By NEIL HARTNELL Tribune Business Editor

THE Government yesterday pledged Bahamas Power & Light (BPL) and its customers will ultimately enjoy $126m in annual savings through “desperately” needed energy reforms that “won’t happen overnight”.

Jobeth Coleby-Davis, minister of energy and transport, in unveiling the Government’s strategy for change signalled that New Providence businesses and households will not feel the full benefits until 2026. This is when construction of a new 177 Mega Watt (MW) generation plant fuelled by liquefied natural gas (LNG) is due to be completed at the Blue Hills power station.

‘We’ve

stopped complaining on high light bills. It’s terrible’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A PROMINENT advo-

cate for Bahamian small businesses yesterday said most of his clients and members have ceased complaining about high energy bills and power outages because it is “so normal”.

Mark A Turnquest, the 242 Small Business Association and Resource Centre’s (SBARC) founder, admitted to Tribune Business it was “terrible” that so many in the private sector have accepted Bahamas Power & Light’s (BPL) high costs and unreliable supply as he urged the Government to provide greater clarity on the benefits of its energy reform strategy and when this will be felt.

“It’s a big killer for small business owners,” he reiterated of energy costs.

“When it comes to summer and load shedding it’s always a problem. For the small business owner, are most significant expenses are rent, salaries, loan payments and, of course, our energy bill. Those are top

for all of them. Those prices are killers.

“Unfortunately, a lot of small business owners, we don’t own our own building. We rent, so we can’t put solar panels up on the building we are renting from. We are at the mercy of BPL and, as a result, we are exhausted. That’s why you don’t hear a lot of small businesses complaining about high energy costs and outages.

“It’s so normal to pay high energy costs and power outages that we don’t even complain. That’s terrible because in the ease

Bahamian firms chosen for renewable contracts

By NEIL HARTNELL Tribune Business Editor

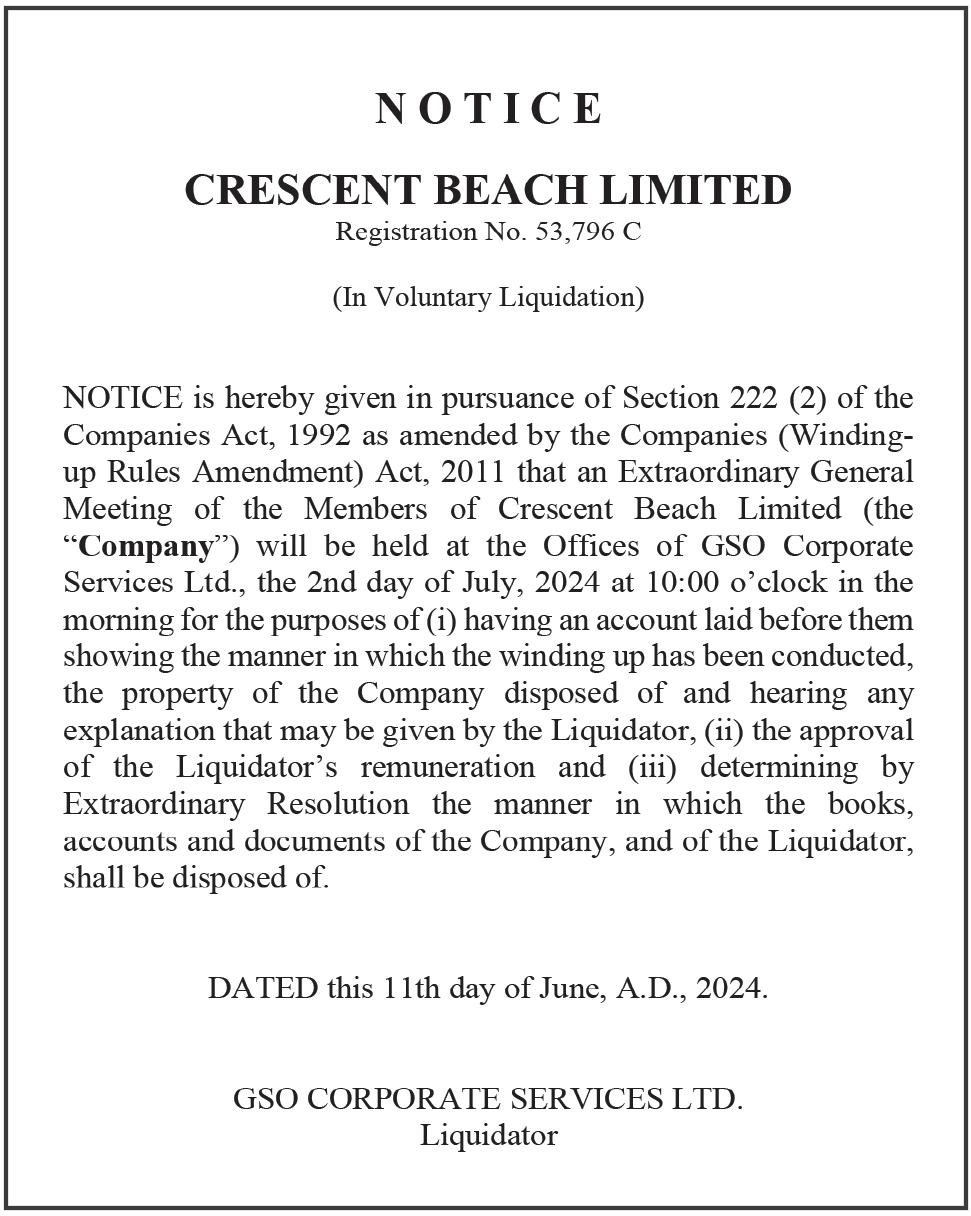

SEVERAL Bahamian providers have been selected as preferred bidders to generate utilityscale renewable energy on New Providence and the Family Islands, it was revealed yesterday.

Jobeth Coleby-Davis, minister of energy and transport, in unveiling the Government’s energy reform strategy disclosed that Compass Power, Inti Corporation and Eco Energy have been chosen as the recommended independent power producers (IPPs) to generate around 70 Mega Watts (MW) of solar energy and 35 MW of battery energy storage systems on New Providence. For the Family Islands, she identified Verdant as the preferred bidder for Abaco; Providence Advisors for Andros; Verdant again and Consus for Eleuthera; Inti Corporation on Exuma and Osprey Construction, while Wilkem Technologies and Roswall Incorporation have been chosen for Long Island, San Salvador and

She confirmed that Shell, the multinational energy giant, will supply the LNG fuel that is key to the baseload generation strategy for New Providence, while

Bahamas Utility Company, a wholly-owned subsidiary of BISX-listed FOCOL Holdings, will be the independent power producer (IPP) responsible for supplying lower-cost, cleaner energy to BPL’s grid and the latter’s customers.

No details were provided on the power purchase agreement (PPA) that will govern this supply, such as the agreement’s likely duration; the locked-in price at which Bahamas Utility Company will sell energy to BPL and its transmission and distribution network; and other key terms and conditions. This suggests

such details are still being finalised and negotiated (see other article on Page 1B).

However, Mrs ColebyDavis said the installation of a new heavy fuel oil (HFO) burner at BPL’s Clifton Pier power station, along with two new 30 Mega Watt (MW) generation turbines equipped to burn LNG at the same location, were projected to save businesses and households a combined $66m per year in fuel costs. The timing for when this will be realised was not mentioned,

FOCOL chair: BPL deal is ‘real change’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

FOCOL Holdings yesterday confirmed “a good portion” of the $70m recently raised from investors will finance its power generation deal with the Government, its chairman pledging: “This is real change.”

Sir Franklyn Wilson, the BISX-listed energy and petroleum products provider’s largest shareholder, told Tribune Business that Bahamians “can take a certain comfort from the fact due diligence was done” on the private sector partners selected to execute the Davis administration’s energy reform strategy despite concerns about the seeming absence of competitive bidding.

Several sources, speaking on condition of anonymity, questioned

whether the country is getting the best possible price and deal given that neither the generation nor the transmission and distribution (T&D) contract were put out to public tender as required by procurement legislation and associated regulations.

“Under what procurement process was Bahamas Utility Company [FOCOL’s wholly-owned subsidiary] chosen for the generation,” one contact asked. “There was no procurement process that went out. It’s not the

same deal as the previous administration negotiated with Shell at all.

“Under what procurement process did they select Bahamas Utility Company as the generation provider, and under what procurement process did they select Island Grid as the transmission and distribution provider? How do they know this is the best possible price.”

Sir Franklyn, though, countered such criticism by describing all three companies selected - FOCOL Holdings (Bahamas Utility

Company); Shell as fuel supplier; and Island Grid - as “credible names” that are all “real companies”. He told this newspaper:

“My bottom line position is that, without a doubt, this is real change. This is real change. Once you accept this is real change, the fact of the matter is once you are doing it it takes time. It takes time.”

Insurer’s 2023 worse than expected in 72% profit

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A BAHAMIAN

insurer yesterday said a “challenging” 2023 turned out worse than expected as profits plunged by almost 72 percent as a result of reinsurance cost hikes outpacing local premium increases.

Timothy Ingraham, chief executive of Summit Insurance Company, through which Insurance Management Company places much of its property and casualty business, told Tribune Business that premium rates for Bahamian businesses and homeowners are “likely to remain high for the near future” given that global reinsurance market pressures show no signs of easing.

“We had anticipated a challenging year in 2023, though not quite as bad as it turned out,” he said.

“The reinsurance market for the 2023 treaty

renewal turned out to be much tougher than most expected, with pricing levels being steeper and the reinsurance capacity crisis being worse than anticipated. We expect 2024 will be a better year, subject, as always, to the storm activity in our area.

“The international reinsurance market continues to suffer from a lack of capacity. Unfortunately, this is likely to mean that prices will remain high for the near future. Predictions of an active storm season for the region will not help with attracting new capital in the near term.”

Summit saw its total comprehensive income for the 12 months to endDecember 2023 drop from $1.702m the year before to $482,493 due largely to the jump in reinsurance costs. “In 2023 Summit, like other regional insurers, saw its reinsurance costs increase dramatically over its 2022

business@tribunemedia.net TUESDAY, JUNE 11, 2024

fall

nhartnell@tribunemedia.net SEE PAGE B3 SEE PAGE B2 SEE PAGE B4 SEE PAGE B5

reform’s $126m ‘game changer’ won’t occur overnight

Energy

nhartnell@tribunemedia.net SEE PAGE B4

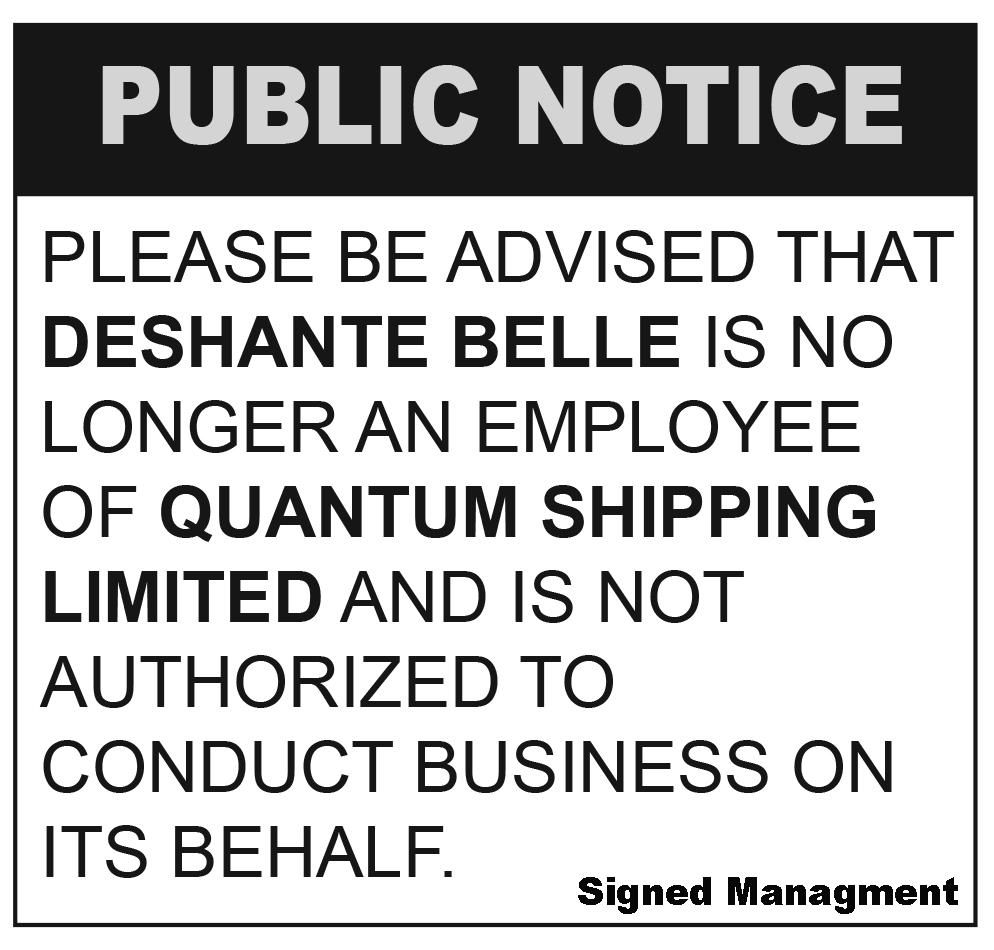

MARK A Turnquest

JOBETH COLEBY-DAVIS

PHILIP DAVIS KC

$5.79 $5.79 $5.74 $5.61

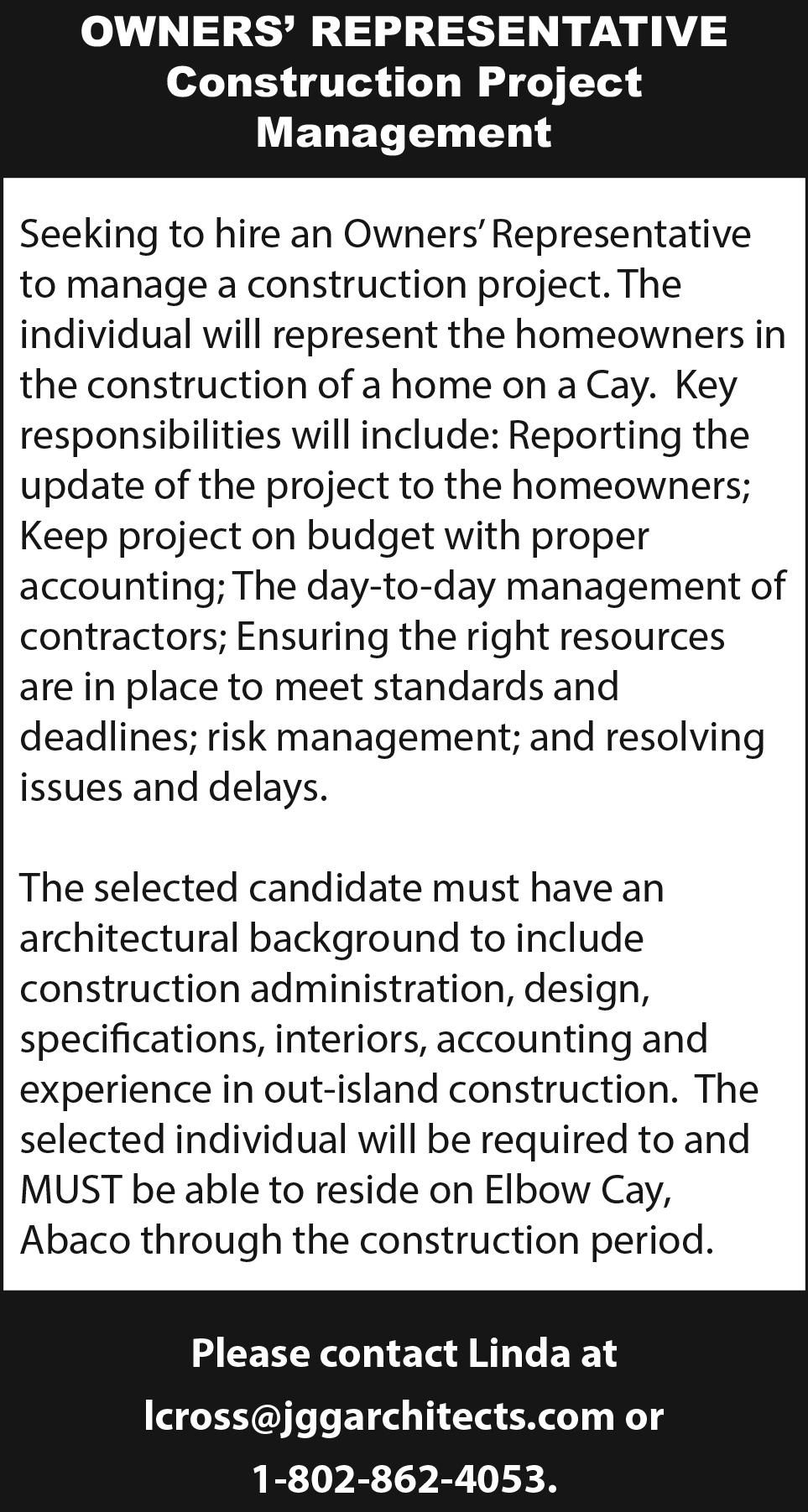

DEXTER ADDERLEY

GB TO HOST FIRST-EVER FOOD TRUCK FESTIVAL

GRAND Bahama will host its first Food Truck Festival at Taino Beach on Saturday June 22 from 11am to 6pm, it has been announced.

Joel Lewis, permanent secretary at the Ministry for Grand Bahama, speaking on behalf of Ginger Moxey, the minister, said that with the rise in popularity of the food truck industry the upcoming festival is “eagerly anticipated”.

“The Ministry for Grand Bahama is committed to promoting new events on our beautiful island,” he added. Mr Lewis described the Food Truck Festival as a “paradigm shift” in food culture in The Bahamas.

“We have been noticing this trend around the world and are happy to see it now being embraced by

the Grand Bahamians,” he continued. Nuvolari Chotoosingh, the Ministry of Tourism, Investments and Aviation’s general manager in Freeport, described the upcoming event as “fantastic” and said it came about because the Ministry of Tourism received several requests from food truck vendors wanting to participate in the annual Goombay Festival. He said: “But for us, to have them featured on the park along with the tents, didn’t make for a good look, so we decided to do something else for the food truck vendors.” After visiting several food trucks and taste testing, the food quality was such that it was decided to give them their

own event – hence the Food Truck Festival.

Once this was decided, partners such as Grand Bahama Power Company, the Grand Bahama Island Promotion Board, the Ministry for Grand Bahama, Aliv and many others were contacted for participation and collaboration.

There will be a variety of food trucks on-site selling Bahamian food, sushi, ice cream and other products. To ensure safety standards, the vendors have been inspected by the relevant authorities to make sure they meet the criteria.

Mr Chotoosingh said: “We hope that, after this event, people will frequent the food truck vendors after seeing how good the food actually is.”

GRAND Bahama will host its first Food Truck Festival on Saturday, June 22, at Taino Beach from 11am to 6pm, when a variety of vendors will have their products on sale. Event co-ordinators shown from left are: Corey Cartwright, LUSCO; Samantha Outten, Grand Bahama Wines and Spirits; Joel Lewis, permanent secretary, Ministry for Grand Bahama; Imani Roberts, strategic projects co-ordinator for the

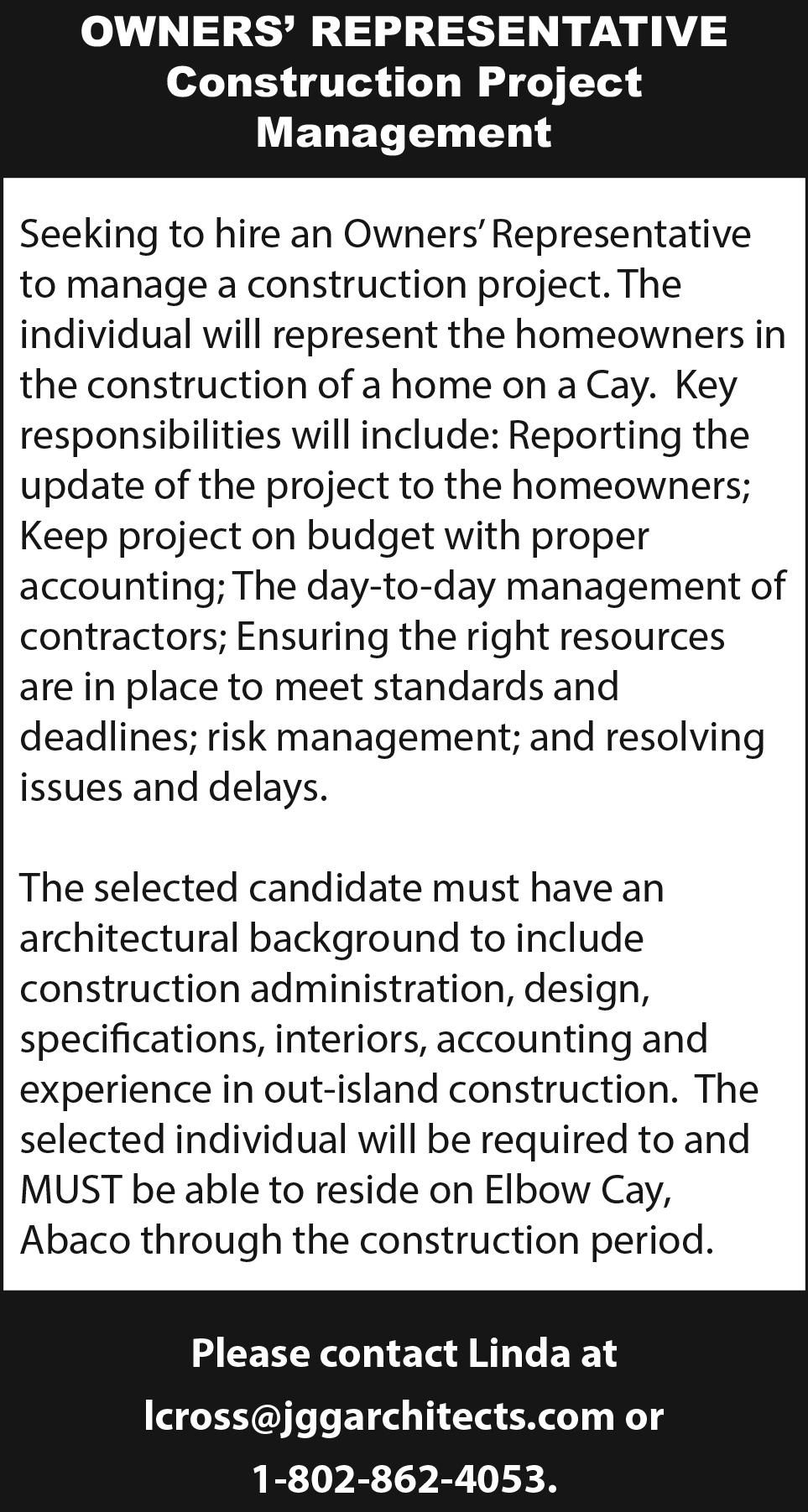

Bahamas-based cloud firm names new senior executive

A Bahamas-based cloud services provider has named Victor Kovacs as chief operating officer for itself and the Athena Group.

Cloud Carib, the provider of sovereign cloud, cyber security, and digital transformation services in the Caribbean and Latin America, said in a statement that Mr Kovacs will play a key role in steering the company. He joins with more than 30 years’ leadership experience in the global IT and digital communications sectors, most recently

serving as chief executive of Digicel assets in the Southwest Indies.

There he oversaw mobile, fibre and wholesale operations. His career also includes work with Caribbean, US, and European technology and digital infrastructure assets, covering a range of industries from telecommunications to cyber security and cloud services. Mr Kovacs was said to have established a solid track record in building, financing and scaling technology companies.

“Today, we are formally announcing our newest member of the executive team, Victor Kovacs, as the chief operating officer of Cloud Carib and the group chief operating officer of Athena Group,” said Cloud Carib’s chief executive, Scott MacKenzie.

“Victor is a highly accomplished expert within our industry and will be tasked with driving service excellence across our business and accelerating growth in the Caribbean and Latin American markets.”

FOCOL chair: BPL deal is ‘real change’

In his new role, Mr Kovacs will oversee operations for all brands under the Cloud Carib and Athena Group umbrellas. His mandate includes driving service excellence, optimising operational processes and accelerating growth initiatives across the Caribbean and Latin American markets. “As information technology and communication infrastructure becomes more complicated with the emergence of AI and the continued risk of cyber threats, it is increasingly

important for governments, enterprises and businesses of all sizes to work with trusted partners in deploying and managing their mission-critical applications,” Mr Kovacs said.

“Cloud Carib has a track record of delivering highly innovative managed service solutions to blue-chip customers regardless of size, complexity or location. I am proud to be the newest member of the Cloud Carib team as we enter an exciting phase of growth and opportunity.”

the Government on various matters with generation.

No details were provided on the power purchase agreement (PPA) that will govern the generation deal, such as the agreement’s likely duration; the lockedin price at which Bahamas Utility Company will sell energy to BPL and its transmission and distribution network; and other key terms and conditions. This suggests such details are still being finalised and negotiated, and Sir Franklyn hinted as much.

what you can say influences when you can say it. Something this big, you cannot say it before it happens. You have to do it at a certain time.

“Government can only say so much at any one time,” he added. “Until it’s done, it’s not done. The fact of the matter is that process is important. To determine

“When you are doing things that represent major change, it takes time. How do you do all this overnight? The bottom line point, when you say about

things being explained, some things the Prime Minister cannot be certain about. There are many variables.”

The energy reform strategy unveiled by the Davis administration yesterday did not answer other pressing BPL-related questions, such as how the state-owned energy

monopoly’s $500m legacy debt and unfunded $100m employee pension plan deficit will be addressed and who will pay for it.

However, Sir Franklyn argued that Bahamians should have confidence in those selected to partner with the Government on energy reform and turning BPL around. “For all the specific names that were called today, the public, it seems to me, can take certain comfort from the fact due diligence was done,” he told Tribune Business.

“These are real companies. Due diligence was done. The good news is all the names called today are entities that the Bahamian public have reason to have a degree of comfort in. He [the Prime Minister] outlined the plans, he called names like Shell, he called names like Island Grid, and the public has reason to assess these are credible names.”

Dexter Adderley, FOCOL’s president and chief executive, was also tight-lipped on many details relating to the role its Bahamas Utility Company will play as an independent power producer (IPP) supplying lower-cost, cleaner energy to BPL using liquefied natural gas (LNG) as the primary fuel.

He directed Tribune Business to speak to the Government and BPL on details such as the energy cost/prices, who will be responsible for constructing the 177 Mega Watt (MW) new power plant at Blue Hills, and the level of investment the company will be making as well as the amount of construction and full-time jobs likely to be created.

However, Mr Adderley confirmed that a significant amount of the funds raised by FOCOL from its two recent Bahamian investor offerings - a $25m equity raise, followed by a $45m preference share placement - will help to finance the generation deal with BPL and the Government although he declined to reveal the exact amount.

“I would say a good portion of it will be used to finance this, assist with the financing of this project,” the FOCOL chief said. “I couldn’t reveal at this point in time how much of it. We’re focused and committed to this project. There’s still work to be done. We are working with BPL and

“As a group we have more than 500, close to 500, employees, and in every sector we have a diverse range of Bahamian talent with vast expertise in the energy sector, particularly in the power generation sector. We’re very confident in our capacity to meet the needs of the Government and BPL for the generation services they require of us.

“One of the things we bring to the table is vast expertise, not just with generation but with the fuel and infrastructure that supports power generation, and we are leveraging that expertise in assisting the Government and BPL.” Mr Adderley said both FOCOL and Bahamas Utility Company have been adding staff since the start of 2024, and are continuing to hire.

He added that he has “absolutely no doubt whatsoever, absolutely no doubt whatsoever” in FOCOL’s ability to deliver what energy reform requires. Jobeth ColebyDavis, minister of energy and transport, yesterday revealed that BPL is presently spending $42m per annum on 145 MW of rental generation split between New Providence and the Family Islands.

A significant amount of that rental generation is presently provided by FOCOL and its affiliates, so the IPP agreement with the Government and BPL will convert the BISX-listed company from a rental to permanent generation supplier via a PPA that could potentially last for up to 30 years.

“In less than a decade, BPL/ BEC amassed almost $500m in debt. BPL has loan interest payments of more than $28m annually and a $122m pension liability,” Mrs Coleby-Davis said. “BPL has about 90 MW of aged/obsolete generation assets teetering on the edge in New Providence and another 30 MW in the Family Islands.....

“Finally, BPL is not well positioned to complement the country’s growth projections for the next five to 10 years as generation projections call for 340MW of power needed for New Providence and 100 MW for the Family Islands.”

PAGE 2, Tuesday, June 11, 2024 THE TRIBUNE

Family Islands, Aliv; Nuvolari Chotoosingh, Ministry of Tourism, Investments and Aviation’s general manager in Freeport; and Jillian Williams, brand representative for the Grand Bahama Island Promotion Board.

Photo:Andrew Miller/BIS

VICTOR KOVACS

FROM

ADVERTISE TODAY! CALL THE TRIBUNE TODAY @ 502-2394

PAGE B1

Bank teams to boost access to healthcare

BANK of The Bahamas (BOB) has teamed with FirstCare Medical Plan to provide health and wellness benefits to its customers and improve access to quality care. The BISX-listed bank, in a statement, said it will incorporate FirstCare’s health plan into its banking services, making it easily accessible to clients through a digital landing page and direct engagements in branches.

Corinna Neely, FirstCare Medical Plan’s president, said: “We are thrilled to partner with Bank of The Bahamas, a pillar in the Bahamian financial sector. At FirstCare, we provide a critical solution for thousands

living without adequate medical insurance.

“Our network includes hundreds of trusted physicians and health professionals across The Bahamas and the US, enabling persons to affordably access critical primary care medical services that help to maintain good health.”

The partnership will extend FirstCare’s network, which offers members unlimited, no-cost primary care doctor visits to any in-network general practitioners and up to 20 percent savings with specialists and pharmacies. The plan covers essential healthcare needs across The Bahamas, including New Providence, Grand Bahama, Abaco, Andros and Exuma.

FirstCare members benefit from lifestyle discounts and offers at spas and restaurants through its rewards programme. The plan offers benefits in the US, discounted rates and packages for treatments such as cancer care, orthopedics and maternity.

Neil Strachan, Bank of The Bahamas’ managing director, said: “Recognising the affordability challenges of health insurance for many, it was imperative for us to partner with an organisation like FirstCare. Their plan’s inclusivity, with no age or medical restrictions, allows them to serve a broader demographic, reinforcing our commitment to being a bank of solutions.”

‘We’ve stopped complaining on high light bills. It’s terrible’

of doing business climate

we’ve not had a very good climate for paying light bills for a very long time.”

Even though many small businesses have become desensitised to high electricity costs, especially over the past two years as a result of up to 163 percent hikes in BPL’s fuel charge due to the hedging controversy, Mr Turnquest said his members have focused on reducing energy consumption by acquiring the most efficient devices such as ductless air conditioning (AC) units.

Food stores have reduced the number of freezers they operate in a bid to cut costs, and he added: “We have been conforming to our strategy for years now. We were not relying 100 percent on the Government to make the change. We welcome any reduction in the light bill, especially as summer is coming, but we don’t know how soon the Government’s strategy will be reflected in our bill.

“We want to know when we will be in a better position, if we are currently spending $1,000 a month on energy, to say it has gone down to $700 a month. We want to know what year and what time. We’re still a year or two away. We have to do what we have got to do.”

Mr Turnquest spoke as the Government yesterday unveiled a revised BPL rate structure, set to take effect from July 1, that is designed to incentivise reduced consumption and greater energy efficiency by residential consumers while also easing the financial burden on the most vulnerable Bahamian families.

Jobeth Coleby-Davis, minister of energy and transport, billed the Equity Rate Adjustment as an initiative that “will make bills more affordable for many Bahamian families” as the Government launches reforms designed to drive down costs and boost supply reliability over the next two years ahead of a likely 2026 general election. These reforms, it added, “could lower fuel costs by at least 10 cents per kWh compared to our most current fuel charge” which is around 19.5 cents per KWh,

thus implying a drop to around 9.5 cents. The new BPL rate structure will eliminate the base tariff rate for the first 200 kilowatt hours (KWh) of energy consumed by all residential customers, while the next 600 units - up to 800 KWh per month - will attract a 2.5 cents discount to the “average rate”. However, the portion of the bill above 800 KWh per month will attract a base rate some 1.5 cents per KWh above the “average”, potentially raising energy costs for high-consuming middle class and wealthy Bahamian families. This portion of the bill is often the greatest, especially in the summer months.

A similar strategy is being employed with BPL’s fuel, the other component of customer bills. The first 800 KWh consumed will attract a rate some 2.5 cents below the monthly fuel charge that is calculated by BPL based on the cost of its prevailing fuel purchases, but the portion of the bill above 800 KWh will be hit with a rate 1.5 cents higher than the actual fuel charge. Mrs Coleby-Davis, meanwhile, said BPL’s Equity Rate Adjustment is designed to slash what she described as a “$20m subsidy” that the present tariff structure provides annually to the utility’s largest customers - the likes of the resort industry, food stores and manufacturers.

This group, known as “general service customers”, will see their base tariff rates increase by between 14.9 percent and 45.16 percent depending on which portion of the bill is being assessed. Robert Sands, the Bahamas Hotel and Tourism Association’s (BHTA) president, said he had not read the Government announcement but the move is likely to fuel cost competitiveness concerns for tourism and other sectors.

“With the existing tariff structure, residential customers and SMEs (small and medium-sized enterprises) are presently subsidising general service customers (high energy users),” Mrs Coleby-Davis said. “The Equity Rate Adjustment is a reduction in the base tariff rate for residential consumers.

The adjustment creates a more equitable balance to the current tariff structure and encourages energy conservation.

“All residential consumers with low and moderate electricity usage will benefit, as the base rate tariff for the first 0 to 200 KWh will be reduced to zero. The upper bands will stay the same, but even if you are a resident with a bill of around 600 KWh you will still benefit from the rate of your first 200 KWh being reduced to zero. Note that everyone will still have to pay for the fuel charge for every unit they consume.”

She added: “We are also amending the fuel charge by reducing the charge for the first 800 KWh by 2.5 cents and increasing the charge above 800 KWh by 1.5cents. Consumers who use less energy will enjoy a lower fuel charge. This is important as the more electricity used on the grid, the more BPL must utilise generators which are more expensive to run.

“The new rates will be in effect until a comprehensive tariff review is completed, and new rates are approved by the government and URCA.” Mrs Coleby-Davis signalled that SMEs and companies that do not fall into the “general services” category will also see a slight reduction in their base tariff.

“The commercial base tariff will drop slightly from 15 cents to 14.5 cents, and the temporary supply base tariff, which particularly affects the Family Islands, will drop from 16.38 cents to 15 cents. Again, they will both continue to also pay for their fuel charge,” the minister added.

“The general service base tariff will rise from

8.7 to 10 cents for the first

900,000 units, and from 6.2 to 9 cents for units above 900,000 units. Currently, general service customers receive a subsidy of about $20m from other BPL customers every year, but they will still be paying less than all other energy classes and will still benefit from a more modest subsidy.”

The Prime Minister’s Office, via a posting on its website, said only 300 “general services” customers - representing 500 accounts and less than 1 percent of BPL’s total customer basewill see an increase in their light bill as a result of the revised rate structure. It hinted that the rise would only be temporary until the full effects of a reform strategy to lower the cost of energy supplied by BPL takes effect.

“However, their electricity bills will still be lower

than during the same months of the prior year, and they will gain enormously from new energy reforms, as transmission and distribution upgrades will increase efficiencies and improve reliability which, along with the integration of solar power and natural gas, will produce meaningfully lower prices in the coming years,” the Prime Minister’s Office said.

Their electricity bills will almost certainly be lower than summer 2023 because that was when BPL’s fuel charge peaked as it sought to regain previously underrecovered fuel costs. As for the impact on residential consumers, the Prime Minister’s Office added: “All residential consumers with low and moderate electricity usage will benefit.

“For the first zero to 200 KWh the tariff base rate

will be at a cost of zero for all customers.... including those who use more than 200 KWh. For electricity usage between 201-800 KWh per month, the rate will be discounted by $0.025 per KWh below the average rate. For electricity usage above 800 KWh per month, the rate will be slightly higher at $0.015 above the average rate.”

As for the fuel charge, it said: “BPL will continue to calculate the total amount it spends on fuel per billing period and divide it among the total units of electricity consumed during that period. However, the first 800 units (KWh )consumed will be billed at 2.5 cents less than the calculated average. Above 800 KWh will be calculated at 1.5 cents above the average.

“If the average is 20 cents per unit (KWh), then the customer will be billed 17.5 cents per KWh for the first 800 units. The remaining units (KWh) will be billed at 21.5 cents.”

THE TRIBUNE Tuesday, June 11, 2024, PAGE 3

BANK of The Bahamas (BOB) and FirstCare Medical Plan have launched their strategic partnership to bring enhanced healthcare solutions to the bank’s customers. Pictured from L to R: Neil Strachan, Bank of The Bahamas managing director; Jihanne Hosmillo-Williams, Bank of The Bahamas chief financial officer; Corinna Neely, president of FirstCare Medical Plan; and Harold Antor, vicepresident of FirstCare Medical Plan.

FROM PAGE B1

Energy reform’s $126m ‘game changer’ won’t occur overnight

and it is unclear if the $66m is part of the $126m annual savings.

The Davis administration’s reform drive, branded as “a new energy era” for The Bahamas, was given a guarded welcome by a private sector that for decades has called for an urgent solution to this nation’s “killer” problem of high-cost, inefficient and unreliable energy supply.

Ben Albury, the Bahamas Motor Dealers Association’s (BMDA) president, told Tribune Business that it was “about time that we tried to crawl out of this third world operation” with BPL and wider energy sector. He added that the proposed reforms will help The Bahamas to “reduce or eliminate” the carbon footprint created by BPL’s 100 percent reliance on fossil fuels for power generation.

“I think not just the automobile industry, but everybody from a personal perspective as well as other companies, are all dealing with the same thing,” Mr Albury said. “The inefficiency, the high cost and unreliability is a killer. Generators have become, for some time now, an essential

piece of equipment for any business or home.

“Any reform is welcome. It’s a step in the right direction. I know LNG has been thrown around for a while.

Leslie Miller was a big proponent. Anything they can do to get us off heavy fuel oil and automotive diesel oil (ADO) is a good thing.”

Mr Albury said the estimated $125.6m in annual electricity cost savings, which Mrs Coleby-Davis said will result from improved generation efficiency and switching to the lowest-cost fuel source, will be “a pretty substantial knock in the right direction” given The Bahamas’ estimated 400,000 population.

“It seems like a very aggressive approach, but it’s definitely well-needed. Desperately needed,” the BMDA chief told this newspaper. “It’s rough being a tourism-driven market, people coming here and the power is off, then it’s on. I can’t tell you how much money we have lost. We have UPS (uninterruptable power source) on everything but they get fried because of the instability. We replace those rather quickly.

“I think it’s about time we tried to crawl out of this

third world operation. It’s very welcome, an excellent move. Now we’ve got to see it come to fruition. I’ll keep my fingers crossed.”

Philip Davis KC, in a video filmed to promote the Government’s energy reforms, branded them as “game changing” but conceded the strategy would take timelikely several years - before its full impact is felt.

“We all know that our country’s electricity infrastructure is decades old, it’s breaking down, it is too expensive, and it cannot transmit clean energy,” the Prime Minister said. “Small changes aren’t enough. We are taking it all on, upgrading and modernising the grid, solar power.

“That’s how we get to lower prices and more reliable electricity. It will not happen overnight but it will be game changing; a new energy era for The Bahamas.” Robert Myers, the former Bahamas Chamber of Commerce and Employers Confederation (BCCEC) chairman, yesterday gave his backing to the reforms but questioned why the new LNG-fuelled power plant is to be located at Blue Hills and not Clifton Pier.

“The plan should have been executed by the last

administration and the one before that,” he told Tribune Business in a messaged reply. “This administration should be commended for this critical and necessary action. Let’s pray that it is action that is delivered by those employed to carry out the plan and not lip services and excuses.

However, Mr Myers said supplying LNG to a power station located in close proximity to Nassau’s residential and commercial areas raised potential safety issues. Parliament recently passed the Natural Gas Act to address regulation and safety in handling fuels such as LNG, but he argued: “It makes absolutely no sense to place the LNG plant at Blue Hills.

“Why would this not be at Clifton where the LNG has to be offloaded and stored? This seems dangerous and very expensive. Please explain the logic and upside of this decision. We would remind the decisionmakers that over the years there have been numerous breaches to the relatively inert diesel fuel line that currently runs from Clifton Pier to Blue Hills.”

Mrs Coleby-Davis, in unveiling the Government’s energy reform strategy, billed LNG’s introduction

as a move “set to revolutionise energy generation in New Providence” by providing a cleaner, lowercost fuel that will reduce electricity prices, boost efficiency and offer an alternative to ADO and heavy fuel oil.

“The bulk purchase of LNG will be sourced from Shell. Other partners in the LNG implementation will include Bahamas Utility Company (BUC) as the independent power producer under a purchase power agreement (PPA),” she added.

“By 2026, we will construct a state-of-the-art 177 MW combined cycle LNG plant at the Blue Hills power station. This innovative facility will feature four natural gas units paired with two steam turbines, maximising efficiency by utilising excess steam from the gas units.

“This combined cycle configuration will be the most cost-effective generation solution in the BPL fleet. It will replace the 107 MW of rented generation capacity and address the 63 MW generation shortfall under contingency conditions, enhancing redundancy and resilience,” Mrs ColebyDavis continued.

“In addition to the new units, BPL will convert two of its original generators at the Blue Hills power station, completing the transition to a more efficient and resilient system. BPL and its consumers are projected to save approximately $125.6m annually through fuel switching and improved engine efficiency.”

The extent of the reduction in Bahamian light bills as a result of these changes was not disclosed apart from the projected all-in savings for New Providence consumers. Mrs ColebyDavis, though, affirmed that “the cost of energy should fall over time because of the efficiency upgrades at BPL”.

Besides the new LNGfuelled plant at Blue Hills, the minister detailed other improvements as including “the installation of a new HFO boiler at Clifton Pier to save $36m per year in fuel costs” plus “installation of two new 30MW LNG burning units, which will save $30m per year in fuel costs”. In addition, BPL’s debt is due to be refinanced in Bahamian dollars, converting from US dollars to save costs.

The Berry Islands. Power purchase agreements (PPA) and other terms now need to be agreed.

Kenwood Kerr, head of Providence Advisors, the Bahamian financial services provider that played a key role in the New Providence landfill deal, said: “We’re excited to be a part of this new energy era that the Bahamas government is launching and to be part of the solution.” He declined to comment further.

Cameron Symonette, head of the Symonette

Group, is understood to be a principal of Compass but could not be reached for comment. Inti Corporation, whose head is Owen Bethel, the former Bahamian financial services executive, has played a key role in developing the first two renewable energy projects that are supplying Grand Bahama Power Company.

“Currently, we are negotiating the power purchase agreements,” Mrs ColebyDavis said of the Family Island renewable deals. Each island has unique energy requirements and geographical constraints,

necessitating a customised energy solution.

“To ensure the most suitable approach, each island’s technical specifications were thoroughly reviewed for applicability. We have finalized the design criteria in terms of agreement and selected both the microgrid controller and the communication profile.

“Long lead time supply chain equipment has been identified and their specifications have been submitted to the respective manufacturers. We anticipate that ground-breaking will begin by the end of 2024.”

As for New Providence, the minister added: “Approximately 70 MW of solar power and 35 MW of battery energy storage systems will be integrated into the existing grid. Twentyfive MW of the solar energy will be paired with the 25 MW of battery energy storage system at the Blue Hills power station.”

Turning to Island Grid’s selection as the entity that will overhaul BPL’s New Providence energy grid, Mrs Coleby-Davis said: “BPL’s transmisson and distribution infrastructure is in desperate need of upgrades as much of it dates to the 1980s and early 1990s with few enhancements to reduce significant system losses.

“BPL’s present infrastructure is crippled by the effects of climate change with soaring temperatures and natural disasters having a detrimental effect on the company’s assets.... The partnership with Island Grid will extend the

infrastructure capabilities beyond what BPL alone can do by bringing in a generation and transmission and distribution expert to pursue much-needed upgrades.

“The partnership with Island Grid will lower the fuel cost, and improve operating efficiency. The benefit of this arrangement will be felt through affordable energy prices and fewer power interruptions. The upgrade of the grid will bring about a more efficient delivery of power, so less energy is wasted getting the power from the generation plant to your home,” she added.

“Third, a well-built and well-sized system will allow for lower ongoing maintenance costs than what we currently have today. All these savings will be passed along to customers.”

Prime Minister Philip Davis KC, in his contribution to energy reform launch, said: “Important parts of our electricity infrastructure, including some transformers and substations, are more than 50 years old –they date back to before independence.

“It’s hard to describe the experience of listening to engineers emphasise that critical parts of our grid are on the verge of collapse, with no chance of revival once they go down. And then there are the generation engines – 60 percent of BPL’s plant in New

NOTICE

Providence, and 80 percent in the Family Islands - need replacement within the next five years.

“So we have an aging, vulnerable, deteriorating, expensive system, dependent on heavy and diesel fuels, that cannot meet current needs let alone the growing energy needs of a digital economy, or the increased demand we have to anticipate as temperatures rise in this new climate era.”

As for the consequences, Mr Davis said: “In every conversation I have with entrepreneurs, business owners, and investors –from the very smallest to the very largest – the high cost of electricity, and the costs and uncertainties associated with unreliable supply, inevitably come up.

“For most Bahamians, the only bill bigger is their rent or mortgage payment. Major bills are a major burden, which means less disposable income, which means less spending and investment in our local economy.

“And, of course, high bills for businesses means high operating costs, affecting our competitiveness and our ability to diversify, and creating obstacles to growth and development – impacting investments, business expansions and job creation.”

Pursuant to the provisions of Section, 218 of Te Companies Act, 1992 notice is hereby given that at an Extraordinary General Meeting of the Members of ROADLINK LTD. held on the 6th day of June, 2024 the following Resolution was unanimously passed: -

RESOLVED that the Company take all such steps as may be necessary to efect its liquidation and forthwith cause its name to be struck of the Register of Companies in accordance with Te Companies Act, 1992 AND that Peter D. Cartwright of #204 Safrey Square, Nassau, N.P. Te Bahamas be and is hereby appointed Liquidator of the Company for the purpose of such liquidation.

Dated the 11th day of June 2024.

PETER D. CARTWRIGHT

Liquidator for the above-named Company

NOTICE

Pursuant to the provisions of Section 222 (2) of Te Companies Act, 1992 notice is hereby given that an Extraordinary General Meeting of the Members of ROADLINK LTD. will be held at the Ofces of PDC Corporate Services Ltd. In No. 204 Safrey Square, East & Bay St in the City of Nassau on the 6th day of June, 2024 at 12 o’clock in the afernoon.

Te purpose of the said Meeting is to have laid before the Members of the Company the Final Statements of the liquidator showing the manner in which the winding up of the Company has been conducted, the property of the Company disposed of, the debts and obligations of the Company discharged and also to hear any explanations that may be given by the Liquidator.

All claims by creditors of the Company must be received by the Liquidator at No. 204 Safrey Square, Nassau, N.P. Te Bahamas before the 11th day of July 2024.

Dated the 11th day of June 2024.

PETER D. CARTWRIGHT

Liquidator for the above-named Company

PAGE 4, Tuesday, June 11, 2024 THE TRIBUNE

FROM PAGE B1

Bahamian firms chosen for renewable contracts FROM PAGE B1 TO ADVERTISE TODAY IN THE TRIBUNE CALL @ 502-2394

CRAIG FEDERIGHI, Apple’s senior vice president of software engineering, speaks during an announcement of new products at the Apple campus in Cupertino, Calif., on Monday, June 10, 2024. Photo/ Jeff Chiu

APPLE LEAPS INTO AI WITH AN ARRAY OF UPCOMING IPHONE FEATURES AND A CHATGPT DEAL TO SMARTEN UP SIRI

By MICHAEL LIEDTKE AP Technology Writer

APPLE has jumped into the race to bring generative artificial intelligence to the masses, spotlighting a slew of features Monday designed to soup up the iPhone, iPad and Mac.

And in a move befitting a company known for its marketing prowess, the AI technology coming as part of free software updates later this year is being billed as “Apple Intelligence.”

Even as it tried to put its own stamp on technology’s the hottest area, Apple tacitly acknowledged during its World Wide Developers Conference that it needs help catching up with companies like Microsoft and Google, which have emerged as the early leaders in AI. Apple is leaning on ChatGPT, made by the San Francisco startup OpenAI, to make its often-bumbling virtual assistant Siri smarter and more helpful.

“All of this goes beyond artificial intelligence, it’s personal intelligence, and it is the next big step for Apple,” CEO Tim Cook said.

Siri’s optional gateway to ChatGPT will be free to all iPhone users and made available on other Apple products once the option is baked into the next generation of Apple’s operating systems. ChatGPT subscribers are supposed to be able to easily sync their existing accounts when using the iPhone, and should get more advanced features than free users would.

To herald the alliance with Apple, OpenAI CEO Sam Altman sat in the front row of the packed conference, which was attended by developers from more than 60 countries.

“Together with Apple, we’re making it easier for people to benefit from what AI can offer,” Altman said in a statement.

Beyond allowing Siri to tap into ChatGPT’s storehouse of knowledge, Apple is giving its 13-year-old virtual assistant an extensive makeover designed to make it more personable and versatile, even as it currently fields about 1.5 billion queries a day.

When Apple releases free updates to the software powering the iPhone and its other products this autumn,

Siri will signal its presence with flashing lights along the edges of the display screen. It will be able to handle hundreds of more tasks — including chores that may require tapping into thirdparty devices — than it can now, based on Monday’s presentations.

Apple’s full suite of upcoming features will only work on more recent models of the iPhone, iPad and Mac because the devices require advanced processors. For instance, consumers will need last year’s iPhone 15 Pro or buy the next model coming out later this year to take full advantage of Apple’s AI package, although all the tools will work on Macs dating back to 2020 after that computer’s next operating system is installed.

The AI-packed updates coming to the next versions of Apple software are meant to enable the billions of people who use the company’s devices to get more done in less time, while also giving them access to creative tools that could liven things up. For instance, Apple will deploy AI to allow people to create emojis, dubbed “Genmojis” on the fly to fit the vibe they are trying to convey.

Apple’s goal with AI “is not to replace users, but empower them,” Craig Federighi, Apple’s senior vice president of software engineering, told reporters. Users will also have the option of going into the device settings to turn off any AI tools they don’t want.

Monday’s showcase seemed aimed at allaying concerns Apple might be losing its edge with the advent of AI, a technology expected to be as revolutionary as the 2007 introduction of the Phone. Both Google and Samsung have already released smartphone models touting AI features as their main attractions, while Apple has been stuck in an uncharacteristically extended sales slump.

AI mania is the main reason that Nvidia, the dominant maker of the chips underlying the technology, has seen its market value rocket from about $300 billion at the end of 2022 to about $3 trillion. The meteoric rise allowed Nvidia to

surpass Apple as the second most valuable company in the U.S. Earlier this year, Microsoft also eclipsed the iPhone maker on the strength of its so-far successful push into AI.

Investors didn’t seem as impressed with Apple’s AI presentation as the crowd that came to the company’s Cupertino, California, headquarters to see it. Apple’s stock price dipped nearly 2% Monday.

Despite that negative reaction, Wedbush Securities analyst Dan Ives asserted in a research note that Apple is “taking the right path.” He hailed the presentation as a “historical” day for a company that already has reshaped the tech industry and society.

Besides pulling AI tricks out of its bag, Apple also used the conference to confirm that it will be rolling out a technology called Rich Communications Service, or RCS, to its iMessage app. The technology should improve the quality and security of texting between iPhones and devices powered by Android software, such as the Samsung Galaxy and Google Pixel.

The change, due out with the next version of iPhone’s operating software, won’t eliminate the blue bubbles denoting texts originating from iPhones and the green bubbles marking text sent from Android devices — a distinction that has become a source of social stigma.

In another upcoming twist to the iPhone’s messaging app, users will be able to write a text (or have an AI tool compose it) in advance and schedule a specific time to automatically send it.

Monday’s presentation marked the second straight year that Apple has created a stir at its developers conference by using it to usher in a trendy form of technology that other companies already had employed.

Last year, Apple provided an early look at its mixedreality headset, the Vision Pro, which wasn’t released until early 2024. Nevertheless, Apple’s push into mixed reality — with a twist that it bills as “spatial computing” — has raised hopes that there will be more consumer interest in this niche technology.

Part of that optimism stems from Apple’s history of releasing technology later than others, then using sleek designs and slick marketing campaigns to overcome its tardy start.

Bringing more AI to the iPhone will likely raise privacy concerns — a topic that Apple has gone to great lengths to assure its loyal customers it can be trusted not to peer too deeply into their personal lives. Apple did talk extensively Monday about its efforts to build strong privacy protections and controls around its AI technology.

One way Apple is trying to convince consumers that the iPhone won’t be used to spy on them is harnessing its chip technology so most of its AI-powered features are handled on the device itself instead of at remote data centers, often called “the cloud.” Going down this route would also help protect Apple’s profit margins because AI processing through the cloud is far more expensive than when it is run solely on a device.

FROM

costs,” Mr Ingraham added These included “lack of capacity in the international reinsurance market as some reinsurers withdrew from the market and others reduced the amount of capacity they offered”, while “the acute lack of capacity meant that prices for the available capacity increased dramatically, as the laws of supply and demand usually dictate”.

Mr Ingraham said:

“Under normal circumstances, new capital will flow into the reinsurance market and provide the needed capacity. However, elevated interest rates in developed markets meant that investors could achieve a reasonable return on their capital without putting it at risk in the reinsurance market. Therefore this traditional relief valve did not operate as it did historically.

“The sharp increase in reinsurance costs outpaced the increase in the original rate charged to customers. This lead to a compression of the company’s margins.

Added to this was a transfer of $3.5m to the unearned premium reserve fund as a result of the increase in premiums.

“The company has taken some measures to relieve the pressure from the margins and a sharp focus on improving margins in other classes will assist moving forward. We are also hopeful that, absent any catastrophe losses, we will begin to see a reduction in our reinsurance expenditure.” Summit, like other Bahamian and global insurers, also had to grapple with a change in accounting standards. “IFRS 17 has proven to be a very challenging standard to implement for the insurance industry, and Summit was no exception,” Mr Ingraham said.

“We incurred significant increased costs and work time to adopt the standard. It has changed significantly the way financials are presented as well as the way some assets and liabilities are measured. The change did not greatly impact the overall result however.”

THE TRIBUNE Tuesday, June 11, 2024, PAGE 5

expected in 72%

fall

Insurer’s 2023 worse than

profit

Legal Notice NOTICE Ganymede Limited NOTICE IS HEREBY GIVEN as follows: (a) Ganymede Limited is in voluntary dissolution under the provisions of Section 138 (4) of the International Business Companies Act 2000. (b) The dissolution of the said Company commenced on the 6th day of June 2024. (c) The Liquidator of the said Company is Baird One Limited of Deltec House, Lyford Cay, P.O. Box N-3229, Nassau, Bahamas. Dated this 11th day of June A.D., 2024 Baird One Limited Liquidator NOTICE Atins Ltd. Incorporated under the International Business Companies Act, 2000 of the Commonwealth of The Bahamas. Registration number 209122 B (In Voluntary Liquidation) Notice is hereby given that the above-named Company is in dissolution, commencing on the 10th day of June A.D. 2024. Articles of Dissolution have been duly registered by the Registrar. The Liquidator is Mr. Pedro Ramos De Siqueira, whose address is Rua Rio Grande, 464, Casa 2, São Paulo, SP, CEP: 04018-001, Brazil. Any Persons having a Claim against the above-named Company are required on or before the 10th day of July A.D. 2024 to send their names, addresses and particulars of their debts or claims to the Liquidator of the Company, or in default thereof they may be excluded from the beneft of any distribution made before such claim is proved. Dated this 10th day of June A.D. 2024. PEDRO RAMOS DE SIQUEIRA Liquidator

PAGE B1

Wall Street ticks to more records

ahead of this week’s Fed meeting

By STAN CHOE AP Business Writer

U.S. stocks ticked to more records Monday ahead of a week with several top-tier reports on inflation due, as well as the Federal Reserve's latest meeting on interest rates.

The S&P 500 rose 13.80 points, or 0.3%, to 5,360.79 and topped its all-time high set last week. The Nasdaq composite also set a record after rising 59.40, or 0.3%, to 17,192.53, while the Dow Jones Industrial Average gained 69.05, or 0.2%, to 38,868.04.

Southwest Airlines flew to one of the market's biggest gains, up 7%, after Elliott Investment Management said it's taken a $1.9 billion ownership stake in the company and is pushing for new leadership to modernize the carrier's software, strategy and operations.

Diamond Offshore Drilling jumped 10.9%

after Noble agreed to buy its rival in a cash-and-stock deal valued at roughly $1.6 billion. Noble added 6.1% in a signal that traders expect the combination to be a winner. Other energy producers also climbed as the price of crude oil recovered some of its sharp losses since the spring.

Huntington Bancshares dropped 6.1% for one of the market's largest losses after cutting its forecast for a key component of profit this year.

Apple fell 1.9% following a highly anticipated conference where it showed how its operating systems will use ChatGPT to offer services using artificialintelligence technology. A furor around AI broadly on Wall Street has helped send stocks to records despite worries about high interest rates and the slowdown in the U.S. economy that they induce.

Data on the economy have come in mixed

recently, and traders are hoping they will ultimately show a slowdown that stops short of a recession and is just right in magnitude. A cooldown would put less upward pressure on inflation, which could encourage the Federal Reserve to cut its main interest rate from its most punishing level in more than two decades. But the data have been tough to parse, with Friday's

stronger-than-expected jobs report quickly on the heels of weaker-thanexpected reports on U.S. manufacturing and other areas of the economy. Even within U.S. consumer spending, the heart of the economy, is a sharp divide between lower-income households struggling to keep up with still-high inflation and higher-income households doing much better.

NOTICE

NOTICE is hereby given that PASTOR ASTLEY WILLIAMS Hibiscus Close, Marathon, Carmichael, Nassau, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 4th day of June, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

THE NEW York Stock Exchange is shown on May 21, 2024, in New York. World stocks are mostly lower on Monday, June 10, 2024, after a U.S. jobs report released Friday was hotter than expected.

Photo:Peter Morgan

price more affordable to investors, after it ballooned to more than $1,000 amid the AI frenzy.

Treasury yields were mixed in the bond market ahead of reports later in the week that will show whether inflation improved last month at both the consumer and wholesale levels.

"Bottom line, the data remains mixed, leaving all of the major macro outcomes still on the table for this year," according to Morgan Stanley strategists led by Michael Wilson.

In the meantime, companies benefiting from the AI boom are continuing to report big growth almost regardless of what the economy and interest rates are doing.

Nvidia, for example, is worth roughly $3 trillion and rose 0.7% Monday after reversing an earlymorning loss. It was the first day of trading for the company since a 10-for-one stock split made its share

On Wednesday, the Federal Reserve will announce its latest decision on interest rates. Virtually no one expects it to move its main interest rate then. But policy makers will be publishing their latest forecasts for where they see interest rates and the economy heading in the future.

The last time Fed officials released such projections, in March, they indicated the typical member foresaw roughly three cuts to interest rates in 2024. That projection will almost certainly fall this time around. Traders on Wall Street are largely betting on just one or two cuts to rates in 2024, according to data from CME Group.

NOTICE

NOTICE is hereby given that KEVIN JOHN JOSEPH Marathon Estates, Lucaya Circle, Nassau, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 4th day of June, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE

NOTICE is hereby given that JUSTIN JAMES LAFLEUR of Fire Trail Road, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas and that any person who knows any reason whyregistration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 4th day of June, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that EVERTON GEORGE COKE SB51353 #2 Shrimp Road, Carmichael, Nassau, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 4th day of June, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE is hereby given that ANNAFAITE PETIT Hamster Road, Carmichael, Nassau, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 4th day of June, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

PAGE 6, Tuesday, June 11, 2024 THE TRIBUNE

STOCK MARKET TODAY

/AP

NOTICE