By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

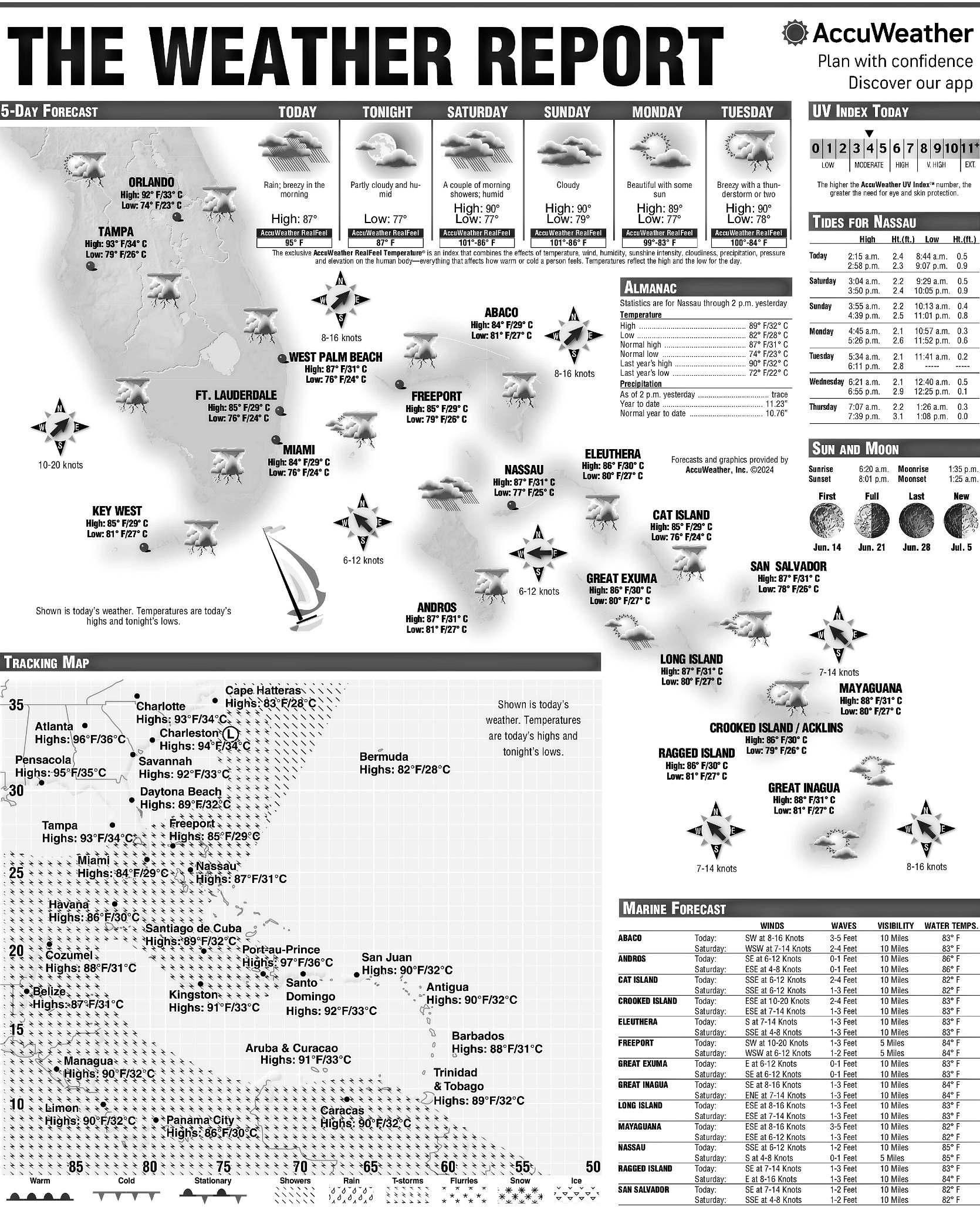

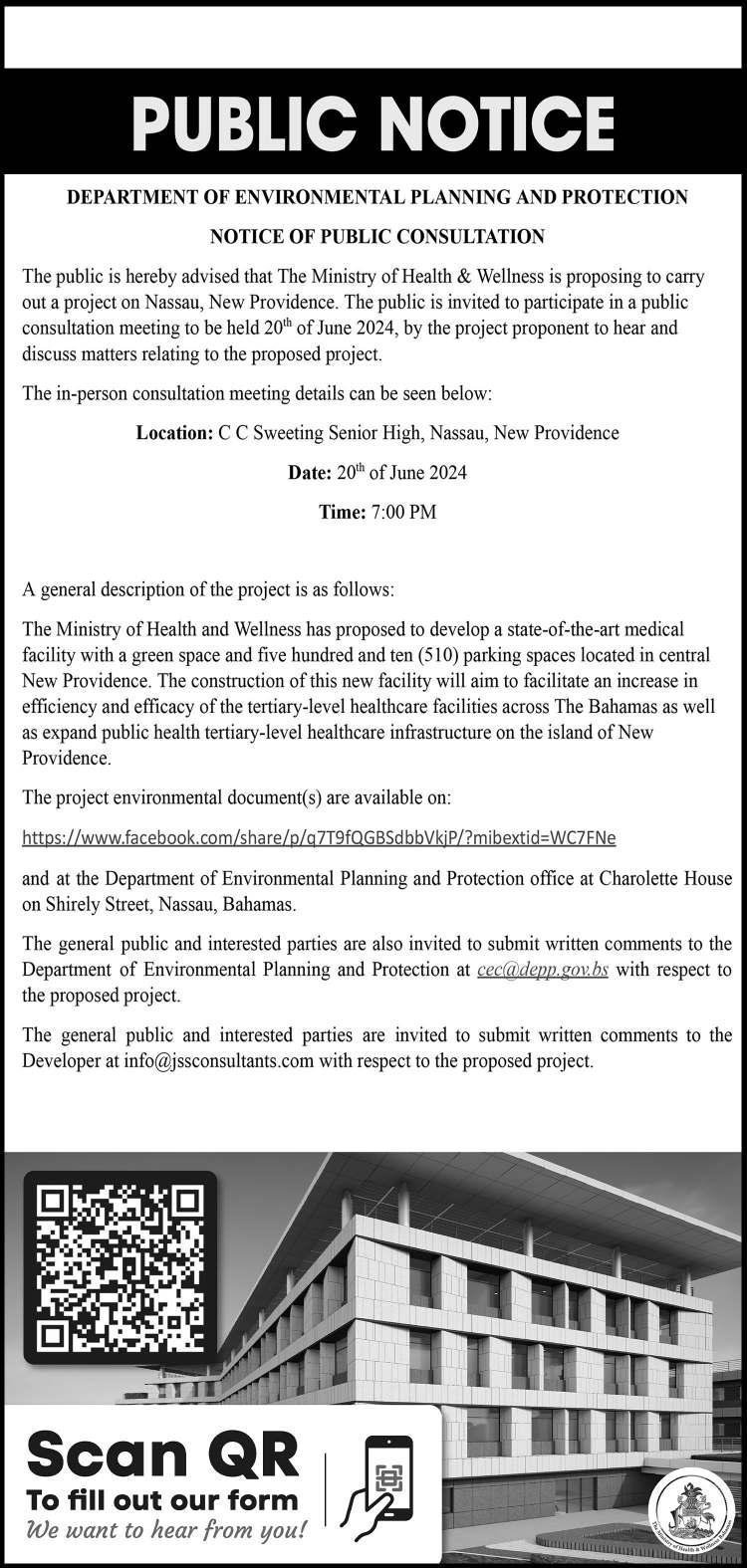

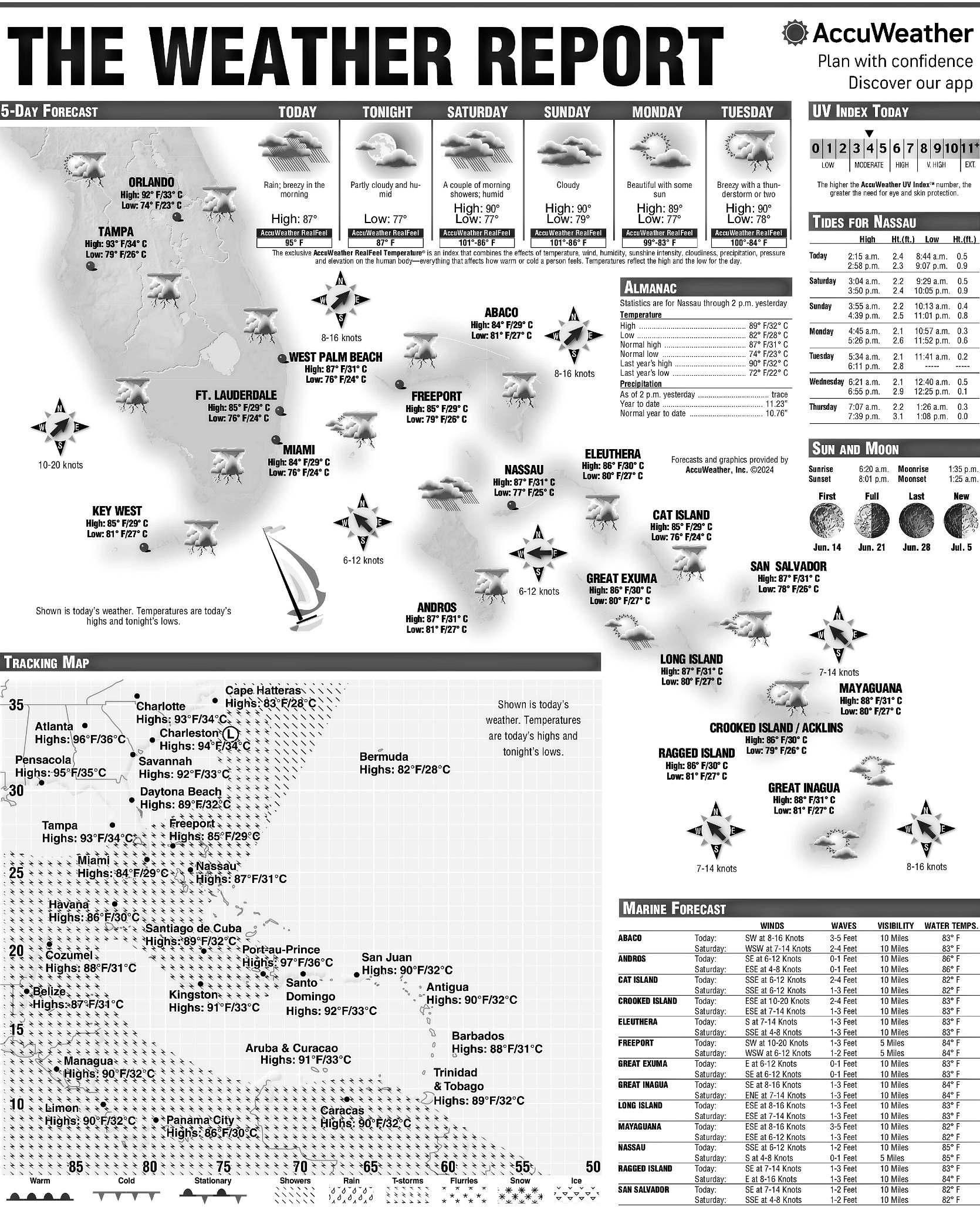

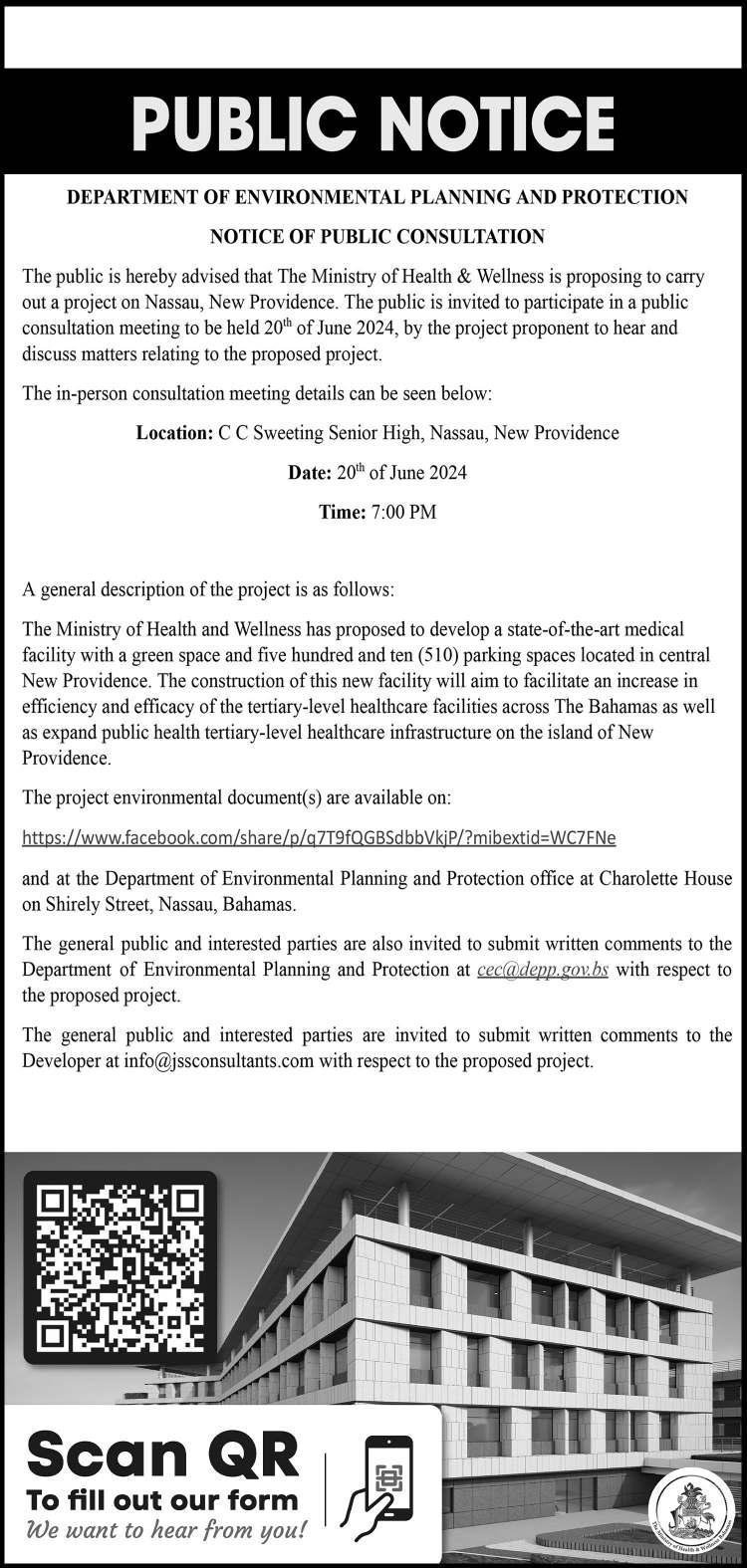

FLOODING risks are “a great concern” for New Providence’s new $290m hospital which will need a 650-strong medical staff to care for the anticipated 400 patients it is set to house daily.

The newly-released Environmental Impact Assessment (EIA) for the proposed specialist maternal and childcare facility disclosed that “historic wellfields” are located at the Perpall Tract site, which presently “act as a natural drainage from surrounding communities”.

With only one existing water run-off, the study by JSS Consulting revealed that “drainage swales and flood control ditches” will be required to prevent flooding in nearby residential communities. It added that “the development of an adequate drainage system that can handle flood water” will be critical to minimising the proposed 50-acre hospital’s impact.

The EIA, meanwhile, estimated that 80 percent of the hospital’s construction workforce will be Bahamian, but hitting that could be a challenge given that Chinese labour and contractors will be a condition sought in return for the hospital’s concessional financing from the China Export-Import Bank, one of Beijing’s state-owned institutions. Bahamians will likely play a greater role once the hospital is open. “During the operational phase, the project is expected to house 400 patients per day and 650 staff members,” the EIA said.

“The complete development of the project will require significant capital investment.

“It is estimated that approximately $289.399m will be invested into the project. Of the total estimated, $238.776m will be allocated for building construction and site development, including the parking area. The balance will be required to purchase medical equipment and furniture.” Parking will be provided for 510 vehicles.

Some $50.623m has been budgeted for purchasing the necessary medical equipment. When combined with the $238.776m construction

costs estimate and VAT at 10 percent, the final near-$290m price tag is achieved.

The EIA’s release came after a prominent Bahamian physician backed “optimising and improving” the existing Princess Margaret Hospital (PMH) rather than constructing a brand new hospital facility, while blasting the lack of consultation with medical professionals over the project as “really pathetic”.

Dr Conville Brown, principal of The Bahamas Heart Centre, Cancer Centre Bahamas and The Medical Pavilion Bahamas, told Tribune Business that the phased expansion and redevelopment of PMH “makes a lot more sense” because all the necessary utilities and other infrastructure required to support it is already in place.

Both the former Christie and Minnis administrations were working on a PMH expansion, rather than constructing a new out-of-town hospital, and Dr Brown said the existing site has the

‘Bahamas best comes together’: Third ex-minister in Jack’s Bay

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

JACK’S Bay’s chairman yesterday asserted that “the best of The Bahamas is coming together to do the best for The Bahamas” after a third former Cabinet minister became an investor in the project.

Sir Franklyn Wilson told Tribune Business that the Eleuthera-based development has ambitions to become “the model for how we are going to develop Family

Island tourism” via Bahamian investment after Dr Ronald Knowles, the former minister of health, confirmed his decision to buy-in. He follows Tommy Turnquest, now Jack’s Bay’s chief executive, and another former tourism minister, Dionisio D’Aguilar. “It’s wonderful to have joined your team,” Dr Knowles said in a recorded video.

Addressing Sir Franklyn, he added: “We are admirers of yourself, and to join a venture such as this, as I’ve mentioned before, we were just taken

away by the beauty of the property and understand its functions and what it’s going to mean to The Bahamas in terms of advancing golf and advancing our tourism product.”

Referring to his friendship with Mr Turnquest, whose Cabinet posts included tourism, Immigration and national security, and others, Dr Knowles added: “I’m very comfortable joining something they are participants and

Govt ‘utterly ignored’ the procurement law on BPL

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Opposition’s leader yesterday accused the Government of “completely and utterly” ignoring public procurement laws in selecting Bahamas Power & Light’s (BPL) new grid and generation partners.

Michael Pintard, in his contribution to the 2024-2025 Budget debate in the House of Assembly, said it was impossible to determine if the Bahamian people are getting the best possible deal and energy costs because these key awards were not put out to competitive bidding where rival offers were entertained.

The Marco City MP also argued that the proposed ownership structure for Bahamas Grid Company, the entity that is gaining a minimum 25-year contract to own, transform and upgrade BPL’s New Providence transmission and distribution network, should be “reversed” so that the Government is the majority - not the minority - shareholder. Under the present ownership structure, which was exclusively revealed by Tribune Business earlier this week, the Government will gain its 40 percent equity ownership by transferring BPL’s New Providence energy grid to Bahamas Grid Company. The assets transferred, according to Jobeth ColebyDavis, minister of energy and transport, will have a “book value” of $100m. Bahamas Grid Company, though, is in line to be 60 percent majority-owned by investors who buy into its $30m equity, or common shares, private placement that is being widely circulated among institutional and high net worth investors in the Bahamian capital markets. The $100m balance of the $130m

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

BAHAMIAN hotels were yesterday bracing for “short-term pain” as a result of Bahamas Power & Light (BPL) rate hikes while praising the Government for “long overdue” action on energy reform.

Robert Sands, the Bahamas Hotel and Tourism Association’s (BHTA) president, told Tribune Business that while the industry is still analysing the Equity Rate Adjustment tariff structure unveiled by the Government this week it is

“disappointed” that rates for BPL’s largest customers - which include the resort sector - have increased.

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Opposition’s leader yesterday compared The Bahamas’ relationship with the cruise lines to “the spider and the fly”, arguing that this nation has been “bamboozled” over the industry’s private islands. Michael Pintard, speaking in the House of Assembly during the 2024-2025 Budget debate, argued that the country has been “played” by giving the cruise lines substantial tax breaks and other

concessions while the economic benefits for Bahamian companies and their staff have been decreasing. He also suggested that The Bahamas was recording “ghost” visitors in its tourism headcount, representing cruise passengers who failed to disembark their vessel while in Nassau or Freeport, and spend most of their vacation dollars either on-board or on the lines’ private islands where most of the earnings exit the jurisdiction.

business@tribunemedia.net FRIDAY,JUNE14,2024

by cruise

islands

Bahamas ‘bamboozled’

lines’

SEE PAGE A23

Hotels eye ‘short-term pain for long-term gain’ on BPL

SEE PAGE A21 SEE PAGE A19

is

Flooding

‘great concern’ for 650-staff new hospital

SEE PAGE A21 SEE PAGE A20

$5.73 $5.79$5.74$5.61

ROBERT SANDS SIR

FRANKLYN WILSON

AFRO-CARIBBEAN MARKETPLACE DEAL SIGNING DURING SUMMIT

By NEIL HARTNELL

THE Africa ExportImport Bank will have a major impact on Grand Bahama and the wider Bahamas by holding its annual meetings here, a Cabinet minister has said.

This is the first time the development bank has held its meetings in the Caribbean. Ginger Moxey, minister of Grand Bahama, said: “This AAM and AfriCaribbean Trade and Investment Forum is critical for nurturing the relationship we have intentionally progressed over the last few years, including the historic signing

between Afreximbank and CARICOM, unlocking an astounding $1.5bn in funding.

“The many trade missions between both regions, and the signing of a project preparation facility with Afreximbank and the Government of The Bahamas on the development of an Afro-Caribbean Marketplace and Logistics Centre on Grand Bahama – my island - a magnificent centre for the promotion of tourism, commerce and trade between both regions.

“As we contemplate the historical ties that bind us, may we recognise the significant role of trade and the immense opportunities that lie before us. Trade has always been the lifeblood

of economies, and as we join hands to explore new avenues, great things will happen.”

Mrs Moxey continued: “The Bahamas, with its strategic location and wellestablished infrastructure, stands as a gateway...and it is at the crossroads of twoway trade. Our beautiful country has emerged as a major transshipment terminal, facilitating the seamless flow of goods and creating linkages across continents.

“The Afro-Caribbean Marketplace and Logistics Centre will not only boost economic growth but also strengthen the bonds of friendship and cultural understanding between both regions.”

GOVT ‘UTTERLY IGNORED’ THE PROCUREMENT LAW ON BPL

in financing this entity requires is due to be sourced from further equity and debt raises.

Mr Pintard, though, challenged why the $130m figure is being used to calculate the private investors’ 60 percent majority stake given that debt is typically not included in a company’s share or equity capital. As a result, he argued that the private interests’ ownership in Bahamas Grid Company should be based on the $30m in equity, leaving them as the minority shareholder and the Government with the majority.

The Marco City MP said that, while the Opposition is not against BPL’s privatisation, “what we do take issue with is the manner in which it is being done by this administration which is doing a disservice to the Bahamian people. BPL, by whichever name you wish to call it, is in the midst of a privatisation exercise. The Government sought to slip into a Budget debate a privatisation process by other means”.

He argued that transferring New Providence’s energy grid to Bahamas Grid Company, which will be managed by Island Grid and its Pike Electrical affiliate, was tantamount to privatisation since that entity will be majority owned by private investors. The deal involves a 25-year contract, with Bahamas Grid Company enjoying an option for a ten-year extension subject to its and the Government’s agreement.

Thus state ownership and control of BPL’s new grid has not been lost for eternity, but only for a long period of time, after which it will likely revert back to BPL and government control. “One hundred million dollars of sovereign assets is being transferred for a quarter of a century to... private ownership and control,” the Opposition leader added.

“So, selling the state-owed transmission and distribution network for a minority stake in a business that will be majority-owned and controlled by the private sector absolutely in south and central Andros, in Garden Hills, in Pinewood, in Nassau Village, in any part of The Bahamas is a privatisation.”

Mr Pintard then attacked the Government’s decision to, in particular, select Bahamas Utility Company, the FOCOL Holdings subsidiary, as BPL’s generation and independent power producer (IPP) partner as well as the choice of Island Grid/ Pike to manage the transmission and distribution network.

Mrs Coleby-Davis on Wednesday confirmed that Bahamas Utility Company was selected using “single source” bidding, which is a process that does not involve soliciting competitive bids from rivals, justifying this on the basis that it “immediately” raised the $75m required to purchase two generation engines whose output will ease summer load shedding fears.

She added that the subsidiary, which is 100 percent owned by the BISX-listed energy and petroleum products supplier, was in “a unique position” to address BPL’s generation woes through its existing on-ground presence. And it will now convert its rental generation agreements with BPL into longer-term power purchase agreements as it readies to construct a

new New Providence power plant.

“While there are some elements of this reform exercise which went to competitive bidding, there are other critical elements for which the procurement law was completely and utterly ignored,” Mr Pintard charged yesterday.

Mrs Coleby-Davis said the Utilities Regulation and Competition Authority (URCA), as energy industry regulator, had issued a “no objection” verdict on BPL’s [and the Government’s] decision to employ a “single source” bidding process.

“BPL applied to URCA under the URCA regulations to get permission for the use of single source procurement for the purchase of generation by way a power purchase agreement and the use of LNG,” she added. “I am pleased to advise that URCA has confirmed its non-objection to the proposed single-source procurement per condition 9 (5) of the procurement regulations for electricity sector licensees 2020

However, Mr Pintard argued that the Government was using URCA and the associated regulations to cover its violation of the Public Procurement Act and accompanying regulations. He asserted that the energy regulator and its regulations cannot trump this law, citing several sections to back his case.

“The Government is trying to use the excuse that URCA gave them permission to do single sourcing.

However, the non-objection from URCA to BPL’s outsourcing efforts does not give the Government any licence to suspend the requirements of the Public Procurement Act 2023,” the Opposition leader charged. He referred to the Act’s provisions stating that it applies to all procuring government entities, such as BPL, and that competitive bidding is required in all but some extremely narrow situations. “The law binds the Government to pursue competitive bidding,” Mr Pintard argued.

“Let’s look at just the outsourcing of the transmission and distribution network. The Government is about to enter into a 25-year obligation involving hundreds of millions of dollars of state assets on a critical element of our public infrastructure.

“The enormity of the undertaking, and the need to do it as effectively and as cost efficiently as possible, should have moved the Government – absent even of the legal requirement to do so – to ensure that this initiative be subject to an open and transparent competitive bidding process.”

Without a competitive bidding process, Mr Pintard said: “We don’t know if it’s the best cost Bahamians could have gotten because we had no other contenders given serious time to enter the bidding process.. Without a competitive bidding process, none of us can have the assurance that the best possible prices are what we are going to end up.”

“This is why we have a law in place to make sure that, to the extent possible, Bahamians get the best possible deal.” Mr Pintard then slammed what he branded as “the the inexplicable and indefensible shareholding arrangement” at Bahamas Grid Company.

He added: “The minister indicated yesterday that the valuation of the BPL transmission and distribution network was $100m. She

indicated that the private sector would be contributing $130m. She did not detail how much of that contribution was equity and how much is debt.”

Noting that Bahamas Grid Company’s initial equity capital raise is $30m, and that the rest of its financing - some $100m - will be sourced via debt and other sources, Mr Pintard queried

why the latter sum is being included to give private investors’ a combined 60 percent majority stake given that it does not represent common shares.

“If you give me $100m of Bahamian assets and you guarantee I have the contract, I just need to shop that around. I have a built-in return on my investment,” the Opposition leader said

of Bahamas Grid Company’s deal. “Now, if the value of the Government’s equity contribution is $100m and the value of the private common share equity is $30m, it would seem to us that there is no justification whatsoever for a 60 percent stake by the private sector participants when they are only putting up 23 percent of the book value of the company on day one,” Mr Pintard blasted.

“Even if you take into consideration the value of the cash and the sweat equity and expertise the private partners bring, the ratio of share ownership should be reversed. It should be 60 percent government and 40 percent to the outsourced partner..... There was and is no compelling and justifiable reason for this administration to turn over $100m of the Bahamian people’s assets on such bad terms.”

THE TRIBUNE Friday, June 14, 2024, PAGE 23

Tribune

nhartnell@tribunemedia.net

Business Editor

GINGER MOXEY, minister for Grand Bahama, welcomed delegates to Afreximbank’s 31st annual meetings and the AfriCaribbean Trade and Investment Forum 2024. It is the first time AAM is being held in the Caribbean region.

Photo:Eric Rose/BIS

FROM PAGE A24

HOW EMPLOYERS CAN SUPPORT FATHERS AMONG THEIR WORKERS

This Sunday the world celebrated fathers in special services, luncheons and awards ceremonies. Voluminous research now points to how integral active and involved fathers are to the healthy ecosystem we call life. Schools, churches, civic organisations and businesses all need to play a greater role in encouraging men to show up in their home and have a more positive impact in the lives of their children.

IAN

Balancing work and family is not easy for anyone. While women are still too often expected to shoulder the bulk of care giving responsibilities at home, which comes at the expense of advancing their careers, men face pressures in the opposite direction. Many fathers want to be more involved in their children’s lives and invested in their family relationships, but are unable to do so because of a lack of support and social norms, policies and structures within their workplace. This week’s column focuses on six practical ways in which employers can support men so that they can have a greater presence at home and be more engaged fathers.

1. Grant flexible work arrangements to men

Flexible work arrangements support a father’s caregiving role by giving them greater freedom to determine when and where to fulfill their job responsibilities. This allows them to respond to the needs of their family, and do their fair share of unpaid care work, while still meeting their workplace commitments.

2. Provide childcare support to fathers too

Supporting fathers, either financially or by setting up workplace childcare facilities, allows men to take on an equal share of caregiving and family responsibilities, especially when childcare hours coincide with work hours. By facilitating childcare arrangements, this also results in lower absenteeism and stress.

3. Offer paternity leave, and incentivise fathers to take it

Providing paid paternity leave and encouraging men to use it enhances gender equality at home, and may reduce the barriers to parenthood. It can have positive effects on a child’s development by allowing fathers to bond and be more engaged with their kids, while helping build men’s confidence around parenting. Paid leave is also increasingly shown to be good for business, improving the retention of employees, increasing job satisfaction and productivity, and minimising absenteeism and turnover while reducing training and staff replacement costs.

4. Attach medical coverage to include children

If the father is the primary policy holder, then the dad

RBC wins Caribbean digital banking award

ROYAL Bank of Canada

(RBC) yesterday said it has received the Best Digital Banking Services (Caribbean) 2024 award frron Capital Finance International (CFI).

is more likely to take the sick child to the doctor for a visit or the well child for the check-up. This simple act gives fathers an opportunity to bond with the child in vulnerable - and sometimes fearful - moments when they need the love and care of a supporting father.

5. Create a workplace culture that values men as fathers and caregivers

Social norms, roles and stereotypes that place men in the breadwinner role, and do not value their contributions as caregivers, can limit men’s confidence and capacity to be engaged fathers and partners. Workplaces can help address that by ensuring zero tolerance for discrimination against fathers, and by taking measures such as creating a peer support network for working fathers.

6. Encourage senior male staff to lead by example

Many men do not take parental leave because they fear it will have a negative impact on their career. Male managers can help address this by being role models, as their taking paternity leave and using other parental benefits normalises these choices for all male employees. When a senior leader takes time to go to report card day or the graduation exercise, it sends the powerful message that leaders put their families first.

a talent management and organisational development consultant, having completed graduate studies with regional and international universities. He has served organisations, both locally and globally, providing relevant solutions to their business growth and development issues. He may be contacted at tcconsultants@ coralwave.com

“We are incredibly proud to receive and celebrate this achievement,” said Chris Duggan, RBC’s head of Caribbean banking. “It is a testament to the hard work and dedication of our entire team.

This is part of our vision to provide a simplified and exceptional client experience in everything we do.”

“As our clients’ needs and expectations continue to evolve in today’s digital world, our focus remains on leveraging new technologies.

Capital Finance International said RBC Caribbean Banking has established itself as a digital leader within the region. “With a strategic approach that

combines technological innovation and a deep understanding of regional nuances, RBC has tailored its services to meet the diverse needs of clients,” noted the Capital Finance International panel of judges.

RBC’s digital platform was praised for offering a user-friendly experience and ensuring clients have access to quality banking services. The bank was also praised for its security measures, including two-factor authentication and the launch of biometrics authentication.

These measures provide clients with knowledge that their transactions and data are secure.

RBC added that 180,000 users are active in digital banking monthly across the Caribbean with a significant percentage using the bank’s platform for bill payments and wire transfers. RBC Caribbean was previously awarded the Best Digital Banking Services (Caribbean) award by Capital Finance International in 2022.

PAGE 22, Friday, June 14, 2024 THE TRIBUNE

FERGUSON

‘BAHAMAS BEST COMES TOGETHER’: THIRD EX-MINISTER IN JACK’S BAY

FROM PAGE A24

something they recommended to us.

“We recognise that this is an important time in our lives as we are now in... I don’t know if I want to call it... it’s not the dawn; it’s tying down the roots and making sure we are stable for old age. We are very comfortable in joining this particular investment. It will be something that will be there for later on in our life and for our children, so thank you for inviting us and we are very humbled to accept your invitation.”

Sir Franklyn yesterday asserted that Dr Knowles’ investment in Jack’s Bay was historic as there are now “three former Cabinet ministers as significant investors in one company.

I don’t think that’s ever happened before in an independent Bahamas”.

“It’s fantastic,” he continued. “The point I am making to you is having Ronnie Knowles, of all the people in politics in the last 30 years, Tommy Turnquest, Dionisio D’Aguilar and Ronnie Knowles are seen as some of the more successful people who have gone into public life. The fact all of them are agreed, this Jack’s Bay thing is really taking off.”

With Chester Cooper, deputy prime minister and minister of tourism, investments and aviation, this week renewing calls for Bahamians to become involved as major investors in resorts and other segments of the country’s largest industry, Sir Franklyn confirmed he hopes Jack’s Bay will set the standard for others to follow in this area.

“Having a group of citizens of this calibre is good

for the country,” he added of the three former Cabinet ministers. “It’s a good thing. Second, it is an important part of differentiating Jack’s Bay from other club-type resorts such as Baker’s Bay and Albany and what not.

“The capacity of our shareholders and directors puts us in a position where we can say we are authentically Bahamian. We are delighted to have Ronnie. It’s a group that is really showcasing The Bahamas and it’s something major. Between the combination of investors, founders and everything else it’s major.”

Sir Franklyn said the combination of “the world’s first” Nicklaus Heritage golf course, and the involvement of the Fazio name in helping to design it, is adding “another dimension of uniqueness” to Jack’s Bay. “These are the best names in the business,” he

added of the golfing industry. “This is really, really major.

“What gives this some amazing traction is that the calibre of Bahamian investors is just opening doors that are indescribable. It’s just incredible. The truth of the matter is that don’t forget we are coming up on about 40 years since we started the effort.

“The first time I got a phone call in connection with this was 1985, and it happened because South Eleuthera at that time was in a serious recession and so the thought was that we needed a different approach. It took us this long to show it, but the hope is that Jack’s Bay will provide the model on how we are going to develop Family Island tourism more locally,” he continued.

“This is the way. I’m almost lost for words. The

best of The Bahamas is coming together to do the best for The Bahamas. The best of The Bahamas are coming together to do the best for The Bahamas.”

As for Jack’s Bay’s development, Sir Franklyn said the Nicklaus Heritage course is “progressing very nicely”. He added: “We are creating the cottages that are going to be sold now. We have the founders who have bought the lots. Now we are creating villas for sale, and are at the stage of taking deposits from people who want to buy villas at price points in the region of $4m going north.

“We are at the stage of taking deposits and reservations on those. I say to all Bahamians: To the extent there is need for caution on anything happening, we need more Bahamians to go to Eleuthera to build homes to people who want

Hotels eye ‘short-term pain for long-term gain’ on BPL

However, he added it was critical that the industry and others focus on the long-term benefits and gains promised by the Government’s reform package which has been touted as ultimately lowering energy costs, improving supply reliability and consistency, and aiding the environment by switching to cleaner fuels.

“I think the bottom line for the industry is we certainly recognise what the Government is trying to achieve in terms of upgrading and lowering energy costs, to be more reliable and sustainable, and creating entrepreneurial opportunities and improving the resilience of the system and, most importantly, moving to a diversified power system in this country,” Mr Sands told this newspaper.

“We still have to do some analysis on the impact of the rate adjustment. We fully support the reduction

for low energy users, but I must say we are disappointed that there was an increase on the large commercial consumers. We are in the process of doing an analysis on what that impact will be but, all in all, action is being taken to improve the grid and improve reliability, sustainability of electricity in the future are all positive and initiatives we support.”

The Prime Minister’s Office, in detailing the Equity Rate Adjustment’s impact, asserted that only BPL’s largest consumers - its 300 general service consumers representing around 500 accounts and less than 1 percent of the utility’s customer base - will see their light bills increase after July 1.

While it said energy costs for the likes of hotels, food store chains and manufacturers will be less year-over-year, that will not be difficult given that the same period in 2023 featured a 163 percent hike in

BPL’s fuel charge compared to October 2022 in a bid to reclaim under-recovered fuel costs.

“Their electricity bills will still be lower than during the same months of the prior year,” the Prime Minister’s Office said, “and they will gain enormously from new energy reforms, as transmission and distribution upgrades will increase efficiencies and improve reliability which, along with the integration of solar power and natural gas, will produce meaningfully lower prices in the coming years.”

The Equity Rate Adjustment structure, though, is likely to be in place for around three years until the Electricity Act provisions governing the Utilities Regulation and Competition Authority’s (URCA) review of BPL’s tariffs kicks-in. And it will also likely be two to three years before the full benefits of the Government’s energy reform strategy are felt.

Mr Sands, though, said yesterday: “It has to be the long-term impact on our businesses going forward.”

Asked whether hotels and other large BPL consumers are being asked to take short-term pain and sacrifice, in the form of higher light bills, for long-term gain, he added: “The indications are that is what it ought to be. But without proper analysis we can only look at what the impact is in July.

“We are looking beyond the six-month window. The initiative and actions are long overdue, and the Government has taken positive steps in the main. We just have to look at how shortterm pain may convert into long-term gain, with more reliability and consistency and lower costs.”

Michael Pintard, the Opposition’s leader, yesterday queried the impact to BPL’s “financial stability” from making the first 200 kilowatt hours (kWh) of residential consumers’

consumption free. He added that this will cost the cash-strapped utility some $2.8m in revenues per month, or $33.6m per year.

The Marco City MP also challenged whether the revised tariff structure will give BPL sufficient revenues to fund its debt repayments and operating expenses, and who will now be responsible for paying the utility’s $320m legacy debt and $120m in unfunded pension liabilities.

The Equity Rate Adjustment will give all consumers a 2.5 cent per kilowatt hour (kWh) discount to their fuel charge on the first 800 kWh that they consume. But, above that threshold, BPL customers will have to pay a 1.5 cent charge for every kWh used over and above BPL’s actual cost of fuel.

The Prime Minister’s Office, giving an example of how this would work, said: “If the [actual fuel charge] is 20 cents per unit (kWh),

to

rent and work there. We need more homes. Investment opportunities abound in Eleuthera....

“The infrastructure in Eleuthera is a problem, the airport is problem. So opportunities totally abound. Any Bahamian who has an ounce of entrepreneurial blood in them, there’s opportunities in Eleuthera. Go do it.”

Asked how much has been invested in Jack’s Bay to-date, Sir Franklyn replied: “We are definitely in the nine-figure money. Nine figures, and we are well beyond the first figure being one... Suffice to say Jack’s Bay is one of the largest employers on the island of Eleuthera.

“It’s taken us going on 40 years to get here, but this is truly a case for the nation to take note of. We can do this thing. We can build our country.”

then the customer will be 17.5 cents per kWh for the first 800 units (kWh). The remaining units (kWh) will be billed at 21.5 cents.” Multiple business community sources have pointed out that enterprises of all sizes - right down to ‘Mom and Pop’ restaurants and shops - consume significantly more energy than 800 kWh per month especially during the upcoming summer period. As a result, while the base rate for small and mediumsized enterprises (SMEs) has decreased slightly, there are now fears that this will be more than offset by increased BPL fuel charges especially over the highconsumption summer. The commercial base tariff will lower slightly from July 1, falling from 15 cents to 14.5 cents per kWh, but many in the private sector will now be scrambling to work out what this means for their business, its expenses and profitability, and if this will be enough to offset the now-anticipated rise in their electricity bill’s fuel component.

THE TRIBUNE Friday, June 14, 2024, PAGE 21

FROM

A24

PAGE

FLOODING IS ‘GREAT CONCERN’ FOR 650-STAFF NEW HOSPITAL

advantage of being centrally located in the heart of downtown Nassau.

He added that Bahamian taxpayers, via the Government, have already sunk “several hundred million dollars” into PMH and its staged upgrades, including the $100m-plus Critical Care Block. Asserting that “we don’t even operate that properly”, Dr Brown said management of existing facilities remains among the biggest healthcare challenges, which is a further argument against the proposed new hospital.

“My vote in a nutshell is that we optimise and improve PMH,” he told this newspaper. “That $300m they’re talking about, my crystal ball tells me we will see cost overruns, underestimates and a challenging cost structure.” The EIA, too, concedes that the $290m figure is an estimate that “represents the best judgment at this preliminary stage” and “is only intended to assist in decision-making to move the project forward”.

Dr Brown, though, added: “I’m strongly of the view that we have already dropped several hundred million into the Public Hospitals Authority (PHA) and PMH. At least it’s central. It’s central to downtown, at the centre of the city, and sits in the centre of the island between east and west.” He also pointed out

that PMH sits on a major road artery, Shirley Street, and is close to others such as Bay Street and Collins Avenue. The proposed new hospital will be located off the road that connects Saunders Beach with the six-legged roundabout at JFK Drive, but Dr Brown argued this will effectively leave the new facility boxed in from a traffic flow perspective because “you have only got one road in and one road out, left and right”. The EIA confirmed no traffic impact study has yet been conducted, although one is planned.

“The FNM administration had already planned it,” Dr Brown said of PMH’s planned phased expansion. “They decided to do a big tower in the front. If parking was an issue, build a big parking deck. It solves most of your problems right there and then.

“That, to me, makes a lot more sense because you can take advantage of all the infrastructure you have in the ground. We’ve spent $100m on the Critical Care Block and don’t even operate that properly. We don’t have the infrastructure and resources-wise. The biggest issue is the management of these things.”

Rather than spend $290m to build a new hospital, the former Minnis administration planned to invest some $55m to construct a six-storey tower at PMH’s

downtown campus that would house several medical units including a new children’s ward, surgical ward, maternal care and gynaecology ward.

Both the Christie and Minnis administrations had hired the Beck Group, a US architectural and engineering firm headed by Bahamian, Fred Perpall, to plan the redevelopment of the PMH campus. Its 141page report, which has been seen by Tribune Business, called for the demolition of existing buildings, including the PMH warehouse and oncology units, to make wake for the new six-storey tower and a helipad.

Further phased redevelopment called for the demolition of existing clinics and storage and their replacement by a medical/ surgical tower; expansion of surgical services; and other facilities. Beck Group had proposed a five-phase approach that also involved the creation of additional parking and a clinical housing complex according to the plans seen by this newspaper.

However, the EIA defends the Perpall Tract move by asserting that space for expansion and redevelopment at PMH is “limited”. Following through with the earlier plans would “would decrease the functionality of the entire hospital”, it added, which was why a new “greenfield” site is now essential to meet the Bahamian public’s healthcare needs.

“More than 20 years ago the Ministry of Health and Wellness created the Dorsett Report, which reviewed the suitability of PMH as

the premier public tertiarylevel healthcare provider to meet the existing and projected demands of the Bahamian population,” the EIA said.

“The report concluded that, in 1999, the hospital’s ability to provide services could not meet the demand of the population at a level that would keep pace and maintain international standards. Due to the old equipment and facilities, renovations of PMH were required. It was recommended that renovation occur in three phases.

“It was stated that the existing PMH site is limited and, to construct a new building on the existing site, would decrease the functionality of the entire hospital in terms of traffic flow, parking, internal circulation and other factors. The relationships between departments in the hospital would also be compromised. This still holds true today.”

As a result, the EIA asserted that while the “first phase of renovation was determined to occur at the existing PMH site” it was “during this time that it was determined a greenfield site was needed for further expansion”. It added that The Bahamas is not receiving value for money on mother/child care as the maternal and infant mortality rates are still viewed as too high compared to monies spent.

“The maternal mortality rates and child mortality rates are less than optimal in PMH, and do not reflect the funds invested in assuring optimal healthcare,” the EIA said. “Therefore, the Government of The

Bahamas has determined that not only the quality of healthcare should be addressed but the facility in which the care is provided.”

And hence the focus on specialist mother and infant healthcare.

Justifying the new hospital’s development, the report said: “The location and development of the project will position a tertiary hospital closer to larger population centres of New Providence, minimise disruption of existing hospital services at PMH, introduce designs that will promote a healing environment, enhance the quality of service and efficiency of operations, offer ample parking, remove the challenges associated with navigating the traffic congestion of downtown and increase the ability to introduce in-patient room designs that can improve patient safety, experience and privacy....

“PMH has a capacity of 402 beds and, although recent renovations have helped to meet the local medical needs of the population, the expansion of clinical spaces has been outpaced by the need for tertiary health services in the country. The current footprint of PMH and available surrounding properties cannot support expansion required to meet demands.”

As a result, the new hospital drive is based on the “current limitations to the expansion of the infrastructure of PMH as the premier public tertiary hospital centre” and “the challenge for physical space at PMH to appropriately allocate hospital resources that support specific women and

G7 leaders tackle the issue of migration on the second day of their summit in Italy

By ELENA BECATOROS Associated Press

LEADERS of the Group of Seven leading industrialized nations are turning their attention to migration on the second day of their summit Friday, seeking ways to combat trafficking and increase investment in countries from where migrants start out on often lifethreatening journeys. The gathering in a luxury resort

in Italy's southern Puglia region is also discussing other major topics, such as financial support for Ukraine, the war in Gaza, artificial intelligence and climate change, as well as China's industrial policy and economic security. But some divisions also appeared to emerge over the wording of the summit's final declaration, with disagreement reported over the inclusion of a reference to abortion. Migration is of

child health conditions”. The Perpall Tract move was also billed as improving PMH’s capacity to manage adult and geriatric services.

Dr Brown, meanwhile, echoed concerns voiced by Dr Gemma Rolle, the Medical Association of The Bahamas (MAB) president, over the Government’s failure to widely consult doctors and other medical professionals over its plans in advance.

“It’s amazing how this was done without any consultation with the people working in the hospital and clinical medicine in this country,” he told Tribune Business. “You say you’re building a specialist hospital and don’t consult with your specialists. You bring people into this country to tell us what we need.

“Why do we get an education, work here for 30-40 years and we’re not in a position to say what the shortcomings are? Suggestions need be relevant to the country. Our solutions are not the same as developed countries who have already gone through their developing stage. That’s a standard modus operandi that we have got and it’s really, really bad.

“I think the MAB president brought it out when she went to the Town Meeting. How could MAB members and the medical community be in the dark on a hospital that you have decided without input from the medical community on how you do that.... I don’t agree with the process. It’s really pathetic, but they have done that with other things.

particular interest to summit host Italy, which lies on one of the major routes into the European Union for people fleeing war and poverty in Africa, the Middle East and Asia. Right-wing Italian Premier Giorgia Meloni, known for her hard-line stance on the issue, has been keen to increase investment and funding for African nations as a means of reducing migratory pressure on Europe. Italy "wanted to

dedicate ample space to another continent that is fundamental to the future of all of us, which is Africa, with its difficulties, its opportunities," Meloni said at the summit opening Thursday. Meloni has a controversial five-year deal with neighboring Albania for the Balkan country to host thousands of asylum-seekers while Italy processes their claims. She has also spearheaded the "Mattei Plan" for Africa, a continentwide strategy to increase economic opportunities at home and so discourage migration to Europe.

PAGE 20, Friday, June 14, 2024 THE TRIBUNE

FROM PAGE A24

Bahamas ‘bamboozled’ by cruise lines’ islands

Arguing that The Bahamas is now effectively substituting stopover visitors for cruise passengers, Mr Pintard said: “What we have here is the tragic but real-life story of the spider and the fly. Cruise companies let our government officials believe that they were being clever in attracting cruise ships to The Bahamas and encouraging them to build massive facilities on their private islands in The Bahamas.

“Our officials were not being clever; they were being played. The spider told the fly everything that the fly wanted to hear, and the fly waltzed into the trap.” The Bahamas, with its proximity to the major Florida ports, multiple private islands and destinations, is

valuable to the cruise lines for several reasons - not least due to the increased popularity of shorter cruises post-COVID.

With Cuba still largely cut-off, The Bahamas is the only viable port of call for the cruise lines to comply with the Jones Act, which requires their foreignflagged vessels to call at an overseas port before they can return to the US.

“The islands of The Bahamas were the god-sent solution to much of the troubles of cruise companies. But instead of our officials negotiating from a position of strength, our officials succumbed to flattery and arrived bearing more gifts for the cruise companies than their executives could have ever imagined,” Mr Pintard added, pointing to VAT and other tax breaks

associated with their private islands.

“The cruise companies are now earning substantial profits beyond their wildest dreams aboard their new ships as well as on the land of their private islands. Meanwhile, the economic growth projections of The Bahamas keep falling along with the revenue in the Treasury...

“Now, let me make it perfectly clear, the cruise companies are our friends in tourism development, they are not our enemies. They are crafty and skilled negotiators. But friends should not let friends drive drunk. Until Cuba reopens to visitors from the US, our most valuable asset is proximity to North America, the largest economy on earth,” the Opposition leader continued.

California legislators break with Gov.

Newsom

over loan to keep state’s last nuclear plant running

By MICHAEL R. BLOOD Associated Press

THE California Legislature signaled its intent on Thursday to cancel a $400 million loan payment to help finance a longer lifespan for the state's last nuclear power plant, exposing a rift with Gov. Gavin Newsom who says that the power is critical to safeguarding energy supplies amid a warming climate.

The votes in the state Senate and Assembly on funding for the twin-domed Diablo Canyon plant represented an interim step as Newsom and legislative leaders, all Democrats, continue to negotiate a new budget. But it sets up a public friction point involving one of the governor's signature proposals, which he has championed alongside the state's rapid push toward solar, wind and other renewable sources.

The dispute unfolded in Sacramento as environmentalists and antinuclear activists warned that the estimated price tag for keeping the seaside reactors running beyond a planned closing by 2025 had ballooned to nearly $12 billion, roughly doubling earlier projections. That also has raised the prospect of higher fees for ratepayers.

Operator Pacific Gas & Electric called those figures inaccurate and inflated by billions of dollars.

H.D. Palmer, a spokesperson for the California Department of Finance, emphasized that budget negotiations are continuing and the legislative votes represented an "agreement between the Senate and the Assembly — not an agreement with the governor."

The votes in the Legislature mark the latest development in a decades-long fight over the operation and safety of the plant, which sits on a bluff above the Pacific Ocean midway between Los Angeles and San Francisco.

Diablo Canyon, which began operating in the mid1980s, produces up to 9% of the state's electricity on any given day.

The fight over the reactors' future is playing out as the long-struggling U.S. nuclear industry sees a potential rebirth in the era of global warming. Nuclear power doesn't produce carbon pollution like fossil fuels, but it leaves behind waste that can remain dangerously radioactive for centuries.

A Georgia utility just finished the first two scratch-built American reactors in a generation at a cost of nearly $35 billion. The price tag for the expansion of Plant Vogtle from two of the traditional large reactors to four includes $11 billion in cost overruns.

In Wyoming, Bill Gates and his energy company have

started construction on a next-generation nuclear power plant that the tech titan believes will "revolutionize" how power is generated.

In 2016, PG&E, environmental groups and plant worker unions reached an agreement to close Diablo Canyon by 2025. But the Legislature voided the deal in 2022 at the urging of Newsom, who said the power is needed to ward off blackouts as a changing climate stresses the energy system. That agreement for a longer run included a $1.4 billion forgivable state loan for PG&E, to be paid in several installments. California energy regulators voted in December to extend the plant's operating run for five years, to 2030. The legislators' concerns were laid out in an exchange of letters with the Newsom administration, at a time when the state is trying to close an estimated $45 billion deficit. Among other concerns, they questioned if, and when, the state would be repaid by PG&E, and whether taxpayers could be out hundreds of millions of dollars if the proposed extension for Diablo Canyon falls through.

Construction at Diablo Canyon began in the 1960s. Critics say potential earthquakes from nearby faults not known to exist when the design was approved could damage equipment and release radiation. One fault was not discovered until 2008. PG&E has long said the plant is safe, an assessment the NRC has supported.

Last year, environmental groups called on federal regulators to immediately shut down one of two reactors at the site until tests can be conducted on critical machinery they believe could fail and cause a catastrophe. Weeks later, the Nuclear Regulatory Commission took no action on the request and instead asked agency staff to review it.

The questions raised by environmentalists about the potential for soaring costs stemmed from a review of state regulatory filings submitted by PG&E, they said. Initial estimates of about $5 billion to extend the life of the plant later rose to over $8 billion, then nearly $12 billion, they said.

"It's really quite shocking," said attorney John Geesman, a former California Energy Commission

“The cruise executives are our friends, but they are better friends to the demands of Wall Street and the demands of their bottom line. No hard feelings. We need to be better friends to the people of The Bahamas and to the Bahamian economy. Anyone involved in a negotiation must first assess their most valuable assets as perceived by the opposite side and also assess what it is that we need from them.

“When we easily and cavalierly give away our most valuable assets, namely, our proximity and our islands, they recognise our lack of appreciation for the value of our assets and begin to demand more. And we delivered each time. Madam speaker, we have managed to assist in saving the cruise business at the expense of

the Bahamian economy.

And we are celebrating it....

“We have to stop giving our birthright away for a bowl of porridge if we are to turn the economy of this country around. If we did not give away our birthright, The Bahamas would be running surpluses because of tourism, like the Turks & Caicos, not deficits.”

Pointing to the imbalance, Mr Pintard added:

“We have a major problem of aiding and abetting the decimation of our more valuable stopover business. The second step is to find ways to make our land-based properties more competitive. We hear the move afoot to increase the cost of electricity for large users. This is heading in the wrong direction.....

“Each one of the new Oasis class and Excel Class

ships has more cabins than Baha Mar has rooms, plus more restaurants, bars and nightclubs to boot. And their cost of electricity is lower, their cost of water is lower, their cost of food is lower, their cost of beverages is lower, and their cost of labour is much, much lower.

“We are hell bent on helping the wrong side. We need to enable our hotels and resorts to become more competitive. Understand, whenever we get six of these vessels in the port of Nassau, they have more cabins than all of the licensed hotel rooms in the Commonwealth of The Bahamas. We have given them the kind of pricing and profit power beyond their wildest dreams.”

member who represents the Alliance for Nuclear Responsibility, an advocacy group that opposes federal license renewals in California. The alliance told the state Public Utilities Commission in May that the cost would represent

"by far the largest financial commitment to a single energy project the commission has ever been asked to endorse."

PG&E spokesperson Suzanne Hosn said the figures incorrectly included billions of dollars of costs unrelated to extending operations at the plant. The company has pegged the cost at $8.3 billion, Hosn said, adding that "the financial benefits exceed the costs."

Notice is hereby given that in accordance with Section 138(4) of the International Business Companies Act. 2000, VERONA ENTERPRISES LIMITED is in dissolution as of June 12, 2024

International Liquidator Services Ltd. situated at 3rd Floor Whitfeld Tower, 4792 Coney Drive, Belize City, Belize is the Liquidator. NOTICE VERONA ENTERPRISES LIMITED In Voluntary Liquidation

LUA CAPITAL LTD.

Incorporated under the International Business Companies Act, 2000 of the Commonwealth of The Bahamas. Registration Number 205793 B (In Voluntary Liquidation)

Notice is hereby given that the above-named Company is in dissolution, commencing on the 13th day of June A.D. 2024.

Articles of Dissolution have been duly registered by the Registrar. The Liquidator is Mr. Fernando Luis Togni Paiva Wolff, whose address is Sao Paulo/SP CEP 04514040, Brazil. Any Persons having a Claim against the above-named Company are required on or before the 13th day of July A.D. 2024 to send their names, addresses and particulars of their debts or claims to the Liquidator of the Company, or in default thereof they may be excluded from the beneft of any distribution made before such claim is proved.

Dated this 13th day of June A.D. 2024. Fernando Luis Togni Paiva Wolff Liquidator

THE TRIBUNE Friday, June 14, 2024, PAGE 19

AN AERIAL photo shows the Diablo Canyon Nuclear Power Plant, California’s last nuclear power plant, in Avila Beach, Calif., June 20, 2010. On Thursday, June 13, 2024, former state and federal officials joined environmentalists to spotlight soaring cost estimates for keeping the plant running beyond 2025.

Photo:Joe Johnston/AP

FROM PAGE A24 ADVERTISE TODAY! CALL THE TRIBUNE TODAY @ 502-2394

L I Q U I D A T O

R

Hopes for AI and rates nudge Wall Street to records, even as most stocks fall

By STAN CHOE AP Business Writer

MOST U.S. stocks slipped Thursday, but hopes for coming cuts to interest rates and Wall Street's continued frenzy around artificial-intelligence technology nudged indexes to more records.

The S&P 500 added 0.2% to its all-time high set the day before, even though the majority of stocks within it weakened. The Nasdaq composite climbed 0.3% from its own record, thanks to gains for technology stocks, while the Dow Jones Industrial Average fell 65 points, or 0.2%.

Treasury yields eased again in the bond market as conviction built that inflation is slowing enough to get the Federal Reserve to cut interest rates later this year. The latest update on inflation showed prices paid at the wholesale level weren't as bad as economists expected. Prices

actually dropped from April into May, when economists were forecasting a rise. It followed a surprising update from Wednesday that showed inflation at the consumer level was lower than expected. Federal Reserve Chair Jerome Powell called that report encouraging and said policymakers need more such data before lowering their main interest rate from the most punishing level in two decades.

"It's a question of when they cut, not if," said Niladri "Neel" Mukherjee, chief investment officer of TIAA Wealth Management. High interest rates have been dragging on some parts of the economy, particularly manufacturing. A separate report on Thursday showed more U.S. workers filed for unemployment benefits last week than economists expected, though the number is still low relative to history.

INTERNATIONAL BUSINESS COMPANIES ACT, 2000 CONNECT-TWO LTD. (IN VOLUNTARY LIQUIDATION)

NOTICE IS HEREBY GIVEN that in accordance with section 138(4) of the International Business Companies Act, 2000, as amended, CONNECTTWO LTD. is in dissolution.

The dissolution of the said Company commenced on June 12, 2024 when the Articles of Dissolution were submitted to and registered with the Registrar General in Nassau, The Bahamas.

The sole liquidator of the said Company is Kim D Thompson of Equity Trust House, Caves Village, West Bay Street, P O Box N 10697, Nassau, Bahamas.

Kim D Thompson Sole Liquidator

The hope on Wall Street is that growth for the job market and economy continues to slow in order to take pressure off inflation, but not so much that it creates a deep recession.

Companies whose profits are most closely tied to the strength of the economy lagged the market Thursday following the reports, such as oil-and-gas producers and industrial companies.

Dave & Buster's Entertainment sank 10.9% after reporting worse drops in profit and revenue for the latest quarter than analysts expected, citing a "complex macroeconomic environment" among other reasons. Other companies have recently been detailing a split among their customers, where lower-income households are struggling to keep up with still-high inflation.

Voluntary Liquidation

Notice is hereby given that in accordance with Section 138(4) of the International Business Companies Act. 2000, WF Arbitration Consulting Ltd. is in dissolution as of June 3, 2024

International Liquidator Services Ltd. situated at 3rd Floor Whitfeld Tower, 4792 Coney Drive, Belize City, Belize is the Liquidator.

Some companies have been able to skyrocket regardless of the pressures on the economy because of an ongoing frenzy around artificial-intelligence technology.

Broadcom jumped 12.3% after the semiconductor company reported stronger profit for the latest quarter than analysts expected, aided once again by AI demand. It also raised its forecast for revenue this year.

Broadcom's stock price has jumped so high, to nearly $1,700, that it will soon give nine shares for every one that investors already hold in in order to lower the price and make it more affordable. It follows a similar move by Nvidia, which has become the poster child of the AI rush and seen its total market value top $3 trillion.

Tesla rose 2.9% after CEO Elon Musk said early voting results indicated shareholders were leaning toward approving his pay package. Without it, Musk had threatened to take AI research to one of his other companies.

All told, the S&P 500 rose 12.71 points to 5,433.74. The Dow slipped 65.11 to

38,647.10, and the Nasdaq rose 59.12 to 17,667.56. In the bond market, the yield on the 10-year Treasury fell to 4.24% from 4.32% late Wednesday and from 4.60% late last month. The two-year yield, which moves more on expectations for the Fed, fell to 4.69% from 4.76%. Most Fed officials are penciling in either one or two cuts to interest rates this year, and traders are hopeful they can begin as soon as September. Such cuts would ease the pressure on the economy and give a boost to all kinds of investment prices.

TIAA's Mukherjee said he's expecting the U.S. economy's growth to keep slowing as spending by lower-income households weakens under the strain of dwindling savings accounts. But he expects the economy to avoid a recession as spending continues by well-off households benefiting from fatter investment portfolios and home values, as well as by governments and corporations. "To me, the soft landing" for the economy where inflation eases without a deep recession "has already been achieved," he said.

In Voluntary Liquidation

Notice is hereby given that in accordance with Section 138(4) of the International Business Companies Act. 2000, SCIROCCO HOLDING BUSINESS LTD. is in dissolution as of June 10, 2024

International Liquidator Services Ltd. situated at 3rd Floor Whitfeld Tower, 4792 Coney Drive, Belize City, Belize is the Liquidator. NOTICE

PAGE 18, Friday, June 14, 2024 THE TRIBUNE

STOCK MARKET TODAY

THE NEW York Stock Exchange is shown on June 12, 2024 in New York. European shares are lower and Asian shares ended mixed on Thursday, June 13, 2024, after the Federal Reserve opted to keep its benchmark interest rate unchanged

The Public is hereby advised that I, JAYLN JOSHUA DAVIS, of Marsha Harbour, Abaco, The Bahamas, intend to change my name to JAYLN JOSHUA BOOTLE If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Offcer, P.O.Box N-742, Nassau, The Bahamas no later than thirty (30) days after the date of publication of this notice. INTENT TO CHANGE NAME BY DEED POLL PUBLIC NOTICE NOTICE is hereby given that EDER TOUSSAINT of Harbour Island, Eleuthera, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 14th day of June, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas. NOTICE CAREER OPPORTUNITY Established restaurant require the services of a Handy man and Assistant Cook to work 40 hours shift per week at a designated restaurant. Interested persons please send resume to rah@sbarrobahamas.com

Photo:Peter Morgan/AP

NOTICE

NOTICE

WF Arbitration Consulting Ltd. In

L I Q U I D A T O R

BUSINESS

L I Q U I D A T O R

SCIROCCO HOLDING

LTD.