the Ultimate Guide to... GETTING ON THE LADDER, THE PROPERTY MARKET AND HELP TO BUY rsttimebuyermag.com June/July 2023 £3.95 771758 973014 9 06> “Don’t get pressurised and ensure you understand the process” THE LOWDOWN ON AFFORDABLE WAYS TO GET ON THE LADDER OUTDOOR LIVING AT ITS BEST WIN! A PROOFVISION IN-WALL SINGLE TOOTHBRUSH CHARGER WORTH £56.90 IMPORTANT QUESTIONS TO ASK A CONVEYANCER SPOTLIGHT ON YOUR CREDIT SCORE

Bowen TV Personality & In uencer

Olivia

EDITORIAL – 020 3488 7754

Editor-in-Chief SARAH GARRETT sarahg@spmgroup.co.uk

Editor LYNDA CLARK lynda@ rsttimebuyermag.co.uk

Editorial Assistant and Head of Special Events

KATIE WRIGHT

Editorial and Special Events Assistant

SOPHIE MUNNERY

Creative Director RYAN BEAL

Sub Editor KAY HILL

Social Media KATIE WRIGHT, SOPHIE MUNNERY

Contributors

CHRIS CLARK, DEBBIE CLARK, BILL DHARIWAL, JULIANA GOODE, KAY HILL, DUNCAN HORTON, JONNIE IRWIN, JAMES JONES, CECILIA MOURAIN, SOPHIE MUNNERY, LAURA DEANOSGOOD, CORALIE PHELAN, LESLEY PRICE, GINETTA VEDRICKAS, KATIE WRIGHT

ADVERTISING – 020 3488 7754

Director of Advertising/Exhibition Sales

LYNDA CLARK lynda@ rsttimebuyermag.co.uk

Special Events KATIE WRIGHT

– First Time Buyer Home Show

– First Time Buyer Readers’ Awards katie@ rsttimebuyermag.co.uk

Accounts accounts@ultimateguidecompany.com

Managing Director SARAH GARRETT sarahg@spmgroup.co.uk

Public Relations

RACHEL COLGAN rachel@buildingrelations.co.uk

SUBSCRIPTIONS

020 3488 7754

SWITCHBOARD

020 3488 7754

All advertising copy for August/September 2023 must be received before 30 June 2023. Send all copy to: lynda @ firsttimebuyermag.co.uk

The content of this publication, either in whole or in part, may not be reproduced, stored

Welcome

We are very excited that after much deliberation our expert panel of judges has decided on the shortlist for our FTB Readers’ Awards 2023. You will find the shortlist entries on pages 77-99 but it is now up to you, our readers, to vote – please take a moment to go to ftbawards.com and cast your allimportant votes – thank you.

The weather has been a little unstable but I am hopeful it will settle down and we can spend some time to enjoy the great outdoors! We have some inspirational accessories on pages 12-13 to help you relish the sunny days ahead.

Many first time buyers do not realise that having a good credit score is vital when the time comes to get a mortgage. On pages 112-113 we explain what the credit score is all about and how important it is on your homebuying journey.

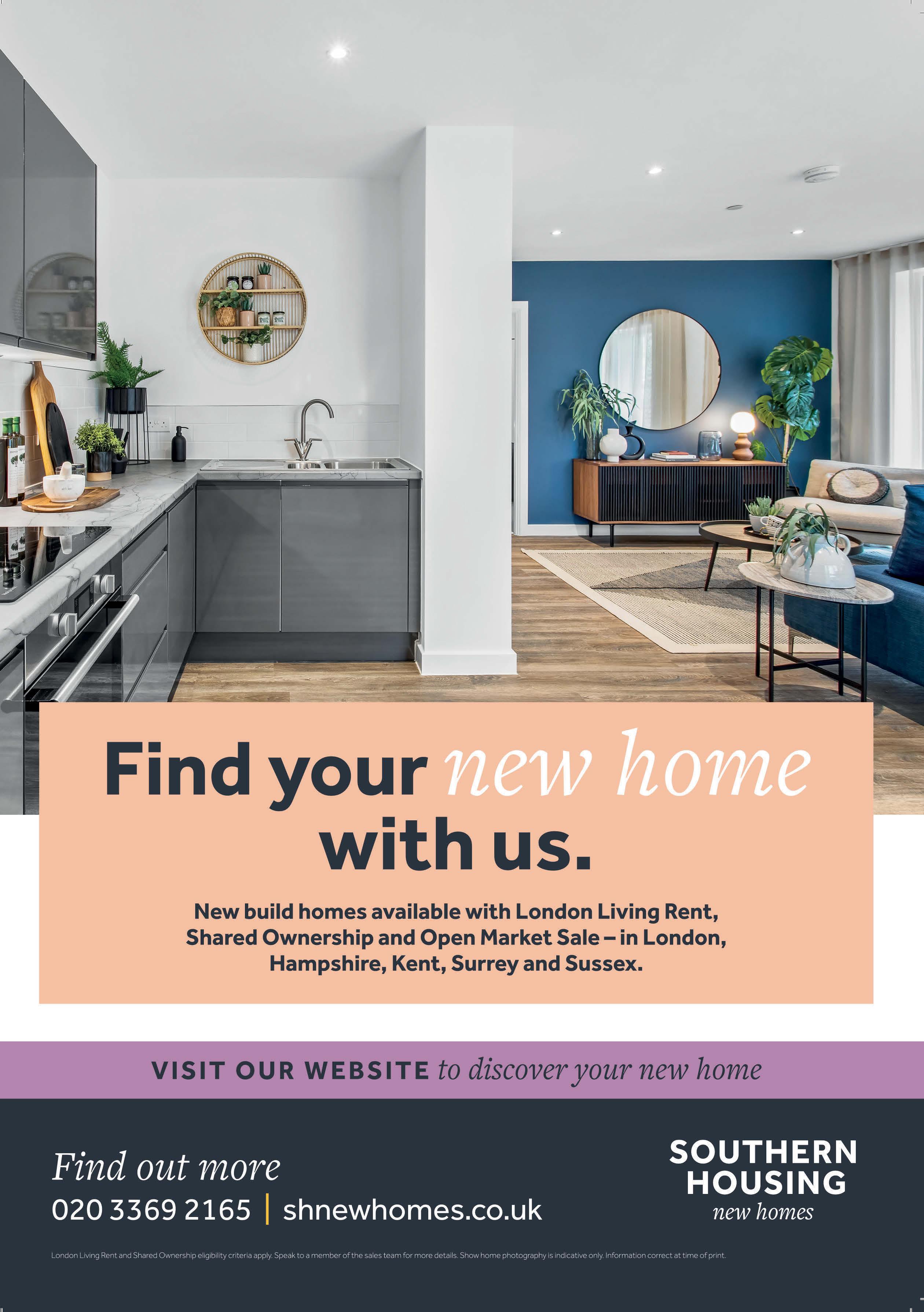

Now that the Government scheme Help to Buy has closed, shared ownership is a very affordable way of getting on the ladder. On pages 24-31 we explain how shared ownership works and also highlight some other schemes available to help you buy your first home.

I hope you enjoy this issue which is packed with information and if you are struggling to understand how it all works then I am sure you will find the answers to your questions inside.

Until next time, happy house hunting

Esaiyas Mollallegn, 20 Questions, page 134

Flo Headlam, At home with, page14

If you’re planning to apply for a mortgage, it’s important to check your credit report.

James Jones, Don’t let a poor credit score turn your mortgage dreams into a nightmare, page 112

EDITOR’S LETTER First Time Buyer June/July 2023 3

This is what we really wanted to nd: a perfect balance between city and country. Kate Rowe, House Hunter, page 16

in a data retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying or otherwise, without prior permission from the publishers. Opinions expressed in First Time Buyer magazine are not necessarily those of the publishers. © The Ultimate Guide Company Ltd 2008-2023. The Ultimate Guide Company Ltd t/a First Time Buyer magazine will take no responsibility for any loss/ claim resulting from a transaction with one of our advertisers/media partners.

firsttimebuyeronline @firsttimebuyer

EDITOR’S PICKS…

When you’re a rst time buyer it can feel like a mine eld, so take some time and really do the research.

If you don’t get good vibes about an area there’s no point thinking of living there.

It hasn’t really hit me that it’s ours yet. This is actually our home, and we own it.

Raymond Wardle and Mark Wardle, Real Life, page 70

What’s in…

71

For sale

– the best FTB properties

70

Raymond and Mark Wardle had been living abroad for years, travelling around the Middle East. When they came back for a short holiday in England, they ended up stuck in the country as the Covid lockdown hit the UK. Unable to travel and trapped living in a friend’s spare room, Raymond and Mark decided they needed to find a permanent place of their own and bought a three bedroom house in East Sussex, which they are thoroughly enjoying.

HOMEPAGE

9 Words from Jonnie TV presenter and property expert, Jonnie Irwin gives his views on the housing market.

10 FTB loves…

Storage is so important! Our round up of some of the best practical products to help maximise your space and clear away the clutter.

12 Living Summer-inspired accessories to help you make the most of the warm days ahead.

14 At home with…

Flo Headlam

Having changed careers after working in the charity sector for 25 years, Flo studied horticulture and joined the presenting team on BBC Gardeners World and is also on her third series of Garden Rescue for BBC1. She talks to Lynda Clark about her first home, her interesting career and has some very good advice for first time buyers.

16 House Hunter

We try to find a home for Kate and Richard Rowe who are searching for a two bedroom house in the North West.

18 Developer’s doctor Louise Mills, Sales and Marketing Director at St Arthur Homes, answers your property questions.

FEATURED

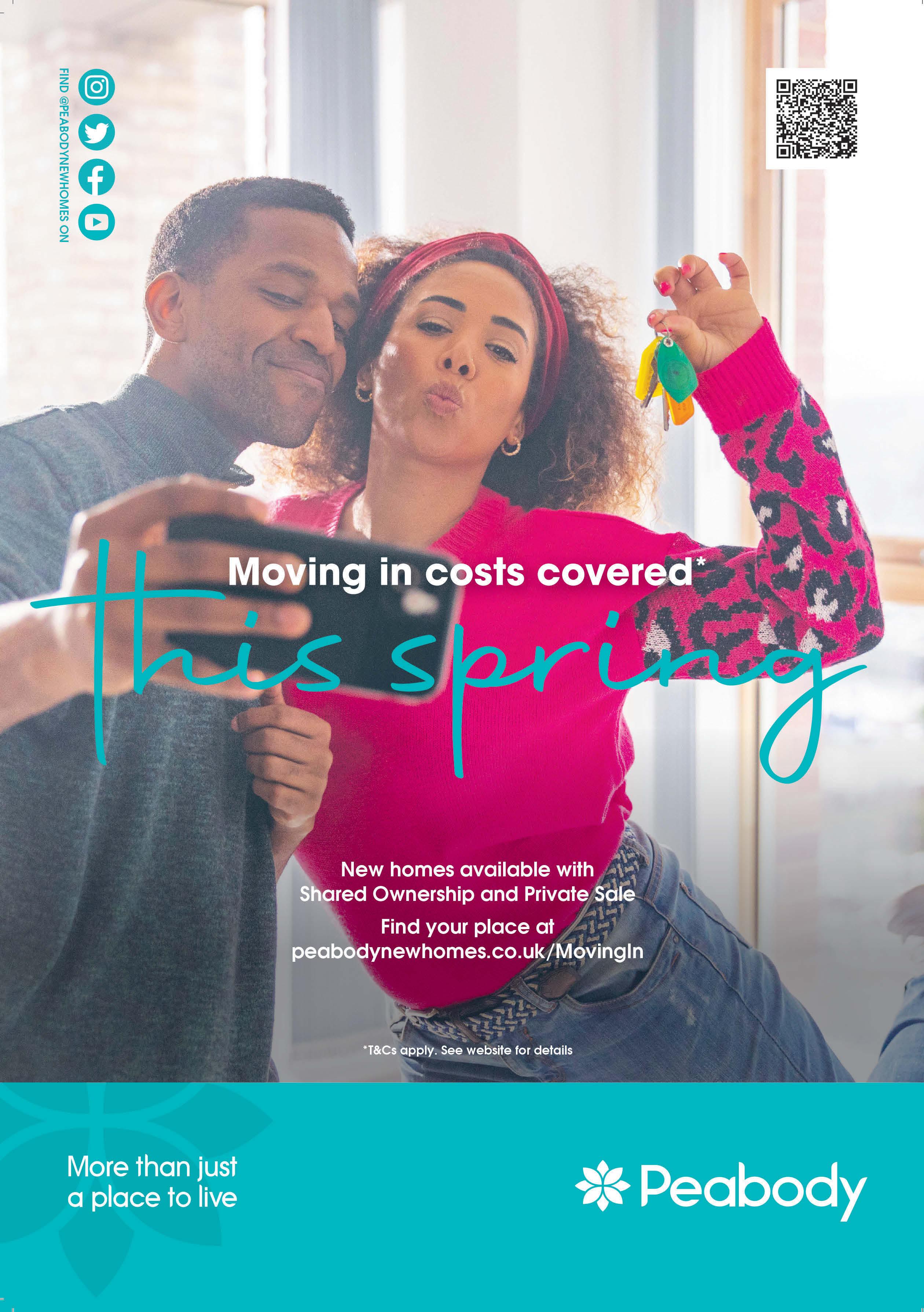

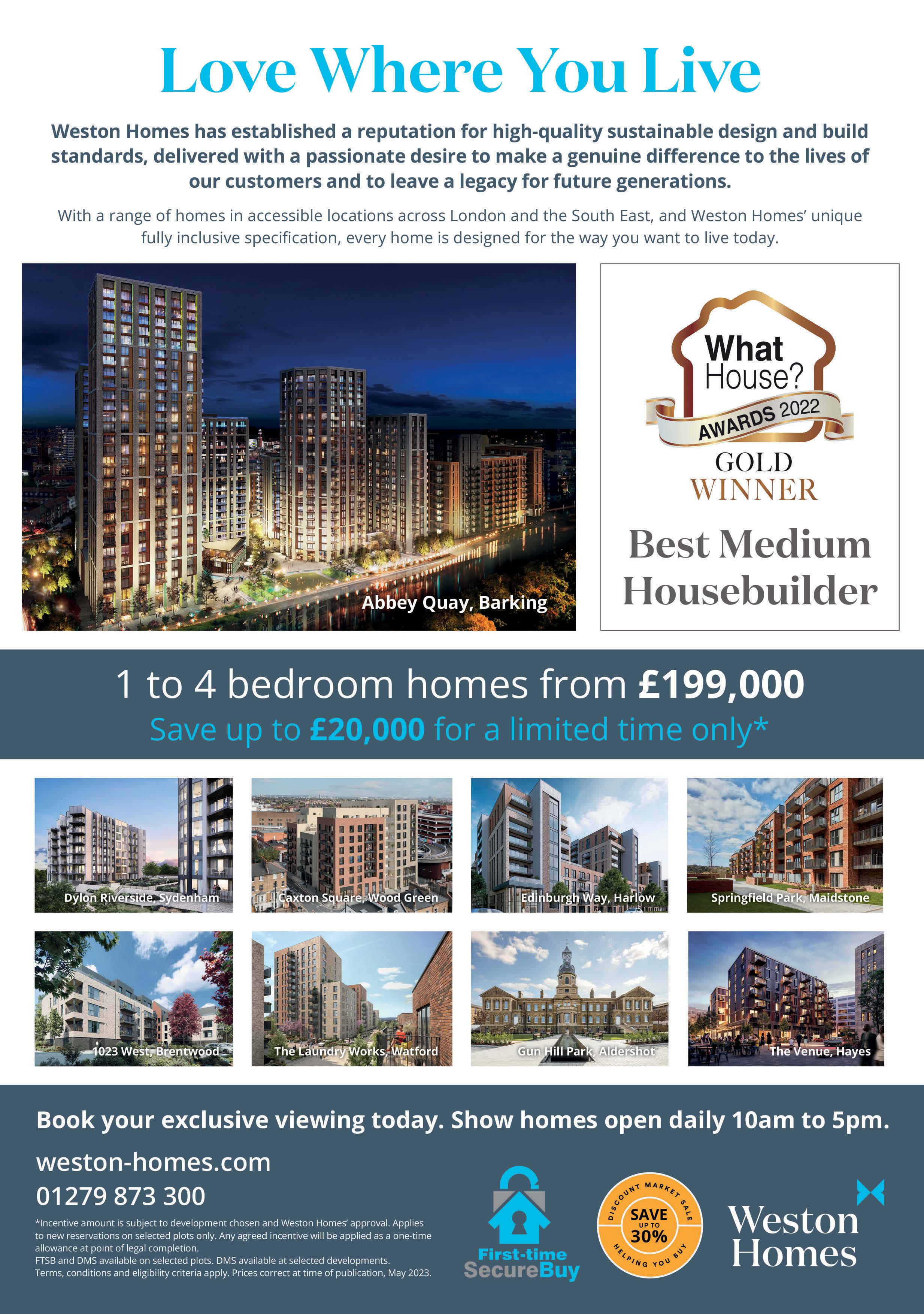

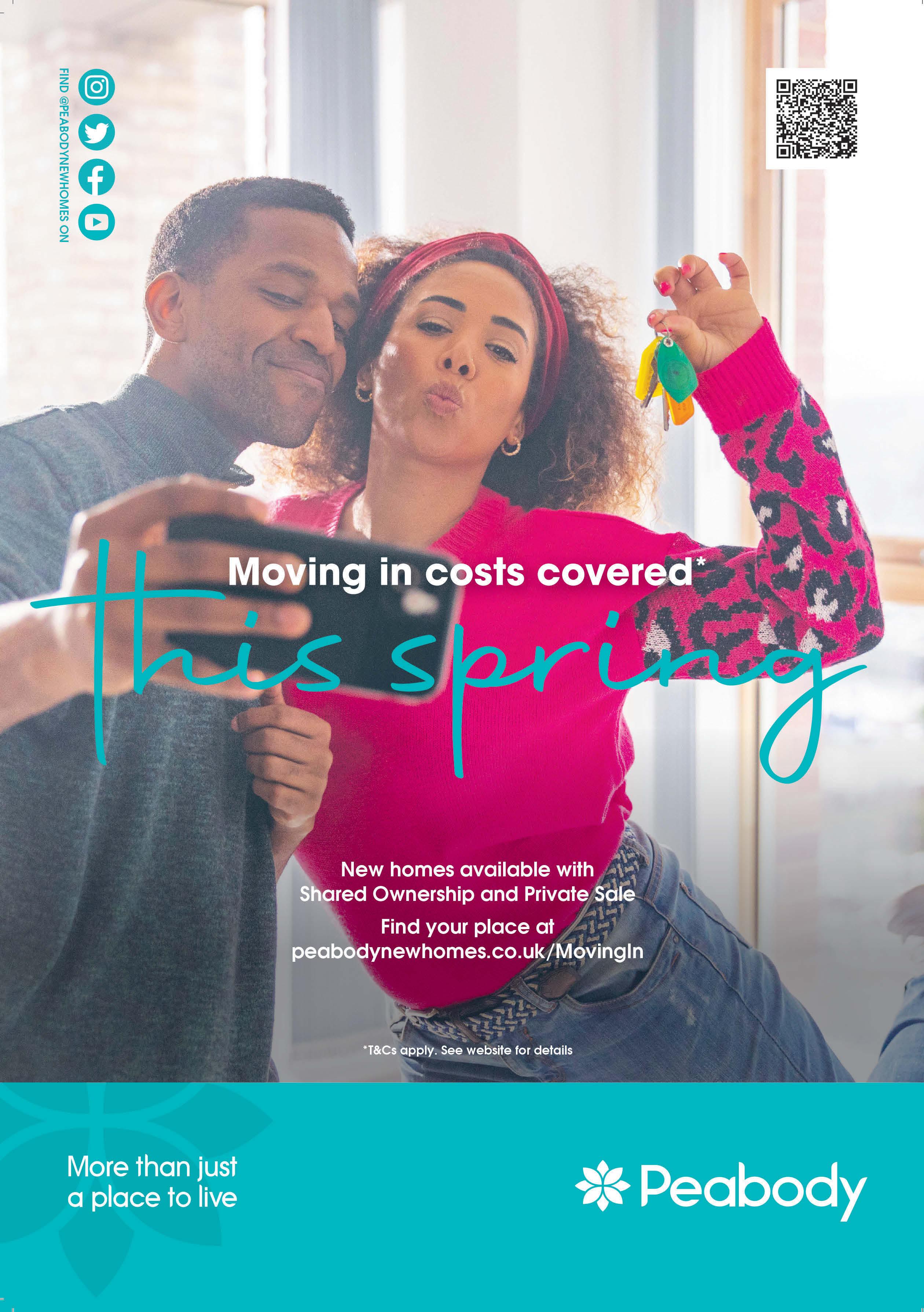

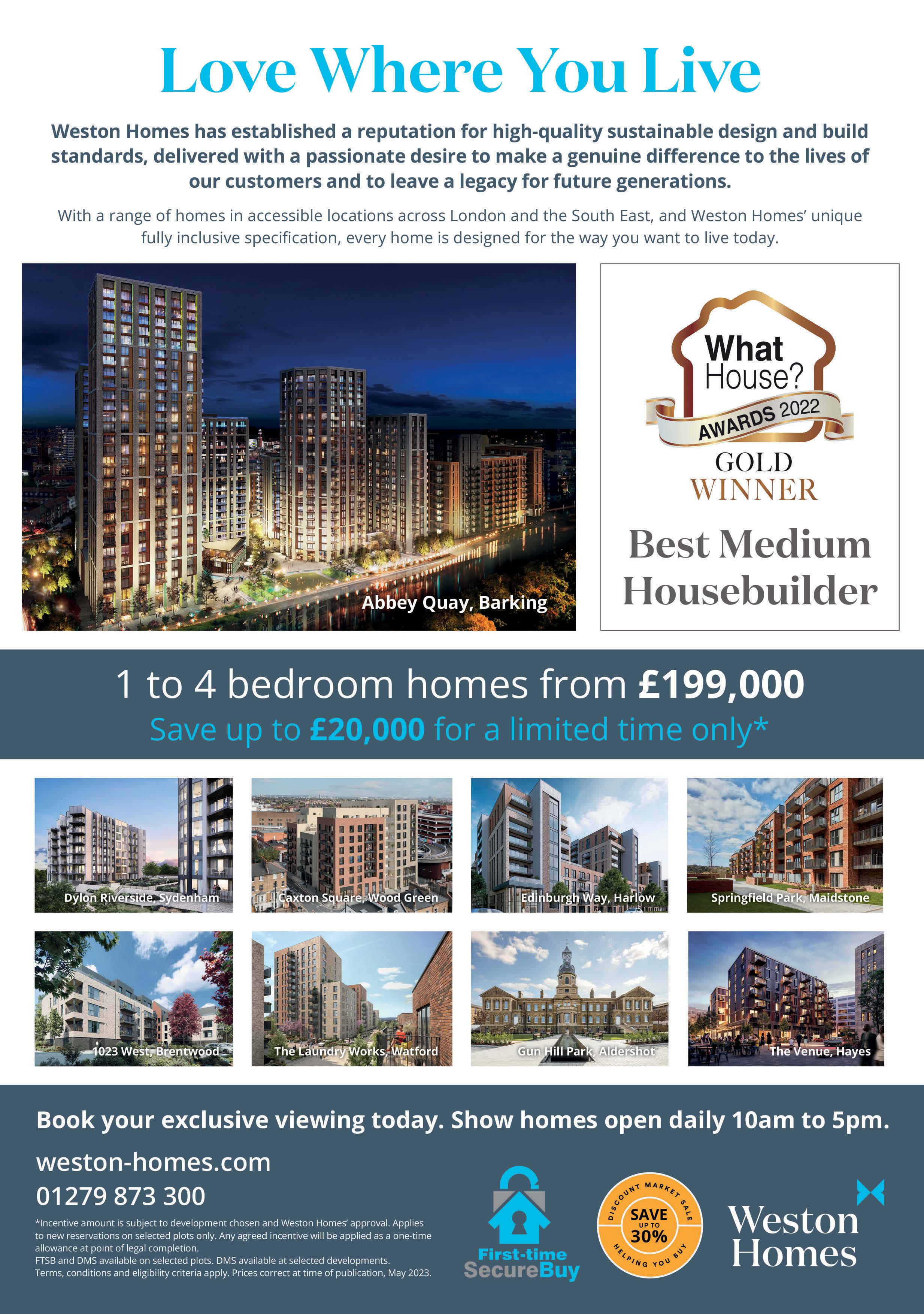

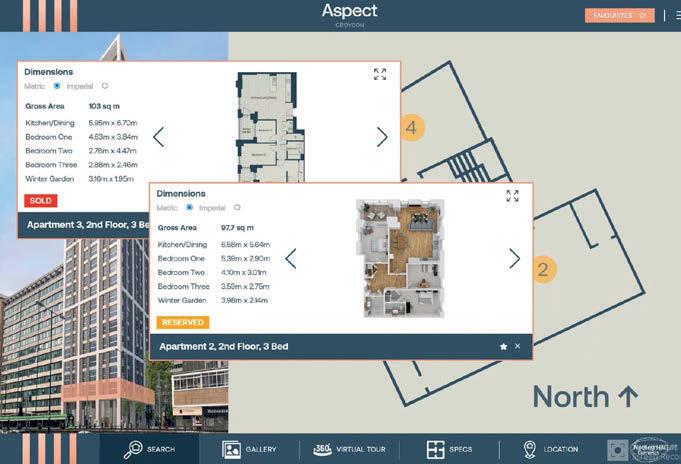

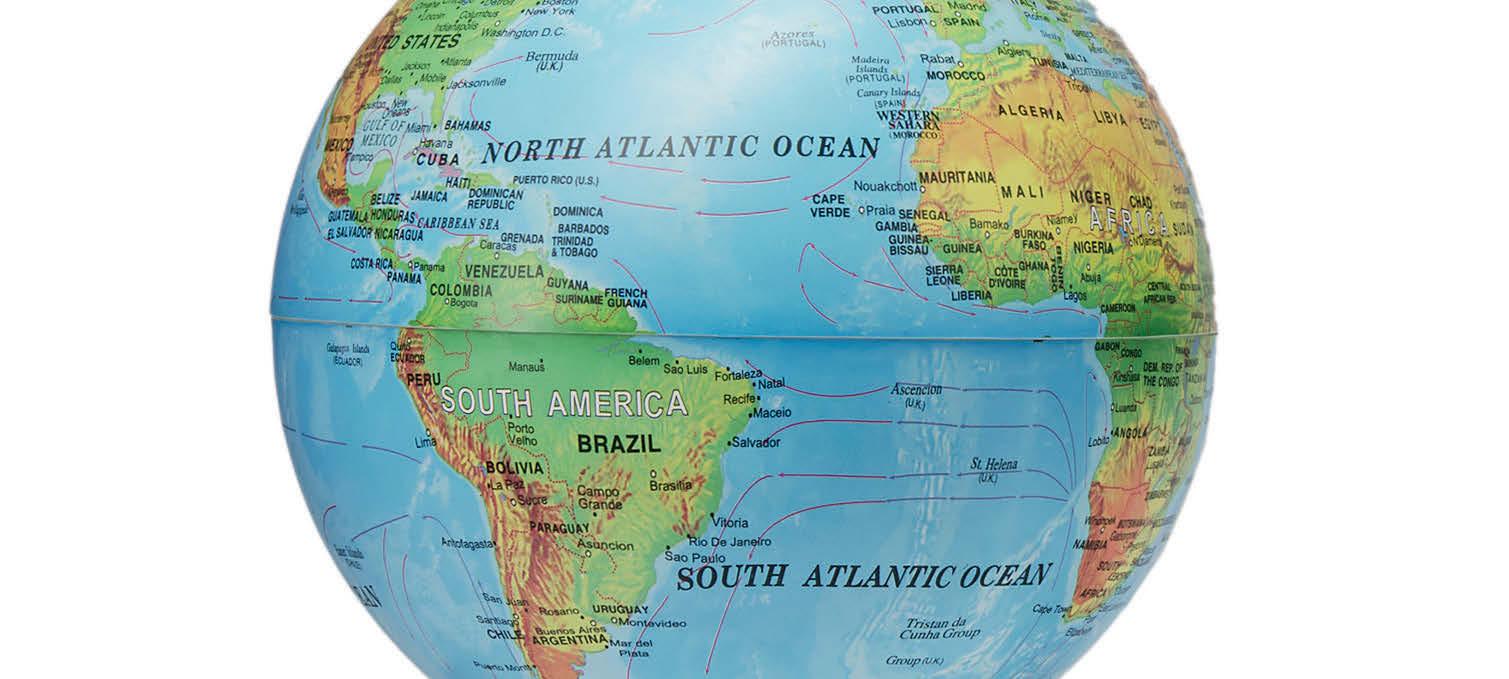

20 The View: Olivia Bowen

Olivia Bowen, then Buckland, came second on Love Island with Alex Bowen and they were the first couple to get married after the show. She has over three million followers on Instagram and keeps them updated @thebowenhome. Olivia is passionate about property and interiors. She has recently renovated her own home using

Frenchic paint throughout, and was so impressed that she has become an ambassador for the Frenchic paint brand.

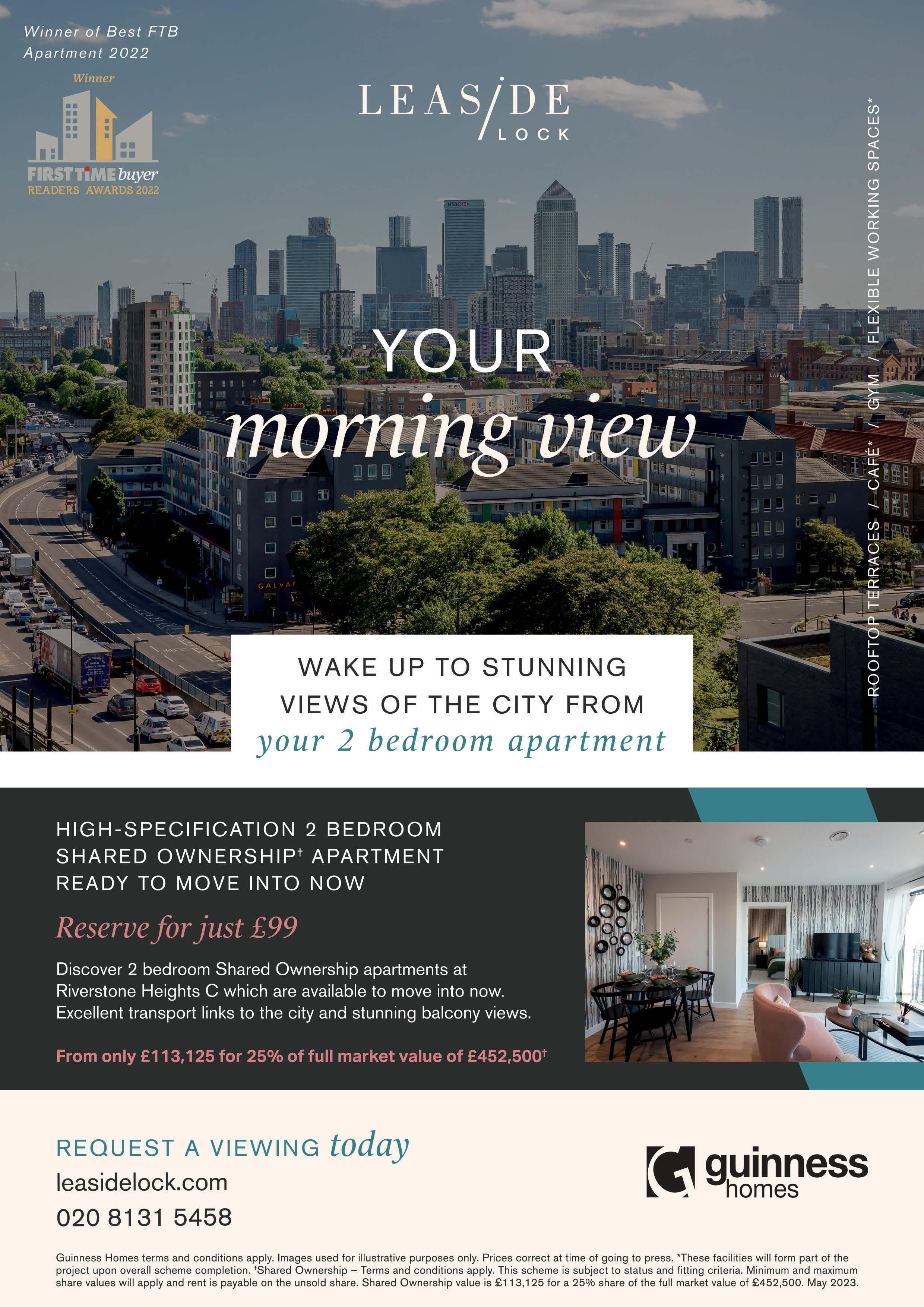

24 Buy and Save

Debbie Clark examines the figures and considers some of the best schemes available to help first time buyers get a foot on the ladder. We also highlight some affordable homes using the schemes to enable you to buy your dream home.

CONTENTS 4 First Time Buyer June/July 2023 JUNE/JULY 2023 / ISSUE 101 / FIRSTTIMEBUYERMAG.CO.UK

Cover Photo © james@jamesrudland.com

24 12

OLIVIA BOWEN, PAGE 20 20

Olivia Bowen

101 Competition

Seven lucky winners will win a ProofVision In-Wall single toothbrush charger (with a choice of faceplate finish) worth £56.90

REGULARS

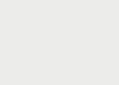

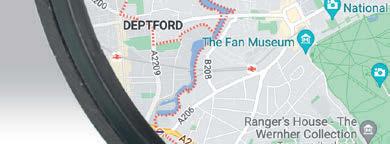

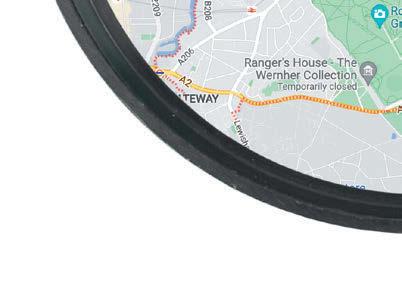

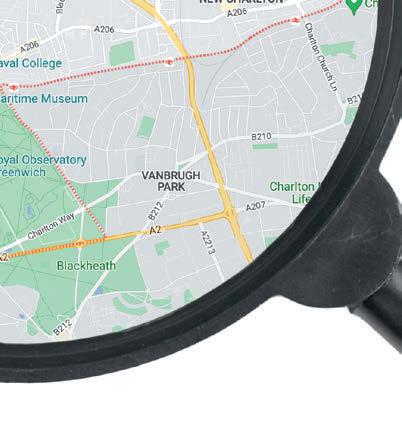

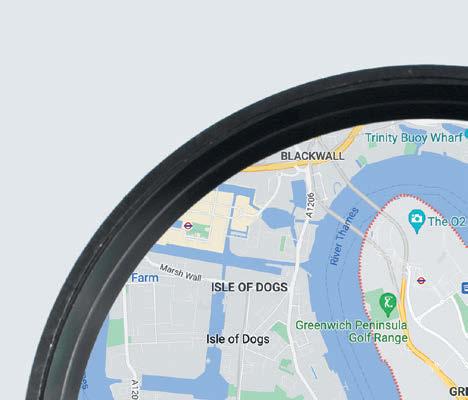

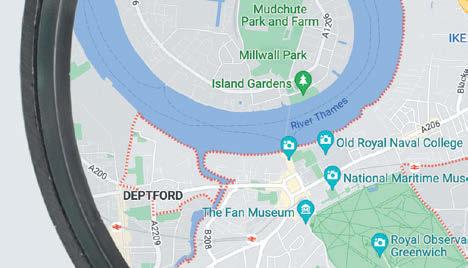

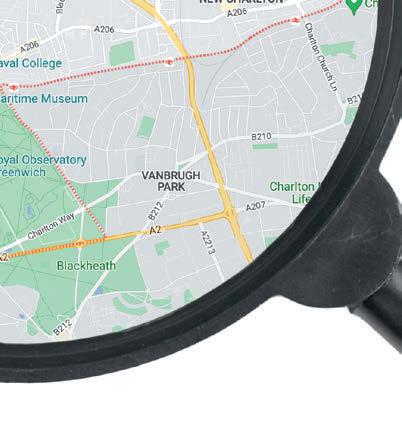

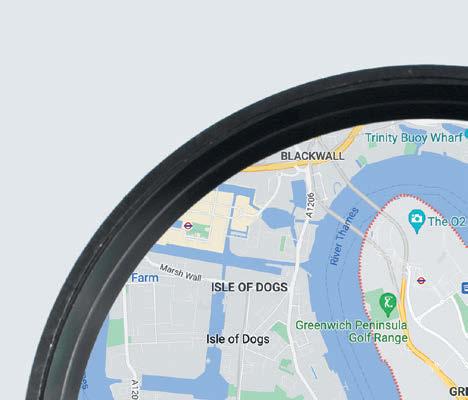

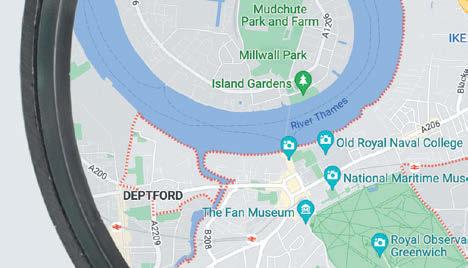

36 Hotspot

We look at Greenwich as a place to live.

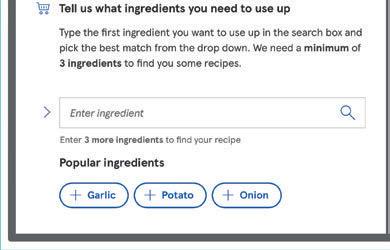

102 First home, first meal

Transform classic French ratatouille into a simple savoury tart for only 91p per serving! From Tesco Real Food, this vegan and dairy-free recipe is ideal for a stress-free midweek dinner.

additional costs

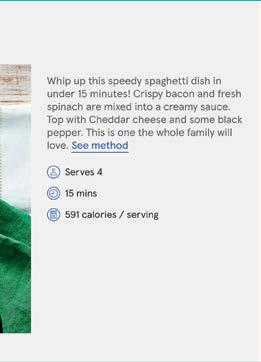

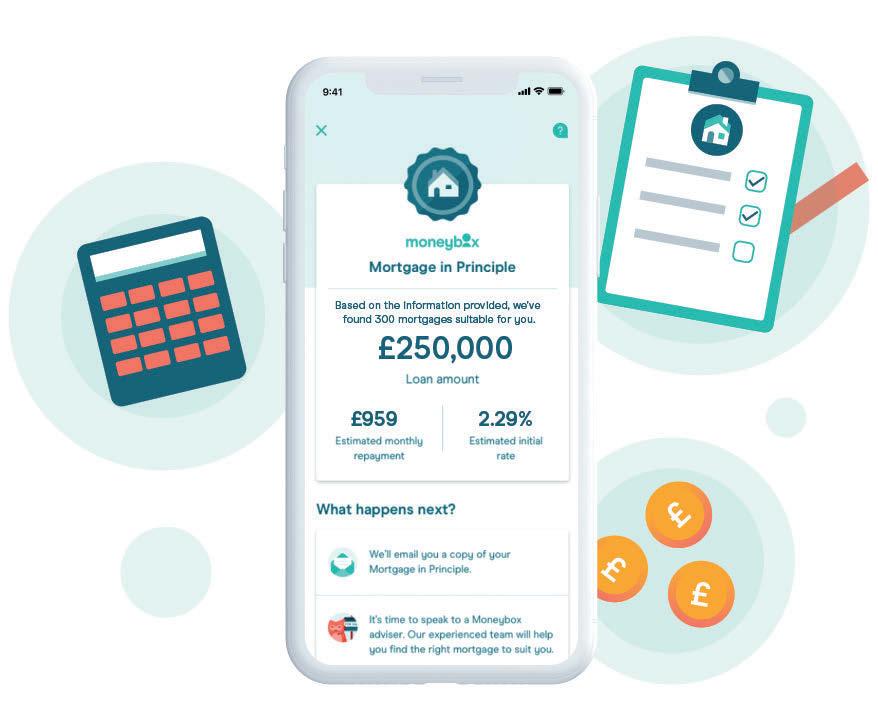

Cecilia Mourain, Managing Director at Moneybox looks at the statistics.

114 Finance

Many first time buyers receive financial help from family – but there are many different forms that this can take. Kay Hill looks at the various possibilities.

116 Market

With reports of worldwide recession making an impact, are British property prices set to fall this year or will more local issues affect the market? Ginetta Vedrickas assesses the situation.

118 Agony Agent

All your property questions answered by our panel of experts.

121 Buyer’s Guide

103 Know How

Simple but very necessary cleaning hacks to add a real sparkle to your new home.

106 Making sense of conveyancing quotes –what first time buyers need to look out for!

Bill Dhariwal, Director and Solicitor, and Duncan Horton, Shared Ownership Manager, at Lawcomm Solicitors look at the questions first time buyers need to ask a conveyancer before they start on the conveyancing process.

110 Third of first time buyers hope to buy within a year but most have yet to seek broker advice, fearing

Check out FTB’s Buyer’s Guide, which walks you through the property buying process.

126 Common questions from a first time buyer about conveyancing?

Coralie Phelan, Partner and Head of New Build Homes at Prince Evans Solicitors LLP, looks at what common questions first time buyers should ask their conveyancer.

128 Directory

A round-up of which schemes are available to first time buyers.

134 20 Questions

We ask 20 quick-fire questions to Esaiyas Mollallegn, Head of Marketing at SO Resi, who is in the spotlight this month.

CONTENTS First Time Buyer June/July 2023 5

TAKE YOUR TIME AND SEE AT LEAST FOUR OR FIVE OTHER PROPERTIES SO YOU CAN DO A COMPARISON AS YOU NEVER KNOW WHAT YOU MIGHT FIND IF YOU RUSH INTO THE FIRST PROPERTY YOU SEE

77 First Time Buyer Readers’ Awards –time to vote!

Mailbox

NO CREDIT SCORE

I have never had a credit card and don’t currently have a credit score. Is it possible to get my first mortgage without one?

Ella Stewart

Ella Stewart

FTB says: Getting a mortgage with no credit history or score can be challenging, but it is not impossible. A credit score is a crucial factor in determining your creditworthiness, and most lenders use it to assess the risk of lending you money, so you may have a harder time convincing lenders that you are a reliable borrower. There is likely to be limited lenders and it is possible that mortgage rates will generally be higher than those with a good credit history so it’s worthwhile as a minimum to register yourself on the voters roll at your current address. It’s essential to do your research, and to save you time and possibly money to work with a specialist mortgage broker that can access all lenders, some not available on the high street, which only offer mortgages through brokers to increase your chances of gaining approval.

Add a splash of colour to your baking days or picnics this summer with this issue’s star letter prize. These oral tins from Lakeland’s beautiful Summer Meadow range, worth £29.99, are designed to t different cake sizes and because they nest you can easily store them away when you’re not using them!

lakeland.com

COMMUNAL AREAS

I see that all the flats that I have been looking at as potential first properties for myself and my partner all have communal areas. Whose job is it to look after these areas and ensure their upkeep?

Caroline Coutts

FTB says: The responsibility for looking after communal areas in flats typically lies with the property management company or the residents’ association, depending on the type of ownership and management structure in place. If the flats are owned on a leasehold basis,

the management of the communal areas is usually the responsibility of the freeholder, who may appoint a property management company to carry out this function. The costs of maintaining the communal areas are typically split between the leaseholders, who are usually required to pay a service charge. In some cases, residents may set up a residents’ association to manage the communal areas themselves, although this is less common. It is important to check the terms of your lease or ownership documents to determine who is responsible in your specific case.

WRITE TO US!

Please send us your questions, comments and suggestions concerning property, or the articles in First Time Buyer magazine.

lynda@ rsttimebuyermag.co.uk

ENERGY SAVING TIPS

I am just about to buy my first home. With energy prices being very expensive at the moment, are there any tips on keeping energy bills down to a minimum in my new home?

Fleur Ramsey

FTB says: As a first time homebuyer, there are many ways to save energy and reduce your utility bills. Here are some tips: Insulation can help keep your home warm in the winter and cool in the summer. Consider insulating walls, roof, and floors to reduce heat loss if they aren’t already.

LED light bulbs use up to 80% less energy than traditional incandescent bulbs and last up to 25 times longer.

A programmable thermostat can save energy by automatically adjusting the temperature in your home based on your schedule. Set it to lower the temperature at night and when you’re away.

The Energy Star label marks appliances that are more energyefficient and can save you money on your energy bills.

Natural light is free, so open blinds and curtains in the day!

NEW BUILD SNAGS

I am about to move into my first property, which is a new build, and have had a look around to do some measurements and noticed a few issues that need rectifying. How should I go about this and does the builder have to repair them?

Andrew Rathburn

FTB says: Snags are issues that arise in a new build, and it is important to address them as soon as possible. The first step is to compile a list of snags and report them to the developer or builder responsible for the property. They should rectify any issues that fall under

the terms of the warranty or guarantee. It’s important to document everything, take pictures, and keep a record of all communication. Always conduct a thorough inspection of the property before completing the purchase to ensure all snags have been addressed. If the builder or developer does not rectify them or is unresponsive, seek advice from a professional such as a surveyor, architect or solicitor.

VISIT OUR WEBSITE

For everything you need to know about buying for the rst time, go to rsttimebuyermag.com

LETTERS First Time Buyer June/July 2023 7

WORLD

I was travelling on location with a director who had a father who was pretty well known in the 80s – he played Simon Templar in The Saint and his character was a super slick crime/ problem-solver – a bit like a private James Bond (who his predecessor in that role, Roger Moore, went on to play). I remember being invited to join the video call and asked him what he was doing these days.

He told me that since that series, work had thinned in the UK, so he went over to the US where he got lots of roles – mainly as a bad guy. It occurred to me that many film characters I had seen in the 80s and 90s were quite cliched – well-spoken, handsome and had a very correct English accent. Back then you knew where you were with bad guys and you were supposed to dislike them immediately and looked forward to their downfall.

Then came the modern crime series. The good guys are often flawed heroes and the bad guys are sometimes unlucky and chose the wrong path or they were born into a life of crime. Series like The Wire (best series of all time in my honest opinion) have you really sympathising with the bad guys or Sopranos where the hero is a murderous gang Godfather. Your moral compass is spinning!

Finally, our series and film makers are telling us that good and bad isn’t an arbitrary subject. Now don’t scoff, but the world of property has its own good and bad guys in the form of landlords and tenants. You might scoff, but I’m so tired of the narrative the popular press rolls out about rogue landlords and property developers, without which countless people would simply be homeless.

Of course there are dodgy landlords but there are tenants who also abuse the properties and rules. Many landlords are private individuals hoping to build something for a pension. I have been one of those people and had the policy that if I provided accommodation to a standard I’d be happy to live in, that it would attract a better tenant. I didn’t want to

overcharge, I’d rather have continuity and long term tenants.

Just the other day I was asked for my opinion on a buy-to-let that had come on the market. It was cheap and had an HMO (house of multiple occupation) licence. When I looked around I could see why the asking price was so reasonable and the rent achieved was so low. The property needed a new roof and was already causing damp in some of the rooms, one of which was empty as the damp was so bad – not a great example of responsible property ownership.

I told my client she had two options – patch and repair and collect the same rent or wait until the end of the lease and spend proper money and replace the roof and at the same time refurb the entire flat bringing the forth bedroom back on line. I recommended option two. Initially it effects the yield due to the extra financial outlay but over time the increase in rent from the fourth bedroom would pay for itself.

From a landlord’s perspective they had the peace of mind that their investment had a new roof, and with the guarantees that come with the work should have fewer issues with associated problems. To refurb the place at the same time will mean that by the time the property comes back to the market it will be at an ideal time and the rent can reflect the higher spec property at proper market value. A property in better shape should attract tenants who respect their home and therefore the landlord’s investment. Of course there’s always the risk of getting a bad tenant, but that’s reflected in the return.

You’ll be pleased to hear she chose option two – so hopefully they’ll be happy tenants moving into a refurbed home in the summer. Good guys on both sides!

OPINION First Time Buyer June/July 2023 9

TV presenter and property expert Jonnie Irwin gives his thoughts and views on first time buyers and the housing market

Say goodbye to the circus!

There are lots of things to consider when buying your first home; location, transport, are you going to be close to family and friends? Often an afterthought when you settle into your first home is lack of storage. What do you do with all this stuff? Make sure lack of storage is only relevant to your inbox and not your home with these practical products that will help maximise space while not looking like an eyesore!

I’m a sucker for you

If you have a little animal lover on your hands, they’ll go wild for this woven storage with in-built shelves. It can be used to store all kinds of treasures. Use the larger shelves to stack books and the cubby holes for favourite toys.

Elephant shelf, £28, primark.com

Obonas wall shelf with suction cup, £5, Obonas triple hook with suction cup, £2.50, Obonas container with suction cup, £3, ikea.com

ÖBONÄS wall organisers offer drill-free storage with the magic of concealed suction cups. The simple design will tidy up your shower tray in no time.

Are you ready? LEGO!

LEGO toy storage box, £12.99, tkmaxx.com

Just like the original LEGO bricks. Perfect to decorate, play, build and have fun or keep toys sorted using them as storage boxes.

Wake up and smell the roses

Flower storage, £5, primark.com

Add a pop of colour on the wall with this fun storage box. A great place to put all those tiny trinkets.

Don’t get your knickers in a twist!

Homelife pack of 2 drawer organisers, £8, studio.co.uk

An ef cient way to keep your drawers neat and tidy. Ideal for everyone, helping to store anything you choose in an orderly fashion.

FTB LOVES 10 First Time Buyer June/July 2023

That’s

Keep those half-used wrapping paper rolls concealed and stored away from sight with this handy storage tube.

a wrap Gift wrap storage tube, £7.99, therange.co.uk

Divide and conquer

Skadis free-standing pegboard, £17, ikea.com

You can store things on both sides of this clever pegboard when you use it as a divider on a table or desk. Choose your own accessorises to add to the board to suit what you need!

Hole in one

Skadis pegboard combination, £19.75, ikea.com

A great way to make it easy to organise all the rooms of the home and quickly nd what you need.

I only have my shelf to blame

Three tier shelf cupboard organisers, £4.49, therange.co.uk

Found a can that expired in 2012?! Then you need this cupboard organiser which enables you to see what you can have for dinner tonight!

Save your sole!

Extendable and stackable shoe rack, £26.99, lakeland.co.uk

The perfect shoe rack to expand with your shoe collection.

A touch of glam

You’ll be blown away

Norberg drop leaf table, £45, ikea.com

Storage bench, £99, tkmaxx.com

A storage box with a velvet nish to add a touch of glam to the bedroom and hide away all the mess.

This is a great space saver! You save space when the table is not being used as it can be easily folded away.

FTB LOVES First Time Buyer June/July 2023 11

LET THE SUN SHINE!

We don’t know about you, but this has had to be the longest winter of all time! Finally, the evenings are longer, the sun is making an appearance, things are heating up and we couldn’t be happier! We have put together a collection of summer-inspired accessories perfect for the new season

Homepage LIVING 12 First Time Buyer June/July 2023

Camping cooler tub, £30, Dunelm

Grow table, £44.99, Dobbies

Glass plant mister, £4, B&M

Picnic blanket, £7.99, Homesense

Chip & dip board, £12, B&M

Planter, £3, B&M

Jug, £8, B&M

Glasses, from £1.50; chip & dip bowl, £12; woven cushions, £10 each; plant mister, £4; candle, £4; candle with rope handle, £12; string lights, £12; planters, from £10; colourful shower resistant cushions, from £10; terracotta planter, £8, B&M

Sun ower wreath, £34.99, Lights4fun

Strawberry plate, £2; drinks dispenser, £8; wine glass, £2, B&M

Seat pads , £8, B&M

Beach chair, £29.99, Dobbies

Lemon and orange plate, £2.50 each, B&M

Flamingo jug, £18; set of 2 bowls; £18; set of 4 wine glasses; £18; set of 4 tumblers; £16; set of 4 plastic tumblers; £16; serving tray, £18, Next

Watermelon dish,

Cooler bag, £14, B&M

Tumblers with straws, pack of 8, £3.50, B&M

CONTACTS

» B&M bmstores.co.uk » Dobbies dobbies.com » Dunelm dunelm.com

» Homesense homesense.com » Lights4fun lights4fun.co.uk

» Next next.co.uk » TK Maxx tkmaxx.com

Homepage LIVING First Time Buyer June/July 2023 13

£9.99, TK Maxx

Plate, £1,50; tumbler, £2, B&M

Tumblers, £5.99, TK Maxx

At home with: Flo Headlam

Flo Headlam changed careers after working in the charity sector for 25 years to become a horticulturist. While continuing her horticulture studies at Capel Manor College, London, the opportunity came along to join the presentation team on BBC Gardeners’ World. She was one of the presenters for three years and is now filming her third series of Garden Rescue for BBC1. Flo is also joining the new team of gardening presenters on QVC. She talks to Lynda Clark about her first home, her fascinating career and has some good advice for first time buyers

FTB Tell us about your first step on the property ladder?

FH: It was in 1991 and I bought a lovely top floor flat in a fourstorey Victorian house with my boyfriend at the time. It had wonderful dormer windows and as we were so high up it felt like a real rooftop retreat. Unusually, it had a sunken bathroom and there were many comedy moments when we had to warn visitors about it otherwise they would’ve fallen into the bath! We did lots of decorating and weren’t afraid of using colour! We had deep green in the sitting room, a bright yellow kitchen, lavender in the bathroom with black and white tiles – it was vibrant and energetic; a great first home. We stayed there for around 10 years and then bought an Edwardian house. It was an interesting layout as the kitchen/diner was downstairs with a utility room and an old coal chute which served as extra storage. The ground floor consisted of a double reception room and a smaller room, which the previous owners used as a fourth bedroom. We converted it into a study/music room. The bathroom and bedrooms were upstairs, so from cooker to shower involved two sets of stairs. It kept me fit! Again, we used lots of colour – we had lilac on the walls and terracotta on the chimney breasts in the through lounge. The hallway was painted white, with chocolate brown skirting and the dado rail was mint green. I remember watching a movie and in one scene, set in a New York apartment, they’d used similar colours. At the time the combination resonated with me, and I reached into that memory and employed those colours. It looked great and really inspired me to be brave with colour.

FTB: Where do you live now?

FH: I live in a 1930s semi-detached house with my two teenage daughters. It is small but perfectly formed, as I like to think of it. But I had to do quite a bit of work to it when we moved in – a complete rewiring, new boiler and radiators, and I completely reconfigured the bathroom, taking out the oversized bath and putting in a generous D-shaped shower. It is west facing so gets a lot of light. The plants love it there!

FTB: Tell us about your career?

FH: I worked for 25 years in the charity sector and for 14 of those years I worked for Comic Relief. It was a great job and I loved it, but I came to a point, after returning from my second maternity leave, when

Homepage LIVING 14 First Time Buyer June/July 2023

“GET TO KNOW THE AREA YOU ARE INTERESTED IN BUYING IN AND DO LOTS OF RESEARCH. IT’S IMPORTANT TO CHECK OUT THE LOCAL COMMUNITY TO SEE IF YOU CAN PICTURE YOURSELF THERE”

I realised I needed to do something completely different. I was lucky that they paid for me to see a life coach and as part of the conversation I was asked to write down everything I’d like to do with my life, money being no object. It was a great surprise when landscaping and grow your own came in my top five. Then I realised that subconsciously I had been going around redesigning people’s front gardens. The penny dropped. I realised that this was something I actually wanted to do. And the stars aligned. I was talking to a friend who had just completed their Level 1 Horticultural City and Guilds qualification at Capel College in Crystal Palace and suggested it might be a route for me. I searched online and found that the one day a week course was running on one of my days off (I was working part time at the time). I signed up and that was the beginning of my journey. Five years later I completed my Diploma in Garden Design at Capel Manor. I absolutely love my job. I bring all the skills I’ve acquired from my previous jobs into what I do now. Most of all I love the creativity and physicality.

FTB: How did your TV career start and what are you working on currently?

FH: It was sheer chance that I got the opportunity to work on television. I was at a professional plant nursery in Kent and ran into Danny Clarke, the Black Gardener, a professional gardener and television gardening presenter. He was with one of the producers of Gardeners’ World. Danny and I just clicked, chatting and connecting. We stayed in touch. Then about six months later, Gardeners’ World was expanding its presenting team and remembered me as they were keen to get more women presenters on the show. They got in touch with Danny who contacted me and the rest, as they say, is history. I got the job! I was part of the presentation team for three years from 2017-2019, during which time I had the pleasure of travelling around the country and meeting incredible individuals, all united in their love of growing. They let me go just before we went into lockdown in 2020. I was actually working quite a lot during lockdown, not really thinking about the next TV adventure when Spungold TV came knocking and offered me the opportunity to join the Garden Rescue team. I am now filming my third series and loving it. I call it my best day at work. I see my design come to life in a matter of days. Telly magic! I love the challenge of each new brief and the chance to push the envelope with my designs. It’s a balance of giving people what they want, what they didn’t know they wanted and making the garden exciting and intriguing. It really does make peoples’ dreams come true and

I love going on that journey with them, making an impact.

FTB: Do you still work with any private clients?

FH: Oh yes, I have a portfolio of private clients I look after, working in London and the South East. This is both design work and some ongoing development in private domestic gardens. I am involved in a few community gardening projects, and support a number of organisations with their campaigning, in particular The Climate Coalition, as a supporter for its Great Big Green Week annual campaign. Having worked in the education team at Comic Relief, I also like to give back to education. I am involved with a couple of organisations that take role models into schools to talk about careers and inspire students to think about working in horticulture. I am an Equity

Ambassador for BALI [British Association of Landscape Industries] and an ambassador for The Great British Garden Festival. I have a lot energy and like to be busy and these roles are very important to me.

FTB: What advice do you have for first time buyers?

FH: Get to know the area you are interested in buying in and do lots of research. Visit at different times of the day to see what is going on and what facilities the area has to offer. Check out the green spaces, shops, cafes and get a feel for the place. It’s important to check out the local community to see if you can picture yourself there. If you don’t get good vibes about an area there’s no point thinking of living there. Transport is key. Even if you have a car, bus and train links are important.

floheadlamgardens.com

Homepage LIVING First Time Buyer June/July 2023 15

“I LOVE THE CHALLENGE OF EACH NEW BRIEF AND THE CHANCE TO PUSH THE ENVELOPE WITH MY DESIGNS”

The HOUSE HUNTER

This month FTB goes on the hunt with Kate and Rich Rowe who are returning to the North to find a family friendly home

What we found…

THE TOWN LIFE THE CITY CONNECTIONS

The Gateway Ascots Green, Manchester

Oakwood Fields Warrington, Cheshire

Names Kate Rowe, 36, and Richard Rowe, 38

Occupations PR manager, IT consultant

Maximum budget £300,000

Requirements A house with two or more bedrooms with a semi-rural feel, good access to local amenities and links to a city or a large town. Room to start a family and have friends to stay is a must

What they wanted…

Myself and my new wife Kate have decided to make a big, bold move and shift our lives back up to the North of the country after years of living in the South West. We’ve rented in Bristol for several years – it’s how we met – but after getting married and changing jobs, we’ve decided to make the move. Kate is originally from Shef eld, while I have family in Manchester and Lancaster. We’re quite open to where we move to – it’s about the lifestyle for us. We want to nd a family friendly place to have children, with lots of space, some nice countryside, pretty villages and a slower pace of life. Both of us work mostly remote, only having to visit of ces in London and Bristol once a month or so, which gives us quite a lot of freedom when it comes to location. We have saved for several years and have a deposit of £30,000 and a budget of £300,000.”

Located on the edge of lively Ancoats, these homes are around a 15-minute walk from the bustling city centre. The new properties here range from contemporary two bedroom apartments to three and four bedroom houses. The houses feature spacious living areas that open to back gardens, plenty of storage and exible spaces. Inside, there are high-quality features throughout, including a rain shower in the bathroom, granite work surfaces in the kitchen and natural stone ooring. The locality has shops and entertainment, while the Northern Quarter is an easy walk.

lovell.co.uk

Set on the edge of open countryside, close to Pennington Flash, this new collection of homes enjoys a semi-rural location, yet with great links to Liverpool and Manchester. For commuters, the development enjoys great road and rail links, while nearby Wigan and Warrington offer shops and leisure facilities. There are just over 100 new three and four bedroom properties here, ideal for growing families, with large living spaces, downstairs WC and en suite from the main bedroom. Outside, the development has communal play areas and parkland.

redrow.co.uk

What they thought…

Manchester is a wonderful and diverse city and we’ve loved it whenever we’ve visited family here. It has de nitely been at the top of our list when we’ve been speaking about moving back to the North. We really love the city, and this location is great for enjoying everything that’s on offer. The homes seem ideal for raising a family, with lots of space and a great garden. It may be a bit more lively than we’re looking for at the moment, but it’s still an excellent option.”

We absolutely love the style of these properties – they remind us of some of the beautiful period homes that we’ve always dreamed of. The design is just lovely – and we can really imagine using the great spaces and making one of these our forever home. Location-wise, it’s pretty good for enjoying two amazing cities, while also getting out and about in the fresh air and some amazing rural surrounds. Having an option like this is pretty exciting to us!”

16 First Time Buyer June/July 2023 Homepage FIRST RUNG

PROFILE

FROM £294,950 FROM £349,995

THE COASTAL CHARMERTHE HISTORIC SETTING

First choice!

Mill Green Warton, Preston Mabel Gardens Lancaster, Lancashire

FROM

The coastal village of Warton is home to this collection of homes offering a great lifestyle for families. The new three and four bedroom houses are on the Fylde Peninsula, close to the popular town of Lytham, with easy access to the coast at Morecambe Bay and Ribble Estuary. Warton is a traditional village with independent shops and pubs, with highly regarded schools within a short drive. The three bedroom homes are arranged over three oors, with a main bedroom with en suite and dressing room on the top oor and exible living spaces.

anwylhomes.co.uk

We’ve always loved the coast and you get your fair share of it here, with options for outdoorsy activities and making the most of the coastline and countryside. Preston is a short drive away if you’re missing the hustle and bustle, plus Blackpool is within easy reach too. There is a good range of property styles on offer here – we particularly like the larger homes with the integral garages. I’ve always dreamed of having that extra garage space and a bit of a workshop.”

This collection of two and three bedroom properties sits just outside Lancaster city centre, close to a great range of facilities, schools and green spaces. The city, known for its medieval castle and food and entertainment scene, was recently named as one of the best places to live in the North. The homes are thoughtfully designed, with separate living and dining rooms downstairs, a ground oor WC, and three well-sized bedrooms upstairs. Travel into the city centre takes as little as ve minutes by car, while the Morecombe coastline can be reached in under 10 minutes.

plumlife.co.uk

THE PERFECT BALANCE

Rowe Gardens Catcliffe, Rotherham

Rowe Gardens Catcliffe, Rotherham

What a fabulous location – so close to lovely Lancaster and the amazing coast at Morecombe Bay. The Lake District is also easy to reach by car from here, and we’d have endless options for day trips or weekends away. This is a lovely part of the country and a far cry from our current lifestyle, which is exciting. We like the properties – the layouts offer so much space and we like the separate living and dining rooms. It would be nice to have a garden after years in a at.”

Just 15 minutes from the centre of Shef eld, yet with beautiful countryside on the doorstep, the homes at Rowe Gardens offer a perfect balance of lifestyles. There are two, three and four bedroom homes available in a range of styles, including semi-detached and detached houses. Inside, the homes have bright living spaces, downstairs WC, and en suite bathrooms in larger properties. All have a rear garden and parking or a driveway. This is a fantastic location, with the pretty village of Catcliffe and local amenities on the doorstep, and Shef eld is an easy car or bus ride away.

plumlife.co.uk

“We have spent some long weekends exploring different areas to get an idea of where we’d like to move to. We’ll now be spending lots of time in and around Catcliffe and Shef eld to get a proper feel of what living here can be like. We have our mortgage offer agreed in principle so we’re ready to go as soon as possible.”

This is what we really wanted to nd: a perfect balance between city and country. These new homes are ideally located for that. We really want to embrace a different lifestyle to our current city centre life and enjoy all that a rural area can offer – but we still don’t want to be too far from it all, so this is ideal. Shef eld is a great place – Kate grew up nearby and she still has some friends and family here, so that’s a de nite plus for us. There’s plenty of shops and amenities in the area, with some beautiful rolling hills within a short drive. Rotherham is also easy to get to, which is a huge bonus. Of course, the properties are really attractive too – we particularly like the three-storey townhouses.”

Homepage FIRST RUNG First Time Buyer June/July 2023 17

*Based on a 25% share of the full market value of £220,000

*Based on a 25% share of the full market value of £235,000

£234,995

FROM £58,750* FROM £55,000*

THE NEXT STEP

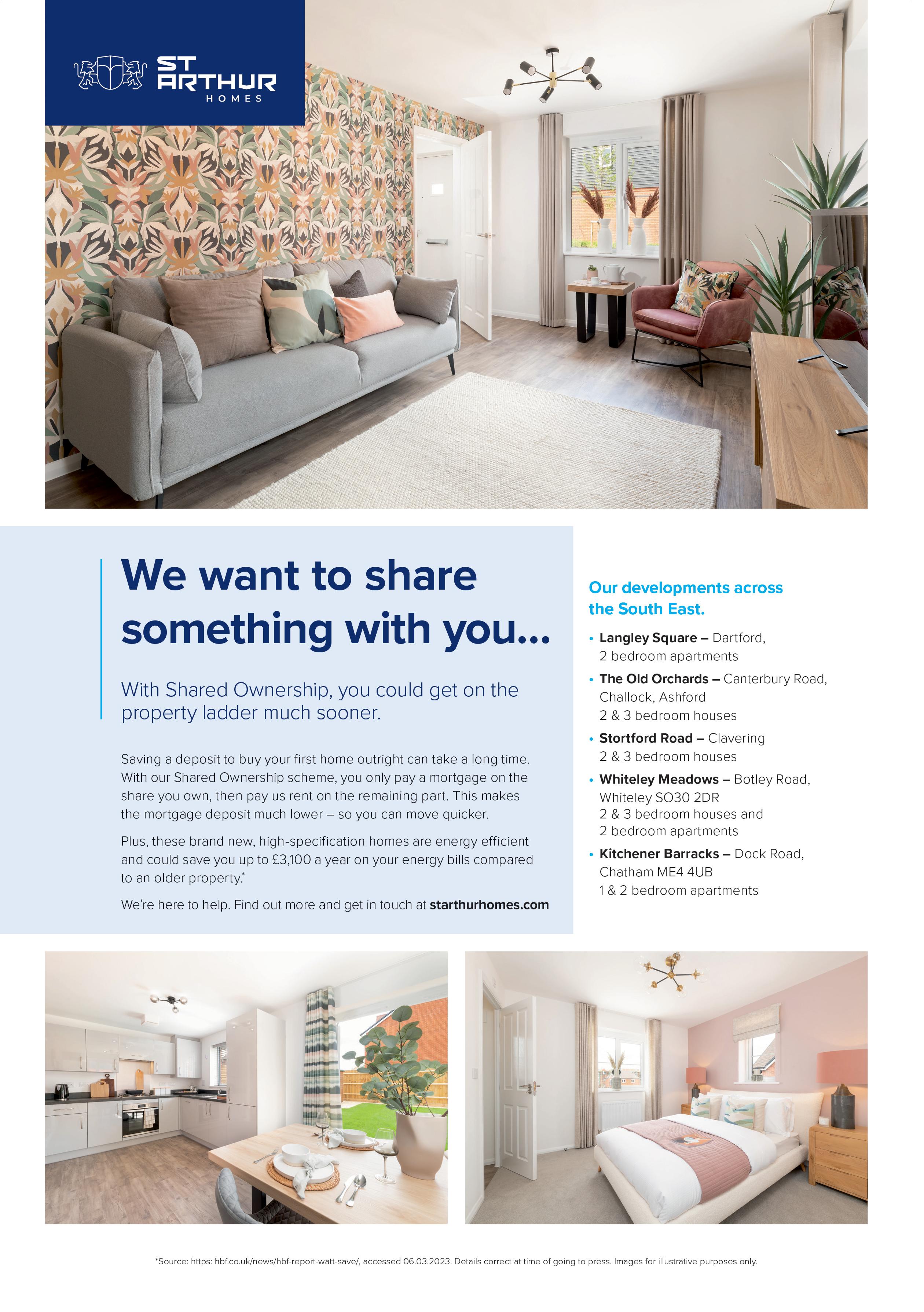

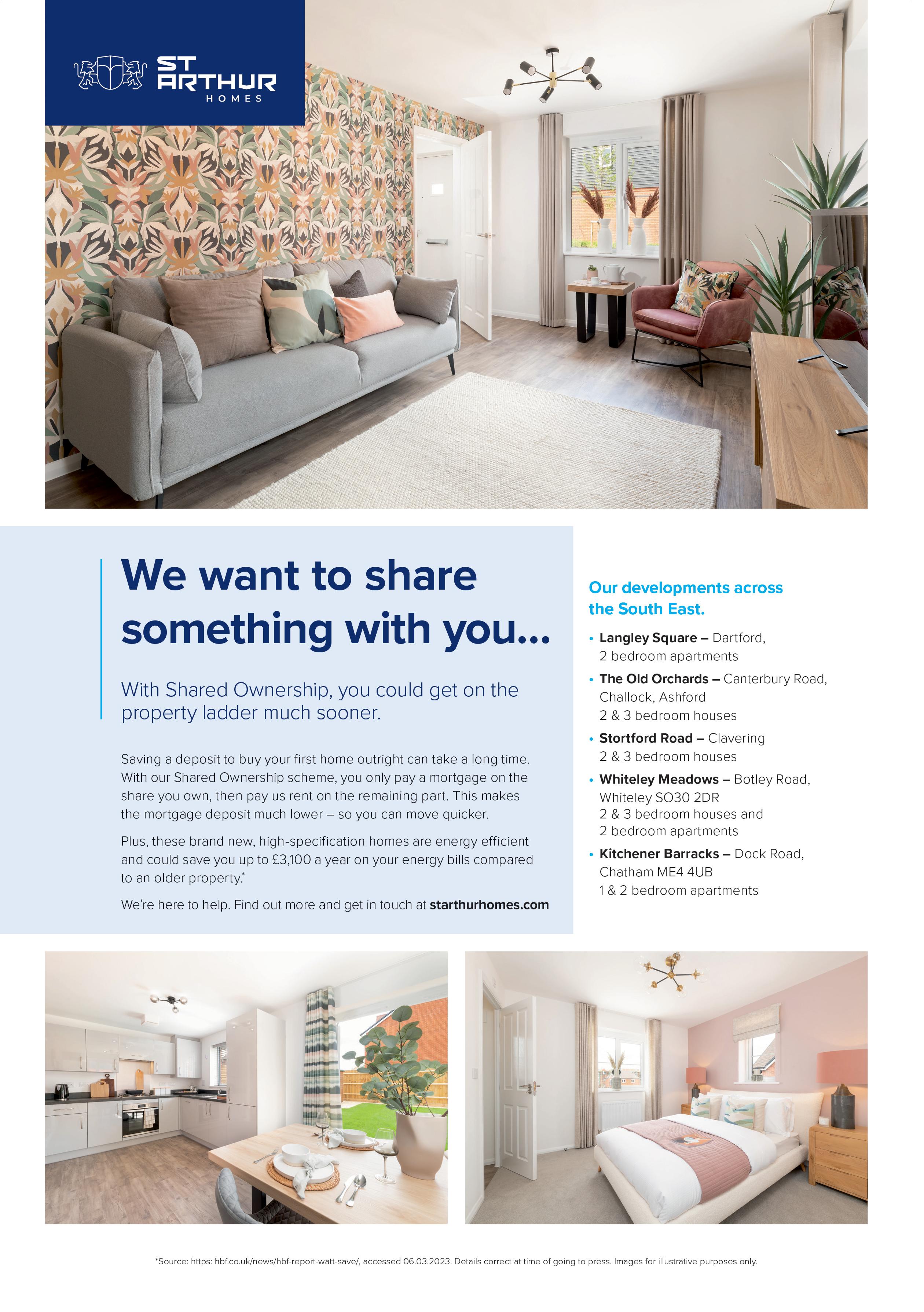

Louise Mills is Sales and Marketing Director of shared ownership housing provider St Arthur Homes, which currently has developments across the South and South East of England, with plans to expand into the Midlands. Bringing a fresh approach to the affordable housing market, Louise and the rest of the St Arthur team believe in providing high-quality homes in desirable locations, while passionately expounding on the many benefits for buyers of choosing this route into homeownership

QI am a first time buyer and I am looking at the various ways of getting on the ladder and I have a couple of questions, as I am getting a little confused. In the last year there has been a 36% increase in affordable housing sales. Why do you think that is?

AWe’ve certainly seen that jump reflected in our visitor and buyer numbers, and I believe there’s a few different reasons for that. Firstly, with Help to Buy ending, first time buyers have had to look at a different way of getting on to the property ladder, and shared ownership has proven ideal for many of them.

Buyers can also choose to embark on a process which we call “staircasing” – which means that initially they buy a percentage of their home and pay rent on the rest of it, then they can choose to buy further percentages of that property as and when they can, building up to 100% ownership if they wish.

Also, with the cost-of-living crisis and house prices being what they are, shared ownership gives hard-working professionals the chance to be a homeowner much sooner, and often for less money, than the other options. It just makes sense.

QWhat do you think is the biggest appeal of a new build home, from a buyer’s point of view?

AThere are so many aspects of a new build that make it more appealing to many people than going for an older property. The obvious answer is, of course, the energy efficiency of newer properties. Recent research from the Home Builders Federation shows that buyers of new build properties can save an average of £3,100 on their energy bills each year – a significant amount!

Then, of course, there’s the fact that, with a new home you aren’t having to fix the mistakes of past homeowners, deal with dodgy decor or rip out old units and appliances. A new build home is a canvas to paint your own life on to.

QThere are many affordable ownership providers around, so what

do you think sets St Arthur Homes apart?

AMany of us at St Arthur Homes come from a background of working at national housebuilders, and we carry a lot of those values with us still. We absolutely believe that a shared ownership home can be an aspirational place to live, and in the current climate they are needed now more than ever. Any stigma that people hold about shared ownership houses dissolves as soon as they look around one of our homes.

We pride ourselves on supporting the

The rst phase of St Arthur Homes’ agship development, Whiteley Meadows, is very nearly sold out, with the next phase set to be released for sale in autumn/winter this year.

Currently, there are a handful of two and three bedroom homes left for sale – with prices currently starting from £141,750 for a 45% share of the two bedroom Hardwick house type.

homebuyer throughout the whole process –from the moment they first contact us, right through to long after they have the keys to their new home.

But we also pride ourselves on the way we work with our partners on-site too. Building relationships with homebuilders is incredibly important, and we strive to be easy to work with, transparent and honest – so that we can continue to work with the very best builders and meet our aims of acquiring 2,000 new homes over the next few years.

Fareham,

Cat Samuels and Tarryn Williams bought a three bedroom property at Whiteley Meadows. They said, “Even though both of us have good jobs, with the current economic climate we knew we’d be looking for a shared ownership property. Without using a scheme like that, we wouldn’t have had a hope of buying our own home for several more years.

“That brought us to St Arthur Homes, which is selling shared ownership properties at Whiteley Meadows, just a few miles away from Fareham. The location was perfect for us and the service was spot on, so we knew we wanted to go for a home here.

“Our sales adviser, Trin, was incredible. No question was too big or small, she guided us through the whole process brilliantly. In fact, everyone we spoke to at St Arthur was lovely. We really wouldn’t hesitate to recommend them to anyone at all.”

through the whole process brilliantly. In fact, everyone we spoke to at St Arthur was lovely. We

When complete, Whiteley Meadows will also include two primary schools, a secondary school and two nurseries, providing an ideal location for families. Handy shops, cute cafes and leading restaurants are also located nearby at Whiteley Shopping, along with a cinema and leisure facilities.

starthurhomes.com

June/July 2023

Whiteley Meadows

*Based on a 45% share with a full market value of £315,000

Louise Mills, Sales & Marketing Director, St Arthur Homes

FROM £141,750*

HAPPY EVER AFTER!

Olivia Bowen, then Buckland, is well known for coming second on Love Island in 2016 with Alex Bowen and they were the first Love Island couple to get married. She has appeared on many TV programmes including This Morning, where she covered for Ferne McCann and Rylan Clark-Neal. Boasting over three million followers on Instagram, she is passionate about property and interiors and has renovated her own home and keeps her followers updated @thebowenhome, where she is also an ambassador for Frenchic Paint. She talks to Lynda Clark about her life and career and has some great advice for first time buyers

Photos © jamesrudland.com

THE VIEW

20 First Time Buyer June/July 2023

THE VIEW First Time Buyer June/July 2023 21

"I JUST LOVE FRENCHIC PAINT AND USED IT IN EVERY ROOM IN THE HOUSE. I LOVE THAT IT IS A BRITISH COMPANY AND IT IS ECO-FRIENDLY AND CERTIFIED SAFE ENOUGH TO PAINT EVEN CHILDREN’S TOYS"

THE VIEW 22 First Time Buyer June/July 2023

"KNUCKLE DOWN ON THE NUMBERS TO MAKE SURE YOU CAN ACTUALLY AFFORD THE HOME"

Olivia is one of the easiest people to chat to – she is warm, friendly and totally charming. She starts the conversation talking about her upbringing. “I have a brother and we had a wonderful childhood. My mum and dad were together until I was 11 and they then split up but it was totally amicable. We went on super holidays, and I was very close to my brother growing up. I did my A-levels and was planning to go to university to study fashion.” Olivia got an unconditional offer but she was then offered a job as a visual designer for American Apparel, which was her dream come true, but sadly the job didn’t quite work out the way she had planned and she decided to leave and get another job. She said, “I found another job in fashion but I really didn’t get along with the managers and I hated being there. I watched the first series of Love Island with my exboyfriend, who I lived with, but it turned out he was a really awful person who eventually cheated on me and we split up.”

After Olivia and her then-boyfriend broke up, she couldn’t go back to live with her mum so she had to rent her first flat on her own. “It was very, very hard and I had no money, so I lived on chicken and rice from a can! It was quite an experience though and because I was young and had so much freedom it really made me grow up! After that I ended up moving in with a friend in Chelmsford and six months later I applied to go on Love Island. I needed a total change and I had to get out of the job I was doing. I was in total shock when I got an interview as it is very rare that anyone actually applies to go on the show as most people are scouted. But to my complete surprise, me and one other guy got on to the show and I was totally amazed.”

While she was on Love Island she met Alex, who later was to become her husband, and they came second in the competition. Three days later, after the end of Love Island, Alex moved into Olivia’s flat. They then rented a house together and bought their first home in 2017, which they lived in for two years until they eventually bought their dream home in the countryside. In the meantime, Alex proposed to Olivia and they got married in 2018 and now have a beautiful little son, Abel.

Olivia says, “ I absolutely love the house we now live in. It was built around 20 years ago and is in the area where I grew up, so it is very special to me and is the best of town and country living. I loved the house and we drove by and I could just imagine us living there. Then it went on the market and our offer was accepted so it was really meant to be. It is a five bedroom house, which had not really been touched and looked very dated. It needed a lot of work but had so much potential.”

They moved in during lockdown and Alex and Olivia had to do a lot of the renovations themselves. Olivia started looking at social media for some inspiration and came across Frenchic paint. She immediately loved the huge range of colours and the endless possibilities it could create and decided to use the paint for her home. “I just love Frenchic paint and used it in every room in the house. I love that it is a British company and it is eco-friendly and certified safe enough to paint even children’s toys. I painted the furniture in Abel’s room, which looks amazing, and it doesn’t bubble or lift, has no nasty painty odours and you can use the paint indoors and outside – it’s so versatile." While they were doing all the renovations, Olivia who studied for an interior design diploma, started an Instagram account, @thebowenhome, documenting all the work they were doing, which has over three million followers and is hugely successful.

She also runs a property business, buying homes and renovating them and then renting them out. “Of course, we use Frenchic paint as it’s brilliant and so easy to use. We have two properties at the moment, but we are looking for another one. I am also going to Paris for work soon, which will be great fun I’m sure and I have my brand work as well. Life is pretty fast-paced especially with Abel running around, but we plan to take some holidays this year to enjoy Abel while he is little and spend time as a family. I also have my horse, Dolly, as I adore riding. When I was little I went horse riding all the time but it became too expensive for my mum, so I worked at the stables to earn my rides but with school and everything it became too much. So, two years ago I decided it was time to start riding again and I got Dolly and ride her as much as I possibly can. We also have two French bulldogs – so life is really hectic!”

With such a busy schedule it’s amazing that she still has any extra time but she is also passionate about fashion and together with Alex they own Exempt Society, a highly successful clothing brand for both women and men.

Olivia has some excellent advice for first time buyers and said, “Live within your means and don’t stretch yourself as you still have to live and pay the bills. I think it’s a good idea to knuckle down on the numbers to make sure you can actually afford the home. Take your time and see at least four or five other properties so you can do a comparison as you never know what you might find if you rush into the first property you see. Finally, don’t get pressurised to complete – just take your time and ensure you understand the process and are completely happy with it.”

Olivia’s passion and enthusiasm is infectious. I will certainly remember our conversation for a long time – she is definitely one to watch!

Follow Olivia’s home renovations on Instagram – @thebowenhome, and find out more about Frenchic at frenchicpaint.co.uk

THE VIEW First Time Buyer June/July 2023 23

Clay Pot, Frenchic

Vintage Rosie, Frenchic

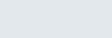

BUY AND SAVE

The average monthly cost of owning a home for first time buyers is now £971 – 4% lower than the cost of renting the equivalent property, according to the latest Halifax Owning vs Renting Review. The analysis, based on housing costs for a three bedroom home, found that owners are paying £971 each month compared to £1,013 for renters. The figures, of course, vary nationally, with the greatest difference in London, where homeowners are paying nearly £3,000 less annually than those renting similar homes. East of England is the only region where it is cheaper to rent. While the gap is down from its peak in 2016, when owners were saving £1,567 annually, these are still significant savings equating to an almost £500 saving per year for the average owner.

First time buyers of new build properties also generally enjoy large savings on their monthly energy bills; particularly pertinent at a time of rising energy costs. The design, insulation and energy-efficient features of new build homes mean those

in a newly built property save as much as £1,200 annually in an apartment and £2,600 annually in a house.

Savings are likely to be even more substantial for first time buyers taking advantage of the Government’s shared ownership scheme. Latimer, the development arm of the not-for-profit Clarion Housing Group, has been crunching the latest rental numbers as part of its "Why rent when you can own" promotion. Based on recent rental price data from Rightmove and Zoopla, the monthly cost of a Latimer shared ownership home is now shown to offer buyers a typical monthly saving of £298 nationally and £250 in London for an equivalent rental property in each development’s local area.

Around 70% of Latimer’s buyers at the start of 2023 were making the move from private rented accommodation into shared ownership, compared to less than 30% of its buyers in 2021; it’s clear that shared ownership offers a highly attractive route into homeownership, and away from the

increasingly expensive rental market. Paul Walker, National Sales Director at Latimer by Clarion Housing Group, comments, “Homebuyers are surprised at how quickly they can get on the housing ladder with shared ownership, as deposit requirements are far more achievable. Many are able to meet the deposit threshold for a shared ownership property in their local area with the equivalent of around two-to-three months’ rent saved as a cash deposit.

"We recognise that may not always be feasible for many renters, but with our latest promotion we encourage those who can save up a small deposit to come and talk to us about the benefits of investing that money into a shared ownership property.”

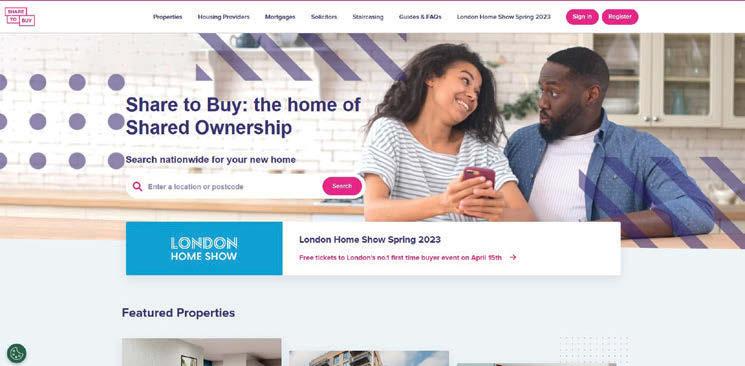

Share to Buy's website (sharetobuy.com) is a great place to start your search for an affordable home. When you find a home you like, register your interest with the housing provider and arrange a viewing. This is also a good time to enquire as to what schemes and incentives they offer. Help to Buy may have ended, but other

GET ON THE LADDER 24 First Time Buyer June/July 2023

The cost of living continues to rise and, for many, the prospect of homeownership can seem unachievable. However, the latest research shows us that it still pays to buy. Debbie Clark examines the figures and considers some of the best schemes available to help first time buyers get a foot on the ladder

schemes have quickly plugged the gap. Uswitch.com mortgage expert, Kellie Steed, comments, “There are several comparable homeownership schemes in the UK, as well as specialised mortgages that can assist first time buyers or individuals who are unable to qualify for a traditional mortgage.”

When you’ve found a home, and checked you meet any eligibility criteria, you can put down a reservation fee to secure the home and a financial assessment is completed. You will then need to secure your mortgage and instruct a solicitor to handle the conveyancing.

Remember, there are other costs to consider besides the mortgage – make sure you’ve budgeted for those too! It’s recommended to allow £4,000 to cover the associated costs of buying a property; you will need money for solicitor’s fees, moving costs and any broker or mortgage arrangement fees. You may also need to pay Stamp Duty, though most first time buyers will benefit from First Time Buyer Relief, meaning you pay 0% on the first £425,000, and 5% on the remainder (on a property costing up to £625,000).

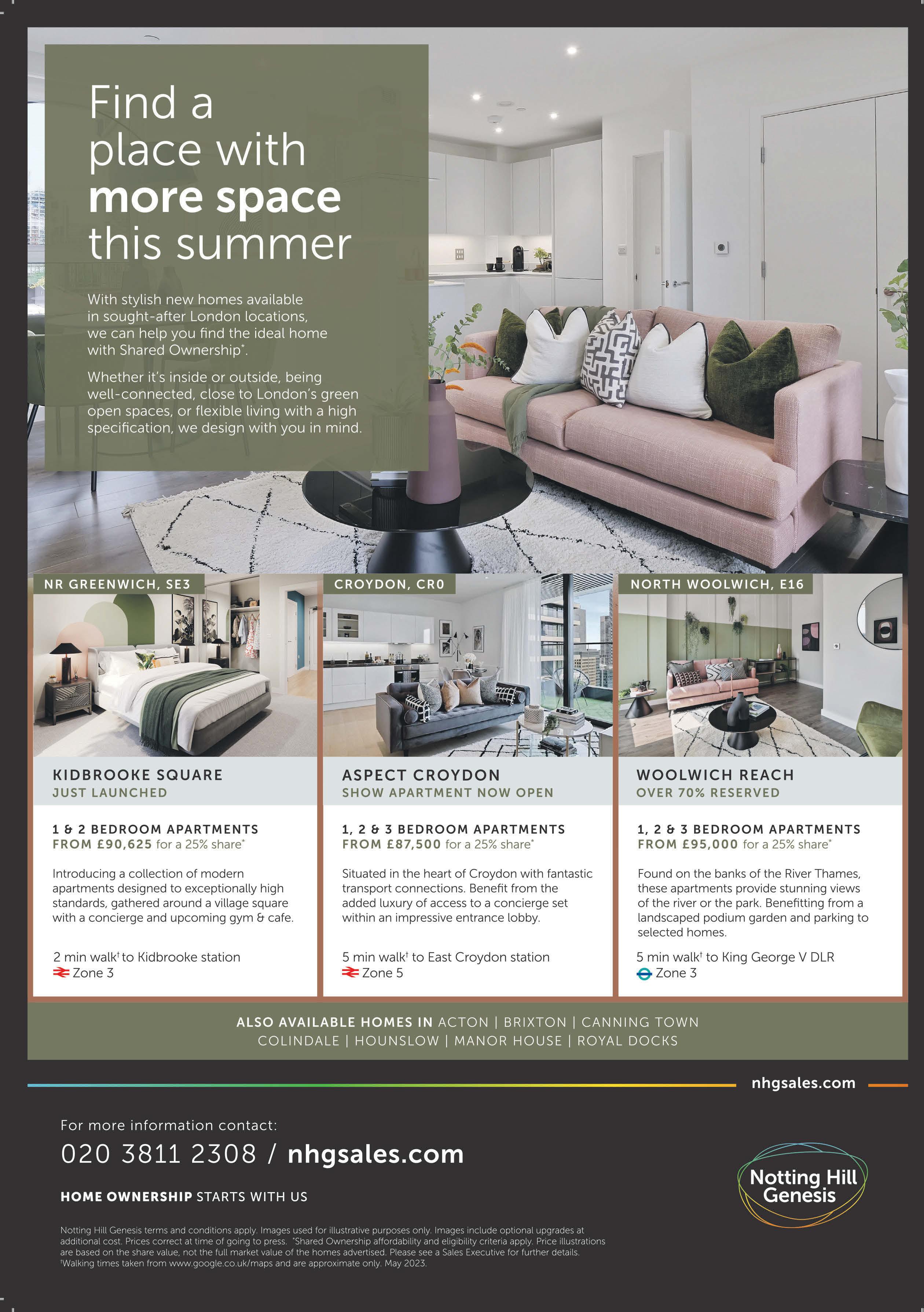

SHARED OWNERSHIP

Shared ownership is a Government-backed scheme allowing buyers in England to purchase a share of a leasehold home and pay rent on the remaining share. The aim is to make homeownership more affordable for those on lower incomes, or with small deposits. The scheme is available on purpose-built new homes and preloved shared ownership homes, called resales. You will need to meet the eligibility criteria:

9 You must be at least 18 years old

9 Your annual household income must be less than £80,000 (£90,000 in London)

9 You cannot own another home (if you do own another property, you must be in the process of selling it)

9 You should not be able to afford to buy a home suitable for your housing needs on the open market

9 You must show you are not in mortgage or rent arrears

9 You must be able to demonstrate that you have a good credit history (no bad debts or County Court Judgements) and can afford the regular payments and costs involved in buying a home.

Individual housing associations may also have their own additional eligibility criteria, for example that you live or work in a given area.

You will undertake a financial assessment to determine the share you can afford to purchase. This is usually a minimum of 10% and maximum of 75%.

In addition to your mortgage repayments,

Paul, a store manager, has bought his first home as a single buyer after five years of saving, thanks to help from a Government-funded scheme.

Paul attended one of Chestnut Homes’ First Homes Discovery Days and was able to secure his dream home at its Kings Manor development in Coningsby, Lincolnshire, using the new Government First Homes scheme. Chestnut Homes is one of the first housebuilders in Lincolnshire to offer the scheme.

He says, “I’ve been wanting to buy a home for over five years now, but with paying rent on a property at the same time and being a single buyer, I never thought it would be possible.”

Paul adds, “It’s always scary buying your first home, especially when you’re going through the process independently, but the team provided endless support throughout, putting me in contact with financial advisers and local solicitors. From putting down the reservation fee to choosing fixtures and fittings, the service was second to none.”

Reflecting on his journey, Paul says, “It’s taken a lot of hard work and time to get to this position, but I am so happy to be settled into my new home. I hope my story shows that it is possible to get on the property ladder without help or a second income.”

you will pay rent on the remaining share, plus a service charge that pays for the upkeep of communal areas of the building. You can then purchase additional shares as your situation allows, "staircasing" in increments of as little as 1% a year for the first 15 years, and will benefit from a share of any increase in the property’s market value. The housing provider will contribute the first £500 of any repairs or maintenance annually for the first 10 years.

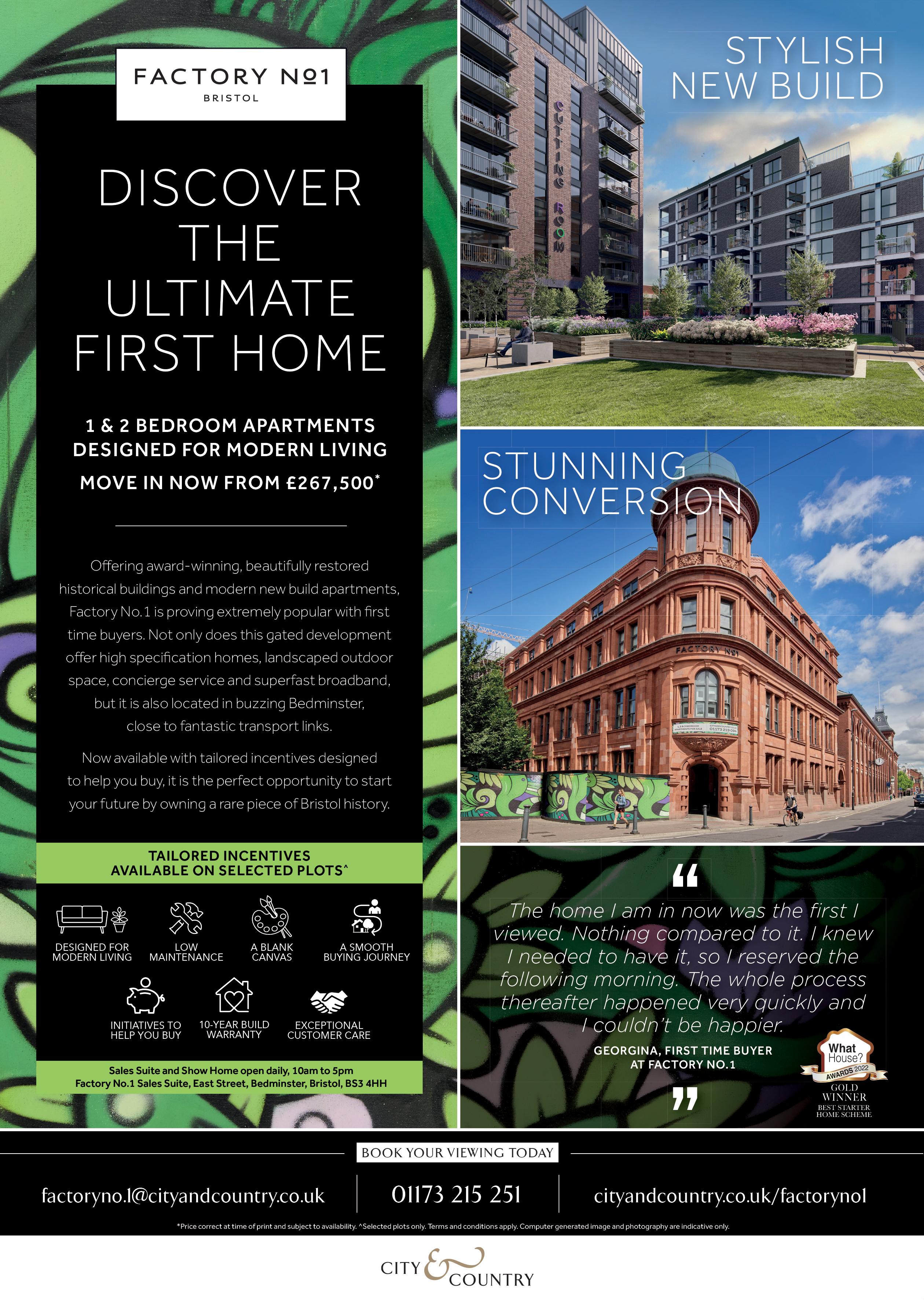

DEPOSIT UNLOCK

Deposit Unlock is a relatively new scheme, developed by the Home Builders Federation (the body that represents housing developers) and reinsurance firm Gallagher Re, designed to "unlock" 95% mortgages for those buying new build homes. Mortgage lenders often set the minimum deposit for new build properties at 15% or even 25% to protect their own interests; with Deposit Unlock the housebuilders pay to insure the mortgages, so lenders are more comfortable offering high LTV mortgages. The property purchased must be your only home and main residence. There are now many housebuilders participating, but some developers do not include studio or one bedroom apartments so you will need to check the terms for each development.

Participating lenders include Newcastle Building Society, Nationwide and Accord Mortgages, with more expected to follow. Like any mortgage, the amount you can borrow will depend on your personal circumstances, but the maximum loan available through the Deposit Unlock scheme is currently £750,000. When an Independent Financial Adviser has qualified you for the scheme, the housebuilder will provide you with written

confirmation so you can apply to specified lenders for a Deposit Unlock mortgage and hopefully reserve your new home.

FIRST HOMES

First Homes is a Government scheme enabling first time buyers in England to purchase a home for 30-50% less than its market value. This can be a new home built by a developer, or a home bought from someone who originally bought it through the scheme.

You will need to meet the eligibility criteria:

9 You must be at least 18 years old

9 You must be a first time buyer

9 You must be able to get a mortgage for at least half the price of the home

9 Your annual household income must be less than £80,000 (£90,000 in London).

The local council may also set some eligibility conditions, for example giving priority to the First Homes scheme to essential workers, people who already live in the area or those on lower incomes (exemptions apply for members of the armed forces and their families).

Homes will be specifically advertised as being part of the First Homes scheme and every home sold is valued by an independent surveyor to make sure the discount is based on its true market value. Homes cannot cost more than £250,000 (£420,000 in London) after the discount has been applied.

To apply, you will need to contact the developer (or estate agent if buying from a previous First Homes buyer) who will help you to complete the application, then send it to the local council. You will pay a fee if buying a new build, which will be refunded if your application is unsuccessful.

GET ON THE LADDER First Time Buyer June/July 2023 25

CASE STUDY

SAVE TO BUY

Fairview New Homes has launched Save to Buy – the only scheme of its kind – to help first time buyers to save for their final deposit via fixed monthly payments while living in their new home, rent free.

Payments are based on the area’s average monthly rent and the buyer’s personal finances, and 100% goes towards the buyer’s deposit and/or affordability deficit on their Fairview home. The maximum term a buyer can use the scheme is two years, but Fairview expects most will complete their home purchase within six to 12 months. Buyers will own 100% of the property, once legally completed.

Chris Hood, Sales and Marketing Director at Fairview, explains why Save to Buy is the perfect solution for many, “Our survey of 1,000 first time buyers found that 79% of renters in the UK and 83% in London feel the cost of renting is negatively impacting their ability to save for a house deposit. In fact, almost two-thirds (64%) blame the cost of rent for saving little or nothing at all towards a house deposit. The Save to Buy scheme is designed to break the vicious rental cycle, which could save first time buyers in London around £15,000 in rental payments over a year.” He believes the Save to Buy scheme could bring forward homeownership for prospective buyers by six years, based on how long it would otherwise take to save a deposit.

Who’s eligible? First time buyers aged 18+, in full-time employment (for a minimum of three months) with minimum savings of 1% of the value of the house they wish to buy. Buyers will need to be qualified by a thirdparty financial adviser to confirm affordability and credit score.

Save to Buy will run until December. Given a record 12-month increase of 16.1% in advertised rental prices in London, the scheme is available on selected Fairview plots in and around London. The scheme will operate on a first-come, first-served basis, and properties are expected to be snapped up quickly. However, plots will be available throughout the year, so if you are interested but not in a position to take part immediately you can be added to a waiting list.

Get in touch with a member of the Fairview Save to Buy team – email sales@fairview.co.uk or call 020 8023 7092. Eligible developments can be found on the Fairview website fairview.co.uk/savetobuy

BUDDY UP INCENTIVE

Fairview New Homes is covering legal advice and fees worth up to £2,000 to empower first time buyers to "Buddy Up" and buy a home with a friend.

Fairview’s national survey of first time buyers revealed that over two thirds (70%) are not able to buy on their own and over half (54%) want to buy their first home with a partner one day. Fairview believes all independent and/or single people are just as entitled to homeownership, and as an incentive to encourage young professionals to purchase their dream home with a friend, are offering those who "Buddy Up" legal fees and expert advice paid up to the value of £2,000, plus a lifestyle gift worth up to £500.

There were many reasons why almost half (43%) of first time buyers said they were unlikely to buy a home with a friend:

9 One in four fear it would risk their friendship

9 24% wouldn’t want to make a long-term commitment with a friend

9 23% do not think it is sensible financially

9 17% do not think it is sensible legally

9 13% say their friends are reluctant

9 12% don’t know how to buy with a friend

Fairview wants to help first time buyers understand the feasibility and benefits of buying with a friend, paired with expert legal advice and first-hand experience. It has teamed up with PCS Legal (Property Lawyers

regulated by the Council for Licensed Conveyancers) to offer expert advice, giving friends the confidence and guidance they need to buy together. Daman Singh, Conveyancing Executive at PCS Legal, says, “Buying with a friend is largely no different to buying with a partner or a family member. We’d always advise parties buying together to get a Trust Deed, also known as a Declaration of Trust, a legally binding document which outlines how much money each person contributed and what happens in various scenarios such as the property being sold or one buying the other out. We advise buyers hold the property as Tenants in Common, so they can detail different shares and enter a Declaration of Trust.”

The Buddy Up incentive is available to friends who purchase a home together with Fairview, and includes a lifestyle gift they can enjoy together to celebrate becoming joint homeowners. Despite the scepticism of some aspiring homeowners over buddying up, friends Dani and Danielle did exactly that and are loving life in their two bedroom flat at the NewHayes development in Hayes.

First time buyer nurse, Dani, who bought with her friend and fashion technician demonstrator Danielle after renting together, says, “I had been renting in London for three years, and I was fed up paying someone else’s mortgage when I could be paying my own. I saved as much as I could, and worked really hard, picking up extra shifts in my role as a nurse throughout the Covid-19 pandemic, but I was still not eligible to buy on my own. Without each other, Danielle and I would not have been able to buy a home by ourselves in London.” She adds, “I had a huge amount of trust in our decision to invest in buying a place together as friends, especially after the legal advice we received which was great, and the whole process was very straightforward.”

Dani hopes to inspire others to purchase a home with a friend, if doing it alone isn’t possible, and has some great tips, “If you cannot afford a property you love and have a very close and reliable friend, buy with them so you can both get out of the renting cycle! If you’re unsure of the process, get trusted legal advice, and have every potentially awkward conversation with your friend in advance, on all of the situations that could play out, to prevent trouble in the future.”

For more information about the Buddy Up scheme visit fairview.co.uk/buying-with-fairview/ways-to-buy/buddy-up/

GET ON THE LADDER 26 First Time Buyer June/July 2023

FIRST HOMES

FROM £250,000

CASE STUDY

Rajeev, 42, his wife Shikha, 42, and their 14-year-old son Kartikeya were keen to set up a permanent base in Chatham, Kent. They had been living in temporary accommodation for six months before moving into a private rented home.

HAYWARDS HEATH, WEST SUSSEX Spring Bank

Sigma Homes’ new development consists of 20 energyefficient homes, two of which will be sold through the First Homes scheme, enabling first time buyers to benefit from a discount of at least 40%. They are now available to reserve off-plan and will be ready in the autumn. The homes will feature EV charging points, contemporary kitchens with Bosch appliances, fitted wardrobes to all bedrooms, and high-quality vinyl and carpeting provided as standard throughout. Mid Sussex District Council has set the eligibility criteria for the First Homes on the development; buyers must have lived in the area for 12 consecutive months, or have a close family member living locally.

sigmahomesgroup.co.uk/developments/west-sussex/ spring-bank

020 3019 0740

LOUGHTON, ESSEX

Epping Gate

Rajeev explains, “We really wanted to buy our own home, but our budget meant we struggled to find anything suitable. During our search we came across Garrison Point, and after researching further, we discovered a new scheme called First Homes which could help us finally buy something. We had a budget of £200,000 which really gave us little option to buy something in Chatham. I work as a Plant Manager in nearby Rochester and my son is settled at secondary school locally, so making a move further afield just wasn’t feasible. The scheme has allowed us to stay in the local area and establish firm roots for our family.

“We’ve been able to purchase a ground floor two bedroom apartment off-plan at Garrison Point, which is ideal for what we need. The development is close to the bus station and in a peaceful location, and the way it has been designed really appealed to us, especially the two bathrooms. We are expecting to move in at the end of the year and it will mean my son will be able to walk to school, which is just 10 minutes away. We will also have our own parking space, which will be such a change from us having to find one at our current rental property.”

FROM £320,000

FIRST HOMES SAVE TO BUY & DEPOSIT UNLOCK

Epping Gate comprises spacious and modern one, two and three bedroom apartments. There is a private residents’ podium garden to enjoy and electric car charging available. Debden station is only a nine-minute walk, where you can get the Central Line to Stratford in 22 minutes and to Liverpool Street in 31 minutes. Fairview’s Save to Buy scheme and Deposit Unlock are both available here, subject to availability. Buyers also benefit from Fairview’s "Essential Starter Pack" – a gift of household items like cleaning products and kitchen items worth £200.

fairview.co.uk/developments/epping-gate

020 8362 7935

CHATHAM, MEDWAY

Chatham Waterfront

FROM £215,000

Waterfront is Chatham’s newest riverside community offering a range of contemporary one and two bedroom apartments by the Medway Development Company. Located less than 40 minutes away from central London, the eye-catching homes are designed to be spacious, affordable and energy efficient with high-quality finishes. These new apartment buildings are complemented by landscaped garden areas, a new public square and spacious remodelling of the riverside park.

medwaydevelopmentcompany.co.uk/find-your-home/waterfront 01634 557 780

GET ON THE LADDER 28 First Time Buyer June/July 2023

CASE STUDY

Linu, 28, and Sam, 29, have purchased their first home with the shared ownership scheme. The young couple, keen to stay in Southall, purchased a 25% share of a two bedroom apartment at Union Walk at the Green Quarter from Latimer, by Clarion Housing Group.

Linu, a senior policy adviser and blogger, says, “Previously, we were renting a one bedroom flat in Southall, but when our rent increased it wasn’t financially viable for us to stay there. We’d heard about shared ownership, so decided to research the scheme and quickly realised that it was the best option for us. I’ve spent most of my life in Southall and having my family and friends nearby was a priority. Without shared ownership, there’s no way we could afford to stay in London.”

Linu and her husband, Sam, a freelance book illustration artist, were able to view both the show home and the plot they decided on. Linu recalls, “Looking around the home, we saw a space we could easily imagine living in.” Now, the couple are reaping the benefits of homeownership, and using the second bedroom as an office has helped Linu to regain a healthy work-life balance.

“It’s amazing to have a home to call our own,” she says, “and although we’re taking our time to decorate and buy furniture, we can already see our dream home taking shape.”

SHARED OWNERSHIP

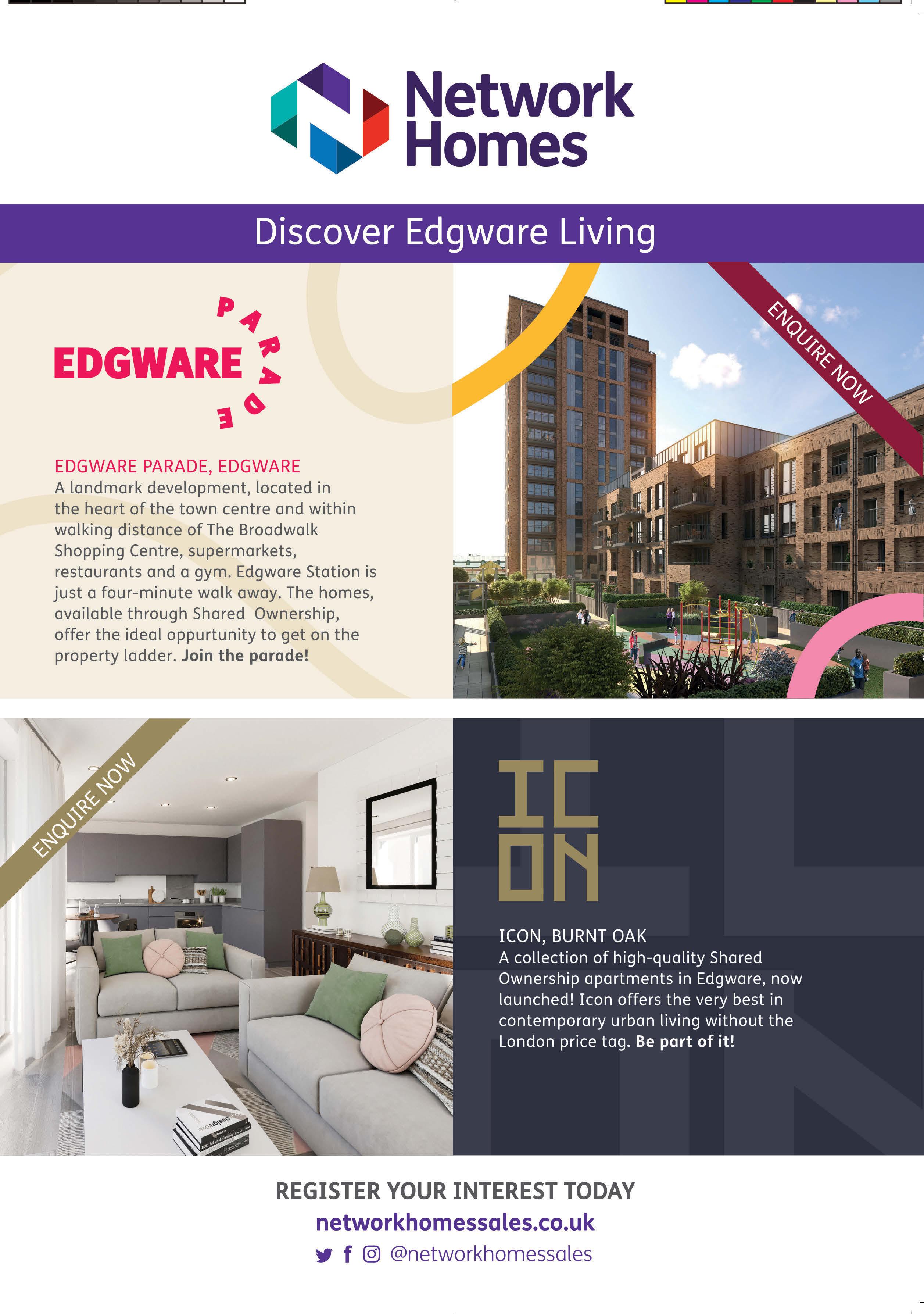

HARINGEY, NORTH LONDON

Evergreen

Evergreen is a modern collection of two bedroom apartments available for shared ownership. All homes boast bright and spacious layouts with engineered oak flooring, modern integrated kitchens with composite stone worktops and integrated appliances, triple glazing for energy efficiency, and private outdoor space to every home. Conveniently located just a short walk from Turnpike Lane underground station, Oxford Circus can be accessed in under 20 minutes. Evergreen is close to Alexandra Palace and Finsbury Park, and is surrounded by eclectic bars, cafes and restaurants.

latimerhomes.com/new-build-homes/london/haringey/evergreen 020 7118 0671

DEPOSIT UNLOCK

FROM £304,995

RAMSGATE, KENT Spitfire Green

Barratt Kent presents a selection of first time buyer and family homes in Ramsgate. Just three miles from the Kent coast, Spitfire Green is surrounded by beautiful green open space with planned wildlife areas and a play park. All homes at Spitfire Green have been constructed with energy efficiency in mind; energy-efficient boilers and high levels of insulation ensure a new Barratt home is up to 57% cheaper to run than the same sized older home with modern day improvements. There will also be electric vehicle charging points to every house. Available with the Deposit Unlock scheme.

barratthomes.co.uk/new-homes/dev-001134-spitfire-green 0333 355 8502

CONINGSBY, LINCOLNSHIRE

Kings Manor

Chestnut Homes is offering an impressive range of two, three and four bedroom homes on the fourth phase at Kings Manor, located in a rural village setting on the edge of the Lincolnshire Wolds. Each house has been designed with traditional architecture and thoughtfully planned internal layouts for modern living. These homes boast a high specification, with carefully considered and selected fixtures, fittings and finishes. With energy efficiency in mind, the homes have gas-fired central heating systems with condensing boilers, thermostatic radiator valves, electronic programmers and high levels of insulation.

chestnuthomes.co.uk/find-a-new-home/kings-manor 01526 343 323

FROM £140,000* FROM £279,950 *Based

GET ON THE LADDER 30 First Time Buyer June/July 2023

25%

on a

share of the full market value of £560,000

FIRST HOMES

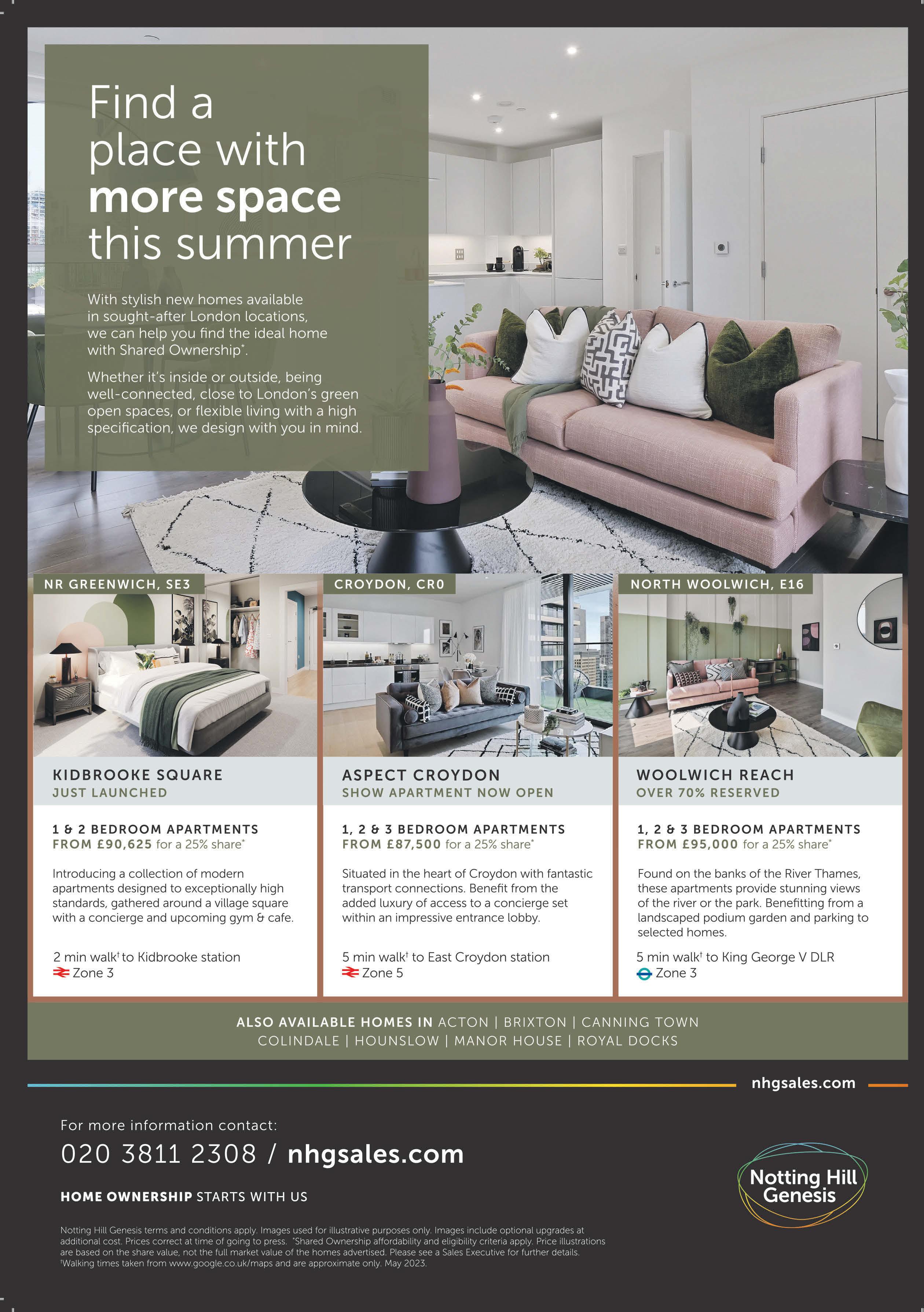

ABBEY WOOD Southmere, Crane Court

Peabody is launching a new collection of two bedroom shared ownership apartments at Southmere, which is part of the Thamesmead regeneration in Abbey Wood.

FROM £105,000*

Open-plan living/kitchen/ dining areas have been thoughtfully designed with clear zoned areas, while large windows allow lots of light into the apartments. Most homes benefit from inset balconies, and residents have access to an exclusive podium garden plus purpose-built amenities including a concierge service, residents’ lounge, meeting rooms and workspaces, opening soon. A communal bicycle storage facility on the ground floor also encourages residents to explore the local landscape on two wheels. Transport connections are excellent and Canary Wharf can be reached in just 11 minutes, Liverpool Street in 17 minutes and Tottenham Court Road in 23 minutes.

southmere.co.uk

FROM £120,000*

Having lived in rental properties with their young son for six years, Sahil and Sheetu decided it was time to find a forever home for their family. Starting their search in the middle of the Covid-19 lockdown, they struggled to find a good quality house that they could move into straight away without needing to do additional work.

As Sahil explains, “We initially looked at properties in Birmingham, as we had previously lived in the city, however many of the houses on the market needed renovation and we were eager to move straight in without having to worry about additional costs.”

With prices on the rise, Sahil and Sheetu decided to make use of the Government-backed shared ownership scheme, which would enable them to initially purchase a percentage share of a property, with a long-term plan to staircase. To ensure that they wouldn’t have to compromise on quality, Sahil and Sheetu redirected their house hunt to nearby areas that would offer more space for their growing family but still benefited from direct trains to both Birmingham and London.

When the couple discovered that L&Q had properties available to purchase through shared ownership in neighbouring Warwickshire, the decision was made. The growing community at Beauchamp Park offered them the perfect combination of new build homes within proximity to excellent transport links and an array of nearby amenities, including top-class schools.

WALTHAMSTOW The Chain

Located in the heart of the vibrant neighbourhood of Walthamstow, The Chain is a collection of 518 one to three bedroom shared ownership apartments. Around the corner from St James Street London Overground station, the development offers contemporary homes centred around attractive communal gardens, close to fantastic transport, retail and food options.

All homes at The Chain have a high-quality specification throughout, with stylish kitchens fitted with integrated appliances and bathrooms complete with modern white sanitaryware. Outside, each home has a private balcony or terrace, as well as access to communal gardens. Residents also benefit from a concierge service, on-site bicycle storage and a three year complimentary membership to Zipcar (terms and conditions apply).

Offering fantastic cultural opportunities on the doorstep, The Chain benefits from excellent transport connections; three railway stations – St James Street, Walthamstow Central, and Walthamstow Queen’s Road are within walking distance, providing residents with both underground and Overground links.

lqhomes.com/thechain

After visiting the show home, the family decided it was right for them. As Sahil comments, “Our hearts were set on Beauchamp Park the moment we came across the development. I knew that the Technology Park was nearby, which meant that my commute to work would be significantly shorter. The development also benefits from easy transport links into London, and with great shopping and schools on the doorstep we knew that it was perfect for us and our son. Initially, we were disappointed that timelines hadn’t aligned as there were no homes available when we first looked. However, thankfully, Lisa from the L&Q Sales team took down our details and contacted us the moment the next launch was confirmed, and we were able to buy in the next release of homes.’’

Sahil and Sheetu purchased a 50% share of a three bedroom home with L&Q for £183,750. Reflecting on the first months living in their new home, Sahil comments, “We love the quality and spacious nature of the rooms – it’s a house we can grow in. Since it is a new build property, all our appliances and finishes are brand new so we don’t have to worry about renovating – and the garden has been a joy for the summer months. Beauchamp Park is located close to both Warwick and Leamington Spa, which both offer lots of local community facilities and shops. We also have Warwick Castle nearby, which we really enjoy visiting – the location is perfect.”

GET ON THE LADDER First Time Buyer June/July 2023 31

CASE STUDY

Based on a 25%

of £420,000 *Based

£480,000

share with a full market value