THURSDAY, JUNE 13,

They won’t Wynn ‘war of attrition’

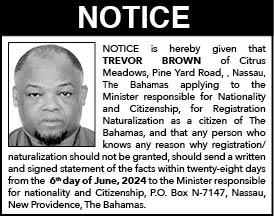

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netTHE leading opponent of

a 14-storey Goodman’s Bay penthouse project yesterday pledged he will not be ground down by the developer’s “war of attrition” and forced into selling his home.

Ed Hoffer, whose property borders Wynn Group’s construction site on its eastern boundary, told Tribune Business he remains committed to the “fight” and argued that the $100m development is another example of the Government favouring foreign direct investment (FDI) over the “health and well-being of the Bahamian people”.

In a series of written replies to this newspaper’s questions, he said recent demolition of a building formerly occupying the GoldWynn Penthouses location has “further damaged my property’s foundation and structural integrity” through a

series of vibrations that made his home’s window glass and security bars shake.

Asserting that the developer failed to live up to the obligations set out in its demolition permit, which included setting up dust screens and geo-fencing to mitigate the

environmental fall-out, Mr Hoffer told this newspaper he and his family are once again living in fear of the impacts once vertical construction ramps up.

He voiced particular concern that his property will fall victim to more frequent and extensive flooding, disclosing that recent heavy rainfall on June 8 “filled my garage and guest cottage”. Suggesting that his home has become “a more dangerous place to live” due to construction next door, Mr Hoffer also alleged that Bahamas Power & Light (BPL) supply was inadvertently disconnected for four days during the demolition.

However, Randy Hart, Wynn’s vice-president, told Tribune Business the developer is “bending over backwards” to minimise any impact from the penthouses’ construction and site preparation on Mr Hoffer and other neighbours.

Asserting that the developer has “played by the rules”, and complied with the planning and environmental approvals processes, he suggested that Wynn will “never be able to satisfy Mr Hoffer but nevertheless we’ll do our best”.

“We’re following all the protocols, and we have an environmental management plan (EMP) programme and we have monitoring,” Mr Hart said of Wynn’s efforts to minimise any disturbance and/or pollution from the construction project. “Ed will never be satisfied with anything we do. This is just

Minister defends ‘single source’ bid process for FOCOL affiliate

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netA CABINET minister yesterday rejected assertions that the Government’s energy reforms violated procurement laws as she defended the “single source” bidding used to select a FOCOL Holdings affiliate.

Jobeth Coleby Davis, minister of energy and transport, used her 2024-2024 Budget debate address to justify Bahamas Utility Company’s selection as Bahamas Power & Light’s (BPL) independent power producer partner on the basis that it “immediately” raised the $75m required to purchase two generation engines whose output will ease summer load shedding fears. She added that Bahamas Utility Company, a subsidiary 100 percent owned by the

Double rooms by 15,000

By NEIL HARTNELL Tribune Business EditorTHE deputy prime min-

ister yesterday said The Bahamas needs to double its capacity by adding 15,000 new hotel rooms over the next decade if it is to “remain the undisputed leader” in Caribbean tourism.

Chester Cooper, also minister of tourism, investments and aviation, during his contribution to the 2024-2025 Budget debate renewed his previous calls for more Bahamians to invest in tourism given the industry’s growth prospects.

“I remain bullish about tourism but I remain concerned that if we are going

to continue the growth that we have seen we need more rooms. In fact, we need to double inventory with another 15,000 rooms over the next 10 years to continue to attract high value

BISX-listed energy and petroleum products supplier, was in “a unique position” to address BPL’s generation woes through its existing onground presence. And it will now convert its rental generation agreements with BPL into longer-term power purchase agreements as it readies to construct a new New Providence power plant.

to stay ‘Caribbean leader’

Chamber warns on energy cost increase for ‘most businesses’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netTHE CHAMBER of Commerce yesterday joined those voicing concern that Bahamas Power & Light’s (BPL) new rate structure will fuel more price increases by raising energy costs for “most businesses”.

The business advocacy group, while praising the ambitions and objectives of the Davis administration’s energy reform strategy and the intended long-term impact, said in a statement it is “very concerned with the short-term impact of the policy shift” that will force companies to subsidise low income, vulnerable households.

“The Chamber is concerned... over what appears to be a strategy to increase the cost of energy for certain consumers using in excess of 800 kilowatt hours (kWh) a month as this will impact most businesses in the country, leading to a further increase in the cost of doing business,” the Bahamas Chamber of Commerce and Employers Confederation (BCCEC) said.

“This could lead to increases in prices for goods and services if these increases are significant and businesses have to pass them on, thereby offsetting some of the benefit provided by energy cuts to other consumers.....

“While we applaud the move to secure our energy infrastructure long-term, we are very concerned with the short-term impact of the policy shift and welcome the opportunity to work closely with the Government, BPL and any proposed partners to ensure safe, secure and successful implementation.”

The Chamber’s comments echo concerns reported by Tribune Business over the past two days regarding the so-called Equity Rate Adjustment strategy, which is set to take effect from July 1, but was only unveiled by the Government on Monday.

The changes will give all consumers - both households and businesses - a 2.5 cent per

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netBAHAMIAN economic output would expand by a further $65m, helping to create more than 1,500 jobs, if the largest categories of illegal and unreported fishing were converted into lawful landings. These estimates were contained in an economic impact assessment commissioned last year by The Nature Conservancy (TNC), which assessed the contribution of both recreational and commercial fishing to Bahamian gross domestic product (GDP), and the fall-out from illegal, unreported and unregulated (IUU) fishing that occurs within this nation’s Exclusive Economic Zone (EEZ). “Including both recreational and commercial fishing in the economic impact total shows fishing supports 26,917 jobs and generates $544.2m in income, $1.2bn in valueadded (contribution to GDP) and $2.2bn in total sale,” The Nature Conservancy said. “Of this total, commercial fishing contributes 5.1 percent and recreational fishing contributes 14.9 percent, to Bahamian GDP. Combined, across both sectors, the entire fisheries

EMPLOYMENT CONTRACTS SAVE SO MUCH DISTRESS

Managing a business is a complex process that requires incredible attention to details. This simple fact can prove to be quite an impediment, especially since managers can easily overlook certain situations as a future problem.

To put it simply, failing to outline the general framework of a contract can sometimes cause irreparable damage. The employment contract is unquestionably one of those powerful documents that may not look so critical but, in its absence, an entire business can face devastation. For all intents and purposes, an employment contract protects employers from liability and potential lawsuits.

What is an employment contract?

An employment contract is a legally binding agreement between an employer and an employee. It establishes the rights and responsibilities of both parties, including job requirements, compensation, termination procedures, benefitsand other important details to ensure everyone is on the same page.

Who benefits from employment contracts?

Employment contracts benefit both employers and employees as they provide a clear understanding of the terms guiding an employment relationship. For employees, it provides a sense of security and helps to prevent conflicts. Employers may agree various types of employment contracts depending on the

nature of the work, some of which include:

* Full-time contracts: These contracts are for permanent employees.

* Part-time contracts: Specifically for employees working less than full-time hours, and who are often not entitled to all the benefits extended to full-time staff.

* Fixed-term contracts: These contracts are for a specific period, often a project or set term.

* Open-ended contracts: Also known as at-will employment, these do not have a fixed period of time. However, they continue in effecr until either party terminates the contract as the duration remains open-ended.

* Freelance contracts: Freelance contracts benefit self-employed professionals who provide services to a company for a specific project or period. Why is an employee contract important?

* It provides a clear understanding of the terms,

benefiting both employers and employees.

* It protects employers from liability and potential litigation.

* It helps manage staff effectively, and ensures compliance and protection for both.

* It provides a sense of security for employees by setting out important terms, including compensation, benefits and working conditions.

* It provides an employer with grounds for disciplining or terminating a worker who does not meet contractual expectations.

Last but not least, employment contracts are a crucial aspect of the hiring process in a business, as they protect the interests of both employers and employees by including important details such as job responsibilities, salary, benefits and termination procedures. Both parties can rely on their contracts as a reference or to clarify information when in doubt. What is more, the contract should be reviewed thoroughly to ensure all the terms and details are understood, with each side sure to keep a signed copy for their records.

Until we meet again, live life for memories as opposed to regrets. Enjoy life and stay on top of your game.

welcomes feedback at deedee21bastian@gmail.comInternational

BAHAMIAN GROUP TRAVELS TO FRANCHISE EXPO VIA EMBASSY

THE US embassy yesterday said it financed and led a 16-strong group of Bahamian entrepreneurs to attend the International Franchise Expo (IFE) in New York earlier this month.

The Nassau-based diplomatic mission, in a statement, said the delegation learned about franchising and met with more than 100 company representatives as part of its ongoing efforts to promote trade and investment between the US and The Bahamas.

The expo allowed delegates to share information about doing business in The Bahamas to US franchise brand representatives.

The embassy gave details on how to navigate the regulatory environment, identify suitable locations and understand unique cultural and economic factors in The Bahamas.

“The support and guidance from the US embassy team was instrumental in making the most of this event,” said Quinn Russell, co-founder of Louis & Steen’s New Orleans Coffeehouse. “Their expertise and connections helped us identify the most promising franchise opportunities and navigate the complexities of international business expansion. We are grateful for the embassy’s commitment to fostering economic growth in The Bahamas.”

The US embassy’s economic and commercial

team accompanied the delegation to New York where they spent three days exploring a wide range of franchising opportunities. The expo also provided workshops sharing effective franchising strategies, legal considerations and market trends.

“The workshops were incredibly informative,” said Brinique Nesbitt, co-owner of The Picnic Brunch Restaurant. “We learned about the intricacies of franchising - from legal frameworks to effective marketing strategies. This knowledge is crucial as we consider our business growth.”

Kendrick Delaney explained how his Bahamian restaurant, The New Duff, was able to rapidly grow as a quick service restaurant in The Bahamas.

“The expo underscored the exciting potential for collaboration and growth between Bahamian businesses and US franchises,” said Mr Delaney. “We are highly optimistic about the prospects.”

US embassy economic and commercial counsellor, Richard Wesch, said:

“The Bahamas delegation’s proactive engagement has opened doors for innovative business ventures in The Bahamas and the United States.” Delegates expressed their optimism about the prospects of bringing new franchise opportunities to SEE PAGE B4

UTILITIES 70% INSTALLED AT NEW CARNIVAL PORT

CARNIVAL revealed that the utilities supply for its $600m Celebration Key port is now 70 percent installed as it hosted Grand Bahama Chamber of Commerce executives aboard one of its cruise vessels.

The cruise line, in a statement, said Chamber executives were given the latest updates on its port destination that is set to bring several million extra visitors per year to Grand Bahama starting in 2025.

Juan Fernandez, Carnival’s vice-president of destination operations, told around 150 Chamber members and directors that it has received hundreds of applications to operate Celebration Key’s retail and dining outlets. These included applications to operate food trucks, ice cream or coffee stands, a teen club and a staff cafeteria.

The cruise line added that it is currently in contract negotiations with several Grand Bahamian-owned

businesses, and expects to announce final partnerships very soon. After finalising these initial agreements, Carnival said it will consider issuing another short Request for Proposal (RFP) process to fill any remaining opportunities in the first retail and food and beverage (F&B) sector. The cruise line is also planning additional RFPs for the artisan and straw market vendors, food cart operators, car rentals and lockers. Mr Fernandez said that, to-date, more than 200 Bahamians from various islands are working on the construction phase of the project, with 29 of the 32 construction companies on-site being wholly Bahamian-owned and operated. He added that the work is progressing well, with foundations already completed for several buildings and vertical works proceeding for the main food and beverage and retail outlets, as well as restrooms and backof-house facilities.

Around 70 percent of the utilities supply has already been installed, while work is underway on the pools. The sites are 100 percent excavated, and about 60 percent of the plumbing and electrical conduits installed.

Philcher Grant-Adderley, Carnival’s director of public and community affairs for The Bahamas, said: “We are always excited to provide updates to the business community and share news to help keep everyone informed.

“Carnival Corporation remains committed to working closely with community leaders, businesses and residents in Grand Bahama and across the country to ensure that our projects benefit as many Bahamians as possible.”

At least 75 percent of the 70 retail and restaurant outlets planned for Celebration Key will be owned and operated by Bahamians. The project will generate more than 700 permanent jobs in Grand Bahama,

Realtor: Approach road repairs with a fresh look

By NEIL HARTNELL Tribune Business EditorA BAHAMIAN realtor is urging the Government to approach road repairs and upgrades from a fresh perspective by using them to impact both communities and the commerce vital to a nation’s health.

Mario Carey, founder of Better Homes & Gardens Real Estate/MCR Bahamas Group, called for the change outlook following a series of roadworks announcements including a $100m project to redesign, rebuild, repave and reshape 163 miles of Eleuthera’s roads.

“This is a once-in-alifetime opportunity to get it right, to change lives, empower businesses, create new communities and build bike paths and sidewalks,” said Mr Carey, who believes that every new or improved road should include a bike path.

Sidewalks, he said, should be included in plans wherever there is pedestrian traffic, especially around schools, shopping centres, churches and city business districts. “Roads are connectors; they link lives. All too often we focus on the paving process rather than the connecting capacity,” Mr Carey added.

“Government has announced an ambitious national plan to overhaul the roads that we all know are in badly need of it. The roads of Exuma are nearly complete. There is Bimini in the north, Eleuthera in the central Bahamas - that’s the $100m project - another $29m plan that will transform Gladstone Road in Nassau from a congested

two-lane nightmare at peak traffic hours to a broad fourlane highway.

“Then there are private sector plans, like the Brickell development road that will link Frank Watson Highway to the new fullyleased Venetian Village shopping centre set to open soon. All of these represent miles of opportunity to empower neighbouring communities, increase desire for investment and improvement in redevelopment as new areas open up,” he continued.

“It gives The Bahamas’ government a chance to rethink parks and green spaces. The one thing that every single new or improved road should include is a bike path, one of the fastest, surest ways to boost a nation’s health.”

“The tendency to overlook the power of roads is understandable,” said Mr Carey. “We drive over them every day. We stop at traffic lights. We glance at other vehicles or get frustrated by traffic delays and all that time we are focusing on what is there in front of us instead of what could be.

“We ignore the potential of roadways to open opportunities for investment, for community-building and for narrow strips that allow bikes to pass safely and sidewalks that encourage people to get out and walk, all adding up to a healthier way of life. We see asphalt when what we should be seeing is opportunity.”

An athlete who has completed 67 triathlons, Mr Carey said cycling is so dangerous on most Bahamian roads that it takes nerves of steel to go for a morning ride. “As a cyclist trying

to live healthy, if you climb on a bike in Nassau you are under so much stress just hoping you do not get hit,” he added.

“You are dodging traffic, cars, motorcycles, trucks, scooters and now fourwheelers that were built for off-the-road and would not be allowed on most roads in other countries, all converging on narrow roads mostly built decades ago.

“As we widen these roads and thoroughfares, we can build paths and create a culture of cycling. It is something that families can do together. Better for your health and for the environment as we try to reduce carbon emissions. And there are thousands of cyclists around the world who choose vacation destinations based on the ability to ride and the settings they would be riding through.”

Mr Carey takes the riding a step further, predicting that as more people take up or return to cycling, groups and small clubs will begin to form, either social or competitive, creating a desire for picnic areas, jogging trails, family get-togethers and barbecues. Cycling, he said, leads to enhanced healthy and wholesome social activity. It can also be competitive.

“The goal is ultimately to stop the brain drain and give young Bahamians, whether their education is academic or vocational, a reason to come home,” said Mr Carey. “We have to drive that and managing what we do with roads is a part of that larger picture, making life in The Bahamas as rich, healthy, wholesome and enjoyable as it can be. This is such an easy call.”

NOTICE TO SHAREHOLDERS

DATE & TIME

Wednesday, June 26th, 2024, at 5:00pm.

Grand Hyatt, Baha Mar Convention, Arts and Entertainment Center, 1 Baha Mar Boulevard, West Bay Street, Cable Beach, New Providence, The Bahamas.

RECORD DATE

Holders of 295,268,556 Common Shares at the close of business on May 16, A.D. 2024 are entitled to vote at the meeting.

Charlene

A. Bosfield Corporate Secretary

the

including 400 Bahamians hired directly by Carnival to help welcome 2.2m guests each year to Grand Bahama starting in 2025.

James Carey, the Grand Bahama Chamber of Commerce president, said: “Carnival Corporation reached out to us to

provide an update to our members on the progress of Celebration Key, and were more than happy to accommodate.

“The business community believes in this partnership, and in Carnival Corporation’s commitment to working with the island in a spirit of true collaboration. We are optimistic about the many opportunities outlined during the ship tour visit, and will work to ensure that as many Grand Bahamians as possible are able to take full advantage.”

BAHAMIAN GROUP TRAVELS TO FRANCHISE EXPO VIA EMBASSY

FROM PAGE B2

The Bahamas and turning their brands into possible franchise models.

“The expo was an eyeopening experience that highlighted the diverse franchising possibilities available to us,” said Katherine Coakley, owner of BahamaFoddie. “We are eager to explore these opportunities and contribute to the economic growth of our country,” added

Patricia Chatti, owner of Cia Monet.

Livity Vegetarian TakeOut and Juice Bar Owner, Jamahl Rolle, who travelled from Grand Bahama, said:

“The networking opportunities were phenomenal. We met with several franchisors who are genuinely interested in the Bahamian market. This is a great step forward for local entrepreneurs looking to expand their businesses.”

“The event exceeded our expectations in every way,” added Marvin Delancy, owner of Rasta Greens N’ Tings. “The knowledge and contacts we gained will be invaluable as we move forward.”

The US Embassy will this summer begin recruiting a delegation to join them at the CosmoProf tradeshow, the leading business-tobusiness beauty trade show in the Americas, to be held in Miami in January 2025.

Illegal fisheries landing halt to spark 1,500 jobs boost

value chain contributes 20 percent to Bahamian GDP.”

As for threats to this impact, The Nature Conservancy said: “Illegal, unreported and unregulated fishing (IUU) is much more than just fish stolen by foreign nationals. It includes legal catches that go unreported, including recreational fishing and subsistence fishing in The Bahamas’ case, and harvests that are unregulated. IUU does harm to the stocks and to Bahamian livelihoods.

“When fish are removed outside of any harvest control rules or other management measures, they deplete the stocks and impinge future productivity. The analysis estimates spiny lobster IUU harvests at 4.1m pounds of tails. The two largest of these categories were IUU harvests by foreign vessels and Bahamians, respectively, totaling 2.7m pounds of tails worth

would support 1,523 jobs and increase GDP by an additional $65.4m.” The statistics were referred to yesterday by Jomo Campbell, minister of agriculture and marine resources, during his House of Assembly contribution to the 2024-2025 Budget debate.

“It was estimated that the commercial fisheries value chain alone provides for some 6,001 jobs., some $208.6m in income, some $265m in value added contribution to GDP, and some $575.5m in total sales. The recreational fisheries value chain provides for some 20,916 jobs; $335.6m in value added contribution to GDP; and $1.7bn in total sales....

“The decrease was due largely because of the decrease in crawfish/lobster landings and price per pound. Crawfish/lobster landings saw a decrease of some 4 percent in total landings in comparison to calendar year 2022 and a 14.4 percent decrease in the total value of crawfish/lobster landings compared to calendar year 2022.

“Further, as you may be aware, the crawfish/lobster fishery is the single largest fishery in The Bahamas. This fishery accounted for 80.7 percent of the total landings in calendar year 2023 by weight and 89.9 percent of the total value of all fishery products landed,” the minister continued.

“If those two highest categories of IUU landings were landed in The Bahamas legally, they

“I believe that we are sitting on a gold mine when it comes to our fisheries and marine resources in the country. We must continue to encourage young Bahamians to enter this industry and to assist them in any way possible to sustain their businesses.”

As for the fisheries industry’s performance in the 2023 calendar year, Mr Campbell said: “Fishery products and resources landings decreased by 0.5 percent by weight and a 12.5 percent decrease in the value of the products and resources landed in comparison to 2022.

“The export value of fishery products and resources exported from The Bahamas during calendar year 2023 was $96.8m. The figure represents a 0.4 percent increase over calendar year 2022. The value of crawfish/ lobster exports from The Bahamas in calendar year 2023 was $93.6m accounting for some 96.7 percent of the total value of all fishery products and resources exports from The Bahamas in 2023.

“The export of frozen lobster tails continues to be The Bahamas’ number one edible commodity of export and remains a leader in the Caribbean.”

Double rooms by 15,000 to stay ‘Caribbean leader’

guests and maintain our position as the undisputed tourism leader in the Caribbean,” Mr Cooper said. His comments echo those of Robert Sands, the Bahamas Hotel and Tourism Association (BHTA) president, who has said increased room capacity is the only way to maintain the industry’s post-COVID growth momentum. Mr Cooper spoke out as he voiced optimism that The Bahamas could enjoy a 20 percent year-over-year visitor increase for 2024 with hotel room rates almost hitting $600 for the peak winter season.

Chester Cooper, also minister of tourism, investments and aviation, told the House of Assembly during his contribution to the 2024-2025 Budget debate that The Bahamas over the year’s first four months was on pace to hit 12m visitors for the year.

While maintaining that growth rate is ambitious, given that the destination still has to go through the traditionally slower months of September and October, he nevertheless said:

“From January to April 2024, we have seen a significant increase in foreign air and sea arrivals, marking a 12.4 percent rise compared to the same period in the record setting 2023.

“Simply put, that translates to almost four million visitors in four months. If this average holds, and we hope it does, a million a month will result in a 20 percent increase year-overyear or 12m overall arrivals at year-end. This growth not only highlights our resilience but also underscores the enduring allure of The Bahamas as a premier travel destination....

“Nassau/Paradise Island remains the most popular destination, welcoming 1.87m visitors from January

to April 2024, a 13.2 percent increase from the same period last year.

Grand Bahama, Abaco and Eleuthera have also shown remarkable growth, with increases of 6.8 percent, 3.8 percent and 2.7 percent respectively.

“Grand Bahama and Abaco continue to lead the way in the increase in arrivals by air with 7 percent and 15.5 percent respectively. The Berry Islands, in particular, have seen an impressive 13.3 percent rise in arrivals.” However, much of the growth in visitor numbers is fuelled by cruise passengers, who spend around $100 in the destination compared to the $2,800 by stopover visitors.

“From January to April 2024, we recorded 3.211m cruise arrivals, marking a 14.8 percent increase from 2023,” Mr Cooper added.

“Our stopover visitors have shown a strong preference for extended stays,

reflecting their desire to fully immerse themselves in the Bahamian experience.

“The average length of stay for stopover visitors in April year-to-date 2024 was 6.6 nights. Notably, visitors from Africa had the longest stays, averaging 10.6 nights, followed by those from the Caribbean and Europe.

“Our hotels, particularly those in Nassau/Paradise Island, have performed exceptionally well. Occupancies remain strong, as do revenues. For instance, the average daily rate (ADR) in March 2024 reached $592.06, a significant increase from previous years. This reflects both the high demand for quality accommodations and the premium that visitors are willing to pay for the unparalleled Bahamian experience.”

Mr Cooper said the Ministry of Tourism is “working tremendously hard to grow that cruise spend number

by deploying strategies to increase the number of guests disembarking, improving numbers of tours and deploying strategies like the smart city initiative” in Nassau with the direct impact of tourist spending estimated at $6bn.

Elsewhere, the deputy prime minister said the Budget process will approve a $125m loan from Saudi Arabia’s development fund that will finance airport upgrades throughout The Bahamas.

The loan, he added, has a concessional 2.5 percent interest rate attached and is to be paid back over 25 years, with no repayments for five years.

The same terms and conditions are also attached to a $10m Saudi loan financing the Tourism and Development Corporation’s business incubation centres.

“These funds will support loans and grants for entrepreneurs, fostering new

business ventures and job creation across our islands,” Mr Cooper said.

“I am proud to have helped negotiate those loan terms along with the Ministry of Finance. In fact, the Saudis have been great friends to us and will help us with our Family Island airport renaissance project.”

As for investment, Mr Cooper added: “I want to send a strong message to investors everywhere. When we give concessions we do so to advance economic growth and empowerment for Bahamians. When we give concessions, when we forego taxes we become partners.

“It is our expectation that you live up to your obligations and treat us like the partners that we are. The model must be a win-win proposition for the Bahamian people.”

Minister defends ‘single source’ bid process for FOCOL affiliate

The Opposition and others have repeatedly challenged whether the Government has obtained the best possible solution, price and terms for resolving The Bahamas’ energy crisis given that neither the generation nor transmission and distribution contracts were put out to public, competitive bidding. Questions have also been raised over whether the process complies with public procurement laws and regulations, which were first implemented in September 2021 but then revised by the Davis administration.

Mrs Coleby-Davis admitted that the Bahamas Utility Company was selected via a “single source” process where just one entity was chosen to bid on providing the required solution.

However, she cited various factors in defence of the move. “Bahamas Utility Company is the only Bahamian group with an existing plant on Nassau, providing them with a unique position to lead this initiative and they are already licensed by URCA,” Mrs Coleby-Davis said, referring to the energy industry regulator.

“Bahamas Utility Company has demonstrated its capability to raise over $75m immediately to acquire 60 mega watts (MW) of new plants for the summer, which will be placed on power purchase agreements (PPAs).” Mrs Coleby-Davis said securing the two engines, which recently arrived on New Providence, was “no small feat” given supply chain challenges and competition from other utilities.

Bahamas Utility Company, together with Aggreko, are the present suppliers of BPL’s 143 MW of rental generation that is costing the state-owned utility $42m per year. Mrs Coleby-Davis said the FOCOL subsidiary will now convert these rental deals into long-term PPAs.

“By aligning with Bahamas Utility Company and leveraging these robust partnerships, we are not only securing the immediate needs of our energy infrastructure but also positioning ourselves to benefit from long-term stability and growth. Our strategic move to single source with Bahamas Utility Company underscores our commitment to efficiency, reliability, and a forwardlooking energy strategy,” the minister added.

Mrs Coleby-Davis also disclosed that the Utilities Regulation and Competition Authority (URCA), as energy industry regulator, had issued a “no objection” verdict on BPL’s [and the Government’s] decision to employ a “single source” bidding process.

“BPL applied to URCA under the URCA regulations to get permission for the use of single source procurement for the purchase of generation by way a power purchase agreement and the use of LNG,” she added.

“I am pleased to advise that URCA has confirmed its non-objection to the proposed singlesource procurement per condition 9 (5) of the procurement regulations for electricity sector licensees 2020. URCA recognised that BPLs proposal had been vetted by the internationally-recognized consulting firm, McKinsey and Company, and that the use of LNG would reduce the environmental impact, provide higher reliability and reduce cost to consumers..”

Turning to accusations that the Government and BPL have breached public procurement laws and regulations during these processes, Mrs ColebyDavis said: “I also want to categorically state that at no point during this energy transformation process as far as I am aware have we violated any procurement rules or laws.

“We entered a joint ven ture as provided by the Electricity Act, and BPL received a letter of no objection from URCA for a single source procurement for the purchase of LNG and the purchase of power by way of a PPA.”

The minister confirmed that Bahamas Utility Com pany - not BPL - will be responsible for constructing New Providence’s new 177 MW liquefied natural gas (LNG) plant by 2026. How ever, she also revealed that it will be the Government - and not Bahamas Utility Company - that will buy the plant’s LNG fuel from Shell via a special purpose vehi cle (SPV).

“The bulk purchase of LNG will be sourced from Shell North America,

specifically, Shell North America LNG. The Government will set up an SPV 100 percent owned by the Government to purchase the LNG directly from Shell and the SPV will then sell to the independent power producers,” Mrs ColebyDavis said.

“Negotiations with Shell North America are ongoing, and we are close to concluding the same. These negotiations are merely a restructuring and renegotiating of a tentative agreement we met in place from the former administration.”

However, questions are likely to be asked as to why the Government will effectively act as middleman in the sourcing of LNG fuel from Shell rather than Bahamas Utility Company and other independent power producers buying directly from the multinational energy giant. The Government’s role as middleman would appear to

add another layer of cost to the supply chain.

“The Ministry of Finance has hired the large consulting firm McKinsey and

Company to advise the Government and BPL to ensure we get the best possible price on our LNG contracts with Shell North

HOTEL SEEKS PROFESSIONAL DANCERS

Te ideal candidates will have a minimum of Level 2 ballet certifcation and training in contemporary, jazz and ethnic dance styles. Responsibilities include performing in our nightly shows, collaborating with choreographers to create and perform original works and participating in rehearsals.

Interested candidates should submit their resume, headshot, and a video reel showcasing their dance skills. We look forward to hearing from you!

email: hhrr.nas@riu.com

Chamber warns on energy cost increase for ‘most businesses’

kilowatt hour (kWh) discount on the first 800 kWh that they consume. But, above that threshold, BPL customers will have to pay a extra 1.5 cent charge over and above BPL’s actual cost of fuel for every kWh used.

The Prime Minister’s Office, giving an example of how this would work, said:

“If the [actual fuel charge] is 20 cents per unit (kWh), then the customer will be 17.5 cents per kWh for the first 800 units (kWh). The remaining units (kWh) will be billed at 21.5 cents.”

Multiple business community sources, though, pointed out that enterprises of all sizes - right down to ‘Mom and Pop’ restaurants and shops - consume significantly more energy than 800 kWh per month especially

during the upcoming summer period. With the bulk of their consumption above this 800 kWh threshold, several in the private sector voiced concern that the reduced base rate for small and medium-sized enterprises (SMEs) will be more than offset by greater BPL fuel charges especially if global oil prices increase due to higher summer demand.

Jobeth Coleby-Davis, minister of energy and transport, yesterday challenged fears of increased energy costs for most Bahamian businesses as a result of the revised BPL tariff structure by asserting that “56 percent of regular commercial consumers always consume less than 800 kWh”. This, she implied, would place most companiesespecially SMEs - below this consumption threshold

and into a space where they will enjoy discounts on both BPL’s base rate and calculated fuel charge. “It is worth mentioning consumption bands for the different classes of consumers,” Mrs Coleby-Davis said.

“Fifty-eight per cent of residential consumers always consume less than 800 kWh. Fifty-six per cent of regular commercial consumers (not on general service) always consume less than 800 kWh.” She added that 69 percent of energy is consumed by BPL’s residential customers who either use less than 200 kWh per month or between 201-800 kWh.

“This means that, while 42 percent of consumers sometimes consume above 800 units, they seldom go way above,” Mrs ColebyDavis said, confirming that the Equity Rate Adjustment

structure will be in place for three years until BPL’s tariff submission is then reviewed and approved by the Utilities Regulation and Competition Authority (URCA).

Bahamian businesses spoken to by Tribune Business yesterday said they are still trying to understand how the new BPL tariff structure will work and what impact it will have for their particular enterprises. Vasco Bastian, the Bahamas Petroleum Retailers Association’s (BPRA) vice-president, told Tribune Business that while unable to comment on the new rates any relief on electricity costs will be welcome.

“I can tell you one thing,” he said. “Any relief we could somehow get from this new deal with the Government, Shell and Island Grid or whoever the partners are, we’ll be happy. I know, as a businessperson who owns gas stations, operating 24 hours a day seven days per week, if those parties can reduce the cost of electricity from $12,000-$13,000 a month to $3,000-$4000 we’ll welcome it.

“Your coolers are running 24.7, your air conditioning is running 24/7, the ATM relies on electricity. Every piece of equipment in a gas station relies on electricity. Between the hotels, the food stores, the hospitals and the gas stations we’ll be happy people in this country if they can reduce the cost of electricity by 30-40 percent.

“If they reduce the cost of electricity by 30-40 percent, we’ll be happy, but we have to get more details on how this impacts us.... I can say

this much: Any type of relief we welcome. We definitely need the help, we definitely need the relief.”

Walter Wells, president and chief executive of Caribbean Bottling Company, the Coca-Cola producer, told Tribune Business that he is also still processing the new rate structure but acknowledged that large corporate energy users such as his business may have to endure short-term pain in their light bills for longer term gain.

The Prime Minister’s Office, in detailing the Equity Rate Adjustment’s impact, asserted that only BPL’s largest consumers - its 300 general service consumers representing around 500 accounts and less than 1 percent of the utility’s customer base - will see their light bills increase after July 1.

While it said energy costs for the likes of hotels, food store chains and manufacturers will be less year-over-year, that will not be difficult given that the same period in 2023 featured a 163 percent hike in BPL’s fuel charge compared to October 2022 in a bid to reclaim under-recovered fuel costs.

Manufacturers such as Caribbean Bottling are likely to feature among BPL’s general service consumers. “To be honest with you, I’ m hoping that is not the way it pans out,” Mr Wells said of the possibility of higher energy costs, “but until I see precisely what they’re proposing I cannot comment with authority on it .

“The reality is that our light bills is very high compared to where it was some years ago and we were hoping they will go down. It sounds like they may not go down that quickly but I’m hoping that some of the things they are proposing will have an impact on the cost of electricity.”

Pointing out that electricity rates are beyond the private sector’s control, Mr Wells added that it was virtually impossible for manufacturers such as Caribbean Bottling to reduce energy consumption because they need to run their production lines for however many hours per day to generate the products that provide their sales income.

“We have to produce product or we don’t,” he said. “I think the same principle applies to any fuel retailer or wholesaler. It’s very difficult to adjust your consumption. I think all of us today are operating with types of equipment that are as efficient as they can be for electricity consumption standards.

“There’s not much we can change. We’re very conscious of electricity costs and are doing everything we can to minimise it.” Asked about switching to renewable energy, Mr Wells replied: “That’s not cheap either. There’s a significant investment, particularly for large operations like we have. Certainly, if we’re going to LNG I’m hoping that, long-term, we should see an impact from the changes that are proposed.”

Widespread outage hits Puerto Rico as customers demand ouster of private electric company

A WIDESPREAD power outage hit Puerto Rico Wednesday night, leaving more than 340,000 customers without electricity after

two of the U.S. territory's power plants shut down.

The capital of San Juan was left without power, as well as neighboring municipalities including Bayamón, Caguas and Carolina.

Luma Energy, which operates transmission and distribution for Puerto Rico's power authority, said on X that the outage was tied to an issue with the power plants' transmission lines. It provided a statement to The Associated Press saying it was investigating the outage that coincided with the shutdown of units operated by Genera PR, which operates and maintains state power generation units.

Gov. Pedro Pierluisi condemned the outage and said he was demanding answers and solutions from Luma and Genera PR.

"The events that have been occurring in recent weeks with our electrical system are unacceptable," he posted on X. "While it is true that we have old plants and transmission lines in terrible condition, the people continue to suffer the consequences of the lack of sense of urgency that

private operators are demonstrating." Both Luma and Genera PR were selected as private operators under Pierluisi's administration.

The outage is the most recent in a string of blackouts to hit Puerto Rico, which is still trying to rebuild the grid after Hurricane Maria razed it in 2017 as a Category 4 storm.

The outage prompted the mayor of the San Juan capital, Miguel Romero, to declare a state of emergency late Wednesday as he accused Luma of sharing limited information about the ongoing blackouts.

"There are thousands of children with specific feeding needs, as well as older adults who often need therapy machines to protect their health and often save their lives," the decree stated. Scores of Puerto Ricans took to social media to condemn the most recent outage and demand the ouster of Luma, noting that it occurred amid excessive heat warnings. Not all on the island of 3.2 million people with a poverty rate of more than 40% can afford generators or solar panels.

They won’t Wynn ‘war of attrition’

going to be an ongoing saga, no doubt.

“There was a challenge to the permits. Ultimately it failed. He [Mr Hoffer] brought a challenge to the permits, we went through due process and ultimately we prevailed. It was determined by the Subdivision and Development Appeals Board that the permit approvals were valid, and we also got our Certificate of Environmental Clearance (CEC).”

Obtaining the CEC was the first step mandated by the Appeal Board for Wynn to turn its “preliminary” site plan approval into a full one. It then also had to satisfy the Ministry of Works’ civil design unit before full site plan approval and a construction/building permit could be granted. This appears to have been done, as a building permit was attached to the fence surrounding the GoldWynn penthouses construction site.

“We have followed all the appropriate steps, we have played by the rules, gone through the process and Mr Hoffer has sour grapes and there’s not much we can do about that,” Mr Hart added. “We’ve done our best to take all proper measures to mitigate any nuisance to our adjacent neighbours as outlined in the EMP.

“Inherent in construction there’s going to be some nuisance. It’s unavoidable, but we’re bending over backwards to ensure that that is mitigated to the greatest extent. Our EMP is quite extensive and we’ve not taken any short cuts. We’ve done what we were mandated to do and have followed due process. We’ll never be able to satisfy Mr Hoffer but nevertheless we’ll do our best.”

Mr Hart said the first two to three months’ construction work on the penthouses will involve pouring the foundation. He added that Wynn and its contractors are using equipment to set the piles that will not cause

any vibrations disturbing neighbouring properties. Mr Hoffer, though, is far from convinced. While Mr Hart made no mention of any desire on Wynn’s part to acquire his property, Mr Hoffer - who mounted a vigorous but seemingly unsuccessful challenge to the developer’s bid to obtain the necessary planning and environmental approvals - asserted he has no plans to sell a home his family has owned for around 50 years.

“There is no ‘for sale’ sign on my property,” Mr Hoffer told Tribune Business. “They are using a war of attrition to get me to sell. Some things are about money until they are not. I choose people over development any day.

“A fight like mine is important for the Bahamian people because it is happening more regularly as the developers can see that The Bahamas government prefer foreign direct investment (FDI) as opposed to the health and well-being of the Bahamian populace.”

Asked what he would say to critics who argue that one man should not hold back an investment billed as creating 300 construction jobs, Mr Hoffer retorted: “This isn’t just about one man – this affects three generations who have to suffer the negative effects to their health and well-being as a result of the project.

“There were also many people who wrote in on the public consultation, adding their voices. It can happen to any seaside residential neighbourhood.” Stating that he would give both the Town Planning Committee and Department of Environmental Planning and Protection (DEPP) “a low mark for effort” when it came to balancing his family’s interests, Mr Hoffer also challenged whether the approvals process was followed.

In particular, he queried why - unlike with Royal Caribbean’s $110m Paradise Island Beach Club project - no report has

been produced detailing the questions raised during and after the public hearing on Wynn’s Environmental Impact Assessment (EIA) and the developer’s answers to them.

The guidelines on the process for obtaining a CEC from DEPP, which have been seen by this newspaper, state in 4 c) that “after the completion of the public consultation phase the applicant [developer] must provide a comprehensive public consultation report which identifies every question or inquiry presented by the public regarding the project and the report submitted to the DEPP for review”.

Such a report, which was disclosed for the Royal Caribbean project, has never been made public in Wynn’s case even though the latter now has its CEC. “Where is the EIA report on the public consultation?” Mr Hoffer asked. “Did the persons who sent in their responses receive an e-mail on those concerns and if and how those concerns will be mitigated/managed?

“In my opinion, the Government agencies have not fully followed the process set out in the certificate of environmental clearance and EIA guidelines/regulations.” He declined, though, to comment on what his next moves might be in terms of challenging the penthouse project’s approvals via the courts.

Revealing that recent demolition work had a similar impact to construction of the GoldWynn Residences, the first phase of the developer’s Goodman’s Bay ambitions, Mr Hoffer told Tribune Business: “Excavators, graters and vibrating

rollers from machinery that took place for seven consecutive weeks further damaged my property’s foundation and structural integrity and created more health hazards.

“The water in my pool moved from the vibrations and, at times, looked like a whirlpool. Water in glasses placed in and outside the house shook. The glass panes on my windows shook and made whistling noises. You could see the security bars secured into the walls shaking....

“Geo-fencing and dust screens were not installed as per the developer’s mitigation promises stated on

their demolition permit. These included notifying the neighbour, installing hoarding and ensuring public utilities would not be disturbed at the site..... Every day my property is covered in dust, and the clean-up is costly and time-consuming. I’ve had to limit my pets from going out of doors.”

Pointing to the growing severity of flooding woes, Mr Hoffer said: “Since the developer’s phase one, there has been more flooding on West Bay Street. Now, with phase two, there will be even more. After heavy rain a few weeks ago, I sent DEPP photos of the

increased water collection in front of my house and in my driveway. “And now, with the heavy rains of June 8, the water has been frighteningly significant. In this last heavy rainfall over a few hours, the water collection on my property is now a severe hazard, mainly because of the elevation and the newly added sidewalk of approximately five feet into West Bay Street. I don’t want to be electrocuted. The recent rainwater filled my garage and guest cottage at the front of my house.”

Senators blast health and law enforcement officials over illegal e-cigarettes used by teens

By MATTHEW PERRONE AP Health WriterSENATORS on Wednesday blasted top health and law enforcement officials for not doing more to combat the rise of illegal electronic cigarettes in the U.S., a multibillion-dollar business that has flourished amid haphazard enforcement.

Democrats and Republicans on the Senate Judiciary Committee expressed frustration and exasperation while questioning officials from the Food and Drug Administration and Justice Department about attempts to stay on top of the vaping industry, which has grown to include thousands of flavored, unauthorized

e-cigarettes originating in China.

Those products, including brands like Elf Bar, have become the most popular choice among American teens who vape.

"I simply do not understand how FDA and DOJ have permitted thousands of products to remain on store shelves when their manufacturers have not received authorization, or, in some cases, even filed an application," said the committee's chairman, Dick Durbin.

The Illinois Democrat displayed a photo of a shelf stocked with brightly colored e-cigarettes, including ones in dragon fruit and watermelon bubblegum flavors, which he said a Senate

NOTICE

NOTICE is hereby given that VALERIE ROBERTS of #5 & #6 Bacardi Road, Nassau, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 13th day of June, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

staffer took at a vape shop near the FDA's Maryland campus.

"These illegal products, clearly designed for children by their flavors, are being sold in the shadow of FDA's building," Durbin said. "How is that allowed to happen?"

FDA's tobacco chief, Brian King, said the agency has been slowed by a backlog of applications submitted by vape companies seeking U.S. approval, which regulators are legally required to review.

"The sheer volume of this product landscape requires that we take the time to conduct scientifically and legally defensible reviews of the 27 million applications," King said.

The FDA has OK'd a handful of e-cigarettes as alternatives for adult smokers. All other products on the market, including major sellers like Juul, are pending review or considered illegal by regulators.

An industry lobbyist told the committee that the FDA has created an untenable marketplace by rejecting more than 99% of applications submitted by companies.

Lawmakers also heard from a high school senior who said she became addicted to nicotine after trying a "blueberry ice" vape in ninth grade.

"I thought I was just enjoying the flavors but soon my 14-year-old brain

NOTICE

NOTICE is hereby given that WILFRED FLORESTAL of #24 Kemp Road Nassau, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 13th day of June, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

craved the nicotine more and more," said Josie Shapiro of Seattle. "I've tried to quit vaping over and over again, but it's really, really hard."

The FDA and DOJ have legally barred about a halfdozen vaping companies for selling products that can appeal to youngsters, but many more manufacturers continue launching new products, primarily disposable vapes that can't be refilled and are thrown in the trash.

Deputy Assistant Attorney General Arun Rao told senators that regulators at the Justice Department and other agencies have signaled that the vaping issue "is a priority across the executive branch."

"I'm against signals," Durbin said. "Do something!"

On Monday, the FDA and DOJ announced a new government task force, which will include the U.S. Postal Service and other agencies, to try and tackle the problem. That step was recommended in 2022 by an outside panel that reviewed longstanding complaints about the FDA's tobacco program.

Republican Senator Thom Tillis called the timing of the announcement "a political stunt," and criticized the absence of other federal agencies from the initiative, including Customs and Border Protection.

"If the timing of the task force formation wasn't evidence of how unserious the

FDA is about tackling the flood of illicit e-cigarettes, FDA's exclusion of CBP from the task force makes it crystal clear," said Tillis, who represents North Carolina, the nation's leading tobacco producer. He urged officials to concentrate enforcement on Chinese brands, rather than large domestic manufacturers like Reynolds American. The FDA can conduct investigations and recommend cases, but only the Justice Department can bring lawsuits. Federal prosecutors may decline to pursue cases for any number of reasons, including competing priorities, weaknesses in the case or the potential repercussions of losing in court.

Using its own authorities, the FDA has sent hundreds of warning letters to vape shops and e-cigarette manufacturers in recent years. But the letters have done little to dissuade companies from flouting FDA rules and introducing new vapes. Industry analysts estimate disposable vapes make up 30% to 40% of the roughly $7 billion-dollar vaping market. The two best-selling disposables — Breeze and Elf Bar — generated more than $500 million in sales last year, according to Nielsen retail sales data analyzed by Goldman Sachs. Both brands have been sanctioned by FDA regulators but remain widely available, in some cases with new names, logos and flavors.

NOTICE is hereby given that STERVENIES FENELUS of McCartney Lane, Wulff Road Nassau, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 13th day of June, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

WEWORK has officially emerged from bankruptcy. And all eyes are on whether its new leadership can guide the long-embattled provider of co-working office space to success.

Once a Wall Street darling promising to revolutionize the world of work, WeWork took a stunning — but anticipated — fall last November when it filed for Chapter 11 bankruptcy protection. Early overexpansion shackled WeWork with mounting debt and unsustainable real estate costs, and the New Yorkbased company turned to restructuring in a bid to resurrect its business.

WeWork emerged from the restructuring, which took effect Tuesday after being finalized in court last month, as a private company. That means its future financial disclosures will be limited, but the company says it’s shed more than $4 billion in debt, raised $400 million of additional equity capital, and cut future lease obligations in half — which it expects to bring some $12 billion in future savings.

WeWork’s real estate footprint also got smaller. The company exited 170 “unprofitable” locations — bringing its portfolio to about 600 wholly owned, franchisee and jointventure locations in 37 countries. That’s down from around 770 locations across 39 countries reported ahead of November’s Chapter 11 filing.

“They rejected a great deal (of leases), so it’s obviously going to put WeWork in a much better position in terms of being lean enough ... to exit bankruptcy and operate without so much crushing overhead,” said John D. Giampolo, a member partner at New York-based law firm Rosenberg & Estis who specializes in corporate bankruptcy reorganization and represented several landlords and creditors in WeWork’s bankruptcy case. Still, the future is uncertain. “Is it going to be enough so that WeWork

becomes sufficiently profitable long-term?” Giampolo added. “I think only time is going to tell.”

The company’s new leadership is also being watched. Corresponding with Tuesday’s announcement about emerging from bankruptcy, WeWork revealed that David Tolley has stepped down as CEO and is being replaced by John Santora, of real estate company Cushman & Wakefield, effective Wednesday.

Santora is the fourth permanent CEO that WeWork has seen over the last five years. His predecessor Tolley, who joined WeWork just last year, became interim CEO in May 2023 — a position that became permanent in October. In a prepared statement, Santora sounded an optimistic note about the company’s role in the coworking space.

“I firmly believe that flexible work is no longer just an option, but rather a strategic imperative for companies wanting to maximize the efficiency of their real estate footprint, as well as their dynamic workforce,” he stated.

Beyond the new chief executive appointment, WeWork also unveiled a new board of directors. More than half of the new members come from real estate software company Yardi Systems, which agreed to acquire a majority stake in WeWork through its wholly owned subsidiary Cupar Grimmond during bankruptcy proceedings. Commercial real estate experts like David Putro, senior vice president at Morningstar Credit Analytics, note that demand for co-working spaces remains strong — and, while WeWork is still the biggest name in the market today, many competitors have popped up over the years. Still, he and others add, having a sustainable business model and keeping up with consumers’ evolving needs is crucial.

While post-pandemic return-to-office efforts have taken “forever to truly manifest” for many workers, Putro says, demand for co-working spaces should

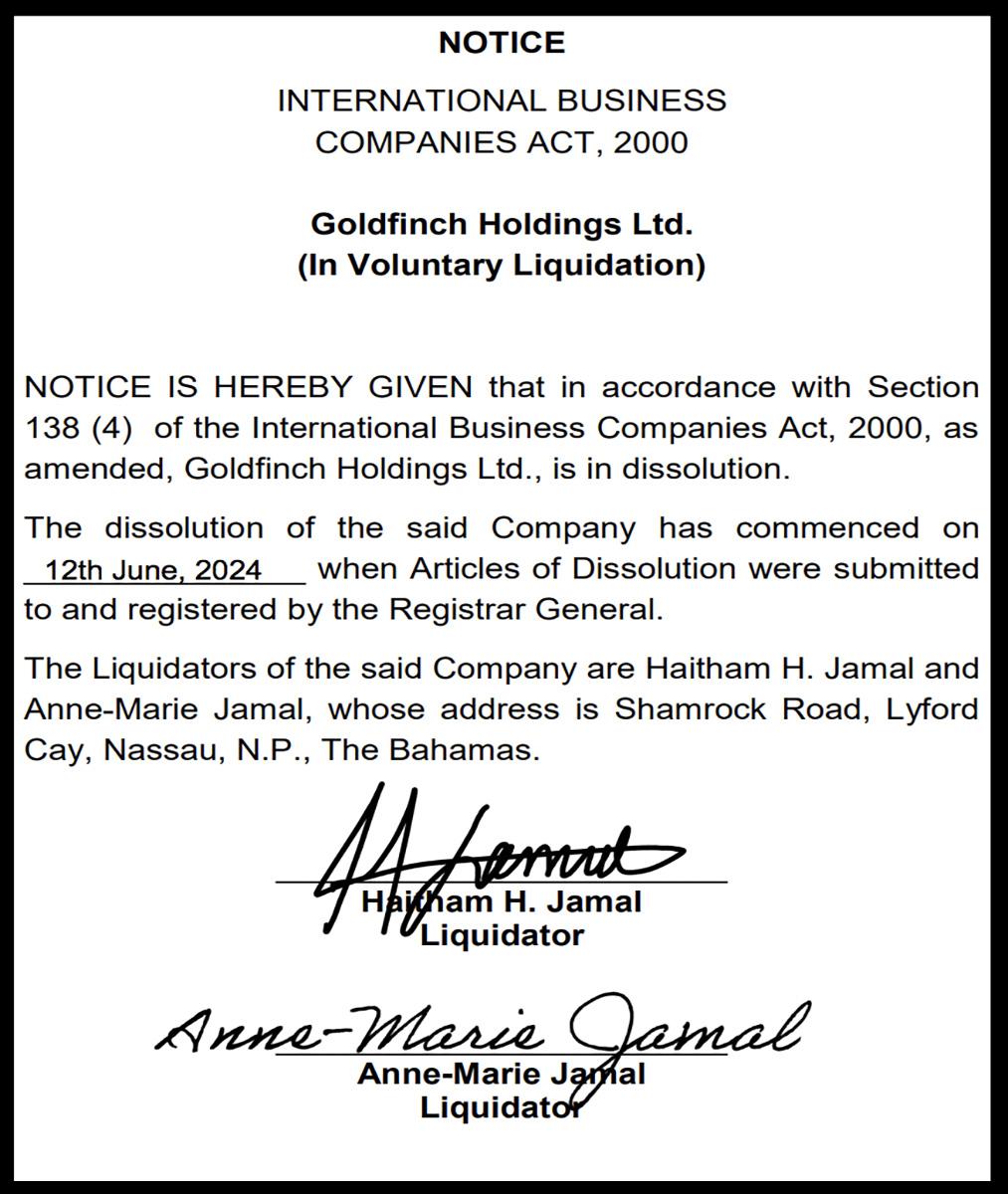

Incorporated under the International Business Companies Act, 2000 of the Commonwealth of The Bahamas. Registration number 210779 B (In Voluntary Liquidation)

Notice is hereby given that the above-named Company is in dissolution, commencing on the 12th day of June A.D. 2024.

Articles of Dissolution have been duly registered by the Registrar. The Liquidator is Mr. Luis Vital Maluf Cunha Vianna, whose address is R Luis Correa De Melo 148, AP 171 BL 1, CEP: 04726- 220, Sao Paulo, SP, Brazil. Any Persons having a Claim against the above-named Company are required on or before the 12th day of July A.D. 2024 to send their names, addresses and particulars of their debts or claims to the Liquidator of the Company, or in default thereof they may be excluded from the beneft of any distribution made before such claim is proved.

Dated this 12th day of June A.D. 2024. Luis Vital Maluf Cunha Vianna Liquidator

be a sizeable part of that conversation.

Still, WeWork’s reemergence from bankruptcy also arrives at a time when demand for office space remains weak overall. The COVID-19 pandemic led to rising vacancies in commercial real estate — with many Americans still spending at least part of the week working from home. Major U.S. markets struggling to improve office space occupancy include San Francisco, New York, Chicago and Washington, D.C.

That makes it even harder for landlords who may have lost major tenants, like WeWork, to fill their spaces again.

“We’re still seeing the residual effects,” said Putro, whose team has tracked WeWork locations that have been shuttered or seen leases terminated both before and after the company’s bankruptcy filing. “In some cases, that means (potentially) losing a building.”

WeWork was founded by Adam Neumann and Miguel McKelvey in 2010. In its early years, the startup saw a meteoric rise — once reaching a valuation as high as $47 billion — but over time, WeWork’s operating expenses soared and the company relied on repeated cash infusions from private investors.

WeWork went public in October 2021, after its first attempt to do so two years earlier collapsed spectacularly. That debacle led to the ousting of Neumann, whose erratic behavior and exorbitant spending spooked early investors. During the bankruptcy process, Neumann himself made a bid to buy back the company, but eventfully accepted defeat.

Federal Reserve sees some progress on inflation but envisions just one rate cut this year

A SCREEN displays a news conference with Federal Reserve Chairman Jerome Powell on the floor at the New York Stock Exchange in New York, May 1, 2024. On Wednesday, June 12, 2024, the Federal Reserve ends its latest meeting by issuing a policy statement, updating its economic and interest-rate projections and holding a news conference with Powell.

Photo:Seth Wenig/AP

By CHRISTOPHER RUGABER AP Economics Writer

By CHRISTOPHER RUGABER AP Economics Writer

FEDERAL Reserve officials said Wednesday that inflation has fallen further toward their target level in recent months but signaled that they expect to cut their benchmark interest rate just once this year.

The policymakers' forecast for one rate cut was down from their previous projection of three cuts, because inflation, despite having cooled in the past two months, remains persistently above their target level. The scaled-back estimate for rate cuts came as something of a surprise, given that the government reported earlier Wednesday that consumer inflation eased in May more than most economists had expected. That report suggested that the Fed's high-rate polices are succeeding in taming inflation.

Financial markets took encouragement, though, from the policy statement the Fed issued after its latest meeting ended, which underscored that it sees progress in its fight against high inflation. Broad stock indexes rose sharply, and bond yields fell in response.

The policymakers, as expected, kept their key rate unchanged Wednesday at roughly 5.3%. The benchmark rate has remained at that level since July of last year, after the Fed raised it 11 times to try to slow borrowing and spending and cool inflation. Whenever the Fed does begin to reduce its benchmark rate, now at a 23-year high, it would eventually lighten loan costs for consumers, who have faced punishingly high rates for mortgages, auto loans, credit cards and other forms of borrowing.

"What we've been getting is good progress on inflation, with growth at a good level and with a strong labor market," the Fed chair said. "Ultimately, we think rates will have to come down to continue to support that. But so far they haven't had to."

Uncertainty over when borrowing rates might come down is keeping some consumers on edge, especially those seeking to buy a home who face painfully high mortgage rates, now averaging around 7%.

David Goines, who owns a four-bedroom, two-bath mobile home in Lexington, Oklahoma, began looking for a new house last year but was put off by the elevated mortgage rates.

"Once we calculated what our payments would be for the house that we were looking at, it was just unfeasible," he said.

Goines, a 36-year-old information technology director, has been holding out hope that rates would ease this year. He's still waiting.

"We're pretty pessimistic of the rates even getting down to 5% in the next 12 months," he said. "Right now, we're just pretty much stuck."

On Wednesday morning, the government reported that inflation eased in May for a second straight month, a hopeful sign that an acceleration of prices that occurred early this year may have passed. Consumer prices excluding volatile food and energy costs — the closely watched "core" index — rose just 0.2% from April, the smallest rise since October. Measured from a year earlier, core prices climbed 3.4%, the mildest pace in three years.

“I don’t think September’s off the table. To get there, you’d have to have a string of inflation reports like the one we got this morning.”Matthew Luzzetti

The central bank's rate policies over the next several months could also have consequences for the presidential race. Though the unemployment rate is a low 4%, hiring is robust and consumers continue to spend, voters have taken a generally sour view of the economy under President Joe Biden. In large part, that's because prices remain much higher than they were before the pandemic struck. High borrowing rates have imposed a further financial burden.

Speaking at a news conference after the Fed meeting ended, Chair Jerome Powell seemed to downplay the significance of the policymakers' collective forecast of just one rate cut in 2024. That forecast is derived from the individual predictions of 19 policymakers, and Powell noted that 15 of the officials projected either one or two rate cuts this year.

"I would look at all of them as plausible," he said. "No one," the Fed chair added, "brings to this a really strong commitment to a particular rate path. It's just what they think in a given moment in time."

Economists say two rate cuts, with the first one coming as early as September, are still possible despite the central bank's prediction of just one. "I don't think September's off the table," said Matthew Luzzetti, chief U.S. economist at Deutsche Bank. "To get there, you'd have to have a string of inflation reports like the one we got this morning."

At his news conference, though, Powell cautioned, "We'll need to see more good data to bolster our confidence that inflation is moving sustainably toward 2%."

He also underscored that with the economy still overall healthy, Fed officials feel little urgency to cut rates.

"We welcome today's (inflation) reading and hope for more like that," Powell said.

Inflation has tumbled from a peak of 9.1% two years ago. The policymakers now face the delicate task of keeping rates high enough to slow spending and fully defeat high inflation without derailing the economy.

Measures of inflation had cooled steadily in the second half of last year, raising hopes that the Fed could achieve a rare "soft landing," whereby it would manage to conquer inflation through rate hikes without causing a recession. But inflation came in unexpectedly high in the first three months of this year, delaying hoped-for Fed rate cuts and potentially imperiling a soft landing.

As part of the updated quarterly forecasts the policymakers issued Wednesday, they projected that the economy will grow 2.1% this year and 2% in 2025, the same as they had envisioned in March. They expect core inflation to be 2.8% by year's end, according to their preferred gauge, up from a previous forecast of 2.6%. And they project that unemployment will stay at its current 4% rate by the end of this year and edge up to 4.2% by the end of 2025.

The expectation that the unemployment rate will remain around those low levels indicates that the officials believe that while the job market will gradually slow, it will remain fundamentally healthy.

"By so many measures," Powell said, "the labor market was kind of overheated two years ago, and we've seen it move back into much better balance between supply and demand."

NYC considers ending broker fees for tenants, angering real estate industry

By JAKE OFFENHARTZ Associated PressIT'S A familiar and agonizing experience for legions of New York City renters: before moving into a new apartment, a tenant must first shell out thousands of dollars in fees to a real estate broker, even if that person was hired by the landlord.

The hefty one-time payments, known as broker fees, are ubiquitous in New York but nearly unheard of anywhere else. In most other cities, landlords cover the commission of agents working on their behalf.

But legislation backed by a majority of the New York City Council would require landlords who hire brokers to pay their fees, marking a potential sea change in one of the country's most expensive housing markets.

Renters, who make up more than two-thirds of city households, are hailing the latest attempt at reform.

At a hearing Wednesday, many New Yorkers recalled paying exorbitant fees to brokers who appeared to do little more than open a door to an apartment or direct them to a lockbox.

"In most businesses, the person who hires the person pays the person," said Agustina Velez, a house cleaner from Queens who said she recently paid $6,000 to switch apartments. "Enough with these injustices. Landlords have to pay for the services they use."

But the proposal has triggered fierce opposition from New York's real estate industry.

Ahead of the hearing, hundreds of brokers gathered to voice their objections at a rally organized by the Real Estate Board of New York, the industry's powerful lobbying group. Through hours of testimony, they warned the legislation would sow chaos in the rental market and decimate the livelihoods of the city's roughly 25,000

real estate agents. Many predicted landlords would pass on the costs of paying brokers to tenants through increased rents or keep apartments off the market altogether.

"This is the start of a top-down governmentcontrolled housing system," said Jordan Silver, a broker with the firm Brown Harris Stevens. "The language is so incredibly vague we actually have no idea what this would look like in the world."

The bill's sponsor, City Councilman Chi Ossé, has said he was moved to act following a recent apartment search that was "tiring, treacherous, and competitive." Another local official, Brooklyn Borough President Antonio Reynoso, testified that he'd once paid a $2,500 fee to a broker he never met. Their frustration was echoed at Wednesday's hearing by dozens of ordinary renters, along with a mix of labor unions, housing policy groups and some prominent business leaders.

Critics said paying brokers' fees serves as a barrier to those who'd otherwise move to the city while preventing low-income New Yorkers from relocating to new homes.

Such broker fees were previously banned in 2020 under a package of renter protection laws passed by the state. But they were quickly reinstated following a lawsuit led by the Real Estate Board of New York.

Brokerage firms estimate that roughly half of the city's apartments require a tenant-paid broker fee. The price of those fees can vary widely, though the standard amount is 15% of the annual rent. For the average apartment in Manhattan, where the median monthly rent recently hit $4,500, that would amount to a fee of $8,100. Under the legislation, tenants would still pay brokers that they hired directly. The bill's brief language

— less than 200 words — only requires the party that hires the real estate agent pay their fee.

"How the market works is not as simple as a few sentences, which is what the bill is," said Ryan Monell, a vice president at the Real Estate Board of New York. "It's a misnomer to compare New York to other cities. This is really an exceptional market."

Brokers are adamant that their jobs are far more intensive than merely opening the door to tenants. Many said they help put together listings, review applications, answer questions posed by tenants and arrange tours at all hours of the day. But some also acknowledged that the current system favors landlords.

"I think it's not logical. The landlord should pay the listing agent who is working on their behalf," said Maria Octavio, a real estate broker with the firm of Douglas Elliman. "Because it's worked this way for many years, the owners are used to it."

Anna Klenkar, a broker at Sotheby's, said the industry group — known as REBNY — had contacted her employer after learning that she planned to testify Wednesday in support of the legislation. "It feels less like we're protecting ourselves, and more like we're protecting landlords, whom REBNY also represents," she testified.

A spokesperson for REBNY did not respond to an emailed inquiry about whether they had reached out to the employer.

Mayor Eric Adams, a Democrat, warned the bill could have unintended consequences. He had strong real estate industry backing during his campaign and moonlighted decades ago as a real estate agent while working in the city's police department.

Tennessee sheriff indicted for profiting from inmate labor, misusing funds

By ADRIAN SAINZ Associated PressTHE sheriff of a rural Tennessee county illegally profited from the work of jail inmates under his supervision and housed dozens of them in a home outside of the prison without permission, officials said Wednesday.

Gibson County Sheriff Paul Thomas was indicted in May in Gibson and Davidson counties on 22 charges including official misconduct, theft, forgery and computer crimes involving jail inmates in his custody, Tennessee Comptroller Jason Mumpower said in a news release.

Thomas turned himself in to authorities this week and he is out on bond, said Davidson County district attorney Stacey Edmonson. Thomas' lawyer said the sheriff deserves the presumption of innocence and he looks forward to defending himself in court.

Investigators said Thomas was an investor in three for-profit companies that provided staffing assistance to local businesses, housed current and former inmates in a transitional home, and provided transportation to work-release inmates and former inmates traveling to and from work. Thomas failed to disclose his ownership interest in the companies, known as Alliance Group, in his annual filings with the Tennessee Ethics Commission, Mumpower said.

Thomas directed more than $1.4 million in inmate wage fees and deductions to profit Alliance Group, investigators said. At least 170 inmates in Thomas' custody were employed by Alliance's staffing agency

during the investigation, investigators said.

Alliance Transportation was paid $18 per day to bring inmates to and from work, while 82 inmates were allowed, without proper approval, to live at Orchard House transitional home instead of the Gibson County jail, investigators said, noting that they were charged $40 per day by the home, He received more than $181,000 in compensation, payroll benefits, and legal representation services from Alliance — money that was illegally derived from inmate labor, the comptroller's office said. Investigators said Thomas also deceived the Tennessee Department of Correction by showing the county jail as the inmate location in the state's offender management system rather than the transitional home, resulting in the county collecting more than $500,000 in reimbursements from the state. Thomas then required the county to give that money to Orchard House without the correction department's knowledge or consent. "Orchard House was neither attached to the jail nor staffed by jail personnel, and no contract existed between the county and Orchard House," the comptroller's office said.

William Massey, Thomas' lawyer, said the indictment "has caused a flurry of activity in the press, but it has no evidentiary weight or value."

"He looks forward to his day in court before 12 jurors when he can defend himself, and his defense team does too," Massey said in an email to The Associated Press.

THEFTS OF CHARGING CABLES POSE YET

ANOTHER OBSTACLE TO APPEAL OF ELECTRIC VEHICLES