Budget optimism ‘tempered’ by fiscal surplus push back

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

MARKET optimism over the Government’s Budget “is tempered” by continual “downward revisions” to its surplus forecast and the need to buck decade-long June deficits that have averaged $180m.

Santander, which financed much of the Government’s $500m loan in early 2024, told institutional investors in a May 31, 2024, research note that the positive revenue numbers and projected deficit for the current 2023-2024

fiscal year were counter-balanced by the need for greater “clarity” on when the Government will finally achieve an annual surplus.

A Budget surplus would mean the Government’s revenue income is greater than its annual spending - something that The Bahamas has rarely, if ever, attained since Independence. Santander, in its missive to the markets, said the Davis administration has revised both the amount and timing of when it will generate such a surplus some three times within 15 months.

The Government initially forecast in the 2022 Fiscal

Wynn penthouses gain full approval - but not all happy

By

A $100m, 14-storey Goodman’s Bay penthouse complex was yesterday said to have received full construction go-ahead despite nearby residents complaining they were “blindsided” by its parking lot plans.

Randy Hart, the Wynn Group’s vice-president, told Tribune Business that the development - the second phase of its Goodman’s Bay ambitions after the already-completed Residences - had received all the necessary permits and approvals to proceed from the Town Planning Committee, Ministry of Works and the Department of Environmental Planning and Protection (DEPP). Asserting that the developer has addressed all issues covered by the Subdivision and Development Appeal Board’s early April 2024 verdict, he added that Wynn is now planning to stage an official

By NEIL HARTNELL and Fay Simmons Tribune Business Reporters

ELEUTHERA businesses yesterday said the “sabotage” that knocked out both Cable Bahamas and Bahamas Telecommunications Company (BTC) services had “wreaked havoc” and left them “in the Stone Age”.

Chris Cates, the Lumber Shed’s principal, told Tribune Business that the loss of Internet, cellular,

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

groundbreaking ceremony for the project once a date is confirmed with the Government.

“We had the planning approval; it was just being challenged. Ultimately, the Appeal Board ruled in our favour and the approvals were deemed to be valid. We’re planning a groundbreaking ceremony; I’m just waiting on a date from the Prime Minister’s Office,” Mr Hart said.

Dr

Rhianna NeelyMurphy, the Department of Environmental Planing and Protection’s (DEPP) director, also confirmed to Tribune Business that Wynn has received its Certificate of Environmental Clearance (CEC) as a signal it has satisfied all the regulator’s environmental concerns relating to the penthouse development.

Obtaining the CEC was the first step mandated by the Appeal Board for Wynn to turn its “preliminary” site plan approval into a full one. It then also had to satisfy the Ministry of Works’

landline and TV services since last week Thursday had “really put the kibosh” on the company’s weekend business with “the bottom dropping out” of sales traffic.

“It wreaks havoc,” he said of the near-total loss of communications throughout the island. “We had no cell phone communication at all, the Internet was down, TV was down. Everything depends on links to the outside world

Strategy Report, released in February 2023, that it would produce a $287.3m surplus equal to 1.9 percent of gross domestic product (GDP) in the upcoming 2024-2025 fiscal year. This was altered three months later, in the 2023-2024 Budget last May, to a $109.2m surplus equivalent to 0.7 percent of GDP or Bahamian economic output.

Now, Santander noted, the timing and size of any fiscal surplus have been altered again in both the 2024-2025 Budget and 2024 Fiscal Strategy Report released together last week. Achieving a surplus has been

pushed back by a whole fiscal year to 2025-2026, with the Davis administration now forecasting a modest $69.8m deficit equal to 0.5 percent of GDP in 2024-2025.

The global bank said the slower-than-anticipated fiscal consolidation path exposes The Bahamas “to higher vulnerability” from external economic and climate change shocks as it seeks to rebuild badly-needed headroom following the combined $13.1bn hit inflicted by COVID19 and Hurricane Dorian. It added that the timing of the surplus delay was far from ideal given that investors typically review their exposure to Bahamas sovereign debt ahead of hurricane season, which has now started. Santander said the decline in the price of outstanding Bahamian government foreign currency debt, immediately following the Budget’s unveiling, may reflect market “disappointment” with the revised surplus push back.

civil design unit before full site plan approval and a construction/building permit could be granted. A building permit was attached to the fence surrounding the GoldWynn penthouses construction site yesterday.

Keenan Johnson, the Town Planning Committee’s chairman, yesterday said he was unaware of whether Wynn had obtained the

and everything was down most of the weekend.

“It was very impactful on our business. We couldn’t make house-to-house or business-to-business calls in the communities. My lumber business is entirely dependent on having communications with the towns in Eleuthera.

“Everything is Internetbased these days..backing up data at the end of the day, doing invoices in the Cloud. It really put the kibosh on a lot of our

necessary building permit and other approvals required for construction to proceed as the process did not come back before the committee.

“That would go through Building Control and Physical Planning to ensure everything is in order,” he said. “That wouldn’t necessarily have to come back to

By NEIL HARTNELL

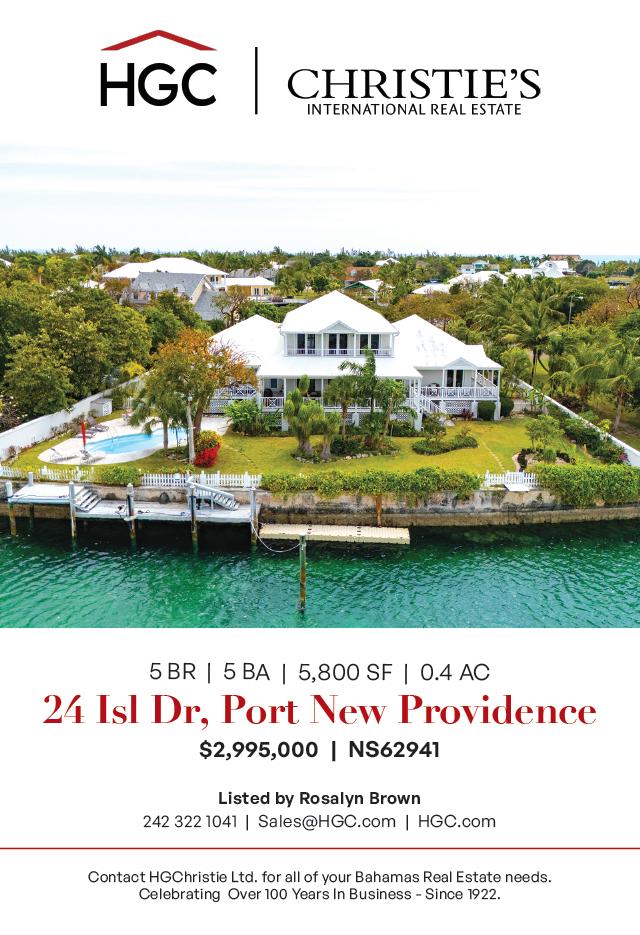

A BAHAMIAN realtor said his firm’s industry “first” in yesterday launching a dedicated sports and entertainment division has the potential to become “a huge part of our business”.

Gavin Christie, broker and managing partner at Corcoran C.A. Christie Bahamas, told Tribune Business that the move will see the company provide a dedicated platform for addressing the multiple property and investment needs of professional athletes and entertainment celebrities that are being attracted to this nation in ever-increasing numbers.

Asserting that such clients have specific needs that require a family officetype approach, he disclosed that “the phones have been ringing non-stop” with inquiries over “strategic partnerships” since Corcoran C.A. Christie formally unveiled the division’s launch yesterday.

Bahamian liquidators will result in “maximising” the

two properties

the portfolio that

add

Simms KC, the Lennox Paton attorney and senior partner, and PricewaterhouseCoopers (PwC) accounting duo of Kevin Cambridge and Peter Greaves, now have to sell. That portfolio is now approaching 40 properties,

business. Trying to order into Nassau was impossible because you couldn’t get out,” Mr Cates added.

“We really saw the bottom drop out of our traffic. Friday and Saturday, which turned out to be incredibly slow sales days, most of our sales are outside Rock Sound. We travel north to Gregory Town and stop at every town on the way. That’s why, when we don’t get calls, it impacts sales. I

Revealing that the real estate firm will be partnering with a small group of financial institutions, who he did not identify, to offer investment opportunities and advice to such clients, Mr Christie told this newspaper that the new venture will not solely focus on international athletes.

A former professional soccer player himself, having spent time on the European circuit, he added that Corcoran C.A. Christie’s new business segment will also target Bahamian athletes presently competing abroad in a bid to look after their real estate and financial needs whenever they return to this nation. With the division’s launch some two years in the making, Mr Christie said it stemmed from his desire to “marry two of my passions” - real estate with sports and health and wellness. “One of the driving factors is that we’ve been seeing an increased number of highprofile professional athletes and entertainment clients that are now, even more so, frequenting The Bahamas from a vacation and rental standpoint,” he added.

business@tribunemedia.net WEDNESDAY, JUNE 5, 2024

Key SBF cronies to hand over $2.34m Bahamas properties TWO of jailed Sam Bankman-Fried’s closest FTX cronies have agreed to hand over their Bahamas residences acquired for a collective $2.34m to local liquidators as part of a settlement deal. John Ray, the FTX US chief in charge of 134 FTX entities in Chapter 11 bankruptcy protection, in legal filings unveiled yesterday revealed that the crypto exchange’s cofounder, Gary Wang, and engineering chief, Nishad Singh, will turn over to his Bahamian liquidator counterparts each of the units they own in the One Cable Beach development. Both properties were allegedly purchased with funds belonging to FTX creditors and investors, and Mr Ray asserted that transferring them to the

value of asset recoveries for victims of the failed crypto exchange.

these

The addition of

will

to

Brian

SEE PAGE A20

FAY SIMMONS and NEIL HARTNELL Tribune Business Reporters

with sports, entertainment launch

Realtor in industry ‘first’

Tribune

nhartnell@tribunemedia.net SEE PAGE A20

Business Editor

Eleuthera

SEE PAGE A21

‘in Stone Age’ on communications sabotage

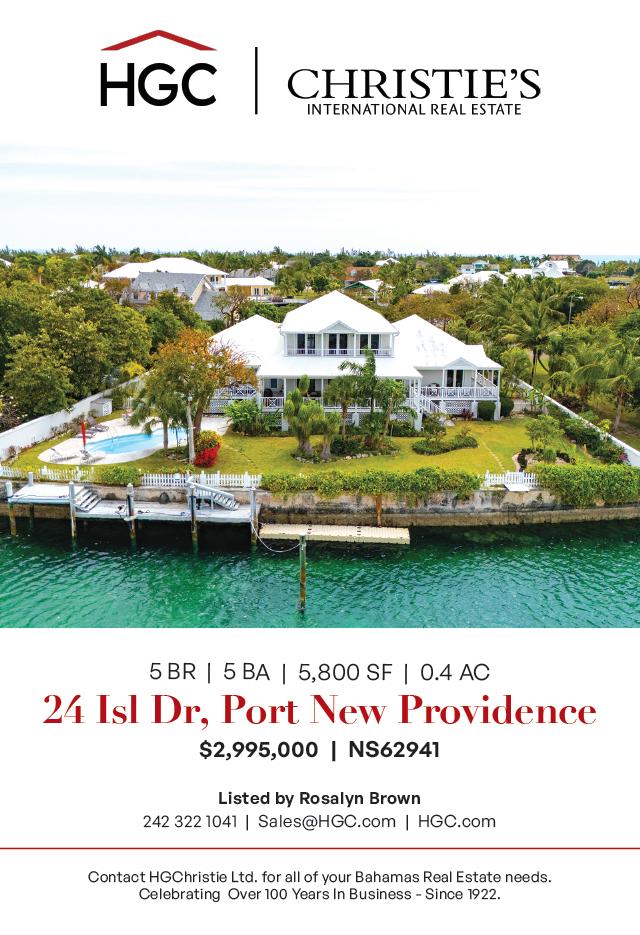

WYNN GROUPS GOODMAN’S BAY PENTHOUSES

SEE PAGE A21 SEE PAGE A20

SAM BANKMAN-FRIED $5.90 $5.91 $5.74 $5.74

GAVIN CHRISTIE

ANDROS FEELS ‘LEFT OUT’ IN LATEST GOV’T BUDGET

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

ANDROS businesses and residents feel “left out” and “wanting” based on the Prime Minister’s 2024-2025 Budget communication, the island’s Chamber of Commerce president says.

Darin Bethel told Tribune Business that the island, especially in the north and central areas, still struggles with frequent electricity outages since Bahamas Power & Light’s (BPL) power plant was destroyed by a fire last July.

He said: “The business community in Andros feels left out, and so we now have to look forward to another Budget to be included. We will hope that our voice would be a little bit louder next time around, and the Prime Minister will include us and consider the people in Andros and the economic impact of our issues.

“We are still struggling here in Andros with the power situation. North and Central Andros, particularly, have consistent power outages that are affecting our community and livelihood.” Mr Bethel added

that while Philip Davis KC mentioned that the Family Islands would benefit from renewable energy sources, he did not give a timeline for their introduction or by how much energy costs will decline.

He said the pledge made by North Andros and the Berry Islands MP, Leonardo Lightbourne, that electricity woes would only be “temporary” was not reassuring to business owners as North Andros has had a temporary airport for more than 20 years.

Mr Bethel said: “The Prime Minister, in his Budget, mentioned renewables for the Family Island with no specifics for the North and Central Andros community. We would have liked to hear a deadline or a timetable as to when these things will come to fruition. And, also, what the plants and rates would be like.

“The member of Parliament said during the economic investment conclave that the situation at BPL is temporary. It was saddening for a lot of business owners hearing that because that is what they said about the airport, and this is 20-plus years now that we had that airport

there in a temporary state. So we know that temporary could be 20 or 30 years”

Mr Bethel added the renewable energy plan for North Andros, which was promised within 18 months after last year’s BPL plant fire, was not mentioned in the Budget and business owners are “anxious” to receive an update.

He said: “It’s been almost a year now since the power station burned down. The minister [JoBeth Coleby Davis] gave word by way of BPL’s representatives that we would have a renewable plan in 18 months. It’s been almost 12 months and we have heard no mention of it in the Budget.

“The business community is anxious to hear that the Prime Minister has recognised the concerns and the inadequacy of electricity from day to day because, when the power goes off, the water goes off, the phone goes off and business stops.”

Mr Bethel said residents were hoping to see more “meat” in the Budget, while some of the projects mentioned - such as the roadworks in Red Bay - are almost completed.

He added: “We would have hoped to see more meat in the Budget for Andros considering that nothing was in the Budget for Andros last year. The Prime Minister recycled monies that have already been spent on the Red Bay road, and that road is basically complete. So, basically, there’s nothing in the Budget for Andros.

“There are 14 airports that the Bahamas government is looking to refurbish over the next couple of months, and it was saddening to know that North Andos was not in there.”

Mr Bethel also called for more support from the Small Business Development Centre (SBDC) for farmers and fishermen in Andros to aid the Government’s goal of boosting food security.

He explained that although some small fishing and farming businesses received grants for machinery under the previous Minnis administration, they have not enjoyed further support and need assistance marketing their goods to become more efficient.

He said: “Fishermen and farmers were able to get grants to get themselves

going, and established small fishing businesses. That industry still needs further support. The Prime Minister referenced that but that happened three years ago, and there’s still some people that feel they need support. “You have fisherman that would’ve gotten boats and engines to run and operate a fishing business, but we don’t have enough people in the marketing aspect of

fishing. If you don’t have people that are willing to purchase their catch on a daily basis, then those same fishermen have to take a day or two away from their boat to find sales so they can keep going.

“Same thing with farmers. You give them equipment or farm supplies but, when they finished, they are stuck with the goods because the market isn’t there so it’s not efficient.”

THE TRIBUNE Wednesday, June 5, 2024, PAGE 23

URCA: Electricity rates wont be set ‘willy nilly’

By FAY SIMMONS Tribune Business

THE Utilities Regulation and Competition Authority (URCA) yesterday said there will be “a lot of things happening very fast” as it moves to implement the Electricity Act and Natural Gas Act.

Juan McCartney, the regulator’s corporate and consumer relations manager, speaking at the hearing for its 2023 annual report and 2024 annual plan, said: “The Natural Gas Act, which came into force on June 1, is going to require us to develop an entire new regulatory framework to govern

natural gas throughout the Bahamas through every point of entry, transport, use, etc.

“We’re going to have to be developing those regulations very quickly. You’ll see quite a number of other consultations coming out that we want the public to respond to, because we’re interested in what they have to say about that.

“So natural gas will now be regulated by URCA, according to the Act. And so you’re going to see a lot of things happening very fast. To put that framework in place. We’ve been doing a lot of work behind the scenes to hit the ground running.”

For the Electricity Act, Mr McCartney said key changes will allow multiple operators to take on generation, transmission and distribution on behalf of Bahamas Power & Light (BPL). He explained that the framework implemented by URCA will allow the regulator to have more oversight of all participants in the sector.

He said: “In terms of the Electricity Act, there are numerous changes, but one of the big changes is with regard to the systems operator. So a systems operator before really referred to one entity working with BPL. Now there are going to be multiple types of system operators to deal with different areas of electricity.

“So you have generation, you have transmission and distribution, you have supply. You can now be a systems operator for any of those things and work with not only BPL but other entities as well. So really, it’s to make sure that there’s a more robust framework and that URCA really can have more regulatory oversight of the sector.”

Mr McCartney said the Electricity Act removes the rate holiday and replaced it with a rate transition. Due to this, electricity providers will have their current rates “locked in” for three years, after which URCA will review the tariffs provided by licensees for approval.

He said: “When the Bill was first released, it did have that concept of a rate holiday still in there. But there’s no longer a holiday; there’s a rate transition period. So as of June 1, whatever the rates were for the public electricity suppliers and authorised public electricity suppliers, those are locked in for a period of time to give them a chance to review their rates and submit to URCA for approval, what they want their rates to be.

“So the rates aren’t just going to be set willy nilly by the suppliers. The rates you have now, they’re locked in for three years.” Mr McCartney added that under the new Electricity Act individuals with off-grid systems can now obtain direct approval from URCA

He said: “One of the other things that is very important is that off-grid systems now, you can notify URCA if you have an offgrid system and you can actually utilise that without going through any other processes.”

PM ‘ACCURATELY REPORTED’ VAT UNDER-PERFORMANCE

THE Government last night defended the Prime Minister as having “accurately reported” VAT’s under-performance in the face of Opposition attacks.

Latrae Rahming, communications director for Philip Davis KC, said the latter was correct when in last week’s Budget communication he reported that just $15.1m - under 8 percent of the full-year target of $190m-plus - had been collected in VAT on real estate transactions worth $1m and more.

Tribune Business was the first to query this, as Budget data showed $81.454m as the figure for how much had been generated from such sales during the nine months to end-March 2024a sum more than five times’ greater than that cited by the Prime Minister. Mr Rahming, though, last night said the $81.454m also included $66.3m generated by “another category of revenue called ‘foreign property transfers’.” Combined, the two figures generated the $81.454m, and he added that “there was no budget allocation specifically” for ‘foreign property transfers’. The Prime Minister will address this in his Budget contribution today.

Bahamas elected vice-president of regional insurance regulators

THE Bahamian insurance industry’s regulator has been named as vicepresident of the Caribbean Association of Insurance Regulators (CAIR).

The Insurance Commission of the Bahamas, in a statement, said in a statement that it was elected to this post at the 2024 CAIR annual conference and annual general board meeting held in Hamilton, Bermuda, on May 28-29, 2024.

Alongside The Bahamas, Jamaica has been elected as CAIR president. The Turks and Caicos will serve

as its secretary, Grenada as treasurer, and the Cayman Islands as immediate past president. The new board takes effect on October 1, 2024, and will hold office for a two-year term.

The previous board that served CAIR for the past six years included the Cayman Islands as president, Barbados as vicepresident, the Turks and Caicos as treasurer, and The Bahamas as secretary.

The Insurance Commission of The Bahamas said it will work to address common regulatory and industry concerns across the

Caribbean, including digital innovation; consumer protection and market conduct; artificial intelligence (AI); cyber risk; climate change; new accounting standards; litigation trends; and recovery and resolution.

The Bahamas is set to host the 2027 annual CAIR conference, with Barbados and Belize due to host the event in 2025 and 2026, respectively. CAIR is an association of insurance regulators in the Caribbean and features 22 member countries currently.

Out Island Promotion Board meets minister

EXECUTIVES from the Bahama Out Islands Promotion Board (BOIPB) paid a courtesy call on Chester Cooper, deputy prime minister and minister of tourism, investments and aviation, and his executive team on Monday at the ministry’s offices.

Pictured from L to R are: Kerry Fountain, the Promotion Board’s executive director; Cheryl Bastian, owner of Swain’s Cay Lodge in Andros and

the Promotion Board’s past president; Molly McIntosh, general manager of Bluff House Beach Resort and Marina on Green Turtle Cay, Abaco, and the Promotion Board’s treasurer; Manny Alexiou, the Promotion Board’s president and owner of Abaco Beach Resort and Boat Harbour Marina; Chester Cooper, deputy prime minister and minister of tourism, investments and aviation; Latia Duncombe,

director-general of tourism; Shavonne Darville, chief financial officer for the Promotion Board and owner of Gems at Paradise Beach resort in Long Island; Lisa Adderley-Anderson, under-secretary, Ministry of Tourism; Carl Rolle, Promotion Board vice-president and owner of Rollezz Villas Beach Resort in Cat Island.

Photo:Kemuel Stubbs/ BIS

PAGE 22, Wednesday, June 5, 2024 THE TRIBUNE

Reporter jsimmons@tribunemedia.net

TO ADVERTISE TODAY IN THE TRIBUNE CALL @ 502-2394

PHILIP DAVIS KC

BUDGET OPTIMISM ‘TEMPERED’ BY FISCAL SURPLUS PUSH BACK

Data from the Frankfurt stock exchange revealed that the price of The Bahamas’ $825m bond, priced with an 8.95 percent coupon and due to mature in 2032, has dipped slightly to a 3.75 percent discount to par value having been close to reaching that benchmark in the past month. Yields, though, remain below double And The Bahamas’ $300m foreign currency bond, due to mature in 2029 with a 6.95 percent interest coupon, has also lowered to 88.15 - a near12 percent discount to par - having been trading at a two-year high of 91.2 within the past month. The yield demanded by investors has also narrowly pushed back into double-digit territory at just over 10 percent.

“The Government has not had a very good explanation for the shifting fiscal targets,” one market source, speaking on condition of anonymity. “I hope the bond prices stabilise. Tracking it every day since the Prime Minister’s speech, it’s dropped. You have temporary blips, but I’m going to be tracking it to see if it sustains or is a momentary blip.”

And Santander added its voice to those arguing that the Government still has much work to do to hit its $210m deficit target for the current 2023-2024 fiscal year. While the Davis administration must maintain a balanced Budget, or slight surplus, during the three months to end-June to reach this goal, the bank noted that such an outcome will fly in the face of past experience. Pointing out that June alone has generated an average $180m monthly deficit for the past decade, Santander warned that “there will be less tolerance on [any] fiscal slippage” during the current fiscal year due to the revised 2024-2025 surplus target.

Speaking to the fiscal figures unveiled by Prime Minister Philip Davis KC for the nine months to endMarch 2024, Santander said in a note released two days after the Budget communication: “This confirms our optimism on stronger revenue collection and much better prospects for nearreaching the ambitious target for this [fiscal] year. This is hugely positive.”

The Government had originally predicted a 20232024 deficit of $131.1m, or 0.9 percent of GDP, and Michael Halkitis, minister

of economic affairs, last week said the overshoot will be in an “acceptable” range if confined to between 1-1.5 percent of nominal economic outputanywhere between $146m and $216m.

Santander, though, was less impressed by the medium-term revisions further out. “The optimism is tempered on the consecutive downward revisions on the fiscal year 2024-2025 target from a 2 percent of GDP surplus to a 0.7 percent of GDP surplus and now a negative 0.5 percent of GDP deficit,” it told the markets.

“[This] begs clarity on the convergence path for fiscal surpluses necessary for debt consolidation. The slower path for debt convergence exposes the economy to higher vulnerability from external shocks. The setback is not ideal as investors review their exposure ahead of the hurricane season. This may explain the slight profit taking.”

The $109m, or 0.7 percent, surplus was held to as recently as an April investor presentation.

Nevertheless, Santander said the Government’s fiscal performance for 2023-2024 “should at least anchor yields” on The Bahamas’ outstanding

foreign currency bonds “at normalised levels below 10 percent” - something that, at least for now, appears to largely be holding. However, it added that international capital market reaction to the Government’s Budget appears lukewarm at best.

“The initial reaction was somewhat cautious with Eurobond prices down half a point maybe on the disappointment of the push back on achieving the 2 percent of GDP nominal surplus,” the bank said. It added, though, that “there is room for optimism” as Budget data showed “a faster pace of revenue collection” that will drive fiscal consolidation equal to 2 percent of GDP.

However, achieving this via the revised 2023-2024 deficit target of around $210m will be no easy ask. “The challenge for the last quarter of the fiscal year will be generating a balanced Budget or a slight surplus to maintain the deficit near $200m to coincide with the revised deficit target range of 1-1.5 percent of GDP,” Santander said.

“This is not easy for typically the large deficit in June average[s] $180m for the past ten years. This will require not only a push on tax collection efficiency

but also a restraint on spending through fiscal year-end. There will be less tolerance on fiscal slippage in 2023-2024 considering the revised guidance for the target for fiscal 2024-2025

“The optimism on the fiscal adjustment this past year is somewhat tempered on the revised guidance for next year. It was always an ambitious trajectory of reducing a fiscal deficit of 3.8 percent of GDP in fiscal year 2022-2023 to a trend fiscal surplus of 2 percent of GDP,” Santander continued.

“The ambitious plan was initially a two-phase process this year and next year to achieve a quick fiscal transformation. This has since become more of a multiyear process.” Adding that it is “all about the revenues”, the bank hailed the “huge improvement” that hitting the Government’s revised 1-1.5 percent deficit would represent since that would slash the prior year’s $534.6m by more than $300m.

Praising the tax authorities’ “more aggressive tactics” in collecting from real property tax delinquents, the research note said: “There should still be a push for accelerating VAT revenues on the benefits of more stringent

Wynn penthouses gain full approval - but not all happy

FROM PAGE A24

the Committee. It would go through the normal permitting process. The Department of Physical Planning would ensure that everything is aligned with what was approved in principle, and then it goes back to Building Control.

Asked about the need to obtain full site plan approval, Mr Johnson added: “All that is usually done at the stage of the building permit. You’d see the entire application and determine if it met the requirements and other conditions there. In reviewing the documents they provide, permitting will be able to see all that stuff. It would come back to Physical Planning to ensure all conditions are correct.”

Wynn’s penthouse project, the second phase of its GoldWynn development, has not escaped opposition.

Ed Hoffer, whose home immediately borders the penthouse construction site on its eastern boundary, has campaigned vociferously against granting the necessary environmental and planning permits.

And now residents of western New Providence’s Grove community are also expressing objections to Wynn’s plans to locate an off-site parking lot for full-time and, possibly, the project’s construction workers within their residential area at the junction of Coral Drive and West Bay Street.

This was detailed by Alfred Saunders, principal of AMS Architects, in a November 1, 2023, letter to Charles Zonicle, director of physical planning.

“The developer commits to providing off-site staff parking, thereby eliminating/mitigating the impact on West Bay Street traffic,” he wrote.

“The developer further undertakes to expressly discourage/prevent staff from parking in or around Goodman’s Bay park area. To this end, an off-site parking lot has been secured nearby on West Bay Street approximately a quartermile to the east as shown in the attachment off-site construction parking lot plan.” Satellite images confirmed the proposed

parking lot site, while a photo showed the location as being occupied by a number of shipping containers. However, Barbara Hepburn, president of the Grove West Homeowners Association, last night decried “the secrecy and lack of transparency” over a plan that residents had to find out about for themselves.

“We do have a problem with that because it seem as if we’re being pushed out or squeezed out by commercial development,” she told Tribune Business. “It’s awful. Whether it be Town Planning, the Government, they are not taking into account people in residential areas.

“I understand that we are not different from any other residential area but I wouldn’t want that in anybody’s area. Wherever you go in the world there are area you can always say are residential. A lot of people in this area are retired people, and many of them have given a life’s service to the Government and people of The Bahamas. I think they want to be in an area that is peaceful and quiet.”

Ms Hepburn said Grove West residents felt squeezed by commercial development on all sides. To the east, there is the Government’s proposed $290m new hospital and the extra traffic congestion that will create. She also referenced a development where a single family lot had been converted into 14 one-bed units that “look like a strip mall”. The Association had opposed it with no success. Now, on the neighbourhood’s western side comes GoldWynn’s planned parking lot. Ms Hepburn voiced fears that it will generate noise pollution and garbage, as well as attract potential undesirables to the Grove area. With no outreach to the homeowners over this plan, she blasted: “Everything seems to be done in secrecy. Why are they not being transparent?

“We are being squeezed by commerce. The Government, Town Planning has shown no concern. When investors are asking for specific concessions we are giving benefits to please

these people and not thinking about our own people.

“We do have a problem with the parking lot being there. It brings in another set of people. We don’t know who’s coming in.

I’m not saying everyone’s a criminal but it changes the tone and aesthetics of a nice, quiet area and is going to be right next to residents. Why put all this noise and parking right next to homes?” Ms Hepburn continued.

“We have a big problem with it, and want to know why the Government is pushing us, squeezing us, in one area and changing what used to be a quiet, quaint

area that people spend plenty of money to be in only for someone to put a parking lot next to you. It’s not fair.”

Ms Hepburn said none of the Grove West residents were aware of the parking lot plan until the architect’s letter was discovered in the Department of Physical Planning’s files. “This is the problem we have with the Government and Town Planning. They are continually changing the size and scope of things,” she added. “The community is all very upset and concerned about it. The Association is not pleased. We don’t like the fact they didn’t give us

notice to say what’s going on. We don’t like the fact there was no transparency and no communication. We didn’t know that it was coming or that it was approved. We just got blindsided.”

Ms Hepburn said the Association is now left “to figure out” where to send its letter of objectionwhether to Town Planning or the Department of Physical Planning, or another government agency. The Environmental Impact Assessment (EIA) for the Wynn penthouses said the project will create 300 construction jobs and generate benefits “that far outweigh”

tactics against tax evasion and tackling the under-performance of VAT on real estate transactions.” Santander placed much emphasis on the new corporate tax, set to be imposed on around 50 Bahamas companies who are part of multinational groups with annual turnovers in excess of 750m euros, for the first time on a full-year basis in 2025-2026. This is expected to generate $140m, although it may not be a net gain as affected firms will likely be exempt from Business Licence fees to avoid double taxation.

Suggesting that the delay in implementing this tax has impacted the pace of fiscal consolidation, and surplus achievement, Santander said: “The delays may be inconvenient. However, approval of tax reform this year would lower the execution risks on reaching the fiscal targets...

“The approval of a corporate tax would provide higher conviction on further fiscal consolidation. This would show a track record for commitment to fiscal discipline necessary for reducing the 80 percent of GDP debt burden towards the 50 percent in fiscal year 2030-2031 and for anchoring yields at normalised levels below 10 percent.”

the touted limited environmental impact. It asserted that the development will create “much-needed economic stimulus for New Providence” by also creating 30 permanent jobs and new tax earnings for the Government. The report, produced by Russell Craig & Associates, whose lead principal is Christopher Russell, former director of forestry in the Ministry of Environment and Natural Resources, described any “unavoidable negative environmental impact” from the development’s construction and operation as “limited” and said sufficient “mitigation measures” will be employed to minmise any fall-out even further.

THE TRIBUNE Wednesday, June 5, 2024, PAGE 21

FROM PAGE A24

Eleuthera ‘in Stone Age’ on communications sabotage

don’t know the dollar value, but we were not the only ones.” Mr Cates said both BTC and Cable Bahamas have “struggled for three to four days to get the system back up”. He added that BTC were “working as expeditiously as they can”, while Cable Bahamas “has an enormous group of trucks on the road. They’ve really struggled to get everything back online”. Cell phone service, though, had been restored by yesterday afternoon.

“It really reflects our dependence on having reliable and good communications,” Mr Cates said.

“These are really daily struggles that go beyond this cable cutting thing. The utility companies across the island have not kept up with its growth and essential services, whether it’s

electricity or water, it’s a matter of coming up short on all counts and doesn’t do much for the growth of our economy.”

Felicia Gibson-Lewis, manager of North Eleuthera Shopping Centre, said it has been hit with frequent power outages and lost cellular phone service for six days amid assertions by BTC that its fibre optic cables serving the island were deliberately cut in a bid to extort money over a land dispute.

Ms Lewis said although her land line service was not disconnected during the outage, customers were unable to reach them on cell phones or outside of opening hours. She added that the area also experienced a five-hour power outage on Saturday, and called for an improvement in the island’s infrastructure, especially its electricity generation.

“They need to improve,” Ms Lewis said, “It’s obvious they are having major issues with the power plant so they need to start there and make some upgrades. We also need to have a power plant on the northern end of Eleuthera because right now we are feeding off Hatchet Bay and it’s a problem when we have bad weather.

“Sometimes we are without power for two or three days because there’s no bucket truck on this end of Eleuthera so it’s a major problem.” Just last month, North Eleuthera was hit with a 34-hour power outage due to generation failures at the Hatchet Bay Power Station.

BTC, in a statement Monday, said it expected all mobile, TV, Internet and fixed-line voice services in impacted areas across Eleuthera to be restored within 24 hours after they

were severed last Thursday by what it alleges is an act of sabotage.

Stephen Coakley-Wells, BTC’s director of legal and government affairs, and corporate secretary, said the near five-day service disruption stems from a dispute as to who owns the property where BTC’s fibre optic cable infrastructure makes landfall in Eleuthera.

The property in question is located close to the island’s iconic Glass Window Bridge, but Mr Coakley-Wells said a person - who he did not identifyhad recently claimed that they own this land and are demanding that BTC pay them compensation for its use. When no payment was forthcoming, they allegedly cut the cables.

Juan McCartney, corporate and consumer relations manager at the Utilities Regulation and Competition Authority (URCA),

said the supervisor was aware of the service interruption and is focused on how many consumers were affected and in helping BTC restore service to the area. He said the land dispute is a matter for the “courts and or the police” and URCA will not get involved. “We’re of course aware of it. We are made aware of any major outages that occur and that is considered a major outage,” Mr McCartney said.

“Now, as far as that issue is concerned, that appears on the face of it to be a land dispute, and an alleged claim of vandalism so that, in particular, would be a matter for the courts and or the police.

“But in terms of service restoration, what URCA is concerned about is how many people are impacted, what we can do to help licensees to get those

Realtor in industry ‘first’ with sports, entertainment launch

FROM PAGE A24

“We’ve seen an increasing influx of top professional athletes and entertainment clients that are starting to frequent The Bahamas. It will start from a vacation standpoint, and it now transcends into investments in second or third home transactions for them.

“We’ve seen the numbers growing year-over-year, and so for us we wanted to be in front of it. So we’ve launched the first-ever sports and entertainment division within a real estate firm in The Bahamas. That division is going to speak specifically to the needs and wants of this very niche group,” Mr Christie continued.

“This is a very specific group of individuals, many of whom would be considered celebrity status, which means they need a custom,

tailor-made approach to everything; what we call a high specialist, high touch level - really a whole game service.”

Corcoran C.A. Christie, in announcing the move, described it as “a groundbreaking venture..... within The Bahamas’ luxury real estate market. Designed exclusively for elite athletes and entertainers, our services cater to high-profile clientele seeking the pinnacle of bespoke living and investment experiences.......

“Corcoran CAC Bahamas Sports and Entertainment Division is a curated sales division within The Bahamas’ luxury real estate market. This division, being the first of its kind in the real estate space in The Bahamas, caters to the unique needs of clients within the sports and entertainment industries and ultra-high net-worth parties, offering benefits to

investing in exclusive properties,” it added.

Mr Christie told Tribune Business: “It’s always good to be the first to market. It’s something we have been working on for the last two years and we finally launched today [yesterday]. The phones have been ringing non-stop. We’ve had a lot of people looking for strategic partnerships.”

Pointing out that professional sportsmen and entertainment clients are often accompanied by an entourage, including agents, coaches and advisers as well as their families, he added: “When they come to The Bahamas they want a familiar face understands what they go through, what they require and understands their needs....

“We are partnering with one or two financial institutions able to provide financial and investment advice and opportunities.

We’ll have enhanced relationship opportunities, exclusive offers with hotels, airport relationships, private aviation and health and wellness establishments.

“That’s what it is if you want to deal with these clients. You have to be able to handle the real estate, but you have to have these contacts and relationships in place if you need to book a private jet, a private yacht for them.... We’re rolling out a platform that speaks specifically to their needs.”

And not just for international athletes but professional Bahamian sportsmen currently earning their living overseas.

“We have a lot of great professional athletes that are in the US or Europe, and they have a very good support system there if they want to buy, invest or have money in the bank. But, when they come back home, they don’t

have anybody,” Mr Christie explained.

“We are now providing a vehicle for Bahamian athletes who are global when they come back to The Bahamas. They will have a place to come and train, and there will be avenues for investment opportunities and investment advice.

“When I moved back from Europe 15 years ago, I had made a decent amount of money sitting in the bank, but came back and did not have a clue what I should do - should I buy real estate, invest in stocks, invest in bonds? That’s one of the reasons why we created this division not only for international athletes and entertainment clients coming here but also for our Bahamians.”

Mr Christie said there had been “substantial growth” in professional sportspersons and entertainers attracted to The

people back up and make sure that their service is provided for. But in terms of the actual dispute that’s going on, URCA doesn’t get involved in that.”

BTC said the party that alleges ownership of the land has failed on multiple occasions to provide it with documents proving their ownership but, within the past month, supplied copies of a purported Crown Land grant dated May 3, 2024. They are now said to be demanding compensation from BTC for past use of the land, even though the Crown grant - if valid - only confirms they have ownership and legal title for just a month. BTC said this person had frequently threatened to cut its fibre optic cables unless monies were paid, adding that it was “reliably informed” this threat was carried out last Thursday.

Bahamas for vacation and investment purposes. He added that “one of the key things that was missing”, but has now been resolved, is the provision of “state-ofthe-art” training and health and wellness facilities in The Bahamas to a standard these persons are accustomed to.

“We have the best hotels, hospitality and real estate but, in the past five to seven years, have developed very high level training and wellness facilities,” Mr Christie said. “We believe this could be a huge part of our business. We’ve just seen an influx of sports and entertainment clients that continue to come.

“We have already this year closed one or two decent-sized transactions with sports and entertainment clients, and we believe that will just continue to grow.” Corcoran C.A. Christie has a three-strong team, led by himself, that is dedicated to the sports and entertainment division.

and they are now seeking to tie down listing agreements with Bahamian realtors to facilitate their marketing and eventual sale.

“Following constructive, arm’s-length negotiations, Wang and Singh have agreed to transfer legal title to the Wang residence and Singh residence, respectively, to FTX Digital Markets, acting by the liquidators, to recover stipulated Digital Markets property,” Mr Ray said in referring to FTX’s Bahamian subsidiary.

“The transfer of the residences now — without having to wait for resolution of all the claims asserted in [litigation] — will benefit the debtors by allowing the debtors and FTX Digital Markets to monetise the portfolio of Bahamas properties in the order and manner that they believe will maximise recoveries for the estates.”

The two properties in question, which Mr Ray alleges were acquired via “fraudulent transfers” using FTX client monies, were units 112 and 209 at One Cable Beach that were owned by Mr Wang and Mr Singh respectively. All parties, including the Bahamian liquidators, have signed an agreement for the units’ hand over which must now be approved by the federal Delaware Bankruptcy Court.

Detailing the background to both property purchases, Mr Ray’s legal filings asserted: “In or around March 2021, it was determined that the residences should be purchased in Wang’s and Singh’s names to enable them to apply for certificates of permanent residence in The Bahamas for business purposes.

“In or around April 2021, Wang, the co-founder and chief technology officer of FTX, entered into an agreement to purchase the Wang residence for US$1.372m.” The purchase price for

Mr Singh’s residence was $950,000.

Julian Alexander Bostwick, a Bahamian attorney with Abaco Law Ltd, was hired by Wang to facilitate the purchase of his property on April 13, 2021, although there is no suggestion the former did anything wrong in relation to the purchases or FTX saga.

“On April 13, 2021, an agreement was purportedly executed in the name of Singh to appoint Julian Alexander Bostwick of Abaco Law to act as an agent for Singh in connection with the purchase of the Singh residence. Although the power of attorney purports to bear his signature, Singh believes that he did not execute the power of attorney and was not made aware of it at the time of its execution,” Mr Ray alleged.

“On April 21, 2021, FTX Trading wired from its Prime Trust account $141,787.13 to Abaco Law Ltd as a deposit on the Wang residence and US$2,856.25 as a search fee for the Wang residence. Also on April 21, 2021, FTX Trading wired from its Prime Trust account $98,700 to Abaco Law Ltd as a deposit on the Singh residence and US$2,856.25 as a search fee for the Singh residence.

“On June 11, 2021, FTX Trading wired from

its Prime Trust account $1.321m to Abaco Law Ltd to pay the balance of the purchase price on Wang’s residence and $189,482.90 to pay the VAT, commissions and fees on the purchase, respectively.”

The One Cable Beach unit was conveyed to Mr Wang on June 14, 2021, some three months before FTX was licensed to operate a crypto exchange from The Bahamas. “On June 15, 2021, FTX Trading wired from its Prime Trust account $808,767.52 to Abaco Law Ltd to pay the balance of the purchase price on the Singh residence and $123,744.75 to pay the VAT, commissions and fees on the purchase, respectively,” Mr Ray added.

“On June 30, 2021, the Singh residence was conveyed to Singh by an indenture and deed of conveyance which is recorded in the Registry of Records in the Commonwealth of The Bahamas. Neither Singh nor Wang lived in the residences. Instead, the FTX group maintained possession of the residences and used the residences to house other FTX group employees over time.”

Justifying the settlement, Mr Ray added: “The settlements are in the best interests of the debtors and their estates because they guarantee that the debtors and/or FTX Digital Markets will recover property that can be monetised for the benefit of the creditors without releasing or resolving any of the debtors’ and/ or FTX Digital Markets’ other claims against either Wang or Singh.

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

“Receiving the residences now, without having to await resolution of [litigation], will allow the debtors and FTX Digital Markets to monetise the portfolio of Bahamas properties in the order and manner that

they believe will maximise recoveries for the estates.”

is also handing over his Albany property to the Bahamian liquidators so that it can be sold to cover the $5.593m restitution he must pay to FTX’s Chapter 11 bankruptcy estate. Key SBF cronies to hand over $2.34m

Ryan Salame, the former FTX Digital Markets head recently sentenced to seven-and-a-half years for his role in the crypto exchange’s operations,

PAGE 20, Wednesday, June 5, 2024 THE TRIBUNE

FROM PAGE A24

Bahamas properties FROM PAGE A24

Share your news

TECH NEWS SITE GIZMODO SOLD FOR THIRD TIME IN 8 YEARS AS EUROPEAN

PUBLISHER KELEOPS LOOKS TO EXPAND

NEW YORK Associated Press

LONGTIME technology news and review site Gizmodo has been sold for the third time in the past eight years, this time to a European publisher looking to expand its coverage of the digital scene.

Switzerland-based Keleops didn't disclose how much it paid for Gizmodo in its Tuesday announcement of the deal. Gizmodo was part of a $135 million deal in 2016 when Univision Communications bought its previous owner,

Gawker Media, after that company filed for bankruptcy in the fallout from a losing legal battle with former professional wrestler Hulk Hogan.

Univision subsequently sold Gizmodo and the satirical publication The Onion to Boston investment firm Great Hill Partners in 2019 at what was believed to be a fraction of the price paid in the 2016 deal. Great Hill formed G/O Media to oversee Gizmodo and other websites In a staff memo provided to The Associated Press, G/O Media CEO

Jim Spanfelle said Gizmodo was sold for substantially more this time than the price paid to Univision in 2019, without providing any specifics.

"This and other increases in valuation stand as strong testament to the work of not only our editorial teams but also the core other areas of our operations," wrote Spanfelle, who said the deal includes a commitment to keep Gizmodo's staff intact.

G/O Media recently sold The Onion to tech executive Jeff Lawson, who became a billionaire after

founding online business software provider Twilio. Lawson is asking Onion readers to donate $1 to help support it financially. Keleops CEO Jean-Guillaume Kleis, who founded his company a decade ago, plans to carry out a more traditional business strategy by leveraging the brand and reputation that Gizmodo has built during its more than 20 years tracking technology.

"The combination of Keleops' unique digital know-how and Gizmodo's rich content and deep editorial expertise will greatly

benefit both our audiences and our partners," Kleis predicted in a statement. New York-based Gizmodo attracted worldwide attention in 2010 after buying an early prototype of Apple's iPhone 4 that Apple's late co-founder

contended was stolen. Jobs, who died in 2011, also accused Gizmodo of trying to extort Apple to get the device back, resulting in an apology from a Gizmodo editor. Local prosecutors in Silicon Valley did not file charges in that caper.

Former OpenAI employees lead push to protect whistleblowers flagging artificial intelligence risks

By MATT O'BRIEN AP Technology Writer

A GROUP of OpenAI's current and former workers is calling on the ChatGPTmaker and other artificial intelligence companies to protect employees who flag safety risks about AI technology.

An open letter published Tuesday asks tech companies to establish stronger whistleblower protections so researchers have the "right to warn" about AI dangers without fear of retaliation.

The development of more powerful AI systems is "moving fast and there are a lot of strong incentives to barrel ahead without adequate caution," said former OpenAI engineer Daniel Ziegler, one of the organizers behind the open letter.

Ziegler said in an interview Tuesday he didn't fear speaking out internally during his time at OpenAI between 2018 to 2021, in which he helped develop some of the techniques that would later make ChatGPT so successful. But he now worries that the race to rapidly commercialize the technology is putting pressure on OpenAI and its competitors to disregard the risks.

Another co-organizer, Daniel Kokotajlo, said he

stop making workers enter into "non-disparagement" agreements that can punish them by taking away a key financial perk — their equity investments — if they criticize the company after they leave.

Social media outrage over language in OpenAI's paperwork for departing workers recently led the company to release all its former employees from those agreements.

The open letter has the support of pioneering AI scientists Yoshua Bengio and Geoffrey Hinton, who together won computer science's highest award, and Stuart Russell. All three have warned about the risks that future AI systems could pose to humanity's existence.

The letter comes as OpenAI has said it is beginning to develop the next generation of the AI technology behind ChatGPT. It formed a new safety committee just after losing a set of leaders, including cofounder Ilya Sutskever, who were part of a team focused on safely developing the most powerful AI systems.

The broader AI research community has long battled over the gravity of AI's short-term and long-term risks and how to square them with the technology's

“We agree that rigorous debate is crucial given the significance of this technology and we’ll continue to engage with governments, civil society and other communities around the world.”

quit OpenAI earlier this year "because I lost hope that they would act responsibly," particularly as it attempts to build betterthan-human AI systems known as artificial general intelligence.

"They and others have bought into the 'move fast and break things' approach and that is the opposite of what is needed for technology this powerful and this poorly understood," Kokotajlo said in a written statement.

OpenAI said in response to the letter that it already has measures for employees to express concerns, including an anonymous integrity hotline.

"We're proud of our track record providing the most capable and safest AI systems and believe in our scientific approach to addressing risk," said the company's statement. "We agree that rigorous debate is crucial given the significance of this technology and we'll continue to engage with governments, civil society and other communities around the world."

The letter has 13 signatories, most of whom are former employees of OpenAI and two who work or worked for Google's DeepMind. Four are listed as anonymous current employees of OpenAI. The letter asks that companies

commercialization. Those conflicts contributed to the ouster, and swift return, of OpenAI CEO Sam Altman last year, and continue to fuel distrust in his leadership.

More recently, a new product showcase drew the ire of Hollywood star Scarlett Johansson, who said she was shocked to hear ChatGPT's voice sounding "eerily similar" to her own despite having previously rejected Altman's request that she lend her voice to the system.

Several who signed the letter, including Ziegler, have ties to effective altruism, a philanthropic social movement that embraces causes such as mitigating the potential worst impacts of AI. Ziegler said it's not just "catastrophic" future risks of out-of-control AI systems that the letter's authors are concerned about, but also fairness, product misuse, job displacement and the potential for highly realistic AI to manipulate people without the right safeguards.

"I'm less interested in scolding OpenAI," he said. "I am more interested in this being an opportunity for all the frontier AI companies to do something that really increases oversight and transparency and maybe increases public trust."

THE TRIBUNE Wednesday, June 5, 2024, PAGE 19

IPHONE fans share a light moment while waiting for the first day sales of iPhone 3GS in Tokyo, Japan, Friday, June 26, 2009. Longtime technology news and review site Gizmodo has been sold for the third time in the past eight years.

Photo:Junji Kurokawa/AP

THE OPENAI logo is seen displayed on a cell phone with an image on a computer monitor generated by ChatGPT’s Dall-E textto-image model, Dec. 8, 2023, in Boston. A group of OpenAI’s current and former workers is calling on the ChatGPT-maker and other artificial intelligence companies to protect whistleblowing employees who flag safety risks about AI technology.

Photo:Michael Dwyer/ AP

OpenAI

Wall Street cleaves between winners and losers on report showing slowing economy

By STAN CHOE AP Business Writer

U.S. stocks were split among winners and losers Tuesday after a report suggested the job market is cooling, the latest signal of a slowing economy that offers both upsides and downsides for Wall Street.

The S&P 500 ticked up by 0.2%, though more stocks within the index fell than rose. The Dow Jones Industrial Average rose 140 points, or 0.4%, and the Nasdaq composite added 0.2%.

The action was stronger in the bond market, where Treasury yields slid after Tuesday morning's report showed U.S. employers were advertising fewer job openings at the end of April than economists expected. Wall Street actually wants the job market and overall economy to slow. That could help get inflation under control and convince the Federal Reserve to cut interest rates, which would ease the pressure on financial markets. Traders upped their expectations for cuts to rates later this year following the report, according to data from CME Group.

The question is whether the slowdown for the economy overshoots and ends up in a painful recession.

That would carry the downside of not only causing layoffs for workers across the country but also weakening profits for companies, which would drag stock prices lower.

Tuesday's report said the number of U.S. job openings at the end of April dropped to the lowest level since 2021. The numbers suggest a return to "a normal job market" following years full of strange numbers caused by the COVID-19 pandemic, according to Bill Adams,

chief economist for Comerica Bank.

But it also followed a report on Monday that showed U.S. manufacturing contracted in May for the 18th time in 19 months.

Worries about a slowing economy have hit the price of crude oil in particular this week, raising the possibility of less growth in demand for fuel.

A barrel of U.S. crude has dropped close to 5% in price this week and is roughly back to where it was four months ago. That

sent oil-and-gas stocks to some of the market's worst losses for a second straight day. Halliburton dropped 2.5%.

Other companies whose profits tend to rise and fall with the cycle of the economy also fell to sharp losses, including steel makers and mining companies. Copper and gold miner FreeportMcMoRan lost 4.5%, and steelmaker Nucor fell 3.4%.

The smaller companies in the Russell 2000 index, which tend to thrive most

THE NEW York Stock Exchange, center, is shown on Tuesday, June 4, 2024. Shares in Europe and Asia were mostly lower on Tuesday after a report showed that U.S. manufacturing contracted in May. Photo:Peter Morgan/AP

when the U.S. economy is at its best, fell 1.2%.

Elsewhere on Wall Street, Bath & Body Works tumbled 12.8% for the worst loss in the S&P 500 despite topping expectations for revenue and profit in the latest quarter. Analysts called its forecast for results in the current quarter underwhelming.

GameStop also gave back some of its big gain from the day before, when euphoria broke out after a central character in the stock's 2021 run returned to say he had built a stake in the video-game retailer. It dropped 5.4%.

On the winning side of Wall Street were dividendpaying stocks. They tend to benefit from lower interest rates because bonds paying lower yields can steer more income-seeking investors to real-estate investment trusts, utilities and other stocks that pay relatively high dividends.

Camden Property Trust, which offers multifamily housing around the country, rose 2.6% for one of the largest gains in the S&P 500. Mid-America

ATLANTA WATER SYSTEM STILL IN REPAIR ON DAY 5 OF OUTAGES

By JEFF AMY and SHARON JOHNSON Associated Press

WORKERS continued to install pipes to replace a ruptured water main in Atlanta on Tuesday, as water problems persisted in some parts of the city for a fifth day.

"Making progress," Mayor Andre Dickens told The Atlanta

Journal-Constitution at the site of the ruptured pipe in the city's Midtown neighborhood. "(I'm) so ready for this to be over. So are the residents around here."

By Monday afternoon, the area under a boilwater advisory was sharply reduced after pressure was restored in many areas following Saturday's repair of the first mammoth leak,

west of downtown. But downtown, Midtown and areas to the east remained under a boil order Tuesday, and water was still shut off in the blocks immediately surrounding that repair site. Workers continued to cut and place new pipes into Tuesday after a leak that sent a gushing river onto the streets of Midtown finally was cut off around sunrise

Monday. Some hotels, offices and residences in high-rise buildings across a broader area were still affected Tuesday, because lower water pressure in the system means toilets won't flush on higher floors and some air conditioning systems won't operate normally.

Norfolk Southern Corp. partially closed its

Apartment Communities rose 2.1%.

Some Big Tech stocks whose fortunes seem to continue to rise no matter what the economy is doing also drove the market higher. Nvidia was the strongest force pushing the S&P 500 upward. It rose 1.2% as it keeps riding a furor on Wall Street around artificialintelligence technology.

All told, the S&P 500 rose 7.94 points to 5,291.34. The Dow gained 140.26 to 38,711.29, and the Nasdaq added 28.38 to 16,857.05.

In the bond market, the yield on the 10-year Treasury slid to 4.33% from 4.39% late Monday and 4.50% late Friday. It had been above 4.60% recently. The two-year yield, which more closely tracks expectations for the Fed, fell to 4.77% from 4.81%.

In stock markets abroad, India's Sensex dropped 5.7% a day after jumping 3.4% following the country's elections. Indexes were mixed across the rest of Asia and lower across much of Europe.

headquarters building about eight blocks from the repair site. The state of Georgia's office complex downtown was still experiencing low pressure and discolored water, but Gerald Pilgrim, the deputy executive director of the Georgia Building Authority, said "all systems are functioning at safe levels."

"We know results are mixed here in terms of buildings and the experience with water service, water pressure," said Brian Carr, a spokesperson for the Midtown Alliance, which promotes development in the Atlanta district.

Many residents are frustrated with the pace of repairs. Officials have provided no estimates of how many residents are still affected or how many were affected at peak.

"In all my life, I've never seen a situation like this," Chris Williams, a Midtown resident, said Tuesday.

"This is a pretty big city and this is kind of giving small city vibes. ... Why couldn't it have been figured out earlier, and how can we not inform more?"

Dickens, a first-term

Democratic mayor, has faced criticism for being out of town and slow to

communicate after the first leak began. Dickens left Friday and stayed overnight in Memphis, Tennessee to raise funds for his 2025 reelection campaign. He said the extent of problems weren't clear when he left. Spokesperson Michael Smith said Dickens met with Memphis Mayor Paul Young and other leaders, and that he was in "constant communication" with Atlanta officials before returning Saturday. Atlanta's water outages are the latest failures as cities across the country shore up faltering infrastructure. A 2022 crisis in Jackson, Mississippi, which has a long-troubled water system, left many residents without safe running water for weeks. Other cities including Flint, Michigan, have also struggled to supply residents with safe drinking water. Atlanta voters support improvements: Last month, they approved continuing a 1-cent sales tax to pay for water and sewer improvements. The city that dumped untreated sewage into creeks and the Chattahoochee River until ordered to stop by a federal court has spent billions to upgrade its aging sewer and water systems, even drilling a tunnel through 5 miles (8 kilometers) of rock to store more than 30 days of water.

PUBLIC NOTICE

INTENT TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, SELINA ALYSSA LYNETTE HAMILTON-TURNQUEST, of 1321 Old Heritage Pl, Greenwood, IN 46143, Nassau, The Bahamas, intend to change my name to SELINA ALYSSA LYNETTE ESTWICK If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Offcer, P.O.Box N-742, Nassau, The Bahamas no later than thirty (30) days after the date of publication of this notice.

Notice is hereby given that in accordance with Section 138(4) of the International Business Companies Act 2000, the above-named Company is in dissolution, which commenced on the 10th day of May, A.D., 2024. The Liquidator is Galnom Ltd., CUB Financial Center, Western Road, Nassau, Bahamas.

PAGE 18, Wednesday, June 5, 2024 THE TRIBUNE

STOCK MARKET TODAY

N O T I C E SONIC INTERNATIONAL SERVICES LIMITED (Voluntary Liquidation)

GALNOM LTD. Liquidator

Sunak and Starmer clash over tax and health in a debate as disruptor Farage roils the UK election

By JILL LAWLESS Associated Press

BRITISH Prime Minister

Rishi Sunak and opposition Labour Party leader Keir Starmer sparred Tuesday over tax, the cost of living and the country's creaking health system in an inconclusive televised debate ahead of a July 4 election expected to make one of them the country's next leader.

Sunak tried to boost his center-right party's dismal outlook by urging voters to back the stability of continued Conservative government. Starmer hoped to cement his status as favorite by arguing that Britain desperately needs change. Both acknowledged the country's many problems, from fraying public services to a broken immigration system. But neither could say outright, when asked, where the money would come from to fix them.

Sunak stressed his stewardship of the economy, which has seen inflation fall to just over 2% from a peak of more than 11% in late 2022. He said should stick with him because his "clear plan" for the economy was working.

Starmer said the election was a choice between more "chaos and division" with the Conservatives and "turning the page and rebuilding with Labour."

Polls currently give center-left Labour a double-digit lead. To win, Starmer must persuade voters who previously

backed the Tories that Labour can be trusted with the U.K.'s economy, borders and security.

Speaking in front of a live audience on a sleek, futuristic set at the studios of broadcaster ITV in Salford, northwest England, both Starmer and Sunak appeared nervous. Voters may have got the impression their choice is between two cautious and rather dull managers. Both stuck to familiar themes. Sunak argued Labour would raise taxes because "it's in their DNA."

Sunak said he would stop people making dangerous journeys to the U.K. in small boats by sending asylum-seekers on a oneway trip to Rwanda, and

NEW YORK CONSIDERS REGULATING WHAT CHILDREN SEE IN SOCIAL

MEDIA FEEDS

By CAROLYN THOMPSON Associated Press

NEW York lawmakers on Tuesday said they were

finalizing legislation that would allow parents to block their children from getting social media posts curated by a platform's algorithm, a move to rein in feeds that critics argue keep young users glued to their screens.

Democratic Gov. Kathy Hochul and Attorney General Letitia James have been advocating for the regulations since October, facing strong pushback from the tech industry. The amended version removes provisions that would have limited the hours a child could spend on a site. With the legislative session ending this week, Albany lawmakers are making a final push to get it passed.

"The algorithmic feeds are designed as dopamine for kids," Assembly sponsor Nily Rozic, a Democrat, said Tuesday. "We are trying to regulate that design feature."

The legislation in New York follows actions taken by other U.S. states to curb social media use among children. Republican Florida Gov. Ron DeSantis signed legislation banning social media accounts for children under 14 and requiring parental permission for 14and 15-year-olds. Utah in March revised its policies, requiring social media companies to verify the ages of their users, but removing a requirement that parents consent to their child creating an account. A state law in Arkansas that also would have required parental consent was put on hold last year by a federal judge.

Supporters say New York's Stop Addictive Feeds Exploitation (SAFE) For Kids Act, which would prohibit algorithm-fed content without "verifiable parental consent," is aimed at protecting the mental health and development of young people by shielding them from features designed to keep them endlessly scrolling.

Instead of having automated algorithms suggest content classified as addictive and based on what a user has clicked on in the past, young account holders would see a chronological feed of content from users they already follow. Rozic said the New York bill doesn't attempt to regulate the content available on social media, only "the vehicle that supercharges the feed and makes it more addictive."

Critics of the bill, including the Surveillance Technology Oversight Project, warn it could make things worse for children, including leading to internet companies collecting more information about users.

"Lawmakers are legislating a fairy tale," the privacy advocacy group's executive director, Albert Fox Cahn, said in a statement. "There simply is no technology that can prove New Yorkers' ages without undermining their privacy."

The tech industry trade group NetChoice, whose members include Meta and X, accused New York of "trying to replace parents with government."

"Additionally, this bill is unconstitutional because it violates the First Amendment by requiring websites to censor the ability of New Yorkers to read articles or make statements online, by blocking default access to websites without providing proof of ID and age, and by denying the editorial rights of webpages to display, organize, and promote content how they want," Carl Szabo, NetChoice's vice president and general counsel, said in an emailed statement.

The legislation also would prohibit sites from sending notifications to minors between midnight and 6 a.m. without parental consent.

Companies could be fined $5,000 per violation.

If passed by the Assembly and Senate, Hochul is expected to sign the bill and another regulating data collection into law after calling the legislation one of her top priorities.

suggested he'd be willing to take the U.K. out of the European Convention on Human Rights if its court blocked the deportations.

Starmer dwelled on the Conservatives' record during 14 years in power, especially the chaotic last few years, which saw Prime Minister Boris Johnson ousted amid money and ethics scandals. Successor Liz Truss, elected by party members, rocked the economy with her uncosted tax-cutting plans and quit after 49 days. Sunak took over, without a national election, in October 2022. "This government has lost control. Liz Truss crashed the economy," Starmer said. "We cannot have five more years of this."

A note of the personal crept in when Starmer took a dig at ex-banker Sunak's wealth, saying his own father had been a factory worker and claiming Sunak did not understand the financial worries facing working-class people.

All 650 seats in the House of Commons are up for grabs on July 4. The leader of the party that can command a majority – either alone or in coalition – will become prime minister.

Both contenders said they would maintain Britain's close ties with the United States if Donald Trump wins in November. Starmer said "the special relationship transcends whoever fills the post of prime minister and president."

Sunak agreed that "having a strong relationship with our closest partner and ally in the United States is critical for keeping everyone in our country safe."

Televised debates are a relatively recent addition to U.K. elections, first held in 2010. That debate spurred support for then-Liberal Democrat leader Nick Clegg, triggering a wave of "Cleggmania" that helped propel him into the deputy prime minister post in a coalition government with the Conservatives.

No debate since has had the same impact, but they have become a regular feature of election campaigns. Several more are scheduled before polling day, some featuring multiple party leaders as well as the two front-runners.

Rob Ford, professor of political science at the University of Manchester, said the lack of a knockout blow by either side counted as a good result for Sunak because he is behind in the polls. "Will it matter in the end? Probably not. But it's a bit of good news for Cons(ervatives) after a pretty rough few days. Will help with morale, at a minimum," he wrote on X, formerly known as Twitter.

The debate came a day after populist firebrand

and

Nigel Farage roiled the campaign, and dealt a blow to Sunak's hopes, by announcing he will run for Parliament at the helm of the right-wing party Reform U.K. Farage kicked off his campaign Tuesday in the eastern England seaside town of Clacton-on-Sea, where he is making an eighth attempt to win a seat in the House of Commons. His seven previous tries all failed.

The return of Farage, a key player in Britain's 2016 decision to leave the European Union, is bad news for Sunak's party. Reform look likely to siphon off votes of socially conservative older voters, a group the Tories have been targeting.

Farage claimed the Conservatives, who have been in office since 2010, had "betrayed" Brexit supporters because immigration had gone up, rather than down, since the U.K. left the EU.

He urged voters to "send me to Parliament to be a bloody nuisance."

As he left a pub where he had been speaking to the media, Farage was splattered with a beverage, which appeared to be a milkshake, by a bystander. Essex Police said a 25-yearold woman from Clacton was arrested on suspicion of assault.

THE TRIBUNE Wednesday, June 5, 2024, PAGE 17

BRITAIN’s Prime Minister Rishi Sunak arrives at the TV studios in Manchester, England, Tuesday, June 4, 2024. Rishi Sunak, leader of the Conservative Party,

Keir Starmer, leader of the Labour Party, are preparing to face off in the first head-to-head TV debate of the election.

Photo:Jon Super/AP

NEW York Gov. Kathy Hochul, left, listens as Attorney General Letitia James speaks during a news conference in New York, Oct. 11, 2023. New York lawmakers on Tuesday, June 4, said they were finalizing legislation that would allow parents to block their children from getting social media posts curated by a platform's algorithm, a move to rein in feeds that critics argue keep young users glued to their screens. Hochul and James have been advocating for the regulations since October, facing strong pushback from the tech industry.

Photo:Seth Wenig/AP