THURSDAY, OCTOBER 17, 2024

Resorts World forecasts ‘never close in 15 years’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

RESORTS World Bimini’s financial performance has “never been close” to budget projections in 15 years, its minority owner is complaining, as the property suffers under an annual $57m debt servicing burden.

The financial plight of Bimini’s major hotel was the focus of Board discussions on March 12, 2024, as representatives of RAV Bahamas, the vehicle created by Miami-based developer Gerardo Capo, demanded to know whether Robert DeSalvio, Genting Americas’ president, had “ever encountered these kinds of financial numbers” during his 40-year career in the hotel industry.

Mr DeSalvio stayed silent.

The Board meeting minutes, filed with the south Florida federal court to support RAV Bahamas’ claim for $600m in damages against its Genting partner, also reveal plans to terminate Hilton as the brand/flag partner for the 305-room resort and the minority owner’s suspicions that

the Asian conglomerate is preparing to sell and exit the property.

Genting, in a statement to the Malaysian stock exchange that appeared to have been forced by this newspaper’s revelation of its Bahamian legal battle, earlier this week slammed RAV Bahamas’ lawsuit as

“baseless and totally without merit” while pledging that it will “vigorously defend” itself against allegations that it perpetrated a “massive and co-ordinated fraud” on its minority partner.

The document trail, though, reveals that the two sides’ relationship has been steadily deteriorating for some years prior to the recent spectacular breakdown that culminated in the Florida lawsuit. An “emergency shareholder” meeting called in March 2020, immediately prior to the COVID pandemic, saw RAV Bahamas blame Genting for multiple “one-star” guest reviews that had caused real estate sales to totally dry up. Similar claims had earlier been aired at a Board meeting for Resorts World Bimini’s immediate holding company, BB Entertainment, that very same day - March 3. “There was a discussion about the amount of negative online reviews of the hotel and the condition of the property,” the meeting minutes state. “It was commented that the reviews from

CLICO failure exposes need to ‘better protect small man’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Bahamas must “better protect the small man” from unscrupulous companies, a prominent cleric urged yesterday, as CLICO victims receive the latest payouts on their surrendered or in-force life insurance policies.

Bishop Simeon Hall, who was himself a client when the insolvent insurer collapsed more than 15-and-a-half years ago, told Tribune Business the suffering inflicted upon thousands of Bahamians who suddenly lost access to their life savings, investments and retirement

income exposed the lack of safeguards for “the most vulnerable” in society.

Asserting that he “really hopes” The Bahamas has learnt the necessary lessons

Companies hail ‘big leap’ on business ease tax promises

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

BAHAMIAN companies yesterday hailed “a big leap” forward if the Government delivers on its pledge to enact ease of business-friendly incentives alongside corporate income tax reforms.

Ben Albury, the Bahamas Motor Dealers Association’s (BMDA) president, told Tribune Business that this country’s ease of doing business remains “the elephant in the room” hindering growth and job creation after Chester Cooper, deputy prime minister, said the Government is working on legislation to help address this.

“I think we all agree that the ease of doing a lot of things here is challenging,” the BMDA chief said. “Business is definitely difficult, there’s a lot of hoops to jump through and a lot to navigate, and I’m sure a lot of young people coming into it get discouraged and frustrated dealing with it.

“We all know it’s the elephant in the room. We’ve always in The Bahamas been rated as challenged when it comes to the ease of doing business. I’m hoping that whatever is being proposed has some teeth and does what it’s stated to do because it’s difficult.

“I feel I almost have to be an attorney, a compliance

Corporate taxation Bill causes Freeport fears

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Attorney General yesterday confirmed that the 15 percent corporate income tax “will apply” in Freeport amid fears it may conflict with the city’s founding treaty and other laws. Ryan Pinder KC, in messaged replies to Tribune Business inquiries, confirmed the Domestic Minimum Top-Up Tax Bill 2024 that was laid in the House of Assembly yesterday will be imposed

on Grand Bahama Port Authority (GBPA) licensees who are part of corporate groups generating more than 750m euros in annual turnover. The Bill itself, using language similar to the recently-enacted Electricity Act, specifically states its provisions apply to the Port Area even though the Hawksbill Creek Agreement, Freeport’s founding treaty, exempts GBPA licensees from paying any form of income tax.

EMBRACE ETHICS AND AVOID CORPORATE PERIL

In today’s rapidlyevolving regulatory environment, governance, risk and compliance (GRC) play a critical role in shaping operational integrity, especially in industries such as telecommunications and banking. Given their reliance on data, trust and global interconnection, these sectors face unique ethical dilemmas.

As this writer prepares to address the topic, ‘Ethical leadership and governance’, at the annual conference staged by the Institute of Internal Auditors’ Bahamas Chapter, this article examines three key challenges: Accountability, integrity and leadership, providing insights into how management executives and corporate leaders can navigate them.

Accountability in Governance

Accountability is essential in governance, risk and compliance. But when the lines blur, what happens? This is a common ethical dilemma, especially in multinational financial institutions and large telecommunications providers. Accountability is often displaced when reporting structures are unclear or internal controls are inadequate. According to a study by the Chartered Institute for Securities & Investment (CISI), lack of accountability is a primary factor in major financial collapses. And the New York Times reported in March 2021: “Credit Suisse suffered humiliation and shareholder wrath this year when it lost $5.5bn from the collapse of the Archegos Capital Management investment fund”. Integrity in Risk Management Risk management relies on integrity. However,

maintaining it in the face of commercial pressures, especially in high-stakes sectors such as telecommunications and finance, presents a substantial ethical dilemma. Compliance officers often find themselves balancing the demands of regulatory requirements against the drive for profitability, which can result in risky behaviour.

A notable example is the 2020 case involving Deutsche Telekom, which faced scrutiny over data privacy concerns. The telecommunications giant was accused of prioritising commercial interests over customer privacy, raising questions about the integrity of its risk management practices. Ethical risk management is not just about adhering to regulations but also ensuring that business decisions are made transparently and with a commitment to fairness.

In The Compliance Blueprint, this writer wrote:

“True integrity is not tested when everything is running smoothly; it’s in moments of conflict between profitability and ethical practice, where the strength of a company’s governance, risk and compliance framework is truly revealed.” Leaders in governance, risk and compliance roles must be vigilant, ensuring that integrity is non-negotiable even when it may hinder shortterm gains.

Leadership’s Role in Ethical Governance

Corporate leadership plays a pivotal role in establishing and upholding ethical standards in governance. Management executives, especially in sectors such as banking, where public trust is fragile, are under constant scrutiny. A significant ethical dilemma arises when leaders either fail to model ethical behaviour or are themselves embroiled in unethical practices.

Strong leadership requires more than just technical knowledge; it requires a deep commitment to ethical practices. Effective leaders

foster a culture where compliance is not seen as an obstacle but as an integral part of business strategy. Leadership in governance, risk and compliance is about setting the tone from the top. A company’s ethical foundation crumbles when leadership fails to demonstrate consistent, transparent behaviour.

Conclusion

The telecommunications and banking sectors must continuously navigate ethical dilemmas in governance, risk and compliance. Top executives and corporate leadership are critical in ensuring that accountability, integrity and strong ethical leadership are not just buzzwords but foundational elements of their company’s governance, risk and compliance frameworks.

A culture where ethical practices are woven into decision-making can protect companies from both financial and reputational damage by addressing ethical dilemmas. Sustainable, long-term success depends on leaders embracing this responsibility.

DEREK SMITH BY

Jr a governance, risk, and compliance professional for more than 20 years with leadership, innovation, and the author of ‘The Compliis a Certified Anti-Money

Vice President, Compliance and MLRO for CG Atlantic’s family of companies (member of Coralisle Group Vincent & The Grenadines,

Bahamas targeting 20 air connectivity agreements

THE Bahamas is aiming to boost tourism and airlift connectivity by signing air services agreements with up to 20 countries at an international conference next week.

Chester Cooper, deputy prime minister and minister of tourism, investments and aviation, will lead his ministry’s delegation to the 16th International Civil Aviation Organisation (ICAO) Air Services Negotiation summit, known as ICAN2024, which is being hosted by Malaysia from October 21-25.

The Ministry of Tourism, Investments and Aviation,

in a statement, said its presence will highlight The Bahamas’ efforts to solidify its status as a major travel destination and expand its global reach. The air service agreements will facilitate increased travel, promote economic growth and attract more international visitors.

“Air connectivity is vital for the growth of our tourism industry, which is the backbone of our economy,” said Mr Cooper. “By engaging with our international partners at ICAN 2024, we will open new avenues for travel, foster

business relationships, and ultimately create jobs for our people.”

The Ministry of Tourism, Investments and Aviation said the anticipated agreements will improve air access and provide opportunities for Bahamian businesses to engage with new markets.

Apart from negotiating the agreements, the Bahamian delegation will participate in discussions on best practices in aviation, sustainability and the future of air travel. This aims to position The Bahamas at the forefront of the evolving travel landscape.

FOCOL AFFILIATE GAINS 30-YEAR POWER DEAL

By FAY SIMMONS Tribune Business

A 30-YEAR power purchase agreement will allow BPL to increase generation capacity and improve reliability for businesses and residents, according to Minister of Energy and Transport JoBeth Coleby-Davis.

Speaking in Parliament yesterday, Mrs ColebyDavis gave an update on the country’s energy reforms and noted that the two dual fuel engines commissioned on Tuesday were due to a 30-year public private partnership (PPP) between

Bahamas Power and Light (BPL) and Bahamas Utilities Holdings (BUH). The Power Purchase Agreeement (PPA) included key performance indicators and penalties for non-performance as well as provisions to lock in rates.

Mrs Coleby Davis maintained the engines are not being rented by BPL and the utility has the opportunity to fully purchase the engines once the company is in a “stronger financial position”.

“The engines are not being rented by BPL. It is a power purchase agreement which includes the cost of fuel and the capacity, not a rental,” said Mrs Coleby-Davis.

“Nothing has been divested out of the hands of

BPL. In these agreements, there is opportunities for when BPL gets in a better and a stronger financial position for them to take over full ownership and control of that portion of generation, albeit whether they do it through that relationship or through them getting the necessary capacity that they need to generate on their own.”

Mrs Coleby-Davis said all existing Bahamas Utilities Company (BUC) plants will be removed from the current rental arrangement and placed under the PPA.

Those engines, with the exception of the Hyundai plant, will be converted to LNG by June 2025 and the Hyundai plant will be

redundant capacity once the other units are online.

She said the Hyundai plant will only be operated in “extreme extenuating circumstances” to increase generation capacity.

“Our strategy also calls for all existing BUC plants to be moved from rental arrangement and placed under the PPA. So all that was presently under rental will also transfer under the structure in this PPA,” said Mrs Coleby-Davis.

“One BUC engine will eventually be converted to LNG, the Hyundai plant, however, is not capable of conversion and will remain on diesel or HFO. Once the combined cycle with steam engine plant is complete,

the Hyundai plant will be redundant capacity. So only if there’s extreme extenuating circumstances that we need that extra generating capacity will we have to turn to the Hyundai plant. The intent is for us to fully operate all of those engines under the PPA, on LNG or in the combined cycle with steam producing generation.”

Mrs Coleby-Davis said the two new turbine engines are 35 percent more efficient than the current engines and will use less fuel leading to cost savings for businesses and residences.

“The engines are 35 percent more efficient than the older turbines that are currently being used,” said Mrs Coleby Davis.

‘CONCERNS’ AS MARGARITAVILLE CUTS SAILINGS TO GRAND BAHAMA

By FAY SIMMONS Tribune Business

DEPUTY Prime Minister Chester Cooper said yesterday the Ministry of Tourism has “some concerns” about Margaritaville at Sea’s schedule of calls for 2025. Responding to concerns raised by Opposition leader Michael Pintard about Margaritaville at Sea, Mr Cooper confirmed the cruise line has decided to reduce the number of trips to Grand Bahama and increased the number of calls to New Providence.

Mr Pintard said Grand Bahama residents had a “tremendous amount of anxiety” about the cruise line’s schedule for 2025 which did not include its

usual number of sailings to Grand Bahama.

“With respect to Margaritaville, there is a notice, as a number of us are aware, particularly those of us in Grand Bahama, that the vessel has determined, that the owners have determined that they will be cancelling one particular schedule that they had in Grand Bahama, and that vessel will now be coming into New Providence,” said Mr Pintard. “We have looked at one of the itineraries that that is circulating from the company, but are uncertain as to whether or not the Margaritaville has completely left Grand Bahama or it has just dramatically reduced its sale and service to Grand Bahama. So, we just wanted to get clarification. It has been the source of

tremendous amount of anxiety in Grand Bahama”

Mr Pintard said the cruise line has been the subject of “intense discussions” over the past months and while they will not be discontinuing service into Grand Bahama they have restructured their calls.

“The Margaritaville cruise to Grand Bahama has been the subject of intense discussions over a number of months,” said Mr Cooper.

“The short answer is they are not discontinuing service to Grand Bahama, however, they are restructuring their calls. Some months there will be more calls than they currently have. Some months there will be less.”

Mr Cooper noted the cruise line discontinued one-way travel from Grand Bahama to Florida and vice

versa earlier this year due to the intervention of US Customs and Immigration (ICE) but ongoing discussions may lead to “some adjustment”.

“We are continuing the dialogue with them on an active basis,” said Mr Cooper.

“There are certain things I cannot say about this entity. I will speak with the leader of opposition offline, but I will tell you that over the course of time, you know that they discontinued service to Bahamians traveling back and forth on Margaritaville at Sea, we are aware that it’s caused some concern. That was precipitated by ongoing dialog that they had been having with the USA Custom and Border Protection Services, it had nothing to do with The Bahamas or the Bahamas government,

and we anticipate that ongoing conversations with Margaritaville at Sea may cause some adjustment.”

He said the Ministry of Tourism has “some concerns” about the cruise line’s adjusted itinerary and will continue to monitor the change.

“The Ministry of Tourism has some concerns as it relates to the schedule, and those conversations are continuing,” said Mr Cooper.

“We met with Margaritaville at Sea only a week ago when we were advised that there would be some adjustments, and we only received the adjusted call schedule yesterday. So this is new, and therefore we’re continuing monitoring, and I’ll make a further comment on it later as it progresses.”

“These efficiencies that we talk about when we talk about engines, it means that the engines don’t have to work as hard to produce the necessary power. That means it does not use the amount of fuel that you may see our older engines currently using because of the strain on them presently. This will have tremendous cost fuel savings for our consumers, and also reduce the cost to BPL. The engines allow for dual fuel technology, which will enhance operational flexibility. However, by June 2025 the engines will run solely on LNG.”

Margaritaville at Sea announced on social media yesterday that Margaritaville Paradise will begin sailings to Nassau on two- to four-night trips.

“Paradise is setting sail to more Bahamas destinations! In addition to Freeport, Paradise will head to one of the most popular cruise ports in the world — Nassau! Enjoy new two- to four-night getaways AND a unique ship-to-resort experience at Margaritaville Resort Nassau,” said Margaritaville at Sea. The company’s website has also been updated to offer two-night Nassau sailing, three-night Nassau weekend sailing and fournight Nassau and Grand Bahama sailing, with either one or two-night stays in Grand Bahama. The cruise line still offers a two-night Grand Bahama sailing and a three-night Grand Bahama weekend sailing.

FIRST APPLEBEE’S EATERY TO HIRE 150 BAHAMIANS

The first-ever Applebee’s restaurant in this nation will hire 150 Bahamians ahead of its November 2024 opening at Fusion Superplex, its local franchisee announced yesterday.

Caribbean Dining, which also holds the IHOP franchise for The Bahamas, said it will recruit staff for all front-of-house and backof-house positions - from servers to hosts and cooks - at a job fair which will be held at The Department of Labour’s Carmichael Road offices on October 21-22 from 9am to 3pm.

“We are ecstatic about the opportunity to employ hundreds of Bahamians at Applebee’s. Our commitment to invest in the

Bahamian economy stands true as we continue to join forces with the best of the best for a prosperous future,” said Caribbean Dining in a statement.

Besides dining at the restaurant, Fusion Superplex guests will also be able to enjoy Applebee’s food and beverage services in the VIP theatres. Interested persons can email hr@caribbeandining.com for more information.

And, after opening its first IHOP location at the Mall at Marathon in early April 2023, Caribbean Dining said it plans to open its second location on Carmichael Road in December 2024 prior to Christmas.

Payments provider unveils three webbased platforms

A BAHAMIAN financial technology provider says it has launched three new web extensions to give consumers greater flexibility in accessing these services directly through their web browser.

MobileAssist, in a statement, said TheBillPlace (bill payment), TicketBox (event ticketing) and DonationStation (donations) extensions will also provide a more convenient and adaptable payment experience for Bahamians.

It added that its clients can now choose between MobileAssist’s app and its new web-based platforms to handle bill payments, purchase event tickets or make charitable donations. The web extensions are designed to integrate seamlessly with clients’ existing processes, adapting to their needs and enhancing convenience.

“This move reflects our dedication to making financial transactions more flexible and accessible,”

said Dr Donovan Moxey, MobileAssist’s chief executive. “By offering both app-based and web-based solutions, we ensure our clients and their customers can choose the platform that best suits their lifestyle and business needs.”

MobileAssist said the event ticketing extension was recently put to use after it won the bid to manage event ticketing for the Eddie Minnis concert at Nassau Cruise Port. It added that attendees “enjoyed a seamless experience” from ticket purchase to entry, underscoring the efficiency of TicketBox. The company said appbased customers such as the Bahamas China Friendship Association are transitioning to the new web platform. New customers, such as Bahama Joy Ride & Snorkeling Adventures, say their guests can now pay using all major credit and debit cards without needing to download the app.

MobileAssist said the Bahamas Basketball Federation has also launched an ongoing fundraising campaign using DonationStation to support its junior and senior national teams.

PALMDALE VETERINARY CLINIC has a vacancy for a Trainee Veterinary Assistant/Receptionist.

Duties will include working on the front desk, restraining patients, assisting veterinarians with surgery, and the administration of medications, and general cleaning. Applicants must have some experience working with animals.

Please take your resume with a cover letter to our clinic or send to palmdale.vet@gmail.com.

The funds raised will assist in Family Island development and grassroots programmes, while also supporting coaches and officials’ training initiatives. MobileAssist said companies using any of its three web-based platforms - TheBillPlace, TicketBox and DonationStation - can embed their personalised payment links in social media posts, websites, WhatsApp messages and e-mail campaigns. They can also generate QR codes for physical or digital display. It added that its payment platforms, including these new web extensions, are fully integrated with Sand Dollar, The Bahamas’ official digital currency.

NAD executive features in aviation panel talks

A NASSAU Airport Development Company (NAD) executive recently participated in a panel discussion at the Routes World 2024 global aviation conference.

Jan Knowles, NAD’s vice-president of marketing and commercial development at Nassau Airport Development Company (NAD), participated in the discussion alongside Antonio MartínMachuca, co-operation manager for the government of Andalusia in Spain, and Vivian Cheung, acting chief executive of Airport Authority Hong Kong.

They focused on how their cities are preparing to host Routes-branded events next year. The Bahamas will host Routes Americas 2025 from February 10-12, while the Government of Andalusia will host Routes Europe and Hong Kong will be the location for Routes World 2025. Each panellist shared insights into their destination’s strategies and preparations, offering a glimpse into the experiences that await attendees.

Speaking on behalf of The Bahamas, Ms Knowles said: “The Bahamas is thrilled to welcome Routes Americas once again,

following our first time as hosts in 2012. At that time, our airport was in the middle of a major infrastructural upgrade. Now, with significant growth and expansion on the horizon, the timing is perfect.” Routes Americas 2025 will attract 1,000 delegates, including airports, airlines and tourism officials, to discuss and explore new route development opportunities. Key partners for The Bahamas event include NAD, the Ministry of Tourism, Aviation and Investments, and the Nassau Paradise Island Promotion Board. The forum will take place at the Atlantis resort.

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

AND MAILLIS

TAKE NOTICE that anyone having a claim against the Estate of SHARON GAYE ALBURY late formerly of the Township of Marsh Harbour in the Island of Abaco and late of the Eastern District of the Island of New Providence, Bahamas, who died on the 5th day of September, 2021, may submit such claim in writing to the law frm of MAILLIS & MAILLIS, Chambers, Fort Nassau House, Marlborough Street, Nassau, Bahamas, Tel: (242) 322-4292/3, Fax: (242) 323-2334 ON OR BEFORE the 31st October, A.D., 2024. ESTATE OF SHARON GAYE ALBURY

TAX INCENTIVE PLAN ‘TO CUT COST’ OF BUSINESS

By FAY SIMMONS

THE government plans to introduce tax incentive legislation to reduce the cost of doing business, according to Deputy Prime Minister Chester Cooper.

While tabling the Domestic Minimum Top-Up Tax bill in Parliament yesterday, Mr Cooper said the bill will introduce an effective tax rate of 15 percent for in-scope multinational enterprises operating in The Bahamas that have annual consolidated revenue of or above 750 million Euros or approximately $818m.

This will be the first such income-based levy in the country’s history, and is intended to ensure The Bahamas complies and fulfils its obligations as one of 140 countries that have signed on to the G-20/ Organisation for Economic Co-Operation and Development (OECD) drive

for a minimum 15 percent global corporate tax.

Mr Cooper said the “lion share” of revenue from the tax will be used for debt reduction and reducing the cost of living in the country. He said along with the tax implementation the government will also introduce incentives to reduce the cost of doing business and will impact small and large businesses.

“The consultation paper foreshadowed the government’s intention to introduce some form of incentives to reduce the cost of doing business in The Bahamas. These incentives will be laid out in a companion piece of legislation,” said Mr Cooper. “These incentives would when introduce would impact all businesses not just businesses which qualify for the DMTT. In this respect, the government within this year and prior to any tax becoming payable under the DMTT would introduce a legislation that will lay out the framework

for such incentives in a manner that will qualify under the GloBe Rules. This proposed Bill because of its impact on all businesses would require public consultation.”

He said during the consultation for the corporate income tax, participants highlighted the need for incentives that will attract new business development in areas such as tourism, finance and technology.

The tax incentive legislation is expected to be revealed during the midyear budget.

“In the consultation process with the DMTT, several respondents suggested that any new incentive regime be aligned with attracting new business development in key economic activity, namely, headquarters, tourism, finance, technology and energy.

“And, in this regard, consideration could also be given to incentives associated with employment, capital expenditures, training, local content spend,

Hospital expansion plans revealed at loyalty launch

By ANNELIA NIXON

anixon@tribunemedia.net

REPRESENTA-

TIVES of Doctor’s

Hospital revealed their plans of expansion on the Family Islands during the announcement of their Loyalty Advantage Membership Programme.

Grand Bahama is opening a brand new 25-bed facility in Grand Bahama, according to Dennis Deveaux, CFO of Doctor’s Hospital.

“So we continue to progress at a very satisfactory pace with our new hospital, which is a 25 bed brand new facility in downtown Grand Bahama,” Mr Deveaux said. “Our hospital is on

budget and we expect the hospital’s opening sometime in the summer to fall of 2025.”

Mr Deveaux added that Doctors Hospital has an urgent care facility in Exuma, as well as clinics in Grand Bahama and Eleuthera.

“Today we are already in Grand Bahama. We have two clinics in Grand Bahama, one in Eight Mile Rock and then one in downtown Freeport on West Mall Drive. We have a full urgent care centre in Georgetown, Exuma, and we are actually planning to announce the opening of a new medical center in Rock Sound, Eleuthera. We’ll be in Eleuthera this

coming Friday to engage the residents of Eleuthera and really understand what their needs are and then how we can cooperate with the existing providers on the ground. Whether it’s Bahamas Wellness, you know, closer to Governor’s, or whether it’s Family Medical Centre a little south Rock Sound, we certainly want to elevate the level of care nationally already in Grand Bahama and Exuma. But our immediate plan certainly will take us into Rock Sound, Eleuthera.”

As for the Paradise Island location, Mr Deveaux said it is to provide urgent medical care for guests and workers on the island and that the decision to open

Businesses question whether bills will be cut by power deal

By ANNELIA NIXON anixon@tribunemedia.net

QUESTIONS have been raised about the effect on BPL rates after Prime Minister Phillip “Brave” Davis announced the government finalised a power purchase agreement for a new 117 megawatt power plant.

Darvin Russell, owner of Bugs B Gone, told Tribune Business he’s not been given reason to disbelieve that he will see a positive change in electricity service and cost, however he questioned what it’s going to cost.

I mean I don’t have any reason not to believe what the good minister is saying in that regard,” Mr Russell said. “My concern is more, what is the rate with which the government is being charged for the power purchase agreement?

“Most of these agreements span decades and the issue that you have is if you don’t have a contract with a favourable kilowatt rate, all you’re in essence doing is really just transferring the cost that you’re paying under the power purchase agreement onto the consumer. So the power may be more reliable from a generation and distribution perspective, but you’re not going to see any relief in the price of electricity, which is Bahamian’s biggest concern before even reliability. I don’t think that the average Bahamian would be as concerned if their power goes off once a week if they were paying ten cents a kilowatt hour for example. So I just wanted to make sure that we’re focused as a country on the right issue.” The manager of an eye care facility shared the same concerns, saying: “I’m hopeful but I think what everybody’s waiting on is the details. If they’re paying more for something, how does that trickle down to us paying less? And I did hear her [JoBeth Colbey-Davis]

briefly as I was driving in

saying something about converting to LNG, which would be cheaper and I do think if they use an alternative source of energy that they can bring down our electrical bills, but I’m not sure with buying two new engines how that works. Are they paying more now? And if so, how does that mean that we’re paying less? I’m not quite sure what the details would be.”

Mr Davis said he will not disclose the details now but all will be revealed in coming weeks as it pertains to energy reform, new engines and partnerships. However, both the manager of the eye care facility and Shirlin Jordine, owner of Easy Technology Bahamas, noted that despite their efforts to not consume too much energy, they are still charged with high bills and they want to believe they will receive some relief.

Mr Jordine said: “That’s something that is needed because of the electricity not being calculated properly. That’s something that they need to, uh, work on. At the time the issue we had was it was wrong. Meaning that we wouldn’t use as much electricity, but it still would remain high. Even though we tried to limit our usage, it still was the same or even more so that showed me that the

research and development costs, the creative industry, and extraterritorial turnover. The government acknowledges the importance of developing this new regime, which would need to apply broadly across businesses in The Bahamas. Consequently, the view was taken that a separate Bill be crafted to reflect the final position of the government and submitted for consideration during the mid-year budget exercise.”

Dr Leo Rolle, CEO of the Bahamas Chamber of Commerce and Employer’s Confederation (BCCEC), said the private sector remains “cautious about incentivised promises that often fail to materialise”.

He said while the BCCEC is open to any initiate that will improve the ease of doing business, government should ensure its implementation is equitable.

“While we acknowledge the government’s intentions, we remain cautious about incentivised promises

that branch was due to high demand.

“So we want to firstly serve the folks that work on this island and improve the medical facilities that are on this island as folks come to work. It’s difficult if you have to leave the island and come back should something happen, if you need to go and run and see a doctor if you need to get some labs drawn, it becomes very, very difficult even to get across the island and back, say, on a lunch hour or before work or immediately after work. So our chief priority really is to serve the people that are working on this island.

“Secondly, we know that there are a lot of tourists and there are a lot of second homeowners, and that drives Airbnb and other forms of transient guests. We want them to know that if something

that often fail to materialise,” said Dr Rolle.

“We welcome any measures that reduce the cost of doing business and improve ease of operations. However, we are still waiting to see when and where the net zero effect will occur for businesses, ensuring that any tax implementation allows for equitable taxation, enabling the business community to operate and grow effectively.”

He said the application and approval process for the ta incentives should be “straightforward” so business owners are not frustrated with its implementation and welcomed the public consultation process so the private sector can participate in its drafting.

“We expect a fair and straightforward application and approval process that does not frustrate the business community, as seen with other government incentivized programs,” said Dr Rolle.

should happen, that there is a world class medical facility here to have that first level of urgent response to their medical needs. And so that core demand, the demand of people working on the island, the demand of guests coming to the island, worried about livability, worried about concerns around their health, that drove our planning to put a facility here.

It’s a 3,500 square foot facility that is able to respond to urgent care. It also has a pharmacy in the front, and so if you need to pick up a prescription or to get an over the counter medication that is now available on Paradise Island for the folks that work here as well as the transient guests.”

Mr Deveaux also spoke on under capacity in hospitals.

“So fundamentally, we recognise that there’s under

“We are pleased that public consultation is required and welcome the opportunity to collaborate with the government to craft fiscal measures and policies that reflect the challenges faced by businesses in the blue, green, and orange economies, who also stand to benefit from the concessionary considerations.”

Dr Rolle also recommended that a “robust” public awareness campaign is launched prior to the implementation of the corporate minimum tax so all businesses understand who it applies to.

“Additionally, we recommend a robust public awareness and education campaign to ensure businesses understand the qualifying parameters under the GloBe Rules and do not feel disenfranchised by the implementation,” said Dr Rolle.

capacity nationally and Bahamians experience this when there are difficulties with accessing medical care, whether that’s attempting to get into PMH or attempting to get into the Rand Memorial. There’s no secret that Bahamians experience this. Our role as a private sector act is certainly to cooperate wherever we can to make our capacity available to people that need it. And fundamentally, what we’ve done today is to make our outpatient product, our urgent care product, something happens and you need to get in to see a doctor right away, we’ve made that more accessible and affordable at $119 per month. We think that really is a huge step. But our inpatient capacity remains broadly available to support the government, however they should require of us.”

electricity wasn’t calculated properly and businesses probably were charged a different price than residential homes instead of commercial properties.”

Energy minister JoBeth Colbey-Davis said the power purchase agreement (PPA) has provisions that will prevent residents and businesses from having to handle “large cost fluctuations.”

“Today, we are commissioning two dual fuel turbine engines because of a public-private partnership between BPL and Bahamas Utilities Holdings,” said Mrs Coleby-Davis.

“The partnership is guided by a power purchase agreement. PPAs are standard practice in the energy field. The PPA for this project includes clearly defined key performance indicators and penalties for non-performance. Provisions have also been included to lock down rates, which will protect Bahamian households and businesses from large cost fluctuations.

“The partnership with Bahamas Utilities Holdings will allow for BPL to increase its generation capacity, with direct benefits for households and businesses in New Providence, such as improved reliability and electricity service.”

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

MINISTRY SHARES DRAFT OF LABOUR REFORM PAPER

By ANNELIA NIXON anixon@tribunemedia.net

A SUMMARY of the first draft of the Labour Reform White Paper has been shared by the Ministry of Labour and the Public Service with tripartite stakeholders revealing recommendations for reforms.

According to the summary, recommendations include “new policies for paternity leave, mental

health leave, and remote work”. Others include “strengthening of existing anti-discrimination laws and introduction of Equal Pay for Equal Work are also recommended for consideration”.

“Among the other notable recommendations are the promotion of Alternative Dispute Resolution (ADR) for labour disputes, reforms to address the triple transition of climate

change, digitalisation, and social justice, and the need to balance the hiring of specialised foreign expertise with the creation of opportunities for Bahamians.”

Some recommendations are also aimed at numerous Acts.

“The recommendations include changes to key legislation such as the Employment Act, Industrial Relations Act, Public Service Act, and General

Orders. The comprehensive list of 255 recommendations are focused on enhancing worker protections, promoting business growth, and ensuring fair and inclusive labour practices.”

The Ministry of Labour will move forward with the review process by the Minister Pia Glover-Rolle and then it will be presented to “Cabinet for approval, and further consultation with key stakeholders, before

a first draft of the bills can be prepared” to better align legislation and policies with international standards.

“We will continue to move forward at an expedited pace to ensure that these reforms can be enacted to bring about change for Bahamian workers as soon as possible,” said legal consultant to the Ministry Keenan Johnson.

“When we’re talking about legislative changes

Resorts World forecasts ‘never close in 15 years’

FROM PAGE B1

guests online are almost exclusively negative.

“RAV Board members presented a collection of bad reviews pulled from travel websites such as Yelp, Trip Advisor and Travelocity. The Board then reviewed a substantial number of the negative reviews. It was commented that much of the property has not been properly maintained and had fallen into disrepair.

“RAV Board members then presented a large presentation with pictures taken that past week showing the neglected and abandoned parts of the property, highlighting the property’s poor condition. It was agreed that the hotel, the property and the amenities need to be managed and maintained in a manner competitive with other resorts.”

The same concerns were then aired more vigorously just one hour later at the “emergency shareholder meeting”, featuring both Genting Americas and RAV Bahamas officials, which appears to have been called in an ultimately failed bid to resolve the two sides’ differences.

Alejandro Capo, RAV Bahamas’ chairman and Gerardo’s son, presented what was described as a “package that contained over 200 reviews from

homeowners that are almost all negative. There are onestar reviews of the service and the food, and reviews saying the property and the client engagement being terrible, customers saying they’ll never go back etc”.

“When RAV takes its real estate clients to the resort to see it, the clients see that the property is in disrepair and Fisherman’s Village is abandoned and in disrepair,” he said. “RAV’s real estate clients spend a substantial amount of money on a second home in Bimini. They want and expect a great experience. However, the current experience they are getting is not good. That results in damages to RAV’s core real estate business.”

Asserting that RAV Bahamas, as the 22 percent minority owner, “can’t sit by and watch” Genting and its management affiliates “run the resort into the ground”, Alejandro Capo added: “We are probably spending nearly $100,000, or more, on equipment that we are replacing because it wasn’t managed and maintained properly.

“And we are spending money on repairs because [Genting’s management firm] allowed the property to fall into disrepair.” Alejandro Capo, according to the meeting minutes, alleged that improvements only occurred after he brought a senior Genting executive, referred to as KJ, to the island to see

conditions at Resorts World Bimini.

“We should not have to drag Genting upper management to Bimini to point these things out before they are maintained. They should always be properly maintained and cared for under the resort management agreement,” Alejandro Capo argued This prompted Missy Lawrence, Resorts World Bimini’s president, to hit back by asserting that RAV Bahamas was equally to blame for the state of the resort and conditions encountered by some 300 homeowners. “This isn’t only Resorts World’s doing; it’s yours, too,” she blasted. However, Alejandro Capo was unwilling to let the matter rest. In one of the meeting’s final remarks, he asserted: “The management of the resort has been awful. We need to work together to make this place make money. RAV’s primary revenue source is real estate sales, and if Resorts World does not do its job, RAV can’t sell real estate. You have affected my core business to the point that I have no sales.

“What you do materially affects what I do. Moving forward, I need to have guaranteed good service at the resort and for our prospective real estate clients to protect BB Entertainment’s image, and to ensure RAV can sell real estate.”

Rafael Reyes, RAV Bahamas’ president and Gerardo Capo’s son-inlaw, added: “The operation of the resort needs to be better all around. People

buy based off of reviews, so we can’t afford to have negative reviews or at least try to limit them to a great extent.” Alejandro Capo added: “Bad reviews affect our bottom line.”

It appears, though, that “the emergency meeting” resolved little with tensions between Resorts World Bimini’s two owners continuing to simmer and fester through the COVID-19 pandemic. The minutes for a January 27, 2022, Board meeting reveal Mr Reyes opened with: “The purpose of this meeting is to emphasize that we need to have transparency and a good relationship with our partners.”

Moving on to the March 12, 2024, Board meeting, Alejandro Capo complained that Resorts World’s sales, general and administrative expenses (SG&A) were “extremely high for a 300room hotel”. He called for a “full breakdown” of salaries and benefits, and added: “This executive team has been here for roughly four years, and the hotel has continued to lose money - less money than in prior years, but still lose money.”

Turning to Mr DeSalvio, as Genting Americas president, Alejandro Capo then asked: “Bob, have you ever encountered these kinds of financial numbers in your 40-year history in the industry?” The meeting minutes record Mr DeSalvio as giving no reply.

However, Shane Pomeroy, Resorts World Bimini’s chief financial officer, replied: “The largest components of the SG&A expense line item are insurance premiums of $2.8m; transportation costs of $2.4m; HOA (homeowners association) fees of $1.6m, freight costs of $1.1m, Hilton royalty fees of $1m; and bank fees of $0.8m totalling nearly $10m.”

And, in response to a question from Mr Reyes, he added: “Debt service is roughly $57m a year.” Alejandro Capo then challenged: “How realistic is the 2024 budget, as these budgets have rarely, if ever, accurately projected the true financial picture?

“In fact, RAV has been through approximately 15

of this magnitude, the scale of inputs from experts and stakeholders, as well as the many steps required to get us to the point of having drafted legislation can be quite extensive. However, working along with the Ministry’s team of seasoned HR and Labour professionals with the full support of this administration behind us, we can anticipate significant progress in a relatively short time frame.”

of these projected financial presentations, and the yearend results have never been close to how the financials were presented.” This saw Mr Pomeroy reply: “We are confident in the numbers.” As for resort operations, Mr DeSalvio said Resorts World planned to either terminate the flag agreement with Hilton or allow it to end. “Resorts World brand does not wish to continue with the Hilton brand,” he confirmed. “The company believes it is the right move for the property to terminate the franchise agreement or let it expire.” The Genting representatives on Resorts World’s Board, though, did not emphatically deny that they were planning to sell Bimini’s ‘anchor’ property when challenged by RAV Bahamas. “Has Genting management attempted to sell the property? Is the hotel for sale,” asked Alejandro Capo.

To which Mr DeSalvio replied: “I’m not aware of any listing agreement to sell the property, but I will check with other Genting executives and respond back to the Board.” Alejandro Capo added: “RAV formally requests disclosure and to be involved in any meeting or communication whatsoever related to the sale of the property. Any discussions, formal or informal, involving the sale of the hotel should include RAV as a shareholder.” RAV Bahamas is essentially accusing Genting of using its 78 percent majority ownership, plus Board and management control, to conceal how it funnelled hundreds of millions of dollars in liabilities incurred elsewhere in its global empire on to the Bimini resort’s books. Complaining that this has undermined the value of its investment, while also “depriving” it of expected profits, RAV Bahamas claimed that Genting “has deliberately kneecapped” its attempts to gain a true understanding of Resorts World Bimini’s true financial position by denying “full access” to the property’s financial records and its calls for an independent audit.

CLICO failure exposes need to ‘better protect small man’

from the CLICO (Bahamas) debacle, with multiple policyholders having died before being fully compensated and others yet to fully recover their assets, he confirmed that the insurer’s Supreme Court-appointed liquidator has made a further payout to victims following a near-20 month pause.

“I think they have made some payment. That’s what I understand,” Bishop Hall told this newspaper. “They haven’t given me much. Some payments have been made. Mr Gomez told me that. It looks like they’ve been spread out over some time. I pray it doesn’t take as long for people to get it as it was long in terms of the legal position reaching this conclusion. Thank God something has happened.”

Mr Gomez is Craig A. ‘Tony’ Gomez, the Baker Tilly Gomez accountant and managing partner, who has been acting as CLICO (Bahamas) liquidator since the insurer was placed under the Supreme Court supervision in February 2009. He is prevented by a gagging Order from speaking publicly about the case.

However, Tribune Business understands that the latest payments to victims have been taking place over the past two weeks with some 60 percent of those who surrendered their life insurance policies now fully compensated and paid out.

The 40 percent of clients yet to be made whole are those whose policies have greater surrender values or are still in effect and being managed by BAF Financial.

“Payments have been going on over the past two weeks,” a well-placed source, speaking on condition of anonymity, confirmed. “They are trying to run a very controlled process and make the payments in a controlled way for the benefit of creditors.” They added that this round of compensation, the first for around 20 months since 2022, may be concluded “by next weekend”.

It is thought about $55m has been paid out to CLICO (Bahamas) victims across three different administrations, with the Government stepping in to finance the compensation in the insurer’s stead via the Bahamian taxpayer. The Government, and those policyholders

CORPORATE TAXATION BILL CAUSES FREEPORT FEARS

James Carey, the Grand Bahama Chamber of Commerce’s president, was among those voicing concern yesterday that the Government’s push to comply with G-20/OECD global 15 percent ‘minimum’ corporate tax drive might be the latest legislative initiative to run afoul of the Hawksbill Creek Agreement’s provisions. However, attorneys spoken to by this newspaper said the issue may not be so simple. They pointed out that Freeport’s investment incentives, including the income tax exemptions, expired in 2015 and were never renewed by the-then Christie government which instead passed the Grand Bahama (Port Area) Investment Incentives Act 2016.

Under this legislation, which the subsequent Minnis administration never gave effect to, only the GBPA, Hutchison Whampoa and their affiliates such as the Grand Bahama Development Company (DevCO) were given an automatic 20-year renewal of their income and other tax breaks through to 2036.

All other GBPA licensees have to apply to be granted these by the Government, including exemptions from taxation on “the earnings of a licensee in the Port Area and outside The Bahamas”. Amid this general

uncertainty now enters the Davis administration’s move to extend the 15 percent corporate income tax to the Port area.

“Clause three of the Bill makes provision for the Bill to apply to the entire Bahamas including the Port Area as defined in the” Hawksbill Creek Agreement and Freeport Bye-Laws Act, the Domestic Minimum Top-Up Tax legislation states. Mr Pinder yesterday said the Bill has nothing to do with the GBPA or Hawksbill Creek Agreement, and is merely intended to give effect to this nation’s compliance with the G-20/OECD initiative.

“The Domestic Minimum Top-Up Tax Bill has nothing to do with the Hawksbill Creek Agreement or the GBPA,” the Attorney General told Tribune Business “It is the legislation to implement Pillar Two - the OECD global corporate minimum income tax. It will apply to GBPA licensees operating in the Port Area. It applies to the entire country.” But only to entities part of corporate groups with turnover greater than 750m euros.

The Government’s position appears to have advanced since its summer 2023 ‘green paper’ on corporate income tax reform, which failed to give a definitive position on whether such a levy could be imposed

yet to receive full compensation, must now wait on Trinidad to pay the agreed $110.827m settlement to CLICO (Bahamas) for their reimbursement. That sum was offered by liquidators for the Bahamian insurer’s Trinidad-based parent, CL Financial, and Sir Ian Winder, the Supreme Court’s chief justice, last year gave Mr Gomez the go-ahead to accept it in his capacity as CLICO (Bahamas) liquidator. The nine-figure sum represents a settlement of CLICO (Bahamas) claim against its Trinidadian parent. CL Financial had guaranteed $58m, or 79.5 percent, of the monies its Bahamian subsidiary had advanced to another group entity, CLICO Enterprises, which subsequently defaulted on the loan repayments. Mr Gomez thus argued that CLICO (Bahamas) was a secured creditor of CL Financial.

However, not a cent of the $110.827m has yet been received from Trinidad. The timing and amount of any payout depends on CL Financial’s liquidators, and the Trinidad courts, and neither Mr Gomez nor anyone in The Bahamas has control

on Freeport given its status as a free-trade zone.

“Businesses under the Hawksbill Creek Agreement in Freeport are exempt from paying the Business Licence fee, alongside the elimination of property taxes and import duties,” it s ‘green paper’ said.

“For these free trade zones, appropriate Bahamian legal advice would be required to determine whether the application of corporate income tax would be legally possible, though any application of corporate income tax would likely erode the competitive advantage afforded to this area.”

GBPA licensees will also be unable to benefit from the elimination of Business Licence fees for those who qualify for the corporate income tax as they presently do not pay this. Instead, they pay a fee to the GBPA.

The GB Chamber’s Mr Carey told Tribune Business: “This is, I guess, the Government’s continued erosion of the permanent power of the Hawksbill Creek Agreement. Maybe it will be another opportunity for the Port to figure out and find out what’s going on with the agreement.

“The question is: Can legislation supersede the Hawksbill Creek Agreement without specifically amending it in the manner prescribed, which requires the consensus of licensees and all that good stuff. I’m not an attorney. I will speak to some of my legal friends and see what their thoughts are. The Government did get VAT implemented in Grand Bahama.

of this. As a result, it could be months and even some years yet before all or part of this money is paid out and received in The Bahamas.

CLICO (Bahamas) is far from being the only CL Financial creditor, and the latter’s Trinidadian liquidators must now work to secure and liquidate assets in that jurisdiction, converting them into cash and then obtaining approval from that nation’s courts before the monies can be transferred to Mr Gomez and the liquidation estate he oversees. All this will take time.

Prime Minister Philip Davis KC earlier this year said the Government planned to make no more payments to the CLICO (Bahamas) policyholders until the payments from Trinidad were received, even though the $110.827m is likely to paid in tranches over a period of time as opposed to a lump sum.

“The liquidators for CLICO have reached a settlement with the Government of Trinidad or the entity controlling CLICO’s assets in Trinidad. This settlement will benefit the funds here, ensuring we can discharge CLICO’s

“Government is intent, apparently, on eroding the power of the Hawksbill Creek Agreement. The sooner they see the back of it the better for them, no doubt. This determination to undo the Port Authority is very real. and strong, but the Prime Minister stated he doesn’t intend to undo the Hawksbill Creek Agreement. It’s the families that are the target.”

Freeport is home to a number of entities that would likely meet the qualifying threshold to attract the 15 percent corporate income tax, including the likes of the Grand Bahama Shipyard; BORCO (Buckeye Bahamas); Carnival’s Celebration Key; Grand Bahama Power Company (Emera); and Polymers International. However, it is unclear whether the 20-year

responsibilities to our customers. In fact, we might see how we can recoup some of the advances we made to assist those affected,” Mr Davis said then.

“The Ministry of Finance and our technical team are meeting with the liquidator to resolve this and ensure the funds are secure. There’s no need for further allocation. It seems significant progress has been made in Trinidad to resolve all related issues, benefiting policyholders here in The Bahamas.

“We do not intend to trouble the policyholders; we want to make them whole. We stepped in to help, and that’s what we did. If we’re able to retrieve some of the taxpayer’s money, it would be a windfall for us.”

However, Bishop Hall told Tribune Business: “I understand the policymakers can be hopeful; optimistic and hopeful. I’m glad for some resolution to have been reached, and I just pray it never happens again. A little something is better than nothing at all. Christmas is coming.

“I think the Government should protect policyholders more than they did with CLICO. I think they should

‘blanket’ tax exemption granted to the GBPA, Hutchison Whampoa and their affiliates in the Grand Bahama (Port Area) Investment Incentives Act 2016 will trump the new legislation that the Government is bringing. Among the entities covered by the 2016 Act are Freeport Harbour Company; Freeport Container Port; Hutchison Freeport Holdings; Hutchison Ports (Bahamas); Hutchison Ports (Bahamas) Holdings and a whole range of other affiliates and subsidiaries.

Michael Pintard, the Opposition’s leader, while emphasising that he was not supporting either the GBPA or Hutchison, yesterday called for “a more robust discussion” around changes that the Government might want to make to the

have been more precise, more particular, more judicious with these foreign companies. There’s nothing there for persons to hold on to than make noise and agitate. What about those who have died? I understand some policyholders’ children are now facing an uphill battle” to claim what is due to their parents’ estate.

“We have to protect the small man. We have to protect those persons who are most vulnerable. Any area of our society where people are vulnerable, I think we should protect them better.” Asked whether The Bahamas has learned the right lessons from CLICO’s failure, Bishop Hall replied: “I hope we have; I really hope we have.

“We have to be more specific and more protecting than we were back then. People are now willing to look a little further and a little deeper than before. Personally, I’ve learned quite a bit from this. We have to cover ourselves when we look at these things and have to be more particular. If a business gets a licence from the Government, the Government has the task of protecting local consumers.”

Hawksbill Creek Agreement rather than “coming and stripping away” its terms gradually with individual pieces of legislation.

Backing the Davis administration’s move to implement corporate income taxation, especially given that failure to do so will allow other countries to collect this revenue, Mr Pintard said: “It makes more sense for us to collect this money than for that money to be collected in other jurisdictions.

“The Government is already missing income in that regard because many countries have signed on to the OECD/G-20 initiative since January. At the end of the day, we support collecting the funds in this jurisdiction given the amount of countries, 147, who have signed on to this.”

Companies hail ‘big leap’ on business ease tax promises

officer, an accountant. You have to know a bit of everything to keep up with what’s happening. Hopefully it’s something the Government can give consideration to and it makes a difference.

I often said that if I didn’t have to do this, I wouldn’t do it,” Mr Albury continued. “It would be a big leap if this is something that has some substance and can improve things.”

When asked what specific improvements he would like to see, he added: “General day-to-day things, and being able to get quicker

and faster responses from various [government] departments. That would be the most important thing.

There’s a lot of changes that have been implemented, some good, some bad, but it can be difficult keeping upto-date with what’s presently the norm.”

Mr Cooper, in tabling the Bill to give effect to the 15 percent minimum corporate tax in the House of Assembly yesterday, promised it will be accompanied by incentive-based legislation designed to address longstanding concerns regarding the ease and efficiency

of doing business in The Bahamas. The Domestic Minimum Top-Up Tax Bill 2024 removes the possibility of double taxation for companies that qualify for the new levy by eliminating the need for them to pay Business Licence fees as well. Only companies that are part of corporate groups with annual turnover in excess of 750m euros will, at present, have to pay corporate income tax on their profits. Referring to the consultation paper on the Domestic Minimum Top-Up Tax Bill, the deputy prime minister said: “The consultation

paper foreshadowed the Government’s intention to introduce some form of incentives to reduce the cost of doing business in The Bahamas. These incentives will be laid out in a companion piece of legislation.

“These incentives would, when introduced, impact all businesses - not just businesses which qualify for the Domestic Minimum Top-Up Tax. In this respect, the Government within this year and prior to any tax becoming payable under the Domestic Minimum Top-Up Tax would introduce legislation that will lay out the framework for such incentives in

a manner that will qualify under the” OECD rules.

Mr Cooper added: “In the consultation process with the Domestic Minimum Top-Up Tax, several respondents suggested that any new incentive regime be aligned with attracting new business development in key economic activity, namely headquarters, tourism, finance, technology and energy.

“And, in this regard, consideration could also be given to incentives associated with employment, capital expenditures, training, local content spend, research and development costs, the creative industries and extra- territorial turnover.

“The Government acknowledges the importance of developing this new regime, which would need to apply broadly across businesses in The Bahamas.

Consequently, the view was taken that a separate Bill be crafted to reflect the final position of the Government and submitted for consideration during the mid-year Budget exercise.” That takes place towards the end of February.

The Government has estimated that it could earn as

much as $140m in annual revenue from the 15 percent corporate tax once it has been in effect for a full year. Mr Cooper yesterday sought to soften the tax reform blow by pledging that the proceeds will be used to reduce the $11.5bn national debt and tackle the ongoing cost of living crisis.

“This Bill seeks to introduce an effective tax rate of 15 percent for in-scope multinational enterprises operating in The Bahamas that have annual consolidated revenue of or above 750 million euros or approximately $818m. At this threshold very few Bahamian-owned and operated businesses would be impacted,” the deputy prime minister added.

“In addition, with the passage of this Bill, The Bahamas would be allowed to retain tax revenues on profits of these entities that would otherwise be subjected to top-up tax in another jurisdiction under the OECD’s Income Inclusion Rule or the Under Taxed Profit Rule.

“As a matter of policy, this administration has already stated that the lion’s share of revenue from this Bill would be dedicated to debt reduction and reducing the cost of living for ordinary Bahamians.”

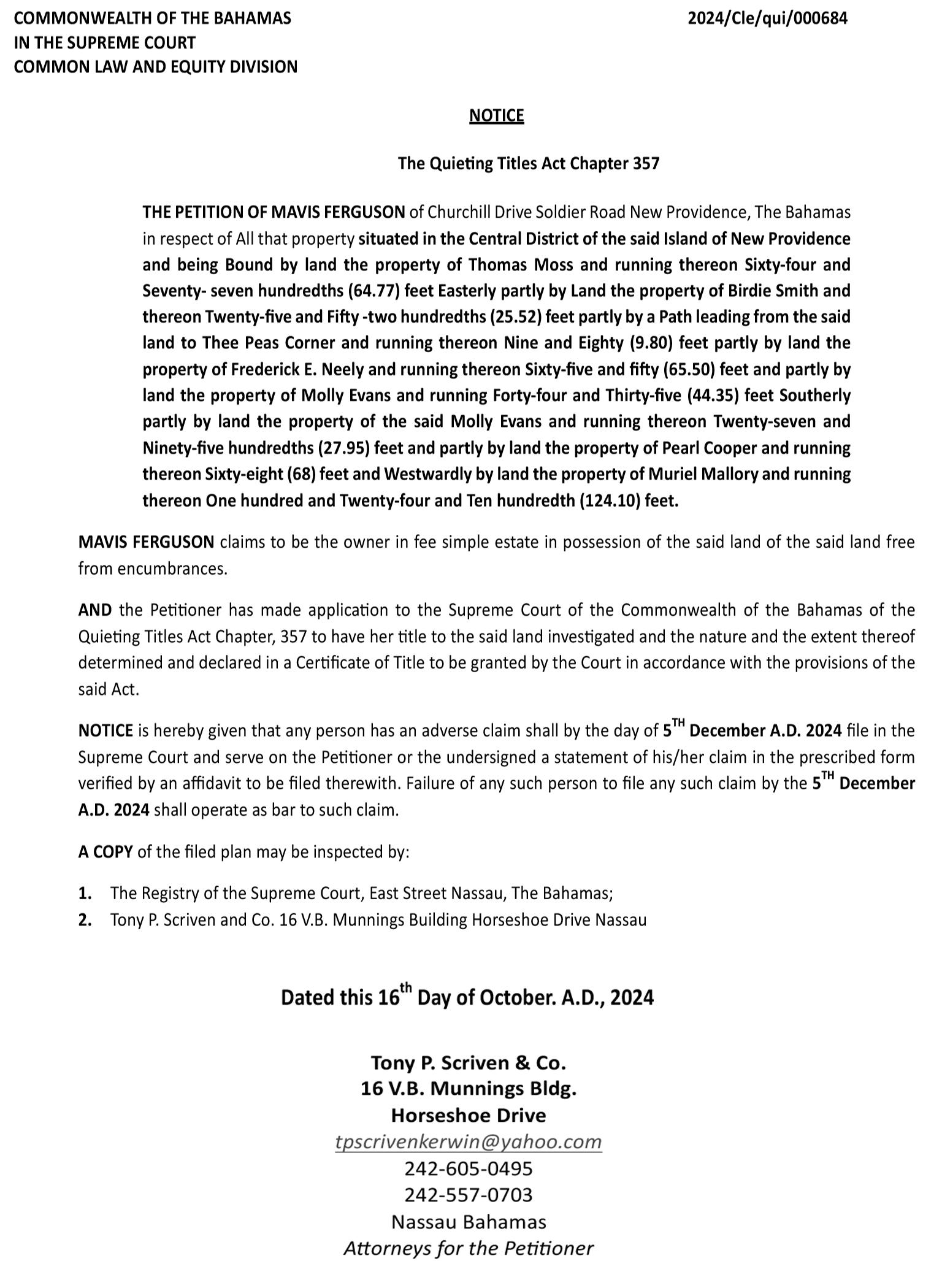

PUBLIC NOTICE

INTENT TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, ASHAKI PHILIPPA STURRUP, of the Island of New Providence, intend to change my name to ASHAKI PHILIPPA BETHEL If there are any objections to this change of name by deed poll, you may write such objections to the Chief Passport Offcer, P.O. Box N-792, Nassau, Bahamas no later than Thirty (30) days after the date of the publication of this notice.

NOTICE

NOTICE is hereby given that QUINCY LADDEUS, of Golden Gates, New Providence, Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 17th day of October, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE

NOTICE is hereby given that ROBINSON ROCK, of Rockcrusher, Carmichael Road, New Providence, Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 17th day of October, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE

NOTICE is hereby given that ASHLEY ARRIANNA JACKSON of P. O. Box GT-2555, #76 Barbados Street, Golden Gates #2, New Providence, Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 17th day of October, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that JUSTIN PAUL , of Balfour Avenue, Miami Street New Providence, Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 17th day of October, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

AUSTRALIA’S PRIME MINISTER IS CRITICIZED FOR BUYING

A WATERFRONT HOME DURING A HOUSING CRISIS

By ROD McGUIRK Associated Press

AUSTRALIAN Prime

Minister Anthony Albanese has been criticized for buying a multimillion-dollar waterfront home during a national housing crisis with federal elections just months away.

Critics argue that the purchase of the 4.3 million Australian dollar ($2.9 million) clifftop home at Copacabana, north of his hometown of Sydney, made him appear out of touch with many Australians who are struggling to buy or rent a home due to elevated interest rates, rising prices and limited supply.

Albanese brushed off criticisms Wednesday when questioned by reporters about concerns raised privately within his own government.

"We want to get on with helping Australians, whether it be public housing, whether it be rentals or whether it be buying their

own homes," Albanese said.

Copacabana and several other beaches in the area have mainly multi-million dollar price tags on their waterfront homes, owned by Sydney-siders who still have homes in the city or have moved to a more tranquil lifestyle.

Opposition lawmaker Sussan Ley described the purchase as evidence that Albanese was "out of touch," and her colleague Angie Bell described the timing as "questionable."

"The real issue for Australians is a lot of people want to be able to buy a home, but they're finding it very, very difficult and the current government is doing a very poor job at getting the policy settings in place to make it easier," opposition lawmaker Paul Fletcher told Sky News Australia.

Government lawmakers have publicly backed Albanese.

"I think the average Australian says, 'Fair enough,

leave him alone, I'll criticize his policies or I'll support his policies, I'll criticize or support his government, but I'm not going to criticize or support what he does with his own bank account with his own money,'" Cabinet minister Chris Bowen told Australian Broadcasting Corp.

Albanese's center-left Labor Party seeks a second three-year term in office at elections due by May next year.

Monash University political scientist Zareh Ghazarian described the buy as "politically risky" ahead of an election in which housing affordability will be "at the top of the policy agenda."

"For the prime minister to make this purchase in this climate is just distracting for the Labor Party," Ghazarian said.

Ghazarian said the home also damaged Albanese's political brand. Albanese, who is paid an annual salary exceeding AU$600,000 ($400,000), maintains that

being raised in public housing by a single mom gave him an appreciation of the financial struggles of lowincome families.

A Sydney radio station first reported the real estate transaction on Tuesday. Albanese's offer for the four-bedroom house was made in September and the sale was expected to be completed by the end of October.

On Tuesday, Albanese explained he was buying the house because the family of his fiancee, Jodie Haydon, lived on the Central Coast. Albanese lives in the prime minister's official residences in Sydney and the national capital Canberra. He said

he was selling his private Sydney house which would help pay for the Copacabana home. "I am much better off as prime minister. I earn a good income. I understand that. I understand that I've been fortunate," Albanese said. "But I also know what it's like to struggle. My mum lived in the one public housing that she was born in for all of her 65 years. And I know what it's like, which is why I want to help all Australians into a home, whether it be public homes or private rentals or home ownership."

Australia's property market is among the most expensive in the world, with

Sydney regularly featuring in lists of the world's least affordable cities.

Residential property prices rose by 32.5% across Australia in four years as of February, despite the cash interest rate rising from 0.25% to 4.35% in that period, according to financial data company CoreLogic.

Sydney is the capital of New South Wales state, where real estate prices are Australia's highest. The price of the average New South Wales dwelling was AU$1.2 million ($817,000) in the latest June quarter, the Australian Bureau of Statistics said.

OIL COMPANY PHILLIPS 66 SAYS IT WILL SHUT DOWN LOS ANGELES-AREA REFINERY

LOS ANGELES Associated Press

OIL company Phillips 66 announced Wednesday that it plans to shut down a Los Angeles-area refinery by the end of 2025, citing market concerns.

The refinery accounts for about 8% of California's refining capacity, according to the state's Energy Commission. The company indicated it will remain operating in the state.

"With the long-term sustainability of our Los Angeles Refinery uncertain and affected by market dynamics, we are working with leading land development firms to evaluate the future use of our unique and strategically located properties near the Port of Los Angeles," CEO Mark Lashier said in a statement. "Phillips 66 remains committed to serving California and will continue to take the necessary steps to meet

our commercial and customer demands."

The closure will impact 600 employees and 300 contractors who help operate the refinery, the company said in a news release. The refinery consists of two facilities that were built more than a century ago.

The announcement comes days after Democratic Gov. Gavin Newsom signed a law aimed at preventing gas prices from spiking at the pump. The law authorizes energy regulators to require refineries to maintain a certain level of fuel on hand. The goal is to avoid sudden increases in gas prices when refineries go offline for maintenance.

Phillips 66 said it supported the state's efforts to keep certain levels of fuel on hand to meet consumer needs.

The company also operates a refinery near San Francisco that accounts for

about 5% of California's refining capacity, according to the state Energy Commission. Phillips 66 Santa Maria, a refinery that was located about 62 miles (100 kilometers) northwest of Santa Barbara, shut down in 2023 after the company announced plans to convert its San Francisco-area site into "one of the world's largest renewable fuels facilities."

Newsom has applied pressure on lawmakers to pass oil and gas regulations. He called the state Legislature into a special session in 2022 to pass legislation aimed at cracking down on oil companies for making too much money. The Democrat often touts California's status as a climate leader. The state has passed policies in recent years to phase out the the sale of new fossil fuel-powered lawn mowers, cars, big rigs and trains.

THE FOUR TECH FEATURES YOU NEED TO GET ON YOUR NEXT VEHICLE

By JOSH JACQUOT Edmunds

TECHNOLOGY

fea-

tures in modern vehicles can make driving easier and more enjoyable. But when buying your next car, it can be hard to know which features are useful and which ones are more like gimmicks. And many times, these features are only available on certain trim levels. To help you out, Edmunds' car experts have come up with a list of their top four features and offer insight on how to get them. Easy phone pairing: wireless connectivity and wireless charging

Most modern vehicles come with Apple CarPlay and Android Auto. These features allow you to display and use many of your smartphone's apps and features on the vehicle's touchscreen. Typically, you'll need to connect your phone with a USB cord to make Apple CarPlay and Android Auto work. But some vehicles also support wireless connectivity. A wireless connection allows you to pair your phone and

stop fussing around with a cord every time you get in to drive.

To make the most of it, buy a vehicle that also has a built-in wireless phone charger. Having a wireless charger fully cuts out the need for a cord. The charging pad also serves as a dedicated location for your phone, which isn't a certainty in every car. How to get it: Research if the vehicle you're interested in supports wireless connectivity for Apple CarPlay and Android Auto. Most vehicles either have it or they don't, though a few do offer it as part of an upgraded infotainment system. A wireless smartphone charger is commonly an option or one of the extra features that come on a more expensive trim level. Perfect parking: surround-view camera

A surround-view camera, also known as a 360-degree camera, uses an array of cameras placed in different locations on the vehicle to create a stitched-together image on the infotainment screen. The view, which looks like it's made

by a single camera hovering above the vehicle, is as amazing as it is helpful.

A surround-view camera system is helpful to have when you're in a tight parking lot or when you're parallel parking. The topdown view makes it a lot easier to park perfectly between the lines or be the right distance from the curb. The most helpful camera systems also come

with parking sensors that provide auditory or visual feedback to indicate how far away you are from an obstacle.

How to get it: A surround-view camera system usually comes on a more expensive trim level or as part of an optional package. Less fatigue in heavy traffic: adaptive cruise control If you frequently navigate stop-and-go traffic on the highway, adaptive cruise control can provide helpful relief from traffic fatigue. Like regular cruise control, it allows you to set a speed that the vehicle will maintain. In addition, adaptive cruise control can

automatically slow your vehicle when it senses a slower vehicle ahead and then accelerate back up to your set speed when traffic is moving again. These systems allow you to set the following distance behind the vehicle in front as well.

Some versions of adaptive cruise can bring your vehicle to a complete stop, shrinking the following distance as speeds decrease. Adaptive cruise will then return your vehicle to a preset speed as traffic begins to move again. And it all happens without touching any pedals.

How to get it: Adaptive cruise is often standard equipment on many new vehicles, even inexpensive ones. Protection from the unseen: rear-cross traffic warning

How many times have you backed out of a parking spot or driveway, unable to see if there's a vehicle bearing down on you from the side? It's a too common scenario that a rear crosstraffic warning system often solves brilliantly. Sensors at the back of the vehicle can sense what's coming before you can and sound or display an alert warning that a vehicle is approaching. These systems usually alert you soon enough that you'll have time to press on the brake and stop. Some vehicles also can also automatically apply the brakes if the driver doesn't react in time.