• Bahamas Grid Company set to take over T&D network

• $30m annual savings target from lower outage, losses

• Several hundred jobs during initial construction phase

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Government is set to hand over New Providence’s electricity grid to a private company in return for a 40 percent ownership interest in that entity, Tribune Business can reveal.

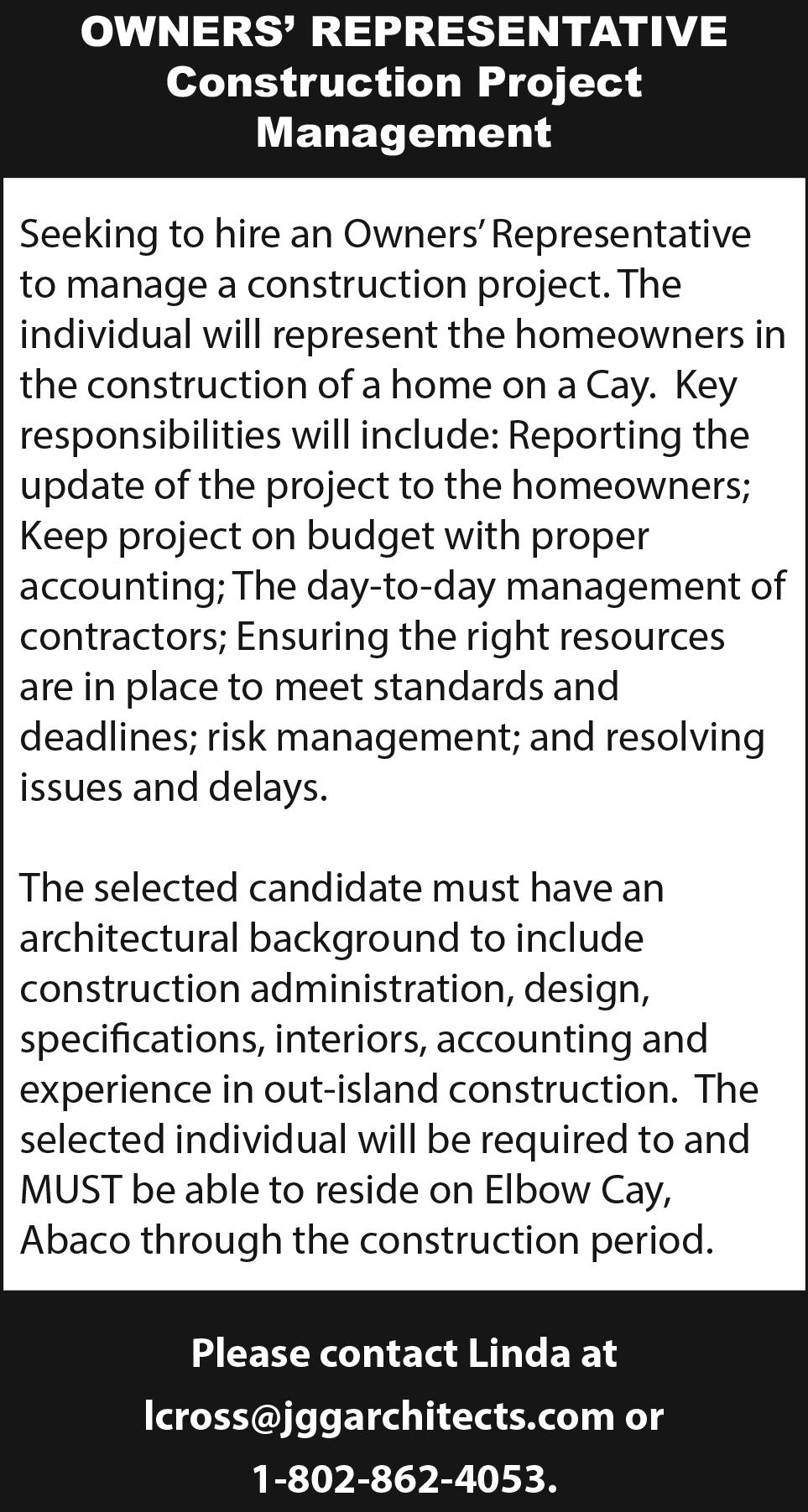

Multiple sources, speaking on condition of anonymity because they were not authorised to speak publicly, yesterday told this newspaper that the plans to overhaul Bahamas Power & Light’s (BPL) transmission and distribution network involve the creation of a new entity called Bahamas Grid Company.

This company will be structured as a public-private

partnership (PPP) that is 60 percent majority-owned by private investors. The Government, which will own the remaining 40 percent, will gain its equity ownership interest by transferring BPL’s New Providence electricity grid - which includes sub-stations,

transformers, poles and wires - to Bahamas Grid Company.

The effort to transform BPL’s transmission and distribution network, of which “critical parts.... are on the verge of collapse” according to Prime Minister Philip Davis KC, is thus far more complex and involved than the reform strategy outlined by the Government in unveiling its “new energy era” on Monday. Island Grid, which was identified as BPL’s transmission and distribution partner, will manage Bahamas Grid Company. It is understood that the latter hopes to complete the initial phase of its work by the 2025 first quarter’s close at end-March next year if it can get moving quickly.

Well-placed sources said Bahamas Grid Company is in line

to receive a 25-year contract to manage and upgrade New Providence’s transmission and distribution network under a proposed Heads of Agreement with the Davis administration that has yet to be signed. They added that its investors - both private and the Government - will gain a return on their investment through a portion of all revenues billed and collected by BPL being allocated to Bahamas Grid Company. A portion of this sum, said to be 5.5 cents per kilowatt hour initially (kWh), will also be used to help pay-off legacy BPL debts estimated at around $500m or half a billion dollars.

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

• Claims investigation findings ‘swept under table’

DR HUBERT Minnis last night challenged the Prime Minister to reveal the findings of a probe into alleged smuggling involving senior Customs and Finance officials which has been “swept under the table”. The former prime minister, in his contribution to the 2024-2025 Budget debate in the House of Assembly, asserted that a witness had implicated “high ups” in the Ministry of Finance and Customs Department for “facilitating” the importation of more than $567,000 in Budweiser beer “and other contraband” discovered in 16 shipping containers. Signalling that he knows the identities of those officials involved, but chose not to reveal them, Dr Minnis said: “I await the report from the Ministry of Finance with respect to 16 containers that were brought into this country presumably by some Sean McKenzie.

• ‘Senior officials’ on video over beer, contraband

• Ex-PM resumes attacks on JDL air freight deal

“When the investigation occurred, one of the individuals questioned, his exact words, Mr deputy [speaker], which I move to state for the record, he indicated there were high-ups involved in the facilitation of these containers in the Ministry of Finance and Bahamas Customs Department.

URCA: ‘No involvement’ in new BPL rate structure

By NEIL HARTNELL

THE Bahamian energy industry regulator yesterday said it had “no involvement” in developing Bahamas Power & Light’s (BPL) new rate structure that takes effect from July 1.

Juan McCartney, the Utilities Regulation and Competition Authority’s (URCA) corporate and consumer relations chief, told Tribune Business that the newly-passed Electricity Act 2024 gives Jobeth ColebyDavis, minister of energy and transport, the legal authority to set BPL’s tariffs without reference to the regulator for three years.

“URCA didn’t have any involvement in it,” he affirmed. “It’s section 38 (9) in the new Electricity Act. The minister has the power for three years to set specific tariffs. That’s under that power is how she’s doing it.” Mr McCartney said he understood Mrs Coleby-Davis either has to issue an order, table them in the House of Assembly or publish the new tariffs via the Government’s gazette.

“The minister has the power to do it for three years,” he added. “BPL cannot do it without it being approved. When BPL wants to set or change its rates, it needs URCA’s approval. The minister doesn’t. She has the power to do it for three years. It was changed.”

The end of that three-year period marks when URCA must review BPL’s tariff submission. Mr McCartney said the stateowned energy monopoly has to submit its application within two-and-a-half years to give URCA time to complete its analysis.

“When we get the official investigation report, who are these high officials in Customs? Who are these high officials in the Ministry of Finance? The investigation is finished but swept under the table. We need to know about the findings of the investigation,” the ex-prime minister continued.

“There are videos of Ministry of Finance personnel in a Kia car who went and was there on

Revenues outpace $50m spending jump for April

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Government yesterday unveiled a $36.2m fiscal surplus for April 2024 after a 29.7 percent year-over-year revenue increase outpaced a $50.3m jump in spending.

The Ministry of Finance’s latest monthly report reflected a lower total revenue figure, at $359.4m, than that given for April by Prime Minister Philip Davis KC in his recent Budget communication. If the $385.8m he cited is the true number then the Government’s surplus could come in some $26.4m higher at $66.4m.

“The preliminary total revenue for April 2024 is estimated to be $385.8m, reflecting a significant increase of $108.6m or 39.2 percent compared to April in the previous year,” Mr Davis said. However, the $359.4m number still represented an $82.2m yearover-year revenue surge even though its was just $1.3m higher than March’s intake.

“For the month of April, the Government’s fiscal operations yielded an appreciably higher surplus of $36.2m compared with $4.2m in the corresponding month of the prior year,” the Ministry of Finance said.

“Developments underlying this outcome were a year-overyear improvement in revenue receipts by 29.7 percent ($82.3m) to $359.4m, which outpaced the 18.4 percent ($50.3m) expansion in total expenditure to $323.2m.” The Government’s direct debt also declined by $50m during the month. April’s surplus, which measures by how much the Government’s revenues exceeded its spending for the month, when combined with the prior month’s $83.5m and February’s more modest $6.9m surplus has created a $126.6m Budget boost that has brought the fiscal deficit down from an end-January 2024 high of just over $300m.

The deficit for the first ten months of the 2023-2024 fiscal year stands at $177.9m at end-April, giving the Davis administration a chance of hitting its revised full-year forecast of $210m - at the top of its $146m-$216m guidance rangeprovided it can contain the ‘red ink’ typically incurred during the final two months of every Budget cycle.

The Government will need to contain the combined deficit for May and June to less than $40m. The Prime Minister

Businesses voice concern on new BPL rate structure

By NEIL HARTNELL Tribune Business Editor

CONCERNS were voiced yesterday that Bahamas Power & Light’s (BPL) new rate structure could undermine economic competitiveness and increase inflation by raising energy costs for many businesses.

Jobeth Coleby-Davis, minister of energy and transport, confirmed to Tribune Business in writing that BPL’s revised fuel charge arrangement - which takes effect in less than three weeks’ time on July 1 - applies to “all classes” of customers, meaning residential as well as businesses of all sizes.

The changes, described as the Equity Rate Adjustment, will give all consumers a 2.5 cent per kilowatt hour (kWh) discount on the first 800 kWh that they consume. But, above that threshold, BPL customers will have to pay a 1.5 cent charge for every

kWh used over and above

BPL’s actual cost of fuel.

The Prime Minister’s Office, giving an example of how this would work, said: “If the [actual fuel charge] is 20 cents per unit (kWh), then the customer will be 17.5 cents per kWh for the first 800 units (kWh). The remaining units (kWh) will be billed at 21.5 cents.”

Mrs Coleby-Davis reiterated that the new rate structure “encourages energy conservation and protects low energy users. Those who use less, pay

business@tribunemedia.net WEDNESDAY, JUNE 12, 2024

Tribune Business Editor nhartnell@tribunemedia.net

SEE PAGE A19 SEE PAGE A19

nhartnell@tribunemedia.net SEE PAGE A20

Minnis challenging PM over Customs probe into ‘high ups’

SEE PAGE A20 BPL grid exchange for 40% Gov’t ownership

BAHAMAS POWER & LIGHT (BPL)

DR HUBERT MINNIS

SEE

PAGE A21

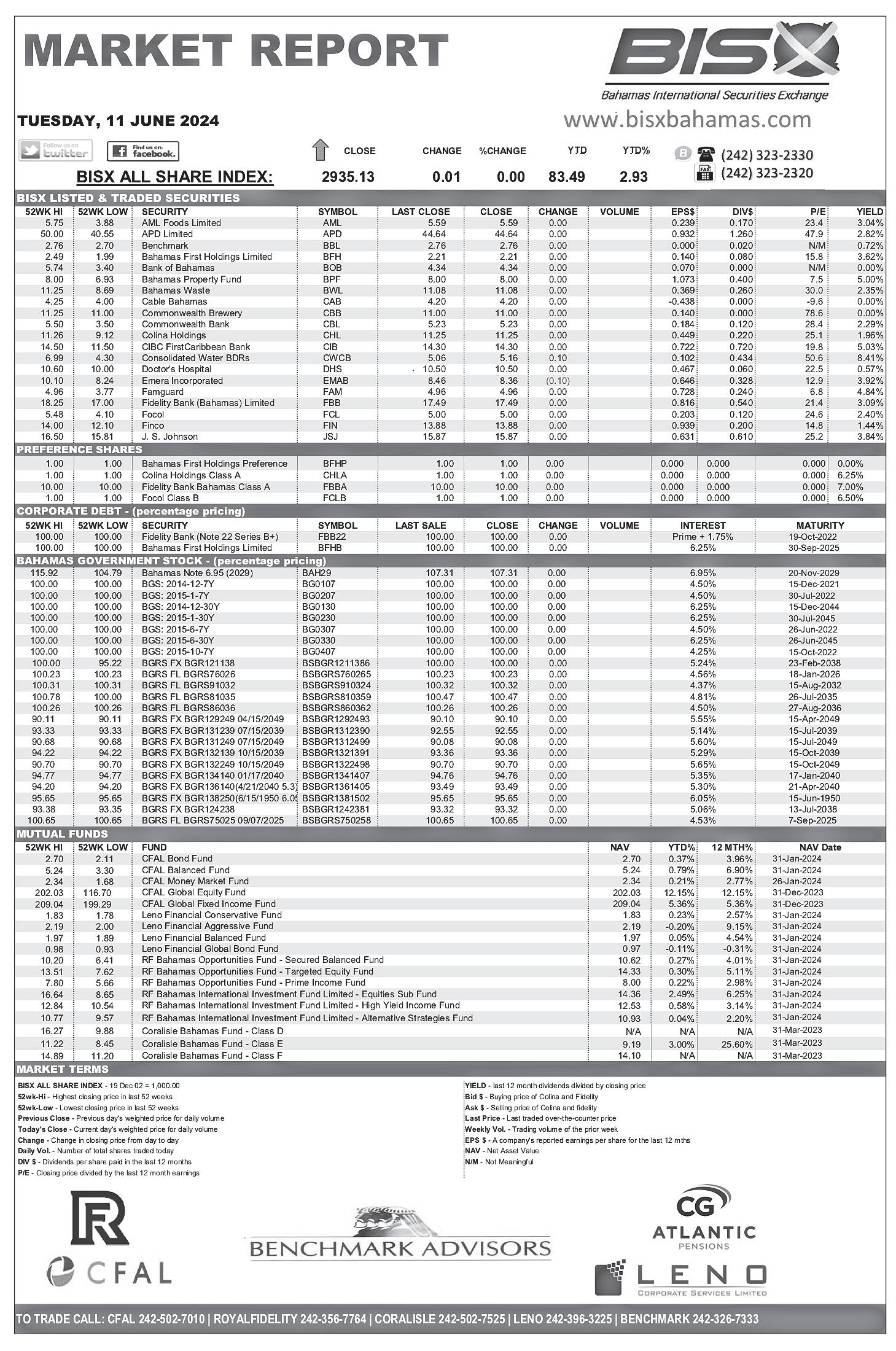

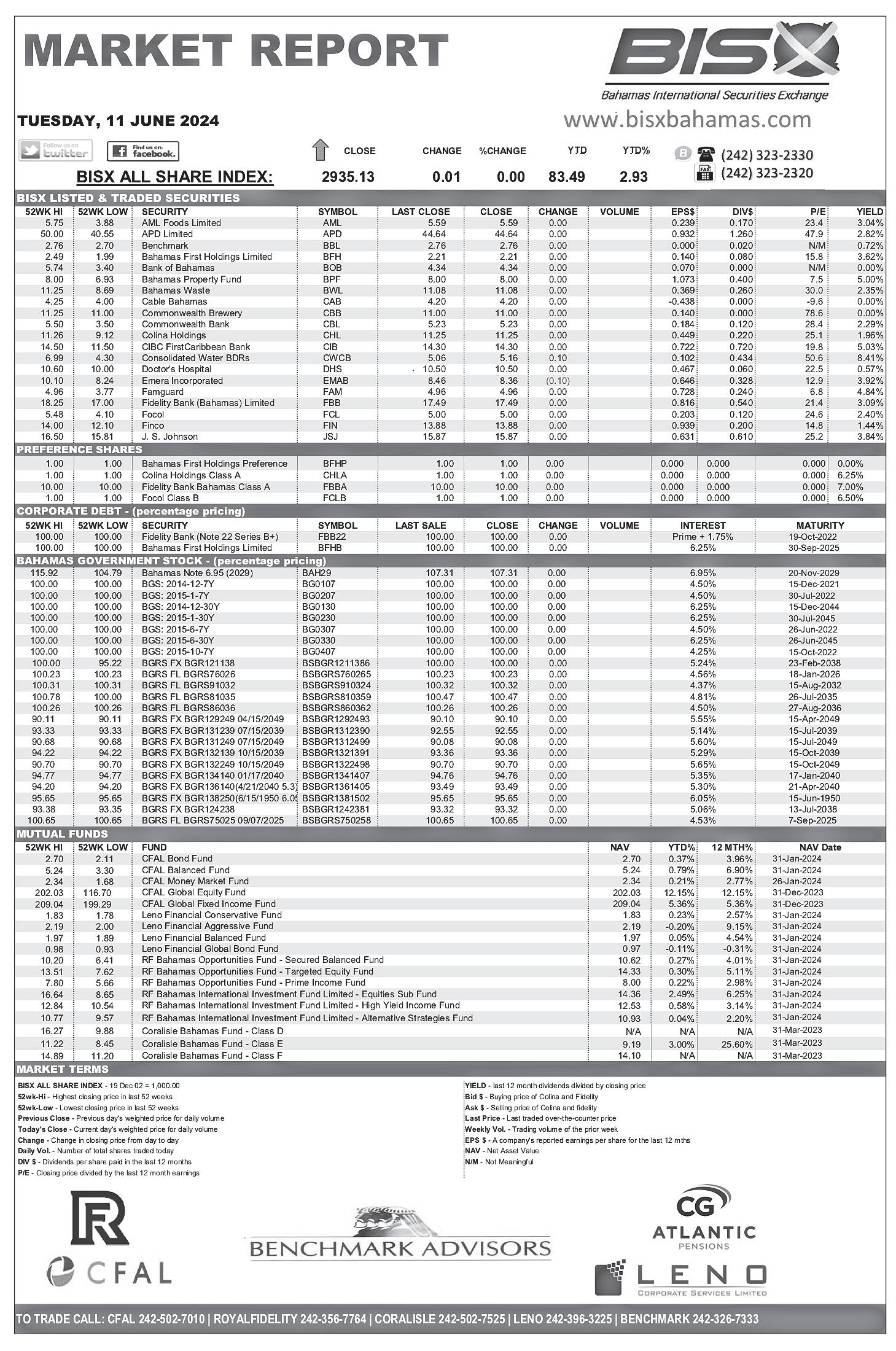

$5.73 $5.79 $5.74 $5.61

JOBETH COLEBY-DAVIS

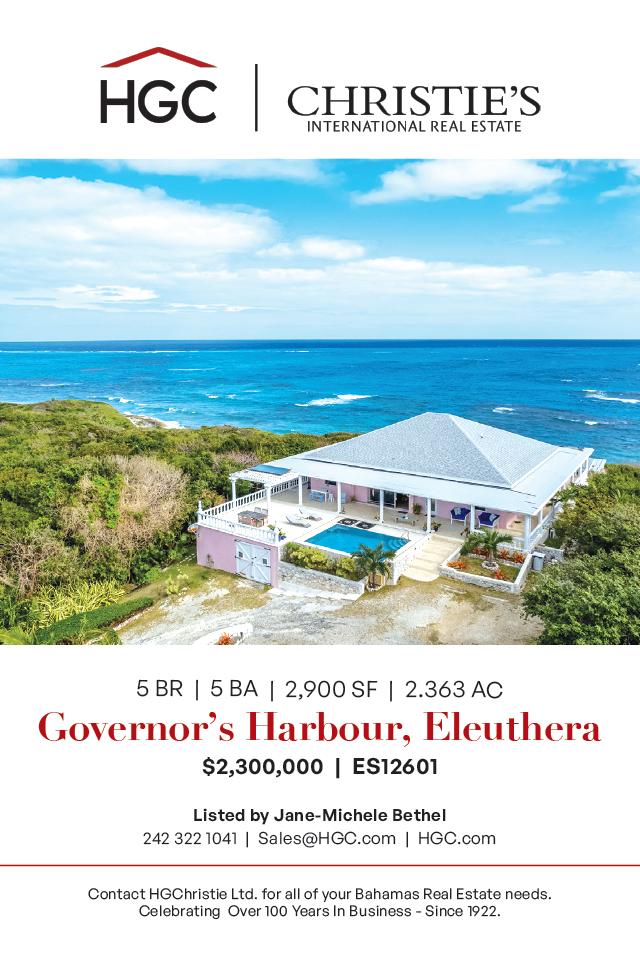

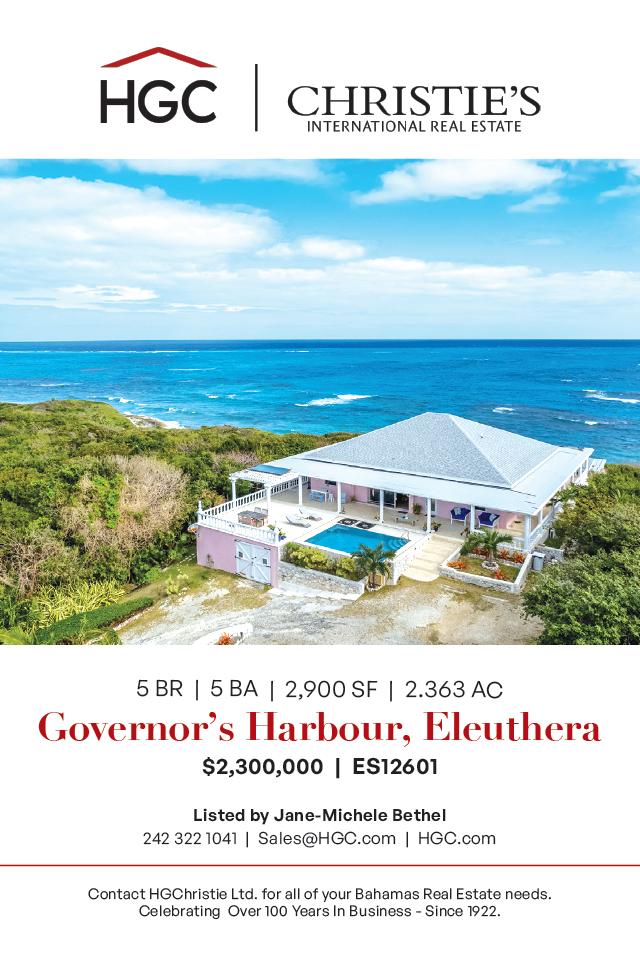

ODYSSEY HAILS MULTI-MILLION EXUMA TERMINAL INVESTMENT

ODYSSEY Aviation

says the multi-million dollar investment in its new Exuma terminal building will improve the travel experience for private aviation passengers and crew.

The fixed-base operator (FBO), in a statement, said Monday’s opening of its 4,800 square foot Exuma International Airport facility also features a six-acre aircraft parking apron and aviation fuel storage terminal.

Customs and Immigration will be present at a terminal featuring a 100 percent Bahamian customer service and line service team. A passenger lounge and coffee bar; flight planning room and pilot lounge; and executive conference room available to Odyssey customers are also included in the facility.

Ground service equipment, together with three 5,000-gallon Jet A refuellers and one 1,000-gallon Avgas refueller, will greet visiting aircraft. Fuel will be stored in a bulk containing 55,000 gallons of Jet A, and 20,000 gallons of Avgas, storage.

ODYSSEY’s

BAMSI partners on bird guide training

THE Bahamas Agriculture and Marine Science Institute (BAMSI) has teamed with the National Audubon Society to strengthen their relationship on bird guide training and conservation in this nation.

The relationship between the two sides, which began in 2021, has resulted in the signing of a Memorandum of Understanding (MoU) between them. The two organisations have been working closely on a bird-guiding national certification, in connection with the Andros Cluster

Development, a community-based tourism project. The project was facilitated by the Ministry of Tourism, Investments and Aviation.

A key component was the implementation of a bird and nature guide training certification programme that will create sustainable economic opportunities for Androsians, and enhance the national tourism product.

The National Audubon Society worked with BAMSI to provide both financial and technical support. This included the donation of birdwatching

equipment and scholarships to facilitate the roll-out of the training in September 2023.

The MOU allows for a collaborative partnership to strengthen and promote bird-based tourism and educational initiatives in The Bahamas. In areas of conservation, the partnership would advance research by further developing the field skills of bird nature guides to conduct surveys and engage in the monitoring of birds and their habitats.

Registrar General warning on corporate portal switch

THE Registrar General’s Department has warned corporate clients its current digital services platform will not be available from 5pm tomorrow as it switches to an improved portal.

“We are excited to open our new terminal building at Odyssey Aviation Exuma, which represents our commitment to providing world-class service and facilities for our customers,” said Steven K. Kelly, Odyssey Aviation’s president. “The

The agency, in a statement, said it is transitioning from its current e-Services corporate digital portal and launching its new platform known as Corporate Administrative Registry Services (C.A.R.S). As a result, from 5pm on Thursday, June 13, the e-Services platform will be disabled and no longer available for public use. For the week between June 14 and June 21, 2024, all corporate services provided by the Registrar General’s Department will be facilitated in person only over-the-counter until C.A.R.S is officially released to the general public.

The Registrar General’s Department said it apologises for any inconvenience caused during the transition period but is aiming to provide a new and improved digital product with better quality of service.

THE TRIBUNE Wednesday, June 12, 2024, PAGE 23

ODYSSEY Aviation officially opened its new terminal building at Exuma International Airport (MYEF) on Monday. The 4,800 square foot terminal includes a six-acre aircraft parking apron and a bulk aviation fuel storage facility.

CHESTER COOPER, deputy prime minister, cut the ribbon on Monday to officially open Odyssey Aviation’s Exuma International Airport (MYEF) terminal after speaking to invited guests at a brief ceremony held on the grounds.

L-R: LESLIE BRACE, manager, sustainable tourism programme at BAMSI; Dr Raveenia RobertsHanna, president, BAMSI; Ines Fernandes, programme associate, Audubon Americas; and Aurelio Ramos, vice-president, Audubon Americas. Photo:Ines Fernandes

new terminal will enhance the overall travel experience for visiting passengers

crew members,

we look for-

welcoming them

new facility.”

operations

four

larg-

requested

available

fuel sup-

founding member

Paragon

network

fixed base operators. CALL 502-2394 TO ADVERTISE IN THE TRIBUNE TODAY!

and

and

ward to

to our

Odyssey Aviation Bahamas has

at

airports on three islands with Nassau the

est. Twenty-four hour service can be

and is

at all locations, which serve as ports of entry with Customs and Immigration available. Odyssey Aviation is a Rubis-branded

plier, and is a

of

Aviation Group, a

of

STEVEN K. KELLY, Odyssey Aviation’s president, takes Mr Cooper on a tour of the company’s latest FBO in Exuma. Photos:Odyssey Aviation

Exuma FBO amenities include a Bahamas Customs and Immigration station; 24/7 concierge services; a passenger lounge and coffee bar; an executive conference room; a flight planning room and pilot lounge; three 5,000 gallon Jet A refuellers and one 1,000-gallon Avgas refueller and bulk fuel storage facility, containing 55,000 gallons of Jet A and 20,000 gallons of Avgas storage.

CIBC HOSTS AUTO AND HOMES FAIR

PAGE 22, Wednesday, June 12, 2024 THE TRIBUNE POTENTIAL homeowners and auto buyers recently joined CIBC Caribbean and other vendors at the bank’s Home and Auto Fair. THE EVENT, held at the bank’s Marathon Mall location, featured realtors, appraisers, legal experts, developers and auto dealers. They included Arawak Homes, Auto Mall, Better Homes Real Estate, Mitre Court, Insurance Management and Easy Car Sales. Each vendor offered insights, special deals and advice.

Minnis challenging PM over Customs probe into ‘high ups’

tape, and there for minutes, but no Customs officer was doing their job. Do we know what was in the containers? Items... Alcohol.

I don’t drink. These items: Bud. I don’t drink, but but $567,432 of Bud beer and other contraband. Where is the report?”

Dr Minnis, confirming that he knew the identities of the senior Ministry of Finance and Customs Department officials allegedly involved, did not reveal them as he issued a challenge to Philip Davis KC. He added: “I want the Prime Minister to tell us. That’s all for now. Mr Prime Minister, this is a matter that must be dealt with.”

The Killarney MP, whose bid to again become FNM leader was recently defeated by Michael Pintard, also resumed his attack on the outsourcing of the Lynden Pindling International Airport (LPIA) air freight terminal to JDL, a company headed by The Island Game web shop chain’s principal, Pete Deveaux.

Besides asserting that JDL has illegally “usurped” Customs authority under the Customs Management Act, Dr Minnis alleged that the variety of new charges and fees it has imposed on imported air freight is further fuelling Bahamian inflation and the cost of living crisis while also sending courier companies “out of business”.

Suggesting there had been no competitive bidding for the air freight terminal deal, the ex-prime minister said it was “very, very suspicious” that JDL had been awarded the $25m public-private partnership (PPP) when his administration had been investigating another deal involving Mr Deveaux and the Ministry of Finance prior to the 2021 general election.

That involved a $1.46m computer supply contract related to the roll-out of Customs’ Electronic Single Window that facilitates the online clearance of goods. The contract was awarded

to Xua Company Ltd, an entity beneficially owned by Mr Deveaux and his wife, even though they appeared to have “no prior involvement in businesses relating to information technology or computer procurement”.

Dr Minnis, stating that Customs has the responsibility to protect The Bahamas’ borders and keep it safe from illegal/harmful goods and smuggling, said: “That responsibility has been usurped and a new company, JDL, has taken on Customs’ responsibilities in spite of the [Customs] Management Act and law that is very clear.

“This company was proposed in 2012-2013 to the then-prime minister, Perry Christie, who refused recognising the challenges it would bring forth to this nation. Now, every package coming into the freight terminal must first be held by this JDL entity and every package is charged 20 cents per pound.”

Pointing out that this is increasing the cost of imported goods just as the Prime Minister complains about inflation and the high cost of living, Dr Minnis added: “In addition to that, they [JDL] have no equipment other than a weight scale. I went and checked. That’s all they have.

“Packages in the bonded area before this were charged $4 per square foot. Now, this entity is charging $40 per square foot plus VAT. That must be paid for by consumers. You have a 20 cents charge plus VAT then a 40 cent charge plus VAT.”

Dr Minnis argued that JDL will pay for the equipment it requires by charging Bahamian consumers and importers “hundreds of thousands of dollars”. He added that JDL will, like Bahamas Customs, charge for overtime which he said amounts to “double dipping”.

“These things add only cost increases, and today couriers are going out of business because they cannot afford these charges,” Dr Minnis said. “Where is the contract? It

was a ‘no bid’ contract. Mr deputy, I could go on and on.”

Simon Wilson, the Ministry of Finance’s financial secretary, previously defended the deal in revealing that the Government has been seeking a solution to the air freight terminal’s deterioration for ten years and, despite approaching multiple parties, was unable to find a PPP partner until JDL appeared.

He said last year: “We were looking for a solution and a Bahamian company came in and was willing to take on the risk for redeveloping the building for Customs purposes. We made no secret of it in the Budget. This is nothing new......

“It will make a massive investment, and the company is willing to do it. A review of the file will show that we have attempted to do this for at least the last seven years. We went far and wide, approached many persons to say: ‘Are you interested?’ There was no interest.

“This started seven to eight years ago when we thought we could use part of that building as an office for Nassau Flight Services (NFS). This is not just something that sprung up. We found one person willing to take the risk upfront. They’re taking the complete risk. If the volume of traffic is not there, they lose their money. Hopefully, this goes well for us. If it does, it will be a precursor for other things where the private sector takes on the risk.”

Dr Minnis, though, yesterday sought to link the JDL deal to an investigation into a contract awarded to Mr Deveaux just prior to the 2017 general election. A report on that probe was tabled in Parliament in December 2018 just prior to the disclosure of Mr Wilson’s legal action against the Government over the Minnis administration’s efforts to move him sideways to the Central Bank.

Mr Wilson was interviewed at length by that report’s author, FTI Consulting, which suggested

that Mr Deveaux did little to earn his $455,000 gross profit since he and his wife merely acted as brokers in outsourcing the procurement of hundreds of desktop computers, monitors and laptops to a Florida company.

Their Xua Company Ltd, which handled the contract, was likely formed specifically to handle the computer equipment deal, given that it was incorporated on February 20, 2017 - less than two months before the deal’s signing, but after the meeting with Mr Wilson and an unnamed “elected official” - the latter of whom had recommended the award.

The report revealed that Xua Company was 213 days late in completing its contractual obligations, with the initial shipment “short” and incomplete, and many desktop computers lacking 50 percent of the promised memory capacity.

“This company is owned or managed by Pete Deveaux,” Dr Minnis said yesterday of JDL. “This is the same entity that, when I became prime minister, I had FTI Consulting investigate with respect to computers brought into this country.”

While JDL and Xua are separate corporate entities, the former prime minister continued: “They were working as middle man

through Xua, and bringing in computers through this entity. FTI was brought in from New York, I think. The financial secretary [Mr Wilson] answered quite a few questions. “There was no bidding process for how those computers were selected or which company would provide the computers. The same entity investigated by my government in 2018 is the same entity involved in JDL. That’s very, very suspicious and it’s adding to inflation. That must stop.” Again, Xua and JDL are separate entities, although they share a common owner in Mr Deveaux.

THE TRIBUNE Wednesday, June 12, 2024, PAGE 21

FROM PAGE A24

PHILIP "BRAVE" DAVIS

BPL grid exchange for 40% Gov’t ownership

These details have emerged after offering documents were issued to Bahamian investors as part of Bahamas Grid Company’s bid to raise $30m in equity capital via a private placement - a deal that was exclusively revealed by this newspaper on Monday.

The $30m equity raise is one component of the $130m in initial financing that the New Providence energy grid reform effort requires, with the remaining $100m likely to involve preference shares or some other form of debt security.

Transferring BPL’s New Providence electricity grid to Bahamas Grid Company in return for 40 percent ownership in the latter makes sense for the Government as it does not have to find a single dollar in liquid cash for its equity contribution amid its ongoing fiscal squeeze. It also enables it to have direct input and influence over upgrading the transmission and distribution network, and how this process rolls-out.

It is also understood that the deal is not a sale of BPL’s New Providence grid. Rather, when the 25-year arrangement with Bahamas Grid Company and Island Grid expires, it is thought likely that the network will revert back to government and BPL ownership. If the transmission and distribution upgrades are executed according to plan, BPL and its customers are initially forecast to enjoy annual savings between $10m-$30m due to a combination of less frequent outages and reduced electricity losses from overhead lines.

Tribune Business was told that the enhancements are also designed to resolve voltage fluctuations responsible for frying electrical equipment, and will ultimately increase the electricity grid’s carrying capacity by 172 Mega Watts (MW) while also making it easier to integrate large resort developments and other projects that will add significantly to New Providence’s load demand.

Several hundred jobsthought to be around 200

- will likely be created during the transmission and distribution build-out phase with BPL staff in line to get first crack at these posts. They will probably work with overseas transmission and distribution workers provided via Pike Electrical, the Carolinas-based specialist with which Island Grid is affiliated. The latter is likely to receive a management fee for its services.

Island Grid’s website lists its co-chief executive as Eric Pike, who is also chairman of Pike Corporation. That is the North Carolinabased energy transmission and distribution specialist, which was named by Kyle Wilson, the Bahamas Electrical Workers Union (BEWU) president, as the entity set to take over management of BPL’s grid via a public-private partnership (PPP) deal with the Davis administration.

The company’s website shows it is headquartered at Shipston House in Lyford Cay. The Shipston Group was founded by the late world renowned investor, Michael Dingman, and David Dingman is named as

an Island Grid director on the company’s website. Island, which bills itself as “bringing 60-plus years of US infrastructure and implementation expertise to islands around the world”, also showcases work done for Grand Bahama Power Company and the private developers at Walker’s Cay in the Abacos (Carl Allen) and Jack’s Bay in Eleuthera. Mr Pike has also previously been named as an investor and equity partner in the Jack’s Bay development, which is chaired by Sir Franklyn Wilson, chairman of BISX-listed FOCOL Holdings. FOCOL’s subsidiary, Bahamas Utility Company, has been named as BPL and the Government’s generation reform partner for the “new energy era”.

Island Grid describes itself as “a one-stop shop for infrastructure services”, offering engineering, construction, project management, advisory, training and even marketing solutions for its clients.

Jobeth Coleby-Davis, minister of transport and energy, told the House of Assembly

BUSINESSES VOICE CONCERN ON NEW BPL RATE STRUCTURE

less”. However, multiple business community sources yesterday pointed out that enterprises of all sizes - right down to ‘Mom and Pop’ restaurants and shops - consume significantly more energy than 800 kWh per month especially during the upcoming summer period.

As a result, while the base rate for small and mediumsized enterprises (SMEs) has decreased slightly, there are now fears that this will be more than offset by increased BPL fuel charges especially over the highconsumption summer.

Mrs Coleby-Davis on Monday disclosed that the commercial base tariff will drop slightly from July 1, falling from 15 cents to 14.5 cents per kWh, but many in the private sector will now be scrambling to work

out what this means for their business, its expenses and profitability, and if this will be enough to offset the now-anticipated rise in their electricity bill’s fuel component.

“There has to be clarity on that,” Mark A Turnquest, the 242 Small Business Association and Resource Centre’s (SBARC) founder, told Tribune Business of BPL’s new rate structure. “If that [fuel charge increases] is going to happen it’s going to affect a lot of small businesses in the country.

“I’m going to get back to the small business owners to give them a better understanding and sense of where we are going.... It’s going to kill us if it ups our costs. We will have to look at sales, and have to look at costs, and determine if sales outweigh costs and if any uptick

NOTICE

IN THE ESTATE of ELLA ELVA ROBERTS late of the Settlement of Resort Area of Treasure Cay on the Island of Abaco, one of the Islands of The Commonwealth of The Bahamas, deceased.

Notice is hereby given that all persons having any claim or demands against the above named Estate are required to send their names, addresses and particulars of the same duly certified in writing to the undersigned on or before the 4th day of July A.D., 2024, and if required, prove such debts or claims, or in default be excluded from any distribution; after the above date the assets will be distributed having regard only to the proved debts or claims of which the Executor shall then have had Notice.

And Notice is hereby given that all persons indebted to the said Estate are requested to make full settlement on or before the aforementioned date.

MICHAEL A. DEAN & CO., Attorneys for the Executor Alvernia Court, 49A Dowdeswell Street P.O. Box N-3114 Nassau, The Bahamas

LEGAL NOTICE

TWYNAM INVESTMENT FUND LTD.

INTERNATIONAL BUSINESS COMPANIES ACT (No.45 of 2000) In Voluntary Liquidation

Notice is hereby given that in accordance with Section 138 (4) of the International Business Companies Act, (No.45 of 2000) TWYNAM INVESTMENT FUND LTD. is in dissolution. The date of commencement of the dissolution is 10th June, 2024 A3 PERFORMANCE GESTÃO DE RECURSOS LTDA is the Liquidator and can be contacted at Estrada da Gavea 712 – SL 405/406, São Conrado, Rio de Janeiro, RJ, Brazil. All persons having claims against the above-named company are required to send their names, addresses and particulars of their debts or claims to the Liquidator before 10th July, 2024

A3 PERFORMANCE GESTÃO DE RECURSOS LTDA Liquidator

in sales might be more than the uptick in expenses.

“It’s got to be a strategic decision. You cannot lose money in business. I don’t care how you do it. You don’t want to make that decision to determine if you have to raise your prices, but decisions have to be made so we have to look at July and our bills to determine what need we need to do.”

The Bahamian private sector is already faced with an increase in National Insurance Board (NIB) contribution rates and the insurable wage ceiling come July 1, and the revised BPL rate structure is now another consideration entering their strategic planning mix.

“This is going to be a discussion we were not thinking about,” Mr Turnquest added, “but now we have to think about it. There are only two things we need to do: Absorb it, or give it to the customer. Everybody needs to look at their individual bill to determine how it’s going to affect their particular business. This is

coming to us very fast. It’s so fast. From one thing to the next.”

The Prime Minister’s Office, in detailing the Equity Rate Adjustment’s impact, asserted that only BPL’s largest consumers - its 300 general service consumers representing around 500 accounts and less than 1 percent of the utility’s customer base - will see their light bills increase after July 1.

While it said energy costs for the likes of hotels, food store chains and manufacturers will be less year-over-year, that will not be difficult given that the same period in 2023 featured a 163 percent hike in BPL’s fuel charge compared to October 2022 in a bid to reclaim under-recovered fuel costs.

“Their electricity bills will still be lower than during the same months of the prior year,” the Prime Minister’s Office said, “and they will gain enormously from new energy reforms, as transmission and distribution upgrades will increase efficiencies and improve

in early March that a $130m investment is required to upgrade BPL’s New Providence transmission and distribution network “in the next two years alone”. And, on Monday, she said: “BPL’s transmission and distribution infrastructure is in desperate need of upgrades as much of it dates to the 1980s and early 1990s with few enhancements to reduce significant system losses. BPL’s present infrastructure is crippled by the effects of climate change with soaring temperatures and natural disasters having a detrimental effect on the company’s assets....

“The partnership with Island Grid will extend the infrastructure capabilities beyond what BPL alone can do by bringing in a generation and transmission and distribution network expert to pursue much-needed upgrades. The partnership with Island Grid will lower the fuel cost, and improve operating efficiency. The benefit of this arrangement will be felt through affordable energy prices and fewer power interruptions....

reliability which, along with the integration of solar power and natural gas, will produce meaningfully lower prices in the coming years.”

The Equity Rate Adjustment structure, though, is likely to be in place for around three years until the Electricity Act provisions governing the Utilities Regulation and Competition Authority’s (URCA) review of BPL’s tariffs kicksin. And it will also likely be two to three years before the full benefits of the Government’s energy reform strategy are felt. Robert Sands, the Bahamas Hotel and Tourism Association’s president, declined to comment on the likely impact of BPL’s new tariff structure prior to an industry meeting tomorrow that will discuss the issue. However, his brother Duane, the FNM’s chairman, argued that any increase in resort energy bills will further undermine the cost competitiveness of The Bahamas as a tourist destination.

“We are already not very competitive,” he told Tribune Business, “because of the cost of stay in The Bahamas whether you are talking

N O T I C E

PRIME TREASURES LTD.

N O T I C E IS HEREBY GIVEN as follows:

(a) PRIME TREASURES LTD. is in voluntary dissolution under the provisions of Section 138 (4) of the International Business Companies Act 2000.

(b) The dissolution of the said company commenced on the 11th June, 2024 when the Articles of Dissolution were submitted to and registered by the Registrar General.

(c) The Liquidator of the said company is Bukit Merah Limited, The Bahamas Financial Centre, Shirley & Charlotte Streets, P.O. Box N-3023, Nassau, Bahamas.

Dated this 12th day of June, A. D. 2024.

Bukit Merah Limited Liquidator

“The upgrade of the grid will bring about a more efficient delivery of power, so less energy is wasted getting the power from the generation plant to your home. A well-built and well-sized system will allow for lower ongoing maintenance costs than what we currently have today. All these savings will be passed along to customers.”

Affirming the Government’s expectation that this will produce improved reliability, Mrs Coleby-Davis added: “The transmission and distribution work is designed to improve reliability along several dimensions - the addition of a new switching station and a new transmission line and proper looping of the system, reconductoring work, substation protection upgrades and targeted distribution protection schemes and voltage regulation.

“These are foundational to the reliable operation of any transmission and distribution system and are currently in urgent need of attention.”

about room rates, whether you are talking about food and beverage, whether you are talking about labour. Any additional charge to that sector will be reflected in more cost.

“They’ve already raised the taxes to come to The Bahamas. They have made this destination, particularly for stopover visitors, significantly more expensive. With this adjustment, by making us less competitive, we would ask if any economist did any modelling to determine what impact these changes will have.”

The Government, in cutting what it says is presently an annual $20m subsidy for BPL’s largest customers, is seeking to reverse this by having those very same big consumers subsidise the lowest and most vulnerable energy users. Eliminating the present 10.95 cents per kWH base charge for the first 200 kWh consumed by residential users will save these consumers some $21.90 per month or near $264 yearly.

However, one source, speaking on condition of anonymity, said: “It seems as if they’re going to subsidise the poor people who consume under 800 kWh. But I don’t think they appreciate that every single small business has to run air conditioning and consumes in excess of well over 800 kWh. A small mom and pop burns 3,000-4,000 kWh easily if they have to run AC.

“All the mom and pops, all the restaurants at Fish Fry, all those guys use in excess of 800 kWh. All of them will see an increase, and all of them will pass it on to consumers in the form of higher prices because they cannot afford to it. This will have a tremendous impact on the cost of doing business and instantly lead to higher prices and inflation.

“The tariffs are not being set on any commercial terms. You’re doing social welfare policies through the power provider and that’s not a recipe for optimal pricing. I don’t think its an optimal way to do it. If you want to give relief to small level consumers there are better ways to do it.”

N O T I C E

AVAIL TRIUMPH HOLDINGS LIMITED

N O T I C E IS HEREBY GIVEN as follows:

(a) AVAIL TRIUMPH HOLDINGS LIMITED is in voluntary dissolution under the provisions of Section 138 (4) of the International Business Companies Act 2000.

(b) The dissolution of the said company commenced on the 11th June, 2024 when the Articles of Dissolution were submitted to and registered by the Registrar General.

(c) The Liquidator of the said company is Bukit Merah Limited, The Bahamas Financial Centre, Shirley & Charlotte Streets, P.O. Box N-3023, Nassau, Bahamas.

Dated this 12th day of June, A. D. 2024.

Bukit Merah Limited Liquidator

PAGE 20, Wednesday, June 12, 2024 THE TRIBUNE

FROM PAGE A24

FROM PAGE A24

Revenues outpace $50m spending jump for April

acknowledged that this will require strict spending containment and management, especially since Santander, the global bank, noted that June deficits alone have averaged $180m for the past ten years.

For the past two fiscal years, 2021-2022 and 20222023, the Government has sustained deficits totalling $353.5m and $293.7m, respectively, for the fourth quarter as a result of government ministries, departments and agencies racing to bring forth bills that the Ministry of Finance knew nothing about so that they can be paid and cleared before the fiscal year-end.

Former Ministry of Finance insiders have told Tribune Business that successive administrations, both PLP and FNM, have found it impossible to break this trend. If repeated, this would likely push the Government’s deficit into the $300m-$350m range.

“Tax collections, at $338.8m, posted a strong upturn of 30.5 percent ($79.2m),” the Ministry of Finance said of April’s performance. “VAT receipts increased by $27.1m to $154.4m, benefiting from the positive impact of recent tax administrative enhancements and enforcement measures on realty-related transactions, alongside gains in the goods and services component

bananas are piled on display at the Heinen’s grocery store in Bainbridge, Ohio in this Aug. 3, 2005 file photo. A federal jury in Florida found that Chiquita Brands must pay $38.3 million to 16 family members of people killed during Colombia’s long civil war by a violent right-wing paramilitary group funded by the company. The verdict Monday, June 10, 2024 by a jury in West Palm Beach marks the first time the company has been found liable in any of multiple similar lawsuits pending elsewhere in U.S. courts, lawyers for the plaintiffs said.

Photo:

Amy Sancetta/AP

FLORIDA JURY FINDS CHIQUITA BRANDS LIABLE FOR COLOMBIA DEATHS, MUST

PAY $38.3M TO FAMILY MEMBERS

By CURT ANDERSON Associated Press

BANANA giant Chiquita Brands must pay $38.3 million to 16 family members of people killed during Colombia's long civil war by a violent right-wing paramilitary group funded by the company, a federal jury in Florida decided.

The verdict Monday by a jury in West Palm Beach marks the first time the company has been found liable in any of multiple similar lawsuits pending elsewhere in U.S. courts, lawyers for the plaintiffs said. It also marks a rare finding that blames a private U.S. company for human rights abuses in other countries.

"This verdict sends a powerful message to corporations everywhere: profiting from human rights abuses will not go unpunished. These families, victimized by armed groups and corporations, asserted their power and prevailed in the judicial process," Marco Simons, EarthRights International General Counsel and one plaintiff's lawyer, said in a news release.

"The situation in Colombia was tragic for so many," Chiquita, whose banana operations are based in Florida, said in a statement after the verdict. "However, that does not change our belief that there is no legal basis for these claims."

According to court documents, Chiquita paid the United Self-Defense Forces

of Colombia — known by its Spanish acronym AUC — about $1.7 million between 1997 and 2004. The AUC is blamed for the killings of thousands of people during those years.

Chiquita has insisted that its Colombia subsidiary, Banadex, only made the payments out of fear that AUC would harm its employees and operations, court records show.

Reacting to the ruling on social media, Colombian president Gustavo Petro questioned why the U.S. justice system could "determine" Chiquita financed paramilitary groups, while judges in Colombia have not ruled against the company.

"The 2016 peace deal … calls for the creation of a tribunal that will disclose judicial truths, why don't we have one?" Petro posted on X, referencing the year the civil conflict ended.

The verdict followed a six-week trial and two days of deliberations. The EarthRights case was originally filed in July 2007 and was combined with several other lawsuits. In 2007, Chiquita pleaded guilty to a U.S. criminal charge of engaging in transactions with a foreign terrorist organization — the AUC was designated such a group by the State Department in 2001 — and agreed to pay a $25 million fine. The company was also required to implement a compliance and ethics program, according to the Justice Department.

given the continuation of positive domestic demand.

“Other taxes on goods and services improved by $36.6m to $79.1m, largely on account of the recent changes positively impacting the dominant Business License fee component. Property taxes were higher by $9.7m at $28.8m. International trade and transactions taxes rose by $5.7m to $75.7m.”

Elsewhere, the Ministry of Finance added: “Nontax revenue posted a gain of 17.3 percent ($3.1m) to $20.7m. Fees from the sale of goods and services, predominantly from Immigration and Custom related activities, rose by $2.9m to $19.7m. Other non-tax

receipts posted a moderate gain of $0.1m to $1m.”

Several sources suggested the spending increase for April reflected the Government using its extra revenue income to pay outstanding bills. “Recurrent outlays for the review month firmed year-over-year by 19.5 percent ($49.1m) to $301.4m,” the Ministry of Finance said.

“Public debt interest payments grew by $14.9m to $85.4m, mainly on account of recent overseas rate hikes and a higher debt stock. Personal emoluments were up by $4.6m to $70.7m. Approximately $48.5m was expended on the use of goods and services, with the $12.7m gain

partly due to timing variations in payments. “Subsidies were relatively stable at $37.9m, while social assistance and pension payments firmed by $9.3m to $27.6m inclusive of the impact of earlier policy related changes. Other payments, which cover support for both households and public enterprises as well as insurance premiums, aggregated $31.4m for a gain of $7.8m.”

On the capital spending side, the Ministry of Finance added: “Capital expenditures increased by 5.6 percent ($1.2m) to $21.8m. Approximately $18.9m (86.9 percent) represented investments in various infrastructure and the remaining $2.9m (13.1

URCA: ‘NO INVOLVEMENT’ IN NEW BPL RATE STRUCTURE

FROM PAGE A24

Duane Sands, the Free National Movement’s (FNM) chairman, was among those to yesterday question URCA’s involvement in the Equity Rate Adjustment tariff structure unveiled on Monday and which is due to take effect from July 1.

The Electricity Act initially stipulated that BPL and other electricity providers can charge different tariffs and prices to different groups of customers for a “transition period” of three years without approval from URCA.

After concerns were raised, the Government amended that provision to “ensure that URCA’s continued role in approving tariff changes under section 38(8) remains steadfast and unaltered”, Mrs ColebyDavis said at the time, adding: “Some have said that URCA is being cut out as regulator, particularly regarding the approval of tariffs. This is not the case.”

Dr Sands yesterday suggested that the Equity Rate Adjustment move showed URCA is “out again. What’s it going to be? Is URCA in or out? It certainly doesn’t appear as if URCA is part of the equation now”. However, according to Mr McCartney, Mrs ColebyDavis exercised her powers using a different section of the Act from the one he referred to.

The FNM chairman, though, argued that it was “voodoo economics” to assert that an increase in electricity costs for BPL’s largest consumers will not impact prices or the cost of living for everyone else. BPL’s “general service” customers - the 300 largest users with 500 accounts, representing the hotels, good stores and other major consumers - will see their rates and power costs rise under the new structure.

“The most concerning thing is they’ve used this arbitrary cut-off at 800 kilowatt hours to determine when your rate moves from what it is now to higher, and they assume that rate impact will not get passed back to the ordinary man and woman, which is an absurd concept,” Dr Sands blasted.

“The impact of increasing rates on the largest consumers means a higher cost of living for everyone else. This is voodoo economics. For those of us who use one light bulb and table lamp per month, your rates are going to go down, but for everyone else your rates are going up. If you are going to the food store, pharmacy and auto shop, all those products will be more expensive.

“The Government will now attempt to say it’s these greedy business people sticking it to you, not us, because we made an effort to reduce your cost of electricity and that is perhaps

the most disingenuous thing of all in its impact.”

The new BPL rate structure will eliminate the base tariff rate for the first 200 kilowatt hours (KWh) of energy consumed by all residential customers, while the next 600 units - up to 800 KWh per month - will attract a 2.5 cents discount to the “average rate”.

However, the portion of the bill above 800 KWh per month will attract a base rate some 1.5 cents per KWh above the “average”, potentially raising energy costs for high-consuming middle class and wealthy Bahamian families. This portion of the bill is often the greatest, especially in the summer months.

A similar strategy is being employed with BPL’s fuel, the other component of customer bills, which applies to all consumers - homes and businesses. The first 800 KWh consumed will attract a rate some 2.5 cents below the monthly fuel charge that is calculated by BPL based on the cost of its prevailing

percent) was by way of capital transfers.” As for the Government’s debt position, the Ministry of Finance added: “During April, central government’s financing operations resulted in a decline of $50.3m in the outstanding debt. Proceeds from borrowings totalled $215.8m denominated in Bahamian dollars only, comprising of Bahamas registered bonds and Central Bank advances. “Repayments totalled $266.1m owing to repayments of government securities in Bahamian dollars (92.4 percent) and international financial institutions and investment banks in foreign currency (7.6 percent).”

fuel purchases, but the portion of the bill above 800 KWh will be hit with a rate 1.5 cents higher than the actual fuel charge.

Mrs Coleby-Davis, meanwhile, said BPL’s Equity Rate Adjustment is designed to slash what she described as a “$20m subsidy” that the present tariff structure provides annually to the utility’s largest customers - the likes of the resort industry, food stores and manufacturers.

This group, known as “general service customers”, will see their base tariff rates increase by between 14.9 percent and 45.16 percent depending on which portion of the bill is being assessed.

“The general service base tariff will rise from 8.7 to 10 cents for the first 900,000 units, and from 6.2 to 9 cents for units above 900,000 units. Currently, general service customers receive a subsidy of about $20m from other BPL customers every year, but they will still be paying less than all other energy classes and will still benefit from a more modest subsidy,” Mrs Coleby-Davis said.

THE TRIBUNE Wednesday, June 12, 2024, PAGE 19

FROM PAGE A24

CHIQUITA

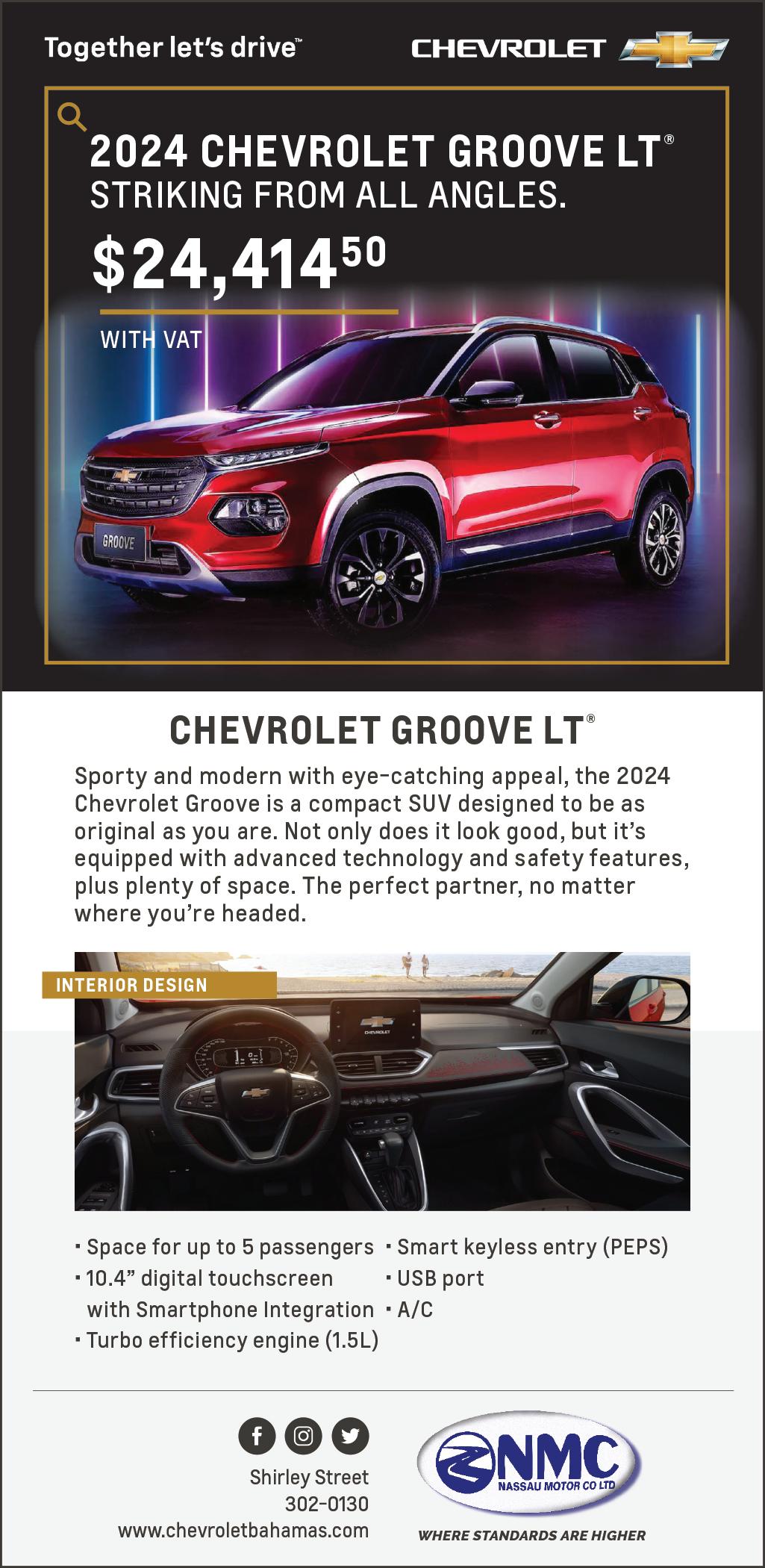

Wall Street drifts to a mixed close but still notches some records

By DAMIAN J. TROISE AP Business Writer

STOCKS drifted to a mixed close overall on Wall Street Tuesday, but the S&P 500 and Nasdaq composite still managed to notch more record highs.

The subdued trading came ahead of a key inflation report and the Federal Reserve’s latest interest rate policy decision on Wednesday.

The S&P 500 rose 14.53 points, or 0.3%, to 5,375.32, driven largely by gains in tech stocks, even though more stocks fell than rose within the index. The techheavy Nasdaq composite rose 151.02 points, or 0.9%, to 17,343.55. Both indexes set record highs for the second straight day.

Apple did the heavy lifting for the broader market. It surged 7.3% after highlighting its push into artificial intelligence technology.

The Dow Jones Industrial Average lagged the market. It slipped 120.62 points, or 0.3%, to 38,747.42.

THE NEW York Stock Exchange is shown on Tuesday, June 11, 2024. Wall Street stumbled in premarket trading ahead of a busy week of inflation reports and the Federal Reserve’s latest interest rate policy decision. Photo:Peter Morgan/AP

last projections in March, they indicated the typical member foresaw roughly three cuts to interest rates in 2024. That projection will almost certainly fall this time around.

Data on the economy have come in mixed recently, and traders are hoping for a slowdown that stops short of a recession and is just right in magnitude. A cooldown would put less upward pressure on inflation, which could encourage the Fed to cut rates. Lower interest rates could fuel more growth for the broader stock market.

“With strong labor market readings, inflation data will be even more important in the months to come,” said Kristy Akullian, head of iShares Investment Strategy Americas.

The key events for the market this week come on Wednesday, when the U.S. releases its latest update on inflation at the consumer level and the Federal Reserve announces its latest update on interest rates. The U.S. will also release its latest update on prices at the wholesale level on Thursday.

By JAKE OFFENHARTZ Associated Press

AMERICAN investor

Martin Shkreli is facing a new lawsuit for allegedly retaining and sharing recordings from a one-of-akind Wu-Tang Clan album that he was forced to sell following his 2017 conviction on securities fraud charges.

Wall Street expects the government’s consumer price index to remain

unchanged at 3.4% in May. Inflation as measured by CPI is down sharply from its peak at 9.1% in 2022, but it has seemingly stalled around 3%. That has complicated the Fed’s goal of taming inflation back to its target rate of 2%.

The Fed has held its main interest rate at its highest level in more than two decades and Wall Street is

The lawsuit was brought Monday by a cryptocurrency collective, PleasrDAO, which purchased the only known copy of the album from Shkreli for $4.75 million. The album, "Once Upon a Time is Shaolin," has not been released to the public, functioning as a rare contemporary art piece since it was auctioned off by the famed hip-hop group in

2015. In the lawsuit filed in Brooklyn, New York, federal court, PleasrDAO accused Shkreli of retaining digital copies of the album in violation of their deal and disseminating them widely among his social media followers. They point to his recent comments on social media boasting of sharing the digital recordings with "thousands of people."

currently hoping for one or two cuts to that rate this year. Virtually no one expects the Fed to move its main interest rate at its current meeting, which started Tuesday. Policymakers will be publishing their latest forecasts on Wednesday for where they see interest rates and the economy heading. When Fed officials released their

Over the weekend, Shkreli played portions of the album during a livestream he hosted on X, which he called a "Wu tang official listening party," according to the lawsuit.

Shkreli did not respond to a request for comment.

The lawsuit marks the latest twist for an unusual album created in protest of the devaluation of music in the streaming era, but purchased at auction by Shkreli, a man known for jacking up the price of a life-saving drug and his "Pharma Bro" persona.

Major indexes have been rallying to records, though, despite worries about sticky inflation and high interest rates.

The economy has remained resilient with support from a strong jobs market and consumer spending. Consumers are becoming increasingly stressed, especially those with lower incomes, and retailers have been warning investors about the potential impact to earnings and revenue. The U.S. jobs market has been showing some signs of cooling, which could ease inflation but put more stress on consumers.

Shkreli was later forced to sell the album — packaged in a hand-crafted silver and nickel case and including a 174-page book wrapped in leather — following his conviction of security fraud charges.

Elsewhere on Tuesday, General Motors rose 1.3% after the automaker announced that its board approved a $6 billion stock buyback. Calavo Growers jumped 8.2% after the avocado grower’s latest quarterly report beat analysts’ forecasts. Banks were among the biggest weights on the market. Fifth Third Bancorp fell 1% after cutting its forecast for revenue growth. JPMorgan fell 2.6% and Citigroup fell 3.7%.

PleasrDAO said it bought the physical copy of the album and its digital rights over two transactions, in 2021 and 2024.

NOTICE

NOTICE is hereby given that MAKINSON UTILE of Robinson Road, Podoleo Street, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas and that any person who knows any reason whyregistration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 12th day of June, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that SULTANE VALCOURT P.O. Box CB 12299 Wilson Track, Nassau, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 5th day of June, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE

NOTICE is hereby given that FRANKEITA DUVERNE Gambier Heights, Nassau, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 5th day of June, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE

American investor Martin Shkreli accused of copying and sharing one-of-a-kind Wu-Tang Clan album NOTICE is hereby given that ERVENS CHARITE of Queen’s Highway, North Andros, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas and that any person who knows any reason whyregistration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 5th day of June, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

PAGE 18, Wednesday, June 12, 2024 THE TRIBUNE

STOCK MARKET TODAY

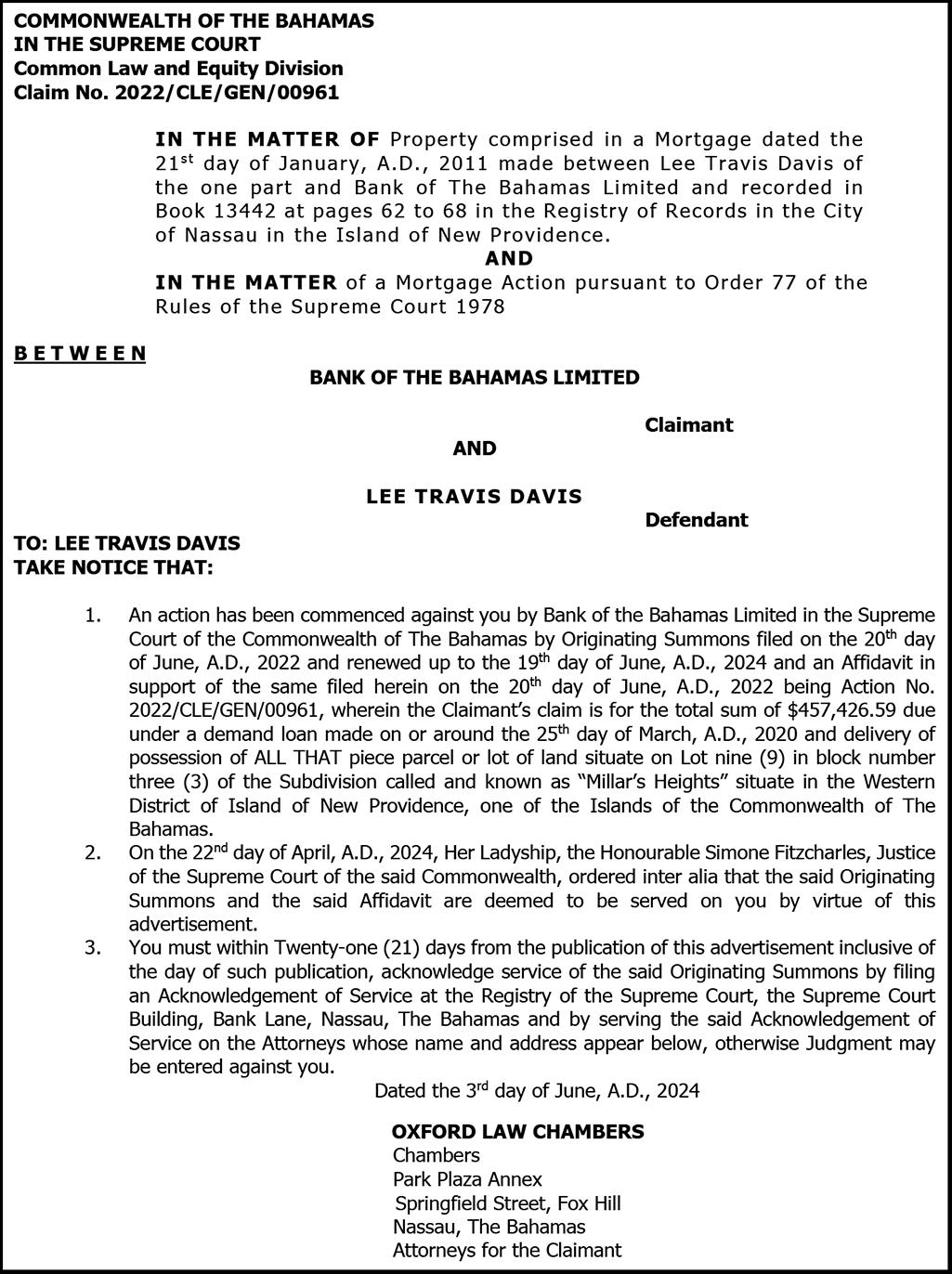

Amazon adds $1.4 billion to affordable housing fund for regions where it has corporate offices

By HALELUYA HADERO AP Business Writer

AMAZON is adding

$1.4 billion to a fund it established three years ago for preserving or building more affordable housing in regions where the company has major corporate offices, CEO Andy Jassy announced Tuesday.

The Seattle-based company said the new sum would go on top of the $2.2 billion it had already invested to help create or preserve 21,000 affordable housing units in three areas: the Puget Sound in Washington state; Arlington, Virginia; and Nashville, Tennessee. When it launched its Housing Equity Fund in January 2021, Amazon said it aimed to fund 20,000 units over five years.

The additional money will go to the same regions with a goal of building or maintaining 14,000 more homes through grants and below-market-rate loans.

To date, most of the funding went to non-profit and for-profit developers in the form of loans that allow Amazon to earn revenue through interest payments.

Amazon said 80% of the

units also benefited from government funding. Like other tech companies that have made similar investments, Amazon launched its affordable housing fund following years of complaints that well-paid tech workers helped drive up housing costs in regions where their employers had set up major hubs.

Housing advocates in cities like Seattle and

San Francisco have long blamed an influx of corporate workers for driving up the demand for housing and pricing out long-time residents.

Alice Shobe, the global director of Amazon Community Impact division, said 59% of the units Amazon supported so far have been preservation projects that make use of existing housing. They include donations and loans to nonprofits and

Older worker accuses defense contractor of discriminating by seeking recent college grads

By MICHAEL CASEY Associated Press

A MAJOR defense contractor was sued Tuesday over allegations that it discriminated against older workers in job ads.

The lawsuit filed in federal court in Boston accuses RTX Corporation of posting ads that target younger workers at the expense of their older peers in violation of the federal Age Discrimination in

Employment Act, the Massachusetts Fair Employment Practices Act, and the Virginia Human Rights Act. RTX, formerly Raytheon Technologies Corporation, is an American multinational aerospace and defense conglomerate headquartered in Arlington, Virginia. The lawsuit alleges it posted ads seeking job applicants who are recent graduates or have less than two years' experience, which excluded older

workers from consideration or deterred them from applying in the first place. "Americans are living and working longer than ever, yet unfair and discriminatory hiring practices are keeping older workers from jobs they're qualified for," the AARP Foundation's senior vice president for litigation, William Alvarado Rivera, said in a statement. "Raytheon's intentional discrimination against experienced job candidates, simply because of their age, is illegal and unacceptable."

local government agencies that can purchase buildings and stabilize rents, or otherwise maintain naturally occurring affordable housing.

In addition to maintaining housing stock, such projects prevent private developers from remodeling apartment buildings and putting the units on the market at much higher prices, Shobe said in an interview.

In a statement, the company denied the allegations. "RTX complies with all relevant age discrimination laws and we're committed to maintaining a diverse workforce," RTX said. "We believe these claims are entirely without merit and we will actively defend our hiring practices."

A 2023 AARP survey found that nearly one in six adults reported they were not hired for a job they applied for within the past two years because of their age. Half of job seekers reported they were asked by an employer to produce their birthdate during the application or interview process. About half of Americans also think there's age discrimination in the workplace, according to a poll by The Associated

CONSTRUCTION vehicles are parked outside of the Station U & O building on Tuesday, June 11, 2024, in Washington. The apartment building was built using investments from Amazon’s Housing Equity Fund. The company said Tuesday its adding $1.4 billion to the fund in order to help preserve or construct more affordable housing units in three regions.

"We've made a big difference in both the amount and quality of affordable housing in these three communities," she said.

Amazon targets its investments to provide housing for individuals with low-to-moderate incomes, which the company defines as those earning 30% to 80% of a given region's "area median income." The company has said it wants to focus on what it calls the "missing middle," a demographic that includes professionals like nursing assistants and teachers who don't qualify for government subsidies but still struggle to pay rent.

In September, Amazon made a $40 million investment to drive home ownership in the three regions. But the rest of the money so far has gone toward apartment buildings.

Photo:Jacquelyn Martin/AP

The company previously received some criticism in Northern Virginia for neglecting the housing needs of people on the lower end of the income spectrum. Projects designed for such individuals are likely to require more government subsidies and take longer to complete, said Derek Hyra, a professor at American University and a founding director of the Metropolitan Policy Center.

Press-NORC Center for Public Affairs Research. But there's a split by age. The poll finds 60% of adults age 60 and over say older workers in the U.S. are always or often discriminated against, while 43% of adults younger than 45 say the same.

The suit, seeking class action status, was filed by the AARP Foundation, Peter Romer-Friedman Law, and Outten & Golden, whose managing partner, Adam Klein, said it should serve as a warning to other big companies engaged in such discrimination.

"Fortune 500 companies should know better than to exclude hardworking older Americans from jobs by targeting 'recent college graduates' in hiring posts," Klein said in a statement, adding that the Equal Employment Opportunity

Shobe said Amazon has worked to maintain a "mixed portfolio" without losing its focus on the missing middle. Currently, the company says most of the units it has supported serve households earning less than 60% of the area median income, which goes up to $82,200 for a family of four in Washington state's King County, where Seattle is located. Companies like Amazon can help with the supply of affordable housing, but their money alone won't do much to move the needle without significant investments from the federal government, according to Hyra.

Commission "has long held that this type of language discourages qualified older workers from applying for jobs."

The plaintiff in the case, Mark Goldstein, 67, alleges he applied for several positions at the company since 2019. Goldstein filed a complaint with the EEOC alleging he wasn't considered for these jobs, and the EEOC found he was denied due to his age. The EEOC also found Raytheon's job advertisements violated the ADEA, the lawsuit says.

The lawsuit is demanding that the company end practices that discriminate against Goldstein and the "tens of thousands" of potential members of the class action who "have applied, attempted to apply, or have been interested in applying" for jobs.

THE TRIBUNE Wednesday, June 12, 2024, PAGE 17