BPL grid bidder seeks $30m Bahamian equity

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netTHE company set to be charged with overhauling Bahamas Power & Light’s (BPL) electricity grid is seeking to raise $30m in equity from local investors, it has emerged.

Multiple Bahamian capital markets sources, speaking on condition of anonymity because they were not authorised to speak publicly, told Tribune Business that Island Grid is seeking to raise a funding mix - split

• Island Grid aiming to raise up to $130m

• To fund transmission, distribution reform

• Move to get local ownership in overhaul

into $30m of equity financing, and around $100m of preference shares or some other form of debt - to help finance the transformation of BPL’s transmission and distribution (T&D) network.

This newspaper was told that the $30m equity ownership portion may have already been placed with Bahamian investors via a private placement overseen by CFAL, the former Colina Financial Advisers. The proceeds will be used to fund

SEE PAGE B13

‘No need for alarm’ over slowing Q3 tourism pace

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netTHE Bahamas Hotel and Tourism Association’s (BHTA) president says there is “no need to raise the alarm yet” over a slowing third quarter booking pace as the industry “normalises” back to single digit growth.

Gov’ts $85.3m March surplus monthly record

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netTHE Government’s $83.5m fiscal surplus for March 2024 was the largest since monthly reporting began almost three years ago - driven by a mix of revenue gains and reduced spending.

The Ministry of Finance’s report for the month, released just prior to the Labour Day holiday, revealed an almost-$56m year-over-year gain in revenues to $358.1m primarily due to a 69.6 percent increase in real property taxes and a $21.7m gain on “other taxes on goods and services”.

While crediting “enhanced enforcement measures” for the more than $21m improvement in property tax collections compared to March 2023, the Government’s fiscal surplus was also expanded by the 7.2 percent or $21.2m year-over-year decline in total spending to $274.6m.

While March 2024’s capital expenditure jumped to $37m, as opposed to just $29.6m one year ago, and civil service compensation rose to $72.4m from $66m as a result of new union

contracts and public service hires, the data released late last week showed yearover-year declines in most recurrent (fixed cost spending) line items. Combined with the revenue gains, the lowered spending resulted in the greatest Budget surplus for the Government since monthly reporting began in July 2021. The March 2024 surplus, which measured the extent to which the Government’s revenue income exceeded its spending for that month, was 81 percent or some $37.5m than the previous record set at $46.1m in April 2022. The March monthly surplus also helped reduce the Government’s direct debt by $80.8m during the months, with some $104.6m in new borrowings overshadowed by $185.4m in repayments to produce the net repayment.

And, while one month does not necessarily signal the start of a trend, the March surplus reversed and eliminated some 28 percent of the $297.7m fiscal deficit incurred through the 20232024 Budget year’s first eight months, dropping it to the $214.2m that was

Robert Sands told Tribune Business that it was too early to be concerned about the late summer and early fall period given that resorts and the wider tourism industry “can pick up a substantial number of rooms in a very short period” given that The Bahamas continues to face a visitor booking window as narrow as 15-30 days out. And, while the tourism industry still faces “shoulder seasons” or lulls in business, he added that these are “not as

PAGE B7

Gov’t ‘not honouring’ industrial agreements

By NEIL HARTNELL Tribune Business EditorA TRADE union leader is warning of rising workplace tensions as he accused various government agencies of failing to either “honour” or “execute” industrial agreements.

Obie Ferguson KC, the Trades Union Congress (TUC) president, told Tribune Business that the Government is not living up to its side of the bargain made in the Memorandum of Understanding (MoU) agreed with the labour movement prior to the 2021 general election even though the unions have “lived up to our commitment to maintain industrial peace for at least three years”. In his address to mark last Friday’s Labour day

PAGE B4

BAZAAR PURCHASE POSITIVE BUT MUST BE PIECE OF WIDER PLANS

By STEPHEN CRANEThe Government’s recent decision to acquire the International Bazaar, a significant asset, is a testament to the Prime Minister’s commitment to reviving Grand Bahama. This acquisition and the Prime Minister’s proactive initiatives regarding the Grand Bahama Port Authority (GBPA) present a unique opportunity to reimagine Grand Bahama’s future development completely. However, a comprehensive development plan for the island is imperative to ensure dynamic growth.

Once this plan is in place, it can be best decided how the International Bazaar fits into a much broader vision. It is important to note that the past few decades have seen too many fragmented investment attempts on Grand Bahama that have not yielded the desired results.

The Prime Minister’s recent speech laid the foundation for that

Gov’t allocates $1m for Royal Oasis deal

By FAY SIMMONS Business ReporterTHE Government has allocated $1m in the 2024-2025 Budget to finance its purchase of the dilapidated Royal Oasis resort with a matching amount for the West Sunrise Highway.

Prime Minister Philip Davis KC, in leading-off the 20242025 Budget debate, said his administration plans to acquire the Princess Towers hotel (Royal Oasis), West Sunrise Road and the nowderelict International Bazaar site for under $4m.

He added that loan financing has been arranged with the African Export-Import Bank to redevelop that site into an African-Caribbean products marketplace. Mr Davis previously indicated that the all-in development cost, including the purchase price, was around $30m.

However, no deal has yet been sealed for either the Royal Oasis or International Bazaar sites. Chris Paine, president of the International Bazaar Owners Association, told Tribune Business after the May 29 Budget that discussions with the Government were only at a preliminary stage although, given that “90 percent of the buildings are vandalised or destroyed by fire”, the only real asset to be acquired is land.

The International Bazaar’s ownership is also somewhat complex with no less than 13 separate entities involved, including the likes of the Bahamas Hotel, Catering and Allied Workers Union (BHCAWU), John Bull and the Chee-A-Tow family. This means it could take some time to get all parties on the same page, and to agree a purchase price plus terms and conditions of sale.

As for the Royal Oasis, it will have been closed for 20 years this September. Tribune Business reported earlier this year that its current owner, Harcourt Developments, the Irish-based property developer, had appointed Colliers, the international real estate firm, to market and sale its Grand Bahama real estate holdings including the resort.

However, no deal has yet been concluded. “There’s been a lot of talk but no action,” one source said of a potential Royal Oasis sale. The Government has allocated $1m towards the “acquisition of Royal Oasis” in both the 2025-2026 and 2026-2027 fiscal years, as well as the one immediately upcoming, indicating it may be hoping to pay-off the resort’s purchase over time.

Ginger Moxey, minister for Grand Bahama, in her 2024-2025 Budget debate

comprehensive development plan. He called for a world-class partnership to work with the Government, emphasising that extraordinary concessions require extraordinary growth. Achieving that extraordinary growth necessitates modernising the Hawksbill Creek Agreement. The Hawksbill Creek Agreement was instrumental in attracting investment and developing Freeport. However, it is crucial to recognise that the agreement is nearly 70 years-old. Updating the agreement to align with the current economic landscape is not just necessary but a strategic move that can empower the Government and local

contribution, said the purchase will help to “revitalise” the surrounding area and stimulate economic growth in Grand Bahama. “The Government has also agreed to acquire the property that the International Bazaar and Royal Oasis tower and casino is situated on for a future development that will revitalise the area and stimulate economic activity for the benefit of the Bahamian people for less than $4m,” she said. “This transaction involves 14 property owners. Thereafter, the properties will be demolished and beautified to make way for an amazing, world-class tourist attraction.”

Mrs Moxey confirmed that the Afro-Caribbean Marketplace will be funded “after indepth analysis” by the Africa Export-Import Bank.

She said: “It is envisioned that the Afro-Caribbean Marketplace on Grand Bahama will provide amazing entrepreneurial opportunities to empower Bahamians, especially in the creative industry – the orange economy.”

The minister for Grand Bahama also weighed in on the ongoing dispute between the Davis administration and the Grand Bahama Port Authority (GBPA) over $357m that the Government claims is owed by the latter for costs incurred in providing public services in Freeport over and above what it has earned in tax revenues for the 2018-2022 period.

She said: “It is that simple. GBPA is obligated to reimburse the Government of The Bahamas in law.” Mrs Moxey said the Davis administration will continue to seek the best deal for the Grand Lucayan’s sale and will make further announcements “when the money is in the bank”.

She asserted that the former Minnis administration purchased the hotel at a rate higher than its appraised value to prevent lay-offs and ended up using “taxpayers’ dollars” to subsequently distribute severance packages to former staff.

Mrs Moxey said: “With the Grand Lucayan, bear in mind, member for East Grand Bahama [Kwasi Thompson], that it was your administration that purchased the hotel for more than its appraised value to ‘save jobs’ then you turned around and still ended up using taxpayers’ dollars to pay severance as you let the same people go.

“In any event, this Davis/ Cooper administration continues to work for you to find the best deal possible, and as the member for Exuma and Ragged Island would say: ‘We’ll have a lot more to say when the money is in the bank’.”

stakeholders to deliver the desired growth. After all, the world has significantly changed since 1955, with the advent of computers, cell phones and, now, artificial intelligence (AI).

With Grand Bahama’s many advantages, particularly its prime location, a comprehensive development plan would lead to major new investment, job creation and economic growth. Dynamic development could drive the Bahamian economy and make it a regional or even global leader in a new form of public-private partnership.

Fostering improved co-operation among the major stakeholders is the

initial crucial step toward realising a comprehensive development plan. A significant stride in this direction could be establishing a trust to hold the island’s key assets collectively; perhaps another trust to administer the GBPA’s Hawksbill Creek Agreement responsibilities. The Government, along with other stakeholders, should be represented on the trust’s boards of trustees. This move would instill confidence in the stakeholders about the modernised Hawksbill Creek Agreement, paving the way for a more collaborative and effective approach. A world-class Bahamian and international talent

PM: Committee to combat living costs no ‘talking shop’

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.netTHE Prime Minister has denied that a committee created to help tackle The Bahamas’ cost of living crisis will merely be “a talking shop”.

Philip Davis KC, in announcing the National Trade Facilitation Committee during his address leading-off the 2024-2025 Budget debate, argued that “structural” problems are a key factor behind the high prices and living costs that Bahamians have had to endure both before and after the COVID19 pandemic.

He added that the high cost of goods cannot simply be blamed on The Bahamas’ regressive, consumption-based tax system, led primarily by VAT and import tariffs, which act as a tax on the cost of living. Or the fact that this nation imports virtually all the goods that it consumes, thus leaving it vulnerable to inflation brought in from the outside world.

Mr Davis said that, since 2021, his administration has been introducing measures to lower the cost of living but, when compared to other countries with similar import volumes and tax rates, The Bahamas still “ranks poorly”.

He said: “There is a widespread, mistaken assumption that high costs here are due to the fact that

we have such high imports, and that Customs duties and government taxes are the cause. This is not the entire story.

“If transportation costs and import taxes and duties are stripped out, the underlying price is still inexplicably high. When compared to other countries with similar imports and taxation arrangements, especially those in the region, we still rank poorly.

“Since our first Budget in 2021, we have introduced a number of measures designed to reduce the cost of living, but they have had little success in producing reductions in prices to the consumer. It is clear that something more structural is at play.”

Mr Davis said his administration is “attacking” the high cost of living through creating the National Trade Facilitation Committee, which will be tasked with increasing competition across supply chains and simplifying trade processes.

He said: “Our government is already attacking the problem of the high costs of living by looking at the challenge from a number of angles. One of the approaches is to reduce the high costs of trade by working through a body that will oversee our country’s overall trade environment.

“We have therefore established a National Trade Facilitation Committee (NTFC) that will coordinate all our efforts across the

team should implement the trusts’ business plans and objectives. The current asset owners would benefit from their assets increasing in value through development and investment. The Government would benefit from economic growth, job creation and increased tax revenue. The country and Grand Bahama would benefit from becoming a dynamic, thriving business hub.

Today, Grand Bahama’s stakeholders need constructive change more than ever before. The stage is set: A comprehensive plan needs to be developed, agreed upon and implemented.

different agencies of our government. This includes the upgrade of the Potter’s Cay port, the digitisation of the trade ecosystem, streamlining and simplifying processes, and increasing competition across supply chains.”

Mr Davis added that the establishment of similar committees in other countries has helped them to reduce costs by up to one-third for the benefit of their citizens. He said: “The National Trade Facilitation Committee is not a talking shop. It is an internationally-recognised structure, one, in fact, which we ought to have set up previously under our existing international treaty obligations.

“Evidence from the World Bank shows that the establishment of an NTFC has a big impact on reducing costs for ordinary people. In fact, countries which have implemented trade facilitation reforms can reduce costs by up to one-third.”

Minister reaffirms 30% renewable energy goal

A CABINET minister has reaffirmed The Bahamas’ ambitions to generate 30 percent of its energy needs from renewable sources by 20233. Vaughn P. Miller, minister of the environment and natural resources,

spoke at the Suriname Energy, Oil and Gas Summit’s (SEOGS) ministerial panel on how renewable energy could benefit The Bahamas, He participated in a roundtable discussion and debate

on ‘Energy for value creation’.

“We are fossil fuel driven. By the year 2033 we are striving to be at least 30 percent renewable,” Mr Miller said.

“Solar is land intense and we have land in our Family Islands that is available for us to make that transition.

“Presently, our transition fuel choice is LNG. Suriname is a very special place. We need collaboration. Suriname is an oil producing country and we are a country that

permanent

VAUGHN P. MILLER, minister of the environment and natural resources, on the panel at the SEOGS ministerial roundtable, which was debating ‘Energy for value creation’.

consumes a great amount of oil, which makes the relationship extremely important. Certainly, as a developing country as well, we would want to assist in helping them build capacity and with the transfer of knowledge in the industry.” Mr Miller was accompanied by David Davis, permanent secretary in the Ministry of the Environment and Natural Resources, and Gilles Deal, chief energy officer. The Summit was held from June 4-7, 2024.

TAXI CHIEF HAILS ‘TREMENDOUS BENEFIT’ FROM EXTRA TAX RELIEF

By NEIL HARTNELL EditorTHE Bahamas Taxi Cab Union’s president has hailed the expanded Excise Tax elimination to cover imported vehicles less than five years-old as “a tremendous benefit” to his members.

Wesley Ferguson told Tribune Business that the move, unveiled as part of the taxation adjustments accompanying the 20242025 Budget, will enable more taxi drivers to afford larger, newer vehicles at a time when “tourism is booming”.

And he added that extending the Excise Tax break, which previously only applied to brand new vehicle imports, to those which are five yearsold or less will mesh well with the taxi cab industry’s new driver code of conduct and drive to boost professionalism.

Prime Minister Philip Davis KC, in unveiling the

expanded Excise Tax concession, told the House of Assembly: “Along with the assorted items that have either had reductions in Customs duty, or have been made duty free, we have increased the vehicle age requirement from three years or less to five years for exemptions for taxis, livery and tour buses under the Excise Act.” The Excise (Amendment) Bill 2024, tabled in the House of Assembly as part of the legislative reforms contained in the 2024-2025 Budget, confirms that the main goal is to “allow taxi cab, livery car and omnibus owners to be able to purchase used motor vehicles five years and under”.

Mr Ferguson, who was unaware of the tax relief until informed by Tribune Business, said: “That would be very beneficial to taxi drivers. They would love a move like that. I applaud the Government for making such a concession to taxi drivers. Vehicles are getting more and more expensive,

and not every driver can afford a brand new vehicle.

“With tourism booming as it is now, taxi drivers need larger vehicles but cannot always afford them. They are very expensive. Presently, in order for taxi drivers to get a duty concession, it has to be a brand new vehicle for this particular year.

“For the Government to relax that to allow taxi drivers to bring in a vehicle not more than five years-old is very welcoming news for the taxi industry. It’s going to be tremendous. I sometimes have to order large vehicles for the taxi union’s use...,” the taxi union chief continued.

“When you have to tack on VAT and duty on to the vehicle’s price, it comes close to what the value of the vehicle is. If we get that duty-free [Excise Tax] concession that will be a big saving for taxi drivers. If a driver wants to operate properly in this industry, and accommodate a large family in his vehicle, he is looking to spend in excess

Cayman health loss doubles to hit Bahamas First profits

By NEIL HARTNELL Business EditorA 149 percent increase in losses incurred by its Cayman health business dropped Bahamas First to $2.293m in comprehensive ‘red ink’ for the 2024 first quarter despite improvements elsewhere.

The BISX-listed property and casualty insurer, unveiling its figures for the three months to end-March 2024, revealed that losses produced by its troubled Cayman health portfolio more than doubled year-over-year from $448,816 to $1.119m. This more than offset improved performances from the carrier’s core property and casualty businesses in both The Bahamas and the Cayman Islands, as each reduced their losses yearover-year. The Bahamas was not far off halving its first quarter loss, reducing this from $1.344m in 2023 to $739,732, while the Cayman property and casualty business lowered its ‘red ink’ from $356,575 to $265,552.

Alison Treco, Bahamas First’s executive chair, said the company’s core insurance underwriting business produced a loss that matched, or was flat, with the prior year’s first quarter loss at $2.124m. However, a more than $350,000 negative swing on its investment income increased total comprehensive losses for the 2024 first quarter compared to the prior year.

Total comprehensive losses thus rose by 16.7 percent or just over $300,000 year-over-year to $2.293m as opposed to $1.965m the year-before. “For the three months ended March 31, 2024, the group reported a loss of $2.1m, which was comparable to the performance in the 2023 first quarter,” Ms Treco wrote. “However, due to the change from positive other comprehensive income in the 2023 first quarter to negative in the 2024 first quarter, the overall total comprehensive loss increased by 16.7 percent over the 2023 first quarter. The change in other comprehensive income was due to the decline in market value of our global bond portfolio and the decline in price of an equity security.”

As for the Cayman health business, Ms Treco wrote: “In the 2024 first quarter, Cayman First Insurance Company’s health premiums continued to decline but the rate of decline was less than anticipated. The insurance service result declined from the first quarter 2023 to the first quarter 2024 from a loss of $0.4m to $1.1m. “While claims declined from prior year at a similar rate as the premiums, the operational costs have seen an increase to support ongoing remediation efforts. The property and casualty segments for Cayman and The Bahamas combined have shown a reduction in the loss over the 2023

first quarter of $0.7m or 40.9 percent.

“This improvement emanated from the insurance service result, specifically within The Bahamas property and casualty segment, which represented $0.6m of the change. The key driver for this was an improvement in insurance service expense which was mostly impacted by the improvement in the motor claims loss ratio. All other components of the property and casualty insurance service result have remained relatively consistent with the prior year.”

Bahamas First also confirmed that it has appointed Michele Fields to its Board of Directors while Judith Whitehead has stepped down as a director after 19 years. Ms Treco, in her report on the insurer’s fullyear 2023 results, pledged to make “strategic changes” after profits slumped by 63.1 percent due primarily to the “ongoing issues” with the Cayman health business.

She signalled that there are several issues she is seeking to put right in her shareholder report on the unaudited results for the 12 months to end-December 2023. “As executive chair, I am currently overseeing the group’s operations as we look to make some strategic changes aimed at improving operational efficiency and, ultimately, the overall performance of the group,” Ms Treco wrote.

“The overall performance for the group for 2023 was

of $50,000, $70,000, $80,000 for a brand new vehicle.”

Mr Ferguson said the Excise Tax elimination on used vehicles less than five years-old was further useful in reducing the cost because commercial banks and other formal lenders typically do not provide loans for used vehicles. “Not many taxi drivers have $35,000 in funds,” he added.

The taxi union president said the improved vehicle affordability also coincides with, and aids, efforts to enhance driver professionalism and portray the industry’s participants as self-employed entrepreneurs.

“With the new taxi franchises, if we’re going to upgrade the tourism product and put us on the cutting edge of technology, and present ourselves as business owners and entrepreneurs, we need some breaks so we can present ourselves to tourists in a very professional manner with a nice vehicle,” Mr Ferguson said. “That’s big for taxi drivers. That’s welcome. It’s a

a comprehensive income of $6m, which was 14.9 percent ($1m) below the prior year. The group’s profit for the year was $1.6m, down 63.1 percent from the prior year’s result of $4.4m.

“The profit for the property and casualty segments for the year ended December 31, 2023, was $6.5m, a 4.5 percent increase from the prior year. Unfortunately, the group’s result was impacted by the ongoing issues with the health segment, which incurred a loss in 2023 of $4.9m compared to a loss in 2022 of $1.8m.”

Bahamas First’s Cayman subsidiary has been plagued with problems stemming from delays in processing claims as a result of introducing a new information technology (IT) system. Ms Treco conceded this had resulted in “a loss of business”, with the improvements and corrections made unlikely to be fully felt until Bahamas First’s 2025 financial year.

happy moment in the taxi industry.”

Jobeth ColebyDavis, minister of transport and energy, previously explained that while a standard of the taxi cab industry “exists in everyone’s mind”, the Code of Conduct aims to document and codify those standards and provide a guide that can be referred to.

“The Code of Conduct will assist in providing a concrete and defined framework for the service standards,” she said. “The standards outlined in the Code of Conduct are not unreasonable, onerous or difficult conditions. We aim for the sector to be the best, and being the best means that we have clear values and expectations.

Mrs Coleby-Davis underscored the important role taxi cab drivers hold as among the first Bahamians with whom tourists interact as “official number one ambassadors” and “driving equality and leading to fight for equality” in the country’s history.

“I’ve met many of them –some who are still driving, who shared stories of how they were able to take care of their families, educate their kids, and make a good living off of the taxi industry,” she said.

The Code of Conduct, a copy of which was provided digitally, listed several provisions for public service drivers to adhere to, including vehicle appearance, disorderly conduct, a ban on smoking and alcohol consumption, littering and solicitation.

The Code of Conduct also outlines the disciplinary procedure, which categorizes breaches of the code between “major” and “minor”.

Some “minor breaches” are the unlicensed sale of items, barbering, littering and non-compliance with dress codes, while “major breaches” can be drunken or disorderly conduct, lewd behaviour, public urination, verbal abuse, threats, and sale of illegal substances, among other breaches.

SOME 555 job seekers registered for a recruitment fair designed to find new workers for Lynden Pindling International Airport’s (LPIA) retail and food and beverage tenants. LPIA’s operator, the Nassau Airport Development Company (NAD), said in a statement that it teamed with the Department of Labour to host the job fair at the National Training Agency on Gladstone Road. More than 15 employers operating at the airport were present Airport recruitment event attracts 555 job seekers

Gov’t ‘not honouring’ industrial agreements

holiday, he called on Prime Minister Philip Davis KC to intervene in at least eight industrial relations situations - involving both the private and public sector - that are becoming increasingly contentious and for the Government to live up to the commitments it made in the MoU while in opposition.

“The major problem we’re having now is we made a commitment to the Government that we’ll try to maintain industrial peace and the evidence shows we’ve done that for at least three years,” Mr Ferguson told this newspaper.

“What’s happening now is that some of the agreements are signed but are not being honoured. We have signed agreements but the relevant government department is not honouring the terms of the agreement. We have the air traffic controllers, for example. BPL, for example.

“We have the agreement in Grand Bahama with the Grand Lucayan, Lucayan Renewal Holdings. We have an agreement which is completed but it’s not executed. We have the nurses

union, the doctors union. Practically all the unions. The ones that they have agreed, they’re not honouring them, and the ones we have completed they are not prepared to have the agreement executed.”

Mr Ferguson added that the Bahamas Hotel and Managerial Association’s (BHMA) 40 middle manager members at the Grand Lucayan were awaiting sign-off by the Government, which ultimately owns the resort via a special purpose vehicle (SPV), to sign-off on an agreement that will see them receive a $6,000 lump sum and increment over the lifetime of the deal.

“I’m going to have to meet with my colleagues,”

Mr Ferguson added. “It’s obvious that the union cannot sit there... We will have, and all other unions affected in this matter, to take a position on this.”

Asked whether this could lead to possible industrial action, and the fraying of workplace harmony, the TUC chief replied: “That is very possible. Very, very possible.

“The workers are upset. They call me for their money. One of them called

me and asked if they would get their money today. We’re going to be doing something about that. We’re not going to let them get away with it. You cannot give workers in Nassau one thing and Grand Bahama something different. That is not going to go down well with us.

“We’re going to have to do what we have to do. We agreed not to have industrial action in our land. We agreed to that, and the evidence shows that we lived up to it at this point.”

Asked how soon the unions need their agreements honoured and recognised, Mr Ferguson replied: “We need it done like yesterday.”

Besides the industrial situations involving public sector healthcare unions, such as the Consultant Physicians Staff Association and Bahamas Doctors Union, Mr Ferguson also singled out the BHMA’s relations with Baha Mar, as well as employers such as Sandals Royal Bahamian and Restaurants (Bahamas). The latter is the Bahamian Kentucky Fried Chicken (KFC) franchise.

Mr Ferguson, who has fought many battles with Sandals in trying to have a

union represent its work-

ers, said in his labour day address: “Sandals Royal Bahamian and Baha Mar are opposed to trade unions being recognised as bargaining agents for their workers. They obviously need a lecture on The Bahamas’ evolution and how it became an investment of choice for foreign investors and local investors....

“All investors coming to invest in The Bahamas should be given a lecture on the history of The Bahamas so that they would see that labour played a pivotal role in The Bahamas from 1942 to present. So, to try to deny the working people the right to join a union of their choice is a fundamental breach of Section 24 of the constitution of The Commonwealth of The Bahamas.

“If an investor or multinational corporation disregards your constitutional right, he/she is disregarding and disrespecting the entire country, which we cannot allow.” Mr Ferguson also urged that The Bahamas “continue to move the goal post towards a livable wage for working people in The Bahamas” as

Kia recalls nearly 463,000 Telluride SUVs due to fire risk, urges impacted consumers to park outside

By WYATTE GRANTHAM-PHILIPS AP Business WriterKIA America is recalling nearly 463,000 Telluride SUVs — and urging owners to park their cars outside and away from other structures until an issue posing a fire hazard is fixed.

The front power seat motor on the affected Tellurides from the 2020-2024 model years may overheat because of a stuck slide knob, according to the National Highway Traffic Safety Administration. That could potentially result in a fire while the car is parked or being driven. Kia made the decision to recall the vehicles on May 29, NHTSA documents published Friday show, after receiving reports of one under-seat fire and six incidents of localized melting in the seat tilt motor between August 2022 and March 2024. No related

injuries, crashes or fatalities were reported at the time.

The recall report notes that strong external impact to the recalled Tellurides' front power seat side cover or seat slide knob can result in internal misalignment — and with continuous operation, that can cause overheating. People driving vehicles with the issue may find they can't adjust the power seat, may notice a burning or melting smell,

or see smoke rising from underneath the seat.

To fix this, dealers will install a bracket for the power seat switch back covers and replace the seat slide knobs at no cost. Until the vehicles are repaired, owners are being instructed to park their cars outside and away from buildings.

Owner notification letters are set to be mailed out starting July 30, with dealer notification a few days prior. Irvine, California-based Kia

opposed to the present minimum wage structure. He based this on both the study by University of The Bahamas (UoB) researchers, who in 2021 pegged Nassau’s monthly living wage at $2,625 and the equivalent for Grand Bahama at $3,550 per month, plus the concept of a livable wage as outlined by the International Labour Organisation (ILO) on March 13, 2024.

The TUC chief said the ILO had defined this as “the wage level that is necessary to afford a decent standard of living for workers and their families, taking into account the country’s circumstances and calculations for the work performed during the normal hours of work”.

Mr Ferguson added: “The agreement says that the estimation of living wages should follow a number of principles including the usage of evidence-based methodologies and robust data, consultations with workers and employers’ organisations, transparency, public availability and the consideration of regional and local contexts and socio-economic and cultural realities.”

America did not immediately respond to The Associated Press' request for comment on why these notifications wouldn't begin until the

In the meantime, drivers can also confirm if their specific vehicle is included in this recall and find more information using the

He also urged trade unions to “widen their scope beyond that of collective bargaining and grievance handling”. Mr Ferguson added: “The trade union movement should be re-classified as the labour movement, making membership available to all working people and not just wage earners. Upon retrenchment, retirement or resignation, workers should be allowed to continue to be members.

“In effect, what I am saying is that the trade union movement will have to cease being a trade union movement and become, once again, a labour movement - a movement representing the interests and needs of working people.

“The new labour movement would have to provide for such things as child care facilities, profit-sharing arrangements, employee stock options and ownership schemes, and further elements of true economic partnership... In closing we must move away from being consumers to owners, tenants to landlords, trustees to beneficiaries. This must change if we want change for the future.”

Gov’ts $85.3m March surplus monthly record

referenced by the Prime Minister in the Budget.

That is still some 163.4 percent higher than the $131.1m full-year deficit target, which the Government has conceded it will “overshoot” but by an “acceptable” margin. It is now forecasting a deficit of between 1-1-1.5 percent of gross domestic product (GDP), which is a range between $146m-$216m.

The Budget percentages unveiled by the Prime Minister place it at the high end of this scale at around $210m.

March is among the Government’s strongest, if not the best, fiscal-performing months because it not only coincides with the peak winter tourism season but is also when the bulk of annual Business Licence fees are paid. It also enjoys significant real property tax inflows, as taxpayers rush to pay before the end-March deadline to obtain their 10 percent discount, while this year was further bolstered by an early Easter.

“I would like to highlight that, historically, March has typically been the highest revenue-generating month in a given fiscal year,” Mr Davis said. “Consistent with that pattern, March 2024 was indeed a strong month.

“But it is the month following to which I draw your attention. The preliminary total revenue for April 2024 is estimated to be $385.8m, reflecting a significant increase of $108.6m or 39.2 percent compared to April in the previous year.

“The strong revenue performance in April shows that fourth quarter revenue performance will be very strong, which provides the basis of our favourable outlook for meeting our revenue targets to the end of the fiscal year.”

Mr Davis did not disclose the spending or deficit numbers for April, and it remains to be seen whether the former - in particular - increases as the Government may use the revenue influx to pay off outstanding bills. An April surplus

matching March’s will likely be needed to withstand the typical heavy end-year deficits, averaging $180m in June alone, and bring the Government in close to target.

“Preliminary data for the month of March 2024 shows a significant improvement in the Government’s fiscal performance. The surplus on the overall balance strengthened significantly to $83.5m from $6.4, in the prior year,” the Ministry of Finance said.

“Underlying this outcome was an 18.5 percent ($56m) boost in revenue receipts to $358.1m alongside a 7.1 percent ($21.1m) decline in spending to $274.6m. Accounting for a dominant 90 percent of total revenue, tax receipts firmed year-on-year by 28.8 percent ($46.7m) to $322.1m.”

Simon Wilson, the Ministry of Finance’s financial secretary, could not be reached for comment before press time last night. However, the Ministry of Finance largely attributed

AIRLINE LAWYERS SPARED RELIGIOUS LIBERTY TRAINING IN CASE ABOUT FLIGHT ATTENDANT’S ABORTION VIEWS

By KEVIN McGILL Associated PressAN appeals court on Friday blocked a federal judge's order that three attorneys for Southwest Airlines get religious liberty training from a conservative advocacy group, saying the judge likely exceeded his authority.

Three judges with the 5th U.S. Circuit Court of Appeals in New Orleans put the training order on hold while appeals are pursued.

The order is an outgrowth of a case in which a Southwest flight attendant, Charlene Carter, sued the airline and her union after she was fired for sending graphic anti-abortion material and disparaging messages to a union leader

and fellow employee. Carter won an $800,000 court award, also the subject of an appeal, after her attorneys argued that she was terminated for her religious beliefs.

The religious-training requirement was part of a contempt order against the airline issued by U.S. District Judge Brantley Starr. After Carter won a jury verdict, Starr ordered the airline to tell flight attendants that under federal law, it "may not discriminate against Southwest flight attendants for their religious practices and beliefs."

Instead, the Dallas-based airline told employees that it "does not discriminate," and told flight attendants to follow the airline policy it cited in firing Carter.

In August, Starr found Southwest in contempt for the way it explained the case to flight attendants. He ordered Southwest to pay Carter's most recent legal costs and dictated a statement for Southwest to relay to employees. He ordered the three lawyers to complete at least eight hours of religious liberty training from the Alliance Defending Freedom, which offers training on compliance with federal law prohibiting religious discrimination in the workplace.

The conservative group has played a high-profile role in multiple legal fights. They include defending a baker and a website designer who didn't want to work on same-sex marriage projects, efforts to limit transgender rights

the improved revenue flows to “gains in property taxes of $21.1m to $51.4m, reflecting enhanced enforcement measures” plus a “boost in other taxes on goods and services by $21.7m to $99.5m”.

The Prime Minister, in his Budget debate lead-off, said real property tax billings have increased by 14 percent which could also help to explain the increased collections. It is unclear, too, whether the Department of Inland Revenue has begun to auction off and receive the proceeds from selling delinquent commercial and foreign-owned vacant land.

VAT, the Government’s main income source, saw a more modest $5.5m yearover-year rise to $111.6m for March 2024. And, after the first three quarters or nine months of the 2023-2024 fiscal year, just $993.9m or 62.5 percent - less than two-thirds - of the $1.591bn full-year VAT target had been collected, signalling that this revenue item was likely to undershoot again.

International trade and transactions taxes, meanwhile, declined by $2.3m to $57.9m year-over-year for March 2024. However, nontax revenue collections, which rose year-on-year by $9.3m to $36m, were driven by a “$0.7m rise in fees derived from the sale of goods and services, mainly associated with Immigration and Custom administrative-related fees; and a more than two-fold hike in other receipts to $15.2m linked to fines, penalties and forfeits”.

As for spending, the Ministry of Finance said for March 2024: “Recurrent expenditures totaled $237.6m, a 10.7 percent ($28.5m) decline compared to the prior year... Capital expenditures increased by 25.1 percent ($7.4m) to $37m, with $32.7m mainly linked to investments in buildings and other structures and $4.4m by way of capital transfers.”

The Government’s outlay on goods and services dropped by $12.7m year-over-year, falling from

$64.2m in March 2023 to $51.5m this time around. This was the major driver behind the expenditure reduction, although social assistance and pension payments dropped yearover-year from $26.1m to $19.8m, and public debt servicing expenses (interest costs) fell from $33m to $25.1m.

“During March 2024, central government’s debt decreased by $80.8m,” the Ministry of Finance said. “Proceeds of borrowings, which were all denominated in Bahamian dollars, totalled $104.6m and comprised issuances of government securities.

“Of the $185.4m in aggregate debt repayment, 56.3 percent was in Bahamian dollars and largely associated with operations in government securities. Transactions in foreign currency were allocated between reduction in liabilities due to investment banks (58.9 percent) and international financial institutions (41.1 percent).”

three

"At bottom, it appears that the district court sought, at least in part, to punish Southwest for what the district court viewed as conduct flouting its holding," the appellate court ruling said. "But its punitive sanctions likely exceed the scope of the court's civil-contempt authority."

and a challenge to longstanding federal approval of a medication used in the most common way to end a pregnancy. Arguments in the appeal were heard Monday. The arguments concentrated on Carter's firing and did not deal with the contempt order. However, in briefs the airline said the contempt order violated its free speech rights and should be overturned.

Still pending is the decision on the effort by Southwest and the flight attendants' union to reverse the $800,000 judgment in Carter's favor. The panel has given no indication when it will rule. Starr was nominated to the federal district court bench by former President Donald Trump.

Airport recruitment event attracts 555 job seekers

and conducted on-the-spot interviews.

Vernice Walkine, NAD’s president and chief executive, said the event was

held to address the pressing need for airport tenants to have access to quality employment candidates.

“It’s important for us at LPIA to ensure that we have good employees

because the airport is really all about improving the passenger experience, ensuring that we provide good customer service, and we’re looking for good persons

to help us achieve that,” Ms Walkine said.

During the five-hour event, the Department of Labour’s team worked closely with NAD to ensure all candidates had

the proper documents and moved seamlessly through the process. Matthew Knowles, manager of My Ocean’s outlet at LPIA, said: “LPIA is the first impression that a tourist has of The Bahamas and its last impression. That’s very important.

“We are ahead of the curve in the tourism industry, there’s no question about that, and LPIA is a reflection of that. As Bahamians we know what we are doing, especially in tourism, and servicing the visitors to this country.”

Thurston, manager of the Department of Labour’s public employment services Unit, said the agency also used the job fair to update its database if candidates were unsuccessful in securing employment at LPIA. Given the positive feedback and successful outcome of the job fair, NAD and the Department of Labour are said to be exploring opportunities for future collaborations. Plans are already underway for additional job fairs and recruitment events to continue supporting the employment needs of the airport and its partners.

‘No need for alarm’ over slowing Q3 tourism pace

pronounced” as they were pre-COVID with occupancies “more elevated” and the “valleys not as deep”.

Mr Sands told this newspaper that the sector’s expectations are still to match 2023’s performance, with the second quarterwhich still has almost three weeks to run - anticipated to be “fairly close to last year” on occupancies and room rates. However, with stopover tourism having returned to - and even slightly surpassed - pre-pandemic levels, the BHTA president said The Bahamas’ largest source of economic activity and employment is likely to revert back to “single digit type” growth without an increase in hotel room inventory that is able to match visitor demand for the destination.

“I think we’re still seeing momentum,” Mr Sands told Tribune Business of the upcoming 2024 third quarter. “It’s not as robust as the last quarter, but momentum continues to take place. It’s still early yet. The third quarter will be the real indication of how things are...

“The pace, while still positive, has slowed a bit so we’re going to continue to

see how this plays out. We don’t have the same level of groups, and groups are booked well in advance, for this particular quarter. Leisure business is still growing.

“We’ll look at it on a month-to-month basis so there is no need to raise the alarm at thus point in time, but the pace is not as robust as it was in the first quarter or second quarter.” Asked why the booking pace has eased, Mr Sands replied: “It’s difficult to say.

“We’ve set expectations based on the results of last year, which was very strong for the destination, and certainly this year we’ve met expectations as things stand. We’ll wait and see. The destination remains a short booking window and you can pick up a substantial number of rooms in a very short period.

“Anywhere within a 15-30 day period you still have the opportunity to pick up occupancy.” The calendar year’s third quarter includes September which, together with October, is typically tourism’s slowest month because it coincides with when children have gone back to school in the US and key source markets as well as the peak of hurricane season.

Mr Sands said that, while there are no external factors

presently posing a major threat to the Bahamian tourism industry’s outlook, “the third quarter is the quarter that has more variables about it than other quarters”.

He added: “We continue to promote, we continue to maintain media visibility and we continue to work towards getting these months as good as or even better than last year..... I wouldn’t say it’s [the third quarter] the most difficult. We have July and August, but the second half of the third quarter is always a far tougher period.

“I think that while there are still slower seasons, they are not as pronounced as they have been in the past. We still have a lot of work to do, but the occupancy levels have become a bit more elevated and those periods are not such deep valley dips.”

The BHTA president, disclosing that the industry expects the 2024 second quarter that closes at endJune to “be fairly close with last year”, said: “It may be a mixed bag of results. In terms of occupancy, in some cases it might be up and in some cases it might be down. In some cases, the rates might be up and occupancy down, but the end result will be fairly close to expectations.

“I think we’re tracking reasonably well. Last year was an exceptional year for the destination. I think the expectations are that we will at least meet those levels we did last year. Let’s see what the next three weeks bring and we will be in a definitive position to tell you that.

“We’ll see how these results come out in the next three weeks. I think we continue to have to be vigilant, continue to deliver exceptional service, continue to bring in high-profile visitors into the jurisdiction to promote and recommend the destination, and continue to be the best that we can and make sure The Bahamas’ offering is always upper mind and that we also exceed guest expectations.”

However, Mr Sands said the only way for the Bahamian hotel and tourism industry to maintain above-average growth rates is to expand room inventory and regain the capacity that was lost with the Melia and Atlantis Beach Towers closures - moves that took around 1,000 rooms offline.

“The only way that will continue,” he added of postCOVID growth rates, “is there’s only so much you can do in terms of occupancy and so much you can do in terms of rate. Capacity. We talk about the

British Colonial’s rooms. The potential for other rooms to come on in future, that’s how we’re going to grow stopover visitors to the islands of The Bahamas.

“Don’t forget. Coming off zero, starting from zero, to get to current occupancies involved significant momentum in that time. We’re not going to see those types of increases from year-toyear. We’ve almost got to a normalised position. We’re going to see single-digit type improvements, be it in occupancy or rate going forward, until there is significant additional capacity in the destination.”

The Central Bank, unveiling its monthly economic developments report for April, disclosed that The Bahamas received a total 3.9m visitors during the first four months of 2024 led largely by the volume-driven

cruise industry. Higheryielding stopover visitors, who typically spend 28 times’ more in-country than their cruise counterparts, were said to have “held steady” at 700,000 arrivals for the period.

“Official figures provided by the Ministry of Tourism indicated that total visitor arrivals rose to 910,000 in April compared to 870,000 a year earlier. The dominant sea segment firmed to 750,000 visitors from 690,000 passengers in the comparative 2023 period. However, the high valueadded air component edged down to 160,000 visitors from 170,000 in the prior year,” the Central Bank said.

“On a year-to-date basis, total arrivals strengthened by 12.4 percent to 3.9m visitors relative to the comparable 2023 period. Sea arrivals rose by 14.4 percent to 3.3m while air traffic held steady at 700,000.”

By MICHELLE CHAPMAN and ALEX VEIGA AP Business Writers

By MICHELLE CHAPMAN and ALEX VEIGA AP Business Writers

meme stock protagonist known as Roaring Kitty took to YouTube Friday to tell his hordes of followers that he still believes GameStop's management team can turn the struggling video game retailer around. In a live stream that drew more than 600,000 views Roaring Kitty, whose real name is Keith Gill, posted a screenshot of an E-Trade account that appears to show he continues to hold a sizeable investment in GameStop. But his remarks couldn't keep shares in the company from plunging almost 40% — a drag on the value of Gill's investment and a warning about the unpredictability of meme stocks.

Gill's appearance on YouTube came hours after the release of GameStop's quarterly results, which showed the company's turnaround has a way to go. GameStop managed to narrow its losses in the first quarter, but its revenue fell as sales weakened for hardware and accessories, software and collectibles. GameStop also filed paperwork with securities regulators to sell up to 75 million shares of stock.

Gill, who has experience as a licensed securities broker and financial wellness educator, was rambling and unfocused at times during his midday live stream, which ran for nearly an hour and marked his first YouTube video in more than three years. "No real game plan here, just wanted to hop in, see what's poppin'," Gill said shortly after the start of the live stream. He appeared with his right arm in a sling and bandages on his head, face and clothes in an apparent reference to the beating GameStop's shares were taking.

Gill at times reiterated his belief that GameStop CEO Ryan Cohen is taking the right approach to transitioning the company from a brick-and-mortar seller of video games and accessories to a successful online gaming company.

"I feel like I see enough here I believe this guy might be able to do it," Gill said, noting that there are no guarantees, however.

"You could lose it all," he said. "You could lose everything."

GameStop and Cohen haven't offered many details of the company's turnaround plan, and Gill didn't offer any ideas of his own.

All told, the company based in Grapevine, Texas, said Friday that it lost $32.3 million, or 11 cents per share, for the period that ended May 4. A year earlier, it lost $50.5 million, or 17 cents per share. Its adjusted loss was 12 cents per share. Quarterly sales dropped to $881.8 million from $1.24 billion a year ago. GameStop did not hold a conference call to discuss its financial performance.

As Gill's live stream went on, GameStop shares sank further. The stock had been down about 20% at $37.29 per share shortly before noon Eastern time, when the live stream was scheduled to begin. It was down just over 40% to $27.65 per share shortly before Gill signed off with an "adios" and "peace!" followed by a short outro video of kittens.

The New York Stock Exchange paused trading in GameStop more than 15 times by early afternoon Friday due to unusually high volatile trading in the stock. Gill also asserted during the live stream that he was not working with a hedge fund or a large institution, a nod to speculation that he may now have the backing of deeper-pocketed investors.

MEXICO’S OUTGOING PRESIDENT VOWS TO PURSUE CHANGES TO CONSTITUTION DESPITE MARKET NERVOUSNESS

By MARK STEVENSON Associated PressMEXICO’S outgoing president pledged Friday to press ahead with j udicial reforms despite nervousness among investors and suggestions from his own handpicked successor that he should go slow.

President Andrés Manuel López Obrador said he would pursue 20 constitutional changes after his Morena party won a two-thirds majority in Congress in Sunday’s elections, including making all judges run for election and enshrining a series of unfunded benefit mandates in the Constitution.

Sunday’s elections ensured that Claudia Sheinbaum, the candidate of López Obrador’s Morena party, will be the next president. Sheinbaum had spent most of the week talking to international financial organizations and investors, trying to calm markets after a 10% drop in the value of the peso. She suggested Thursday the reforms had not yet been decided and should be subject to dialogue.

“It has not yet been decided,” Sheinbaum said Thursday. “My position is that a dialogue will have to be opened, the proposal must be debated.”

But on Friday López Obrador mocked any opposition to the changes. He called critics of the reforms “the promoters of nervousness,” and claimed that big corporations were worried about losing judges who he claimed are protecting them. At present, judges are appointed or approved by legislators.

“There are justices who are employees of the big corporations,” López Obrador said at his morning press briefing. “They have some judges on their keychains, adding “justice is above the markets.”

Analysts say the president is angry that the country’s judiciary has blocked several of his previous reforms because they were ruled unconstitutional.

Markets did not seem reassured Friday. The peso closed at 18.36 to $1, about 10% below where it was the week before the elections.

Mexican stocks also closed off about 2.7% Friday.

“Everything indicates that the volatility in Mexican financial markets will continue,” said Gabriela Siller, director of analysis at Nuevo Leon-based Banco Base, noting that Mexico could take a rhetorical bruising in the runup to the U.S. presidential elections. But most worrisome to markets is that López Obrador’s Morena party won a two-thirds majority in Congress, which would allow them to pass changes to the Constitution, like the judicial reform, as well as mandates for a series of yet-unfunded government benefit programs.

López Obrador pledged Friday to continue to press for 20 constitutional changes, including one that would undo the country’s current system of individual retirement accounts and the elimination of most independent government oversight and regulatory agencies.

Sheinbaum has spoken by phone or in person this week with officials from the World Bank, the International Monetary Fund and the head of the BlackRock investment company, after the peso plunged and the stock market briefly dipped on Monday. But the questions remains of how much influence López Obrador will continue to exert after Sheinbaum takes office Oct. 1. López Obrador has previously said he will retire from politics entirely upon leaving office. But on Friday he said he would continue talking on the phone with Sheinbaum if she calls, and pledged “to continue using my right to dissent, all my life.”

Any questions about how devoted Sheinbaum remains to her political mentor, López Obrador, were erased Friday when she wrote in her social media accounts Friday that “tears came to my eyes from emotion” when the president congratulated her on her victory.

Markets are also concerned about Mexico’s current budget deficit equivalent to about 6% of GDP, and payments to the country’s debt-laden stateowned oil company, Pemex.

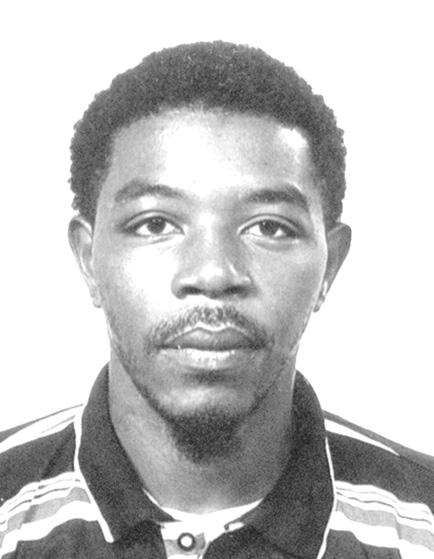

NOTICE is hereby given that DWIGHT GLEN KENNEDY of #27 Bishop Street, Nassau Village, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas and that any person who knows any reason whyregistration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 3rd day of June, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

Mexico also continues to struggle with persistently high inflation of nearly 5%, despite high domestic

interest rates of 11%. Those high returns on government securities had also tended to shore up the value of the

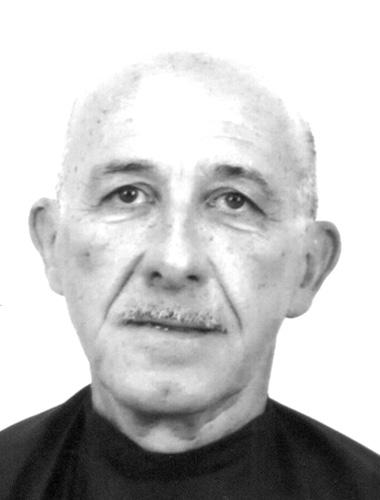

NOTICE is hereby given that PHILIPPE MICKEL SAHNOUNE of P.O. Box CB13639, #576 Parrot Close, Serenity, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas and that any person who knows any reason whyregistration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 3rd day of June, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

Mexican peso over the last year. But a devaluation like this week’s is likely to make inflation worse.

López Obrador has previously bragged about the peso’s strength, and a reduction in the number of Mexican living in poverty (though extreme poverty has increased.) But experts say the peso’s former strength and poverty gains are due in part to remittances, the money sent home by migrants working abroad, which have almost doubled since 2019.

On Friday, López Obrador predicted this year Mexico would see a record $65 billion in remittances.

BPL grid bidder seeks $30m Bahamian equity

FROM PAGE B1

much-needed upgrades to, and the modernisation of, BPL’s New Providence grid infrastructure in a bid to halt the frequent outages and brownouts that destroy electrical equipment.

“The first piece is correct, $30m,” one capital markets source said of the equity raise. “I believe it’s gone, subject to all approvals. It’s been a while, but should have been closed. It’s just the equity part of the transmission and distribution. The debt piece, the $100m, hasn’t been circulated.”

Island Grid’s website lists its co-chief executive as Eric Pike, who is also chairman of Pike Corporation. That is the North Carolinabased energy transmission and distribution specialist, which was named by Kyle Wilson, the Bahamas Electrical Workers Union (BEWU) president, as the entity set to take over management of BPL’s grid via a public-private partnership (PPP) deal with the Davis administration.

Pike Corporation is named as one of Island Grid’s two principal “partners”. Tribune Business contacts suggested that the Bahamian capital raise may be part of the latter’s agreement with the Davis administration, which likely would have wanted a local ownership component and financing to be included in the deal.

“I think they have money but want to finance it locally,” one source said of Island Grid. Another added: “They’re getting everybody involved. $130m, that’s correct. They’ve [the Government] got to get it done. The road has run out. Everybody has kicked the can down the road, but the road has run out. It should have been done a long time ago. We need liquefied natural gas. LNG has to happen here.”

Tribune Business was told that the planned upgrades to BPL’s transmission and distribution network will also involve a focus on grid stability, and eliminating peaks and dips in voltage. This is critical to facilitating the smooth integration of the up to 100 Mega Watts (MW) of utility-scale renewable energy that the Government is seeking to attract for New Providence.

“Dealing with the transmission and distribution capital expenditure they expect,” was how one source described Island Grid’s plans for its local financing. “If you are going to have all this green energy, you need to make sure the transmission and distribution can handle the energy coming from those sources. Some of it is upgrades and some of it is making sure you don’t have dips and surges in voltages.”

The Prime Minister and his office are due to unveil what is being billed as “new and comprehensive energy reforms across the Commonwealth of The Bahamas” this morning. Based on what has

emerged to-date, this will likely involve splitting BPL’s assets and functions into possibly three separate entities - generation, transmission and distribution, and customer collections and billing.

While Island Grid/Pike will handle transmission and distribution, it is widely thought that a combination of Shell North America and BISX-listed FOCOL Holdings will assume responsibility for managing and overhauling BPL’s generation assets while also supplying LNG as their primary fuel source.

Island Grid, in a section on its website listing the projects it has worked on, reveals it has teamed with Bahamas Utility Company, a FOCOL Holdings subsidiary, to help “connect a new power plant to the BPL grid on New Providence” via the creation of a hurricane and corrosion-resistant sub-station.

“Working with the Bahamas Utility Company to build an Air Insulated Substation (AIS) connecting a new power plant to the BPL grid on New Providence so that the substation will be wind-rated and corrosion resistant,” Island Grid proclaimed.

Sir Franklyn Wilson, FOCOL’s chairman, was coy when contacted by Tribune Business about Island Grid’s reference to working with Bahamas Utility Company. “It’s what they say,” he replied, adding that he knew nothing about its $130m capital raising plans. Island Grid’s website shows it is headquartered at Shipston House in Lyford Cay. The Shipston Group was founded by the late world renowned investor, Michael Dingman, and David Dingman is named as an Island Grid director on the company’s website. Mr Dingman did not respond to Tribune Business inquiries seeking comment before press time despite a message being left on his cell phone. The company, which bills itself as “bringing 60-plus years of US infrastructure and implementation expertise to islands around the world”, also showcases work done for Grand Bahama Power Company and the private developers at Walker’s Cay in the Abacos (Carl Allen) and Jack’s Bay in Eleuthera.

Mr Pike has also previously been named as an investor and equity partner in the Jack’s Bay development, which is chaired by Sir Franklyn. Island Grid describes itself as “a one-stop shop for infrastructure services”, offering engineering, construction, project management, advisory, training and even marketing solutions for its clients.

Jobeth Coleby-Davis, minister of transport and energy, told the House of Assembly in early March that a $130m investment is required to upgrade BPL’s New Providence transmission and distribution network “in the next two years alone”.

Pegging BPL’s capital investment needs at $500m or half-a-billion dollars, she said then: “BPL operates 29 power stations on 17 islands. Over the next five years, BPL will need an investment of over $500m to upgrade its infrastructure.” Mrs Coleby-Davis said.

This, Mrs Coleby-Davis added, was broken down into a collective $300m investment in new generation assets spread across New Providence and the Family Islands; $130m to upgrade New Providence’s transmission and distribution network “in the next two years alone”; $35m for the roll-out of advanced metering infrastructure (AMI); and $70m in undefined “other costs”.

“Today, to fix BPL, we need over $500m to address its debts and over $500m to upgrade and improve its aged and deteriorated infrastructure. Mr deputy speaker, that’s over $1bn,” Mrs Coleby-Davis said. And the Prime Minister, in his recent Budget communication, reiterated how high energy costs and unreliable electricity supply have undermined The Bahamas’ economic competitiveness.

Noting the heavy financial toll this has imposed on families and businesses, Mr Davis said: “The cost of electricity has been a huge expense and a huge burden to Bahamian families and businesses. We need system-wide change because, in order to reduce the cost of electricity for consumers, we need a grid that is well-designed, effective and efficient.

“We simply cannot lower costs – or meet our full potential as a nation – with an outdated, deteriorating energy grid. An aging 20th century grid cannot support a modern 21st century economy. And the reality is, demand for energy is going up while our grid is falling apart.

“We also need to add the capacity to integrate large-scale renewable energy. Solar energy has always been essential to our plans, but solar power is intermittent. That means the amount of solar power generated will fluctuate –will vary – depending on whether it’s a sunny day or a cloudy day, day-time or night-time,” he added.

“Using solar energy across our archipelago requires careful planning and design, and major new investments in grid flexibility and energy storage... I look forward to sharing plans for a new energy future for our country, including extensive use of solar power, in New Providence and in the Family Islands, LNG as a partner fuel and a modern power grid.”

The Island Grid capital raise is a private placement, targeted at specific institutional investors and high net-worth individuals, so no members of the public should seek to participate.

INTERNET GROUP SUES GEORGIA TO BLOCK LAW REQUIRING SITES TO GATHER DATA ON SELLERS

By JEFF AMY Associated PressAN INTERNET trade group is suing the state of Georgia to block a law requiring online classified sites to gather data on highvolume sellers who advertise online but collect payment in cash or some other offline method.

NetChoice, which represents companies including Facebook parent Meta and Craigslist, filed the lawsuit Thursday in federal court in Atlanta. The group argues that the Georgia law scheduled to take effect July 1 is blocked by an earlier federal law, violates the First Amendment rights of sellers, buyers and online

services, and is unconstitutionally vague. The lawsuit asks U.S. District Judge Steven D. Grimberg to temporarily block the law from taking effect and then to permanently void it.

Kara Murray, a spokesperson for Georgia Attorney General Chris Carr, declined to comment. Carr, a Republican, is charged with enforcing the law, which carries civil penalties of up to $5,000 per violation.

Supporters have said the law is needed to further crack down on organized thieves who are stealing goods from stores and then advertising them online.

Georgia passed a law in 2022, which was followed by a federal law in 2023, mandating that high-volume sellers that collect electronic payment on platforms such as Amazon and eBay provide bank account and contact information to the platform. The rules apply to sellers who make at least 200 unique sales worth at least $5,000 in a given year. The idea is that thieves will be less likely to resell stolen goods if authorities can track them down.

But retailers say the law needs to be expanded to cover people who are advertising goods online but collecting payment in

"This would be a deterrent for those criminals who are coming in and stealing products from our retailers," Ben Cowart, a lobbyist for trade group Georgia Retailers, told a state House committee in March. "It would be a deterrent for them because it makes them accountable for what they're doing in online selling."

REAL-WORLD MILEAGE STANDARD FOR NEW VEHICLES RISING TO 38 MPG IN 2031 UNDER NEW BIDEN RULE

By MATTHEW DALY Associated PressNEW vehicles sold in the U.S. will have to average about 38 miles per gallon of gasoline in 2031 in real-world driving, up from about 29 mpg this year, under new federal rules unveiled Friday by the Biden administration.

The final rule will increase fuel economy by 2% per year for model years 2027 to 2031 for passenger cars, while SUVs and other light trucks will increase by 2% per year for model years 2029 to 2031, according to requirements released by the National Highway Traffic Safety Administration.

The final figures are below a proposal released last year. Administration officials said the less stringent requirements will allow the auto industry flexibility to focus on electric vehicles, adding that higher gas-mileage requirements would have imposed significant costs on consumers without sufficient fuel savings to offset them.

President Joe Biden has set a goal that half all of new

vehicles sold in the U.S. in 2030 are electric, part of his push to fight climate change.

Gasoline-powered vehicles make up the largest single source of U.S. greenhouse gas emissions.

The 50% sales figure would be a huge increase over current EV sales, which accounted for 7.6% of new vehicle sales last year. Even as he promotes EVs, Biden needs cooperation from the auto industry and political support from auto workers, a key political voting bloc, as the Democratic president seeks

reelection in November.

The United Auto Workers union has endorsed Biden but has said it wants to make sure the transition to electric vehicles does not cause job losses and that the industry pays top wages to workers who build EVs and batteries. Biden's likely opponent, former President Donald Trump, and other Republicans have denounced Biden's push for EVs as unfair for consumers and an example of government overreach.

The new standards will save almost 70 billion

OREGON resident Patrick Coffin fills up his car at a gas station in Portland, Ore., Aug. 4, 2023. New vehicles sold in the U.S. will have to average about 38 miles per gallon of gasoline in 2031 in real world driving, up from about 29 mpg this year, under new federal rules unveiled Friday, June 7, 2024, by the Biden administration. President Joe Biden has set a goal that half all of new vehicles sold in the U.S. in 2030 are electric. Photo:Claire Rush/AP

gallons of gasoline through 2050, preventing more than 710 million metric tons of carbon dioxide emissions by midcentury, the Biden administration said.

"Not only will these new standards save Americans money at the pump every time they fill up, they will also decrease harmful pollution and make America less reliant on foreign oil," Transportation Secretary Pete Buttigieg said in a statement. "These standards will save car owners more than $600 in gasoline costs over the lifetime of their vehicle."

The highway safety agency said it has sought to line up its regulations so they match new Environmental Protection Agency rules that tighten standards for tailpipe emissions. But if there are discrepancies,

automakers likely will have to follow the most stringent regulation. In the byzantine world of government regulation, both agencies essentially are responsible for setting fuel economy requirements since the fastest way to reduce greenhouse emissions is to burn less gasoline. Fuel economy figures used by The Associated Press reflect real-world driving conditions that include factors such as wind resistance, hills and use of air-conditioning. Because of those factors, the real-world numbers are lower than mileage figures put forward by NHTSA. New passenger cars would have to average nearly 49 miles per gallon in 2031 under the new rule, up from about 36.5 miles per gallon this year. "These new fuel economy standards will save our

nation billions of dollars, help reduce our dependence on fossil fuels and make our air cleaner for everyone,'' said NHTSA Deputy Administrator Sophie Shulman.

John Bozzella, president and CEO of the Alliance for Automotive Innovation, a leading industry group, said the Biden administration "appears to have landed on a CAFE rule that works with the other recent federal tailpipe rules.'' Bozzella was using an acronym for the fuel standards, which are officially known as the corporate average fuel economy rules. Dan Becker at the Center for Biological Diversity, an environmental group, slammed the new rules as inadequate.

The highway safety agency is supposed to set strong standards for gaspowered vehicles, he said, "but instead it sat on its tailpipes, leaving automakers free to make cars, SUVs and pickups that will guzzle and pollute for decades to come and keep America stuck on oil.''