UK Govt: Nigeria’s Capital Market Needs $10bn Financing Yearly to Meet SDGs by 2030

The UK government yesterday, said it was committed to supporting Nigeria to develop its thriving capital market and sees its Mobilising Institutional

Capital Through Listed Product Structures (MOBILIST) programme as a strong basis for collaboration with Nigeria’s financial sector. The UK government also said Nigeria’s capital market could help

contribute to the delivery of the country’s economic goals, including the ambition to transition to clean energy solutions, but would need about $10 billion in financing per year to meet the Sustainable Development

Goals (SDGs) by 2030. At two MOBILIST events hosted by the Nigerian Exchange Limited (NGX) and the British Deputy High Commission (BDHC) in Lagos yesterday, the UK government

underlined its commitment to work with Nigeria to enable private capital mobilisation at scale. The events in the Nigeria’s financial hub brought together stakeholders from across the finance

community, including representatives of the Securities and Exchange Commission (SEC) and pension fund industry, to discuss opportunities to

Continued on page 9

www.thisdaylive.com

Minimum Wage talks: Labour rejects NECA, FG's Offer of N54,000... Page 5 Prosecutor says He Was told iCC Was Established for African, russian

&

Ganduje: Although Not Election Period Yet, We’re Working to Secure Tinubu’s Reelection

FG’s policies focused on what works best for Nigeria, Shettima’s aide discloses National Chairman of All Progressives Congress (APC), Dr Abdullahi

Again, CBN Raises MPR to

to Subdue Inflation

Cardoso: Monetary tightening yielding desired outcomes, banking system safe, sound despite headwinds Plans stronger regulatory framework for fintechs NECA, Teriba, CPPE say aggressive monetary tightening squeezing businesses, hurting borrowers Naira sustains gains on official window, stable at parallel FX market

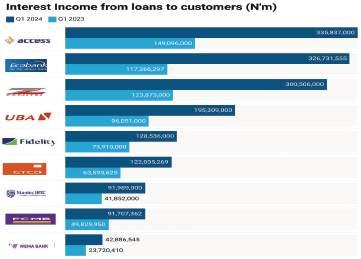

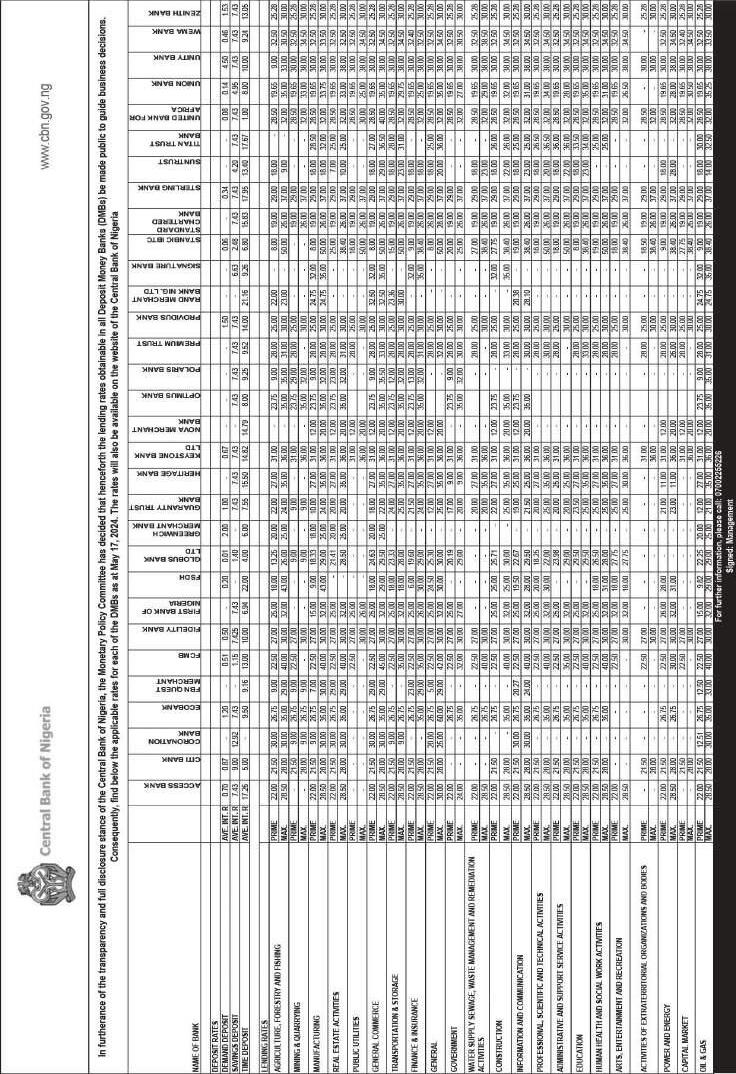

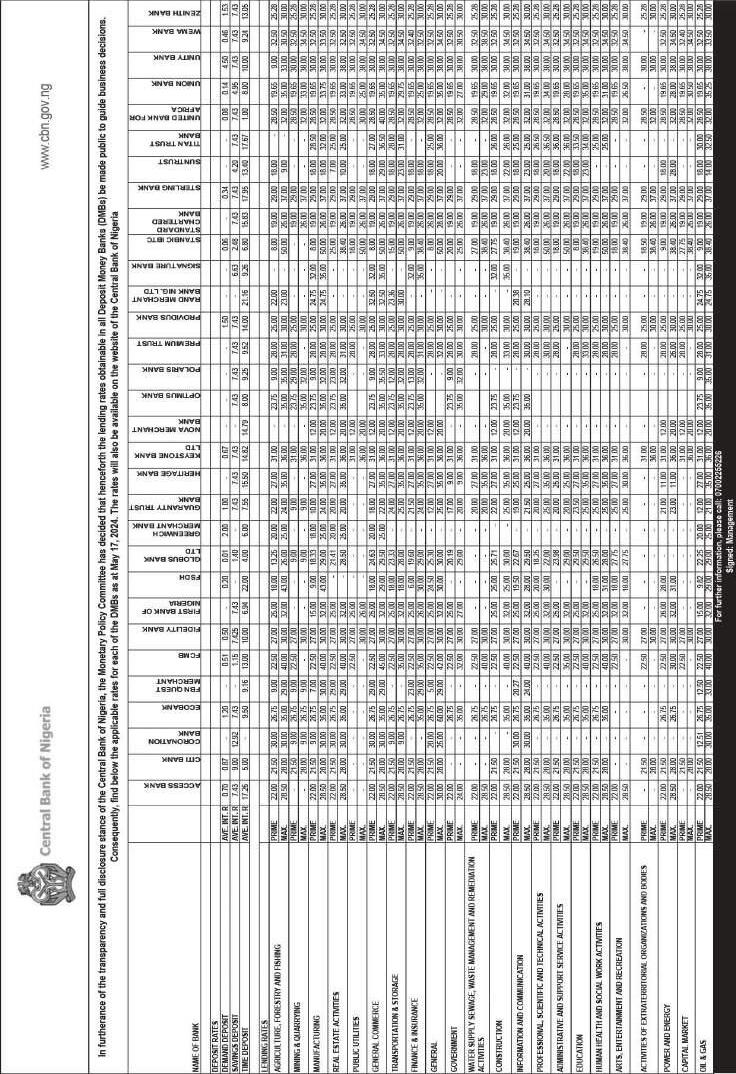

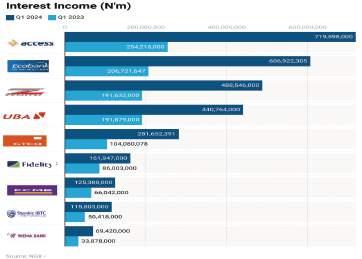

James Emejo in Abuja, Nume Ekeghe and Dike Onwuamaeze in Lagos Walking the talk, the Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) yesterday resolved to further raise the Monetary Policy Rate (MPR), the benchmark interest rate by 150 basis points to 26.25 per cent from 24.75 per cent, in its sustained effort to bring down inflation.

However, reacting to the decision of the MPC, Director General of Nigeria Employers’ Consultative Association (NECA), Mr. Adewale-Smatt Oyerinde; Chief Executive Officer, Economic Associates, Dr. Ayo Teriba; Chief Executive Officer, Centre for the Promotion of Private Enterprise (CPPE), Dr. Muda Yusuf; Managing Director/Chief Executive, Dignity Finance and Investment Limited, Dr. Chijioke Ekechukwu;

Continued on page 9 Continued

Wednesday 22 May, 2024 Vol 29. No 10633. Price: N400 TRUTH

REASON

Emma Okonji and Oluchi Chibuzor

L-R: ,Chairman Senate Committee on Agriculture, Saliu Mustapha; Minister of Finance and Coordinating Minister of the Economy, Mr Wale Edun, President of the Senate, Godswill Akpabio; and Chairman, Senate Committee on NDDC, Asuquo Ekpenyong, during a courtesy call on the Senate President by the

Minister ... yesterday

on page 9

26.25%

Ganduje, yesterday, said while it was not election period yet, the party’s leadership was already working to secure President Bola Tinubu’s second term for consolidation. Ganduje spoke in Abuja at the

Page

Leaders...

9

Deji Elumoye and Adedayo Akinwale in Abuja

WEDNESDAY MAY 22, 2024 • THISDAY 2

WEDNESDAY MAY 22, 2024 • THISDAY 3

WEDNESDAY MAY 22, 2024 • THISDAY 4

APC PROFESSIONALS FORUM POLICY ROUNDTABLE...

L-R: National Chairman, All Progressives Congress (APC), Dr. Abdulahi Ganduje, in tete a tete with former Governor of

policy roundtable in Abuja ... yesterday

Minimum Wage Talks: Labour Rejects NECA, FG's Offer of N54,000

Onyebuchi Ezigbo in Abuja

The Organised Labour yesterday, rejected federal government's new minimum wage offer of N54,000. Following the outright rejection of government's N48,000 by organised labour representatives - Nigeria Labour Congress (NLC) and the Trade Union Congress (TUC) at their previous engagement, the government side yesterday decided to raise it's offer to N54,000 to be at par with what the organised private sector

proposed.

Speaking to journalists after the resumed meeting of the Tripartite Committee on Minimum Wage yesterday, a member of committee representing NLC, Professor Theophilus Ndubuaku, said that labour has maintained position on it's demand for N615,000 as new minimum wage.

He also said that the May 31 deadline labour had given to the government to conclude every negotiations still stands, adding that

AFD, EU Support NAPTIN with $46m to Boost Skills in Nigeria’s Power Sector

The European Union (EU) and Agence Française de Développement (AFD) are collaborating with the National Power Training Institute of Nigeria (NAPTIN) to boost skills and capacity in Nigeria’s power sector for enhanced service delivery.

Under the “Enhancing Vocational Training Delivery for the Nigerian Power Sector” Project jointly funded by the EU and AFD, NAPTIN would receive up to $46 million to help in providing power sector stakeholders with a workforce whose skills have been developed and capacities adapted to their needs.

According to a statement yesterday, at the 10th Steering Committee Meeting of the project held in NAPTIN Headquarters, Abuja, on the April 18th 2024, stakeholders reviewed the progress

made by the initiative, including upscaling the training catalogues; developing, renovating and equipping NAPTIN’s training centers with state-of-the-art standards and equipment; and enhancing the corporate governance and business model of NAPTIN.

“With the biggest hydropower producer and the largest oil reserves in the ECOWAS region, Nigeria also offers great potential for renewable energy.

“In order to have these resources managed by the most skilled workers, NAPTIN was established as part of a larger framework for a robust training program for the power sector. It aims to continuously develop the capacity of the power sector personnel and coordinate training activities across the country and the continent,” the statement added.

there may not be any other notice to government for strike if it fails to keep to the deadline.

He explained that before the N54,000 offer was made, it took the government team time to make up their mind.

According to him, the government's team wasted time coming up with a position before the Minister of State for Labour and Employment, Hon. Nkeiruka Onyejeocha made the pronouncement of N54,000.

"We still told them that the ground they shifted was not enough and that they have not started the negotiation because as at now, the take home of the lowest paid worker is over

N70,000. So, by their own standard we have not started negotiating minimum wage.

"What we are negotiating now is wage reduction because what they are now telling us is that if we walk out from there, if we agree on N54,000, that means we will come out and tell people who are already earning N77,000 that their wage has been reduced.

"We told them that it is not possible for workers to start earning less than what he/she was earning. Is it that there is reduction on inflation or that the cost of living has improved, or is it that the cost of food has come down?

Tinubu Inaugurates

"Why will they now be negotiating wage reduction? It's unthinkable, we cannot be involved in this kind of a thing - that labour will sit down and be negotiating wage reduction. On what will it be based? Will it be based on the fact that the money they are collecting now since petroleum subsidy was removed has reduced?

"Or why will they now be talking about wage reduction when even the inflation is going higher and the cost of living is going higher? So, we told them that that it is not acceptable, but then we had to adjourn because we cannot continue to negotiate without the presence of governors, it will not augur well for the Tripartite

Committee.

"They said they didn't know why the governors were not there, six of them are supposed to be on that committee. We told them that this is a serious matter because when they refuse to come even if at the end we agree on anything they will say it's not binding on them because they were not there.

"There was a permanent secretary that represented one governor and the person has no input, so nobody will take decision on their (governors) behalf when they are not there. So we said let's adjourn and invite the governors formally. So, we had to adjourn to tomorrow (today) by 4pm."

15-member NEITI Board, Recommits to Removing Opacity in Extractive Industry

Emmanuel Addeh in Abuja

President Bola Ahmed Tinubu yesterday inaugurated the National Stakeholders Working Group (NSWG) of the Extractive Industries Transparency Initiative (NEITI), pledging to ensure transparency in Nigeria’s extractive sector.

The president also reaffirmed Nigeria’s commitment to the implementation of the principles and Standard of the global Extractive Industries Transparency Initiative (EITI) in Nigeria.

Represented by the Secretary to the Government of the Federation (SGF), Senator George Akume,

who also chairs the new NEITI board, the president stated that transparency in the extractive sector as well as prudent management of Nigeria’s resources was central to his administration's economic agenda and the anticorruption policies of the government.

“The present administration is passionate and remains fully committed to the global extractive industries transparency initiative, the work of NEITI and the visible impacts which the EITI process has achieved so far in Nigeria.

“Our faith in the EITI process is not just because it is central to our key government agendas,

NCC to Review Three Regulatory Instruments

The Nigerian Communication Commission (NCC) has decided to review three regulatory instruments which include the telecoms networks interconnection regulations; guidelines on procedures for granting approvals to disconnect telecoms operators and guidelines for disputes resolution.

NCC’s Executive Vice Chairman, Dr. Aminu Maida, who disclosed this at the opening of a public inquiry on three subsidiary regulations of the Commission, yesterday, in Abuja, said the review was critical to the growth of the telecoms industry.

He pointed out that the review was in a bid to avoid the interconnection debt crisis that had occurred between two telecoms companies - MTN and Glo.

He stated that the interconnection regulatory instrument plays a vital role in seamless communication between two different networks and grows the industry.

"The first regulatory instrument in our agenda today is the telecoms networks interconnection regulation. As we all know, interconnection plays a vital role in seamless communications between two different networks, and facilitating the growth of the telecom industry in Nigeria.

"This review is crucial to keep pace

with technological advancements, foster competition, protect consumers' interest and align with international standards and improve regulatory efficiency in the industry.

"The guidelines for procedures for granting approvals to disconnect telecoms operators: As the industry continues to evolve, there may be instances where the disconnection of operators become necessary. These guidelines are procedural framework through which such approval are granted to ensure that they are carried out in a transparent and accountable manner.

"Guidelines for disputes resolution: Disputes are inevitable part of any industry. There should be a robust

framework for disputes resolution.

The guidelines aim to provide a clear and transparent mechanism for resolving conflicts within the telecoms sector, promote timely resolution and ensuring that all stakeholders are treated fairly.

"As this needs arise, we must evaluate and review the guidelines to ensure they are effective in resolving conflicts and promoting a stable telecoms ecosystem.

"These regulatory instruments have played a vital role in driving our telecommunications landscape and it is essential that we revisit and revise them to address emerging challenges, trends and opportunities in the industry.

but also because, over the years, NEITI has demonstrated a high degree of competence, integrity and commitment to the values that the country requires to achieve economic growth and development in the sector through availability of reliable information and data required for national planning and reforms.

“NEITI has supported phenomenal revenue growth in the sector through meticulous application of EITI principles. Our national and global focus are on energy security, efficiency and justice in energy financing, renewables and control of emissions.

“ The work of NEITI is so important to our country and particularly this administration in helping us to define our country’s engagement strategy on the energy transition debate through consultations, constructive engagement driven by reliable information and data”, the president affirmed.

Tinubu emphasised NEITI's non-partisan nature, calling on the NSWG members to conduct themselves according to the EITI that defines the function of the NSWG to be focused on policy and oversight, not day-to-day management.

“It is also necessary for me to stress that your appointment is a part-time one. Your appointment as a member of the NSWG is not a full-time job and as members, please note this very carefully to avoid getting involved on issues of day-to-day management which

is the work of NEITI management under the leadership of the executive secretary. You are therefore advised to conduct yourselves in accordance with this requirement,” he added.

Addressing the board shortly after inauguration, Akume stated that his appointment demonstrates the federal government’s prompt and timely response to the recent global EITI assessment of Nigeria’s implementation of the initiative which among other observations stressed the urgent need to reconstitute NEITI’s board to avoid sanctions.

The chairman of the board stressed the need for the new NEITI board to immediately take steps to address the other outstanding issues raised by the EITI validation report which the NEITI secretariat has already prepared a detailed corrective action plan for the board to consider.

“This board has the responsibility to understand the issues and provide policy support to the secretariat to successfully implement the plan. Nigeria scored 72 points in that global assessment and it is my hope that Nigeria will score 100 points at the next validation due in January 2026 under this board and my chairmanship”

“Our duty as a board is to provide strong policy direction for NEITI and the extractive sector for the full implementation of the EITI principles and standards to ensure transparency and accountability in the sector.

THISDAY • WEDNESDAY, MAY 22, 2024 5 NEWS Group News Editor: Goddy Egene Email: Goddy.egene@thisdaylive.com, 0803 350 6821, 0809 7777 322, 0807 401 0580

Emma Okonji in Lagos and Oghenevwede Ohwovoriole in Abuja

Bauchi State, Dr. Isa Yuguda, during the APC Professionals Forum

Photo: ENoCK REUBEN

FRC, NNPCL Bicker over Remittances to CRF

The Fiscal Responsibility Commission (FRC) yesterday, said the agency had no record of remittances by the Nigerian National Petroleum Company Limited

FG

(NNPCL) as expected by law. However, in reaction, the Chief Financial Officer of the NNPCL, Umar Ajiya, said the national oil company had remitted all it ought to have remitted up to the point that it was no longer a corporation.

Chairman of the FRC, Victor Mururako, made the allegation against the NNPCL in Abuja, when he appeared before the House of Representatives on Finance. Muruako, who was represented by Mrs. Victoria Adizou-Angakuru,

said between 2007 and 2018, they computed liabilities against NNPCL.

He explained: “Ours is just a plea as regards their remittance to the purse of the government, which is the Consolidated Revenue

Unveils Portal for Sale of New Houses, Pledges to Ensure Transparency

Partnering firms say Nigerians to buy houses from comfort of their homes

The federal government yesterday launched a portal that will enable Nigerians carry out all their transactions in the purchase of Renewed Hope Housing estates nationwide, insisting that no citizen needs to know anyone in government once they qualify for the scheme.

Speaking at the unveiling of the Renewed Hope Housing Platform, in Abuja, the Minister of Housing, Ahmed Dangiwa stated that President Bola Tinubu was determined to break all the barriers to homeownership for Nigerians.

He assured that the event was in line with government’s promise to facilitate and promote the creation of technology systems and private sector-led initiatives that will make it simpler, easier, and more convenient for Nigerians to own their homes.

Dangiwa said the new platform provides an online, transparent, easy-to-use, integrated web-based application for the sale of homes under the Renewed Hope Cities and Estates Programme of the Ministry, which the president launched earlier this year.

Describing the new portal as smooth and straightforward, he stated that it ensures a seamless and secure registration process with identity verification, enabling potential homeowners to efficiently search for properties using various filters, ensuring they find homes that meet their specific needs.

“The platform also integrates features that offer flexible payment options, including both one-time payments and instalment plans, catering to different financial situations. It also provides easy access to mortgage plans, allowing homebuyers to check their eligibility and apply from anywhere in the world.

“It supports equity contributions for mortgages, streamlining financial planning for buyers. Integrated features like credit checks and bank

statement generation simplify the application process. Buyers can also apply for the release of up to 25 per cent of their Retirement Savings Account (RSA) balance for additional financial support,” he said.

Dangiwa stressed that the ministry was not duplicating housing delivery systems, but supports the mainstreaming of a better, carefully designed, more efficient, and futuristic housing platform that builds on the lessons learned from earlier ones.

“As you may recall, in December 2023, we signed a Memorandum of Understanding (MoU) with a consortium of developers led by Continental Civil to deliver 100,000 housing units nationwide.

“This platform is a key part of this partnership. With this online housing sales platform, we aim to streamline the process for the marketing and sale of houses being built under the Renewed Hope Cities and Estates Programme,” he added.

“Currently, we have Estates in 12 locations and 3 Cities across the country. The Estates are sited in Yobe, Gombe, Ebonyi, Abia, Nasarawa, Benue, Akwa Ibom, Delta, Katsina, Sokoto, Oyo and Osun. The Cities are in Abuja, Kano and Lagos,” he added.

Also speaking, Managing Director of Quantum Agency Services Limited, the marketing partners for the project, Adetola Jagunna, said the new arrangement will be very different feom what obtained in the past.

She said that from the comfort of their homes, Nigerians can start from the beginning to the end once they log on to the platform, including pre-qualification to repayment and offer letter with a step-by-step display of the completion rate during the process.

“You can get your offer letter from the platform. There’s no bureaucracy. You accept your offer letter on the platform, you can make your initial deposit from the platform, you get your receipt

generated from the platform, get your allocation from the platform and then it's off the market.

“So this is very different. It is not the one that you say, it's been distributed among them. No. The same way I am going to apply is the same way every other person is going to apply,” she added.

She added that it was also very deliberate to make it affordable since government is trying to provide housing for even first-time low-income earners who want to own homes.

In his remarks, Consultant to the consortium, Continental Civil and Ceezalli, responsible

for the delivery of some 100,000 housing units, Damola Akindolire, described the programme as transformative.

He argued that economies thrive when the private sector is given an opportunity to engage, stressing that while it took months and years in the past, the process is now shorter and more transparent.

“It brings about accountability. It brings about efficiency. And from the comfort of your living room or your office space, you can access any of the estates or units being built under the Renewed Hope Citizens Estates Programme,” he added.

Fund (CRF).

“The Commission has observed that NNPCL has not really been having a good rapport with the FRC. They have been meeting other agencies like RMFAC and OAGF to resolve disputes regarding their operating surplus remittances, but they have never come to FRC for reconciliation.

“Our table shows that from 2007 to 2018, we have computed liabilities against NNPCL but we are not saying these liabilities are still existing but we don't have any evidence as against any remittance they could have made.

“We want to plead that they should also meet with the FRC, the custodians of the Act in which these other agencies are using to determine their liability.”

However, in response, Ajiya, said the national oil company had reconciled up to the point that they were no longer a corporation.

“As a corporation, we are obligated by law to remit operating surplus and we have evidence that we have remitted all that should be remitted,” he said.

The Committee Chairman, Hon James Faleke directed the NNPCL to reconcile its accounts and give feedback by next Wednesday.

Meanwhile, the House of Committee on Finance queried

the National Social Insurance Trust Fund (NSITF) over discrepancies in the submissions and resolved to place it on status enquiry. This followed inconsistencies in the submissions by the agency to the Committee in the ongoing probe to monitor revenue by Ministries, Departments and Agencies of the federal government.

Managing Director of NSITF, Mrs Maureen Allagoa, appeared before the committee but delegated the responsibility to make submission of the agency to the Director, Finance and Administration, Adedeji Adegoke.

The Committee queried the agency over discrepancies in the submissions and resolved to place it on status enquiry.

“In view of the various submissions available to us as a committee and the discrepancy noticeable in all of your submissions I hereby move that a status enquiry be set to comprehensively the true position of the workings of your agency.

“The status enquiry is from 2018 to date. This means a comprehensive analysis of all their records. Get ready, we are coming and can request for any relevant documents anytime. We would not be giving you notice. Reconcile all your records,” Faleke ruled.

Fubara: My Administration Started Taking Decisions, Confronting Governance in Feb

blessing ibunge in Port Harcourt

Rivers State Governor, Siminalayi Fubara, has reiterated that the projects he was inaugurating were accomplishments of four months because his administration has only started taking decisions, and confronting governance in February, 2024.

He, however, assured the people that his administration would continue to deliver projects that impact positively on the people directly while also empowering them to live better lives.

Fubara gave the assurances yesterday during the inauguration of Egbeda Internal Roads project in Emohua Local Government Area.

He stated that the Egbeda Internal Roads Project, has been accomplished to satisfy the needs of the people by making them happy and solving the perennial flooding problems experienced in the area.

The governor acknowledged the support of the people before, during and after the elections, and said what his administration owed them was the dividends of democracy that included projects and social service

delivery.

Fubara insisted that good governance, service and projects were being delivered at a cost-effective rate.

"We are just starting but I assure you more attention. If in four months, we can do this, and we are getting

this level of applause, you can imagine what will happen when we do one year of our record time, two years of our own record time, Rivers State would have experienced something different from the regular governance.

"I know why I said four months. We started full governance in February, 2024. That was when we started taking decisions, when we started confronting governance. And I am proud to say that our people are happy with what we have done.”

ECOWAS Parliament Proposes Mediation Committee for Mali, Burkina Faso, Niger

Michael olugbode in Abuja Economic Community of West African States (ECOWAS) Parliament has proposed the appointment of an Adhoc Mediation Committee to prevail on Mali, Burkina Faso and Niger, to retrace their steps and reunite with other member nations.

Acting Speaker of the Parliament, Barau Jibrin, who is also the Deputy President of the Nigerian Senate, said the machinery has been set in motion to do this.

Jibrin, speaking at the opening of 2024 Second Extraordinary Session of

the Sixth Legislature of the ECOWAS Parliament in Kano State yesterday, noted that there was no alternative to a strong united regional bloc.

''I will, in consultation with my colleagues on the Bureau, be proposing the appointment of an Ad hoc Mediation Committee whose mandate will be to work with all stakeholders in getting our brothers to rescind their decision and come home and work towards promoting dialogue with a view to resolving conflicts in the region.

“It’s no doubt that we are stronger and there is absolutely no alternative to our collective

aspirations of a united, peaceful and secure ECOWAS,” he said. Niger, Mali and Burkina Faso had in January this year announced their withdrawal from the Economic Community of West African States, ECOWAS.

The junta-led countries had been suspended from the regional bloc for coup d’état and were urged to return to democratic rule.

But in a shocking reaction to the suspension, the three governments took the decision to withdraw from ECOWAS as according to them it was a "sovereign decision" to withdraw from the regional bloc.

6 WEDNESDAY, MAY 22, 2024 • THISDAY NEWS Public Markets-Focused Finance engageMent...

L–R: Chairman, Nigerian Exchange Limited (NGX), Mr. Ahonsi Unuigbe; British Deputy High Commissioner, Mr. Johnny Baxter; and acting Chief Executive Officer, NGX, Mr. Jude Chiemeka, during the Public Markets-focused Finance Engagement organised by Mobilist & NGX in Lagos... yesterday

emmanuel addeh in Abuja

adedayo akinwale in Abuja

WEDNESDAY MAY 22, 2024 • THISDAY 7

INAUGURAtION OF LAFARGE AFRICA SUPPLIERS SUMMIt...

L-R: Legal Compliance Officer, Nigeria Area Compliance Officer East and South Africa, Lafarge Africa Plc. Mrs. Anuoluwapo Gbadegesin; Procurement and Operations Planning Director, Lafarge Africa Plc. Mr. Saeed Ande; Assistant Chief Enterprise Officer, Small and Medium Enterprises Development Agency of Nigeria (SMEDAN), Mr. Leke Babalola; GMD/CEO, Lafarge Africa Plc. Mr. Lolu AladeAkinyemi; Manager for Governance, Risk and Compliance, PwC Nigeria, Mrs. Temilola Abdul; Group Managing Director, Bhojsons Group, Mr. Vishant Dalamal; and Head of Acquisition and Specialised Sectors, Stanbic IBTC Bank, Mr. Patrick Eneh at the Inaugural Lafarge Africa Suppliers’ Summit at Eko Hotels and Suites, Victoria Island, Lagos... on Monday

Agora Policy: Despite International Endorsement,

Macroeconomic Variables Not Favouring Nigerians

Agora Policy, a Nigerian think tank and non-profit organisation, has argued that despite the international endorsement of the Bola Tinubu administration's policies, Nigerians had yet to feel the favourable impact of the government’s recent decisions.

In its latest report on Nigeria’s monetary policy, the Waziri Adio-led group stated that at the heart of the ongoing divergence is the lack of a concerted effort by policymakers to address the forex liquidity problem that underlies the exchange rate turmoil.

“Despite strong action on the monetary policy front, which has garnered widespread praise from domestic and international observers, Nigeria’s key macroeconomic variables have yet to respond favourably for the populace.

“At the heart of this ongoing divergence is the lack of a concerted effort by policymakers to address the forex liquidity problem that underlies the exchange rate turmoil.

“Specifically, the absence of a tractable source of USD liquidity to fill the shortfall from oil flows, which remain largely encumbered, continues to hinder the Central Bank of Nigeria (CBN) efforts to manage the foreign exchange situation," Agora explained.

It argued that without tangible progress on this front, the persistent weakness of the Naira will continue to drive higher inflation, necessitating even higher interest rates and leaving a precarious outlook for non-oil sector growth.

The group stressed that Nigeria’s external sector gap, looking at the shortfall between the current account is largely driven by negative trends

in foreign net flows and ongoing domestic financial outflows, reflecting the negative impact of the previous era policy of negative real interest rates.

“To bridge that 2023 gap, Nigeria would have needed total flows of $7-$10 billion to prevent significant external reserve drawdowns. Though a return to orthodox policies has partially addressed this issue, a complete restoration to historical trend levels will take time. In short, Nigeria needs a temporary dollar liquidity bridge to allow reforms to take effect.

“Beyond the rhetoric of orthodox reforms, Nigeria’s economic managers need to directly address the forex illiquidity problem by exploring optimal solutions. “These options include a possible Eurobond sale in the $5-10 billion range, though this might be challenging to execute without commercially punitive terms,” it added.

It emphasised that asset sales have

been suggested as a way to raise dollar flows, including the sale of certain strategic public corporations.

However, Agora explained that outside the oil sector, Nigeria lacks assets of sufficient strategic value to raise large sums quickly.

‘’Another option is the possibility of sovereign placements, similar to Egypt’s receipt of large foreign dollar deposits from the UAE, alongside support from the EU, UK, and western donors.

“However, such flows depend on international diplomacy, and Nigeria lacks a strong history of focused international relations to unlock capital flows. Alternatively, engaging multilateral agencies like the International Monetary Fund (IMF) for financing options within the context of a reform programme is a viable route.

“Given the difficult reforms undertaken over the last 12 months (hikes in fuel and electricity prices and a shift to a flexible exchange

WHO Targets

The World Health Organisation (WHO) has said it has launched the second edition of sodium benchmark on processed foods expected to guide countries in setting feasible and effective sodium reformulation programme.

Speaking at this year's World Salt Awareness Day organised bytge Federal Ministry of Health and Social Welfare in Abuja, the WHO Country Representative, Dr. Walter Kazadi Mulombo, said this year's

rate system), Nigeria is in a position to negotiate a favourable financing package,” the group posited.

While these are fiscal decisions, not within the monetary policy remit, Agora policy said they are crucial for the CBN to stabilise the Naira exchange rate.

Success in this area, it argued, would stabilise exchange rate trends associated with portfolio flows and build confidence to unlock private and foreign USD flows.

Over the medium term, Nigeria, it said, must focus on restoring organic dollar flows from oil exports by clearing the backlog of encumbrances.

Transparency regarding the nature and size of these liabilities will improve confidence about potential timelines for reserve recovery.

“Beyond the immediate forex liquidity problem, there is a pressing need for a credible basis for conducting monetary policy over the medium term. While various Nigerian central bank

governors have considered inflation targeting, these have largely been declarative positions without the empirical groundwork for setting achievable inflation targets and the policy leeway to attain these goals.

"The crisis of the last 12 months has underscored the importance of the exchange rate in anchoring inflationary expectations. In a small open economy like Nigeria, monetary policy must balance exchange rate stability, crucial for near-term inflation, with non-mineral export competitiveness.

“This boils down to achieving a Naira Real Effective Exchange Rate (REER) level that anchors inflationary expectations sustainably.

"Additionally, there is a need to clarify monetary policy implementation in light of Nigeria’s regime of fiscal liquidity dominance. Nigeria’s fiscal petrodollar-to-Naira monetisation generates surplus Naira liquidity, complicating the execution of monetary policy.

“Unlike other oil-exporting countries that use fiscal rules to determine the rate of export USD monetisation, Nigeria injects transformed export dollars to Naira at a fiat exchange rate, leading to excess financial system liquidity,” it pointed out.

The significant costs associated with curbing the impact of this excess Naira liquidity on inflation and USD demand, it stressed , drive actual monetary policy.

It argued that recalibrating Nigeria’s monetary policy implementation toolkit to address monthly government liquidity transformations was central to improving monetary policy transmission.

"Ideally, this would require a fiscal rule which requires political capital to reform. If the status quo persists, the default monetary policy posture will be to constantly curtail financial system liquidity to manage the fallout of excess liquidity on USD demand,” it argued.

30% Global Reduction in Sodium In-take

World Salt Awareness Week aims to encourage the implementation of evidence-based interventions to reduce salt consumption in the population to protect cardiovascular health and help prevent many other diseases.

He explained that this year’s theme was, “It's time to shine the spotlight on salt," was meant to highlight the issue of the “hidden" salt (sodium) in many processed and ultra-processed products.

He further said three-quarters of sodium in the diet comes from

ultra-processed and processed foods, such as bread, sauces and dressings, crackers and cookies, ready-to-eat meals,

According to Molumbo, salt/ sodium intake reduction was one of the most cost-effective interventions to check hypertension and cardiovascular diseases. He said WHO recommends less than five grammes of salt per day for an adult which is less than tea-spoonful.

"The objective of these benchmarks is to achieve a 30 percent global reduction in sodium intake. We

Tollgate Fees: House Directs Aviation Minister, Others to Exempt Members of Armed Forces

The House of Representatives has directed the Minister of Aviation to mandate the relevant authorities to exempt Members of the Armed Forces from tollgate and parking fees at airports, seaports and train stations across Nigeria.

The resolution followed the adoption of a motion of urgent national importance on the, “need to waive tollgate fees in all Nigerian airports for members of the armed forces of Nigeria,” moved by Hon. Abdussammad Dasuki, during plenary yesterday.

Dasuki, noted that it was reported on May 14, 2024, by

online and print media that the Minister of Aviation had announced that the Federal Executive Council (FEC) approved the cancellation of all exemptions on airport access payments for VIPs in Nigeria due to the huge revenue losses they cause to the federal government. He also noted that the Minister of Aviation would implement the decision of the FEC by sending out circulars to relevant authorities in a matter of days. The lawmaker further noted that men and women of the Armed Forces, “honour our nation with the highest form of service and without reservation; keeping us

safe from harm, protecting our wealth and territorial integrity, ensuring safe navigation on our territorial waters, protecting our borders including the Gulf of Guinea, Creeks, Sahara Desert and forests, and fighting armed bandits who invade our communities.”

Dasuki added: "It is important to show gratitude by honouring our brothers and sisters who are voluntarily serving under our flag, putting in their active years to keep our nation safe with some losing their lives, and some becoming disabled from the battlefield amidst other effects."

He stressed that honouring men and women in uniform, and

also encouraging fellow citizens to acknowledge their service to the nation is the right step to take as a way to appreciate the immeasurable sacrifices they make.

"Honoring those who fight for our survival, will also inspire our youths to enrol in the military not as a means of escaping the web of unemployment, but as a valuable call to higher service to the nation. Concerned that members of the Armed Forces are subjected to paying for access to our airports where they are also expected to protect citizens and foreigners alike whether or not they are on duty and even while they are passengers themselves.

will like to reiterate our commitment to supporting the country in the development and implementation priority Activities towards sodium reduction.

"We therefore join our voices to this call-to-action with a call to: countries to adopt the global sodium benchmarks to reduce their populations’ sodium intake, We urge Industries to implement the global sodium benchmarks, reformulate food products," he said.

The WHO scribe said the organisation along with other partners are working with the federal government to develop national targets setting and sodium benchmarking.

According to WHO Country Representative, the collaboration would help to accelerate reformulation action, adding that it also continues to monitor progress in reduction sodium intake around the world by updating on sodium country card and periodically publishing global sodium reduction reports.

Coordinating Minister of Health and Social Welfare, Prof. Muhammad Pate, who was represented by the Permanent Secretary in the ministry, Daju Kachallom said an estimated 10 percent of hypertension cases in the country was being caused by excessive salt consumption.

He listed measures being taken by government to address excessive salt consumption in the country to include implementation of the National Multi-sectoral Action Plan (NMSAP) for the prevention and control of Non-Communicable Diseases 2019

which aims at combating the silent epidemic of non-communicable diseases through strategic policy intervention.

Another step being taken by government was the revision of the national policy on food safety and quality and its implementation plan for 2023.

"This revision includes a crucial emphasis on healthy diets and underscores the importance of developing a National Guideline for Sodium Reduction," she said.

The minister also said the ministry has inaugurated the National Technical Working Group on Sodium Reduction.

"Together, they are developing the first National Guideline on Sodium Reduction. This groundbreaking work is expected to reach completion in the 3rd Quarter of 2024. We have initiated the development of the First National Sodium Benchmark.

"This involves drafting mandatory sodium targets for selected food categories, a step that will pave the way for scientific and measurable progress in our fight against excessive salt consumption," she said.

On its part, the National Agency for Food and Drug Administration and Control (NAFDAC), said that apart from promoting public health through sensitisation and advocacy on sodium/salt reduction, it carried out stakeholders’ engagements and implementation of mandatory nutrition labelling, introduction of front-of-pack labelling and encouraging industry to reformulate food products.

8 WEDNESDAY, MAY 22, 2024 • THISDAY NEWS

Emmanuel Addeh in Abuja

Juliet Akoje in Abuja

Onyebuchi Ezigbo in Abuja

Prosecutor Says He Was Told ICC Was Established for African, Russian Leaders

Says he won’t be swayed by criticisms

Emmanuel Addeh in Abuja

The Chief Prosecutor of the International Criminal Court (ICC), Karim Khan, has disclosed that he was expressly told that the court is not for Europe and American leaders, but for African and Russian deviants.

Speaking with CNN’s Christiane Amanpour, a British Iranian journalist, Khan lamented the seeming double standard exhibited by the West, saying that the comments by US lawmakers, vowing to ensure sanctions against the organisation and its leaders, was obviously a threat.

In a move rarely seen, Khan, had applied for arrest warrants for Israeli Prime Minister, Benjamin Netanyahu, an American ally, as well as the country’s Defence Minister, Yoav Gallant.

Wealth Management and Business Development Consultant, Mr. Ibrahim Shelleng; and Managing Director/Chief Executive, SD&D Capital Management Limited, Mr. Idakolo Gbolade, argued that it would further squeeze operators in the real sector of the economy, have negative consequences on borrowers and slowdown economic growth.

The apex bank recently signaled a return to orthodox monetary policy regime as CBN Governor, Mr. Olayemi Cardoso, vowed to continue to adopt a contractionary policy stance to tackle inflation to achieve price stability – as long as it takes.

The CBN had raised interest rates by a total of 7.5 per cent since its maiden meeting in February as manufacturers continue to groan under high cost of funds. The MPR is the rate at which commercial banks borrow from the economy and often determines the cost of funds.

The bank at yesterday’s meeting, however, retained the asymmetric corridor around the MPR at +100/-300 basis points, and left Cash Reserve Ratio of Deposit Money Banks, and the Liquidity Ratio unchanged at 45 per cent and 30 per cent respectively.

Addressing journalists after the two-day meeting of the MPC in Abuja, Cardoso, said the focus of the committee remained to achieve price

APC Professionals Forum Policy Roundtable Conference on "Asiwaju Score Card Series". He praised the Tinubu leadership and said Nigeria was on the path of progress, with ongoing reforms across key sectors of the economy.

Special Adviser to the President on General Duties, in the Office of the Vice President), Dr. Aliyu Modibbo, who was also at the event, said the programmes and policies of the administration of Tinubu were focused on what worked best for the country, given its present circumstances.

The APC chairman, who spoke about the intentions of the APC, said the National Working Committee (NWC) of the party was working to reinvigorate the party to get new state governors come 2027.

He reaffirmed his commitment to the ideals of APC to set new standards and benchmarks in the nation's democratic sphere, stating that the party is “reinvigorating itself to ensure that success across board in future elections”.

Ganduje stated, “Even though it is not yet an election period, we are reinvigorating that party to ensure that come 2027, we will retain and get new governors, as well as Mr President to secure another mandate to continue with his government's policies and programmes.

“We are gradually restructuring our party into a truly grassroots progressive party. We have directed our state chapters to liaise with their respective governors and other stakeholders to ensure that we have full-fledged, functional offices in every political ward and state to enable

The ICC prosecutor said his office had applied to the world court’s pre-trial chamber for arrest warrants for the military and political leaders on both Israeli and Hamas’ sides for war crimes.

While the Hamas leaders are wanted for crimes of extermination, murder, hostage taking, rape, sexual assault and torture, Netanyahu and Gallant are accused of extermination, causing starvation as a method of war, the denial of humanitarian relief supplies and deliberately targeting civilians

The ICC has previously issued warrants for the Russia’s Vladimir Putin, Muammar Gaddafi of Libya, and the Ugandan warlord Joseph Kony.

But President Joe Biden and US lawmakers quickly rose in defence

stability by effectively using tools available to the monetary authority to rein in inflation.

He said the MPC was faced with the option of either continuing with policy tightening or hold to observe the impact of previous rate hikes.

The CBN governor said, “Following an extensive review of risks and the near-term inflation outlook, the balance of risks suggests further tightening of policy to build on the benefits accruing from previous rate hikes.”

The Consumer Price Index (CPI) which measures the rate of change in prices of goods and commodities soared to 33.69 per cent in April with the food index peaking at 40.53 per cent year-on-year.

He said the MPC members observed that while year-on-year headline inflation in April 2024 rose moderately, the month-on-month measures of headline, food and core all declined significantly, coupled with a month-on-month decline of both headline and food indexes in March 2024.

This, he said, suggested that the recent tight monetary policy stance of the apex was beginning to yield the desired outcomes. He said the rate of increase in prices had now moderated.

The committee pointed out that inflationary pressure continued to

our members across the country to have symbolic representation in their“Thisneighbourhood. measure will ensure that party activities are rolled out all year round, not during political campaigning and elections only.”

The APC national chairma said the NWC had also constituted a committee that would reconcile all aggrieved party members, and such committees would be established at the state, local government and ward levels.

On his part, Modibbo declared, “Every country's journey is distinct. Every country is shaped by its economic history and challenges. We respect the efforts of other nations, but we are focused on what works best for Nigeria."

He said the eight-point agenda of the Tinubu administration provided a clear framework for its policies and programmes, even as he outlined core areas of concentration.

These, he said, included driving "job creation, economic growth, food security, poverty eradication, access to capital, the rule of law, anti-corruption efforts, and inclusive development.

“These initiatives are not just plans on paper; they are actions being implemented to create tangible improvements in the lives of everyday Nigerians.

“Similarly, we are also focused on reducing unemployment and underemployment through various initiatives, including the Outsource to Nigeria Initiative, Investment in Digital and Creative Enterprises, and the Expanded National MSME Clinics. These programs are designed to create more job opportunities and

of the Israeli leader, slamming the ICC and calling the warrants “outrageous.”

However, in an interview with CNN, Khan stated that ultimately, he was only sticking with the rule of law by attempting to declare Israeli and Hamas leaders as war criminals.

He acknowledged that in the last two years he had worked amicably with the Joe Biden administration, whether it's in Ukraine or Dafur, explaining that American values were against bullying.

“It's against the untrammelled power against the most vulnerable, it's the rights to the dignity of the individual. It's the protection of babies. I mean, these are fundamental American values that should engender bipartisan support.

“Now, of course, this situation

be driven largely by food inflation, attributable to rising cost of transportation of farm produce; infrastructure-related constraints along the line of distribution network; security challenges in some food producing areas; and exchange rate pass-through to domestic prices for imported food items.

The MPC urged the fiscal authority to do more to address the security of farming communities to guarantee improved food production in these areas.

The committee further observed the recent volatility in the foreign exchange market, which it attributed to seasonal demand – a “reflection of the interplay between demand and supply in a freely functioning market system”.

The committee also noted the marginal increase in the external reserve balance between March and April 2024 and urged the CBN to sustain its focus on accretion to reserves.

Cardoso, who read the committee’s communique, said members commended the apex bank for the recent approval of licenses of 14 international Money Transfer operators (IMTOS), adding that this was expected to improve competition and lower the cost of transactions, and attract more remittances through formal channels.

foster economic inclusivity.

“This initiative will empower our youth and ensure that they have the resources needed to succeed, and I assure you that the policy is in place to offer interventions to vulnerable or disadvantaged Nigerians without discrimination or favouritism”.

Chairman, Board of Trustees, of APC Professionals Forum, Dr Isa Yuguda, said the roundtable was organised to take stock of the first year of Tinubu's Renewed Hope Agenda under the banner of the Asiwaju scorecard series.

Citing examples across different

solve some of the principal barriers to increasing investment in the SDGs via public markets.

This week’s events come after former UK Foreign Secretary James Cleverly’s visit to Nigeria last year and his participation in the launch of the partnership between MOBILIST and NGX intended to catalyse greater investment in the SDGs via new investment structures listed on the exchange.

MOBILIST provides investment capital in the form of equity as well as technical assistance to overcome barriers and enable the listing of pioneering products that can mobilise institutional capital at scale to deal with the twin challenges of development and the climate transition.

British Deputy High Commissioner Jonny Baxter, while delivering his remarks at the event, said: “The UK government is committed to supporting Nigeria in the continued

unfortunately, lies on the fault of international politics and strategic interests. And of course, I've had some elected leaders speak to me and we're very, very blunt.

“This court is built for Africa and for folks like Vladimir Putin, was what one senior leader told me. But we don't do it like that. This court is the legacy of Nuremberg, this court is a sad indictment of humanity.

“This court should be the triumph of law, over power and brute force and grab what you can, take what you want, do what you will. And we're not going to be dissuaded by threats or any other activities because in the end, we have to fulfil our responsibilities as prosecutors, as the men and women of the office, as judges, as the registry.

He said the committee noted with satisfaction that the banking system remains safe, sound, and stable, despite the headwinds confronting the economy.

It also commended the recent recapitalisation initiative and urged the management to sustain its regulatory oversight to ensure the continued stability of the banking system.

According to him, members focused on the best policy approach to continue to guide the economy towards achieving an overall macroeconomic balance.

Asked about the disposition of the central bank to the fact that inflation pressure had persisted despite the recent aggressive MPR hikes, Cardoso said: “It is important to say that in terms of looking at the inflationary pressure over the past year, yes, it may appear that inflation is indeed getting more and more of an issue and frankly.

“However, I think there is light at the end of the tunnel, and that is because much as we see an increase in inflationary figures, way to go down to the specifics in terms of food, in terms of core, headline inflation, you'll see that it is moderating and decelerating in increment, and that's the good news.”

The CBN governor added, “For first time since October, we

sectors, including the oil and gas industry, Yuguda said Tinubu had been vindicated in his insistence on removal of subsidy on petrol.

He explained, “Indeed, the president has today been proved right with the manner petrol importation has gone down by 50 per cent since June 2023 and it is almost certain to go down more in a few months when the 650,000 barrels per day Dangote Refinery begins to produce PMS locally as well as the impending resumption of production at the Port Harcourt and Warri Refineries.”

development of its capital market to help deliver the country’s economic goals, including its ambitions to transition to clean energy solutions.

“A liquid and well-regulated capital market benefits the entire economy by enabling companies to raise capital to fund their expansion, which in turn helps deliver crucial development, job opportunities and improved incomes.

“MOBILIST’s focus on stimulating the creation of innovative listed products can make a unique and impactful contribution to achieving these objectives.”

In his goodwill remarks, the Chairman, NGX, Ahonsi, Unuigbe, highlighted the need for addressing barriers hindering public listings through collaborative discussions.

According to Unuigbe, “The discussions we have today are crucial as we address barriers hindering public listings and explore

“And this is something bigger than ourselves, which is the fidelity to justice. And we're not going to be swayed by the different types of threats, some of which are from Republicans or maybe not," he maintained.

US senators and US congress people, mostly Republicans, had written a letter signed by Senator Tom Cotton, Mitch McConnell, Ted Cruz, Marco Rubio and others, to target the ICC and its leaders if Khan went ahead with the resolve to declare Netanyahu a war criminal.

“If you move forward with the measures indicated in the report, we will move to end all America’s support for the ICC, sanction your employees and associates and you and your families from the United States,” the lawmakers

have seen a relatively significant moderation in the rate of increase on those components of inflation. So, that is very good news. I believe very strongly that the tools that the central bank is using are working.

“I have said several times that there's no magic wand, these are things that need to take their own time, the pass-through and the effect of the measures in advanced countries in developing countries, they take time; but at least I am confident that the figures show it themselves that we are beginning to get some relief.

“And I believe that in another couple of months or so, we will see more positive outcomes from what the central bank has been doing.”

On why the central bank initially introduced the controversial cybersecurity levy which had now been suspended, Cardoso said, “Now for clarity, the cybersecurity levy originated from the CyberCrime Act in 2015 and 2024. The Act introduced the levy. It is important to say that given that it is an Act, it was considered extensively by both the House of Representatives and the Senate, and of course there was a public hearing as a result.

“After that, there was the issue of the levy which was stated clearly as 0.5 per cent, and was embedded within the final law.

“As central bank and as bankers to the government, we were merely implementing the law that had been enacted, and subsequently, as the federal government amended its position, we withdrew the circular that we issued to the various banks.”

The CBN governor also spoke on the recent directive of the apex bank that barred fintechs from onboarding new customers, noting that it was in the interest of Nigerians that the platform remained safe and secure. He also refuted suggestions that fintech may have been solely targeted.

He also clarified that contrary to reports, the central bank has not revoked the operating licenses of fintechs, adding that the current moves by the apex bank was to

actionable solutions. By overcoming these obstacles, we can unlock the full potential of our capital market, enabling more businesses to access the funding they need to grow and thrive. Some of these obstacles are significant such as regulatory challenges, high listing costs, and market volatility.”

MOBILIST Programme Lead at the FCDO, Ross Ferguson said: “MOBILIST is the expression of the UK’s conviction that public markets have a underutilised but potentially critical role in financing sustainable development at scale by mobilising private capital to flow where it is needed most – to the firms that are going to contribute most to solving developmental challenges and help deliver a fair and orderly climate transition for Nigeria.”

While delivering the welcome address, the Acting CEO of NGX, Jude Chiemeka, emphasised the

Karim Khan

Karim Khan

had threatened. But Khan stated that there were ‘hotheads’ everywhere, but added that there are also people that are mature statesman and stateswoman and leaders that have fidelity to something greater than themselves.

ensure that they operate in a properly regulated manner amid cases of money-laundering and other abuses. He said, “The fintechs have not been singled out, or any exceptional kinds of treatment, they have not. So, I have read a couple of things in the press more recently, and I want to assure you that that is the farthest from the truth.

“On the contrary, we are very proud of what the fintechs over the years have been able to do for the country and the positive impact that it is having not just in the country but globally. So, it is for us to support them and help them to strengthen what they've already been able to accomplish.

“However, regulation is very critical in a sector that seems to have grown so incredibly rapidly. More recently we had spoken about that in the past, we had cause to take a deep dive look at the whole issue of illicit flows and money laundering particularly within the more heavilyregulated banking system.

“And we all know some of the issues that came out with crypto and some of the messages that we put out after that, which of course, gave us some cause to know that there was a need for heightened surveillance.

“And again, we are very happy that we have been able to have a very major handshake with the law enforcement agencies, which have helped in no small measure for us to identify where the potential leakages are and the places where we need to tighten regulation and surveillance.”

Cardoso said, “And for that reason, we were concerned about how we saw issues of money-laundering and illicit flows as they made their way within various sub-sectors of the financial industry. “We felt there was a need for us to take a breather and see how we could work with the different players there to strengthen regulations, not by any means to

Continued on page 36

impact of the partnership with MOBILIST.

He stated: “Our partnership with MOBILIST is geared towards advancing market efficiency, sustainability reporting, and integrating Environmental, Social, and Governance (ESG) principles.

“This event represents a significant milestone in our ongoing efforts to enhance the performance and deepening of Nigeria’s capital market by promoting sustainable capital flows and enhancing listing diversity.

“The discussions from today are poised to yield actionable insights on how we can collectively catalyse economic growth through the capital market. By harnessing the potential of our capital market, we can unlock new opportunities for funding businesses, fostering entrepreneurship, and ultimately driving sustainable development across Nigeria.”

nine THISDAY • WEDNESDAY, MAY 22, 2024 9

A n D uje: AlTH ou GH n oT e lec TI

Per I o D Ye T, We’re Work I n G To Secure T I nubu’ S r eelec TI on uk Gov T: nIG er IA’ S cAPITA l M A rke T n ee DS $10bn F I n A nc I n G Ye A rlY T o Mee T SDG S b Y 2030 A GAI n, cbn rAIS e S MP r T o 26.25% T o Sub D ue In F l ATI on

G

on

WEDNESDAY MAY 22, 2024 • THISDAY 10

WEDNESDAY MAY 22, 2024 • THISDAY 11

WEDNESDAY MAY 22, 2024 • THISDAY 12

WEDNESDAY MAY 22, 2024 • THISDAY 13

WEDNESDAY MAY 22, 2024 • THISDAY 14

WEDNESDAY MAY 22, 2024 • THISDAY 15

politics

Email: deji.elumoye@thisdaylive.com

How Constitutional Is Soludo’s Quarterly Sack of Anambra LG Chairmen?

David-Chyddy Eleke writes about Governor Charles Soludo’s recent sack of all the 21 local government chairmen in anambra state and wonders if the governor’s quarterly act since 2022 is constitutional.

For two years since he has been governor of Anambra State, Chief Chukwuma Soludo, has been running the 21 local government councils in the state with members of his party, handpicked by himself. This is despite his campaign promise in 2021 that one of his priorities would be to conduct local government election, an exercise that has not been held since over 14 years ago.

The local government system in Anambra state which over the years have been run by transition/caretaker committees involves a set of people, who ordinarily should stay in office for just three months to take care of the affairs of the councils as arrangements are made to elect substantive chairmen.

But in Anambra, Soludo’s predecessor, Chief Willie Obiano, used his cronies to run the council, while renewing their tenure every three months by writing to the state assembly, until the end of his eight-year term.

Soludo also continued with the arrangement, and within two years, he has renewed the appointment of the same set of chairmen seven times, until last weekend, when he announced a sack of all of them.

In a letter dated May 17, 2024, signed by the Commissioner for Local Government, Chieftaincy and Community Affairs, Mr Tony Collins Nwabunwanne, Soludo directed the Chairmen to handover the affairs of their Local Government Councils to the Head of Local Government Administration (HLGA) latest on Monday, 20/05/2024.

The letter read in part: “Following the expiration of your tenure as Transition Committee Chairman, you are hereby directed to handover the affairs of your Local Government Council to the Head of Local Government Administration (HLGA), in your respective Local Government Councils.

This directive takes effect from Monday, 20th day of May, 2024. Thank you for your service to the state. All replies to be addressed to the Honourable Commissioner.”

Considering the fact that there is still no State Independent Electoral Commission (SIEC) in place, many political analysts in the state have concluded that even though Soludo has sacked his cronies as chairmen, there may not be plans to hold any local government election soon, rather, the governor may replace them with a different set of cronies. This has elicited outcry from some well meaning individuals in the state.

The member representing Ogbaru Federal Constituency in the House of Representatives, Hon. Afam Ogene, has condemned any plans to appoint a new set of administrators. Ogene, who is the Labour Party’s House Caucus Leader said: “Records show that Governor Soludo changes LGA Transition Committee members every three months, and has therefore, made these curious changes seven times since assumption of office in 2022. By the time he makes another of such change this month, that would be the eighth time within two years in office.

“That to me, would be an inglorious record by a democratically elected governor. This puppeteering style of leadership, which toys with the destiny, aspiration and desires of the grassroots, must be resisted and not allowed to continue to shrink the development potential of the LGAs. The local government ought to be the most important tier of government, as envisaged by the Nigerian Constitution, because it’s not

only the tier that is closest to the people, it is also the obvious foundation of both the subnational and the federal government. And should not be at the whims of state governors.

“Such undemocratic practice of appointing LGA administrators, rather that democratic election, is an enabler of impunity and lack of democratic accountability and also hurts transparency in the local governments and the state as a whole, as those so appointed would only scramble for personal interests during the three months of their stay in office. This does not help the management

of scarce resources or the development of the LGAs.

“What manner of meaningful development plan would a Transition Committee chairman articulate and execute within a period of three months? Isn’t it troubling that Governor Soludo, a prominent economist, is promoting this charade? What really is Governor Soludo afraid of in conducting elections in the LGAs, in line with his campaign promises and the desires of the people in the grassroots and provisions of the Constitution?”, the lawmaker queried.

Meanwhile, THISDAY gathered that there is already a directive by the governor for all stakeholders of All Progressives Grand Alliance (APGA) in all

Records show that Governor Soludo changes LGA Transition Committee members every three months, and has therefore, made these curious changes seven times since assumption of office in 2022. By the time he makes another of such change this month, that would be the eighth time within two years in office. That to me, would be an inglorious record by a democratically elected governor. This puppeteering style of leadership, which toys with the destiny, aspiration and desires of the grassroots, must be resisted and not allowed to continue to shrink the development potential of the LGAs. The local government ought to be the most important tier of government, as envisaged by the Nigerian Constitution, because it’s not only the tier that is closest to the people, it is also the obvious foundation of both the subnational and the federal government. And should not be at the whims of state governors.

the local government to come together and nominate three persons for possible consideration as the chairman of such local government. It was gathered that the directive which was handed over through the office of the Special Adviser to the Governor on Political Matters, Dr. Alex Obiogbolu, insisted that all three nominations must include at least a female nominee.

A source said: “The party stakeholders in each Local Government are expected to meet on May 18th or 19th 2024, to consider and recommend for his consideration, three persons for the position of TC Chairman and three persons for Local Government Education Secretaries. The three recommendations for Transition Committee Chairmen shall include at least one woman; while the three recommendations for Education Secretary shall be two women and one man.”

He said the circular emphasized that persons for the Transition Chairmen must be persons of good standing, and with demonstrable competence and passion to contribute to the transformation of the Local Government.

Already, there are protests in some local governments about plans to foist some nominees on the local government. In Idemili South Local Government Area, political turmoil erupted as stakeholders vehemently opposed the reappointment of former TC Chairman, Hon. Amaka Obi. Protesters who stormed the local government secretariat in Ojoto said there were feelers that the powers that be in the local government have plan to reappoint the lady politician again, after she had already done two years.

The protesters contended that she was from Awka Etiti, which is just one out of the many communities that make up the local government area. They also insisted that before her, the former chairman who held sway was from same community, and that there was need for rotation.

The protesters said: “Idemmili South comprises Akwu-Ukwu, Alor, Awka-Etiti, Ojoto, Nnokwa, Oba, and Nnobi, yet Awka Etiti alone has monopolized the chairmanship position for an uninterrupted eight-year period, contravening democratic principles and zoning arrangements. Hon. Don Unachukwu, from Awka-Etiti, served as transition Chairman of Idemmili South from 2016 to 2022, before Hon. Amaka Obi, hailing from the same Awka-Etiti, assumed office in 2022. The reshuffle in local government leadership, by Governor Soludo’s administration, is expected to uphold equity and fairness in Idemmili South and accommodate other communities in the local government area.”

Beyond all these, the Senator representing Anambra South Senatorial district, Ifeanyi Ubah, has condemned the refusal of past and current administrations of the state to conduct local government elections in the state in the last 18 years. Ubah speaking on the floor of the Senate lamented that Anambra State has not conducted local government elections in the last 18 years.

He said; “If we want to promote good governance in this country, we need to look at section 7 of the 1999 constitutional framework so we can start having value for democracy in our respective states. In a state like Anambra State has not conducted elections in the last 18 years. When you look at the decadence of governance, poor infrastructure, non employment of youths and other economic problems is due to the non implementation of the 1999 constitutional framework.”

Acting Group Politics Editor DEJI ELUMOYE

(08033025611 SMS ONLY ) THISDAY • WEDNES DaY M aY 22, 2024 16

Soludo

How ActionAid Nigeria is Building Capacity for Positive Social Change

ActionAid Nigeria, a subsidiary of ActionAid International, recently organised a three-day training for Movement groups in Lagos. Esther Oluku reports that it was part of the nationwide capacity building campaign to strengthen movements with the requisite knowledge to drive positive social change

"For to be free is not only to cast off one's chains but to live in a way that respects and enhances the freedom of others" Nelson Mandela

"When I arrived at Ikoyi prison, we were in a small room that naturally would have been for two persons max. We were more than a hundred in that room. When we want to sit down, we had to sit with our laps spread open so that another person can sit within them.

"You will sit like that from morning till 7pm and within this time, you would be granted only 15 minutes break to use the restroom and eat. When it is 7pm, you have to sleep, and how do you sleep, on one shoulder.

"Another time I spent in prison was the new year of 2011. I spent my first 11 days across different police cells. First, I was detained at Abattoir in Abuja at a Special Anti Robbery Squad detention centre and from there I was moved and remanded at a solitary confinement at Kuje Prison.

"From there I was dumped at the Police headquarters all within 11 days before I was granted bail. These detentions have not deterred my spirit. In all, they have only reinforced my conviction that we live in a system of injustice and we must address it," said the Director, Take It Back Movement Nigeria, Sanyaolu Juwon on the sidelines of the three day capacity building training themed party: "Movement Mindset" organised by ActionAid Nigeria, recently.

What are Social Movements?

A Social Movement is the coming together of dissatisfied people in society to confront existing social injustices for the purpose of catalysing positive social change. These groups are organically inspired and steered by the collective power of people united in purpose towards achieving a particular goal.

The target of Social Movement may include the upholding of fundamental human rights of a people, championing the cause of social justice and serving as a medium for checkmating government programmes and policies for the prevention of arbitrary rule.

Social movements cuts across various sectors of the economy such as education, politics, human rights and democracy amongst others. Their activities include organisation of members passionate about their set goals, periodic meetings and trainings for members and members of the public and periodic organisation of demonstrations to raise awareness on pressing social issues.

Modern Social Movements as an Offshoot of the Civil Rights Movements

The origin of social movements can be traced to the early Civil Rights Movements around

the world. In the early days of Civil Rights Movements, the demands of groups were centered around leveling the grounds of social interactions and creating equal opportunities for people of all race, ethnicity and colour to thrive.

From Martin Luther King in America to Mahatma Gandhi in India, Nelson Mandela in South Africa to the various nationalists movements across Africa, one thing lies at the core; the need to correct existing social norms and a quest for the dividends of democracy and fundamental human rights

Civil rights movement were borne out of a determination to assert the identity and uniqueness of groups as a significant aspect of an entire social structure.

With the removal of race barriers in apartheid South Africa and America

and the attainment of independence in former European colonies came the need to address new problems of neocolonialism with it's attendant characteristics of repression and injustice giving birth to the need for modern Social Movements.

In Nigeria, from the Aba Women Riot of the 1800s to the very recent #EndSars protest of 2020, Social Movements stand as a veritable tool to confront breaches in fundamental human rights of a people.

Social

Movements

as a Catalyst for Social Change

The United Nations International Children Educational Fund (UNICEF) submits that social movements are at the core of social change.

All over the world, Social Movements have been a veritable tool for holding government to account by serving as a means of checkmating government policies and programmes to prevent

All areas of the economy are inadvertently linked and when there is friction or imbalance in one sector, it has a ripple effect on other sectors hence the need to empower Social Movements with the requisite knowledge to work efficiently across Nigeria

arbitrary rule.

In Nigeria, social movements lie at the crux of Nigeria's independence, women inclusion in politics and the breakthrough of democracy, a government of the people, by the people and for the people.

Declining Power of Social Movement in Nigeria

With the 2020 #EndSars Movement which has variously been described as an unprecedented expression of youth social restiveness on the subject of police brutality and the fall out of the 2023 elections which followed a torturous journey to it's resolution, the majority of young people have recoiled from activism.

This situation, explained a facilitator at the Movement Mindset training by ActionAid, Ms. Josephine Adokwu, is a stage in the life cycle of Movements which should be accepted but not stayed at.

This viewpoints was shared by many attendees at the event and through training, ActionAid Nigeria has expressed it's vision to strengthen the capacity of Movements and lift 50 million Nigerians out of poverty by 2034.

ActionAid Intervention

The Social Mobilisation Manager, ActionAid Nigeria, Mr. Seun Akioye, who spoke with journalists on the sidelines of the event stated that among the most challenging of problems at the moment is the widening class difference in modern Nigerian society necessitated by skyrocketing inflation rates and cut-throat prices of essential commodities like food.

Akioye noted that all areas of the economy are inadvertently linked and when there is friction or imbalance in one sector, it has a ripple effect on other sectors hence the need to empower Social Movements with the requisite knowledge to work efficiently across Nigeria.

He said: "We believe that we need to harness the power in the collective, the power in people and make it work for the people. What we are saying is that in the next 10 years, our plan is to lift five million Nigerian out of poverty and how are we going to do this, by collective mobilisation.

"We are looking at social movements groups around nigeria and we want to empower them with training, with technical assistance. All of us are going to come together and we are going to make demands of the government. The resources of Nigeria belong to all Nigerians.

"There is hunger in the land. Let people have money to meet their basic needs. It's all we are asking for now. I don't believe it's a tall order for Nigeria. If democracy is anything to go about, government should listen to the peaceful and legitimate demands of the people who have voted them into power and that is what will spur the change, the good change."

FEaturEs Group Features Editor: Chiemelie Ezeobi Email: chiemelie.ezeobi@thisdaylive.com, 07010510430 17 THISDAY • WEDNES Day M ay 22, 2024

Country Director ActionAid Nigeria, Mr. Andrew Mamedu

A cross section of Movement groups at the event

WEDNESDAY MAY 22, 2024 • THISDAY 19

WEDNESDAY MAY 22, 2024 • THISDAY 20 WEDNESDAY MAY 22, 2024 • THISDAY 21

Crime&Punishment

After Second Conviction, Kidnapper Don Evans Opts for Plea Bargain

Funke Olaode

In his hay days, he was a Lord to himself. His larger-than-life image was lived under the radar without any traces of opulence in what you