• Judge petitioned to return cash seized by Feds

• Local liquidators, Ray assert ‘superior interest’

• Also want two planes returned from Bahamas

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

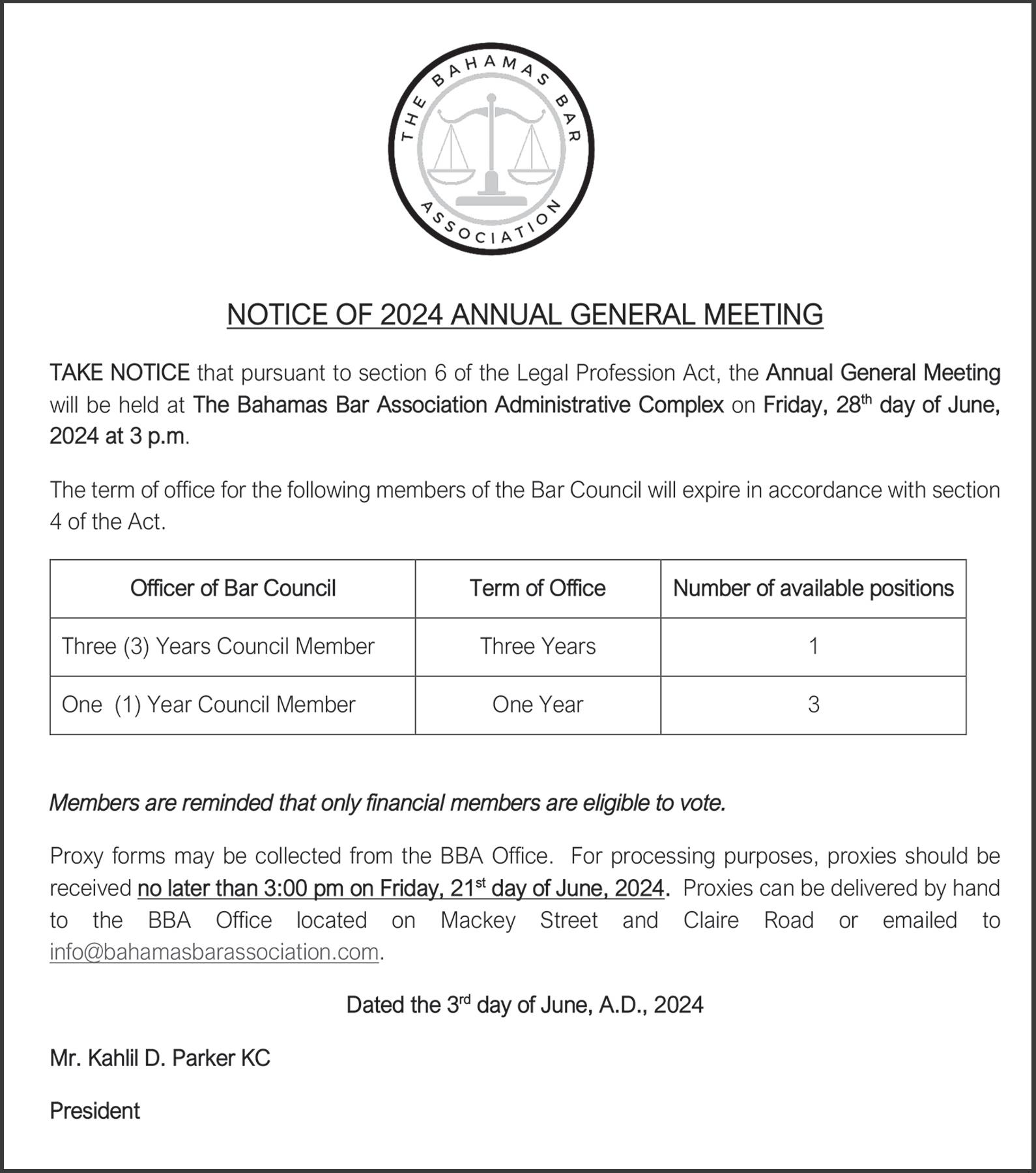

A NEW York judge is being urged to return $143m seized by the US federal authorities to FTX’s Bahamian liquidators who have a “superior interest” to these assets.

John Ray, FTX’s US chief, and his Bahamian counterparts have partnered in petitioning Judge Lewis Kaplan to order that the cash and other assets be handed over to their combined liquidation estate so that they can finance investor recoveries and be paid out to victims of the failed crypto exchange.

Contractor chief: Chinese hospital labour likely 90%

• Says higher than 80% cited in House exchange

• PM: Figure not right, but won’t give correct one

• Taxpayer dollars means locals must be involved

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Bahamian Contractors Association’s (BCA) president yesterday asserted that the ratio of Chinese labour employed on the $290m new hospital will be higher than the 80 percent cited in Parliament. Leonard Sands told Tribune Business that, based on past experience with The Pointe project, the ratio of Chinese construction workers to Bahamians could

By NEIL HARTNELL Tribune Business Editor

nhartnell@tribunemedia.net

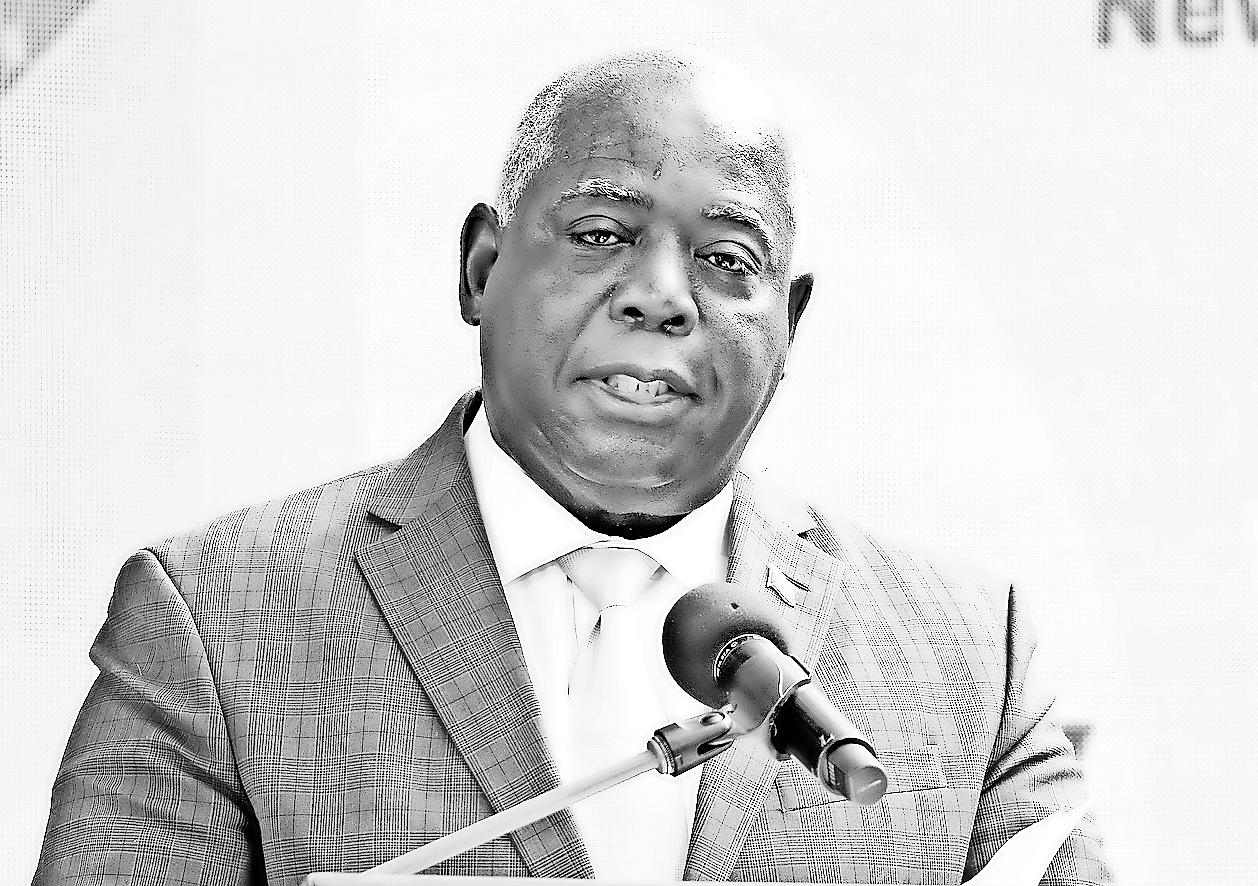

THE Prime Minister yesterday vowed that the days of The Bahamas serving as “a playground for the elite who....disobey the law and fail to pay their taxes” is over.

Philip Davis KC, in closing the 2024-2025 Budget debate in the House of Assembly, yesterday asserted that wealthy

reach as high as 90/10 as he urged the Government to ensure “daily” monitoring mechanisms are in place to prevent past workforce “abuses” from being repeated.

The Government is planning to finance New Providence’s new hospital with concessional financing from the China Export-Import Bank, an institution owned by the Beijing government, at a

The $143m, which was seized by the US Justice Department from two US banks in late 2022 within weeks of FTX’s collapse, is among assets being held by the federal authorities to help satisfy a mammoth $11.02bn forfeiture order and money judgment against Sam Bankman-Fried, the exchange’s

disgraced founder who is now serving a 25-year jail term. Also included in the assets that Mr Ray and FTX Digital Markets’ liquidators want transferred to the liquidation estate are the two aircraft acquired with $27.445m of FTX funds by Bahamian aviation operator, Trans-Island Airways.

The firm’s principal, Paul Aranha, recently handed over the last of the two planes after securing a $2m settlement with Mr Ray and the US Justice Department. Brian Simms KC, the Lennox Paton senior partner, and PricewaterhouseCoopers (PWc) accounting duo, Kevin Cambridge and Peter Greaves, in their joint petition with Mr Ray are arguing that the $143m, two planes and other assets were never owned by

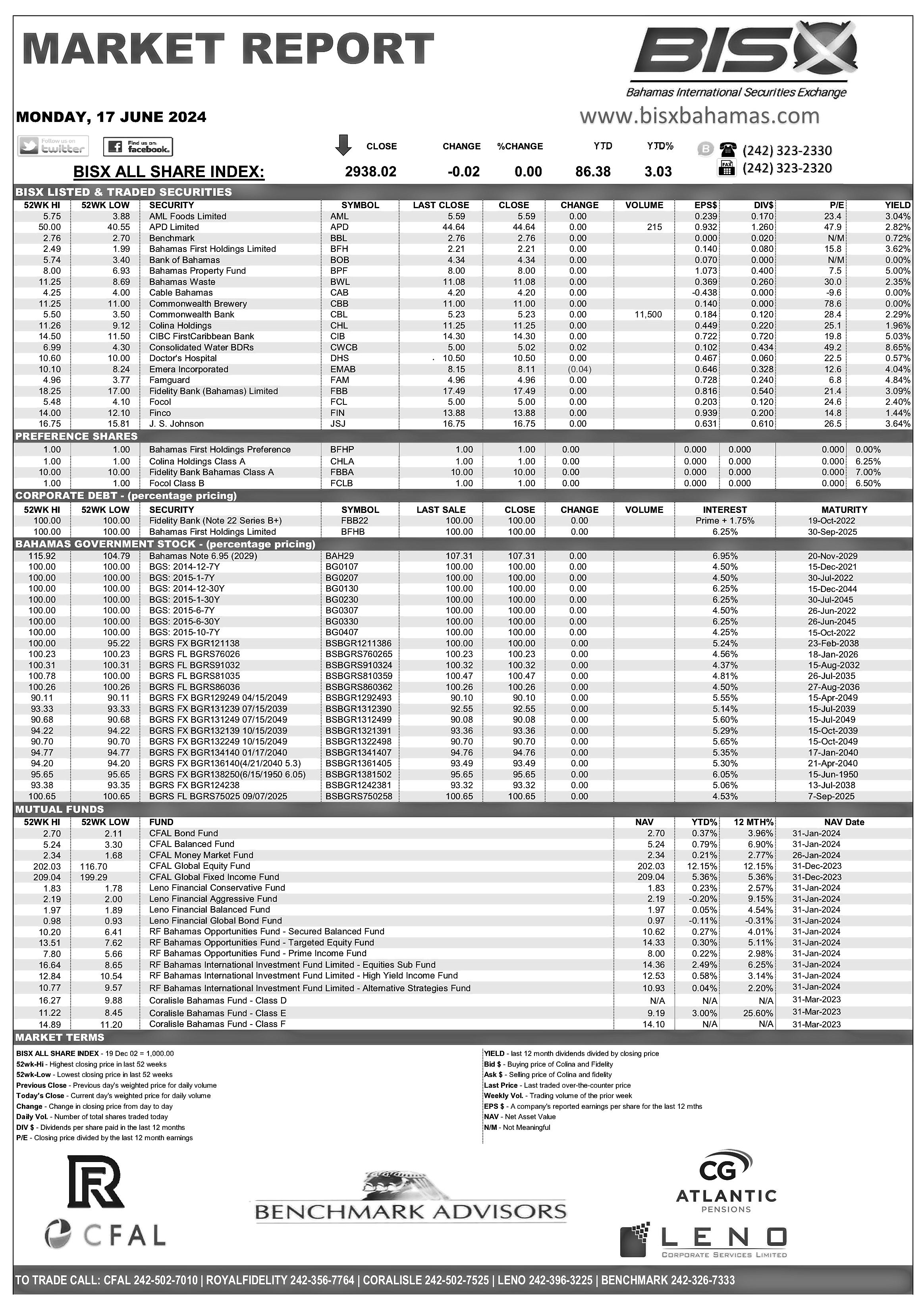

Benchmark avoids qualified audit opinion for third year

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A BISX-listed company’s top executive yesterday voiced delight it had avoided a “qualified opinion” on its annual financial results for a third consecutive year, saying: “Nobody wants that.”

Julian Brown, Benchmark (Bahamas) president and chief executive, told Tribune Business he had always been confident “we would get it done” as the investment, brokerage and real estate firm saw net comprehensive income for

By NEIL HARTNELL Tribune Business Editor

THE Prime Minister yesterday pledged that further details on wideranging energy reforms will be revealed “as soon as the ink is dry”, promising that Bahamians will not be “left in the dark”.

Philip Davis KC, in concluding the 2024-2025 Budget debate in the House of Assembly, spent much of his address justifying the Government’s approach to changing Bahamas Power & Light (BPL) and the wider energy industry while conceding that not all aspects of the deal have

homeowners and boaters will no longer be able to dodge paying due taxes or make minimal contributions to the Public Treasury due to his administration’s enhanced compliance and enforcement efforts.

“There are special interests out there who pay their mouthpieces a lot of money to push narratives about us that do not reflect reality,” the Prime Minister asserted, while calling no names. “They pretend

there are new taxes when, really, they are unhappy that businesses are simply being asked to comply with the law, and pay what they owe, same as everyone else. This is a basic principle of fairness.

“These paid talking heads defend people who own million dollar properties who feel they are above paying taxes in The Bahamas, and luxury boat owners who want to enjoy

2023 more than triple yearover-year to $1.675m.

PKF Bahamas in 2023 gave Benchmark (Bahamas) accounts a clean bill of health for the first time in three years, having ‘qualified’ its audit opinion on the annual financials for 2021 and 2022, and Mr Brown said the findings confirm all issues have been resolved and the company can now put the issue behind it.

“We thought we would get it done,” he told this newspaper of the unqualified audit opinion. “Like we said last year, we had a a transition over to a new piece of software... we had

been publicly disclosed because they are still being negotiated.

BPL, and the Government’s, new private sector partners are Bahamas Grid Company, which with its Island Grid/Pike Electrical manager, will oversee the transformation of New Providence’s energy grid, plus Bahamas Utility Company, the FOCOL Holdings subsidiary, which will be responsible for constructing a new 177 Mega Watt (MW) liquefied natural gas (LNG) generation plant at Blue Hills.

Mr Davis acknowledged the unanswered questions surrounding the deal with key details yet to be agreed with BPL’s selected

our paradise while making minimal contributions.

“This idea that we are a playground for the elite who get to dictate policies, disobey the law and fail to live up to their tax obligations while reaping all the benefits of living here is just one example of how the status quo has harmed us.”

Referring to when the former Minnis administration altered its real property tax policies, after Lyford Cay and other highend communities warned they could have a chilling effect on foreign direct

Bankman-Fried but, instead, were vested in FTX Digital Markets or the 134 entities under Mr Ray’s care in Delaware.

Thus their title, interest and rights to these assets is “superior” to all other claims, and the southern New York court should order that they be returned to either Mr Ray or FTX’s Bahamian subsidiary to help cover creditor claims.

“The funds formerly held in the accounts registered in the name of FTX Digital Markets are not, and have never been, BankmanFried’s assets, and the interests of the debtors and/or FTX Digital Markets in those funds were at all relevant times superior to any interests of Bankman-Fried,” the

introduced new accounting software and, or course, the transition then didn’t work out as we thought it would.

“We’ve got it all resolved now. There’s no qualified opinion for this year. It was never a concern of ours. It was all to do with an intra-company transaction we were creating. We’re happy, glad it’s gone. No one likes a qualified opinion. Nobody wants that. Everybody is happy when it goes away. We’re just glad it’s done.” The sum at the centre of the auditors’ verdict was reduced year-over-year from an initial $337,369 in

2021 to $91,549 in the 2022 accounts.

Renee Lockhart, PKF Bahamas’ lead audit partner on the Benchmark (Bahamas) financials, last year flagged up a further issue relating to almost $1m in combined accounts receivables, payables and “other receivables and pre-payments” that were not referred to in the 2021 audited financials. Auditors were unable to obtain sufficient evidence to either “reconcile” or “verify” the sums in question. Explaining the basis for PKF Bahamas’ “qualified opinion” in 2022, the accounting firm informed Benchmark (Bahamas) shareholders: “The group is carrying a balance in its due from customers account amounting to $1.85m, which is presented

partners, including the preferred bidders for the New Providence and Family Island renewable and solar generation contracts.

Referring to Jobeth Coleby-Davis, minister of energy and transport, he said: “The leader of the side opposite [Michael Pintard] asked many questions about the BPL reforms, which the member for Elizabeth addressed during her contribution.

“The member was forthright and disclosed the facts that she had on hand. She explained that negotiations were ongoing in certain

business@tribunemedia.net

JUNE 18, 2024

TUESDAY,

PM:

is over

Tax dodging elite’s era

PM: We will not keep you ‘in dark’ on energy reform

SEE PAGE B4 SEE PAGE B4

nhartnell@tribunemedia.net

SEE PAGE B2

SEE PAGE B3

$143m back to Bahamas!’

‘Give FTX’s

LEONARD SANDS PHILIP DAVIS KC

BRIAN SIMMS KC JOHN RAY

SEE PAGE B4 $5.73 $5.79 $5.74 $5.61

‘TIME FOR TALKIN’ DONE’ ON BOOSTING SIDS RESILIENCE

By LIAM MILLER

AT LAST week’s African Export-Import Bank (Afreximbank) conference held in Nassau, Prime Minister Philip Davis KC called for the use of a multidimensional vulnerability index (MVI) as a tool to assess the challenges endemic to Small Island Developing States (SIDS). According to the Alliance of Small Island States (AOSIS), a multi-dimensional vulnerability index is “a tool which finally takes the special circumstances of SIDS into account, designed to help us access critical support to drive sustainable development”. Developed by various high-level stakeholders, and recently discussed at

the International Conference on Small Island Developing States, an MVI will be debated at the upcoming United Nations General Assembly (UNGA). I believe MVI is the right step forward in safeguarding the success and survival of SIDS such as The Bahamas. For far too long, SIDS have been excluded from acquiring the necessary financial support due to the size of their gross domestic product (GDP) and gross national income (GNI). A country such as The Bahamas, despite being classified by the World Bank as a “high income economy”, suffers from endemic issues such as continual fiscal deficits, limited diversification, food insecurity and trade imbalances. These issues

are exacerbated by other factors such as natural disasters, whether biological, as in the case of COVID19; weather-related through hurricanes; and economic, as in the case of global recessions. These ervents have continuously revealed the fragility of SIDS economies. Yet the size of their income levels or productive capabilities would prevent them from obtaining concessional financing. Common indicators such as GDP and World Bank classifications (middle income or high income) are only half the story. If you focus solely on half the problem, you will generate half-baked solutions. Multi-dimensional indicators such as the MVI can show a much fairer and

Contractor chief: Chinese hospital labour likely 90%

low-cost interest rate of 2 percent.

But, while conceding that Chinese labour and contractors are always part of any deal involving Beijing’s money, Mr Sands told this newspaper that the Davis administration must ensure that Bahamian contractor and worker participation in such projects “is at the level where there are some economic benefits to The Bahamas”.

He added that this was especially important given that Bahamian taxpayers will be called upon to finance the 20-year loan’s repayment, and said the implementation of “safeguards” for local involvement is critical given that Chinese-financed projects have not always complied with labour ratios stipulated in Heads of Agreement with the Government.

Mr Sands spoke out following heated House of Assembly exchanges yesterday over the $290m hospital project and, particularly, the likely Chinese labour component. Patricia Deveaux, the House speaker, at one point said she was “striking from the record” a suggestion by Michael Pintard, the Opposition leader, that the construction workforce will be 80 percent Chinese. This figure was rejected by both Prime Minister Philip Davis KC and Michael Darville, minister of health and wellness, although the former ultimately declined to specify what the actual ratio will be. The exchanges were sparked after Mr Davis hit back at the Free National Movement’s (FNM) criticism of plans to build the hospital at a new site rather than expand the Princess Margaret Hospital (PMH) campus.

“The chairman said we should just slap some repairs on what was already there,” Mr Davis said, referring to comments by Dr Duane Sands. “They just wanted to put another expansion on PMH. They implied we don’t have the local talent to ensure the success of the facility.”

This prompted an intervention by Mr Pintard, who appeared to cite a study conducted by the Beck Group, a US architectural and engineering firm headed by Bahamian, Fred Perpall, to plan the redevelopment of the PMH campus.

“He’s seeking to mislead the public, madam speaker. The chairman of the FNM was very clear in what he said,” the Opposition leader retorted. “There was a study conducted by a group that even this Government is utilising for their expertise.

“The resources were allocated to conduct a comprehensive study. That

fuller picture of a country’s economic health.

The incorporation of an MVI into the international financial system also allows for reform of the debt system that primarily prioritises repayments, rather than debt sustainability, for countries, especially those adversely impacted by climate change. Statistics from the European Network on Debt and Development (Eurodad) reveal that, between 2016-2020, SIDS only received $1.5bn in climate finance compared to collectively paying more than $26.6bn to external creditors. A Jubilee year can also be considered for countries at a very high risk of natural disasters, as these events can exponentially increase debt.

study revealed a greenfield development, the brandnew development of a hospital, was not necessary and it could be done on the same site and surrounding areas.

“You could improve it. It is a transformation of the entire medical plant, the infrastructure and ecosystem. His words were misleading to the public. You are quoting someone incorrectly. There was a study conducted and therefore you could have transformed the existing area. You have chosen to go elsewhere. That’s a different story.”

Beck Group’s 141-page report, which has been seen by Tribune Business, called for the demolition of existing buildings, including the PMH warehouse and oncology units, to make wake for the new six-storey tower and a helipad.

Further phased redevelopment called for the demolition of existing clinics and storage and their replacement by a medical/ surgical tower; expansion of surgical services; and other facilities. Beck Group had proposed a five-phase approach that also involved the creation of additional parking and a clinical housing complex according to the plans seen by this newspaper.

Mr Davis responded to Mr Pintard by doubling down on his earlier comments. “I said he [Dr Sands] wanted us to repair what was already there; we should just slap some repairs on what was already there, that what he said. They just want us to put another expansion on PMH.

“They implied we don’t have the local talent to ensure the success of the facility. I said: Why do you keep on under-estimating the Bahamian people man? Obviously we won’t neglect the healthcare infrastructure already in place. We are upgrading PMH, renovating our clinics, building new hospitals in New Providence and Grand Bahama. We’re doing it all at one time, madam speaker, that’s what we’re doing”

Mr Pintard, though, hit back immediately. “The irony of the Prime Minister’s comments that we do not respect or have confidence in local talent,” he said. “Eighty percent of the employees coming to work on the new hospital will be from the Far East. Think about that, Madam Speaker, think about that. That’s not true. We support Bahamian excellence.”

This resulted in an intervention from Dr Darville who, referring to Mr Pintard, said: “The member for Marco City is misleading this honourable House. He made a statement that 80 percent of the workers will be foreign. He should withdraw that statement because it’s incorrect.”

The Opposition leader, though, persisted: “The traditional arrangement, where resources have been borrowed from the Chinese government, the traditional arrangement has

Stemming from colonial and racial bias, risk assessments have historically been heavily skewed to the benefit of more developed nations in the Global North while causing disadvantage to developing countries and stopping them from building a more favourable international standing. An MVI can help level the playing field in risk assessments by boosting investor confidence in SIDS. The index can attract attention from investors and organisations to help SIDS better implement climate adaptation and mitigation strategies through climate financing. International investment in blue and green industries can heighten climate resilience among SIDS. Though an MVI is primarily designed for SIDS

been 80 percent/20 percent Bahamian.

“If this government has a different configuration which it has negotiated they should then indicate they have departed from the traditional arrangement. If you have departed we would applaud that and would love to know what the new arrangement is.”

The House speaker then intervened to say she was “striking from the record the 80 percent”, but Mr Pintard persisted: “That has been the traditional arrangement. I’m asking what is the percentage.”

This prompted Mr Davis to accuse his Opposition counterpart of “grandstanding”.

“In my [Budget] communication and opening this debate, I talk of changing the status quo. That means moving away from tradition. Don’t rely on tradition,” Mr Davis said. Dr Darville could also be heard saying: “We’ll let you know. It’s not 80 percent.” The Prime Minister concluded by asserting: “We’re not going to answer it. It’s not what you say, and we’re not prepared to tell you what it is.”

Mr Sands, though, told Tribune Business that the Chinese labour component is likely higher than that cited in the House exchanges. “I would argue that the ratio will be 90/10,” he said. “I’m convinced about that because of our dealings with China State” Construction and Engineering Corporation and its affiliate, China Construction America (CCA), the latter of which owns the British Colonial and The Pointe.

“At the Pointe, the arrangement proposed was 70/30,” the BCA president said of the project’s labour ratio, “but after investigation it was found to be 95 percent Chinese and only a handful of Bahamian workers for The Pointe’s phase one and two.

“We have no reason to believe it [the new hospital] will be anything other than what we are accustomed to when dealing with China. Unless the Government has some kind of mechanism in place to ensure the ratio of Bahamians to Chinese is monitored daily, there’s no reason to assume abuse will not occur.

“Our position has always been that while we don’t disapprove of the engagement of contractors and workers when the funding is provided by the Chinese state, as we understand it always comes with their labour

and developing countries, it can even serve as a rallying cry for global economic dogma to switch its focus from narrow growth to broader socio-environmentalism. An MVI is a positive step forward in rebuilding the international financial architecture for the better. It can propel SIDS to not be a silent face at the tables of global finance, but an active body that influences policy discourse. As former Jamaican prime minister P.J. Patterson stated at last week’s conference: “Time for talkin’ done, time for acting now”, and it is time for the rest of the international community to follow suit.

component, our recommendation has always been that the Government ensure by contractual terms and management of the process that the level of Bahamian contractor involvement is at least at the level where there’s some economic benefit to The Bahamas.”

Mr Sands, conceding that the BCA cannot tell the Government how to achieve this, argued that ensuring reasonable Bahamian participation on the hospital’s $290m construction is more important in this instance because the project is ultimately being financed by the taxpayer dollars that will repay China ExportImport Bank’s loan.

“I have no doubt that this contract will provide them with a new hospital,” he said. “Our concern as the BCA is to what extent will Bahamian contractors be involved in that development. To that extent, it [the proportion of Chinese labour] should not be a secret.

“The public should be advocating to what extent Bahamian contractors are involved. At the end of the day, repayment of the $290m, even at 2 percent, is being paid by public funds. The point raised should be clearer.

“We are borrowing this money to be repaid with public funds. We demand to know the extent to which Bahamians will be involved with this project. And we demand that, if the contract is breached in any way, it has stiff penalties involving thousands of dollars or termination of the contract,” Mr Sands continued.

“The language of the Government of The Bahamas has to be that we will watch this daily and monitor it, and not tolerate any breach of contract in terms of manpower and contractual obligations. We’d like to know how you will maintain your end of the bargain because you have not done so in the past. We want you to tell us what safeguards will be in place to make us comfortable here.”

Mr Sands said too many administrations, “past and present”, have excluded construction industry professionals from development-related negotiations. He added that this has been “the downfall” of previous administrations, and why “we will suffer the same results”.

“I stand by that,” the BCA president added.

“The last time we had this agreement is was the BCA investigation, from persons on the ground who said the labour ratio is significantly being breached. We implore the Government to do something different this time and engage us so the benefits to Bahamian contractors are accrued across the board in this contract.”

PAGE 2, Tuesday, June 18, 2024 THE TRIBUNE

FROM PAGE B1

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story. Share your news

MICHAEL PINTARD MICHAEL DARVILLE

TOURISM STAGES FIRST-EVER ENTREPRENEURIAL WORKSHOP

THE deputy prime minister encouraged young Bahamians to pursue their business ideas at the Tourism Development Corporation’s (TDC) first ‘Generation Impact’ youth entrepreneurial workshop.

The inaugural event, held at the Andre Rodgers National Baseball Stadium, targeted high school students who over the next 14 weeks will develop business ideas with a tourism industry focus. Upon leaving high school, many of the youngsters will be hired by the tourism industry.

Chester Cooper, who is also minister of tourism,

investments and aviation, said the aim is to guide future generations of young Bahamians towards entrepreneurship and “owning our Bahamas”. He added: “Start where you are, use what you have......that’s all it takes” with the Tourism Development Corporation able to provide access to necessary financing.

Ian Ferguson, the Tourism Development Corporation’s executive director and chief executive, also spoke to the attendees. Photos:Kemuel Stubbs/ BIS

Legacy’s return to the US,” the joint petition said.

joint petition asserted over the $143m.

“FTX Digital Markets was founded in The Bahamas in November 2020, after which time FTX Trading and affiliated entities transferred approximately $143m into FTX Digital Markets’ bank accounts at Farmington State Bank, doing business as ‘Moonstone Bank’, and Silvergate Bank.

“After extensive negotiations, the debtors and FTX Digital Markets have reached an agreement regarding the disposition of the funds held in the FTX Digital Markets accounts.” Referring to the courtapproved settlement that both sides have entered into, the petition added: “FTX Digital Markets is subject to a liquidation proceeding in The Bahamas.

‘“The global settlement agreement also represents the successful outcome of months-long negotiations between the debtors and the joint official liquidators of FTX Digital Markets over commitments to co-ordinate the insolvency proceedings and maximise recoveries for creditors.

“Following the return of these funds, and upon the confirmation of the debtors’ plan of reorganisation, the funds held in these accounts will be distributed to creditors by FTX Digital Markets in accordance with the stipulated property allocation in the global settlement agreement between the debtors and FTX Digital Markets.”

The US Justice Department’s seizure of the $143m from FTX Digital Markets’ US bank accounts initially starved the Bahamian liquidators of much-needed funds to finance their work. However, as part of the two sides’ global settlement

deal, Mr Ray and his team committed to helping recover this money and securing its release from the federal authorities.

FTX’s liquidators, almost exactly one year ago, warned creditors in their second report to the Supreme Court that it was then increasingly likely they would have to battle the US Justice Department in the courts to recover the $143m given that prospects of an amicable resolution had become “more remote”.

Revealing at the time that they had received legal advice concluding there are “grounds to challenge” the federal government’s seizure of the funds, the trio added that they had negotiated “patiently and constructively” with the US Justice Department to secure their return but time to reach a consensual solution was running out and they saw no choice but to initiate litigation to recover such a substantial sum.

Meanwhile, Mr Ray and the Bahamian liquidators, in their June 14, 2024, legal filings are also seeking an order requiring the US Justice Department to hand over to their combined liquidation estate the two planes - a Bombardier Global 5000 and Embraer Legacy - that were acquired with funds belonging to FTX and Alameda Research, the latter being Bankman-Fried’s private trading arm.

“Beginning in early 2022, Bankman-Fried and other senior FTX group employees expressed a desire to acquire private planes, but noted concerns about the potential reaction if their ownership of those planes were publicly known,” the joint petition asserted.

“To obscure the acquisition of the planes, on February 1, 2022, Trans Island Airways, a charter company that had prior

dealings with the FTX group, entered into a letter of intent to purchase the Global for $15.9m at the direction of senior FTX group employees.

“On February 2, 2022, debtor Alameda wired a $500,000 deposit directly to Global’s escrow agent, and on March 3, 2022, Ryan Salame [former head of FTX Digital Markets] caused another $15.4m of Alameda funds to be transferred to the escrow agent to complete the purchase of the Global. The debtors thus paid the entire $15.9m purchase price of the Global,” the legal filings continued.

“In addition, on August 16, 2022, debtor Alameda transferred $11.545m to the Legacy’s escrow agent, representing the entire purchase price of the Legacy. The debtors thus paid a total of $27.445m to purchase the planes.

“In addition to selecting the planes and paying their entire purchase price, the debtors also incurred extensive renovation costs to satisfy the whims of Bankman-Fried and other senior FTX group executives,” the documents added.

“For example, more than $4m in debtor funds were transferred to Paul Aranha, owner of Trans-Island Airways, for purported upgrades to the planes and other related invoices, including nearly $1.3m for Wi-Fi upgrades, approximately $900,000 for interior renovations and ‘aircraft bed systems’, and $975 for ‘board game purchases for SBF for airplane’.”

Both planes are presently in the custody of US authorities waiting to be auctioned off with the proceeds to be used to compensate FTX victims. “The debtors and the [US] government spent many months negotiating with Aranha to secure the

“As part of a resolution designed to avoid further expense and to maximise value for the debtors’ creditors and Bankman-Fried’s victims, the debtors and the government agreed to a stipulation and order whereby Aranha would return the Legacy to the US and consent to an interlocutory sale of the planes in exchange for being reimbursed for certain out-of-pocket expenses associated with maintaining the planes post-petition and returning the Legacy to the US.” The plane’s return has already happened.

“Amending the preliminary forfeiture order to provide for the return of the specific property to the debtors and/or FTX Digital Markets will benefit all the creditors and stakeholders in the Debtors’ Chapter 11 bankruptcy proceedings and FTX Digital Markets’ liquidation in The Bahamas,” Mr Ray and the Bahamian liquidators argued.

“With respect to the accounts identified, the debtors and/or FTX Digital Markets have a superior interest to Bankman-Fried.

The Preliminary forfeiture order should be amended to exclude each of these categories of specific property and to provide for their return to the debtors and/ or FTX Digital Markets to allow them to be distributed for the benefit of the debtors’ creditors and Bankman-Fried’s victims pursuant to the Debtors’ plan of reorganisation.”

However, Mr Ray and the Bahamian liquidators face competition from former FTX clients who have an ongoing class action lawsuit in the south Florida district court that has named Deltec Bank & Trust and its chairman, Jean Chalopin, among the defendants. Both have denied any wrongdoing in relation to FTX and the claims against them.

Meanwhile, Bahamian liquidators have informed FTX victims that they are in line to recover more than the value of their assets/ investments should Mr Ray’s Chapter 11 reorganisation plan be approved by the Delaware courts on June 25.

“Customers of FTX.com or ‘FTX International’ are entitled to claim in either The Bahamas process or the US Process (the Chapter 11 bankruptcy of FTX Trading and its debtor

affiliates),” they wrote on June 12, 2024.

“In either process, customers can expect to receive the same distribution at broadly the same time. At this stage, subject to the approval of the Chapter 11 plan, customers are anticipated to receive between 119-143 cents on the dollar.

“For those customers who submitted a proof of debt claim in the Bahamas process we will shortly be writing to you to confirm that you wish to continue to have your claim administered, processed adjudicated and settled in The Bahamas.

“For those customers who have not yet submitted a proof of debt claim in The Bahamas process, you will be able to do so up to the claim bar date, currently anticipated to be mid-August 2024.”

THE TRIBUNE Tuesday, June 18, 2024, PAGE 3

‘GIVE FTX’S $143M BACK TO BAHAMAS!’ FROM PAGE B1 CAREER OPPORTUNITY Established restaurant require the services of a Assistant Cook to work 40 hours shift per week at a designated restaurant. Interested persons please send resume to rah@sbarrobahamas.com

BENCHMARK AVOIDS QUALIFIED AUDIT OPINION FOR THIRD YEAR

net of provision in the consolidated statement of financial position at December 31, 2022.

“We were unable to obtain sufficient appropriate audit evidence to reconcile this amount to the underlying accounts, specifically the subsidiary ledger. The unreconciled difference between the consolidated statement of financial position and the subsidiary ledger amounted to $91.549.”

These findings matched almost exactly those detailed in Benchmark (Bahamas) 2021 “qualified” audit opinion on the same topic, albeit the numbers were different. The “due from customers balance” referred to in the 2021 results was much

higher at $18.44m, while the “unreconciled difference” was more than three times’ larger at $337,369.

However, Ms Lockhart in the 2023 annual financials signed-off on June 3, 2024, confirmed that Benchmark Bahamas has put these woes behind it. The company generated a 442 percent increase in net comprehensive income compared to the $378,0790 profit generated for the 12 months to end-December 2022 despite a more than eight-fold jump in operating losses to $948,251. That compared to just a $98,484 operating loss the prior year. Benchmark’s 2023 profits, though, were driven by a $2m unrealised gain on the value of the securities in its investment portfolio, compared to just a $177,46 increase in 2022,

as well as a $761,779 gain on the value of its investment property holdings.

Besides its Carmichael and Old Fire Trail Road property, where Bank of The Bahamas is the ‘anchor’ tenant, Mr Brown disclosed that Benchmark had benefited from the full inclusion for the first time of other real estate investments.

“We have some other investments that are now closed so their valuation comes into the portfolio,” he explained. “Part and parcel of our real estate portfolio. We have an investment at GoldWynn and an investment at Perpall Tract, so with those investments you can calculate them at their full market value.

“They are now being reported at their full market

value. We don’t take them

100 percent until they’re fully paid. We have a unit at GoldWynn, and a unit at Villanova at Perpall Tract. Both of them are doing quite well.”

Mr Brown said the Carmichael and Old Fire Trail Road commercial complex is presently around 85 percent leased. “We have two units left on the upper floor, but the rest of the building is fully leased,” he added. “We’re always looking for opportunities in real estate because it is one of the stable and growth areas of the business. If we see something there we will certainly consider the opportunity.”

The Benchmark chief said shareholders and investors should not read too much into the fact its balance sheet showed it had

PM: WE WILL NOT KEEP YOU ‘IN DARK’ ON ENERGY REFORM

respects, and details of those negotiations would be disclosed when finalised. And I can assure you that as soon as the ink is dry on those agreements, the details will be shared with the Bahamian people.”

Most Bahamians and observers would agree that reform at BPL and in the wider energy sector has been needed for almost two decades, dating back to at least 2006-2007, and Mr Davis yesterday asserted that this cannot be postponed any longer otherwise the country’s state-owned power provider and energy grid will be at the point of collapse.

“BPL has needed major reforms for many years. Much of the existing infrastructure and machinery have needed to be replaced and modernised for

decades. At this point, we are facing the prospect of an energy crisis as crucial parts of our aging power grid are in danger of collapse, which would literally leave us in the dark,” the Prime Minister argued. “Let’s be honest. There’s a reason that governments have kicked the can down the road, hoping and praying that band-aids and patches could hold our electricity grid together, declining to do the hard and challenging work of comprehensive reform. Fixing BPL ain’t for the faint of heart, and no one says it’s going to happen overnight. But it’s happening – finally.” Mr Davis said the $1bn required to fix BPL, with $500m needed to cover its legacy debt and a further half a billion dollars to fund necessary capital infrastructure upgrades, is three times’ greater than

the Government’s $344.5m capital spending Budget for the 2024-2025 fiscal year.

“To put that in perspective, our entire capital expenditure budget for this upcoming fiscal year, which is spread across all ministries, would not even make up one third of the amount needed just for BPL,” he added. “The entire capital expenditure budget, that is only one-third of what is required for BPL.” Hence the need to attract private sector partners who can access the financing required.

“So we had three paths to choose from,” Mr Davis said. “The first option was to continue business as usual. To continue, in other words, with the status quo — using patchwork fixes as things break, and pray that nothing major goes down. With this option, we would continue burning dirty,

expensive fuels that pollute our air, make climate change worse, and making electricity bills more expensive.

“The status quo path would also mean continuing to let debts rise, and leaving BPL’s finances in disarray, threatening employee pensions and preventing the company from rolling out real solutions.

“This might – and I emphasize might – because we must remember the real possibility of catastrophe; this might have cost us less in the shorter term, but that’s the way only shortterm thinkers think. Not the way people who actually understand the true risks and consequences of the status quo think,” the Prime Minister continued.

“The second option was to pay the full bill for modernisation and upgrades

PM: Tax dodging elite’s era is over

investment (FDI) in the real estate sector, Mr Davis said: “We all remember how just one letter from a private community when the FNM was in office got them to alter the planned real property tax rate on multi-million dollar homes.

“That tactic may have worked before, but it won’t work with this administration. We are building a foundation for a more

inclusive and fair society where everyone truly pays their fair share.”

Mr Davis also hit out at the Free National Movement (FNM) for opposing his administration’s bid to achieve change in Freeport and at the Grand Bahama Port Authority (GBPA), having demanded that the latter reimburse it for public spending incurred over and above tax revenues

Pursuant to the provisions of Section 138 (8) of the International Business Companies Act (as amended), NOTICE is hereby given that Distracta Variacta Investments Ltd. has been dissolved and has been struck from the Register with effect from 12th April, 2024.

Ian Atkins and Juliana Glinton LIQUIDATORS

c/o EFG Bank & Trust (Bahamas) Ltd Goodman’s Bay Corporate Centre, 3rd Floor, West Bay Street and Sea View Drive P.O. Box CB 10956 Nassau, Bahamas

generated by the city during the period 2018-2022.

Also seeking to place all the blame on Freeport’s quasi-governmental authority for the island’s economic struggles, he said: “Our fight for prosperity on Grand Bahama will continue with our efforts to completely revamp the arrangement with the Grand Bahama Port Authority, which has stymied growth on the island for decades.

“I caution the members opposite to keep in mind that the people of Grand Bahama will remember who stood with them for a better Grand Bahama, and the people will also remember who served as water boys, carrying water for the Port Authority.

zero cash at the bank when 2023 closed. Pointing out that this figure had been between $10m-$13m just three years ago, he added that the drop-off reflected increased client trading activity and money movements. As a broker, Mr Brown said not all assets belonged to the company. The financials also reveal that Benchmark’s largest shareholder, Braun & Cie, which holds 47.1 percent and is owned by Mr Brown and his family, last year advanced a $100,000 short-term loan to the BISX-listed entity “to assist with its cash flow”. The loan carries no interest and is repayable by September 30, 2024. “We advanced a small loan from Braun & Cie because we didn’t sell any of the assets in the

ourselves. No private partners, just putting the expense on the backs of the Bahamian public. This would require us to add $500m in debt on top of the $500m in legacy debt.

“It would take many years for these changes to be rolled out, which means that it would be years before bills could be lowered and the power grid could be strengthened and expanded to prevent failures and make load shedding a thing of the past,” he added.

“Even after all the reforms and upgrades were in place, the $1bn in debt we’d incur would limit the amount we could decrease electricity bills by because, ultimately, BPL would have to generate the money to pay that $1bn back. Taking this option would come at the cost of delaying energy reforms, holding back our economic growth and putting an even bigger bill on the Bahamian people.

portfolio,” Mr Brown said.

“We didn’t want to liquidate any of the assets in the investment portfolio so we did a short-term loan. It was an investment that we made just to augment other investments the company was making. We didn’t want to sell any of the securities in the portfolio, so we made a short-term loan.

“Our portfolio has grown quite nicely since we became public. The overall business, the company’s asset base, has grown and we intend to keep doing that and adding value. We were only a $4m company, and now we’re a $17m company, so over the years I think we have done quite well.”

As a result, Mr Davis said his administration has opted for comprehensive energy reform through partnership. “The decisions we made to select our energy partners are based on the recognised need for urgency. Our power grid doesn’t have years to wait for our resources to catch up with our needs,” he added.

“We partnered with a wide range of local solar providers to ensure that solar solutions could be fine tuned for each island and implemented simultaneously. The selections were made based on a full RFP process that included competitive bidding and objective standards for selection. In cases where we used alternative procurement processes, such as single sourcing, the appropriate official justifications and selection channels were used.”

“Fearmongering to try to make Grand Bahamians afraid to challenge the status quo won’t work this time. Those scare tactics are falling on deaf ears as the vast majority of people on the island are hungry for change. And, while we’re on the topic, let’s stop pretending that pushing for improvement is somehow bad for the investment climate,” the Prime Minister continued.

“The way Grand Bahama’s economy is set up right now, investors are eagerly anticipating the changes at the Port Authority, too. So, I encourage the side opposite to stand on the side of change, or be remembered as the enemies of progress. Be remembered as the water boys who were on the wrong side of history.

“Because we will not stop pushing for progress on Grand Bahama until the Port Authority does right by the people and all parties can come to an agreement on a solution that serves the best interests of Grand Bahamians.”

Notice is hereby given that in accordance with Section 138(4) of the International Business Companies Act 2000, the above-named Company is in dissolution, which commenced on the 6th day of June, A.D., 2024. The Liquidator is Galnom Ltd., CUB Financial Center, Western Road, Nassau, Bahamas.

Mr Davis also acknowledged that the Government “can’t take on the cost of living and the cost of doing business in The Bahamas without taking on the cost of electricity.

“The impact of our innovative energy reforms will be felt across our islands,” he promised. These energy reforms are central to our efforts to build an economy that is more competitive, more prosperous, more dynamic, and more inclusive, with more paths to security and success for more Bahamians........

“Local small businesses that pay thousands in electrical costs each month may not be able to keep their doors open waiting for a long and slow solution that will only bring about noticeable results years from now.

“In every conversation I have with Bahamian entrepreneurs of every size – from the small corner stores to large corporate enterprises – the consensus is clear: The high cost of electricity is a barrier to starting a business and makes it difficult to generate profits and keep their doors open. We talk a lot about the need to improve the ease of doing business,” the Prime Minister added.

“Well, the cost of electricity and the reliability of the power supply are two of the main inputs considered when countries want to make doing business easier. When we lower the cost and improve the reliability of our power supply, we give Bahamian business owners a better chance at thriving. These businesses are the lifeblood of our economy.

“It is in our best interest to give them every chance at success possible as our policies bring about unprecedented growth within a new Bahamian economy.”

PAGE 4, Tuesday, June 18, 2024 THE TRIBUNE

PAGE B1

FROM

FROM PAGE B1

FROM PAGE B1

PHILIP DAVIS KC

NOTICE

LEGAL NOTICE

GALNOM LTD. Liquidator N O T I C E BARRES COMPANY LIMITED (Voluntary Liquidation)

New Jersey power broker is charged with racketeering in waterfront redevelopment case

By MIKE CATALINI Associated Press

NEW Jersey Democratic power broker George E. Norcross III was charged Monday with operating a racketeering enterprise, threatening people whose properties he sought to take over, and orchestrating tax incentive legislation to benefit organizations he controlled.

Norcross, seated in the front row during a news conference by Attorney General Matt Platkin, angrily denounced the charges, later calling Platkin a "coward" and demanding a speedy trial.

The charges against the 68-year-old Norcross and five others come as New Jersey is already under a political and legal microscope, with Democratic U.S. Sen. Bob Menendez on trial in New York on federal corruption charges. Platkin, also a Democrat, cast the charges as law enforcement cracking down on wrongdoing.

"When we say no one is above the law, we mean it and we will continue to hold accountable anyone who puts their interest above the public interest, no matter how powerful they may be," Platkin said.

In a 111-page indictment unsealed on Monday, the attorney general alleges a scheme reaching back to 2012 in which the defendants — called the "Norcross

Enterprise" in the indictment — used his political influence to craft legislation that served their own interests.

Among the allegations against Norcross are charges that he threatened a developer who would not relinquish his rights to waterfront property in Camden, New Jersey, on Norcross' terms. The indictment cites a profanity-laden phone recording of Norcross in which he tells the developer he will face "enormous consequences."

The person asks if Norcross is threatening him, according to the indictment. "Absolutely," Norcross replies.

The indictment also said Norcross and the codefendants extorted and coerced businesses with property rights on Camden's waterfront and obtained tax incentive credits, which they then sold for millions of dollars. Platkin

described Camden as long suffering from economic decline.

Defense lawyer Michael Critchley accused Platkin of having a "vendetta" against Norcross, noting that the waterfront development had been investigated for years by several agencies, including federal prosecutors in Philadelphia and New Jersey, as well as Platkin's predecessor.

"And every agency that looked at this matter for the past seven years … came up with nothing," he said at a news conference.

Norcross, the executive chairman of the insurance firm Connor Strong & Buckelew, had been widely viewed as among the most influential unelected Democrats in the state.

He was a Democratic National Committee member until 2021 and previously served as the head of the Camden County Democratic Party. A close

Judge orders railway to pay Washington tribe nearly $400 million for trespassing with oil trains

By GENE JOHNSON Associated Press

BNSF Railway must pay nearly $400 million to a Native American tribe in Washington state, a federal judge ordered Monday after finding that the company intentionally trespassed when it repeatedly ran 100-car trains carrying crude oil across the tribe's reservation.

U.S. District Judge Robert Lasnik initially ruled last year that the railway deliberately violated the terms of a 1991 easement with the Swinomish Tribe north of Seattle that allows trains to carry no more than 25 cars per day. The judge held a trial earlier this month to determine how much in profits BNSF made through trespassing from 2012 to 2021 and how much it should be required to disgorge.

"We know that this is a large amount of money. But that just reflects the enormous wrongful profits that BNSF gained by using the Tribe's land day after day, week after week, year after year over our objections," Steve Edwards, chairman of the Swinomish Indian Tribal Community, said in a statement. "When there are these kinds of profits to be gained, the only way to deter future wrongdoing is to do exactly what the Court did today — make the trespasser give up the money it gained by trespassing."

The company based in Fort Worth, Texas, said in an email it had no comment.

The tribe, which has about 1,400 members, sued in 2015 after BNSF dramatically increased, without the tribe's consent, the number of cars it was running across the reservation so that it could ship crude oil from the Bakken Formation in and around North Dakota to a nearby refinery. The route crosses sensitive marine ecosystems along the coast, over water that connects with the Salish Sea, where the tribe has treaty-protected rights to fish. Bakken oil is easier to refine into the fuels sold at the gas pump and ignites more easily. After train cars carrying Bakken crude oil exploded in Alabama, North Dakota and Quebec, a federal agency warned in 2014 that the oil has a higher degree of volatility than other crudes in the U.S. Last year, two BNSF engines derailed on

Swinomish land, leaking an estimated 3,100 gallons (11,700 liters) of diesel fuel near Padilla Bay. The tribe pointed out that a corporate predecessor of BNSF laid the tracks in the late 19th century over its objections. The tribe sued in the 1970s, alleging decades of trespassing, and only in 1991 was that litigation settled, when the tribe granted an easement allowing limited use of the tracks. The easement limited rail

traffic to one train of 25 cars per day in each direction. It required BNSF to tell the tribe about the "nature and identity of all cargo" transported across the reservation, and it said the tribe would not arbitrarily withhold permission to increase the number of trains or cars.

The tribe learned through a 2011 Skagit County planning document that a nearby refinery would start receiving crude oil trains.

CAREER OPPORTUNITY

Established restaurant require the services of a Handy man to work 40 hours shift per week at a designated restaurant. Interested persons please send resume to rah@sbarrobahamas.com

NOTICE

IN THE ESTATE of ALTHEA LEONA FARRINGTON late of #3 Frangipani Avenue, Garden Hills Number Two of the Southern District of the Island of New Providence, one of the Islands of The Commonwealth of The Bahamas, deceased.

Notice is hereby given that all persons having any claim or demands against the above named Estate are required to send their names, addresses and particulars of the same duly certified in writing to the undersigned on or before the 8th day of July A.D., 2024, and if required, prove such debts or claims, or in default be excluded from any distribution; after the above date the assets will be distributed having regard only to the proved debts or claims of which the Executors shall then have had Notice.

And Notice is hereby given that all persons indebted to the said Estate are requested to make full settlement on or before the aforementioned date.

MICHAEL A. DEAN & CO., Attorneys for the Executors

Alvernia Court, 49A Dowdeswell Street P.O. Box N-3114 Nassau, The Bahamas

COOPER University Hospital board chairman George Norcross III listens in Camden, N.J., May 15, 2012, during a groundbreaking ceremony for the Cooper Cancer Institute. New Jersey’s attorney general has charged the influential Democratic power broker Norcross with racketeering and other charges in connection with government issued tax credits, according to an indictment unsealed Monday, June 17, 2024.

friend to the former state Senate president, he was a behind-the-scenes power player and well-known financial backer to Democrats in the state and nationwide.

Norcross, a resident of Palm Beach, Florida, once listed as a member of Donald Trump's Mara-Lago club, cast the prosecution as politically motivated. He said Platkin blamed southern New Jersey Democrats for fallout from allegations that a staff member on Democratic Gov. Phil Murphy's 2017 gubernatorial campaign had been sexually assaulted. It wasn't immediately clear what that fallout was. Platkin was Murphy's general counsel when the Legislature investigated the allegations.

"I want Matt Platkin to come down here and try this case himself, because he's a coward, because he has forced people in this building to implement his will," Norcross said Monday outside the attorney general's office.

Photo:Mel Evans/AP

Norcross explained why he appeared at the news conference.

"I want to witness an extraordinary embarrassment and outrageous conduct from a government official who stands up there and tries to act like he's holier than thou," Norcross said.

In addition to Norcross, the defendants are: his brother Philip A. Norcross, 61, of Philadelphia, a New Jersey lawyer; George Norcross's longtime lawyer William M. Tambussi, 61, of Brigantine, New Jersey; Camden Community Partnership chief executive and former Camden Mayor Dana L. Redd, 56, of Sicklerville, New Jersey; Sidney R. Brown, 67, of Philadelphia, chief executive of trucking and logistics company NFI; and development company executive John J. O'Donnell, 61, of Newtown, Pennsylvania.

An attorney representing Philip Norcross called him a stellar lawyer with an "unblemished reputation."

"The notion that he would be charged with

crimes is simply outrageous," Kevin Marino told The Associated Press. Marino declined to address specific allegations in the indictment.

Philip Norcross, the attorney, and U.S. Rep Donald Norcross, are all brothers of George.

U.S. Rep. Donald Norcross said in a statement that he looks forward to his brothers telling their side of the story.

"I love my brothers," he said in a statement.

"I believe in the rule of law, and they will have the opportunity to defend themselves during their day in court.

Henry Klingeman, Redd's attorney, said she was surprised by the charges.

"She's done nothing wrong," Klingeman said.

"What she has done is serve the Camden community in public and not-for-profit roles for more than three decades. She has cooperated fully with the grand jury investigation for over a year and is unaware of evidence of wrongdoing by her or others."

Messages seeking comment were left with a lawyer for Tambussi.

Brown and O'Donnell had no attorneys yet, according to the attorney general's office.

THE TRIBUNE Tuesday, June 18, 2024, PAGE 5

Wall Street rises to more records as big tech stocks keep climbing

By STAN CHOE AP Business Writer

U.S. stocks rose to records Monday as gains for technology companies keep pushing the market higher.

The S&P 500 climbed 0.8% to top its all-time high set on Thursday. The Dow Jones Industrial Average gained 188 points, or 0.5%, while the Nasdaq composite added 1% to its own record.

Autodesk jumped 6.5% for one of the market's biggest gains after an investment firm said it will try to delay the software company's annual meeting so it can nominate new directors for the board.

Starboard Value also outlined how it says Autodesk hasn't performed as well financially as it should have. In response, Autodesk said it will review Starboard's suggestions but added that it has "a clear strategy that is working."

Close behind Autodesk was chip company Broadcom, which rose 5.4% to add to gains from last week after it reported better profit than expected and said it would undergo a

10-for-one stock split to make its price more affordable. Broadcom followed Nvidia, the company that's become the poster child of Wall Street's frenzy around artificial-intelligence technology and just executed a similar split.

Broadcom was one of the strongest forces pushing the S&P 500 upward, along with a 2% rise for

Apple and 1.2% climb for Microsoft.

Continued momentum for Big Tech stocks, along with easing pressure on inflation, has investors "cheering the 'glass half full' outlook" instead of focusing on the struggles of lower- and middle-income Americans and other challenges, according to Anthony Saglimbene,

chief market strategist at Ameriprise.

Super Micro Computer, which sells server and storage systems used in artificial intelligence and other computing, leaped 5.1% to bring its gain for the year so far to a staggering 212.2%. It's also part of the supernova around AI that's been overshadowing almost everything else on Wall Street.

Federal appellate panel sends Michigan pipeline challenge to state court

PUBLIC NOTICE

INTENT TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, SONOVIA BODIE of Market Street Nassau, Bahamas, Parent of JADEN ALEXANDER BODIE A minor intend to change my child’s name to JADEN ALEXANDER If there are any objections to this change of name by Deed Poll, you may write such objections to the Deputy Chief Passport Officer, P.O. Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice.

By TODD RICHMOND Associated Press

Michigan Attorney General Dana Nessel's lawsuit seeking to shut down part of a petroleum pipeline that runs beneath the Straits of Mackinac belongs in state court, a federal appellate panel ruled Monday. The pipeline's operator, Enbridge Inc., moved the case from state court

to federal court more than two years past the deadline for changing jurisdictions. A three-judge panel from the 6th U.S. Circuit Court of Appeals found Enbridge clearly missed the deadline and ordered the case remanded to state court.

Nessel filed the lawsuit in June 2019 seeking to void a 1953 easement that enables Enbridge to operate a 4.5-mile (6.4-kilometer)

2024, as markets recovered from shocks of recent elections across the region.

The gains for tech helped offset pressure on the stock market caused by rising Treasury yields in the bond market. The climb in yields erased some of the slack created last week when better-than-expected reports on inflation raised hopes that the Federal Reserve will cut interest rates later this year.

This upcoming week has few top-tier economic reports for the United States, outside of Tuesday's update on how much customers are spending at U.S. retailers and Friday's preliminary look at the state of U.S. business activity. Markets will also be closed Wednesday for the Juneteenth holiday.

The Fed is trying to hold rates high for long enough to slow the economy and snuff out high inflation, but it wants to cut rates and reverse the momentum before the slowdown evolves into a painful recession.

High interest rates hurt all kinds of investments, and they tend to hit some areas particularly hard. Utilities in the S&P 500 fell 1.1% for Monday's largest loss among the 11 sectors that make up the index. They often get hurt when bonds are paying more in interest and drawing away income-seeking investors who would otherwise gravitate to dividend-paying utility stocks.

GameStop was another laggard and fell 12.1% following its annual shareholder meeting. The stock has been soaring and sinking as it rides waves of enthusiasm by smallerpocketed investors.

A report on Monday said manufacturing in New York state is still contracting, though not by as much as economists expected. Manufacturing has been one of the areas hardest hit by the Federal Reserve's zeal to keep its main interest rate at the highest level in more than two decades.

section of Line 5 beneath the straits, which link Lake Michigan and Lake Huron.

Concerns over the section rupturing and causing a catastrophic spill have been growing since 2017, when Enbridge engineers revealed they had known about gaps in the section's protective coating since 2014. A boat anchor damaged the section in 2018, intensifying fears of a spill.

The attorney general won a restraining order from a state judge in June 2020, although Enbridge was allowed to restart operations after complying with safety requirements. The energy company moved the lawsuit into federal court in December 2021.

Nessel argued to the 6th U.S. Circuit panel that the

lawsuit belongs in state court. During oral arguments before the panel in Cincinnati in March, her attorneys insisted the case invokes the public trust doctrine, a concept in state law in which natural resources belong to the public, as well as the Michigan Environmental Protection Act. Enbridge attorneys countered the case should stay in federal court because it affects trade between the U.S. and Canada. Line 5 moves petroleum products from northwestern Wisconsin through Michigan into Ontario.

The judges — Richard Griffin, Amul Thapor and John Nalbandian — did not address the merits of the case.

NOTICE

NOTICE is hereby given that NAENDA GESTIN of Dundas Town, Abaco, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas and that any person who knows any reason whyregistration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 18th day of June, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that ENARSHA TILME of Buttonwood Avenue, Nassau, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 18th day of June, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE

NOTICE is hereby given that EMILIENNE McKENZIE of #80 Wulff Road, Nassau, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 18th day of June, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

PAGE 6, Tuesday, June 18, 2024 THE TRIBUNE

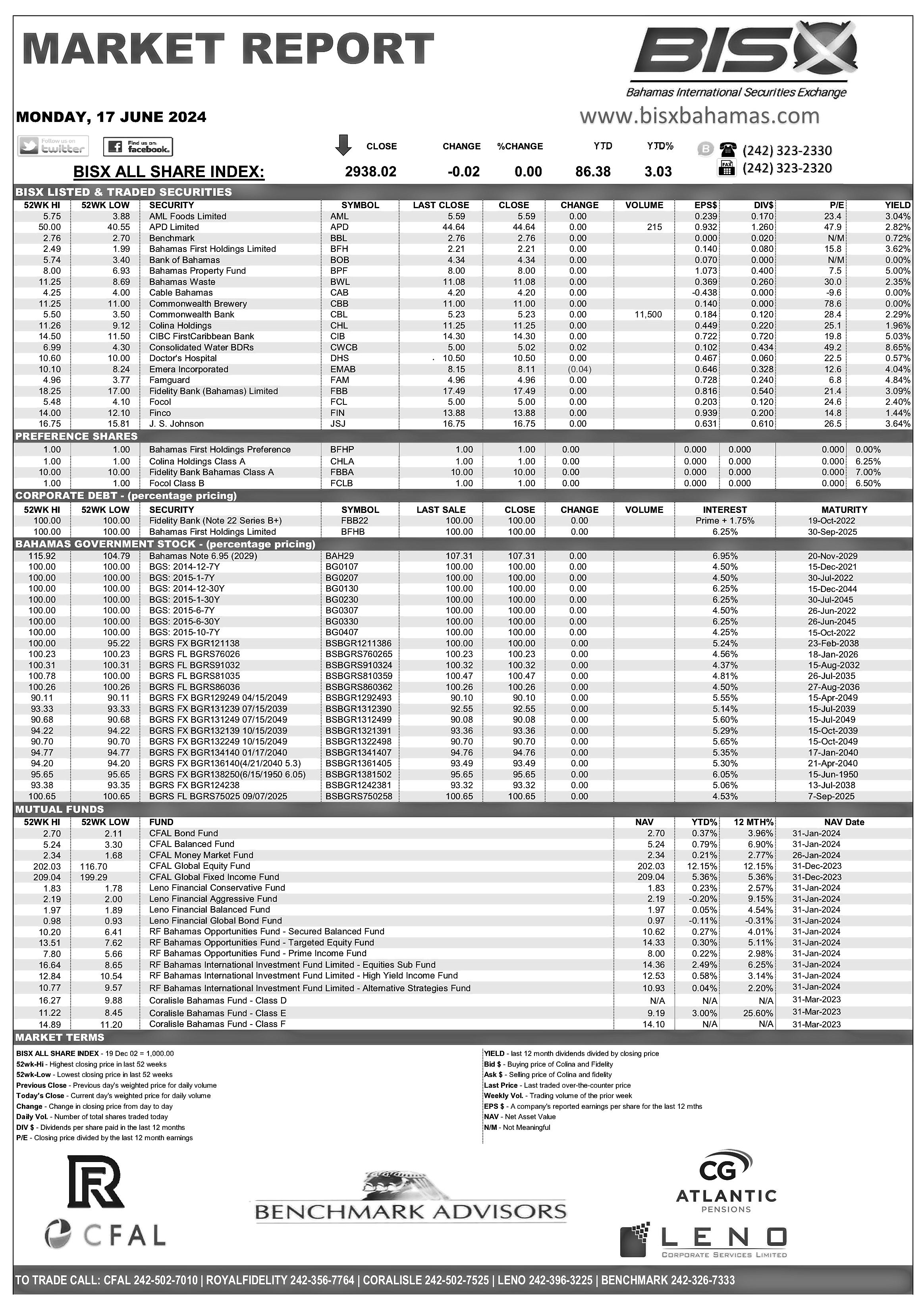

STOCK MARKET TODAY

TRADER WILLIAM LOVESICK, right works on the floor of the New York Stock Exchange, June 12, 2024. Shares have opened mixed in Europe on Monday, June 17,

Photo:Richard Drew/AP

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net