CUPBOARD AND WORKTOP PAINT WORTH £27

AUTUMN TREATS FOR ALL THE FAMILY

the Ultimate Guide to... GETTING ON THE LADDER, NEW HOMES AND SHARED OWNERSHIP rsttimebuyermag.com October/ November 2023 £4.99 10 9 771758 973021 >

SAVE TO BUY WITH LONDON

RENT FREE SUPPLEMENT: ALL YOU NEED TO KNOW ABOUT SHARED OWNERSHIP

“Buy a property that you feel you will be happy with in five or eight years' time”

LIVING

WIN!

A 2L TUB OF V33 RENOVATION

LOCATION!

Damergi TV Presenter, A Place in the Sun

LOCATION! HOW TO SPOT AN UP-ANDCOMING AREA Sara

EDITORIAL – 020 3488 7754

Editor-in-Chief SARAH GARRETT sarahg@spmgroup.co.uk

Editor LYNDA CLARK lynda@ rsttimebuyermag.co.uk

Editorial Assistant and Head of Special Events KATIE WRIGHT

Editorial and Special Events Assistant

SOPHIE MUNNERY

Creative Director RYAN BEAL

Sub Editor KAY HILL

Social Media KATIE WRIGHT, SOPHIE MUNNERY

Contributors

CHRIS CLARK, DEBBIE CLARK, KAY HILL, EMILIA HUNT, SOPHIE MUNNERY, LAURA DEAN-OSGOOD, CORALIE PHELAN, LESLEY PRICE, MIKE PRIOR, GINETTA VEDRICKAS, KATIE WRIGHT

ADVERTISING – 020 3488 7754

Director of Advertising/Exhibition Sales LYNDA CLARK lynda@ rsttimebuyermag.co.uk

Special Events KATIE WRIGHT

– National Home Buying Week

– First Time Buyer Readers’ Awards katie@ rsttimebuyermag.co.uk

Accounts

accounts@ultimateguidecompany.com

Managing Director SARAH GARRETT sarahg@spmgroup.co.uk

Public Relations

RACHEL COLGAN rachel@buildingrelations.co.uk

SUBSCRIPTIONS

020 3488 7754

SWITCHBOARD

020 3488 7754

All advertising copy for December/January 2024 must be received before 3 November 2023. Send all copy to: lynda @ firsttimebuyermag.co.uk

The content of this publication, either in whole or in part, may not be reproduced, stored in a data retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying or otherwise,

Welcome

It was amazing to celebrate the First Time Buyer Readers’ Awards recently and have the opportunity to meet up with so many housing industry colleagues. This year we have been overwhelmed with the support we have had with a record number of entries and a sell-out at the lunch despite the train strike! A very big thank you to everyone for taking the time to vote – it really means so much and if you turn to pages 79-89 you can see all the winners and highly commended.

The annual Shared Ownership Week campaign returns from 2026 September, aiming to help homebuyers understand how using the scheme can help you buy an affordable home. I do hope that you enjoy our shared ownership supplement where you can find lots of information and many lovely developments available through the Government scheme plus an explanation of how the scheme works. We are often referring to areas which are up-and-coming but how do you recognise if the location you are looking to buy in, is really on the up? Turn to pages 22-26 where we give you some top tips of what to look out for, which I think you will find very useful.

I hope you enjoy this issue which is packed with information and help on buying your first home – enjoy!

Until next time, happy house hunting firsttimebuyeronline @firsttimebuyer

EDITOR’S PICKS…

We found a really lovely apartment in Rotherhithe which is the perfect base for when we are in London.

John Bruce, At home with, page 12

Ask Emilia, page 96

Start by looking at options, what buying schemes can you afford?

Jon Lord, 20 Questions, page 118

We can’t wait to show our parents around and I’m sure they’ll be giving their seal of approval too.

Zara Dhillon, House Hunter, page

14

EDITOR’S LETTER First Time Buyer October/November 2023 3

I’d say to anyone moving into their rst home, cherish that rst week. It is super amazing. Claire Dowd, Real Life, page 70

without prior permission from the publishers. Opinions expressed in First Time Buyer magazine are not necessarily those of the publishers. © The Ultimate Guide Company Ltd 2008-2023. The Ultimate Guide Company Ltd t/a First Time Buyer magazine will take no responsibility for any loss/ claim resulting from a transaction with one of our advertisers/media partners.

It’s always good to speak to a mortgage adviser, and be clear about all forms of income.

What’s in…

71

For sale

– the best FTB properties

70

It wasn’t a hard choice for Claire Dowd and Dom Barlow to decide on their first dream home. They heard about a new Bellway development planned for the village of Penllergaer near Swansea, and immediately knew it was in the perfect location for them near family members, and before construction even began, they set their hearts on living there.

HOMEPAGE

8 FTB Loves...

With Halloween fast approaching, we have ideas to decorate your home spooky style! Plus, we all want to buy recycled products –see our round-up of what we love.

10 Living

We all enjoy the sunshine so why not bring the outside indoors with

these striking accessories with a California Dreaming theme, to help brighten up the cooler autumn days ahead.

12 At home with: John Bruce

John is the founder of PRM models, the most diverse model agency in the world, and his company’s sponsorship programme offers a new start to refugees from war torn countries. John is passionate about interiors and he talks to Lynda Clark about his interesting life, his first home and gives some advice for first time buyers.

14 House Hunter

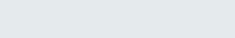

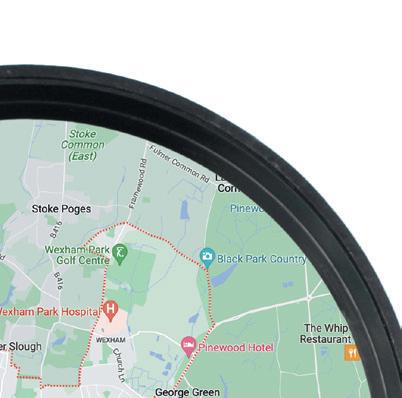

We try to find a home for Zara and Amar Dhillon who are looking for their first home in Berkshire with good links to London and Reading.

16 Developer’s doctor

Melissa Toomey, Director of Sales at Home Reach, answers your property question.

18 The View: Sara

Damergi

Sara presents A Place in the Sun for Channel 4 and also has a property company with her brother, building and renovating homes. She talks to Lynda Clark about her work, her interesting career and offers some excellent advice for first time buyers.

22 Secure Your Future

What is an up-and-coming area?

Debbie Clark looks at how homebuilders choose their next location and has some excellent advice on what to look out for when deciding if a location is right for you. Watch for places where shops don’t stay empty for long and transport links are improving!

CONTENTS 4 First Time Buyer October/November 2023 OCTOBER/NOVEMBER 2023 / ISSUE 103 / FIRSTTIMEBUYERMAG.CO.UK

Cover Photo © Gemma Day

22 10

FEATURED

SARAH DAMERGI, PAGE 18

18

REGULARS

96 Ask Emilia...

79 First Time Buyer Readers’ Awards – Your winners revealed

42 Hotspot

We look at the benefits of Slough as a place to live.

91 Competition

Nine lucky winners will win a 2L tub of V33 Renovation Cupboard & Worktop paint worth £27.

92 First home, first meal

This recipe for Autumn Tea from Bake Well Being has a loaf that is full of flavours and textures that evoke nostalgia and warmth and a special recipe for a warming hot drink. So, celebrate the season by indulging in the comforting flavours of this bake and tea treat.

93 Know How

Some practical and creative DIY hacks you will find useful around the home.

94 Keep Calm and Keep Moving

Moving to a new house can be a difficult time. Lesley Price FCILEx of CGM Solicitors provides advice on what you can do to keep things moving and to manage delays when they occurs.

Emilia, Sales Director at Metro Finance, outlines the various types of income types that can be used to buy a shared ownership home.

98 Finance

Kay Hill looks at savings rates following the interest rate rises on mortgages, but also reflects on the tax implications for savers.

100 MARKET

Housing Secretary Michael Gove, recently outlined his plans to help fix the UK’s housing shortage. Ginetta Vedrikas looks at his new proposal which calls for homes to be built in cities on brownfield sites rather than in rural areas.

102 Agony Agent

All your property questions answered by our panel of experts.

105 Buyer’s Guide

Check out FTB’s Buyer’s Guide, which walks you through the property process.

110 Common questions from a first time buyer about conveyancing?

Coralie Phelan Partner and Head of New Build Homes, at Prince Evans Solicitors LLP explains the key steps to staircasing on your shared ownership home.

112 Directory

A round-up of which schemes are available to first time buyers.

118 20 Questions

We ask 20 quick-fire questions to Jon Lord, Managing Director at Metro Finance.

CONTENTS First Time Buyer October/November 2023 5

Sara Damergi

MOVING HOME IS COSTLY SO YOU SHOULD CONSIDER IF THE PROPERTY WOULD BE BIG ENOUGH IN THE FUTURE

Mailbox

STAIRCASING AND STAMP DUTY

If I buy a 25% share of a property, how does Stamp Duty work? Will I have to pay more if I staircase to 100%?

Alex Williams

FTB says: When it comes to staircasing in shared ownership, the rules on Stamp Duty can be quite beneficial, calculated differently to traditional home purchases. When you buy your first share in the property, you may be eligible for a reduced or discounted Stamp Duty rate. The amount payable will be based on the market value of the share you are purchasing, not on the full market value. This can result in significant savings. If you decide to staircase further and purchase more shares in the property in the future, the same principle applies. You will only pay Stamp Duty on the additional share you are buying, not on the entire property value. This means you can continue to save on Stamp Duty as you gradually increase your ownership stake in the shared ownership property.

This issue’s star letter prize wins a ZeroWater Ready-Read Jug worth £44.99 – the first water filter jug with a built-in TDS meter. TDS (total dissolved solids) are minerals and substances dissolved in water. UK tap water is safe to drink, but it can have a high TDS level as it’s treated with chemicals, including chlorine and fluoride, and could have traces of lead in homes with older pipework. These chemicals can give tap water a bitter taste and may be harmful to your health. Easy to use, simply fill the jug with tap water, and the filter will do the rest.

zerowater.co.uk

JOINT BORROWER SOLE PROPRIETOR

Can I buy a home in just my name as I am a first time buyer but also have my partner named on the mortgage?

Louise Riley

FTB says: There is a way for you to purchase a home in your name while having both of you on the mortgage, it’s called a “joint borrower sole proprietor” mortgage. Not all lenders offer this, so it’s advisable to consult an independent

mortgage adviser to find one that suits your needs. With this arrangement, both of you would share responsibility for the mortgage payments, but only you would have ownership of the property. To avoid any issues further down the line, it’s essential for your partner to be comfortable with not being registered as a joint owner at the Land Registry, as this means they won’t have any legal rights over the property’s equity or any profits generated from it.

WRITE TO US!

Please send us your questions, comments and suggestions concerning property, or the articles in First Time Buyer magazine.

lynda@firsttimebuyermag.co.uk

INHERITANCE AND SHARED OWNERSHIP

My wife and I might receive a modest inheritance. Presently, we are content with our rental situation and location. However, if we decide to utilise the inheritance, we could potentially afford to purchase a 25% share of a shared ownership property in our area. We wonder if shared ownership properties are a wise investment and if we would encounter any difficulties selling the property if we choose to move elsewhere, perhaps within the next five years, for work reasons?

Chris Wadsworth

FTB says: Based on the testimonials featured on the Share to Buy website, it’s evident that shared ownership properties are highly beneficial. The most compelling advantage is that it grants individuals the opportunity to purchase a home in an area that would otherwise be financially out of reach. Opting for shared ownership requires a smaller cash deposit, making it a more accessible and affordable pathway to homeownership. When it comes to selling, you are usually required to offer your housing provider a designated timeframe to find a buyer. This requirement can prove advantageous because housing providers maintain an extensive database of potential buyers who meet the eligibility criteria so have numerous buyers waiting for suitable properties.

WHAT TO DO FIRST?

I am soon going to be moving into my first home. Although I am very excited, I am a little overwhelmed with what I should do once I am moved in. Do you have any tips?

Joe Seymour

FTB says: Moving into your first home is an exciting milestone! Here are some essential tasks you should consider doing as soon as you move in:

• Inspect for damages

• Set up utilities and services

• Clean and unpack essentials

• Find and organise all your important documents

• Notify change of address

• Consider any necessary home security measures

• Learn about essential home maintenance

• Meet neighbours and explore the neighbourhood

• Personalise your space. Remember, moving in can be overwhelming, so prioritise tasks and take your time settling in. Enjoy the process of making your new house a warm and inviting home!

VISIT OUR WEBSITE

For everything you need to know about buying for the first time, go to firsttimebuyermag.com

LETTERS First Time Buyer October/November 2023 7

Hinza bag, £30, Daisy Park daisypark.co.uk

Made from recycled plastic, the handles are made of bio-based plastic, sourced from sugar cane, a renewable raw material.

WE RENEWED

Purchasing recycled products is an eco-conscious and socially responsible choice that benefits both individuals and the planet. Check out why FTB loves these products and continues embracing them!

Recycled 24cm stockpot, £50, Dunelm dunelm.com

Made from recycled aluminium.

Garden Wildlife recycled Evie peanut butter feeder, £10.99, National Trust nationaltrust.org.uk

Made from 100% recycled plastic drinks cartons.

Fentress recycled table lamp, £45, Dunelm dunelm.com

A true classic with a sustainable twist. Crafted from recycled glass.

Willow recycled throw, £12.99, Dunelm dunelm.com

Part of the Dunelm Conscious Choice range and made from 100% recycled polyester.

Sylvia recycled velvet dining chair, £119, Cult Furniture cultfurniture.com

The velvet used in this stool is made from 100% recycled PET plastic so it is kinder to the environment.

FTB LOVES 8 First Time Buyer October/November 2023

SO CHIC ITS SPOOKY!

Embrace the spirit of the season with sophisticated decor ideas that evoke both spookiness and style!

FTB LOVES First Time Buyer October/November 2023 9

Skeleton bath mat, £10, George Home direct.asda.com

Bamboo pumpkin serving platter, £3.99, The Range therange.co.uk

Hey Pumpkin cushion, £9.99, The Range therange.co.uk

Autumnal LED lantern, £12.99, The Range therange.co.uk

Halloween black cat candle, £6.99, Homesense homesense.com

Knit effect ceramic pumpkin, £6, George Home direct.asda.com

CALIFORNIA DREAMING

Taking inspiration from California’s never-ending sunshine and vibrant coast, add some warmth into the home by bringing the outside indoors with luscious shades of greens, leaf prints and pops of bright colour to make the autumn days feel brighter

Homepage LIVING 10 First Time Buyer October/November 2023

Green Riverside reactive glaze dispenser, £5; Green Riverside reactive glaze tumbler, £3, George Home

Black ceramic vase, £8; organic glass vase, £7; large solar powered natural lantern, £24; faux eucalyptus in black pot, £7, B&M

Caro bed, £329.99; Cole 2 drawer bedside table, £199.99, Furniture and Choice Paint – Pale Peony matt, from £36.49, Dulux Patterned cotton cushion cover, £6.99, H&M

Leaf vase, £6, B&M

Caramel brown leaf towel range, from £5, George Home

Mushroom table lamp, £45, Habitat

Leopard door knocker, £32.50, Oliver Bonas

Fabric doorstop, £19.50, Oliver Bonas

Octopus table lamp, £49, Dunelm

Geo tufted cushion, £10, George Home

Jericho side table, £120; Hashi ceramic table lamp, £80; cotton print cushion, £10; braided jute circle rug, from £60; Koba rattan two-seater sofa, £950, Habitat Monkey

Knock Knock doormat, £19.50, Oliver Bonas

Just Vibing mirrored wall art, £25, Dunelm

Flowers in

» B&M bmstores.co.uk beaumonde.co.uk

» Daisy Park daisypark.co.uk » Desenio desenio.co.uk » Dulux dulux.co.uk

» Dunelm dunelm.com » Furniture and Choice furniturechoice.co.uk

» Gardenesque gardenesque.com » George Home direct.asda.com » H&M hm.com

» Habitat habitat.co.uk » Oliver Bonas Oliverbonas.com

Homepage LIVING First Time Buyer October/November 2023 11

Paint no.2 poster, from £13.95; Le Jardin no.12 poster, from £13.95; Green Botanical on Linen poster, from £9.95; Abstract in Emerald poster, from £13.95, Desenio

book ends, £45, Oliver Bonas

Tall green leaf ceramic plant vase, £15.99, Gardenesque

Elements Viggo table lamp, £40, Dunelm

Green piped taper candle holder, £15, Daisy Park

Spherical leaf gold and green glass vase, £46.90, Beaumonde

Confetti glass, £12, Dunelm

Crab-shaped cushion, £10, George Home

Sunset Festival poster, from £9.95, Desenio

Riviera poster, from £13.95, Desenio

At home with: John Bruce

John is the founder of PRM models, the most diverse model agency in the world, where his sponsorship programme brings over refugees from war-torn countries. He and his husband, Paulo, enjoy living by the river in London and both have a real eye for interior design. John tells Lynda Clark about his interesting life, his first home and gives some advice for first time buyers

FTB: Tell us about your first step on the property ladder?

JB: I am originally from south east London and have always loved the area. We found a really lovely two bedroom apartment in Rotherhithe which is the perfect base for when we are in London. We both travel a great deal – I am away at least two or three times a month and in February, June and September it is Fashion Week so I am spending time in New York, Paris and Milan which is super busy. Paulo is from Brazil and spends around two and a half months there. We have a house there and his mother, who is getting older, still lives in Brazil and he is looking for a larger home at the moment so she can move in. We absolutely love living in Rotherhithe as it’s very quiet, has loads of open green spaces, a wonderful riverside walk that is perfect for running and, best of all, watching the sun setting over the river.

FTB: Tell us about your career?

JB: I was born in Woolwich and when I was around three years old my mum and I moved to South Africa. My grandparents had moved there the year before and we went to join them. My grandfather had a paper business and so I went to school there and from about the age of 17 I started modelling with Topco Models in Johannesburg. I moved back to London when I was around 19 as I still had family living here and was determined to get a job with a model agency. On the third day after I came back I was offered a Model Agent position at Nevs modelling agency and although I loved my work I actually preferred being in the office dealing with clients and booking the models. I was very lucky as I got the chance to work in the office, which was perfect for me. I have always had a great work ethos and it has always been important to me to be in control of my finances. I stayed at Nevs

Homepage LIVING 12 First Time Buyer October/November 2023

“IT’S MUCH TOUGHER FOR PEOPLE NOWADAYS BUT DECIDE EXACTLY WHERE YOU WOULD LIKE TO LIVE AND ALSO LOOK A LITTLE FURTHER OUTSIDE OF LONDON WHERE YOU WILL FIND THE PRICES MUCH BETTER AND THE QUALITY OF LIFE VERY GOOD”

for around five years and then moved to Premier models where I did some TV work which was fun. Then in 2012, I decided to open my own agency and started PRM.

FTB: How is it running your own agency?

JB: It’s great fun and very busy! We deal with all the big designers and magazines, like British Vogue, Harpers and Elle. We also have a lot of success on the runway and recently we had four girls walk for Valentino and two for Dior. We are always on the lookout for new models. We do a lot of scouting in the high street and find some amazing young people.

FTB: Tell us about your charity work?

JB: We sponsor an orphanage in Brazil which is very important to us. My grandmother lost her family in the war and went to an orphanage, so it is very

close to my heart. We also have a licence from the Home Office to sponsor people from countries which are very poor. We have scouts in Africa and we have bought over girls from a refugee camp in South Sudan where life is very tough. We really look after them and it completely changes their lives. We sponsored 10 models in 2020 and it gives me the greatest pleasure to help people and give them amazing opportunities.

FTB: You enjoy interior design – tell us about that?

JB: Both Paulo and myself love our home and it is like our baby. We adore plants and experimenting with colours and making the most of the natural light from the windows. The view is wonderful, so we want to enjoy that as much as possible. Many people are working more at home

these days so it’s important to make the space work for both work and home life –you really need to feel good about how it feels and how it looks.

FTB: What advice do you have for first time buyers?

JB: It’s much tougher for people nowadays but I would advise first timers to decide exactly where they would like to live and also look a little further outside of London where you will find the prices much better and the quality of life very good. If you are buying with a partner make sure you both agree to save as there will be problems if one person is saving and the other one isn’t. There is no feeling quite like buying your first home and watching it grow with you and flourish.

prm-agency.com

Homepage LIVING First Time Buyer October/November 2023 13

“WE ABSOLUTELY LOVE LIVING IN ROTHERHITHE AS IT’S VERY QUIET, HAS LOADS OF OPEN GREEN SPACES, A WONDERFUL RIVERSIDE WALK WHICH IS PERFECT FOR RUNNING AND, BEST OF ALL, WATCHING THE SUN SETTING OVER THE RIVER”

John with one of PRM’s models

The HOUSE HUNTER

This month FTB goes on the hunt with Zara and Amar Dhillon who are looking for their first home in Berkshire with good links to London and Reading

What we found…

THE VILLAGE LIFE THE NEW COMMUNITY

Finchwood Park Finchampstead, Berkshire

The Longwater Collection at Green Park Village

Reading, Berkshire

Names Zara Dhillon, 28, Amar Dhillon, 34

Occupations Graphic designer, Project lead

Maximum budget £270,000

Requirements A one or two bedroom home in Berkshire or the surrounding areas, with good transport links to both Reading and London and plenty of options for entertainment within easy reach

What they wanted…

We’re getting married next year and we’ve decided we want to buy our rst home before we do. After ve years in the capital, we’ve also decided to move from our shared rented place in London and look in the Berkshire area, where we’re both from. We grew up in neighbouring towns – although we didn’t know each other until we met in London – so moving back that way is an easy decision for us. Not only will we be closer to family and friends, but we’ll also get more for our money. We’re lucky that we can both work from home a great deal, and Amar’s company has of ces in Reading, so he would need to get there once or twice a week. We both love the countryside, but also like nothing more than an evening out with friends and family, so it’s important to us that there’s some liveliness within a short drive or train ride away.”

Residents at this new collection of one bedroom apartments will have the very best of the Berkshire countryside right on their doorstep. The pretty village of Finchampstead lies a short drive away, while the bigger towns of Wokingham and Reading are just 15 and 20 minutes away by car. The apartments are light and bright, with open-plan areas that feature a Juliet balcony to welcome in summer rays or a gentle breeze. The kitchen has a range of integrated appliances and there’s built-in storage in the bedroom and hallway.

abrihomes.co.uk

Part of the wider Green Park Village – a growing community just outside Reading – this new collection of one and two bedroom apartments is a commuter’s dream. Reading, 21 minutes from London Paddington by rail, can be reached in six minutes by train from the development’s station. Homes are designed for modern living, with stylish and spacious interiors and private outdoor space. Residents also have parking as well as on-site facilities including a market square, landscaped areas and a picturesque lake.

berkeleygroup.co.uk

What they thought…

These homes are in a good location for reaching a lot of places – with Reading, Basingstoke, Guildford and Windsor all really close by car. We love the pretty villages in this area – such as Finchampstead – and there are so many lovely places to visit for long walks or bike rides. The apartments are really sleek and we love the green outlook from the Juliet balconies – very serene. There are also on-site sports facilities here, which would be ideal for us.”

The pretty lake and grounds are a far cry from our current town centre apartment – and we really like the contemporary styling of the buildings. The apartments are impressive inside, too, and are a good size with lots of light. The proximity to Reading makes this an attractive option in terms of Amar getting to his of ce and for days and evenings out and shopping. The new Elizabeth Line makes it so easy to get into London, too, so we’d be able to go out there really easily.”

14 First Time Buyer October/November 2023 Homepage FIRST RUNG

PROFILE

*Based on a 40% share of the full market value of £245,000

FROM £98,000* FROM £300,000

THE CENTRAL LOCATION THE PROMINENT POSITION

L&Q at Huntley Wharf Reading, Berkshire

Silkmakers Court Wokingham, Berkshire

First choice!

THE SOUGHT-AFTER LOCALE

Sunninghill Square

Sunninghill, Berkshire

These new homes form part of an exciting new hub set along the riverside in the buzzing town of Reading. The new locale will feature restaurants, gym and shops – all located at the new Riverside Square, along with open spaces to explore. The one and two bedroom apartments feature open-plan living/dining spaces that open to a balcony, along with contemporary kitchens and hallway utility cupboard. Reading station is a short stroll away for services to London and there are good road links to Oxford, Slough, Guildford and Windsor.

lqhomes.com

What a cool development – with great views out over the local area and right by the river. We think this looks like a great place to live, especially with the restaurants, shops and gym in the immediate vicinity. It would be so convenient for us – and we love that the railway station is so close, too. The apartments are super stylish – with contemporary kitchens and oor-to-ceiling windows and doors to the balcony. This is a top option for us.”

The sought-after Berkshire town of Wokingham lies just a 10-minute walk from this new collection of one, two and three bedroom homes. The properties feature generously proportioned bedrooms, open-plan living space and a private balcony. While Wokingham has a good offering of shops and amenities, there are also superb connections to Reading, which is 10 minutes away by train, for a wealth of entertainment ideas. From nearby Wokingham railway station, trains run to London Waterloo in around 40 minutes.

bellway.co.uk

We have friends and family in Wokingham and have always liked this area. There’s plenty to do and great shopping, while getting around is super-easy too. This development is pretty appealing, and we like that there are larger homes here too, bringing a family vibe, which would be nice. The layouts of the one bedroom homes are really nice –with added storage space and large living areas, great for us after living in a shared house for so long.”

There is a range of one and two bedroom apartments available at this new development nestled in Sunninghill – named as one of the best places to live in Berkshire. Outside, the homes have been created in keeping with their surroundings, while inside, the apartments are bright and spacious, with living areas that lead to a private balcony. There are plenty of options for days and evenings out nearby, including the towns of Ascot and Windsor around a 10-minute drive. Sunninghill high street, for a range of local amenities, is less than a 10-minute walk away.

abrihomes.co.uk

THE NEXT STEP

”We are so committed to moving back to Berkshire and are really excited at the prospect of living in Sunnninghill. We can’t wait to show our parents around and I’m sure they’ll be giving their seal of approval too.“

This new development ticks a lot of boxes for us! The apartments are really light and airy and we love the design of the buildings. The high street in Sunninghill is only a short walk away, which is ideal – and the immediate surroundings are so pretty. My parents live on the other side of Ascot, so they’d only be a short drive away, while Reading is only 30 minutes by car for Amar’s work. There’s so much that we love within easy reach – with beautiful areas such as Windsor and Virginia Water close at hand – and the on-site parking makes things even simpler. There’ll be no more looking for parking spaces like we currently have to!”

Homepage FIRST RUNG First Time Buyer October/November 2023 15

*Based on a 25% share of the full market value of £375,000

*Based on a 25% share of the full market value of £287,500

FROM £71,875* FROM £255,000

FROM £93,750*

Melissa Toomey is Director of Sales at Home Reach, and has been working in property sales for over 15 years – so she knows a thing or two about buying a home! Mel has made it her mission to help as many people on to the property ladder as possible, and is a huge advocate for shared ownership. Home Reach has one of the largest shared ownership programmes in the country, with over 7,000 homes. Its mission is to provide the highest standards of service for its continually growing pool of new house buyers

QI’ve been living at home with my parents since I graduated from university, and I’m thinking about moving out and getting my own place. I’d been considering renting, but a friend mentioned shared ownership to me, and I’d like to understand the scheme more. I know I’ll need to start saving for a deposit, and I’m not sure how much saving I’ll need to do before I’m in a position to buy. Could you offer any advice?

AIt sounds like shared ownership could be perfect for you! The Governmentbacked shared ownership scheme is available to eligible first time buyers, allowing them to purchase a proportion of the property (up to 75%), with deposits starting from just 5% of the share you buy with Home Reach.

As a guide of how this would work, it means that for a property that has a full market value £300,000, with shares from 50% initial purchase tranche, a mortgage of only £150,000 is required. The 5% deposit is from as little as £7,500. This means that buyers require a much smaller deposit than they would typically need if they were buying on the open market.

Shared owners pay a mortgage on the share they own, and pay rent to a housing provider, such as Home Reach, on the portion they do not own.

Shared ownership allows buyers to purchase more of their home over time through a process called staircasing. Staircasing is the process of buying more shares until you own the property outright. As you purchase more shares, the amount of rent paid to the housing provider will go down, and buyers will pay more towards their mortgage.

When you own the home outright, you will pay no rent at all – just the monthly mortgage payments and any relevant service charges.

There is an eligibility criteria that applies for shared ownership; for example, you

must have a household income of less than £90,000 if you are buying in London, or £80,000 if you are buying outside the capital, and priority is sometimes given to those who live or work in the borough.

We would always advise speaking to an independent financial adviser – they can

Melissa Toomey, Director of Sales, Home Reach

help you work out how much of a deposit you need to save and how much a mortgage provider could be willing to lend to you, so it’s a really great place to start.

Here at Home Reach, we have a wide selection of developments across the UK perfect for buyers like you!

FROM £79,500*

Dover Court is an exclusive development of one and two bedroom apartments in Southall, west London, all uniquely designed with a focus on light and size. The spacious and contemporary apartments feature open-plan kitchen/ living areas, alongside an abundance of built-in storage. Homes come complete with private outdoor space, and additional exclusive access to the residents-only landscaped garden.

Dover Court, Southall

Dover Court provides purchasers with the opportunity to enjoy all that Southall has to offer on their doorstep, conveniently located close to local cafes, bars, convenience stores and parkland. There’s a treasure trove of things to do; residents at Dover Court have plenty nearby, including:

• Direct access into London via the nearby Southall railway station, providing services into Paddington in just 18 minutes.

• The new Elizabeth Line is just an 11-minute walk away.

• An abundance of green spaces, including Osterley Park, which is within half an hour’s walking distance.

• Two gyms on the doorstep, including The Gym Group and Featherstone Sports Centre.

• Hanwell Zoo, just a 20-minute drive from Dover Court.

• Extra sports facilities nearby, including West Middlesex Golf Club just 2.5 miles away.

A perfect choice for a new home purchaser looking for style, convenience and luxury. Prices for a one bedroom apartment at Dover Court start from £79,500 for a 25% share (full market value of £318,000), and deposits from £3,975.

For more information, visit homereach.org.uk

*Based on a 25% share with a full market value of £318,000

October/November 2023

GLOBE TROTTER!

Sara Damergi is of both Lebanese and English descent and presents A Place in the Sun for Channel 4. She also has a property company with her brother, building and renovating homes. She talks to Lynda Clark about her fascinating career, her work and gives some great advice for first time buyers

THE VIEW 18 First

Time Buyer October/November 2023

THE VIEW First Time Buyer October/November 2023 19

"IT’S A GOOD IDEA TO LOOK AT AREAS YOU DON’T PARTICULARLY LIKE. THERE IS SO MUCH REGENERATION GOING ON THAT AREAS WHICH MIGHT SEEM RUN-DOWN NOW SUDDENLY ARE ON THE UP"

Sara appears to have no boundaries when it comes to taking risks. She has led a very exciting and remarkable life and is passionate about both property and travelling. She was born in Paddington and lived with her Lebanese father and English mother in London. Her father had a bespoke business dealing with Arabic VIP clients relocating, investing or holidaying in London and when she was just three years old the family moved to Beirut. Sara has very fond memories of her time there and at the time could speak fluent Arabic.

Unfortunately, when the war broke out in Lebanon the family had to move back to England and her parents divorced. “I then divided my time between London and Kent and as my dad was a workaholic, it was given that I would be part of the business deals, property viewings and general dayto-day duties when I was staying with him. I was answering the phone in his office and helping wherever I could. It may seem odd that I was part of the business when I was young but no one ever questioned it and I think it was partly cultural too. Family is everything in the Middle East. I got to meet Sheiks and diplomats and see their homes and go on property viewings as well. It was a whirlwind really but a great learning experience in the property business.”

Sara went to a very quaint school in Kent, which had originally been the home of Charles Dickens. She said, “It was like something out of a Harry Potter film. There were only five pupils, so it was very unusual and I ended up being head girl, but with so few pupils to choose from it wasn’t really that special! I then moved on to do my A-levels at a grammar school, which had more pupils, and I loved it. In fact, I am still friends with some of the girls now.”

Before she went to university, she lived in Ibiza and Cyprus for a while where she started up a club night. “My television career started by chance when I was at my mum’s house and we were watching a local channel and my mum said that she thought I could be a presenter. So, I called them up and said I would like to give it a go and believe it or not they offered me a job and I got £50 a day!"

She continued working with her father on and off up until he moved back to Beirut when she was in her early 20s. "I started up my internet business, which is still going strong. That allowed me to become a digital nomad and travel the world with no fixed address, which was amazing. I stayed with tribes in rural Vietnam, an aristocratic artist in Sri Lanka, went snowboarding in Japan and cruising in Kerala to name a few! I was also the lead presenter on the international extreme sports show The Crunch, which was filmed across remote China and

broadcast on primetime TV on Granada, Astra and TV NZ across various territories."

Always dipping in and out of working with her father in his property business, Sara said, “Some of the people my father worked with were extremely wealthy and it was totally another world. He found property for people and short-term holiday lets. Sometimes they would stay in a place for a very short period of time but would want it completely refurbished. I can remember having to go to Harrods and buy pairs of pyjamas that cost thousands of pounds.”

Sadly her father passed away last year and Sara and her brother have taken over his business. They are currently fitting out 10 apartments in Beirut, but Sara says, “The economy in Lebanon has crashed really badly. Here in Beirut, it is hard to sell anything in the current climate as property prices have dropped by 50%. It is the worst financial crisis since the 1800s and generally people are renting and biding their time until prices change. On a happier note though, as it’s summer, Beirut is buzzing with lots of tourists, which is great because they certainly need money pumped into the economy at the moment.”

Sara presented A Place in Sun, A Place in the Sun – Winter Sun and A Place in the Sun – Home or Away for three years, which she thoroughly enjoyed. “I had a wonderful time and travelled to some great places and it fitted perfectly with my love for presenting and my bug for travel!” She then needed a well-earned rest and enjoyed having some time off. She bought an apartment in Catford, south east London, which she renovated and now rents out. She also studied yoga nidra and iRest which is a form of meditation and can help with post-traumatic stress disorder.

She said, “It was a very interesting and fulfilling time. I then worked on Coast v Country for Channel 4, which was great fun and after that I was offered my presenting role back on A Place in the Sun. In 2018 I became pregnant with my first son and took a little time off, but I was soon back working. I remember going to Italy to film during the pandemic and taking the baby with me – looking back I wonder what I was thinking of!” Sara then became pregnant with her second son, which was a complete surprise, but she is now back filming and has recently travelled to Portugal, France

and Italy. She said, “When I returned to filming it was so lovely to meet up and have a reunion as many of the crew are still working there.”

She now lives in London with her family and rents out her flat. She said, “I have had some real problems though – I had somebody who rented it from me and just suddenly decided not to pay the rent! I had to go to court and won the case but thank goodness I had insurance cover as I got all the money back and more as he had to pay me extra. So my advice would be to any landlord to get insurance as it is essential.”

Sara also has some excellent advice for first time buyers and said, “Do not overstretch yourself, especially as interest rates have gone up. Life goes on and you have to live and there is nothing worse than being stressed and anxious if you can’t pay the bills. So, before you take the plunge, work out your finances to ensure you can afford everything from the mortgage to the bills and running costs.

"You should buy a property that you feel you will be happy with in five or eight years' time! Moving home is costly so you should consider if the property would be big enough in the future for say, a growing family? It is also sometimes a good idea to look at areas you don’t particularly like. There is so much regeneration going on that areas which might seem run-down now suddenly are on the up. When I bought in Catford it wasn’t very trendy but now it is. Places like Ladywell, Lewisham, Tooting and Balham are now extremely soughtafter too. Transport links are also very important, especially if you are commuting. Check out what trains and underground stations are nearby. For example, the new Elizabeth Line has made such a huge difference to anyone commuting. New shopping centres are also a great indicator and consider what is important to you, is it shops, schools, green space?

There certainly never seems a dull moment in Sara’s very exciting life, and she is full of enthusiasm. “I’m so enjoying filming A Place in the Sun and of course my two boys are very special. I think I’ve got the ideal scenario at the moment as I still travel but I also have a wonderful family life – it can’t get much better than that.”

A Place in the Sun is on Channel 4

THE VIEW 20 First Time Buyer October/November 2023

"WHEN I RETURNED TO FILMING IT WAS SO LOVELY TO MEET UP AND HAVE A REUNION AS MANY OF THE CREW ARE STILL WORKING THERE"

THE VIEW First Time Buyer October/November 2023 21

"BEFORE YOU TAKE THE PLUNGE, WORK OUT YOUR FINANCES TO ENSURE YOU CAN AFFORD EVERYTHING FROM THE MORTGAGE TO THE BILLS AND RUNNING COSTS"

SECURE YOUR FUTURE

As a first time buyer, you want to be confident that you’re spending your money in the right place. If that feels like a huge responsibility, spare a thought for Jamie MacArthur, Bellway London’s Regional Planning Director, whose job involves spotting up-and-coming areas for the company and overseeing millions of pounds worth of land deals every year! Bellway London (bellwaylondon.co.uk) is currently involved in regeneration projects on brownfield sites right across the capital, creating contemporary apartment developments.

Of course, you don’t get that level of responsibility without a great deal of knowledge and experience, so we are grateful for the inside scoop. Jamie says, “It might seem as though you need a crystal ball to predict this kind of trend. It is something of a skill, but there are some practical considerations that will guide you towards locations that are full of possibilities.”

Buying in an up-and-coming area is a great way for first time buyers to both stretch their budget and maximise future returns. Jamie advises, “Getting in on the ground floor with your first property purchase can set you up for growth in the years ahead. A bit of homework at the start of your property journey will pay dividends later.”

With that in mind, Jamie has shared five top tips on what to look out for and why:

New job opportunities are coming in – “If major firms are opening offices, a business park is being built or supermarkets are investing in a big new store, take note. Jobs bring in people with money to spend and that leads to growing property prices and a thriving neighbourhood.”

Retail outlets don’t stay empty for long –

“Just as rows of empty dilapidated shops tell a story of decline, the opposite is also significant. If chain stores and independent outlets are keen to snap up retail space when it becomes available, it bodes well. National chains will only invest if they are confident of getting a return and they don’t do so lightly. So, take advantage of their hard work and research, and check out where major stores are choosing to open up.”

Transport options are expanding – “If a location is getting new transport options, that mean you can quickly and easily get to the more in-demand areas – such as central London – that location is suddenly more appealing. My top tip here is to widen your perspective. Don’t just look at the rail and tube services, check out expansions in bus services and cycle routes as well as any major improvements to the road infrastructure.”

New places to learn are opening – “If you find universities are expanding and the number of schools and colleges is increasing, that tells you that the demographic is changing, and more people are expected to come in and use those facilities. And a well-educated and skilled population is likely to attract important employers to the area.”

It has a good and improving reputation –“Never underestimate local knowledge. Find out what kind of reputation the area has and whether that is changing and developing. By all means, start with an online search, but there is no substitute for getting out there in person. Walk around, get chatting to the locals and get a feel for the place.”

That last tip is key. You may have been told that when you find your new home, you’ll "just know". That gut feeling goes for the area too, and what suits one person or family, won’t suit another. Online research will only get you so far – there really is a lot to be said for experiencing a new area first-hand, so when visiting a potential new home, try to build in extra time to pop in to the local shops and go for lunch. If you can, explore the local transport options too.

If you’re looking at a new development, talk to people already living there to get a feel for who your neighbours will be, or ask the sales team about the current demographic. New builds tend to have a particularly strong community feel, as people are generally moving in around the same time and are often at a similar stage of life.

Ultimately, buying your first home is likely to be the biggest investment you’ll ever make and while buying in a popular, established area may feel like the safe option, actively looking for up-and-coming areas is likely to secure you a home with more space in the short-term and a better return in the long run, when you find your "up-and-coming" home has in fact arrived!

UP-AND-COMING 22 First Time Buyer October/November 2023

Developers are forever telling us that areas are "up-and-coming", but how can they be so sure? Debbie Clark looks at how housebuilders choose their next development locations, and what giveaways you can look out for to satisfy yourself that an area is indeed on the up!

HOMES AROUND THE COUNTRY

FARNHAM, SURREY SO Resi Farnham

SO Resi Farnham is an exciting new collection of one and two bedroom shared ownership homes. Features include high-specification interiors, contemporary kitchens with integrated technology and appliances, and an allocated parking space for each apartment. Brightwells Yard, a shopping centre with a six-screen cinema, is right on the doorstep. The development is within walking distance of the town centre and Farnham station, with regular services to London Waterloo taking just one hour. So Resi Farnham also falls within the catchment area for several Outstanding Ofsted-rated primary and secondary schools.

soresi.co.uk/find-a-property/so-resi-farnham

THAMESMEAD

Southmere

Peabody’s new collection of one, two and three bedroom shared ownership apartments has launched at Southmere. Set in a vibrant lakeside setting, the properties benefit from a new public square and civic building including a library, a fitness studio and a cafe, with other commercial and community spaces to follow. Abbey Wood is within walking distance and has excellent links to the heart of the city – the Elizabeth Line will take you to Canary Wharf in 11 minutes and to Stratford or Liverpool Street in less than 20.

peabodynewhomes.co.uk/developments/southmere

020 3369 2170

ESHER

Luna Place

FROM £69,375* FROM £113,750* FROM £360,000

Register your interest for this new development, due spring 2024. Comprising 25 one and two bedroom apartments, Luna Place will be arranged over two apartment buildings with lift access. Located minutes from Esher High Street and railway station, which offers services to London Waterloo in 22 minutes, the gated development has a prime location by Sandown Park Racecourse. Each home will have private parking with an EV charging point, and some will have private patios and Juliet balconies. A communal wildflower garden will be accessible for all residents to enjoy.

chanceryhomes.co.uk/luna-place

020 8481 7588

First time buyer Kuriakose, an electrical engineer, has found his ideal home with his family in Rugby. Kuriakose, 37, and his wife Rintu moved into their brand new property at Barratt Homes’ Ashlawn Gardens development in March, along with their two children.

Kuriakose says, “My family is very important to me, so finding a home we would all be happy with was my top priority. We all love it here, and coming home after a hard day at work to a house of my own, with my wife and children, is a wonderful feeling.”

Ashlawn Gardens is a fast-growing community where residents can enjoy plenty of green open spaces, while also benefiting from excellent commuter links. The quaint town of Dunchurch is on the doorstep and Rugby town centre is less than two miles away.

This convenient location suited the family’s needs. Kuriakose says, “Ashlawn Gardens is perfectly located as well, and this makes our commutes to work very easy. I have a four-year-old daughter and a one-year-old son, so having great schools for all ages close by was a huge selling point. It seems like a great place to lay down some roots.”

The family have settled seamlessly into their new home. “It feels great to finally be on the property ladder after renting for so long, and Barratt Homes has been very helpful all through that process,” reflects Kuriakose.

So far, the family haven’t met many neighbours as they were among the first to move in, but Kuriakose says they are “very much looking forward to welcoming more people to the community” in the coming weeks.

UP-AND-COMING First Time Buyer October/November 2023 23 CASE STUDY

*Based on a 25% share of the full market value of £277,500

*Based on a 25% share of the full market value of £455,000

CROWBOROUGH, EAST SUSSEX

The Brambles

FROM £315,000

Millwood Designer Homes has launched the first seven of 26 properties off-plan at The Brambles – a premium collection of homes ranging from two bedroom apartments to four bedroom houses. The development benefits from a tranquil rural backdrop of mature woodland, and offers easy access to a selection of country walks. Walshes Country Park is just 1.5 miles away, and the nearby Ashdown Forest – inspiration for AA Milne’s Winnie-thePooh – can be reached in under 20 minutes by road. Crowborough station is within easy walking distance, providing a direct regular service to London Bridge in just over one hour and London Victoria in 75 minutes.

millwooddesignerhomes.co.uk

01892 646 440

ROYAL WHARF, NEWHAM

East River Wharf

FROM £96,875*

Ultra-modern one, two and three bedroom apartments are on offer at Legal & General Affordable Homes’ new development. Each home has a private balcony and plenty of space to work from home. Residents will also benefit from a wide range of amenities including a spa, fitness studio, residents’ gym, 24-hour concierge and security services. The Sky Lounge – a 16th floor space in the development that is perfect to meet, collaborate and socialise while taking in the spectacular views of the city skyline and the River Thames – is also accessible to residents. The development is a short walk to both West Silvertown DLR and Pontoon Docks stations which makes it perfect for connections, while the C3 cycleway will take you all the way to Westminster.

east-river-wharf.co.uk

020 4587 2319

FROM £190,000

BIRMINGHAM Belgrade Village

Wavensmere Homes, in partnership with Galliard Homes and Apsley House Capital, is delivering central Birmingham’s first EPC B-Rated houses (eligible for green mortgages), boasting air source heat pumps, natural ventilation, low energy appliances and EV car charging points, to enable occupiers to lower their carbon footprint and household bills. The development also offers abundant green outside space and, once complete, residents will have access to a gym, co-working space, screening room, and concierge service. All 174 two, three and four bedroom houses are sold with a parking space, and buyers have the opportunity to buy parking with the 238 one and two bedroom apartments.

belgravevillage.co.uk

0121 212 0800

Young couple Lauren, 21, and Callum, 24, have just secured their first home – a two bedroom Abbott style apartment – at the Glenvale Park development in Wellingborough.

Lauren and Callum, a service adviser and technician respectively, were previously living with parents but wanted their own space. Lauren says, “We really wanted to start living together, so began saving up for a home. We chose a new build apartment as it’s a perfect starter home, and didn’t want something too big or too small so the Abbott was ideal. We love the open-plan kitchen/ living/dining area that makes the home both cosy and roomy.”

The couple found the move effortless. Lauren says, “Our moving experience with Barratt Homes was amazing. From us viewing the property to moving in was only six weeks! It was easy and painless, and the team helped us every step of the way.”

Glenvale Park is a thriving new community set among 200 acres of green parkland, with planned amenities including sports pitches, a large play area and shops, in addition to a community centre and a primary school. The development offers easy access to major roads, and London is just under an hour away by train.

Lauren explains, “We chose Glenvale Park as the development was within our price range, it has an excellent location with a railway station close by and a lot of open space and paths to walk around. We really like the local area, there are lots of great amenities nearby including a pub and a supermarket.”

The couple have settled right in and are excited to meet the neighbours. “The new community really feels amazing,” says Lauren. “There is a Facebook group so we are able to chat with others in the area, which has been very helpful. It’s really feels like a community rather than a development!”

UP-AND-COMING 24 First Time Buyer October/November 2023 CASE STUDY

*Based on a 25% share of the full market value of £387,500

FROM £80,000*

FROM £322,500 FROM £189,000*

MOULSECOOMB, EAST SUSSEX

Home X

Situated between the South Downs and the sea, Home X comprises a collection of 318 studio, one, two and three bedroom apartments; part of Brighton’s Preston Barracks regeneration. These high-quality new homes, with energyefficient EPC B ratings, offer communal gardens and open green spaces. Facilities include flexible work and collaboration spaces on-site and at nearby Plus X. All residents also receive two years' free membership with Enterprise Car Club (with cars available at Home X) and a choice between either a 12-month NetworkSAVER ticket, providing unlimited travel on all Brighton and Hove buses, or a £150 bike voucher or 12-month BTN Bikeshare membership.

home-x.co.uk

01273 068 032

*Based on a 25% share of the full market value of £320,000

FROM £183,995

HAINE, RAMSGATE Spit re Green

Barratt Homes is offering one, two and three bedroom homes here. The development is surrounded by green open space with planned wildlife areas and a play park, and is just three miles from the Kent coast. Discount Market Sale (DMS) apartments are available here for those who live and work in Thanet. Thanet Parkway railway station is now open, with high-speed services to Ashford and London.

barratthomes.co.uk/new-homes/dev001134-spit re-green 0330 057 2452

*For a DMS apartment

CASE STUDY

Chris, 31, has just purchased a one bedroom apartment for £315,000 at Starling Court, Southmere, after living with his parents for three years to save for a deposit. Dartford local Chris, an architect, was eager to get on to the property ladder close to his family home in south east London and, unsurprisingly given his profession, design was key!

HYTHE, KENT

Martello Lakes

This seaside development comprises one and two bedroom apartments, a five-minute walk from Hythe beach. Homes are energy efficient and the development has an on-site sailing and fishing lake, with tennis, fishing and cricket clubs nearby. Incentives are available.

barratthomes.co.uk/new-homes/dev000521martello-lakes

0330 057 2452

WHITSTABLE Whitstable Heights

Whitstable Heights, located just a seven-minute drive from the seafront, forms part of the newly proposed “Garden City” in the seaside town. The development offers two, three and four bedroom homes, with captivating views over Whitstable Bay and the Kent coastline. Each home has been built to a high specification as standard, with contemporary kitchens and integrated appliances, turfed gardens and quality flooring included at no additional cost.

hydenewhomes.co.uk/whitstable-heights 0808 208 5151

Chris recalls his first viewing of the lakeside Peabody development: “I went straight down to the marketing suite and had a look at the model and show apartment. As an architect, I was immediately impressed by the design and layout of the apartments at Southmere. One of the biggest attractions for me was the large balcony, which is more than twice the size it would typically be. The balcony is also inset, which means I can use it all year round. The development also offered an opportunity to get a great view of the city, looking west for evening sunsets, and being high up means I have an amazing view.”

Southmere, the first phase of Peabody’s ambitious redevelopment of the iconic Thamesmead area, has transformed the area into a dynamic and exciting new town for the capital. The neighbourhood offers over 240 hectares of parks and green space, five lakes, and seven kilometres of canals – a lure for Chris, who says, “I was immediately drawn to the lake and multiple parks, which I know is so rare to have on your doorstep in London, especially in a new development. As a keen runner, the prospect of running around the lake and Lesnes Abbey ruins was also a key selling point.”

Chris has quickly made his new apartment home and is already making the most of the quicker commute into central London now the Elizabeth Line has opened at nearby Abbey Wood station. He reflects, “I am excited to finish furnishing my apartment and watch the neighbourhood continue to thrive and grow. As the new public square comes to life with restaurants, shops and events, and the new facilities on the lake are delivered, I look forward to enjoying living in Southmere as much as I already do.”

UP-AND-COMING 26 First Time Buyer October/November 2023

RENT – SAVE – BUY!

Network Homes is passionate about helping first time buyers and is offering London Living Rent at some of its developments, which is the ideal way to save and buy.

HOW IT WORKS

Funded by the Mayor of London, the idea behind London Living Rent is to help people switch from renting to shared ownership. It is designed for people who want to build up their savings to eventually buy a home through shared ownership.

London Living Rent offers affordable homes for private rent on shorthold tenancies for three to 10 years.

SIMPLY:

9 Find a London Living Rent home that suits you and your needs

9 Rent the home at a discount

9 Save the discount for your deposit

9 Buy shares in your home through shared ownership.

Discounted rental contracts can be renewed, if needed, for up to 10 years after the launch of each scheme, during which time you will be able to gradually build up your deposit.

When you’re ready, you have the option to buy the home you’ve been renting (or another eligible Network Homes property) on a shared ownership basis. The good news is that when you buy is flexible and Network Homes will support you to save during your rental stay, so you can buy at your own pace.

ANY QUESTIONS?

DO I QUALIFY FOR LONDON LIVING RENT?

To qualify for London Living Rent you must meet the following criteria:

9 Your annual household income must not exceed £60,000

9 You must live or work in London

9 You must not own a residential property in the UK or overseas

9 You must meet the minimum income required for your preferred property

9 You must be unable to buy a home, including shared ownership, in the local area

9 You must meet lenders' general criteria to obtain mortgage finance. The full eligibility criteria and priority policy for a particular development can be found on the advertised listing.

CAN I MOVE TO AN ALTERNATIVE LONDON LIVING RENT APARTMENT ONCE MY TERM ENDS?

You can’t move to an alternative if you’ve completed the stated London Living Rent term (usually three to 10 years).

MUST I SAVE A MINIMUM AMOUNT EACH MONTH?

You are the best judge of what amount is affordable for you to save each month. By renting through London Living Rent you benefit from a below-market rent so you will have the ability to save based on the minimum income requirement for your London Living Rent

home. The more you save the quicker you will raise the deposit required to buy your first home.

MUST I DEPOSIT ANY SAVINGS WITH YOU?

No. You will need to deposit and manage your savings with your bank.

HOW SOON AFTER MOVING INTO MY LONDON LIVING RENT APARTMENT CAN I PURCHASE MY FIRST SHARE?

You can buy the first share after six months as long as you have the deposit and income to meet the repayment obligations.

MUST I BUY THE APARTMENT I AM LIVING IN?

No, as a London Living Rent resident you will be considered a priority applicant (along with other housing association and council tenants) for shared ownership apartments across London.

LONDON LIVING RENT 28 First Time Buyer October/November 2023

Saving for that all-important deposit is becoming more and more of a problem for so many first time buyers who are very keen to get on to the property ladder. But London Living Rent could be the answer to help you eventually buy your first dream home

It was a happy ever after story for Hamid Sahil, whose inspiring story will give many first time buyers an incentive to use London Living Rent as a way to buy their dream home.

Hamid Sahil lives with his family in Network Homes’ Acton Works development in Park Royal. He was already a resident of the housing association and moved into his London Living Rent apartment back in October 2021.

London Living Rent is a Greater London Authority scheme that allows people to rent their apartment for a discount and save for a deposit to buy shares in their home on a shared ownership basis. It’s specially designed for middle income Londoners who are struggling to get into the housing market or trapped in expensive private rentals.

Network Homes has been offering homes for London Living Rent since 2018. It was one of the first housing associations to offer the tenure, launching its flagship purpose-built development in Harrow on the Hill. Since then, the organisation has delivered 230 homes for London Living Rent with a further 121 under construction.

What’s so great about the scheme is that you don’t have to buy into the home you live in, but you can use it to save in order to purchase elsewhere. So far 12 residents have now purchased, or part-bought, with three buying a share of their current home and nine buying elsewhere. Five sales are currently in the process of going through.

Before discovering London Living Rent, Hamid and his wife were living in a one bedroom flat, but when she became pregnant, they knew they needed a bigger home for their growing family. Hamid says, “I wasn’t aware of London Living Rent, and I was telling Network Homes staff about my situation and that my wife was expecting a baby and they said there was a scheme that might suit our needs. They were very helpful, giving us a lot of information and navigating us through the website.”

Hamid was impressed by the London Living Rent scheme and the opportunities it provided to pay lower rent, save for a deposit and make

the first steps on the property ladder. So he bit the bullet and completed the application. He said, “One of the biggest reasons that I applied for London Living Rent is that living in London makes it almost impossible to accumulate any type of savings in order to buy your own place. It can be a struggle even to pay your bills, especially with the current cost-of-living crisis and high inflation rate. I think schemes like this are a wonderful opportunity to pay lower rent than you would normally pay in London and at the same time, save that money towards your mortgage or towards buying a place.”

Hamid believes passionately that London Living Rent offers the solution to so many Londoners who are paying high rents in the private rented sector and who might feel homeownership is a distant dream. Particularly as London Living Rent is around 60% of private market rents.

“I think there are a lot of people who are not aware of the London Living Rent scheme who would benefit, like young and medium-sized families. I’d say to them that this scheme is what you want to apply for. This is a life changer. It is almost unreal.”

Location is key, and Hamid was able to find that perfect location with Network Homes’ Acton Works development close to work and great transport links. He added, “It’s very close to where I work which is next door at Central Middlesex Hospital as my job is in pharmaceuticals. So, there’s easy access to work, easy access to central London along with other places. But more importantly, we’ve got a nursery nearby for my little one. Having a two bedroom apartment is much more spacious and it’s modern. There’s a great community here and our neighbours are wonderful people. I would like to say thank you to Network Homes who have been excellent and given us great service. And finally, wonderful. It’s been a wonderful opportunity.”

Network Homes is offering one, two and three bedroom homes at Chailey Place, Hayes, in west London for London Living Rent with monthly rent ranging from £915 to £1,118 per calendar month. Find out more at networkhomes.org.uk

LONDON LIVING RENT First Time Buyer October/November 2023 29

CASE STUDY

CAN THE FIRST TIME BUYER MARKET STAY RESILIENT THIS WINTER?

It has been nothing short of a rocky ride for first time buyers in 2023, with unstable house prices, a cost-of-living crisis and rising mortgage rates. However, there are some signs that the first time buyer market has resisted these pushbacks and that aspiring homeowners can get on to the property ladder over the cooler months, says Kevin

Sims, Director of Sales and Marketing at SO Resi

As we now look towards a cool winter market, we are seeing some positive signs of how the 2024 housing market may look, and the delivery of affordable housing will be the key for many first time buyers to get on to the all-important property ladder.

Summer data from Halifax revealed that despite a drop in house prices in 2023, the first time buyer market stayed more or less resilient¹. As more and more buyers look ahead to the winter and start making plans for moving in the new year, many are questioning whether they can get on to the property ladder amid high, albeit falling, mortgage rates. As the country’s leading shared ownership provider, SO Resi’s aim is to allow all types of buyers to take a step on to the property ladder, and support those with the long-term goal of staircasing to 100%.

Although mortgage costs are one of the biggest obstacles in getting on to the property ladder, another challenge for first time buyers is saving up enough for a deposit. Despite popular belief, first time buyers do not struggle to save up

for a deposit because of “iced lattes” and “avocado on toast”, it is largely due to the rising costs of everyday items and getting stuck in the rental trap. This is a big benefit of shared ownership, as deposits can be as low as 5% of the share they are buying, rather than the full price of the property.

Over the summer, we invited buyers to view our 17 new one and two bedroom apartments available at SO Resi Whetstone, which is a good example of starter homes in the London market. Buyers here only need to put down a £5,000 deposit for a one bedroom apartment (5% deposit of 25% share valued at £100,000, full value £400,000), compared with staggering data from Yahoo Finance, finding that the average London property requires a £144,550 deposit²

We also understand that a big obstacle in saving for a deposit is being stuck in the rental trap. Rents this year have hit a new record high and are now a third more than pre-pandemic³. We have recently launched our brand new development, SO Flexi Slough, venturing into the Rent to Buy market for the first time. All homes

here are available to rent on a two-year fixed contract, with monthly rent capped at 80% below local market values and prices starting at £880 per month for a one bedroom apartment. To help combat the rental trap and to go that one step further in our affordable housing offering, tenants will be encouraged to use the savings from the discounted rent in order to save up a 5% deposit, in order to purchase the property using shared ownership at the end of the rental term.

With a slightly more optimistic outlook for next year and the first time buyer market performing arguably more positively than expected in 2023, the next generation of first time buyers are set for a second chance to ride out a political storm, build up some savings, and purchase their home when the time is right.

1 news.sky.com/story/house-prices-continue-to-fall-butmarket-showing-resilience-12935270

2 zoopla.co.uk/discover/property-news/whats-theaverage-first-time-buyer-deposit-by-region/ 3 rightmove.co.uk/news/rental-price-tracker/

SO Flexi Slough: A selection of one and two bedroom apartments recently launched in August. All of the homes are available on the Rent to Buy scheme, with monthly rents starting from £880 and no service charge to be paid.

soresi.co.uk/soflexi/slough/

SO Resi Hendon Waterside: An array of 42 studio, one and two bedroom apartments, and two and three bedroom duplex homes all available with shared ownership and launching in autumn 2023.

soresi.co.uk/find-a-property/hendon-waterside/

SO Resi Whetstone, Barnet: Perfectly positioned in the leafy borough of Barnet with a range of amenities, SO Resi Whetstone is now available for all to view. With a mixture of one and two bedroom apartments available, all coming with spacious balconies, just seven remain, starting from £100,000 for a 25% share. soresi.co.uk/find-a-property/so-resi-whetstone/

SHARED OWNERSHIP 30 First Time Buyer October/November 2023

SOWN: YOUR DREAM HOME MAY SURPRISE YOU

Do you dream of buying your first home? A place you can finally put your stamp on? Somewhere you can proudly show your family and friends… some day?

What if that dream home didn’t need to wait? With shared ownership, getting on the property ladder could be easier than you expected.

Shared ownership allows you to buy a share in a property and rent the remaining part. You don’t need a large deposit (which means you can buy your first home sooner) and over time, you can “staircase” up to full ownership by buying more shares. Unlike the traditional housing market, shared ownership gives you more flexibility in securing the right home for your needs.

How do you get started with shared ownership? Enter SOWN, a dedicated team of shared ownership experts. Recently launched under a new name, our brand is rooted in experience and expertise. Formerly known as Leaders and Romans Shared Ownership, in the past five years we’ve helped over 2,000 households to get on the property ladder – sowing the seeds of new beginnings.

We have the same knowledgeable team in place, but we’re taking a more innovative approach. As SOWN, we’re on a mission to bust the myths that surround shared ownership and provide the advice that first time buyers need to find a home that’s right for them.

What’s even handier is that first time buyers can get help with everything they need. As part of the wider Leaders Romans Group, we can provide you with access to surveyors, legal services and our specialist mortgage adviser, Mortgage Scout. We’ll be there for you throughout the journey until that dream of picking up the keys to your first home becomes a reality. (And if you decide to sell later down the line, we can help you with that too!).

So, where’s home? At SOWN, we have a wide range of properties on our books, located across the country.

PROPERTY SPOTLIGHT

One current exciting scheme is Clarendon on Hornsey High Street. Clarendon is an extremely popular development of 1,700 homes on a 12-acre plot in the heart of north London. As a “cultural quarter”, Clarendon will include beautifully landscaped gardens, as well as extensive

business, retail, and community spaces. It will include a central boulevard to significantly improve connectivity between the surrounding neighbourhoods of Hornsey, Wood Green and Alexandra Park, which offer a variety of transport connections.

Another popular scheme is Heart of Hale, developed by Sage Housing Association and located just moments from Tottenham Hale station. Designed by the award-winning architects at Pollard Thomas Edwards, these intelligently designed homes have everything you could want within walking distance. They’re

based around modern stylish piazzas filled with cafes, shops, bars, gyms, and an Everyman cinema.

Join the like-minded community of thousands of people who have chosen shared ownership to unlock beautiful and well-connected homes across the country. If your household income is under £80,000 (£90,000 in London), shared ownership could be the right move for you.

Visit sownso.co.uk to view the wide range of shared ownership properties on the market. We won’t be surprised if you find your dream home there!

AFFORDABLE HOMES 32 First Time Buyer October/November 2023

NEED A HELPING HAND BUYING YOUR FIRST DREAM HOME?

charged on an increasing sum; most lifetime mortgages have a fixed interest rate.

USING PROPERTY AS SECURITY

A parent or family member can offer equity, usually up to 20% of the value of the property you are buying, by agreeing to a legal charge on their own property as security. This means their property cannot be sold until it’s repaid. Once again, this will help to reduce monthly payments by accessing a lower interest rate and it could enable you to buy a bigger home now and avoid moving again later.

NOT-TO-BE-MISSED TAX SAVINGS

BANK OF MUM AND DAD TO HELP GET YOU MOVING

Buying your first home can sometimes feel like an unattainable goal. The search for a property within budget is challenging, it takes a long time to save and many buyers are faced with the prospect of flying the nest later than anticipated. This was how the future appeared to be shaping up for Emily Lyle, who couldn’t have bought her first home without the help of her mother who topped up her deposit. Emily recently moved into her luxurious two bedroom, third floor apartment at The Venue, Hayes by Weston Homes.

Asking parents to contribute towards a deposit means you can borrow less, have a lower loan to value (LTV) and in turn access a lower interest rate. Taking out a longerterm mortgage between 35 and 40 years will also make repayments more affordable –these terms can be reduced later if you can afford higher monthly repayments or the interest rates come down.

INTEREST-EARNING GIFTS SWEETEN THE DEAL

A growing number of lenders are giving family members the option to deposit cash up to 20% of the purchase price to act as

a deposit in a savings account which pays interest. Savings can also be gifted in an offset mortgage account where interest is paid on the difference between the total value of the mortgage and the savings in the account at any one time, so the bigger the gift the lower the repayment.

GET A GENERATIONAL INCOME BOOSTER

Income Boosters offered by some lenders including “Generation Home” allow you to have up to six family members as your Income Booster. The “boosters” can choose to contribute an amount each month or be responsible for the mortgage payments if they are missed. This can help maximise the amount of lending available to you. Visit generation.com for details.

CONSIDER A LIFETIME LIFELINE