the Ultimate Guide to... GETTING ON THE LADDER, THE PROPERTY MARKET AND HELP TO BUY rsttimebuyermag.com December 2022/ January 2023 £3.95 771758 973014 9 12> “Try to get as much information as you can about the homebuying process before you start” CHRISTMAS! ALL WRAPPED UP WIN! A YALE FLOODLIGHT CAMERA WITH PROFESSIONAL INSTALLATION WORTH £368.99 GAME OF HOMES THE MINI-BUDGET UNRAVELLED ENERGY-SAVING PROPERTIES

Tayo Oguntonade TV presenter

EDITORIAL 020 3488 7754

Editor-in-Chief SARAH GARRETT sarahg@spmgroup.co.uk

Editor LYNDA CLARK lynda@ rsttimebuyermag.co.uk

Editorial Assistant and Head of Special Events KATIE WRIGHT

Editorial and Special Events Assistant SOPHIE MUNNERY

Creative Director RYAN BEAL

Sub Editor KAY HILL

Social Media KATIE WRIGHT, SOPHIE MUNNERY

Contributors

CHRIS CLARK, DEBBIE CLARK, MARILYN DICARA, BILL DHARIWAL, TONY HARKER, KAY HILL, JONNIE IRWIN, SOPHIE MUNNERY, LAURA DEAN-OSGOOD, CORALIE PHELAN, GINETTA VEDRICKAS, KATIE WRIGHT

ADVERTISING 020 3488 7754

Director of Advertising/Exhibition Sales LYNDA CLARK lynda@ rsttimebuyermag.co.uk

Special Events KATIE WRIGHT

– First Time Buyer Home Show

– First Time Buyer Readers’ Awards katie@ rsttimebuyermag.co.uk

Accounts accounts@ultimateguidecompany.com

Managing Director SARAH GARRETT sarahg@spmgroup.co.uk

Public Relations RACHEL COLGAN rachel@building-relations.co.uk

SUBSCRIPTIONS

020 3488 7754

SWITCHBOARD

020 3488 7754

All advertising copy for February/March 2023 must be received before 13 January 2023. Send all copy to: lynda @ firsttimebuyermag.co.uk

The content of this publication, either in whole or in part, may not be reproduced, stored in a data retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying or otherwise, without prior permission from the publishers. Opinions expressed in First Time Buyer magazine are not necessarily those of the publishers.

© The Ultimate Guide Company Ltd 2008-2023. The Ultimate Guide Company Ltd t/a First Time Buyer magazine will take no responsibility for any loss/ claim resulting from a transaction with one of our advertisers/media partners.

Welcome

I don’t know if you all agree but this year seems to have flown by! It’s been an interesting one with Prime Ministers coming and going and a miniBudget which caused havoc within the financial markets. But we, at First Time Buyer, always remain upbeat and positive. We know many of you are desperate to get on the property ladder and we truly believe this is really still possible.

So, with Christmas just around the corner I hope you enjoy our festive features – we have suggestions for decorations, the best Christmas fayre from the supermarkets and some wonderful gift ideas for all the family including your favourite pet!

Also on the horizon is the World Cup – it has been quite controversial this time round but with so many avid football fans we thought you might like our fascinating feature on how many homes you could buy with the money spent on footballers’ transfers this summer – it’s quite astounding!! Do turn to pages 24-28 and find the team you support and check it out – we also highlight many affordable homes in the various cities with leading football teams.

Other very interesting features are what the effects of the mini-Budget will be for first time buyers (pages 86-87) and how to save on energy costs (pages 88-89).

I would like to wish you all a very happy Christmas and a prosperous and healthy New Year.

I hope you enjoy this issue which is packed with information and help on buying your first home – enjoy!

Until next time, happy house hunting

firsttimebuyeronline @firsttimebuyer

EDITOR’S PICKS…

The old saying “a week is a long time in politics” could be amended from a week to just a day.

Jonnie Irwin, Jonnie’s World, page 9

I would also recommend everyone to do lots of research, which can be quite overwhelming.

Ella Stewart, At home with, page14

I could picture us living in here immediately and planned out where everything was going to go.

Nate and Bianca, Real Life, page 70

We will spend as much time as we can getting to know the area.

Jivan Tankian, House Hunter, page 16

Get a good nancial adviser and solicitor who works with your housing association as this will speed things up.

Hellyn Fairbrother, 20 Questions, page 106

EDITOR’S LETTER

December 2022/January 2023 3

First Time Buyer

What’s in…

71

For sale – the best FTB properties

HOMEPAGE

9 Words from Jonnie

TV presenter and property expert Jonnie Irwin gives his views on the housing market.

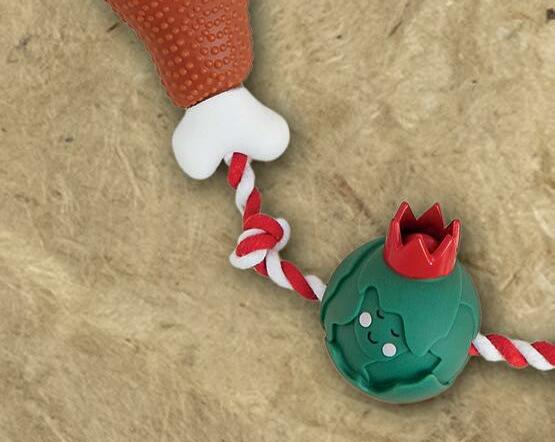

11 FTB loves…

A selection of our favourite hot buys for the Christmas season.

12 Living

Our round-up of the best Christmas decorations to help make your home sparkle this holiday season.

14 At home with… Ella Stewart

Baker and supporter of mental health awareness Ella Stewart has combined her two passions to create Bake Well Being. She talks to Lynda Clark about how it all began, buying her first home and gives some great advice for first time buyers.

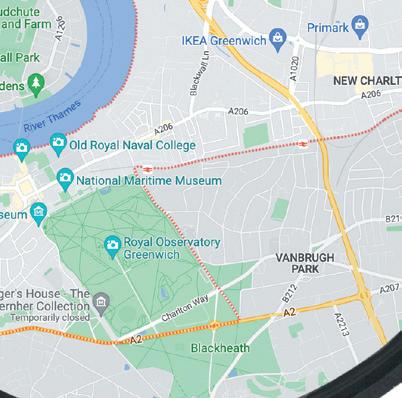

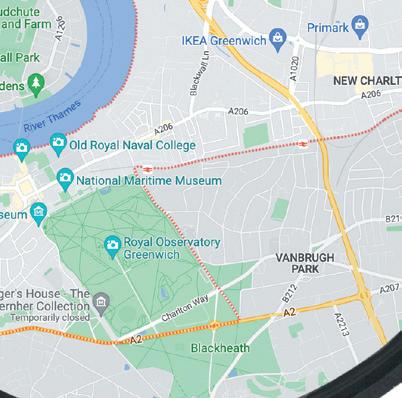

16 House Hunter

We try to find a home for Jivan and Darron Tankian who are searching for a two bedroom property in south east London.

18 Developer’s doctor

Stuart Hensby, Associate Director of Sales and Marketing at Abri, answers your property question.

70

Nate and Bianca moved into their one bedroom apartment at Notting Hill Genesis’ Royal Albert Wharf. As first time buyers, the couple were drawn to the riverside development due to the spacious apartments, the opportunity to belong to a growing community and the easy transport connections into central London and beyond.

FEATURED

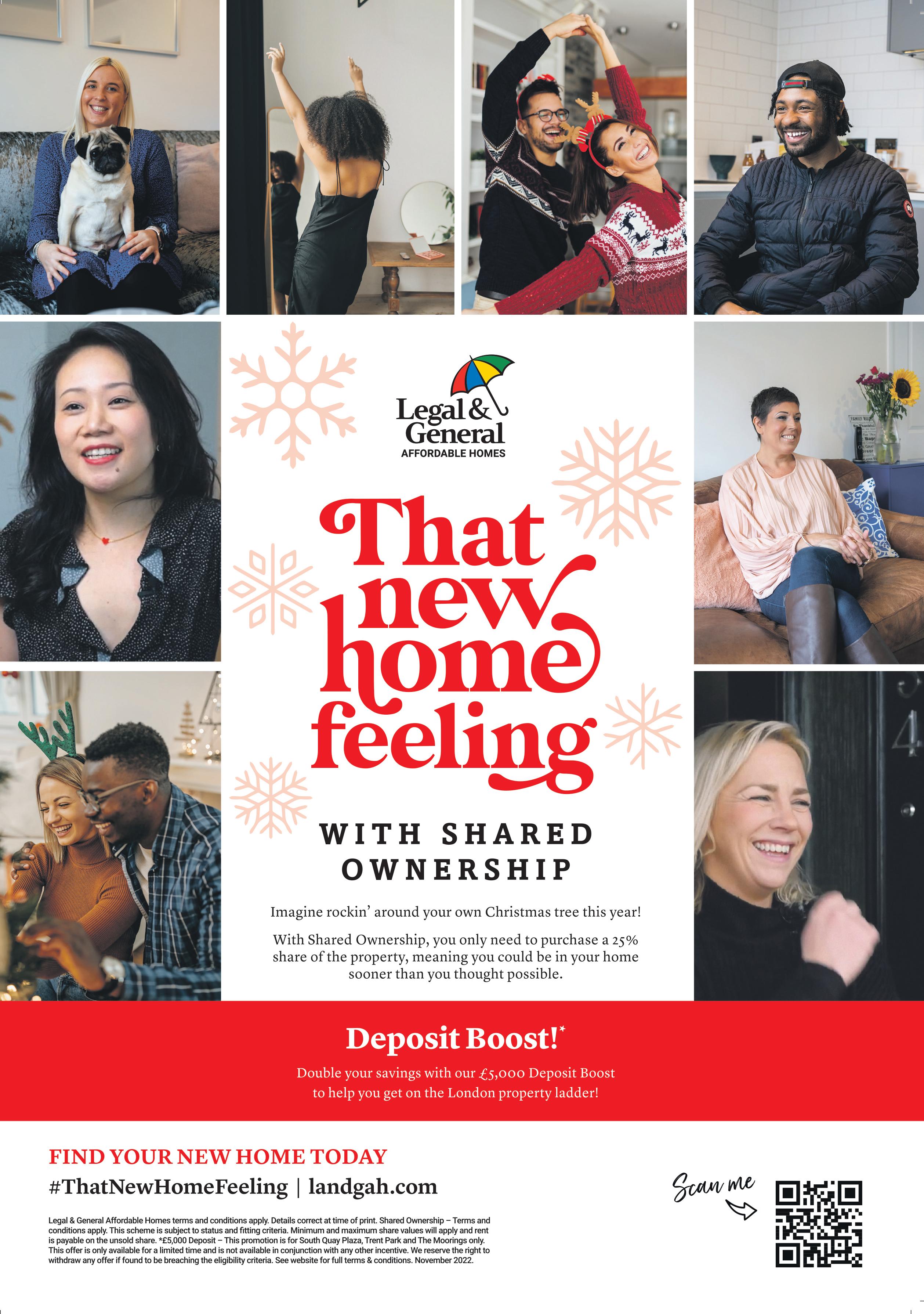

20 The View: Tayo Oguntonade

TV presenter Tayo Oguntonade can be seen presenting Great House Giveaway on Channel 4. He is also an experienced mortgage broker, property expert and influencer. He tells Lynda Clark about his fascinating life, the first property he bought and has some sound advice for first time buyers.

24 Football’s Coming Home

With the FIFA World Cup kicking off in Qatar, we are thinking all things football! Property developer Stripe Property Group

recently looked at the cash splashed by each Premier League team during the summer transfer window, the current average house price in each of their respective areas and how many homes they could purchase based on their summer transfer window spend. Debbie Clark looks at the findings and highlights some affordable homes.

30 Happy ever after!

Highlighting three happy first time buyers who have all bought their dream home using shared ownership through Be West.

Should I buy a resale or new build given the current costof-living crisis?

Urban Moves leads the market in shared ownership resales and looks at the options and the advantages and disadvantages.

CONTENTS 4 First Time Buyer December 2022/January 2023 DECEMBER 2022/JANUARY 2023 / ISSUE 98 / FIRSTTIMEBUYERMAG.CO.UK

© Channel 4

Cover photo

Win a Yale floodlight camera with professional installation worth £368.99.

REGULARS 32 Hotspot We look at Greenwich as a place to live. 81 Inspector Gadget Highlighting some of the best kitchen gadgets on the market to help minimise the stress and labour of cooking this Christmas. 82 Money laundering checks

Bill Dhariwal, Solicitor and Managing Director of Lawcomm, explains what money laundering checks are required when buying your home.

84 Ask Emilia

Emilia is the Sales Director at Metro Finance. Here she gives her top tips when applying for a mortgage. 86 Finance

Kay Hill takes a look at the recent controversial mini-Budget and considers if it was good news or bad news for first time buyers.

88 Market

Ginetta Vedrickas highlights how first time buyers can protect themselves against rising energy costs. 90 Agony Agent All your property questions answered by our panel of experts.

93 Buyer’s Guide

Check out FTB’s Buyer’s Guide, which walks you through the property process.

98 Buying with friends and family

Coralie Phelan, Partner and Head of New Build Homes at Prince Evans Solicitors LLP, looks at the legal aspects and whether buying with friends and family is the right option for you. 100 Directory Where and how to contact your Help to Buy Agents or providers. 106 20 Questions

We ask 20 quick-fire questions to a property expert and in this issue

Hellyn Fairbrother, London and South East Regional Sales Manager for The Guinness Partnership is in the spotlight.

CONTENTS First Time Buyer December 2022/January 2023 5 TAYO OGUNTONADE, PAGE 20 20

Tayo Oguntonade 79 Competition

IT IS HARD TO GET ON THE LADDER BECAUSE MOST PEOPLE ARE PAYING RENT AND BILLS AND CANNOT SAVE FOR THEIR VERY IMPORTANT DEPOSIT 76 FTB’s Festive Fast Food Eat, drink and be merry! First time buyer has scoured the supermarkets to find the tastiest and best value Christmas food and drink to enjoy with friends and family this festive season.

Mailbox

LOCATION, LOCATION

I recently decided to start looking for a property to purchase for the first time. I’m really excited but I’m not sure where to start and want to make sure that I’m choosing the right area. Can you advise me of any particular things to look out for or avoid? Holly Freeman

FTB says: One of the most important things to consider when looking for a property is location. A good first step when picking an area is considering how long your commute to work will be. Once you find the areas you like, you can narrow down which you prefer. Everyone has a different list of important criteria when looking at an area so decide what is important to you. Consider things like – are there nearby amenities? Are there good transport links? Is the area safe? Does it fit into your price range? Once you consider all these aspects you’ll have a much clearer idea and be well on the way to finding your new home.

HELP WITH INSURANCE

I am buying my first home and I know I need to get insurance before I move in, however I don’t know very much about it and what needs to be covered. Could you please tell me which type of insurance I should get?

Michael Davidson

WRITE TO US!

Please send us your questions, comments and suggestions concerning property, or the articles in First Time Buyer magazine.

lynda@ rsttimebuyermag.co.uk

STAMP DUTY CHANGES

I have heard that Stamp Duty thresholds are changing in England and Northern Ireland after the recent mini-Budget. What are these changes?

Jackson Wu

FTB says: Indeed, it was recently announced in the “mini-Budget” that new rates of Stamp Duty came into effect on 23 September 2022. This is being done to “support growth, increase confidence and help families aspiring to own their own home.” According to the announcement, no Stamp Duty will be paid on the first £250,000 of a property, and for first time buyers, the threshold will be £425,000. The value of the property where first time buyers can claim relief has been increased to £625,000. All these numbers have risen quite significantly, which is good news for first time buyers. Be aware that different rates apply in both Scotland and Wales.

GUARANTOR MORTGAGE

Warm up this winter with this month’s star letter prize! This Herringbone hot water bottle from Lakeland, worth £18.99, will be sure to make the perfect snuggly companion to take the chill away on the long dark and dreary nights ahead.

lakeland.co.uk

FTB says: You are correct in saying you need insurance before you move in, as it is essential to protect your home and all your belongings. There are two types of insurance you should look at. Firstly, buildings insurance, which protects the building from damage such as fire, water and bad weather and secondly contents insurance. Contents insurance protects your possessions inside the home if they are damaged, destroyed or stolen. It is important that you look at all your items and make sure you aren’t under-insured. Insurance can give you piece of mind and provides reassurance if something does go wrong.

I live in England and want to take out a guarantor mortgage for my first home, but the person I’d like as my guarantor currently lives abroad. Can they still be my guarantor even if they do not live in the country?

Jenna Mansell

FTB says: It’s highly unlikely that a lender would allow someone who is based overseas, even if they are a British citizen, to act as a mortgage guarantor. A guarantor agrees to ensure the mortgage payments are made in full and on time. They also agree that they can be tracked for any outstanding money in the event of a loss on repossession. The point of a guarantor is to pay the mortgage

if you can’t. The lender needs to be able to implement this obligation, which could be incredibly difficult if the guarantor is situated overseas. The lender would have to deal with the laws and protocols of another country. This could present potential barriers if it had to attempt to take legal action in pursuit of payment. Also, the logistics involved in tracking the guarantor and arranging payment would make it difficult if the guarantor was situated anywhere but in the same country.

VISIT OUR WEBSITE

For everything you need to know about buying for the rst time, go to rsttimebuyermag.com

LETTERS First Time Buyer December 2022/January 2023 7

TV presenter and property expert Jonnie Irwin gives his thoughts and views on first time buyers and the housing market

A week is a long time…

I like a bit of period drama. Not so much your Downton Abbey, although very pleasant and gentle Sunday viewing it was. Personally, I like a bit of darkness – some menace of the likes of Taboo, North Water or a bit of Peaky Blinders will stop me looking at my phone for an hour or so.

I’m not so keen on time travelling films, (A Christmas Carol and Back to the Future are obvious exceptions!). I find myself sitting on the sofa, settling in to watch my evening’s entertainment when suddenly a character pops through a wormhole to another dimension of reality. Now I’ve been plunged unwittingly into having to think. That takes effort and invariably involves me continually pressing the pause button and shouting “what?!”at the screen. I must have watched The Tenet three times now and am still none the wiser. Perhaps Christopher Nolan just requires more IQ from his audience than I have. I find myself asking questions like; which is the true reality? What is real? And then ultimately I wonder, what’s on the other channels? Click…

If you think time travel films move quickly, they appear at a glacial pace when compared to UK politics. The old saying used to be “a week is a long time in politics” well that could be amended from a week to just a day.

I appreciate some of my recent columns have included quite a bit of politics but that’s because it’s having such an impact on the property sector – to be fair it affects everything as we all know, but let’s stick to our area.

By the time you’re reading this article the fact that Kwasi Kwarteng was ever Chancellor will be distant memory or did we just dream it? Or was that another strange wormhole into an alternative universe?

Of course, our dire economic outlook was influenced by events that took place long before the ill thought-out mini-Budget, but the financial powers that be knew straight away that this wasn’t just the wrong direction, it was a further mistake that would have even harsher consequences. So, who is running the country? You could argue the financial institutions if their interventions can force the Government to turn around its policies like it did. You could argue that also changing tack and adopting some of Labour’s policies makes the shadow cabinet more than just an influence. At the very least, the newly installed Jeremy Hunt to Chancellor is arguably in

control from Number 11, but by the time you’re reading this, anybody could be residing at Downing Street.

Whatever happens now we can be sure that any Government decision will affect us immediately. Within hours of the Kamikaze Budget, money lenders had removed mortgage products from the shelves leaving buyers marooned. The effect it’s had on the first time buyer market is obvious, with the ability to buy suddenly taken from purchasers, putting further time between them and being able to fulfil their dream of buying their first property. Some buyers were only weeks away from completion, now who knows how long they’ll have to wait?

Even if more favourable mortgage products are once again offered back to the market, one thing for sure is that they will be at higher interest rates, which at the very least will have a negative impact on buyers’ ability to buy at the levels they were excitedly considering just weeks ago.

In order to gauge the mood of some experts in the first time buyer market I had a ring round and spoke to some mortgage brokers.

One, who I speak to quite regularly summed it up perfectly, “After the 2008 financial crisis, Brexit, Covid, Putin and now the Kamikaze budget I’m used to things being a bit sh!te.”

A bit of gallows humour, but slightly encouraging is the thought there will be a way forward sometime soon. I see the broker’s point but it also illustrates the one thing that can’t be extinguished with policy – and that’s desire.

The will is there, let’s take five and see what the next few weeks bring and in the meantime, try not to be too consumed by the hourly political briefings. My only offering is for us to appreciate that we are indeed powerless when faced with the decisions of numbers 10 and 11 Downing Street, but take a bit of comfort in the fact that there was a body of people in the financial sector who took the toys from the clowns until they started to act more rationally. Not particularly democratic, but then the Prime Minister and Chancellor have no mandate, so if you can’t beat ‘em…

What we must continue to do, is to be politically engaged and informed. Everything that we face, good and bad, comes in consequence of policy made for, and voted for, by us, the electorate. I’m not here to tell you how to vote, just to be aware of what we are voting for, in detail, because in such a sensitive economy our lives are changed with an ‘X’.

OPINION First Time Buyer December 2022/January 2023 9

WORLD

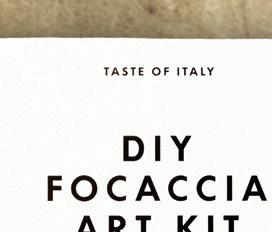

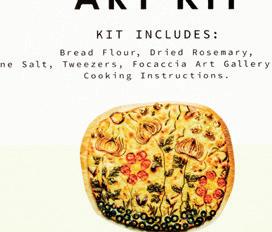

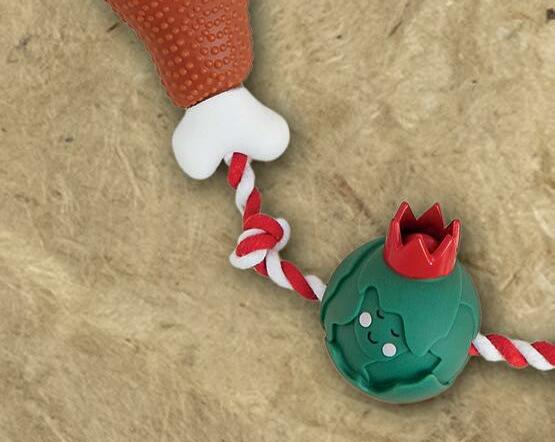

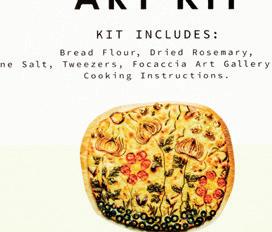

FTB LOVES First December 2022/January 2023 11 Let’s wrap things way. This month we select our For friends and family, little extra treats for stocking fillers and even the perfect present for our four-legged companions irst Time Buyer Roast on a string pet toy, £6, M&S William Morris at Home Canine Companion dog walker’s kit, £29.99, Dobbies Garden Centre PlayPud MegaBall, £14.99, Dobbies Garden Centre London edition folding skyline chess set, £95, John Lewis & Partners Christmas gingerbread Oh Snap socks, £2.49, New Look DIY Foccacia kit, £10; DIY fortune cookie kit, £10; DIY sushi set, £12, Primark Make your own gardener’s hamper, cost varies according to contents, Wilko Personalised leather bi-fold wallet, £35; personalised women’s rib beanie hat, £19.50; personalised women’s striped straight t T-shirt, £15, M&S CONTACTS » Dobbies dobbies.com » Hotel Chocolat hotelchocolat.com » John Lewis & Partners johnlewis.com » Marks & Spencer marksandspencer.com » New Look newlook.com » Oliver Bonas oliverbonas.com » Primark primark.com » Wilko wilko.com Quentin alphabet initial mini travel jewellery box, £14.50, Oliver Bonas The chocolate wreath box, £43.50, Hotel Chocolat

I'M DREAMING OF A WHITE CHRISTMAS

Turn your home into a Winter Wonderland with our exciting array of Christmas decorations and pieces to make your home sparkle this holiday season. You probably have the annual bunch of baubles stashed in the loft, but it is always exciting to add a few new pieces to the collection. Go ahead and treat your elf!

Homepage LIVING 12 First Time Buyer December 2022/January 2023

F T B

Rudolph oil burner, £5, George at Asda

Holly Berry Christmas stocking, £19.50, Sophie Allport

Christmas tree candle, £4.99, TK Maxx

Pinecone candle, £3, PEP&CO at Poundland

Disney Mickey Mouse Christmas serving platter, set of 2, £20, George at Asda

Christmas Gingerbread Man pasta bowl, set of 4, £12, George at Asda

Gonk, £1.50, PEP&CO at Poundland

Osby star window light trio, £44.99; Crown light-up Christmas tree topper, £24.99; LED Christmas bauble trio, £12.99; TruGlow® LED pillar candle trio, £26.99, Lights4fun

Christmas tree stocking, £14; Christmas tree duvet set, £30; Christmas tree cushion, £14, M&Co

Feather bauble, £2.50, B&M

Angel tree decoration, £1.50, PEP&CO at Poundland

Silver disco ball bauble, £1.50, PEP&CO at Poundland

Icicle band bauble, £3.99, Gisela Graham London

Glass bauble with gold London scene, £4.49, Gisela Graham London Glitter snow ake tree decoration, £1.50, PEP&CO at Poundland

Light up mushroom scene cloche, £20, Habitat

Frost ceramic lantern, £15; Frost metal snow ake wreath, £8; pair of metal stars, £12; Frost eucalyptus and berries garland, £9; Frost white tree, £20; Frost ower decoration, £2.50, Wilko

Geometric decorations, 3 pack, £2; globe decoration, £1.50; Champagne decoration, £1.50; spiral decorations, 8 pack, £2; gift Bag, £1; wrapping paper –assorted designs, £1; gift bow and ribbon pack £1, Poundland

Christmas Eve plate, £10, M&Co

Studley forest and reindeer silhouette Christmas window light, £29.99, Lights4fun

Ceramic House, £9.99, TK Maxx

Homepage LIVING First Time Buyer December 2022/January 2023 13

» B&M

»

» Gisela Graham

» Lights4fun

»

» Poundland

» Sophie

» TK

»

CONTACTS

bmstores.co.uk

George at Asda direct.asda.com

London giselagraham.co.uk

lights4fun.co.uk

M&Co mandco.com

poundland.co.uk

Allport sophieallport.com

Maxx tkmaxx.com

Wilko wilko.com

At home with: Ella Stewart

Ella Stewart has two great passions, one is baking and the other is supporting mental health awareness. She has combined them both and created Bake Well Being where she holds workshops, bake-alongs plus one-to-one and group coaching. She talks to Lynda Clark about how it all began, buying her first home and gives some great advice for first time

buyers

FTB: You are soon to buy your first home; can you tell us about it?

ES: I am very lucky and in a privileged position because I currently live between my parents’ and my boyfriend’s houses, and they don’t take any rent from me. This has enabled me to save and I now have quite a decent deposit. I have spoken to a mortgage adviser and I am actively searching on different websites like Zoopla for a possible home I can buy within my price range. I am hoping to buy and move in by next spring. It’s very exciting to think I will have bought my first home by the time I am 25.

FTB: When did you start baking?

ES: When I was little I used to spend time with my grandparents while my mum was at work. My grandmother used to bake with me, which I thoroughly enjoyed, and we used to make fairy cupcakes. When I was old enough, I got a Saturday job in a cake shop, which also sold equipment and supplies to professional bakers who would come into the shop and gave me the chance to talk to them, which really inspired me. I stayed at the shop for eight years and loved every moment of it.

FTB: What did you do after you left school?

ES: I have always been very interested in mental health. I went to university to study Events Management and in my third year I pitched my idea in the University of Greenwich Enterprise Challenge and won the Social category. With the funding I got from my prize I decided to train and completed my Mental Health First Aid training and became a qualified Wellness and Resilience Coach. It was during the

pandemic, so I had a lot of free time and apart from studying I spent time in the kitchen baking and practising different cake decorating skills. I also, with the help of my boyfriend, renovated a van and put in a kitchen and oven which can host around six people for workshops. It’s the Bake Well Being Mobile, her nickname is Van-essa, and it’s very exciting as I can take it to different places and do pop-up events and get out and about in the community. My boyfriend did most of the work but he did let me put a few screws in! It was a great project and we both had lots of fun while we remodelled it.

FTB: Tell us about Bake Well Being?

ES: At the moment, I run Bake Well Being as a Social Project missioning to get people baking for our wellbeing. I do this alongside having a full-time job as a PA at a school. I am lucky because I get long holidays and finish work at 4.30pm so I am home by 5pm and have plenty of time to focus on Bake Well Being initiatives in the evenings and school breaks. I run workshops and baking classes and host webinars in all the free time I have aiming to get every person talking, baking, and eating cake for their mental health. I’ve recently been working with Bromley Y, which supports young people with their mental health, and I run baking classes with a group of teenagers in conjunction with their mentoring programme encouraging them to use baking as a positive coping strategy.

FTB: Which cakes do you enjoy baking the most?

ES: During lockdown I spent so much time practicing every sort of cake and decoration

I could image. But, I love to make a good old classic cupcake – it’s simply sponge and buttercream and then I pipe and decorate it in all different creative ways. It’s reminiscent of when I first started making fairy cakes with my grandmother, so it’s a bake that’s close to my heart and makes me feel very nostalgic.

FTB: What advice have you got for first time buyers?

ES: Think ahead as it can be a long process. When I initially started my search, I thought it was a box ticking exercise and it would all be done in a few months. But, one thing leads to another and it can take a really long time. I would advise any first timer to think where you would like to be in three years’ time and follow that through with the choice of home you go for – consider location, size and what you really need and want. Don’t feel pressurised or rushed as it’s a huge decision. I would also recommend everyone to do lots of research, which can be quite overwhelming. When I started looking online I got about 30,000 web results so I had no idea where to start. I think you need to work smarter and not harder and only go to trusted first time buyer sites to gather your knowledge and information and of course First Time Buyer magazine has a wealth of really useful features that essentially does a lot of the work for you!

FTB: What are your plans for the future?

ES: My goal is for Bake Well Being to become a full-time social enterprise one day. I need to be careful though because I have got a mortgage based on my full-time job and I don’t want to mess that up. I see Bake Well Being as my passion project until I am financially stable, but I will continue to follow my dreams in any way I can. I have around 2,300 followers on Instagram and lots of YouTube tutorials which are very popular, so my aim is to grow that number and pass on my passion to as many people as possible.

Instagram: @bakewellbeing Website: bakewellbeing.co.uk Email: info@bakewellbeing.co.uk

Homepage LIVING 14 First Time Buyer December 2022/January 2023

WOULD ADVISE ANY FIRST TIMER TO THINK WHERE YOU WOULD LIKE TO BE IN THREE YEARS’ TIME AND FOLLOW THAT THROUGH WITH THE CHOICE OF HOME YOU GO FOR”

“I

Homepage LIVING First Time Buyer December 2022/January 2023 15 “I THINK YOU NEED TO WORK SMARTER AND NOT HARDER AND ONLY GO TO TRUSTED FIRST TIME BUYER SITES TO GATHER YOUR KNOWLEDGE AND INFORMATION”

The HOUSE HUNTER

This month FTB goes on the hunt with Jivan and Darron Tankian who are searching for a two bedroom property in south east London

What we found…

THE LIVELY LOCATION THE FAMILY FRIENDLY

NINE

Brixton, south east London

FROM £155,000*

Sydenham Groves Sydenham, south east London

FROM £108,000*

PROFILE

Maximum budget £280,000

Requirements A two bedroom home in south east London with private outdoor space. Close to local amenities, including shops, eateries and entertainment options

What they wanted…

My partner Darron and I are looking for our rst proper home together. We currently live with my mum in Clapham, south west London, and although we’re so grateful for her generosity over the past two years, we are all feeling the need for our own space. Darron and I really want to stay in south London as it’s where we’re from and where we work. We’re happy to go a little further east, to say, Lewisham, and are looking at all the areas between Brixton and there. We’d love two bedrooms and some outdoor space – and as we like to eat out, it would be great to be close to a town centre, high street or other cool things such as food markets. We’ve paid minimal rent at my mum’s, which has allowed us to save, save, save! We have a healthy deposit of just under £30,000, and having spoken to a mortgage adviser, we have a budget of around £280,000.”

You’re never far from the buzz of Brixton at this stylish new collection of homes in south east London. The two bedroom apartments are just a few minutes’ walk from a great range of shops, bars, famous venues, markets, the POP Brixton container park with its bars and eateries and Brockwell Park – as well as fantastic tube, train and bus links. The contemporary homes are light and bright and feature plenty of storage space. Openplan living areas lead to private balconies, while some properties also have balconies from the main bedroom.

nhgsales.com

*Based on a 25% share of the full market value of £620,000

This new collection of one and two bedroom apartments and three bedroom townhouses has proven hugely popular since its recent release. With the high street and a choice of three rail and Overground stations within walking distance, this is a great spot for enjoying the local area and getting into central London. The properties are thoughtfully designed, with bright open-plan living areas that lead to outdoor space. There is onsite parking as well as play space for families. A great opportunity to buy in an increasingly popular part of London.

peabodysales.co.uk

*Based on a 30% share of the full market value of £360,000

What they thought…

We love Brixton and have spent many days and evenings enjoying everything it has to offer – we love meeting up with friends here and there is always something good to see or do. These homes are really well located, not quite right in the centre of the town, but only a short walk to everything you need. It would be a really exciting place to live and I know our friends would love it too. The interiors are really chic – we just love those pastel kitchens and the parquet-style ooring.”

Darron works at a school in this area, so I’m sure he’d be happy to be closer to work. We also have friends nearby, so we know the surrounding towns pretty well. The apartments look beautiful – we love the styling and the layouts look pretty spacious. We particularly like how the development is set in a quiet cul-de-sac, but is also so close to the high street – I think you’d really feel like you could retreat back to your own peaceful space here after a long day at work.”

16 First Time Buyer December 2022/January 2023 Homepage FIRST RUNG

Name Jivan Tankian, 27, and Darron Tankian, 34 Occupation Teacher, Programme manager

First choice!

Southmere Thamesmead, south east London

FROM £121,500*

Lazenby Square Bermondsey, south London

FROM £138,750*

THE GREAT ENTERTAINER

No.1 Creekside Deptford, south east London

FROM £98,750*

Forming part of the ongoing, award-winning regeneration of Thamesmead, Southmere features a selection of two and three bedroom apartments – situated minutes from Abbey Wood station and its impressive new Elizabeth Line connections. Set around ve lakes and a central square, amenities include a library and community centre, with an arts and culture of ce, restaurants, cafes, shops, shared working spaces and pop-up markets all coming soon. Properties feature bright, open-plan living spaces and plenty of natural light, perfect for modern living.

peabodysales.co.uk

*Based a 30% share of the full market value of £405,000

There’s lots we love about this development. There’s so much green space on the doorstep, a major plus point in terms of getting out and enjoying some fresh air. The travel links are great, too – we’d both easily be able to get to work if we’re not driving. Plus, the properties themselves are really attractive and in keeping with our taste. I have to admit we don’t know this area too well, and it is a little further east than we’d hoped to move – but it is very tempting indeed.”

Set around a stunning courtyard, the new homes at Lazenby Square offer a tranquil retreat from city life, which lies just on the doorstep. The one, two and three bedroom apartments are bright and spacious, with balconies, and en suites in the bigger properties. These Zone 2 apartments are just a 15-minute walk from Tower Bridge, the river front, Borough Market and everything those areas bring for round-the-clock entertainment. Bermondsey Spa Gardens can be reached in under a minute, with supermarkets, shops and cafes slightly further a eld.

peabodysales.co.uk

*Based on a 25% share of the full market value of £555,000

We have always liked this area, as there’s a cool vibe and some of our favourite parts of London on the doorstep. The proximity to Borough Market and the river is great, but it’s also really close to Peckham, Brixton and Camberwell, so the choices for going out are second to none! The apartments are lovely and the central courtyard would be a bonus in the summer. The area has seen lots of development in recent years, so it’s exciting to see such positive growth.”

The one, two and three bedroom apartments at No.1 Creekside are housed within two buildings that are linked by raised communal gardens. The small development sits just moments from Deptford Bridge DLR and railway stations, as well as the creek and thriving market – making it a perfect location for lovers of all things London. Both Greenwich and New Cross are an easy walk away, while a good range of parks, shops and eateries lie just a stone’s throw from the front door.

lewishamhomes.org.uk

THE NEXT STEP

*Based on a 25% share of the full market value of £395,000

“We are super interested in making No.1 Creekside our home. We will begin the application process, which involves speaking with the nancial team to ensure we’re suitable candidates and booking a second visit to view the development. We will spend as much time as we can getting to know the area a little better, too. We’re really excited about these homes!

What a lively and convenient location – so close to the station, the market, great pubs and the creek. It really does have it all. I know that this would be a really fun and interesting place to live, and it would be super exciting to have such great options for entertainment in Deptford, Greenwich or close by every day and night of the week. Greenwich Park – which we love – is also within walking distance. The local transport connections are good, too, meaning work and family are never far away. The building is stylish and in keeping with the area, and the interiors are smart and modern, which is what we appreciate. There’s lots to like here!”

Homepage FIRST RUNG First Time Buyer December 2022/January 2023 17

THE GREEN SERENE THE CONVENIENCE KING

AWith most people feeling the pinch in one way or another, it’s understandable that those with their sights on homeownership are taking a moment to pause. Fortunately, there are still affordable ways to get on the ladder. Although the popular Help to Buy: Equity Loan scheme is coming to an end, shared ownership, one of the market’s leading products, can still make homeownership a reality.

Shared ownership is when you buy an initial percentage of your home, usually between 10% and 75%, and pay a lowcost rent on the rest. You can then buy further shares of the property (known as staircasing) which will decrease the amount of rent you pay. For example, a 35% share of a two bedroom mid-terraced house at Abri Homes’ Violet Cross development in Dorset can be purchased for just £95,375, instead of the full market value of £272,500.

Shared ownership may be a good option if, due to the recent rise in inflation and the impact this has had on affordability criteria, you’ve found yourself priced out of the open market. Homes purchased with shared ownership are more affordable, as you’ll only need a mortgage for your share of the property. And with the option to staircase in increments as low as just 1%, you can move towards owning 100% of your home at a rate that works for you, all while paying towards your mortgage. Deposits start from 5% of the share you’re purchasing, meaning you may be able to step on to the ladder a lot sooner than you thought.

There could be a benefit to acting quickly, too. Interest rates are rising – and while we don’t have a crystal ball, there’s a possibility they could continue to do so, meaning it could be a good idea to lock in a mortgage

rate sooner than later. The recent Stamp Duty cuts also mean that there are big savings to be had, particularly for first time buyers who could save thousands.

As one of the south’s largest housing providers, Abri has a range of high-quality new homes that are available through shared ownership. Most of Abri’s shared ownership homes have a higher EPC rating, helping to reduce your energy usage and lower your bills as energy prices soar. Good for the environment and your bank balance!

Green credentials could also save you money on your mortgage. A growing number of lenders now offer “green mortgages” for homes with an EPC rating of A or B. These mortgages can come

Discover Shackleton Heights, a new collection of two, three and four bedroom houses and apartments in Lockleaze, available with shared ownership and on the open market. Bristol city centre is just a hop and a skip away, famous for its street art and hot air balloon festival. Unwind at Harbourside on the weekends, or take advantage of the city’s vibrant nightlife, the choice is yours.

with better interest rates, which have the potential to reduce the overall amount of money you pay back over the course of your borrowing.

At Abri, we believe home isn’t just a place, it’s a feeling. It’s feeling safe, secure, and happy. And because of that, buying a home will undoubtedly be one of the biggest decisions you’ll make in your life – both financially and emotionally. That’s why we’ll make the process as easy as possible.

To find out more about our wide range of homes across the South and South West of England, and for top tips and resources including a mortgage affordability calculator, visit abrihomes.co.uk

Each home at Shackleton Heights bene ts from brand new appliances and neutral nishes throughout. So, you’ll be ready to start creating your new home as soon as you get the keys.

Shackleton Heights Lockleaze, Bristol

And with eco-friendly features such as wild ower gardens, electric vehicle charging points and low-carbon air source heat pump heating systems, these homes have been built with modern life in mind.

Prices are coming soon, with the next homes due to be released this winter. Register your interest now for information and to visit our show home. abrihomes.co.uk

Stuart Hensby, Associate Director Sales and Marketing at Abri, is passionate about helping customers on their homeownership journey. With over 16 years’ experience in the property industry, Stuart leads Abri’s sales and marketing across different tenures including shared ownership, resales and open market sales. Stuart champions an innovative way of marketing affordable homes, with his substantial experience in commercial markets, he advocates for an exciting and fresh approach that puts the customer at the heart of the process

Stuart Hensby, Associate Director Sales and Marketing at Abri, is passionate about helping customers on their homeownership journey. With over 16 years’ experience in the property industry, Stuart leads Abri’s sales and marketing across different tenures including shared ownership, resales and open market sales. Stuart champions an innovative way of marketing affordable homes, with his substantial experience in commercial markets, he advocates for an exciting and fresh approach that puts the customer at the heart of the process

Q

I am a first time buyer and I would really like to take a step on the property ladder. But can I still afford to buy with the cost of living crisis?

December 2022/January 2023

FROM £TBC

Stuart Hensby, Associate Director Sales and Marketing, Abri

TIPPED FOR THE TOP!

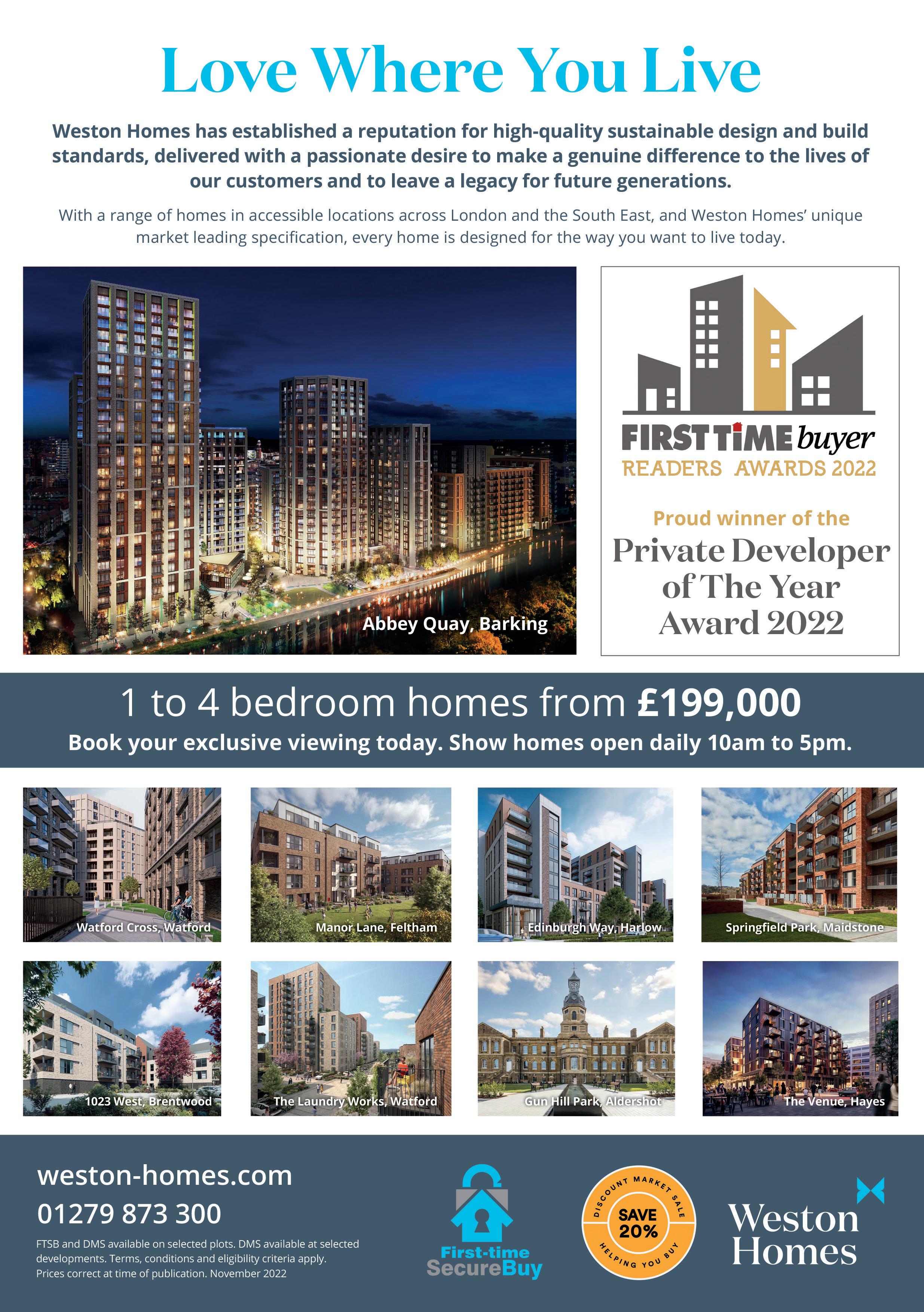

Tayo Oguntonade is a TV presenter and can be seen presenting Great House Giveaway on Channel 4, which this year scored a hattrick, winning Best Daytime Programme at the BAFTAs, RTS and Broadcast Awards. He is also an experienced mortgage broker, property expert and influencer. He tells Lynda Clark about his fascinating life, the first property he bought at the age of 22 and has some great advice for first time buyers

THE VIEW

20 First Time Buyer December 2022/January 2023

Photos © Channel 4

THE VIEW First Time Buyer December 2022/January 2023 21

"I WAS 22 AND I DECIDED TO WORK OUT WHAT I COULD AFFORD AND LOOKED AROUND THE SITTINGBOURNE AREA. IT WAS A BIT OF A GAMBLE AS I DIDN’T KNOW THE AREA BUT I REALISED IT WAS UP-AND-COMING SO WOULD BE A GOOD INVESTMENT"

Imet Tayo for our chat on a Zoom call, which is the norm nowadays, and even though we were talking through a screen I immediately knew he was passionate about property and helping others get on the ladder and that we were going to get on really well. Tayo was brought up in south east London and he describes the area as “tough”. His parents, who are originally from Nigeria, instilled in Tayo and his two brothers that getting a good education was very important and so he took his schooling very seriously.

“I loved maths as I am a numbers person. My parents moved to Catford and then further out to Orpington in Kent, which was a big change for me as all my friends were back in south east London and it was quite a long journey to go to see them. I eventually went to a sixth form college in Beckenham and many of my old friends went there too, which was great. It was rather strange though because we were surrounded by quite privileged people. For example, when they passed their driving test they would be given a brand new car straight out of the showroom and that was never going to be the situation for me or my friends. So, I realised if I wanted a car I would have to work and save. We all got jobs – I worked in Sainsbury’s – and I saved and saved and eventually bought a 12-year-old Ford Fiesta, which wasn’t new but it got me around and opened up my world.”

Tayo went on to study economics at university and explained, “My student loan didn’t cover what I needed for rent let alone living expenses. Again, I had to get a part-time job to help and I also managed to save again. I was crazy on cars at that time so it made me work really hard so I could save up to buy a new car. I worked for a telesales company and I even stayed there during the holidays, often working between 60 and 70 hours a week, so I could continue working and saving and I actually managed to change my car three times during the period I was studying because I was saving so hard.

"My interest in property started when I was in a house share and I got friendly with the landlord and as I am a numbers man I worked out how much he made from all the rents he took. After I left uni I went back home and lived with my parents who didn’t want me to pay any rent, which was very good of them. I got a job and managed to save about £1,100 a month and then I spent whatever was left over on myself. I did realise though that every time I bought a new car its value depreciated the minute I drove it away and it got me thinking that I needed to invest in something that actually went up in value.

"I was 22 and I decided to work out

what I could afford and looked around the Sittingbourne area. It was a bit of a gamble as I didn’t know the area but I realised it was up-and-coming so would be a good investment. I eventually bought my first house there, a three bedroom terraced home which I bought for £150,000. My mortgage was £500 a month and I thought back to what my landlord had told me and I rented out the big double bedroom for £500 a month and the single one for £400 a month, so my mortgage was taken care of and I made a profit as well! Sittingbourne is well placed for commuting and with my house share model I was very happy.”

He worked as a personal banker for Santander at the time and realised that to further his career he needed to become a mortgage adviser. He asked Santander if they would train him and they agreed but kept saying maybe next year, so Tayo decided to do it himself and paid for his training and to take the exams. He passed and immediately left his job and moved on to working for the biggest estate agent in Kent. He now lives in south east London with his wife and two young daughters in a four bedroom terraced house. He still has the house he originally bought in Sittingbourne, which has doubled in value.

"Then in late 2019 my wife and I started BrickzwithTipz, a property blogging platform, as we had started using social media to give advice on buying your first home. It has been a huge success and it was the perfect timing to launch it as we soon went into lockdown and people had a lot of time on their hands and generally the property world was booming. We have well over 70,000 followers and we really enjoy giving our expertise to help dispel the myths of buying a home.”

It was during the pandemic that Chwarel, a production company in North Wales, saw a YouTube video he had made and contacted him about presenting a show on Channel 4 called Great House Giveaway He was a great success and has just finished filming the third series. This year the show won Best Daytime Programme

at the BAFTAs, RTS and Broadcast Awards and Tayo was also nominated for Best Debut Presenter at the Edinburgh Television Festival.

He has also joined the presenting team on Channel 4 on a show called Key to a Fortune. The show reunites families with homes and relatives they didn’t know they had and he is thoroughly enjoying it. He is also a regular on Steph’s Packed Lunch, Rip Off Britain, Watchdog, the BBC News and Morning Live. Although he is a very busy he still has time to support and work with 2020 Change, a youth empowerment organisation renowned for helping young people realise their potential and cultivate the right mindset to engage with today’s changing society.

Tayo has some excellent advice for first time buyers and said, “Time in the market is better than timing the market. A good example of this is in January 2020; there were 95% mortgages available but many people didn’t take this up as they thought property prices would go down. But they were wrong as house prices have shot up and so have interest rates, so timing is very important. After the financial crash in 2008 it took seven years for prices to recover to the level they were before the crash so property is a long-term investment.

"But, for first time buyers your first home will not be your forever home. It is hard to get on the ladder because most people are paying rent and bills and cannot save for their very important deposit. It does look like an impossible goal but try to get as much knowledge and information about the homebuying process before you start as it will put you in a much better position.

In 2022 Tayo was selected to be in the Top 25 Entrepreneurs to Watch list, which is run by UK Black Business Week and sponsored by HSBC. I certainly think Tayo is one to watch and I think we will be seeing a great deal more of him in the years to come. IG:

THE VIEW 22 First Time Buyer December 2022/January 2023

@brickzwithtipz

@brickzwithtipz

IN THE MARKET IS BETTER THAN TIMING THE MARKET. A GOOD EXAMPLE OF THIS IS IN JANUARY 2020; THERE WERE 95% MORTGAGES AVAILABLE BUT MANY PEOPLE DIDN’T TAKE THIS UP AS THEY THOUGHT PROPERTY PRICES WOULD GO DOWN"

TikTok:

Website: brickzwithtipz.com "TIME

THE VIEW First Time Buyer October/November 2022 23 "I REALISED IF I WANTED A CAR I WOULD HAVE TO WORK AND SAVE. WE ALL GOT JOBS – I WORKED IN SAINSBURY’S – AND I SAVED AND SAVED AND EVENTUALLY BOUGHT A 12-YEAR-OLD FORD FIESTA, WHICH WASN’T NEW BUT IT GOT ME AROUND AND OPENED UP MY WORLD” First Time Buyer December 2022/January 2023

FOOTBALL’S COMING HOME

With the FIFA World Cup kicking off in Qatar, we have football on the brain at First Time Buyer, but we always like to keep things closer to home. Property developer Stripe Property Group recently looked at the cash splashed by each Premier League team during the summer transfer window, the current average house price in each of their respective areas and how many homes they could purchase based on their summer transfer window spend. Debbie Clark takes a look at their findings, to find out which areas are topping the property league

CASE STUDY

First time buyer Emily has recently purchased her rst home – an apartment in Liverpool. Raised in Shef eld, where her family are still based, Emily moved to the city to study medicine but says, “I very much saw myself making my home in Liverpool, even after I graduate to be a doctor.” The impressive Tobacco Warehouse development, at Liverpool’s iconic Stanley Dock, wowed her with its double-height ceilings, unique architecture and luxury feel. Emily knew that this was de nitely the place she wanted to call "home".

While homeownership is a distant dream for most students, Emily was fortunate to have a deposit to purchase her rst home, thanks to her late grandparents and cautious parents. She explains, “My grandparents sadly died when I was quite young and left me a small legacy. My parents took responsibility for it, so no poor nancial decisions were made by me with the money when I was a teenager, which I am really grateful for, else I might not be in the position I am in now.”

A huge £2.01bn was spent during this summer’s transfer window, enough to snap up a massive 6,605 homes based on the current average house price across England and Wales. However, Stripe Property Group has revealed that Newcastle United topped the Premier League table when it comes to the ability to buy the most homes surrounding their home ground with their estimated spend of £122.4m – an impressive 652, given the current average house price of £187,871. Managing Director of Stripe Property Group, James Forrester, commented, “Although Newcastle may not have spent the most this summer, the fact they sit top of the table when it comes to the ability to purchase the most homes is quite fitting given the changes the city is currently undergoing. Not only is it a very exciting time for the city with respect to the team itself, but we’re also seeing Newcastle benefit from a high level of regeneration. The rejuvenation of the Quayside area is just one ongoing project that is breathing new life into the city, with a focus not only on its social offering, but also as a place to

Nottingham Forest (424). At an estimated £251.09m, Chelsea spent the most this summer. However, they just scrape in to the top 10 of this table as Hammersmith and Fulham, home to both Stamford Bridge and Craven Cottage, is also home to the highest average house price of all Premier League stadiums (£772,447). As a result, Chelsea’s summer transfer window spend is enough to see them purchase just 325 homes. The club are in good company however, with West Ham, Aston Villa, Tottenham Hotspur and Southampton also between 250 and 400 homes.

At the other end of the table, with a meagre £15.3m spent, Leicester could afford to purchase just 67 properties around their stadium. Arsenal, Brentford, Brighton & Hove Albion, Crystal Palace, Fulham and Bournemouth didn’t fare much better, all close to bottom of the league, with the buying power for under 100 homes.

legacy. My parents took responsibility for it, so

Emily started the search for her rst home in early 2020, not long before the rst Covid-19 national lockdown, and the Tobacco Warehouse instantly caught her eye. Having waited patiently for restrictions to ease, Emily nally went to see the development in October 2020. A second viewing followed, this time with her parents in tow, and the location, build quality and size of the apartment made it a clear winner in everyone’s eyes. She quickly placed a reservation fee!

work, study and live.”

Meanwhile, Wolverhampton Wanderers sit second in the table, with their summer spend of £122.94m enough to buy 627 homes around Molineux, closely followed by Manchester United (591), Manchester City

(558), Liverpool (458), Everton (442), Leeds United (426), and

Thankfully, even if your budget is more Leicester than Chelsea, you will be able to find the perfect property close to your club. Or maybe even move to Wembley so you’re nice and local when the boys follow the Lionesses home with the World Cup!

PREMIER LEAGUE HOMES 24 First Time Buyer December 2022/January 2023

Team Location Stadium

Newcastle United Newcastle

Current average house price

Est transfer expenditure summer window (season 22/23)

Est number of homes purchased with transfer window spend

St James' Park £187,871 £122,400,000 652

Wolverhampton Wanderers Wolverhampton Molineux Stadium £195,980 £122,940,000 627

Manchester United Trafford Old Trafford £362,475 £214,220,000 591

Manchester City Manchester Etihad Stadium £225,113 £125,550,000 558

Liverpool Liverpool An eld £177,602 £81,270,000 458

Everton Liverpool Goodison Park £177,602 £78,480,000 442

Leeds United Leeds Elland Road £232,909 £99,130,000 426

Nottingham Forest Rushcliffe The City Ground £343,396 £145,760,000 424

West Ham United Newham London Stadium £414,586 £163,800,000 395

Chelsea Hammersmith and Fulham Stamford Bridge £772,447 £251,090,000 325

Aston Villa Birmingham Villa Park £225,561 £63,000,000 279

Tottenham Hotspur Haringey

Tottenham Hotspur Stadium £577,614 £152,910,000 265

Southampton Southampton St Mary's Stadium £238,869 £59,760,000 250

Arsenal Islington Emirates Stadium £717,487 £118,860,000 166

Brentford Hounslow Brentford Community Stadium £441,269 £45,450,000 103

Brighton & Hove Albion Brighton and Hove

Amex Stadium £438,264 £43,020,000 98

Crystal Palace Croydon Selhurst Park £416,641 £31,140,000 75

Fulham Hammersmith and Fulham Craven Cottage £772,447 £55,260,000 72

Bournemouth Bournemouth, Christchurch and Poole Vitality Stadium £347,436 £24,210,000 70

Leicester City Leicester

King Power Stadium £227,144 £15,300,000 67

Overall £304,867 £2,013,550,000 6,605

HALEWOOD, LIVERPOOL

The Finches at Hilton Grange

The three bedroom Letchworth and Warwick homes at The Finches are some of the homebuilder’s most popular house styles for rst time buyers, enjoying a high speci cation as standard. With Redrow’s online tool, My Redrow, buyers can choose from a wide selection of options and upgrades too. Both styles of home come with their own garden and access through wide patio doors from the kitchen. The homes are built to be energy ef cient, and those who work from home will appreciate bre to the properties, allowing for faster broadband services.

redrow.co.uk/the nches 0151 391 7310

LIVERPOOL Tobacco Warehouse

FROM £304,995 FROM £260,000

The largest brick-built warehouse in the world, and Liverpool’s largest listed building, is being converted into super-sized apartments. The spacious warehouse homes are at the heart of Merseyside’s historic docks, with phase one now complete and ready to move into. This stunning collection of luxury loft apartments is at the centre of the city’s most ambitious regeneration programme, an area being transformed into a thriving new creative neighbourhood.

tobaccowarehouse.co.uk 0151 920 2404

CASE STUDY

NHS worker Danny’s family of ve have found the perfect home at Hyde New Homes’ Amberdown development in the popular residential area of Hove.

As Brighton house prices continued to rocket post-pandemic, the family faced the prospect of leaving the vibrant south coast city they called home as the goal of owning a three bedroom home with a garden seemed unobtainable. However, after discovering shared ownership at Amberdown, Danny realised that their dream could become a reality. He says, “Our main goal was to nd a family home in the Brighton area, and we’d never even considered shared ownership as an option. When we discovered that Amberdown offered the scheme, however, we decided to investigate.”

Danny visited the stunning development of three bedroom mews houses, situated near the popular Poets Corner area, on its launch day and returned the very next day to put in an offer. “We were hugely impressed, not only with the look and feel of Amberdown but also the commitment to sustainability,” says Danny. “All of the homes come with solar panels as well as electric car charging points. This was excellent news to us as we are looking to purchase an electric car in the near future.”

The three storey Shelley design the family chose boasts three good-sized bedrooms, with an en suite to the principal bedroom, as well as a family bathroom and ground oor cloakroom. The open-plan living/dining room opening on to the rear garden makes this a fantastically sociable home. Residents also bene t from a short 20-minute walk to the beach with its restaurants, cafes and watersports facilities.

Danny said, “We hadn’t considered shared ownership initially, but the scheme has allowed us to buy in the area which we love. And in time, we plan to staircase and progress from there.”

PREMIER LEAGUE HOMES First Time Buyer December 2022/January 2023 25

NEWCASTLE UPON TYNE Sycamore Grove

Coming soon, Sycamore Grove is an exclusive development situated in the heart of Newcastle upon Tyne, offering a collection of two, three, four and ve bedroom homes surrounded by green open space and mature trees.

The high-quality homes are perfect for those looking to get on to the property ladder or looking for more space for the family to grow. There is a range of local amenities close by and Walkergate Metro is a short walk away, as well as Newcastle Central station which is less than four miles from the development, offering national and local rail services.

Or, why not take a trip to the coast with Tynemouth just seven miles away?

barratthomes.co.uk/new-homes/dev-001160

CROYDON 8 Croham Valley Road

This stylish development, located in the heart of South Croydon (with Crystal Palace just ve miles away), features a detailed brick facade which complements neighbouring properties on the street and large feature windows that ll each apartment with natural light. The nine premium two and three bedroom apartments are designed to offer spacious open-plan layouts with modern ttings and high-quality appliances throughout, generously sized private balconies or terraces and access to landscaped communal grounds and cycle storage.

Residents can reach London Bridge in less than 20 minutes from South Croydon station, making it an ideal location for London commuters.

fernham-homes.co.uk/our-developments/8croham-valley-road 0173 275 7158

CASE STUDY

UPTON PARK, WEST HAM Upton Gardens

This fantastic development of more than 800 homes transformed the historic old Boleyn Ground in Upton Park, which was the former stadium for West Ham FC, and is set to complete in spring 2023. On-site amenities include a residents’ gym, concierge service, car club, landscaped grounds and family play areas, as well as a proposed cafe and community space. This thriving new east London community is just a six-minute walk from Upton Park underground station in Zone 3, with fast connections to central London in under 15 minutes, making this an ideal location for professionals and families.

barratthomes.co.uk/new-homes/dev002240upton-gardens 0330 057 6666

WINCHESTER, SOUTHAMPTON Whiteley Meadows

St Arthur Homes is offering a range of impeccably designed two and three bedroom apartments and houses at Whiteley Meadows. Set in a market town location just nine miles from the vibrant city of Southampton and surrounded by countryside, making it an attractive and sustainable place to live, this exclusive collection of contemporary shared ownership homes offers the ideal combination of style and affordability. The multi-phase development will deliver more than 3,000 new homes alongside new schools, a care home, community centre, green spaces and shops.

starthurhomes.com/whiteley-meadows 020 3859 7017

Joanne, 37, has recently bought a 35% share of a new home in Royton, Oldham, for herself and her two children.

Having previously been on the property ladder, Joanne’s relationship broke down and she felt her best option was to sell and move closer to family. However, the home Joanne was renting was not a long-term solution for the family. She says, “I was renting in Chadderton. My little girl’s bedroom would only t a toddler bed in and she was rapidly outgrowing it so I knew I had to move soon to accommodate her. And I was dealing with problems in the property. On rainy days it was raining more inside than it was outside!”

Having been renting for some time, Joanne happened to notice a Plumlife board when she was out for a walk one day, advertising shared ownership and affordable homes. This caught her attention and when she got home, she began researching and spoke to family and friends about it. Joanne recalls, “After understanding more about shared ownership I kept going on the website to look for developments in the area.”

Joanne soon found Carding Gardens and arranged to view the show home with her children. The location was perfect, with a park just a ve-minute walk away, and a turfed back garden for her football-loving son. “I told them not to get their hopes up and it was something I was trying to achieve,” she says, “as I didn’t believe myself I could own one of these beautiful homes. But – we did it – I secured a property at Carding Gardens, and I didn’t realise how easy it would be!”

Joanne found the whole process very smooth and is already making memories in her family’s forever home, with plans to staircase in future to make it all theirs. “Being on the property ladder is a dream come true,” she says. “I was devastated to have to sell my previous home after the relationship breakdown – it felt like I was taking a step backwards, but with the help of Plumlife I’ve managed to do it on my own this time. And my little girl has her big girl bed that she can stretch her legs out in! I would 100% recommend shared ownership. I’m a homeowner again which I never thought possible being a single mum of two.”

PREMIER LEAGUE HOMES 26 First Time Buyer December 2022/January 2023

FROM £TBC FROM £381,000 FROM £144,000* FROM £485,000

*Based on a 45% share of the full market value of £320,000

HOUNSLOW

The Bellevue, Lampton Parkside

Notting Hill Genesis is launching its rst phase of shared ownership homes at Lampton Parkside, located just minutes from Hounslow Central underground station, complementing the mix of private sale homes already available at the development. Each home in this collection of stylish two bedroom apartments comes with a private balcony, integrated appliances and open-plan living spaces, with touches of luxury throughout, including matt- nish handleless units in the kitchen, built-in mirrored wardrobes and energy-ef cient under oor heating. With connections into central London in just 30 minutes and the open green space of the 40-acre Lampton Park on the doorstep, the development places the city and nature in perfect harmony.

nhgsales.com/sales-developments/lamptonparkside 020 3733 3571

SOLIHULL

SO Resi Solihull, Oakhurst Village

SO Resi Solihull is a new shared ownership development, forming part of the wider Oakhurst Village scheme, in the small town of Shirley. This collection of two bedroom apartments is just a couple of miles from vibrant Solihull, boasting speedy transport links into the centre of Birmingham, and a HS2 promise of a commute of less than an hour to central London. Every home has private outdoor space – turfed gardens in the case of the houses, and balconies or terraces to the apartments –extending the living space into the open.

soresi.co.uk/ nd-a-property/solihull

ROYTON, OLDHAM

Vernon Gardens

Plumlife is delighted to introduce a brand new selection of properties at Vernon Gardens in Royton. The Byron is a three bedroom family home with parking and a generous sized private garden. Homes include a spacious living room to the front, with a modern tted kitchen diner to the rear, leading out on to the garden.

plumlife.co.uk/property/the-byron 0161 447 5050

BRIGHTON Home X

Home X is a fresh development forming part of a new neighbourhood in Lewes Road, Brighton. The 369 new homes in the seaside city are part of the wider £150m regeneration masterplan of the former Preston Barracks site. Over multiple phases, 124 homes including a selection of studio, one, two and three bedroom apartments will be available through open market sale. A further 194 shared ownership homes are also available to rst time buyers, including family-sized triplexes.

home-x.co.uk

WEMBLEY

Nexus

Octavia presents a collection of 32 one and two bedroom apartments, and one exclusive three bedroom apartment coming soon to Zone 4. Each of the shared ownership apartments will bene t from a spacious open-plan kitchen living area, stylish modern bathroom and a balcony or terrace. Located just a ve-minute walk from Wembley Park underground station, trains to central London take just 12 minutes.

octavialiving.org.uk/about/our_projects/ nexus_wembley_ha9_0nl 020 8354 5500

MANCHESTER

Belle Vue Place

Plumlife Homes is proud to introduce Belle Vue Place, part of a wider Countryside Homes development, offering great transport links to the city centre. There are 17 terraced and semi-detached "Arun" homes available. The Arun is a two bedroom family home with parking and a generously sized private garden. Homes include a spacious open-plan living area and modern tted kitchen and bathroom, and an integrated fridge-freezer is included with each property.

plumlife.co.uk/property/the-arun-2 0161 447 5050

PREMIER LEAGUE HOMES 28 First Time Buyer December 2022/January 2023

FROM £105,625* FROM £75,000* FROM £68,125* FROM £78,750* FROM £75,250* FROM £257,000** FROM £95,000* *Based

*Based on a 30% share of the full market value of £250,000 *Based on a 25% share of the full market value of £272,500 *Based on a 35% share of the full market value of £225,000 **Outright market sales

*Based on a 35% share of the full market value

on a 25% share of the full market value of £422,500

*Based on a 25% share of the full market value of £380,000

of £215,000

HAPPY EVER AFTER!

ALEX WILLIAMS

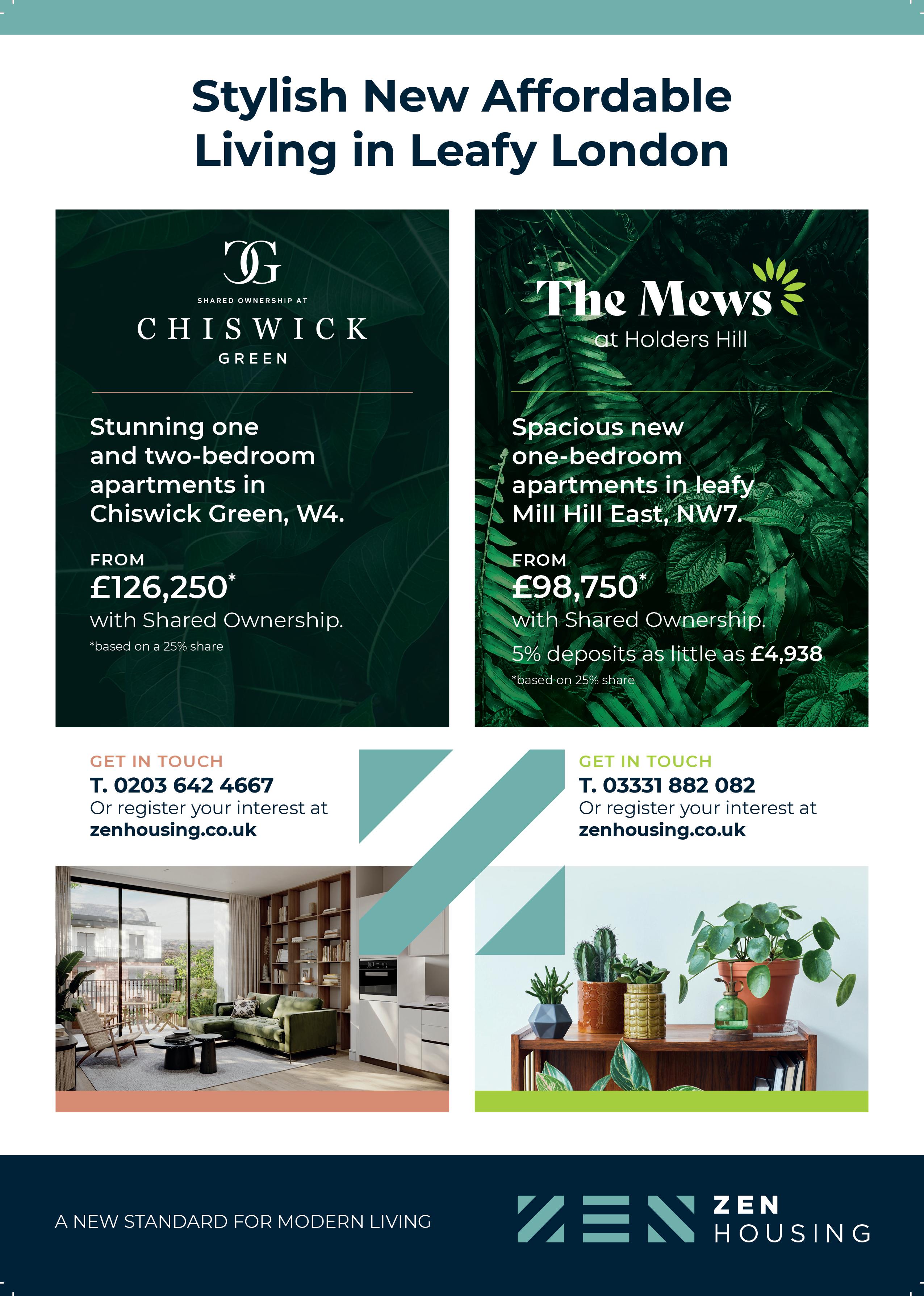

Nearly 40% of London-based first time buyers were forced to leave the capital last year to find a home they could afford¹ – and with first home prices rising by £24 a day², many more find themselves stuck in a cycle of being unable to make progress saving for a deposit while paying high rents.

But not everyone wants to flee to the suburbs or beyond in order to buy a home –some are Londoners through and through, like 30-year-old Alex Williams. He had no intention of giving up the dream of a place of his own in his home town, and is delighted to have just moved into a two bedroom apartment at Aw4ken, a shared ownership development in Chiswick from Be West.

“I grew up in the Richmond area and had rented four or five properties after leaving home, the latest in Wimbledon, so not too far away from my family. I work in Fulham, and I’m not at the point in my career where I want to work remotely full-time, so I needed to be within easy reach of the office. I certainly never wanted to consider moving out of London.”

Alex, who is a PR Account Director, had been saving hard towards a first home, and carefully considered all his options before opting for shared ownership. “The prices on the open market were a bit too high for my liking,” he said. “I looked at Help to Buy, but because the Government contribution is quite limited and prices are rising, I couldn’t buy the kind of home I really wanted.”

When he started to view shared ownership homes in the area he was initially put off by the thought of highrise living – but then he visited Aw4ken, a development of just 12 one and two bedroom apartments over three storeys, in a quiet residential area.

“It’s a safe, leafy neighbourhood, surrounded by nice houses, and I was really taken by one of the properties on the second floor,” he said. “I visited some 12-floor tower blocks in Acton and Kew and wasn’t sure about them. Here I don’t feel like I’m towering over people – the development fits in rather than sticking out.”

In addition to the location and type of building, Alex was also instantly impressed with the internal layout of his new home, which was quite different from others he’d seen. “So many places I looked at elsewhere

had completely open-plan living rooms, with the kitchen in one corner so you can see the sink from the sofa – I really didn’t like that.

“Here, the kitchen and living room are separated by a half-wall so you don’t have to see any of your cooking mess! I also love the super-large open balcony, which has already been put to good use. Everyone who visits comments on how light it is inside; I have huge windows letting in the sun so that it’s bright inside from dawn to dusk.”

Aw4ken, in W4, is a short walk from three Zone 3 London Underground stations. Chiswick Park is the nearest, with District Line services to King’s Cross taking 48 minutes, while Gunnersbury, around a 20-minute walk, has Overground services to Stratford in less than an hour. Alex’s trip to work is 45 minutes door-to-door, a far cry from the commute endured by those moving to the suburbs.

Alex was able to buy a 40% share in the home, which had a full market value of £740,000, putting down a good-sized deposit

and borrowing the rest with a five-year fixed rate mortgage from Santander. He also plans to staircase in the future.

“My day-to-day costs are similar, as the mortgage plus rent works out much the same as what I was paying before just to rent. I would absolutely recommend shared ownership; the scheme is designed specifically to help people on to the housing ladder and in my opinion it’s a sensible approach to acquiring a home on a stepby-step basis – having an asset is really important. Rather than waiting another five years to try to afford a two bedroom home on the open market in the area, I have got myself on to the property ladder now, and I have a genuine asset in the share I own.”

There are no homes available at Aw4ken but for other developments visit bewest.co.uk

1 hamptons.co.uk/research/articles/londoners-spend-arecord-on-property-outside-the-capital#

2 cityam.com/london-average-hits-440k-first-time-buyers-infor-a-shock-as-house-prices-for-newcomers-rise-24-per-day

FIRST HOMES 30 First Time Buyer December 2022/January 2023

Buying your first home is a dream come true. Here we highlight three first time buyers who have taken that first step on the property ladder using shared ownership through Be West –their stories are inspirational!

C A SEST UDY

“MY DAY-TODAY COSTS ARE SIMILAR, AS THE MORTGAGE PLUS RENT WORKS OUT MUCH THE SAME AS WHAT I WAS PAYING BEFORE JUST TO RENT”

COSMIN SABAU

House shares can be fun when you’re young, but the novelty can soon wear off, especially if you work anti-social hours and have to try to sleep when your flatmates are awake. That’s exactly the scenario that 32-year-old Cosmin Sabau found himself in before he was finally able to move into a home of his own at The Apex in Fulham.

“I was living in a shared house in West Acton, it was in a lovely area, very clean and green. But when you are in a shared house you do end up living with a real mix of people. I was working long hours and needed my privacy, plus I really like things to be clean and tidy. It was becoming difficult and stressful, especially as I was working shifts and other people were making a noise and enjoying a drink when I was trying to sleep. All of that was driving me to really want my own property.”

Cosmin works in property management for luxury developments in central London, after moving to the UK from a Romanian seaside town six years ago. The luxury homes he looks after mainly belong to foreign investors and even royalty – but it made him despair of ever managing to buy a place of his own.

“Prices in London are crazy and simply not affordable for ordinary people,” he says. “A lot of investors are coming from overseas and purchasing properties as an investment and pushing prices up unrealistically high. Fortunately, shared ownership provides an affordable way to buy a property.”

Cosmin had been saving hard for several years, and when he joined forces with his brother Flavius they were able to purchase

SARA PONNE

When Sara Ponne phoned her mother to say she was about to buy a home in London, she was met with astonishment that it was even possible. Yet thanks to looking a little further afield and using the Government-backed shared ownership scheme, the 38-year-old analyst for a drinks company is now settling down in a home of her own at Be West’s Waterside Heights development in West Drayton.

Sara, who is originally from Brazil, had been living in Hammersmith in a shared flat with two others. “London is so expensive; I used to live by myself in Brazil but couldn’t afford to do that here, so I’ve been sharing for three years. Even though it’s nice to have flatmates it’s not common in Brazil so I was not used to it. I liked it in Hammersmith, but I didn’t earn enough to afford to buy around here, so I started looking at ways it might be possible for me to buy – including shared ownership. I started to look at different areas of London and I was looking further and further afield until I suddenly found West Drayton. I really liked the look of the homes at Waterside Heights as they are right next to the station as well as being close by the Grand Union Canal and its lovely bridge.”

Sara does hybrid working, with two or three days in the office at Chiswick Park and the rest at home, so having good public transport was important to her.

a 25% share of a two bedroom apartment at The Apex with a full market value of £612,500. “It wasn’t a sudden decision, I had been putting my money away for six years, working like crazy, with no days off, to save up a large deposit. I knew what I wanted and that kept me going and I never gave up,” he says.

The first thing on Cosmin’s wish list for his new home was to be a little nearer to his job. “All my work was in central London and I cycle everywhere as I don’t have a car. I was feeling exhausted cycling from West Acton over to Green Park or Kensington every evening, so I wanted something closer to my work. When this development came up I was really excited by the location, and when I visited it seemed ideal for me.”

There are no homes currently available at The Apex, but resale shared ownership homes are available in nearby Shepherds Bush with prices starting from £95,000 for a 25% share.

For more information visit bewest.co.uk

made some calls and managed to get it changed to 25% just for me.”

Despite loving the apartment, Sara still had some questions. “After I left I realised I still didn’t know how much the deposit would be, and I was terrified it was going to be £20,000 or £30,000 and I would never be able to afford it. I sent an email to Charlotte and when she replied that it was only around £4,000, which was something that I could afford, I was so excited and started the process straight away.” Sara was able to buy a 25% share, worth £74,000. “I had been saving up for six months and I didn’t spend hardly any money during that time, so I was able to find the deposit and the legal fees.

When she first went to view Waterside Heights she had intended to only look at the cheapest property, but in the end she viewed several different possibilities and particularly liked a one bedroom apartment on the second floor – with the stylish decor really convincing Sara, who has a background in design, that it was the place for her. “It was north facing but it didn’t bother me that I didn’t get the direct sun because it’s super light inside – but what I really liked was that the kitchen units and the flooring were a lovely cream colour. The problem was it was advertised as a 35% minimum share which I couldn’t afford, but Charlotte the sales adviser

“My advice to anyone stuck in shared accommodation is to take a good look at shared ownership and just do it – if I can, anyone can! Do a spreadsheet, work out how much you can save and then go for it. If I were spending the same amount of money a month renting a whole place for myself in Zone 2 I would only be able to afford one of those awful old studios where the shower and cooker are next to the bed! Instead, I have a lovely spacious open-plan living area, with a great balcony, and it’s perfect for me. I’m so glad I have taken this first step. I want to staircase next year, as soon as I can.”

There are no homes available at Waterside Heights but for more information on other homes around the capital visit bewest.co.uk

FIRST HOMES First Time Buyer December 2022/January 2023 31

C A SEST UDY

C A SEST

UDY