X was followed with a YouTube video from years before when Gill championed the beleaguered company GameStop saying, "That's all for now cuz I'm out of breath. FYI here's a quick

4min video I put together to summarize the $GME bull case."

GameStop in 2021 was a video game retailer that was struggling to survive as consumers switched rapidly from discs to digital downloads. Big Wall Street hedge funds and major investors were betting against it, or shorting its stock, believing that its shares would continue on a drastically downward trend.

Gill and those who agreed with him changed the trajectory of a company that appeared to be headed for bankruptcy by buying up thousands of GameStop

“It just seems to me to be burdening people when they have the information,” the Dominion Management Services chief said. “They can get on the phone, call people and say they have not paid or are late. It’s ridiculous, adding to the burden, man, adding to the burden. I hope the BFSB objects to it. It’s burdening us with too much.

“They really have to stop, and they’re talking about ease of doing business in the country? This is adding to the bureaucracy of it. It’s ridiculous, man. It’s crazy. It’s crazy. I don’t know where they [the DIR] to manage this. It’s up to them. I wonder what they’re doing.

“I hope they take those amendments out of there. It makes no sense to put the burden on registered offices. It should be on the Department of Inland Revenue. They cannot abdicate their responsibilities and put it on the private sector to do their jobs.”

now. They didn’t do anything for so long. Our occupancies have gone down and the market is changing.”

Besides paying the 4 percent Port Department levy, Mr Maury said the SeaZ Pass portal allowed visiting boaters to pay their charter fee and obtain the associated licence, as well as clear Customs and Immigration online and enter The Bahamas.

“Now you have to send an e-mail to the Port Department, they e-mail you back a bill and you have to connect with a payment provider. We’re back to the same old junk we had before,” he added. “Everybody who wants a charter licence has to wait. It’s so ridiculous.

“The charter licence is like $2,500, but the money on the actual charter is worth tens of thousands, hundreds of thousands, millions in some cases. They get overly bureaucratic so that it slows the whole process down. Everyone suffers, but mainly the Bahamian people.”

shares in the face of almost any accepted metrics that told investors that the company was in serious trouble. That began what is known as a "short squeeze," when those big investors that had bet against GameStop were forced to buy its rapidly rising stock to offset their massive losses.

The day's meme surge also included movie theater chain AMC Entertainment Holdings, which gained more than 11%. But others shed their gains over the course of the day. Koss Corp. a headphone manufacturer, which was 17% at one point, ended up less than 1%. And BlackBerry, the one time dominant smartphone maker, finished unchanged after being up almost 6%.

JOB OPPORTUNITY

ACCOUNTS CLERK WANTED

The role involves:

• Preparing general ledger postings

• Account reconciliations

• Payables processing and vendor payments

• Customer billings and collections

• Clerical assistance and other administrative tasks

Applicants should have the following attributes:

• 3-5 years’ experience in an accounting department

Good communications and team building skills

Please respond via email with copies of academic certifcates and two references to: portagency429@gmail.com

PAGE 4, Tuesday, June 4, 2024 THE TRIBUNE

FROM PAGE B1 FROM PAGE B1

• •

•

•

‘Pressure cooker’ race to meet audit deadlines

to high-turnover companies. “Despite being a minority, some entities were unable to meet the March 31 deadline for the review of their Business Licence return,” the BICA chief said.

“They now find themselves in a desperate scramble to secure the services of available practitioners to assist with compliance. Information coming in indicates that accounting firms across the country are overwhelmed, juggling the demands of the new Business Licence deadlines alongside existing annual regulatory commitments.”

Such “commitments” involve meeting deadlines to submit audited financials to the likes of the Central Bank and Securities Commission involving hundreds of their licensees.

“This has created a pressure cooker

environment at the moment where the survival of businesses hinges on compliance,” Mr Albury told Tribune Business

“Licensed BICA members are committed to ensuring their clients remain compliant. However, they face mounting pressure as the June 30 [Business Licence] deadline looms large. The accounting community is overworked and stretched thin, striving to meet not only the new Business Licence requirements but also the annual regulatory deadlines that were already in place.

“Firms are maxed out, and many are concerned about their capacity to meet these demands. Adding to the strain, the Department of Inland Revenue (DIR) has threatened significant fines for those who fail to meet the June 30 deadline,” he continued.

“This has escalated the urgency for both businesses

Port’s ‘serious’ Nassau harbour concern eyes year-end repairs

ever-more urgent with “interruptions” to the unloading of cargo vessels “increasing” in recent months. Mr Bethell said then that while services have typically been disrupted twice a year by high seas this had escalated to the point where, over summer 2023, cargo operations were impacted on eight to ten days.

This poses an everincreasing threat to The Bahamas’ import-driven economy, with 90 percent of international shipping cargo passing through APD’s Arawak Cay facilities. The Bahamas, though, has received IDB financing for coastal protection and restoration, and the APD chief said “included in that is the repair and restoration of the breakwater at the western end of Paradise Island and the breakwater in front of our facility”.

The breakwaters, which function as Nassau harbour safeguards, have been in place since Majority Rule some 56 years ago but are “no longer able to absorb the energy from the ocean” especially at high tide or during rough weather.

This impacts “the channel” cargo vessels use to access Nassau’s major commercial shipping port, and complicates the work of APD staff, service providers and ship’s crew in unloading and working on the boat. The “roll”, or pitch, of cargo vessels in such circumstances can be

between “six to ten feet up and down”, which is unforgiving on APD’s cranes and other equipment and results in significant wear and tear.

While vessels can still safely enter and exit the Arawak Cay-based port, APD has previously said it “won’t compromise” on safety. Junkanoo Beach, and the area in close proximity to The Pointe, were already selected as one of the sites to benefit from the $35m IDB loan in a bid enhance coastal zone management and related infrastructure in the face of climate change impacts.

APD, in previous annual reports, reiterated that failure to repair Nassau harbour’s western breakwater could “result in immense damage to, and threaten life”, in the city centre. It added that reversing the continued deterioration of this protective barrier against storm surge and high seas remains on its “front burner” due to the danger posed not just to its own viability but Nassau’s cruise tourism product.

Meanwhile, Mr Bethell confirmed that APD remains interested in the bid to take over and manage Marsh Harbour’s port even though this will “never be a significant revenue stream for the company”. He added that no response has been received as yet from the Government to a proposal that was submitted in summer 2023.

“We remain interested in developing operating

and their accounting partners, who are now in a race against time to avoid these punitive measures. The financial implications of missing the deadline are severe, exacerbating an already stressful situation.”

Mr Albury said that “compounding these challenges are communication and support issues with the Department of Inland Revenue. Many businesses and practitioners report that queries and concerns are not being addressed in a timely manner, leaving them in the lurch as they navigate complex compliance requirements”.

He added: “The lack of timely responses and support from the Department of Inland Revenue has been a recurring cry, further complicating efforts to ensure all client concerns are adequately managed.

“In light of these challenges, there is a call for understanding and

the Marsh Harbour, Abaco port. We are certain that our proposal to the RFP and the Government is the best option to the Abaco business community and the residents of Abaco,” Mr Bethell said. “We have not received any response from the Government of The Bahamas on this project and our proposal.

“This project is important to APD from the standpoint of nation building and Family Island development. This project would never be a significant revenue stream for APD. We are certain that with our expertise and experience we could provide Marsh Harbour with the necessary security plan and framework to pass its ISPS (International Ship and Port Security) audits and assessments.”

Shipping industry sources, speaking on condition of anonymity, told this newspaper that nothing has been heard since August/ September last year on the bidding process launched by the Government to find private sector operators willing to finance, redevelop and manage both Marsh Harbour and the north Abaco port in Cooper’s Town.

Tribune Business previously revealed that the Government is eyeing a combined $100m investment to transform Abaco’s two commercial shipping ports into facilities that meet global best practices and standards.

The public-private partnership (PPP) tender documents for both the Marsh Harbour and Cooper’s Town ports revealed that bidders on the former must show they have combined equal capital and access to debt financing of “at least $60m”. For Cooper’s Town, the figure was slightly less at $40m in collective equity and debt funding.

Mr Bethell, though, said the 150 kilowatt (KW)

flexibility from the Department of Inland Revenue. The business community is urging the Government to consider the practical difficulties faced by practitioners and businesses alike.”

BICA, on behalf of Bahamian accountants, had urged the Government to delay the Business Licence audit requirement for firms with an annual turnover of $5m or more by one year. That was rejected by the Ministry of Finance, which set end-April 2024 as the deadline for $5m-plus businesses to provide audited financials. However, it allowed those with good and valid reasons to obtain an extension to end-June.

Simon Wilson, the Ministry of Finance’s financial secretary, said that based on the Government’s own records there are only about 25-30 standalone companies that fall into the $5m-plus annual turnover

expansion to APD’s solar system is set to go live within the next 30 days.

“Very little progress has been made to put a vehicle inspection facility at APD,” he added. “The Government of The Bahamas just recently confirmed

bracket. All others are part of larger corporate groups, either the parent or its subsidiaries, and could be addressed as one with costs spread over and shared between these entities.

This was backed by Philip Davis KC, who in last week’s Budget communication said that only about 1 percent of Business Licence applicants - roughly between 500 to 600 companies - fell into the $5m-plus annual turnover category that maintains they submit audited financial statements.

Mr Williams yesterday said Department of Inland Revenue’s upgraded tax and Business Licence online portal is “running very smoothly” with companies able to receive their Business Licences within the required turnaround time.

The portal was rolled out on January 1 and faced a number of technical issues

the relocation of the Road Traffic Department from the Thomas A Robinson Stadium.

“We have recently completed the expansion of our solar system capacity by 150 kW. This system is set to go live within the next 30

that frustrated businesses that were trying to meet VAT and Business Licence filing deadlines with the latter set at end-January 2024. Mr Williams said although there are a “few kinks”, the system has been running smoothly and businesses can now file their VAT payments and renew Business Licences on the platform.

He said: “Everything has cleared out quite well and everything is running smooth. Persons are able to apply. Depending on the type of business, you are able to get it within the required time and persons have been getting used to the new system and the new system is flowing. Now, of course, we still have a few kinks here and there, but for the majority things have been running very smoothly.”

THE TRIBUNE Tuesday, June 4, 2024, PAGE 5

FROM PAGE B1

days. It is not cost effective to continue with the solar project at our Gladstone Freight Terminal facility at this time. We will continue to assess and review our solar options at Gladstone Freight Terminal.”

FROM PAGE B1

Wall Street drifts to mixed finish after

the latest signal of a slowing economy

By STAN CHOE AP Business Writer

U.S. stocks drifted to a mixed finish Monday following the latest signal showing the U.S. economy is slowing.

The S&P 500 edged up by 5.89 points, or 0.1%, to 5,283.40, even though the majority of stocks within the index fell. The Dow Jones Industrial Average dropped 115.29, or 0.3%, to 38,571.03, and the Nasdaq composite rose 93.65, or 0.6%, to 16,828.67.

Treasury yields also slid in the bond market after a report showed U.S. manufacturing shrank in May for the 18th time in 19 months, according to the Institute for Supply Management.

Manufacturing has been hit particularly hard by high interest rates meant to get high inflation under control.

"Demand remains elusive as companies demonstrate an unwillingness to invest due to current monetary policy and other conditions," said Timothy Fiore, chair of the Institute for Supply Management's manufacturing business survey committee.

Stocks of companies whose profits are most closely tied to the strength

of the economy dropped to the market's worst losses. That included the oil-andgas industry, as the price of crude tumbled on worries about weaker demand growth for fuel.

Halliburton dropped 5.3%, and Exxon Mobil fell 2.4%. They sank as the price of a barrel of U.S. oil dropped 3.5%. Brent crude, the international standard, lost a similar amount despite moves over the weekend by Saudi Arabia and other oil-producing countries meant to prop up its price. On the winning side of Wall Street were some big technology stocks that keep

flying regardless of what the economy is doing.

Nvidia climbed another 4.9% to bring its gain for this year to 132.2% after unveiling new products and services over the weekend. It's been delivering blowout profits to keep at bay criticism that investors have become overzealous about the prospects for AI. Nvidia was by far the strongest force pushing the S&P 500 upward.

The jump was even bigger in another corner of Wall Street well accustomed to stomach-churning swings, both up and down.

GameStop soared 21% in a move reminiscent of its early 2021 rocket ride

SPECIALIST MICHAEL PISTILLO, left, and trader Robert Charmak work on the floor of the New York Stock Exchange, May 30, 2024. World shares began June mostly higher after a report showing that inflation in the U.S. is not worsening drove a rally on Wall Street.

that shook Wall Street and brought the term "meme stock" into the parlance of our times. GameStop jumped after a Reddit account associated with a central character in the 2021 episode said it had built a stake of 5 million shares, along with options to buy more. The post from Sunday night said the position was worth $181.4 million.

The post made tidal waves online because it came from the same Reddit account that showed similar screenshots of big GameStop holdings in 2021 that helped the struggling video-game retailer's stock price rocket higher, way beyond what many critics on Wall Street called rational.

"Meme stock" has become the way to describe companies whose prices move more on the enthusiasm of smaller-pocketed investors than on any fundamental change in their business prospects. Other meme stocks also rose Monday, including

CEOS GOT HEFTY PAY RAISES IN 2023, WIDENING THE GAP WITH THE WORKERS THEY OVERSEE

By MAE ANDERSON, PAUL HARLOFF and BARBARA ORTUTAY Associated Press

THE typical compensation package for chief executives who run companies in the S&P 500 jumped nearly 13% last year, easily surpassing the gains for workers at a time when inflation was putting considerable pressure on Americans' budgets.

Photo:Richard Drew/AP

an 11.1% climb for AMC Entertainment. In a more traditional move for the market, Stericycle jumped 14.6% after Waste Management said it would buy the medicalwaste company for $5.8 billion in cash and assume $1.4 billion of its net debt. Waste Management fell 4.5%.

Hertz Global sank 5.3% after it said its chief operating officer is leaving and named a new chief financial officer.

In the bond market, the yield on the 10-year Treasury fell to 4.39% from 4.50% late Friday. The two-year yield, which more closely tracks expectations for action by the Federal Reserve, fell to 4.81% from 4.88%.

The hope among investors is for the U.S. economy to hit a precise bull's eye where it slows enough to keep pressure off inflation but not so much that it causes a recession. That in turn could allow the Federal Reserve to cut its main interest rate.

have served at least two full consecutive fiscal years at their companies, which filed proxy statements between Jan. 1 and April 30.

The Fed has been keeping the federal funds rate at the highest level in two decades, which intentionally slows the economy and hurts investment prices in hopes of getting high inflation fully under control.

This upcoming week has several high-profile economic reports that could send yields on additional sharp swings.

On Tuesday, the U.S. government will show how many job openings employers were advertising at the end of April. And on Friday, it will give the latest monthly update on overall growth for jobs and workers' wages.

In stock markets abroad, India's Sensex jumped 3.4% after the country's 6-week-long national election came to an end with most exit polls projecting that Prime Minister Narendra Modi will extend his decade in power with a third consecutive term.

Stocks in Mexico, meanwhile, slumped 6% after Claudia Sheinbaum claimed victory in that country's presidential election.

Elsewhere in the world, stock indexes were higher across much of Europe and Asia, though Shanghai and London were exceptions.

surpassed that of the S&P 500.

The median pay package for CEOs rose to $16.3 million, up 12.6%, according to data analyzed for The Associated Press by Equilar. Meanwhile, wages and benefits netted by private-sector workers rose 4.1% through 2023. At half the companies in AP's annual pay survey, it would take the worker at the middle of the company's pay scale almost 200 years to make what their CEO did. "In this post-pandemic market, the desire is for boards to reward and retain CEOs when they feel like they have a good leader in place," said Kelly Malafis, founding partner of Compensation Advisory Partners in New York.

Hock Tan, the CEO of Broadcom, topped the AP survey with a pay package valued at about $162 million.

The AP's CEO compensation survey included pay data for 341 executives at S&P 500 companies who

Broadcom granted Tan stock awards valued at $160.5 million on Oct. 31, 2022, for the company's 2023 fiscal year. Tan was given the opportunity to earn up to 1 million shares starting in fiscal 2025, according to a securities filing, provided that Broadcom's stock meets certain targets – and he remains CEO for five years. At the time of the award, Broadcom's stock was trading at $470. The stock has skyrocketed since, and reached an all-time high of $1,436.17 on May 15. Tan will receive the full award if the average closing price is at or above $1,125 for 20 consecutive days between October 2025 and October 2027.

Broadcom noted that under Tan its market value has increased from $3.8 billion in 2009 to $645 billion (as of May 23) and that its total shareholder return during that time easily

Other CEOs at the top of AP's survey are William Lansing of Fair Isaac Corp, ($66.3 million); Tim Cook of Apple Inc. ($63.2 million); Hamid Moghadam of Prologis Inc. ($50.9 million); and Ted Sarandos, co-CEO of Netflix ($49.8 million).

Lisa Su, CEO of chipmaker Advanced Micro Devices, was the highest paid female CEO in the AP survey for the fifth year in a row in fiscal 2023, bringing in compensation valued at $30.3 million — flat with her compensation package in 2022. Her overall rank rose to 21 from 25. Workers across the country have been winning higher pay since the pandemic, with wages and benefits for private-sector employees rising 4.1% in 2023 after a 5.1% increase in 2022, according to the Labor Department.

Even with those gains, the gap between the person in the corner office and everyone else keeps getting wider. Half the CEOs in this year's pay survey made at least 196 times what their median employee earned. That's up from 185 times in last year's survey.

Notice is given hereby in accordance with Section 138(8) of the International Business Companies Act, 2000, the dissolution of APPLEDALE LTD. has been completed, a Certifcate of Dissolution has been issued and the Company has therefore been struck off the Registrar. Aegis Corporate Services Limited Caves Village, Building Six, West Bay Street, P.O. Box SP-63771 Nassau, Bahamas Liquidator

PAGE 6, Tuesday, June 4, 2024 THE TRIBUNE

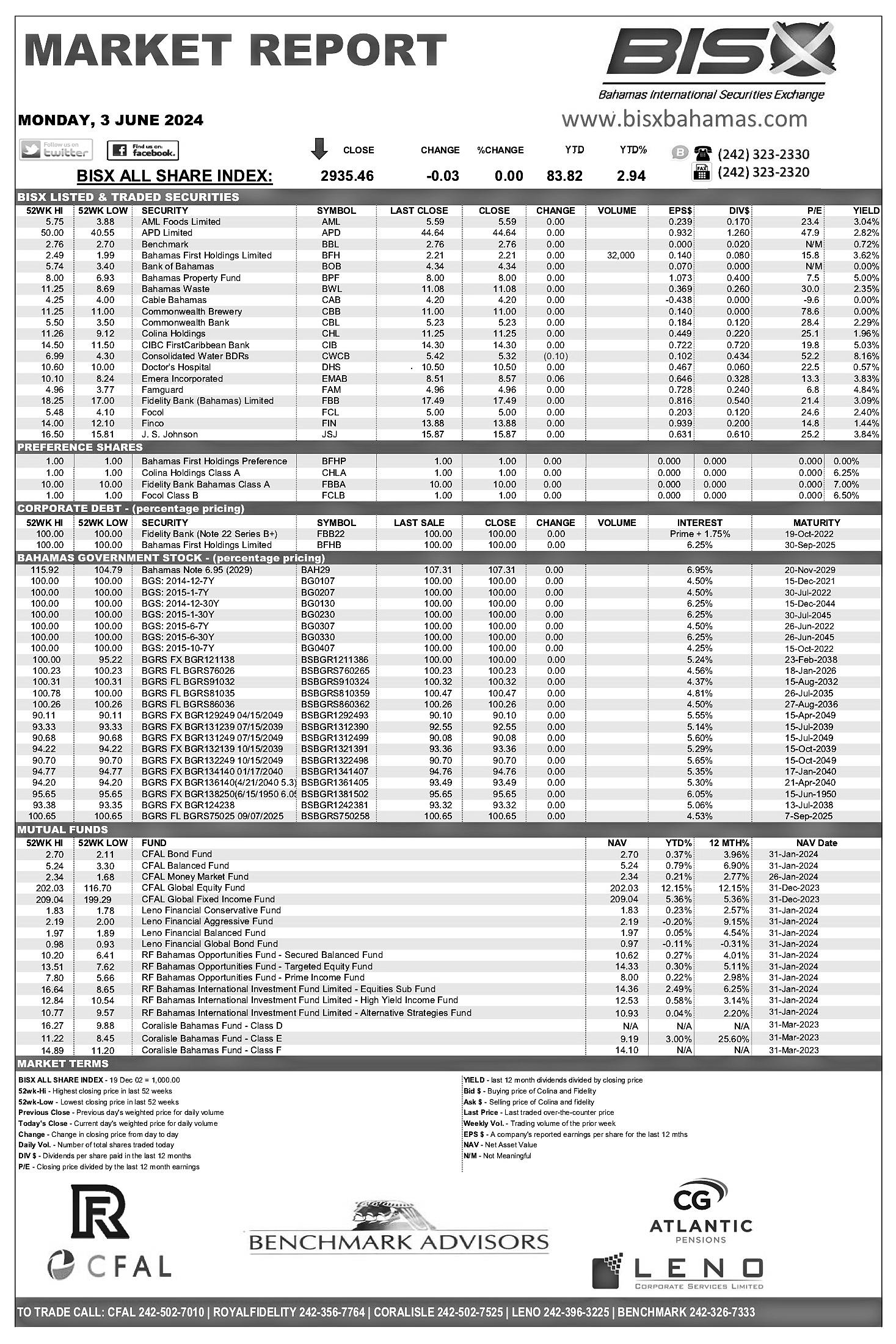

STOCK MARKET TODAY

US CEO PAY NOTICE APPLEDALE LTD.

STEPHEN COAKLEY-WELLS

STEPHEN COAKLEY-WELLS