‘It

doesn’t take a blind man’: Sarkis ally says CCA losing

By NEIL HARTNELL

Akey Sarkis Izmirlian ally yesterday asserted

“it doesn’t take a blind man” to see that Baha Mar’s contractor will likely lose its appeal against the growing $1.642bn damages awarded to the original developer.

Dionisio D’Aguilar, who sat on Baha Mar’s Board prior to Mr Izmirlian’s ouster from the mega resort project, nevertheless told Tribune Business that China Construction America’s (CCA) threatened liquidation of its Bahamian assets - namely the British Colonial and Margaritaville Beach Resort - “won’t come into play at all” as a result of yesterday’s New York verdict.

The New York State Supreme Court’s appeals division, in a brief onepage decision, overturned the temporary injunction

previously obtained by CCA and its affiliates that barred Baha Mar’s original developer from enforcing the earlier $1.642 damages award plus interest that he obtained against them.

The ruling leaves the Chinese state-owned contractor once again scrambling to raise, and post, the $1.9bn bond surety bond mandated by the New York court otherwise it will be unable to pursue its appeal against Mr Izmirlian’s initial comprehensive legal win.

CCA and its affiliates have previously disclosed in legal filings that they lack both the assets and means to raise this security. They warned that if Mr Izmirlian was not restrained from enforcing

his award they may have to place their Bahamian corporate entities, including the downtown Nassau resorts, into liquidation proceedings before the Supreme Court. Mr D’Aguilar, though, dismissed such an outcome as inconceivable as

the Chinese government’s “reputation is on the line” if it permits one of its stateowned companies to fall into bankruptcy or liquidation. As a result, while CCA and its affiliates could threaten to liquidate the two Bahamian resorts, he dismissed it as “not a viable

option” for resolving its long-running legal battle with Mr Izmirlian.

Instead, the former minister of tourism and aviation argued that CCA faces “one of two choices”. These, Mr D’Aguilar said, are pursuing an appeal, with all the uncertainty and extra legal costs that involves, or reaching a settlement with Mr Izmirlian. He described the latter as the “cheapest” option given that an unsuccessful CCA appeal could take the damages payout to near $2bn by the time a verdict is rendered.

CCA, though, gave no hint that it is backing down with yesterday’s defiant response signalling it has

SEE PAGE B4

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Balmoral Club’s president yesterday hailed the planning appeals Board’s decision to overturn rejection of its $25m condo hotel as “a win-win” for both developer and the community.

Dwayne Mortimer told Tribune Business that the reversal of the Town Planning Committee’s initial verdict was akin to an early Christmas present as he pledged that the Club will reapply for the required approvals “in the first full week of the New Year”. He added that the project, when completed, will help to support between 75-100 full-time Bahamian jobs at the Club. The Subdivision and Development Appeal

CONTROVERSIAL CEMETERY PROPOSAL IS DISMISSED

By NEIL HARTNELL Tribune Business Editor

A SIX-YEAR battle over a controversial 13-acre cemetery proposed for Bernard Road has resulted in the developer’s application being dismissed by the planning authorities. The Subdivision and Development Appeal Board, in a December 19, 2024, verdict on a project that sparked intervention by Fred Mitchell in his capacity as the area’s MP, identified several factors which meant that the appeal by James Bain and Three Phase Investment seeking to overturn their initial rejection “cannot be

ROYALSTAR’S TOP RATINGS AFFIRMED BY AM BEST

A Bahamian property and casualty insurer has seen its financial strength and creditworthiness reaffirmed by the industry’s top international rating agency. AM Best, in a statement, said it has confirmed the financial strength rating of ‘A’ (Excellent), plus the long-term issuer credit rating of ‘a’ (Excellent), for RoyalStar Assurance. The outlook for these credit ratings is stable. The rating agency said its assessment reflects RoyalStar’s balance sheet strength, which it described

as strongest, as well as its robust operating performance, limited business profile and appropriate enterprise risk management (ERM).”Royal Star Assurance has the strongest level of risk-adjusted capitalisation, as measured by Best’s capital adequacy ratio (BCAR),” AM Best said. “The BCAR also remains assessed at strongest on a catastrophe-stressed basis, which indicates that some level of stability should be maintained through potential tail-risk events. However, the company has

a high dependence on reinsurance to manage capital exposure to catastrophic events, as is typical of Caribbean insurers.

“Royal Star Assurance holds appropriate protection from catastrophic events with high-quality reinsurers. Capital growth has been hampered by the payment of dividends to transfer assets from Royal Star Assurance to the holding company,” the agency added.

“Royal Star Assurance’s invested assets are conservative with short-term

deposits and fixed income securities comprising over half of invested assets at year-end 2023. The remainder of investments are held in equities and a real estate holding company.

“Royal Star Assurance is limited to Bahamas-domiciled investments that can impact its ability to manage investment quality. Royal Star Assurance has low financial leverage, driven by a bank loan and the issuance of preference shares a few years ago.”

Turning to the underwriter’s financial performance,

AM Best added: “Royal Star Assurance’s operating performance remains strong as seen by consistent operating income in four of the last five years supported by favourable underwriting results and increasing investment income, a trend which continued in 2024.

“Furthermore, the company’s return-on-equity metrics have remained in the low to mid-teens. Gross premiums written have increased, driven by rising property rate increases as well as modest expansion in the Cayman Islands and

US Virgin Islands. Royal Star Assurance’s business profile is limited. More than 60 percent of business is written in The Bahamas, followed by the Cayman Islands at almost 20 percent, presenting geographic concentration risk.

“Material geographic expansion is limited based upon reinsurance capacity constraints in the region. Royal Star Assurance offers a number of general insurance products through a network of agents and brokers in several Caribbean territories.”

Gov’t set to accept Sand Dollar for public services

BAHAMIANS will now be able to pay for multiple public services using the country’s Central Bankbacked digital currency, the Government confirmed yesterday.

The Ministry of Economic Affairs’ digital transformation unit, in a statement, said the Sand Dollar has been integrated into MyGateway, the online portal for accessing

government services. It added that this provides Bahamians and residents with a fast, secure and totally digital payment option for a wide range of public services.

The Government departments now accepting Sand Dollar payments via MyGateway.gov.bs are the Department of Immigration; Department of Labour; the Royal Bahamas Police Force; Office of the Judiciary; Road Traffic Department; Registrar General’s Office; General Post Office; and the Attorney Generals’s Office.

The digital transformation unit said: “This upgrade offers a fully cashless solution, enabling users to access services, pay fees and complete transactions at their convenience. This Sand Dollar integration will

enable 100 percent digital payments, and allow users to securely make transactions directly from their Sand Dollar wallets without the need for physical cash or in-person visits.

“Payments are processed instantly, ensuring real-time transactions and faster service delivery.

“Additionally, Sand Dollar payments are backed by the Central Bank of The Bahamas, providing robust security and trustworthiness.”

To make Sand Dollar payments on MyGateway, the Unit said Bahamians and residents can log into

their MyGateway account, select the service they wish to pay for, choose the Central Bank-backed digital currency as their payment method and follow the steps to complete the transaction. It added: “This integration represents a significant milestone in The Bahamas’ journey toward a more digitally-inclusive society. By offering a secure and efficient way to make payments for government services, the Government continues to enhance public service delivery while promoting innovation and accessibility,” said the digital transformation unit.

Resort operator concern on Bahamasair sick-out impact

By ANNELIA NIXON Tribune Business Reporter anixon@tribunemedia.net

FAMILY Island resort operators yesterday said that while they dodged any major fall-out from Bahamasair’s day-long grounding they fear for the destination’s reputation and possible future industrial action.

Speaking as Bahamasair revealed that some staff involved in Wednesday’s sick-out have yet to return to work despite a Supreme Court injunction ordering all workers to report “when scheduled to do so”, hoteliers voiced concern about the long-term impact as a result of that day’s flight cancellations

The national flag carrier added that the continued disruption by some members of the Airport, Airline and Allied Workers Union (AAAWU) would have a continued negative impact on operations, causing “delays and possible cancellations” through yesterday.

Jill Smith, owner and operator of Stella Maris, said Long Island “just cannot afford any more flight disruptions right now”. She added that while guest deposits are nonrefundable, the hotel will still lose revenue if visitors cannot arrive.

“People then say, ‘oh, but you have a deposit’,” Ms Smith said. “Yeah, okay, but let’s just say you’re expecting a family of eight and they have three rooms blocked or a villa. So, yeah, you have a three-night or four-night deposit, which is fine, which they would lose because we’re not responsible for Bahamasair. But the problem is also the anticipated income that you’re hoping for.

“A family of eight is going to have breakfast, is going to have lunch, is going to have dinner days, going to have drinks. It’s going to have activities, it’s going to go to the grocery store, it’s going to go one of the local places to get on a boat, to go scuba diving, to go bone fishing. So it’s not just the room revenue that you will be losing. It’s across the board.

“Then the taxi driver, the tour operator, the grocery store, the liquor store. Across the board you could potentially be losing eight people times eight days worth of food, activity, beverages,” Ms Smith

added. “Once you get into that spiral of the first day they miss their flights. The second day, they miss their flights. How are they going to eventually get here?

“Like, how is Bahamasair going to recover? There’s no back-up to Long Island. It’s not like they can put them on Jet Blue or American Airlines to Long Island. There’s no such thing. All the charter operators are fully booked. There’s no such thing.

“So, these poor people then that are just going to be stuck and stuck in Nassau. Who knows, then, if they’re going get hotel rooms in Nassau? So the spiral effect of this, if this doesn’t get corrected very soon, is very tragic. It’s going to be tragic for everyone.”

Ms Smith said Stella Maris has already prepared for a specified number of guests and placed “liquor orders” and “food orders”. However, she added that if Bahamasair does not get the situation under control it “can really wipe out your entire Christmas revenue.” Airlift to Long Island is currently in short supply prior to Bahamasair’s industrial action.

“And here’s our problem on Long Island or any of these remote islands that will be affected,” Ms Smith said. “Let’s just say cancellations start pouring in because they can’t get here. You cannot recover. If we were in New York City or any other place in the world, there’s other airlines coming in, there’s other avenues to sell your room night, to sell your meals, to sell your breakfast.

“But Long island and the other Out islands, I would presume we don’t have that luxury. We have those people that are scheduled to arrive and that’s it.

There’s no other possibility to sell your hotel room. To whom? There’s nobody else coming to Long Island right now because there are no flights available.

“Our airlift is so limited that if somebody cancels now, that’s it for that room or that villa. There’s a 10 percent chance that you could possibly sell it to somebody else that might have a private plane that might decide, ‘okay, well, the weather’s great, let’s fly to Long Island’,” Ms Smith added.

“But, other than that, there’s no possibility to still sell your room right now. There’s no way for people to get here, and it’s booked out till January. So your schedule’s in place right now. Unless, like I say, a boat pops up and there might be a family on there or somebody in a private plane. Those are the only two possibilities where we can still sell room nights.”

Molly McIntosh, general manager of Abaco’s Bluff House Beach Resort and Marina, said that while her operation has not been negatively impacted she worries about the reputational damage this sick-out has caused.

“The problem is the reputation,” Ms McIntosh said. “Bahamasair has been doing really well, gotten a much better reputation, giving people options to get over here, and that’s really good. And now this happens. People lose confidence. They get worried. And that’s the thing that hurts.

“I don’t want the flag carrier to lose. They’ve worked hard to gain the reputation back and doing a pretty good job. I don’t want to see that go downhill. And, at the same time, the cost of living is so high.

cancel’. That makes people nervous.”

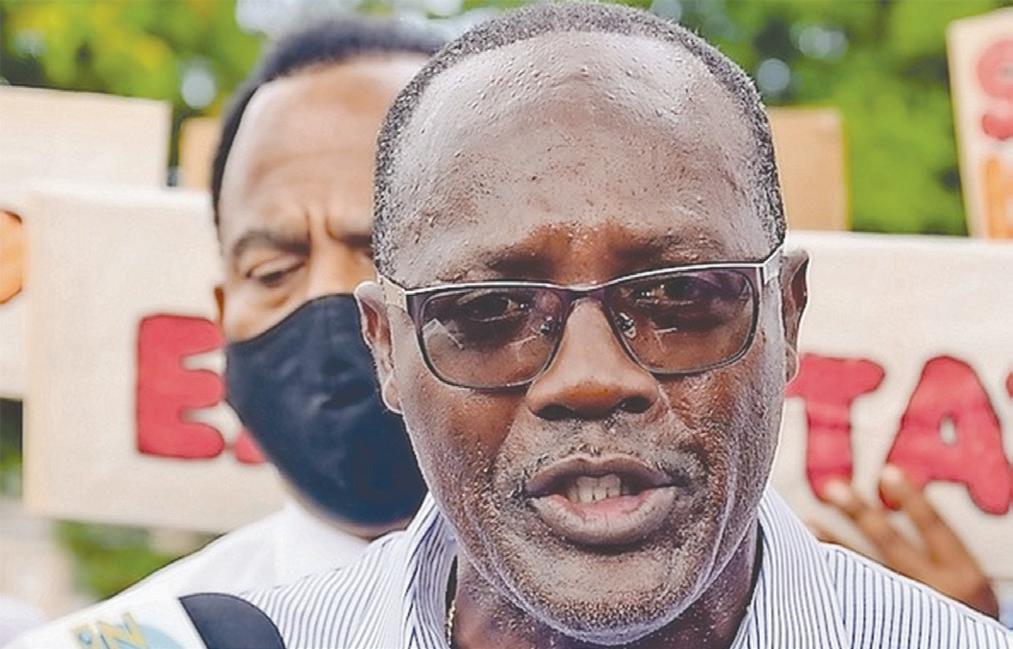

Obie Ferguson, the Trades Union Congress (TUC) president, said there is a process to initiating strike action.

“There’s the first thing that must happen when you decide to take a strike, he said. “You should get the consensus from your membership. That’s the first thing.

Everybody’s getting fed up trying to make ends meet. “So I’m kind of neutral on it. I think it’s unfortunate. Even if it doesn’t hurt me, it didn’t hurt my actual reservation, it hurts the reputation. It makes people wary to book Bahamasair. ‘Oh, they might

“Second thing is, if you have a trade dispute or an issue arising out of an employment arrangement where you have a union, the union should file its trade dispute and particularise all of the issues affecting their members. They notify the Ministry of Labour that they wish to have a poll.

“The ministry is bound to supervise the poll and make sure all the requirements to permit the poll has been complied with and that the members ought to be allowed to vote freely

without any interference,” Mr Ferguson continued.

“Once the poll is taken, the ministry then issues a certificate indicating that the polling was done in accordance with the law and is then open…for the union to take industrial action.

“Once the union follows the rules, they cannot be terminated. Only when they take what we call a wildcat strike, if that happens, then the consequences are on the union and ultimately the members. So the strike must follow those procedures.

“If you didn’t follow those procedures, you are exposing the union to substantial financial loss because it would be taken into consideration, not only the losing of the case, but also potentially whatever the business will experience as a loss. That is also a factor that must be taken into consideration.”

doesn’t take a blind man’: Sarkis ally says CCA losing

every intention of pursuing an appeal. “This ruling has no bearing on the merits of our case and will not deter us from seeking to have the trial court’s errorridden decision overturned on appeal,” the Chinese state-owned contractor said in a statement responding to Tribune Business inquiries.

“As we intend to show, the lower court failed to apply well-established principles of New York law and disregarded clear evidence that BML Properties grossly mismanaged the Baha Mar project and then drove it into a wrongful, secret bankruptcy to eliminate its obligations to other stakeholders, including the Government and people of The Bahamas.” BML Properties is Mr Izmirlian’s corporate vehicle.

Asked about the consequences of yesterday’s verdict, Mr D’Aguilar told Tribune Business: “I go back to my original message. I think it would behoove CCA to attempt to settle. They have taken it to court and they have lost. All their motions at the original trial they lost, they lost the original trial, and they tried to stay the proceedings of the appeal and they’ve lost. “Now they’ve got one of two choices. They can appeal or they can settle. Their record thus far has not been successful. They’ve lost in every instance. It doesn’t take a blind man to see where this is headed. They are most probably going to lose their appeal and, by that time, with 9 percent interest and the projected time to appeal being two years, that $1.642bn will have grown to $1.8-$1.9bn.”

Mr D’Aguilar said CCA and its affiliates are “clearly having trouble” raising the $1.9bn bond security needed to prosecute the New York appeal based on their own legal filings. “That’s why they asked the court to intervene and stop the appeal proceeding,” he added of the temporary

injunction that was yesterday dismissed.

“It’s clear to see they are losing this,” Mr D’Aguilar reiterated. “They were wrong. They failed to live up to the terms of their contract and, in some instances, committed fraud. Now they have to pay someone who has been wronged. They have to settle or appeal. For me and everybody looking at it, it will be cheaper to settle.”

Asked about CCA’s warnings that, if unable to raise the bond, it may be forced to declare bankruptcy in the US as well as initiate liquidation proceedings before the Supreme Court, Mr D’Aguilar reiterated that this was an unlikely outcome and predicted there will be no impact for the British Colonial, Margaritaville Beach Resort and the hundreds of Bahamian jobs that depend on them.

“They can threaten to do that,” he told Tribune Business, “but the implications of that are far-reaching. This is a company, CCA, that is ultimately owned by the state of the People’s Republic of China. First of all, I’m sure this has never happened before where a state-owned company has

contemplated declaring bankruptcy.

“The Bahamas would never contemplate that. We would fulfill the obligations of any company owned by the Government of The Bahamas. If they [CCA] were to do that, everyone would look at every stateowned Chinese company and say ‘wow, I don’t know if I want to do business with them because if they fail to live up to the terms of the contract they will declare bankruptcy.

“I just don’t think that’s an option,” Mr D’Aguilar reiterated. “I’m not even going to contemplate their bankruptcy. I don’t think it’s an issue for the local hotels here. I just think the lawyers can talk it, but I don’t think it’s a viable option once sensible heads gather in a room and discuss how they are going to deal with it.

“This is the country with the second largest economy in the world... I don’t see any other option for them other than to appeal or settle and, of the two, the cheapest is to settle. You have all these legal fees and have not succeeded thus far. The New York appeal court has allowed the appeal to proceed. You have got to pay to appeal, and put up the bond, or settle.”

Asked about the implications for the two downtown Nassau resorts, Mr D’Aguilar said: “None whatsoever. I don’t think they’ll come into play at all. They’ve really got nothing to do with this case in my opinion. The Chinese government’s reputation is on the line. Are they governed by the rule of law or not? Are they governed by the rule of law in the places they do business or are they not?

“If they want to engage themselves internationally these are the rules of engagement. They can settle now or they can appeal. It saves them face if they appeal.” Yesterday’s verdict, which allows both

the appeal proceedings to proceed and Mr Izmirlian to move ahead with enforcing his damages award, means the next move is CCA’s.

Ryan Pinder KC, the attorney general, yesterday said the Davis administration was not worried by the New York appeals court’s ruling and its potential impact as the Government “has to be involved” in whatever developments take place.

“We’re not concerned. The Government has the mind of the Bahamian people first and foremost. Whatever happens, the Government has to be involved in the process and, ultimately, they have to come to government to effect any kind of Order or any kind of result that they achieve, and the Government - when they approach that - they will approach that with the mindset of Bahamians first,” Mr Pinder said. He added that his office’s review of the original verdict that awarded Mr Izmirlian his $1.642bn, a sum that continues to increase with each passing day, has not uncovered anything for the Government to be concerned about.

“We have reviewed the ruling,” Mr Pinder said.

“We don’t see any instances in the ruling that would really point to anything that the Government should be concerned about, and that was the first ruling, so we’ll review the court of appeal ruling that just came down and see if that has any implications.”

CCA had previously asserted it was “willing to pledge” its two Nassau resorts, which have a combined value of up to $355m, as security for its appeal against Mr Izmirlian’s original verdict.

Genguo Ju, CCA (Bahamas) executive vicepresident, asserted in an affidavit that the shares giving it ownership of both resorts were valued

at $146m in the company’s most recent audited financial statements. And an appraisal conducted earlier this year had priced the combined real estate worth of the two properties at between $232.7m and $355.1m.

“CCA (Bahamas), a Bahamian company, is primarily a holding company whose only material assets are its interests in two Bahamian subsidiaries. These two subsidiaries together own two hotels in Nassau, Bahamas: The British Colonial Hotel & Office Complex and the Margaritaville Beach Resort complex,” he said.

“Earlier this year, CCA (Bahamas) obtained appraisals of the two hotels from Cushman & Wakefield and Jones Lang LaSalle (JLL). Cushman and JLL appraised the collective value of the hotels as between $232.7m and $355.1m. CCA (Bahamas) would be willing to provide those valuation reports to the court [privately] and under seal, and to make them available to plaintiff subject to an appropriate confidentiality order.”

Reasserting CCA’s position that surety financiers would not accept the two Nassau resorts as collateral for the proposed $1.9bn bond, Mr Ju added:

“Nonetheless, independent of any bond, CCA Bahamas is willing to pledge its shares of its two subsidiaries as security against the judgment.

“Those shares were carried on CCA Bahamas’ books in its most recent audited financial statement at approximately $146m. CCA Bahamas would be willing to provide that statement to the court in [private] or under seal, and to make it available to plaintiff subject to an appropriate confidentiality order. CCA Bahamas intends to continue to operate the hotels in the regular course during the pendency of this appeal.”

Balmoral’s $25m hotel appeal ruling labelled a ‘win-win’

FROM PAGE B1

Board, in a December 19, 2024, verdict found that the Town Planning Committee’s decision to reject the eight-storey, 50-unit condo hotel “lacks the requisite reasoning” given that it had previously approved a smaller-scale version of the development at the same location.

The Committee, in its original late 2023 decision, rejected the Balmoral Club’s expansion plan because it was “incompatible” with land use and development trends in the gated Sanford Drive community. However, the Board, chaired by attorney Dawson Malone, suggested it did not make sense for the Committee to have earlier approved the same type of land use only to them turn around and use it as the basis for rejection.

“The Board finds it difficult to accept that the decision - being the Town Planning Committee refusal - should be upheld,” it said in its verdict. “The refusal lacks the requisite reasoning which, while not legally mandated, the Board finds that such reasoning was required when the previous approval for the same type of land use was granted.

“The absence of reasons in these circumstances renders the decision unsustainable given the basis if the refusal. In light of this, the refusal is set aside and the matter is referred back to the Town Planning Committee for rehearing should the appellants wish to reapply.”

Mr Mortimer, while unsure why the Appeals Board has referred the condo hotel project back to Town Planning, confirmed to Tribune Business that the Club will quickly reapply for the relevant site plan and other planning permissions necessary to advance the development.

The Appeals Board also upheld the original February 22, 2022, decision by the Town Planning Committee to grant approval for the smaller-scale condo hotel at the same location. It did so on the basis that the law requires all planning appeals to be lodged within 21 days and, since the Balmoral homeowners association missed this deadline, it now has no jurisdiction to hear the action.

Mr Mortimer, who pointed out that February 2025 will mark three years since that initial site plan approval was granted, not surprisingly agreed with the Appeals Board that it did

“not make sense” for Town Planning to have approved the land use originally only to them turn around and reject it - for the same purpose and at the same site - following objections by some of Balmoral’s homeowners.

Responding to some of those concerns, the Balmoral Club president said the level of investment, number of rooms and room rates that will be charged showed the condo hotel is targeted specifically at highend clients and there will be no ‘free for all’ in terms of who has access to the gated western New Providence community that is located in close proximity to the US ambassador’s residence.

“We intend to put up a five-star hotel with room rates at $400 to $500 per night,” Mr Mortimer told Tribune Business. “This really serves to enhance and upgrade the community. I would have, during the appeal process, made reference to a number of gated communities in The Bahamas where the model [boutique hotel in a gated community] works well.

“I’m not sure if they [homeowners] thought it through properly. The majority of units here are town homes with two bedrooms, with some having three bedrooms. How convenient will that [condo hotel] be when they have guests in town? It’s a boutique hotel and we already have a lot of amenities in place.

“I think the ruling is a win-win for the Club and a win-win for the community,” Mr Mortimer added. “Some may not see it at the moment, but we are going to hit the ground running, and when we finish it they’ll approve. Yes, we are going to resubmit our application and I’m hopeful that will be approved and done expeditiously.

“From our side it’s just a matter of resubmission and, to make sure our paperwork does not get lost in the holiday, in the first full week of the New Year we expect to have the application in. When it’s coupled with the additions to our restaurants, the addition of a spa and expansion of the gym, believe it or not it’s not large in the scheme of things but it’s going to create between 75-100 highquality jobs.”

Suggesting that the Balmoral Club may revert to the original, slightly smaller-scale condo hotel project if it encounters further planning approval challenges, Mr Mortimer added: “If you think about

it, $25m for a $50m condo hotel, that tells you what the cost per key is right there......

“Three to four months ago, the deputy prime minister and minister of tourism [Chester Cooper] made the pronouncement that, over the next ten years, The Bahamas needs 15,000 more hotel rooms. I would hate to see those rooms all roll into massive hotels. It’s time that Bahamians start to own part of the tourism pie. This is one step, not the first step, in that direction and I definitely hope it’s not the last.”

The Balmoral Club chief added that the presence of hotel guests within the community will require its security to be beefed up with a full-time guard presence on the grounds. He added that, as investors in both the Club and other properties in the community, it would make no sense for himself and his group to undermine their holdings by reckless development.

“The peace and tranquility that they enjoy today,” Mr Mortimer said of Balmoral homeowners, “that is going to be one of the primary selling points; that peace and tranquility at the heart of Nassau at the Balmoral hotel.

“We will be reasonable. We are mindful these are people’s lives and livelihoods which they have worked hard for. We are mindful of that. Our group has a number of properties; our group is the biggest investor in the

Balmoral community. As I said before, and as I say to you, we are not going to do anything that negatively impacts our existing investment.

“We’re going to do this special. We are a Bahamian-owned and operated club. We will contract with one of the large Bahamian contractors for sure. There

are ways to contract others, but this is a bit more than the bottom line. This is a statement for The Bahamas and a statement about Bahamians.”

Farmers, business owners and fire

survivors face uncertainty after $100Bn in disaster relief flounders

By TRAVIS LOLLER, LEAH WILLINGHAM and JENNIFER

SINCO

KELLEHER Associated Press

NASHVILLE, Tenn.

(AP) — American farmers, small business owners and wildfire survivors are among those who will suffer if Congress cannot agree on a new spending bill after President-elect Donald Trump abruptly rejected a bipartisan plan that included more than $100 billion in disaster aid.

A mayor in Hawaii is watching closely to see what happens because a potential allocation of $1.6 billion in funding is on the line. It’s critical to ongoing disaster recovery efforts from the 2023 Maui fire, which proved to be the deadliest U.S. wildfire in more than a century.

“I think what funding does is provides people with hope so they can plan for their future,” Maui Mayor Richard Bissen told The Associated Press Thursday. “And the longer we go without funding, the longer people wallow and wonder, is there a chance? Is there a path? Do I cut my losses? Do I leave?”

While money from the Federal Emergency Management Administration has provided temporary relief, the disaster recovery funding was intended for long-term needs such as housing assistance and rebuilding infrastructure, he said. The historic town of Lahaina is still struggling after the August 2023 fire killed at least 102 people and leveled thousands of homes, leaving behind an estimated $5.5 billion in damage.

The money is also urgently needed after Hurricanes Helene and Milton slammed the southeastern United States one after the other this fall. Helene alone was the deadliest storm to hit the U.S. mainland since

REPUBLICAN presidential nominee former President Donald Trump delivers remarks on the damage and federal response to Hurricane Helene, in Swannanoa, N.C., Oct. 21, 2024. (AP

Katrina in 2005, killing at least 221 people. Nearly half were in North Carolina where flooding and winds caused an estimated $60 billion in damage.

“I’m tracking this bill like a hawk right now, to be honest,” Asheville Tea Co. founder and CEO Jessie Dean said. “I think a lot of us are.”

Flooding from Helene in September washed away the company’s building along with all of its equipment and inventory. Her small business employs 11 people directly and also works with small farmers in the area to supply the herbs for its teas.

On Thursday, Republicans released a new version of the bil l to keep the government operating and to

restore the disaster aid with Trump’s support. But it was rejected by the House of Representatives. The next steps are uncertain.

“I realize there are other distractions that are going on, but I would just bring everybody back to their commitment to help disaster survivors,” said Bissen, Maui’s mayor. “And that’s really all this is. We have a proven and established, legitimate disaster that took place. And we are coming up on 16 months, which no other disasters ever had to wait that long for.”

In Asheville, Dean is extremely grateful for support the business has received from customers and nonprofits that is helping it stay afloat right now, but more is needed. So far

she has received no money from the U.S. Small Business Administration after applying for a disaster relief loan. Neither have any of the other business owners she knows.

“In day to day life right now, I’m talking to friends every day who are struggling with the decision around whether or not to continue to run their business, whether or not they can,” she said.

Many farmers are in the same boat, since about $21 billion of the disaster aid in the earlier version of the bill was assistance for them.

“Without federal disaster money right now, or without some assistance, people like me will not be farming much longer,” Georgia pecan farmer Scott Hudson

said. He farms 2,600 acres (1,050 hectares) of pecans across five counties in southeastern Georgia that were hammered by Hurricane Helene.

“We lost thousands of trees that will be decades before they are back to where they were the night before the storm,” he said.

“And we lost upwards to 70% of the crop in certain counties.”

Some of his fellow farmers fared even worse.

“Whether you’re a Democrat or Republican, the farmers need this money,” he said. “American ag needs this money ... not to be profitable, to just stay in business.”

People like retired engineer Thomas Ellzey are also counting on disaster aid. He has been living in a mud-filled house in Fairview, North Carolina, for almost three months.

Although he pre-qualified for a low-interest loan from the SBA that helps homeowners rebuild, officials have told him the agency does not have the money and is waiting on Congress to act.

Ellzey is 71 years old and said he budgeted carefully for his retirement, trying to prepare for every possible emergency that could come up once he stopped working. But he couldn’t have predicted a hurricane, he said.

“Everything I owned was paid for, including my cars, the house, the land. I had no bills,” he said. “Going back in debt is kind of rough at my age.”

The earlier version of the spending bill included

)

included funding for low-interest loans for businesses, nonprofits and homeowners trying to rebuild after a disaster; money for rebuilding damaged roads and highways; and funds for helping communities recover through block grants administered by the Department of Housing and Urban Development.

The block grant money is one of the key funds for homeowners who don’t have insurance or enough insurance recover from disasters.

Although hurricanes Helene and Milton are the most recent large natural disasters to hit the U.S., a lot of the money was intended more generally for relief from any major disaster in recent years, including droughts and wildfires.

Stan Gimont is senior adviser for community recovery at Hagerty Consulting who used to run the community development block grant program at HUD. He noted that the country is still paying for disasters that happened while it simultaneously prepares for events that will happen in the future.

The Maui fire is a clear example.

“It took a year to clean that up and to get it to a point where they have removed all the debris, all the toxic materials and the burned up cars, whatever was in those houses,” Gimont said. “So even though that event occurred in the past, the bills for that are going to come due in the future.”

N O T I C E

IN THE ESTATE OF CYPRIANA VALENTINE FLEISCHER late of 16 Pear Street, Sans Souci in the Eastern District of the Island of New Providence, one of the Islands of the Commonwealth of Te Bahamas, deceased.

NOTICE is hereby given that all persons having any claim or demand against the above Estate are required to send the same duly certifed in writing to the Undersigned on or before 24 January 2025, afer which date the Executor will proceed to distribute the assets having regard only to the claims of which he shall then have had notice.

AND NOTICE is hereby also given that all persons indebted to the said Estate are requested to make full settlement on or before the date hereinbefore mentioned.

DELANEY PARTNERS

Attorneys for the Executor P. O. Box CB-13007 5th Floor, Lyford Cay House, Western Road, Lyford Cay New Providence, Te Bahamas

Controversial cemetery proposal is dismissed

sustained”. The Board, chaired by attorney Dawson Malone, upheld the Town Planning Committee’s original rejection of the project on the basis that part of the 13-acre site is being acquired by the Government using its powers of compulsory acquisition. And, separately, three lots are being occupied by unnamed persons whose presence on the site is being challenged in the Supreme Court.

“While the grounds of appeal presented by the appellant were reviewed, the appeal must be refused particularly due to the breadth of the approval sought over property which is subject to a compulsory acquisition and parcels duly occupied by persons,” the Board determined.

“In regards to the public acquisition, a portion of the subject property is undergoing compulsory acquisition and therefore, as the request made encompassed this area of property the appeal cannot be sustained over the subject property.

“In addition, there are at least three lots within the subject property that are occupied by individuals and their occupation is sub judice vide Supreme Court proceedings. While this in and of itself may not be grounds to refuse, it does weight against the grant.”

The Board also voiced disquiet that help from the Department of Physical Planning in relation to the cemetery hearing was “disappointingly.. delayed and partial”. However, the impact was not sufficient to alter the decision’s outcome.

The proposed 13-acre cemetery site, which is located near the Budget Convenience store, east of Sands Addition and just past the 700 Wines and Spirits liquor store heading east on Bernard Road, has been heavily opposed by local residents.

Mr Mitchell, minister of foreign affairs, PLP chairman and Fox Hill MP, wrote to the Subdivision and Appeals Board on February

19, 2024, urging that the appeal be dismissed “and the status quo maintained” on the basis that permitting the project would devalue nearby properties and disturb his constituents’ way of life.

Asserting that roads in the area would be unable to handle the increase in vehicle traffic generated by the cemetery, he added that the Government is also “in the early stages” of using its compulsory powers under the Acquisition of Land Act to purchase either the entire property or “pieces and parcels” of it.

Mr Mitchell’s intervention, which was sent to the Appeals Board’s nowformer secretary, Carol Martinborough, surfaced at the pre-hearing for the appeal against the Town Planning Committee’s 2018 rejection of Mr Bain’s application to build the cemetery on vacant land he owns.

“I wish to register the interest in the above captioned matter and urge that the appeal be dismissed and the status quo maintained,” said Mr Mitchell.

“The use of the land for a cemetery is not supported by most constituents in the area. The roads in the area do not, and cannot, support the additional commercial traffic, and given the experience of Woodlawn [Gardens], the increased nuisance to residents would be exponential, displacing and devaluing their properties and disturbing their quiet enjoyment.

“In addition, the Government is in the early stages of exercising its powers under the Public Acquisition Act to [acquire] the land in question or pieces or parcels therein.” However, the Board’s dismissal of the appeal comes amid concerns that the public cemetery on Spikenard Road is running out of space. Clay Sweeting, minister of works, said he was aware of the need to expand the location.

The cemetery proposal sparked considerable protest from area residents when it surfaced in 2018, culminating in a wellattended public hearing at LW Young Junior High

NOTICE

LPF (INTERNATIONAL) LTD.

In Voluntary Liquidation

Notice is hereby given that in accordance with Section 138(4) of the International Business Companies Act. 2000, LPF (INTERNATIONAL) LTD. is in dissolution as of December 18, 2024.

Gestam Administration Ltd. situated at Suite 102, Bay Street & Bank Lane is the Liquidator.

L I Q U I D A T O R

NOTICE

PEARSON VALLEY INC.

In Voluntary Liquidation

Notice is hereby given that in accordance with Section 138(4) of the International Business Companies Act. 2000, PEARSON VALLEY INC. is in dissolution as of December 17, 2024.

International Liquidator Services Ltd. situated at 3rd Floor Whitfield Tower, 4792 Coney Drive, Belize City, Belize is the Liquidator.

L I Q U I D A T O R

School where concerns were voiced. Among the chief fears were that traffic would increase, while the value of properties in the area would decline. Residents were also concerned the project would impact the water table and increase flooding in the area.

Attorney Bjorn Ferguson, an opponent of the proposed cemetery, told this newspaper at the time: “We’re just happy that the [Town Planning] committee gave weight to the relevant factors and arrived at the right conclusion. We would greatly appreciate

consideration being given to adding more green and recreational space in our community.

“The children in the affected communities are forced to play in the streets due to the lack of green and recreational space. We would fully endorse

developments that included these considerations. We do understand that a developer has a right to develop his land but his development cannot negatively impact the community It should provide a positive impact to the community and society at large.”

Stock market today: Wall Street ends little changed after giving up a big morning gain

By STAN CHOE AP Business Writer

NEW YORK (AP) —

An early rebound for U.S. stocks yesterday petered out by the end of the day, leaving indexes close to flat.

The S&P 500 edged down by 0.1% following Wednesday’s tumble of 2.9% when the Federal Reserve said it may deliver fewer cuts to interest rates next year than earlier thought. The index had been up as much as 1.1% in the morning.

The Dow Jones Industrial Average rose 15 points, or less than 0.1%, following Wednesday’s drop of 1,123 points, while the Nasdaq composite slipped 0.1%.

This week’s struggles have taken some of the enthusiasm out of the market, which critics had been warning was overly buoyant and would need everything to go correctly for it to justify its high prices.

But indexes remain near their records, and the S&P 500 is still on track for one

of its best years of the millennium with a gain of 23%.

Traders are now expecting the Federal Reserve to deliver just one or maybe two cuts to interest rates next year, according to data from CME Group. Some are even betting on none.

A month ago, the majority saw at least two cuts in 2025 as a safe bet.

Wall Street loves lower interest rates because they give the economy a boost and goose prices for investments, but they can also provide fuel for inflation.

Micron Technology was one of the heaviest weights on the S&P 500 Thursday. It fell 16.2% despite reporting stronger profit for the latest quarter than expected.

The computer memory company’s revenue fell short of Wall Street’s forecasts, and CEO Sanjay Mehrotra said it expects demand from consumers to remain weaker in the near term. It gave a forecast for revenue in the current quarter that fell well short of what analysts were thinking.

NOTICE is hereby given that KEMONE KNIGHT of P.O.box N-4570, #22 Eneas Avenue, Stapledon Gardens, New Providence, The Bahamas applying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 20th day of December, 2024 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

SPECIALIST Anthony Matesic works on the floor of the New York Stock Exchange as the rate decision of the Federal Reserve is announced, Wednesday, December 18.

Lamb Weston, which makes French fries and other potato products, dropped 20.1% after falling short of analysts’ expectations for profit and revenue in the latest quarter. It also cut its financial targets for the fiscal year, saying demand for frozen potatoes is continuing to soften, particularly outside North America. The company replaced its chief executive.

Such losses helped overshadow a 14.7% jump for Darden Restaurants, the company behind Olive Garden and other chains. It delivered profit for the latest quarter that edged past analysts’ expectations. The operator of LongHorn Steakhouses also gave a forecast for revenue for this fiscal year that topped analysts’.

Accenture rose 7.1% after the professional

services company likewise topped expectations for profit in the latest quarter.

CEO Julie Sweet said it saw growth around the world, and the company raised its forecast for revenue this fiscal year.

Amazon shares added 1.3%, even as workers at seven of its facilities went on strike Thursday in the middle of the online retail giant’s busiest time of the year. Amazon says it doesn’t expect an impact on its operations during what the workers’ union calls the largest strike against the company in U.S. history.

In the bond market, yields were mixed a day after shooting higher on expectations that the Fed would deliver fewer cuts to rates in 2025. Reports on the U.S. economy came in mixed.

One showed the overall economy grew at a 3.1%

annualized rate during the summer, faster than earlier thought. The economy has remained remarkably resilient even though the Fed held its main interest rate at a two-decade high for a while before beginning to cut them in September.

A separate report showed fewer U.S. workers applied for unemployment benefits last week, an indication that the job market also remains solid. But a third report said manufacturing in the mid-Atlantic region is unexpectedly contracting again despite economists’ expectations for growth.

The yield on the 10-year Treasury rose to 4.57% from 4.52% late Wednesday and from less than 4.20% earlier this month.

But the two-year yield, which more closely tracks expectations for action by the Fed in the near term, eased back to 4.31% from 4.35%.

The rise in longer-term yields has put pressure on the housing market by keeping mortgage rates higher. Homebuilder Lennar fell 5.2% after reporting weaker profit and revenue for the latest quarter than analysts expected.

CEO Stuart Miller said that “the housing market that appeared to be improving as the Fed cut

short-term interest rates, proved to be far more challenging as mortgage rates rose” through the quarter.

“Even while demand remained strong, and the chronic supply shortage continued to drive the market, our results were driven by affordability limitations from higher interest rates,” he said.

A report on Thursday may have offered some encouragement for the housing industry. It showed a pickup in sales of previously occupied homes.

All told, the S&P 500 slipped 5.08 points to 5,867.08. The Dow Jones Industrial Average added 15.37 to 42,342.24, and the Nasdaq composite lost 19.92 to 19,372.77.

In stock markets abroad, London’s FTSE 100 fell 1.1% after the Bank of England paused its cuts to rates and kept its main interest rate unchanged on Thursday. The move comes as inflation there moved further above the central bank’s 2% target rate, while the British economy is flatlining at best.

The Bank of Japan also kept its benchmark interest rate unchanged, and Tokyo’s Nikkei 225 fell 0.7%. Indexes likewise sank across much of the rest of Asia and Europe.

Pursuant to the provisions of Section 138 (4) of the International Business Companies Act, 2000, (As Amended) NOTICE is hereby given that OLYM HOLDINGS SA is in dissolution and that the date of commencement of the dissolution is the 17th day of December, A. D. 2024.

Union leader concern on public sector pay switch

By ANNELIA NIXON Tribune Business Reporter anixon@tribunemedia.net

KIMSLEY Ferguson, the Bahamas Public Services Union’s (BPSU) president, said the major complaint from civil servants he has spoken with relates to their ability to budget and control their finances if they are paid every fortnight as opposed to monthly.

He added that BPSU members have said they are “disciplined enough” to handle their financial matters when paid via this frequency. “Well, a number of persons that I would have spoken to oppose the change simply because they feel disciplined enough to take care of their personal affairs and commitments in a monthly fashion as opposed to doing it twice monthly,” Mr Ferguson said.

“So that was one of the responses that we got. A lot of them, and the majority that I would have spoken to, really would prefer to remain as is. Again, that’s only the number of persons that I’ve spoken to. But from what I’m hearing, the

general consensus is persons would like to remain the way that they are, not that the union is opposed to change.

“I know that certain comments were made by the Prime Minister in his statement in the House of Assembly as to the benefits of the bi-monthly situation. Again, from what I would have read, and I don’t want to specifically quote, I think it’s more beneficial for the Government in relation to ensuring that the local economy remains buoyant,” Mr Ferguson added.

“I’m still trying to explore how the persons that we will represent, or we do represent, will benefit from the change. And so again, we are still expecting there to be some form of consultation with our unions so that we can go back to our people and apprise them of the views of the Government and how it can benefit them individually and the country nationally.”

Mr Ferguson said days would have to be allocated to allow persons to deal with their responsibilities twice a month rather than once. “Again, what was a concern for me, is we have

a pay date which previously, or what I wouldn’t say previously, but currently, is two working days before the end of the month,” he added.

“Again, you’re looking at how that’s going to affect the work environment now that you have to go and take care of stuff twice monthly now. And so you’re going to have to be given some time off to go there and address these particular concerns.”

Transparency and lack of information was another concern for Mr Ferguson and other union leaders, including Deron Brooks, the Bahamas Customs Immigration & Allied Workers Union (BCIAWU) president.

“We weren’t able to get the information from the major stakeholder, which is the employer, and take that back to our people so that we can get a consensus,” Mr Brooks said. “I do believe that something of this nature should be done in the form of a poll where the Government can organise it.

“Again, we have a responsibility to the persons that we represent. And again, once we are provided

with the information, we can go back and arrive at a consensus and come forward and give an official response,” Mr Brooks added. “They want to move away from paying us once a month to twice per month. We don’t know how that’s going to affect our people.

“We don’t know how that affects your loan with the bank. We don’t know anything. You go to the accounts department, they can’t tell you because they want to know, too. Now, again, that word ‘consultation’ seems to be something few and far apart when it comes to the employer. They use it when it’s convenient for them.”

A meeting was held to discuss union concerns regarding bi-monthly pay but the BPSU could not attend. “Again, we were invited to a meeting, I think Friday prior, that we were in attendance to, and based on scheduling we were unable to make that meeting,” Mr Ferguson said. “Again, the invitation to attend that meeting was very, very impromptu and we had prior commitments that didn’t allow us to be at that meeting.

“Again, please note that the meeting that we were invited to, we were in attendance to it. Myself, the executive vice-president, Mrs Wilson and one of her executives. We waited for a

little over an hour. Apparently nobody there was able to say which meeting was going to be held. We were given the venue, we were given the time, we were present.”

Almost 100 Gaming Board workers gain five-year deal

By ANNELIA NIXON Tribune Business Reporter anixon@tribunemedia.net

SOME 97 Gaming Board employees will benefit from the regulator’s signing yesterday of a five-year industrial agreement with the Bahamas Public Services Union (BPSU)/

The deal, which has been outstanding for almost a year, will provide numerous benefits although both parties declined to reveal financial figures and terms. “Well, we would have seen increased benefits in the area of phone allowances, mileage allowances, on-call allowances,” Kimsley Ferguson, the Bahamas Public Services Union (BPSU) president, said.

“But more so the general focus, while there were improvements in those areas, was the salary increases themselves over the course of a five-year period.

“We’re pleased and satisfied that persons will be able to move to even a little higher standard of living based on the increases that we would have been able to agree to today.”

While not willing to disclose a dollar value, Dr Daniel Johnson, the Gaming Board’s executive chairman, added that a detailed annual report will be published on the regulator’s website.

“I would say as a regulatory body we don’t generally speak of values of what we do inside here but, at the end of every year, we will publish a report and this stuff you will now see on our website going forward,” Mr Johnson said.

KIMSLEY FERGUSON, president of the Bahamas Public Services Union (BPSU).

“So we’ll have an annual report and it’ll be posted on the website with painstaking detail. But we don’t generally talk money at the Gaming Board because we hold a lot of people’s private information.”

Mr Ferguson said the before the agreement can take effect, it must be “registered and vetted”. He added: “Well we’ve been at it for months, let’s put it that way. And again, because there was a revamping of the document so to speak, we visited a number of items.

“We made adjustments and improvements to a number of items in the industrial agreement so that the persons who actually carry out the day-to-day functions over here at the Gaming Board can do so in an improved environment.

“Again, the document has to be properly registered and vetted at the Department of Labour. I believe we’re pleased to have had a legal team that ensured we were on point, and so we believe that if there’s any vetting in order it’ll be minimal.”

“Unity dynamic in The Bahamas is very important - important for us as a country, important for the Government, important for unions and stakeholders,” Mr Johnson said. “I want to congratulate everyone involved in this process; the government agencies, industry stakeholders and staff.

“This is a result of good communication, good collaboration and good compromise. And I hope that in our wider sphere, we continue to communicate, collaborate and compromise where it’s mutually beneficial. The Gaming Board is really happy to say that we enjoy very good relations with unions, stewards, staff…

“We are trying to become a top-tier regulator of the 21st century. Top tier regulator. The Bahamas has been involved in gaming for some 100 years. We are the most respected destination and jurisdiction in the Western Hemisphere. We have a story to tell. And if we stop competing and get to caring, we can get our story out there.”