Obaseki, Oborevwori, Yahaya, Ododo, Others Felicitate Christians at Easter

Chuks Okocha in Abuja

Motivated by the outcome of the recent presidential election in Senegal, which produced 44-year-old Bassirou Diomaye Faye as president of that country, former Vice President Atiku Abubakar, has called on opposition political parties in Nigeria to learn from

Kayode Tokede At 39.84 per cent year-till-date (YtD) gain, the Nigerian stock market, in the first quarter of 2024, offered investors the second best return in Africa on the back of the economic reforms embarked upon by the President Bola Tinubu administration. The Nigerian stock market, in the period under consideration, according to available data, came ahead of other exchanges, excluding the Zimbabwe Stock Exchange (ZSE) All Share Index, which had about 314.19 per cent YtD growth. The gain in the NGX All-Share Index (NGX ASI) came, despite rising insecurity, double-digit inflation rate, a recent rise to 24.75 per cent www.thisdaylive.com TRUTH & REASON Continued on page 5 Monday, April 1, 2024 Vol 29. No 10582. Price: N400 Remi Tinubu: Getting Nigeria Back on Track is Responsibility of All... Page 5 Continued on page 5 Chuks Okocha, Sunday Aborisade in Abuja, Segun Awofadeji in Gombe, Sylvester Idowu in Warri, Ibrahim Oyewale in Lokoja and Hammed Shittu in Ilorin At 39.84%, Nigeria’s Stock Market Offers Near Best Investors’ Return in Africa Continued on page 5 Says outcome gives hope to future of constitutional democracy Inspired By Senegalese Election, Atiku Rallies Opposition to Form Coalition Monetary Policy Rate (MPR) from the earlier 22.75 per cent, among other macroeconomic SENEGAL'S PRESIDENT HONOURS SAMAILA ZUBAIRU... President/CEO, Africa Finance Corporation, Samaila

Dalhat Zubairu, being decorated with Senegal's national honour by President of Senegal, Macky Sall in Dakar at the weekend

L-R: Music, Altar Servers and Readers, Cathedral Church of Christ Marina, Lagos, Ven. Uchenna Ubadinobi; Provost, Very Revd. Dr. Adebola Ojofeitimi; Diocesan Bishop of Lagos, The Rt Revd. Ifedola Senasu Gabriel Okupevi; his wife, Modupe; Canon Resident (CR), Ven. Henry Adelagan; Care Ministry, Revd. Canon Adekunle Dina; Youth/Confirmation Class, Revd. Henry Moah; and People's Warden, Prince Dapo Opeaye, during the 2024 Easter Celebration Church Service at Cathedral Church of Christ Marina, Lagos...yesterday KOLAWOLE ALLI

the exercise and form a coalition ahead of the 2027 general election.

opposition political parties to unite into

strong

the case in

when the opposition

Congratulating the Senegalese president-elect, Atiku said one of the ways to remove APC from office was for

a

coalition, as was

2015,

MONDAY APRIL 1, 2024 • THISDAY 2

MONDAY APRIL 1, 2024 • THISDAY 3

MONDAY APRIL 1, 2024 • THISDAY 4

Remi Tinubu: Getting Nigeria Back on Track is Responsibility of All

Says result of her husband’s programmes are beginning to show

Deji Elumoye in Abuja

Wife of the president, Senator Oluremi Tinubu, has declared that the task of getting Nigeria back on track is a collective responsibility.

Speaking at the weekend at an Iftar she hosted at State House, Abuja, the first lady expressed optimism that the country will be greater. She stated, “Mr. President will do all it takes to make the nation better, that even when we leave here, we will go back to a better Nigeria. “We all have tasks to do to get this nation back on track.”

were on track, and the results were beginning to show.

Mrs Tinubu noted that the various programmes being implemented by the president

Earlier in her remarks, the wife of the vice president, Nana Shettima, urged women to be one another’s keeper. She pointed out that governance was a collective responsibility and urged women to remember the country in their prayers,

especially in these last 10 days of Ramadan.

On her part, the guest lecturer, Professor Rafatu Abdul’Hammed of the University of Abuja, advised women not to forget all they learnt during the Ramadan, saying they should continue in that line.

According to her, living in love, piety, humility and

tolerance will enhance the lives of Nigerians.

Prayers were thereafter offered for the country, President Bola Tinubu, and the world.

Those that attended the Iftar included former first ladies, female justices, wives of governors, female ministers, wives of ministers, and wives of service chiefs.

AT 39.84%, NIGERIA’S STOCK MARKET OFFERS NEAR BEST INVESTORS’ RETURN IN AFRICA

challenges.

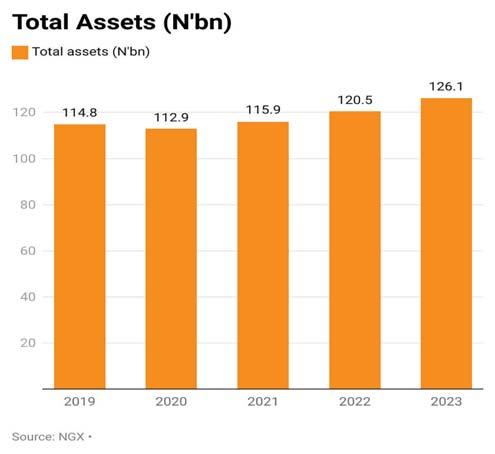

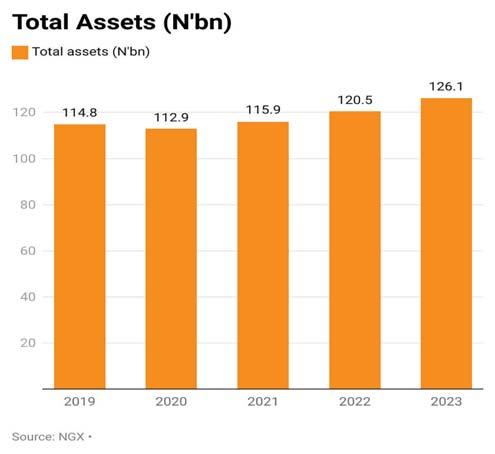

Specifically, the NGX ASI, an indicator used to measure the performance of listed firms on the exchange, opened the year at 74,773.77 basis points, implying an increase of 39.84 per cent, to close March 28, 2024 at 104,562.06 basis points.

In Q1, 2023, the overall market performance measured by NGX ASI rose by 5.11 per cent to close at 54,232.34 basis points.

Remi Tinubu

Remi Tinubu

In the period under review, NGX Alternative Securities Market (ASeM) Index gained 135.25 per cent YtD to emerge as the best performing index, followed by NGX Industrial Goods Index, which rose by 78.49 per cent YtD to close Q1, 2024 at 4,28441.20 basis points.

The NGX Banking Index and NGX Insurance Index appreciated by 14.76 per cent and 26.20 per cent YTD, respectively. The NGX

Since the beginning of 2024, the stock market had witnessed an unprecedented rally and increased buying interest, especially in the industrial goods, financial services, and consumer sub-sectors, which continued to trigger massive bargain hunting in large company shares.

Consumer Goods Index also rose by 43.66 per cent YtD to close March 28, 2024 at 1,610.80 basis points.

These pushed the key performance indices and stimulated activities in the market, a development that led to the rating of the stock market as the second bestperforming in Africa, behind the Zimbabwean exchange.

As of the close of trading March 2024, market capitalisation stood at N59.12 trillion, representing an increase of N18.2 trillion or 44.49 per cent from N40.918 trillion it opened for trading this year.

The monthly breakdown of market capitalisation revealed that the stock market in January 2024 gained N14.44 trillion in market capitalisation, while in February, the stock market capitalisation dropped by N650.5 billion, amid corporate earnings by listed companies, as investors divested into the Treasury Bills (T-bills) market.

In addition, the market capitalisation added N4.41 trillion amid mixed corporate earnings by listed companies.

Capital market analysts stated that the stock market performance in Q1, 2024 was against the backdrop of

OBASEKI, OBOREVWORI, YAHAYA, ODODO, OTHERS FELICITATE CHRISTIANS AT EASTER

More Nigerian leaders, yesterday, celebrated the Easter with Christians and advised them to apply the essence of the occasion as lessons for the country.

Edo State Governor, Mr. Godwin Obaseki, urged Christians to reflect on the lessons of Easter celebration, saying they should not lose hope amid the economic headwinds in the country.

Obaseki, in his Easter message in commemoration of the resurrection of Jesus Christ, stated, “I heartily felicitate with our Christian faithful as we commemorate the death and resurrection of our Lord Jesus Christ.

“Easter is a time for reflection, love, sacrifice, renewal and hope. I urge that we use this opportunity to ponder on the lessons and purpose of the celebration and renew our resolve towards achieving a more progressive and prosperous Nigeria.

“As a people, we may have been stretched beyond limits, occasioned by the high cost of living and other economic headwinds, but we must not lose hope. Working together in unity, we can overcome these challenges and place our country on the path of sustainable growth and development.”

Delta State Governor Sheriff Oborevwori also urged Deltans and other Nigerians to show love to one another and be willing to make sacrifices for the greater unity, peace and progress of the country.

Oborevwori, in his Easter message signed by his Chief Press Secretary, Sir Festus Ahon, urged Deltans and Nigerians, in general, to use the Easter season to soberly reflect on what they needed to do as a people in order to guarantee peaceful co-existence, while working towards a better future for all Nigerians.

The statement said, “As Christians, we must reflect on the import of Easter celebrations in our dealings, not only with other Christians, but with people of other faiths and convictions.

“We must eschew bitterness and all forms of violence, because the progress, peace and security of the nation rest squarely on good neighbourliness and peaceful co-existence among Nigerians.”

On his part, Chairman of Northern States Governors'

Forum and Governor of Gombe State, Alhaji Muhammadu Inuwa Yahaya, called for prayers for sustained peace and stability in Gombe State, the northern region, and Nigeria, as a whole.

Yahaya emphasised the significance of unity, brotherhood, and service to God and humanity during and beyond the Easter period.

The governor, who highlighted the essence of Easter as symbolising love, sacrifice, and the triumph of good over evil, urged Christians to reflect on these core principles and integrate them into their daily lives.

He stated, "I extend warm congratulations to our Christian brethren for completing the Lenten Season and celebrating Easter. We are grateful to the Almighty for granting you the strength to go through this significant spiritual journey.

“May the blessings of this period rejuvenate our nation and steer us towards lasting peace, progress and prosperity."

The governor expressed optimism in overcoming prevailing socio-economic and security challenges in the country through collective effort and divine intervention.

Kogi State Governor Usman Ododo urged the people to remain united and resilient in the face of economic challenges.

In a press statement by his Special Adviser on Media, Ismaila Isah, Ododo stated that the promises of renewal and hope associated with Easter would usher in greater prosperity for the people of the state.

He said, "As we gather in families and communities across the state to celebrate Easter, let us dwell on the values of renewal, hope, and unity that define us as citizens of one state.

“Just as the resurrection of Jesus Christ symbolises new beginnings and the triumph of light over darkness, let us embrace the opportunity to renew our commitment to building a brighter future for our beloved state, as exemplified by the Renewed Hope Agenda of President Bola Ahmed Tinubu (GCFR)."

Presidential candidate of Labour Party (LP) in 2023, Peter Obi, celebrated Easter with inmates and admonished them not to feel isolated and finished because, according to him, everyone in Nigeria was in prison and sought the

face of God for freedom and redemption.

In a statement by Chief Spokesman of the Obi/ Datti Presidential Campaign, Dr Yunusa Tanko, said Obi celebrated the Easter mass with prisoners at the Correctional Centre in Onitsha, Anambra State.

He told the prisoners that from the day’s reading, Mary Magdalene, who was the first to discover the resurrected Christ, was once unholy but she was reformed and privileged to discover the rising of Christ even before the Apostles.

"What that means is that being in prison is not the end of life, as they could get corrected and enjoy salvation even before the so-called free people," he said.

During the dancing and praises, Obi discovered a little child of about one year six months, Musochukwu Ejiofor, whose mother was serving in the prison following a N250, 000 business deal that went wrong.

Obi carried the child, who was also in dancing attire like the mother, and celebrated with them and their cultural groups.

Nigerian Southern Senators Forum, in a goodwill message jointly signed by the chairman, Senator Mukhail Adetokunbo Abiru, and the publicity secretary, Senator Asuquo Ekpenyong, said Easter was a time of reflection, renewal, and rejoicing.

The federal lawmakers also commended Tinubu and President of the Senate, Godswill Akpabio, for their efforts at galvanising the country's economy for national development.

They stated, "In the spirit of this joyous occasion, let us embrace the values of unity, compassion, sacrifice and solidarity.

"Let us reach out to our fellow citizens with kindness, understanding, and empathy, especially during these challenging times, while we await the gains of the government's bold reforms and initiatives.

"Let us renew our patriotism and our commitment to building a stronger, more prosperous, and more united Nigeria.”

The senator for Delta Central Senatorial district, Senator Ede Dafinone, called for peace and prayers for victims of Okuama crisis, particularly the families of the dead 17 officers and men of the Nigerian Army and other

civilians, including women and children, as the country marked this year's Easter celebration.

Dafinone said peace was a priceless gift, and appealed for restraint from all actors in the crisis to prevent any further escalation of the violence. He advised that government should allow for an independent and unbiased panel of investigators to probe the incident and bring all the perpetrators to book. Director General of the National Institute for Legislative and Democratic Studies (NILDS), Professor Abubakar Sulaiman, also called on Nigerians to embrace the values of accountability and transparency. Sulaiman said doing so would lead to good governance and genuine development in Nigeria at all levels, adding that the key concepts of accountability and transparency would make democracy thrive further in the country and bring about the aspirations of Nigerians.

Archbishop of Onitsha Catholic Archdiocese, His Grace Valerie Okeke, also celebrated the Easter mass with about 12 other priests inside the Correctional Centre, Onitsha.

Okeke said, in a homily, that if Mary Magdalene could transform to be among the early beneficiaries of Christ’s resurrection, even those in the correctional centre could turn around to be great in the society and before God.

Bishop, Diocese of Kwara, Anglican Communion, Rt. Rev. Sunday Timothy Adewole, urged Nigerians to return their faith on God in order to overcome the various challenges facing the country. Adewole stated this in an interview with newsmen in Ilorin after his Easter message at Cathedral of St. Barnabas, Sabo-Oke, Ilorin, the state capital.

He said, "When the people of the country shift their attention to God, there is no doubt things will work well for us.”

He said the various challenges facing the country, including the economic difficulties, insecurity, and unemployment, would become a thing of the past and the country would move forward if the people returned their focus on God.

He also stressed the need for citizens to sacrifice time, talent, and treasure for the good of the country and humanity, assuring, "Peace will reign supreme across the parts of the country."

mixed corporate earnings by listed companies, the federal government’s reforms in the foreign exchange market, and fuel subsidy removal.

Responding to market performance in Q1, 2024, Vice President, Highcap Securities Limited, Mr. David Adnori, stated that investors traded based on sentiment.

Adnori stated that the emergence of Tinubu as president further energised the stock market, since market participants had confidence in his ability to rejig the economy and implement economy-friendly policies.

Adnori was also optimistic that the stock market might maintain its positive momentum in the second quarter of 2024, against the backdrop of banking sector recapitalisation and expected 2023 corporate earnings by, especially, the banks, first quarter result and accounts for March 31, 2024.

Amid the hike in MPR to 24.75 per cent, capital market experts stated that its impact had created sentiment trading among investors who saw fixed-income market as alternative investment opportunity to hedge against double-digit inflation.

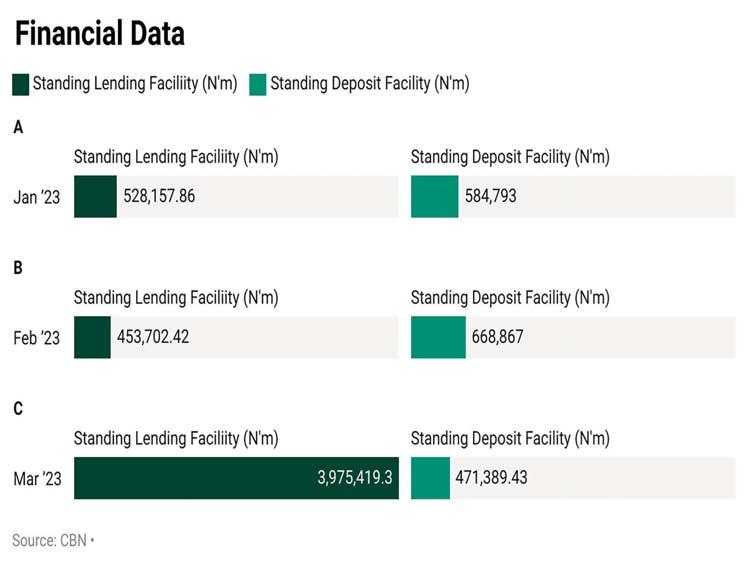

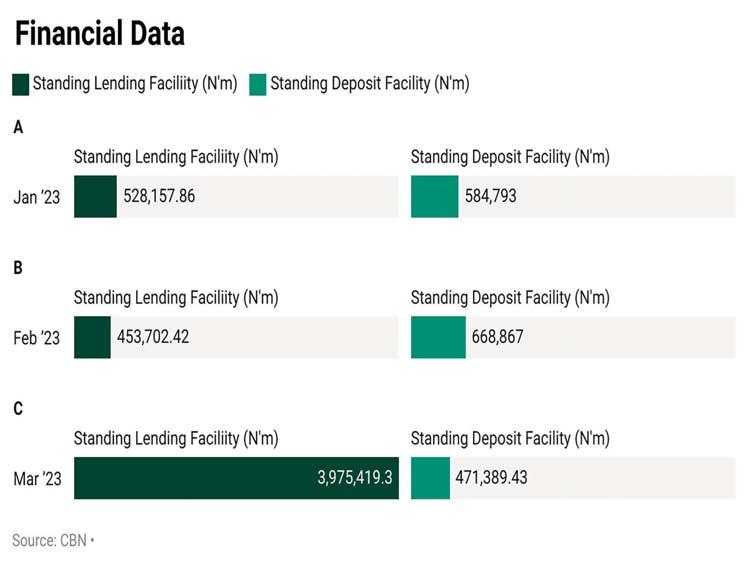

At the second Monetary Policy Committee (MPC) meeting in 2024, Governor of Central Bank of Nigeria (CBN), Olayemi Cardoso,

stated that the committee’s decisions were centred on the current inflationary and exchange rate pressures, projected inflation, and rising inflation expectations.

Cardoso said, “Members were concerned about the persistent rise in the level of inflation and emphasised the committee’s commitment to reverse the trend as the balance of risk leaned towards rising inflation.

“The committee, however, acknowledged the trade-off between the pursuit of output growth and taming inflation, but was convinced that an enduring output expansion is possible only in an environment of low and stable inflation.”

An Investment banker and stockbroker, Mr. Tajudeen Olayinka, stated that the drive by many investors to hedge against inflationary spiral put their buy interests in equity.

Olayinka stated, “And this is demonstrated by simultaneous rise in interest rates and equity prices. Beyond this analogy, economy is still grossly awash with Godwin Emefiele’s N30 trillion illegally printed for the use of former President Muhammadu Buhari’s administration.

“So, there is excess liquidity in the system, chasing fewer profitable investment opportunities in the economy.”

INSPIRED BY SENEGALESE ELECTION, ATIKU RALLIES OPPOSITION TO FORM COALITION

rallied together to remove the Peoples Democratic Party (PDP) from power.

In 2014, the now defunct parties: Action Congress of Nigeria (ACN), All Nigeria Peoples Party (ANPP), and Congress for Progressive Change (CPC), and other smaller political parties formed a coalition that removed the PDP government under President Goodluck Jonathan from office.

Already, Atiku, who was the presidential candidate of PDP in last year’s general election; the Labour Party (LP) presidential election, Peter Obi; and their counterpart from New Nigeria Peoples Party (NNPP), Rabiu Kwankwaso, had been contemplating a coalition to oust APC in 2027.

In a statement highlighting lessons from the Senegalese presidential election, Atiku said, "Against the backdrop of recent military interventions in the West African sub-region, the election of Bassirou Diomaye Faye as Senegal’s President-elect in the election of March 24, 2024 gives hope to the future of constitutional democracy in the region.

"For us in Nigeria and elsewhere, there's a huge lesson to be learnt from the Senegal experience. It is an affirmation that democracy, which is anchored on the supremacy of the ballot, represents the best form of government.

“It is also possible for the electoral umpire to run an election on the basis of the law and its own guidelines that give confidence to all parties and the voters.

“Our experiences in both 2019 and 2023 show clearly that INEC performed below this expectation.

“Whereas in Senegal, the responses of the major actors and the citizens are a validation of the process of the election that voted for President-elect Bassirou Diomaye.”

Atiku added, “It is important to note that last Sunday's election in Senegal follows the trend of that in Nigeria in 2015, that the opposition can, indeed, be victorious in an election conducted by the ruling party.

“And, for the opposition parties, the lessons are in agreement with my persistent call for our opposition parties to forge a coalition that is formidable enough to oust the ruling party if the salvaging of Nigeria is to stand any chance."

The PDP 2023 presidential candidate congratulated the Senegalese president-elect, saying, “President-elect Faye, it is my hope and prayer that your election will not only be hugely beneficial to the people of Senegal but also an inspiration to the rest of us in the West African sub-region."

THISDAY • MONDAY, APRIL 1, 2024 PAGE FIVE

5

EASTER SERVICE AT METHODIST CHURCH OF TRINITY...

L-R: Pro-Presbyter, Methodist Church of the Trinity, Tinubu, Lagos, Very Rev. (Dr.)

FG: N7bn So Far Paid Contractor Handling Carter Bridge in Lagos

Umahi pledges to ramp up work on Ekiti roads

Emmanuel Addeh in Abuja and Gbenga Sodeinde in Ado Ekiti

The Minister of Works, David Umahi, at the weekend stated that the contractor handling the Carter Bridge in Lagos has so far been mobilised to the tune of N7 billion for the ongoing repairs of the facility.

The minister spoke in Lagos while

on an inspection tour of the three bridges linking Lagos Mainland with Victoria Island, including the ongoing rehabilitation works on the first section of the 3rd Mainland Bridge.

It was gathered that the project which has a total cost of N25 billion is being handled by Julius Berger.

Umahi also said that the successful completion of the

rehabilitation works on phase one of the third mainland bridge was a clear indication that the Bola Tinubu administration was on course to carrying out comprehensive repairs on other bridges in Lagos.

A statement by the Director of Information in the ministry, Ben Goong, quoted the minister as saying that though the aesthetics of markings and solar lights on the

TCN Alerts on Planned Attack on Abuja Power Facilities, Blames Gas Shortage for Grid Failures

Emmanuel Addeh in Abuja

The Transmission Company of Nigeria (TCN) yesterday said it had information of a planned attack on its facilities in Zuba, Abuja, urging residents to report any suspicious movement around the area to the security agencies.

The TCN also said that until there’s some level of consistent gas supply to Generation Companies (Gencos), managing the grid and minimising grid disturbances may be difficult.

In a statement by the General Manager, Public Affairs of the company, Ndidi Mba, the government-owned TCN stressed that vandalism also remains a major cause of grid collapses in the country.

This year alone, the national grid has suffered two known collapses, throwing the entire country into total blackout.

Also, Gencos have recently blamed their inability to sustain power generating because of about N3 trillion owed them by the federal government. The Minister of Power, Chief Adebayo Adelabu, promised at the weekend that the gradual payment of the debts will begin this April.

“As efforts to stabilise gas supply progress, TCN emphasises the importance of consistent gas availability to sustain optimal power generation and facilitate easier grid management, reducing system disturbances. It is a fact that low power generation substantially increases grid fragility.

“In addition to gas supply challenges, TCN faces various sector-specific hurdles, some impact

other players in the value chain, but invariably affect grid stability.

“Vandalism is a persistent challenge, as clearly seen in the first quarter of 2024 alone, in which five significant vandalism incidents disrupted transmission operations, necessitating emergency repairs and, in some cases, complete tower reconstruction and/or transmission line replacement due to acts of vandalism.

“These highlight the critical need for increased community support and vigilance in protecting transmission infrastructure.

“TCN urges heightened vigilance, for now, particularly in the Zuba area, following alerts of a planned attack on TCN facilities in Zuba.

“We implore residents to remain vigilant and report any suspicious activities around power facilities in the area to safeguard the integrity of our infrastructure and ensure uninterrupted power supply to all.

“Again, we urge everyone, especially those living close to TCN towers nationwide, to please join hands with TCN in safeguarding power transmission towers and cables,” the statement added.

The TCN also acknowledged the efforts of the minister of power , who it said has had a series of meetings with the stakeholders, with a view to removing the bottlenecks hindering Nigeria from having stable and reliable power supply.

The TCN noted that it remains committed to managing the grid and ensuring grid stability amidst ongoing challenges, such as the persistent low gas supply affecting power generation into the nation's grid.

“Our diligent grid controllers work

tirelessly day and night to balance the grid and prevent any kind of disturbance amidst challenges. The recent grid disturbance on March 28, 2024, was promptly managed by our skilled operators, with power restoration achieved in some areas within 21 minutes of the disturbance.

We acknowledge the collaborative efforts of the federal government, particularly the minister of power, who has been working hard to address the root causes of low gas supply.

“The minister has held meetings with Gencos and Gas Companies (Gascos) to secure a higher volume of gas supply and consistency for enhanced power generation,” the statement added.

Oworonshoki end of the bridge was beautiful, the underwater aspects of the project remained the most “complicated and critical.”

He added that the underwater structural damage to the three bridges called for serious concern, but expressed optimism that the Tinubu administration was equal to the task and will confront the challenges head-on.

“He revealed that the contractor handling the Carter Bridge has been mobilised to the tune of N7 billion a couple of days ago, adding that rehabilitation works will commence in the coming days,” the statement stressed.

Also speaking during an interview session with journalists, Chairman Senate Committee on Works, Senator Barinada Mpigi and the Chairman House Committee on Works, Akin Alabi, were quoted as calling on the president to declare a state of emergency on the nation's infrastructure, given the enormity of the challenges on ground.

The chairmen said the situation calls for thinking outside the box, adding that the financial requirements needed to fix the nation's infrastructure is well beyond the capacity of annual appropriations.

The duo however assured that the National Assembly will do everything possible within the

limits of the law to help fund the projects, given their importance in the scheme of things in the nation's commercial nerve centre.

Conducting the minister around different sections of the 3rd Mainland Bridge, the Carter and Eko Bridges, Federal Controller of Works in Lagos state, Olukorede Kesha told the minister that the underwater damage to the three bridges was far more colossal than anyone had imagined.

Kesha also took the minister and members of his entourage to several sections of the Lagos-Calabar Coastal Highway, some sections of the Lagos-Ibadan express way, among other federal projects in Lagos state.

Meanwhile, Umahi has assured the Ekiti State Governor, Mr. Biodun Oyebanji of the federal government’s plan to speed up the construction and rehabilitation of roads in the state.

The minister spoke when he and the ministry’s team, in company with the governor undertook an inspection of some federal roads in the state.

The minister who was received by Oyebanji at the Akure Airport, inspected the Akure- Ikere -Ado dualised road, the Ado- ABUADIjan road that was recently awarded and visited the ABUAD Industrial Park Road, which is a model of

concrete road construction.

Speaking with journalists in Ado Ekiti shortly after the inspection, Umahi said the purpose of the visit was to assess the level of work done on some ongoing roads projects in the state, particularly Ado, Ijan road and Ado – Ikere – Akure road and to also see the state of federal roads in the state.

Acknowledging that the roads are major corridors to other parts of the country, the minister assured that his ministry will ensure timely completion of the roads for the benefit of citizens and economic development of the state.

Speaking about his assessment on the work done on the road, the minister said he was not satisfied with the level of work done on the Akure- Ikere- Ado road, and revealed that the contractor had been invited for further instruction.

“We came to look at some of the ongoing projects in Ekiti state, especially Ado- Ekiti to Ijan road. I didn’t know it was a major corridor that evacuates a lot of commercial produce from Benin to Lokoja and the southern part of the country.

"The governor is very desirous of this road and of course Chief Afe Babalola, we have looked at the roads and we are coming back. My team will give it all the desired attention, that’s what the governor wants,” the minister stated.

Mary Nnah

A US-based Nigerian author, poet, and clinical nurse, Mrs. Maggie Offoha, has advised Nigerians who plan to relocate abroad due to economic hardship to conduct thorough research before making any decisions. She explained that it is essential to equip oneself with the necessary information about the country of choice to avoid regrets and societal pressures.

Offoha, who has lived in the US for over 22 years, made this call during the official launch of her three books, "Return to Where I Belong," "Dark Shadows on My

Path," and "Poetry for Thought" in Lagos. The books, she said, reflect her experiences abroad and highlight the expectations of any immigrant.

“The experiences gained abroad are the inspiration behind writing the books. They contain my experiences as an immigrant in the US and what those planning to leave should expect. There is a general situation those travelling abroad will face because it is a general principle of life,” she said.

Offoha urged Nigerians to revive the reading culture, especially among the youth, to stay informed about happenings worldwide, calling on the government to invest more in the youth, who are the future leaders

of the country. She cautioned that while reasons presented by youths for emigrating may seem appealing, there are underlying factors that must be considered before leaving the country of birth.

Offoha highlighted cultural differences, loss of identity, and unplanned and unexpected circumstances as some of the challenges that immigrants could face.

She advised those planning to relocate abroad to carry out thorough research of the country to which they are planning to go, to avoid regrets.

She explained that most times, there is a lot of loss when people

relocate abroad, such as family, relationships, and properties. She added that children are also caught between two cultures, unsure of their identity.

“Some of us are at a crossroads; that is why I want to tell people planning to relocate abroad to do their research very well. It is not in my position to discourage those who want to leave due to the hostile economy.

“Some of our children are now caught in between two cultures, while some of them do not even know where they belong. Some of these experiences are what I wrote about in the book: ‘Return to Where I Belong’,” she said.

6 THISDAY • MONDAY, APRIL 1, 2024 NEWS Group News Editor: Goddy Egene Email: Goddy.egene@thisdaylive.com, 0803 350 6821, 08074010580

US-Based Nigerian Author Advises Aspiring Immigrants to Undertake Due Diligence Before Relocation

Jonathan Osin; Bishop of the Trinity Church, Rt. Rev. (Dr.) Oladapo Omotayo Babalola; Prelate of the Church, His Eminence Dr. Oliver Ali Aba; Bishop of Evangelism and Discipleship, Rt. Rev. Offiong Okon Inyang; and other officiating priests of the church, during Methodist Church of the Trinity 2024 Easter Church Service in Lagos…yesterday.

KOLAWOLE ALLI

MONDAY APRIL 1, 2024 • THISDAY 7

SERAP Asks 36 Governors, FCT Minister to Account for N5.9tn, $4.6bn Loans

Chuks Okocha in Abuja

THE Socio-Economic Rights and Accountability Project (SERAP) has issued a one-week ultimatum to Nigeria’s 36 state governors and the Minister of the Federal Capital Territory (FCT), Mr Nyesom Wike, to account for loan agreements and spending details of some N5.9 trillion and $4.6 billion loans obtained by their states and the FCT.

SERAP’s request also includes details and locations of projects executed with the loans.

It also urged them to: “Promptly invite the Independent Corrupt Practices and Other Related Offences Commission (ICPC) and Economic and Financial Crimes Commission (EFCC) to investigate the spending of the domestic and external loans obtained by your state and the FCT.”

SERAP’s request followed the disclosure last week by Governor Uba Sani of Kaduna State that the immediate past administration of Nasir el-Rufai left $587 million and N85 billion debt as well as 115 contractual liabilities, making it impossible for the state to pay salaries.

In the Freedom of Information (FoI) request dated March 30, 2024 and signed by SERAP Deputy Director Kolawole Oluwadare, the organisation said that it is in the public interest to publish copies of the loan agreements and details of how the loans obtained were spent.

SERAP said: “Nigerians have the

right to know how their states are spending the domestic and external loans obtained by the governors. Widely publishing copies of the loan agreements and spending details of the loans obtained would ensure that persons with public responsibilities are answerable to the people for the performance of their duties in the management of public funds.

“We would be grateful if the recommended measures are taken within seven days of the receipt and/or publication of this letter.

If we have not heard from you by then, SERAP shall take all appropriate legal actions to compel you and your state to comply with our request in the public interest.

“SERAP is seriously concerned that many of the country’s 36 states and FCT are allegedly mismanaging public funds which may include domestic and external loans obtained from bilateral and multilateral institutions and agencies.

“Transparency in the spending of the loans obtained by your state is fundamental to increase accountability, prevent corruption, and build trust in democratic institutions with the ultimate aim of strengthening the rule of law,” it said.

Quoting Nigeria’s Debt Management Office (DMO), it said the total public domestic debt portfolio for the country’s 36 states and the FCT is N5.9 trillion, with the total public external debt portfolio at $4.6 billion.

“Many states and the FCT reportedly owe civil servants’ salaries and pensions. Several states are borrowing to pay salaries. Millions of Nigerians resident in your state and the FCT continue to be denied access to basic public goods and services such as quality education and healthcare.

“Several states including your state are also reportedly spending public funds which may include the domestic and external loans to fund unnecessary travels, buy exotic and bulletproof cars and generally fund the lavish lifestyles of politicians,” the organisation said.

It stated that it was seriously concerned that the domestic and external loans obtained by the states and the FCT are vulnerable to corruption and mismanagement.

“Your government has a responsibility to ensure transparency and accountability in how any loans obtained by your state are spent, to reduce vulnerability to corruption and mismanagement.

“Publishing copies of the loan agreements obtained by your state and the FCT would allow Nigerians to scrutinise them, and promote transparency and accountability on the spending of public funds

including the loans obtained.

“SERAP believes that providing and widely publishing the details of the spending of the domestic and external loans obtained by your state and the FCT would enable Nigerians to effectively and meaningfully engage in the management of the loans,” it added.

The organisers said it believes that the constitutional principle of democracy also provides a foundation for Nigerians’ right to know the details of loan agreements and how the loans obtained are spent.

Citizens’ right to know, it

pointed out, promotes openness, transparency, and accountability that is in turn crucial for the country’s democratic order.

“The effective operation of representative democracy depends on the people being able to scrutinise, discuss and contribute to government decision making, including on the spending of loans obtained by your state and the FCT.

“To do this, they need information to enable them to participate more effectively in the management of public funds by their state government and the FCT,” it said.

Recapitalisation: ProvidusBank in Pole Position to Acquire Unity Bank

James Emejo in Abuja

There are strong indications that ProvidusBank Limited is in talks to acquire a majority stake in Unity Bank Plc.

The move comes amid the new recapitalisation hurdles imposed on banks by the Central Bank of Nigeria (CBN).

THISDAY gathered that the development was part of ProvidusBank’s expansion plan, and importantly a bold initiative to further shore-up its capital base amid the current recapitalisation challenge.

Sources said the odds are in favour of the bank, adding that the deal appeared to have been officially approved recently.

However, it was not yet clear whether the deal would involve an outright purchase or merger of the two entities as Providus remains the only candidate in the bid.

The apex bank recently announced new minimum capital requirements of N500 billion and N200 billion for commercial banks with international and national authorisation respectively. This included a new capital base of N50 billion for banks with regional

New Capital Base: Don't Adopt Uniform CRR for Banks, Expert Urges CBN

Ndubuisi Francis in Abuja

A financial expert and Director, Institute of Capital Market Studies (ICMS), Nasarawa State University, Keffi (NSUK, Prof. Uche Uwaleke has admonished the Central Bank of Nigeria (CBN) to adopt a differentiated Cash Reserve Ratio (CRR) for various categories of banks instead of a uniform rate (currently at 45 per cent) for commercial banks.

CRR is the portion of the cash that the CBN asks respective commercial banking institutions to keep aside and not use for lending or investment purposes.

His admonition is coming amid the apex bank's newly-proposed N500

billion and N200 billion capital base for commercial banks with international and national authorisation, respectively, The CBN had via a circular, last Thursday urged the banks to consider injecting fresh equity capital through private placements, rights issues and/ or offers for subscription; mergers and acquisitions (M&As); and/or upgrade or downgrade of licence authorisation to enable them to meet the new capital requirements.

All fresh capital requirements are to be satisfied by March 31, 2026.

Reacting to the new development in a statement to THISDAY, Uwaleke, a former finance commissioner in Imo State applauded the CBN for

the step. He said: "It is a welcome development that will help strengthen the country's financial system and a potential boost to the stock market

"In view of naira devaluation following unification of exchange rates, the new caliberated minimum capital requirements seem OK unlike the uniform capital base of N25 bn stipulated in 2005.

"Shareholders' funds comprise Paid up share capital plus reserves.

"If my memory serves me right, this was permitted in 2005 but now disallowed possibly from the experience of the last exercise.

licenses.

The fresh capital hurdles were disclosed in a statement issued by CBN acting Director, Corporate Communications Department, Mrs. Hakama Sidi Ali, adding that all fresh capital requirements are to be satisfied by March 31, 2026.

The central bank also pegged the new minimum capital for merchant banks at N50 Billion, while non-interest banks with national and regional authorisations are mandated to raise their capital thresholds to N20 billion and N10 billion, respectively. The development came days after the CBN urged the financial institutions to expedite action on the recapitalisation to strengthen the financial system.

financing has been struggling for years,” the source who pleaded to remain anonymous said.

Unity Bank commenced operations in January 2006, following the merger of nine banks with competences in investment, corporate and retail banking. It is one of Nigeria’s leading retail banks with 213 business offices spread across the 36 States and Federal Capital Territory.

In 2018, there was a botched move by Milost Global Inc., a New York-based private equity firm to invest $1billion in the bank and since then the bank has been seeking a preferred suitor.

It recently posted negative results in its recently released financials for the 9-month (9M) period ended September 30, 2023.

"The stock market (Option 1) presents the most feasible option as few will likely go the M&A (Mergers and acquisitions) route "Access Bank has already announced it is raising N365 billion via Rights issue.

"I also think the two years period allowed is sufficient to implement recapitalisation."

According to him, a number of banks including FBN, Access and Fidelity had already commenced the process of recapitalisation before now, especially since the CBN Governor made the announcement in November last year.

"I believe the FUGAZ (FBN, UBA, GTB, Access and Zenith) banks with international authorisation will have no difficulty meeting this requirement.

In November 2023, ProvidusBank Limited, a commercial bank founded in 2016, had taken bold steps to acquire Unity Bank as part of the former’s business expansion plan.

THISDAY gathered from a reliable industry source that the arrangement which Unity Bank that had been struggling to beef up its minimum capital requirement since 2017, has termed a business combination, was being monitored by the Central Bank of Nigeria (CBN).

“This has been in the works since June this year and they have been updating the CBN on it. Part of the deal is that Providus must have asked for the isolation of Unity Bank’s bad loans. Unity Bank which is big in agriculture

Precisely, the bank’s financial results released on the Nigerian Exchange Limited (NGX) had shown loss after tax of N47.917billion, down by 2,461 per cent from profit after tax (PAT) of N2.029billion in same nine months period of 2022.

It had also reported Foreign Exchange (FX) revaluation loss of N38.162 billion, an increase by 70,565 percent from N54.005 million FX revaluation loss it recorded in nine months to September 2022.

Its gross income in the nine month period was also N38.183 billion, which was a decrease by 10 per cent, from N42.292 billion gross income recorded in the comparable period of 2022.

8 THISDAY • MONDAY, APRIL 1, 2024 NEWS

NBAWF 4TH ANNUAL GENERAL MEETING AND INT'L WOMEN’S DAY EVENT 2024...

L-R: Council Member, Nigerian Bar Association Women’s Forum (NBAWF), Adama Mohammed; Treasurer, NBAWF, Mercy Ijato Agada; Keynote Speaker, Bolanle Austen-Peters; Attorney General of Lagos State, Hon Lawal Pedro; Chairperson NBAWF, Chinyere Okorocha; Chairperson, Conference Planning Committee, Folashade Alli, and Secretary, NBAWF, Irene Ini Pepple, during the NBAWF fourth Annual General Meeting and International Women’s Day Event 2024 held in Lagos…recently

MONDAY APRIL 1, 2024 • THISDAY 9

MONDAY APRIL 1, 2024 • THISDAY 10

UMAHI TOURS ADO-EKITI- ABUAD- IJAN EKITI ROADS...

In New Report, Egypt, Nigeria, S’Africa

Emerge Africa’s Most Polluted Nations

Emmanuel Addeh in Abuja

Egypt, Nigeria, and South Africa have emerged Africa’s most polluted countries in terms of air pollution disease burden, amid health consequences and exacerbated impacts on climate change, a new report by Greenpeace Africa and Greenpeace Middle East & North Africa has revealed.

Titled: “Major Air Polluters in Africa Unmasked”, the report investigated the biggest human sources of air pollution across Africa, focusing on major industrial and economic sectors, including the fossil fuel industry.

It stated that every year in Africa, as many as 1.1 million premature deaths have been linked to air pollution.

The report added that Egypt, Nigeria, and South Africa consistently exhibit large disease burdens, with the highest mortality linked to fossil fuel air pollution in these nations.

It highlighted the sparse monitoring of air quality in Africa, revealing that only 19 African countries have legislation incorporating ambient air quality standards, according to the First Global Assessment of Air Pollution Legislation by the United Nations Environmental Programme.

Nigeria’s energy sector and its oil and gas industry are responsible for large amounts of flaring, it said, is the result of development practices in the 1960s and 1970s when there was limited demand for fossil gas and environmental

standards were not stringent.

With no market for the gas produced as a by-product of oil wells, flares were installed as a disposal Nigeria features method. Decades later, it added that Nigeria is in the top 10 continues to flare large volumes . . of fossil gas, quoting previous reports.

“In many parts of Africa a lack of air quality monitoring has allowed pollution to remain hidden. However, there is abundant evidence that African nations face a serious public health crisis from air pollution.

“The root causes of this crisis are the air pollutant emitters. Data from satellites and even fuel sales in each country allow scientists to investigate emission sources,”

Senior Scientist at the Greenpeace

Research Laboratories, Dr Aidan Farrow said.

The report found that Africa is home to some of the worst nitrogen dioxide and sulphur dioxide hotspots in the world, all of which are primarily linked to thermal power plants. The report also found that Eskom, a public utility company that has the government of South Africa as its sole shareholder, operates many of the most polluting plants in South Africa.

Key findings compiled by the report include that: Exposure to air pollution is the second leading risk factor for death in Africa and that achieving World Health Organisation (WHO) guidelines could result in significant gains in life expectancy.

Hunger, Malnutrition Threatening Nigeria's Human Capital Devt, Says Group

Onyebuchi Ezigbo in Abuja

The Civil Society-Scaling Up Nutrition in Nigeria (CS-SUNN) has raised an alarm on the looming consequences of the current food crisis and economic hardship in the country.

It expressed concern that if the situation is not promptly addressed, it could lead to worsening hunger and malnutrition with the attendant negative impact the country's human capital development.

CS-SUNN Executive Secretary, Mr. Sunday Okoronkwo raised the concern during a media roundtable on: “Investing in Nutrition for Human Capital Development in Nigeria” in Abuja He said that nutrition plays a vital role in Human Capital Development (HCD), serving as the cornerstone for the physical and mental well-being of individuals.

He explained that deficiencies in essential nutrients result in malnutrition and adversely impacting both the health and productivity of individuals.

"It is therefore important to recognise that malnutrition not only undermines an individual's health but also exerts a profound toll on economic prosperity, hindering the nation's progress towards achieving its human

capital development goals," he said.

According to Okoronkwo, Nigeria's human capital development vision is for "healthy, educated and productive Nigerians by the Year 2030", with targets across three thematic areas.

He said the recent establishment of a multi-sectoral committee to spearhead the federal government’s human capital development programme signifies a significant step in enhancing Nigeria's human capital index with a renewed focus on health and nutrition, labour force participation, and education, coupled with a comprehensive framework for monitoring and evaluation.

"However, amidst these commendable efforts, there is a pressing concern: the persistent challenge of malnutrition. Despite ongoing initiatives, Nigeria continues to grapple with alarming rates of malnutrition, posing a barrier to unlocking the nation's human capital potential.

"The 2020 Human Capital Index (HCI) of Nigeria according to the assessment by World Bank is currently 0.36; ranking 2 out of 157 countries, reflecting the urgent need for concerted action to address this. In addition, budgetary allocations for nutrition remain insufficient, and release rates are dismally low,” he said.

CS-SUNN underscored the key role of nutrition in driving human capital development, adding that malnutrition not only undermines investments in health and education but also perpetuates a cycle of poverty and underdevelopment.

By advocating a strong nutrition governance, enhanced data availability, and increased domestic financing, CS- SUNN said it seeks to catalyse transformative change and propel Nigeria towards its HCD objectives.

While speaking in an interview with THISDAY,CS-SUNN, Communications Officer, Lillian Okafor said there was need for innovative financing mechanisms to bridge the gap, emphasising the need for increased domestic funding and strategic resource mobilisation.

She said: "For us in Nigeria the burden of malnutrition has continued to impede our efforts to attain high level human capital development target.

“And we have seen that part of the key challenges is poor investment in nutrition. So the essence of this roundtable is to trigger the media to begin to speak up and advocate and call upon our policy makers to ensure that more investments are channelled towards providing better nutrition outcomes for the greater segment of our population.”

She said that this will not only improve the health of the citizens, but also the productivity of the country's workforce.

Okafor specifically called for more investments in the area of maternal and child healthcare, community management of acute malnutrition, nutrition sensitive and nutrition specific interventions, such upgrading skills of nutritionists and ensuring their availability in the hospitals and primary healthcare facilities.

According to her, there is need for funding of sensitisation programmes to educate rural women on the importance of good nutrition practices.

She said that most often even when funds were budgeted, actual releases were not made and as such utilisation is poor and does not address issues intended to addressed.

"We are this opportunity to call on the government of Nigeria to invest in multiple micro nutrient supplements because it is very key to addressing the issue anaemia in women of child-bearing age," she said.

Okafor disclosed that UNICEF has agreed to provide counterfunding for the procurement of micro nutrient supplements to address the problem of anaemia in Nigeria.

Health impact studies, it said, suggest that life expectancy could be improved by up to three years in some African nations if air quality met WHO guidelines.

“According to WHO, exposure to air pollution, including nitrogen dioxide and sulphur dioxide, can cause both short- and long-term health problems. These include heart and lung diseases, pregnancy problems, kidney issues and cancer,” the report added.

The report presents recommendations to address the critical issue of air pollution in

Africa, emphasising the need for investment in clean technologies, especially in the energy sector.

“International institutions share a significant responsibility in sustainably developing the African continent. Many of the causes of air pollution, such as the combustion of oil, coal, and gas, are also sources of greenhouse gas emissions.

“ Policies aimed at reducing air pollution, therefore, offer a win-win strategy for both climate and health, ” the Greenpeace report stated.

Lawmaker Threatens Legal Action against Airline for Alleged Breach of Contract

Francis Sardauna in Katsina

The Chairman House Committee on Interior and member representing Musawa/Matazu Federal Constituency, Hon. Abdullahi Ahmed, has threatened to institute legal action against the management of Air Peace Limited over alleged breach of contract.

The lawmaker, who disclosed this yesterday, said the Nigerian airline had changed his flight from business class to economy class after paying about N12 million from Mallam Aminu Kano International Airport to Jeddah.

Ahmed, who boarded flight P4752 alongside his family to King Abdulaziz International Airport, Jeddah for lesser hajj, said the flight was supposed to depart Kano airport on March 27, 2024, but it was delayed till the following day.

He said: “I paid about N12 million for a business class ticket on 22 March 2024 and we were supposed to depart Mallam Aminu Kano International Airport on March 27 to Jeddah for lesser hajj. But the Air Peace operator changed the ticket to economy class without compensation.

“Unfortunately, they delayed our flight till the next day. This is a clear case of a breach of contract by Air Peace. They should pay back the money otherwise I will be left with no option but to approach the court for a redress.”

He expressed displeasure at the alarming cases of incessant delays,

flight disruptions, and schedule changes without adequate notice to passengers by the management of the Air Peace Limited.

The legislator stated that the current record of flight disruptions, poor customer experience and poor handling of passengers by Air Peace is inhuman, unacceptable and must be tackled immediately.

He explained that the legal action was imperative because the scenario that happened between him and Air Peace is one of the numerous abnormalities customers are forced to suffer in the Nigerian aviation sector.

The Talban-Musawa and Dujiman-Katsina said his planned legal action against the operator of the airline would address the unabated ill-treatment being meted against passengers across the country.

He vowed to work with his colleagues in the National Assembly to ensure that Air Peace and other errant airlines are sanctioned appropriately, noting that it is no longer business as usual.

Another affected passenger, Ibrahim Shehu, called on the Nigeria Civil Aviation Authority (NCAA) and relevant government agencies to intervene and recover money paid to Air Peace by affected passengers.

He also called on the federal government to wade in, and stop the ongoing maltreatment of Nigerians and other travellers by Air Peace and other airlines in the country.

NEWS

11 THISDAY • MONDAY, APRIL 1, 2024

L-R: Minister of Works, Engr. Dave Umahi; Ekiti State Governor, Mr Biodun Oyebanji; with Senator Cyril Fasuyi (Ekiti North), during the Minister’s inspection of the Ado-Ekiti- Abuad- Ijan Ekiti road and other federal roads in Ado-Ekiti last Saturday

NACCIMA Urges Increased Private-public Sector Partnership, Hails Re-launch of NTFC

The National President of the Nigerian Association of Chambers of Commerce, Industry, Mines and Agriculture (NACCIMA), Dele Oye, has commended the federal government for the re-launch of the National Trade Facilitation Committee (NTFC), urging increased privatepublic sector partnership to drive economic growth and development in the country. Oye who spoke at the re-launch at the Bank of Industry (BoI) conference room, in Abuja, said it is through partnership that Nigeria can optimise the use of its assets for the greater good.

“It is both an honour and a privilege to stand before you today as we witness the re-launching of the National Trade Facilitation Committee (NTFC) under the auspices of the Federal Ministry of Industry, Trade, and Investment.

“As the President of NACCIMA, I am here to articulate the collective voice of the Organised Private Sector (OPS) and to affirm our steadfast commitment to the goals and aspirations that this committee embodies.

FG Asked to Foster Inclusive Growth for Marginalised Groups

Michael Olugbode in Abuja

The federal government has been asked to evolved actionable strategies to address the issues of economic exclusion and foster inclusive growth for marginalised groups in Nigeria.

The appeal was made in Abuja at the International Women’s Month Economic Empowerment Summit for ASHWAN and Other Marginalised Groups in Nigeria, with the theme: “Inclusive Economic Growth and Development; A Catalyst for Reducing Vulnerability and

Poverty Among Marginalized Groups”.

The Summit was organised by the UN Women, in collaboration with UNAIDS, National Agency for the Control of AIDS (NACA), Association of Women Living with HIV (ASWHAN), and other partners.

The spotlight of the event was placed on the often-overlooked issue of exclusion faced by women living with HIV, disabilities, older women, and segments of impoverished youth, and actionable strategies to address the issues of economic exclusion and foster

Hajj Fares: Sule Says He’s Consulting with Colleagues to Ensure Intending Pilgrims' Participation

Igbawase Ukumba in Lafia

The Nasarawa State Governor, Abdullahi Sule, has said he is in talks with his colleague governors to see that pilgrims perform this year's hajj in spite of the hajj fares’ increase.

The National Hajj Commission (NAHCON) recently announced an increase in fares for the year 2024 pilgrimage to Saudi Arabia by N1.9 million.

This was after initially pegging the fare at N4.9 million, asking those who had paid the initial amount to add a balance of N1.9 million, to raise the amount to N6.8 million.

However, in a chat with journalists shortly after visiting the NAHCON headquarters of in Abuja Friday, the governor said he was at the office to intervene regarding the recent increase in the

fares for pilgrims from Nasarawa State, as well as the country at large.

He said: "I am also speaking with some of my colleague governors to see what steps we can take. Now that I have first hand information from NAHCON, it gives me the opportunity to be able to share with the governors what we can do to ensure that our pilgrims are able to perform the Hajj this year," he said. Sule commended the NAHCON Chairman on his effort to extend the deadeline for the intending pilgrims to complete the payment for the new rate.

Also speaking, Chairman of NAHCON, Jalal Arabi, said he was encouraged by the visit by Sule, especially since the governor has always shared his knowledge and experience on the way forward.

inclusive growth for marginalised groups in Nigeria.

Speaking at the summit, the UN Women Nigeria Country Representative, Ms. Beatrice Eyong, emphasised the importance of collaborative efforts in achieving gender equality and empowering marginalised communities.

She noted: “Inclusion is not just an act of policymaking but rather essential for the survival of the human race. We are working hard to make ‘Leaving No One Behind’ practical."

Representatives of civil society organisations (CSOs) echoed similar sentiments. Mrs. Esther Hindi, the National Coordinator of ASWHAN, encouraged the need for tailored policies and programmes to address the unique challenges faced by marginalized groups, particularly

“The NTFC, as a vital organ within the framework of our national economic architecture, has a profoundly significant role to play. Trade facilitation is not just about expediting the movement, release, and clearance of goods; it is about creating a more efficient trade environment that is conducive to economic diversification, industrialisation, and job creation.

women living with HIV, women with disabilities, and elderly women.

Executive Director of the African Centre for Leadership, Strategy, and Development, Dr. Otive Igbuzor, in his keynote address, delivered an insightful exposition on the root causes of exclusion, particularly focusing on resource-poor and vulnerable groups.

Igbuzor highlighted the gaps in government policies, including social investment and welfare programmes, and concluded by offering practical strategies and solutions to address these disparities.

The President of the Abuja Chambers of Commerce, in a gesture of solidarity, provided guidance on business and funding opportunities available to the marginalised groups, signalling a commitment to support their empowerment.

“The integration of the Trade Facilitation and Liberalization Sub-Committee of the Presidential Council on Industrial Revitalisation with the NTFC is a strategic move that signals our government's resolve to harmonise efforts and streamline operations.

“Such synergy is critical in the pursuit of the Renewed Hope Agenda, which aims to rekindle the spirit of enterprise, stimulate industrial growth, and engender a more vibrant economy.

“As we stand on the cusp of this revitalisation, let us underscore the importance of trade facilitation in the context of the Nigerian economy.

“The committee is tasked with the formidable challenge of implementing reforms that will enhance our trade protocols, reduce barriers, and improve the ease of doing business. By doing so, we can attract more foreign direct investment, boost our export potential, and create a nexus of opportunities for employment and wealth creation,” he stated.

He added that the chambers of commerce across Nigeria are integral to the journey, explaining that as conduits of commerce and industry, they represent the interests and aspirations of businesses large and small.

Besides, he noted that they provide a platform for the articulation of policy recommendations, the sharing of best practices, and the fostering of partnerships that span the globe.

In essence, he described NACCIMA as the building blocks of the private sector's contribution to national development.

“The question of why government and the private sector must collaborate is one that bears no ambiguity. In a world of finite resources and unending challenges, it is through partnership that we can optimise the use of our assets for the greater good of Nigeria.

“The public sector provides the regulatory framework and policy direction, while the private sector brings to the table innovation, efficiency, and execution capability. Together, we form a formidable force that can transform visions into tangible realities,” he pointed out.

The NTFC, with its renewed vigour and strategic focus, he said, stands ready to play its part in this transformative journey.

“It is our time to demonstrate what is possible when government and private enterprise unite towards a common goal. Let us move forward with a sense of purpose, a commitment to excellence, and a vision for a Nigeria where trade is a cornerstone of our national success,”

200 Small Scale Entrepreneurs Benefit From Olawepo-Hashim Foundation's N10m Grant

Folalumi Alaran

A non-profit humanitarian organization, The Gbenga Olawepo-Hashim Foundation has set aside 10 million naira as grants to 200 smalescale entrepreneurs in Abuja as part of its Economic Empowerment Programme for vulnerable people in the society.

The Foundation, promoted by a former Presidential Candidate and Chieftain of the All Progressives Congress, Mr Gbenga OlawepoHashim gave fifty thousand naira to each of the 200 beneficiaries

In his speech at the event,

Olawepo-Hashim explained that his gesture which is to give back to the society has no relationship with his political aspirations.

According to him, "I have been doing this for decades. I have a passion to make society better. That was why I was involved in student unionism in those days. I was also involved in the Committee for Defence of Human Rights (CDHR) and now I'm a businessman. So, one way to intervene is in the area of economic empowerment. "What I can do at this time when things are really bad is to

show love to underprivileged people in particular, and that we have been doing for decades. We have done training of young people in this digital acquisition over 1000 of them. So this is going to be continuous thing."

One of the beneficiaries, Luka Dakwoyi, in his remarks, urged the rich in the society to emulate the APC chieftain, saying there are many Nigerians out there in need of succor as the state of the economy bites harder. Not a few of the participants at the event commended gesture of the Olawepo-Hashim

Foundation and called on well meaning Nigerians to emulate the non-partisan approach of Mr. Olawepo-Hashim towards ameliorating the plight of the less privileged.

According to Statista.com, in 2022, an estimated population of 88.4 million people in Nigeria lived in extreme poverty.

The number of men living on less than 1.90 U.S. dollars a day in the country reached around 44.7 million, while the count was at 43.7 million for women. The Nigeria Bureau of Statistics, NBS puts its own figure at 133 million.

THISDAY • MONDAY, APRIL 1, 2024 NEWS 12 UNVEILING

AND PARALYMPICS

Director, Corporate Communications, Visa West Africa,

100 meters hurdles,

holder

throw,

EVENT SPONSORS OF THE OLYMPIC

GAMES PARIS 2024... L-R:

Mr. Niyi Adebiyi; Team Visa Athlete and World Record holder

Tobi Amusan; Team Visa Athlete and World Record

discus

Goodness Nwachukwu; Vice

President and Cluster Head, Visa West Africa, Mr. Andrew Uaboi; and Director Marketing, Visa West Africa, Adaramola Oluwaseun, at the Team Visa Athlete unveiling event sponsors of the Olympic and Paralympics Games Paris 2024 held in Lagos...recently

MONDAY APRIL 1, 2024 • THISDAY 13

MONDAY DISCOURSE

INEC Steps Up Preparation for Scheduled Guber Polls in Edo, Ondo

Adedayo Akinwale writes that the Independent National Electoral Commission is engaging critical stakeholders in the electoral process ahead of the fast approaching governorship polls in Edo and Ondo States.

The Independent National Electoral Commission (INEC) last week held its regular quarterly consultative meeting with major stakeholders in the electoral process including political parties, civil society organisations and the media.

The quarterly meeting was the first since the conclusion of the by-elections and courtordered re-run polls held in February, 2024 in 26 States of the Federation.

The main focus of last week’s meeting was the off-cycle governorship elections in Edo and Ondo States. The Edo State Governorship election is scheduled to hold on Saturday 21st September, 2024; while the Ondo State Governorship election is scheduled for Saturday, 16th November, 2024.

Already, party primaries for the Edo State Governorship election have been concluded. By the timetable and schedule of activities for the election, political parties have 20 days to upload the list and personal particulars of their candidates to the commission’s dedicated portal.

INEC chairman, Prof. Mahmood Yakubu, who presided over the meetings said the commission has trained party Liaison Officers and established a Help Desk for political parties. He said the dedicated portal opened on 4th March 2024 and expectedly will automatically shut down at 6pm on Saturday, 24th March 2024.

According to him, two weeks after it was opened, not all the parties had uploaded their nominations to the portal.

To this end, the Commission called on the political parties to keep to the commission’s schedule of activities and avoid last minute rush that might undermine their ability to successfully nominate their candidates.

“There will be no extension of time beyond the deadline already published in the Timetable and Schedule of Activities for the election, to enable us publish the personal particulars of candidates (Form EC9) on 31st March 2024 as required by law,” Yakubu warned.

Moreso, for the Ondo State Governorship election, party primaries will commence on 6th April 2024, and end on 27th April 2024. So far, 16 out of 19 political parties have indicated interest in participating in the election.

Yakubu said: “I urge political parties to adhere strictly to your proposed dates and modes of primaries. Frequent changes as we witnessed recently during the Edo primaries are not only disruptive but costly. The Commission cannot mobilise, demobilise and remobilise our officials for the monitoring of party primaries at the convenience of political parties.

“Parties should stick to their proposed dates and modes of primaries for certainty and optimal deployment of resources. Similarly, political parties should avoid acrimonious primaries. Increasingly, the conduct of parallel primaries and the emergence of multiple candidates is a frequent occurrence.

“So too is the tendency to grant waivers to candidates who were a few days earlier card-carrying members of other political parties and nominating such persons to the Commission as their candidates for election. Some of these infractions lead to unnecessary litigations among party members in which the Commission is always joined as a party. The legal fees and cost of producing Certified True Copies (CTCs) of documents can be used more productively in other electoral activities by both the political parties and the Commission. We must find a solution to this situation.”

Responding to Yakubu’s remarks, the Chairman, Inter Party Advisory Council (IPAC) and Chairman Allied People’s Movement (APM), Yusuf Dantalle said there should be no excuse for poor performance in the forthcoming off cycle elections in Edo and Ondo states.

He assured that IPAC would constantly engage INEC and major stakeholders to ensure

the success of these elections and will be there for mobilisation of voters, sensitisation and monitoring of polls.

Dantalle was of the opinion that it is their duty as political leaders to ensure the elections meet international best practices and also hold critical stakeholders accountable.

According to him, vote selling and buying, thuggery, voter apathy and intimidation of electoral officials particularly to declare results under duress are still issues militating against the conduct of credible polls in Nigeria.

Dantalle added that the current leadership of IPAC would live up to its mandate to ensure an environment conducive for the conduct of successful elections.

IPAC, he said, would set up a Constitution and Electoral Act Amendments Committee to review glaring irregularities in recent elections and make proposals to the National Assembly in its ongoing Constitution and Electoral Act amendments.

His words: “Accordingly, IPAC will set up a Constitution and Electoral Act Amendments Committee to review glaring irregularities in recent elections and make proposals to the National Assembly in its ongoing Constitution and Electoral Act amendments.

“In this regard, IPAC will be proactive to ensure that the Edo and Ondo States gubernatorial elections meet the expectations of Nigerians and international community.

The quarterly meeting was the first since the conclusion of the by-elections and court-ordered re-run polls held in February, 2024 in 26 states of the federation. The main focus of last week’s meeting was the off-cycle governorship elections in Edo and Ondo States. The Edo State Governorship election is scheduled to hold on Saturday 21st September, 2024; while the Ondo State Governorship election is scheduled for Saturday, 16th November, 2024. Already, party primaries for the Edo State Governorship election have been concluded. By the timetable and schedule of activities for the election, political parties have 20 days to upload the list and personal particulars of their candidates to the commission’s dedicated portal.

“There should be no excuse for poor performance. IPAC will constantly engage INEC and major stakeholders to ensure the success of these elections and will be there for mobilization of voters, sensitization and monitoring of polls.”

During the engagement with CSOs, the Commission called on them to engage with political parties and observe their primaries.

The commission said by doing so, the CSOs would strengthen their advocacy for inclusivity for groups such as women, youths and Persons with Disabilities (PwDs) that are under-represented in elective offices at National and State level.

Yakubu said: “Turning to Ondo State, political parties will commence their primaries for the Governorship election in the next two weeks. Sixteen Political Parties have indicated interest in participating in the election.

“I urge Civil Society Organisations (CSOs) to engage with Political Parties and observe their primaries just as you engage with INEC and deploy observers to the main election conducted by the Commission.

“By doing so, you will strengthen your advocacy for inclusivity for groups such as women, youths and Persons with Disability (PwD) that are under-represented in elective offices at National and State level.”

The INEC Chairman said while some of the CSOs have submitted their reports on the 2023 elections, some have not. He noted that some of the reforms and innovations introduced by the Commission over the years were drawn from their observation reports.

His words: “However, while many of you have submitted your reports, some accredited observers are yet to do so for the general election, supplementary elections, off-cycle elections, by-elections and re-run elections.

“May I therefore seize this opportunity to remind those that are yet to submit their observation reports that it is mandatory to do so being one of the conditions for eligibility to observe future elections. Going forward, the Commission will operate strictly on the policy of “No Observation Report, No Accreditation.”

While meeting with the security agencies, the Commission demanded that security agencies should start security preparations very early ahead of the Edo and Ondo State governorship elections.

Interestingly, both Edo and Ondo States have 18 Local Government Areas each. While Edo has 2,501,081 registered voters, 192 Registration Areas/Wards and 4,519 Polling Units; Ondo State has 1,991,344 registered voters, 203 Registration Areas/Wards and 3,933 Polling Units.

However, the terrain differs in the two states, while there are a few riverine locations in Edo State, two Local Government Areas in Ondo State (Ese Odo and Ilaje) are predominantly riverine.

According to Yakubu: “It is important to start security preparations very early. In particular, the number of personnel and other assets to be deployed to strategic locations should be determined and mobilised early enough.

“It was this proactive approach that led to the successful conduct of the last Governorship election in Edo State on 19th September 2020 and in Ondo State on 10th October 2020.

“There were no security incidents, materials were delivered promptly, logistics deployed smoothly, polling units opened on time, voters attended to efficiently and results collated and announced transparently.

“Let us replicate the successful conduct of the last Governorship elections in Edo and Ondo States. In fact, working together, we should ensure that the 2024 Governorship elections in Edo and Ondo States are an improvement on the success story of 2020.”

Like the usual practice, the engagements with critical stakeholders will continue till the elections are held.

POLITICS

Acting Group Politics Editor DEJI ELUMOYE Email: deji.elumoye@thisdaylive.com 08033025611 SMS ONLY 14 THISDAY MONDAY APRIL 1, 2024

Yakubu

MONDAY APRIL 1, 2024 • THISDAY 15

www.thisdaylive.com

opinion@thisdaylive.com

IN DEFENCE OF THE BUHARI ADMINISTRATION

Aisha W. Ibrahim argues that the administration did not print money aimlessly as being touted

EDO 2024 GUBERNATORIAL ELECTION OUTLOOK

The joint ticket of Asue Ighodalo and Osarodion Ogie will be difficult to beat, reckons Austin Isikhuemen

EDITORIAL AND THE BORROWINGS CONTINUE...

THE BATTLE AGAINST INFLATION

Is the CBN using the right tools? asks Nick Agule

The Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) held its 294th meeting on the 25th and 26th of March 2024. At the end of the meeting, the MPC diagnosed the pressure remain the strong exchange rate pass-through to domestic prices; rising cost of transportation; high cost of energy and other production inputs; lingering insecurity, especially in food producing areas; and the main cost-push and not demand-pull.

are expected to choose savings (to take advantage of high interest rates) over consumption, thus demand is lowered.

In the light of the causative factors of members came to this decision point:

“…either progressing with its tightening cycle or hold, to observe the impact of the previous rate hike and adjustment of the

But inexplicably, and for reasons not made clear, the members despite the data above decided to continue with tightening therefore increased the Monetary Policy Rate (MPR) by 200 basis points (2%) with an increase from 22.75% to 24.75%. Between 27th February 2024 and 26th March 2024 (a period of one month), the MPR has increased by 600 basis points (6%) from 18.75% to 24.75%.

Examining the impact of this huge jump following data:

One, for the seven months (July 2023 –January 2024) preceding the February 2024 MPC meeting, MPR remained the same at rose from 24.08% to 29.9% an increase of 5.84% which averaged 0.83% per month.

2Two, after the MPC hiked rates by 400 basis points (4%) in February 2024 from from 29.9% to 31.72%, an increase of 1.8% in just one month!

Three, it’s clear from the above data variation with MPR whereas the objective of variation with MPR.

Four, given the scenarios above, it would appear that the MPC is hiking MPR not exchange rates and Foreign Portfolio Investment (FPI). An examination of these two objectives is needed.

Foreign Portfolio Investment (FPI). There is a point that if interest rates are raised interest rates), it will attract FPI. But there are questions with this approach: If the MPC is concerned about money supply in the Nigerian economy and have taken policy measures to mop up liquidity – increased MPR, increased CRR, sold treasury bills, etc – why is the CBN now targeting FPI which will consequentially increase liquidity?

Two, where will the monies brought in by the FPIs at such high interest rates be invested to generate enough returns to service the investments and still break-even?